MARKET INFORMATION

This Annual Report contains certain industry and market data that were obtained from third-party sources, such as industry surveys and industry publications, including, but not limited to, publications by Azoth Analytics, Benchmark Mineral Intelligence, Bloomberg LP, BNEF, Emergen Research, Trading Economics, and the U.S. Department of the Interior. This Annual Report also contains other industry and market data, including market sizing estimates, growth and other projections and information regarding our competitive position, prepared by our management on the basis of such industry sources and our management’s knowledge of and experience in the industry and markets in which we operate (including management’s estimates and assumptions relating to such industry and markets based on that knowledge). Our management has developed its knowledge of such industry and markets through its experience and participation in these markets.

In addition, industry surveys and industry publications generally state that the information they contain has been obtained from sources believed to be reliable but that the accuracy and completeness of such information is not guaranteed and that any projections they contain are based on a number of significant assumptions. Forecasts, projections and other forward-looking information obtained from these sources involve risks and uncertainties and are subject to change based on various factors, including those discussed in the section “Forward-Looking Statements” below. You should not place undue reliance on these statements.

FORWARD LOOKING STATEMENTS

This Annual Report contains forward-looking statements. Forward-lookingWe intend such forward-looking statements to be covered by the safe harbor provisions for Brazil Minerals, Inc. reflect forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact contained in this Annual Report are forward-looking statements, including without limitation, statements regarding current expectations, as of the date of this Annual Report, our future results of operations and involve certain financial position, our ability to effectively process our minerals and achieve commercial grade at scale; risks and uncertainties. Actualhazards inherent in the mining business (including risks inherent in exploring, developing, constructing and operating mining projects, environmental hazards, industrial accidents, weather or geologically related conditions); our ability to derive any financial success from the Memorandum of Understanding entered into with Mitsui & Co., Ltd. in December 2022; uncertainty about our ability to obtain required capital to execute our business plan; our ability to hire and retain required personnel; changes in the market prices of lithium and lithium products and demand for such products; the uncertainties inherent in exploratory, developmental and production activities, including risks relating to permitting, zoning and regulatory delays related to our projects; uncertainties inherent in the estimation of lithium resources. These statements involve known and unknown risks, uncertainties and other important factors that may cause actual results, couldperformance or achievements to differ materially from those anticipated inany future results, performance or achievement expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as a result“may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential”, or “continue” or the negative of various factors. these terms or other similar expressions Factors that could cause future results to materially differ from the recent results or those projected in forward-looking statements include, among others

The forward-looking statements in this Annual Report.

You should read this Annual Report and the documents that we reference in this Annual Report completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

| 3 |

PART I

Item 1. Business.

Overview

Atlas Lithium Corporation (“Atlas Lithium”, the “Company”, “we”, “us”, or “our” refer to Atlas Lithium Corporation and its consolidated subsidiaries) is a mineral exploration and development company with lithium projects and exploration properties in other critical and battery minerals, including nickel, rare earths, graphite, and titanium, to power the increased demand for electrification in our daily living, as exemplified by the rise in demand for electric vehicles, and simultaneous transition away from fossil fuels. Our current focus is on developing our hard-rock lithium project located in Minas Gerais State in Brazil at a well-known, premier pegmatitic district in Brazil. We intend to produce and sell lithium concentrate, a key ingredient for the global battery supply chain.

We are also in the initial stages of planning to develop and own 100% of a plant capable of producing 150,000 tons of lithium concentrate annually. However, there can be no assurance that such a facility may ultimately come to fruition or, if developed, that the production capacity will equal our expectations.

In December 2022, we signed a non-binding Memorandum of Understanding (“MOU”) with Mitsui & Co., Ltd. (“Mitsui”), a global enterprise headquartered in Tokyo. The MOU contemplates potential funding from Mitsui to us of up to $65 million, to be made in tranches and subject to the achievement of specific milestones acceptable to Mitsui, that would give Mitsui the right to buy, at market price, up to 100% of our production from our planned plant with output capacity of 150,000 tons of lithium concentrate per year. There are no certainties that we will enter into a binding agreement with Mitsui, or that we will achieve any milestones acceptable to Mitsui or receive any funding from them.

All of our mineral projects and properties are located in Brazil and, as of the date of this Annual Report, our mineral rights portfolio for critical and battery minerals includes approximately 75,040 acres (304 km2) for lithium in 64 mineral rights, 54,950 acres for nickel (222 km2) in 15 mineral rights, 30,054 acres (122 km2) for rare earths in seven mineral rights, 22,050 acres (89 km2) for titanium in seven mineral rights, and 13,766 acres (56 km2) for graphite in three mineral rights.

Minas Gerais Lithium Project

Our Minas Gerais Lithium Project is currently our largest endeavor and primary focus. This project is located in northeastern Minas Gerais, Brazil along the prolific Eastern Brazilian Pegmatite Province (“EBP”) that extends more than 850 kilometers across eastern Minas Gerais. Pegmatites are igneous bodies derived during the final stages of crystallization of a larger parent igneous intrusion, most commonly a granitic rock. They are distinctive for their very coarse-grained crystalline texture, and in some instances, complex composition with unusual minerals and rare elements. Commercially productive lithium mineralization along the EBP is centered around the Araçuaí mining district which is host to the majority of Brazil’s commercial lithium production and reported mineral reserves.

Our current lithium property position in the State of Minas Gerais comprises 57 mineral rights totaling 58,774 acres (304 km2) which include five main clusters of prospective mineralization: Neves (currently being explored by drilling campaign), Itinga, Salinas, Santa Clara, and Tesouras. Our Neves and Santa Clara clusters are located directly adjacent to and along trend of a large cluster of lithium deposits currently being developed by Sigma Lithium Resources (Nasdaq: SGML).

Because of the region’s long mining history, basic local infrastructure near our mineral properties ranges from adequate to robust, with access to hydroelectric power and water supplies, a well-established road network with direct access to commercial ports. Basic goods and services, industrial suppliers and a skilled and semi-skilled labor force are also generally available from the surrounding communities where we operate.

Since initiating exploration at our Minas Gerais Lithium Project in early 2021, we have confirmed the widespread presence of hard-rock lithium-bearing pegmatites across our property portfolio.

During the second quarter of 2022, we engaged SLR International Corporation (“SLR”) to prepare an initial Technical Report Summary (“TRS”) compliant with the requirements of Items 1300 through 1305 of Regulation S-K (“Regulation S-K 1300”) on the ongoing and planned exploration of our 100%-owned Neves Lithium Project, located in Araçuaí, Minas Gerais, Brazil (the “Neves Project”). SLR is a global technical consulting firm which is well-known in the mining industry as a premier provider of technical reporting and certification. SLR visited our project site and discussed technical details with our geologists during the preparation of the TRS.

The TRS on the Neves Project is included as Exhibit 96.2 to this Annual Report. The effective date of such report is August 10, 2022.

Geology

The EBP is considered to be one of the world’s largest geologic belts of granites and related pegmatite intrusive bodies, encompassing more than 150,000 km2 and with more than 90% of the belt located in eastern Minas Gerais state. Pegmatites are igneous rocks that form during the final stages of a granitic magma’s crystallization. They are readily identifiable by their exceptionally coarse crystalline texture, with individual crystals averaging one centimeter or more in size. Most pegmatites have a simple mineral composition common to granitic rocks, however some may also contain less common minerals that are rarely found in other types of rocks. These include lithium minerals of commercial interest such as spodumene which can contain up to 3.73% Li (8.03% LiO2), and petalite with up to 2.09% Li (4.50% LiO2).

| 4 |

Our progressproject area encompasses multiple areas of mineralized pegmatites, in general occurring as series of sub-parallel elongate tabular bodies, referred to as ‘pegmatite dike swarms,’ hosted in metamorphic shists. Individual pegmatite bodies range from several meters to more than 50 meters thick and from tens of meters up to one (1) kilometer in lateral strike length. They are primarily composed of the minerals quartz, feldspar and mica with localized concentrations of spodumene and petalite. Individual feldspar and spodumene crystals can reach up to two meters in length, but typically are more homogeneously distributed and ranging in size from one to a few centimeters in length.

Exploration

Since initiating our exploration program in 2021, our team has focused on evaluating the Neves target area through a systematic approach involving a combination of basic prospecting, geologic field mapping, trenching and geochemical sampling, and diamond drilling.

Exploration Targets

Neves target area

From August 2021 to March 2023, 81 diamond drill holes totaling 9,285 meters have been completed at Atlas’ flagship Das Neves (“Neves”) property. At Neves, our current focus is on the Abelhas pegmatite cluster, a system of northeasterly trending intrusive dikes (or ‘dike swarm’) that has been steady,mapped over an approximate 1,000-meter by 400-meter area.

| 5 |

| 6 |

Seven diamond drill core rigs are currently operating, with an eighth drill expected for early April 2023.

Recently, we released assay results for the drill holes completed at Neves. Significant highlights for such drill holes include:

| 1.72% Li2O over 3.5 meters Estimated True Width (“ETW”) in hole AB-11 | ||

| 1.22% Li2O over 17.3 meters ETW in hole AB-11B | ||

1.33% Li2O over 4.8 meters ETW in hole AB-12 1.21% Li2O over 7.9 meters ETW in hole AB-13 | ||

| 1.00% Li2O over 18.2 meters ETW in hole AB-15 | ||

| 1.00% Li2O over 8.0 meters ETW in hole AB-18 | ||

1.00% Li2O over 21.2 meters ETW in hole AB-21 1.49% Li2O over 8.0 meters ETW in hole AB-39B 1.29% Li2O over 6.9 meters ETW in hole AB-39B 1.30 Li2O over 27.0 meters ETW in hole AB-41 1.37% Li2O over 14.0 meters ETW in hole AB-57 1.15% Li2O over 21.6 meters ETW in hole AB-64 |

Initially, drilling at Abelhas began immediately south of the historic working, returning multiple pegmatite intercepts over thicknesses ranging from 1 to 11 meters ETW. As the majority of these intercepts were relatively shallow and within 50 meters vertical depth from surface, lithium contents were generally low due to the effects of near-surface weathering and oxidation. Systematic step-out drilling to the south has returned multiple intercepts of higher-grade lithium mineralization hosted in fresh un-weathered pegmatite with grades ranging from 1.00% Li2O to as high as 3.26% Li2O.

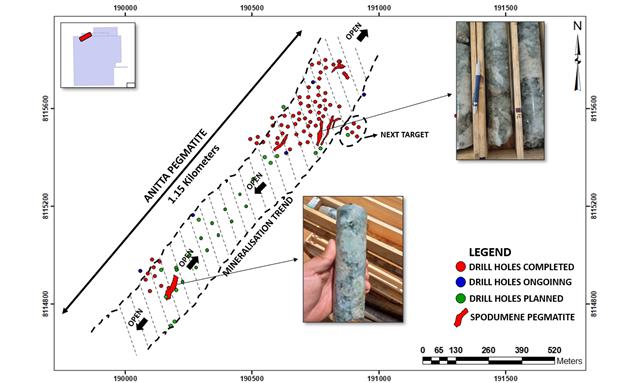

In February 2023, a new target named “Anitta” was intercepted, extending the “Neves” trend ore body to approximately 1.1 kilometer. The initial Anitta drilling holes (southeast of the mineralization trend) intersected pegmatite intervals with spodumene mineralization, including a section of 4.40% Li2O. A grid of 100 drill holes is currently being executed encompassing areas on and around the Southwestern portion of Anitta, as well as areas connecting the Southwestern portion of Anitta to the original Abelhas target. This drilling campaign phase is expected to be finalized in eight weeks.

Main intersects of the new target:

DHAB-69 – 02 intersects totaling 16.0 meters of pegmatite.

DHAB-68 – 04 intersects totaling 67.1 meters of pegmatite.

DHAB-70 – 04 intersects totaling 44.6 meters of pegmatite.

DHAB-77 – 02 intersects totaling 29.1 meters of pegmatite.

DHAB-47 – 03 intersects totaling 28.3 meters of pegmatite.

| 7 |

Additionally, through geological mapping in the identification of new outcrops and the soil geochemistry work carried out so far, new trends mineralized in lithium to the East and Northwest of Abelhas were identified, as shown in the map below. Exploration holes are planned for early April 2023 in these respective areas.

| 8 |

Geological map indicating potential mineralized pegmatite bodies northwest of the traverse.

Soil Geochemistry

Since November 2022, soil geochemistry campaigns have been started in the Neves project with the aim of identifying areas with the existence of a lithium anomaly and also comparing the anomalies with data from the geological mapping already carried out.

The survey was guided by NW-SE direction lines spaced every 100 meters. Sampling points were defined along these lines, every 25 meters on average, depending on physiographic conditions (topography, vegetation, obstacles such as outcrops). For the process of collecting soil samples, a portable mechanized auger equipped with a gasoline engine, rods and drills or shells was used. The sample collection was carried out with an average depth of 1 meter, in order to go beyond the layer of organic soil.

| 9 |

Drilling sampling machine.

The first campaign was carried out in November 2022 with the results obtained in December. A second campaign started at the end of January 2023 and ended at the beginning of March 2023. Part of the chemical results of the second campaign have already been made available and interpreted. Additional soil geochemistry campaigns are underway and planned.

| 10 |

| 11 |

Map 1: results of the first soil campaign and part of the 2nd campaign.

Map 2: General overview and planning of upcoming campaigns

In parallel with our ongoing drilling campaign at Neves, our field crews have also been actively conducting field reconnaissance surveys over our other exploration mineral rights in the district. This work has so far resulted in the positive identification by our Qualified Person for lithium of multiple pegmatite occurrences exposed in surface outcrops and historic artisanal mine workings.

| 12 |

Tesouras Target

At the Tesouras Target, reconnaissance field mapping and sampling has returned multiple samples containing anomalous lithium in association with petalite mineralization exposed at surface.

| 13 |

Santa Clara Target

At the Santa Clara Target, preliminary reconnaissance mapping has identified petalite-bearing pegmatite with anomalous concentrations of lithium exposed in an inactive artisanal mine working and nearby outcrops that are exposed over an area measuring approximately 100 meters long by 30 meters wide. The three other pegmatites identified in the Santa Clara area have been mapped over areas ranging from 150 to 240 meters in length by 10 to 15 meters in width. All three of these bodies are only partially exposed at surface, remaining open in both directions along strike and at depth.

| 14 |

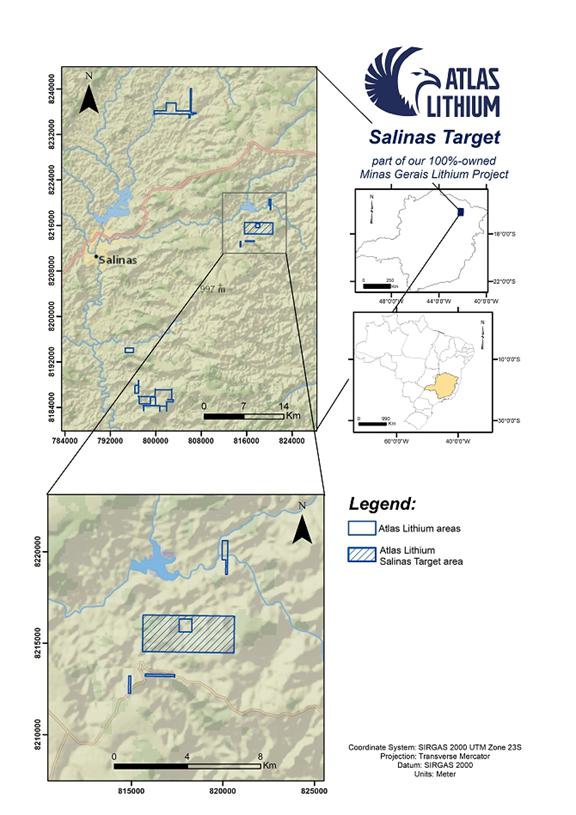

Salinas Target

At the Salinas Target, preliminary field reconnaissance by our team of geologists has identified several spodumene-bearing pegmatites. The exposed outcropping portion of one of these pegmatites measures approximately 200 meters in length by 40 meters in width. This pegmatite is located one kilometer from “Lavra do Oscar,” a large artisanal mining site that has produced spodumene in the past.

| 15 |

Itinga Target

The Itinga project includes four newly acquired mineral rights and two mineral rights previously owned by us

Geological mapping work was carried out in these areas and areas with potential lithium mineralization were identified.

Expressive pegmatitic body outcropping in artisanal mines

Northeastern Brazil Lithium Project

Our Northeastern Brazil Lithium Project encompasses seven mineral rights spread over approximately 16,266 acres (66 km2) in the States of Paraíba and Rio Grande do Norte, both located in Brazil’s Northeastern region. We have identified pegmatites in many of our areas, and several of our mineral rights are located near to or adjacent to areas known to have spodumene, a lithium-bearing mineral. We plan to continue to explore our areas to assess whether we have any economic deposits.

| 16 |

Metallurgical Testing

A comprehensive metallurgical testing of a representative ore sample of our Neves Project has been carried out at the SGS analytical laboratory in Lakefield, Canada (“SGS Lakefield”). SGS Lakefield is a world-renowned testing facility within the mining industry and has been providing independent assessments since 1941. Preliminary results from studies with our ore indicate three important characteristics: easy separation of lithium, robust concentration of lithium, and low impurities such as iron. SGS Lakefield was able to process our ore to commercial grade spodumene concentrate (also called lithium concentrate) using standard dense media separation (“DMS”) methods. We expect to receive the complete report on such studies from SGS Lakefield in April 2023.

Looking forward, in parallel with our ongoing exploration program, we plan to conduct metallurgical testing on an ongoing basis as we continue to drill test and delineate potential lithium mineral resources across our property portfolio.

Lithium

Market

In 2021, the Global Lithium market was valued at USD 4,650 Million in 2021 and is expected to grow at a CAGR of 13.5% during the forecast period of 2023-2028. The market for lithium-ion batteries is predicted to grow even larger over the forecast period as a result of the electrification of cars.

Due to the strict rules that ICE automakers must adhere to in order to minimize carbon dioxide emissions from automobiles, the automotive application market is predicted to increase significantly over the course of the projection period. This has caused automakers to become more interested in creating EVs, which is expected to increase demand for lithium and related goods. Together with investments in this area, government subsidies for Electric Vehicles (EVs) are projected to serve as an additional catalyst for the market’s expansion.”

Source: Global Lithium Market (2023 Edition) - Analysis By Value and Volume, Source (Brine, Hardrock), Applications, End Users, By Region, By Country: Market Size, Insights, Competition, Covid-19 Impact and Forecast (2023-2028). Azoth Analytics. Published: February, 2023. Accessed: March, 2023.

Electric Vehicle Demand

Increasing demand for lithium for manufacturing EV batteries is another factor driving market revenue growth. Despite the effects of COVID-19 in the automobile industry, sales of EVs increased by almost 50% in 2020 and increased almost double to about seven million units in 2021. When compared to a five-year average of about USD 14,500 per metric ton, lithium prices have risen by about 550% in a year due to surge in EV demand. By the beginning of March 2022, price of lithium carbonate had surpassed USD 75,000 per metric ton and price of lithium hydroxide had surpassed USD 65,000 per metric ton. Moreover, almost all traction batteries used currently in EVs and consumer gadgets are produced using lithium, while other uses for lithium-ion (Li-ion) batteries include everything from energy storage to air travel. There are numerous unknowns regarding how the battery market will impact future lithium demand as battery content changes depending on active materials mix and new battery technologies are entering the market. For instance, compared to currently popular mixes using a graphite anode and lithium metal anode, which increases energy density in batteries, has roughly quadruple lithium needs per kilowatt-hour.”

Source: Lithium Mining Market, By Source, By Type (Chloride, Lithium Hydroxide, Carbonate, and Concentrate), By End-Use (Flux Powder, Polymers, Batteries, Refrigeration, Air Conditioning Equipment, and Glass & Ceramics), By Region Forecast to 2030. Emergen Research. Published: September, 2022. Accessed: March, 2023.

| 17 |

Recent Developments Potentially Affecting Lithium Demand

United States

On August 25, 2022, the Washington Post published an article titled “Did California just kill the gas-powered car?” and with the sub-heading “California’s decision to ban the sales of combustion engine cars is the latest victory in the transition to electric vehicles,” stating among things that:

“California, which already leads the nation with 18% of new cars sold electric, is expected to approve a regulation to ban the sales of new gas-only powered vehicles by 2035. In addition to EVs, only a limited number of plug-in hybrids will be allowed to be sold and that in California’s car market is only slightly smaller than those of France, Italy and Britain - and while many countries have promised to phase out sales of gas cars by such-and-such date, few have concrete regulations like California.”

| 18 |

US EV battery demand is strong

European Union

On June 8, 2022, the European Union Parliament voted to ban the sale of new diesel and gasoline cars and vans starting in 2035.

Although no assurances can be measuredgiven, these recent developments, if left unchallenged, may potentially increase demand for lithium in at least two quantifiable ways. First,the U.S., European Union and other jurisdictions adopting similar bans on gas-powered vehicles.

Dynamic Lithium Prices

Directly relevant to our goal to produce lithium concentrate (also called spodumene concentrate) for sale, it is important to note that the prices of such commodity have been volatile. According to Platts, a unit of S&P Global, a market intelligence firm, the price of spodumene concentrate FOB Australia (ticker symbol: BATSP03) was $6,300 per ton on January 13, 2023 and more recently, on March 27, 2023, it was $4,750.

| 19 |

Current Predictions

Benchmark Mineral Intelligence, a well-respected global consulting firm specializing in termsthe battery supply chain market, predicts that:

| i) | demand for lithium-ion batteries is set to grow six-fold by 2032 as global automakers scale up production of EVs, and |

| ii) | to meet the world’s lithium requirements would require 74 new lithium mines with an average size of 45,000 tonnes by 2035. |

Future Production and Sales

We expect the demand for our lithium concentrate, once in production, to be facilitated by Brazil’s strong mining tradition and its substantial annual trade with China, the United States, and the European Union. We intend to utilize third party intermediaries for the sale of mineral assets,our products to allow us to focus on our core competencies of exploration and extraction.

Other Mineral Properties

We also have 100%-ownership of early-stage projects and properties in early 2013, our initial year of operations underother minerals that are needed in the current business modelbattery supply chain and management team, we had 3 mineral rights. Nowhigh technology applications such as nickel, rare earths, graphite, and titanium. We believe that the shift from fossil fuels to battery power will yield long-term opportunities for us not only in lithium but also in the other critical and battery minerals.

Additionally, we have 30 mineral rights. These include:

As of the date of this Annual Report we also own: (i) 45.11% of the common stock of Apollo Resources Corporation (“Apollo Resources”), a private company with exploration projects for detailsiron in Brazil, and primarily focused on eachthe development of these mineral rights.

We have determined that Apollo Resources and Jupiter Gold represent Variable Interest Entities (see our “Variable Interest Entities” discussion on page [34] of this Annual Report). As a result of such determination, the results of operations from both Apollo Resources and Jupiter Gold are consolidated in our financial statements under the United States general accepted accounting principles (“U.S. GAAP”).

Nickel & Cobalt

Market

Nickel and cobalt are key battery minerals needed for the growth phase in EV production. Cobalt is on the list of the 35 minerals considered critical to the economic and national security of the United States as first published by the U.S. Department of the Interior on May 18, 2018. In general, the greater the amount of nickel and cobalt, the greater the energy density of an EV battery, a factor that contributes to the storage of more energy. As a practical example of the importance of nickel and cobalt, EVs whose batteries have a higher energy density can run more kilometers before a recharge is needed. According to Benchmark Mineral Intelligence, 72 mining projects with a known presencean average size of gold.

Summary of Mineração Duas Barras Ltda. ("MDB"). MDB holds title toOur Opportunity

We own 15 mineral rights for nickel (including two mineral rights includingfor both nickel and cobalt) totaling approximately 54,950 acres (222 km2). These mineral rights are divided in two sub-groups according to geography: Nickel I Properties in the State of Goiás and Nickel II Properties in the State of Piauí. Several of our mineral rights are located near to or adjacent to areas of known nickel and associated cobalt mineralization.

Nickel and associated cobalt mineralization often occurs as near-surface deposits hosted within a large complex of magnesium and iron rich plutonic rocks, referred to as ultramafics, that originally formed in the earth’s lower crust and upper mantle. In addition to magnesium and iron, ultramafic rocks typically contain minor amounts of nickel along with lesser amounts of cobalt. Tectonic uplift of the ultramafic sequence followed by exposure to intense tropical weathering processes has resulted in the formation of a nickel and cobalt enriched rock commonly referred to as nickel laterite. Nickel laterite deposits currently account for 40% of global nickel production are becoming an increasingly important source of nickel metal for world demand. They typically occur as very large tonnage, low grade deposits, and being close to the surface, are very amenable to open pit mining concessionmethods.

| 20 |

Our Nickel I property located in the Niquelandia district in north-central Goiás state has been Brazil’s national center of commercial nickel production since the early 1980’s. Here nickel laterite mineralization is reported to occur in nickel-bearing iron oxides and clays which are processed via pyrometallurgical recovery methods. Cobalt is recovered as a secondary by-product. Our Nickel II property in southeastern Piauí state is located in the general area of a newly commissioned open pit mining operation which commenced commercial production earlier this year. Based on reports published by the mine operator, a publicly traded company, nickel laterite mineralization in the area occurs as clay-poor, oxide rich material amenable to lower cost heap leach recovery methods. This relatively new approach to nickel ore processing and recovery offers the potential for diamonds, goldthe commercial development of lower grade resources that would otherwise be uneconomic using more conventional pyrometallurgical recovery methods.

We plan to assess the potential of our nickel-cobalt properties through a systematic three-phase exploration approach. The first phase will involve a combination of analysis and sand. It also ownsinterpretation of commercially available remote sensing satellite data, followed by geologic field reconnaissance and operatesregional scale geochemical stream sediment sampling to identify areas offering the largest alluvial processing plantbest potential for diamondsnew nickel-cobalt discoveries. Based on the results of the first phase, the second phase will involve a combination of more detailed geologic mapping, geochemical soil and goldrock grid sampling, and airborne and ground-based geophysical surveys to identify and prioritize the most prospective areas for drill targeting. The third phase will involve first pass reconnaissance drilling of selected targets to test the presence and distribution of prospective mineralization, with additional follow-up drilling to be conducted as results warrant.

Rare Earths

Market

The rare earth elements (“REE”) are on the list of the 35 minerals considered critical to the economic and national security of the United States as first published by the U.S. Department of the Interior on May 18, 2018. REEs consist of the lanthanide series (lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, and lutetium) as well as scandium and yttrium. REEs are classified as “light” and “heavy” based on atomic number. Light REEs (LREEs) are comprised of lanthanum through gadolinium (atomic numbers 57 through 64). Heavy REEs (HREEs) are comprised of terbium through lutetium (atomic numbers 65 through 71) and yttrium (atomic number 39), which has similar chemical and physical attributes to the HREEs. Neodymium and praseodymium are key critical materials in Latin Americathe manufacturing of magnets that have the highest magnetic strength among commercially available magnets and has a Brazilian permitenable high energy density and high energy efficiency in diverse uses. Dysprosium and terbium are key critical materials often added to export its diamond production.

Summary of RST Recursos Minerais Ltda. ("RST"). RST holds title to storiedOur Opportunity

We own seven mineral rights for rare earths totaling approximately 30,054 acres (122 km2). These mineral rights are divided in two sub-types according to geology: Rare Earths I Properties in the States of Goiás and Tocantins, and Rare Earths II Properties in the State of Bahia. Several of our mineral rights are located near to or adjacent to areas known to have rare earths deposits. Preliminary geochemical sampling of some of our areas indicated presence of rare earths. We plan to continue to explore our areas to assess as to whether we have any economic deposits.

Titanium

Titanium is on the list of the 35 minerals considered critical to the economic and national security of the United States as first published by the U.S. Department of the Interior on May 18, 2018. Titanium can withstand high temperatures and its non-magnetic nature prevents interference with data storage components. It has widespread use in high-technology and aerospace applications.

| 21 |

We own seven mineral rights for titanium totaling approximately 22,050 acres (89 km2). These mineral rights are all located in the State of Minas Gerais and are referred to as our Titanium Properties. Several of our mineral rights are located near to or adjacent to areas known to have titanium deposits. We plan to explore our areas to assess as to whether we have any economic deposits.

Graphite

Graphite is on the list of the 35 minerals considered critical to the economic and national security of the United States as first published by the U.S. Department of the Interior on May 18, 2018. Graphite is the most used anode in lithium batteries, benefitting from its high energy and power density. The global need for high-quality, low impurity graphite is directly related to the growth in EV adoption as discussed above. According to Benchmark Mineral Intelligence, to meet demand for anode materials, an estimated 97 natural flake graphite mines will need to be built by 2035, assuming an average size of 56,000 tonnes a year and no contribution from recycling.

We own three mineral rights for graphite totaling approximately 13,766 acres (56 km2). These mineral rights are all located in the State of Minas Gerais and are referred to as our Graphite Properties. All of our mineral rights are located immediately adjacent to areas known for graphite deposits. We plan to explore our areas to assess as to whether we have any economic deposits.

Iron (Through Our Partial Ownership of Apollo Resources Corporation)

Market

Historically, iron has been an essential metal to human development and economic growth. According to the U.S. Geological Survey, over 98% of mined iron ore is used in steel manufacturing. Brazil is the second biggest iron ore producer and exporter in the world, after Australia. Despite the COVID-19 pandemic, iron ore prices reached a six-year high in 2021 primarily fueled by demand from China, the largest importer, while demand from India continues to increase, according to Trading Economics, a market intelligence firm.

Summary of Our Opportunity

Our subsidiary, Apollo Resources, is focused on iron projects in Brazil. Apollo Resources currently owns 56,290 acres of mineral rights for iron distributed in six projects, five of which are in early stage while its Rio Piracicaba Project in Brazil’s well-known Iron Quadrangle mining district is being advanced towards an iron mine, expected to begin operations in 2024 (the “Rio Piracicaba Project”). The Iron Quadrangle is one of the premier iron producing regions in the world.

In 2020, Apollo Resources acquired from a third-party 641-acre mineral right where its Rio Piracicaba Project is now located. This mineral right sits immediately adjacent to Agua Limpa, a producing iron mine owned and operated by Vale S.A. (NYSE: VALE).

During the first and second quarters of 2021, detailed drilling and trenching under the supervision of iron geologists was carried out in approximately 10% of the mineral right area encompassing the Rio Piracicaba Project. Subsequently, a Qualified Person for iron, as the term is defined in Regulation S-K 1300, worked on the analysis and interpretation of the geotechnical work performed.

A Technical Report Summary of the Rio Piracicaba Project (the “Rio Piracicaba TRS”) prepared in accordance with the requirements of Regulation S-K 1300 is included as Exhibit 96.1 to this Annual Report. The effective date of Rio Piracicaba TRS is March 30, 2022. This report was prepared by Orlando Garcia Rocha Filho, a principal at RCS Geologia e Meio Ambiente Ltda., and Volodymyr Myadzel, PhD, an independent consultant at the time, and currently a member of our internal lithium geological team. With respect to the Rio Piracicaba TRS, Mr. Rocha Filho and Dr, Myadzel are Qualified Persons for Iron according to Regulation S-K 1300.

Apollo Resources has full and titled ownership of the mineral right in which the Rio Piracicaba Project is being developed and 100%-ownership of such project. Therefore, the resources presented in the Rio Piracicaba TRS are attributable to Apollo Resources’ interest in such property. A summary table for each class of mineral resource (measured, indicated, and inferred) as found in the Rio Piracicaba TRS is also included below:

| Measured Mineral Resource | Indicated Mineral Resource | Inferred Mineral Resource | ||||||||||||||||||||||

| Amount (tons) | Grade | Amount (tons) | Grade (% iron) | Amount (tons) | Grade (% iron) | |||||||||||||||||||

| Iron - Rio Piracicaba Project | - | - | 2,646,141 | 33.74 | 5,206,771 | 30.40 | ||||||||||||||||||

The following disclosures apply to the summary table above:

1. “Mineral Resources” is defined in accordance with the requirements of Regulation S-K 1300.

2. Mineral Resources are estimated at a cut-off grade of 20% iron.

3. Mineral Resources are estimated using a long-term iron ore price of US$90 per dry metric tonne for the Platts/IODEX 62% iron fines CFR China, and US$/BRL exchange rate of 5.25.

4. Reasonable prospects for economic extraction were determined by benchmarking similar operations and developing a 20% iron cut-off grade based on operating costs.

5. The effective date is March 30, 2022.

The specific point of reference for the mineral resources estimated in the Rio Piracicaba Project has the following coordinates: 19o 56’ 24.40” S and 43o 12’ 7.58” W. The specific point of reference is also identified in the map below.

| 22 |

In October 2022, Apollo Resources received from ANM, an initial permit to commercially mine its Rio Piracicaba Project. During 2021 and part of 2022, all studies required for the operational licensing of an iron mine have been completed and such permit application submitted by Apollo Resources to SUPRAM, where the analysis of such request takes place, may take an additional 12 months from the date of this Annual Report.

As of the date of this Report, Atlas Lithium owns 45.11% of the common stock of Apollo Resources.

| 23 |

Quartzite (Through Our Subsidiary Jupiter Gold Corporation)

Market

Quartzite is a very hard rock composed predominantly of an interlocking mosaic of quartz crystals. Recently polished quartzite slabs have become sought after as a higher-end substitute to granite in kitchen countertops and tiles. Brazil has a robust quartzite mining industry centered in the neighboring the States of Minas Gerais and Espírito Santo with smaller producers being the norm. Each quarry produces quartzite of different color and texture and therefore stones are unique to their location. Mining is via simple open pit procedures, not particularly labor intensive, and with the mined product normally prepared as cubes of raw quartzite measuring ten meters in each diameter. Buyers are normally responsible for the logistics of transporting such raw quartzite blocks from the mine. Buyers for quartzite mined in Brazil are primarily from four locations: Brazil itself, United States, China, and Italy. It is common for mines to develop an exclusive selling relationship to a buyer.

Summary of Our Opportunity

While our subsidiary Jupiter Gold is primarily focused on gold in Brazil, in one of its mineral rights, measuring 233 acres, a greenfield deposit of quartzite was identified by its exploration team and became its “Quartzite Project”. The Quartzite Project is in the State of Minas Gerais in Brazil, in a region known for quartzite mining.

In 2021, Jupiter Gold studied the Quartzite Project with detailed drilling, and a preliminary volumetric estimate of a deposit was obtained. In 2021, Yan Taffner Binda, a mining engineer with vast experience in quartzite, who meets the definition of a Qualified Person in Regulation S-K 1300, prepared the operational plan for an open pit quarry at the Quartzite Project. An initial mining license from ANM has been obtained.

In 2021, Geoline, an independent engineering and environmental licensing consultancy, performed the field studies needed to file Jupiter Gold’s petition to the applicable regulatory body for an operation license. Jupiter Gold’s expectation is to obtain such approval within the next three to six months, which would allow it to start operations and thereafter revenues in 2023. Jupiter Gold anticipates that its quartzite quarry will require five on-site full-time employees; expected prices for the type of color and texture of the quartzite anticipated to be mined range from $1,200 to $2,000 per cubic meter. In December 2022, Jupiter Gold received the operational license for its quartzite mine, and plans to begin operations in 2023.

As of the date of this Report, we own 28.72% of the common stock of Jupiter Gold.

Gold (Through Our Subsidiary Jupiter Gold Corporation)

Market

Brazil has been a gold producer for over 200 years. According to the World Gold Council, in 2021 Brazil produced 90.1 tons of gold and was the 14th largest gold producer country. Minas Gerais was the largest gold producing state in Brazil, accounting for over half of the country’s production in 2021, according to Statista, a market intelligence firm.

Summary of Our Opportunity

Our subsidiary Jupiter Gold owns 142,017 acres of mineral rights for gold distributed in seven projects, six of which are in early stage while one of them, the “Alpha Project,” has been preliminarily researched and is being developed towards a gold mine. The Alpha Project is located in the State of Minas Gerais at the eastern edge of the Iron Quadrangle mining district, the number one gold-producing region in Brazil.

| 24 |

Jupiter Gold’s 100%-owned Alpha Project encompasses 31,650 acres distributed in twelve mineral rights for gold. Approximately 2% of this total area has been studied over 15 years ago by a prior owner, by drilling superficial terrain layers of saprolite and colluvium and identifying gold in multiple targets. The technical report produced at that time under the ANM standard had an estimated gold mineralization for the small area of the deposit in which work was performed.

In 2020, detailed trenching under the supervision of gold geologists was carried out in approximately 2% of the mineral right area encompassing the Alpha Project. In 2021, Oxford Geoconsultants, a technical consulting firm with a geologist that meets the Qualified Person definition of Regulation S-K 1300, released an independent technical report on the project.

RCS, an independent advisory firm with a gold geologist that meets the Qualified Person definition of Regulation S-K 1300, has preliminarily indicated that the gold deposits at the Alpha Project are of greenstone belt type. Further work is planned for 2023 and 2024at the Alpha Project to expand the knowledge of and the measured size of the deposit.

As of the date of this Report, Atlas Lithium owns 28.72% of the common stock of Jupiter Gold.

Alluvial Gold and Diamonds

We own several mining concessions for gold and diamonds and gold along a premier area inthe banks of the Jequitinhonha River valley, a well-known area for diamonds and gold for over two centuries. Many ofin the RST areas are located near MDB's plant.

The predecessor owner of over 1 million residents, isone of our current mining concessions for gold and diamonds was Valdiaam, a TSXV-listed company. Such company performed detailed drilling and other studies leading to the publication of technical reports.

We own an attractive market for our mortar.

We are not currently engaged in alluvial diamond and gold |

Raw Materials

We do not have any material dependence on any raw materialmaterials or raw material supplier. All of the raw materials that we need are available from numerous suppliers and at market-driven prices.

| 25 |

We have secured the right to use the name "Hercules" for our mortar with the Braziliando not own or license any intellectual property agency. We have proprietary formulations for three different types of mortar thatwhich we sell.

Government Regulation

Mining Regulation and Compliance

Mining regulation in Brazil is carried out by the mining department,ANM, a federal entity. Eachentity, with offices in each state in Brazil has a state-level office of this federal entity.Brazil.. For each mineral right that we own, we file anythe required paperwork related to it inwith the ANM office of the mining department in the state in which such mineral right occurs.

Environmental Regulation and Compliance

Environmental regulation in Brazil is carried out by a state-level agency, which may have multiple offices, one for each region of the state. For instance, in Minas Gerais State, such agency is called SUPRAM. For each mineral right that we own, after sufficient exploration work has been conducted, we filemay apply for operational permitting towards mining by filing any such paperwork related to it inwith the local office of the environmental agency that has the applicable geographical jurisdiction.

Surface disturbance from any open pit mining at MDBperformed by us is in full compliance with itsour mining plan. Furthermore, MDBplan as approved by the local regulatory agencies. We regularly recuperatesrestore areas that have been exploited.exploited by us. The current environmental regulations state that for a period of five years after all mining hasoperations have ceased at MDB (however long that may take), therewe would still be five years of available time forrequired to perform any necessary recuperation work.

Environmental, Social and Governance

We are committed to be performed. The separation processEnvironmental, Social, and Corporate Governance (“ESG”) causes. Our Chief of Environmental, Social and Corporate Governance coordinates our efforts in these important matters. We believe that our efforts make a difference in the communities in which we operate. For example, in the period from 2018 to 2020e planted more than 6,000 trees of diverse types for diamonds and gold at MDB does not use any chemical products. Tests are conducted regularly and there are no recordsthe benefit of groundwater contamination.

| 26 |

Form &and Year of Organization & History to Date

We were incorporated in the State of Nevada on December 15, 2011. 2011 under the name Flux Technologies, Corp. From inception until December 18, 2012, we were focused inon the software business, which generated minimal revenues andbusiness was discontinued whenafter entering into a Contribution Agreement with Brazil Mining, Inc. (“Brazil Mining”), pursuant to which, in exchange for 51% of the currentoutstanding shares of common stock of the Company, Brazil Mining contributed to the Company by way of an Assignment of Mineral Rights, certain mineral exploration rights. Since then, our management team has been focused on the exploration and business focus began. Thedevelopment of certain mineral rights in Brazil. In October 2022, the Company changed its name to Brazilfrom “Brazil Minerals, Inc.” to “Atlas Lithium Corporation.” On January 12, 2023, the Company completed its firm underwritten public offering of 776,250 shares of the Company’s common stock (which includes the shares subject to the overallotment option, exercised by the underwriter in December 2012.

Legal Proceedings

We are not a party to any material legal proceedings.

Available Information

We maintain a website at www.brazil-minerals.com.www.atlas-lithium.com. We make available free of charge, through the Public Filings section of the Investors tab on our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC.Securities and Exchange Commission (the “SEC”). The information on our website is not, and shall not be deemed to be, a part hereof or incorporated into this or any of our other filings with the SEC.

Our SEC filings are available from the SEC'sSEC’s internet website at www.sec.gov which contains reports, proxy and information statements and other information regarding issuers that file electronically. These reports, proxy statements

Employees

As of the date of this Annual Report, we have 30 full-time employees and other information may also3 part time employees. None of our employees are represented by labor unions or covered by collective bargaining agreements. We consider our relationship with our employees to be inspected and copied at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549.good.

| 27 |

Item 1A. Risk Factors.

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this Annual Report, including our financial statements and the related notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding whether to invest in our securities. The occurrence of any of the risks, the events or developments described below could harm our business, financial condition, operating results, and growth prospects. In such an event, the market price of our common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. You should consider carefully the risks and uncertainties summarized and set forth in detail below and elsewhere in this Annual Report before you decide to invest in our common stock.

Summary of Risk Factors

We are providing the following summary of the risk factors contained in this Annual Report to enhance the readability and accessibility of our risk factor disclosures. This summary does not address all of our operatingthe risks that we face. We encourage you to carefully review the full risk factors andcontained in this Report in their entirety for additional information regarding the risks of anymaterial factors that make an investment in our securities speculative or risky. The primary categories by which we classify risks include those related to: (i) our business, (ii) regulatory and industry, (iii) country and currency, and (iv) common stock. Set forth below within each of these categories is a summary of the principal factors that make an investment in our common stock are listed below.speculative or risky.

Business Risks

| ● | Our future performance is difficult to evaluate because we have a limited operating history. |

| ● | We have a history of losses and expect to continue to incur losses in the future. |

| ● | We are an exploration stage company, and there is no guarantee that our properties will result in the commercial extraction of mineral deposits. |

| ● | Because the probability of an individual prospect ever having reserves is not known, our properties may not contain any reserves, and any funds spent on exploration and evaluation may be lost. |

| ● | We face risks related to mining, exploration and mine construction, if warranted, on our properties. |

| ● | Our long-term success will depend ultimately on our ability to achieve and maintain profitability and to develop positive cash flow from our mining activities. |

| ● | We depend on our ability to successfully access the capital and financial markets. Any inability to access the capital or financial markets may limit our ability to fund our ongoing operations, execute our business plan or pursue investments that we may rely on for future growth. |

| ● | Our quarterly and annual operating and financial results and our revenue are likely to fluctuate significantly in future periods. |

| ● | Our ability to manage growth will have an impact on our business, financial condition and results of operations. |

| ● | We depend upon Marc Fogassa, our Chief Executive Officer and Chairman. |

| ● | Our growth will require new personnel, which we will be required to recruit, hire, train and retain. |

| ● | Certain executive officers and directors may be in a position of conflict of interest. |

| 28 |

Regulatory and Industry Risks

| ● | The mining industry subjects us to several risks. |

| ● | Our mineral projects will be subject to significant government regulations. |

| ● | We will be required to obtain governmental permits in order to conduct development and mining operations, a process which is often costly and time-consuming. |

| ● | Compliance with environmental regulations and litigation based on environmental regulations could require significant expenditures. |

| ● | Our operations face substantial regulation of health and safety. |

| ● | Our operations are subject to extensive environmental laws and regulations. |

| ● | Mineral prices are subject to unpredictable fluctuations. |

Country and Currency Risks

| ● | Our ability to execute our business plan depends primarily on the continuation of a favorable mining environment in Brazil and our ability to freely sell our minerals. |

| ● | The perception of Brazil by the international community may affect us. |

| ● | Exposure to foreign exchange fluctuations and capital controls may adversely affect our costs, earnings and the value of some of our assets. |

Common Stock Risks

| ● | Our common stock price has been and may continue to be volatile. |

| ● | We do not intend to pay regular future dividends on our common stock and thus stockholders must look to appreciation of our common stock to realize a gain on their investments. |

| ● | We may seek to raise additional funds, finance acquisitions, or develop strategic relationships by issuing securities that would dilute your ownership. |

| ● | Our Series A Preferred Stock has the effect of concentrating voting control over us in Marc Fogassa, our Chief Executive Officer and Chairman. |

| ● | Marc Fogassa, our Chief Executive Officer and member of our Board of Directors, owns greater than 50% of the Company’s voting securities, which means we are deemed a “controlled company” under the rules of Nasdaq. |

| ● | Our stock price may be volatile, and you could lose all or part of your investment. |

| ● | You will experience dilution as a result of future equity offerings. |

| ● | Our existing stockholders have substantial influence over our company and their interests may not be aligned with the interests of our other stockholders, which may discourage, delay or prevent a change in control of our company, which could deprive our stockholders of an opportunity to receive a premium for their securities. |

| ● | Sales of a substantial number of shares of our common stock by our stockholders in the public market could cause our stock price to fall. |

| ● | Costs as a result of operating as a public company are significant, and our management is required to devote substantial time to compliance with our public company responsibilities and corporate governance practices. |

| ● | Our internal control over financial reporting may not meet the standards required by Section 404 of the Sarbanes-Oxley Act, and failure to achieve and maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act, could have a material adverse effect on our business and share price. |

| 29 |

Business Risks Related

Our future performance is difficult to Our Operations

Investors should evaluate an investment in us considering the uncertainties encountered by mineral exploration companies. Although we were incorporated in 2011, we began to implement our current business modelstrategy in 2016, which is primarily focused on the exploration of strategic minerals. We have generated limited revenues from operations and management team hasour cash flow needs have been in place only since December 2012. Our limited operating history makes it difficult to evaluatefinanced primarily through debt or equity and not through cash flows derived from our business or prospective operations. As an early stage company,a result, we have little historical financial and operating information available to help you evaluate and predict our future performance. In addition, advancing our projects will require significant capital and time, and we are subject to all of the risks inherentassociated with developing and establishing new mining operations and business enterprises as further described in the initial organization, financing, expenditures, complications, and delays inherent in a new business. Investors should evaluate an investment in us in light of the uncertainties encountered by developing companies in a competitive environment. Our business is dependent upon the implementation of our business plan.these risk factors. There can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

We have a history of losses and expect to continue to incur losses in the future.

We have incurred losses in each of the two past years, have negative cash flow from operating activities, have had limited revenues and expect to continue to incur losses in the future.

We have an accumulated deficit of approximately $58.7 million as of December 31, 2022. We expect to continue to incur losses unless and until such time as our projects or one of our future acquired properties enters into commercial production and generates sufficient revenues to fund continuing operations and we are able to develop at least one economic deposit. We recognize that if we are unable to generate cash flows from our operations, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties encountered by companies at the mineral exploration stage. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition.

There is uncertainty regarding our ability to implement our business plan and to grow our operations with our existing financial resources without additional financing. Our ability to implement our business plan is dependent on us generating cash from operations, the sale of our stock and/or obtaining debt financing. Historically, we have funded our operations primarily through the issuance of debt and equity securities. Management’s plan to fund our capital requirements and ongoing operations include the generation of revenue from our mining operations and projects. Management’s secondary plan to cover any shortfall is selling our equity securities, including our common stock, or common stock in Apollo Resources and Jupiter Gold that we own, and obtaining debt financing, There is no assurance that we will be successful in implementing our business plan or that we will be able to generate sufficient cash from operations, sell securities or borrow funds on favorable terms or at all. Our inability to generate significant revenue or obtain additional financing could have a material adverse effect on our ability to fully implement our business plan and grow our business to a greater extent than we can with our existing financial resources

We are an exploration stage company, and there is no guarantee that our properties will result in the commercial extraction of mineral deposits.

We are engaged in the business of exploring and developing mineral properties with the intention of locating economic deposits of minerals. An economic deposit is a mineral property which can be reasonably expected to generate profits upon extraction and commercialization of its minerals after considering all costs involved. Our property interests are at the exploration stage. Accordingly, it is unlikely that we will realize profits in the short term, and we also cannot assure you that we will realize profits in the medium to long term. Any profitability in the future from our business will be dependent upon development of at least one economic deposit and most likely further exploration and development of other economic deposits, each of which is subject to numerous risk factors. including all of the risks associated with developing and establishing new mining operations and business enterprises including:

| ● | completion of studies to verify reserves and commercial viability, including the ability to find sufficient ore reserves to support a commercial mining operation; |

| ● | the timing and cost, which can be considerable, of further exploration, preparing studies, permitting and construction of infrastructure, mining and processing facilities; |

| ● | the availability and costs of drill equipment, exploration personnel, skilled labor, and mining and processing equipment, if required; |

| ● | the availability and cost of appropriate smelting and/or refining arrangements, if required; |

| ● | compliance with stringent environmental and other governmental approval and permit requirements; |

| ● | the availability of funds to finance exploration, development, and construction activities, as warranted; |

| ● | potential opposition from non-governmental organizations, local groups or local inhabitants that may delay or prevent development activities; |

| ● | potential increases in exploration, construction, and operating costs due to changes in the cost of fuel, power, materials, and supplies; and |

| ● | potential shortages of mineral processing, construction, and other facilities related supplies. |

| 30 |

Further, we cannot assure you that, even if an economic deposit of minerals is located, any of our property interests can be commercially mined. The exploration and development of mineral deposits involves a high degree of financial risk over a significant period which a combination of careful evaluation, experience and knowledge of management may not eliminate. While discovery of additional ore-bearing deposits may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Significant expenses may be required to establish reserves by drilling and to construct mining and processing facilities at a particular site. It is impossible to ensure that our current exploration programs will result in profitable commercial mining operations. The profitability of our operations will be, in part, related to the cost and success of its exploration and development programs which may be affected by several factors. Additional expenditures are required to establish reserves which are sufficient to commercially mine and to construct, complete and install mining and processing facilities in those properties that are mined and developed.

In addition, exploration-stage projects like ours have no operating history upon which to base estimates of future operating costs and capital requirements. Exploration project items, such as any future estimates of reserves, metal recoveries or cash operating costs will to a large extent be based upon the interpretation of geologic data, obtained from a limited number of drill holes and other sampling techniques, as well as future studies. Actual operating costs and economic returns of all exploration projects may materially differ from the costs and returns estimated, and accordingly our financial condition, results of operations, and cash flows may be negatively affected.

Because the probability of an individual prospect ever having reserves is unknown, our properties may not contain any reserves, and any funds spent on exploration and evaluation may be lost.

We are an exploration stage company, and we have no “reserves.” A mineral reserve is defined in Regulation S-K 1300 as an estimate of tonnage and grade or quality of “indicated mineral resources” and “measured mineral resources” (as those terms are defined in Regulation S-K 1300) that, in the opinion of a “qualified person” (as defined in Regulation S-K 1300), can be the basis of an economically viable project. We cannot assure you about the existence of economically extractable mineralization at this time, nor about the quantity or grade of any mineralization we may have found. Because the probability of an individual prospect ever having reserves is uncertain, our properties may not contain any reserves and any funds spent on evaluation and exploration may be lost. Even if we confirm reserves on our properties, any quantity or grade of reserves we indicate must be considered as estimates only until such reserves are mined. We do not know with certainty that economically recoverable minerals exist on our properties. In addition, the quantity of any reserves may vary depending on commodity prices. Any material change in the quantity or grade of reserves may affect the economic viability of our properties. Further, our lack of established reserves means that we are uncertain about our ability to generate revenue from our operations.

Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that they can be developed into producing mines and that we can extract those minerals. Both mineral exploration and development involve a high degree of risk, and few mineral properties that are explored are ultimately developed into producing mines.

Exploration activities require significant amounts of capital that may not be recovered and may exceed our budget.

Mineral exploration activities are subject to many risks, including the risk that no commercially productive or extractable resources will be encountered. There can be no assurance that the Company’s activities will ultimately lead to an economically feasible project or that it will recover all or any portion of its investment. Mineral exploration often involves unprofitable efforts, including drilling operations that ultimately do not further exploration efforts. Despite our efforts to budget such costs, the cost of minerals exploration is often uncertain, and cost overruns are common. Substantial expenditures are required to establish reserves through drilling, to develop processes to extract the ore and, in the case of new properties, to develop the extraction and processing facilities and infrastructure at any site chosen for extraction. Although substantial benefits may be derived from the discovery of a major deposit, we cannot provide any assurance that any such deposit will be commercially viable or that we will be able to obtain the funds required for development on a timely basis. Drilling and exploration operations may be curtailed, delayed or canceled as a result of numerous factors, many of which are beyond the Company’s control, including title problems, weather conditions, protests, compliance with governmental requirements, including permitting issues, and shortages or delays in the delivery of equipment and services. For example, following recent results of our exploration plans of our Minas Gerais Lithium Project, we expect to incur greater cost related to such exploration activities than originally budgeted for. While we believe we have sufficient resources to fund our operations for the next twelve months, an increase in our drilling campaigns to keep pace with positive findings of potential economic deposits, may require us to raise additional capital which, if not available on reasonable terms, may cause us to curtail our operations and impair our ability to become profitable.

We face risks related to mining, exploration and mine construction, if warranted, on our properties.

Our level of profitability, if any, in future years will depend to a great degree on prices of minerals set by global markets and whether our exploration-stage properties can be brought into production. We cannot provide any assurances that the current and future exploration programs and/or studies on our existing properties will establish reserves. Whether it will be economically feasible to extract a mineral depends on a number of factors, including, but not limited to: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; drilling costs; mineral prices; mining, processing and transportation costs; the willingness of lenders and investors to provide project financing; labor costs and possible labor strikes; and governmental regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting materials, foreign exchange, environmental protection, employment, worker safety, transportation, and reclamation and closure obligations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us receiving an inadequate return on invested capital.

| 31 |

Our long-term success will depend ultimately on our ability to achieve and maintain profitability and to develop positive cash flow from our mining activities.

Our long-term success, including the recoverability of the carrying values of our assets, and our ability to continue with exploration, development and commissioning and mining activities on our existing projects or to acquire additional projects, depends ultimately on our ability to achieve and maintain profitability and to develop positive cash flow from our operations by establishing ore bodies that contain commercially recoverable minerals and to develop these into profitable mining activities. We cannot assure you that any ore body that we extract mineralized materials from will result in achieving and maintaining profitability and developing positive cash flow.

We depend on our ability to successfully access the capital and financial markets. Any inability to access the capital or financial markets may limit our ability to fund our ongoing operations, execute our business plan depends primarilyor pursue investments that we may rely on for future growth.

Until commercial production is achieved from one of our larger projects, we will continue to incur operating and investing net cash outflows associated with among other things maintaining and acquiring exploration properties, undertaking ongoing exploration activities and the development of mines. As a result, we rely on access to capital markets as a source of funding for our capital and operating requirements. We cannot assure you that such additional funding will be available to us on satisfactory terms, or at all.

In order to finance our current operations and future capital needs, we will require additional funds through the issuance of additional equity and/or debt securities. Depending on the continuationtype and the terms of any financing we pursue, shareholders’ rights and the value of their investment in our shares could be reduced. Any additional equity financing will dilute shareholdings, and new or additional debt financing, if available, may involve restrictions on financing and operating activities. For example, on January 30, 2023, the Company raised an aggregate of $4 million in gross proceeds from the sale of its common stock in transaction exempt under Regulation S of the Securities Act. In addition, if we issue secured debt securities, the holders of the debt would have a favorable mining environmentclaim to our assets that would be prior to the rights of shareholders until the debt is paid. Interest on such debt securities would increase costs and negatively impact operating results.

The global decline in Brazil.

Our quarterly and annual operating and financial results and our revenue are likely to fluctuate significantly in future periods.

Our quarterly and annual operating and financial results are difficult to predict and may fluctuate significantly from period to period.period.based on activities related to our exploration projects. Our revenues, net income and results of operations may fluctuate as a result of a variety of factors that are outside our control including, but not limited to, lack of sufficient working capital, equipment malfunction and breakdowns, inability to timely find spare machines or parts to fix the broken equipment, regulatory or licensing delays and severe weather phenomena.

| 32 |

Our ability to manage growth will have an impact on our business, financial condition and results of operations.

Future growth may place strains on our financial, technical, operational and administrative resources and cause us to rely more on project partners and independent contractors, potentially adversely affecting our financial position and results of operations. Our ability to grow will depend on several factors, including:

| ● | our ability to successfully complete our exploration activities and develop existing projects; | |

| ● | our ability to identify new projects; | |

| ● | our ability to continue to retain and attract skilled personnel; | |

| ● | our ability to maintain or enter into relationships with project partners and independent contractors; | |

| ● | the results of our exploration programs; | |

| ● | the market prices for our minerals; | |

| ● | our access to capital; and | |

| ● | our ability to enter into agreements for the sale of our minerals. |

We may not be successful in upgrading our technical, operational and administrative resources or increasing our internal resources sufficiently to provide certain of the services currently provided by third parties, and we may not be able to maintain or enter into new relationships with project partners and independent contractors on financially attractive terms, if at all. Our inability to achieve or manage growth may materially and adversely affect our business, results of operations and financial condition.

We depend upon Marc Fogassa, our Chief Executive Officer and Chairman.

Our existing operations and continued future development are largely dependent upon the personal efforts and continued performance of Marc Fogassa, our Chief Executive Officer and Chairman and principal stockholder. The loss of the services of Mr. Fogassa would have a material adverse effect on our business and prospects. We maintain key-man life insurance on the life of Mr. Fogassa. See “Management.” If we were to lose Mr. Fogassa, we may not be able to find appropriate replacements on a timely basis and our financial condition and results of operations could be materially adversely affected. Although Mr. Fogassa spends significant time with the Company and is highly active in our management, he does not devote his full time and attention to Atlas Lithium. Mr. Fogassa also currently serves as Chief Executive Officer and director of Apollo Resources Corporation (“Apollo Resources”) and Jupiter Gold Corporation (“Jupiter Gold”).

Our growth will require new personnel, which we will be required to recruit, hire, train and retain.

Our ability to recruit and assimilate new personnel will be critical to our performance. We compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. As we grow, we will be required to recruit additional personnel and to train, motivate and manage employees. If we are unable to successfully compete for qualified employees, our exploration and development programs may be slowed down or suspended.

Certain executive officers and directors may be in a position of conflict of interest.

Marc Fogassa, our Chief Executive and Chairman, also serves as chief executive officer and director of Apollo Resources and Jupiter Gold. Joel Monteiro, Esq., one of our officers, is a director in both Apollo Resources and Jupiter Gold. Areli Nogueira, one of our officers, is a director in Jupiter Gold. We have partial equity ownership in both Apollo Resources and Jupiter Gold. There exists the possibility that one or more of these individuals, or others, may in the future be in a position of conflict of interest. where their interests may not be aligned with the interests of our other stockholders, and he may from time to time be incentivized to take certain actions that benefit his other interests and that our other stockholders do not view as being in their interest as investors in our company.

Adverse developments affecting the financial services industry, including events or concerns involving liquidity, defaults or non-performance by financial institutions or transactional counterparties, could adversely affect our business, financial condition or results of operations.