UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedAugust 31, 20172021

[ ]TRANSITION]TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from [ ] to [ ]

Commission file number000-51866

ENERTOPIA CORP.

(Exact name of registrant as specified in its charter)

Nevada | 20-1970188 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

#18 1873 SPALL RD., KELOWNA, BRITISH | |

COLUMBIA, CANADA | V1Y 4R2 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: 250-870-2219 | |

Registrant's telephone number, including area code:250-765-6412

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange On Which Registered |

N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

N/A

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act

Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large"large accelerated filer,” “accelerated filer”" "accelerated filer" and “smaller"smaller reporting company”company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] | Accelerated filer [ ] |

Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

State the aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and ask price of such common equity, as of the last business day of the registrant’sregistrant's most recently completed second fiscal quarter.

The aggregate market value of Common Stock held by non-affiliates of the Registrant on February 28, 20172021 [129,726,700] was $6,948,750$18,486,054 based on a $0.075$0.1425 closing price for the Common Stock on February 28, 2017.2021. For purposes of this computation, all executive officers and directors have been deemed to be affiliates. Such determination should not be deemed to be an admission that such executive officers and directors are, in fact, affiliates of the Registrant.

Indicate the number of shares outstanding of each of the registrant’sregistrant's classes of common stock as of the latest practicable date.

104,898,031142,002,700 common shares as of November 10, 20172, 2021

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

PART I

Item 1. Business

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”"may", “should”"should", “expects”"expects", “plans”"plans", “anticipates”"anticipates", “believes”"believes", “estimates”"estimates", “predicts”"predicts", “potential”"potential" or “continue”"continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”"Risk Factors" that may cause our or our industry’sindustry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares”"common shares" refer to the common shares in our capital stock.

As used in this annual report and unless otherwise indicated, the terms "we", "us", "our”"our", “our"our Company, “the Company”"the Company", and "Enertopia" mean Enertopia Corp.

General Overview

Enertopia Corp. was formed on November 24, 2004 under the laws of the State of Nevada and commenced operations on November 24, 2004.

From inception until April 2010, we were primarily engaged in the acquisition and exploration of natural resource properties. Beginning in April 2010, we began our entry into the renewable energy sector by purchasing an interest in a solar thermal design and installation company. In late summer 2013, we began our entry into medicinal marijuana business. During our 2014 fiscal year end our activities in the clean energy sector were discontinued. During fiscal 2015 our activities in the Medicinal Marijuana sector were discontinued. During fiscal 2016 our activities in the Women’sWomen's personal healthcare sector were discontinued.

The Company is actively pursuing business opportunities inannounced the resource sector, whereby we signed a definitive agreement for a Lithium Brine Project in May 2016. In May 2017 the Company dropped the Lithium Brine Project and subsequently acquiredacquisition of the Clayton Valley NV Lithium Project announcedproject in August 2017.The Company’s main focus is2017. The company has been focused on using modern technology on extracting lithium and verifying or sourcing other intellectual property in natural resource sectorthe EV & green technology sectors in developing environmental solutions. In May and licensed patent pending technology from Genesis Water Technologies, used for Lithium extraction through brines.August 2021, it announced three provisional patents applicable to the above sectors.

The address of our principal executive office is 156 Valleyview RD,#18 1873 Spall Rd., Kelowna, British Columbia V1X 3M4.V1Y 4R2. Our telephone number is (250) 765-6412. In addition, we have a second office located in Kelowna, British Columbia.870-2219. Our current location provideprovides adequate office space for our purposes at this stage of our development.

Summary of Recent Business

Our Company is diverse in its pursuit of business opportunities in the natural resource sector and clean technology used in the resource sector.

OnSeptember 19, 2016, we entered into a one year Investor Relations Consulting agreement with Duncan McKay. Based on the terms of the agreement, Mr. McKay can earn up to a maximum of 10% commissions on capital raised. We issued 800,000 stock options with an exercise price of $0.07.

OnSeptember 23, 2016, we closed the final tranche of a private placement of 3,858,571 units at a price of CAD$0.035 per unit for gross proceeds of CAD$135,050. Each unit consistsof one common share of our Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of our Company for a period of 24 months from the date of issuance, at a purchase price of US$0.07. A cash finders’ fee of CAD$3,300 and 286,666 full broker warrants that expire June 8, 2019 was paid to Canaccord Genuity and Leede Jones Gable.

OnOctober 7, 2016, we issued 175,000 common shares of our Company and paid $5,000 to comply with the Definitive Agreement signed May 12, 2016.

OnDecember 6, 2016, we signed a Definitive Commercial Agreement with Genesis Water Technologies with regard to the acquisition of exclusive licensing rights of the technology as outlined in the agreement.

OnJanuary 20, 2017, the Company closed the first tranche of a private placement of 1,000,000 units at a price of CAD$0.04 per unit for gross proceeds of CAD $40,000. Each unit consists of one common share of the Company and one-nontransferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.06. A cash finders’ fee of CAD$800 and 20,000 full broker warrants that expire January 20, 2019 was paid to Leede Jones Gable Inc.

OnJanuary 20, 2017, the Company granted 1,535,000 stock options to directors, officers and consultant of the Company with an exercise price of $0.07 which vested immediately, expiring January 20, 2022.

OnJanuary 31, 2017, the Company granted 1,500,000 stock options to consultant of the Company with an exercise price of $0.07 vested immediately, expiring January 31, 2022.

OnFebruary 28, 2017, the Company closed the first tranche of a private placement of 4,250,000 units at a price of CAD$0.04 per unit for gross proceeds of CAD $170,000. Each unit consists of one common share of the Company and one-nontransferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.06. A cash finders’ fee of CAD$11,100 and 227,500 full broker warrants that expire February 28, 2019 was paid to Leede Jones Gable Inc., Canaccord Genuity and Duncan McKay.

OnFebruary 28, 2017,29, 2020 the Company signed a Letter1% royalty agreement with respect to any future commercial lithium production from the Company's Clayton Valley, Nevada claims in exchange for $250,000. The Company has a right of Engagement with Adam Mogilfirst refusal to repurchase the royalty upon any proposed sale by the royalty holder to a third party.

On November 12, 2020 the Company signed Flathead Business Solutions to a 12 month contract for $12,000 and issued 1,000,000 warrantthe issuance of 500,000 stock options valid for 5 years at $0.05 cents each.

On December 14, 2020 the Company signed Definitive Agreement to convert toacquire 100% interest in United States Patent and Trademark Office ("USPTO") patent #6,024,086 - Solar energy collector having oval absorption tubes by issuing 1,000,000 common shares of the Company. The Company issued 1,000,000 additional common shares in escrow to Adam Mogil to provide corporate services. The warrants have an exercise pricebe released upon the successful approval of $0.09 and expire August 28, 2017. These warrant options expired without being exercised.patent pending work derived from patent #6,024,086.

OnApril 21, 2017, December 14, 2020 the Company signed Rodney Blake to a 12 month contract for the issuance of 100,000 stock options valid for 5 years at $0.05 cents each.

On December 14, 2020 the Company signed Albert Clark Rich to a 12 month contract for the issuance of 500,000 stock options valid for 5 years at $0.05 cents each.

On January 9, 2021 the Company issued 95,50070,000 common shares for gross proceedsas a result of $5,685 from the exercise of warrants of previous financings70,000 options exercised at $0.05 and $0.07.

OnApril 30, 2017 the Company issued 166,500 shares for gross proceeds of $11,655 from the exercise of warrants from a previous financing at $0.07.

OnApril 30, 2017, the Company closed the first and final tranche of a private placement of 3,224,000 units at a price of CAD$0.09$0.065 per unit for gross proceeds of CAD $290,160. Each unit consists of one common share of the Company and one-nontransferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.12. A cash finders’ fee of CAD$20,736 and 230,400 full broker warrants that expire April 28, 2019 was paid to Leede Jones Gable and Canaccord Genuity.

OnMay 5, 2017, the Company granted 500,000 stock options to consultant of the Company with an exercise price of $0.10 vested immediately, expiring May 5, 2022.

OnMay 5, 2017, the Company terminated the Definitive Agreement dated May 12, 2016 with the Vendor on the Nevada Lithium brine properties.

OnJuly 31, 2017, the Company announced the resignation of CFO and Director Bal Bhullar, the appointment of Kristian Ross as director and president Robert McAllister assuming the interim duties of CFO.

OnAugust 14, 2017 the Company announced the appointment of Davidson and Company, LLP, Chartered Professional Accountants as its new independent registered auditing firm which replaced MNP LLP independent registered auditing firm.

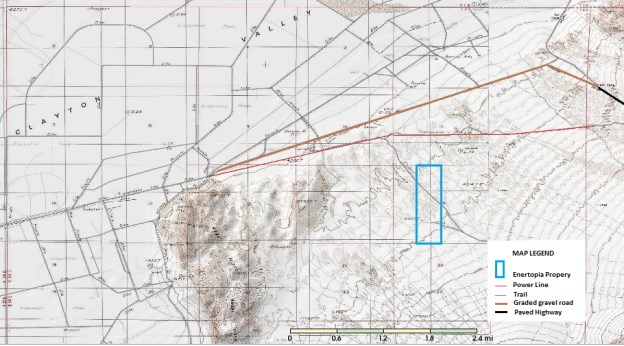

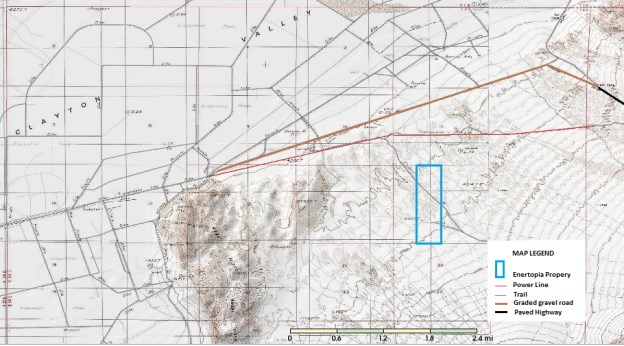

OnAugust 30, 2017 the Company announced the Staking of lode and placer claims covering approximately 160 acres for Lithium in Clayton Valley, NV.

Chronological Overview of our Business over the Last Five Yearsshare.

On January 31, 2011, the Company entered into a letter of intent and paid US$7,500 deposit to Wildhorse Copper Inc. and its wholly owned subsidiary Wildhorse Copper (AZ) Inc. (collectively, the “Optionors”). On April 11, 2011, the Company signed a Mineral Purchase Option Agreement with the Optionors respecting an option to earn a 100% interest, subject to a 1% NSR capped to a maximum of $2,000,000 in a property known as the Copper Hills property. The Copper Hills property was comprised of 56 located mining claims covering a total of 1,150 acres located in New Mexico, USA. The Optionors held the Copper Hills property directly and indirectly through property purchase agreements between the Optionors and third parties (collectively, the “Indirect Agreements”). Pursuant to the Option Agreement the Optionors assigned the Indirect Agreements to the Company. In order to earn the interest in the Copper Hills property, the Company was required to make aggregate cash payments of $591,650 over an eight year period and issue an aggregate of 1,000,000 shares of its common stock over a three year period. As at August 31, 2012, the Company issued 500,000 shares at price of $0.15 per share and 150,000 shares at price of $0.10 per share to the Optionors and made aggregate cash payment of $106,863 (August 31, 2011-$72,045); the Company has expensed the exploration costs of $143,680 (August 31, 2011-$14,094).

On March 3, 2011, we14, 2021, Enertopia closed a private placement of 8,729,0003,000,000 units at a price of CAD$0.10 per unit for gross proceeds of CAD$872,900, US$893,993. Each unit consisted of one common share in the capital of our company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share in the capital of our company until March 3, 2013, subject to accelerated expiry as set out in the warrant certificate, at a purchase price of CAD$0.20. Per the terms of the Subscription Agreement, our company granted to the Subscribers a participation right to participate in future offerings of our securities as to their pro rata shares for a period of 12 months from the closing of the private placement. We paid broker commissions of $48,930 in cash and issued 489,300 brokers warrants. Each full warrant entitled the holder to purchase one additional common share in the capital of our company until March 3, 2013, subject to accelerated expiry as set out in the warrant certificate, at a purchase price of CAD$0.20.

On March 16, 2011, we entered into a debt settlement agreement with an officer of our company, whereby we issued 78,125 shares of common stock in connection with the settlement of $12,500 debt at a deemed price of $0.16 per share pursuant to a consulting agreement. We recorded $12,422 in additional paid in capital for the gain on the settlement of the debt.

On April 27, 2011, we entered into a debt settlement agreement with the President of our Company regarding a related party in the amount of $46,000, whereby $25,000 was settled by issuing common shares of 100,000, and $21,000 was forgiven for Nil consideration. In connection with the debt settlement, we recorded $100 in share capital and $45,900 in additional paid in capital for the gain on the settlement of the debt.

On May 31, 2011, we settled the amount due to related parties into two promissory notes of $80,320 (CAD$84,655) and $90,000. Both promissory notes were unsecured, non-interest bearing and due on May 31, 2012 at an imputed interest rate of 12% per annum upon the settlement. On April 27, 2011, we entered into a debt settlement agreement with one of the holders, a company controlled by the Chairman/CEO of our Company, whereby we issued 360,000 common shares to the holder, and the holder agreed to accept the shares as full and final payment of the promissory note of $90,000. On the same day, we entered into a debt settlement agreement with a company controlled by the Chairman/CEO of our Company, whereby the holder agreed to forgive the repayment of debt for Nil consideration. In connection with the settlements and forgiveness of the above promissory notes, the Company recorded $79,997and $77,415 in additional paid in capital for the gain on settlement of debt, respectively.

On June 22, 2011, Chang Lee LLP (“Chang Lee”) resigned as our independent registered public accounting firm because Chang Lee was merged with another company: MNP LLP (“MNP”). Most of the professional staff of Chang Lee continued with MNP either as employees or partners of MNP and continued their practice with MNP. On June 22, 2011, we engaged MNP as our independent registered public accounting firm.

On July 19, 2011, we entered into a letter of intent and paid US$15,000 deposit to Altar Resources. Subsequent to August 31, 2011, on October 11, 2011, we signed a Mineral Purchase Option Agreement with Altar Resources with respect to an option to earn 100% interest, subject to a 2.5% NSR in a property known as Mildred Peak. The mining claims were located in Arizona, and covered approximately 6,220 acres controlled by Altar Resources directly and indirectly through federal mining claims and state mineral exploration leases. The Company was required to make aggregate cash payments of $881,000 over a five year period and issue an aggregate of 1,000,000 shares of its common stock over a four year period. As at August 31, 2012, Enertopia had made aggregate cash payments of $84,980 and issued 100,000 shares at price of $0.10 per share to Altar Resources, and expensed the exploration costs of $31,423 in relation to the property.

On January 6, 2012, we entered into a share purchase agreement with a third party. The Company agreed to sell to the Purchaser 250,000 units of Lexaria Corp. at a purchase price of US$0.15 per unit, for a total of US$37,500, by the effective closing date of January 6, 2012. In addition, pursuant to the terms of the Agreement, the purchaser had an option, at its sole discretion, to pay US$0.25 per unit or approximately US$62,500 to purchase the remaining 249,893 units on or before March 2, 2012. The Purchaser did not exercise the option to purchase the remaining 249,893 units.

On February 9, 2012, the Company signed a Loan Agreement with Robert McAllister, director of the Company to borrow $50,000 (CAD$50,000). The loan was unsecured, due on May 9, 2012 and subject to an interest rate of 10% per annum. This loan was repaid in full in 2014.

On March 19, 2012, the Company’s Board appointed Dr. John Thomas as Director and Mr. Tony Gilman and Dr. Stefan Kruse as Advisors of the Company. The Company concurrently granted an additional 450,000 stock options to Directors and Advisors of the Company. The exercise price of the stock options was $0.15, of which 225,000 options vested immediately and 225,000 options vested on August 15, 2012. The options expire March 19, 2017. On March 27, 2012, the Company granted 250,000 stock options to an Investor Relations company with an exercise price of $0.15, of which 125,000 vested immediately and 125,000 vested on June 27, 2012, all of which expire on March 27, 2017.

On April 10, 2012, the Company granted 25,000 stock options to a consultant of the Company with an exercise price of $0.15, which vested immediately and expire on April 10, 2017.

All proposals were approved by the shareholders. The proposals are described in detail in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on March 13, 2012.

On April 10, 2012, the Company issued 93,750 common shares in connection with the settlement of debt of $9,375 at a price of $0.10 per common share pursuant to a consulting agreement (See Note 11(h)).

On April 13, 2012, the Company closed an offering memorandum placement of 2,080,000 units at a price of CAD$0.10 per unit for gross proceeds of CAD$208,000, US$208,000. Each Unit consisted of one common share of the Issuer and one common share purchase warrant. Each warrant was exercisable into one further common share at a price of US$0.15 per warrant share for a period of twelve months following closing; or at a price of US$0.20 per warrant for the period that was twelve months plus one day to twenty-four months following closing. The Company paid broker commissions of $14,420 in cash and issued 144,200 brokers warrants in connection with the private placement.

On July 27, 2012, the Company closed the first tranche of an offering memorandum placement of 600,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$30,000 or US$30,000. Each Warrant was exercisable into one further share at a price of US$0.10 per warrant share for a period of twelve months following closing; or at a price of US$0.20 per warrant share for a period that is twelve months and one day to thirty-six months following closing. The Company’s President and CEO participated in the private placement for $10,000.00 and $5,000.00 dollars respectively. The Company issued 60,000 brokers warrants in connection with the private placement.

On July 30, 2012, the Company entered into a share purchase agreement with the President of the Company, Robert McAllister. The Company sold to Mr. McAllister 249,893 shares of Lexaria Corp. at a purchase price of US$0.075 per share, for a total of US$18,741. As at August 31, 2012, the difference of the purchase price of $0.075 per share and the stock market price of $0.11 per share, in the amount of $8,746, was recorded as stock based compensation.

On August 24, 2012, the Company closed the second tranche of an offering memorandum placement of 160,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$8,000 or US$8,000. Each warrant was exercisable into one further share at a price of US$0.10 per warrant share for the period of twelve months following closing; or at a price of US$0.20 per warrant share for the period of twelve months and one day to thirty-six months following closing. The Company’s President participated in the private placement for $4,000.00 dollars. The Company issued 16,000 brokers warrants in connection with the private placement for broker commissions.

On September 28, 2012, the Company closed an offering memorandum placement of 995,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$49,750 or US$49,750. Each Unit consisted of one common share of the Issuer and one common share purchase warrant. Each warrant was exercisable into one further common share at a price of US$0.15 per warrant share for a period of twelve months following closing; or at a price of US$0.20 per warrant for the period of twelve months plus one day to twenty-four months following closing. The Company issued 79,500 shares, 79,500 warrants and 79,500 broker warrants in connection with the private placement.

On October 24, 2012, the Company issued 100,000 common shares to Altar Resources at the price of $0.06. per share ($6,000 in the aggregate) pursuant to its option agreement for Mildred Peak property

On November 15, 2012, the Company closed an offering memorandum placement of 1,013,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$50,650 or US$50,650. Each Unit consisted of one common share of the Issuer and one common share purchase warrant. Each warrant was exercisable into one further common share at a price of US$0.10 per warrant share for a period of twelve months following closing; or at a price of US$0.20 per warrant for the period of twelve months plus one day to twenty-four months following closing. The Company issued 38,000 common shares, 101,300 units, and 101,300 broker warrants in connection with the private placement.

As at August 31, 2012, we had acquired a 9.82% (August 31, 2011 – 8.14%) ownership interest in Global Solar Water Power Systems Inc. (“GSWPS”) pursuant to our February 28, 2010 Asset and Share Purchase Agreement with Mr. Mark Snyder. The aggregate purchase cost was $145,500 and an issuance of 500,000 shares of the Company at $0.25 per share for a combined value of $270,500. In November 2012, we obtained a valuation report from RwE Growth Partners Inc. regarding our investment in GSWPS. As a result of the report, the Company’s long-term investment in GSWPS was written down to $68,500 during fiscal 2012

On March 1, 2013, we settled accrued consulting fees of $42,000 payable to Mr. Mark Snyder by transferring 1.68% of our ownership interest in GSWPS back to Mr. Snyder, thereby reducing the our interest in GSWPS from 9.82% to 8.14% . During the year ended August 31, 2013, based on our management’s assessment of GSWPS’s current operations, we wrote down our long-term investment in GSWPS to $1.

On March 1, 2013, the Company settled a debt of $16,000 incurred from September 1, 2011 to February 28, 2013 for consulting fees paid to Mr. Mark Snyder by issuing 160,000 restricted common shares of the Company at a price of $0.10 per share.

On May 30, 2013, the Company terminated its Option Agreement with Altar Resources with respect to the Mildred Peak property.

On June 26, 2013, the Company terminated its Option Agreement with Wildhorse Copper Inc. with respect to the Copper Hills property.

On September 17, 2013 we entered into an AMI Participation Agreement with Downhole Energy LLC to participate in 100% gross interest and 75% net revenue interest for drilling, completion and production of up to 100 oil wells on certain oil and gas leases covering 2,924 in the historic field located in Forest and Venango counties, Pennsylvania. On execution of this agreement we issued 100,000 of our common shares to Downhole Energy LLC. The Company decided not to continue with the agreement and wrote off the asset.

On October 4, 2013 we entered into a consulting agreement with Olibri Acquisitions and issued 750,000 of our common shares to Olibri.

On November 1, 2013 we entered into a Letter of Intent Agreement (“LOI”) with 0786521 BC Ltd. (also known as World of Marijuana Productions Ltd. or WOM) to acquire 51% of the issued and outstanding capital stock of WOM. WOM was the owner and operator of a Medical Marihuana operation located in Mission, British Columbia, Canada. The LOI was not comprehensive and subject to the negotiation of a definitive agreement. Upon execution of the LOI, we issued 10,000,000 of our common shares to WOM. The LOI was superseded by our joint venture agreement with WOM dated January 16, 2014, described below.

On November 5, 2013 we granted 675,000 stock options to directors, officers, and consultant of our Company with an exercise price of $0.06 vested immediately, expiring November 5, 2018.

On November 18, 2013, we granted 25,000 stock options to consultant of our with an exercise price of $0.09 vested immediately, expiring November 18, 2018.

On November 18, 2013, we entered into an investor relations contract with Coal Harbour Communications Inc. The initial term of this agreement began on the date of execution of the agreement and continue fortwo months. Thereafter the agreement continues on a month-by-month basis subject to cancelation by 30 days written notice. In consideration for the services the Company paid the designees of Coal Harbour Communications a one-time payment of two hundred thousand shares (200,000) of our restricted common stock. We also agree to pay to Coal Harbour Communications a monthly fee of $5,000 payable on the 1st day of each monthly period starting 60 days from the signing of the agreement and $500 per month to cover expenses incurred on our Company’s behalf. Any expenses above $500 per month must be pre-approved.

On November 26, 2013, our Company closed the first tranche of a private placement of 2,720,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$136,000 ($136,000). Each warrant is exercisable into one further share at a price of US$0.10 per warrant share for a period of thirty-six month following the close.

On November 29, 2013, our wholly-owned subsidiary, Target Energy, Inc. was discontinued and dissolved.

On December 23, 2013, we closed the final tranche of a private placement of 2,528,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$126,400 ($126,400). Each warrant is exercisable into one further share at a price of $0.10 per warrant share for a period of thirty-six months following closing. We also paid a cash finders’ fee of $10,140 and 202,800 broker warrants to Canaccord Genuity and Wolverton Securities that are exercisable into one common share per warrant at a price of $0.10 that expire on December 23, 2016.

On January 1, 2014, we entered into a Social Media/Web Marketing Agreement with Stuart Gray. The initial term of the agreement began on the date of execution and continued for threemonths. In consideration for the services we paid Stuart Gray a monthly fee of $5,000. As additional compensation we issued 200,000 stock options to Mr. Gray. The exercise price of the stock options is $0.075, with 100,000 stock options vested immediately, 50,000 stock options vested 30 days after the grant, and 50,000 stock options vested 60 days after the grant, expiring January 1, 2019.

On January 13, 2014, we entered into a corporate development agreement with Don Shaxon for an initial term of twelve months. Thereafter the agreement continued on a month-by-month basis subject to cancelation by 30 days written notice. In consideration for the services we paid to Mr. Shaxon a signing stock bonus of 250,000 of our common shares, a one-time cash bonus of $40,000, and a monthly fee of $3,500 plus $500 in monthly expenses. Upon execution of the Agreement we also granted 250,000 stock options to Mr. Shaxon with an exercise price of $0.16, vesting immediately and expiring January 13, 2019.

On January 16, 2014 we entered into a Joint Venture Agreement with WOM to acquire up to a 51% ownership interest in a prospective medical marijuana production facility to be located at WOM’s establishment in Mission, British Columbia. WOM was to hold a 49% interest in the joint venture and was responsible to acquire a medical marijuana production licence from Health Canada. The Joint Venture Agreement superseded the Letter of Intent between our company and WOM dated November 1, 2013 (the "LOI"). As at March 11, 2014 our Company had earned a 31% interest in the World of Marijuana Joint Venture by paying and advancing $375,000 and issuing 16,000,000 million shares of our common stock. The $375,000 was intended to fund the joint venture through completion of facility upgrades and completion of the licensing process. Pursuant to the terms of the Joint Venture Agreement, our company could purchase up to a 51% interest in the joint venture in consideration of an additional 4,000,000 shares and $1,000,000 in the aggregate. On January 31, 2014, we accepted and received gross proceeds of CAD$40,500 (US$37,500), for the exercise of 350,000 stock options; 100,000 at $0.075 each, 150,000 stock options at $0.10 each, and 100,000 stock options at $0.15 each; into 350,000 common shares of our Company.

On January 31, 2014, we closed the first tranche of a private placement of 4,292,000 units at a price of US$0.10 per unit for gross proceeds of US$429,200. Each Unit consists of one share of our common stock and one half (1/2) of one non-transferable common share purchase warrant Each whole warrant is exercisable to purchase one common share at a price of US$0.15 per share for a period of twenty four (24) months following closing. A cash finders’ fee consisting of $29,616 and 296,160 full broker warrants that expire on January 31, 2016 with an exercise price of $0.15 was paid to Canaccord Genuity, Leede Financial and Wolverton Securities.

On February 5, 2014, Ryan Foster joined our Company as an advisor. We granted 50,000 stock options to Mr. Foster with an exercise price of $0.35 per common share expiring February 5, 2019. 25,000 of the stock options vested immediately and 25,000 vested on July 1, 2014.

On February 13, 2014, we closed the final tranche of a private placement by issuing 12,938,000 units at a price of US$0.10 per unit for gross proceeds of US$1,293,800. Each unit consists of one common share and one half (1/2) of one non-transferable share purchase warrant with each whole warrant exercisable into one common share at a price of US$0.15 per share for a period of twenty four (24) months following closing. One director and one officer of our Company participated in the final tranche for $30,000. A cash finders’ fee consisting of $98,784; 8,000 common shares in lieu of $800 and 995,840 full broker warrants that expire on February 13, 2016 with an exercise price of $0.15 was paid to Canaccord Genuity, Global Market Development LLC and Wolverton Securities.

On February 13, 2014, 50,000 stock options were exercised at a price of $0.06 by a Director and 50,000 stock options were exercised at a price of $0.075 by a Consultant for net proceeds to our Company of CAD$7,050 (US$6,750) into 100,000 common shares of the Company.

On February 13, 2014, 541,500 warrants from previous private placements were exercised into 541,500 common shares of our Companyper unit for net proceeds of $101,100.

On February 27, 2014, 585,000 warrants from previous private placements were exercised into 585,000 common shares of our Company for net proceeds of $115,000.

On February 27, 2014, we signed a $50,000 12 month marketing agreement with Agoracom payable in shares of our common stock. The first quarter payment of $12,500 was paid with the issuance of 54,347 common shares of our Company at a market price of $0.23 per share.

On February 28, 2014, we entered into a Joint Venture Agreement with The Green Canvas Ltd.("GCL") pursuant to which we could acquire up to a 75% interest in the business of GCL, being the business of legally producing, manufacturing, propagating, importing/exporting, testing, researching and developing, and selling marijuana for medical purposes. We paid $100,000 to the GCL upon execution of the agreement. Subsequently, we issued to GCL an aggregate of 10,000,000 of our common shares at a price of $0.235 per share; and paid to GCL the aggregate sum of $500,000, to earn a 49% interest in GCL’s business by February 28, 2015. With the exception of $113,400 payable to Wolverton Securities, the full amount of the $500,000 was to be used by GCL to upgrade the GCL’s existing medical marijuana production facility to meet the standards introduced by the Marihuana for Medical Purposes Regulations (“MMPR”) administered by Health Canada.

On March 5, 2014, our Company and our CEO and Director, Robert McAllister, entered into a Joint Venture Agreement with Lexaria Corp. to jointly source and develop business opportunities in the medical marijuana industry. Pursuant to the terms of the agreement, Lexaria Corp. issued to our Company 1 million restricted common shares and issued 500,000 common shares to Mr. McAllister for his participation as a key representative for the joint venture. Additionally Lexaria agreed to issue to Mr. McAllister options to purchase 500,000 common shares of Lexaria in consideration for Mr. McAllister’s participation on the Lexaria Advisory Board.

On March 10, 2014, our Company’s Board appointed Mathew Chadwick as Senior Vice President of Marijuana Operations and entered into a Management Agreement with Mr. Chadwick for his services. The initial term of the agreement began on the date of execution of this agreement and continued for six months. Thereafter the agreement continued on a month-by-month basis until it was terminated on October 16, 2014 pursuant to a termination and settlement agreement, dated effective October 14, 2014, with World of Marijuana Productions Ltd. and Mr. Chadwick. We paid in total $125,000 to Mr. Chadwick pursuant to the Management Agreement. Mr. Chadwick resigned as a director and officer of our Company on October 16, 2014.

On March 11, 2014, Robert Chadwick and Clayton Newbury joined the Company as advisors and were each paid a $1,000 honorarium. Robert Chadwick was issued a one-time 100,000 common shares of our Company. On March 11, 2014, we granted 100,000 stock options to Robert Chadwick with an exercise price of $0.68 per share expiring March 11, 2019. 50,000 of the stock options vested immediately, and 50,000 vested on September 11, 2014. We also granted 100,000 options to Clayton Newbury on the same terms. Robert Chadwick and Clayton Newbury stepped down as advisors on October 17, 2014.

On March 14, 2014, we signed a six month contract for $21,735 with The Money Channel to provide services for national television, internet and radio media campaign.

On March 14, 2014, 815,310 warrants from previous private placements were exercised into 815,310 common shares of our Company for net proceeds of $163,062.

On March 14, 2014, we accepted and received gross proceeds from a director of our Company of CAD$8,250 (US$7,500), for the exercise of 50,000 stock options at an exercise price of $0.15, into 50,000 common shares of our Company.

On March 17, 2014, 1,548,000 warrants from previous private placements were exercised into 1,548,000 common shares of our Company for net proceeds of US$289,475.

On March 25, 2014, we accepted and received gross proceeds of $67,750, for the exercise of 325,000 stock options at $0.06 to $0.25 each, into 325,000 common shares of our Company.

On March 25, 2014, 1,095,000 warrants from previous private placements were exercised into 1,095,000 common shares of our Company for net proceeds of US$114,250.

On March 26, 2014, our Board appointed Dr. Robert Melamede as an Advisor to the Board of Directors. We paid to Dr. Melamede, an honorarium of $2,500 for the first year of participation on our Advisory Board and issued 250,000 shares of our common stock. On March 26, 2014 we granted to Dr. Melamede 500,000 stock options with an exercise price of $0.70 and expiring March 26, 2019. 250,000 of the stock options vested immediately and the remaining 250,000 stock options vested on September 26, 2014, Dr. Melamede stepped down as an advisor on June 16, 2015.

On April 1, 2014, we entered into a one year consulting agreement with Kristian Dagsaan to provide controller services for CAD$3,000 (plus goods and services tax) per month. We also granted 100,000 fully vested stock options with an exercise price of $0.86, expiring April 1, 2019. The agreement was cancelled effective August 31, 2014.

On April 1, 2014, we entered into a 90 day investor relations contract for CAD $9,000 with Ken Faulkner. We also granted 100,000 fully vested stock options to Mr. Faulkner with an exercise price of $0.86, expiring April 1, 2019.

On April 3, 2014, we entered into another 3 month Social Media/Web Marketing Agreement with Stuart Gray. In consideration for the services the Company we agreed to pay Mr. Gray a monthly fee of $5,000. Upon execution of the Agreement, we issued 100,000 stock options to Mr. Gray with an exercise price of $0.72, expiring on April 3, 2019. The agreement was terminated on July 31, 2014.

On April 3, 2014, 1,293,500 warrants from previous private placements were exercised into 1,293,500 common shares of our Company for net proceeds of US$177,950.

On April 3, 2014, we accepted and received gross proceeds from past consultant of our Company of US$1,500 for the exercise of 25,000 stock options at an exercise price of $0.06, into 25,000 common shares of our Company.

On April 8, 2014, we granted 50,000 fully vested stock options to a consultant of our Company, Taven White. The stock options are exercisable at $0.50 per share and expire on April 8, 2019.

On April 10, 2014, we entered into a Letter of Intent ("LOI") with Lexaria Corp regarding the establishment of a joint venture to establish a medical marijuana production facility in Burlington, Ontario under the MMPR regulations. Pursuant to the LOI Lexaria issued 500,000 of its common shares to our company to be held in escrow subject to receipt of an MMPR production license by our joint venture. Lexaria also contributed $55,000 to acquire a 49% interest in the joint venture and the responsibility to pay 55% of all joint venture expenses. We contributed $45,000 for a 51% interest and the responsibility to pay 45% of all expenses. We were to be responsible for management of the joint venture for as long as we maintained majority ownership.

Also effective April 10, 2014 the Burlington Joint Venture entered into a letter of intent with Mr. Jeff Paikin on behalf of 1475714 ONTARIO INC. to secured a future lease for a 30,000 ft² medical marijuana production space in Burlington, Ontario. We also acquired a right of first refusal for another 45,000 ft² to accommodate future growth. We issued 38,297 common shares to Mr. Paikin at a deemed price of $0.47 to secure our interest in the lease. The production target for the facility based on 30,000 ft² (with approximately 50% devoted to production space) was approximately 10,000 kilograms per year production.

On April 14, 2014, the Company appointed Mr. Jeff Paikin to its Advisory Board for a period of not less than one year, but to be determined by certain performance thresholds described in the letter. Upon signing of the letter of acceptance the Company issued 90,000 common shares at a deemed price of $0.34. Based on the milestones listed in the letter, Mr. Paikin can be eligible to receive up to a total of 472,500 common shares of the Company. Consulting agreement amended on June 18, 2014, Mr. Paikin can be eligible to receive up to a total of 1,350,000 common shares of the Company. Based on the milestones listed in the amended contract, the Company issued Mr. Paikin 135,000 common shares at a deemed price of $0.14 on July 14, 2014.

On April 17, 2014, our Company accepted and received gross proceeds from a director of CAD$8,475 (US$7,500), for the exercise of 50,000 stock options at $0.15 into 50,000 common shares of our Company.

On April 17, 2014, 651,045 warrants from previous private placements were exercised into 651,045 common shares of our Company for net proceeds of $110,209.

On April 24, 2014 our Company entered into a one year consulting contract with Clark Kent as Media Coordinator for a monthly fee of CAD$2,250 plus GST. We issued 90,000 common shares to the consultant at a deemed price of $0.34. Based on the milestones listed in the contract, Mr. Kent can be eligible to receive up to a total of 472,500 common shares of our Company. On June 18, 2014, the consulting agreement was amended so that Mr. Kent can be eligible to receive up to a total of 1,350,000 common shares of our Company. Based on achievement of the milestones listed in the amended contract, we issued to Mr. Kent 135,000 common shares at a deemed price of $0.14 on July 14, 2014. This agreement was terminated on February 4, 2015.

On April 24, 2014 we entered into a one year consulting contract with Don Shaxon as Ontario Operations Manager for a monthly fee of CAD$3,375 plus GST. Upon signing of the contract we issued to Mr. Shaxon 90,000 common shares at a deemed price of $0.34. Based on the milestones listed in the contract, Mr. Shaxon can be eligible to receive up to a total of 472,500 common shares of our Company. We amended the consulting agreement on June 18, 2014, following which Mr. Shaxon became eligible to receive up to a total of 1,350,000 common shares of our Company. Based on achievement of the milestones listed in the amended contract, we issued to Mr. Shaxon 135,000 common shares at a deemed price of $0.14 on July 14, 2014. The agreement was terminated on June 16, 2015.

On April 24, 2014 we entered into a one year consulting contract with 490072 Ontario Ltd. operating as HEC Group, for the services of Greg Boone as Human Resources Manager. Upon signing of the contract we issued 90,000 common shares at a deemed price of $0.34. Based on the milestones listed in the contract, Mr. Boone or his company can be eligible to receive up to a total of 472,500 common shares of our Company. We amended the agreement on June 18, 2014, further to which Mr. Boone became eligible to receive up to a total of 1,350,000 common shares of our Company. Based on achievement of the milestones listed in the amended contract, the Company issued Mr. Boone 135,000 common shares at a deemed price of $0.14 on July 14, 2014. This agreement was terminated on February 4, 2015.

On April 24, 2014 we entered into a one year consulting contract with Jason Springett as Master Grower for Ontario Operations for a monthly fee of $3,375 plus GST. Upon signing of the contract we issued 90,000 common shares at a deemed price of $0.34. Based on the milestones listed in the contract, Mr. Springett was eligible to receive up to a total of 472,500 common shares of the Company. We amended the agreement on June 18, 2014 further to which Mr. Springett became eligible to receive up to a total of 1,350,000 common shares of our Company. Based on achievement of the milestones listed in the amended contract, we issued Mr. Springett 135,000 common shares at a deemed price of $0.14 on July 14, 2014. This agreement was terminated on June 16, 2015.

On April 24, 2014 we entered into a one year consulting contract with 2342878 Ontario Inc. for the services of Chris Hornung as Assistant Operations Manager. Upon signing of the contract we issued 90,000 common shares to the consultant at a deemed price of $0.34. Subject to achievement of the milestones listed in the contract, Mr. Hornung or his company were eligible to receive up to a total of 472,500 common shares of our Company. Mr. Hornung resigned on July 14, 2014 prior to the accrual of additional compensation. The 90,000 common shares of the Company that were issued have been returned back to treasury on September 24, 2014.

On April 30, 2014, 200,000 warrants from previous private placements were exercised into 200,000 common shares of our Company for net proceeds of $40,000.

On May 3, 2014 we entered into a one year consulting contract with B. Mullan and Associates for the services of Brian Mullan as Security Consultant. Upon signing of the contract we issued to the consultant 45,000 common shares at a deemed price of $0.28. Subject to achievement of the milestones listed in the contract, Mr. Mullan or his company are be eligible to receive up to a total of 225,000 common shares of our Company. Subsequently, we issued an additional 45,000 common shares to the consultant at a deemed price of $0.14 on July 14, 2014. This agreement was terminated on February 4, 2015.

On May 28, 2014, our LOI with Lexaria was replaced by a definitive joint venture agreement (the “Burlington Joint Venture”) to establish a medical marijuana production facility under the MMPR at our planned Burlington, Ontario location. We received municipal zoning approval for the proposed site in July, 2014. Design and construction of the proposed facility was anticipated to cost approximately $3,000,000, and we would be responsible for $1,350,000 of this cost. Unable to estimate when a production license might be granted by Health Canada, the joint venture sought assurances from Health Canada prior to commencement of construction. In the event that Health Canada did not grant a production license by May 27, 2015, the Burlington Joint Venture was to terminate.

On May 29, 2014, we accepted and received gross proceeds of $20,000 for the exercise of 200,000 warrants at $0.10 each into 200,000 common shares of our Company.

On June 2, 2014, we signed a 30 day contract for $10,000 with TDM Financial to provide services for original video production, original coverage, network placement of video and article, article and video syndication, email distribution, and reporting.

On June 9. 2014, Pursuant to our 12 month marketing agreement with Agoracom dated February 27, 2014, we made a second quarter payment to Agoracom of $12,500 plus GST paid by the issuance of 72,917 common shares of the Company at a market price of $0.18 per share.

On July 1, 2014, we entered into a one year services agreement with TDM Financial for $120,000 payable in common shares of our Company. TDM Financial will provide marketing solutions and strategies to our Company. Upon the signing of the contract with TDM Financial, we issued 750,000 common stock of our Company at a deemed price of $0.16.

On July 23, 2014, 252,000 warrants from previous private placements were exercised into 252,000 common shares of our Company for net proceeds of $25,200.

On August 1, 2014 we entered into a three month Investor Relations and Marketing Agreement with Neil Blake with a monthly fee of CAD$2,500.

On August 1, 2014, through our wholly owned subsidiary Thor Pharma Corp. we signed an extension to the letter of intent with 1475714 ONTARIO INC. and Lexaria Canpharm Corp. (a subsidiary of Lexaria) to secure a 5 year lease on the Burlington, Ontario facility for our Burlington Joint Venture. In consideration of the extension, on August 5, 2014, we issued 118,416 of our common shares of to the lessor at a deemed price of $0.19 per share.

On September 16, 2014, our joint venture with the Green Canvas Ltd. made an application to Health Canada under the Marihuana for Medical Purposes Regulations (MMPR) to obtain a medical marijuana production license for a proposed facility located near Regina, Saskatchewan. Pursuant to the joint venture agreement, if a Heath Canada production license was not received by the first anniversary date of the agreement (February 28, 2015) our company would have no further obligations under the joint venture. If a license was obtained by February 28, 2015, we would be responsible to pay to the GCL $250,000 and 3,000,000 common shares in consideration of an additional 2% interest in the joint venture.

On September 18, 2014 we announced that we had provided notice to WOM alleging default under the terms of the joint venture agreement for, among other things, WOM’s failure to provide an accounting and financial information for the use of proceeds paid into the joint venture. On October 16, 2014 we entered into a termination and settlement agreement, dated effective October 14, 2014, with WOM and Mathew Chadwick (WOM’s representative and our former director), pursuant to which we relinquished our 31% interest in the joint venture and exchanged mutual releases with WOM and Mr. Chadwick. Mr. Chadwick resigned from our board of directors and as an officer of our company, and WOM returned for cancellation 15,127,287 of our common shares that had been issued to it. Given the foregoing, all relationships between the parties, including but not limited to the joint venture, have been terminated. No production license under the MMPR had been awarded or was forthcoming at the time of termination.

On October 16, 2014, we entered into a termination and settlement agreement, dated effective October 14, 2014, with World of Marihuana Productions Ltd. (“)WOM” and Mathew Chadwick (WOM’s representative and our former director), pursuant to which we relinquished our 31% interest in the joint venture and exchanged mutual releases with WOM and Mr. Chadwick. Mr. Chadwick resigned from our board of directors and as an officer of our company, and WOM returned for cancellation 15,127,287 of our common shares that had been issued to it. Given the foregoing, all relationships between the parties, including but not limited to the joint venture, have been terminated. No production license under the MMPR had been awarded or was forthcoming at the time of termination.

On November 3, 2014, the Company granted 2,100,000 stock options to directors, officers and consultants of the Company, vesting immediately with an exercise price of $0.10, expiring November 3, 2019.

On November 18, 2014, the Company granted 100,000 stock options to a consultant of the Company, vesting immediately with an exercise price of $0.10, expiring November 18, 2019.

On January 30, 2015, we closed the first tranche of a private placement of 1,665,000 units at a price of CAD$0.06 per unit for gross proceeds of US$79,920, CAD$99,900.$180,000. Each Unit consists of one common share of the Company and fullone-half non-transferable Share purchase warrant.warrant (each whole warrant, a "Warrant"). Each Warrant will be exercisable into one further Share (a "Warrant Share") at a price of US$0.10$0.09 per Warrant Share at any time until the close of business on the day which is 2412 months from the date of issue of the Warrant, and thereafter at a price of US$0.15 per Warrant Share at any time until the close of business on the day which is 36 months from the date of issue of the Warrant.

On February 6, 2015, the Company’s Board has appointed Bal Bhullar as a Director of the Company. Ms. Bhullar has been and continues to be the Chief Financial Officer ofJanuary 28, 2021 the Company since October 9, 2009.

February 6, 2015,signed Mark Snyder to a 12 month contract for $30,000 and the Boardissuance of Directors accepted the resignation of John Thomas as Director of the Company.2,000,000 stock options valid for 5 years at $0.14 cents each.

On February 9, 2015, Enertopia announced the launch of a new product line V-LoveTMfor women’s sexual pleasure. V-LoveTM is a brand new water based, silky smooth fragrance free personal lubricant and intimate gel especially designed for women.

On March 12, 2015,January 29, 2021 the Company closed its final tranche of a private placement of 590,000 units at a price of CAD$0.06 per unit for gross proceeds of CAD$35,400. Each unit consistsof oneissued 1,500,000 common share of the Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 36 months from the date of issuance, at a purchase price of US$0.10 during the first 24 months and at US$0.15 after 24 months. A cash finders’ fee of CAD$2,832 and 47,200 full broker warrants that expire on March 12, 2018 was paid to Canaccord Genuity.

In May, 2015, V-LoveTM was available to the retail market for purchase in stores and at various events.

On June 11, 2015, we entered into a mutual Termination Agreement with The Green Canvas Ltd. pursuant to which we terminated our relationship and relinquished our 49% interest in the joint venture to establish a medical marijuana production facility near Regina, Saskatchewan. In consideration of the termination, The Green Canvas returned for cancellation 6,400,000 shares of our common stock previously issued to GCL.

On June 11, 2015, we entered into a Letter of Intent dated June 10, 2015 with Shaxon Enterprises Ltd. to sell our 51% interest in our Burlington Joint Venture with Lexaria Corp., including our interest in MMPR application number 10QMM0610 for the proposed Burlington, Ontario production facility. The sale would be completed by the sale of our wholly owned subsidiary, Thor Pharma Corp.

Subsequent to the LOI with Shaxon Enterprises Ltd., the Burlington Joint Venture between Enertopia and Lexaria which was entered into on May 28, 2014 was terminated due to the pending sale of the project. Asas a result of the termination, 500,000 restricted and escrowedexercise of 1,773,224 cashless options exercised at $0.02 per common share.

On February 4, 2021 the Company signed Barry Brooks to a 12 month contract for the issuance of 100,000 stock options valid for 5 years each at $0.18 cents each.

On February 5, 2021 the Company signed Paul Sandler to a 12 month contract for the issuance of 100,000 stock options valid for 5 years each at $0.18 cents each.

On February 5, 2021 the Company signed Bruce Shellinger to a 12 month contract for the issuance of 100,000 stock options valid for 5 years each at $0.18 cents each.

On February 5, 2021 the Company signed Richard Smith to a 12 month contract for the issuance of 100,000 stock options valid for 5 years each at $0.18 cents each.

On March 2, 2021 the Company issued 250,000 common shares as a result of Lexariathe exercise of 250,000 options exercised at $0.07 per common share.

On March 3, 2021 the Company issued 300,000 common shares as a result of the exercise of 300,000 options exercised at $0.07 per common share.

On April 27, 2021 the Company signed Michael Cornelius to oura 12 month contract for the issuance of 100,000 stock options valid for 5 years at $0.12 cents each.

On May 25, 2021 the Company at a deemedannounced the filing of provisional patent #1, known as the Enertopia Solar Booster TM

On May 26, 2021the Company announced the filing of provisional patent #2, known as Enertopia Heat ExtractorTM

On May 28, 2021, the Company issued 50,000 stock options to one of the consultants of the Company with an exercise price of $0.40 will be returned to treasury and cancelled. The Enertopia and Lexaria Master Joint Venture Agreement entered into on March 5, 2014 is still effective and governs the relationship between the parties.$0.12 vested immediately, expiring May 28, 2026.

On June 26, 2015, we signed1, 2021, the Company issued 2,000,000 common shares as a Definitive agreement to sell our wholly owned subsidiary, Thor Pharma Corp along withresult of the MMPR application number 10MMPR0610. The Burlington MMPR license application will continue inexercise of 2,000,000 warrants exercised at $0.05 per common share.

On June 8, 2021, the application process under new ownership. PursuantCompany issued 400,000 common shares to the agreement, we receivedCompany CEO as a non-refundable $10,000 deposit and are entitled to receive up to $1,500,000 in milestone payments uponresult of the Burlington facility becoming licensed underexercise of 400,000 warrants exercised at $0.05 per common share.

On June 8, 2021 the MMPR. These monies would be split equally with Lexaria Corp. NotwithstandingCompany issued 100,000 common shares as a result of the foregoing, we can neither guarantee nor provide a meaningful time estimate regarding the potential grantexercise of a production license for the Burlington facility.100,000 options exercised at $0.07 per common share.

On June 29, 2015, we that announced V-LoveTM became available2021 the Company issued 100,000 common shares as a result of the exercise of 100,000 warrants exercised at London Drugs Limited stores. V-LoveTM is currently available at London Drugs stores across Western Canada in the provinces of British Columbia, Alberta, Saskatchewan and Manitoba.$0.05 per common share.

On July 7, 2015 we announced that V-Love TM became available for purchase online in Canada29, 2021 the Company issued 40,000 common shares as a result of the exercise of 40,000 warrants exercised at Amazon.ca.$0.04 per common share.

On July 30, 2015 we29, 2021 the Company announced it had engaged Fundamental Research Corp. Fundamental Research Corp. is an issuer-paid independent research house.

On August 17, 2021 the Company announced the launchfiling of V-Love.co, our product website for V-Loveprovisional patent #3, known as Enertopia RainmakerTM. As at August 31, 2016, with

On Aug 23, 2021 the Company’s strategic direction mostly being focused on natural resources and technology relating to the resource sector, the health and wellness portionCompany issued 40,000 common shares as a result of the business is discontinued.exercise of 40,000 warrants exercised at $0.04 per common share.

On Aug 31, 2021 the Company issued 40,000 common shares as a result of the exercise of 40,000 warrants exercised at $0.04 per common share.

Chronological Overview of our Business over the Last Five Years

On October 23, 2015, the Company’sCompany's Board has appointed Kevin Brown as a Director of the Company and Victor Lebouthillier as an advisor to the Board of Directors.

On October 23, 2015, the Board of Directors accepted the resignation of Donald Findlay as Director of the Company.

On October 23, 2015, we granted 1,850,000 stock options to Directors, Executives and Consultants of the Company. The exercise price of the stock options is $0.05, vested immediately, expiring October 23, 2020.

On December 16, 2015, extended two classes of warrants by two years with all other terms and conditions remaining the same. We approved the expiry extension from January 31, 2016 till January 31, 2018 on 2,167,160 warrants that remain outstanding from the non-brokered private placement that closed on January 31, 2014. The Company approved the expiry extension from February 13, 2016 till February 13, 2018 on 7,227,340 warrants that remain outstanding from the non-brokered private placement that closed on February 13, 2014.

On February 4, 2016, the Company’sCompany's Board has appointed Olivier Vincent as an Advisor the Board of Directors and a consultant for a term of one year and granted 100,000 stock options to Olivier Vincent. The exercise price of the stock options is $0.05, vested immediately, expiring February 4, 2021. We issued 100,000 common shares at a price of $0.05 per share on exercise of these options.

On March 9, 2016, we closed a binding Letter of Intent to acquire 100% of an established profitable private nutritional vitamin/supplement company. The private nutritional vitamin/supplement company has been in business for over 5 years showing good positive cash flows. All products are manufactured by a GMP, NSF, FDA approved manufacturer in the United States. Enertopia has agreed subject to further due diligence, review of financials and financing to a total amount of $350,000 for the acquisition, with $300,000 due on the signing of the Definitive Purchase Agreement. The Definitive Purchase Agreement is expected to be completed before the end of April. The Company did not further pursue this.

On April 21, 2016, Enertopia has signed a binding letter of intent with a to enter into negotiations to effect the optional acquisition of certain placer mining claims (the “Claims”"Claims") in Nevada covering approximately 2,560 acres from S P W Inc. S P W Inc. holds the Claims directly (“("Underlying Owner”Owner"). Upon the closing date of the transaction (the “Effective Date”"Effective Date") S P W Inc. will have the right to transfer, option, sell or assign the Claims to Enertopia. The Placer mining claims and any underlying agreements will be acquired by Enertopia through a mineral property option agreement, an assignment agreement or an asset acquisition (the “Transaction”"Transaction").

On May 12, 2016 Enertopia has signed the Definitive Agreement with the Vendor respecting the option to purchase a 100% interest in approximately 2,560 acres of placer mining claims in Churchill, Lander and Nye Counties Nevada, USA. These placer mining claims are subject to a 1.5% NSR from commercial production with the Company able to buy back the NSR at the rate of $500,000 per 0.5% NSR.

On May 20, 2016, Enertopia closed the first tranche of a private placement of 6,413,333 units at a price of CAD$0.015 per unit for gross proceeds of US$74,074 (CAD$96,200). Each Unit consists of one common share of the Company and full non-transferable Share purchase warrant (each whole warrant, a “Warrant”"Warrant"). Each Warrant will be exercisable into one further Share (a “Warrant Share”"Warrant Share") at a price of US$0.05 per Warrant Share at any time until the close of business on the day which is 18 months from the date of issue of the Warrant, and thereafter at a price of US$0.10 per Warrant Share at any time until the close of business on the day which is 36 months from the date of issue of the Warrant.

On June 8, 2016, Enertopia closed its final tranche of a private placement of 3,016,667 units a price of CAD$0.015 per unit for gross proceeds of US$34,390 (CAD$45,250). Each Unit consists of one common share of the Company and full non-transferable Share purchase warrant (each whole warrant, a “Warrant”"Warrant"). Each Warrant will be exercisable into one further Share (a “Warrant Share”"Warrant Share") at a price of US$0.05 per Warrant Share at any time until the close of business on the day which is 18 months from the date of issue of the Warrant, and thereafter at a price of US$0.10 per Warrant Share at any time until the close of business on the day which is 36 months from the date of issue of the Warrant. A cash finders’finders' fee of CAD$3,300 and 286,666 full broker warrants that expire June 8, 2019 was paid to Canaccord Genuity, Leede Jones Gable, PI Financial and Mackie Research.

On August 9, 2016, we closed the first tranche of a private placement of 4,500,000 units at a price of CAD$0.035 per unit for gross proceeds of CAD$157,500. Each unit consistsofconsistsof one common share of our Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of our Company for a period of 24 months from the date of issuance, at a purchase price of US$0.07.

On August 10, 2016, we retained a private consulting firm to assist with mergers, acquisitions and market awareness for a 12 month contract. The consulting firm operates a resource holding company that has been active in acquiring out of favor mining assets over the past several years. It also provides breaking news, commentary and analysis on listed companies. We engaged and paid the consulting firm USD$75,000.

On August 15, 2016 binding Letter of Intent was signed by us and Genesis Water Technologies, Inc. ("GWT") with regard to the acquisition by Enertopia (the "Acquisition") of the exclusive worldwide licensing rights (the "Licensing Rights") of all of the technology used in the process of recovering and extraction of battery grade lithium carbonate powder Li2CO3 grading 99.5% or higher purity from brine solutions (the "Technology") and covered under patent pending process #XXXXXX (the "Pending Patent"). On August 15, 2016, we issued 250,000 common shares at an exercise price of $0.05 per share as per the binding LOI signed with Genesis Water Technologies Inc. On July 4, 2018, the Company provided GWT with a formal notice of termination of the commercialization agreement.

On August 31, 2016, with the Company’sCompany's strategic direction mostly being focused on natural resources and technology relating to the resource sector, the health and wellness portion of the business is discontinued.

On September 19, 2016, we entered into a one year Investor Relations Consulting agreement with Duncan McKay. Based on the terms of the agreement, Mr. McKay can earn up to a maximum of 10% commissions on capital raised. We issued 800,000 stock options with an exercise price of $0.07.

On September 23, 2016, we closed the final tranche of a private placement of 3,858,571 units at a price of CAD$0.035 per unit for gross proceeds of CAD$135,050. Each unit consists of one common share of our Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of our Company for a period of 24 months from the date of issuance, at a purchase price of US$0.07. A cash finders' fee of CAD$3,300 and 286,666 full broker warrants that expire June 8, 2019 was paid to Canaccord Genuity and Leede Jones Gable.

On October 7, 2016, we issued 175,000 common shares of our Company and paid $5,000 to comply with the Definitive Agreement signed May 12, 2016.

On December 6, 2016, we signed a Definitive Commercial Agreement with Genesis Water Technologies with regard to the acquisition of exclusive licensing rights of the technology as outlined in the agreement.

On January 20, 2017, the Company closed the first tranche of a private placement of 1,000,000 units at a price of CAD$0.04 per unit for gross proceeds of CAD $40,000. Each unit consists of one common share of the Company and one-nontransferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.06. A cash finders' fee of CAD$800 and 20,000 full broker warrants that expire January 20, 2019 was paid to Leede Jones Gable Inc.

On January 20, 2017, the Company granted 1,535,000 stock options to directors, officers and consultant of the Company with an exercise price of $0.07 which vested immediately, expiring January 20, 2022.

On January 31, 2017, the Company granted 1,500,000 stock options to consultant of the Company with an exercise price of $0.07 vested immediately, expiring January 31, 2022.

On February 28, 2017, the Company closed the first tranche of a private placement of 4,250,000 units at a price of CAD$0.04 per unit for gross proceeds of CAD $170,000. Each unit consists of one common share of the Company and one-nontransferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.06. A cash finders' fee of CAD$11,100 and 227,500 full broker warrants that expire February 28, 2019 was paid to Leede Jones Gable Inc., Canaccord Genuity and Duncan McKay.

On February 28, 2017, the Company signed a Letter of Engagement with Adam Mogil and issued 1,000,000 warrant options to convert to 1,000,000 common shares to Adam Mogil to provide corporate services. The warrants have an exercise price of $0.09 and expire August 28, 2017. These warrant options expired without being exercised.

On April 21, 2017, the Company issued 95,500 shares for gross proceeds of $5,685 from the exercise of warrants of previous financings at $0.05 and $0.07.

On April 30, 2017 the Company issued 166,500 shares for gross proceeds of $11,655 from the exercise of warrants from a previous financing at $0.07.

On April 30, 2017, the Company closed the first and final tranche of a private placement of 3,224,000 units at a price of CAD$0.09 per unit for gross proceeds of CAD $290,160. Each unit consists of one common share of the Company and one-nontransferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.12. A cash finders' fee of CAD$20,736 and 230,400 full broker warrants that expire April 28, 2019 was paid to Leede Jones Gable and Canaccord Genuity.

On May 5, 2017, the Company granted 500,000 stock options to consultant of the Company with an exercise price of $0.10 vested immediately, expiring May 5, 2022.

On May 5, 2017, the Company terminated the Definitive Agreement dated May 12, 2016 with the Vendor on the Nevada Lithium brine properties.

On July 31, 2017, the Company announced the resignation of CFO and Director Bal Bhullar, the appointment of Kristian Ross as director and president Robert McAllister assuming the interim duties of CFO.

On August 14,2017 the Company announced the appointment of Davidson and Company, LLP, Chartered Professional Accountants as its new independent registered auditing firm which replaced MNP LLP independent registered auditing firm.

On August 30, 2017 the Company announced the Staking of lode and placer claims covering approximately 160 acres for Lithium in Clayton Valley, NV.

On October 27, 2017 we entered into a one year Investor Relations Consulting agreement with FronTier Merchant Capital Group. Terms of the agreement, FronTier Capital Group has been retained for a 12-month period at $87,000 (plus applicable sales tax) per annum plus direct expenses. The company will also grant 300,000 stock options to FronTier at an exercise price of 0.05 per share expiring 5 years from the date of grant.

On November 1, 2017, we closed the first tranche of a private placement of 2,600,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$130,000. Each unit consists of one common share of our Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of our Company for a period of 24 months from the date of issuance, at a purchase price of $0.06.

On November 1, 2017, we granted 500,000 stock options to a director of the company at an exercise price of 0.05 per share expiring 5 years from the date of grant.

On December 8, 2017, we closed the second tranche of a private placement of 3,954,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD $197,700. Each unit consists of one common share of our Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of our Company for a period of 24 months from the date of issuance, at a purchase price of $0.06. A cash finder's fee for CAD $12,770 and 230,400 full broker warrants was paid to third parties. Each full broker warrant entitling the holder to purchase one additional common share of our Company for a period of 24 months from the date of issuance, at a purchase price of $0.06.

On December 8, 2017 we issued 240,000 common shares of our Company on the exercise of 240,000 stock options that were exercised by a director of the Company at $0.05 for $12,000 for net proceeds to the company.

On December 15, 2017 we paid Genesis Water Technologies (GWT) $96,465 for the second and final payment for the Second phase of the second bench test and $8,998 for the bill of materials for the bench test.

On January 12, 2018, we closed the final tranche of a private placement of 1,611,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$80,550. Each unit consists of one common share of the Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.06. A cash finder's fee of CAD$3,880 and 77,600 broker warrants was paid to a third party. The broker warrants have the same terms as the warrants issued as part of the unit offering.

On February 2, 2018 we issued 50,000 common shares of our Company on the exercise of 50,000 warrants that were exercised at $0.07 for $3,500 for net proceeds to the company.

On May 11, 2018, we issued 200,000 shares for gross proceeds of $12,000 from the exercise of stock options at $0.06.

On May 11, 2018, we closed the first tranche of a private placement of 1,746,900 units at a price of CAD$0.06 per unit for gross proceeds of CAD$104,814. Each unit consists of one common share of the Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.075. A cash finders' fee of CAD$9,281 and 144,690 full broker warrants that expire May 11, 2020 was paid to third parties. The broker warrants have the same terms as the warrants issued as part of the unit offering.

On May 22, 2018, we entered into an Investor Relations Consulting agreement with FronTier Flex Marketing. Terms of the agreement, FronTier Flex Marketing has been retained for a 9-month period at $66,000 (plus applicable sales taxes) plus direct expenses. The Company will also grant 300,000 stock options at an exercise price of $0.07 per share expiring 5 years from the date of grant.

On May 25, 2018, we closed the final tranche of a private placement of 2,470,000 units at a price of CAD$0.06 per unit for gross proceeds of CAD$148,200. Each unit consists of one common share of the Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.075. A cash finders' fee of CAD$5,820 and 70,000 full broker warrants that expire May 25, 2020 was paid to third parties. The broker warrants have the same terms as the warrants issued as part of the unit offering.

On July 4, 2018, the Company, after receiving 3rd party lab results that reported impurities above allowable limits for battery-grade Li2CO3, provided formal notice of termination to GWT of the commercialization agreement dated December 6, 2016 and as amended on October 9, 2017.