Our director and officers are not residents of the United States making the enforcement of liabilities against them difficult.

The director and executive officers reside outside the United States and in the Republic of the Philippines. If a shareholder had a desire to sue them for damages, the shareholder would have to serve a summons and complaint. Even if personal service is accomplished and a judgment is entered against that person, the shareholder would then have to locate the assets of that person, and register the judgment in the foreign jurisdiction where the assets are located.

Our Officers have other time commitments that will prevent them from devoting full-time to our operations, which may affect our future operations.

Because Our Officers, who are responsible for all of our business activities, do not devote their full working time to our operation and management, the implementation of our business plans may be impeded. They have other obligations and time commitments, which may slow our future operations and impact our financial results. Additionally, when the Officers become unable to handle the daily operations on their own, we may not be able to hire additional qualified personnel to replace them in a timely manner. If this event should occur, we may not be able to implement our business plan in a timely manner or at all. See “Directors and Executive Officers”.

The probability of a mineral claim having profitable reserves is very rare and our claim, even with large investments, may never generate a profit.

We are dependent upon our mining property for success. All anticipated future revenues would come directly from the Palayan Gold Claim. Should we fail to extract and sell gold from this property, our business will fail. Mineral deposit estimates are imprecise and subject to error, and resource calculations when made may prove unreliable. Assumptions made regarding the supporting data may prove inaccurate and unforeseen events may lead to further inaccuracies. Sample variability, mining and processing adjustments, environmental changes, metal price fluctuations, and law and regulation changes are all factors that could lead to deviances from the original estimations. No assurances can be given that any mineral deposit estimate will ever be reclassified as a reserve. We have no known ore reserves. Despite future investment in exploration activities, there is no guarantee we will locate a commercially viable ore reserve. Most exploration projects do not result in discovery of commercially viable mineable deposits. With little capital available, we will have to limit our exploration which decreases the chances of finding a commercially viable ore body. Even if gold is identified, the Palayan Gold Claim may not be put into production due to high extraction costs, low gold prices, or inadequate amount and reduced recovery rates. If the exploration activities do not suggest a commercially successful prospect, then we may altogether abandon plans to develop the property.

The exploration and prospecting of minerals is speculative and extremely competitive which may make success difficult.

We face strong competition from other mining companies for the acquisition of new properties. New properties increase the probability of discovering a profitable reserve. Most companies have greater financial and managerial resources than we do and can acquire and explore attractive new mining properties. We will face similar difficulties raising new capital to expand operations against the larger, better capitalized competitors. Limited supply and unforeseen demand from larger, more competitive companies may make secure all necessary equipment and materials difficult and may result in periodic interruptions or even business failure. Success depends on a combination of many factors including but not limited to the quality of management, technical (geological) expertise, quality of land available for exploration and the capital available for exploration.

We are subject to inherent mining hazards and risks that may result in future financial obligations.

Risks and hazards associated with the mining industry may adversely affect our future operations such as but not limited to: political and country risks, industrial accidents, labor disputes, inability to retain necessary personnel or equipment, environmental hazards, unexpected geologic formations, cave-ins, landslides, flooding and monsoons, fires, explosions, power outages, processing problems. Personal injury and death could result as well as property damage, delays in mining, environmental damage, legal liability and monetary loss. We may not be able to obtain insurance to cover these risks at economically reasonable premiums. We do not carry any sort of insurance and may have difficulties obtaining such once operations start as insurance is generally sparse and cost prohibitive.

We do not expect positive cash flow from future operations in the near term. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business.

We do not expect positive cash flow from future operations in the near term. There is no assurance that actual cash requirements will not exceed our estimates. In particular, additional capital may be required in the event that:

drilling, exploration and completion costs for our Palayan Gold Claim increase beyond our expectations; or

we encounter greater costs associated with general and administrative expenses or other costs.

The occurrence of any of the aforementioned events could adversely affect our ability to meet our business plans.

We will depend almost exclusively on outside capital to pay for the continued exploration and development of our properties. Such outside capital may include the sale of additional stock and/or commercial borrowing. We can provide no assurances that any financing will be successfully completed.

Capital may not continue to be available if necessary, to meet these continuing development costs or, if the capital is available, that it will be on terms acceptable to us. The issuance of additional equity securities by us would result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease future operations for our business, the result of which would be that our stockholders would lose some or all of their investment.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claim, we will not be able to earn profits or continue future operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position.

Our By-laws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our By-laws contain provisions with respect to the indemnification each of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him, including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which he is made a party by reason of his being or having been one of our directors or officers.

Risks Related to the Ownership of Our Stock

The continued sale of our equity securities will dilute the ownership percentage of our existing stockholders and may decrease the market price for our common stock.

Given our lack of revenues and the doubtful prospect that we will earn significant revenues in the next several years, we will require additional financing for the next 12 months, which may require us to issue additional equity securities. We expect to continue our efforts to acquire financing to fund our planned development and expansion activities, which may result in dilution to our existing stockholders.

We do not intend to pay dividends and there will thus be fewer ways in which you are able to make a gain on your investment.

We have never paid dividends and do not intend to pay any dividends for the foreseeable future. To the extent that we may require additional funding currently not provided for in our financing plan, our funding sources may prohibit the declaration of dividends. Because we do not intend to pay dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will therefore be fewer ways in which you are able to make a gain on your investment.

| 3 |

Because the SEC imposes additional sales practice requirements on brokers who deal in shares of penny stocks, some brokers may be unwilling to trade our securities. This means that you may have difficulty reselling your shares, which may cause the value of your investment to decline.

Our shares are classified as penny stocks and are covered by section 15(g) of the Securities Exchange Act of 1934 (the “Exchange Act”) which imposes additional sales practice requirements on brokers-dealers who sell our securities. For sales of our securities, broker-dealers must make a special suitability determination and receive a written agreement prior from you prior to making a sale on your behalf. Because of the imposition of the foregoing additional sales practices, it is possible that broker-dealers will not want to make a market in our common stock. This could prevent you from reselling your shares and may cause the value of your investment to decline.

FINRAThe Financial Industry Regulatory Authority’s (“FINRA”) sales practice requirements may limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

Our compliance with the Sarbanes-Oxley Act and SEC rules concerning internal controls will be time-consuming, difficult, and costly.

It will be time-consuming, difficult and costly for us to develop and implement the internal controls, processes and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional personnel to do so, and if we are unable to comply with the requirements of the legislation, we may not be able to obtain the independent accountant certifications that the Sarbanes-Oxley Act requires publicly traded companies to obtain.

Item 1B.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

Item 2. Properties

Our principal executive offices are located at 223 De La Cruz Road, Pasay, Metro Manila Philippines.850 Teague Trail, #580, Lady Lake, FL 32159. Our telephone number is +(63)(914)2699345.(407) 536-9422.

Palayan Gold Claim Property

| Item 3. | Legal Proceedings |

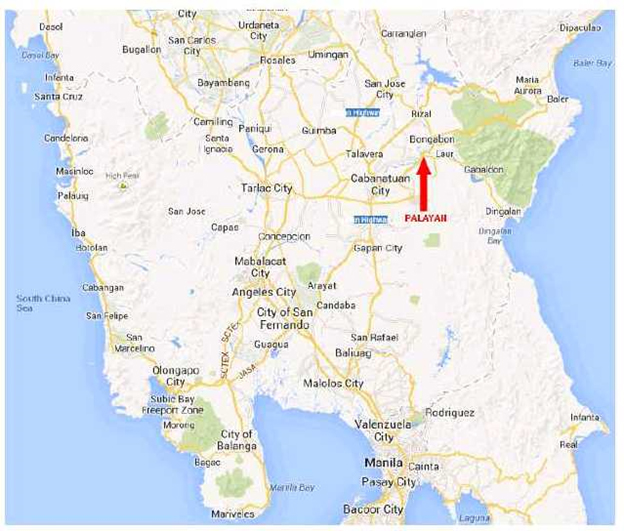

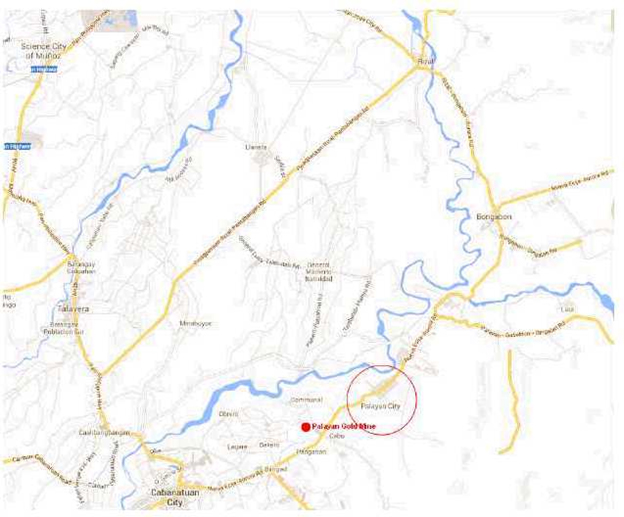

Location and Access

The Palayan Gold Claim consists of an 82.7 hectare, eight-unit claim block located near Nueve Ecija, the Philippines, at 15 degrees 53’ 33’ north, 121 degrees 08’ 33’’ east.

Description of Claim

The mineral claim was assigned to us by Verdasco Enterprises LLC (an unrelated company) and the said assignment was filed with the Mines and Geosciences Bureau (MGB) of the Department of Environment and Natural Resources of the Philippines (DENR). We own 100% of this claim with no encumbrance on the claim.

There are no known environmental concerns or parks designated for any area contained within the claims. As advanced exploration proceeds there may be bonding requirements for reclamation.

The primary identifying information of the Palayan Gold Claim is a Parcel Identifier as registered with the Department of Environmental and Natural Resources – Mines and Geosciences. The Parcel Identifier of the Palayan Gold Claim is 217-119-862 as recorded both with the above authority and the Office of the Register of Land Title for the Province of Nueva Ecija. The area of the claim is 82.7 hectares. In order to obtain a mining license in the Philippines, an applicant company must apply with the Department of Environment and Natural Resources – Mines and Geosciences. The above authority then conducts a search of the local titles office and its own records to verify that the applicant company is the owner and rights holder of the claim. Once that has been verified, the Department of Environment and Natural Resources – Mines and Geosciences issues a license and permit for Mining and Exploration. The license usually takes seven to ten business days to obtain and is valid for one year.

Except as described above, there are no material terms of the land or mineral rights securing agreements with respect to the Palayan Gold Claim.

The mining license described above is the only permit in order to explore or mine the Palayan Gold Claim.

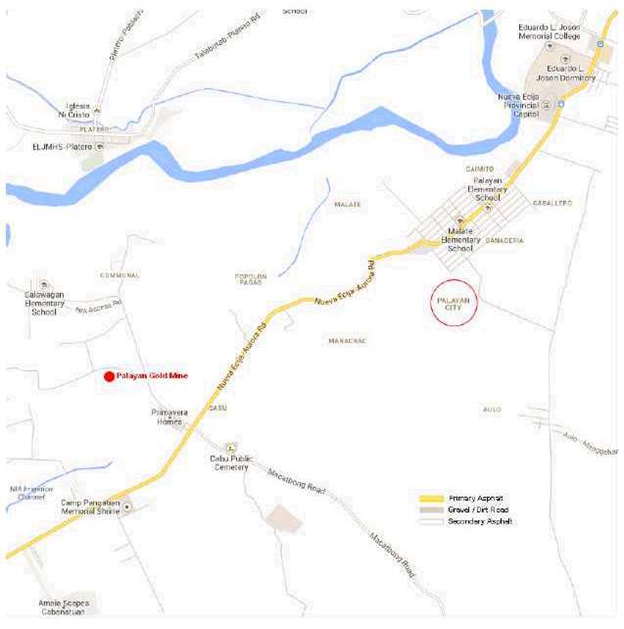

A map of the Palayan Gold Claim is set forth below:

Royalty Obligations and Other Underlying Agreements

None.

Accessibility, Climate, Local Resources, Infrastructure, and Topography

The Palayan Gold Claim is located approximately 10 km southwest of Palayan City, the capital of Nueva Ecija province in the Philippines. It is about 12 km northwest of the city of Cabanatuan, and Manila is a five-hour drive away.

Palayan City is classified as Type 2 climate zone characterized by distinct dry and wet seasons. Rainy season typically starts from May to early December with peak rainfall in the months of July and August. The average amount of rain is 1,597 mm annually and peaks to around 3,304 mm in the month of August. Average temperatures range from 22 degrees to 36 degrees Celsius. We anticipate that exploration work and production, if any, can be carried out throughout the year, although production, if any, may be slower during heavy monsoon rains.

Transportation infrastructure in the area is modern and developed in that there is a network of all-weather roads, highways, and bridges, that make the Palayan Gold Claim highly accessible.

There have been confirmed reports that communist rebels have been sighted near the borders of Nueva Vizcaya, Nueva Ecija and Aurora provinces, near Kasibu town where a number of mining exploration activities are ongoing. The New People’s Army, the armed wing of the Communist Party of the Philippines has made threats to mining companies, which they view as exploiting the country’s natural resources. The Philippine Army has given assurances that they will protect mining companies from communist guerillas. However, there can be no assurance that the Philippine Army will be able to do so.

General Geology and Topography

The lithology of the area in which the Palayan Gold Claim is located is composed of alluvium deposits formed by the Agno River.

The Palayan Gold Claim sits atop a bedrock of native gold occurrences and numerous relatively small alluvial gold deposits. Mineralization was discovered in the area in the early 1920’s and since then has been the site of multiple small to mid-scale placer operations. Alluvial gold deposits appear to be widespread in the region and these types of deposits have been the main target of small-scale individual miners. Native gold is readily panned from the surrounding areas, generally in areas of minor excavations and mine workings and also from creeks. Grains of native gold up to 4 mm in size have been observed in rock samples from the project.

Present Condition of the Property and Current State of Exploration

We are still in the process of attempting to raise capital in order to implement Phase 1 exploration work on the Palayan Gold Claim. There has been no previous work on the Palayan Gold Claim including any attempts to drill. Records indicate that no detailed exploration has been completed on the Palayan Gold Claim.

Geological Setting

Regional Geology of the Area

The following are the main stratigraphic units in the region.

Caraballo Formation

Pantabangan Formation

Guadalupe Formation

Caraballo Formation

The Caraballo Formation is located in the northeastern part of San Jose City, Nueva Ecija. It is the most extensively exposed rocks in the Northern Sierra Madre, previously designated as Caraballo Group, and subdivided into Formations I, II and III. This formation is composed of a proximal and distal volcano-sedimentary facies and is dated in the Late Cretaceous to Late Eocene which is widely distributed in the Caraballo Mountains.

The distal facies of the Caraballo Formation are well-exposed along the eastern side of the Northern Sierra Madre range, in Divilacan Bay, west and south of Dinapique, south and east of San Ildefonso Peninsula and north of Dingalan. These facies consists of well bedded red and green mudstones, siltstones, sandstones, and pyroclastic rocks, with occasional fragmental flows and conglomerates. On the western side of the northern Sierra Madre, from San Jose to Digdig, Nueva Ecija, red and green siltstones and mudstones are overlain by gray to black tuffs and conglomerates which coarsen upwards and become intercalated with pillow basalts.

Pantabangan Formation

The Pantabangan Formation is facing the highlands located east of San Jose City, Nueva Ecija. This formation is a series of sandstone, mudstone and polymictic conglomerates forming the gently rolling hills in the area of Pantabangan Basin. A uniqueness separates this formation from the underlying Palali and Santa Fe formations.

An increase in the amount of conglomerates towards the south and east suggests its origin from this direction. The formation is believed to be partly equivalent to the PlioPleistocene Ilagan Formation of the Cagayan Valley Basin. A dating of 1.3 Ma (Pleistocene) for a biotite extracted from an andesite intruding the Pantabangan Formation was found. Furthermore, correlation of this formation to the Tartar Formation on the western flank of the Southern Sierra Madre dates as PlioPleistocene from benthonic foraminifera. It is estimated to attain a thickness of 1000m.

Guadalupe Formation

The Guadalupe Formation is found beneath the highland eastern parts of Cabanatuan City, Nueva Ecija. It has been called the Guadalupe Tuffs or the Guadalupe Formation with a lower Alat Conglomerate member and an upper Diliman Tuff member. The formation overlies Miocene rocks and on the basis of the presence of Stegodon fossils and other vertebrates remains, leaf imprints and artifacts, it is assigned a Pleistocene age.

The Alat Conglomerate was first mapped and named by Alvir after marine littoral conglomerate exposed along Sapang Alat about 3 km north of the Novaliches reservoir near Novaliches town where it overlies Miocene lavas. The Alat consists of massive conglomerate, deeply weathered silty mudstone and tuffaceous sandstone. The most common rock type, the poorly sorted conglomerate, consists of well-rounded pebbles and small boulders of the underlying igneous, metamorphic and sedimentary rocks cemented by a coarse-grained, calcareous sandy matrix. The interbedded sandstone is massive to poorly-bedded, tuffaceous fine — to medium grained, loosely-cemented, friable and exhibits cross bedding. The mudstone is medium to thin bedded, soft, sticky, silty and tuffaceous. The maximum estimated thickness of this member is 200 m.

The whole series is flat-lying, medium to thin bedded and consists of fine grained vitric tuffs and welded pyroclastic breccias with minor fine to medium grained tuffaceous sandstone. Dark mafic minerals and bits of pumiceous and scoriaceous materials are dispersed in the glassy tuff matrix. The thickness of the Diliman Tuff is 1,300-2,000 m.

Tectonic Setting

The major structural element recognized in the area of Nueva Ecija is the Dingalan Cabaldon Rift which is part of the Philippine Fault. The fault appears to be the major factor that influences the formation of Gabaldon Valley. It trends N 40°W and branches out into numerous secondary faults of minor magnitude that the northeastern part, cutting the Cretaceous-Paleogene rock series. These secondary faults appear to have sliced the rocks into a series of parallel fault blocks. The orientation of these faults, together with the schistocity and fold axes appears to be closely related to the major northwest structure.

The Philippine Fault Zone is a major left-lateral strike-slip fault zone that has a mapped length of 1,200 km from the eastern part of Mindanao to Northern Luzon. Slip on the Philippine Fault Zone accommodates a significant portion of oblique convergence between the Philippine Sea and Eurasian Plates. The Philippine Fault Zone trends northwest from Dingalan Bay just east of Gabaldon to the southern end of the Central Cordillera. Northwest of Gabaldon, the Philippine Fault splays into the Digdig Fault and the San Jose Fault The convergence rate of the Philippine Plate relative to Eurasia falls in the range of 8.0 cm/yr. The movement is accommodated on three main parallel zones:

The westward verging subduction zones running through the Taiwan Mindoro-Panay trenches

The Philippine Plate at the eastern side, subducting westward along the Philippine Trench; and

In between the two, the Philippine Fault, an active left-lateral strike-slip which runs from Southern Mindanao to Northern Luzon.

The subduction at the Philippine Trench and the Philippine Fault are young features, initiated in late Early Pliocene, probably in response to increasing blockage by collisions along Eurasia's boundary. Most of the oblique convergence would have since been partitioned between the two structures.

In Luzon, the South China Sea plate is subducted eastward along the Manila Trench while at the eastern side; the Philippine Trench is indented by the Benham Rise. A strike slip fault zone along the East Luzon Trough, borders the latter. The area of Northern Luzon is wedged and compressed by the two opposing subduction zones.

No mineralization has been reported for the area of the property but structures and shear zones affiliated with mineralization on adjacent properties pass through it.

Exploration

Previous exploration work has not included any attempt to drill the structure on the Palayan Gold Claim. Records indicate that no detailed exploration has been completed on the property.

Drilling Summary

No drilling has been reported on the Palayan Gold Claim.

Sampling Method, Sample Preparation, Data Verification

All the exploration conducted to date has been conducted according to modernly accepted exploration procedures, methods and practices. Preliminary samples have also been prepared in ways that adhere to current procedures. No comment as to the quality of the samples taken can be presented. Appropriate measures of quality control were in place, though no comment can be made on the lack of any additional measure of such controls.

Report Recommendations

At the present time, the exact mineralization of the Palayan Gold Mine has not been sufficiently explored as previous work has been inconsistent and limited. A two-phased, intensive exploration program to further determine the production potential, if any, of the Palayan Gold Claim is recommended.

The first phase would consist of

Aerial photography to locate structures and understand the topography;

Detailed geological mapping of the region in addition to the Palayan Gold Claim in order to more broadly understand its geological setting;

Geophysical survey using magnetic and electromagnetic instrumentation of both the region and main area for exploration; and

Geochemical soil sample of the Palayan Gold Claim to determine areas of most significant mineral wealth and more exactly determine the mineralization of the site.

Phase 1 exploration work should determine the exact mineralization of the property and whether Phase 2 work, consisting of geochemical surveying and surface sampling, is justifiable.

Budget

The proposed budget for the recommended work is PHP 840,327 (approximately $19,260) as follows (in order of priority)

|

|

|

| ||

|

|

|

|

|

|

| ||

|

|

|

|

| Mine Safety Disclosures |

We currently do not have the necessary funding to complete both phases above. We believe that sufficient funding will be available from additional borrowings and private placements to meet our business objectives, including anticipated cash needs for working capital, for a reasonable period of time. However, there can be no assurance that we will be able to obtain sufficient funds to continue the development of our business operation, or if obtained, upon terms favorable to us.

Glossary of Mining Terms

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

| |

|

| |

|

| |

| ||

|

| |

| ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

| |

|

| |

| ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Item 3. Legal Proceedings

None.

Item 4. Mine Safety Disclosures

No information concerning mine safety violations or other regulatory matters required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 104 of Regulation S-K (17 CFR 229.104) is required to be disclosed herein because we are not the operator of any mine (we have no subsidiaries).

| 4 |

PART II

Item 5. Market for Registrant's

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our outstanding shares of common stock, par value $.001 per share, are listed on OTC Markets Group, an American financial market providing price and liquidity information for almost 10,000 over-the-counter securities. Our trading symbol is PLYN. As of June 24, 2022, there were 17 holders of our common stock.

None.Dividends

Item 6. We have never declared or paid any cash dividends on our common stock nor do we anticipate paying any in the foreseeable future. Furthermore, we expect to retain any future earnings to finance our operations and expansion. The payment of cash dividends in the future will be at the discretion of our Board of Directors and will depend upon our earnings levels, capital requirements, any restrictive loan covenants and other factors the Board considers relevant.

| Item 6. | Selected Financial Data |

The following selected financial data should be read together with "Management's Discussion

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and Analysis of Financial Condition and Results of Operations" andare not required to provide the financial statements, including the related notes, found elsewhere ininformation required under this Form 10-K.item.

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation |

Working Capital

| March 31, 2019 $ |

| March 31, 2018 $ |

Current Assets | 2,111 |

| 1,918 |

Current Liabilities | 150,359 |

| 118,500 |

Working Capital Deficit | (148,248) |

| (116,582) |

Cash Flows

| Year ended March 31, 2019 $ |

| Year ended March 31, 2018 $ |

Cash Flows used in Operating Activities | (20,307) |

| (38,358) |

Cash Flows from (used in) Investing Activities | - |

| - |

Cash Flows from (used in) Financing Activities | 20,500 |

| 32,000 |

Net increase (decrease) in Cash During Period | 193 |

| (6,358) |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation

Management’s Discussion and Analysis of Financial Position and Results of Operations

The financial statements and historical financial information included in this report are presented in United States dollars as substantially allFor a description of our Company’s business, refer to Item 1 of Part I of this annual report on Form 10-K. As indicated in Item 1, we are a mineral exploration and production company engaged in the exploration, acquisition, and development of mineral properties. The following provides information that management believes is relevant to an assessment and understanding of our results of operations use this denomination. Inand financial condition. The discussion should be read in conjunction with the financial statements and historical financial information, monetary assets and liabilities denominated in Philippine Pesos are translated to their US dollar equivalents using the exchange rates which prevailed at the balance sheet date.accompanying notes.

This discussion should be considered in conjunction with unaudited and auditedCRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our Company prepares our financial statements of our company, which have been prepared in accordanceconformity with accounting principles generally accepted in the United States and forward-looking statements contained here apply from this date and involve some risks and uncertainties.of America. We are a start-up, pre-exploration stage company. We have a limited operating history and have not yet generated or realized any revenues fromdisclose our activities. We have yet to undertake any exploration activity on our sole property --the Palayan Gold Claim. Our property issignificant accounting policies in the early stage of exploration and there is no reasonable likelihood that revenue can be derived from the property in the foreseeable future. Our plan isnotes to explore the Palayan Gold Claim for gold; we want to proceed but the lack of sufficient cash is our limiting factor. The two phase exploration program will cost approximately $7,800 for Phase I and approximately $9,000 for Phase II. No revenues have yet been earned. We do not anticipate revenues until a commercially profitable product can be extracted and sold. As exploration has not yet commenced, we remain uncertain as to whether we will ever discover profitable amounts of mineral and what the market will be for it when and if we do produce some. If conditions are favorable, then upon discovery we will enter into production. If we do not proceed then we will try to acquire an interest in another mineral claim. Should we not have sufficient funds to purchase another mineral claim outright then we may have to make a share offering to obtain an option on a property. If that succeeds then we would again try to explore with money raised by offering our stock, engaging in borrowing, or locating a joint venture partner. We have not generated any revenues and no revenues are anticipated until we begin removing and selling minerals, if ever. Accordingly, we must raise cash from sources other than the sale of gold or other minerals found on the Palayan Gold Claim.

Phase I of our exploration program consists only of geological mapping and geophysical surveying. In order to determine the prospects of the Palayan Gold Claim, we must complete both Phase I and Phase II of the exploration program. When the mapping and surveying contemplated by Phase I has been completed with satisfactory results, Phase II will be undertaken (subject to available funds.)

To implement further exploration work on the Palayan Gold Claim and to stay in business, we must raise additional cash – particularly over the next 12 months. If we cannot raise additional funds we will not have sufficient funds to satisfy our cash requirements and would have to go out of business. Since our business activity is related solely to the exploration and evaluation of the Palayan Gold Claim, it is the opinion of management that the most meaningfulaudited financial information relates primarily to current liquidity and solvency. We may look to secure additional funds through future debt or equity financings. Such financings may not be available or may not be available on reasonable terms. As of March 31, 2019, we had working capital deficit of $148,248. On March 31, 2019, we had cash on hand of approximately $2,111. Our future financial success will be dependent on the success of the exploration work on the Palayan Gold Claim. Such exploration may take years to complete and future cash flows, if any, are impossible to predict at this time. The realization value from any mineralization which may be discovered by us is largely dependent on factors beyond our control such as the market value of metals produced, mining regulations in the Philippines and foreign exchange rates.

Forward Looking Statements

This report contains certain forward-looking statements. All statements other than statements of historical fact are “forward-looking statements” for the purposes of this report, including any projections of earnings, revenues, or other financial items; any statements of the plans, strategies, and objectives of management for future operation; any statements concerning proposed new products, services, or developments; any statements regarding future economic conditions or performance; statements of belief; and any statements of assumptions underlying any of the foregoing. Such forward-looking statements are subject to inherent risks and uncertainties and actual results could differ materially from those anticipated by the forward-looking statements.

Liquidity and Capital Resources

Since inception we have raised capital through private placements of common stock aggregating $30,000 with our only two shareholders and officers: Mr. Cortez and Mr. Soo. Our capital commitments for the coming 12 months consist of administrative expenses, expenses associated with the completion of our planned exploration program and costs of distribution of the securities being registered in this report. Including this exploration work and other costs, we estimate that we will have to incur the following expenses during the next 12 months:

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Budget Items are listed in order of priority.

(2) Includes $16,600 for accounting and auditing.

(3) For Phase I and Phase II of the recommended exploration program.

We have no plantelected to use the extended transition period for complying with new or significant equipment to sell, nor are we going to buy any plant or significant equipment during the next 12 months. We will not buy any equipment unless we locate a body of ore and determine that it is economical to extract the ore from the land. We may attempt to interest other companies to undertake exploration work on the Palayan Gold Claim through joint venture arrangement or even the sale of partrevised accounting standards under Section 102(b)(1) of the Palayan Gold Claim. NeitherJOBS Act. This election allows us to delay the adoption of these avenues has been pursued as of the datenew or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this report. Our geologist has recommended an exploration program for the Palayan Gold Claim. However, even if the results of this work suggest further exploration work is warranted, we doelection, our financial statements may not presently have the requisite funds and so will be unablecomparable to complete anything beyond the exploration work on Phase I recommended in the Report until we raise more money or find a joint venture partner to complete the exploration work. If we cannot find a joint venture partner and do not raise more money, we will be unable to complete any work beyond the exploration program recommended by our geologist. If we are unable to finance additional exploration activities, we do not have alternative operational plans. We do not intend to hire any employees at this time. All of the work on the Palayan Gold Claim will be conducted by Mr. Cortez who has extensive experience in geology. He will be responsible for supervision, surveying, exploration, and excavation and will be capable of evaluating the information derived from the exploration and excavation including advising ourcompanies that comply with public company on the economic feasibility of removing any mineralized material we may discover.effective dates.

Limited Operating History; Need for Additional Capital

There is no historical financial information about us upon which to base an evaluation of our performance as an exploration corporation. We are an exploration stage company and have not generated any revenues from our exploration activities. We cannot guarantee we will be successful in our exploration activities. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

To become profitable and competitive, we must invest in the exploration of our property before we start production of any minerals that we may find. Therefore, we must obtain equity or debt financing to provide the capital required to fully implement both phases of our exploration program. We have no assurance that financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to commence, continue, develop or expand our exploration activities. Even if available, equity financing could result in additional dilution to existing shareholder.

Results of Operations

For the years ended March 31, 2019 and 2018

Lack of Revenues

We have limited operational history. From our inception on July 26, 2013 (date of inception) to March 31, 2019, we did not generate any revenues. As a mineral pre-exploration company, we anticipate that we will incur substantial losses for the foreseeable future and do not believe we will be able generate revenues during the next 12 months.

Expenses

During the year ended March 31, 2019, we incurred operating expenses of $31,666 comprised of $17,493 of professional fees relating to legal, accounting, and audit fees with respect to our SEC filings, and $14,173 for general and administrative costs which included transfer agent and filing costs. During the year ended March 31, 2018, we incurred operating expenses of $39,858 comprised of $21,852 of professional fees relating to legal, accounting, and audit fees with respect to our SEC filings, and $18,006 for general and administrative costs which included $12,000 of transfer agent costs relating to obtaining our DTC eligibility status. The decrease in our operating expenses was due to lower legal fees and transfer agent costs as we incurred expenses in the prior year relating to our DTC eligibility status.

Net Loss

During the year ended March 31, 2019, we incurred a net loss of $31,666 or $nil per share compared with $39,858 and $nil per share for the year ended March 31, 2018.

Our Planned Exploration Program

We must conduct exploration to determine what, if any, amounts of minerals exist on the Palayan Gold Claim and if such minerals can be economically extracted and profitably processed.Going Concern

Our planned exploration program is designed to efficiently explore and evaluate our property.

Our anticipated exploration costs for Phase I and Phase II work on the Palayan Gold Claim are approximately $19,260. We will have to raise additional funds within the next 12 months in order to satisfy our ongoing cash requirements and finance work on the Palayan Gold Claim.

Balance Sheets

At March 31, 2019, we had cash and total assets of $2,111 compared with cash and total assets of $1,918 as of March 31, 2018. The overall cash balance was consistent with prior year as the Company had minimal transactions during the year and all out-of-pocked expenditures were financed by loans from related parties.

During the years ended March 31, 2019 and 2018, we did not have any capital transactions.

Cash Flows

Operating Activities

During the year ended March 31, 2019, we used cash of $20,307 for operating activities compared with $38,358 during the year ended March 31, 2018. The decrease in the cash used for operating activities is due to the fact that the Company incurred $12,000 of DTC eligibility costs as part of its normal operating costs during the prior year.

Investing Activities

During the years ended March 31, 2019 and 2018, we did not have any investing activities.

Financing Activities

During the years ended March 31, 2019 and 2018, we received $20,500 and $32,000 of financing from the President of the Company, respectively. The amounts owing are unsecured, non-interest bearing, and due on demand.

Trends

We are in the pre-exploration stage, have not generated any revenue and have no prospects of generating any revenue in the foreseeable future. We are unaware of any known trends, events or uncertainties that have had, or are reasonably likely to have, a material impact on our business or income, either in the long term of short term, other than as described in this section or in “Risk Factors”.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Inflation

The effect of inflation on our revenues and operating results has not been significant.

Critical Accounting Policies

Set forth below are certain of our important accounting policies. For a full explanation of these and other of our important accounting policies, see Note 2 to Notes to the Financial Statements below.

Our financial statements are presented in United States dollars and are prepared using the accrual method of accounting which conforms to US GAAP.

Going Concern

The Company’s financial statements have been prepared on a going concern basis, which implies that the Companywe will continue to realize itsour assets and discharge itsour liabilities in the normal course of business. The Company hasWe have generated no revenues to date and hashave an accumulated deficit of $176,248.$1,004,986 as of March 31, 2022. The continuation of theour Company as a going concern is dependent upon the continued financial support from itsour shareholders, the ability to raise equity or debt financing, and the attainment of profitable operations from the Company'sour future business. These factors raise substantial doubt regarding the Company’sour ability to continue as a going concern for a period of one year from the issuance of these financial statements.concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Companywe be unable to continue as a going concern.

The Company’s plan of action over the next twelve months is to raise capital financing to conduct exploration and drilling on its mineral property claims held in Nueva Ecija, Philippines as well as exploring for new mineral property claims.

| 5 |

Use of Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods presented. We are required to make judgments and estimates about the effect of matters that are inherently uncertain. Although, we believe our judgments and estimates are appropriate, actual future results may be different; if different assumptions or conditions were to prevail, the results could be materially different from our reported results.

Mineral PropertiesFair Value of Financial Instruments

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants as of the measurement date. Applicable accounting guidance provides an established hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs that market participants would use in valuing the asset or liability and are developed based on market data obtained from sources independent of our Company. Unobservable inputs are inputs that reflect our Company’s assumptions about the factors that market participants would use in valuing the asset or liability. There are three levels of inputs that may be used to measure fair value:

| Level 1 - Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets. | |

| Level 2 - Include other inputs that are directly or indirectly observable in the marketplace. | |

| Level 3 - Unobservable inputs which are supported by little or no market activity. |

The fair value hierarchy also requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value.

Fair value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of March 31, 2022 and 2021. The respective carrying value of certain on-balance-sheet financial instruments approximated their fair values. These financial instruments include cash, prepaid expense, accounts payable and accrued expenses, related party advances and notes payable. Fair values for these items were assumed to approximate carrying values because they are short-term in nature or they are payable on demand. Fair values for derivative liabilities were determined under level 2 since inputs used are either directly or indirectly observable in the marketplace.

Derivative Financial Instruments – We account for convertible debt with conversion features representing embedded derivative liabilities in accordance with ASC 815, Derivatives and Hedging. ASC 815-15-25-1 requires that embedded derivative instruments be bifurcated and assessed on their issuance date and measured at their fair value for accounting purposes. In determining the appropriate fair value, we use the Black-Scholes option valuation method, resulting in a reduction of the initial carrying amount of the notes as unamortized debt discount. The unamortized discount is amortized over the term of each note using the effective interest method.

The Company has beenfair value of derivative instruments is recorded and shown separately under liabilities. Changes in the exploration stage sincefair value of derivative liabilities are recorded in the consolidated statement of operations under non-operating income (expense).

| 6 |

We evaluate each of our financial instruments to determine if such instruments are derivatives or contain features that qualify as embedded derivatives. For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its formation on July 26, 2013fair value and has not yet realized any revenues from its planned operations. Mineral property acquisition costs are capitalized as incurred. Exploration and evaluation costs are expensed as incurred until proven and probable reserves are established. The Company assesses the carrying costs for impairment under ASC 360, “Property, Plant, and Equipment”is then re-valued at each fiscal quarter end. When it has been determined thatreporting date, with changes in the fair value reported in the consolidated statements of operations. For stock-based derivative financial instruments, we use a mineral property canweighted average Black-Scholes-Merton option-pricing model to value the derivative instruments at inception and on subsequent valuation dates. The classification of derivative instruments, including whether such instruments should be economically developedrecorded as a resultliabilities or as equity, is evaluated at the end of establishing proven and probable reserves,each reporting period. Derivative instrument liabilities are classified in the costs then incurred to develop such property, are capitalized. Such costs will be amortized using the units-of-production method over the estimated lifebalance sheet as current or non-current based on whether net-cash settlement of the probable reserve. If mineral properties are subsequently abandoned or impaired, any capitalized costs willderivative instrument could be charged to operations.required within twelve months of the balance sheet date.

Long-Lived Assets

Long-Lived assets, such as property and equipment, mineral properties, and purchased intangibles with finite lives (subject to amortization), are evaluated for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable in accordance with AAccounting Standards Codification (“ASC”) 360 “Property, Plant, and Equipment”. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life.

Recoverability of assets is measured by a comparison of the carrying amount of an asset to estimated undiscounted future cash flows expected to be generated by an asset. If the carrying amount of an asset exceeds its estimated future cash flows, an impairment charge is recognized as the amount by which the carrying amount exceeds the estimated fair value of the asset. The estimated fair value is determined using a discounted cash flow analysis. Any impairment in value is recognized as an expense in the period when the impairment occurs. Our management has considered the conditions outlined in ASC 360 and determined that there was an impairment charge of $5,000 for the mineral property as at March 31, 2016.

Income Taxes

Potential benefits of income tax losses are not recognized in the accounts until realization is more likely than not. The Company hasWe have adopted ASC 740,Accounting for Income Taxes, as of its inception. Pursuant to ASC 740, the Company iswe are required to compute tax asset benefits for net operating losses carried forward. The potential benefits of net operating losses have not been recognized in these financial statements because the Companywe cannot be assured it is more likely than not itwe will utilize the net operating losses carried forward in future years.

Recent Accounting Pronouncements

We review new accounting standards as issued. Although some of these accounting standards issued or effective after the end of our previous fiscal year may be applicable to us, we have not identified any standards that we believe merit further discussion. We believe that none of the new standards will have a significant impact on our financial position, future operations or cash flows.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

None.

| 7 |

Item 8. Financial Statements and Supplementary DataRESULTS OF OPERATIONS

We have limited operational history. From our inception on July 26, 2013 to March 31, 2022, we did not generate any revenues. We anticipate that we may incur substantial losses for the foreseeable future and do not believe we will be able generate revenues during the next 12 months.

Years Ended March 31, 2022 Compared to Year Ended March 31, 2021

Operating Expenses

During the year ended March 31, 2022, we incurred operating expenses of $260,233 compared to $441,653 in the previous year. The main difference in operating expenses is that the 2021 period includes several expenses not incurred in 2022, including the $150,000 expense related to the issuance of preferred stock to our CEO, and the $31,000 expense on the abandonment of the SMG-Gold acquisition.

Other Income and Expense

Other expense totaled $32,812 for the year ended March 31, 2022 versus $18,851 for the comparable period in the prior year. The difference consisted of the following

| · | Interest expense increased $10,662 on higher levels of debt. |

| · | We reported derivative income in the 2022 period of $142,104 versus expense of $58,082 in the 2021 period. See Notes 6 and 7 to the accompanying financial statements. |

| · | Debt discount amortization increased $91,194 as explained in Note 6 to the accompanying financial statements. |

| · | Gain on extinguishment of debt decreased $112,291. See Notes 7 and 11 to the accompanying financial statements. |

Net Loss

Our net loss for the year ended March 31, 2022 of $293,045 ($0.01 per share) compares to a net loss of $460,504 ($0.01 per share) in the previous year.

LIQUIDITY AND CAPITAL RESOURCES

Since inception we have raised capital through debt financing, advances from related parties and private placements of our common stock. As described in Note 1 to the accompanying financial statements, on December 9, 2021 we executed an MOU with a Singapore based holding company whose subsidiaries are engaged principally in foreign exchange remittance services. Under the MOU, our Company is proposing to acquire 100% of the Singapore based company for a purchase price of $80,000,000, consisting of common and preferred stock totaling $70,000,000 and subordinated debt of $10,000,000. The proposed acquisition is subject to due diligence customary to transactions of this type. There can be no assurance that a definitive agreement between the parties to the transaction can be reached.

| 8 |

Notwithstanding what may happen with our proposed acquisition, our capital commitments for the coming 12 months consist of administrative expenses, expenses associated with investment in companies, and costs of distribution of our securities. We estimate that we will have to incur the following expenses during the next 12 months:

| Description | Estimated Date (1) | Estimated Expenses ($) |

| Legal and accounting fees and expenses(2) | 12 months | 95,000 |

| Investor relations and capital raising | 12 months | 125,000 |

| General and administrative expenses | 12 months | 175,000 |

| Transfer Agent and Edgar Services | 12 months | 18,000 |

| Total | 413,000 |

| (1) | Budget Items are listed in order of priority. | |

| (2) | Includes $45,000 for accounting and auditing. |

Since our initial share issuances, our company has been unable to raise significant additional equity funds, forcing us to rely on cash advances and debt financing to meet operating needs. Based on our cash on hand of $426 at March 31, 2022, we will be required to raise additional funds to execute our current plan of operation. As discussed in Note 6 to the accompanying financial statements, although we have a credit line agreement with Mambagone, S.A de C.V. (“Mambagone”), they are no longer honoring additional required advances under the agreement. At present, we have no commitment from anyone to contribute funds to our Company. If we are unable to raise sufficient funds to execute our plan of operation, we intend to scale back our operations commensurately with the funds available to us. In that regard, we will prioritize expenditures to (in order of priority): (i) maintain our mineral exploration license; and (ii) to conduct our planned exploration activities. We intend to raise the capital that we require through the private placement of our securities or through loans. However, we have not received any financing commitments and there is no guarantee that we will be successful in so doing.

We have no plant or significant equipment to sell, nor are we going to buy any plant or significant equipment during the next 12 months. We do not intend to hire any employees at this time.

Limited Operating History; Need for Additional Capital

There is no historical financial information about us upon which to base an evaluation of our performance as an exploration corporation. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources.

We have no assurance that financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to commence, continue, develop, or expand our exploration activities. Even if available, equity financing could result in additional dilution to existing shareholders.

Balance Sheets

At March 31, 2022, we had cash of $426 and total assets of $3,167 compared with cash of $98,889 and total assets of $99,755 as of March 31, 2021. The overall cash and asset balance decreased from the prior year primarily due to the lack of outside financing.

| 9 |

During the year ended March 31, 2022, we issued 1,596,799 common shares to a company for services provided. 201,451 of those shares were “to be issued” as of March 31, 2021. In addition, we issued a total of 1,353,334 common shares in settlement of related party debt and an additional 250,000 in settlement of other debt.

During the year ended March 31, 2021, we issued 4,000,000 common shares in connection with the SMG-Gold transaction. We also issued 30,968 common shares to two individuals for Board of Director services and 315,790 common shares to a company (with an additional 201,451 shares committed to be issued) for services provided. Extinguishment of related party debt increased our Additional Paid-in Capital by $172,895. Finally, we sold 10,000 shares for $5,000.

Cash Flows

Operating Activities

During the year ended March 31, 2022, we used cash of $98,463 for operating activities compared with $295,665 during the year ended March 31, 2021. The decrease in the cash used for operating activities resulted mainly from a lower net loss in 2022.

Investing Activities

We had no capital expenditures in the 2022 period versus $1,123 in 2021.

Financing Activities

During the year ended March 31, 2022, there were no financing activities. During the year ended March 31, 2021, we received $5,000 from the sale of 10,000 shares of our common stock. In addition, we received proceeds of $390,600 from debt financing, $50,600 or which came from related parties.

Trends

We have not generated any revenue and, notwithstanding the possible acquisition discussed in Note 1 to the accompanying financial statements, have no prospects of generating any revenue in the foreseeable future. We are unaware of any known trends, events or uncertainties that have had, or are reasonably likely to have, a material impact on our business or income, either in the long term or short term, other than as described in this section or in “Risk Factors”.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Inflation

The effect of inflation on our revenues and operating results has not been significant.

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk |

None.

| 10 |

| Item 8. | Financial Statements and Supplementary Data |

Index to Financial Statements

| 11 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of Palayan Resources, Inc.

March 31, 2019

| |

|

|

|

|

|

|

|

|

|

|

|

|

Palayan Resources Inc.

Balance Sheets

(Expressed in U.S. dollars)

| March 31, 2019 $ |

| March 31, 2018 $ |

ASSETS |

|

|

|

Current Assets |

|

|

|

Cash | 2,111 |

| 1,918 |

|

|

|

|

Total Assets | 2,111 |

| 1,918 |

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

Accounts payable | 6,184 |

| 1,500 |

Due to related party | 144,175 |

| 117,000 |

|

|

|

|

Total Liabilities | 150,359 |

| 118,500 |

|

|

|

|

Stockholders’ Deficit |

|

|

|

Common Stock Authorized: 75,000,000 common shares, with par value $0.001 Issued and outstanding: 30,000,000 common shares | 30,000 |

| 30,000 |

|

|

|

|

Accumulated Deficit | (178,248) |

| (146,582) |

Total Stockholders’ Deficit | (148,248) |

| (116,582) |

|

|

|

|

Total Liabilities and Stockholders’ Deficit | 2,111 |

| 1,918 |

(The accompanying notes are an integral part of these financial statements)

Palayan Resources Inc.

Statements of Operations

(Expressed in U.S. dollars)

|

| Year ended March 31, 2019 |

| Year ended March 31, 2018 |

|

| $ |

| $ |

|

|

|

|

|

Revenue |

| - |

| - |

Operating Expenses |

|

|

|

|

General and administrative |

| 14,173 |

| 18,006 |

Professional fees |

| 17,493 |

| 21,852 |

|

|

|

|

|

Loss from Operations |

| 31,666 |

| 39,858 |

Provision for Income Taxes |

| - |

| - |

|

|

|

|

|

Net Loss |

| (31,666) |

| (39,858) |

|

|

|

|

|

Net Loss Per Share – Basic and Diluted |

| (0.00) |

| (0.00) |

Weighted Average Shares Outstanding – Basic and Diluted |

| 30,000,000 |

| 30,000,000 |

(The accompanying notes are an integral part of these financial statements)

Palayan Resources Inc.

Statement of Stockholders’ Deficit

(Expressed in U.S. dollars)

|

| Shares |

| Par Value |

| Accumulated Deficit |

| Total |

|

| # |

| $ |

| $ |

| $ |

|

|

|

|

|

|

|

|

|

Balance as at March 31, 2017 |

| 30,000,000 |

| 30,000 |

| (106,724) |

| (76,724) |

Net loss for the year |

| - |

| - |

| (39,858) |

| (39,858) |

|

|

|

|

|

|

|

|

|

Balance as at March 31, 2018 |

| 30,000,000 |

| 30,000 |

| (146,582) |

| (116,582) |

Net loss for the year |

| - |

| - |

| (31,666) |

| (31,666) |

|

|

|

|

|

|

|

|

|

Balance as at March 31, 2019 |

| 30,000,000 |

| 30,000 |

| (178,248) |

| (148,248) |

(The accompanying notes are an integral part of these financial statements)

Palayan Resources Inc.

Condensed Statements of Cash Flows

(Expressed in U.S. dollars)

|

| Year ended March 31, 2019 |

| Year ended March 31, 2018 |

|

| $ |

| $ |

Operating Activities |

|

|

|

|

Net loss for the year |

| (31,666) |

| (39,858) |

Expenses Paid by Related Party |

| 6,675 |

| - |

Changes in operating assets and liabilities: |

|

|

|

|

Accounts payable and accrued liabilities |

| 4,684 |

| 1,500 |

|

|

|

|

|

Net Cash Used In Operating Activities |

| (20,307) |

| (38,358) |

|

|

|

|

|

Financing Activities |

|

|

|

|

Proceeds from related party loan |

| 20,500 |

| 32,000 |

|

|

|

|

|

Net Cash Provided By Financing Activities |

| 20,500 |

| 32,000 |

|

|

|

|

|

Increase (Decrease) in Cash |

| 193 |

| (6,358) |

Cash – Beginning of Period |

| 1,918 |

| 8,276 |

Cash – End of Period |

| 2,111 |

| 1,918 |

|

|

|

|

|

Supplemental disclosures |

|

|

|

|

Interest paid |

| - |

| - |

Income taxes paid |

| - |

| - |

(The accompanying notes are an integral part of these financial statements)

Palayan Resources

Notes to Financial Statements

1.NatureWe have audited the accompanying balance sheets of Operations and Continuance of Business

Palayan Resources, Inc. (the “Company”) was incorporatedas of March 31, 2022 and 2021, the related statements of operations, stockholders’ deficit, and cash flows for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of March 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the State of Nevada on July 26, 2013 and is a mineral exploration and production company engaged in the exploration, acquisition, and development of mineral properties. The Company’s plan of action over the next twelve months is to raise capital financing to acquire new mineral property claims on properties the Company is currently in negotiations with to conduct exploration and drilling as well as exploring for new mineral property claims.United States.

Going Concern Matter

TheseThe accompanying financial statements have been prepared on a going concern basis, which impliesassuming that the Company will continue to realize its assets and discharge its liabilitiesas a going concern. As discussed in the normal course of business. As of March 31, 2019,Note 2, the Company has generated no revenues to date, suffered recurring losses from operations and has a net capital deficiency that raises substantial doubt about its ability to continue as a going concern. Management’s plans regarding these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

| 12 |

Valuation of Derivative Liabilities for Conversion Features in Convertible Debt

Description of the Matter: At March 31, 2022, the Company’s derivative liability was $180,181. As described in Note 2 to the financial statements, the Company records a derivative liability for embedded conversion features by performing a valuation of the conversion features using the Black-Scholes option valuation model. The use of the Black-Scholes option valuation model requires the Company to determine appropriate inputs to put into the model. Auditing the valuation of the derivative liability requires testing and analysis of the underlying estimates and assumptions the Company used as inputs in the Black-Scholes option valuation model.

How We Addressed the Matter: Our audit procedures consisted of testing the key inputs that were used in the Black-Scholes option valuation model by calculating our own internal valuation of the derivative liability and comparing to what was recorded by the Company.

/s/ TAAD LLP

TAAD LLP

We have served as the Company’s auditor since 2020

Diamond Bar, CA

June 28, 2022

| 13 |

PALAYAN RESOURCES, INC.

BALANCE SHEETS

| March 31, 2022 | March 31, 2021 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | 426 | $ | 98,889 | ||||

| Prepaid expense | 2,250 | 0 | ||||||

| Total current assets | 2,676 | 98,889 | ||||||

| Equipment, net | 491 | 866 | ||||||

| Total Assets | $ | 3,167 | $ | 99,755 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | 43,063 | $ | 5,168 | ||||

| Notes payable – related party | 25,000 | 25,000 | ||||||

| Convertible note payable – non-related party, net of debt discount | 204,419 | 0 | ||||||

| Derivative liabilities | 180,181 | 0 | ||||||

| Due to related parties | 54,582 | 0 | ||||||

| Total current liabilities | 507,245 | 30,168 | ||||||

| Long-term liabilities: | ||||||||

| Convertible note payable – non-related party, net of debt discount | 0 | 34,116 | ||||||

| Derivative liabilities | 0 | 322,285 | ||||||

| Total long-term liabilities | 0 | 356,401 | ||||||

| Total Liabilities | 507,245 | 386,569 | ||||||

| Commitments and contingencies | 0 | 0 | ||||||

| Stockholders’ deficit: | ||||||||

| Preferred stock, $ par value, shares authorized | ||||||||

| Series A – shares authorized; shares issued and outstanding at March 31, 2022 and 2021, respectively | 2,500 | 2,500 | ||||||

| Series B – shares authorized; shares issued and outstanding at March 31, 2022 and 2021, respectively | 0 | 0 | ||||||

| Series C – shares authorized; shares issued and outstanding at March 31, 2022 and 2021, respectively | 0 | 0 | ||||||

| Common stock, $ par value, shares authorized; and shares issued and outstanding at March 31, 2022 and 2021, respectively | 37,377 | 34,377 | ||||||

| Common stock to be issued, and shares at March 31, 2022 and 2021, respectively | 0 | 201 | ||||||

| Additional paid-in capital | 461,031 | 388,049 | ||||||

| Accumulated deficit | (1,004,986 | ) | (711,941 | ) | ||||

| Total Stockholders’ Deficit | (504,078 | ) | (286,814 | ) | ||||

| Total Liabilities and Stockholders’ Deficit | $ | 3,167 | $ | 99,755 | ||||

See accompanying Notes to the financial statements

| 14 |

PALAYAN RESOURCES, INC.

STATEMENTS OF OPERATIONS

| For the Year Ended March 31, 2022 | For the Year Ended March 31, 2021 | |||||||

| Operating expenses: | ||||||||

| Selling and marketing expense | $ | 1,426 | $ | 7,750 | ||||

| General and administrative expense | 258,807 | 433,903 | ||||||

| Total operating expense | 260,233 | 441,653 | ||||||

| Operating loss | (260,233 | ) | (441,653 | ) | ||||

| Other income (expense): | ||||||||

| Interest expense | (23,403 | ) | (12,741 | ) | ||||

| Derivative income (expense) | 142,104 | (58,082 | ) | |||||

| Debt discount amortization | (165,513 | ) | (74,319 | ) | ||||

| Gain on extinguishment of debt | 14,000 | 126,291 | ||||||

| Total other income (expense) | (32,812 | ) | (18,851 | ) | ||||

| Loss before provision for income taxes | (293,045 | ) | (460,504 | ) | ||||

| Provision for income taxes | 0 | 0 | ||||||

| Net loss | $ | (293,045 | ) | $ | (460,504 | ) | ||

| Weighted average shares basic and diluted | 36,300,711 | 33,543,005 | ||||||

| Weighted average basic and diluted loss per common share | $ | (0.01 | ) | $ | (0.01 | ) | ||

See accompanying Notes to the financial statements

| 15 |

PALAYAN RESOURCES, INC.

STATEMENTS OF STOCKHOLDERS’ DEFICIT

| Preferred Stock | Preferred Stock | Preferred Stock | Common Stock | Additional | Total | ||||||||||||||||||||||||||||||||||

| Series A | Series B | Series C | Common Stock | To Be Issued | Paid-In | Accumulated | Stockholders’ | ||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Deficit | |||||||||||||||||||||||||||

| Balance - March 31, 2020 | – | $ | – | – | $ | – | – | $ | – | 30,020,000 | $ | 30,020 | – | $ | – | $ | 13,019 | $ | (251,437 | ) | $ | (208,398 | ) | ||||||||||||||||

| Stock issued as deposit for acquisition | – | – | – | – | – | – | 4,000,000 | 4,000 | – | – | 12,000 | – | 16,000 | ||||||||||||||||||||||||||

| Sale of stock | – | – | – | – | – | – | 10,000 | 10 | – | – | 4,990 | – | 5,000 | ||||||||||||||||||||||||||

| Beneficial conversion feature | – | – | – | – | – | – | – | – | – | – | 36,000 | – | 36,000 | ||||||||||||||||||||||||||

| Stock issued for services | 2,500,000 | 2,500 | – | – | – | – | – | – | – | – | 147,500 | – | 150,000 | ||||||||||||||||||||||||||

| Stock issued or issuable for services | – | – | – | – | – | – | 346,758 | 347 | 201,451 | 201 | 1,645 | – | 2,193 | ||||||||||||||||||||||||||

| Extinguishment of related party debt | – | – | – | – | – | – | – | – | – | – | 172,895 | – | 172,895 | ||||||||||||||||||||||||||