Local franchise authorities have the ability to impose additional regulatory constraints on our business, which could further increase our expenses.

In addition to the franchise agreement, cable authorities in some jurisdictions have adopted cable regulatory ordinances that further regulate the operation of cable systems. This additional regulation increases the cost of operating our business. We cannot assure you that the local franchising authorities will not impose new and more restrictive requirements. Local franchising authorities who are certified to regulate rates in the communities where wethey operate generally have the power to reduce rates and order refunds on the rates charged for basic service and equipment.

Further regulation of the cable industry could cause us to delay or cancel service or programming enhancements, or impair our ability to raise rates to cover our increasing costs, resulting in increased losses.

Currently, rate regulation is strictly limited to the basic service tier and associated equipment and installation activities. However, the FCC and Congress continue to be concerned that cable rate increases are exceeding inflation notwithstanding the additional channels and services being provided.inflation. It is possible that either the FCC or Congress will further restrict the ability of cable system operators to implement rate increases. Should this occur, it would impede our ability to raise our rates. If we are unable to raise our rates in response to increasing costs, our losses would increase.

There has been legislative and regulatory interest in requiring cable operators to offer historically bundled programming services on an á la carte basis, or to at least offer a separately available child-friendly “family tier.” It is possible that new marketing restrictions could be adopted in the future. Such restrictions could adversely affect our operations.

Actions by pole owners might subject us to significantly increased pole attachment costs.

Changes in channel carriage regulations could impose significant additional costs on us.

Cable operators also face significant regulation of their channel carriage. We can be required to devote substantial capacity to the carriage of programming that we might not carry voluntarily, including certain local broadcast signals; local PEGpublic, educational and government access (“PEG”) programming; and unaffiliated, commercial leased access programming (required channel capacity for use by persons unaffiliated with the cable operator who desire to distribute programming over a cable system). Under two recently released FCC orders, it appears that our carriage obligations regarding local broadcast programming and commercial leased access programming will increase substantially if these orders are not reversed in administrative reconsiderations or judicial appeals. The FCC recently adopted a new transition plan in 2007 addressing the

cable industry’s broadcast carriage obligations once the broadcast industry migration from analog to digital transmission is completed, which is expected to occur in FebruaryJune 2009. Under the FCC’s transition plan, most cable systems will be required to offer both an analog and digital version of local broadcast signals for three years after the digital transition date. This burden could increase further if we are required to carry multiple programming streams included within a single digital broadcast transmission (multicast carriage) or if our broadcast carriage obligations are otherwise expanded. The FCC also adopted new commercial leased access rules which dramatically reduce the rate we can charge for leasing this capacity and dramatically increase our associated administrative burdens. These regulatory changes could disrupt existing programming commitments, interfere with our preferred use of limited channel capacity, and limit our ability to offer services that would maximize our revenue potential. It is possible that other legal restraints will be adopted limiting our discretion over programming decisions.

Offering voice communications service may subject us to additional regulatory burdens, causing us to incur additional costs.

We offer voice communications services over our broadband network and continue to develop and deploy VoIP services. The FCC has declared that certain VoIP services are not subject to traditional state public utility regulation. The full extent of the FCC preemption of state and local regulation of VoIP services is not yet clear. Expanding our offering of these services may require us to obtain certain authorizations, including federal and state licenses. We may not be able to obtain such authorizations in a timely manner, or conditions could be imposed upon such licenses or authorizations that may not be favorable to us. The FCC has extended certain traditional telecommunications requirements, such as E911, and Universal Service fund collection, CALEA, Customer Proprietary Network Information and telephone relay requirements to many VoIP providers such as us. Telecommunications companies generally are subject to other significant regulation which could also be extended to VoIP providers. If additional telecommunications regulations are applied to our VoIP service, it could cause us to incur additional costs.

Our principal physical assets consist of cable distribution plant and equipment, including signal receiving, encoding and decoding devices, headend reception facilities, distribution systems, and customer premise equipment for each of our cable systems.

Our cable plant and related equipment are generally attached to utility poles under pole rental agreements with local public utilities and telephone companies, and in certain locations are buried in underground ducts or trenches. We own or lease real property for signal reception sites, and own most of our service vehicles.

Our subsidiaries generally lease space for business offices throughout our operating divisions. Our headend and tower locations are located on owned or leased parcels of land, and we generally own the towers on which our equipment is located. Charter Holdco owns the real propertyland and building for our principal executive offices.office.

The physical components of our cable systems require maintenance as well as periodic upgrades to support the new services and products we introduce. We believe that our properties are generally in good operating condition and are suitable for our business operations.

We and our parent companies are also defendants or co-defendants in several other unrelated lawsuits claiming infringement of various patents relating to various aspects of our businesses. Other industry participants are also defendants in certain of these cases, and, in many cases including those described above, we expect that any potential liability would be the responsibility of our equipment vendors pursuant to applicable contractual indemnification provisions.

In the event that a court ultimately determines that we infringe on any intellectual property rights, we may be subject to substantial damages and/or an injunction that could require us or our vendors to modify certain products and services we offer to our subscribers, as well as negotiate royalty or license agreements with respect to the patents at issue. While we believe the lawsuits are without merit and intend to defend the actions vigorously, all of these patent lawsuits could be material to our consolidated results of operations of any one period, and no assurance can be given that any adverse outcome would not be material to our consolidated financial condition, results of operations, or liquidity.

factual and legal defenses to the claims at issue, in order to avoid the cost and distraction of continuing to litigate the case, we reached a settlement with the plaintiffs, which received final approval from the court on January 26, 2009. We have been subjected, in the normal course of business, to the assertion of other similar claims and could be subjected to additional such claims. We cannot predict the ultimate outcome of any such claims.

Other Proceedings

We and our parent companies also are party to other lawsuits and claims that arise in the ordinary course of conducting our business. The ultimate outcome of these other legal matters pending against us or our parent companies cannot be predicted, and although such lawsuits and claims are not expected individually to have a material adverse effect on our consolidated financial condition, results of operations, or liquidity, such lawsuits could have in the aggregate a material adverse effect on our consolidated financial condition, results of operations,

or liquidity. Whether or not we ultimately prevail in any particular lawsuit or claim, litigation can be time consuming and costly and injure our reputation.

Our membership interests are not publicly traded.

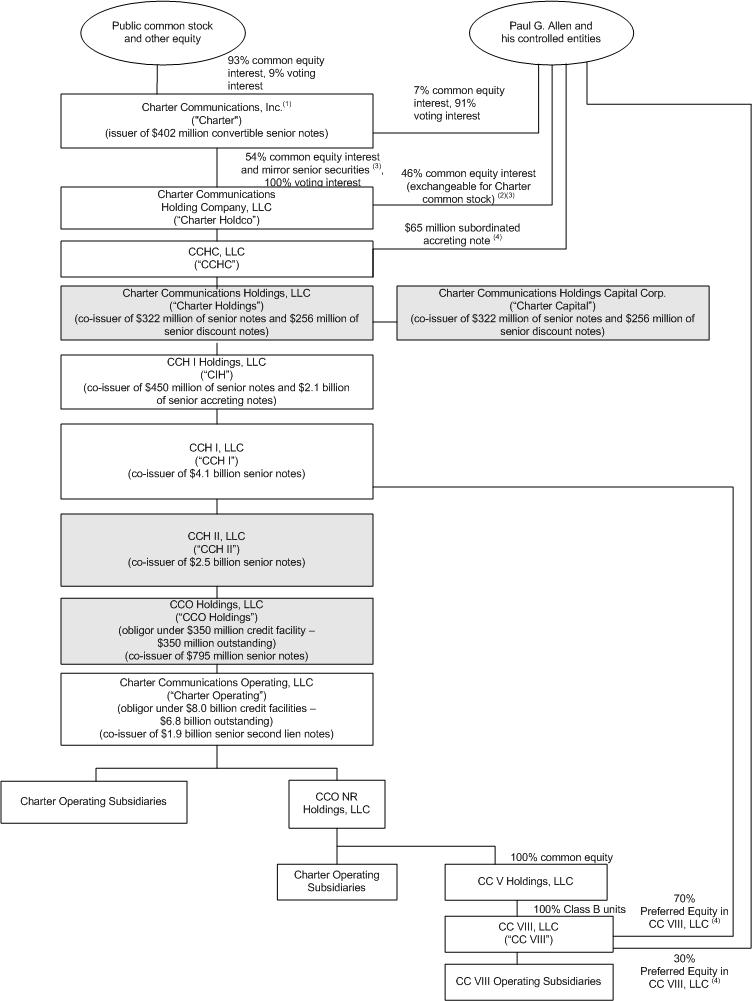

All of the membership interests of Charter Holdings are owned by CCHC. All of the outstanding capital stock of Charter Capital is owned by Charter Holdings. All of the membership interests of CCH II are owned by CCH I and indirectly by Charter Holdings. All of the outstanding capital stock of CCH II Capital Corp. is owned by CCH II. All of the membership interests of CCO Holdings are owned by CCH II and indirectly by Charter Holdings. All of the outstanding capital stock of CCO Holdings Capital Corp. is owned by CCO Holdings.Holdings, an indirect subsidiary of Charter.

None.

(D) Securities Authorized for Issuance Under Equity Compensation Plans

The following information is provided as of December 31, 20072008 with respect to equity compensation plans of Charter:

| | | Number of Securities | | | | Number of Securities |

| | | to be Issued Upon | | Weighted Average | | Remaining Available |

| | | Exercise of Outstanding | | Exercise Price of | | for Future Issuance |

| | | Options, Warrants | | Outstanding Options, | | Under Equity |

| Plan Category | | and Rights | | Warrants and Rights | | Compensation Plans |

| | | | | | | |

Equity compensation plans approved by security holders | | 25,681,561 | (1) | | | $ 4.02 | | 22,759,689 |

Equity compensation plans not approved by security holders | | 289,268 | (2) | | | $ 3.91 | | -- |

| | | | | | | | | |

| TOTAL | | 25,970,829 | | | | $ 4.02 | | 22,759,689 |

_____________| | | Number of Securities | | | | Number of Securities |

| | | to be Issued Upon | | Weighted Average | | Remaining Available |

| | | Exercise of Outstanding | | Exercise Price of | | for Future Issuance |

| | | Options, Warrants | | Outstanding Options, | | Under Equity |

| Plan Category | | and Rights | | Warrants and Rights | | Compensation Plans |

| | | | | | | |

Equity compensation plans approved by security holders | | 22,043,636 | (1) | | $ | 3.82 | | 8,786,240 |

Equity compensation plans not approved by security holders | | 289,268 | (2) | | $ | 3.91 | | -- |

| | | | | | | | | |

| TOTAL | | 22,332,904 | | | $ | 3.82 | | 8,786,240 |

| (1) | This total does not include 4,112,37512,008,625 shares issued pursuant to restricted stock grants made under Charter’s 2001 Stock Incentive Plan, which were or are subject to vesting based on continued employment, or 28,008,98533,036,871 performance shares issued under Charter’s Long Term Incentive Program under Charter’s 2001 Stock Incentive Plan,LTIP plan, which are subject to vesting based on continued employment and Charter’s achievement of certain performance criteria. |

| (2) | Includes shares of Charter’s Class A common stock to be issued upon exercise of options granted pursuant to an individual compensation agreement with a consultant. |

For information regarding securities issued under Charter’s equity compensation plans, see Note 18 to our accompanying consolidated financial statements contained in “Item 8. Financial Statements and Supplementary Data.”

Reference is made to “Item“Part I. Item 1. Business – Recent Developments” which describes the Proposed Restructuring and “Part I. Item 1A. Risk Factors” especially the risk factors “—Risks Relating to Bankruptcy” and “Cautionary Statement Regarding Forward-Looking Statements,” which describe important factors that could cause actual results to differ from expectations and non-historical information contained herein. In addition, the following discussion should be read in conjunction with the audited consolidated financial statements of Charter Holdings, CCH II and CCO Holdings and subsidiaries as of and for the years ended December 31, 2008, 2007, 2006, and 2005.

2006.

Overview

Charter Holdings, including its indirect subsidiaries, CCH II and CCO Holdings through their operating subsidiary, Charter Operating, operateis a broadband communications businessescompany operating in the United States with approximately 5.65.5 million customers at December 31, 2007. Through our hybrid fiber2008. CCO Holdings Capital Corp. is a wholly-owned subsidiary of CCO Holdings and coaxial cable network, wewas formed and exists solely as a co-issuer of the public debt issued with CCO Holdings. CCO Holdings is a direct subsidiary of CCH II, which is an indirect subsidiary of Charter Holdings. Charter Holdings is an indirect subsidiary of Charter. We offer our customers traditional cable video programming (analog(basic and digital, which we refer to as "video" service), high-speed Internet access, and telephone services, as well as advanced broadband services (such as OnDemand, high definition television service and DVR). Results for Charter Holdings, CCH II, and CCO Holdings are discussed below. Because all operating activities take place at our subsidiary, Charter Operating, and its subsidiaries, results of operations are identical through operating income from continuing operations.

Approximately 89% and 88%86% of our revenues for each of the years ended December 31, 20072008 and 2006, respectively,2007 are attributable to monthly subscription fees charged to customers for our video, high-speed Internet, telephone, and commercial services provided by our cable systems. Generally, these customer subscriptions may be discontinued by the customer at any time. The remaining 11%14% of revenue for fiscal years 2008 and 12% of revenue2007 is derived primarily from advertising revenues, franchise fee revenues (which are collected by us but then paid to local franchising authorities), pay-per-view and OnDemand programming (where users are charged a fee for individual programs viewed), installation or reconnection fees charged to customers to commence or reinstate service, and commissions related to the sale of merchandise by home shopping services.

The cable industry's and our most significant competitive challenges stem from DBS providers and DSL service providers. In addition, telephoneTelephone companies either offer, or are making upgrades of their networks that will allow them to offer, services that provide features and functions similar to our video, high-speed Internet, and telephone services, and they also offer them in bundles similar to ours. We believe that competition from DBS and telephone companies has resulted in net video customer losses. In addition, we face increasingly limited opportunities to expandupgrade our video customer base now that approximately 56%62% of our video customers subscribe to our digital video service. These factors have contributed to decreased growth rates for digital video customers. Similarly, competition from DSLhigh-speed Internet providers along with increasing penetration of high-speed Internet service in homes with computers has resulted in decreased growth rates for high-speed Internet customers. In the recent past, we have grown revenues by offsetting video customer losses with price increases and sales of incremental services such as high-speed Internet, OnDemand, DVR, high definition television, and telephone. We expect to continue to grow revenues through price increases and high-speed Internet upgrades, increases in the number of our customers who purchase bundled services including high-speed Internet and telephone, and through sales of incremental advanced services including wireless networking, high definition television, OnDemand, and DVR service.services. In addition, we expect to increase revenues by expanding the sales of our services to our commercial customers. However, we cannot assure you that we will be able to grow revenues at historical rates, if at all. Dramatic declines in the housing market over the past year, including falling home prices and increasing foreclosures, together with significant increases in unemployment, have severely affected consumer confidence and may cause increased delinquencies or cancellations by our customers or lead to unfavorable changes in the mix of products purchased. The general economic downturn also may affect advertising sales, as companies seek to reduce expenditures and conserve cash. Any of these events may adversely affect our cash flow, results of operations and financial condition.

Our expenses primarily consist of operating costs, selling, general and administrative expenses, depreciation and amortization expense, impairment of franchise intangibles and interest expense. Operating costs primarily include programming costs, the cost of our workforce, cable service related expenses, advertising sales costs and franchise fees. Selling, general and administrative expenses primarily include salaries and benefits, rent expense, billing costs, call center costs, internal network costs, bad debt expense, and property taxes. We are attempting to control our costs of operations by maintaining strict controls on expenses. More specifically, we are focused on managing our cost structure by improving workforce productivity, and leveraging our growth,scale, and increasing the effectiveness of our purchasing activities.

Our

For the year ended December 31, 2008, our operating loss from continuing operations was $614 million and for the years ended December 31, 2007 and 2006, income from continuing operations increased towas $548 million and $367 million, respectively. We had a negative operating margin (defined as operating loss from continuing operations divided by revenues) of 9% for the year ended December 31, 2007 from $367 million for the year ended December 31, 2006. We had2008 and positive operating margins (defined as operating income from continuing operations divided by revenues) of 9% and 7% for the years ended December 31, 2007 and 2006, respectively. For the year ended December 31, 2008, the operating loss from continuing operations and negative operating margin is principally due to impairment of franchises incurred during the fourth quarter. The improvement in operating income from continuing operations in 2007 as compared to 2006 and positive operating margin for the years ended December 31, 2007 and 2006 is principally due to an increase in revenue over expenses as a resultincreased sales of increased customers for high-speed Internet, digital video,our bundled services and telephone customers, as well as overall rate increases.improved cost efficiencies.

We have a history of net losses. Further, we expect to continue to report net losses for the foreseeable future. Our net losses are principally attributable to insufficient revenue to cover the combination of operating expenses and interest expenses we incur because of our high amounts of debt, and depreciation expenses resulting from the capital investments we have made and continue to make in our cable properties. We expect that these expenses will remain significant.properties, and the impairment of our franchise intangibles.

Beginning in 2004 and continuing through 2007,2008, we sold several cable systems to divest geographically non-strategic assets and allow for more efficient operations, while also reducing debt orand increasing our liquidity. In 2006, 2007, and 2007,2008, we closed the sale of certain cable systems representing a total of approximately 390,300, 85,100, and 85,10014,100 video customers, respectively. As a result of these sales we have improved our geographic footprint by reducing our number of headends, increasing the number of customers per headend, and reducing the number of states in which the majority of our customers reside. We have also made certain geographically strategic acquisitions in 2006 and 2007, adding 17,600 and 25,500 video customers, respectively.

In 2006, we determined that the West Virginia and Virginia cable systems, which were part of the system sales disclosed above, comprised operations and cash flows that for financial reporting purposes met the criteria for discontinued operations. Accordingly, the results of operations for the West Virginia and Virginia cable systems (including a gain on sale of approximately $200 million recorded in the third quarter of 2006), have been presented as discontinued operations, net of tax, for the year ended December 31, 2006, and all prior periods presented herein have been reclassified to conform to the current presentation.2006.

Results of Operations

The following tables settable sets forth the percentages of revenues that items in the accompanying consolidated statements of operations constituteconstituted for the indicated periods presented (dollars in millions):

| | | Charter Holdings |

| | | Year Ended December 31, |

| | | 2007 | | 2006 |

| | | | | | | | | | | |

| Revenues | | $ | 6,002 | | 100% | | $ | 5,504 | | 100% |

| | | | | | | | | | | |

| Costs and Expenses: | | | | | | | | | | |

| Operating (excluding depreciation and amortization) | | | 2,620 | | 44% | | | 2,438 | | 44% |

| Selling, general and administrative | | | 1,289 | | 21% | | | 1,165 | | 21% |

| Depreciation and amortization | | | 1,328 | | 22% | | | 1,354 | | 25% |

| Impairment of franchises | | | 178 | | 3% | | | -- | | -- |

| Asset impairment charges | | | 56 | | 1% | | | 159 | | 3% |

| Other operating (income) expenses, net | | | (17) | | -- | | | 21 | | -- |

| | | | | | | | | | | |

| | | | 5,454 | | 91% | | | 5,137 | | 93% |

| | | | | | | | | | | |

| Operating income from continuing operations | | | 548 | | 9% | | | 367 | | 7% |

| | | | | | | | | | | |

| Interest expense, net | | | (1,811) | | | | | (1,811) | | |

| Gain (loss) on extinguishment of debt | | | (35) | | | | | 81 | | |

| Other income (expense), net | | | (55) | | | | | 17 | | |

| | | | | | | | | | | |

| Loss from continuing operations before income taxes | | | (1,353) | | | | | (1,346) | | |

| Income tax expense | | | (20) | | | | | (7) | | |

| | | | | | | | | | | |

| Loss from continuing operations | | | (1,373) | | | | | (1,353) | | |

| | | | | | | | | | | |

| Income from discontinued operations, net of tax | | | -- | | | | | 238 | | |

| | | | | | | | | | | |

| Net loss | | $ | (1,373) | | | | $ | (1,115) | | |

| | | Year Ended December 31, |

| | | 2008 | | 2007 |

| | | | | | | | | | | |

| Revenues | | $ | 6,479 | | 100% | | $ | 6,002 | | 100% |

| | | | | | | | | | | |

| Costs and Expenses: | | | | | | | | | | |

| Operating (excluding depreciation and amortization) | | | 2,792 | | 43% | | | 2,620 | | 44% |

| Selling, general and administrative | | | 1,401 | | 22% | | | 1,289 | | 21% |

| Depreciation and amortization | | | 1,310 | | 20% | | | 1,328 | | 22% |

| Impairment of franchises | | | 1,521 | | 23% | | | 178 | | 3% |

| Asset impairment charges | | | -- | | -- | | | 56 | | 1% |

| Other operating (income) expenses, net | | | 69 | | 1% | | | (17) | | -- |

| | | | | | | | | | | |

| | | | 7,093 | | 109% | | | 5,454 | | 91% |

| | | | | | | | | | | |

| Income (loss) from operations | | | (614) | | (9%) | | | 548 | | 9% |

| | | | | | | | | | | |

| Interest expense, net | | | (818) | | | | | (776) | | |

| Change in value of derivatives | | | (62) | | | | | (46) | | |

| Loss on extinguishment of debt | | | -- | | | | | (32) | | |

| Other expense, net | | | (19) | | | | | (24) | | |

| | | | | | | | | | | |

| Loss before income tax expense | | | (1,513) | | | | | (330) | | |

| Income tax benefit (expense) | | | 40 | | | | | (20) | | |

| | | | | | | | | | | |

| Net loss | | $ | (1,473) | | | | $ | (350) | | |

| | | CCH II |

| | | Year Ended December 31, |

| | | 2007 | | 2006 |

| | | | | | | | | | | |

| Revenues | | $ | 6,002 | | 100% | | $ | 5,504 | | 100% |

| | | | | | | | | | | |

| Costs and Expenses: | | | | | | | | | | |

| Operating (excluding depreciation and amortization) | | | 2,620 | | 44% | | | 2,438 | | 44% |

| Selling, general and administrative | | | 1,289 | | 21% | | | 1,165 | | 21% |

| Depreciation and amortization | | | 1,328 | | 22% | | | 1,354 | | 25% |

| Impairment of franchises | | | 178 | | 3% | | | -- | | -- |

| Asset impairment charges | | | 56 | | 1% | | | 159 | | 3% |

| Other operating (income) expenses, net | | | (17) | | -- | | | 21 | | -- |

| | | | | | | | | | | |

| | | | 5,454 | | 91% | | | 5,137 | | 93% |

| | | | | | | | | | | |

| Operating income from continuing operations | | | 548 | | 9% | | | 367 | | 7% |

| | | | | | | | | | | |

| Interest expense, net | | | (1,014) | | | | | (975) | | |

| Loss on extinguishment of debt | | | (32) | | | | | (27) | | |

| Other income (expense), net | | | (70) | | | | | 2 | | |

| | | | | | | | | | | |

| Loss from continuing operations before income taxes | | | (568) | | | | | (633) | | |

| Income tax expense | | | (20) | | | | | (7) | | |

| | | | | | | | | | | |

| Loss from continuing operations | | | (588) | | | | | (640) | | |

| | | | | | | | | | | |

| Income from discontinued operations, net of tax | | | -- | | | | | 238 | | |

| | | | | | | | | | | |

| Net loss | | $ | (588) | | | | $ | (402) | | |

| | | CCO Holdings |

| | | Year Ended December 31, |

| | | 2007 | | 2006 |

| | | | | | | | | | | |

| Revenues | | $ | 6,002 | | 100% | | $ | 5,504 | | 100% |

| | | | | | | | | | | |

| Costs and Expenses: | | | | | | | | | | |

| Operating (excluding depreciation and amortization) | | | 2,620 | | 44% | | | 2,438 | | 44% |

| Selling, general and administrative | | | 1,289 | | 21% | | | 1,165 | | 21% |

| Depreciation and amortization | | | 1,328 | | 22% | | | 1,354 | | 25% |

| Impairment of franchises | | | 178 | | 3% | | | -- | | -- |

| Asset impairment charges | | | 56 | | 1% | | | 159 | | 3% |

| Other operating (income) expenses, net | | | (17) | | -- | | | 21 | | -- |

| | | | | | | | | | | |

| | | | 5,454 | | 91% | | | 5,137 | | 93% |

| | | | | | | | | | | |

| Operating income from continuing operations | | | 548 | | 9% | | | 367 | | 7% |

| | | | | | | | | | | |

| Interest expense, net | | | (776) | | | | | (766) | | |

| Loss on extinguishment of debt | | | (32) | | | | | (27) | | |

| Other income (expense), net | | | (70) | | | | | 2 | | |

| | | | | | | | | | | |

| Loss from continuing operations before income taxes | | | (330) | | | | | (424) | | |

| Income tax expense | | | (20) | | | | | (7) | | |

| | | | | | | | | | | |

| Loss from continuing operations | | | (350) | | | | | (431) | | |

| | | | | | | | | | | |

| Income from discontinued operations, net of tax | | | -- | | | | | 238 | | |

| | | | | | | | | | | |

| Net loss | | $ | (350) | | | | $ | (193) | | |

Revenues. Average monthly revenue per basic video customer, measured on an annual basis, has increased from $82 in 2006 to $93 in 2007.2007 to $105 in 2008. Average monthly revenue per video customer represents total annual revenue, divided by twelve, divided by the average number of basic video customers during the respective period. Revenue growth in 2007 and 2006 primarily reflects increases in the number of telephone, high-speed Internet, and digital video customers, price increases, and incremental video revenues from OnDemand, DVR, and high-definition television services.services, offset by a decrease in basic video customers. Cable system sales, net of acquisitions, in 20062007 and 20072008 reduced the increase in revenues in 20072008 as compared to 20062007 by approximately $90$31 million. See “Part I. Item 1A – Risk Factors – Risks Relating to Bankruptcy – Our operations will be subject to the risks and uncertainties of bankruptcy.”

Revenues by service offering were as follows (dollars in millions):

| | | Year Ended December 31, | | | | |

| | | 2007 | | | 2006 | | | 2007 over 2006 | |

| | | Revenues | | | % of Revenues | | | Revenues | | | % of Revenues | | | Change | | | % Change | |

| | | | | | | | | | | | | | | | | | | |

| Video | | $ | 3,392 | | | | 56 | % | | $ | 3,349 | | | | 61 | % | | $ | 43 | | | | 1 | % |

| High-speed Internet | | | 1,252 | | | | 21 | % | | | 1,051 | | | | 19 | % | | | 201 | | | | 19 | % |

| Telephone | | | 343 | | | | 6 | % | | | 135 | | | | 2 | % | | | 208 | | | | 154 | % |

| Advertising sales | | | 298 | | | | 5 | % | | | 319 | | | | 6 | % | | | (21 | ) | | | (7 | %) |

| Commercial | | | 341 | | | | 6 | % | | | 305 | | | | 6 | % | | | 36 | | | | 12 | % |

| Other | | | 376 | | | | 6 | % | | | 345 | | | | 6 | % | | | 31 | | | | 9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ | 6,002 | | | | 100 | % | | $ | 5,504 | | | | 100 | % | | $ | 498 | | | | 9 | % |

| | | Year Ended December 31, | | | | |

| | | 2008 | | | 2007 | | | 2008 over 2007 | |

| | | Revenues | | | % of Revenues | | | Revenues | | | % of Revenues | | | Change | | | % Change | |

| | | | | | | | | | | | | | | | | | | |

| Video | | $ | 3,463 | | | | 53 | % | | $ | 3,392 | | | | 56 | % | | $ | 71 | | | | 2 | % |

| High-speed Internet | | | 1,356 | | | | 21 | % | | | 1,243 | | | | 21 | % | | | 113 | | | | 9 | % |

| Telephone | | | 555 | | | | 9 | % | | | 345 | | | | 6 | % | | | 210 | | | | 61 | % |

| Commercial | | | 392 | | | | 6 | % | | | 341 | | | | 6 | % | | | 51 | | | | 15 | % |

| Advertising sales | | | 308 | | | | 5 | % | | | 298 | | | | 5 | % | | | 10 | | | | 3 | % |

| Other | | | 405 | | | | 6 | % | | | 383 | | | | 6 | % | | | 22 | | | | 6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ | 6,479 | | | | 100 | % | | $ | 6,002 | | | | 100 | % | | $ | 477 | | | | 8 | % |

Video revenues consist primarily of revenues from analogbasic and digital video services provided to our non-commercial customers. VideoBasic video customers decreased by 213,400174,200 customers in 2007,2008, of which 97,10016,700 were related to systemasset sales, net of acquisitions. Digital video customers increased by 112,000213,000 customers in 2007.2008. The increase in 2007 was reduced by the sale, net of acquisitions, of 38,1007,600 digital customers. The increase in video revenues areis attributable to the following (dollars in millions):

| | | 2007 compared to 2006 | |

| | | | |

| Rate adjustments and incremental video services | | $ | 88 | |

| Increase in digital video customers | | | 59 | |

| Decrease in analog video customers | | | (41 | ) |

| System sales, net of acquisitions | | | (63 | ) |

| | | | | |

| | | $ | 43 | |

| | | 2008 compared to 2007 | |

| | | | |

| Incremental video services and rate adjustments | | $ | 87 | |

| Increase in digital video customers | | | 77 | |

| Decrease in basic video customers | | | (72 | ) |

| Asset sales, net of acquisitions | | | (21 | ) |

| | | | | |

| | | $ | 71 | |

High-speed Internet customers grew by 280,300192,700 customers in 2007.2008. The increase in 20072008 was reduced by systemasset sales, net of acquisitions, of 8,8005,600 high-speed Internet customers. The increase in high-speed Internet revenues from our non-commercialresidential customers areis attributable to the following (dollars in millions):

| | | 2007 compared to 2006 | |

| | | | |

| Increase in high-speed Internet customers | | $ | 150 | |

| Rate adjustments and service upgrades | | | 62 | |

| System sales, net of acquisitions | | | (11 | ) |

| | | | | |

| | | $ | 201 | |

| | | 2008 compared to 2007 | |

| | | | |

| Increase in high-speed Internet customers | | $ | 113 | |

| Rate adjustments and service upgrades | | | 3 | |

| Asset sales, net of acquisitions | | | (3 | ) |

| | | | | |

| | | $ | 113 | |

Revenues from telephone services increased primarilyby $220 million in 2008, as a result of an increase of 513,500389,500 telephone customers in 2007, of which 500 were related to acquisitions.

Advertising sales revenues consist primarily of revenues from commercial advertising customers, programmers and other vendors. In 2007, advertising sales revenues decreased primarily as a result of a decrease in national advertising sales, including political advertising, as a result of decreases in advertising sales revenues from

programmers, and2008, offset by a decrease of $3$10 million, as a result of system sales. For the years ended December 31, 2007 and 2006, we received $13 million and $17 million, respectively, in advertising sales revenues from vendors.related to lower average rates.

Commercial revenues consist primarily of revenues from services provided to our commercial customers. Commercial revenues increased primarily as a result of anincreased sales of the Charter Business Bundle® primarily

to small and medium-sized businesses. The increase in commercial high-speed Internet revenues. The increases werewas reduced by approximately $6$2 million in 2007 as a result of systemasset sales.

Advertising sales revenues consist primarily of revenues from commercial advertising customers, programmers and other vendors. In 2008, advertising sales revenues increased primarily as a result of increases in political advertising sales and advertising sales to vendors offset by significant decreases in revenues from the automotive and furniture sectors, and a decrease of $2 million related to asset sales. For the years ended December 31, 2008 and 2007, we received $39 million and $15 million, respectively, in advertising sales revenues from vendors.

Other revenues consist of franchise fees, equipment rental,regulatory fees, customer installations, home shopping, late payment fees, wire maintenance fees and other miscellaneous revenues. For each of the years ended December 31, 20072008 and 2006,2007, franchise fees represented approximately 47% and 52%, respectively,46% of total other revenues. The increase in other revenues in 2008 was primarily the result of increases in universal service fund revenues,franchise and other regulatory fees and wire maintenance fees, and late payment fees. The increase was reduced by approximately $7$3 million as a result of systemasset sales.

Operating expenses. The increase in our operating expenses is attributable to the following (dollars in millions):

| | | 2007 compared to 2006 | |

| | | | |

| Programming costs | | $ | 106 | |

| Labor costs | | | 49 | |

| Costs of providing high-speed Internet and telephone services | | | 33 | |

| Maintenance costs | | | 20 | |

| Other, net | | | 23 | |

| System sales, net of acquisitions | | | (49 | ) |

| | | | | |

| | | $ | 182 | |

| | | 2008 compared to 2007 | |

| | | | |

| Programming costs | | $ | 90 | |

| Labor costs | | | 44 | |

| Franchise and regulatory fees | | | 23 | |

| Maintenance costs | | | 19 | |

| Costs of providing high-speed Internet and telephone services | | | 5 | |

| Other, net | | | 13 | |

| Asset sales, net of acquisitions | | | (22 | ) |

| | | | | |

| | | $ | 172 | |

Programming costs were approximately $1.6 billion and $1.5$1.6 billion, representing 60%59% and 61%60% of total operating expenses for the years ended December 31, 20072008 and 2006,2007, respectively. Programming costs consist primarily of costs paid to programmers for analog,basic, premium, digital, OnDemand, and pay-per-view programming. The increasesincrease in programming costs areis primarily a result of annual contractual rate increases.adjustments, offset in part by asset sales and customer losses. Programming costs were also offset by the amortization of payments received from programmers in support of launches of new channels of $22$33 million and $32$25 million in 20072008 and 2006,2007, respectively. We expect programming expenses to continue to increase, and at a higher rate than in 2008, due to a variety of factors, including amounts paid for retransmission consent, annual increases imposed by programmers, amounts paid for retransmission consent, and additional programming, including high-definition, OnDemand, and OnDemandpay-per-view programming, being provided to our customers.

Labor costs increased primarily due to an increase in headcount to support improved service levelsemployee base salary and telephone deployment.benefits.

Selling, general and administrative expenses. The increase in selling, general and administrative expenses is attributable to the following (dollars in millions):

| | | 2007 compared to 2006 | |

| | | | |

| Customer care costs | | $ | 62 | |

| Marketing costs | | | 58 | |

| Employee costs | | | 24 | |

| Property and casualty costs | | | (7 | ) |

| Other, net | | | 2 | |

| System sales, net of acquisitions | | | (15 | ) |

| | | | | |

| | | $ | 124 | |

| | | 2008 compared to 2007 | |

| | | | |

| Marketing costs | | $ | 32 | |

| Customer care costs | | | 23 | |

| Bad debt and collection costs | | | 17 | |

| Stock compensation costs | | | 14 | |

| Employee costs | | | 7 | |

| Other, net | | | 24 | |

| Asset sales, net of acquisitions | | | (5 | ) |

| | | | | |

| | | $ | 112 | |

Depreciation and amortization. Depreciation and amortization expense decreased by $26$18 million in 2007.2008. During 2007,2008, the decrease in depreciation was primarily the result of systemasset sales, certain assets becoming fully depreciated, and an $8$81 million decrease due to the impact of changes in the useful lives of certain assets.assets during 2007, offset by depreciation on capital expenditures.

Impairment of franchises. LargelyWe recorded impairment of $1.5 billion and $178 million for the years ended December 31, 2008 and 2007, respectively. The impairment recorded in 2008 was largely driven by lower expected revenue growth resulting from the current economic downturn and increased competition. The impairment recorded in 2007 was largely driven by increased competition being experienced by us and our peers, we lowered our projected revenue and expense growth rates and increased our projected capital expenditures, and accordingly revised our estimates of future cash flows as compared to those used in prior valuations. As a result, we recorded $178 million of impairment for the year ended December 31, 2007. The valuation completed at October 1, 2006 showed franchise values in excess of book value, and thus resulted in no impairments.competition.

Asset impairment charges. Asset impairment charges for the yearsyear ended December 31, 2007 and 2006 representrepresents the write-down of assets related to cable asset sales to fair value less costs to sell. See Note 4 to the accompanying consolidated financial statements contained in “Item 8. Financial Statements and Supplementary Data.”

Other operating (income) expenses, net. The decreasechange in other operating (income) expenses, net is attributable to the following (dollars in millions):

| | | 2007 compared to 2006 | |

| | | | |

| Decrease in losses on sales of assets | | $ | (11 | ) |

| Decrease in special charges, net | | | (27 | ) |

| | | | | |

| | | $ | (38 | ) |

| | | 2008 compared to 2007 | |

| | | | |

| Increase in losses on sales of assets | | $ | 16 | |

| Increase in special charges, net | | | 70 | |

| | | | | |

| | | $ | 86 | |

For more information, see Note 15 to the accompanying consolidated financial statements contained in “Item 8. Financial Statements and Supplementary Data.”

Interest expense, net.

Charter Holdings. Net interest expense was $1.8 billion for each of the years ended December 31, 2007 and 2006. The impact of the increase in average debt outstanding from $18.7 billion in 2006 to $19.2 billion in 2007 was partially offset by the impact of a decrease in our average borrowing rate from 9.6% in 2006 to 9.3% in 2007.

CCH II. Net interest expense increased by $39$42 million in 20072008 from 2006.2007. The increase in net interest expense from 2007 to 2008 was a result of an increase in average debt outstanding increasing from $10.9 billion in 2006 to $11.9$9.4 billion in 2007 and was partiallyto $10.3 billion in 2008, offset by a decrease in our average borrowing rate from 8.6%7.6% in 20062007 to 8.1%6.9% in 2007.2008.

CCO HoldingsChange in value of derivatives.. Net Interest rate swaps are held to manage our interest costs and reduce our exposure to increases in floating interest rates. We expense the change in fair value of derivatives that do not qualify for hedge accounting and cash flow hedge ineffectiveness on interest rate swap agreements. The loss from the change in value of interest rate swaps increased by $10from $46 million in 2007 from 2006. The increaseto $62 million in net interest expense was a result of an increase in average debt outstanding from $8.7 billion in 2006 to $9.4 billion in 2007 and was partially offset by a decrease in our average borrowing rate from 8.2% in 2006 to 7.6% in 2007.2008.

Gain (loss)Loss on extinguishment of debt. Gain (loss)Loss on extinguishment of debt consists of the following for the years ended December 31, 20072008 and 2006 (dollars in millions).2007.

| | | Year Ended December 31, | |

| | | 2007 | | | 2006 | |

| | | | | | | |

| CCO Holdings debt refinancings | | $ | (19 | ) | | $ | (3 | ) |

| Charter Operating credit facility refinancing | | | (13 | ) | | | (24 | ) |

| | | | | | | | | |

| Gain (loss) on extinguishment of debt – CCH II and CCO Holdings | | | (32 | ) | | | (27 | ) |

| Charter Holdings debt exchanges and refinancings | | | (3 | ) | | | 108 | |

| | | | | | | | | |

| Gain (loss) on extinguishment of debt – Charter Holdings | | $ | (35 | ) | | $ | 81 | |

| | | Year Ended December 31, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| CCO Holdings notes redemption | | $ | -- | | | $ | (19 | ) |

| Charter Operating credit facilities refinancing | | | -- | | | | (13 | ) |

| | | | | | | | | |

| | | $ | -- | | | $ | (32 | ) |

For more information, see Notes 9 and 16 to the accompanying consolidated financial statements contained in “Item 8. Financial Statements and Supplementary Data.”

Other income (expense),expense, net. The decreasechange in other income,expense, net is attributable to the following (dollars in millions):

| | | 2007 compared to 2006 | |

| | | Charter Holdings | | | CCH II and CCO Holdings | |

| | | | | | | |

| Decrease in gain (loss) on derivative instruments and hedging activities, net | | $ | (52 | ) | | $ | (52 | ) |

| Decrease in minority interest | | | (3 | ) | | | (2 | ) |

| Decrease in investment income | | | (15 | ) | | | (15 | ) |

| Other, net | | | (2 | ) | | | (3 | ) |

| | | | | | | | | |

| | | $ | (72 | ) | | $ | (72 | ) |

| | | 2008 compared to 2007 | |

| | | | |

| Decrease in minority interest | | $ | 9 | |

| Decrease in loss on investment | | | 1 | |

| Other, net | | | (5 | ) |

| | | | | |

| | | $ | 5 | |

For more information, see Note 17 to the accompanying consolidated financial statements contained in “Item 8. Financial Statements and Supplementary Data.”

Income tax expense.benefit (expense). Income tax benefit for the year ended December 31, 2008 was realized as a result of the decreases in certain deferred tax liabilities of certain of our indirect subsidiaries, attributable to the write-down of franchise assets for financial statement purposes and not for tax purposes. Income tax benefit for the year ended December 31, 2008 included $32 million of deferred tax benefit related to the impairment of franchises. Income tax expense in 2007 was recognized through increases in deferred tax liabilities and current federal and state income tax expenses of certain of our indirect subsidiaries. Income tax expense for the year ended December 31, 2007 includes $18 million of income tax expense previously recorded at our indirect parent company.

Income from discontinued operations, net of tax. Income from discontinued operations, net of tax, decreased in 2007 compared to 2006 due to the sale of the West Virginia and Virginia systems in July 2006.

Net loss. The impact to net loss in 2008 and 2007 and 2006as a result of asset impairment charges, impairment of franchises, and extinguishment of debt and gain on sale of discontinued operations, net of related tax effects, at Charter Holdings was to increase net loss by approximately $267 million$1.5 billion and decrease net loss by approximately $160 million, respectively, and at CCH II and CCO Holdings was to increase net loss by $264 million, and decrease net loss by approximately $52 million for each, respectively.

Liquidity and Capital Resources

Introduction

This section contains a discussion of our liquidity and capital resources, including a discussion of our cash position, sources and uses of cash, access to credit facilities and other financing sources, historical financing activities, cash needs, capital expenditures and outstanding debt.

Recent Developments – Restructuring

On February 12, 2009, Charter reached agreements in principle with the Noteholders holding approximately $4.1 billion in aggregate principal amount of notes issued by our parent companies, CCH I and CCH II. Pursuant to the Restructuring Agreements, on March 27, 2009, we and our parent companies filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code to implement the Proposed Restructuring pursuant to the Plan aimed at improving our parent companies’ capital structure.

The Proposed Restructuring is expected to be funded with cash from operations, the Notes Exchange, the New Debt Commitment, and the Rights Offering for which Charter has received a Back-Stop Commitment from certain Noteholders. In addition to the Restructuring Agreements, the Noteholders have entered into Commitment Letters, pursuant to which they have agreed to exchange and/or purchase, as applicable, certain securities of Charter, as described in more detail below.

Under the Notes Exchange, existing holders of CCH II Notes will be entitled to exchange their CCH II Notes for New CCH II Notes. CCH II Notes that are not exchanged in the Notes Exchange will be paid in cash in an amount equal to the outstanding principal amount of such CCH II Notes plus accrued but unpaid interest to the bankruptcy petition date plus post-petition interest, but excluding any call premiums or prepayment penalties and for the avoidance of doubt, any unmatured interest. The aggregate principal amount of New CCH II Notes to be issued pursuant to the Plan is expected to be approximately $1.5 billion plus accrued but unpaid interest to the bankruptcy petition date plus post-petition interest, but excluding any call premiums or prepayment penalties (collectively, the “Target Amount”), plus an additional $85 million.

Under the Commitment Letters, certain holders of CCH II Notes have committed to exchange, pursuant to the Notes Exchange, an aggregate of approximately $1.2 billion in aggregate principal amount of CCH II Notes, plus accrued but unpaid interest to the bankruptcy petition date plus post-petition interest, but excluding any call premiums or any

prepayment penalties. In the event that the aggregate principal amount of New CCH II Notes to be issued pursuant to the Notes Exchange would exceed the Target Amount, each Noteholder participating in the Notes Exchange will receive a pro rata portion of such Target Amount of New CCH II Notes, based upon the ratio of (i) the aggregate principal amount of CCH II Notes it has tendered into the Notes Exchange to (ii) the total aggregate principal amount of CCH II Notes tendered into the Notes Exchange. Participants in the Notes Exchange will receive a commitment fee equal to 1.5% of the principal amount plus interest on the CCH II Notes exchanged by such participant in the Notes Exchange.

Under the New Debt Commitment, certain holders of CCH II Notes have committed to purchase an additional amount of New CCH II Notes in an aggregate principal amount of up to $267 million. Participants in the New Debt Commitment will receive a commitment fee equal to the greater of (i) 3.0% of their respective portion of the New Debt Commitment or (ii) 0.83% of its respective portion of the New Debt Commitment for each month beginning April 1, 2009 during which its New Debt Commitment remains outstanding.

Under the Rights Offering, Charter will offer to existing holders of CCH I Notes that are accredited investors (as defined in Regulation D promulgated under the Securities Act) or qualified institutional buyers (as defined under Rule 144A of the Securities Act), the Rights to purchase shares of the new Class A Common Stock of Charter, to be issued upon our and our parent companies’ emergence from bankruptcy, in exchange for a cash payment at a discount to the equity value of Charter upon emergence. Upon emergence from bankruptcy, Charter’s new Class A Common Stock is not expected to be listed on any public or over-the-counter exchange or quotation system and will be subject to transfer restrictions. It is expected, however, that Charter will thereafter apply for listing of Charter’s new Class A Common Stock on the NASDAQ Stock Market as provided in the Term Sheet. The Rights Offering is expected to generate proceeds of up to approximately $1.6 billion and will be used to pay holders of CCH II Notes that do not participate in the Notes Exchange, repayment of certain amounts relating to the satisfaction of certain swap agreement claims against Charter Operating and for general corporate purposes.

Under the Commitment Letters, the Backstop Parties have agreed to subscribe for their respective pro rata portions of the Rights Offering, and certain of the Backstop Parties have, in addition, agreed to subscribe for a pro rata portion of any Rights that are not purchased by other holders of CCH I Notes in the Rights Offering (the “Excess Backstop”). Noteholders who have committed to participate in the Excess Backstop will be offered the option to purchase a pro rata portion of additional shares of Charter’s new Class A Common Stock, at the same price at which shares of the new Class A Common Stock will be offered in the Rights Offering, in an amount equal to $400 million less the aggregate dollar amount of shares purchased pursuant to the Excess Backstop. The Backstop Parties will receive a commitment fee equal to 3% of its respective equity backstop.

The Restructuring Agreements further contemplate that upon consummation of the Plan (i) CCO Holdings’ and Charter Operating’s notes and bank debt will remain outstanding, (ii) holders of notes issued by CCH II will receive New CCH II Notes pursuant to the Notes Exchange and/or cash, (iii) holders of notes issued by CCH I will receive shares of Charter’s new Class A Common Stock, (iv) holders of notes issued by CIH will receive warrants to purchase shares of common stock in Charter, (v) holders of notes of Charter Holdings will receive warrants to purchase shares of Charter’s new Class A Common Stock, (vi) holders of convertible notes issued by Charter will receive cash and preferred stock issued by Charter, (vii) holders of common stock will not receive any amounts on account of their common stock, which will be cancelled, and (viii) trade creditors will be paid in full. In addition, as part of the Proposed Restructuring, it is expected that consideration will be paid by holders of CCH I Notes to other entities participating in the financial restructuring. The recoveries summarized above are more fully described in the Term Sheet.

Pursuant to the Allen Agreement, in settlement of their rights, claims and remedies against Charter and its subsidiaries, and in addition to any amounts received by virtue of their holding any claims of the type set forth above, upon consummation of the Plan, Mr. Allen or his affiliates will be issued a number of shares of the new Class B Common Stock of Charter such that the aggregate voting power of such shares of new Class B Common Stock shall be equal to 35% of the total voting power of all new capital stock of Charter. Each share of new Class B Common Stock will be convertible, at the option of the holder, into one share of new Class A Common Stock, and will be subject to significant restrictions on transfer. Certain holders of new Class A Common Stock and new Class B Common Stock will receive certain customary registration rights with respect to their shares. Upon consummation of the Plan, Mr. Allen or his affiliates will also receive (i) warrants to purchase shares of new Class A common stock of Charter in an aggregate amount equal to 4% of the equity value of reorganized Charter, after giving effect to the Rights Offering, but prior to the issuance of warrants and equity-based awards provided for by the Plan, (ii) $85 million principal amount of New CCH II Notes, (iii) $25 million in cash for amounts owing to CII under a management agreement, (iv) up to $20 million in cash for reimbursement of fees and expenses in connection

with the Proposed Restructuring, and (v) an additional $150 million in cash. The warrants described above shall have an exercise price per share based on a total equity value equal to the sum of the equity value of reorganized Charter, plus the gross proceeds of the Rights Offering, and shall expire seven years after the date of issuance. In addition, on the effective date of the Plan, CII will retain a 1% equity interest in reorganized Charter Holdco and a right to exchange such interest into new Class A common stock of Charter.

The Restructuring Agreements also contemplate that upon emergence from bankruptcy each holder of 10% or more of the voting power of Charter will have the right to nominate one member of the initial Board for each 10% of voting power; and that at least Charter’s current Chief Executive Officer and Chief Operating Officer will continue in their same positions. The Restructuring Agreements require Noteholders to cast their votes in favor of the Plan and generally support the Plan and contain certain customary restrictions on the transfer of claims by the Noteholders.

In addition, the Restructuring Agreements contain an agreement by the parties that prior to commencement of the Chapter 11 cases, if performance by us or our parent companies of any term of the Restructuring Agreements would trigger a default under the debt instruments of CCO Holdings and Charter Operating, which debt is to remain outstanding such performance would be deemed unenforceable solely to the extent necessary to avoid such default.

The Restructuring Agreements and Commitment Letters are subject to certain termination events, including, among others:

| · | the commitments set forth in the respective Noteholder’s Commitment Letter shall have expired or been terminated; |

| · | Charter’s board of directors shall have been advised in writing by its outside counsel that continued pursuit of the Plan is inconsistent with its fiduciary duties, and the board of directors determines in good faith that, (A) a proposal or offer from a third party is reasonably likely to be more favorable to the Company than is proposed under the Term Sheet, taking into account, among other factors, the identity of the third party, the likelihood that any such proposal or offer will be negotiated to finality within a reasonable time, and the potential loss to the company if the proposal or offer were not accepted and consummated, or (B) the Plan is no longer confirmable or feasible; |

| · | the Plan or any subsequent plan filed by us with the bankruptcy court (or a plan supported or endorsed by us) is not reasonably consistent in all material respects with the terms of the Restructuring Agreements; |

| · | a disclosure statement order reasonably acceptable to Charter, the holders of a majority of the CCH I Notes held by the Requisite Holders and Mr. Allen has not been entered by the bankruptcy court on or before the 50th day following the bankruptcy petition date; |

| · | a confirmation order reasonably acceptable to Charter, the Requisite Holders and Mr. Allen is not entered by the bankruptcy court on or before the 130th day following the bankruptcy petition date; |

| · | any of the Chapter 11 cases of Charter is converted to cases under Chapter 7 of the Bankruptcy Code if as a result of such conversion the Plan is not confirmable; |

| · | any Chapter 11 cases of Charter is dismissed if as a result of such dismissal the Plan is not confirmable; |

| · | the order confirming the Plan is reversed on appeal or vacated; and |

| · | any Restructuring Agreement or the Allen Agreement has terminated or been breached in any material respect subject to notice and cure provisions. |

The Allen Agreement contains similar provisions to those provisions of the Restructuring Agreements. There is no assurance that the treatment of creditors outlined above will not change significantly. For example, because the Proposed Restructuring is contingent on reinstatement of the credit facilities and certain notes of Charter Operating and CCO Holdings, failure to reinstate such debt would require Charter to revise the Proposed Restructuring. Moreover, if reinstatement does not occur and current capital market conditions persist, we and our parent companies may not be able to secure adequate new financing and the cost of new financing would likely be materially higher. The Proposed Restructuring would result in the reduction of Charter’s debt by approximately $8 billion.

The above summary of the Restructuring Agreements, Commitment Letters, Term Sheet and Allen Agreement is qualified in its entirety by the full text of the Restructuring Agreements, Commitment Letters, Term Sheet and Allen Agreement, copies of which are filed as Exhibits 10.1, 10.2, 10.3 and 10.4, respectively, to this Annual Report on Form 10-K, and incorporated herein by reference. See “Part I. Item 1A - Risk Factors – Risks Relating to Bankruptcy.”

Recent Developments – Interest Payments

Two of our parent companies, CIH and Charter Holdings, did not make the January Interest Payment on the Overdue Payment Notes. The Indentures for the Overdue Payment Notes permits a 30-day grace period for such interest payments through (and including) February 15, 2009. On February 11, 2009, in connection with the Commitment Letters and Restructuring Agreements, Charter and certain of its subsidiaries also entered into the Escrow Agreement. As required under the Indentures, Charter set a special record date for payment of such interest payments of February 28, 2009. Under the Escrow Agreement, the Ad-Hoc Holders agreed to deposit into an escrow account the Escrow Amount and the Escrow Agent will hold such amounts subject to the terms of the Escrow Agreement. Under the Escrow Agreement, if the transactions contemplated by the Restructuring Agreements are consummated on or before December 15, 2009 or such transactions are not consummated on or before December 15, 2009 due to material breach of the Restructuring Agreements by Charter or its direct or indirect subsidiaries, then the Ad-Hoc Holders will be entitled to receive their pro-rata share of the Escrow Amount. If the transactions contemplated by the Restructuring Agreements are not consummated on or prior to December 15, 2009 for any reason other than material breach of the Restructuring Agreements by Charter or its direct or indirect subsidiaries, then Charter, Charter Holdings, CIH or their designee shall be entitled to receive the Escrow Amount.

One of Charter’s subsidiaries, CCH II, did not make its scheduled payment of interest on March 16, 2009 on certain of its outstanding senior notes. The governing indenture for such notes permits a 30-day grace period for such interest payments, and Charter and its subsidiaries, including CCH II, filed voluntary Chapter 11 Bankruptcy prior to the expiration of the grace period.

Recent Developments – Charter Operating Credit Facility

On February 3, 2009, Charter Operating made a request to the administrative agent under the Credit Agreement, to borrow additional revolving loans under the Credit Agreement. Such borrowing request complied with the provisions of the Credit Agreement including section 2.2 (“Procedure for Borrowing”) thereof. On February 5, 2009, we received a notice from the administrative agent asserting that one or more Events of Default (as defined in the Credit Agreement) had occurred and was continuing under the Credit Agreement. In response, we sent a letter to the administrative agent on February 9, 2009, among other things, stating that no Event of Default under the Credit Agreement occurred or was continuing and requesting the administrative agent to rescind its notice of default and fund Charter Operating’s borrowing request. The administrative agent sent a letter to us on February 11, 2009, stating that it continues to believe that one or more events of default occurred and was continuing. As a result, with the exception of one lender who funded approximately $0.4 million, the lenders under the Credit Agreement have failed to fund Charter Operating’s borrowing request.

On March 27, 2009, JPMorgan Chase Bank, N. A., as Administrative Agent under the Credit Agreement, filed an adversary proceeding in bankruptcy court against Charter Operating and CCO Holdings seeking a declaration that there have been events of default under the Credit Agreement. Such a judgment would prevent Charter Operating and CCO Holdings from reinstating the terms and provisions of the Credit Agreement through the bankruptcy proceeding. Although it has not yet answered the complaint, Charter denies the allegations made by JP Morgan and intends to vigorously contest this matter.

Overview of Our Debt and Liquidity

We have significant amounts of debt. As of December 31, 2007,2008, the accreted value of Charter Holdings’, CCH II’s, and CCO Holdings’our total debt was approximately $19.5$11.8 billion, $12.3 billion, and $9.9 billion, respectively, as summarized below (dollars in millions):

| | | December 31, 2007 | | | | |

| | | | | | | Semi-Annual | | |

| | | Principal | | Accreted | | Interest Payment | | Maturity |

| | | Amount | | Value(a) | | Dates | | Date(b) |

| Charter Operating: | | | | | | | | | |

| 8.000% senior second-lien notes due 2012 | $ | 1,100 | $ | 1,100 | | | 4/30 & 10/30 | | 4/30/12 |

| 8 3/8% senior second-lien notes due 2014 | | 770 | | 770 | | | 4/30 & 10/30 | | 4/30/14 |

| Credit facility | | 6,844 | | 6,844 | | | | | varies |

| CCO Holdings: | | | | | | | | | |

| 8 3/4% senior notes due 2013 | | 800 | | 795 | | | 5/15 & 11/15 | | 11/15/13 |

| Credit facility | | 350 | | 350 | | | | | 9/6/14 |

| Total CCO Holdings | | 9,864 | | 9,859 | | | | | |

| | | | | | | | | | |

| CCH II (a): | | | | | | | | | |

| 10.250% senior notes due 2010 | | 2,198 | | 2,192 | | | 3/15 & 9/15 | | 9/15/10 |

| 10.250% senior notes due 2013 | | 250 | | 260 | | | 4/1 & 10/1 | | 10/1/13 |

| Total CCH II | | 12,312 | | 12,311 | | | | | |

| | | | | | | | | | |

| CCH I (a): | | | | | | | | | |

| 11.00% senior notes due 2015 | | 3,987 | | 4,083 | | | 4/1 & 10/1 | | 10/1/15 |

| CIH (a): | | | | | | | | | |

| 11.125% senior notes due 2014 | | 151 | | 151 | | | 1/15 & 7/15 | | 1/15/14 |

| 13.500% senior discount notes due 2014 | | 581 | | 581 | | | 1/15 & 7/15 | | 1/15/14 |

| 9.920% senior discount notes due 2014 | | 471 | | 471 | | | 4/1 & 10/1 | | 4/1/14 |

| 10.000% senior notes due 2014 | | 299 | | 299 | | | 5/15 & 11/15 | | 5/15/14 |

| 11.750% senior discount notes due 2014 | | 815 | | 815 | | | 5/15 & 11/15 | | 5/15/14 |

| 12.125% senior discount notes due 2015 | | 217 | | 217 | | | 1/15 & 7/15 | | 1/15/15 |

| Charter Holdings: | | | | | | | | | |

| 10.000% senior notes due 2009 | | 88 | | 88 | | | 4/1 & 10/1 | | 4/1/09 |

| 10.750% senior notes due 2009 | | 63 | | 63 | | | 4/1 & 10/1 | | 10/1/09 |

| 9.625% senior notes due 2009 | | 37 | | 37 | | | 5/15 & 11/15 | | 11/15/09 |

| 10.250% senior notes due 2010 | | 18 | | 18 | | | 1/15 & 7/15 | | 1/15/10 |

| 11.750% senior discount notes due 2010 | | 16 | | 16 | | | 1/15 & 7/15 | | 1/15/10 |

| 11.125% senior notes due 2011 | | 47 | | 47 | | | 1/15 & 7/15 | | 1/15/11 |

| 13.500% senior discount notes due 2011 | | 60 | | 60 | | | 1/15 & 7/15 | | 1/15/11 |

| 9.920% senior discount notes due 2011 | | 51 | | 51 | | | 4/1 & 10/1 | | 4/1/11 |

| 10.000% senior notes due 2011 | | 69 | | 69 | | | 5/15 & 11/15 | | 5/15/11 |

| 11.750% senior discount notes due 2011 | | 54 | | 54 | | | 5/15 & 11/15 | | 5/15/11 |

| 12.125% senior discount notes due 2012 | | 75 | | 75 | | | 1/15 & 7/15 | | 1/15/12 |

| Total Charter Holdings | $ | 19,411 | $ | 19,506 | | | | | |

| | | December 31, 2008 | | | | |

| | | | | | | | Semi-Annual | | |

| | | Principal | | | Accreted | | Interest Payment | | Maturity |

| | | Amount | | | Value(a) | | Dates | | Date(b) |

| CCO Holdings, LLC: | | | | | | | | | |

| 8 3/4% senior notes due 2013 | | $ | 800 | | | $ | 796 | | 5/15 & 11/15 | | 11/15/13 |

| Credit facility | | | 350 | | | | 350 | | | | 9/6/14 |

| Charter Communications Operating, LLC: | | | | | | | | | | | |

| 8.000% senior second-lien notes due 2012 | | | 1,100 | | | | 1,100 | | 4/30 & 10/30 | | 4/30/12 |

| 8 3/8% senior second-lien notes due 2014 | | | 770 | | | | 770 | | 4/30 & 10/30 | | 4/30/14 |

| 10.875% senior second-lien notes due 2014 | | | 546 | | | | 527 | | 3/15 & 9/15 | | 9/15/14 |

| Credit facilities | | | 8,246 | | | | 8,246 | | | | varies |

| | | | | | | | | | | | |

| | | $ | 11,812 | | | $ | 11,789 | | | | |

| (a) | The accreted values presented above generally represent the principal amount of the notes less the original issue discount at the time of sale, plus the accretion to the balance sheet date. However, certain notes are recorded for financial reporting purposes at values different from the current accreted value for |

| legal purposes and notes indenture purposes (the amount that is currently payable if the debt becomes immediately due). As is equal to the principal amount of December 31, 2007, the accreted value of Charter Holdings’, CCH II’s, and CCO Holdings’ debt for legal purposes and notes indentures purposes was $19.4 billion, $12.3 billion, and $9.9 billion, respectively.notes. |

| (b) | In general, the obligors have the right to redeem all of the notes set forth in the above table (except with respect to the 10.000% Charter Holdings notes due 2009, the 10.75% Charter Holdings notes due 2009, and the 9.625% Charter Holdings notes due 2009) in whole or in part at their option, beginning at various times prior to their stated maturity dates, subject to certain conditions, upon the payment of the outstanding principal amount (plus a specified redemption premium) and all accrued and unpaid interest. For additional information see Note 9 to |

| the accompanying consolidated financial statements contained in “Item 8. Financial Statements and Supplementary Data.” |

In 2008, $65each of 2009, 2010, and 2011, $70 million of Charter Operating’s credit facility matures, and in 2009, an additional $188 million of Charter Holdings’ notes mature, and $65 million of Charter Operating’s credit facilityour debt matures. In 20102012 and beyond, significant additional amounts will become due under our remaining long-term debt obligations. The following tables summarizetable summarizes our payment obligations as of December 31, 20072008 under our long-term debt and certain other contractual obligations and commitments (dollars in millions).

| | | Charter Holdings | |

| | | Payments by Period | |

| | | | | | Less than | | | | 1-3 | | | | 3-5 | | | More than | |

| | | Total | | | 1 year | | | years | | | years | | | 5 years | |

| | | | | | | | | | | | | | | | | | |

| Contractual Obligations | | | | | | | | | | | | | | | | | |

| Long-Term Debt Principal Payments (1) | | $ | 19,411 | | | $ | 65 | | | $ | 2,550 | | | $ | 1,586 | | | $ | 15,210 | |

| Long-Term Debt Interest Payments (2) | | | 9,965 | | | | 1,632 | | | | 3,232 | | | | 2,758 | | | | 2,343 | |

| Payments on Interest Rate Instruments (3) | | | 155 | | | | 44 | | | | 91 | | | | 20 | | | | -- | |

| Capital and Operating Lease Obligations (4) | | | 91 | | | | 21 | | | | 32 | | | | 19 | | | | 19 | |

| Programming Minimum Commitments (5) | | | 1,020 | | | | 331 | | | | 418 | | | | 215 | | | | 56 | |

| Other (6) | | | 475 | | | | 374 | | | | 99 | | | | 2 | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | |

| Total | | $ | 31,117 | | | $ | 2,467 | | | $ | 6,422 | | | $ | 4,600 | | | $ | 17,628 | |

| | | Payments by Period | |

| | | | | | Less than | | | | 1-3 | | | | 3-5 | | | More than | |

| | | Total | | | 1 year | | | | years | | | | years | | | 5 years | |

| | | | | | | | | | | | | | | | | | |

| Contractual Obligations | | | | | | | | | | | | | | | | | |

| Long-Term Debt Principal Payments (1) | | $ | 11,812 | | | $ | 70 | | | $ | 140 | | | $ | 3,355 | | | $ | 8,247 | |

| Long-Term Debt Interest Payments (2) | | | 3,184 | | | | 650 | | | | 1,238 | | | | 1,190 | | | | 106 | |

| Payments on Interest Rate Instruments (3) | | | 443 | | | | 127 | | | | 257 | | | | 59 | | | | -- | |

| Capital and Operating Lease Obligations (4) | | | 96 | | | | 22 | | | | 35 | | | | 21 | | | | 18 | |

| Programming Minimum Commitments (5) | | | 687 | | | | 315 | | | | 206 | | | | 166 | | | | -- | |

| Other (6) | | | 475 | | | | 368 | | | | 88 | | | | 19 | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | |

| Total | | $ | 16,697 | | | $ | 1,552 | | | $ | 1,964 | | | $ | 4,810 | | | $ | 8,371 | |

| | | CCH II | |

| | | Payments by Period | |

| | | | | | Less than | | | | 1-3 | | | | 3-5 | | | More than | |

| | | Total | | | 1 year | | | years | | | years | | | 5 years | |

| | | | | | | | | | | | | | | | | | |

| Contractual Obligations | | | | | | | | | | | | | | | | | |

| Long-Term Debt Principal Payments (1) | | $ | 12,312 | | | $ | 65 | | | $ | 2,328 | | | $ | 1,230 | | | $ | 8,689 | |

| Long-Term Debt Interest Payments (2) | | | 4,326 | | | | 836 | | | | 1,666 | | | | 1,264 | | | | 560 | |

| Payments on Interest Rate Instruments (3) | | | 155 | | | | 44 | | | | 91 | | | | 20 | | | | -- | |

| Capital and Operating Lease Obligations (4) | | | 91 | | | | 21 | | | | 32 | | | | 19 | | | | 19 | |

| Programming Minimum Commitments (5) | | | 1,020 | | | | 331 | | | | 418 | | | | 215 | | | | 56 | |

| Other (6) | | | 475 | | | | 374 | | | | 99 | | | | 2 | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | |

| Total | | $ | 18,379 | | | $ | 1,671 | | | $ | 4,634 | | | $ | 2,750 | | | $ | 9,324 | |

| | | CCO Holdings | |

| | | Payments by Period | |

| | | | | | Less than | | | | 1-3 | | | | 3-5 | | | More than | |

| | | Total | | | 1 year | | | years | | | years | | | 5 years | |

| | | | | | | | | | | | | | | | | | |

| Contractual Obligations | | | | | | | | | | | | | | | | | |

| Long-Term Debt Principal Payments (1) | | $ | 9,864 | | | $ | 65 | | | $ | 130 | | | $ | 1,230 | | | $ | 8,439 | |

| Long-Term Debt Interest Payments (2) | | | 3,496 | | | | 585 | | | | 1,164 | | | | 1,213 | | | | 534 | |

| Payments on Interest Rate Instruments (3) | | | 155 | | | | 44 | | | | 91 | | | | 20 | | | | -- | |

| Capital and Operating Lease Obligations (4) | | | 91 | | | | 21 | | | | 32 | | | | 19 | | | | 19 | |

| Programming Minimum Commitments (5) | | | 1,020 | | | | 331 | | | | 418 | | | | 215 | | | | 56 | |

| Other (6) | | | 475 | | | | 374 | | | | 99 | | | | 2 | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | |

| Total | | $ | 15,101 | | | $ | 1,420 | | | $ | 1,934 | | | $ | 2,699 | | | $ | 9,048 | |

| (1) | | The tables presenttable presents maturities of long-term debt outstanding as of December 31, 2007.2008. Refer to Notes 9 and 21 to our accompanying consolidated financial statements contained in “Item 8. Financial Statements and Supplementary Data” for a description of our long-term debt and other contractual obligations and commitments. DoesThe table above does not include $123 million, $123 million, and $332the $240 million of Loans Payable – Related Party for Charter Holdings, CCH II,Party. See Note 10 to the accompanying consolidated financial statements contained in “Item 8. Financial Statements and CCO Holdings, respectivelySupplementary Data.” |

| | |

| (2) | | Interest payments on variable debt are estimated using amounts outstanding at December 31, 20072008 and the average implied forward London Interbank Offering Rate (LIBOR) rates applicable for the quarter during the interest rate reset based on the yield curve in effect at December 31, 2007.2008. Actual interest payments will differ based on actual LIBOR rates and actual amounts outstanding for applicable periods. |

| | | |

| (3) | | Represents amounts we will be required to pay under our interest rate hedgeswap agreements estimated using the average implied forward LIBOR applicable rates for the quarter during the interest rate reset based on the yield curve in effect at December 31, 2007.2008. As a result of our filing of a Chapter 11 bankruptcy, the counterparties to the interest rate swap agreements have the option to terminate the underlying contract and, upon emergence of Charter from bankruptcy, receive payment for the market value of the interest rate swap agreement as measured on the date the contract is terminated. |

| | | |

| (4) | | We lease certain facilities and equipment under noncancelable operating leases. Leases and rental costs charged to expense for the years ended December 31, 2008 and 2007 and 2006, were $23$24 million and $23 million, respectively. |

| | |

| (5) | | We pay programming fees under multi-year contracts ranging from three to ten years, typically based on a flat fee per customer, which may be fixed for the term, or may in some cases escalate over the term. Programming costs included in the accompanying statement of operations were approximately $1.6 billion and $1.5 billion, forin each of the years ended December 31, 20072008 and 2006, respectively.2007. Certain of our programming agreements are based on a flat fee per month or have guaranteed minimum payments. The table sets forth the aggregate guaranteed minimum commitments under our programming contracts. |

| | | |

| (6) | | “Other” represents other guaranteed minimum commitments, which consist primarily of commitments to our billing services vendors. |

The following items are not included in the contractual obligations tablestable because the obligations are not fixed and/or determinable due to various factors discussed below. However, we incur these costs as part of our operations:

| | · | We rent utility poles used in our operations. Generally, pole rentals are cancelable on short notice, but we anticipate that such rentals will recur. Rent expense incurred for pole rental attachments for each of the years ended December 31, 20072008 and 2006,2007 was $47 million and $44 million, respectively.million. |

| | · | We pay franchise fees under multi-year franchise agreements based on a percentage of revenues generated from video service per year. We also pay other franchise related costs, such as public education grants, under multi-year agreements. Franchise fees and other franchise-related costs included in the accompanying statement of operations were $172$179 million and $175$172 million for the years ended December 31, 20072008 and 2006,2007, respectively. |

| | · | We also have $136$158 million in letters of credit, primarily to our various worker’s compensation, property and casualty, and general liability carriers, as collateral for reimbursement of claims. These letters of credit reduce the amount we may borrow under our credit facilities. |