UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 10-K

______________

|

| | |

| (Mark One) |

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934 |

| | | |

| | For the fiscal year ended December 31, 20112013 |

| or |

| | | |

o¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934 |

For the Transition Period From to

Commission File Number: 001-33664

Charter Communications, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 43-1857213 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | | |

12405 Powerscourt Drive400 Atlantic Street

St. Louis, Missouri 63131Stamford, Connecticut 06901

| | (314) 965-0555(203) 905-7801 |

| (Address of principal executive offices including zip code) | | (Registrant’s telephone number, including area code) |

Securities registered pursuant to section 12(b) of the Act:

|

| | |

| Title of each class | | Name of Exchange which registered |

| Class A Common Stock, $.001 Par Value | | NASDAQ Global Select Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrants have submitted electronically and posted on their corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrants were required to submit and post such files). Yes xNo o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. xo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer o Non-accelerated filer oSmaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes oNo x

The aggregate market value of the registrant of outstanding Class A common stock held by non-affiliates of the registrant at June 30, 20112013 was approximately $2.6$8.8 billion, computed based on the closing sale price as quoted on the NASDAQ Global Select Market on that date. For purposes of this calculation only, directors, executive officers and the principal controlling shareholders or entities controlled by such controlling shareholders of the registrant are deemed to be affiliates of the registrant.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes xNo o

There were 100,518,414106,144,075 shares of Class A common stock outstanding as of JanuaryDecember 31, 2012.2013. There were no shares of Class B common stock outstanding as of the same date.

Documents Incorporated By Reference

Information required by Part III is incorporated by reference from Registrant’s proxy statement or an amendment to this Annual Report on Form 10-K to be filed by April 29, 201230, 2014.

CHARTER COMMUNICATIONS, INC.

FORM 10-K — FOR THE YEAR ENDED DECEMBER 31, 20112013

TABLE OF CONTENTS

This annual report on Form 10-K is for the year ended December 31, 20112013. The Securities and Exchange Commission (“SEC”) allows us to “incorporate by reference” information that we file with the SEC, which means that we can disclose important information to you by referring you directly to those documents. Information incorporated by reference is considered to be part of this annual report. In addition, information that we file with the SEC in the future will automatically update and supersede information contained in this annual report. In this annual report, “we,” “us” and “our” refer to Charter Communications, Inc. and its subsidiaries.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS:

This annual report includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding, among other things, our plans, strategies and prospects, both business and financial including, without limitation, the forward-looking statements set forth in Part I. Item 1. and in Part II. Item 7. under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this annual report. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions, including, without limitation, the factors described in Part I. Item 1A. under “Risk Factors” and in Part II. Item 7. under the heading, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this annual report. Many of the forward-looking statements contained in this annual report may be identified by the use of forward-lookingforward‑looking words such as “believe,” “expect,” “anticipate,” “should,” “planned,” “will,” “may,” “intend,” “estimated,” “aim,” “on track,” “target,” “opportunity,” “tentative,” “positioning”“positioning,” “designed,” “create” and “potential,” among others. Important factors that could cause actual results to differ materially from the forward-looking statements we make in this annual report are set forth in this annual report and in other reports or documents that we file from time to time with the SEC, and include, but are not limited to:

our ability to sustain and grow revenues and free cash flow from operations by offering video, Internet, telephone,voice, advertising and other services to residential and commercial customers, to adequately meet the customer experience demands in our markets and to maintain and grow our customer base, particularly in the face of increasingly aggressive competition, the need for innovation and the related capital expenditures and the difficult economic conditions in the United States;

the development and deployment of new products and technologies;

the impact of competition from other market participants, including but not limited to incumbent telephone companies, direct broadcast satellite operators, wireless broadband and telephone providers, and digital subscriber line (“DSL”) providers, and competition from video provided over the Internet;

general business conditions, economic uncertainty or downturn, high unemployment levels and the level of activity in the housing sector;

our ability to obtain programming at reasonable prices or to raise prices to offset, in whole or in part, the effects of higher programming costs (including retransmission consents);

the development and deployment of new products and technologies including in connection with our plan to make our systems all-digital in 2014;

the effects of governmental regulation on our business;business or potential business combination transaction;

the availability and access, in general, of funds to meet our debt obligations prior to or when they become due and to fund our operations and necessary capital expenditures, either through (i) cash on hand, (ii) free cash flow, or (iii) access to the capital or credit markets; and

our ability to comply with all covenants in our indentures and credit facilities any violation of which, if not cured in a timely manner, could trigger a default of our other obligations under cross-default provisions.provisions; and

the ultimate outcome of any possible transaction between Charter and Comcast Corporation ("Comcast") and/or Time Warner Cable Inc. ("TWC") including the possibility that Charter will not pursue any transaction; and if a transaction were to occur, the ultimate outcome and results of integrating the operations, the ultimate outcome of Charter’s pricing and packaging and operating strategy applied to the acquired systems and the ultimate ability to realize synergies.

All forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by this cautionary statement. We are under no duty or obligation to update any of the forward-looking statements after the date of this annual report.

PART I

Item 1. Business.

Introduction

We are among the largest providers of cable services in the United States, offering a variety of entertainment, information and communications solutions to residential and commercial customers. Our infrastructure consists of a hybrid of fiber and coaxial cable plant passingwith approximately 12.012.8 million homes,estimated passings, with 98% of homes passed97% at 550 megahertz (“MHz”) or greater and 98% of plant miles two-way active. A national Internet Protocol (IP) infrastructure interconnects Charter Communications, Inc. (“Charter”) markets. See "Item 1. Business — Products and Services" for further description of these terms and services, including "customers."

For the year ended December 31, 2011, we generated approximately $7.2 billion in revenue, of which approximately 50% was generated from our residential video service. We also generated revenue from Internet, telephone service and advertising. Internet and telephone service in both residential and commercial markets contributed the majority of the recent growth in our revenue.

As of December 31, 20112013, we served approximately 5.25.9 million residential and commercial customers. We sell our video, Internet and telephonevoice services primarily on a subscription basis, often in a bundle of two or more services, providing savings and convenience to our customers. Bundled services are available to approximately 97% of our homes passed,passings, and approximately 62% of our customers subscribe to a bundle of services.

We served approximately 4.14.2 million residential video customers as of December 31, 20112013, and approximately 79%92% of our video customers subscribed to digital video service. Digital video enables our customers to access advanced video services such as high definition ("HD") television, Charter OnDemand™ (“OnDemand”) video programming, an interactive program guide and digital video recorder (“DVR”) service. We initiated our all-digital initiative in 2013 in a number of our markets. We expect to complete our all-digital rollout by the end of 2014. Once a market is all-digital, we will offer over 200 HD channels and faster Internet speeds in these areas.

We also served approximately 3.54.4 million residential Internet customers as of December 31, 20112013. Our Internet service is available in a variety of download speeds up to 100 megabits per second (“Mbps”) and upload speeds of up to 5 Mbps. We also offer home networking service, or in-home Wi-Fi, enablingApproximately 75% of our Internet customers to connect up to five computers wirelessly inhave at least 30 Mbps download speed which currently is the home.minimum speed we offer.

We provided telephonevoice service to approximately 1.82.3 million residential customers as of December 31, 20112013. Our telephonevoice services typically include unlimited local and long distance calling to the U.S., Canada and Puerto Rico, plus other features, including voicemail, call waiting and caller ID.

Through Charter Business®Business®, we provide scalable, tailored broadband communications solutions to business and carrier organizations, such as video entertainment services, Internet access, business telephone services, data networking and fiber connectivity to cellular towers and office buildings, video entertainment services and business telephone services.buildings. As of December 31, 20112013, we served approximately 476,200567,000 commercial primary service units, primarily small- and medium-sized commercial customers. Our advertising sales division, Charter Media®, provides local, regional and national businesses with the opportunity to advertise in individual markets on cable television networks.

For the year ended December 31, 2013, we generated approximately $8.2 billion in revenue, of which approximately 84% was generated from our residential video, Internet and voice services. We also generated revenue from providing video, Internet, voice and fiber connectivity services to commercial businesses and from the sale of advertising. Sales from residential triple play customers, Internet and video revenues and from commercial services have contributed to the majority of our recent revenue growth.

We have a history of net losses. Our net losses are principally attributable to insufficient revenue to cover the combination of operating expenses, interest expenses that we incur on our debt, depreciation expenses resulting from the capital investments we have made, and continue to make, in our cable properties, amortization expenses resulting from the application of fresh start accountingrelated to our customer relationship intangibles and non-cash taxes resulting from increases in our deferred tax liabilities.

Charter was organized as a Delaware corporation in 1999. On March 27, 2009, we and certain affiliates filed voluntary petitions in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”), to reorganize under Chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”). The Chapter 11 cases were jointly administered under the caption In re Charter Communications, Inc., et al., Case No. 09-11435. On May 7, 2009, we filed a Joint Plan of Reorganization (the “Plan”) and a related disclosure statement with the Bankruptcy Court. The Plan was confirmed by the Bankruptcy Court on November 17, 2009, (the “Confirmation Order”), and became effective on November 30, 2009, (the “Effective Date”), the date on which we emerged from protection under Chapter 11 of the Bankruptcy Code. The final decree closing the case was entered by the Bankruptcy Court on December 30, 2013.

The terms “Charter,” “we,” “our” and “us,” when used in this report with respect to the period prior to Charter’s emergence from bankruptcy, are references to the Debtors (“Predecessor”) and, when used with respect to the period commencing after Charter’s emergence, are references to Charter (“Successor”). These references include the subsidiaries of Predecessor or Successor, as the case may be, unless otherwise indicated or the context requires otherwise.

Our principal executive offices are located at 12405 Powerscourt Drive, St. Louis, Missouri 63131.400 Atlantic Street, Stamford, Connecticut 06901. Our telephone number is (314) 965-0555,(203) 905-7801, and we have a website accessible at www.charter.com. Since January 1, 2002, ourOur annual reports, quarterly reports and current reports on Form 8-K, and all amendments thereto, have been madeare available on our website free of charge as soon as reasonably practicable after they have been filed. The information posted on our website is not incorporated into this annual report.

Recent Events

On January 13, 2014, Charter issued a press release announcing that it has sent a letter to TWC proposing that the companies immediately engage in discussions to conclude a merger agreement to combine the companies. On February 11, 2014, Charter provided a notice of intent to nominate 13 candidates for the board of directors of TWC. On February 13, 2014, TWC and Comcast announced an agreement for TWC to merge with Comcast. Comcast also announced that it intended to sell systems with 3 million subscribers in connection with its purchase of TWC. Prior to Comcast's announcement on February 13, 2014, Charter and Comcast were actively engaged in discussions to work together for Charter to purchase TWC and for Charter to sell systems to Comcast. We cannot predict if we will be successful in completing any acquisitions of TWC or Comcast cable systems.

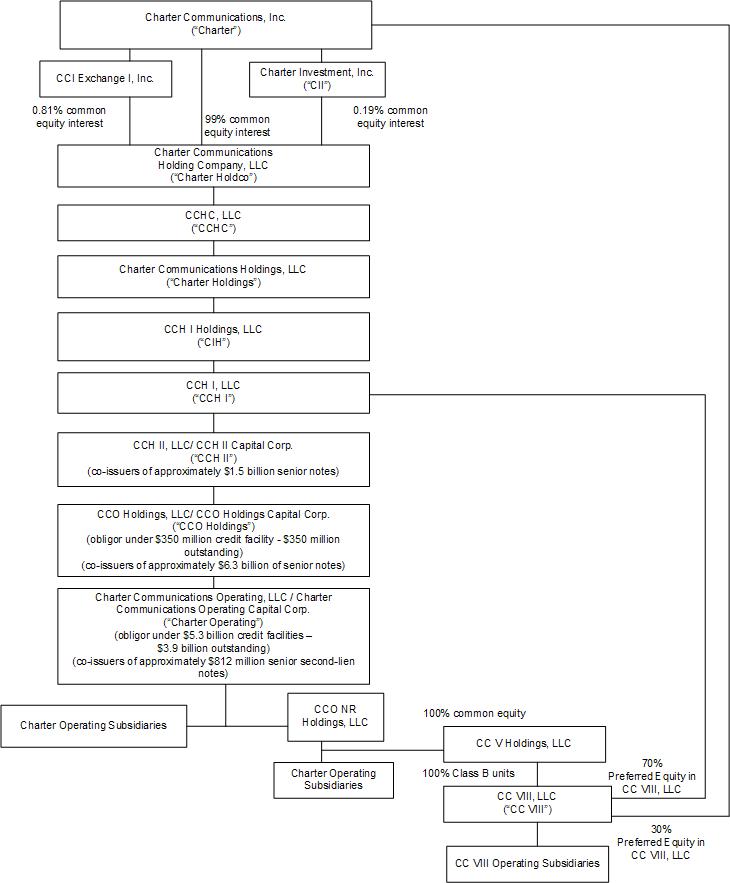

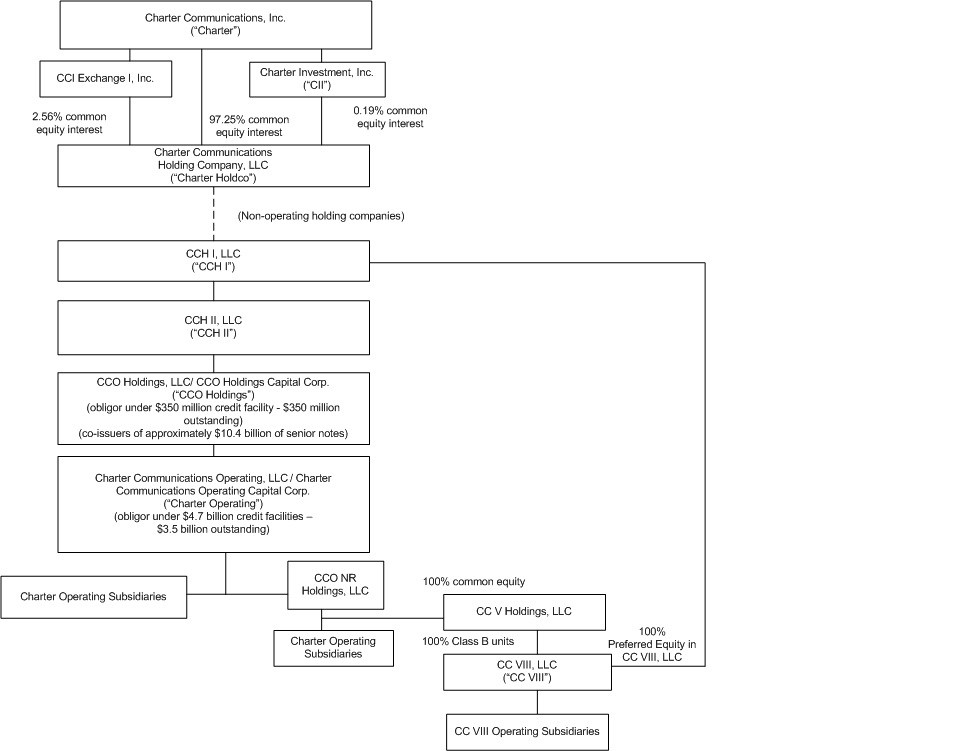

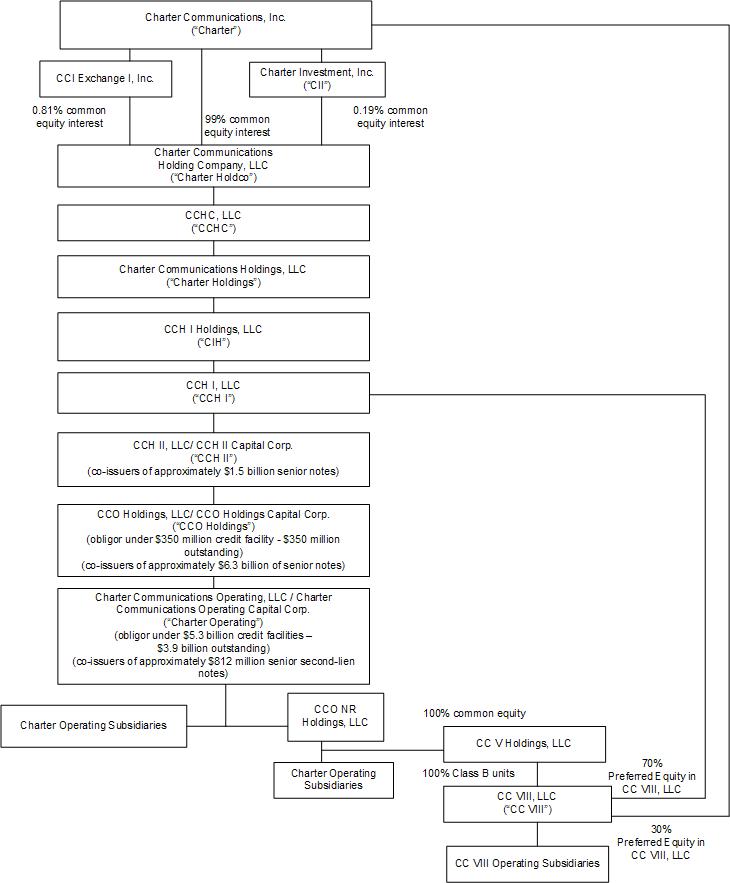

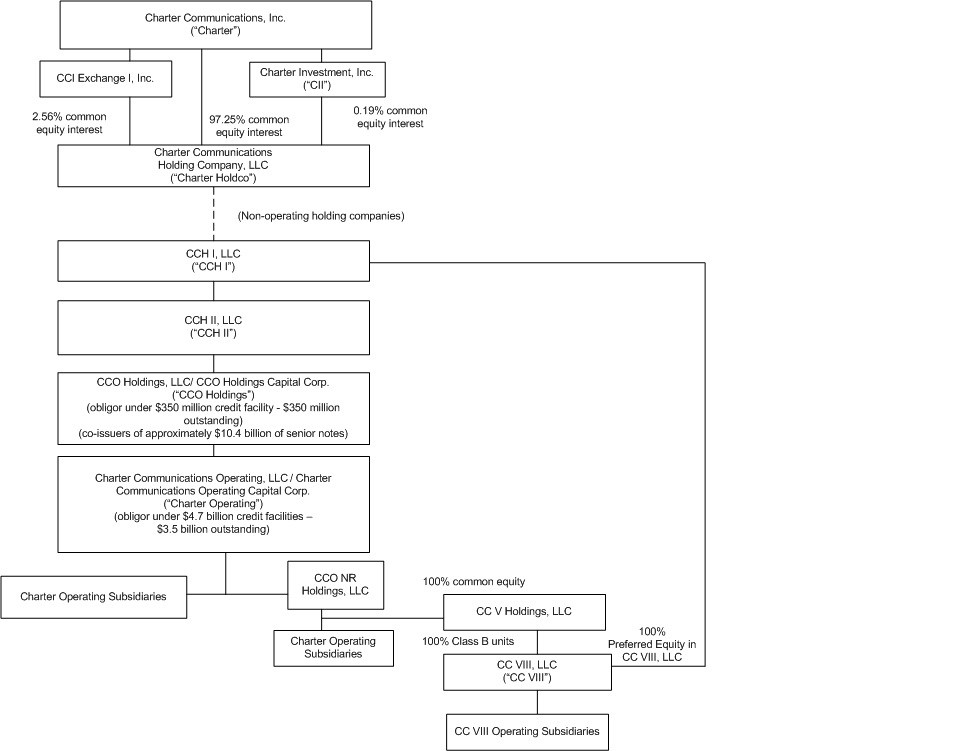

Corporate Entity Structure

The chart below sets forth our entity structure and that of our direct and indirect subsidiaries. This chart does not include all of our affiliates and subsidiaries and, in some cases, we have combined separate entities for presentation purposes. The equity ownership percentages shown below are approximations and do not give effect to any exercise of then outstanding warrants. Effective December 31, 2013, Charter contributed all of its 30% preferred equity in CC VIII, LLC ("CC VIII") through intermediary subsidiaries to CCH I, LLC ("CCH I") resulting in CCH I Holding 100% of the preferred equity in CC VIII. As a result of this restructuring, the respective common equity interests in Charter Communications Holding Company, LLC (“Charter Holdco”) were adjusted to reflect each entity's respective contributions. Indebtedness amounts shown below are principal amounts as of December 31, 20112013. See Note 78 to the accompanying consolidated financial statements contained in “Item 8. Financial Statements and Supplementary Data,” which also includes the accreted values of the indebtedness described below.

Charter Communications, Inc. Charter owns 100% of Charter Communications Holding Company, LLC (“Charter Holdco”).Holdco. Charter Holdco, through its subsidiaries, owns cable systems. As sole manager under applicable operating agreements, Charter controls the affairs of Charter Holdco and its limited liability company subsidiaries. In addition, Charter provides management services to Charter Holdco and its subsidiaries under a management services agreement.

Interim Holding Company Debt Issuers.Companies. As indicated in the organizational chart above, our interim holding company debt issuerscompanies indirectly own the subsidiaries that own or operate all of our cable systems, subject to a CC VIII LLC (“CC VIII”) 70%100% preferred interest held by CCH I, and two of these companies, CCO Holdings, LLC (“CCH I”("CCO Holdings") and 30% preferred interest held by Charter Communications Operating, LLC ("Charter Operating"), had debt obligations as described below.of December 31, 2013. For a description of the debt issued by these issuers please see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Description of Our Outstanding Debt.”

Preferred Equity in CC VIII. At December 31, 2011, Charter owned 30% of the CC VIII preferred membership interests. CCH I, an indirect subsidiary of Charter, directly owned the remaining 70% of these preferred interests. The common membership interests in CC VIII are indirectly owned by Charter Operating.

3

Products and Services

Through our hybrid fiber and coaxial cable network, we offer our customers traditional cable video services, (basic and digital, which we refer to as “video” services), as well as advanced video services (such as OnDemand, HD television, and DVR service), Internet services and telephonevoice services. Our telephonevoice services are primarily provided using voice over Internet protocol (“VoIP”) technology, to transmit digital voice signals over our systems. Our video, Internet, and telephonevoice services are offered to residential and commercial customers on a subscription basis, with prices and related charges that vary primarily based on the types of service selected, whether the services are sold as a “bundle” or on an individual basis, and the equipment necessary to receive the services, with some variation in prices.services.

The following table summarizes our customer statistics for basic video, digital video, Internet and telephonevoice as of December 31, 20112013 and 20102012.

|

| | | | | | | |

| | Approximate as of |

| | December 31, |

| | 2011 | (a) | | 2010 | (a) |

| | | | | | |

| Video (b) | 4,090,300 |

| | | 4,278,400 |

| |

| Internet (c) | 3,491,800 |

| | | 3,246,100 |

| |

| Telephone (d) | 1,791,300 |

| | | 1,717,000 |

| |

| Residential PSUs (e) | 9,373,400 |

| | | 9,241,500 |

| |

| | | | | | |

| Video (b)(f) | 234,500 |

| | | 242,000 |

| |

| Internet (c)(g) | 162,800 |

| | | 138,500 |

| |

| Telephone (d) | 78,900 |

| | | 59,900 |

| |

| Commercial PSUs (e) | 476,200 |

| | | 440,400 |

| |

| | | | | | |

| Digital video RGUs (h) | 3,410,400 |

| | | 3,363,200 |

| |

| | | | | | |

Total RGUs (i) | 13,260,000 |

| | | 13,045,100 |

| |

|

| | | | | | | |

| | Approximate as of |

| | December 31, |

| | 2013 (a) | | 2012 (a) |

| Residential | | | |

| Video (b) | 4,177 |

| | 3,989 |

|

| Internet (c) | 4,383 |

| | 3,785 |

|

| Voice (d) | 2,273 |

| | 1,914 |

|

| Residential PSUs (e) | 10,833 |

| | 9,688 |

|

| | | | |

| Residential Customer Relationships (f) | 5,561 |

| | 5,035 |

|

| Revenue per Customer Relationship (g) | $ | 107.97 |

| | $ | 105.78 |

|

| | | | |

| Commercial | | | |

| Video (b)(h) | 165 |

| | 169 |

|

| Internet (c) | 257 |

| | 193 |

|

| Voice (d) | 145 |

| | 105 |

|

| Commercial PSUs (e) | 567 |

| | 467 |

|

| | | | |

| Commercial Customer Relationships (f)(h) | 375 |

| | 325 |

|

After giving effect to divestituresthe acquisition of Bresnan Broadband Holdings, LLC and acquisitions of cable systemsits subsidiaries (collectively, “Bresnan”) in 2010July 2013, December 31, 2012 residential video, Internet and 2011, residential basic video customers, residential Internet customers and residential telephonevoice customers would have been approximately 4,305,800, 3,263,2004,286,000, 4,059,000 and 1,721,800,2,073,000, respectively, as of December 31, 2010. After giving effect to divestitures and acquisitions of cable systems in 2010commercial video, Internet and 2011, commercial basic videovoice customers commercial Internet customers, commercial telephone customers and digital video revenue generating units would have been approximately 241,900, 138,500, 59,900177,000, 210,000 and 3,371,300, respectively, as of December 31, 2010.116,000, respectively.

| |

| (a) | We calculate the aging of customer accounts based on the monthly billing cycle for each account. On that basis, atas of December 31, 20112013 and 20102012, customers include approximately 18,60011,300 and 15,70018,400 customers, respectively, whose accounts were over 60 days past due in payment, approximately 2,500800 and 1,8002,600 customers, respectively, whose accounts were over 90 days past due in payment, and approximately 900 and 1,700 customers, respectively, whose accounts were over 120 days past due in payment. |

were over 90 days past due in payment, and approximately 1,400 and 1,000 customers, respectively, whose accounts were over 120 days past due in payment.

| |

| (b) | “Video customers” represent those customers who subscribe to our video cable services. |

| |

| (c) | “Internet customers” represent those customers who subscribe to our Internet service. |

| |

| (d) | “TelephoneVoice customers” represent those customers who subscribe to our telephonevoice service. |

| |

| (e) | “Primary Service Units” or “PSUs” represent the total of video, Internet and telephonevoice customers. |

| |

| (f) | "Customer Relationships" include the number of customers that receive one or more levels of service, encompassing video, Internet and voice services, without regard to which service(s) such customers receive. This statistic is computed in accordance with the guidelines of the National Cable & Telecommunications Association ("NCTA"). Commercial customer relationships include video customers in commercial structures, which are calculated on an EBU basis (see footnote (h)) and non-video commercial customer relationships. |

| |

| (g) | "Revenue per Customer Relationship" is calculated as total residential video, Internet and voice quarterly revenue divided by three divided by average residential customer relationships during the respective quarter. |

| |

| (h) | Included within commercial video customers are those in commercial and multi-dwelling structures, which are calculated on an equivalent bulk unit (“EBU”) basis. We calculate EBUs by dividing the bulk price charged to accounts in an area by the published rate charged to non-bulk residential customers in that market for the comparable tier of service. This EBU method of estimating basic video customers is consistent with the methodology used in determining costs paid to programmers and is consistent with the methodology used by other multiple system operators (“MSOs”).operators. As we increase our published video rates to residential customers without a corresponding increase in the prices charged to commercial service or multi-dwelling customers, our EBU count will decline even if there is no real loss in commercial service or multi-dwelling customers. For example, commercial video customers decreased by 10,000 during the year ended December 31, 2013 due to published video rate increases. |

| |

(g) | Prior year commercial Internet customers were adjusted to reflect current year presentation. |

| |

(h) | “Digital video RGUs” include all video customers that rent one or more digital set-top boxes or cable cards. |

| |

(i) | “Revenue generating units” or “RGUs” represent the total of all basic video, digital video, Internet and telephone customers, not counting additional outlets within one household. For example, a customer who receives two types of service (such as basic video and digital video) would be treated as two RGUs and, if that customer added on Internet service, the customer would be treated as three RGUs. This statistic is computed in accordance with the guidelines of the National Cable & Telecommunications Association (“NCTA”). |

Video Services

In 20112013, residential video services represented approximately 50%49% of our total revenues. Our video service offerings include the following:

Basic and Digital Video. All of our video customers receive a package of basic programming which generally consists of local broadcast television, local community programming, including governmental and public access, and limited satellite-delivered or non-broadcast channels, such as weather, shopping and religious programming. Our digital video services include a digital set-top box, an interactive electronic programming guide with parental controls, an expanded menu of digital tiers, premium and pay-per-view channels, including OnDemand (available nearly everywhere), digital quality music channels and the option to also receive a cable card. In addition to video programming, digital video service enables customers to receive our advanced video services such as DVRsDVR's and HD television.

Premium Channels.These channels provide original programming, commercial-free movies, sports, and other special event entertainment programming. Although we offer subscriptions to premium channels on an individual basis, we offer an increasing number of digital video and premium channel packages, and we offer premium channels combined with our advanced video services. Customers who purchase premium channels also have access to thatMuch of our programming is now offered OnDemand and increasingly over the Internet. Charter offers premium sports content and access to a number of cable programmers such as HBO, Cinemax, EPIX and Turner on an authenticated basis over the Internet on charter.net.

OnDemand, Subscription OnDemand and Pay-Per-View. In most areas, we offer OnDemand service which allows customers to select from hundreds of movies and other programming10,000 or more titles at any time. OnDemand includes standard definition, HD and three dimensional ("3D") content. OnDemand programming options may be accessed for free if the content is associated with the customer’s linear subscription, or for a fee or, in some cases, for no additional charge. In some areas weon a transactional basis. OnDemand services may also offerbe offered on a subscription OnDemand for a monthly fee orbasis included in a digital tier premium channel subscription.subscription or for a monthly fee. Pay-per-view channels allow customers to pay on a per eventper-event basis to view a single showing of a recently released movie, a one-time special sporting event, music concert, or similar event on a commercial-free basis.

High Definition Television. HD television offers our digital customers certain video programming at a higher resolution to improve picture and audio quality versus standard basic or digital video images. We have invested and continueIn 2014, we plan to invest in switched digital video (“SDV”) technology and simulcastcomplete our transition to all-digital transmission of channels which will allow us to increase the number of HD channels offered.offered to more than 200 in substantially all of our markets.

Digital Video Recorder. DVR service enables customers to digitally record programming and to pause and rewind live programming. Multi-roomCharter customers may lease multiple DVR service permits customersset-top boxes to access and watch any of their video recordingsmaximize recording capacity on any other connected televisionmultiple televisions in the customer's home. Most of Charter customers also have the ability to program their DVR's remotely via atablet and phone applications or our website. In early 2011, we entered into an agreement with TiVo to develop software code and allow for the deployment of TiVo enabled set top boxes in our markets. The product utilizes the TiVo user interface and a hybrid platform that leverages traditional cable and next generation IP technologies. We have deployed a version of the TiVo product in our Fort Worth, Texas market and are working with TiVo to actively field test the TiVo product in several other markets with our employees. Charter does not expect that testing to be completed in time for it to fully launch TiVo across the enterprise by the end of the second quarter as previously projected.

| |

| • | Charter TV App. The Charter TV App enables Charter video customers to search and discover content on a variety of customer owned devices, including the iPhone®, iPad®, and iPod Touch®, as well as the most popular Android™ based tablets. The Charter TV App allows customers to watch over 100 channels of cable TV and use the device as a remote to control their digital set-top box while in their home. It also allows customers the ability to browse Charter's program guide, search for programming, and schedule DVR recordings from inside and outside the home. Charter's online offerings include many of our largest and most popular networks. We also currently offer content already available online through Charter.net such as HBO Go® and WatchESPN® with other online content. We are currently testing a network based user interface with the same look and feel of the Charter TV App. The user interface is being designed to work with all of our existing and future set-top boxes. A second alternative is to deploy the user interface to the majority of our existing set-top boxes and all of our new set-top boxes which are Data Over Cable Service Interface Specification ("DOCSIS") enabled. |

Online. Online video offers our customers the ability to watch traditional TV content over the Internet from any Internet connection in the United States once they are authenticated as a Charter customer. In 2011, Charter added content from HBO Go, Max Go, BTN2Go ("Big Ten Network") and from popular Turner networks to its Online offerings. Charter intends to expand its Online capabilities and to continue to add content in 2012. We also offer a free search and discovery tool which organizes video content already available online through Charter.net such as HBO Go and EPIX with online content from sites such as Netflix, Amazon and Hulu into a single online directory which, we believe, makes it easier for customers to find what they want regardless of the source.

5

Internet Services

In 20112013, residential Internet services represented approximately 24%27% of our total revenues. Approximately W94%e completed the roll out of our estimated passings have DOCSIS 3.0 to 93% of our homes passed in 2011,wideband technology, allowing us to offer severalmultiple tiers of Internet services with speeds up to 100 megabytes per secondMbps download to our residential customers. Our Internet services also include our Internet portal, Charter.net, which provides multiple e-mail addresses, as well as variety of content and media from local, national and international providers including entertainment, games, news and sports. We also offer home networking gateways to ourFinally, Charter Security Suite is included with Charter Internet customers permitting our customers to wirelessly connect up to five devices within a home. Charter launched its Cloud Drive product in 2011 whichservices and protects computers from viruses and spyware and provides for on-line storage and back up of customer files and permits customers to access such files remotely at anytime.parental control features.

Accelerated growth in the number of IP devices and bandwidth used in homes has created a need for faster speeds and greater reliability. Charter is focused on providing services to fill those needs. In 2011,2013, we focused on promotingreintroduced an in-home WiFi product permitting customers to lease a high performing wireless router to maximize their wireless Internet experience. Our base Internet speed offering is 30 Mbps download and leveragingwe offer speeds up to 100 Mbps in all of our structural broadband advantagemarkets. As we complete the all-digital initiative, we expect to create new customer relationships. Charter'sincrease our minimum offered Internet service received top rankings from PC Magazinespeed to 60 Mbps, and high marks from100 Mbps in certain markets, with the FCC in speed testing in 2011.ability to go faster.

TelephoneVoice Services

In 20112013, residential telephonevoice services represented approximately 12%8% of our total revenues. We provide voice communications services primarily using VoIP technology to transmit digital voice signals over our systems.network. Charter TelephoneVoice includes unlimited nationwide and in-state calling, voicemail, call waiting, caller ID, call forwarding and other features. Charter Telephone®Voice also provides international calling either by the minute or in a packagethrough packages of 250 minutes per month. For Charter Voice and video customers, caller ID on TV is available.

Commercial Services

In 20112013, commercial services represented approximately 8%10% of our total revenues. Commercial services offered through Charter Business, include scalable broadband communications solutions for businesses and carrier organizations of all sizes such as Internet access, data networking, fiber connectivity to cellular towers and office buildings, video entertainment services and business telephone services.

Small Business. Charter offers small businesses (1 - 19 employees) services similar to our residential offerings including a full range of video programming tiers and music services, coax Internet speeds up to 100 Mbps downstream and up to 57 Mbps upstream in its DOCSIS 3.0 markets, a set of business cloud services including web hosting, e-mail and security, and multi-line telephone services with a rich set of more than 30 business features including web-based service management.

Medium Business. In addition to its other offerings, Charter also offers medium sized businesses (20-199 employees) more complex products such as fiber Internet with symmetrical speeds of up to 1 Gbps and voice trunking services such as primary rate interface (“PRI”Primary Rate Interface ("PRI") and Session Initiation Protocol ("SIP") Trunks which provide higher-capacity voice services delivered via fiber optic connection.services. Charter also offers Metro Ethernet service that connects two or more locations for commercial customers with geographically dispersed locations with speeds up to 10 Gbps. Metro Ethernet service can also extend the reach of the customer's local area network or “LAN”"LAN" within and between metropolitan areas.

Large Business. Charter offers large businesses (200+ employees) with multiple sites more specialized solutions such as custom fiber networks, Metro and long haul Ethernet, PRI and SIP Trunk services.

Carrier Wholesale. Charter offers high-capacity last-mile data connectivity services to wireless and wireline telephone providers,carriers, Internet service providersService Providers ("ISPs") and other competitive carriers on a wholesale basis.

Sale of Advertising

In 20112013, sales of advertising represented approximately 4% of our total revenues. We receive revenues from the sale of local advertising on satellite-delivered networks such as MTV®MTV®, CNN®CNN® and ESPN®ESPN®. In any particular market, we generally insert local advertising on up to 40 channels. We also provide cross-channel advertising to some programmers. In addition, we sell advertising on our Internet portal, Charter.net. In most cases, the available advertising time is sold by our sales force, however in some cases, we enter into representation agreements with contiguous cable system operators under which another operator in the area will sell advertising on our behalf for a percentage of the revenue. In some markets, we sell advertising on behalf of other operators.

Charter has deployed Enhanced TV Binary Interchange Format (“EBIF”) technology to set topset-top boxes in selectmost service areas within the Charter footprint. EBIF is a technology foundation that will allow Charter to deliver enhanced and interactive television applications and enable our video customers to use their remote control to interact with their television programming and its advertisements. EBIF will enable Charter’s customers to request such items as coupons, samples, and brochures from advertisers and also will enable advertisers to reach audiences in new ways.advertisers.

From time to time, certain of our vendors, including programmers and equipment vendors, have purchased advertising from us. For the years ending December 31, 20112013, 20102012 and 20092011, we had advertising revenues from vendors of approximately $51$41 million $46, $59 million and $41$51 million, respectively. These revenues resulted from purchases at market rates pursuant to binding agreements.

Pricing of Our Products and Services

Our revenues are derived principally from the monthly fees customers pay for the services we provide. We typically charge a one-time installation fee which is sometimes waived or discounted during certain promotional periods. The prices we charge for our products and services vary based on the level of service the customer chooses and in some cases the geographic market. In accordance with FCCFederal Communications Commission ("FCC") rules, the prices we charge for video cable-related equipment, such as set-top boxes and remote control devices, and for installation services, are based on actual costs plus a permitted rate of return in regulated markets.

In mid-2012, Charter launched a new pricing and packaging approach which emphasizes the triple play products of video, Internet and voice services and combines our most popular services in core packages at a fair price. We offer reduced-pricebelieve the benefits of this new approach are:

simplicity for both our customers in understanding our offers, and our employees in service for promotional periods in orderdelivery;

the ability to attract new customers, to promote the bundling of two orpackage more services and to retain existing customers. We often also offer a two-year price guarantee to our customers. There is no assurance that these customers will remain as customers or at the regulartime of sale and include more product in each service, thus increasing revenue per customer;

higher product offering quality through more HD channels, improved pricing for HD and HD/DVR equipment and faster Internet speeds;

lower expected churn as a result of higher customer satisfaction; and

gradual price whenincreases at the end of promotional pricing period expires. When customers bundle services, generally the prices are lower per service than if they had only purchased a single service. Approximately 62%periods.

As of December 31, 2013, approximately 64% of our customers, subscribe to a bundleor 68% excluding those acquired in the acquisition of services.Bresnan, are in the new pricing and packaging plan.

Our Network Technology

Our network includes three components: the national backbone, regional/metro corenetworks and the "last-mile.""last-mile" network. Both our national backbone and regional/metro corenetwork components utilize or plan to utilize a redundant Internet Protocol ("IP”) ringring/mesh architecture with the capability to differentiate quality of service for each residential or commercial product offering. The national backbone provides connectivity from the master headendsregional demarcation points to nationally centralized content, connectivity and services such as HD programming, voice interexchange points and Internet interexchange points.services. The regional/metro corenetwork components provide connectivity between the master headendsregional demarcation points and headends within a specific geographic area and enable the delivery of content and services between these network components.

Our last-mile componentnetwork utilizes thea traditional hybrid fiber coaxial cable (“HFC”) architecture, which combines the use of fiber optic cable with coaxial cable. In most systems, we deliver our signals via fiber optic cable from the headend to a group of nodes, and use coaxial cable to deliver the signal from individual nodes to the homes passed served by that node. For our fiber Internet, Ethernet, carrier wholesale, SIP and PRI commercial customers, fiber optic cable is extended from the individual nodes all the way to the customer's site. On average, our system design enables up to 400340 homes passed to be served by a single node and provides for six strands of fiber to each node, with two strands activated and four strands reserved for spares and future services. We believe that this hybrid network design provides high capacity and signal quality. The design also provides two-way signal capacity for the addition of further interactive services.

HFC architecture benefits include:

bandwidth capacity to enable traditional and two-way video and broadband services;

dedicated bandwidth for two-way services, which avoids return signal interference problems that can occur with two-way communication capability; and

signal quality and high service reliability.

Approximately 98%97% of our homes passedestimated passings are served by systems that have bandwidth of 550 megahertz or greater and 98% are two-way activated at as of December 31, 2011.2013. This bandwidth capacity enables us to offer digital television, Internet services, telephone servicevoice services and other advanced video services.

AsIn 2013, we initiated a transition from analog to digital transmission of December 31, 2011,the channels we have deployed DOCSIS 3.0 wideband technology to 93% of our homes passed allowing us to offer faster high-speed Internet service. We have also deployed SDV technology to accommodate the increasing demands for greater capacity in our network. SDV technology expands network capacity by transmitting only those digital and HD video channels that are being watched within a given grouping of homes at any given timedistribute which allows us to expand bandwidth for additional services. As of December 31, 2011, 86%recapture bandwidth. We completed this transition in approximately 15% of our homes passed received some portionfootprint in 2013 and expect to complete the initiative in 2014 across our remaining footprint. The all-digital platform enables us to offer a larger selection of theirHD channels, faster Internet speeds and better picture quality while providing greater plant security and lower transaction costs.

In 2013, we initiated a trial of a network, or “cloud,” based user interface designed to enable our customers to enjoy a common user interface with a state-of-the-art video service via SDV technology.experience on all existing and future set-top boxes. We plan to continue to trial and enhance this technology in 2014.

Management, Customer Care and Marketing

Our operations are centralized with our corporate office is responsible for coordinating and overseeing operations including establishing company-wide strategies, policies and procedures. TheSales and marketing, network operations, field operations, customer care, engineering, advertising sales, human resources, legal, government relations, information technology and finance are all directed at the corporate office performs certain financiallevel. Regional and administrative functions on a centralized basis and performs these services on a cost reimbursement basis pursuant to a management services agreement with one of our subsidiaries. Ourlocal field operations are managed by geographic areas with shared service centersresponsible for our field salesservicing customers and marketing function, human resourcesmaintenance and training function, finance, and certain areasconstruction of customer operations.outside plant.

Charter continues to focus on improving the customer experience through improvements to our customer care processes, product offerings and the quality and reliability of our service. Our customer care centers are managed centrally. We have eight internal customer care locations including our “centers of excellence” which route calls to the appropriate agents, plus several third-party call center locations that through technology and procedures functionsfunction as an integrated system. We also have two additional customer care locations acquired as part of the acquisition of Bresnan. See “Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Overview.” We increased the portion of service calls handled by Charter employees in 2013 and intend to continue to do so in 2014. We also utilize our website to enable our customers to view and pay their bills online,on-line, obtain information regarding their account or services, and perform various equipment troubleshooting procedures. Our customers may also obtain support through our on-line chat and e-mail functionality. We are also focusing on improvingincreased our outside plant maintenance activities in 2012 and 2013 to improve the reliability and technical quality of our plant to avoid repeat trouble calls, which has resulted in reductions in the number of service-related calls to our care centers and in the number of trouble call truck rolls in 2011 versus 2010.2012 and 2013.

Our marketing strategy emphasizes our bundled services through targeted direct response marketing programs to existing and potential customers and increases awareness and value of the Charter brand. Marketing expenditures increased by $18$57 million, or 8%14%, over the year ended December 31, 20102012 to $257$479 million for the year ended December 31, 20112013. as a result of increased media investment and commercial marketing efforts. Our marketing organization creates and executes marketing programs intended to increase customers, retain existing customers and cross-sell additional products to current customers. We monitor the effectiveness of our marketing efforts, customer perception, competition, pricing, and service preferences, among other factors, to increase our responsiveness to our customers. Our marketing organization also manages and directs several sales channels including direct sales, on-line, outbound telemarketing and Charter stores.

Programming

General

We believe that offering a wide variety of programming influences a customer’s decision to subscribe to and retain our cable services. We rely on our experience in programming cable systems, which includes market research, customer demographics and local programming preferences to determine channel offerings

in each of our markets. We obtain basic and premium programming from a number of suppliers, usually pursuant to written contracts. Our programming contracts generally continue for a fixed period of time, usually from three to teneight years, and are subject to negotiated renewal. Some programming suppliers offer financial incentives to support the launch of a channel and/or ongoing marketing support. We also negotiate volume discount pricing structures. We have more recently negotiated for moreadditional content rights allowing us to provide programming on-line to our authenticated customers. Programming costs are usually payable each month based on calculations performed by us and are generally subject to annual cost escalations and audits by the programmers.

Costs

Programming is usually made available to us for a license fee, which is generally paid based on the number of customers to whom we make such programming available. SuchProgramming costs are usually payable each month based on calculations

performed by us and are generally subject to annual cost escalations and audits by the programmers. Programming license fees may include “volume” discounts available for higher numbers of customers, as well as discounts for channel placement or service penetration. Some channels are available without cost to us for a limited period of time, after which we pay for the programming. For home shopping channels, we receive a percentage of the revenue attributable to our customers’ purchases, as well as, in some instances, incentives for channel placement.

Our programming costs have increased in every year we have operated in excess of customary inflationary and cost-of-living type increases. We expect them to continue to increase due to a variety of factors including amounts paid for retransmission consent, annual increases imposed by programmers with additional selling power as a result of media consolidation and additional programming, including new sports services and non-linear programming for on-line and OnDemand programming. In particular, sports programming costs have increased significantly over the past several years.years as well as increases in the demands of large media companies who link carriage of their most popular networks to carriage and cost increases for all of their networks. In addition, contracts to purchase sports programming sometimes provide for optional additional games to be added to the service and made available on a surcharge basis during the term of the contract. Additionally, programmers continue to create new networks and migrate popular programming such as sporting events to those networks.

Federal law allows commercial television broadcast stations to make an election between “must-carry” rights and an alternative “retransmission-consent” regime. When a station opts for the retransmission-consent regime, we are not allowed to carry the station’s signal without the station’s permission. Continuing demands by owners of broadcast stations for cash payments at substantial increases over amounts paid in prior years in exchange for retransmission consent will likely increase our programming costs or require us to cease carriage of popular programming, potentially leading to a loss of customers in affected markets.

Over the past several years, increases in our video service rates have not fully offset increasing programming costs, and with the impact of increasing competition and other marketplace factors, we do not expect them to do so in the foreseeable future. Although in 2010, we began passingpass along a portion of amounts paid for retransmission consent to the majority of our customers, our inability to fully pass these programming cost increases on to our video customers has had and is expected in the future to have an adverse impact on our cash flow and operating margins associated with the video product. In order to mitigate reductions of our operating margins due to rapidly increasing programming costs, we continue to review our pricing and programming packaging strategies, and we plan to continue to migrate certain program services from our basic level of service to our digital tiers, remove underperforming services and limit the launch of non-essential, new networks. As we migrate our programming to our digital tier packages, certain programming that was previously available to all of our customers via an analog signal may only be part of an elective digital tier package offered to our customers for an additional fee. As a result, we expect that the customer base upon which we pay programming fees will proportionately decrease, and the overall expense for providing that service will also decrease. However, reductions in the size of certain programming customer bases may result in the loss of specific volume discount benefits.

We have programming contracts that have expired and others that will expire at or before the end of 2012.2014. We will seek to renegotiate the terms of these agreements. There can be no assurance that these agreements will be renewed on favorable or comparable terms. To the extent that we are unable to reach agreement with certain programmers on terms that we believe are reasonable, we have been, and may in the future be, forced to remove such programming channels from our line-up, which may result in a loss of customers.

Franchises

As of December 31, 20112013, our systems operated pursuant to a total of approximately 3,1003,300 franchises, permits, and similar authorizations issued by local and state governmental authorities. Such governmental authorities often must approve a transfer to another party. Most franchises are subject to termination proceedings in the event of a material breach. In addition, most franchises require us to pay the granting authority a franchise fee of up to 5.0% of revenues as defined in the various agreements, which is the maximum amount that may be charged under the applicable federal law. We are entitled to and generally do pass this fee through to the customer.

Prior to the scheduled expiration of most franchises, we generally initiate renewal proceedings with the granting authorities. This process usually takes three years but can take a longer period of time. The Communications Act of 1934, as amended (the “Communications Act”), which is the primary federal statute regulating interstate communications, provides for an orderly franchise renewal process in which granting authorities may not unreasonably withhold renewals. In connection with the franchise renewal process, many governmental authorities require the cable operator to make certain commitments, such as building out certain of the franchise areas, customer service requirements, and supporting and carrying public access channels. Historically we have been able to renew our franchises without incurring significant costs, although any particular franchise may not be renewed on commercially favorable terms or otherwise. Our failureIf we failed to obtain renewals of franchises representing a significant number of our franchises, especially those in the major metropolitan areas where we have the most customers, it could have a material adverse effect on our consolidated financial condition, results of operations, or our liquidity, including our ability to comply with our debt covenants. See “— Regulation and Legislation — Video Services — Franchise Matters.”

Markets

We operate in geographically diverse areas which are organized in regional clusters we call key market areas. These key market areas are managed centrally on a consolidated level. Our twelve key market areas and the customer relationships within each market as of December 31, 2013 are as follows (in thousands):

|

| | |

| Key Market Area | | Total Customer Relationships |

| | |

| California | | 595 |

| Carolinas | | 585 |

| Central States | | 599 |

| Alabama/Georgia | | 626 |

| Michigan | | 644 |

| Minnesota/Nebraska | | 346 |

| Mountain States | | 384 |

| New England | | 357 |

| Northwest | | 499 |

| Tennessee/Louisiana | | 530 |

| Texas | | 193 |

| Wisconsin | | 578 |

Competition

We face competition for both residential and commercial customers in the areas of price, service offerings, and service reliability. WeIn our residential business, we compete with other providers of video, high-speed Internet access, telephonevoice services, and other sources of home entertainment. In our commercial business, we compete with other providers of video, high-speed Internet access and related value-added services, fiber solutions, business telephony, and Ethernet services. We operate in a very competitive business environment, which can adversely affect the results of our business and operations. We cannot predict the impact on us of broadband services offered by our competitors.

In terms of competition for customers, we view ourselves as a member of the broadband communications industry, which encompasses multi-channel video for television and related broadband services, such as high-speed Internet, telephone,voice, and other interactive video services. In the broadband communications industry, our principal competitors for video services isare direct broadcast satellite (“DBS”) and telephone companies.companies that offer video services. Our principal competitorcompetitors for high-speed Internet services is DSL service and high-speed Internetare the broadband services provided by telephone companies.companies, including both traditional DSL, fiber-to-the-node, and fiber-to-the-home offerings. Our principal competitors for telephonevoice services are established telephone companies, other telephone service providers, and other carriers, including VoIP providers. At this time, we do not consider other cable operators to be significant competitors in our overall market, as overbuilds are infrequent and geographically spotty (although in any particular market, a cable operator overbuilder would likely be a significant competitor at the local level). We could, however, face additional competition from multi-channel video providersother cable operators if they began distributing video over the Internet to customers residing outside their current territories.

Our key competitors include:

DBS

Direct broadcast satellite is a significant competitor to cable systems. The two largest DBS providers now serve more than 3334 million subscribers nationwide. DBS service allows the subscriber to receive video services directly via satellite using a dish antenna.

Video compression technology and high powered satellites allow DBS providers to offer more than 285280 digital channels from a single satellite, thereby surpassing the traditional analog cable system.channels. In 2011,2013, major DBS competitors offered a greater variety of channel packages, and were especially competitive with promotional pricing for more basic services. While we continue to believe that the initial investment by a DBS customer exceeds that of a cable customer, the initial equipment cost for DBS has decreased substantially, as the DBS providers have aggressively marketed offers to new customers of incentives for discounted

or free equipment, installation, and multiple units. DBS providers are able to offer service nationwide and are able to establish a national image and branding with standardized offerings, which together with their ability to avoid franchise fees of up to 5% of revenues and property tax, leads to greater efficiencies and lower costs in the lower tiers of service. Also, DBS providers are currently offering more HD programming, including local HD programming. However, weWe believe that cable-delivered OnDemand and Subscription OnDemand services, which include HD programming, are superior to DBS service, because cable headends can provide two-way communication to deliver many titles which customers can access and control independently, whereas DBS technology can only make available a much smaller number of titles with DVR-like customer control. DBS providers have also made attempts at deployment of Internet access services via satellite, but those services have been technically constrained and of limited appeal.

Telephone Companies and Utilities

TelephoneIncumbent telephone companies, including AT&T Inc. (“AT&T”) and Verizon Communications, Inc. ("Verizon"), offer video and other services in competition with us, and we expect they will increasingly do so in the future. Upgraded portions of these networks carryThese companies are able to offer two-way video, data services and provide digital voice services similar to ours.ours in various portions of their networks. In the case of Verizon, high-speed data

services (fiber optic service (“FiOS”)) offer speeds as high as or higher than ours. In addition, these companies continue to offer their traditional telephone services, as well as service bundles that include wireless voice services provided by affiliated companies. Based on internal estimates, we believe that AT&T and Verizon are offering video services in areas serving approximately 31% to 34%30% and 3% to 4%, respectively, of our estimated homes passed as of December 31, 2011passings and we have experienced customer losses in these areas. AT&T and Verizon have also launched campaigns to capture more of the multiple dwelling unit (“MDU”) market. Additional upgradesAT&T has publicly stated that it expects to roll out its video product beyond the territories currently served although it is unclear where and product launches are expectedto what extent. When AT&T or Verizon have introduced or expanded their offering of video products in marketsour market areas, we have seen a decrease in which we operate.our video revenue as AT&T and Verizon typically roll out aggressive marketing and discounting campaigns to launch their products.

In addition to incumbent telephone companies obtaining franchises or alternative authorizations in some areas, and seeking them in others, they have been successful through various means in reducing or streamlining the franchising requirements applicable to them. They have had significant success at the federal and state level in securing FCC rulings and numerous statewide franchise laws that facilitate telephone company entry into the video marketplace. Because telephone companies have been successful in avoiding or reducing franchise and other regulatory requirements that remain applicable to cable operators like us, their competitive posture has often been enhanced. The large scale entry of majorincumbent telephone companies as direct competitors in the video marketplace has adversely affected the profitability and valuation of our cable systems.

Most telephone companies, including AT&T and Verizon, which already have plant, an existing customer base, and other operational functions in place (such as billing and service personnel), offer Internet access via traditional DSL service. DSL service allows Internet access to subscribers at data transmission speeds greater than those formerly available over conventional telephone lines. We believe DSL service is competitive withan alternative to our high-speed Internet service and is often offered at prices lower than our Internet services, although typically at speeds lower than the speeds we offer. However one DSL provider, Century Link, offers DSL services in approximately 12% of our homes passed with speeds comparable to our lower speed tiers. DSL providers may currently be in a better position to offer telephonevoice and data services to businesses since their networks tend to be more complete in commercial areas. We expect DSL to remain a significant competitor to our high-speed Internet services. In addition,

Many large telephone companies also provide fiber-to-the-node or fiber-to-the-home services in select areas of their footprints. Fiber-to-the-node networks can provide faster Internet speeds than conventional DSL, but still cannot typically match our Internet speeds. Our primary fiber-to-the-node competitor is AT&T's U-verse. The competition from U-verse is expected to intensify over time as AT&T completes the continuing deployment of fiber optics into telephone companies’expansion plans announced in late 2012. Fiber-to-the-home networks, (primarily by Verizon) will enable themhowever, can provide Internet speeds equal to provide even higher bandwidthor greater than Charter's current Internet services.speeds. Verizon's FiOS is the primary fiber-to-the-home competitor.

Our telephonevoice service competes directly with establishedincumbent telephone companies and other carriers, including Internet-based VoIP providers, for both residential and commercial voice service customers. Because we offer voice services, we are subject to considerable competition from telephonesuch companies and other telecommunications providers, including wireless providers with an increasing number of consumers choosing wireless over wired telephone services. The telecommunications and voice services industry is highly competitive and includes competitors with greater financial and personnel resources, strong brand name recognition, and long-standing relationships with regulatory authorities and customers. Moreover, mergers, joint ventures and alliances among our competitors have resulted in providers capable of offering cable television, Internet, and telephonevoice services in direct competition with us.

Additionally, we are subject to limited competition from utilities and/or municipal utilities (collectively, "Utilities") that possess fiber optic transmission lines capable of transmitting signals with minimal signal distortion. Certain utilitiesUtilities are also developing broadband over power line technology, which may allow the provision of Internet, phone and other broadband services to homes and offices.

Traditional Overbuilds

Cable systems are operated under non-exclusive franchises historically granted by state and local authorities. More than one cable system may legally be built in the same area. It is possible that a franchising authority mightFranchising authorities may grant a second franchise to another cable operator and that such franchise mightmay contain terms and conditions more favorable than those afforded us. Well-financed businesses from outside the cable industry, such as public utilities that already possess fiber optic and other transmission lines in the areas they serve, may over timehave in some cases become competitors. There are a number of cities that have constructed their own cable systems, in a manner similar to city-provided utility services. There also has been interest in traditional cable overbuilds by private companies not affiliated with established local exchange carriers. Constructing a competing cable system is a capital intensive process which involves a high degree of risk. We believe that in order to be successful, a competitor’s overbuild would need to be able to serve the homes and businesses in the overbuilt area with equal or better service quality, on a more cost-effective basis than we can. Any such overbuild operation would require access to capital or access to facilities already in place that are capable of delivering cable television programming.

As of December 31, 2011, excluding telephone companies, we are aware of traditional overbuild situations impacting approximately 8% We cannot predict the extent to 9% of our total homes passed and potential traditional overbuild situations in areas servicing approximately anwhich additional 2% of our total homes passed. Additional overbuild situations may occur.

Broadcast Television

Cable television has long competed with broadcast television, which consists of television signals that the viewer is able to receive without charge using an “off-air” antenna. The extent of such competition is dependent upon the quality and quantity of broadcast signals available through “off-air” reception, compared to the services provided by the local cable system. Traditionally, cable television has provided higher picture quality and more channel offerings than broadcast television. However, the recent licensing of digital spectrum by the FCC now provides traditional broadcasters with the ability to deliver HD television pictures and multiple digital-quality program streams, as well as advanced digital services such as subscription video and data transmission.

Internet Delivered Video

Internet access facilitates the streaming of video, including movies and television shows, into homes and businesses. Increasingly, content owners are using Internet-based delivery of content directly to consumers, some without charging a fee to access the content. Further, due to consumer electronic innovations, consumers are able to watch such Internet-delivered content on televisions, personal computers, tablets, gaming boxes connected to televisions and mobile devices. We believe some customers have chosen to receive video over the Internet rather than through our VOD and premium video services, thereby reducing our video revenues. We can not predict the impact that Internet delivered video will have on our revenues and adjusted EBITDA as technologies continue to evolve.

Private Cable

Additional competition is posed by satellite master antenna television systems, or SMATV systems, serving MDUs, such as condominiums, apartment complexes, and private residential communities. Private cable systems can offer improved reception of local television stations, and many of the same satellite-delivered program services that are offered by cable systems. Although disadvantaged from a programming cost perspective, SMATV systems currently benefit from operating advantages not available to franchised cable systems, including fewer regulatory burdens and no requirement to service low density or economically depressed communities. The FCC previously adopted regulations that favor SMATV and private cable operators serving MDU complexes, allowing them to continue to secure exclusive contracts with MDU owners. This regulatory disparity provides a competitive advantage to certain of our current and potential competitors.

Other Competitors

Local wireless Internet services operate in some markets using available unlicensed radio spectrum. Various wireless phone companies are now offering third and fourth generation (3G and 4G) wireless high-speed Internet services. In addition, a growing number of commercial areas, such as retail malls, restaurants and airports, offer Wi-Fi Internet service. Numerous local governments are also considering or actively pursuing publicly subsidized Wi-Fi and WiMAX Internet access networks. Operators are also marketing PC cards and “personal hotspots” offering wireless broadband access to their cellular networks. These service options offer another alternative to cable-based Internet access.

Regulation and Legislation

The following summary addresses the key regulatory and legislative developments affecting the cable industry and our three primary services for both residential and commercial customers: video service, Internet service, and telephonevoice service. Cable system operations are extensively regulated by the federal government (primarily the FCC), certain state governments, and

many local governments. A failure to comply with these regulations could subject us to substantial penalties. Our business can be dramatically impacted by changes to the existing regulatory framework, whether triggered by legislative, administrative, or judicial rulings. Congress and the FCC have frequently revisited the subject of communications regulation and they are likely to do so again in the future. We could be materially disadvantaged in the future if we are subject to new regulations that do not equally impact our key competitors. We cannot provide assurance that the already extensive regulation of our business will not be expanded in the future.

Video Service

Cable Rate Regulation. The cable industry has operated under a federal rate regulation regime for approximately two decades. TheFederal regulations currently restrict the prices that cable systems charge for the minimum level of video programming service, referred to as “basic service,” and associated equipment. All other video service offerings are now universally exempt from rate regulation. Although basic service rate regulation operates pursuant to a federal formula, local governments, commonly referred to as local franchising authorities, are primarily responsible for administering this regulation. The majority of our local franchising authorities

have never been certified to regulate basic service cable rates (and order rate reductions and refunds), but they generally retain the right to do so (subject to potential regulatory limitations under state franchising laws), except in those specific communities facing “effective competition,” as defined under federal law. We have secured FCC recognition of effective competition, and become rate deregulated, in many of our communities.

There have been frequent calls to impose expanded rate regulation on the cable industry. Confronted with rapidly increasing cable programming costs, it is possible that Congress may adopt new constraints on the retail pricing or packaging of cable programming. For example, there has been legislative and regulatory interest in requiring cable operators to offer historically combined programming services on an à la carte basis. Any such mandateconstraints could adversely affect our operations.

Federal rate regulations include certain marketing restrictions that could affect our pricing and packaging of service tiers and equipment. As we attempt to respond to a changing marketplace with competitive pricing practices, we may face regulations that impede our ability to compete.

Must Carry/Retransmission Consent. There are two alternative legal methods for carriage of local broadcast television stations on cable systems. Federal “must carry” regulations require cable systems to carry local broadcast television stations upon the request of the local broadcaster. Alternatively, federal law includes “retransmission consent” regulations, by which popular commercial television stations can prohibit cable carriage unless the cable operator first negotiates for “retransmission consent,” which may be conditioned on significant payments or other concessions. Broadcast stations must elect “must carry” or “retransmission consent” every three years, with the election date of October 1, 2009, for the current period of 2012 through 2014. Either option has a potentially adverse effect on our business by utilizing bandwidth capacity. In addition, popularPopular stations invoking “retransmission consent” have been demanding substantial compensation increases in their recent negotiations with cable operators.operators, thereby significantly increasing our operating costs.

In September 2007, the FCC adopted an order increasing the cable industry’s must-carry obligations by requiring most cable operators to offer “must carry” broadcast signals in both analog and digital format (dual carriage). This requirement, which does not currently include any obligation to carry multiple program streams included within a single digital broadcast transmission (multicast carriage), is scheduled to expire in June 2012, but may be extended by the FCC. Additional government-mandated broadcast carriage obligations could disrupt existing programming commitments, interfere with our preferred use of limited channel capacity, and limit our ability to offer services that appeal to our customers and generate revenues.