UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20202023

Commission file number 1-14287

Centrus Energy Corp.

| | | | | |

| Delaware | 52-2107911 |

| (State of incorporation) | (IRS Employer Identification No.) |

6901 Rockledge Drive, Suite 800, Bethesda, Maryland 20817

(301) 564-3200

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A Common Stock, par value $0.10 per share | LEU | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o☐. No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o☐. No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No o☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Smaller reporting company | ☒☐ |

| Accelerated filer | ☐☒ | | Emerging growth company | ☐ |

| Non-accelerated filer | ☒☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý☒

The aggregate market value of Common Stock held by non-affiliates computed by reference to the price at which the Common Stock was last sold as reported on the New York Stock Exchange as of June 30, 2020,2023, was $64.5$411.7 million. As of MarchFebruary 1, 2021,2024, there were 12,660,67614,956,434 shares of the registrant’s Class A Common Stock, par value $0.10 per share, and 719,200 shares of the registrant’s Class B Common Stock, par value $0.10 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for the 20212024 annual meeting of shareholders to be filed with the Securities and Exchange commissionCommission within 120 days after the end of fiscal year 20202023 are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| | PART I | |

Items | Business | | |

| Risk Factors | | |

| | |

Item 2. | Properties | | |

| Legal Proceedings2. | | |

| | |

| | |

| | PART II | |

| | |

| Selected Financial Data | | |

| | |

| | |

| | |

| | |

| | |

| Other Information | | |

| | |

| | PART III | |

| | |

| Executive Compensation | | |

| | |

| | |

| | |

| PART IV | |

| | |

| | |

| |

| |

| |

Glossary of Certain Terms and Abbreviations

| | | | | |

| Centrus Energy Corp. and Related Entities |

| Board | Centrus Energy Corp.’s Board of Directors |

| Centrus | Centrus Energy Corp. |

| Enrichment Board | Separate Board of Directors at Enrichment Corp., a subsidiary of Centrus Energy Corp. |

| Enrichment Corp. | United States Enrichment Corporation |

| Oak Ridge | Technology and Manufacturing Center in Oak Ridge, Tennessee |

| Paducah GDP | Paducah Gaseous Diffusion Plant, an enrichment plant in Paducah, Kentucky formerly operated by Enrichment Corp. |

| Piketon | Production facility in Piketon, Ohio |

| Portsmouth GDP | Portsmouth Gaseous Diffusion Plant, an enrichment plant near Portsmouth, Ohio, formerly operated by Enrichment Corp. |

| USEC-Government | Enrichment Corp. prior to 1993, when it was a wholly-owned government corporation |

| |

| Other Terms and Abbreviations |

| 2002 DOE-USEC Agreement | June 17, 2002 agreement between Centrus (then known as USEC Inc.) and the DOE |

| 2014 Plan | The Company’s 2014 Equity Incentive Plan |

| 2019 Plan | The Company’s 2019 Executive Incentive Plan |

| 5B Cylinders | Storage cylinders for HALEU UF6 produced by the cascade |

| 8.25% Notes | 8.25% Notes, maturing February 2027 |

| Annual Meeting | The Company’s annual meeting of shareholders |

| ARDP | DOE’s Advanced Reactor Demonstration Program |

| ATM | At the Market |

| Atomic Energy Act | Atomic Energy Act of 1954 |

| Centrifuge IP | Centrifuge Technology Intellectual Property |

| Class A Common Stock | Class A common stock, $0.10 par value per share |

| Class B Common Stock | Class B common stock, $0.10 par value per share |

| CNEIC | China Nuclear Energy Industry Corporation |

| COBC | Centrus’ Code of Business Conduct |

| Code | Internal Revenue Code of 1986 |

| Common Stock | Class A Common Stock and Class B Common Stock |

| Consent Solicitation | Consent solicitation related to the results of the 2021 tender offer |

| COVID-19 | 2019 Novel Coronavirus |

| D&D | Decontamination & Decommissioning |

| DOC | U.S. Department of Commerce |

| |

| DOE | U.S. Department of Energy |

| EU | European Union |

| Exchange Act | Securities Exchange Act of 1934, as amended |

| Exchange Agreement | Exchange Agreement entered into by the Company and Kulayba LLC, dated February 2, 2021 |

| FAR | U.S. Government’s Federal Acquisition Regulations |

| HALEU | High Assay Low-Enriched Uranium |

| | | | | |

| HALEU Demonstration Contract | Three-year, $115 million cost-share contract with DOE signed in 2019 by Centrus’ subsidiary, ACO |

| HALEU Operation Contract | HALEU production contract with DOE signed in 2022 |

| IEA | International Energy Agency |

| IT | Information Technology |

| ITC | U.S. International Trade Commission |

| LEU | Low-Enriched Uranium; term is also used to refer to the Centrus Energy Corp. business segment which supplies commercial customers with various components of nuclear fuel |

| MB Group | Mr. Morris Bawabeh, Kulayba LLC and M&D Bawabeh Foundation, Inc. |

| Natural Uranium | Raw material needed to produce LEU and HALEU |

| NAV | Net asset value |

| NOL | Net Operating Loss |

| NRC | U.S. Nuclear Regulatory Commission |

| NRV | Net realizable value |

| NUBIL | Net unrealized built-in loss |

| Orano | Orano Cycle |

| Orano Supply Agreement | Long-term supply of SWU contained in LEU, signed by United States Enrichment Corporation with Orano in 2018 |

| Order Book | LEU Segment order book of sales under contract |

| Power MOU | Memorandum of understanding between the DOE and USEC-Government |

| Price-Anderson Act | Price-Anderson Nuclear Industries Indemnity Act (Section 170 of the U.S. Atomic Energy Act of 1954, as amended) |

| RFP | Request for Proposal |

| Rosatom | Russian State Atomic Energy Corporation |

| RSA | 1992 Russian Suspension Agreement, as amended |

| SARs | Stock appreciation rights |

| SEC | U.S. Securities & Exchange Commission |

| SWU | Separative work unit |

| Technical Solutions | The Centrus Energy Corp. business segment which offers technical, manufacturing, engineering, and operations services to public and private sector customers |

| TENEX | Russian government-owned entity TENEX, Joint-Stock Company |

| TENEX Supply Contract | Agreement with TENEX through 2028 |

| TRISO | Tri-Structural Isotopic fuel manufacturing process |

| U.S. GAAP | Generally accepted accounting principles in the United States |

U235 | Uranium-235 isotope |

U238 | Uranium-238 isotope |

U3O8 | Uranium oxide, aka “yellowcake” |

UF6 | Uranium hexafluoride |

| URENCO | Urenco, Limited, a consortium owned or controlled by the British and Dutch governments and two German utilities |

| USW | United Steelworkers Local 689-5 union |

| Voting Agreement Amendment | The Company’s amendment to its existing Voting and Nomination Agreement with the MB Group |

| Voting Rights Agreement | The Company’s agreement with the MB Group entered into in December 2022 |

| | | | | |

| Warrant | Warrant to purchase common stock of Centrus Energy Corp., held by Kulayba LLC and dated February 2, 2021 |

| New Warrant | Amended Warrant to extend the terms of the Warrant held by Kulayba LLC |

| WNA | World Nuclear Association |

| |

FORWARD-LOOKING STATEMENTS

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K including Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part II, Item 7,Centrus (the “Company,” “we” or “us”) contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934.1934, as amended, and the Private Securities Litigation Reform Act of 1995. In this context, forward-looking statements mean statements related to future events, which may addressimpact our expected future business and financial performance, and often contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “will”, “should”, “could”, “would” or “may” and other words of similar meaning. These forward-looking statements are based on information available to us as of the date of this Annual Report on Form 10-K and represent management’s current views and assumptions with respect to future events and operational, economic and financial performance. Forward-looking statements are not guarantees of future performance, events or results and involve known and unknown risks, uncertainties and other factors, which may be beyond our control.

The factors that could cause actual results to differ materially from the forward-looking statements made by their nature address mattersus include those factors discussed herein, including those factors discussed in (a) Part I, Item 1A. Risk Factors, (b) Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, (c) Part II, Item 8. Financial Statements and Supplementary Data: Note 17, Commitments and Contingencies, and (d) other factors discussed in the Company’s filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this Report. The Company does not undertake any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances that are, to different degrees, uncertain. may arise after the date of this Annual Report on Form 10-K unless required by law.

For Centrus, Energy Corp., particular risks and uncertainties (hereinafter “risks”) that could cause our actual future results to differ materially from those expressed in our forward-looking statements include but are not limited to the following and which are, and willmay be, exacerbated by the novel coronavirus (COVID-19) pandemic and any worsening of the global business and economic environment include but are not limited to the following:

Risks related to the war in Ukraine primarily include:

•risks related to the war in Ukraine and geopolitical conflicts and the imposition of sanctions or other measures by (i) the U.S. or foreign governments and institutions, (ii) organizations (including the United Nations or other international organizations), or (iii) entities (including private entities or persons), that could directly or indirectly impact our ability to obtain, deliver, transport, or sell LEU or the SWU and natural uranium hexafluoride components of LEU delivered to us under the TENEX Supply Contract or make related payments or deliveries of natural uranium hexafluoride to TENEX;

•risks related to proposed legislation to ban imports of Russian LEU into the United States or similar bills become law and the potential inability to secure a waiver or other exception from the ban in a timely manner or at all in order to allow us to continue importing Russian LEU under the TENEX Supply Contract;

•risks related to the refusal or inability of TENEX to deliver LEU to us if, among other reasons, (i) U.S. or foreign government sanctions are imposed on LEU from Russia or on TENEX, (ii) for any reason, TENEX is unable or unwilling to deliver LEU, receive payments, receive the return of natural uranium hexafluoride, or conduct other activities related to the TENEX Supply Contract; or (iii) TENEX elects, or is directed (including by its owner or the Russian government), to limit or stop transactions with us or with the United States or other countries; and

•risks related to disputes with third parties, including contractual counterparties, that could result if we are unable to receive timely deliveries of LEU under the TENEX Supply Contract.

Risks related to economic and industry factors primarily include:

•risks related to whether or when government funding or demand for HALEU for government or commercial uses will materialize and at what level;

•risks regarding funding for continuation and deployment of the American Centrifuge technology;

•risks related to (i) our ability to perform and absorb costs under the HALEU Operation Contract, (ii) our ability to obtain new contracts and funding to be able to continue operations and (iii) our ability to obtain and/or perform under other agreements;

•risks that (i) we may not obtain the full benefit of the HALEU Operation Contract and may not be able or allowed to operate the HALEU enrichment facility to produce HALEU after the completion of the HALEU Operation Contract or (ii) the HALEU enrichment facility may not be available to us as a result: future source of supply;

•risks related to our dependence on others, such as TENEX, under the TENEX Supply Contract, Orano under the Orano Supply Agreement and other suppliers (including, but not limited to, transporters) who provide us the goods and services we need to conduct our business;

•risks related to natural and other disasters, including the continued impact of the March 2011 earthquake and tsunami in Japan, on the nuclear industry and on our business, results of operations and prospects;

•risks related to financial difficulties experienced by customers or suppliers, including possible bankruptcies, insolvencies, or any other inabilitysituation, event or occurrence that affect the ability of others to pay for our products or services in a timely manner or delays in making timely payment; at all;

•risks related to pandemics, endemics, and other health crises, such as the global COVID-19 pandemic;crises;

•risks related to the impact and potential extended duration of the currenta supply/demand imbalance in the market for low-enriched uranium (“LEU”); LEU;

•risks related to our ability to sell or deliver the LEU we procure pursuant to our purchase obligations under our supply agreements; risks related toagreements and the impositionimpacts of sanctions restrictions or other requirements,limitations on imports of such LEU, including those imposed under the 1992 Russian Suspension

Agreement (“RSA”), as amended,RSA, international trade legislation and other international trade restrictions;

•risks related to existing or new trade barriers and to contract terms that limit our ability to procure LEU for, or deliver LEU to customers;

•risks related to pricing trends and demand in the uranium and enrichment markets and their impact on our profitability;

•risks related to the movement and timing of customer orders; our dependence on others for deliveries of LEU including deliveries from

•risks related to the Russian government-owned entity TENEX, Joint-Stock Company (“TENEX”), under a commercial supply agreement with TENEX and deliveries under a long-term supply agreement with Orano Cycle (“Orano”); risks associated with our reliance on third-party suppliers to provide essential products and services to us;fact that we face significant competition from major LEU producers who may be less cost sensitive or are wholly or partially government owned;government-owned;

•risks that our ability to compete in foreign markets may be limited for various reasons;

•risks related to the fact that our revenue is largely dependent on our largest customers; and

•risks related to our sales order book,Order Book, including uncertainty concerning customer actions under current contracts and in future contracting due to market conditions, andglobal events or other factors including our lack of current production capability; capability.

Risks related to operational factors primarily include:

•risks related to whether or when government funding or demand for high assay low enriched uranium (“HALEU”) for government or commercial uses will materialize; risks and uncertainties regarding funding for continuation and deployment of the American Centrifuge technology and our ability to perform and absorb costs under our agreement with DOE to demonstrate the capability to produce HALEU and our ability to obtain and/or perform under other agreements; uncertainty regarding our ability to commercially deploy competitive enrichment technology;

•risks related to the potential for further demobilization or termination of our American Centrifuge work; the HALEU Operation Contract;

•risks that we will not be able to timely complete the work that we are obligated to perform;

•risks related to the government’s inability to satisfy its obligations, including supplying government furnished equipment necessary for us to produce and deliver HALEU under the HALEU Operation Contract and processing security clearance applications due to a government shutdown or other reasons;

•risks related to our ability to obtain the government’s approval to extend the term of, or the scope of permitted activities under, our lease in Piketon, Ohio;

•risk related to cybersecurity incidents that may impact our business operations;

•risks related to our ability to perform fixed-price and cost-share contracts such as the HALEU Operation Contract, including the risk that costs that we must bear could be higher than expected; expected and the risk related to complying with stringent government contractual requirements; and,

•risks related to a government shutdown that could result in program cancellations, disruptions and/or stop work orders and could limit the U.S. government’s ability to make timely payments, and our ability to perform our U.S. government contracts and successfully compete for our work.

Risks related to financial factors primarily include:

•risks related to our significant long-term liabilities, including material unfunded defined benefit pension plan obligations and postretirement health and life benefit obligations;

•risks relatingrelated to our 8.25% notes (the “8.25% Notes”)Notes maturing in February 2027 and our Series B Senior Preferred Stock; the 2027;

•risks of revenue and operating results fluctuating significantly from quarter to quarter, and in some cases, year to year;

•risks related to the impact of financial market conditions on our business, liquidity, prospects, pension assets and insurance facilities;

•risks related to the Company’s capital concentration;

•risks related to the value of our intangible assets related to the sales order bookOrder Book and customer relationships;

•risks related to the limited trading markets in our securities;

•risks related to decisions made by our Class B stockholders and our Series B Senior PreferredCommon Stock stockholders regarding their investment in the Company, including decisions based upon factors that are unrelated to the Company’s performance; risk

•risks that a small number of holders of our Class A stockholdersCommon Stock (whose interests may not be aligned with other holders of our Class A Common Stock), may exert significant influence over the direction of the Company and whosemay be motivated by interests maythat are not be aligned with the Company’s other Class A stockholders;

•risks related to (i) the use of our net operating loss (“NOLs”)NOL carryforwards and net unrealized built-in losses (“NUBILs”)NUBILs to offset future taxable income and the use of the Rights Agreement (as defined herein) to prevent an “ownership change” as defined in Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”)IRC and (ii) our ability to generate taxable income to utilize all or a portion of the NOLs and NUBILs prior to the expiration thereof;thereof and NUBILs; and

•risks related to failures or security breaches of our information technology systems;systems.

Risks related to general factors primarily include:

•risks related to our ability to attract and retain key personnel; the potential for DOE to seek to terminate or exercise its remedies under its agreements with the Company;

•risks related to actions, including government reviews or audits, that may be taken by the United StatesU.S. government, the Russian government, or other governments that could affect our ability to perform under our contractcontractual obligations or the ability of our sources of supply to perform under their contractcontractual obligations to us;

•risks related to our ability to perform and receive timely payment under our agreements with the DOE or other government agencies, including risks and uncertainties related to the ongoing funding by the government and potential audits; any

•risks related to changes or termination of our agreements with US government;the U.S. government or other counterparties, or the exercise of contract remedies by such counterparties;

•risks related to the competitive environment for our products and services;

•risks related to changes in the nuclear energy industry;

•risks related to the competitive bidding process associated with obtaining contracts, including government contracts;

•risks that we will be unable to obtain new business opportunities or achieve market acceptance of our products and services or that products or services provided by others will render our products or services obsolete or noncompetitive; and

•risks related to potential strategic transactions whichthat could be difficult to implement, that could disrupt our business or that could change our business profile significantly;significantly.

Risks related to legal and compliance factors primarily include:

•risks related to the outcome of legal proceedings and other contingencies (including lawsuits and government investigations or audits);

•risks related to the impact of government regulation and policies, including by the U.S. Department of Energy (“DOE”)DOE and the U.S. Nuclear Regulatory Commission; NRC;

•risks of accidents during the transportation, handling, or processing of toxic hazardous or radioactive material that may pose a health risk to humans or animals;animals, cause property or environmental damage, or result in precautionary evacuations, and lead to claims against the Company;

•risks associated with claims and litigation arising from past activities at sites we currently operate or past activities at sites that we no longer operate, including the Paducah, Kentucky, and Portsmouth, Ohio, GDPs; and

•other risks and uncertainties discussed in this and our other filings with the Securities and Exchange Commission.SEC.

For a more detailed discussion of these risks and uncertainties and other factorsothers that may affectcould cause actual results to differ materially from those contained in our future results,forward-looking statements, please see (a) Part I, Item 1A, Risk Factors, (b) Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, (c) Part II, Item 8, Financial Statements and Supplementary Data: Note 17, Commitments and Contingencies, and (d) other factors discussed in our filings with the other sections of this Annual Report on Form 10-K and our subsequently filed documents.SEC. These factors may not constitute all factors that could cause actual results to differ from those discussed in any forward-looking statement. Accordingly, forward-looking statements should not be relied upon as a predictor of actual results. Readers are urged to carefully review and consider the various disclosures made in this report and in our other filings with the Securities and Exchange Commission (“SEC”) that attempt to advise interested parties of the risks and factors that may affect our business. We do not undertake to update our forward-looking statements to reflect events or circumstances that may arise after the date of this Annual Report on Form 10-K, except as required by law.

PART I

Item 1. Business

Overview

Centrus Energy Corp., a Delaware corporation, (“Centrus” or the “Company”), is a trusted supplier of nuclear fuel components and services for the nuclear power industry, which provides a reliable source of carbon freecarbon-free energy. References to “Centrus”, the “Company”, “our”, or “we” include Centrus Energy Corp. and its wholly ownedwholly-owned subsidiaries as well as the predecessor to Centrus, unless the context otherwise indicates. We were incorporated in 1998 as part of the privatization of the United States Enrichment Corporation.U.S. government’s uranium enrichment enterprise.

Centrus operates two business segments: (a) low-enriched uranium (“LEU”),LEU, which supplies various components of nuclear fuel to utilitiescommercial customers from our global network of suppliers, and (b) technical solutions,Technical Solutions, which provides advanced engineering, design, and manufacturing services to government and private sector customers and is deploying uranium enrichment and other capabilities necessary for production of advanced nuclear fuel production capabilities to power existing and next-generation reactors around the world.

Our LEU segment provides most of the Company’s revenue and involves the sale of enriched uranium, the fissile component of nuclear fuel, primarily to utilities operatingthat operate commercial nuclear power plants. The majority of these sales are for the enrichment component of LEU, which is measured in separative work units (“SWU”).SWU. Centrus also sells natural uranium hexafluoride (the raw material needed to produce LEU) and occasionally sells uranium concentrates, uranium conversion, or LEU with the natural uranium uranium conversion,hexafluoride and SWU components combined into one sale.

LEU is a critical component in the production of nuclear fuel for reactors that produce electricity. We supply LEU and its components to both domestic and international utilities for use in nuclear reactors worldwide. We provide LEU from multiple sources, including our inventory, medium- and long- termlong-term supply contracts, and spot purchases. As a long-term supplier of LEU to our customers, our objective is to provide value through the reliability and diversity of our supply sources.

Our global order bookOrder Book includes long-term sales contracts with major utilities through 2030. We have secured cost-competitive supplies of SWU under long-term contracts through the end of this decade designed to allow us to fill our existing customer orders and make new sales. A market-related price reset provision in the TENEX Supply Contract, which is our largest supply contract, occurred in 2018 and took effect at the beginning of 2019 – when market prices for SWU were near historic lows – which has significantly lowered our cost of sales and contributed to improved margins. Spot price indicators for SWU have risen by approximately 56%margins since bottoming out in August 2018. Refer to LEU Segment Order Book and Suppliers below.2019.

In October 2020, the U.S. Department of Commerce (“DOC”) reached agreementUnder a contract with the Russian Federation on an extension of the 1992 Russian Suspension Agreement (“RSA”), a trade agreement that allows for Russian-origin nuclear fuel to be imported into the United States in limited quantities. The two parties agreed to extend the agreement through 2040 and to set aside a significant portion of the import quotas through 2028 to execute Centrus’ long-term supply agreement (the “TENEX Supply Contract”) with the Russian government entity TENEX, Joint -Stock Company (“TENEX”). This outcome allows for sufficient quota for Centrus to continue serving its U.S. utility customers.

Our technical solutionsDOE, our Technical Solutions segment is deploying uranium enrichment and other capabilities necessary for production of advanced nuclear fuel production capabilities to meet the evolving needs of the global nuclear industry and the U.S. government, whilegovernment. We also leveringare leveraging our unique technical expertise, operational experience, and specialized facilities to expand and diversify our business beyond uranium enrichment, offering new services to existing and new customers in complementary markets.

Our technical solutionsTechnical Solutions segment has as its goalis dedicated to the restoration of America’s domestic uranium enrichment capability in order for us to play a critical role in meeting U.S. national security and energy security requirements and advancing America’s nonproliferation, objectives,energy, and deliveringclimate objectives. Our Technical Solutions segment also is focused on repairing broken and vulnerable supply chains, providing clean energy jobs, and supporting the communities in which we operate. Our goal is to deliver major components of the next-generation nuclear fuels that will power the future of nuclear energy providingas it provides reliable carbon freecarbon-free power around the world.

The U.S.United States has not had a domestic uranium enrichment capability suitable to meet U.S. national security requirements since the aging Paducah Gaseous Diffusion Plant (“Paducah GDP”)GDP shut down in 2013. CentrusDOE continues to draw down its finite stockpile of Cold War-era enriched uranium but is expected to need a new source of U.S.-origin enrichment in the future. Longstanding U.S. policy and binding nonproliferation agreements prohibit the use of foreign-origin enrichment technology for U.S. national security missions. Our AC100M centrifuge currently is the only American company working to deploy an enrichment technology and our AC100M centrifuge is the only deployment-ready U.S. uranium enrichment technology that can meet these national security requirements.

Centrus is uniquely positioned to leadpioneering U.S. production of HALEU, enabling the transition todeployment of a new generation of HALEU-fueled reactors to meet the world’s growing need for carbon-free power. On October 11, 2023, the Company announced that it began enrichment operations at its HALEU production facility in Piketon, Ohio under its contract with DOE. HALEU is a high-performance nuclear fuel known as High-Assay, Low-Enriched Uranium (“HALEU”),component which is expected towill be required by the commercial and/or government sectors for a number of advanced reactor and fuel designs currentlythat are now under development.development for commercial and government uses. While existing reactors typically operate on LEU with the uranium-235 isotopeU235 concentration below 5%, HALEU hasis further enriched so that the U235 concentration is between 5% and 20%. The higher U235 concentration offers a uranium-235 concentration rangingnumber of potential advantages, which may include better fuel utilization, improved performance, fewer refueling outages, simpler reactor designs, reduced waste volumes, and greater nonproliferation resistance.

The lack of HALEU supply is widely viewed as a major obstacle to the successful commercialization of these new reactors. For example, in surveys of advanced reactor developers conducted by the U.S. Nuclear Industry Council in 2020 and 2021, respondents indicated that the number one issue that “keeps you up at night” was access to HALEU. As the only company with a license from 5%the NRC actively enriching up to 20%, giving it several potential technical U235 assay HALEUand economic advantages. For example, the higher concentration of uranium-235 means that fuel assemblies and reactors can be smaller and reactors will require less frequent refueling. Reactors can also achieve higher “burnup” rates, meaning thatis operating a smaller volume of fuel will be required overall and less waste will be produced.small scaled HALEU may also be usedproduction facility, Centrus is uniquely positioned to fill a critical gap in the futuresupply chain and facilitate the deployment of these promising next-generation reactors.

The war in Ukraine has contributed to fabricate next-generation fuel formsa significant increase in market prices for enrichment and (along with proposed legislation to limit imports of LEU from Russia) has prompted calls for public and private investment in new, domestic uranium enrichment capacity not only for HALEU production but also for LEU production to support the existing fleet of reactors inreactors. As a result, Centrus is exploring the opportunity to deploy LEU enrichment alongside HALEU enrichment to meet a range of commercial and U.S. and around the world. These new HALEU-based fuelsgovernment requirements, which could improve the economics of nuclear reactors and inherent safety featuresbring operational synergies while increasing sales opportunities. Our ability to deploy LEU and/or HALEU enrichment, and the amounttiming, sequencing, and scale of electricitythose capabilities, is subject to the availability of funding and offtake commitments.

Under the HALEU Demonstration Contract signed in 2019, Centrus constructed and installed a cascade of 16 AC100M centrifuges in Piketon, Ohio to demonstrate HALEU production. The HALEU Demonstration Contract was originally set to expire on June 1, 2022. However, the DOE extended the HALEU Demonstration Contract to November 30, 2022. The Company is currently performing closeout activities on the HALEU Demonstration Contract. Due to challenges the DOE experienced in providing withdrawal cylinders as government furnished equipment, the DOE elected to change the scope of the HALEU Demonstration Contract and moved the operational portion of the demonstration to a new, competitively awarded contract that can be generated at existing reactors.provides for operations beyond the term of the HALEU fuel may also ultimately be used in new commercial and government applications inDemonstration Contract. DOE incrementally funded the future, such as reactors for the military.HALEU Demonstration Contract with total funding to date of $173.0 million.

In 2019,On November 10, 2022, after a competitive solicitation, the DOE awarded the HALEU Operation Contract to the Company’s subsidiary. Work began on December 1, 2022. The base contract value is approximately $150 million in two phases through 2024. Phase 1, which was completed in November 2023, included an approximately $30 million cost share contribution from Centrus began work on a three-year, $115matched by approximately $30 million cost-share contract (the “HALEU Contract”) withfrom the U.S. DepartmentDOE to complete construction of Energy (“DOE”) to deploy athe cascade of 16 of our AC100M centrifuges to demonstrate productionsupport systems, begin operations and produce the initial 20 kilograms of HALEU with domestic technology. As part of this effort, Centrus expects its Piketon, Ohio facility to become the first plant in the nation licensed to produce HALEU, with enrichment levels up to a U-235 concentration just below 20%. At the conclusion of the demonstration program funding in 2022, our goal is to continue production and scale up the facility in modular fashion as demand for HALEU grows in the commercial and/or government sectors. Refer to “UFTechnical Solutions - Government Contracting6” below for additional details.

Despite the challenges of COVID-19, we have continued to make progress under the contract. On June 23, 2020, the U.S. Nuclear Regulatory Commission (“NRC”) accepted for review our application to amend our license to permit the production of HALEU up to 20% U235 enrichment. We believe our investment in the HALEU technology will position the Company to meet the needs of our customers in the future as they deploy advanced reactors and next generation fuels. Advanced nuclear reactors promise to provide an important source of reliable carbon free power. By investing in HALEU technology now, and as the only domestically-owned company with HALEU enrichment capability, we believe the Company could be well positioned to capitalize on a potential new market as the demand for HALEU-based fuels increases with the development of advanced reactors. There are no guarantees about whether or when government or commercial demand for HALEU will materialize, and there are a number of technical, regulatory and economic hurdles that must be overcome for these fuels and reactors to come to the market. Since the HALEU demonstration program will conclude in early 2022, we are focused on developing options to sustain and expand our demonstrated capability for the period immediately following the conclusion of the program.

In late 2020, DOE announced ten awards under its Advanced Reactor Demonstration Program (“ARDP”) aimed at helping innovative, next generation reactor designs overcome technical and financial obstacles to successfully commercialize. This includes a commitment to support construction to two demonstration reactors over the next seven years and awards to support continued development of eight other reactor designs. Nine of the ten reactor designs chosen are expected to require HALEU fuel.

Centrus has built formal and informal relationships with mostPhase 2 of the ARDP awardeescontract includes continued operations and expectsmaintenance and production for a full year at an annual production rate of 900 kilograms of HALEU UF6. The DOE owns the HALEU produced from the demonstration cascade. In Phase 2, Centrus is being compensated on a cost-plus-incentive-fee basis, with an expected Phase 2 contract value of approximately $90 million, subject to be firstCongressional appropriations. Concurrently, pursuant to market with domestically-produced HALEU that could be usedan amendment to fuel these reactors. For example, on September 15, 2020, Centrus made a joint announcement with TerraPower LLC (“TerraPower”) that the two companies plan to work together toward establishing commercial-scale domestic HALEU production capabilities. Centrus also has worked under a series of contracts with X Energy, LLC (“X-energy”), a pioneering advanced reactor and advanced nuclear fuel company, to support X-energy’s work to develop a facility to fabricate HALEU into an advanced fuel called tristructural isotropic (TRISO) fuel. TerraPower and X-energy were the two companies chosen by DOEour lease for the largest awards underPiketon facility, the Advanced Reactor Demonstration Program. While first year funding forDOE assumed all D&D liabilities arising out of the two companies totaled $160 million, DOE announced its intent to ultimately provide a combined total of $3.2 billion over a seven year period to help TerraPower and X-energy build their first reactors. The awards are subject to annual appropriations by Congress and there can be no assurance that the projects will be completed or that TerraPower and X-energy will ultimately purchase HALEU from Centrus.Operation Contract.

On October 13, 2020, Centrus announcedUnder the signingHALEU Operation Contract, DOE is obligated to provide the 5B Cylinders necessary to collect the output of a memorandumthe cascade, but supply chain challenges have created difficulties for DOE in securing enough 5B Cylinders for the entire production year. To support the DOE in mitigating the risk of understanding with Terrestrial Energy USA (“TEUSA”) to secure fuel supply for a future fleetfurther delays in delivery of TEUSA’s Integral Molten Salt Reactor (“IMSR”) power plants. The two companies will evaluate the logistical, regulatory, and transportation requirements to establish fuel supply for IMSR power plants, which use LEU. There can be no assurance that5B Cylinders, the Company received technical direction and TEUSA will ultimately enter into a contract on terms that will be acceptable.

Withmodification from the specialized capabilitiesDOE to procure compliant 5B Cylinders and workforce at our Technology and Manufacturing Center in Oak Ridge, Tennessee, we are performing technical, engineering and manufacturing services for a range of commercial and government customers and actively workingcomponents while the contractual obligation to secure new customers. Our experience developing, licensing, manufacturing, and operating advanced nuclear components and systems positions usfurnish compliant 5B Cylinders under the HALEU Operation Contract continues to provide critical design, engineering, manufacturing, and other services to a broad range of potential clients, including those involving sensitive or classified technologies. This work includes design, engineering, manufacturing, and licensing services support for advanced reactor and fuel fabrication projects as well as decontamination and decommissioning (“D&D”) work.

rest with the DOE. The Company continues to look at opportunities to improve its capital structureis also performing additional work on infrastructure and to enhance shareholder value. As a result, on September 1, 2020, the Company completed the sale of 2,537,500 shares of the Company’s Class A Common Stock pursuant to the Registration Statement on Form S-3 that became effective on August 5, 2020, as supplemented by the prospectus supplement filed with the SEC on August 21, 2020. The price to the public in the offering was $10.00 per share. The aggregate gross proceeds from the offering were approximately $25.4 million, before deducting underwriting discountsfacility repairs under separate DOE technical direction and commissions and other estimated offering expenses payable by the Company of $2.3 million. The Company currently intends to use the net proceeds from this offering for general working capital purposes, to invest in technology development and to repay outstanding debt or retire shares of its Series B Senior Preferred Stock.

On November 17, 2020, pursuant to a tender offer announced on October 19, 2020, the Company completed the purchase of 62,854 shares of its outstanding Series B Preferred Stock at a price per share of $954.59, less any applicable withholding taxes, for an aggregate purchase price of approximately $60 million. The purchase price per share represented a 25% discount from the aggregate liquidation preference, including accrued but unpaid dividends, of $1,272.78 per share as of September 30, 2020. These shares represented approximately 60% of the Company's outstanding Series B Preferred Shares as of September 30, 2020. The remaining Series B Preferred shares outstanding after the transaction was 41,720 shares.

On December 31, 2020, the Company entered into an At Market Sales Agreement with B. Riley Securities, Inc. and Lake Street Capital Markets, LLC, relating to the at the market offering of shares of the Company’s Class A Common Stock, $0.10 par value per share. The shares of Class A Common Stock were issued pursuant to the Company’s shelf registration statement on Form S-3 (File No. 333-239242), which became effective on August 5, 2020, and a prospectus supplement dated December 31, 2020 to the prospectus, dated August 5, 2020. subsequent contract modification. For further details refer to Note 21,Subsequent Events of the consolidated financial statements.Business - Technical Solutions - Government Contracting.

The nuclear industryDOE is contemplating awarding additional contracts to ensure availability of HALEU for the ARDP and for the advanced reactor market in general, and received a $700 million congressional appropriation from the nuclear fuel industryInflation Reduction Act as a first step in particular, is inestablishing a perioddomestic supply chain for HALEU. On November 28, 2023, the DOE issued an RFP focusing on deconversion of significant change, which continuesHALEU and on January 9, 2024, issued an RFP focusing on the production of HALEU. The Company expects to affectsubmit bids for both RFPs, with the competitive landscape. Ingoal of expanding HALEU production capability at the years following the 2011 Fukushima accident in Japan, the published market prices for uranium enrichment declined more than 75% through mid-2018. While the monthly price indicators have since increased, the uranium enrichment segmentPiketon facility and building a deconversion facility, subject to, among other things, availability of the nuclear fuel market remains oversupplied (including because foreign-owned enrichers continued to expand even as demand fell) and faces uncertainty about future demand for nuclear power generation. Changes in the competitive landscape affect pricing trends, change customer spending patterns, and create uncertainty. To address these changes, we have taken steps to adjust our cost structure; we may seek further adjustments to our cost structure and operations and evaluate opportunities to grow our business organically or through acquisitions and other strategic transactions.

We are also actively considering, and expect to consider from time to time in the future, potential strategic transactions, which could involve, without limitation, acquisitionsfunding and/or dispositions of businesses or assets, joint ventures or investments in businesses, products or technologies or changes to our capital structure. In connection with any such transaction, we may seek additional debt or equity financing, contribute or dispose of assets, assume additional indebtedness, or partner with other parties to consummate a transaction.

We believe that our position as a leading provider of enriched uranium and our long-standing global relationships will enable us to increase our future market share in the nuclear fuel market and support our growth into complementary areas of the nuclear and other industries. We are well-positioned to capitalize on our heritage, industry-wide relationships, and diversity of supply to provide reliable and competitive sources of nuclear fuel and related services. Centrus continues to be valued by its customers as a source of diversity, stability, and competition in the enrichment market.offtake commitments.

For further details, refer to Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations - Market Conditions and Outlook. For a discussion of the potential risks and uncertainties facing our business, see Part I, Item 1A, Risk Factors.

Low Enriched Uranium

LEU consists of two components: separative work units (“SWU”)SWU and uranium.natural uranium hexafluoride. Revenue from our LEU segment is derived primarily from:

•sales of the SWU component of LEU,

•sales of both the SWU andnatural uranium components of LEU,hexafluoride, uranium concentrates, or uranium conversion, and

•sales of enriched uranium product that include both the natural uranium.uranium hexafluoride and SWU components of LEU.

Revenue from ourOur LEU segment accounted for approximately 77%84% of our total revenue in 2020. Ourfor the year ended December 31, 2023. The majority of our customers are primarily domestic and international utilities that operate nuclear power plants. Our agreements with electric utilities are primarily mediummedium-term and long-term, fixed-commitment contracts. Under these contracts, under which our customers are obligated to purchase a specified quantity of the SWU component of LEU from us. Our agreements for natural uranium and enriched uranium product sales,Contracts where we sell both the SWU and natural uranium componenthexafluoride components of LEU to utilities or where we sell natural uranium hexafluoride to utilities and other nuclear fuel related companies are generally shorter-term, fixed-commitment contracts.

Uranium and Enrichment

Uranium is a naturally occurring element and is mined from deposits located in Kazakhstan, Canada, Australia, and several other countries, including the United States. According to the World Nuclear Association (“WNA”),WNA, there are adequate measured resources of natural uranium to fuel nuclear power at current usage rates for about 90 years. In its natural state, uranium is principally comprised of two isotopes: uranium-235 (“U235”) and uranium-238 (“U238”). The concentration of U235 in natural uranium is only 0.711% by weight. Uranium enrichment is the process by which the concentration of U235 is increased. Most commercial nuclear power reactors require LEU fuel with a U235 concentration greater than natural uranium andof up to 5% by weight. Future reactor designs currently under development will likely require higher U235 concentration levels of up to 20%. Uranium enrichment is the process by which the concentration of U235 is increased.

SWU is a standard unit of measurement that represents the effort required to transform a given amount ofseparate natural uranium into two components:between enriched uranium, having a higher percentage of U235, and depleted uranium, having a lower percentage of U235. The SWU contained in LEU is calculated using an industry standard formula based on the physics of enrichment. The amount of enrichment deemed to be contained in LEU under this formula is commonly referred to as its SWU component and the quantity of natural uranium hexafluoride deemed to be contained in LEU under this formula is referred to as its uranium or “feed” component.

While in some cases customers purchase both the SWU and uranium components of LEU from us, utility customers typically provide the natural uranium hexafluoride to us as part of their enrichment contracts and in exchange we deliver LEU to these customers and charge for the SWU component. Title to natural uranium hexafluoride provided by customers generally remains with the customer until delivery ofCentrus delivers the LEU, at which time title to the LEU is transferred to the customer, and we takeCentrus takes title to the uranium.natural uranium hexafluoride.

The following outlines the steps for converting natural uranium into LEU fuel, commonly known as the nuclear fuel cycle:

Mining and Milling. Natural, or unenriched, uranium is removed from the earth in the form of ore and then crushed and concentrated.

Conversion. Uranium concentrates (“U3O8”) are is combined with fluorine gas to produce uranium hexafluoride (“UF6”), a solid at room temperature and a gas when heated. UF6 is shipped to an enrichment plant.

Enrichment. UF6 is enriched in a process that increases the concentration of the U235 isotope in the UF6 from its natural state of 0.711% up to 5%, or LEU, which is usable as a fuel for current light water commercial nuclear power reactors. Future commercial reactor designs may use uranium enriched up to 20% U235, or HALEU.

Fuel Fabrication. LEU is then converted to uranium oxide and formed into small ceramic pellets by fabricators. The pellets are loaded into metal tubes that form fuel assemblies, which are shipped to nuclear power plants. As the advanced reactor market develops, HALEU may be converted to uranium oxide, metal, chloride or fluoride salts, or other forms and loaded into a variety of fuel assembly types optimized for the specific reactor design.

Nuclear Power Plant. The fuel assemblies are loaded into nuclear reactors to create energy from a controlled chain reaction. Nuclear power plants generate approximately 20%18% of U.S. electricity and 10% of the world’s electricity.

Used Fuel Storage. After the nuclear fuel has been in a reactor for several years its efficiency is reduced and the assembly is removed from the reactor’s core. The used fuel is warm and radioactive and is kept in a deep pool of water for several years. Many utilities have elected to then move the used fuel into steel or concrete and steel casks for interim storage.

LEU Segment Order Book

Our order book of sales under contract in the LEU segment (“order book”)Order Book extends to 2030. As of December 31, 2020,2023, and December 31, 2022, our order bookOrder Book was approximately $960 million.$1.0 billion. The order bookOrder Book is the estimated aggregate dollar amount of revenue for future SWU and uranium deliveries, and includes approximately $328 million$0.3 billion of deferred revenue and advances from customers as of December 31, 2020,2023, whereby customers have made advance payments to be applied against future deliveries. We estimate that approximately 2% ofNo orders in our order book isOrder Book are considered at risk related to customer operations. We anticipate our SWU and uranium revenue from sales currently under contractThis Order Book is for the LEU segment only; it does not include the HALEU Operation Contract or other work in our order book will be in a range of $130 million to $140 million during 2021. As of December 31, 2019, our order book was approximately $1.0 billion.Technical Solutions segment.

Most of our customer contracts provide for fixed purchases of SWU during a given year. Our order bookOrder Book estimate is based partially on customers’ estimates of the timing and size of their fuel requirements and other assumptions that are subject to change. For example, depending on the terms of specific contracts, the customer may be able to increase or decrease the quantity delivered within an agreed range. Our order bookOrder Book estimate is also based on our estimates of selling prices, which may be subject to change. For example, depending on the terms of specific contracts, prices may be adjusted based on escalation using a general inflation index, published SWU price indicators prevailing at the time of delivery, and other factors, all of which are variable. We use external composite forecasts of future market prices and inflation rates in our pricing estimates. Refer to Part I, Item 1A, Risk Factors, for a discussion of risks related to our order book.Order Book.

Suppliers

We have a diverse base of supply that includes:

•existing inventory of LEU (Refer to Part II, Item 8, Financial Statements and Supplemental Data: Note 4, Inventories, in the Consolidated Financial Statements in Part IV of this Annual Report);

•mid- and long-term contracts with enrichment producers,producers;

•purchases and loans from secondary sources, including fabricators and utility operators of nuclear power plants that have excess inventory,inventory; and

•spot purchases of SWU, uranium, and LEU.

We have and will seekaim to continue to further diversify this base of supply and take advantage of opportunities to obtain additional short and long-term supplies of LEU.

Currently, our largest suppliers of SWU are the Russian government entityis TENEX andfollowed by the French government ownedgovernment-owned company, Orano Cycle (“Orano”).Orano.

Under the TENEX Supply Contract, we purchase SWU contained in LEU, received from TENEX, and we deliver natural uranium hexafluoride to TENEX for the LEU’s uranium component. The TENEX Supply Contract originally was signed with commitmentsextends through 2022 but was modified in 2015 to give us the right to reschedule certain quantities of SWU of the original commitments into the period 2023 and beyond, in return for the purchase of additional SWU in those years.2028. We have exercised our right to reschedule deliveries through 2028 when the TENEX Supply Contract is scheduled to terminate.

Under the TENEX Supply Contract, wetypically pay for the SWU contained in the LEU delivered to us, and either supply natural uranium to TENEX for the natural uranium content of the LEU or, in limited cases, pay for such content.component. SWU pricing is determined by a formula that usesusing a combination of market-related price points and other factors. The LEU that we obtain from TENEX under the TENEX Supply Contract currently is subject to quotas and other restrictions under an agreementthe RSA between the United States and the Russian Federation governingwhich governs exports of Russian uranium products to the United States. This agreement was scheduled to expire as of December 31, 2020.However, it was extended through 2040 under an agreement reached in October 2020 by the DOC and the Russian State Atomic Energy Corporation (“ROSATOM”).The extension providesCurrently, these quotas for shipments of Russian uranium products to the United States after 2020, and allocates a substantial portion of the quotas through 2028 for use under Centrus’ TENEX Supply Contract. These quotas will allow us to continue to supply Russian LEU to our U.S. customers through 2028. Shortly after the extension was signed, theThe terms of the RSA, as extended, were also adopted into law by the U.S. Congress in the Consolidated Appropriations Act, 2021. Refer to Item 1A, Risk Factors - Operational Risks for further discussion.

The amount of SWU we must purchase from TENEX under the TENEX Supply Contract exceeds our current sales order book and, therefore, weCentrus will need to make newadditional sales to place all the Russian LEU we must orderrequired to meet our SWU purchase obligations to TENEX. In addition, becauseAlthough the RSA quotas do not cover allmost of the LEU that we must order to fulfill our purchase obligations under the TENEX Supply Contract, we expect that a small portion of the Russian LEU that we order during the term of the TENEX Supply Contract will need to be delivered to customers whothat will use it in non-U.S. reactors.

useThe war in Ukraine has escalated tensions between Russia and the international community. As a result, the United States and other countries have imposed, and may continue imposing, additional sanctions and export controls against certain Russian products, services, organizations and/or individuals. In December 2023, for example, the U.S. House of Representatives passed H.R. 1042, the “Prohibiting Russian Uranium Imports Act”, that, if enacted into law, would ban imports of LEU from Russia beginning ninety (90) days after the date of enactment.The Secretary of Energy could waive this ban for imports prior to January 1, 2028 where there is no alternative viable source of LEU to sustain the continued operation of a nuclear reactor or a U.S. nuclear energy company or where the imports are in the national interest.The prospects for H.R. 1042, which still needs Senate approval and Presidential signature, to become law remain uncertain.Similar legislation was adopted by the Senate Committee on Energy and Natural Resources in July 2023 and the White House endorsed the idea of a long-term ban on imports of enriched uranium in an October 2023 fact sheet on funding priorities. To date, however, other than the quotas and provisions of the RSA and the law implementing the RSA, there are no U.S. sanctions on imports of LEU into the United States.

Sanctions imposed by other countries to date also do not preclude the import of Russian uranium products into the United States. However, it in overseas reactors. Theis possible that additional restrictions could be added that would affect our ability to purchase and re-sell Russian uranium enrichment, or implement the TENEX Supply Contract, which could have a negative material impact on our business. Further, sanctions by the United States, Russia or other countries may impact our ability and cost to transport, export, import, take delivery, or make payments related to the LEU we purchase. For example, due to restrictions imposed by Canada on the ability of Canadian persons and entities to provide ocean transportation services to Russia, a permit is required for our shipper, a Canadian company, to transport the LEU that we procure under the TENEX Supply Contract to the United States. A Canadian permit issued to our shipper was recently extended to early July 2024, but for so long as the Canadian sanctions remain in place, the shipper will require further extensions of the permit for us to continue to use the shipper beyond July 2024.

Any proposal for a U.S. ban on LEU imports represents a significant risk to our business because the TENEX Supply Contract is the major source of supply that the Company relies upon today to meet its delivery obligations and to earn the revenues needed to fund our advanced technology work. Through 2027, well over one-half of the LEU that we expect to deliver to international customers can be delivered eitheris anticipated to come from material supplied to us under the TENEX Supply Contract. While we have other sources, they are not sufficient to replace the TENEX supply. Refer to Item 1A, Risk Factors- Economic and Industry Risks - Dependence on our largest customers or suppliers could adversely affect us.

In addition to limitations targeted specifically at fabrication facilities inimports of LEU, the expanding sanctions imposed by the United States or overseas.and foreign governments on the mechanisms used to make payments to Russia and to obtain services, including transportation have increased the risk that implementation of the TENEX Supply Contract may be disrupted in the future.

Given all of the foregoing, we continue to monitor the situation closely and assess the potential impact of any new sanctions and how the impact on the Company might be mitigated. Refer to Part I, Item 1A, Risk Factors - Operational Risks and - War in Ukraine Risks, for further discussion.

We also have an agreement with Orano (the “Orano Supply Agreement”) for the long-term supply of SWU contained in LEU, nominally commencingwith deliveries that commenced in 2023. Under the Orano Supply Agreement, we will purchase SWU contained in LEU received from Orano, and then deliver natural uranium to Orano for the natural uranium feed material component of LEU. We have therecently exercised our option to extend the six-year purchase period for an additional two years.years, electing to take the additional supply in 2029 and 2030. The Orano Supply Agreement provides significant flexibility to adjust purchase volumes, subject to annual minimums and maximums, in fixed amounts that vary year by year. The pricing for the SWU purchased by usSWU is determined by a formula that uses a combination of market-related price points and other factors, and is subject to certain floors and ceilings. Prices are payable in a combination of U.S. dollars and euros.

We procure LEU from other sources under short-term and long-term contracts and have inventories available that diversify our supply portfolio and provide flexibility to help us meet the needs of our customers. We also have agreements to borrow SWU whichthat we can use to optimize our purchases and deliveries over time.

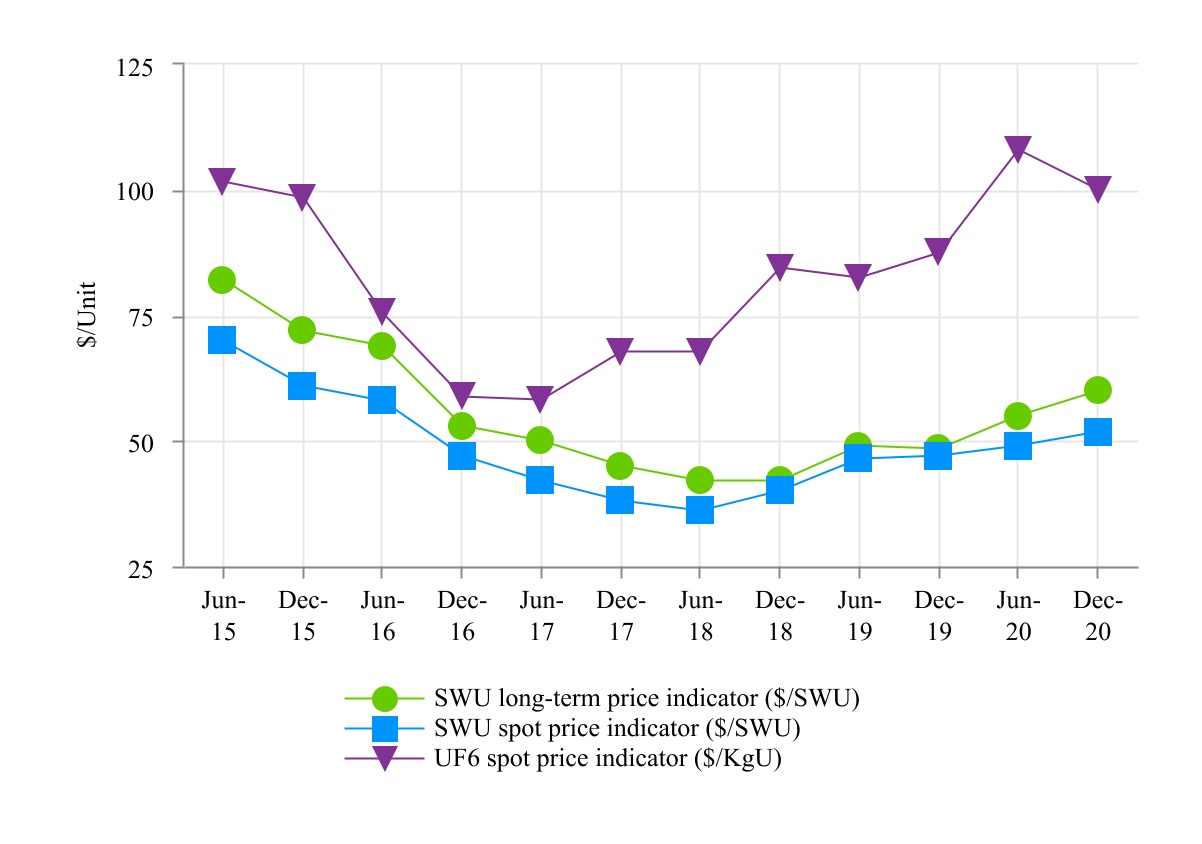

Market prices for SWU fell substantially in the aftermath of the nuclear incident at Fukushima, Japan in 2011. Recent purchases2011, bottoming out in 2018. Since 2018, SWU prices have steadily increased and, following the Russian invasion of SWU and our long-term contractUkraine, have increased to levels consistent with Orano reflect this decline in market prices. We signed our large, long-term supply agreement with TENEX in 2011. Pricesthose prior to the 2011 Fukushima incident.

Centrus’ purchase prices under the TENEX Supply Contract also have beenwere adjusted to reflect lower market prices based on a one-time market related price reset that was agreed when we signed the contract in 2011.reset. The price reset occurred in 2018, reducing the unit cost perfor our purchases from 2019 through 2028. Similarly, Centrus’ SWU for purchases we madeunder our long-term contract with Orano reflect the lower market prices that prevailed in 2019-2020 and will make for2018, when Centrus signed the duration of the contract.long-term contract with Orano.

Technical Solutions

Our technical solutionsTechnical Solutions segment reflects our technical, manufacturing, engineering, and operations services offered to public and private sector customers, including the American Centrifuge engineering, procurement, construction, manufacturing, and operations services being performed under the HALEU Operation Contract. Subject to the availability of sufficient funding and offtake commitments, our goal is to expand our uranium enrichment capacity to meet the full range of U.S. government and commercial requirements for enriched uranium. With our government and private sector customers, we seek to leverage our domestic enrichment experience, as well as our engineering know-how and precision manufacturing facility to assist customers with a range of engineering, design and advanced manufacturing projects, including the production of fuel for next-generation nuclear reactors and the development of related facilities. Refer to Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations - COVID-19.

Government Contracting

On October 31, 2019, we signed the cost-share HALEU Contract with DOE to deploy a cascade of centrifuges to demonstrate production of HALEU for advanced reactors. The three-year program has been under way since May 31, 2019, when the Company and DOE signed an interim HALEU letter agreement that allowed work to begin while the full contract was being finalized. We continue to invest in advanced technology because of the potential for future growth into new areas of business for the Company, while also preserving our unique workforce at our Technology and Manufacturing Center in Oak Ridge, Tennessee, and our production facility near Piketon, Ohio. Refer to Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Government Contracting

On October 31, 2019, we signed the cost-share HALEU Demonstration Contract with the DOE to deploy a cascade of centrifuges to demonstrate production of HALEU for advanced reactors. The three-year program commenced on May 31, 2019, when the Company and the DOE signed an interim HALEU letter agreement that allowed work to begin while the full contract was being finalized. We have significantly invested in advanced technology because of the potential for future growth into new areas of business for the Company, while also preserving our unique workforce at our technology and manufacturing center in Oak Ridge, Tennessee, and our production facility near Piketon, Ohio. The Company entered into this cost-share contract with the DOE as a critical first step on the road back to the commercial production of enriched uranium, which the Company had terminated in 2013 with the closure of the Paducah GDP. TheUnder the 2019 HALEU Demonstration Contract, once fully implemented, is expected to result in the Company havingconstructed and installed 16 centrifuges for eventual site operations and HALEU production. Additionally, the first NRC-licensed HALEU production facility inCompany designed, procured, and installed most of the United States and will have demonstratednecessary support systems. Centrus currently is the abilityonly company with an NRC license to enrich uranium up to a 19.75%the 20% U-235 concentration that is contained in HALEU and is the only company known to us to produce HALEU outside of the U-235 isotope.Russia.

HALEU is expected to be required by many of the advanced reactor designs now under development, including nine out of the ten reactor designs that were selected in 2020 for the U.S. Department of Energy’s Advanced Reactor Demonstration Program.HALEU may also be used in advanced nuclear fuels under development for the existing fleet of reactors.In addition to commercial demand, HALEU may be needed for microreactor designs that are now under development for the U.S. Department of Defense.Our HALEU Contract expires in 2022 and although we believe demand for HALEU will emerge over the next several years, there are no guarantees about whether or when government or commercial demand for HALEU will materialize,

and there are a number of technical, regulatory and economic hurdles that must be overcome for these fuels and reactors to come to the market.

Under the HALEU Demonstration Contract, the DOE agreed to reimburse the Company for up to 80% of its costs incurred in performing the contract. The DOE modified the contract upseveral times to a maximum of $115increase the total contract funding to $173.0 million. The Company’s cost share isHALEU Demonstration Contract’s period of performance ended in November 2022. Costs under the corresponding 20%HALEU Demonstration Contract included program costs, including direct labor and anymaterials and associated indirect costs incurred above these amounts.that are classified as Cost of Sales, and an allocation of corporate costs supporting the program that are classified as Selling, General and Administrative Expenses. Services to be provided overunder the three-year contract includeincluded constructing and assemblinginstalling centrifuge machines and related infrastructure, in a cascade formation and productiontraining and qualifying the workforce for operation of a small quantity of HALEU.the facility. When estimates of remaining programtotal costs to be incurred for such an integrated, construction-type contract exceed estimates of total revenue to be earned, a provision for the remaining loss on the contract is recorded. Arecorded to Cost of Sales in the period the loss provisionis determined. Our corporate costs supporting the program are recognized as expense, as incurred over the duration of $18.3 millionthe contract term. The previously accrued loss on the HALEU Demonstration Contract was realized over the contract term.

During the HALEU Demonstration Contract, the DOE experienced a supply chain delay in obtaining HALEU 5B Cylinders. Since it was not possible to begin HALEU production without the 5B Cylinders, it was not possible to complete the operational portion of the HALEU Demonstration Contract before the expiration date of the contract. As a result, the DOE elected to change the scope of the HALEU Demonstration Contract and move the operational portion of the demonstration to a new, competitively-awarded, contract that provides for operations beyond the term of the HALEU Demonstration Contract. Under the HALEU Demonstration Contract, Centrus completed construction of a cascade of 16 AC100M centrifuges in Piketon, Ohio, for the DOE to demonstrate HALEU production. The HALEU Demonstration Contract was originally set to expire on June 1, 2022. However, the DOE extended the HALEU Demonstration Contract to November 30, 2022. The Company is currently performing closeout activities on the HALEU Demonstration Contract.

As discussed above, the Company began work on the HALEU Operation Contract on December 1, 2022. On November 7, 2023, the Company announced that it made its first delivery of HALEU to the DOE, completing Phase 1 by successfully demonstrating its HALEU production process. The portion of the Company’s anticipated cost share under Phase 1 of the HALEU Operation Contract representing the Company’s share of projected program costs was recognized in Cost of Sales as an accrued loss in the fourth quarter of 2019. The accrued loss on the contract is beingended December 31, 2022, and was adjusted over the remainingPhase 1 contract term based on actual results and remaining program cost projections. As of December 31, 2020, the accrued contract loss balance was $7.7 million, and Cost of Sales in 2020 benefited by $10.6 million for previously accrued contract losses attributable to work performed in 2020. The HALEU Contract is incrementally funded and DOE is currently obligated for costs up to approximately $87.4 million of the $115 million. The Company has received aggregate cash payments of $55.8 million through December 31, 2020.

OverDuring November 2023, the past fiveCompany transitioned to Phase 2 of the HALEU Operation Contract. The DOE will own the HALEU produced from the demonstration cascade and Centrus will be compensated on a cost-plus-incentive-fee basis, with an expected Phase 2 contract value of approximately $90 million, subject to Congressional appropriations. The HALEU Operation Contract also gives DOE options to pay for up to nine additional years our government contracts with UT-Battelle LLC (“UT-Battelle”) have provided for engineeringof production from the cascade beyond the base contract; those options are at the DOE’s sole discretion and testing work onsubject to the American Centrifuge technology at our facilities in Oak Ridge, Tennessee. In February 2020, an additional $4.4 million fixed-price agreement was entered into with UT-Battelle.availability of Congressional appropriations. The Company which had already begun this scopehas filed a license amendment to increase its possession limit above 900 kilograms of work in 2019, completed the work during the second quarter of 2020. Revenue was $4.4 million in 2020, with approximately 58% of associated costs recognized in 2019 HALEU UF6 and 42% in 2020.expects to receive NRC approval prior to reaching its current possession limit.

In addition, we have entered into other contracts withUnder the HALEU Operation Contract, the DOE other agencies and their contractorsis contractually required to provide engineering, designthe 5B Cylinders necessary to collect the output of the cascade, but supply chain challenges have created difficulties for the DOE in securing enough 5B Cylinders for the entire production year. Centrus’ delivery of the 900 kilograms was conditioned on the DOE’s ability to provide the 5B Cylinders on a timeline that allowed for continuous production throughout Phase 2 of the contract. During periods where 5B Cylinders are insufficient, the Company will not be able to produce HALEU, but will be able to continue operations of the cascade and manufacturing services.perform preventive maintenance and regulatory compliance type activities. Centrus anticipates that the delays in obtaining 5B Cylinders will be temporary, but no longer expects to achieve delivery of the 900 kilograms of HALEU UF6 anticipated for Phase 2 of the contract which extends to November 2024. The target fee for Phase 2 of the contract had been estimated to be $7.5 million based on the estimated costs for the contract and is subject to a contract minimum fee of $6.9 million.

To support the DOE in mitigating the risk of further delays in delivery of 5B Cylinders, the Company received technical direction and a contract modification from the DOE to procure compliant 5B Cylinders and components, while the contractual obligation to furnish compliant 5B Cylinders under the HALEU Operation Contract continues to rest with the DOE. The Company also is performing additional work on infrastructure and facility repairs under the DOE’s technical direction. On September 28, 2023, the DOE modified the HALEU Operation Contract to incorporate additional scope, which are not subject to cost-share, for infrastructure and facility repairs, and costs associated with 5B Cylinder refurbishment, for an estimated additional contract value of $5.8 million. On October 19, 2023, the DOE provided additional funding of $5.5 million for the additional scope under the HALEU Operation Contract.

Centrus believes it is well positioned to compete for any follow-on contract(s) to expand HALEU production capability at the Piketon site. As discussed above, on November 28, 2023, the DOE issued an RFP focusing on deconversion of HALEU and on January 9, 2024, issued an RFP focusing on the production of HALEU.The Company expects to submit bids on both RFPs.

For further details, refer to Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations - Market Conditions and Outlook.

Commercial Contracting