UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20002003

Commission File Number 1-7850

SOUTHWEST GAS CORPORATION

(Exact name of registrant as specified in its charter)

| California | 88-0085720 | |

| ||

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | ||

5241 Spring Mountain Road Post Office Box 98510 Las Vegas, Nevada | 89193-8510 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (702) 876-7237

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange | |

| on which registered | |

Common Stock, $1 par value | New York Stock Exchange, Inc. | |

| Pacific | ||

7.70% Preferred Trust | New York Stock Exchange, Inc. | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes [X]þ No [ ]¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]þ

Indicate by check mark whether the registrant is an accelerated filer.Yesþ No¨

Aggregate market value of the voting and non-voting common stock held by nonaffiliates of the registrant:

$668,250,178715,068,782 as of March 13, 2001June 30, 2003

The number of shares outstanding of common stock:

Common Stock, $1 Par Value, 31,882,16534,517,481 shares as of March 13, 20011, 2004

DOCUMENTS INCORPORATED BY REFERENCE

Description | Part Into Which Incorporated | |

Annual Report to Shareholders for the Year Ended December 31, | Parts I, II, and IV | |

2004 Proxy Statement | Part III |

PART I

| PAGE | ||||||||

Item 1. | 1 | |||||||

| 1 | ||||||||

| 1 | ||||||||

| 2 | ||||||||

| 3 | ||||||||

| 3 | ||||||||

| 4 | ||||||||

| 5 | ||||||||

| 5 | ||||||||

| 5 | ||||||||

| 6 | ||||||||

Item | 8 | |||||||

Item 3. | 10 | |||||||

Item 4. | ||||||||

| 10 | ||||||||

| PART II | ||||||||

Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 10 | ||||||

Item 6. | 10 | |||||||

Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 10 | ||||||

Item 7A. | 10 | |||||||

Item 8. | 10 | |||||||

Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |||||||

| 11 | ||||||||

Item 9A. | 11 | |||||||

| PART III | ||||||||

Item 10. | 12 | |||||||

Item 11. | 13 | |||||||

Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 13 | ||||||

Item 13. | ||||||||

| 14 | ||||||||

Item 14. | 14 | |||||||

| PART IV | ||||||||

Item 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES, AND REPORTS ON FORM 8-K | |||||||

TABLE OF CONTENTS

PART I

| 15 | ||||||||

PART I

| 20 | ||||

The registrant,

Item 1. BUSINESS

Southwest Gas Corporation (the Company), is“Company”) was incorporated, effective March 1931, under the laws of the Statestate of California. The executive offices of the Company are located at 5241 Spring Mountain Road, Las Vegas, Nevada.

The Company is comprised of two business segments: natural gas operations (Southwest(“Southwest” or the natural“natural gas operationsoperations” segment) and construction services. Southwest is engaged in the business of purchasing, transporting, and distributing natural gas to residential, commercial, and industrial customers in geographically diverse portions of Arizona, Nevada, and California. Southwest is the largest distributor in Arizona, selling and transporting natural gas in most of southern, central and northwesternsouthern Arizona, including the Phoenix and Tucson metropolitan areas. Southwest is also the largest distributor and transporter of natural gas in Nevada, and servesserving the Las Vegas metropolitan area and northern Nevada. In addition, Southwest distributes and transports natural gas in portions of California, including the Lake Tahoe area in northern California and the high desert and mountain areas in San Bernardino County.

Northern Pipeline Construction Co. (Northern(“NPL” or the construction services“construction services” segment), a wholly owned subsidiary, is a full-service underground piping contractor whichthat provides utility companies with trenching and installation, replacement, and maintenance services for energy distribution systems.

Financial information with respect to industryconcerning the Company’s business segments is included in Note 11 of the Notes to Consolidated Financial Statements which is included in the 20002003 Annual Report to Shareholders and is incorporated herein by reference.

The Company maintains a website (www.swgas.com) for the benefit of shareholders, investors, customers, and other interested parties. The Company makes its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports available, free of charge, through its website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”).

NATURAL GAS OPERATIONS

General Description

Southwest is subject to regulation by the Arizona Corporation Commission (ACC)(“ACC”), the Public Utilities Commission of Nevada (PUCN)(“PUCN”), and the California Public Utilities Commission (CPUC)(“CPUC”). These commissions regulate public utility rates, practices, facilities, and service territories in their respective states. The CPUC also regulates the issuance of all securities by the Company, with the exception of short-term borrowings. Certain accounting practices, transmission facilities, and rates are subject to regulation by the Federal Energy Regulatory Commission (FERC)(“FERC”). NPL is not regulated by the state utilities commissions in any of its operating areas.

As of December 31, 2003, Southwest purchases, transports,purchased, transported, and distributesdistributed natural gas to 1,337,0001,531,000 residential, commercial, and industrial customers in geographically diverse portions of Arizona, Nevada, and California. There were 63,00067,000 customers added to the system during 2000.2003 (and an additional 9,000 in central Arizona associated with the acquisition of Black Mountain Gas Company (“BMG”) in October 2003).

The table below lists the percentage of operating margin (operating revenues less net cost of gas) by major customer class for the years indicated:

| Residential and | Other | |||||||||||

| For the Year Ended | Small Commercial | Sales Customers | Transportation | |||||||||

| December 31, 2000 | 84 | % | 3 | % | 13 | % | ||||||

| December 31, 1999 | 83 | 4 | 13 | |||||||||

| December 31, 1998 | 84 | 5 | 11 | |||||||||

| Distribution | Transportation | |||||

For the Year Ended | Residential and Small Commercial | Other Sales Customers | ||||

December 31, 2003 | 84% | 6% | 10% | |||

December 31, 2002 | 83% | 7% | 10% | |||

December 31, 2001 | 82% | 8% | 10% | |||

Southwest is not dependent on any one or a few customers to the extent that the loss of any one or several would have a significant adverse impact on earnings.

Transportation of customer-secured gas to end-users accounted for 5754 percent of total system throughput in 2000.2003. Although the volumes were significant, these customers provide a much smaller proportionate share of operating margin. In 2000, customersCustomers who utilized this service transported 148134 million dekatherms.

1

dekatherms in 2003, 133 million dekatherms in 2002, and 127 million dekatherms in 2001.

The demand for natural gas is seasonal. Variability in weather from normal temperatures can materially impact results of operations. It is the opinion of management that comparisons of earnings for interim periods do not reliably reflect overall trends and changes in operations. Also, earnings for interim periods can be significantly affected by the timing of general rate relief.

Rates and Regulation

Rates that Southwest is authorized to charge its distribution system customers are determined by the ACC, PUCN, and CPUC in general rate cases and are derived using rate base, cost of service, and cost of capital experienced in a historical test year, as adjusted in Arizona and Nevada, and projected for a future test year in California. The FERC regulates the northern Nevada transmission and liquefied natural gas (LNG)(“LNG”) storage facilities of Paiute Pipeline Company (Paiute)(“Paiute”), a wholly owned subsidiary, and the rates it charges for transportation of gas directly to certain end-users and to various local distribution companies (LDCs)(“LDCs”). The LDCs transporting on the Paiute system are: Sierra Pacific Power Company (serving Reno and Sparks, Nevada), Avista Utilities (serving South Lake Tahoe, California), and Southwest Gas Corporation (serving Truckee and North Lake Tahoe, California and various locations throughout northern Nevada).

Rates charged to customers vary according to customer class and rate jurisdiction and are set at levels allowingthat are intended to allow for the recovery of all prudently incurred costs, including a return on rate base sufficient to pay interest on debt, preferred securities distributions, and a reasonable return on common equity. Rate base consists generally of the original cost of utility plant in service, plus certain other assets such as working capital and inventories, less accumulated depreciation on utility plant in service, net deferred income tax liabilities, and certain other deductions. Rate schedules in all service areas contain purchased gas adjustment (PGA)(“PGA”) clauses, which allow Southwest to file for rate adjustments as the cost of purchased gas changes. In Nevada, tariffs provide for annual adjustment dates for changes in purchased gas costs. In addition, Southwest may requestmake additional requests to adjust rates, more often, if market conditions warrant. In Arizona, Southwest adjusts rates monthly for changes in purchased gas costs, within pre-established limits. In California, a monthly gas cost adjusteradjustment based on forecasted monthly prices became effective December 2000.is used to adjust rates. PGA rate changes affect cash flows but have no direct impact on profit margin. Filings to change rates in accordance with PGA clauses are subject to audit by the appropriate state regulatory commission staffs.staff. Information with respect to recent general rate cases and PGA filings is included in the Rates and Regulatory Proceedings section of Management’s Discussion and Analysis (MD&A)(“MD&A”) in the 20002003 Annual Report to Shareholders.

The table below lists the docketed general rate filings last initiated and/or completedand the status of such filing within each ratemaking area:

Ratemaking Area | Type of Filing | Month Filed | Month Final Rates Effective | |||

Arizona | General rate case | May 2000 | November 2001 | |||

California: | ||||||

Northern and Southern | ||||||

| General rate case | Pending | |||||

| | ||||||

| General rate case | ||||||

| | General rate case | |||||

| July 1996 | January 1997 |

2

Recent Regulatory and Legislative Developments

Both the CPUC and the PUCN have started to develop new rules for further restructuring of the natural gas distribution industry to allow more competition. Recently, the development of new rules has slowed. Similar initiatives may also begin in Arizona. The following is a summary of significant activity to date.

Nevada

During 1998, the PUCN issued two natural gas-related restructuring orders. The orders identified several distinct components of natural gas service and established the procedures to make a determination that a component of service is potentially competitive. In 1999, the PUCN continued the restructuring effort by adopting regulations for licensing requirements and fees for alternate sellers. Large commercial and industrial customers who currently have competitive gas supply purchase options can continue to be served by nonutility gas suppliers if the suppliers obtain a license from the PUCN. To date, three such applications have been approved. Except for large customer gas suppliers mentioned above, no party is providing competitive natural gas services or has requested that any utility services currently provided by Southwest be declared potentially competitive. Further issues such as unbundling of rates, licensing of alternative sellers, and recovery of stranded costs have not yet been decided by the PUCN.

In October 2000, an Energy Policy Committee was formed by the Governor to recommend a long-term energy plan for Nevada. The 17-member committee, which included state government officials, utility company executives and other community and industry representatives, submitted their recommendations in January 2001. They submitted a series of policy proposals regarding conservation and alternative energy sources, but made it clear that given the current instability of the electric energy market, they did not support full deregulation in the immediate future. During the 2001 session of the Nevada State Legislature, several bills were introduced which would modify or repeal utility deregulation legislation previously passed. These proposals add further uncertainty to the likelihood of utility deregulation.

California

In November 2000, the CPUC issued a proposed decision in its investigation to further reform the California natural gas industry. The proposed decision would adopt an interim settlement that takes incremental steps to address customer concerns and promote gas commodity, transmission, storage and balancing services for customers of regulated natural gas utilities. The vote on this proposed decision remains deferred before the CPUC pending resolution of the current energy market issues facing the state. Under legislation adopted in 1999, the incumbent utility remains the provider of last resort and the provider of safety-related services under any restructuring that may be adopted.

Demand for Natural Gas

Deliveries of natural gas by Southwest are made under a priority system established by state regulatory commissions. The priority system is intended to ensure that the gas requirements of higher-priority customers, primarily residential customers and other customers who use 500 therms of gas per day or less, are fully satisfied on a daily basis before lower-priority customers, primarily electric utility and large industrial customers able to use alternative fuels, are provided any quantity of gas or capacity.

Demand for natural gas is greatly affected by temperature. On cold days, use of gas by residential and commercial customers may be as much as eightsix times greater than on warm days because of increased use of gas for space heating. To fully satisfy this increased high-priority demand, gas is withdrawn from storage in certain service areas, or peaking supplies are purchased from suppliers. If necessary, service to interruptible lower-priority customers may be curtailed to provide the needed delivery system capacity. No curtailment occurred during the latest peak heating season. Southwest maintains no significant backlog on its orders for gas service.

3

Natural Gas Supply

Southwest is responsible for acquiring (purchasing) and arranging delivery of (transporting) natural gas to its system for all sales customers. Southwest believes that natural gas supplies and pipeline capacity for transportation will continue to be sufficient to meet market demands in its service territories.

The primary objective of Southwest with respect to acquiring gas supply is to ensure that adequate, as well as economical, supplies of natural gas are available from reliable sources. Gas is acquired from a wide variety of sources and a mix of purchase provisions, including spot market purchases and firm supplies with a variety of terms. During 2000,2003, Southwest acquired gas supplies from approximately 6048 suppliers. This practice mitigates the risk of nonperformance by any one supplier.

Balancing reliable supply assurances with the associated costs results in a continually changing mix of purchase provisions within the supply portfolios. To address the unique requirements of its various market areas, Southwest assembles and administers a separate natural gas supply portfoliosportfolio for each of its jurisdictional areas. Firm and spot market natural gas purchases are made in a competitive bid environment. California purchasesSouthwest has experienced price volatility over the past five years, as the weighted average delivered cost of natural gas has ranged from a low of 28 cents per therm in 1999 to a high of 55 cents per therm in 2001. During 2003, Southwest paid an average of 46 cents per therm. To mitigate customer exposure to market price volatility, Southwest continues to purchase a significant percentage of its forecasted annual normal weather requirements under firm, fixed-price arrangements that are subjectsecured periodically throughout the year.

The firm, fixed-price arrangements are structured such that a stated volume of gas is required to both fixed-pricebe scheduled by Southwest and index-based pricing arrangements. Fordelivered by the Nevada and Arizona portfolios,supplier. If the majority of purchases involve index-based firm pricing arrangements. However,gas is not needed by Southwest or cannot be procured by the supplier, the contract provides for fixed or market-based penalties to be paid by the non-performing party. In the event that demand on Southwest’s system is lower than expected, Southwest may have the opportunity to forego the purchase at a portionnegotiated price in excess of the firm supplies is contracted on a fixed-price basis. This process allows Southwest to acquire gas at current market prices with mitigationprice during periods of extreme price volatility. Any savings would reduce the overall cost of gas for the purchase period.

In managing its gas supply portfolio,portfolios, Southwest uses the fixed-price arrangements noted above, but does not currently utilize other stand-alone derivative financial instruments, butinstruments. In the future stand-alone derivatives may do so in the futurebe used to hedge against possible price increases. AnyHowever, any such change would be undertaken only with the knowledge of Southwest’s various regulatory commission authorization.commissions.

From

Storage capability can influence the second through the fourth quarter of 2000, Southwest experienced unprecedented increases in natural gas prices. High natural gas prices are also expected for 2001. The recent increase is due to many factors and is a nationwide phenomenon affecting utilities and consumers throughout the United States. These increases escalated in December 2000 when the system-wide average costannual price of gas, for Southwest exceeded $6.00 per dekatherm. Just one year prior, the same average was approximately $2.00 per dekatherm.

There are several factors affecting natural gas prices. Natural gasas storage levels going into the winter heating season were low as gas normally earmarked for storage was usedallows a company to meet customer needs. Prices for crude oil, which is a competitive energy source, reached 16-year highs. The demand for electricity resulting from growth in the national economy increased the demand for natural gas, as most new electric generating plants under construction or recently completed are fueled with natural gas. Consequently, electric utilities, natural gas utilities, and industrial and commercial users are competing for the same supplies of natural gas. The changing structure of the electric utility industry is causing both the price of the power sold and the price of the fuel to operate the natural gas generating plants to be extremely volatile. A depressed market price forpurchase natural gas in larger quantities during the mid-1990s caused explorationoff-peak season and drillingstore it for use in high demand periods when prices may be greater. Southwest currently has no storage availability in its Arizona or southern Nevada rate jurisdictions. Limited storage capabilities exist in southern and northern California and northern Nevada. A contract with Southern California Gas Company is intended for delivery only within Southwest’s southern California rate jurisdiction. In addition, a contract with Paiute for its LNG facility in northern Nevada and northern California allows for peaking capability only. Gas is purchased for injection during the off-peak period for use in the high demand months, but is again limited in its impact on the overall price. The LNG plant is currently leased from a third party, and the contract expires in July 2005. While

negotiations continue between the owner of the plant and Paiute to decline. This trend has recently reversed dueallow for the purchase of the facility, preparations are being made to increased market prices. The new supplies, however, will take 6provide alternatives to 18 monthsthe leased facility to reach the market.be in service by July 2005.

Gas supplies for the southern system of Southwest (Arizona, southern Nevada, and southern California properties) are primarily obtained from producing regions in Colorado and New Mexico (San Juan basin), Texas (Permian basin), and Rocky Mountain areas. For its northern system (northern Nevada and northern California properties), Southwest primarily obtains gas from Rocky Mountain producing areas and from Canada. Primarily as a result of established procurement programs, price increases did not affect the Company’s ability to obtain gas supplies during the recent winter heating season. Increased drilling activity is expected to positively impact future gas supplies.

Southwest arranges for transportation of gas to its Arizona, Nevada, and California service territories through the pipeline systems of El Paso Natural Gas Company (El Paso)(“El Paso”), Kern River Gas Transmission Company (Kern River)(“Kern River”), Transwestern Pipeline Company, Northwest Pipeline Corporation, Paiute, and Southern California Gas Company.Company and Paiute. Supply and pipeline capacity availability on both short- and long-term bases areis continually monitored by Southwest to ensure the continued reliability of service to its customers. Southwest currently receives firm transportation service, both on a short- and long-term basis, for all of its service territories on the pipeline systems noted above, and also has interruptible contracts in place that allow additional capacity to be acquired as needed.

4

should an unforeseen need arise.

The Company believes that the current level of contracted firm interstate capacity is sufficient to serve each of theits service territories. As the need arises to acquire additional capacity on one of the interstate pipeline transmission systems, primarily due to customer growth, Southwest considerswill continue to consider available options to obtain thethat capacity, either through the use of firm contracts with a pipeline company or by purchasing capacity on the open market.

Southwest continuesis dependent upon the El Paso pipeline system for the transportation of gas to evaluate naturalvirtually all of its Arizona service territories. Historically, Southwest received transportation service from El Paso to its Arizona service territories under a full requirements contract. Under full requirements service, El Paso was obligated to transport all of a customer’s gas storage as an optionrequirements each day, and the customer was obligated to enablehave El Paso, and only El Paso, transport its requirements. Virtually all of El Paso’s customers in Arizona, New Mexico, and Texas have been full requirements customers, while El Paso has transported gas for its customers in California and Nevada subject to a specific maximum daily quantity, or contract demand limitation.

Since November 1999, the Federal Energy Regulatory Commission has been examining capacity allocation issues on the El Paso system in several proceedings. This examination resulted in a series of orders by the FERC in which all of the major full requirements transportation service agreements on the El Paso system, including the agreement by which Southwest obtained the transportation of gas supplies to its Arizona service areas, were converted to contract demand-type service agreements, with fixed maximum service limits, effective September 2003. At that time, all of the transportation capacity on the system was allocated among the shippers. In order to help ensure that the converting full requirements shippers would have adequate capacity to meet their needs, El Paso was authorized to expand the capacity on its system by adding compression.

The FERC is continuing to examine issues related to the implementation of the full requirements conversion. Petitions for judicial review of the FERC’s orders mandating the conversion have been filed.

Management believes that it is difficult to take advantagepredict the ultimate outcome of dailythe proceedings or the impact of the FERC action on Southwest. Southwest has had adequate capacity for its customers’ needs during the 2003/2004 heating season to date and seasonal natural gas price differentials andmanagement believes adequate capacity exists for the remainder of the heating season. Additional costs may be incurred to acquire capacity in the future as a resource to help meet both projected and unanticipated peak-day requirementsresult of its rapidly growing customer base.

Competitionthe FERC order. However, it is anticipated that any additional costs would be collected from customers principally through the PGA mechanism.

Electric utilities are Southwest’sthe principal competitors of Southwest for the residential and small commercial markets throughout its service areas. Competition for space heating, general household, and small commercial energy needs generally occurs at the initial installation phase when the customer/builder typically makes the decision as to which type of equipment to install and operate. The customer will generally continue to use the chosen energy source for the life of the equipment. As a result of its success in these markets, Southwest has experienced consistent growth among the residential and small commercial customer classes.

Unlike residential and small commercial customers, certain large commercial, industrial, and electric generation customers have the capability to switch to alternative energy sources. To date, Southwest has been successful in retaining most of these customers by setting rates at levels competitive with alternative energy sources such as electricity, fuel oils, and coal. However, increases in natural gas prices, if sustained for an extended period of time, may impact Southwest'sSouthwest’s ability to retain some of these customers. Overall, management does not anticipate any material adverse impact on operating margin from fuel switching.

Southwest continues to compete with interstate transmission pipeline companies, such as El Paso, Kern River, and Tuscarora Gas Transmission Company, to provide service to certain large end-users. End-use customers located in close proximity to these interstate pipelines pose a potential bypass threat and, therefore, requirethreat. Southwest attempts to closely monitor each customer situation and provide competitive service in order to retain the customer. Southwest has remained competitive through the use of negotiated transportation contract rates, special long-term contracts with electric generation and cogeneration customers, and newother tariff programs. These competitive response initiatives have helped mitigatemitigated the financial impact from the threat of bypass and the potential loss of margin currently earned from large customers.

Environmental Matters

Federal, state, and local laws and regulations governing the discharge of materials into the environment have had little direct impact upon Southwest. Environmental efforts, with respect to matters such as protection of endangered species and archeological finds, have increased the complexity and time required to obtain pipeline rights-of-way and construction permits. However, increased environmental legislation and regulation are also beneficial to the natural gas industry. Because natural gas is one of the most environmentally safe fossil fuels currently available, its use helpscan help energy users to comply with stricter environmental standards.

Employees

At December 31, 2000,2003, the natural gas operations segment had 2,4912,550 regular full-time equivalent employees. Southwest believes it has a good relationship with its employees. In May 1999,employees, of which 507 full-time equivalent non-exempt employees in the Centralcentral Arizona Division voted to havewere represented by the International Brotherhood of Electrical Workers (IBEW) represent them in employee-related matters with Southwest. In July 2000, Southwest, the National Labor Relations Board (NLRB) and the IBEW entered into an NLRB Settlement Agreement whereby Southwest recognized the IBEW as the bargaining agent for these employees. As part of the settlement, the IBEW dropped all of its legal actions against Southwest and Southwest withdrew its complaint at the D.C. Circuit Court of Appeals challenging the legality of the union vote.Workers. No other natural gas operations segment employees are represented by a union. At December 31, 2000, there was notSouthwest believes it has a contractgood relationship with its employees and that compensation, benefits, and working conditions afforded its employees are comparable to those generally found in place with the IBEW related to the 508 non-exempt Central Arizona Division employees.utility industry.

5

CONSTRUCTION SERVICES

Northern Pipeline Construction Co. (Northern or the construction services segment) is a full-service underground piping contractor whichthat provides utility companies with trenching and installation, replacement, and maintenance services for energy distribution systems. NorthernNPL contracts primarily with LDCs to install, repair, and maintain energy distribution systems from the town border station to the end-user. The primary focus of business operations is main and service replacement as well as new business installations. Construction work varies from relatively small projects to the piping of entire communities. Construction activity is seasonal.seasonal in most areas. Peak construction periods are the summer and fall months in colder climate areas, such as the midwest. In the warmer climate areas, such as the southwestern United States, construction continues year round.

Northern

NPL business activities are often concentrated in utility service territories where existing energy lines are scheduled for replacement. An LDC will typically contract with NorthernNPL to provide pipe replacement services and new line installations. Contract terms generally specify unit-price or fixed-price arrangements. Unit-price contracts establish prices for all of the various services to be performed during the contract period. These contracts often have annual pricing reviews. During 2000,2003, approximately 9694 percent of revenue was earned under unit-price contracts. As of December 31, 20002003 no significant backlog existed with respect to outstanding construction contracts.

Materials used by NPL in its pipeline construction activities are typically specified, purchased, and supplied by NPL’s customers. Construction contracts also contain provisions which make customers generally liable for remediating environmental hazards encountered during the construction process. Such hazards might include digging in an area that was contaminated prior to construction, finding endangered animals, digging in historically significant sites, etc.

Otherwise, NPL’s operations have minimal environmental impact (dust control, normal waste disposal, handling harmful materials, etc.).

Competition within the industry has traditionally been limited to several regional competitors in what has been a largely fragmented industry. Recently, severalSeveral national competitors have emerged through consolidationalso exist within the industry. NorthernNPL currently operates in approximately 1617 major markets nationwide. Its customers are the primary LDCs in those markets. During 2000, Northern2003, NPL served 4441 major customers, with Southwest accounting for approximately 3430 percent of their revenues. NoWith the exception of one other customer that accounted for approximately 12 percent of revenue, no other customer had a relatively significant contribution to Northern’sNPL revenues.

Employment fluctuates between seasonal construction periods, which are normally heaviest in the summer and fall months. At December 31, 2000, Northern2003, NPL had 1,7391,822 regular full-time-equivalentfull-time equivalent employees. Employment peaked in November 2000May 2003 when there were 2,0252,040 employees. The majority of the employees are represented by unions and are covered by collective bargaining agreements, which is typical of the utility construction industry.

Operations are conducted from 17 field locations with corporate headquarters located in Phoenix, Arizona. All buildings are leased from third parties. The lease terms are typically five years or less. Field location facilities consist of a small building for repairs and land to store equipment.

NPL is not directly affected by regulations promulgated by the ACC, PUCN, CPUC or FERC in its construction services. NPL is an unregulated construction subsidiary of Southwest Gas Corporation. However, because NPL performs work for the regulated natural gas segment of the Company, its construction costs are subject indirectly to “prudency reviews” just as any other capital work that is performed by third parties or directly by Southwest. However, such “prudency reviews” would not bring NPL under the regulatory jurisdiction of any of the commissions noted above.

COMPANY RISK FACTORS

Described

Although the Company is not able to predict all factors that may affect future results, described below are some of the identified risk factors ofidentified by the Company that may have a negative impact on our future financial performance.performance or affect whether we achieve the goals or expectations expressed or implied in any forward-looking statements contained herein. Unless indicated otherwise, references below to “we”,“we,” “us” and “our” should be read to refer to Southwest Gas Corporation and its subsidiaries.

OUR LIQUIDITY, AND IN CERTAIN CIRCUMSTANCES, EARNINGS, COULD BE ADVERSELY AFFECTED BY THE COST OF PURCHASING NATURAL GAS DURING PERIODS IN WHICH NATURAL GAS PRICES ARE RISING SIGNIFICANTLY.

Our liquidity, and in certain circumstances our earnings, may be reduced during periods in which natural gas prices are rising significantly or are more volatile.

Rate schedules in each of our service territories contain purchased gas adjustment clauses which permit us to file for rate adjustments to recover increases in the cost of purchased gas. Increases in the cost of purchased gas have no direct impact on our profit margins, but do affect cash flows and can therefore impact the amount of our capital resources. Natural gas prices have recently risen sharply. We have used short-term borrowings in the past to temporarily finance this increaseincreases in purchased gas costs, and we expect to continue to do so during 2001.2004, if the need again arises.

We have recently filed, and expect tomay file in the future, requests for rate increases to cover the increasesrise in the costs of purchased gas we have experienced.gas. Due to the nature of the regulatory process, there is a risk of a disallowance of full recovery of these costs during any period in which there has been a substantial run-up of these costs.costs or our costs are more volatile. Any material disallowance of purchased gas costs could have a material impact onmay reduce cash flow and earnings.

6

SIGNIFICANT CUSTOMER GROWTH IN ARIZONA AND NEVADA COULD STRAIN OUR CAPITAL RESOURCES AND IMPACT EARNINGS.Increases in the cost of natural gas may arise from a variety of factors, including weather, changes in demand, the level of production and availability of natural gas, transportation constraints, transportation capacity cost increases, federal and state energy and environmental regulation and legislation, the degree of market liquidity, natural disasters, wars and other catastrophic events, and the success of our strategies in managing price risk.

Governmental policies and regulatory actions can reduce our earnings.

Governmental policies and regulatory actions, including those of the ACC, the CPUC, the FERC, and the PUCN relating to allowed rates of return, rate structure, purchased gas and investment recovery, operation and construction of

facilities, present or prospective wholesale and retail competition, changes in tax laws and policies, and changes in and compliance with environmental and safety laws and policies, can reduce our earnings. Risks and uncertainties relating to delays in obtaining regulatory approvals, conditions imposed in regulatory approvals, or determinations in regulatory investigations can also impact financial performance.

We are unable to predict what types of conditions might be imposed on Southwest or what types of determinations might be made in pending or future regulatory proceedings or investigations. We nevertheless believe that it is not uncommon for conditions to be imposed in regulatory proceedings, for Southwest to agree to conditions as part of a settlement of a regulatory proceeding, or for determinations to be made in regulatory investigations that will reduce our earnings and liquidity. For example, we may request recovery of a particular operating expense in a general rate case filing that a regulator disallows.

Significant customer growth in Arizona and Nevada could strain our capital resources.

We continue to experience significant population and customer growth throughout our service territories. During 20002003, we added 63,00067,000 customers, a five percent growth rate. It wasAnother 9,000 customers were added in October 2003 with the seventh consecutive year in whichBMG acquisition. Over the past ten years, customer growth was at leasthas averaged five percent.percent per year. This growth has required large amounts of capital to finance the investment in new transmission and distribution plant. In 2000,2003, our natural gas construction expenditures totaled $205$228 million. Approximately 7472 percent of these current-period expenditures represented new construction, and the balance represented costs associated with routine replacement of existing transmission, distribution, and general plant.

Cash flows from operating activities (net of dividends) have been inadequate, and are expected to continue to be inadequate, to fund all necessary capital expenditures. We have been fundingfunded this shortfall through the issuance of additional debt and equity securities, and willexpect to continue to do so. OurHowever, our ability to issue additional securities is dependent upon, among other things, conditions in the capital markets, regulatory authorizations, and our level of earnings.

Significant customer growth in Arizona and Nevada could also impact earnings.

Our ability to earn the imputed rates of return authorized by the Arizona Corporation CommissionACC and the Public Utilities Commission of NevadaPUCN is also adversely affected bymore difficult because of significant customer growth, because thegrowth. The rates we charge our distribution customers in Arizona and Nevada are derived using rate base, cost of service, and cost of capital experienced in ana historical test year, as adjusted. This results in “regulatory lag” which delays our recovery of some of the costs of capital improvements and operating costs from customers in Arizona and Nevada.

OUR EARNINGS ARE GREATLY AFFECTED BY VARIATIONS IN TEMPERATURE DURING THE WINTER HEATING SEASON.

Our earnings are greatly affected by variations in temperature during the winter heating season.

The demand for natural gas is seasonal and is greatly affected by temperature. Variability in weather from normal temperatures can materially impact results of operations. On cold days, use of gas by residential and commercial customers may be as much as eightsix times greater than on warm days because of the increased use of gas for space heating. Weather has been and will continue to be one of the dominant factors in our financial performance.

SIGNIFICANT CLAIMS HAVE BEEN ASSERTED AGAINST US IN CONNECTION WITH THE FAILED ACQUISITION OF US BY ONEOK, INC. AND THE REJECTION OF AN UNSOLICITED OFFER BY SOUTHERN UNION COMPANY.

Uncertain economic conditions may affect our ability to finance capital expenditures.

After we rejected the unsolicited offer by Southern Union Company to acquire us, Southern Union filed a complaint that, as amended, alleges that we, certain of our senior officers and others acted in violation of state and federal criminal laws, including federal and Arizona racketeering statutes, in connection with our acceptance of the ONEOK offer and the rejection of the Southern Union offer. On December 15, 2000, the Arizona District Court granted our motion to dismiss federal racketeering claims against us. Southern Union has also alleged that the defendants (other than us and our Chairman of the Board) fraudulently induced Southern Union to enter into a confidentiality and standstill agreement, intentionally interfered with a business relationship between us and Southern Union, and tortiously interfered with contractual relations between us and Southern Union. Southern Union is seeking damages in an amount not less than $750 million, subject to being trebled for alleged violations of criminal laws, plus interest, and punitive damages. There is also an ongoing joint federal, state and county criminal investigation in Phoenix concerning activities surrounding the failed acquisition by ONEOK. We are cooperating fully with this investigation.

Arthur Klein has filed a purported class action complaint on behalf of himself and our shareholders, other than defendants and their affiliates and families. The complaint, as amended, alleges that our directors breached their duties of loyalty, due care, candor and good faith and fair dealing in connection with the approval of the ONEOK offers and the rejection of the Southern Union offer, and that there were misrepresentations and omissions in our proxy statement relating to our proposed acquisition by ONEOK and the rejection of the Southern Union offer. The amount of damages being sought is unspecified.

7

You may find additional information about these claims as well as claims we have filed against ONEOK and Southern Union underItem 3. Legal Proceedings.

UNCERTAIN ECONOMIC CONDITIONS MAY AFFECT OUR ABILITY TO FINANCE CAPITAL EXPENDITURES.

Our ability to finance capital expenditures and other matters will depend upon general economic conditions in the capital markets. The direction of interest rates is currently uncertain. Declining interest rates are generally believed to be favorable to utilities while rising interest rates are believed to be unfavorable because of the high capital costs of utilities. In addition, our authorized rate of return is based upon certain assumptions regarding interest rates. If interest rates are lower than assumed rates, our authorized rate of return in the future could be reduced. If interest rates are higher than assumed rates, our abilityit will be more difficult for us to earn our currently authorized rate of return mayreturn.

A significant reduction in our credit ratings could materially and adversely affect our business, financial condition and results of operations.

We cannot be adversely impacted.certain that any of our current ratings will remain in effect for any given period of time or that a rating will not be lowered or withdrawn entirely by a rating agency if, in its judgment, circumstances in the future so

OUR ABILITY TO PAY DIVIDENDS, ALTHOUGH RESTRICTED BY CALIFORNIA CORPORATION LAW, IS LIKELY TO BE DEPENDENT UPON FUTURE EARNINGS.

warrant. Any downgrade could increase our borrowing costs, which would diminish our financial results. We do not anticipate that restrictions imposed by California Corporation Law will impact our abilitywould likely be required to pay dividendsa higher interest rate in future financings, and our potential pool of investors and funding sources could decrease. A downgrade could require additional support in the foreseeable future. During 1996form of letters of credit or cash or other collateral and 1997, the amount paid out in dividends exceeded earnings by an aggregateotherwise adversely affect our business, financial condition and results of $21 million. It is likely that the amount of dividends declared by our Board of Directors will depend to a substantial degree on the level of our future earnings.

The plant investment of Southwest consists primarily of transmission and distribution mains, compressor stations, peak shaving/storage plants, service lines, meters, and regulators, which comprise the pipeline systems and facilities located in and around the communities served. Southwest also includes other properties such as land, buildings, furnishings, work equipment, vehicles, and software systems in plant investment. The northern Nevada and northern California properties of Southwest are referred to as the northern system; the Arizona, southern Nevada, and southern California properties are referred to as the southern system. Several properties are leased by Southwest, including an LNG storage plant on itsin northern Nevada, system, a portion of the corporate headquarters office complex located in Las Vegas, Nevada, and the administrative offices in Phoenix, Arizona. Total gas plant, exclusive of leased property, at December 31, 20002003 was $2.4$3.1 billion, including construction work in progress. It is the opinion of management that the properties of Southwest are suitable and adequate for its purposes.

Substantially all gas main and service lines are constructed across property owned by others under right-of-way grants obtained from the record owners thereof, on the streets and grounds of municipalities under authority conferred by franchises or otherwise, or on public highways or public lands under authority of various federal and state statutes. None of the numerous county and municipal franchises are exclusive, and some are of limited duration. These franchises are renewed regularly as they expire, and Southwest anticipates no serious difficulties in obtaining future renewals.

With respect to the right-of-way grants, Southwest has had continuous and uninterrupted possession and use of all such rights-of-way, and the associated gas mains and service lines, commencing with the initial stages of the construction of such facilities. Permits have been obtained from public authorities and other governmental entities in certain instances to cross or to lay facilities along roads and highways. These permits typically are revocable at the election of the grantor and Southwest occasionally must relocate its facilities when requested to do so by the grantor. Permits have also been obtained from railroad companies to cross over or under railroad lands or rights-of-way, which in some instances require annual or other periodic payments and are revocable at the grantors’ elections.election of the grantors.

Southwest operates two primary pipeline transmission systems: (i) a system owned by Paiute, a wholly owned subsidiary, extending from the Idaho-Nevada border to the Reno, Sparks, and Carson City areas and communities in the Lake Tahoe area in both California and Nevada and other communities in northern and western Nevada; and (ii) a system extending from the Colorado River at the southern tip of Nevada to the Las Vegas distribution area.

8

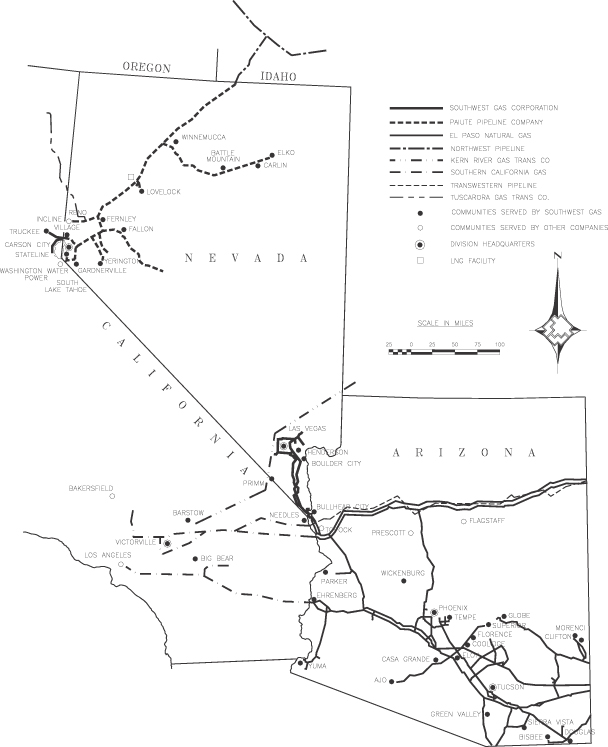

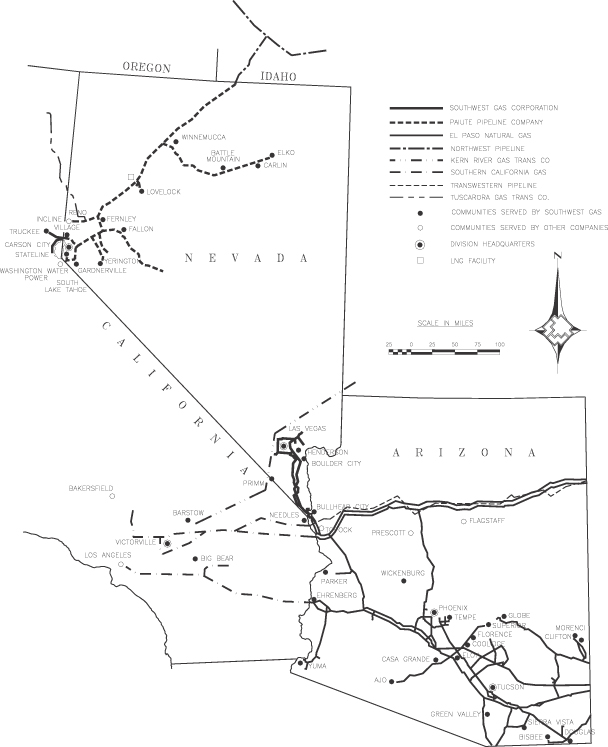

The following map shows the locations of major Southwest facilities and transmission lines, and principal communities to which Southwest supplies gas either as a wholesaler or distributor. The map also shows major supplier transmission lines that are interconnected with the Southwest systems.

The information appearing in Part I, Item 1,

Information on properties of NPL can be found on page 6 with respect to the construction services segment is incorporated herein by reference.of this Form 10-K under Construction Services.

9

[MAP]

[DESCRIPTION: Map of Arizona, Nevada, and California indicating the location of Southwest service areas. Service areas in Arizona include most of the central and southern areas of the state including Phoenix, Tucson, Yuma, and surrounding communities. Service areas in northern Nevada include Carson City, Yerington, Fallon, Lovelock, Winnemucca, and Elko. Service areas in southern Nevada include the Las Vegas valley (including Henderson and Boulder City) and Laughlin. Service areas in southern California include Barstow, Big Bear, Needles, and Victorville. Service areas in northern California include the north shore of Lake Tahoe and portions of Truckee. Companies providing gas transportation services for Southwest are indicated by showing the location of their pipelines. Major transporters include El Paso Natural Gas Company, Kern River Gas Transmission Company, Transwestern Pipeline Company, Northwest Pipeline Corporation, and Southern California Gas Company. The location of the Paiute Pipeline Company transmission pipeline (extending from the Idaho/Nevada border to the Reno/Tahoe area) and Southwest’s pipeline (extending from Laughlin/Bullhead City to the Las Vegas valley) are indicated. The LNG facility is located near Lovelock, Nevada.]

10

Litigation is pending in California and Arizona relating to the now terminated acquisition of the Company by ONEOK, Inc. (ONEOK) and the Company’s rejection of the unsolicited offers by Southern Union Company (Southern Union), which is described below.

California Litigation

On December 16, 1998, Arthur Klein filed a purported class action complaint on behalf of himself and shareholders of the Company (excluding defendants and their affiliates and families) in the Superior Court of the State of California in San Diego County (Case No. 726615) against the Company and its directors. The complaint has been amended three times. As amended, the complaint alleges breach of the duties of loyalty, due care, candor and good faith and fair dealing and sets forth claims relating to the Company’s proxy statement for its annual meeting of shareholders in 1999, including allegations of misrepresentations or omissions relating to the proposed acquisition of the Company by ONEOK and the rejection of the Southern Union offers. The complaint, as amended, further seeks to implement an auction of the Company or similar process, unspecified damages, and a declaration that the action is properly maintainable as a class action on behalf of all shareholders.

The case has been removed from the California Superior Court in San Diego to the U.S. District Court for the Southern District of California (Case No. 99 cv 1891-L (JAH)). On October 6, 1999, GAMCO Investors, Inc. and Gabelli Funds LLC filed a notice of appearance in this matter.

Arizona Federal Court Litigation

On July 19, 1999, Southern Union filed a complaint in the United States District Court of Arizona (Civ ’99 1294 PHX ROS), which was amended on October 11, 1999 and July 25, 2000. As amended, the complaint alleges that the Company, Michael O. Maffie, President and Chief Executive Officer of the Company, Thomas Y. Hartley, Chairman of the Board of the Company, and Edward S. Zub, Senior Vice President Regulation and Pricing of the Company, ONEOK, and other named individuals have conspired to block the Company’s shareholders from voting upon Southern Union’s offer and have acted to ensure that the Company’s Board of Directors would approve and recommend the ONEOK offer to the Company’s shareholders and to influence the vote of members of regulatory commissions required to approve the proposed acquisition of the Company by ONEOK in violation of state and federal criminal laws. The complaint, as amended, further alleges that the defendants fraudulently induced Southern Union to enter into the February 21, 1999 confidentiality and standstill agreement, Southwest breached the terms of that agreement and its covenant of good faith and fair dealing, and all defendants, other than Southwest, Mr. Hartley and Mr. Zub, intentionally interfered with a business relationship between the Company and Southern Union and tortiously interfered with contractual relations between the Company and Southern Union. The complaint, as amended, further alleges, that the defendants violated both the federal and Arizona racketeering statutes. On December 15, 2000, the United States District Court for the District of Arizona granted the Company’s motion to dismiss Southern Union’s federal racketeering claim.

Southern Union seeks damages in an amount not less than $750 million to be trebled for the alleged violations of state and federal criminal law, compensatory damages in an amount not less than $750 million, plus interest, rescission of the confidentiality and standstill agreement between the Company and Southern Union and punitive damages.

On January 21, 2000, ONEOK filed a complaint against the Company in the United States District Court for the Northern District of Oklahoma seeking a declaratory judgment that ONEOK properly terminated the merger agreement. On September 18, 2000, this action was transferred to the United States District Court for the District of Arizona.

11

On April 30, 1999, the Company filed a complaint in the U.S. District Court, District of Nevada against Southern Union alleging breach of the confidentiality and standstill agreement between the Company and Southern Union, breach of the implied covenant of good faith and fair dealing, misappropriation of trade secrets, intentional interference with contract, intentional interference with prospective economic advantage, violation of Section 14(a) of the Securities Exchange Act of 1934 and other violations of California and Nevada law. This action was transferred to the U.S. District Court for the District of Arizona on March 8, 2000.

On January 24, 2000, the Company filed a complaint against ONEOK and Southern Union in the U.S. District Court for the District of Arizona (Case No. CIV’00, 0119 PHX ROS). The lawsuit seeks unspecified damages from ONEOK for breach of contract, breach of the implied covenant of good faith and fair dealing, fraud in the inducement, and fraud related to its actions connected to the Merger Agreement and its cancellation of the Merger Agreement.

The Company has also sued Southern Union seeking unspecified damages for breach of contract, breach of the implied covenant of good faith and fair dealing, interference with a contract and misappropriation of trade secrets, all related to Southern Union’s attempts to block the proposed Southwest Gas-ONEOK combination after Southern Union’s unsolicited offers were rejected by the Company.

There is also an ongoing joint federal, state and county criminal investigation in Phoenix, Arizona concerning activities surrounding the failed acquisition of the Company by ONEOK. The Company is cooperating fully with this investigation.

Other Proceedings

The Company has been named as a defendant in various other legal proceedings. The ultimate dispositions of these proceedings are not presently determinable; however, it is the opinion of management that none of this litigation individually or in the aggregate will have a material adverse impact on the Company’s financial position or results of operations.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

PART IIItem 5.MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The principal markets on which the common stock of the Company is traded are the New York Stock Exchange and the Pacific Stock Exchange. At March 13, 2001,1, 2004, there were 24,06023,259 holders of record of common stock, and the market price of the common stock was $20.96.$23.45. The quarterly market price of, and dividends on, Company common stock required by this item are included in the 20002003 Annual Report to Shareholders filed as an exhibit hereto and are incorporated herein by reference.

The Company has a common stock dividend policy which states that common stock dividends will be paid at a prudent level that is within the normal dividend payout range for its respective businesses, and that the dividend will be established at a level considered sustainable in order to minimize business risk and maintain a strong capital structure throughout all economic cycles. The quarterly common stock dividend was 20.5 cents per share throughout 2003. The dividend of 20.5 cents per share has been paid quarterly since September 1994.

Item 6. SELECTED FINANCIAL DATA

Information required by this item is included in the 2000 Annual Report to Shareholders and is incorporated herein by reference.

Information required by this item is included in the 20002003 Annual Report to Shareholders and is incorporated herein by reference.

12

Information responding to Item 7A appearsrequired by this item is included in the 20002003 Annual Report to Shareholders and is incorporated herein by reference.

Item 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Information required by this item is included in the 2003 Annual Report to Shareholders under the heading “Management’s Discussion and Analysis” and under Notes 6 and 7 of the Notes to Consolidated Financial Statements. This informationStatements and is incorporated herein by reference. Other risk information is included under the heading “Company Risk Factors” inItem 1. Business of this report.Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Consolidated Financial Statements of Southwest Gas Corporation and Notes thereto, together with the reportreports of PricewaterhouseCoopers LLP, Independent Auditors, and Arthur Andersen LLP, Independent Public Accountants, are included in the 20002003 Annual Report to Shareholders and are incorporated herein by reference.

None.

13On May 28, 2002, the Company dismissed Arthur Andersen LLP as its independent auditor. The decision to dismiss Arthur Andersen was recommended by the Company’s Audit Committee and approved by its Board of Directors.

Arthur Andersen’s report on the financial statements of the Company for the year ended December 31, 2001 did not contain an adverse opinion or a disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope, or accounting principles.

During the years ended December 31, 2000 and 2001, and the interim period between December 31, 2001 and May 28, 2002, there were no disagreements between the Company and Arthur Andersen on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Arthur Andersen, would have caused it to make reference to the subject matter of the disagreements in connection with its report. During the years ended December 31, 2000 and 2001, and the interim period between December 31, 2001 and May 28, 2002, there were no reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K promulgated by the SEC). In May 2002, Arthur Andersen furnished the Company with a letter addressed to the SEC stating that it agrees with the statements above. A copy of the letter was included as an exhibit to the Form 8-K filed by the Company in May 2002.

The Company engaged PricewaterhouseCoopers LLP as its independent auditor, effective May 28, 2002. During the years ended December 31, 2000 and 2001, and the interim period between December 31, 2001 and May 28, 2002, neither the Company nor anyone on its behalf consulted with PricewaterhouseCoopers LLP regarding (i) the application of accounting principles to a specified transaction, either completed or proposed, (ii) the type of audit opinion that might be rendered on the Company’s financial statements, or (iii) any matter that was either the subject of a disagreement (as described above) or a reportable event.

The Company has not been able to obtain, after reasonable efforts, the written consent of Arthur Andersen to the incorporation by reference in the Company’s previously filed Form S-3 Registration Statements (Nos. 333-98995 and 333-106419) and Form S-8 Registration Statements (Nos. 333-31223, 333-106762 and 333-111034) of the report of Arthur Andersen on the 2001 financial statements included in this Annual Report, as required by the Securities Act of 1933. Therefore, in reliance on Rule 437a promulgated under the Securities Act of 1933, the Company has dispensed with the requirement to file a written consent from Arthur Andersen with this Annual Report. As a result, the ability of persons who purchase the Company’s securities pursuant to these Registration Statements to assert claims against Arthur Andersen may be limited.

Because the Company has not been able to obtain the written consent of Arthur Andersen, such persons may not have an effective remedy against Arthur Andersen for any untrue statements of a material fact contained in Arthur Andersen’s report or the financial statements covered thereby or any omissions to state a material fact required to be stated therein.

The Company has established disclosure controls and procedures that are designed to provide reasonable assurance that information required to be disclosed in reports filed or submitted under the Securities Exchange Act of 1934 is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and benefits of controls must be considered relative to their costs. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or management override of the control. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

Based on the most recent evaluation, as of December 31, 2003, management of the Company, including the Chief Executive Officer and Chief Financial Officer, believe the Company’s disclosure controls and procedures are effective at attaining the level of reasonable assurance noted above.

There have been no changes in the Company’s internal controls over financial reporting during the fourth quarter that have materially affected, or are likely to materially affect, the Company’s internal controls over financial reporting.

PART IIIItem 10.DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

Item 10. DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

(a)Identification of Directors.Information with respect to Directors is set forth under the heading “Election of Directors” in the definitive 2004 Proxy Statement, dated March 31, 2001, which by this reference is incorporated herein.

(b)Identification of Executive Officers.The name, age, position, and period position held during the last five years for each of the Executive Officers of the Company are as follows:

Name | Age | Position | ||||||

Period Position | ||||||||

Michael O. Maffie | 56 | Chief Executive Officer | 2003-Present | |||||

| President and Chief Executive Officer | ||||||||

Jeffrey W. Shaw | 45 | President | 2003-Present | |||||

| Senior Vice President/Gas Resources and Pricing | 2002-2003 | |||||||

| Senior Vice President/Finance and Treasurer | 2000-2002 | |||||||

| Vice President/Treasurer | 1999-2000 | |||||||

George C. Biehl | 56 | Executive Vice President/Chief Financial Officer and | ||||||

| Corporate Secretary | 2000-Present | |||||||

| Senior Vice President/Chief Financial Officer and | | |||||||

| Corporate Secretary | 1999-2000 | |||||||

James P. Kane | 57 | Executive Vice President/Operations | 2000-Present | |||||

| Senior Vice President/Operations | ||||||||

Edward S. Zub | 55 | Executive Vice President/Consumer Resources and | ||||||

| Energy Services | 2000-Present | |||||||

| Senior Vice President/Regulation and Product Pricing | | 1999-2000 | ||||||

James F. Lowman | 57 | Senior Vice President/Central Arizona Division | ||||||

Thomas R. Sheets | 53 | Senior Vice President/Legal Affairs and General Counsel | 2000-Present | |||||

| Vice President/General Counsel | ||||||||

Dudley J. Sondeno | 51 | Senior Vice President/Chief Knowledge and | ||||||

| Technology Officer | ||||||||

Roy R. Centrella | 46 | Vice President/Controller and Chief Accounting Officer | ||||||

| Controller | 2001-2002 | |||||||

| �� | Assistant Controller | 1999-2001 | ||||||

Kenneth J. Kenny | 41 | Treasurer | 2003-Present | |||||

| Assistant Treasurer/Director Financial Services | 2000-2003 | |||||||

| Senior Manager/Treasury | 1999-2000 |

(c)Identification of Certain Significant Employees.Employees. None.

(d)Family Relationships.No Directors or Executive Officers are related to any other either by blood, marriage, or adoption.

(e)Business Experience.Information with respect to Directors is set forth under the heading “Election of Directors” in the definitive 2004 Proxy Statement, dated March 31, 2001, which by this reference is incorporated herein. All Executive Officers have held responsible positions with the Company for at least five years as described in (b) above.

(f)Involvement in Certain Legal Proceedings.None.

(g)Promoters and Control Persons.None.

(h) Audit Committee Financial Expert. Information with respect to the financial expert of the Board of Directors’ audit committee is set forth under the heading “Committees of the Board” in the definitive 2004 Proxy Statement, which by this reference is incorporated herein.

(i) Identification of the Audit Committee. Information with respect to the composition of the Board of Directors’ audit committee is set forth under the heading “Committees of the Board” in the definitive 2004 Proxy Statement, which by this reference is incorporated herein.

Section 16(a) Beneficial Ownership Reporting Compliance.Section 16(a) of the Securities Exchange Act of 1934 requires officers and directors, and persons who own more than ten percent of a registered class of equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission (SEC)SEC and the New York Stock Exchange. Officers, directors, and beneficial owners of more than ten percent of any class of equity securities are required by SEC regulation to furnish the Company with copies of all

Section 16(a) forms they file.

14

The Company has adopted procedures to assist its directors and executive officers in complying with

Section 16(a) of the Securities and Exchange Act of 1934, as amended, which includes assisting in the preparation of forms for filing. For 2000,2003, all but two of the reports were timely filed. An acquisition

Code of 1,000 sharesBusiness Conduct and Ethics.The Company has adopted a code of Company common stockbusiness conduct and ethics for its employees, including its chief executive officer, chief financial officer, chief accounting officer, and non-employee directors. A code of ethics is defined as written standards that are reasonably designed to deter wrongdoing and to promote: 1) honest and ethical conduct; 2) full, fair, accurate, timely, and understandable disclosure in March 2000 by Thomas Hartley, Chairmanreports and documents that a registrant files; 3) compliance with applicable governmental laws, rules, and regulations; 4) the prompt internal reporting of violations of the Boardcode to an appropriate person or persons identified in the code; and 5) accountability for adherence to the code. The Company’s Code of Directors, was not reported but was instead reported in Mr. Hartley’s Form 5 for 2000. Also, an amended Form 4 was filed in January 2001 by James Lowman, anBusiness Conduct & Ethics can be viewed on the Company’s website (www.swgas.com). If any substantive amendments to the Code of Business Conduct & Ethics are made or any waivers are granted, including any implicit waiver, from a provision of the Code of Business Conduct & Ethics, to the Company’s chief executive officer, ofchief financial officer and chief accounting officer, the Company showing an additional 31 shareswill disclose the nature of Company common stock (performance shares) acquired throughsuch amendment or waiver on the Management Incentive Plan.Company’s website, www.swgas.com.

| Item 11. | ||

| EXECUTIVE COMPENSATION |

Information with respect to executive compensation is set forth under the heading “Executive Compensation and Benefits” in the definitive 2004 Proxy Statement, dated March 31, 2001, which by this reference is incorporated herein.

| Item 12. | ||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

(a)Security Ownership of Certain Beneficial Owners.Information with respect to security ownership of certain beneficial owners is set forth under the heading “Securities Ownership by Directors, Director Nominees, Executive Officers, and Certain Beneficial Owners” in the definitive 2004 Proxy Statement, dated March 31, 2001, which by this reference is incorporated herein.

(b)Security Ownership of Management.Information with respect to security ownership of management is set forth under the heading “Securities Ownership by Directors, Director Nominees, Executive Officers, and Certain Beneficial Owners” in the definitive 2004 Proxy Statement, dated March 31, 2001, which by this reference is incorporated herein.

(c)Changes in Control.Control. None.Item 13.CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

(d)Securities Authorized for Issuance Under Equity Compensation Plans.

At December 31, 2003, the Company had two stock-based compensation plans. With respect to the first plan, the Company may grant options to purchase shares of common stock to key employees and outside directors.

| Equity Compensation Plan Information | |||||||

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance | ||||

(Thousands of shares) | |||||||

Equity compensation plans approved by security holders | 1,502 | $ | 21.83 | 1,016 | |||

Equity compensation plans not approved by security holders | — | — | — | ||||

Total | 1,502 | $ | 21.83 | 1,016 | |||

Pursuant to the terms of the management incentive plan, the Company may issue restricted stock in the form of performance shares to encourage key employees to remain in its employment to achieve short-term and long-term performance goals.

Plan category | Number of securities to be issued upon vesting of performance shares | Weighted-average grant date fair value of award | Number of securities remaining available for future issuance | ||||

(Thousands of shares) | |||||||

Equity compensation plans approved by security holders | 381 | $ | 21.41 | — | |||

Equity compensation plans not approved by security holders | — | — | — | ||||

Total | 381 | $ | 21.41 | — | |||

Additional information regarding the two equity compensation plans is included in Note 9 of the Notes to Consolidated Financial Statements in the 2003 Annual Report to Shareholders.

Item 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

None.

15

PART IVItem 14.EXHIBITS, FINANCIAL STATEMENT SCHEDULES, AND REPORTS ON FORM 8-K

Item 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES, AND REPORTS ON FORM 8-K

(a) The following documents are filed as part of this report on Form 10-K:

| (1) | The Consolidated Financial Statements of the Company (including the |

Consolidated Balance Sheets | 37 | |

Consolidated Statements of Income | ||

Consolidated Statements of Cash Flows | ||

Consolidated Statements of Stockholders’ Equity | ||

Notes to Consolidated Financial Statements | ||

Report of Independent Auditors | 62 | |

Report of Independent Public Accountants |

| (2) | All schedules have been omitted because the required information is either inapplicable or included in the Notes to Consolidated Financial Statements. |

| (3) | SeeLIST OF |

(b) Reports on Form 8-K.

On February 17, 2004, the Company furnished summary financial information for the quarter and year ended December 31, 2003 pursuant to Item 12 of Form 8-K.

(c) SeeLIST OF EXHIBITS.

| Exhibit Number | Description of Document | |

| 3(i) | | |

(c) SeeLIST OF EXHIBITS.

16

LIST OF EXHIBITS

| Restated Articles of Incorporation, as amended. Incorporated herein by reference to the report on Form 10-Q for the quarter ended March 31, 1997. | |||

| 3(ii) | Amended Bylaws of Southwest Gas Corporation. Incorporated herein by reference to the report on Form 10-Q for the quarter ended September 30, 2003. | ||

| Indenture between Clark County, Nevada, and Harris Trust and Savings Bank as Trustee, dated December 1, 1993, with respect to the issuance of $75,000,000 Industrial Development Revenue Bonds (Southwest Gas Corporation), 1993 Series A, due 2033. Incorporated herein by reference to the report on Form 10-K for the year ended December 31, 1993. | |||

| Indenture between City of Big Bear Lake, California, and Harris Trust and Savings Bank as Trustee, dated December 1, 1993, with respect to the issuance of $50,000,000 Industrial Development Revenue Bonds (Southwest Gas Corporation Project), 1993 Series A, due 2028. Incorporated herein by reference to the report on Form 10-K for the year ended December 31, 1993. | |||

| 4.03 | Form of Deposit Agreement. Incorporated herein by reference to the Registration Statement on Form S-3, No. 33-55621. | ||

| 4.04 | Form of Depositary Receipt (attached as Exhibit A to Deposit Agreement included as Exhibit 4.03 hereto). Incorporated herein by reference to the Registration Statement on Form S-3, No. 33-55621. | ||

| 4.05 | Indenture between the Company and Harris Trust and Savings Bank dated July 15, 1996, with respect to Debt Securities. Incorporated herein by reference to the report on Form 8-K dated July 26, 1996. | ||

| First Supplemental Indenture of the Company to Harris Trust and Savings Bank dated August 1, 1996, supplementing and amending the Indenture dated as of July 15, 1996, with respect to 7 1/2% and 8% Debentures, due 2006 and 2026, respectively. Incorporated herein by reference to the report on Form 8-K dated July 31, 1996. | |||

| Second Supplemental Indenture of the Company to Harris Trust and Savings Bank dated December 30, 1996, supplementing and amending the Indenture dated as of July 15, 1996, with respect to Medium-Term Notes. Incorporated herein by reference to the report on Form 8-K dated December 30, 1996. | |||

17

| 4.08 | ||

| Indenture between Clark County, Nevada, and Harris Trust and Savings Bank as Trustee, dated as of October 1, 1999, with respect to the issuance of $35,000,000 Industrial Development Revenue Bonds (Southwest Gas Corporation), Series 1999A and Taxable Series 1999B or convertibles of Series B (Series | ||

| 4.09 | Third Supplemental Indenture between the Company and The Bank of New York, dated as of February 13, 2001, supplementing and amending the Indenture dated as of July 15, 1996, with respect to the $200,000,000, 8.375% Notes, due 2011. Incorporated herein by reference to the report on Form 8-K dated February 8, 2001. | |

| 4.10 | Fourth Supplemental Indenture of the Company to The Bank of New York as successor to Harris Trust and Savings Bank dated as of May 6, 2002, supplementing and amending the Indenture dated as of | |

| July 15, 1996, with respect to the 7.625% Senior Unsecured Notes due 2012. Incorporated herein by reference to the report on Form 8-K dated May 1, 2002. | |||

| 4.11 | Certificate of Trust of Southwest Gas Capital II. Incorporated herein by reference to the Registration Statement on Form S-3, No. 333-106419. | ||

| 4.12 | Certificate of Trust of Southwest Gas Capital III. Incorporated herein by reference to the Registration Statement on Form S-3, No. 333-106419. | ||

| 4.13 | Certificate of Trust of Southwest Gas Capital IV. Incorporated herein by reference to the Registration Statement on Form S-3, No. 333-106419. | ||

| 4.14 | Trust Agreement of Southwest Gas Capital III. Incorporated herein by reference to the Registration Statement on Form S-3, No. 333-106419. | ||