Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

| (Mark One) | | |

þ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2009 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

|

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2006

OR

o TRANSITION REPORT PERSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 0-1375

FARMER BROS. CO.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

| | 95-0725980

|

Delaware

(State of Incorporation) | | 95-0725980

(I.R.S. Employer Identification No.) |

20333 South Normandie Avenue, Torrance, California 90502

(Address of Principal Executive Offices; Zip Code) |

Registrant's telephone number, including area code310-787-5200 |

20333 South Normandie Avenue, Torrance, California, 90502

(Address of Principal Executive Offices; Zip Code)

Registrants’s telephone number, including area code 310-787-5200

Securities registered pursuant to Section 12(g) of thethe Act:

| | |

| Title of Each Class |

|

| | Name of Each Exchange on Which Registered

|

|---|

Common stock,Stock, $1.00 par value |

| NASDAQ |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES þ NO o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES o NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’sregistrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a non-accelerated filer. Large Accelerated Filer o Accelerated Filer þ Non-Accelerated Filer osmaller reporting company.

| | | | | | |

| Large accelerated filer o | | Accelerated filer þ | | Non-accelerated filer o | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the closing price at which the Farmer Bros. Co. common stock was sold on June 30, 2006December 31, 2008 was approximately $146$167 million.

On September 1, 2006 the registrant had 16,075,080 shares outstanding of its common stock, par value $1.00 per share, which is the registrant’s only class of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents are incorporated by reference into Part III of this Form 10-K: certain portions of the definitive proxy statement for the fiscal year ended June 30, 20062009 that is expected to be filed with the U.S. Securities and Exchange Commission on or before October 28, 2006.2009.

On September 3, 2009 the registrant had 16,126,580 shares outstanding of its common stock, par value $1.00 per share, which is the registrant's only class of common stock.

Table of Contents

Table of Contents

PART I

Item 1. Business

GeneralOverview

Farmer Bros. Co. (the “Company,” “we,” “our”, a Delaware corporation (including its consolidated subsidiaries unless the context otherwise requires, the "Company," "we," "our" or “Farmer"Farmer Bros.”") is a manufacturer, wholesaler and distributor of coffee and spicesnon-coffee ("allied") products to the institutional food service segment. The Company wasWe were incorporated in California in 1923, and reincorporated in Delaware in 2004. We operate in one business segment and are in the business of roasting, packaging, and distributing coffee and allied products through direct and brokered sales to our customers throughout the contiguous United States.

Business Strategy

On April 27, 2007, to enhance our product offerings to include specialty coffee products, we completed the acquisition of Coffee Bean Holding Co., Inc., a Delaware corporation ("CBH"), the parent company of Coffee Bean International, Inc., an Oregon corporation ("CBI"), a specialty coffee manufacturer and wholesaler headquartered in Portland, Oregon (the "CBI Acquisition"). To expand our national presence and improve our channel penetration, on February 28, 2009, we completed the acquisition from Sara Lee Corporation, a Maryland corporation ("Sara Lee"), and Saramar, L.L.C., a Delaware limited liability company ("Saramar" and collectively with Sara Lee, "Seller Parties") of certain assets used in connection with Seller Parties' direct store delivery coffee business in the United States (the "DSD Coffee Business"). The acquired business also includes the distribution, sale and service of brewed and liquid coffee equipment as well as the right to distribute sauces and dressings to customers of the DSD Coffee Business.

Our mission is to "sell great coffee and allied products and provide superior service one customer at a time." In fiscal 2009, the acquisition of the DSD Coffee Business furthered our efforts to achieve this mission. As a primary result of this acquisition, our sales grew to $341.7 million in fiscal 2009 from $266.5 million in fiscal 2008, and we acquired over 2,000 new SKU's and over 60 trademarks, tradenames and service marks including the major regional brands MCGARVEY®, CAIN'S®, IRELAND®, JUSTIN LLOYD®, METROPOLITAN®, PREBICA®, WECHSLER®, WORLD'S FINEST® and CAFÉ ROYAL®, and the national brand SUPERIOR®, broadened and diversified our customer base to include a major presence in the gaming industry as well as significant national chain accounts, and expanded geographically from our previous 28 state marketing area into all 48 contiguous states. During fiscal 2010 we plan to complete the post-acquisition integration of the DSD Coffee Business in an effort to realize the selling and operating efficiencies of the combined organization through consolidation of product offerings and SKU's, streamlining of routes and distribution logistics, and consolidation of warehouses and distribution centers, with an expanded, customer-focused organization enabled by enhanced information management tools and training.

Business Operations

Our product line is specifically focused on the needs of our market segment: restaurants and other institutional food service establishments that prepareincluding restaurants, hotels, casinos, hospitals and market meals, including hotels, hospitals,food service providers, as well as retailers such as convenience stores, coffee houses, general merchandisers, private-label retailers and fast food outlets.grocery stores. Our product line includes roasted coffee, liquid coffee, coffee related products such as coffee filters, sugar and creamers, assorted teas, cappuccino, cocoa, spices, gelatins and puddings, soup, gravy and beverage bases.sauce mixes, pancake and biscuit mixes, and jellies and preserves. Our product line presently includes over 300400 items. For the past three fiscal years sales of roasted coffee products represented approximately 50% of our total sales and no single product other than roasted coffee accounted for more than 10% of our revenue.total sales. Coffee purchasing, roasting and packaging takes place at our

Table of Contents

Torrance, Portland and Houston plants. Spice blending and packaging takes place at our Torrance, California plant, which also servesand Oklahoma City, Oklahoma plants. Our distribution centers include our Torrance, Houston and Portland plants, as thewell as new distribution hub for our branches.centers in Fridley, Minnesota, Bensenville, Illinois and Moonachie, New Jersey.

Raw Materials and Supplies

Our primary raw material is green coffee, an agricultural commodity. Green coffee is mainly grown outside the United States and can be subject to volatile price fluctuations. Weather, real or perceived shortages, political unrest, labor actions, andcurrency fluctuations, armed conflict in coffee producing nations, and government actions, including treaties and trade controls between the U.S. and coffee producing nations, can affect the price of green coffee. Green specialty coffees sell at a premium to other green coffees due to the inability of producers to increase supply in the short run to meet rising demand. As a result, the price spread between specialty coffee and non-specialty coffee is likely to widen as demand continues to increase.

Green coffee prices can also be affected by the actions of producer organizations. The most prominent of these are the Colombian Coffee Federation, Inc. (CCF), the Association of Coffee Producing Countries (ACPC) and the International Coffee Organization (ICO). These organizations seek to increase green coffee prices largely by attempting to restrict supplies, thereby limiting the availability of green coffee to coffee consuming nations.

Other raw materials used in the manufacture of our non-coffeeallied products (“allied products”) include a wide variety of spices, such as pepper, chilies, oregano and thyme, as well as cocoa, dehydrated milk products, salt and sugar. These raw materials are agricultural products and can be subject to wide cost fluctuations. Such fluctuations, however, historically have not had a material effect on our operating results.

Trademarks and Licenses

We own 62132 registered U.S. trademarks which are integral to customer identification of our products. It is not possible to assess the impact of the loss of such identification. The Company and Sara Lee have entered into certain operational agreements that include trademark and formula license agreements.

Seasonality

We experience some seasonal influences. The winter months are generally the best sales months. However, our product line and geographic diversity provide some sales stability during the warmer months when coffee consumption ordinarily decreases. Additionally, we usually experience an increase in sales during the summer months from seasonal businesses located in vacation areas.

Distribution

Sales Most sales are made “off-truck”"off-truck" to our institutional food service customers at their places of business by our sales representatives who are responsible for soliciting, selling and collecting from and otherwise

maintaining our customer accounts. We serve our customers from six distribution centers strategically located for national coverage. Our distribution trucks are replenished from 179 branch warehouses located in a number of cities inthroughout the westerncontiguous United States. We operate our own long haul trucking fleet in an effort to more effectively control the supplysupport our long-haul distribution requirements. A portion of our products to these warehouses. Inventoryare distributed by third parties or are direct shipped via common carrier. We maintain inventory levels are maintained at each branch warehouse consisting of our complete product line and additional safety stocks to accommodate a modestallow for minimal interruption in supply.

Customers

We serve a wide variety of customers, from small restaurants and donut shops to large institutional buyers like restaurant chains, hotels, casinos, hospitals, food service providers and convenience stores.

Table of Contents

As a result of the CBI Acquisition we added additional customer categories including gourmet coffee houses, private-label retailers, national mass market merchandisers and other national accounts, and grocery stores. We believe customer contact, our distribution network and our service quality, are integral to our sales effort. No single customer represents a significant concentration of sales. As a result, the loss of one or more of our larger customer accounts is not likely to have a material adverse effect on our results of operations. We serve a wide variety of customers, from small restaurants and donut shops to large institutional buyers like restaurant chains, hospitals, hotels, contract food services and convalescent hospitals. Customer contact, our distribution network and our service quality, are integral to our sales effort.

Competition

Competition

We face competition from many sources, including the institutional food service divisions of multi-national manufacturers of retail products such as Procter & GambleThe J.M. Smucker Company (Folgers Coffee), Kraft Foods Inc. (Maxwell House Coffee) and Sara Lee Foods (Superior Coffee),Corporation, wholesale grocery distributors such as Sysco Corporation and U.S. Food Service, and regional institutional coffee roasters such as S & D Coffee, Inc. and Boyd Coffee Company. Management believes we may have some competitive advantages due toCompany, and specialty coffee suppliers such as Green Mountain Coffee Roasters, Inc. and Peet's Coffee & Tea, Inc. We believe our longevity, strong regional roots and our sales and service force. We differentiate ourselves from our competitors by the quality of our products, our national distribution network and our superior customer service. Someservice operations are the major factors that differentiate us from our competitors.

Competition is robust and is primarily based on products and price, with distribution often a major factor. Most of our competitors outsource their productcustomers rely on us for distribution, while othershowever some of our customers use third party distribution or conduct their own distribution. Some of our customers are “price”"price" buyers, seeking the low cost provider with little concern about service;service, while others find great value in the service programs we provide. We compete well when service and distribution are valued by our customers, and are less effective when only price matters. Our customer base is price sensitive, and we are often faced with price competition.

Working Capital

We finance our operations internally and wethrough borrowings under our $50 million senior secured revolving credit facility with Wachovia Bank, National Association. We believe thatthis credit facility, in addition to our other liquid assets, provides sufficient capital resources and flexibility for the next twelve months to allow us to make investments in the DSD Coffee Business, fund integration expenses, meet necessary working capital requirements and implement our business plan without relying solely on cash flow from internal sources will be adequate for the coming fiscal year.operations.

Foreign Operations

We have no material revenues from foreign operations.

Other

On June 30, 20062009 we employed 1,0912,218 employees, 441691 of whom are subject to collective bargaining agreements. Compliance with government regulations relating to the discharge of materials into the environment has not had a material effect on our financial condition or results of operations. The nature of our business does not provide for maintenance of or reliance upon a sales backlog. No portionNone of our business may beis subject to renegotiation of profits or termination of contracts or subcontracts at the election of the Government.government.

Available Information

We file reports electronically with the U.S. Securities and Exchange Commission (“SEC”), including Forms 10-K, 10-Q, 8-K and amendments thereto. The public may read and copy any materials filed with the SEC at the SEC’s Public Reading Room at 450 Fifth Street, NW, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC

at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The site address is http://www.sec.gov.

Our Internet website address is http://www.farmerbroscousa.comwww.farmerbros.com (the website address is not intended to function as a hyperlink, and the information contained in our website is not intended to be part of this filing), where we make available, free of charge, copies of our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K including amendments thereto as soon as

Table of Contents

reasonably practicable after filing such material electronically or otherwise furnishing it to the SEC. The Company’s Code of Ethics for its principal executiveSecurities and principal financial officers is also posted on our Internet website.Exchange Commission ("SEC").

Item 1A. Risk Factors

Certain statements contained in this Annual Reportannual report on Form 10-K regarding the risks, circumstances and financial trends that may affect our future operating results, financial position and cash flows may beare not based on historical fact and are forward-looking statements within the meaning of federal securities laws.laws and regulations. These statements are based on management’smanagement's current expectations, assumptions, estimates and observations about our businessof future events and are subjectinclude any statements that do not directly relate to risks and uncertainties. As a result, actual results could materially differ from the forward-looking statements contained herein.any historical or current fact. These forward-looking statements can be identified by the use of words like “expects,” “plans,” “believes,” “intends,” “will,” “assumes”"anticipates," "feels," "estimates," "projects," "expects," "plans," "believes," "intends," "will," "assumes" and other words of similar meaning. These and other similar words can be identified byOwing to the fact that they do not relate solely to historical or current facts. While we believe our assumptions are reasonable, we caution that it is impossible to predict the impact of such factors which could causeuncertainties inherent in forward-looking statements, actual results tocould differ materially from predicted results.those set forth in forward-looking statements. We intend these forward-looking statements to speak only at the time of this report and do not undertake to update or revise these statements as more information becomes available. For these statements, we claimavailable except as required under federal securities laws and the protectionrules and regulations of the safe harbor forSEC. Factors that could cause actual results to differ materially from those in forward-looking statements provided byinclude, but are not limited to, fluctuations in availability and cost of green coffee, competition, organizational changes, our ability to successfully integrate the Private Securities Litigation Reform ActCBI and DSD Coffee Business acquisitions, the impact of 1995.

The Company’sa weaker economy, business its future performance and forward-looking statements are affected by generalconditions in the coffee industry and market conditionsfood industry in general, our continued success in attracting new customers, variances from budgeted sales mix and growth rates, general U.S.weather and non-U.S. economic and political conditions (includingspecial or unusual events, changes in the global economy), competition, interest rate and currency exchange rate fluctuations,quality or dividend stream of third parties' securities and other events. The following items are representativeinvestment vehicles in which we have invested our assets, as well as other risks described in this report and other factors described from time to time in our filings with the SEC.

You should consider each of the risks, uncertainties andfollowing factors as well as the other conditions that may impact the Company’s business, future performance and the forward-looking statements that it makesinformation in this Annual Reportannual report in evaluating our business and our prospects. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also negatively affect our business operations. If any of the following risks actually occurs, our business and financial results could be harmed. In that case, the trading price of our common stock could decline. You should also refer to the other information set forth in this annual report on Form 10-K, including our financial statements and the related notes.

WE MAY NOT BE ABLE TO SUCCESSFULLY INTEGRATE THE DSD COFFEE BUSINESS INTO OUR EXISTING BUSINESS, WHICH MAY PREVENT US FROM REALIZING THE EXPECTED SYNERGIES AND OTHER BENEFITS OF THE ACQUISITION, WHICH COULD ADVERSELY AFFECT OUR FUTURE RESULTS.

The integration of the DSD Coffee Business into our business is a complex, costly and time-consuming process which presents significant challenges and risks to our business, including:

- •

- distraction of management from ongoing business concerns;

- •

- assimilation and retention of employees and customers of the DSD Coffee Business;

- •

- differences in the culture of the DSD Coffee Business and the Company's culture;

- •

- unforeseen difficulties in integrating the DSD Coffee Business, including information systems and accounting controls;

- •

- failure of the DSD Coffee Business to continue to generate income at the levels upon which we based our acquisition decision;

Table of Contents

- •

- managing the DSD Coffee Business operations through offices in Downers Grove, Illinois, which is distant from the Company's headquarters in Torrance, California;

- •

- expansion into new geographical markets in which we have limited or

thatno experience;

- •

- integration of technologies, services and products; and

- •

- achievement of appropriate internal control over financial reporting.

We may fail to successfully complete the integration of the DSD Coffee Business into our business and, as a result, may fail to realize the operating efficiencies, synergies, economies of scale, cost savings and other benefits expected from the acquisition. We may fail to grow and build profits in the DSD Coffee Business or achieve sufficient cost savings through the integration of customers or administrative and other operational activities. Furthermore, we must achieve these objectives without adversely affecting our revenues. If we are not able to successfully achieve these objectives, the anticipated benefits of the acquisition may not be realized fully or at all, or it may maketake longer to realize them than expected, and our results of operations could be adversely affected.

WE ARE RELYING ON SARA LEE TO PROVIDE US WITH CERTAIN TRANSITION SERVICES THAT ARE CRITICAL TO THE ONGOING OPERATION OF THE DSD COFFEE BUSINESS.

We continue to rely on Sara Lee to provide us with certain services previously provided by Sara Lee to the DSD Coffee Business for a transition period of up to eighteen (18) months through August 2010 depending on the specific service. These services include maintaining the IT infrastructure and communications services, including network hosting, monitoring and reporting. Sara Lee provides the support for the software and processes that record and maintain sales transactions, create accounts receivable and bills customers, maintain accounts payable and pays vendors, provide inventory control and generally provide for most critical business accounting needs. These transition services are critical to the ongoing operation of the DSD Coffee Business during the transition period. If Sara Lee fails or is unable to continue to provide such services to us, we may be unable to service customers of the DSD Coffee Business which may harm our reputation and adversely affect the business, financial condition and results of operations of the DSD Coffee Business. Our dependency on Sara Lee for IT services during the transition period may increase the risk of material internal control deficiencies and the related probability of a restatement of our operating results as a result of untraced accounting errors within the Sara Lee maintained software and/or Sara Lee's inability to effectively maintain both internal control and data integrity.

UPON EXPIRATION OF THE TRANSITION PERIOD, WE MAY BE UNABLE TO PROVIDE THE TRANSITION SERVICES OURSELVES OR OBTAIN SUCH SERVICES FROM A THIRD-PARTY ON COMMERCIALLY REASONABLE TERMS.

After the dates on which Sara Lee is no longer required to provide transition services to us, we expect that such services will be provided by our internal operations and/or third-party service providers. These services include integrating the IT infrastructure of several hardware and software systems. A failure to identify all of the components of IT infrastructure and personnel necessary to transition successfully from Sara Lee may adversely impact our ability to operate the DSD Coffee Business following the transition period. There can be no assurance that we will be able to develop the ability to provide these services ourselves on a cost efficient basis or obtain such services from a third-party on commercially reasonable terms.

Table of Contents

WE RELY ON INFORMATION TECHNOLOGY AND ARE DEPENDENT ON ENTERPRISE RESOURCE PLANNING SOFTWARE IN OUR OPERATIONS. ANY MATERIAL FAILURE, INADEQUACY, INTERRUPTION OR SECURITY FAILURE OF THAT TECHNOLOGY COULD AFFECT OUR ABILITY TO EFFECTIVELY OPERATE OUR BUSINESS.

We rely on information technology systems across our operations, including management of our supply chain, point-of-sale processing, and various other processes and transactions. Our ability to effectively manage our business and coordinate the production, distribution and sale of our products depends significantly on the reliability and capacity of these systems. The failure of these systems to operate effectively, problems with transitioning to upgraded or replacement systems, our inability to integrate the DSD Coffee Business systems with ours, or a breach in security of these systems could result in delays in processing replenishment orders from our branches, our inability to record product sales and reduced operational efficiency. Significant capital investments could be required to remediate any potential problems.

We rely on WTS, a company affiliated with Oracle, and its employees, in connection with the hosting of our integrated management information system. This system is essential to our operations and currently includes all accounting and production software applications. WTS also hosts our route sales application software. If WTS were to experience financial, operational or quality assurance difficulties, or if there were any other disruption in our relationship with WTS, we might be unable to produce financial statements, fill replenishment orders for our branch warehouses, issue payroll checks, process payments to our vendors or bill customers. Any of these items could have a material adverse effect on the Company.

IMPAIRMENT CHARGES RELATED TO OUR GOODWILL OR LONG-LIVED ASSETS COULD ADVERSELY AFFECT OUR FUTURE OPERATING RESULTS.

We perform an analysis on our goodwill balances to test for impairment on an annual basis or whenever events occur that may indicate impairment possibly exists. Goodwill is deemed to be impaired if the net book value of a reporting unit exceeds the estimated fair value. The impairment of a long-lived intangible asset other than goodwill is only deemed to have occurred if the sum of the forecasted undiscounted future cash flows related to the asset are less than the carrying value of the intangible asset we are testing for impairment. If the forecasted cash flows are less than the carrying value, then we must write down the carrying value to its estimated fair value.

For the purposes of this analysis, our estimates of fair value were based on a combination of the income approach, which estimates the fair value of our reporting units based on the future discounted cash flows, and the market approach, which estimates the fair value of our reporting units based on comparable market prices. Our estimates of future cash flows included estimated growth rates and assumptions about the extent and duration of the current economic downturn and operating results of our subsidiary, CBI.

As of June 30, 2009, we had a goodwill balance of $5,310,000. Goodwill impairment analysis and measurement is a process that requires significant judgment and the use of significant estimates related to valuation such as discount rates, long term growth rates and the level and timing of future cash flows. As a result, several factors could result in impairment of a material amount of our $5,310,000 goodwill balance in future periods, including, but not limited to:

- •

- A decline in our stock price and resulting market capitalization, if we determine that the decline is sustained and is indicative of a reduction in the

future. Our actualfair value of any of our reporting units below its carrying value.

Table of Contents

- •

- Further weakening of the economy or the failure of CBI to reach our internal forecasts could impact our ability to achieve our forecasted levels of cash flows and reduce the estimated discounted cash flow value of our reporting units.

It is not possible at this time to determine if any such future impairment charge would result from these factors, or, if it does, whether such charge would be material. We will continue to review our goodwill and other intangible assets for possible impairment. We cannot be certain that a future downturn in CBI's business, changes in market conditions or a longer-term decline in the quoted market price of our stock will not result in an impairment of goodwill and the recognition of resulting expenses in future periods, which could adversely affect our results could differ materially from anticipatedof operations for those periods.

We also test our other long-lived assets for impairment whenever events or changes in circumstances indicate that their carrying amount may be impaired. Failure to achieve our forecasted operating results, due to somefurther weakness in the economic environment or allother factors, could result in impairment of the factors discussed below.a significant amount of our long-lived intangible or tangible assets. As of June 30, 2009, we had $35,921,000 of long-lived intangible assets.

OUR EFFORTS TO SECURE AN ADEQUATE SUPPLY OF QUALITY COFFEES MAY BE UNSUCCESSFUL AND EXPOSE US TO COMMODITY PRICE RISK.

Maintaining a steady supply of green coffee is essential to keep inventory levels low and secure sufficient stock to meet customer needs. To help ensure future supplies, we may purchase our coffee on forward contracts for delivery as long as six months in the future. In the event of non-performanceNon-performance by the suppliers the Company could be exposedexpose us to credit and supply risk. EnteringAdditionally, entering into such future commitments also leaves the Company subjectexposes us to purchase price risk. Various techniquesBecause we are usednot always able to hedge these purchases against untowardpass price movement. Competitive factors make it difficult for the Companychanges through to “pass through” such price fluctuationour customers due to its customers. Therefore,competitive pressures, unpredictable price changes can have an immediate effect on operating results that cannot be corrected in the short run. To reduce itsour potential price risk exposure to the volatile fluctuation of green coffee costs, Farmer Bros. has,we have, from time to time, entered into futures contracts to hedge coffee purchase commitments. Open contracts associated with these hedging activities are described in Item 7A. “Quantitative"Quantitative and Qualitative Disclosures About Market Risk.”"

INCREASES IN THE COST OF GREEN COFFEE COULD REDUCE OUR GROSS MARGIN AND PROFIT.

Our primary raw material is green coffee, an agricultural commodity. Green coffee is mainly grown outside the U.S.United States and can be subject to volatile price fluctuations. Weather, real or perceived shortages, political unrest, labor actions, political unrest andcurrency fluctuations, armed conflict in coffee producing nations, and government actions, including treaties and trade controls between the U.S. and coffee producing nations, can affect the price of green coffee. Green specialty coffees sell at a premium to other green coffees due to the inability of producers to increase supply in the short run to meet rising demand. As a result, the price spread between specialty coffee and non-specialty coffee is likely to widen as demand continues to increase.

Green coffee prices can also be affected by the actions of producer organizations. The most prominent of these are the Colombian Coffee Federation, Inc. (CCF), and the International Coffee Organization (ICO) and the Association of Coffee Producing Countries (ACPC). These organizations seek to increase green coffee prices largely beby attempting to restrict supplies, thereby limiting the availability of green coffee to coffee consuming nations. As a result these organizations or others may succeed in raising green coffee prices.

In the past, we generally have been able to pass on increases in green coffee costs to our customers. However, there can be no assurance that we will be successful in passing such fluctuations on to our customers without losses in sales volume or gross margin in the future. Similarly, rapid, sharp decreases in the cost of green coffee could also force us to lower sales prices before realizing cost reductions in our green coffee inventory.

Table of Contents

OUR INDUSTRY IS HIGHLY COMPETITIVE AND WE MAY NOT HAVE THE RESOURCES TO COMPETE EFFECTIVELY.

We primarily compete with other coffee companies, including multi-national firms with substantially greater financial, marketing and operating resources than the Company. We face competition from many sources including the food service divisions of multi-national manufacturers of retail products such as Proctor and Gamble (Folgers Coffee), Kraft Foods (Maxwell House Coffee) and Sara Lee Foods (Superior Coffee), wholesale grocery distributors such as Sysco and U.S. Food Service, and regional coffee roasters such as Boyd Coffee Company. Some of our competitors outsource their product distribution, while others conduct their own distribution. Large roasters have volumes far in excess of ours, with a business model that is substantially different from ours. We compete with those firms and others for a wide variety of customers, from small restaurants and donut shops, to large institutional buyers like restaurant chains, hospitals, hotels, contract food services and convalescent hospitals. If we do not succeed in differentiating ourselves from our competitors or our competitors adopt our strategies, then our competitive position may be weakened. At Farmer Bros. we differentiate ourselves from our competitors by the quality of our products, our distribution network and our customer service. Some of our customers are “price” buyers, seeking the low cost provider with little concern about service; others find great value in the service programs we provide. We compete well when service and distribution are valued by our customers, and are less effective when only price matters. Our customer base is price sensitive and we are often faced with price competition.

CHANGES IN CONSUMER PREFERENCESLEVEL OF INDEBTEDNESS COULD ADVERSELY AFFECT OUR BUSINESS.ABILITY TO RAISE ADDITIONAL CAPITAL TO FUND OUR OPERATIONS, AND LIMIT OUR ABILITY TO REACT TO CHANGES IN THE ECONOMY OR OUR INDUSTRY.

Our continued success depends, in part, upon the demand for coffee. Shifts in consumer preferences away from We have a “standard” cup$50 million senior secured revolving credit facility. As of coffeeSeptember 3, 2009, approximately $9 million was outstanding under this credit facility. Maintaining a large loan balance under our credit facility could adversely affect our profitability.business and limit our ability to plan for or respond to changes in our business. Additionally, our borrowings under the credit facility are at variable rates of interest, exposing us to the risk of interest rate volatility, which could lead to a decrease in our net income. Our primary market is restaurantsdebt obligations could also:

- •

- increase our vulnerability to general adverse economic and industry conditions;

- •

- require us to dedicate a portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow for other purposes, including the payment of dividends, funding daily operations, investing in future business opportunities and capital expenditures;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate thereby placing us at a competitive disadvantage compared to our competitors that may have less debt or debt with less restrictive debt covenants;

- •

- limit, by the financial and other

food service establishments. We also provide coffeerestrictive covenants in our loan agreement, our ability to borrow additional funds; and related products

- •

- have a material adverse effect on us if we fail to

offices. We believecomply with the successcovenants in our loan agreement because such failure could result in an event of default which, if not cured or waived, could result in our indebtedness becoming immediately due and payable.

RESTRICTIVE COVENANTS IN OUR CREDIT FACILITY MAY RESTRICT OUR ABILITY TO PURSUE OUR BUSINESS STRATEGIES.

Our senior secured revolving credit facility contains various covenants that limit our ability and/or our subsidiaries' ability to, among other things:

- •

- incur additional indebtedness;

- •

- pay dividends on or make distributions in respect of capital stock or make certain other restricted payments or investments;

- •

- sell assets;

- •

- create liens on certain assets to secure debt; and

- •

- consolidate, merge, sell or otherwise dispose of all or substantially all of our

market segment is dependent upon personalassets.

Our credit facility also contains restrictive covenants that require the Company and business expendituresits subsidiaries to satisfy financial condition tests. Our ability to meet those tests may be affected by events beyond our control, and there can be no assurance that we will meet those tests. The breach of any of these covenants or our failure to meet the financial condition tests could result in restaurantsa default under the credit facility, and other food service businesses. There are many beverages, hotthe lender could elect to declare all amounts borrowed thereunder, together with accrued interest, to be due and cold, competing forpayable and could proceed against the same restaurant dollar.collateral securing that indebtedness.

OUR BUSINESS IS SUBJECT TO RISKS ASSOCIATED WITH THE CURRENT ECONOMIC CLIMATE.

Our restaurant customers report that competition from such beverages continuesrevenues and performance depend significantly on consumer confidence and spending, which have deteriorated due to dilute the demand for coffee. Consumers who choose soft drinks, bottled water,current economic conditions. This economic downturn and flavored coffees and teas are all reducing the restaurant dollar formerly spent on a “standard” cup of coffee. While restaurants and coffee houses that sell “specialty” coffee and flavored coffee products may have increaseddecrease in

the demand for coffee beverages,Table of Contents

consumer spending may continue to adversely impact our revenues, and may affect our ability to market our products or otherwise implement our business strategy. Additionally, many of these establishments have taken market share from existing Farmer Bros. customers. Wethe effects and consequences of the global financial crisis and a broader global economic downturn are currently unknown; any one or all of them could potentially have a line of products that compares favorably with products soldmaterial adverse effect on our liquidity and capital resources, including our ability to sell third-party securities in such “specialty coffee” stores, but mostwhich we have invested some of our restaurant customers do not specializeshort-term assets or raise additional capital, if needed, or the ability of our lender to honor draws on our credit facility, or otherwise negatively impact our business and financial results.

VOLATILITY IN THE EQUITY MARKETS OR INTEREST RATE FLUCTUATIONS COULD SUBSTANTIALLY INCREASE OUR PENSION COSTS AND NEGATIVELY IMPACT OUR OPERATING RESULTS.

At the end of fiscal 2009, the projected benefit obligation of our defined benefit pension plans was $100.1 million and assets were $61.7 million. The difference between plan obligations and assets, or the funded status of the plans, significantly affects the net periodic benefit costs of our pension plans and the ongoing funding requirements of those plans. Among other factors, changes in coffee drinks. As a result, a further shift toward “specialty” coffee housesinterest rates, mortality rates, early retirement rates, investment returns and the market value of plan assets can affect the level of plan funding, cause volatility in the net periodic pension costs, and increase our future funding requirements. We expect to make approximately $4.8 million in contributions to our pension plans in fiscal 2010 and record an accrued expense of approximately $7 million per year beginning in fiscal 2010. These payments are expected to continue at this level for several years, and the current economic environment increases the risk that we may adversely impactbe required to make even larger contributions in the demand for the Company’s products.future.

REDUCTIONS IN CONSUMER DISCRETIONARY SPENDING COULD ADVERSELY AFFECT OUR BUSINESS.

Our success depends to a significant extent on a number of factors that affect discretionary consumer spending, including economic conditions, disposable consumer income and consumer confidence. In a slow economy, businesses and individuals scale back their discretionary spending on travel and entertainment, including “dining out.”"dining out" as well as the purchase of high-end consumables like specialty coffee. Economic conditions may also cause businesses to reduce travel and entertainment expenses, and may even cause office coffee benefits to be eliminated. These factors could reduce demand for our products or impose practical limits on pricing, either of which could adversely affect our business, financial condition, operating results and cash flows.

CHANGES IN CONSUMER PREFERENCES COULD ADVERSELY AFFECT OUR BUSINESS.

Our continued success depends, in part, upon the demand for coffee. We believe that competition from other beverages continues to dilute the demand for coffee. Consumers who choose soft drinks, juices, bottled water, teas and other beverages all reduce spending on coffee. Consumer trends away from coffee could negatively impact our business.

OUR INDUSTRY IS HIGHLY COMPETITIVE AND WE MAY NOT HAVE THE RESOURCES TO COMPETE EFFECTIVELY.

We primarily compete with other coffee companies, including multi-national firms with substantially greater financial, marketing and operating resources than the Company. We face competition from many sources including the food service divisions of multi-national manufacturers of retail products such as The J.M. Smucker Company (Folgers Coffee), Kraft Foods Inc. (Maxwell House Coffee) and Sara Lee Corporation, wholesale grocery distributors such as Sysco Corporation and U.S. Food Service, regional coffee roasters such as S & D Coffee, Inc. and Boyd Coffee Company and specialty coffee suppliers such as Green Mountain Coffee Roasters, Inc. and Peet's Coffee & Tea, Inc.

Table of Contents

If we do not succeed in differentiating ourselves from our competitors or our competitors adopt our strategies, then our competitive position may be weakened.

OUR SALES AND DISTRIBUTION NETWORK IS COSTLY TO MAINTAIN.

Our sales and distribution network requires a large investment to maintain and operate. Costs include the fluctuating cost of gasoline, diesel and oil, the costs associated with managing, purchasing, leasing, maintaining and insuring a fleet of delivery vehicles, the costscost of maintaining distribution centers and branch warehouses throughout the country, and the costscost of hiring, training and managing our route sales professionals. Many of these costs are beyond our control, and others are fixed rather than variable. Some competitors use alternate methods of distribution that eliminate somemany of the costs associated with our method of distribution.

WE ARE SELF-INSURED. OUR RESERVES MAY NOT BE SUFFICIENT TO COVER FUTURE CLAIMS.

We are self-insured for many risks up to significant deductible amounts. The premiums associated with our insurance have recently increased substantially.continue to increase. General liability, fire, workers’workers' compensation, directors and officers liability, life, employee medical, dental and vision and automobile risks present a large potential liability. While we accrue for this liability based on historical experience, future claims may exceed claims we have incurred in the past. Should a different amountnumber of claims occur compared to what was estimated or the cost of the claims increase or decrease beyond what was anticipated, reserves recorded may not be sufficient and the accruals may need to be adjusted accordingly in future periods.

EMPLOYEE STRIKES AND OTHER LABOR-RELATED DISRUPTIONS MAY ADVERSELY AFFECT OUR OPERATIONS.

We have union contracts relating to the majoritya significant portion of our workforce in California, Oregon, Washington and Nevada.workforce. Although we believe union relations have been amicable in the past, there is no assurance that this will continue in the future. There are potential adverse effects of labor disputes with our own employees or by others who provide transportation (shipping lines, truck drivers) or cargo handling (longshoremen), both domestic and foreign, of our raw materials or other products. These actions could restrict our ability to obtain, process and/or distribute our products.

WE MAY ENTER INTO NEW BUSINESS VENTURES THAT COULD HAVE A NEGATIVE IMPACT ON OPERATING RESULTS.

From time to time, we evaluate potential business ventures and acquisitions. Entering into any such transaction entails many risks, any of which could materially harm our business. There is no assurance that any such venture, should we decide to enter into one, will accrue the projected returns. It is possible that such ventures could result in losses or returns that would have a negative impact on operating results.

5

OUR ROASTING AND BLENDING METHODS ARE NOT PROPRIETARY, SO COMPETITORS MAY BE ABLE TO DUPLICATE THEM, WHICH COULD HARM OUR COMPETITIVE POSITION.

We consider our roasting and blending methods essential to the flavor and richness of our coffeecoffees and, therefore, essential to our brand. Because the Company’sour roasting methods cannot be patented, we would be unable to prevent competitors from copying these methods if such methods became known. If our competitors copy our roasts or blends, the value of our brand may be diminished, and we may lose customers to our competitors. In addition, competitors may be able to develop roasting or blending methods that are more advanced than our production methods, which may also harm our competitive position.

BECAUSE A SUBSTANTIAL PORTION OF OUR BUSINESS IS BASEDWE ARE LARGELY RELIANT ON MAJOR FACILITIES IN CALIFORNIA, TEXAS COLORADO, ARIZONA AND WASHINGTON, AN INTERRUPTION IN OPERATIONS IN ANYOREGON FOR PRODUCTION OF THESE MARKETS WOULD ADVERSELY IMPACT OUR BUSINESS.PRODUCT LINE.

Over half of our business is conducted in California, Texas, Colorado, Arizona and Washington. We expect that these operations will continue to generate a substantial portion of our revenue. A significant interruption in operations at our manufacturing facilities in these markets,Torrance, California (our largest facility), Houston, Texas or Portland, Oregon, whether as a result of an earthquake, hurricane, natural disaster, terrorism or other causes, could significantly impair our ability to operate our business. Our major manufacturing facility and distribution hub is in Los Angeles County. The majority of our green coffee comes through the PortPorts of Los Angeles, or the Port of Long Beach.Beach, Houston, San Francisco and Portland. Any interruption to port operations, highway arteries, gas mains or electrical

Table of Contents

service in this areathese areas could restrict our ability to supply our branches with product and would adversely impact our business.

OUR OPERATING RESULTS MAY HAVE SIGNIFICANT FLUCTUATIONS FROM QUARTER TO QUARTER WHICH COULD HAVE A NEGATIVE EFFECT ON OUR STOCK PRICE.

From time to time, our Our operating results likely will fall below investor expectations. These results are influenced bymay fluctuate from period to period or within certain periods as a result of a number of factors, including fluctuations in the price and supply of green coffee, fluctuations in the selling prices of our products, the success of our hedging strategy, competition from existing or new competitors in our industry, and changes in consumer preferences.

Quarterly fluctuationspreferences, and our ability to manage inventory and fulfillment operations and maintain gross margins. Fluctuations in our operating results as thea result of these factors or for any other reason, could cause our stock price to decline. Accordingly, we believe that period-to-period comparisons of our historical or future operating results are not necessarily meaningful, and such comparisons should not be relied upon as indicators of future performance.

OPERATING LOSSES MAY CONTINUE AND, AS A RESULT, THE PRICE OF OUR STOCK MAY BE NEGATIVELY AFFECTED.

For We have incurred operating losses for each of the prior three fiscal year ended June 30, 2006, we had an operating loss of ($2,965,000). For the fiscal year ended June 30, 2005, we had an operating loss of ($6,583,000)years and a net loss in two of ($5,427,000). Wethe prior three fiscal years. If our current strategies are unsuccessful we may not achieve the levels of sales and earnings we expect. As a result, we could suffer additional losses in future years and as a result our stock price could decline.

FUTURE FUNDING DEMANDS UNDER PENSION PLANS FOR CERTAIN UNION EMPLOYEES ARE UNKNOWN.

We participate in twoseveral multi-employer defined benefit plans for certain union employees. The management, funding status and future viability of these plans is not known at this time. The nature of the contract with these plans allows for future funding demands that are outside our control or ability to estimate.

WE RELY ON A SINGLE THIRD PARTY SUPPLIER TO MANAGE OUR INTEGRATED ORACLE SYSTEM THAT IS INTEGRAL TO THE SUCCESS AND OPERATION OF OUR BUSINESS.

We rely on WTS, a company affiliated with Oracle, and its employees, in connection with the hosting of our integrated Management Information System. This System is essential to our operations and currently includes all accounting and production software applications. By the end of fiscal 2007, WTS is also expected to host our Route Sales application software. If WTS were to experience financial, operational, or quality assurance difficulties, or if there were any other disruption in our relationship with WTS, we might be unable to produce financial statements, fill replenishment orders for our branch warehouses, issue payroll checks, process payments to our vendors or bill customers. Any of these items could have a material adverse effect on the Company.

WE ARE DEPENDENT ON ENTERPRISE RESOURCE MANAGEMENT (“ERP”) SOFTWARE TO OPERATE OUR BUSINESS. SHOULD WE FAIL TO OPERATE EFFECTIVELY OR IF WE ENCOUNTER DIFFICULTIES INTEGRATING SYSTEMS OR SUFFER ILL-TIMED POWER OR COMMUNICATIONS FAILURES, THE RESULT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR OPERATIONS.

We rely on complex software and hardware to invoice our customers, produce customer statements, account for our inventory and manufacturing costs, fill branch inventory replenishment orders, pay our bills, pay our employees and produce our financial statements. We have in the past encountered, and in the future may encounter, software and hardware errors, system design errors and errors in the operation of our systems. This has resulted in and may in the future result in a number of adverse consequences, including: users being disconnected from systems and being unable to perform their job functions, delays in producing financial statements and other key management system information.

Reliance on such software also leaves us exposed to harmful software programs such as viruses that could disrupt our business and damage our network. It is possible that a security breach or inappropriate use of our network could expose us to the possibility of system failure or other disruption. A security breach could jeopardize security of confidential information and thereby expose the Company to potential legal liability.

THE COMPANY DEPENDSDEPEND ON THE EXPERTISE OF KEY PERSONNEL. THE UNEXPECTED LOSS OF ONE OR MORE OF THESE KEY EMPLOYEES COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR OPERATIONS ORAND COMPETITIVE POSITION.

Our continued success largely depends on the efforts and abilities of our executive officers and other key personnel. There is limited management depth in certain key positions throughout the Company. We must continue to recruit, retain and motivate management and other employees sufficient to maintain our current business and support our projected growth. The unexpected loss of one or more of these key employees could have a material adverse effect onadversely affect our operations and competitive position.

Our former Chairman and Chief Executive Officer and sole coffee buyer, Roy E. Farmer, died unexpectedly in January 2005. Guenter W. Berger, a long time member We do not maintain key person life insurance policies on any of our Board of Directors and Vice President, Production was appointed interim CEO and in August 2005 assumed the title of Chairman, CEO and President. A new coffee buyer was hired in June 2005. In July 2006 we hired Roger M. Laverty III as President and COO. We continue to evaluate and recruit key personnel to enhance the depth of our management.executive officers.

WE ARE SUBJECT TO RE-FUNDING OBLIGATIONS AND MAY ACQUIRE ADDITIONAL SHARES UNDER THE ESOP.

The Farmer Bros. Co. Employee Stock Ownership Plan (the "ESOP") was designed to help us attract and retain employees and to better align the efforts of our employees with the interests of our stockholders. To that

end, the Company has purchased 3,000,500 shares of Company stock for the ESOP to allocate to employees over the next 12 years. It is possible that additional shares could be acquired that might deplete the Company’s cash.our available cash or require us to borrow additional funds. We expect that the future re-funding liability of the existing shares in the ESOP will increase and require additional investment as the ESOP matures and individual holdings grow. When employees vested in the ESOP leave the Company, they have the right to “put”"put" their shares to the Company for cash. This requiresOur re-funding liability for fiscal 2010 is estimated to be

Table of Contents

$2.1 million. Major assumptions which lead to this result include a 5% appreciation rate in the Company to repurchase those shares atprice of our common stock, the current market value. Assuming allnumber of shares currently owned byin the ESOP are fully distributed, the Company’s re-funding liability is approximately $64,700,000 based on the June 30, 2006 closing share price.and participant demographics.

CONCENTRATION OF OWNERSHIP AMONG OUR EXISTING PRINCIPAL STOCKHOLDERS MAY PREVENT NEW INVESTORS FROM INFLUENCING SIGNIFICANT CORPORATE DECISIONS AND MAY RESULT IN A LOWER TRADING PRICE FOR OUR STOCK THAN IF OWNERSHIP OF OUR STOCK WAS LESS CONCENTRATED.

As of September 1, 2006,3, 2009, members of the Farmer family or entities controlled by the Farmer family (such as(including trusts or business entities)and a family partnership) as a group beneficially owned approximately 40% of our outstanding common stock. As a result, these stockholders, acting together, may be able to influence the outcome of stockholder votes, including votes concerning the election and removal of directors and approval of significant corporate transactions. This level of concentrated ownership along with the factors described in “Risk Factors—ANTI-TAKEOVER PROVISIONS COULD MAKE IT MORE DIFFICULT FOR A THIRD PARTY TO ACQUIRE US,” may have the effect of delaying or preventing a change in the management or voting control of the Company. In addition, this significant concentration of share ownership may adversely affect the trading price forof our common stock if investors perceive disadvantages in owning stock in a company with such concentrated ownership.

FUTURE SALES OF SHARES BY EXISTING STOCKHOLDERS COULD CAUSE OUR STOCK PRICE TO DECLINE.

All of our outstanding shares are eligible for sale in the public market, subject in certain cases to limitations under Rule 144 of the Securities Act of 1933, as amended (the "Securities Act"). Also, shares subject to outstanding options and restricted stock under the Farmer Bros. Co. 2007 Omnibus Plan are eligible for sale in the public market to the extent permitted by the provisions of various vesting agreements, our stock ownership guidelines, and Rule 144 under the Securities Act. If these shares are sold, or if it is perceived that they will be sold in the public market, the trading price of our common stock could decline.

ANTI-TAKEOVER PROVISIONS COULD MAKE IT MORE DIFFICULT FOR A THIRD PARTY TO ACQUIRE US.

We have adopted a stockholder rights plan (the “Rights Plan”"Rights Plan") and declared a dividend distributionpursuant to which each share of our outstanding common stock is accompanied by one preferred share purchase right (a “Right”"Right") for each outstanding share of our common stock to stockholders of record as of March 28, 2005.. Each Right, when exercisable, will entitle the registered holder to purchase from the Company one one-hundredth of a share of Series A Junior Participating Preferred Stock, $1.00 par value per share, at a purchase price of $112.50, subject to adjustment. The Rights expire on March 28, 2015, unless they are earlier redeemed, exchanged or terminated as provided in the Rights Plan. Because the Rights may substantially dilute the stock ownership of a person or group attempting to take us over without the approval of our Board of Directors, our Rights Plan could make it more difficult for a third party to acquire us (or a significant percentage of our outstanding capital stock) without first negotiating with our Board of Directors regarding such acquisition.

In addition, our Board of Directors has the authority to issue up to 500,000 shares of Preferred Stockpreferred stock (of which 200,000 shares have been designated as Series A Junior Participating Preferred Stock) and to determine the price, rights, preferences, privileges and restrictions, including voting rights, of those shares without any further vote or action by the stockholders. The rights of the holders of our common stock may be subject to, and may be adversely affected by, the rights of the holders of any preferred stock that may be issued in the future. The issuance of preferred stock may have the effect of delaying, deterring or preventing a change of control of Farmer Bros.the Company without further action by the stockholders and may adversely affect the voting and other rights of the holders of our common stock.

Table of Contents

Further, certain provisions of our charter documents, including a classified board of directors, provisions eliminating the ability of stockholders to take action by written consent, and provisions limiting the ability of stockholders to raise matters at a meeting of stockholders without giving advance notice, may have the effect of delaying or preventing changes in control or management of Farmer Bros.,the Company, which could

have an adverse effect on the market price of our stock. In addition, our charter documents do not permit cumulative voting, which may make it more difficult for a third party to gain control of our Board of Directors. Further, we are subject to the anti-takeover provisions of Section 203 of the Delaware General Corporation Law, which will prohibit us from engaging in a “business combination”"business combination" with an “interested stockholder”"interested stockholder" for a period of three years after the date of the transaction in which the person became an interested stockholder, even if such combination is favored by a majority of stockholders, unless the business combination is approved in a prescribed manner. The application of Section 203 also could have the effect of delaying or preventing a change of control or management.

FAILURE TO MAINTAIN EFFECTIVE INTERNAL CONTROLS IN ACCORDANCE WITH SECTION 404 OF THE SARBANES-OXLEY ACT OF 2002 COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS AND STOCK PRICE.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX”("SOX"), the SEC adopted rules requiring us, as a public company, to include a report of management on our internal controls over financial reporting in our annual report on Form 10-K and quarterly reports on Form 10-Q that contains an assessment by management of the effectiveness of our internal controls over financial reporting. In addition, our independent auditors must attest to and report on management’smanagement's assessment of the effectiveness of our internal controls over financial reporting as of the end of the fiscal year. Compliance with SOX Section 404 has been a challenge for many companies. Our ability to continue to comply is uncertain as we expect that our internal controls will continue to evolve as our business activities change. If, during any year, our independent auditors are not satisfied with our internal controls over financial reporting or the level at which these controls are documented, designed, operated, tested or assessed, or if the independent auditors interpret the requirements, rules or regulations differently than we do, then they may decline to attest to management’smanagement's assessment or may issue a report that is qualified. In addition, if we fail to maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with SOX Section 404. Failure to maintain an effective internal control environment could have a material adverse effect on our stock price. In addition, there can be no assurance that we will be able to remediate material weaknesses, if any, that may be identified in future periods.

COMPLIANCE WITH CHANGING REGULATION OF CORPORATE GOVERNANCE AND PUBLIC DISCLOSURE MAY RESULT IN ADDITIONAL EXPENSES.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including SOX, new SEC and Public Accounting Oversight Board regulations and NASDAQ National Market rules, are creating uncertainty for public companies. These new or changed laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, and as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We are committed to maintaining high standards of corporate governance and public disclosure. As a result, our efforts to comply with evolving laws, regulations and standards have resulted in, and are likely to continue to result in, increased general and administrative expenses and management time related to compliance activities. Substantial costs have been incurred in fiscal 2006, and will continue to be incurred to comply with various of these mandates, including the engagement of separate public accounting firms to perform work that is now prohibited to be performed by our regular independent accounting firm, internal costs associated with documenting the adequacy of our internal controls over financial reporting and similar compliance activities, and increased costs of audit by our independent accounting firm. If our efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or

governing bodies due to ambiguities related to practice, our reputation may be harmed and we might be subject to sanctions or investigation by regulatory authorities, such as the SEC. Any such action could adversely affect our financial results and the market price of our common stock. While Farmer Bros. believes that it has been at all times in material compliance with laws and regulations pertaining to the proper recording and reporting of our financial results, there can be no assurance that future regulations, implementing SOX and otherwise, will not have a material adverse impact on our reported results as compared with prior reporting periods.

Item 1.B. Unresolved Staff Comments

None.

Item 2. Properties

Our largest and most significant facility consists of our roasting plant, warehouses and administrative offices in Torrance, California. This facility is our primary manufacturing facility and the distribution hub for our long haullong-haul trucking fleet. Coffee purchasing, roasting and packaging takes place at our Torrance, California, Portland, Oregon, and Houston, Texas plants. Spice blending and packaging takes place at our Torrance, California and Oklahoma City, Oklahoma plants. Our distribution centers include our Torrance, Portland and Houston plants as well as new distribution centers in Fridley, Minnesota, Bensenville, Illinois and Moonachie, New Jersey.

Table of Contents

During fiscal 2008 we completed improvements to a new 125,000 square foot leased manufacturing facility in Portland, Oregon that serves as the manufacturing and distribution point for our specialty coffee customers. CBI relocated to this new facility in August 2008.

We stage our products in 101 small179 branch warehouses throughout our service area.the contiguous United States. These warehouses, taken together, represent a vital part of our business, but no individual warehouse is material to the groupbusiness as a whole. Our branch warehouses vary in size from approximately 2,500 to 20,00050,000 square feet. Approximately 40%34% of these warehousesour facilities are leased with a variety of expiration dates through 2011.2014. The lease on the new CBI facility expires in 2018 and has a 10 year renewal option.

We believe our existing plantplants, distribution centers and branch warehouses will continue to provide adequate capacity for the foreseeable future.

A complete list of properties and facilities operated by Farmer Bros. is attached hereto, and incorporated herein by reference, as Exhibit 99.1.

Item 3. Legal Proceedings

We are both defendant and plaintiff in various legal proceedings incidental to our business which are ordinary and routine. It is our opinion that the resolution of these lawsuits will not have a material impact on our financial condition or results of operations.

Item 4. Submission of Matters to a Vote of Security Holders

During the fourth quarter of fiscal 20062009 no matters were submitted to a vote of security holders, through the solicitation of proxies or otherwise.

10

Table of Contents

PART II

Item 5. Market for Registrant’sRegistrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

We have one class of common stock which is traded on the NASDAQ NationalGlobal Market under the symbol “FARM.”"FARM." The following table sets forth, for the periods indicated, the cash dividends declared and the high and low sales prices of the shares of Common Stockcommon stock of the Company. Prices areCompany as reportedquoted on the NASDAQ National Market and represent prices between dealers, without including retail mark-up, mark-down or commission, and do not necessarily represent actual trades.Global Market.

| | | 2006 | | 2005 | | | Fiscal year ended June 30, 2009 | | Fiscal year ended June 30, 2008 | |

|---|

| | High | | Low | | Dividend | | High | | Low | | Dividend | | | High | | Low | | Dividend | | High | | Low | | Dividend | |

|---|

1st Quarter | | $ | 24.98 | | $ | 19.50 | | | $ | 0.105 | | | $ | 27.55 | | $ | 24.50 | | | $ | 0.100 | | | | $ | 28.49 | | $ | 20.21 | | $ | 0.115 | | $ | 25.33 | | $ | 19.89 | | $ | 0.115 | |

2nd Quarter | | $ | 22.87 | | $ | 19.11 | | | $ | 0.105 | | | $ | 28.40 | | $ | 24.03 | | | $ | 0.100 | | | | $ | 25.46 | | $ | 17.00 | | $ | 0.115 | | $ | 27.25 | | $ | 21.30 | | $ | 0.115 | |

3rd Quarter | | $ | 22.61 | | $ | 19.31 | | | $ | 0.105 | | | $ | 29.65 | | $ | 22.05 | | | $ | 0.100 | | | | $ | 25.49 | | $ | 14.26 | | $ | 0.115 | | $ | 24.50 | | $ | 20.12 | | $ | 0.115 | |

4th Quarter | | $ | 23.18 | | $ | 19.72 | | | $ | 0.105 | | | $ | 24.49 | | $ | 20.78 | | | $ | 0.100 | | | | $ | 25.49 | | $ | 17.31 | | $ | 0.115 | | $ | 25.00 | | $ | 21.15 | | $ | 0.115 | |

Holders

There were approximately 3,9372,291 holders of record on September 1, 2006.3, 2009. Holders of record is based upon the number of record holders and individual participants in security position listings.

Effective asDividends

Dividends have been or will be funded through cash flow from operations and available cash on hand. We, at the discretion of March 17, 2005, our Board of Directors approvedand subject to applicable law, anticipate paying regular quarterly dividends on our common stock for the foreseeable future. The amount, if any, of the dividends to be paid in the future will depend upon our then available cash, anticipated cash needs, overall financial condition, loan agreement restrictions, future prospects for earnings and cash flows, as well as other relevant factors. For a stockholder rights plan (the “Rights Plan”), pursuantdescription of the loan agreement restrictions on the payment of dividends, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources" included in Part II, Item 7 of this Form 10-K and Note 9 to which the Company entered into a Rights Agreement dated March 17, 2005 (the “Rights Agreement”) with Wells Fargo Bank, N.A., as Rights Agent,consolidated financial statements included in Part II, Item 8 of this Form 10-K.

Equity Compensation Plan Information

This information appears in Part III, Item 12, hereof.

Table of Contents

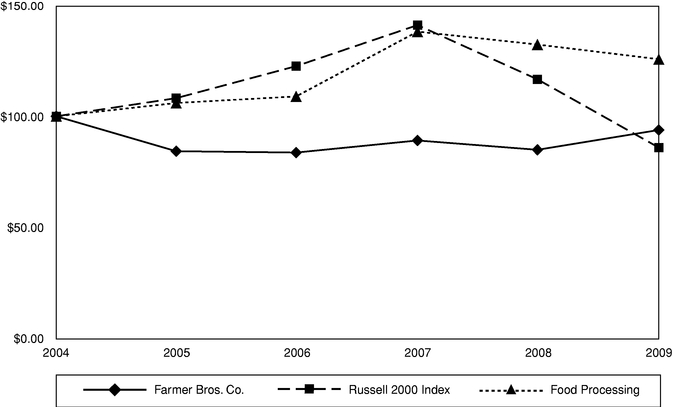

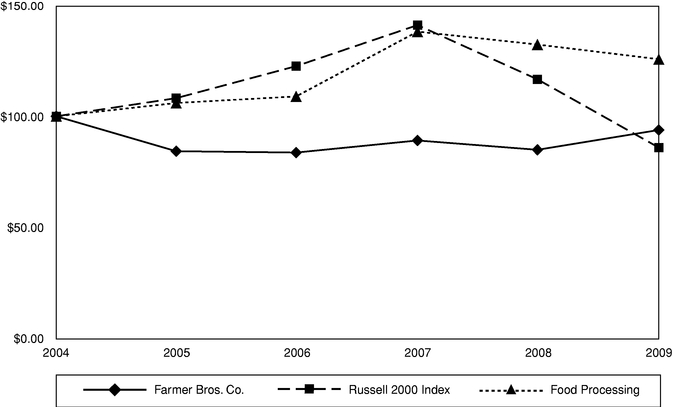

Performance Graph

The chart set forth below shows the value of an investment of $100 on June 30, 2004 in each of Farmer Bros. Co. common stock, the Russell 2000 Index and the Board declared a dividend of one preferred share purchase right (a “Right”) for each outstanding shareValue Line Food Processing Index. All values assume reinvestment of the Company’s Common Stock to stockholderspre-tax value of recorddividends paid by companies included in these indices and are calculated as of June 30 of each year. The historical stock price performance of the Company's common stock shown in the performance graph below is not necessarily indicative of future stock price performance.

Comparison of Five-Year Cumulative Total Return*

Farmer Bros. Co., Russell 2000 Index And Value Line Food Processing Index

(Performance Results Through 6/30/09)

| | | | | | | | | | | | | | | | | | | |

| | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | |

|---|

Farmer Bros. Co. | | $ | 100.00 | | $ | 84.31 | | $ | 83.70 | | $ | 89.13 | | $ | 84.94 | | $ | 93.84 | |

Russell 2000 Index | | $ | 100.00 | | $ | 108.14 | | $ | 122.51 | | $ | 140.94 | | $ | 116.59 | | $ | 85.93 | |

Food Processing | | $ | 100.00 | | $ | 105.97 | | $ | 108.90 | | $ | 138.02 | | $ | 132.21 | | $ | 125.63 | |

Assumes $100 invested at the close of business on March 28, 2005. Each Right, when exercisable, will entitletrading June 30, 2004 in Farmer Bros. Co. common stock, Russell 2000 Index, and Value Line Food Processing Index.

* Cumulative total return assumes reinvestment of dividends.

Source: Value Line, Inc.

Factual material is obtained from sources believed to be reliable, but the registered holder to purchase from the Company one one-hundredthpublisher is not responsible for any errors or omissions contained herein.

Table of a share of Series A Junior Participating Preferred Stock, $1.00 par value per share, at a purchase price of $112.50, subject to adjustment. The description and terms of the Rights are set forth in the Rights Plan. Initially, ownership of the Rights is evidenced by the certificates representing our Common Stock then outstanding, and no separate Rights Certificates, as defined in the Rights Plan, have been distributed. The Rights are not exercisable until the distribution date, as described in the Rights Agreement, and will expire on March 28, 2015, unless they are earlier redeemed, exchanged or terminated as provided in the Rights Plan. ContentsNo rights have been exercised at this time.

Item 6. Selected Financial Data

| | | For the fiscal years ended June 30, | | | For the fiscal years ended June 30, | |

|---|

| | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | | 2009(1) | | 2008(2) | | 2007 | | 2006 | | 2005 | |

|---|

| | (In thousands, except per share data) | | | (In thousands, except per share data)

| |

|---|

Net sales | | $ | 207,453 | | $ | 198,420 | | $ | 193,589 | | $ | 201,558 | | $ | 205,857 | | | $ | 341,724 | | $ | 266,485 | | $ | 216,259 | | $ | 207,453 | | $ | 198,420 | |

(Loss) income from operations | | $ | (2,965 | ) | $ | (6,583 | ) | $ | 3,763 | | $ | 23,888 | | $ | 38,210 | | | $ | (15,203 | ) | $ | (10,644 | ) | $ | (4,076 | ) | $ | (2,965 | ) | $ | (6,583 | ) |

Net income (loss) | | $ | 4,756 | | $ | (5,427 | ) | $ | 12,687 | | $ | 23,629 | | $ | 30,569 | | |

Net income (loss) per common share(a) | | $ | 0.34 | | $ | (0.40 | ) | $ | 0.81 | | $ | 1.30 | | $ | 1.65 | | |

Net (loss) income (3) | | | $ | (33,270 | ) | $ | (7,924 | ) | $ | 6,815 | | $ | 4,756 | | $ | (5,427 | ) |

Net (loss) income per common share | | | $ | (2.29 | ) | $ | (0.55 | ) | $ | 0.48 | | $ | 0.34 | | $ | (0.40 | ) |

Total assets | | $ | 317,237 | | $ | 314,923 | | $ | 317,871 | | $ | 416,415 | | $ | 417,524 | | | $ | 330,017 | | $ | 312,984 | | $ | 337,609 | | $ | 317,237 | | $ | 314,923 | |

Dividends per common share(a) | | $ | 0.42 | | $ | 0.40 | | $ | 0.38 | | $ | 0.36 | | $ | 0.34 | | |

Capital lease obligations | | | $ | 1,252 | | $ | — | | $ | — | | — | | — | |

Cash dividends per common share | | | $ | 0.46 | | $ | 0.46 | | $ | 0.44 | | $ | 0.42 | | $ | 0.40 | |

- (1)

- Includes the results of operations of the DSD Coffee Business since it was acquired by the Company on February 28, 2009.

- (2)

- Includes the results of operations of CBH since it was acquired by the Company on April 27, 2007.

- (3)

- Includes deferred tax asset valuation allowance in the amount of $19,663,000 recorded as a tax expense in fiscal 2009.

(a) All per share disclosures have been adjusted The Notes to reflectConsolidated Financial Statements and Management's Discussion and Analysis of Financial Condition and Results of Operations included elsewhere in this annual report should be read in conjunction with the stock split that became effective on May 10, 2004.selected financial data in order to understand factors such as business combinations and unusual items which may affect the comparability of the information shown above.

11

Item 7. Management’sManagement's Discussion and Analysis of Financial Condition and Results of Operations