Revenue declined $75 million or 0.4% from 2022; a decline of 0.3% in constant currency1 | | Income from Operations declined $279 million or 9.4% from 2022

| Adjusted Income from Operations1 declined $50 million or 1.7% from 2022 | | | | Operating margin down 140 bps compared to 2022

Adjusted Operating Margin1 down 20 basis points from 2022 | | | | Diluted EPS declined $0.20 or 4.5% from 2022

Adjusted Diluted EPS1 increased $0.15 or 3.4% from 2022 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 Adjusted Income From Operations, andAdjusted Operating Margin, Adjusted Diluted EPS and constant currency revenue growth are not measurements of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” for more information and reconciliations to the most directly comparable GAAP financial measures. | | | | | | | | | | Cognizant | 28 | December 31, 2023 Form 10-K |

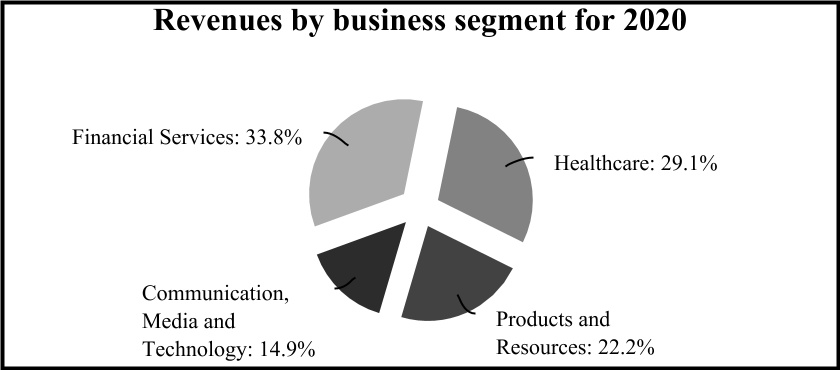

The following charts set forth revenues and change in revenues by business segment and geography forDuring the year ended December 31, 20202023, revenues decreased by $75 million as compared to the year ended December 31, 2019:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Financial Services | | Healthcare | | | | | | | | | Increase / (Decrease) | | | | Increase / (Decrease) | | | | | | | | | | Dollars in millions | | Revenues | | $ | | % | | CC %2 | | Revenues | | $ | | % | | CC %2 | | | | | | | | | | North America | | $ | 4,013 | | | (124) | | | (3.0) | | | (3.0) | | | $ | 4,181 | | | 34 | | | 0.8 | | | 0.8 | | | | | | | | | | | United Kingdom | | 463 | | | (21) | | | (4.3) | | | (4.7) | | | 157 | | | 27 | | | 20.8 | | | 19.8 | | | | | | | | | | | Continental Europe | | 629 | | | (99) | | | (13.6) | | | (14.0) | | | 434 | | | 93 | | | 27.3 | | | 24.0 | | | | | | | | | | | Europe - Total | | 1,092 | | | (120) | | | (9.9) | | | (10.3) | | | 591 | | | 120 | | | 25.5 | | | 22.9 | | | | | | | | | | | Rest of World | | 516 | | | (4) | | | (0.8) | | | 2.0 | | | 80 | | | 3 | | | 3.9 | | | 6.0 | | | | | | | | | | | Total | | $ | 5,621 | | | (248) | | | (4.2) | | | (4.0) | | | $ | 4,852 | | | 157 | | | 3.3 | | | 3.1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Products and Resources | | Communications, Media and Technology | | | | | | | | | Increase / (Decrease) | | | | Increase / (Decrease) | | | | | | | | | | Dollars in millions | | Revenues | | $ | | % | | CC %2 | | Revenues | | $ | | % | | CC %2 | | | | | | | | | | North America | | $ | 2,650 | | | (28) | | | (1.0) | | | (1.0) | | | $ | 1,737 | | | (27) | | | (1.5) | | | (1.5) | | | | | | | | | | | United Kingdom | | 371 | | | (9) | | | (2.4) | | | (3.0) | | | 344 | | | 25 | | | 7.8 | | | 6.8 | | | | | | | | | | | Continental Europe | | 413 | | | (40) | | | (8.8) | | | (8.7) | | | 177 | | | 8 | | | 4.7 | | | 2.1 | | | | | | | | | | | Europe - Total | | 784 | | | (49) | | | (5.9) | | | (6.1) | | | 521 | | | 33 | | | 6.8 | | | 5.2 | | | | | | | | | | | Rest of World | | 262 | | | 3 | | | 1.2 | | | 4.7 | | | 225 | | | 28 | | | 14.2 | | | 20.2 | | | | | | | | | | | Total | | $ | 3,696 | | | (74) | | | (2.0) | | | (1.7) | | | $ | 2,483 | | | 34 | | | 1.4 | | | 1.6 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2022, representing a decrease of 0.4%, or a decrease of 0.3% on a constant currency basisAcross all2. Revenue decline was driven by our business segments and regions, revenues wereFinancial Services segment, which was negatively impacted by weakness in the COVID-19 pandemic and the ransomware attack. Retail, consumer goods, travel and hospitality clients within our Products and Resources segment as well as communications and media clientsbanking sector, partially offset by growth in our Communications, Media and Technology, segment were particularly adversely affected by the pandemic. Revenues in our Financial Services segment in our Continental Europe region were negatively impacted by $118 million dueProducts and Resources and Health Sciences segments. Our recently completed acquisitions contributed 110 basis points to the Proposed Exit. Additionally, we continued to see certain financial services and healthcare clients transition the support of some of their legacy systems and operations in-house. Revenuerevenue growth, among our life sciences clients was driven by revenues from Zenith and increased demand for our services among pharmaceutical companies while revenues from our healthcare clients benefited from stronger software license sales. Our manufacturing, logistics, energy and utilities clients withinprimarily benefiting our Products and Resources segment generated revenue growth due to our clients' continued adoption and integration of digital technologies. Revenues among our technology clients in our Communications,Communications, Media and Technology segment in the North America region were negatively impacted by approximately $178 million due to our exit from certain content-related services. We continue to see growing demand from our technology clients for other more strategic digital content services. Additionally, the year-over-year change in our revenues included 210 basis points of benefit from our recently completed acquisitions, including Collaborative Solutions, Zenith and Contino.segments. Our operating margin and Adjusted Operating Margin2 decreased to 12.7%was 13.9% and 14.4%15.1%, respectively, for the year ended December 31, 2020 from 14.6%2023. This compares to operating margin and 16.6%, respectively,Adjusted Operating Margin of 15.3% for the year ended December 31, 2019.2022. Our 2023 GAAP and Adjusted Operating Margin2 Margins were adverselynegatively impacted by higher incentive-basedincreased compensation accrual rates, investments intended to drive organic and inorganic revenue growth, the impact of the Proposed Exit, the decline in revenues brought on by the COVID-19 pandemic and the impact of the ransomware attack on both revenues and costs. These impacts were partially offset by a significant decrease in travel and entertainment expenses due to the COVID-19 pandemic, the cost savings generatedcosts, primarily as a result of two merit increase cycles for the 2020 Fit for Growth Plan, lower immigration costs andmajority of our employees since October 2022, partially offset by the benefit of the depreciation of the Indian rupee against the U.S. dollar.dollar, savings generated from our NextGen program and improvement in profitability of a large contract with a Health Sciences client in 2023. In addition, our 2019 GAAP operating margin included a 0.7% negative impact of the incremental accrual in 2019 related to the India Defined Contribution Obligation as discussed in Note 154 to our audited consolidated financial statements, while our 20202023 GAAP operating margin was negatively impacted by COVID-19 Charges.

2 Constant currency revenue growth (CC) andthe NextGen charges, which were excluded from our Adjusted Operating Margin are not measurementsMargin.

As a global professional services company, we compete on the basis of financial performance preparedthe knowledge, experience, insights, skills and talent of our employees and the value they can provide to our clients. We closely monitor attrition trends focusing on the metric that we believe is most relevant to our business. This metric, which we refer to as Voluntary Attrition - Tech Services, includes all voluntary separations with the exception of employees in accordanceour Intuitive Operations and Automation practice. For the year ended December 31, 2023 our Voluntary Attrition - Tech Services was 13.8% as compared to 25.6% for the year ended December 31, 2022. We finished 2023 with GAAP. See “Non-GAAP Financial Measures” for more information and a reconciliationapproximately 347,700 employees as compared to 355,300 employees at the most directly comparable GAAP financial measure, as applicable.

Business Outlook We have fourSee "Overview" within Part I, Item 1. Business for information on our six strategic priorities as we seek to increase our commercial momentum and accelerate growth. These strategic priorities are:•Accelerating digital - growing our digital business organically and inorganically;priorities.

•Globalizing Cognizant - growing our business in key international markets and diversifying leadership, capabilities and delivery footprint;

•Repositioning our brand - improving our global brand recognition and becoming better known as a global digital partner to the entire C-suite; and

•Increasing our relevance to our clients - leading with thought leadership and capabilities to address clients' business needs.

We continue to expect the long-term focus of our clients to be on their digital transformation into software-driven, data-enabled, customer-centric and differentiated businesses. As ourWe believe clients seek to optimize the cost of supporting their legacy systems and operations, our core portfolio of services may be subject to pricing pressure and lower demand due to clients transitioning certain work in-house. At the same time, clients continue to adopt and integrate digital technologies and their demand for our digital operations services and solutions has only increased since the beginning of the COVID-19 pandemic, as demand for mobile workplace solutions, e-commerce, automation and AI and cybersecurity services and solutions has grown. Our clients will likely continue to contend with industry-specific changes driven by evolving digital technologies, uncertainty in the regulatory environment, industry consolidation and convergence as well as international trade policiespolicies and other macroeconomic and geopolitical factors, including the increasing uncertainty related to the global economy, which couldhas affected and may continue to affect their demand for our services. The COVID-19 pandemic may continue

We are focused on expanding our partner ecosystem across a broad range of technology companies, including hyperscalers, cloud providers, enterprise software companies, best-in-class digital software enterprises and emerging start-ups. We believe this partner ecosystem will enable us to negatively impact demand, particularly amongenhance our retail, consumer goods, travel and hospitality clients withininnovative, integrated offerings, by combining third-party products with our Products and Resources segment as well as communications and media clientsservice solutions, to deliver enterprise-wide digital transformation. We increasingly use AI-based technologies, including GenAI, in our Communications, Mediaclient offerings and Technology segment. Theour own internal operations. AI technologies and services are part of a highly competitive and rapidly evolving market. We plan to make significant and evolving nature ofinvestments in our AI capabilities to meet the COVID-19 pandemic makes it difficult to estimate its future impact on our ongoing business, results of operations and overall financial performance. See Part I, Item 1A. Risk Factors. As a global professional services company, we compete on the basis of the knowledge, experience, insights, skills and talentneeds of our employeesclients and theharness its value they can providein a flexible, secure, scalable and responsible way. As AI-based technologies evolve, we expect that some services that we currently perform for our clients will be replaced by AI or forms of automation. This may lead to our clients. Competitionreduced demand for skilled labor is intense and our success is dependent, in large part, oncertain services or harm our ability to keepobtain favorable pricing or other terms for our supply of skilled employees, in particular those with experience in key digital areas, in balance with client demand around the world. As such, we will continue to focus on recruiting, talent management and employee engagement to attract and retain our employees.

We will continue to pursue strategic acquisitions, investments and alliances that will expand our talent, experience and capabilities in key digital areas or in particular geographies or industries.services.

In addition, our future results may be affected by immigration law changes that may impact our abilityconnection with the NextGen program, in 2023 we incurred $229 million in employee separation, facility exit and other costs. We currently expect to do business or significantly increase ourincur total costs of doing business,approximately $300 million in connection with the NextGen program, with approximately $70 million of such costs anticipated in 2024. In addition to the NextGen program, potential tax law changes and other potential regulatory changes, including possible U.S. corporate income tax reform and potentially increased costs in 2021 and future years for employment and post-employment benefits in India as a result of the issuance of the Code in late 2020, as well as costs related to the potential resolution of legal and regulatory matters discussed in Note 15 toon Social Security, 2020, among other items, may impact our consolidated financial statements.future results. For additional information, see Part I, Item 1A. Risk FactorsFactors..

For a discussion of our results of operations for the year ended December 31, 2018, including a year-to-year comparison between 2019 and 2018, refer to Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report Form 10-K for the year ended December 31, 2019.

The Year Ended December 31, 2020 Compared to The Year Ended December 31, 2019

The following table sets forth certain financial data for the years ended December 31:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | % of | | | | % of | | | | | | Increase / Decrease | | | | | | | 2020 | | Revenues | | 2019 | | Revenues | | | | | | $ | | % | | | | | | | (Dollars in millions, except per share data) | | | | Revenues | | $ | 16,652 | | | 100.0 | | $ | 16,783 | | | 100.0 | | | | | | $ | (131) | | | (0.8) | | | | | | Cost of revenues(1) | | 10,671 | | | 64.1 | | 10,634 | | | 63.4 | | | | | | 37 | | | 0.3 | | | | | | Selling, general and administrative expenses(1) | | 3,100 | | | 18.6 | | 2,972 | | | 17.7 | | | | | | 128 | | | 4.3 | | | | | | | Restructuring charges | | 215 | | | 1.3 | | 217 | | | 1.3 | | | | | | (2) | | | (0.9) | | | | | | | Depreciation and amortization expense | | 552 | | | 3.3 | | 507 | | | 3.0 | | | | | | 45 | | | 8.9 | | | | | | | Income from operations | | 2,114 | | | 12.7 | | 2,453 | | | 14.6 | | | | | | (339) | | | (13.8) | | | | | | | Other income (expense), net | | (18) | | | | | 90 | | | | | | | | | (108) | | | (120.0) | | | | | | | Income before provision for income taxes | | 2,096 | | | 12.6 | | 2,543 | | | 15.2 | | | | | | (447) | | | (17.6) | | | | | | | Provision for income taxes | | (704) | | | | | (643) | | | | | | | | | (61) | | | 9.5 | | | | | | | Income (loss) from equity method investments | | — | | | | | (58) | | | | | | | | | 58 | | | (100.0) | | | | | | | Net income | | $ | 1,392 | | | 8.4 | | $ | 1,842 | | | 11.0 | | | | | | $ | (450) | | | (24.4) | | | | | | | Diluted EPS | | $ | 2.57 | | | | | $ | 3.29 | | | | | | | | | $ | (0.72) | | | (21.9) | | | | | | Other Financial Information 3 | | | | | | | | | | | | | | | | | | | | | | Adjusted Income From Operations and Adjusted Operating Margin | | $ | 2,394 | | | 14.4 | | $ | 2,787 | | | 16.6 | | | | | | (393) | | | (14.1) | | | | | | | Adjusted Diluted EPS | | $ | 3.42 | | | | | $ | 3.99 | | | | | | | | | $ | (0.57) | | | (14.3) | | | | | |

(1) Exclusive of depreciation and amortization expense.

Revenues - Overall

During 2020, revenues decreased by $131 million as compared to 2019, representing a decline of 0.8%, or 0.7% on a constant currency basis3. Across all business segments and regions, revenues were negatively impacted by the ransomware attack and the COVID-19 pandemic. In addition, our exit from certain content-related services and the Proposed Exit negatively impacted our revenues by $178 million and $118 million, respectively. We continue to experience pricing pressure within our core portfolio of services as our clients optimize the cost of supporting their legacy systems and operations. At the same time, clients are adopting and integrating digital technologies and their demand for our digital services and solutions has continued to increase since the beginning of the COVID-19 pandemic as a result of increased demand for mobile workplace solutions, e-commerce, automation and AI and cybersecurity services and solutions. Additionally, the year-over-year change in our revenues included 210 basis points of benefit from our recently completed acquisitions, including Collaborative Solutions, Zenith and Contino. Revenues from clients added during 2020, including those related to acquisitions, were $342 million.

32 Adjusted Income From Operations, Adjusted Operating Margin Adjusted Diluted EPS and constant currency revenue growth are not measurements of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” for more information and reconciliations to the most directly comparable GAAP financial measures, as applicable.measures.

| | | | | | | | | | Cognizant | 29 | December 31, 2023 Form 10-K |

For a discussion of our results of operations for the year ended December 31, 2021, including a year-to-year comparison between 2022 and 2021, refer to Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report Form 10-K for the year ended December 31, 2022. The Year Ended December 31, 2023 Compared to The Year Ended December 31, 2022 The following table sets forth certain financial data for the years ended December 31: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | % of | | | | % of | | | Increase / Decrease | | (Dollars in millions, except per share data) | | 2023 | | Revenues | | 2022 | | Revenues | | | $ | | % | | Revenues | | $ | 19,353 | | | 100.0 | | $ | 19,428 | | | 100.0 | | | $ | (75) | | | (0.4) | | Cost of revenues(a) | | 12,664 | | | 65.4 | | 12,448 | | | 64.1 | | | 216 | | | 1.7 | | Selling, general and administrative expenses(a) | | 3,252 | | | 16.8 | | 3,443 | | | 17.7 | | | (191) | | | (5.5) | | | Restructuring charges | | 229 | | | 1.2 | | — | | | — | | | 229 | | | N/A | | Depreciation and amortization expense | | 519 | | | 2.7 | | 569 | | | 2.9 | | | (50) | | | (8.8) | | | Income from operations and operating margin | | 2,689 | | | 13.9 | | 2,968 | | | 15.3 | | | (279) | | | (9.4) | | | Other income (expense), net | | 98 | | | | | 48 | | | | | | 50 | | | 104.2 | | | Income before provision for income taxes | | 2,787 | | | 14.4 | | 3,016 | | | 15.5 | | | (229) | | | (7.6) | | | Provision for income taxes | | (668) | | | | | (730) | | | | | | 62 | | | (8.5) | | | Income (loss) from equity method investments | | 7 | | | | | 4 | | | | | | 3 | | | 75.0 | | | Net income | | $ | 2,126 | | | 11.0 | | $ | 2,290 | | | 11.8 | | | $ | (164) | | | (7.2) | | | Diluted EPS | | $ | 4.21 | | | | | $ | 4.41 | | | | | | $ | (0.20) | | | (4.5) | | Other Financial Information 3 | | | | | | | | | | | | | | | Adjusted Income From Operations and Adjusted Operating Margin | | $ | 2,918 | | | 15.1 | | $ | 2,968 | | | 15.3 | | | $ | (50) | | | (1.7) | | | Adjusted Diluted EPS | | $ | 4.55 | | | | | $ | 4.40 | | | | | | $ | 0.15 | | | 3.4 | |

(a) Exclusive of depreciation and amortization expense N/A Not applicable3

During the year ended December 31, 2023, revenues declined by $75 million as compared to the twelve months ended December 31, 2022, representing a decline of 0.4%, or a decline of 0.3% on a constant currency basis.3Our recently completed acquisitions contributed 110 basis points of growth to the change in revenues.

3 Adjusted Income from Operations, Adjusted Operating Margin, Adjusted Diluted EPS and constant currency revenue growth are not measures of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” for more information and reconciliations to the most directly comparable GAAP financial measures, as applicable. | | | | | | | | | | Cognizant | 30 | December 31, 2023 Form 10-K |

| | | | Revenues - Reportable Business Segments and Geographic Markets |

Revenues by reportableof $19,353 million across our business segmentsegments and geographies were as follows:follows for the year ended December 31, 2023: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2020 | | 2019 | | | | Increase / (Decrease) | | | | | | | | $ | | % | | CC%4 | | | | | | | | | (Dollars in millions) | | Financial Services | | $ | 5,621 | | | $ | 5,869 | | | | | $ | (248) | | | (4.2) | | | (4.0) | | | | | | | | | Healthcare | | 4,852 | | | 4,695 | | | | | 157 | | | 3.3 | | | 3.1 | | | | | | | | | Products and Resources | | 3,696 | | | 3,770 | | | | | (74) | | | (2.0) | | | (1.7) | | | | | | | | | Communications, Media and Technology | | 2,483 | | | 2,449 | | | | | 34 | | | 1.4 | | | 1.6 | | | | | | | | | Total revenues | | $ | 16,652 | | | $ | 16,783 | | | | | $ | (131) | | | (0.8) | | | (0.7) | | | | | | | |

Financial Services | | | | | | | | | | | | | | | | | | | | | | | | | | 2023 as compared to 2022 | | | | | Increase / (Decrease) | | (Dollars in millions) | | $ | | % | | CC %4 | | | Financial Services | | | | | $ | (263) | | | (4.3) | | | (4.2) | | | | Health Sciences | | | | | 43 | | | 0.8 | | | 0.5 | | | | Products and Resources | | | | | 62 | | | 1.4 | | | 1.5 | | | | CMT | | | | | 83 | | | 2.6 | | | 3.1 | | | | Total revenues | | | | | $ | (75) | | | (0.4) | | | (0.3) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | 2023 as compared to 2022 | | | | | Increase / (Decrease) | | (Dollars in millions) | | $ | | % | | CC %4 | | | North America | | | | | $ | (172) | | | (1.2) | | | (1.1) | | | | United Kingdom | | | | | 75 | | | 4.1 | | | 3.5 | | | | Continental Europe | | | | | 114 | | | 6.4 | | | 4.3 | | | | Europe - Total | | | | | 189 | | | 5.2 | | | 3.9 | | | | Rest of World | | | | | (92) | | | (6.6) | | | (2.6) | | | | Total revenues | | | | | $ | (75) | | | (0.4) | | | (0.3) | | |

Revenues from

Change in revenues was driven by the following factors: •Reduced demand for discretionary work negatively impacted revenues across all segments, and primarily in North America. Banking clients in our Financial Services segment, declined 4.2%, or 4.0% on a constant currency basis4,retail and consumer goods clients in 2020. Revenues among our insurance clients decreased by $85 million as compared to a decrease of $163 million from our banking clients. The Proposed Exit negatively impacted our revenues from banking clients by $118 million. Revenues from clients added during 2020, including those related to acquisitions, were $70 million. Moderate revenue growth generated by our digital services did not fully offset revenue declines attributable to certain financial services clients who continued to transition the support of some of their legacy systems and operations in-house. Healthcare

Revenues from our Healthcare segment grew 3.3%, or 3.1% on a constant currency basis4, in 2020. Revenues in this segment increased by $173 million among our life science clients while revenues from our healthcare clients decreased $16 million. Revenue growth among our life sciences clients was driven by revenues from Zenith and increased demand for our services among pharmaceutical companies. Revenues from our healthcare clients were negatively impacted by the establishment of an offshore captive by a large client, partially offset by the 2019 negative impact of a customer dispute with a healthcare client related to a large volume based contract. Additionally, revenues from our healthcare clients benefited from stronger software license sales in 2020. Revenues from clients added during 2020, including those related to acquisitions, were $50 million. Demand from our healthcare clients may continue to be affected by uncertainty in the regulatory and political environment while demand from our life sciences clients may be affected by industry consolidation.

Products and Resources

Revenues from our Products and Resources segment declined 2.0%, or 1.7% on a constant currency basis4,and clients in 2020. Retail, consumer goods, travel and hospitality clients were particularly adversely affected by the COVID-19 pandemic. Thus, revenue from our travel and hospitality clients and from our retail and consumer goods clients decreased by $126 million and $100 million, respectively. Revenues from our manufacturing, logistics, energy and utilities clients increased by $152 million due to our clients' adoption and integration of digital technologies. Revenues from clients added during 2020, including those related to acquisitions, were $105 million.

Communications, Media and Technology

Revenues from our Communications, Media and Technology segment grew 1.4%, or 1.6% on a constant currencywere particularly affected;

•Recently completed acquisitions which contributed 110 basis points of growth to the overall change in revenues, including 230 basis points of growth to our Products and Resources segment (primarily in North America) and 290 basis points of growth to our Communications, Media and Technology segment (primarily in Continental Europe and the United Kingdom); •4,North America revenues in 2020. Revenues from our communicationsthe Communications, Media and media clients increased $72 million while revenues from our technology clients decreased $38 million. RevenuesTechnology segment included growing demand among our technologythe largest clients in this segment, including for services related to digital content; •The resale of third-party products in North America in connection with our integrated offerings strategy, primarily in the Financial Services and Products and Resources segments, contributed 70 basis points of growth to the overall change in revenue; •North America revenues in the Communications, Media and Technology and Products and Resources segments were negatively impacted by approximately $178 million due to our exit from certain content-related services. Additionally, revenues were negativelypositively impacted by the COVID-19 pandemic, particularly amongramp up of several recently won large deals; •Revenue growth in the United Kingdom was driven by expansion of work public sector clients included in our communicationsCommunications, Media and media clients, partially offsetTechnology and Financial Services segments; •Revenues in the Continental Europe region were driven by growingincreased demand from pharmaceutical clients within the Health Sciences segment and automotive clients within the Products and Resources segment; and •Revenue decline in our technology clients for other more strategic digital content services. Revenues from clients added during 2020, including those related to acquisitions, were $117 million.Rest of World region was primarily driven by weakness in the Financial Services segment and the negative impact of foreign currency exchange rate movements.

4 Constant currency revenue growth is not a measurementmeasure of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” for more information. | | | | | | | | | | Cognizant | 31 | December 31, 2023 Form 10-K |

Revenues - Geographic Locations | | | | Cost of Revenues (Exclusive of Depreciation and Amortization Expense) |

Revenues by geographic market, as determined by client location, were as follows: | | | | | | | | | | | | | | é | $216M | | | | | | | | | é | 1.3% as a % of revenues | | | | | | | ¡% of Revenues | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2020 | | 2019 | | | | Increase / (Decrease) | | | | | | | | $ | | % | | CC %5 | | | | | | | | | (Dollars in millions) | | | | North America | | $ | 12,581 | | | $ | 12,726 | | | | | $ | (145) | | | (1.1) | | | (1.1) | % | | | | | | | | United Kingdom | | 1,335 | | | 1,313 | | | | | 22 | | | 1.7 | | | 1.0 | % | | | | | | | | Continental Europe | | 1,653 | | | 1,691 | | | | | (38) | | | (2.2) | | | (3.3) | % | | | | | | | | Europe - Total | | 2,988 | | | 3,004 | | | | | (16) | | | (0.5) | | | (1.4) | % | | | | | | | | Rest of World | | 1,083 | | | 1,053 | | | | | 30 | | | 2.8 | | | 6.4 | % | | | | | | | | Total revenues | | $ | 16,652 | | | $ | 16,783 | | | | | $ | (131) | | | (0.8) | | | (0.7) | % | | | | | | |

North America continues to be our largest market, representing 75.6% of total 2020 revenues. Our North America region was negatively impacted by our exit from certain content-related services in our Communications, Media and Technology segment and the transition of the support of legacy systems for certain financial services and healthcare clients in-house. Our Continental Europe region was negatively impacted by the Proposed Exit, partially offset by growth from our life sciences customers. Revenues in our United Kingdom region have particularly benefited from our recently completed acquisitions. Revenue growth in our Rest of World region was driven by our Communications, Media and Technology clients.

Cost of Revenues (Exclusive of Depreciation and Amortization Expense)

Our cost of revenues consists primarily of salaries, incentive-based compensation, stock-based compensation expense, employee benefits, project-related immigration and travel for technical personnel, subcontracting and equipment costs of third-party products and services relating to revenues. Our cost of revenues increased by 0.3% during 2020 as compared to 2019, increasing as a percentage of revenues to 64.1% in 2020 compared to 63.4% in 2019. The increase, in cost of revenues, as a percentage of revenues, was due primarily to an increase in costs related to higher incentive-based compensation accrual rates in 2020 and the impact of the Proposed Exit, the COVID-19 pandemic and the ransomware attack. These impacts were partially offset by a significant decrease in travel and entertainment costs for delivery personnel, primarily as a result of a reduction in travel due totwo merit increase cycles for the COVID-19 pandemic, the cost savings generated as a resultmajority of our cost optimization strategy andemployees since October 2022, partially offset by the benefit of the depreciation of the Indian rupee against the U.S. dollar.dollar and improvement in profitability of a large contract with a Health Sciences client in 2023. | | | | SG&A Expenses (Exclusive of Depreciation and Amortization Expense) |

SG&A expenses consist primarily of salaries, incentive-based compensation, stock-based compensation expense, employee benefits, immigration, travel, marketing, communications, management, finance, administrative and occupancy costs. SG&A expenses increased by 4.3% during 2020 as compared to 2019, increasing as a percentage of revenues to 18.6% in 2020 as compared to 17.7% in 2019. The increase,decrease, as a percentage of revenues, was primarily due primarily to an increase in costs related to higher incentive-based compensation accrual rates in 2020, investments intended to drive organic and inorganic revenue growthsavings generated from our NextGen program and the impactsbeneficial impact of the COVID-19 pandemic, the Proposed Exit and the ransomware attack. These negative impacts wereforeign currency exchange rate movements, partially offset by a significant decrease in travel and entertainmenthigher compensation costs, primarily as a result of a reduction in travel due totwo merit increase cycles for the COVID-19 pandemic and lower immigration costs, in addition to the $117 million incremental accrual in 2019 related to the India Defined Contribution Obligation as discussed in Note 15 tomajority of our consolidated financial statements.employees since October 2022. | | | | | | | | | | | | | | ê | $191M | | | | | | | | | ê | 0.9% as a % of revenues | | | | | | | ¡% of Revenues | | | | | | |

Restructuring charges consist of our 2020 Fit for Growth Plan and our realignmentcosts related to the NextGen program. Restructuring charges were $215$229 million or 1.3%1.2%, as a percentage of revenues during 2020, as compared to $217 million, or 1.3% as a percentage of revenues, during 2019.for the year ended December 31, 2023. For further detail on our restructuring charges see Note 4 to our audited consolidated financial statements. | | | | Depreciation and Amortization Expense |

Depreciation and amortization expense increaseddecreased by 8.9% during 20208.8%, and by 0.2% as a percentage of revenues, in 2023 as compared to 2019. The increase was2022, primarily driven by a reduction in amortization expense due to procurementcertain intangible assets reaching the end of additional computer equipment primarily to provision work-from-home arrangementstheir useful lives and amortization of intangiblessavings generated from recently completed acquisitions.our NextGen program. | | | Operating Margin and Adjusted Operating Margin5 - Overall |

Our 2023 operating margin and Adjusted Operating Margin5 were negatively impacted by increased compensation costs, primarily as a result of two merit increase cycles for the majority of our employees since October 2022, partially offset by the benefit of the depreciation of the Indian rupee against the U.S. dollar, savings generated from our NextGen program and improvement in profitability of a large contract with a Health Sciences client in 2023. In addition, as discussed in Note 4 to our audited consolidated financial statements, our 2023 GAAP operating margin was negatively impacted by the NextGen charges, which were excluded from our Adjusted Operating Margin5.

5 Constant currency revenue growth isAdjusted Income From Operations and Adjusted Operating Margin are not a measurementmeasurements of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” for more information.information and reconciliations to the most directly comparable GAAP financial measures, as applicable. | | | | | | | | | | Cognizant | 32 | December 31, 2023 Form 10-K |

Operating Margin - Overall

Our operating margin and Adjusted Operating Margin6 decreased to 12.7% and 14.4%, respectively,A predominant portion of our costs in 2020 from 14.6% and 16.6%, respectively, during 2019. Our GAAP and Adjusted Operating Margin6 were adversely impacted by higher incentive-based compensation accrual rates, investments intended to drive organic and inorganic revenue growth, the impact of the Proposed Exit, the declineIndia are denominated in revenues brought on by the COVID-19 pandemic and the impact of the ransomware attack on both revenues and costs. These impacts were partially offset by a significant decrease in travel and entertainment expenses due to the COVID-19 pandemic, the cost savings generated as a result of the 2020 Fit for Growth Plan, lower immigration costs and the depreciation of the Indian rupee, against representing approximately 24% of our global operating costs during the U.S. dollar. In addition, our 2019 GAAP operating margin included a 0.7% negative impact of the incremental accrual in 2019 related to the India Defined Contribution Obligation as discussed inyear ended Note 15December 31, 2023. These costs are subject to our consolidated financial statements, while our 2020 GAAP operating margin was negatively impacted by COVID-19 Charges.Excluding the impact of applicable designated cash flow hedges, the depreciation of the Indian rupee against the U.S. dollar positively impacted our operating margin by approximately 92 basis points or 0.92 percentage points in 2020, while in 2019 the depreciation of the Indian rupee against the U.S. dollar positively impacted our operating margin by approximately 53 basis points or 0.53 percentage points. Each additional 1.0% change inforeign currency exchange rate between the Indian rupee and the U.S. dollar willfluctuations, which have the effectan impact on our results of moving our operating margin by approximately 17 basis points or 0.17 percentage points.

operations. We enter into foreign exchange derivative contracts to hedge certain Indian rupee denominated payments in India. These hedges are intended to mitigate the volatility of the changes in the exchange rate between the U.S. dollar and the Indian rupee. TheNet of the impact of the settlementhedges, the depreciation of the Indian rupee contributed 90 basis points to the improvement in our cash flow hedges was immaterial in 2020 and 2019. Our most significant costs are the salaries and related benefitsoperating margin for our employees. These costs are affected by the impact of inflation. In certain regions, competition for professionals with the advanced technical skills necessary to perform our services has caused wages to increase at a rate greater than the general rate of inflation.

We finished the year ended December 31, 2020 with approximately 289,500 employees, which is a decrease of 3,0002023 as compared to December 31, 2019. For2022.

Excluding the three months ended December 31, 2020, annualized turnover, including both voluntary and involuntary, was approximately 19.0%. Turnover for the years ended December 31, 2020 and 2019, including both voluntary and involuntary, was approximately 20.6% and 21.7%. Voluntary attrition normally constitutes the significant majorityimpact of our attrition. In 2020, we saw elevated levels of involuntary attrition due to our Fit for Growth Plan, including the exit from certain content-related services. We also saw a decrease in voluntary attrition from historic levels in the early stages of the COVID-19 pandemic. Both voluntary and involuntary attrition are weighted towards our more junior employees. Segment Operating Profit and Margin

Segment operating profit and margin were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2020 | | Operating Margin % | | 2019 | | Operating Margin % | | | | | | Increase /(Decrease) | | | | (Dollars in millions) | | Financial Services | $ | 1,449 | | | 25.8 | | | $ | 1,605 | | | 27.3 | | | | | | | $ | (156) | | | | | Healthcare | 1,383 | | | 28.5 | | | 1,261 | | | 26.9 | | | | | | | 122 | | | | | Products and Resources | 1,078 | | | 29.2 | | | 1,028 | | | 27.3 | | | | | | | 50 | | | | | Communications, Media and Technology | 794 | | | 32.0 | | | 732 | | | 29.9 | | | | | | | 62 | | | | | Total segment operating profit and margin | 4,704 | | | 28.2 | | | 4,626 | | | 27.6 | | | | | | | 78 | | | | | Less: unallocated costs | 2,590 | | | | | 2,173 | | | | | | | | | 417 | | | | | Income from operations | $ | 2,114 | | | 12.7 | | | $ | 2,453 | | | 14.6 | | | | | | | $ | (339) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Across all our business segments, operating margins benefited from a significant decrease in travel and entertainment costs due to COVID-19 related reductions in travel, cost savings generated by our cost optimization initiatives andapplicable designated cash flow hedges, the depreciation of the Indian rupee against the U.S. dollar positively impacted our operating margin by approximately 96 basis points in 2023. Each additional 1.0% change in exchange rate between the Indian rupee and the U.S. dollar will have the effect of moving our operating margin by approximately 19 basis points (excluding the impact of our cash flow hedges). In 2023, the settlement of our cash flow hedges negatively impacted our operating margin by approximately 13 basis points, compared to a negative impact of 7 basis points in 2022.

We finished the year ended December 31, 2023 with approximately 347,700 employees as compared to 355,300 employees for the year ended December 31, 2022. For the year ended December 31, 2023 our Voluntary Attrition - Tech Services was 13.8% as compared to 25.6% for the year ended December 31, 2022. In 2023, we made certain changes to the internal measurement of segment operating profit for the purpose of evaluating segment performance and resource allocation. The primary reason for the change was to reflect a more complete cost of delivery. Specifically, segment operating profit now includes an allocation of both SG&A costs related to our integrated practices and the excess or shortfall of incentive-based compensation for commercial and delivery employees as compared to target, which were previously included in "unallocated costs." We have reported 2023 segment operating profits using the new allocation methodology and have recast the 2022 and 2021 results to conform to the new methodology. See Note 18 to our audited consolidated financial statements for the recast 2021 segment operating profits. Segment operating profit and operating margin percentage were as follows:

| | | | | | | | | | | | | | | | | | | | Segment operating profit | | % | Segment operating margin |

In 2023, segment operating margins across all our segments were negatively impacted by increased compensation costs, primarily as a result of two merit increase cycles for the majority of our employees since October 2022, partially offset by investments intended to drive organic and inorganic revenue growth and the negative impact on revenuesbenefit of the COVID-19 pandemicdepreciation of the Indian rupee against the U.S. dollar and the ransomware attack. The 2020savings generated from our NextGen program. In addition, 2023 segment operating margin in our Financial ServicesHealth Sciences benefited from the improvement in profitability of a large contract with a payer client, while segment operating profit in Communications, Media and Technology was negatively impactedaffected by higher costs typical to the Proposed Exit. Additionally, the 2019 operating margininitial phases of several recently won large deals in our Healthcare segment was negatively impacted by client mergers within the segment and a dispute with a customer related to a large volume based contract. The increase in unallocated costs in 2020 compared to 2019 is primarily duethis segment. | | | | | | | | | | Cognizant | 33 | December 31, 2023 Form 10-K |

6 Adjusted Operating Margin is not a measurement of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” for more information and a reconciliation to the most directly comparable GAAP financial measure.

Total segment operating profit was as follows for the year ended December 31: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (Dollars in millions) | 2023 | | % of Revenues | | 2022 | | % of Revenues | | Increase / (Decrease) | | Total segment operating profit | $ | 4,117 | | | 21.3 | | | $ | 4,353 | | | 22.4 | | | $ | (236) | | | Less: unallocated costs | 1,428 | | | 7.4 | | | 1,385 | | | 7.1 | | | 43 | | | Income from operations | $ | 2,689 | | | 13.9 | | | $ | 2,968 | | | 15.3 | | | $ | (279) | |

to a smaller shortfall

The increase in 2020 than in 2019 of incentive-based compensationunallocated costs for 2023 as compared to target, COVID-19 Charges and costs related to the ransomware attack, partially offset2022 was primarily driven by the 2019 India Defined Contribution Obligation discussedNextGen charges in 2023, see Note 154 to our audited consolidated financial statements.statements, partially offset by lower corporate expenses. | | | | Other Income (Expense), Net |

Total other income (expense), net consists primarily of foreign currency exchange gains and losses, interest income and interest expense. The following table sets forth total other income (expense), net for the years ended December 31: | | 2020 | | 2019 | | | Increase / Decrease | | | (in millions) | | Foreign currency exchange (losses) | $ | (53) | | | $ | (73) | | | | $ | 20 | | | | (in millions) | | | (in millions) | | | (in millions) | | | Foreign currency exchange gains (losses) | | | Foreign currency exchange gains (losses) | | | Foreign currency exchange gains (losses) | | | (Losses) gains on foreign exchange forward contracts not designated as hedging instruments | (Losses) gains on foreign exchange forward contracts not designated as hedging instruments | (63) | | | 8 | | | | (71) | | | | Foreign currency exchange (losses), net | (116) | | | (65) | | | | (51) | | | | (Losses) gains on foreign exchange forward contracts not designated as hedging instruments | | | (Losses) gains on foreign exchange forward contracts not designated as hedging instruments | | | Foreign currency exchange gains (losses), net | | | Foreign currency exchange gains (losses), net | | | Foreign currency exchange gains (losses), net | | | Interest income | | | Interest income | | | Interest income | Interest income | 119 | | | 176 | | | | (57) | | | | Interest expense | Interest expense | (24) | | | (26) | | | | 2 | | | | Interest expense | | | Interest expense | | | Other, net | | | Other, net | | | Other, net | Other, net | 3 | | | 5 | | | | (2) | | | | Total other income (expense), net | Total other income (expense), net | $ | (18) | | | $ | 90 | | | | $ | (108) | | | | Total other income (expense), net | | | Total other income (expense), net | |

The foreign currency exchange gains and losses were primarily attributed to the remeasurement of the Indian rupee denominated net monetary assets and liabilities in our U.S. dollar functional currency India subsidiaries and, to a lesser extent, the remeasurement of other net monetary assets and liabilities denominated in currencies other than the functional currencies of our subsidiaries. The gains and losses on our foreign exchange forward contracts not designated as hedging instruments related to the realized and unrealized gains and losses on foreign exchange forward contractscontracts entered into to offset our foreign currency exposure to non-U.S. dollar denominated net monetary assets and liabilities. exposures. As of December 31, 2020,2023, the notional value of our undesignated hedges was $637$1,317 million. The decreaseincrease in interest income of $57 millionand interest expense was each primarily attributable to lower yieldshigher interest rates in 2020. Provision for Income Taxesthe current period.

The provision for income taxes was $704 million in 2020 and $643 million in 2019. | | | | Provision for Income Taxes |

| | | | | | | | | | | | | | ê | $62M | | | | ¡Effective Income Tax Rateê0.2% | | | | |

The effective income tax rate increased to 33.6% in 2020 as compared to 25.3% in 2019decreased primarily driven by the Tax on Accumulated Indian Earnings, the impactgeographical mix of the Proposed Exit, which was not deductible for tax purposes, and the depreciation of the Indian rupee against the U.S. dollar, which resultedearnings in non-deductible foreign currency exchange losses in our consolidated statement of operations. Income (loss) from equity method investments

In 2019, we recorded an impairment charge of $57 million on one of our equity method investments2023 as further described incompared to 2022. See Note 511 to our consolidated financial statements.statements for additional information.In December 2021, the OECD adopted model rules for a global framework to impose a 15% global minimum tax referred to as Pillar Two with a targeted effective date of January 1, 2024. The OECD has continued and is continuing to issue additional guidance on the operation of the model rules. While the United States has not enacted Pillar Two, certain countries in which we operate have adopted their own version of the Pillar Two model rules. Although Management continues to monitor additional guidance from the OECD and countries’ implementation of Pillar Two, based on current guidance, we believe that our net income, cash flows, or financial condition will not be materially impacted by Pillar Two. Net IncomeTh

Net income was $1,392 million in 2020 and $1,842 million in 2019. Net income as a percentage of revenues decreased to 8.4% in 2020 from 11.0% in 2019. Thee decrease in net income was primarily driven by lower income from operations, partially offset by higher foreign currency exchange losses (inclusive of losses on our foreign exchange forward contracts not designated as hedging instruments), lower interest income and a higherlower provision for income taxes.taxes in 2023.

| | | | | | | | | | | ê | $164M | | | | | ê | 0.8% as a % of revenues | | | | | | ¡% of Revenues | | |

| | | | | | | | | | Cognizant | 34 | December 31, 2023 Form 10-K |

Non-GAAP Financial Measures Portions of our disclosure include non-GAAP financial measures. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures should be read in conjunction with our financial statements prepared in accordance with GAAP. The reconciliations of our non-GAAP financial measures to the corresponding GAAP measures set forth below should be carefully evaluated.

Our non-GAAP financial measures Adjusted Operating Margin and Adjusted Income Fromfrom Operations andexclude unusual items, such as NextGen charges. Our non-GAAP financial measure Adjusted Diluted EPS excludeexcludes unusual items. Additionally, Adjusted Diluted EPS excludesitems, such as NextGen charges and the effect of recognition in the third quarter of 2022 of an income tax benefit related to a specific uncertain tax position that was previously unrecognized in our prior-year consolidated financial statements, and net non-operating foreign currency exchange gains or losses and the tax impact of all the applicable adjustments. For further detail on the NextGen charges, see Note 4 to our audited consolidated financial statements. The income tax impact of each item excluded from Adjusted Diluted EPS is calculated by applying the

statutory rate and local tax regulations in the jurisdiction in which the item was incurred. Constant currency revenue growth is defined as revenues for a given period restated at the comparative period’s foreign currency exchange rates measured against the comparative period's reported revenues. Free cash flow is defined as cash flows from operating activities net of purchases of property and equipment.

We believe providing investors with an operating view consistent with how we manage the Company provides enhanced transparency into our operating results. For our internal management reporting and budgeting purposes, we use various GAAP and non-GAAP financial measures for financial and operational decision-making, to evaluate period-to-period comparisons, to determine portions of the compensation for our executive officers and for making comparisons of our operating results to those of our competitors. Therefore, it is our belief that the use of non-GAAP financial measures excluding certain costs provides a meaningful supplemental measure for investors to evaluate our financial performance. We believe that the presentation of our non-GAAP financial measures, alongwhich exclude certain costs, read in conjunction with our reported GAAP results and reconciliations to the most comparable GAAP measure, as applicable, can provide useful supplemental information to our management and investors regarding financial and business trends relating to our financial condition and results of operations. A limitation of using non-GAAP financial measures versus financial measures calculated in accordance with GAAP is that non-GAAP financial measures do not reflect all of the amounts associated with our operating results as determined in accordance with GAAP and may exclude costs that are recurring such as our net non-operating foreign currency exchange gains or losses. In addition, other companies may calculate non-GAAP financial measures differently than us, thereby limiting the usefulness of these non-GAAP financial measures as a comparative tool. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from our non-GAAP financial measures to allow investors to evaluate such non-GAAP financial measures. | | | | | | | | | | Cognizant | 35 | December 31, 2023 Form 10-K |

The following table presents a reconciliation of each non-GAAP financial measure to the most comparable GAAP measure, as applicable, for the years ended December 31: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2020 | | % of

Revenues | | 2019 | | % of

Revenues | | | | | | (Dollars in millions, except per share data) | | | | | | GAAP income from operations and operating margin | $ | 2,114 | | | 12.7 | % | | $ | 2,453 | | | 14.6 | % | | | | | Realignment charges (1) | 42 | | | 0.3 | | | 169 | | | 1.0 | | | | | | 2020 Fit for Growth Plan restructuring charges (2) | 173 | | | 1.0 | | | 48 | | | 0.3 | | | | | | COVID-19 Charges (3) | 65 | | | 0.4 | | | — | | | — | | | | | | Incremental accrual related to the India Defined Contribution Obligation (4) | — | | | — | | | 117 | | | 0.7 | | | | | | | Adjusted Income From Operations and Adjusted Operating Margin | 2,394 | | | 14.4 | | | 2,787 | | | 16.6 | | | | | | | | | | | | | | | | | | | GAAP diluted EPS | $ | 2.57 | | | | | $ | 3.29 | | | | | | | | | Effect of above adjustments, pre-tax | 0.52 | | | | | 0.60 | | | | | | | | Effect of non-operating foreign currency exchange losses (gains), pre-tax (5) | 0.22 | | | | | 0.11 | | | | | | | | Tax effect of above adjustments (6) | (0.15) | | | | | (0.15) | | | | | | | | Tax on Accumulated Indian Earnings (7) | 0.26 | | | | | — | | | | | | | | Effect of the equity method investment impairment (8) | — | | | | | 0.10 | | | | | | | | Effect of the India Tax Law (9) | — | | | | | 0.04 | | | | | | | | | Adjusted Diluted EPS | $ | 3.42 | | | | | $ | 3.99 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | (Dollars in millions, except per share data) | 2023 | | % of

Revenues | | 2022 | | % of

Revenues | | | | | | GAAP income from operations and operating margin | $ | 2,689 | | | 13.9 | % | | $ | 2,968 | | | 15.3 | % | | | | | NextGen charges (1) | 229 | | | 1.2 | | | — | | | — | | | | | | | Adjusted Income From Operations and Adjusted Operating Margin | $ | 2,918 | | | 15.1 | % | | $ | 2,968 | | | 15.3 | % | | | | | | | | | | | | | | | | | | GAAP diluted EPS | $ | 4.21 | | | | | $ | 4.41 | | | | | | | | | Effect of NextGen charges, pre-tax | 0.45 | | | | | — | | | | | | | | Effect of non-operating foreign currency exchange losses (gains), pre-tax (2) | — | | | | | (0.01) | | | | | | | | Tax effect of above adjustments (3) | (0.11) | | | | | 0.07 | | | | | | | | Effect of recognition of income tax benefit related to an uncertain tax position (4) | — | | | | | (0.07) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Adjusted Diluted EPS | $ | 4.55 | | | | | $ | 4.40 | | | | | | | | | | | | | | | | | | | | | Net cash provided by operating activities | $ | 2,330 | | | | | $ | 2,568 | | | | | | | | | Purchases of property and equipment | (317) | | | | | (332) | | | | | | | | | Free cash flow | $ | 2,013 | | | | | $ | 2,236 | | | | | | | |

(1) As part of our realignmentthe NextGen program, during 2020, the year ended December 31, 2023, we incurred employee retention costsseparation, facility exit and certain professional services fees and, during 2019, we incurred Executive Transition Costs, employee separation costs, employee retention costs and third party realignmentother costs. See Note 4 to our audited consolidated financial statements for additional information. (2) As part of our 2020 Fit for Growth plan, during 2020, we incurred certain employee separation, employee retention and facility exit costs and other charges and, during 2019, we incurred certain employee separation, employee retention and facility exit costs under the plan. See Note 4 to our consolidated financial statements for additional information.

(3) During2020, we incurred costs in response to the COVID-19 pandemic including a one-time bonus to our employees at the designation of associate and below in both India and the Philippines, certain costs to enable our employees to work remotely and provide medical staff and extra cleaning services for our facilities. Most of the costs related to the pandemic are reported in "Cost of revenues" in our consolidated statement of operations.

(4) In 2019, we recorded an accrual of $117 million related to the India Defined Contribution Obligation as further described in Note 15 to our consolidated financial statements.(5) Non-operating foreign currency exchange gains and losses, inclusive of gains and losses on related foreign exchange forward contracts not designated as hedging instruments for accounting purposes, are reported in "Foreign currency exchange gains (losses), net" in our consolidated statements of operations.

(6)(3) Presented below are the tax impacts of each of our non-GAAP adjustments to pre-tax income:income for the years ended December 31:

| | | | | | | | | | | | | | | For the years ended December 31, | | | | 2020 | | 2019 | | | | (in millions) | | Non-GAAP income tax benefit (expense) related to: | | | | | | | Realignment charges | $ | 11 | | | $ | 43 | | | | | 2020 Fit for Growth Plan restructuring charges | 45 | | | 13 | | | | | COVID-19 Charges | 17 | | | — | | | | | Incremental accrual related to the India Defined Contribution Obligation | — | | | 31 | | | | | Foreign currency exchange gains and losses | 6 | | | (1) | | | |

| | | | | | | | | | | | | | | | | | | (in millions) | 2023 | | 2022 | | | | Non-GAAP income tax benefit (expense) related to: | | | | | | | NextGen charges | $ | 59 | | | $ | — | | | | | Foreign currency exchange gains and losses | (6) | | | (39) | | | |

(7) In 2020, we reversed our indefinite reinvestment assertionThe effective tax rate related to non-operating foreign currency exchange gains and losses varies depending on Indian earnings accumulatedthe jurisdictions in prior yearswhich such income and recorded $140 millionexpenses are generated and the statutory rates applicable in those jurisdictions. As such, the income tax expense.effect of non-operating foreign currency exchange gains and losses shown in the above table may not appear proportionate to the net pre-tax foreign currency exchange gains and losses reported in our consolidated statements of operations.

(8) In 2019,(4) As previously reported in our 2022 Annual Report on Form 10-K, during the three months ended September 30, 2022, we recordedrecognized an impairment chargeincome tax benefit of $57$36 million on one ofrelated to a specific uncertain tax position that was previously unrecognized in our equity investments as further described in Note 5 to ourprior-year consolidated financial statements.(9) In 2019, we recorded a one-time net income tax expense of $21 million as a result The recognition of the enactmentbenefit in the third quarter of 2022 was based on management’s reassessment regarding whether this unrecognized tax benefit met the more-likely-than-not threshold in light of the lapse in the statute of limitations as to a new tax law in India.portion of such benefit.

| | | | | | | | | | Cognizant | 36 | December 31, 2023 Form 10-K |

| | | | | | | | | | | | | | | | Liquidity and Capital Resources |

Cash generated from operations has historically been our primary source of liquidity to fund operations and investments to grow our business. As of December 31, 2020,2023, we had cash, cash equivalents and short-term investments of $2,724$2,635 million. Additionally, as of December 31, 2020,2023, we had available capacity under our credit facilities of approximately $1,928 million.$2.0 billion. The following table provides a summary of our cash flows for the years ended December 31: | | 2020 | | 2019 | | | Increase / Decrease | | | (in millions) | | (in millions) | | | (in millions) | | | (in millions) | | | Net cash provided by (used in): | | | Net cash provided by (used in): | | | Net cash provided by (used in): | Net cash provided by (used in): | | | | | | Operating activities | Operating activities | | $ | 3,299 | | | $ | 2,499 | | | | $ | 800 | | | | Operating activities | | | Operating activities | | | Investing activities | | | Investing activities | | | Investing activities | Investing activities | | (1,238) | | | 1,588 | | | | (2,826) | | | | Financing activities | Financing activities | | (2,009) | | | (2,569) | | | | 560 | | | | Financing activities | | | Financing activities | | Other Cash Flow Information6 | | Other Cash Flow Information6 | | Other Cash Flow Information6 | | | Free cash flow | | | Free cash flow | | | Free cash flow | |

Operating activities6 The increase indecrease in cash generated fromprovided by operating activities for 2020in 2023 compared to 20192022 was primarily driven by an increase in income tax payments. In 2023, we made tax payments related to the mandatory capitalization of research and experimental expenditures for the 2022 tax year of approximately $300 million as well as the estimated tax payments for 2023 of approximately $230 million. Cash provided by operating activities for 2023 benefited from improved collections onof our trade accounts receivable deferrals of certain payments dueas compared to COVID-19 pandemic regulatory relief provided by several jurisdictions in which we operate, and lower incentive-based compensation payouts and cash taxes paid in 2020.2022. We monitor turnover, aging and the collection of trade accounts receivable by client. Our DSO calculation includes trade accounts receivable, net of allowance for doubtful accounts,credit losses, and contract assets, reduced by the uncollected portion of our deferred revenue. DSO was 7077 days as of December 31, 2020 and 732023, 74 days as of December 31, 2019.

Investing activities NetThe increase in cash used in investing activities in 20202023 compared to 2022 was primarily driven by lower net maturities of investments in 2023 as compared to 2022 and higher payments for acquisitions. Net cash provided by investing activitiesbusiness combinations in 2019 was driven by net sales of investments partially offset by payments for acquisitions and outflows for capital expenditures.2023.

Financing activities The decreasedecrease in cash used in financing activities in 20202023 compared to 2019 is2022 was primarily due todriven by lower repurchases of common stock in 2020.stock. We have a Credit Agreement providing for a $750$650 million Term Loan and a $1,750$1,850 million unsecured revolving credit facility, which are each due to mature in November 2023.October 2027. We are required under the Credit AgreementAgreement to make scheduled quarterly principal payments on the Term Loan.Loan beginning in December 2023. See Note 10 to our consolidated financial statements. During the first quarter of 2020, we borrowed $1.74 billion against our revolving credit facility and repaid this amount in full in the fourth quarter of 2020. We believe that we currently meet all conditions set forth in the Credit Agreement to borrow thereunder, and we are not aware of any conditions that would prevent us from borrowing part or all of the remaining available capacity under the revolving credit facility as of December 31, 20202023 and through the date of this filing. As of December 31, 2020,2023, we had no outstanding balance on our revolving credit facility. In February 2020,March 2023, our India subsidiary renewed its one-year 13working capital facility at 15 billion Indian rupee ($178180 million at the December 31, 20202023 exchange rate)working capital. This facility which requires us to repay any balances drawn down within 90 days from the date of disbursement. There is a 1.0% prepayment penalty applicable to payments made within 30 days ofafter disbursement. This working capital facility contains affirmative and negative covenants and may be renewed annually in February.annually. As of December 31, 2020, there was no balance outstanding2023, we have not borrowed funds under the working capital facility.this facility or any of its predecessor facilities. During 2020, we returned

6 $2,034 mFree cash flow is not a measurement of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” for more information. | | | | | | | | | | Cognizant | 37 | December 31, 2023 Form 10-K |

Capital Allocation Framework  | | | | | | | Acquisitions | | | | Share repurchases | | | | Dividend payments | | |

Our capital allocation framework anticipates the deployment of approximately 50% of our free cash flow7 for acquisitions, 25% for share repurchases under our stock repurchase program and $480 million in25% for dividend payments. Our stock repurchase program, as amended by our Board of Directors in December 2020, allows for the repurchase of an aggregate of up to $9.5 billion, excluding fees and expenses, of our Class A common stock. As of December 31, 2020, we have $2.8 billion, excluding fees and expenses, available for repurchases under the program. Our shares outstanding decreased to 530 million as of December 31, 2020 from 548 million as of December 31, 2019. We review our capital return planallocation on an on-goingongoing basis, considering the potential impacts of COVID-19 pandemic, our financial performance and liquidity position, investments required to execute our strategic plans and initiatives, acquisition opportunities, the economic outlook, regulatory changes and other relevant factors. As these factors may change over time, the actual amounts expended on stock repurchase activity, dividends, and acquisitions, if any, during any particular period cannot be predicted and may fluctuate from time to time. Other Liquidity and Capital Resources Information We seek to ensure that our worldwide cash is available in the locations in which it is needed. As part of our ongoing liquidity assessments, we regularly monitor the mix of our domestic and international cash flows and cash balances. We evaluate on an ongoing basis what portion of the non-U.S. cash, cash equivalents and short-term investments is needed locally to execute our strategic plans and what amount is available for repatriation back to the United States.States. In March 2020, the Indian parliament enacted the Budget of India, which contained a number of provisions related to income tax, including a replacement of the DDT, previously due from the dividend payer, with a tax payable by the shareholder receiving the dividend. This provision reduced the tax rate applicable to us for cash repatriated from India. Following this change, during the first quarter of 2020, we limited our indefinite reinvestment assertion to India earnings accumulated in prior years. In July 2020, the U.S. Treasury Department and the IRS released final regulations, which became effective in September 2020, that reduced the tax applicable on our accumulated Indian earnings upon repatriation. As a result, during the third quarter of 2020, after a thorough analysis of the impact of these changes in law on the cost of earnings repatriation and considering our strategic decision to increase our investments to accelerate growth in various international markets and expandour global delivery footprint, we reversed our indefinite reinvestment assertion on Indian earnings accumulated in prior years and recorded a $140 million Tax on Accumulated Indian Earnings. The recorded income tax expense reflects the India withholding tax on unrepatriated Indian earnings, which were $5.2 billion as of December 31, 2019, net of applicable U.S. foreign tax credits. On October 28, 2020, our subsidiary in India remitted a dividend of $2.1 billion, which resulted in a net payment of $2.0 billion to its shareholders (non-Indian Cognizant entities), after payment of $106 million of India withholding tax.

We expect our operating cash flows, cash and short-term investment balances, together with ourthe available capacity under our revolving credit facilities, to be sufficient to meet our operating requirements, including purchase commitments, tax payments, including Tax Reform Act transition tax payments, and serviceservicing our debt for the next twelve months. Our remaining Tax Reform Act transition tax payments are $123 million and $157 million in the years 2024 and 2025, respectively. In 2023, our Tax Reform Act transition tax payment was $94 million. In addition, we also have purchase commitments of approximately $615 million that will be paid over the next four years, of which approximately $180 million will be paid during the next twelve months. In addition, see Note 7 to our consolidated financial statements for a description of our operating lease obligations.In connection with our ongoing dispute with the ITD, on January 8, 2024, the SCI ruled that, in order to proceed with our appeal, we must deposit 30 billion Indian rupees ($355 million at the December 31, 2023 exchange rate), representing the time deposits of CTS India under lien, on the condition that, if CTS India prevails at the High Court, the amount deposited will be returned to CTS India, along with interest accrued, within 4 weeks of the judgment. The SCI also requested the High Court to consider and dispose of the appeal as expeditiously as possible, preferably within 6 weeks of the January 8, 2024 ruling. We made the required deposit in January 2024. See Note 11 to our consolidated financial statements. The ability to expand and grow our business in accordance with current plans, make acquisitions, meet our long-term capital requirements beyond a twelve-month period and execute our capital return plan will depend on many factors, including the rate, if any, at which our cash flow increases, our ability and willingness to pay for acquisitions with capital stock and the availability of public and private debt, including the ability to extend the maturity of or refinance our existing debt, and equity financing. We cannot be certain that additional financing, if required, will be available on terms and conditions acceptable to us, if at all.

| | | | | | | | | | | | | | | Commitments and Contingencies |

Commitments

As of December 31, 2020, we had the following obligations and commitments to make future payments under contractual obligations and commercial commitments:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Payments due by period | | | | Total | | Less than

1 year | | 1-3 years | | 3-5 years | | More than

5 years | | | | (in millions) | Long-term debt obligations(1) | | $ | 703 | | | $ | 38 | | | $ | 665 | | | $ | — | | | $ | — | | Interest on long-term debt(2) | | 19 | | | 7 | | | 12 | | | — | | | — | | | Finance lease obligations | | 23 | | | 11 | | | 11 | | | 1 | | | — | | | Operating lease obligations | | 1,271 | | | 260 | | | 398 | | | 264 | | | 349 | | Other purchase commitments(3) | | 432 | | | 216 | | | 184 | | | 28 | | | 4 | | | Tax Reform Act transition tax | | 478 | | | 50 | | | 145 | | | 283 | | | — | | | Total | | $ | 2,926 | | | $ | 582 | | | $ | 1,415 | | | $ | 576 | | | $ | 353 | |

(1) Consists of scheduled repayments of our Term Loan.

(2) Interest on the Term Loan was calculated at interest rates in effect as of December 31, 2020.

(3) Other purchase commitments include, among other things, communications and information technology obligations, as well as other obligations that we cannot cancel or where we would be required to pay a termination fee in the event of cancellation.

As of December 31, 2020, we had $193 million of unrecognized income tax benefits. This represents the income tax benefits associated with certain income tax positions on our U.S. and non-U.S. tax returns that have not been recognized on our financial statements due to uncertainty regarding their resolution. The resolution of these income tax positions with the relevant taxing authorities is at various stages, and therefore we are unable to make a reliable estimate of the eventual cash flows by period that may be required to settle these matters.

Contingencies

See Note 15 to our consolidated financial statements for additional information.

| | | | | | | | | | | | | | | Off-Balance Sheet Arrangements |

Other than our foreign exchange forward and option contracts, there were no off-balance sheet transactions, arrangements or other relationships with unconsolidated entities or other persons in 2020 and 2019 that have, or are reasonably likely to have, a current or future effect on our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

| | | | | | | | | | | | | | | | Critical Accounting Estimates |

Management’s discussion and analysis of our financial condition and results of operations is based on our accompanying consolidated financial statements that have been prepared in accordance with GAAP. We base our estimates on historical experience, current trends and on various other assumptions that are believed to be relevant at the time our consolidated financial statements are prepared. We evaluate our estimates on a continuous basis. However, the actual amounts may differ from the estimates used in the preparation of our consolidated financial statements.

We believe the following accounting estimates are the most critical to aid in fully understanding and evaluating our consolidated financial statements as they require the most difficult, subjective or complex judgments, resulting from the need to make estimates about the effect of matters that are inherently uncertain. Changes to these estimates could have a material effect on our results of operations and financial condition. Our significant accounting policies are described in Note 1 to our consolidated financial statements. 7 Free cash flow is not a measurement of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” for more information. | | | | | | | | | | Cognizant | 38 | December 31, 2023 Form 10-K |

Revenue Recognition. Revenues related to fixed-price contracts for application development and systems integration services, consulting or other technology services are recognized as the service is performed using the cost to costcost-to-cost method, under which the total value of revenues is recognized on the basis of the percentage that each contract’s total labor cost to dateto-date bears to the total expected labor costs. Revenues related to fixed-price application maintenance, testingquality engineering and assurance and business process services are recognized using the cost to costcost-to-cost method, if the right to invoice is not representative of the value being delivered. The cost to costcost-to-cost method requires estimation of future costs, which is updated as the project progresses to reflect the latest available information. Such estimates and changes in estimates involve the use of judgment. The cumulative impact of any revision in estimates is reflected in the financial reporting period in which the change in estimate becomes known. Net changes in estimates of such future costs and contract losses were immaterial to the consolidated results of operations for the periods presented. Income Taxes. Determining the consolidated provision for income tax expense,taxes, deferred income tax assets (and related valuation allowance, if any) and liabilities requires significant judgment. We are required to calculate and provide for income taxes in each of the jurisdictions where we operate. Changes in the geographic mix of income before taxes or estimated level of annual pre-tax income can affect our overall effective income tax rate. In addition, transactions between our affiliated entities are arranged in accordance with applicable transfer pricing laws, regulations and relevant guidelines. As a result, and due to the interpretive nature of certain aspects of these laws and guidelines, we have pending applications for APAs before the taxing authorities in some of our most significant jurisdictions. It could take years for the relevant taxing authorities to negotiate and conclude these applications. The consolidated provision for income taxes may change period to period based on changes in facts and circumstances, such as settlements of income tax audits, the expiration of the applicable statute of limitations or finalization of our applications for APAs. Our provision for income taxes also includes the impact of reserves established for uncertain income tax positions, as well as the related interest, which may require us to apply judgment to complex issues and may require an extended period of time to resolve. Although we believe we have adequately reserved for our uncertain tax positions, no assurance can be given that the final outcome of these matters will not differ from our recorded amounts. We adjust these reserves in light of changing facts and circumstances, such as the closing of a tax audit.audit or the expiration of the applicable statute of limitations. To the extent that the final outcome of these matters differs from the amounts recorded, such differences will impact the provision for income taxes in the period in which such determination is made. Business Combinations, Goodwill and Intangible Assets. Goodwill and intangible assets, including indefinite-lived intangible assets, arise from the accounting for business combinations. We account for business combinations using the acquisition method which requires us to estimate the fair value of identifiable assets acquired, liabilities assumed, including any contingent consideration, and any noncontrolling interest in the acquiree to properly allocate purchase price to the individual assets acquired and liabilities assumed. The allocation of the purchase price utilizes estimates and assumptions in determining the fair values of identifiable assets acquired and liabilities assumed, especially with respect to intangible assets, including the timing and amount of forecasted revenues and cash flows, anticipated growth rates, client attrition rates and the discount rate reflecting the risk inherent in future cash flows.