Our core technologies include our proprietary VGF technique used to produce high quality crystals that are processed into compound substrates, and the technologies of our joint venture companies,

which enable us to manufacture a range of products that are used in the manufacture of compound semiconductor substrates or can be sold as raw materials to third parties.

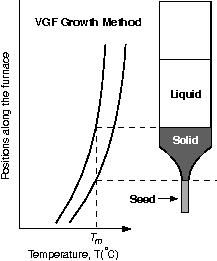

Our VGF technique is designed to control the crystal-growth process with minimal temperature variation and is the current technique we use to produce our GaAs, InP and Ge substrates. Unlike traditional techniques, our VGF technique places the hot compound melt above the cool crystal, and minimizes the temperature gradient between the crystal and the melt which reduces the turbulence at the interface of the melt and the solid crystal. In comparison, in the LEC technique the melt and crystal are inverted, there is a higher temperature gradient between the melt and the crystal, and more turbulence at the interface of the melt and solid crystal. These aspects of the VGF technique enable us to grow crystals that have a relatively low defect density and high uniformity. The crystal and the resulting substrate are mechanically strong, resulting in lower breakage rates during a customer’scustomer's manufacturing process. Since the temperature gradient is controlled electronically rather than by physical movement, the sensitive crystal is not disturbed as it may be during some competitors’competitors' VGF-like growth processes. In addition, the melt and growing crystal are contained in a closed chamber, which isolates the crystal from the outside environment to reduce potential contamination. This substrate isolation allows for more precise control of the gallium-to-arsenic ratio, resulting in better consistency and uniformity of the crystals.

Our Although we are exploring the use of other methods to control the crystal-growth process, including the CZ and LEC methods for select applications, for our traditional GaAs substrates, our VGF technique offers several benefits for producing our GaAs substrates when compared to traditional crystal growing technologies. The HBHorizontal Bridgman (HB) technique is the traditional method for producing semi-conducting GaAs substrates for opto-electronic applications. The HB technique holdsapplications, but because of the techniques used to hold the GaAs melt, in a semi-cylindrical container, causing crystals grown using the HB method to have a semi-circular, or D-shaped, cross-section. Accordingly, more crystal material is discarded when the D-shaped substrate is subsequently trimmed to a round shape. In addition, crystals grown using the HB technique have a higher defect density than VGF-grown crystals. The HB technique cannot be used cost-effectively to produce substrates greater than three inches in diameter. TheIn addition, the HB technique houses the GaAs melt in a quartz container during the growth process, which can contaminate the GaAs melt with silicon impurities, making it unsuitable for producing semi-insulating GaAs substrates.

Our VGF technique also offers advantages over the LEC technique for producing semi-insulating GaAs substrates for electronicwireless applications. During the LEC process, the crystal is grown by dipping a seed crystal through molten boric oxide into a melt of gallium and arsenic poly-crystal material and slowly pulling the seed up into the cool zone above the boron oxide where the crystal hardens. Unlike the VGF technique, the LEC technique is designed so that the hotter GaAs melt is located beneath the cooler crystal, resultingcan result in greater turbulence in the melt, and at a temperature gradient that is significantly higher than the VGF technique. The turbulence and high temperature gradienttechnique, which can cause LEC-grown crystals to have a higher dislocation density than VGF-grown crystals, resulting in a higher rate of breakage during the device manufacturing process. As an open process,However, the LEC technique also results in greater propensitycan be useful for contaminationGaAs semi-conducting substrates since the LED application specifications and difficulty controlling the ratiorequirements are less stringent than those of gallium to arsenic. It requires large, complex electro-mechanical systems that are expensive and require highly skilled personnel to operate.

The following table provides a comparison of these three techniques: in 2003, LEC retains about 40% of the semi-insulating market and HB is still present in the semi-conducting or opto-electronics market.wireless applications.

|

|

| ||||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

|

We design, develop, manufacture and distribute high-performance semiconductor substrates. We make semi-insulating GaAs substrates used in applications such as amplifiers and switches for wireless handsets, and semi-conducting GaAs substrates used to create opto-electronic products including HBLEDs, which are often used to backlight wireless handsets and LCD TVs and for automotive and general illumination applications. InP is a high performance semiconductor substrate used in broadband and fiber optic applications. Ge substrates are used in emerging applications such as triple junction solar cells for space and terrestrial photovoltaic applications and for optical applications.

The table below sets forth our products and selected applications:

| Product | Applications | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Substrates | Electronic | Opto-electronic | |||||||||||||

|

|

| • | LEDs | |||||||||||

|

|

| |||||||||||||

|

| Lasers | |||||||||||||

| High-performance transistors |

| Optical couplers | ||||||||||||

| Satellite communications | ||||||||||||||

InP |

| Fiber optic communications |

| Lasers | |||||||||||

| Satellite communications | ||||||||||||||

| High-performance transistors | ||||||||||||||

| Automotive collision avoidance radar | ||||||||||||||

Ge |

| Satellite solar cells | • | Optical applications | |||||||||||

Substrates.We currently sell compound substrates manufactured from GaAs and InP, as well as single-element substrates manufactured from Ge. We supply GaAs substrates in two-, three-, four-, five- and six-inch diameters. We manufacture InP substrates in two-, three- and four-inch diameters and Ge substrates in two- and four-inch diameters.

Materials.We participate in five joint ventures in China that sell raw materials used by us in substrate manufacturing and by others. These joint ventures produce products including 99.99% pure gallium (4N Ga), high purity gallium, arsenic, and germanium, germanium dioxide, paralytic boron nitride (pBN) crucibles, and boron oxide (B2O3)(B2O3). In 2005,2007 and 2006, sales of raw materials to parties other than us were approximately $4.8$13.8 million and $5.3 million, respectively, which comprised of all of these products.

We sell our compound semiconductor substrates and materials worldwide. Our top revenue producing customers include:

| Avago Technologies Manufacturing (Singapore) Pte. Ltd. | • | Intelligent Epitaxy Technology |

|

| Picogiga International SAS | ||||

|

|

| • | IQE (Europe) Limited | • | Recapture Metals Limited | ||||

|

| China Electronics Technology Group | • | IQE, plc. | • | Sumika Epi Solution Co., Ltd. | ||||

|

|

| ||||||||

|

| • | Ningbo Ker Ning Da Ri Fang Magnet Co., Ltd. | • | Visual Photonics Epitaxy Co., Ltd. | |||||

|

| Epitech Technology Corporation | • | MBE Technology Pte. Ltd. | • | Xiamen Sanan Electronics Co., Ltd. | ||||

|

| Epiworks, Inc. | • | MCP, UK. | • | Xiamen Xinde Co., Ltd. | ||||

| • | Freescale Semiconductor, Inc. | • | Osram Opto Semiconductors GmbH |

Historically, we have sold a significant portion of our products in any particular period to a limited number of customers. TwoNo customer represented greater than 10% of revenue for the year ended December 31, 2007, while one customer, Visual Photonics Epitaxy Co., Ltd., represented greater than 10% of revenue, totaling 12.8%, for the year ended December 31, 2006, while two customers, Osram Opto Semiconductors GmbH, and MBE Technology Pte. Ltd., represented greater than 10% of revenue, totaling 20.7%, for the year ended December 31, 2005, while no customers represented greater than 10% of revenue for the years ended December 31, 2004 and 2003. The company’s2005. Our top five customers represented 37.5%33.0% of revenues for the year ended December 31, 2005, 30.1% ofour revenue for the year ended December 31, 2004, and 28.9%2007, 40.0% of our revenue for the year ended December 31, 2003.2006, and 37.5% of our revenue for the year ended December 31, 2005. We expect that sales to a small number of customers will continue to comprise a significant portion of our revenue in the future.

The There have been no third party customers for our raw materials products are in many instancesthat account for greater than 10% of revenue for the same as our customers for substrates.years ended December 31, 2007, 2006 and 2005. Our joint ventures are a key strategic benefit for us as they give us a strong competitive advantage of allowing our customers to work with one supplier for all their substrate and raw material requirements.

Manufacturing, Raw Materials and Supplies

We believe that our results are partially due to our manufacturing efficiency and high product yields and we continually emphasize quality and process control throughout our manufacturing operations. We performmanufacture all of our substrate manufacturing operationsproducts at our facilities in Beijing, China. During 2004, we discontinued our manufacturingChina, which generally has favorable costs for facilities and research and development activities at our Fremont, California facility.labor. We believe that our capital investment and subsequent operating costs are lower for our manufacturing facilities in China relative to the U.S. Many of our manufacturing operations are fully automated and computer monitored or controlled, enhancing reliability and yield.yield, and we expect to continue to improve our processes and increase the number of automated processes in 2008. We use proprietary equipment in our substrate manufacturing operations to protect our intellectual property and control the timing and pace of capacity additions. All of our manufacturing facilities are ISO 9001 or 9002 certified. In January 2006, our Beijing facility successfully passed the ISO 14001 certification audit,audit.

We have five joint ventures in China that provide us favorable pricing, reliable supply and we expectshorter lead-times for raw materials central to receive the final documentationour manufactured productsm including gallium, arsenic, germanium, germanium dioxide, pyrolitic boron nitride crucibles, and boron oxide. We believe that these joint ventures and investments will be advantageous in the first quarter of 2006.

Althoughprocuring materials to support our growth and cost management goals. In addition, we purchase supply parts, components and raw materials from several other domestic and international suppliers, wesuppliers. We depend on a single or limited number of suppliers for certain critical materials used in the production of our substrates, such as quartz tubing, and polishing solutions. We generally purchase these materials through standard purchase orders and not pursuant to long-term supply contracts. Although we seek to maintain sufficient inventory levels of certain materials to guard against interruptions in supply and to meet our near term needs, and have to date been able to obtain sufficient supplies of materials in a timely manner, there may be shortages of certain key materials, such as gallium.

Accordingly, to help ensure continued supply of materials, we formed five joint ventures with and made investments in some suppliers of key raw materials required to manufacture our products, including gallium, arsenic, germanium, germanium dioxide, pyrolitic boron nitride crucibles, and boron oxide. We believe that these joint ventures and investments will be advantageous in procuring materials to support our growth and cost management goals.

We advertise in trade publications, distribute promotional materials, conduct marketing and sales programs, and participate in industry trade shows and conferences in order to raise market awareness of our products.

We sell our substrate products direct to customers through our direct sales force in the U.S. and through independent sales representatives in France, Germany, Japan, South Korea, Taiwan and the United Kingdom. Our direct sales force is knowledgeable in the use of compound and single-element substrates. Our applications engineers work with customers during all stages of the substrate

manufacturing process, from developing the precise composition of the substrate through manufacturing and processing the substrate to the customer’scustomer's specifications. We believe that maintaining a close relationship with customers and providing them with ongoing engineering support improves customer satisfaction and will provide us with a competitive advantage in selling other substrates to our customers. The substrate division launched a program in late 2000 with selected customers in which we guaranteed that certain volumes of six-inch GaAs and other substrates would be delivered on specific dates and the customer made a prepayment for part of the value of the entire order. Several major customers participated in this program. As of December 31, 2005, the unearned pre-payments we retain under this program equaled $125,000. We do not expect to continue this program.

International Sales.International sales are an important part of our business. For the year ended December 31, 2005, salesSales to customers outside North America (primarily United States) accounted for 80.5%80% of our revenue as compared with 78.8% in 2004,2007, 71% of our revenue in 2006 and with 65.4%81% of our revenue in 2003.2005. The primary markets for sales of our substrate products outside of the United States include countriesare to customers located in Asia and Western Europe.

In 2005, we increased our focus in our five joint ventures. In 2006, We also sell through our joint ventures we plan to expand our raw material offering that will includematerials including 4N, 6N, and 7N gallium, boron oxide, (B2O3), germanium, arsenic, germanium dioxide, paralytic boron nitride (pBN) crucibles used in crystal growth and parts for MBE (Molecular Beam Epitaxy). Our joint ventures are a key strategic benefit for us as they give us a strong competitive advantage of allowing our customers to work with one supplier for all their substrate and raw material requirements.

To maintain and improve our competitive position, we focus our research and development efforts on designing new proprietary processes and products, improving the performance of existing products and reducing manufacturing costs. We have assembled a multi-disciplinary team of skilled scientists, engineers and technicians to meet our research and development objectives.

Our current substrate research and development activities focus on continued development and enhancement of GaAs, InP and Ge substrates, including haze reduction, improved yield, enhanced surface and electrical characteristics and uniformity, greater substrate strength and increased crystal length. During 2005,2007, we continued to spend some research and development resources to reduce surface quality problems we experienced with our GaAs and InP substrates for some customers, particularly related to surface morphology. We continue to work on issues related to surface quality.

Research and development expenses were $1.7 million in 2005,2007, compared with $1.5$2.4 million in 20042006 and $1.3$1.7 million in 2003.2005. We expect to maintainmodestly increase our rate of expenditure on research and development costs in 2006.2008 as we explore other methods to grow our crystals.

Research and development at our joint ventures will remain at a minimal level.has been minimal.

The semiconductor substrate industry is characterized by rapid technological change and price erosion, as well as intense foreign and domestic competition. We believe we currently have a leading position in the market for GaAs substrates for HBLED applications primarily as a result of our expertise in VGF technology, overall product quality, response times and prices. However, we face actual and potential competition from a number of established domestic and international companies who may have advantages not available to us.us including substantially greater financial, technical and marketing resources; greater name recognition; and more established relationships in the industry and may utilize these advantages to expand their product offerings more quickly, adapt to new or emerging technologies and changes in customer requirements more quickly, and devote greater resources to the marketing and sale of their products.

We believe that the primary competitive factors in the markets in which our substrate products compete are:

·

- •

- quality;

· - •

- price;

·

- •

- performance;

· - •

- meeting customer specifications; and

· - •

- customer support and satisfaction.

Our ability to compete in target markets also depends on factors such as:

·

- •

- the timing and success of the development and introduction of new products and product features by us and our competitors;

· - •

- the availability of adequate sources of raw materials;

· - •

- protection of our products by effective use of intellectual property laws; and

· - •

- general economic conditions.

A compound semiconductor substrate customer typically has two or three substrates suppliers that it has qualified for the production of its products. These qualified suppliers must meet industry-standard specifications for quality, on-time delivery and customer support. Once a substrate supplier has qualified with a customer, price, consistent quality and current and future product delivery lead times become the most important competitive factors. A supplier that cannot meet customers' current lead times or that a customer perceives will not be able to meet future demand and provide consistent quality can lose current market shares. Our primary competition in the market for compound semiconductor substrates includes China Crystal Technologies, Freiberger Compound Materials, Japan Energy, Mitsubishi Chemical Corporation, and Sumitomo Electric Industries. We believe that at least two of our competitors are shipping high volumes of GaAs substrates manufactured using a technique similar to our VGF technique. In addition, as a result of quality problems that we have experienced, we believe that some customers have allocated some of their requirements for VGF grown substrates across more competitors and we believe that we may have lost revenue and market share as a result of these customer decisions. In addition, we also face competition from compound semiconductor device manufacturers that produce substrates for their own internal use, including Hitachi, and from companies such as IBM that are actively developing alternative compound semiconductor materials.

We are the only compound semiconductor substrate supplier to offer a full suite of raw materials and we believe that it gives us a strong competitive advantage in our marketplace.

Protection of our Intellectual Property

Our success and the competitive position of our VGF technique depend on our ability to maintain trade secrets and other intellectual property protections. We rely on a combination of patents, trademark and trade secret laws, non-disclosure agreements and other intellectual property protection methods to protect our proprietary technology. We believe that, due to the rapid pace of technological innovation in the markets for our products, our ability to establish and maintain a position of technology leadership depends as much on the skills of our development personnel as upon the legal protections afforded our

existing technologies. To protect our trade secrets, we take certain measures to ensure their secrecy, such as executing non-disclosure agreements with our employees, customers and suppliers. However, reliance on trade secrets is only an effective business practice insofar as trade secrets remain undisclosed and a proprietary product or process is not reverse engineered or independently developed.

To date, we have been issued two U.S.US patents and have three U.S. patent applications pending, which relate to our VGF products and processes.processes that expire in 2021 and 2016, respectively. We have twenty-threetwo US patent applications pending, seven foreign patent applications pending (in PCT/Patent Cooperation Treaty ("PCT")/national stage process) in Europe, Canada, China, Japan and South Korea which are based on our U.S.US patents that relate to our VGF processes. We have two issued foreign patents.

In connection with a final settlement of litigation, we entered into a global intellectual property cross-licensing agreement with Sumitomo Electric Industries, Ltd. (SEI). Under the terms of the settlement, we will make on-going royalty payments through 2012 on certain products sold by us in Japan.

In the normal course of business, we periodically receive and make inquiries regarding possible patent infringement. In dealing with such inquiries, it may become necessary or useful for us to obtain or grant licenses or other rights. However, there can be no assurance that such licenses or rights will be available to us on commercially reasonable terms. If weare not able to resolve or settle claims, obtain necessary licenses on commercially reasonable terms and/or successfully prosecute or defend its position, our business, financial condition and results of operations could be materially and adversely affected.

Environmental Regulations

We are subject to federal, state and local environmental laws and regulations, including laws in China as well as the U.S. These laws, rules and regulations govern the use, storage, discharge and disposal of hazardous chemicals during manufacturing, research and development and sales demonstrations. We maintain a number of environmental, health and safety programs that are primarily preventive in nature. As part of these programs, we regularly monitor ongoing compliance. If we fail to comply with applicable regulations, we could be subject to substantial liability for clean-up efforts, personal injury and fines or suspension or cessation of our operations.

As of December 31, 2005,2007, we had 8421,057 employees, of whom 680857 were principally engaged in manufacturing, 116 in sales and administration, and 4684 in research and development. Of these employees, 5538 are located in the U.S., and 7871,019 in China. As of December 31, 2004,2006, we had 1,0101,022 employees, of whom 854819 were principally engaged in manufacturing, 112119 in sales and administration, and 4484 in research and development. Of these employees, 6539 were located in the U.S., 943and 983 in China and 2 in Japan.China.

As a result of shifting more of our substrate manufacturing to China, we continued to reduce our headcount in our Fremont, California facility and accordingly announced our restructuring plan in In December 2005, which would eliminate approximately 15 positions over the next 120 days. Earlier in 2005, we also reduced our workforce at our Beijing, China manufacturing facility as part of our ongoing effort to reduce our cost structureFremont, California facility headcount, we reduced the workforce at the facility by 15 full-time equivalent positions that we no longer required to support production and bring capacity in line with current market demand.operations, or approximately 29% of the workforce based at this facility. Some of our employees in China are represented by a union, but we have never experienced a work stoppage. Although morale has been affected by our workforce reductions in California, we consider our relations with our employees to be good.

Our principal executive offices are located at 4281 Technology Drive, Fremont, CA 94538, and our main telephone number is (510) 683-5900. The public may read and copy any material we file with the Securities and Exchange Commission, or SEC, at the SEC’sSEC's Public Reference Room at 450 Fifth Street, N.W., Washington D.C., 20549. The public may obtain information on the operations of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site,http://www.sec.gov, that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

11 Our web site is www.axt.com. We make available, free of charge, on or through our web site, our annual, quarterly and current reports, and any amendments to those reports as soon as reasonably practicable after those reports are filed with the SEC. The information on our seb site does not constitute a part of this Annual Report on Form 10-K and is not incorporated herein.

For ease of reference, we have divided these risks and uncertainties into the following general categories:

- •

- Risks related to our general business;

- •

- Risks related to international aspects of our business;

- •

- Risks related to our financial results and capital structure;

- •

- Risks related to our intellectual property; and

- •

- Risks related to compliance and other legal matters.

Risks Related to Our General Business

Our operatingThe Chinese Government has indicated that it plans to shutdown polluting factories for nine weeks within a 200 kilometer radius of Beijing to clear the smog for the 2008 Olympics, and if such restrictions are imposed on our facilities, it could materially and adversely impact our results depend in large part on further customer acceptance of operations and our existing substrate products manufactured in China.financial condition.

As Although we are now manufacturing only in China, if the shift of our substrate manufacturing operations to China is to be successful,do not currently believe that we will needhave any of the following restrictions imposed on us, and we currently understand from the Chinese authorities that our customers to qualify products manufactured in China. If weoperations are unable to continue to achieve qualifications for these products, our China facility will be underutilized, our investments in Chinanot a polluting factory and will not be recoupedaffected by these restrictions, the Chinese government has indicated that it plans to shutdown polluting factories for nine weeks from July 17, 2008 through September 20, 2008 within a 200 kilometer radius of Beijing to clear the smog for the 2008 Olympics and weParalympics. The areas reported to be affected include Beijing, Tianjin, Hebei, Shanxi, Inner Mongolia and Shandong provinces. The radius could be expanded by the Chinese Government if the air quality does not improve sufficiently prior to the Olympic Games. In addition, there could be a shut down of material transportation and power plants to clear the air. Some polluting factories have been given time limits to reduce emissions and others will have restricted operations from August 8, 2008 to August 24, 2008. Some companies may have to adjust their production time, some may have to reduce production and some may have to suspend their operations during this period, particularly businesses in heavily-polluting industries of power, iron and steel, chemicals and concrete. If, in the future, restrictions are imposed on our operations, including any requirement to curtail or close production during the Olympic Games, our ability to meet customer demand or supply current or new orders would be unablesignificantly impacted. Customers could then be required to lowerpurchase product from our costs by movingcompetitors, causing our competitors to China.take market share from us, and could result in our customers supplying future needs from our competitors. Land transportation and air transportation of certain raw materials is likely to be restricted during this period as well. Restrictions on material transport could limit our ability to transport our product, and could result in bottlenecks at shipping ports, limiting our ability to deliver products to our customers. We may lose salesincrease our stock of critical materials (such as arsenic, gallium, and other chemicals) for use during the period that these restrictions are likely to last, which will increase our products to competitors who are not manufacturinguse of cash and increase in China, or whose operations in China have already been qualified by customers. If customers do not fully qualify our China production, we may lose additional customers and fail to achieve revenue growth.

Furthermore, some customers reduced their orders from us until our surface quality is as good and consistent as that offered by competitors. As a result, some customers allocated their requirements for compound semiconductor substrates across more competitors and although our quality is improving, resulting in increased sales, we believe that we have lost revenue and market share as a resultinventory level. Any of these customer decisions, which we may be unable to recover. If we are unable to recoverrestrictions could materially and retainadversely impact our market share, we may be unable to growresults of operations and our business.financial condition.

Defects in our products could diminish demand for our products.

Our products are complex and may contain defects. We have experienced quality control problems with somemany of our products, which caused customers to return products to us, reduce orders for our products, or both. Although our quality has improved, resulting in some increases in product sales, we believe that we continue to experience some reduction in orders as a result of our prior product quality problems. If we continue to experience quality control problems, or experience these or other problems in new products, customers may cancel or reduce orders or purchase products from our competitors,

we may be unable to maintain or increase sales to our customers and sales of our products could decline. Defects in our products could cause us to incur higher manufacturing costs and suffer product returns and additional service expenses, all of which could adversely impact our operating results.

If new products developed by us contain defects when released, our customers may be dissatisfied and we may suffer negative publicity or customer claims against us, lose sales or experience delays in market acceptance of our new products.

If we fail to comply with environmental and safety regulations, we may be subject to significant fines or cessation of our operations; in addition, we could be subject to suits for personal injuries caused by hazardous materials.

We are subject to federal, state and local environmental and safety laws and regulations in all of our operating locations, including laws and regulations of China, including, but not limited to, regulations related to the development, manufacture and use of our products, the operation of our facilities, and the use of our real property. These laws, rules and regulations govern the use, storage, discharge and disposal of hazardous chemicals during manufacturing, research and development, and sales demonstrations. If we fail to comply with applicable regulations, we could be subject to substantial liability for clean-up efforts, personal injury and fines or suspension or cessation of our operations, and/or the suspension or termination of development, manufacture or use of certain of our products, or may affect the operation of our facilities or use of our real property, each of which could have a material adverse effect on our business, financial condition and results of operations.

In March 2001, we settled a claim made by the California Occupational Safety and Health Administration, or Cal-OSHA, in an investigation primarily regarding impermissible levels of potentially

hazardous materials in certain areas of our manufacturing facility in Fremont, California for $200,415, and during 2004 we were the target of press allegations and correspondence purportedly on behalf of current and/or former employees concerning our environmental compliance programs and exposure of our employees to hazardous materials. In June 2005, a complaint was filed against us and a current and former officer, alleging personal injury, general negligence, intentional tort, wage loss and other damages, including punitive damages, as a result of exposure of defendants, who are former employees of AXT, including a minor child in utero, to high levels of gallium arsenide in gallium arsenide wafers, and methanol. There is a possibility that other current and/or former employees may bring additional litigation against us. Although we have put in place engineering, administrative and personnel protective equipment programs to address these issues, our ability to expand or continue to operate our present locations could be restricted or we could be required to acquire costly remediation equipment or incur other significant expenses. Existing or future changes in laws or regulations in the United States and China may require us to incur significant expenditures or liabilities, or may restrict our operations. In addition, our employees could be exposed to chemicals or other hazardous materials at our facilities and we may be subject to lawsuits seeking damages for wrongful death or personal injuries allegedly caused by exposure to chemicals or hazardous materials at our facilities.

Litigation is inherently uncertain and while we would expect to defend ourselves vigorously, it is possible that our business, financial condition, results of operations or cash flows could be affected in any particular period by such litigation now pending, and any additional litigation if brought against us.

Existing or future litigation could result in significant judgments against us, or cause us to incur costly settlements.

In June 2005, a complaint was filed against us and a current and former officer, alleging personal injury, general negligence, intentional tort, wage loss and other damages, including punitive damages, as a result of exposure of plaintiffs, who are former employees of AXT, including a minor child in utero, to high levels of gallium arsenide in gallium arsenide wafers, and methanol. In addition, we are defendants in an ongoing securities litigation matter. Litigation is inherently uncertain and while we would expect to defend ourselves vigorously, it is possible that our business, financial condition, results of operations or cash flows could be affected in any particular period by such litigation now pending, and any additional litigation if brought against us. In addition, response to such litigation could divert management’s attention from our business and operations, causing our business and financial results to suffer. We could incur defense or settlement costs in excess of the insurance covering such litigation matters, or such litigation could result in significant judgments against us, in excess of our insurance limits.

Decreases in average selling prices of our products may reduce gross margins.

The market for compound semiconductor substrates is characterized by pressures on average selling prices resulting from factors such as increased competition or overcapacity. We have experienced and expect to continue to experience price pressures on our products, and if average selling prices decline in the future, our revenuesrevenue and gross margins could decline. We may be unable to reduce the cost of our products sufficiently to counteroffset the effect of lower selling prices and allow us to keep pace with competitive pricing pressures, and our margins could be adversely affected.

The loss of one or more of our key substrate customers would significantly hurt our operating results.

A small number of substrate customers have historically accounted for a substantial portion of our total revenue. Our top five customers represented 37.5%, 30.1% and 28.9%33.0% of revenues for the year ended December 31, 2007, 40.0% of revenue for the yearsyear ended December 31, 2005, 2004,2006, and 2003, respectively.37.5% of revenue for the year ended December 31, 2005. We expect that a significant portion of our future revenue will continue to be derived from a limited number of substrate customers. Our customers are not obligated to purchase a specified quantity of our products or to provide us with binding forecasts of

product purchases. In addition, our customers may reduce, delay or cancel orders at any time without any significant penalty, and duringpenalty. In the past, year, we have experienced slower bookings, significant push outspush-outs and cancellation of orders from some customers. If we lose a major customer or if a customer cancels, reduces or delays orders, our revenue would decline. In addition, customers that have accounted for significant revenue in the past may not continue to generate revenue for us in any future period. Any delay in scheduled shipments of our products could cause revenue to fall below our expectations and the expectations of market analysts or investors, causing our stock price to decline.

We may incur claims or other liabilities or obligations related to our failure to follow requirements for testing of products and provision of testing data and information relating to customer requirements. Additionally, customers may cancel or reduce future shipments in response to these failures, or require re-qualifications.

During the first quarter of 2004, we determined that we had not followed requirements for testing of products and provision of testing data and information relating to customer requirements. We notified affected customers concerning our findings, however, there can be no assurance that we will not incur customer claims or other liabilities or obligations in connection with this matter, nor, if we receive any such claims, that we will not have to restate results from prior periods. In addition, revenue in future periods may be adversely impacted if customers decide not to order from us as a result of this disclosure. We experienced several cancellations of future orders by customers pending further information regarding enhancements to our product testing and quality control systems. In addition, some customers are requiring additional qualification of our China operations before placing future orders with us. We cannot be sure that we will not receive additional cancellations of orders by other customers, or fail to win expected future orders from customers, as a result of our disclosure of our investigation conclusions, or that our customers will qualify our China operations and place future orders with us.

Problems incurred by our joint ventures or venture partners could result in a material adverse impact on our financial condition or results of operations

We have invested in five joint venture operations in China that produce products including 99.99% pure gallium (4N Ga), high purity gallium, arsenic, germanium, germanium dioxide, paralytic boron nitride (pBN) crucibles, and boron oxide. We purchase the materials produced by these ventures for our use and sell other portions of their production to third parties. Our ownership interest in these entities ranges from 25 percent to 83 percent. We consolidate the three ventures in which we own a majority interest and employ equity accounting for the two joint ventures in which we have a 25 percent interest. Several of these ventures occupy facilities within larger facilities owned and/or operated by one of the other venture partners. Several of these venture partners are engaged in other manufacturing activities at or near the same facility. In some facilities, we share access to certain functions, including water, treatment of hazardous waste or air quality treatment. If any of our joint venture partners in any of these five ventures experience problems with their operations, disruptions of our joint venture operations could result, having a material adverse effect on the financial condition and results of operation of our joint ventures, and correspondingly on our financial condition or results of operations.

In addition, if any of our joint ventures or venture partners with whom our joint ventures share facilities are deemed to have violated applicable laws, rules or regulations governing the use, storage, discharge or disposal of hazardous chemicals during manufacturing, research and development, or sales demonstrations, the operations of our joint ventures could be adversely affected and we could be subject to substantial liability for clean-up efforts, personal injury and fines or suspension or cessation of our joint venture operations as a result of the actions of the joint ventures or other venture partners. Employees working at the operations of our joint ventures or the operations of any of the other venture partners could bring litigation against us as a result of actions taken at the joint venture or venture partner facilities, even though we are not directly controlling the operations, including actions for exposure to chemicals or other

hazardous materials at the facilities of our joint ventures or the facilities of any venture partner that are shared by our joint ventures. If litigation is brought against us, litigation is inherently uncertain and while we would expect to defend ourselves vigorously, it is possible that our business, financial condition, results of operations or cash flows could be affected in any particular period by such litigation if brought against us, particularly if, as a non-Chinese company, litigation with us is deemed advantageous. Even if we are not deemed responsible for the actions of the joint ventures or venture partners, litigation could be costly, time consuming to defend and divert management attention; in addition, pursuit of us could occur if we are deemed to be the most financially viable of the partners.

Going forward, we believe that investing in additional joint ventures will be important to remaining competitive in our marketplace and ensuring a supply of critical raw materials. However, we may not be able to identify complementary joint venture opportunities or, even once opportunities are identified, we may not be able to reach agreement on the terms of the venture with the other venture partners. Additional joint ventures could cause us to incur contingent liabilities or other expenses, any of which could adversely affect our financial condition and operating results.

Since all of our joint venture activity is expected to occur in China, these activities could subject us to a number of risks associated with conducting operations internationally, including:

• difficulties in managing geographically disparate operations;

• difficulties in enforcing agreements through non-U.S. legal systems;

• unexpected changes in regulatory requirements that may limit our ability to export the venture products or sell into particular jurisdictions or impose multiple conflicting tax laws and regulations;

• political and economic instability, civil unrest or war;

• terrorist activities that impact international commerce;

• difficulties in protecting our intellectual property rights, particularly in countries where the laws and practices do not protect proprietary rights to as great an extent as do the laws and practices of the United States;

• changing laws and policies affecting economic liberalization, foreign investment, currency convertibility or exchange rates, taxation or employment; and

• nationalization of foreign owned assets, including intellectual property.

Intellectual property infringement claims may be costly to resolve and could divert management attention.

Other companies may hold or obtain patents on inventions or may otherwise claim proprietary rights to technology necessary to our business. The markets in which we compete are comprised of competitors who in some cases hold substantial patent portfolios covering aspects of products that could be similar to ours. We could become subject to claims that we are infringing patent, trademark, copyright or other proprietary rights of others. For example, we have previously been involved in two separate lawsuits alleging patent infringement, and could in the future be involved in similar litigation.

The semiconductor industry is cyclical and has experienced a downturn which has adversely impacted our operating results.

Our continuing business depends in significant part upon manufacturers of electronic and opto-electronic semiconductor devices, as well as the current and anticipated market demand for such devices and products using such devices. As a supplier to the semiconductor industry, we are subject to the business cycles that characterize the industry. The timing, length and volatility of these cycles are difficult to predict. The semiconductor industry has historically been cyclical because of sudden changes in demand

for semiconductors, the manufacturing capacity of these semiconductors and changes in the technology employed in the semiconductors. The rate of changes in demand, including end demand, is high, and the effect of these changes upon us occurs quickly, exacerbating the volatility of these cycles. These changes have affected the timing and amounts of customers’ purchases and investments in new technology. These industry cycles create pressure on our revenue, gross margin and net income (loss).

The industry has in the past experienced periods of oversupply that result in significantly reduced demand and prices for semiconductor devices and components, including our products, both as a result of general economic changes and overcapacity. When these periods occur, our operating results and financial condition are adversely affected, and create pressure on our revenue, gross margins and net income (loss). Inventory buildups in telecommunications products and slower than expected sales of computer equipment resulted in overcapacity and led to reduced sales by our customers, and therefore reduced purchases of our products. During periods of weak demand such as those experienced over the past years, customers typically reduce purchases, delay delivery of products and/or cancel orders of component parts such as our products.

Increased price competition has resulted, causing pressure on our net sales, gross margin and net income (loss). We experienced cancellations, price reductions, delays and push outs of orders, which have resulted in reduced revenues. If the economic downturn occurred again, further order cancellations, reductions in order size or delays in orders could occur and would materially adversely affect our business and results of operations. Actions to reduce our costs, such as those we have recently taken, may be insufficient to align our structure with prevailing business conditions. We may be required to undertake additional cost-cutting measures, and may be unable to invest in marketing, research and development and engineering at the levels we believe are necessary to maintain our competitive position. Our failure to make these investments could seriously harm our business.

During periods of increasing demand for semiconductor devices, we must have sufficient manufacturing capacity and inventory to meet customer demand, and must be able to attract, hire, train and retain qualified employees to meet demand. If we are unable to effectively manage our resources and production capacity during an industry upturn, there could be a material adverse effect on our business, financial condition and results of operations.

Our results of operations may suffer if we do not effectively manage our inventory.

We must manage our inventory of component parts, work-in-process and finished goods effectively to meet changing customer requirements, while keeping inventory costs down and improving gross margins. Some of our products and supplies have in the past and may in the future become obsolete while in inventory due to changing customer specifications, or become excess inventory due to decreased demand for our products and an inability to sell the inventory within a foreseeable period. Furthermore, if current costs of production increase or sales prices drop below the standard prices at which we value inventory, we may need to take a charge for a reduction in inventory values. We have in the past including during 2004, had to take inventory valuation and impairment charges. Any future unexpected changes in demand or increases in costs of production that cause us to take additional charges for un-saleable, obsolete or excess inventory, or to reduce inventory values, could adversely affect our results of operations. charges.

The impact of changes in global economic conditions on our customers may cause us to fail to meet expectations, which would negatively impact the price of our stock.

Our operating results can vary significantly based upon the impact of changes in global economic conditions on our customers. The revenue growth and profitability of our business depends on the overall demand for our substrates, and we are particularly dependant on the market conditions for the wireless, solid-state illumination, fiber optics and telecommunications industries. Because our sales are primarily to

major corporate customers whose businesses fluctuate with general economic and business conditions, a softening of demand for products that use our substrates, caused by a weakening economy may result in decreased revenues. Customers may find themselves facing excess inventory from earlier purchases, and may defer or reconsider purchasing products due to the downturn in their business and in the general economy.

If we have low product yields, the shipment of our products may be delayed and our operating results may be adversely impacted.

Our products are manufactured using complex technologies, and the number of usable substrates we can produce can fluctuate as a result of many factors, including:

- •

- contamination of the manufacturing environment;

- •

- substrate breakage;

- •

- equipment failure, power outages or variations in the manufacturing process; and

- •

- performance of personnel involved in the manufacturing process.

If our yields decrease, our revenue could decline if we are unable to produce needed product on time. At the same time, while our manufacturing costs could remain fixed, or could increase. We have experienced product shipment delays and difficulties in achieving acceptable yields on both new and older products, and delays and poor yields have adversely affected our operating results. We may experience similar problems in the future and we cannot predict when they may occur or their severity. In particular, many of our manufacturing processes are new and are still being refined, which can result in lower yields.

If our manufacturing processes result in defects in our products making them unfit for use by our customers, our products would be rejected, resulting in compensation costs paid to our customers, and possible disqualification. This could lead to revenue loss and market share loss.

If we do not successfully develop new products to respond to rapidly changing customer requirements, our ability to generate revenue, obtain new customers, and retain existing customers may suffer.

Our success depends on our ability to offer new products and product features that incorporate leading technology and respond to technological advances. In addition, our new products must meet customer needs and compete effectively on quality, price and performance. The life cycles of our products are difficult to predict because the markets for our products are characterized by rapid technological change, changing customer needs and evolving industry standards. If our competitors introduce products employing new technologies or performance characteristics, our existing products could become obsolete and unmarketable. During the past twothree years, we have seen our competitors selling more substrates manufactured using a crystal growth technology similar to ours, which has eroded our technological differentiation. Other companies, including Triquent, are actively developing substrate materials that could be used to manufacture devices that could provide the same high-performance, low-power capabilities as GaAs- and InP-based devices at competitive prices. If these substrate materials or VGF-derived products are successfully developed and semiconductor device manufacturers adopt them, demand for our GaAs substrates could decline and our revenue could suffer.

The development of new products can be a highly complex process, and we may experience delays in developing and introducing new products. Any significant delays could cause us to fail to timely introduce and gain market acceptance of new products. Further, the costs involved in researching, developing and engineering new products could be greater than anticipated. If we fail to offer new products or product enhancements or fail to achieve higher quality products, we may not generate sufficient revenue to offset our development costs and other expenses or meet our customers’customers' requirements.

17

Intense competition in the markets for our products could prevent us from increasing revenue and sustaining profitability.

The markets for our products are intensely competitive. We face competition for our substrate products from other manufacturers of substrates, such as Freiberger Compound Materials, Hitachi Cable Japan Energy and Sumitomo Electric, and from semiconductor device manufacturers that produce substrates for their own use, and from companies, such as Triquent, that are actively developing alternative materials to GaAs and somemarketing semiconductor devices are being marketed using these alternative materials. We believe that at least two of our major competitors are shipping high volumes of GaAs substrates manufactured using a

technique similar to our VGF technique. Other competitors may develop and begin using similar technology. If we are unable to compete effectively, our revenue may not increase and we may be unable to bebecome profitable. We face many competitors that have a number of significant advantages over us, including:

Our competitors could develop new or enhanced products that are more effective than our products are.

The level and intensity of competition has increased over the past year and we expect competition to continue to increase in the future. Competitive pressures caused by the current economic conditions have resulted in reductions in the prices of our products, and continued or increased competition could reduce our market share, require us to further reduce the prices of our products, affect our ability to recover costs orand result in reduced gross margins.

In addition, new competitors have and may continue to emerge, such as a small crystal growing company established by a former employee of ours in China that is supplying ingots to the market. While new competitors such as this company currently do not appear to be fully competitive, competition from sources such as this could increase, particularly if these competitors are able to obtain large capital investments.

Demand for our products may decrease if our customers experience difficulty manufacturing, marketing or selling their products.

Our products are used as components in our customers’customers' products. Accordingly, demand for our products is subject to factors affecting the ability of our customers to successfully introduce and market their products successfully, including:

If demand for the end userend-user applications for which our products are used decreases, or our customers are unable to develop, market and sell their products, demand for our products will decrease.

The financial condition of our customers may affect their ability to pay amounts owed to us.

Many of our customers are facing business downturns that have reduced their cash balances and their prospects. We frequently allow our customers extended payment terms after shipping products to pay for products we ship to them within 30 to 120 days after delivery.them. Subsequent to our shipping a product, some customers have been unable to make payments aswhen due, reducing our cash balances and causing us to incur charges to allow for a possibility that some

accounts might not be paid. During 2004, a customer of one agent filed for bankruptcy protection. We incurred a charge equal to the amount owed us and believe that there is a substantial likelihood that we will not be able to recoup any of this amount. Other customersCustomers may also be forced to file for bankruptcy. If our

customers do not pay their accounts when due, we will be required to incur charges that would reduce our earnings.

We purchase critical raw materials and parts for our equipment from single or limited sources, and could lose sales if these sources fail to fill our needs.

We depend on a limited number of suppliers for certain raw materials, components and equipment used in manufacturing our products, including key materials such as quartz tubing, polishing solutions and paralytic boron nitride. Although several of these raw materials are purchased from suppliers in whomwhich we hold an ownership interest, we generally purchase these materials through standard purchase orders and not pursuant to long-term supply contracts and no supplier guarantees supply of raw materials or equipment to us. If we lose any of our key suppliers, our manufacturing efforts could be significantly hampered and we could be prevented from timely producing and delivering products to our customers. We havePrior to investing in the pastour raw material joint ventures, we sometimes experienced delays obtaining critical raw materials and spare parts, including gallium, due to shortages of these materials. Although we hope to alleviate some of thesematerials and could experience such delays and shortages as a result of our interestsagain in our joint ventures, we may experience delaysthe future due to shortages of materials and may be unable to obtain an adequate supply of materials. These shortages and delays could result in higher materials costs and cause us to delay or reduce production of our products. If we have to delay or reduce production, we could fail to meet customer delivery schedules and our revenue and operating results could suffer.

We have made and may continue to make strategic investments in raw materials suppliers, which may not be successful and may result in the loss of all or part of our investment.

We have made investments through our five joint ventures in raw material suppliers in China, thatwhich provide us with opportunities to gain supplysupplies of key raw materials that are important to our substrate business. These affiliates each have a market beyond that provided by us. We do not have influence over all of these companies, each of which is located in China, and in some we have made only a strategic, minority investment. We may not be successful in achieving the financial, technological or commercial advantage upon which any given investment is premised, and we could end up losing all or part of our investment.

Our substrate products have a long qualification cycle that makes it difficult to plan our expenses and forecast our results.

Customers typically place orders with us for our substrate products three months to a year or more after our initial contact with them. The sale of our products may be subject to delays due to our customers’customers' lengthy internal budgeting, approval and evaluation processes. During this time, we may incur substantial expenses and expend sales, marketing and management efforts while the customers evaluate our products. These expenditures may not result in sales of our products. If we do not achieve anticipated sales in a period as expected, we may experience an unplanned shortfall in our revenue. As a result, we may not be able to cover expenses, causing our operating results to vary. In addition, if a customer decides not to incorporate our products into its initial design, we may not have another opportunity to sell products to this customer for many months or even years. In the current competitive and economic climate, the average sales cycle for our products has lengthened even further and is expected to continue to make it difficult to accurately forecast our future sales.sales accurately. We anticipate that sales of any future substrate products will also have lengthy sales cycles and will, therefore, be subject to risks substantially similar to those inherent in the lengthy sales cyclecycles of our current substrate products.

Risks Related to International Aspects of Our Business

Changes in tariffs, import restrictions, export restrictions or other trade barriers may reduce gross margins.

We may incur increases in costs due to changes in tariffs, import or export restrictions, or other trade barriers, or unexpected changes in regulatory requirements, any of which could reduce our gross margins. For example, in 2006, tax authorities in the PRC changed the treatment of refunds of value-added taxes that companies pay when they purchase certain raw materials, including gallium and arsenic. The cumulative effect is that our PRC joint venture companies no longer receive a refund of value-added tax for exports of gallium or arsenic, including certain shipments to our wholly-owned PRC subsidiary that are treated as exports under PRC tax regulations. Given the relatively fluid regulatory environment in the PRC, there could be additional tax or other regulatory changes in the future. Any such changes could directly and materially adversely impact our financial results and general business condition.

Our operating results depend in large part on continued customer acceptance of our substrate products manufactured in China and continued improvements in product quality.

We manufacture all of our products in China, and source most of our raw materials in China. Accordingly, we continue to seek customer qualification of our China-manufactured products. In addition, we have in the past experienced quality problems with our China-manufactured products. Our previous quality problems caused us to lose market share to our competitors, as some customers reduced their orders from us until our surface quality was as good and consistent as that offered by competitors and customers allocated their requirements for compound semiconductor substrates across more competitors. If we are unable to protectcontinue to achieve customer qualifications for our products, or if we again experience quality problems, customers may not increase purchases of our products, our China facility will become underutilized, and we will be unable to achieve expected revenue growth. We may again lose sales of our products to competitors and experience loss of market share. If we are unable to recover and retain our market share, we may be unable to grow our business.

Problems incurred by our joint ventures or venture partners could result in a material adverse impact on our financial condition or results of operations.

We have invested in five joint venture operations in China that produce products including 99.99% pure gallium (4N Ga), high purity gallium, arsenic, germanium, germanium dioxide, paralytic boron nitride (pBN) crucibles and boron oxide. We purchase a portion of the materials produced by these ventures for our use and sell the remainder of their production to third parties. Our ownership interest in these entities ranges from 25% to 83%. We consolidate the three ventures in which we own a majority or controlling financial interest and employ equity accounting for the two joint ventures in which we have a 25% interest. Several of these ventures occupy space within larger facilities owned and/or operated by one of the other venture partners. Several of these venture partners are engaged in other manufacturing activities at or near the same facility. In some facilities, we share access to certain functions, including water, hazardous waste treatment or air quality treatment. If any of our joint venture partners in any of these five ventures experiences problems with its operations, disruptions of our joint venture operations could result, having a material adverse effect on the financial condition and results of operation of our joint ventures, and correspondingly on our financial condition or results of operations.

In addition, if any of our joint ventures or venture partners with which our joint ventures share facilities is deemed to have violated applicable laws, rules or regulations governing the use, storage, discharge or disposal of hazardous chemicals during manufacturing, research and development, or sales demonstrations, the operations of our joint ventures could be adversely affected and we could be subject to substantial liability for clean-up efforts, personal injury and fines or suspension or cessation

of our joint venture operations as a result of the actions of the joint ventures or other venture partners. Employees working for our joint ventures or any of the other venture partners could bring litigation against us as a result of actions taken at the joint venture or venture partner facilities, even though we are not directly controlling the operations, including actions for exposure to chemicals or other hazardous materials at the facilities of our joint ventures or the facilities of any venture partner that are shared by our joint ventures. If litigation is brought against us, litigation is inherently uncertain and, while we would expect to defend ourselves vigorously, it is possible that our business, financial condition, results of operations or cash flows could be affected in any particular period by any litigation if brought against us, particularly if litigation with us, as a non-Chinese company, is deemed advantageous. Even if we are not deemed responsible for the actions of the joint ventures or venture partners, litigation could be costly, time consuming to defend and divert management attention; in addition, pursuit of us could occur if we are deemed to be the most financially viable of the partners.

Going forward, we believe that investing in additional joint ventures will be important to remaining competitive in our marketplace and ensuring a supply of critical raw materials. However, we may not be able to identify complementary joint venture opportunities or, even once opportunities are identified, we may not be able to reach agreement on the terms of the venture with the other venture partners. Additional joint ventures could cause us to incur contingent liabilities or other expenses, any of which could adversely affect our financial condition and operating results.

Since all of our joint venture activity is expected to occur in China, these activities could subject us to a number of risks associated with conducting operations internationally, including:

- •

- difficulties in managing geographically disparate operations;

- •

- difficulties in enforcing agreements through non-U.S. legal systems;

- •

- unexpected changes in regulatory requirements that may limit our ability to export the venture products or sell into particular jurisdictions or impose multiple conflicting tax laws and regulations;

- •

- political and economic instability, civil unrest or war;

- •

- terrorist activities that impact international commerce;

- •

- difficulties in protecting our intellectual property

we may lose valuable assets or incur costly litigation.We rely on a combination of patents, copyrights, trademark and trade secret laws, non-disclosure agreements and other intellectual property protection methods to protect our proprietary technology. However, we believe that, due to the rapid pace of technological innovationrights, particularly inthe markets for our products, our ability to establish and maintain a position of technology leadership also depends on the skills of our development personnel.Despite our efforts to protect our intellectual property, a third party could develop products or processes similar to ours. Our means of protecting our proprietary rights may not be adequate and our competitors may independently develop similar technology, duplicate our products or design around our patents. We believe that at least two of our competitors have begun to ship GaAs substrates produced using a process similar to our VGF technique. Our competitors may also develop and patent improvements to the VGF technology upon which we rely, and thus may limit any exclusivity we enjoy by virtue of our patents or trade secrets.It is possible that pending or future United States or foreign patent applications made by us will not be approved, that our issued patents will not protect our intellectual property, or that third parties will challenge the ownership rights or the validity of our patents. In addition,countries where the lawsof some foreign countries mayand practices do not protectourproprietary rights to as great an extent as do the laws and practices of the UnitedStatesStates; - •

- changing laws and

itpolicies affecting economic liberalization, foreign investment, currency convertibility or exchange rates, taxation or employment; and - •

- nationalization of foreign-owned assets, including intellectual property.

Changes in global economic conditions on our customers may be more difficult to monitoradversely impact us, resulting in a decline in our revenue and profitability.

Our operating results can vary significantly based upon the useimpact of changes in global economic conditions on our customers. The revenue growth and profitability of our intellectual property. Our competitorsbusiness depends on the overall demand for our substrates, and we are particularly dependent on the market conditions for the wireless, solid-state illumination, fiber optics and telecommunications industries. Because our sales are primarily to major corporate customers whose businesses fluctuate with general economic and business conditions, a softening of demand for products that use our substrates, caused by a weakening economy, may be able to legitimately ascertain non-patented proprietary technology embeddedresult in our systems. If this occurs, wedecreased revenue. Customers may not be able to prevent the development of technology substantially similar to ours.

We may have to resort to costly litigation to enforce our intellectual property rights, to protect our trade secrets or know-how or to determine their scope, validity or enforceability. Enforcing or defending our proprietary technology is expensive, could cause us to divert resourcesfind themselves facing excess inventory from earlier purchases, and may not prove successful. Our protective measures may prove inadequatedefer or reconsider purchasing products due to protect our proprietary rights,the downturn in their business and if we fail to enforce or protect our rights, we could lose valuable assets.

For example, we have recently been involved in litigation with Sumitomo Electric Industries, Ltd. (“SEI”) in Japan as well as interference actions in the United States. We and SEI approved a settlement of this litigation during the fourth quarter of 2004 and the litigation was withdrawn and we abandoned the interference proceeding. We incurred an initial charge of approximately $1.4 million and will have to pay ongoing royalties to SEI on certain of our products.general economy.

We derive a significant portion of our revenue from international sales, and our ability to sustain and increase our international sales involves significant risks.

Our revenue growth depends in part on the expansion of our international sales and operations. International sales represented 81%80%, 71% and 79%81% of our total revenue for the years ended December 31, 20052007, 2006 and 2004,2005, respectively. We expect that sales to customers outside the U.S., particularly sales to customers in Asia, will continue to represent a significant portion of our revenue, particularly sales to customers in Asia.revenue.

Currently, an increasing percentage of our sales areis to customers headquartered in Asia. CertainAll of our manufacturing facilities and some of our suppliers are also located outside the U.S. Managing our globaloverseas operations presents challenges, including periodic regional economic downturns, trade balance issues, varying business conditions and demands, political instability, variations in enforcement of intellectual property and contract rights in different jurisdictions, differences in the ability to develop relationships with suppliers and other local businesses, changes in U.S. and international laws and regulations including U.S. export restrictions, fluctuations in interest and currency exchange rates, the ability to provide sufficient levels of technical support in different locations, cultural differences, shipping delays and terrorist acts or acts of war, among other risks. Many of these challenges are present in China, which

represents a large potential market for semiconductor equipmentdevices and where we anticipate significant opportunity for growth. Global uncertainties with respect to: (i) economic growth rates in various countries; (ii) sustainability of demand for electronics products; (iii) capital spending by semiconductor manufacturers; (iv) price weakness for certain semiconductor devices; and (v) political instability in regions where we have operations may also affect our business, financial condition and results of operations.

Our dependence on international sales involves a number of risks, including:

Our sales are denominated in U.S. dollars, except for sales to our Japanese and some Taiwanese customers, which are denominated in Japanese yen. Thus, increases in the value of the U.S. dollar could increase the price of our products in non-U.S. markets and make our products more expensive than competitors’competitors' products in these markets.

Also, denominating some sales in Japanese yen subjects us to fluctuations in the exchange rates between the U.S. dollar and the Japanese yen. The functional currenciescurrency of our Chinese subsidiaries aresubsidiary and joint ventures is the local currencies.currency. We incur transaction gains or losses resulting from consolidation of expenses incurred in local currencies for these subsidiaries,entities, as well as in translation of the assets and liabilities of thesetheir assets at each balance sheet date. If we do not effectively manage the risks associated with international sales, our revenue, cash flows and financial condition could be adversely affected.

Because ofIf there are power shortages in China,the PRC, we may have to temporarily close our China operations, which would adversely impact our ability to manufacture our products and meet customer orders, and would result in reduced revenues.revenue.

The In the past, the Chinese government has faced a power crunch over the summer of 2004 and reported thatshortage resulting in power demand in 24 provinces outstrippedoutstripping supply in peak periods during the first four months of 2004.periods. Instability in electrical supply in past years has caused sporadic outages among residential and commercial consumers. As a result,consumers causing the Chinese government implementedto implement tough measures in 2004 to ease the energy shortage. Provinces imposed power brownouts during 2004 to reduce electricity demandshortage, and some companies in Beijing were ordered to give their employees a week off to ease the pressure on power supply. The plants, most of which are state-owned, were closed and reopened on a staggered schedule to reduce power consumption during the capital’s hottest months during 2004. Asas a result, we closed most of our operations for a week in late July 2004 in conformance with this policy. Although

In 2006 we were able to switch the electrical supply for our manufacturing facility onto the same power grid as that used by vital PRC government services such as hospitals and police. However, if even despite this switch, further problems with power shortages requiring closure of facilities did not occur during summer 2005, ifare incurred in the future, and we are required to make additional temporary closures of our Beijingsubsidiary and joint venture operations, at any time during 2006, we may be unable to manufacture our products, and would then be unable to meet customer orders except from inventory on hand. As a result, weour revenue could lose sales,be adversely impacting our revenues,impacted, and our relationships with our customers could suffer, impacting our ability to generate future sales.revenue. In addition, if power is shut off at our Beijing operationssubsidiary at any time, either voluntarily or as a result of unplanned brownouts, during certain phases of our manufacturing process including our crystal growth phase, the work in process may be ruined and rendered unusable, causing us to incur expense that will not be covered by revenue, and negatively impacting our cost of goods soldrevenue and

gross margins. We are attempting to partially mitigate the potential effects of power outages by building inventory in anticipation of power outages during the summer. This inventory build is prepared to accommodate forecast demand rather specific customer orders. If the inventory we build is not ordered by customers, we may have to scrap these products and incur a cost which will reduce our gross margins.