Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 20062009

Commission File Number 1-4949

CUMMINS INC.

|

| |

Indiana | 35-0257090 |

500 Jackson Street

Box 3005

Columbus, Indiana 47202-3005

(Address of principal executive offices)

Telephone (812) 377-5000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |||

|---|---|---|---|---|

Common Stock, $2.50 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ýx No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ýx

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ýx No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceeding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’sregistrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a non-accelerated filer.smaller reporting company. See the definition of “accelerated"large accelerated filer," "accelerated filer" and large accelerated filer”"smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ýx

The aggregate market value of the voting stock held by non-affiliates was approximately $6.4$7 billion at July 2, 2006.June 28, 2009. This value includes all shares of the registrant's common stock, except for treasury shares.

As of February 4, 2007,January 29, 2010, there were 52,099,611201,359,036 shares outstanding of $2.50 par value common stock.

Documents Incorporated by Reference

Portions of the registrant’sregistrant's definitive Proxy Statement for its 2010 annual meeting of shareholders, which will be filed with the Securities and Exchange Commission pursuant to Regulationon Schedule 14A arewithin 120 days after the end of 2009, will be incorporated by reference in Part III of this Form 10-K.10-K to the extent indicated therein upon such filing.

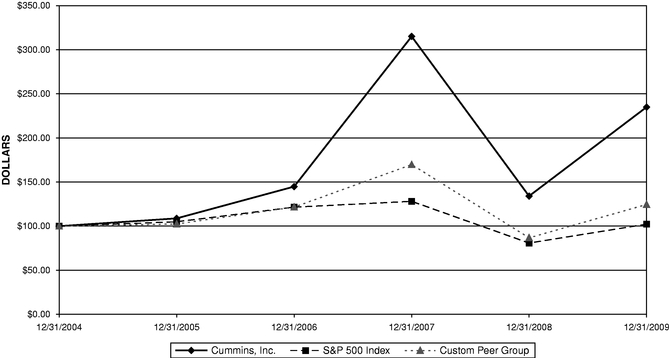

TABLE OF CONTENTS Part Item Page 3 3 3 4 6 7 8 10 11 12 13 13 13 13 13 14 14 15 16 18 19 20 24 24 24 24 25 27 Management’s Discussion and Analysis of Financial Condition and Results of Operations 28 62 64 Changes in and Disagreements with Accountants on Accounting and Financial Disclosure 64 64 65 66 67 Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 67 67 67 67 67 126 127 Cautionary Statements Regarding Forward-Looking Information I Business Overview Operating Segments Engine Segment Power Generation Segment Components Segment Distribution Segment Joint Ventures, Alliances and Non-Wholly-Owned Subsidiaries Supply Patents and Trademarks Seasonality Largest Customers Backlog Research and Development Expense Environmental Compliance Employees Available Information Executive Officers of the Registrant Risk Factors Unresolved Staff Comments Properties Legal Proceedings Submission of Matters to a Vote of Security Holders II Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Selected Financial Data Management's Discussion and Analysis of Financial Condition and Results of Operations Quantitative and Qualitative Disclosures About Market Risk Financial Statements and Supplementary Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships, Related Transactions and Director Independence Principal Accountant Fees and Services IV Exhibits and Financial Statement Schedules Index to Financial Statements Exhibit Index Signatures Cummins Inc. Certain parts of this annual report, particularly "Management's Discussion and Analysis of Financial Condition and Results of Operations", contain forward-looking statements intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those that are based on current expectations, estimates and projections about the industries in which we operate and management's beliefs and assumptions. Forward-looking statements are generally accompanied by words such as "anticipates," "expects," "forecasts," "intends," "plans," "believes," "seeks," "estimates," "could," "should," or words of similar meaning. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which we refer to as "future factors," which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some future factors that could cause our results to differ materially from the results discussed in such forward-looking statements are discussed below and shareholders, potential investors and other readers are urged to consider these future factors carefully in evaluating forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Future factors that could affect the outcome of forward-looking statements include the following: In addition, such statements could be affected by general industry and market conditions and growth rates, general domestic and international economic conditions, including the price of crude oil (diesel fuel), interest rate and currency exchange rate fluctuations, commodity prices and other future factors. Cummins Inc. was founded in 1919 as a corporation in Columbus, Indiana, as one of the first diesel engine manufacturers. We are a global power leader that designs, manufactures, distributes and services diesel and natural gas engines, electric power generation systems and engine-related component products, including filtration, We Engine segment Percent of consolidated net sales(1) Percent of consolidated EBIT(1)(2) Our Engine segment manufactures and markets a broad range of diesel and natural Our Engine segment is provide diesel or natural gas engines for The principal customers of our In the markets served by our Engine segment, we compete with independent engine manufacturers as well as OEMs who manufacture engines for their own products. Our primary competitors in North America are Percent of consolidated net sales(1) Percent of consolidated EBIT(1)(2) Our Power Generation segment developing countries. In addition, utilities, independent power producers and large power customers for use as prime or peaking For revised sales data by product category for 2008 and 2007 see "Management's Discussion and Analysis of Financial Condition and Results of Operations." This Our customer base for power generation products is highly diversified, with customer groups varying based on their power needs. This operating segment competes with a variety of engine manufacturers and generator set assemblers across the world. Components segment sales and EBIT as a percentage of consolidated results were: Percent of consolidated net sales(1) Percent of consolidated EBIT(1)(2) Our Components segment Our Components segment Customers of our Components segment generally include our Engine and Distribution segments, truck manufacturers and other OEMs, Our Components segment competes with other manufacturers of filtration, Percent of consolidated net sales(1) Percent of consolidated EBIT(1)(2) Our Distribution segment consists of The Distribution segment is organized into four primary geographic regions: EMEA and Asia Pacific are composed of seven smaller regional distributor organizations (Greater Europe, Africa, the Middle East, India, China, Northeast/Southeast Asia and the South Pacific) which allow us to better manage these vast geographic territories. Our largest market, North and Central America, is mostly comprised of a network of partially-owned distributors. Internationally, our network consists of independent, partially-owned and wholly-owned distributors. Through this network, In addition to managing our investments in wholly-owned and partially-owned distributors, our Distribution segment is responsible for managing the performance and capabilities of our independent distributors. Our distributors collectively serve a highly diverse customer base with approximately Financial information about our distributors accounted for under the equity method are incorporated by reference from Note 1, "SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES," and Note 2, "INVESTMENTS IN EQUITY INVESTEES," to ourConsolidated Financial Statements. During 2008, we purchased a majority interest in three previously independent North American distributors in order to increase our ownership interests in key portions of the distribution channel. The acquisitions were accounted for under the purchase method of accounting and resulted in an aggregate purchase price of $81 million which we funded with $54 million of borrowings and $27 million of cash. The assets of the acquired businesses were primarily accounts receivable, inventory and fixed assets. There was less than $1 million of goodwill generated from these transactions. Our distributors We have entered into a number of joint venture agreements and alliances with business partners around the world. Our joint ventures are either distribution or manufacturing entities. We also own a controlling interest in a non-wholly-owned manufacturing subsidiary. In the event of a change of control of either party to these joint ventures and other strategic alliances, certain consequences may result including automatic termination and liquidation of the venture, exercise of "put" or "call" rights of ownership by the non-acquired partner, termination or transfer of technology license rights to the non-acquired partner and increases in component transfer prices to the acquired partner. We will continue to evaluate joint venture and partnership opportunities in order to penetrate new markets, develop new products and generate manufacturing and operational efficiencies. Financial information about our Our equity income from these investees was as follows: Distribution Entities North American distributors Komatsu Cummins Chile, Ltda. All other distributors Manufacturing Entities Chongqing Cummins Engine Company, Ltd. Dongfeng Cummins Engine Company, Ltd. Valvoline Cummins, Ltd. Shanghai Fleetguard Filter Co., Ltd. Tata Cummins Ltd. Cummins MerCruiser Diesel Marine, LLC All other manufacturers Cummins share of net income(1) Distribution Entities Our licensing agreements with independent and partially-owned distributors generally have a three-year term and are restricted to specified territories. Our distributors develop and maintain a network of dealers with which we have no direct relationship. The distributors are permitted to sell other, noncompetitive products only with our consent. We license all of our distributors to use our name and logo in connection with the sale and service of our products, with no right to assign or sublicense the marks, except to authorized dealers, without our consent. Products are sold to the distributors at standard domestic or international distributor net prices, as applicable. Net prices are wholesale prices we establish to permit our distributors an adequate margin on their sales. Subject to local laws, we can refuse to renew these agreements at will and we may terminate them upon 90-day notice for inadequate sales, change in principal ownership and certain other reasons. Distributors also have the right to terminate the agreements upon 60-day notice without cause, or 30-day notice for cause. Upon termination or failure to renew, we Manufacturing Entities Manufacturing joint ventures are China. in automotive and industrial applications. Products include transmission fluids, hydraulic lubricants, automotive filters, cooling system products, greases and specialty products. Non-Wholly-Owned Manufacturing Subsidiary We have a controlling interest in Cummins We source our materials and manufactured components from leading suppliers both domestically and internationally. We machine and assemble some of the We own or control a significant number of patents and trademarks relating to the products we manufacture. These patents and trademarks have been granted and registered over a period of years. Although these patents and trademarks are generally considered beneficial to our operations, we do not believe any patent, group of patents, or trademark (other than our leading brand house trademarks) is considered significant to our business. While individual product lines may experience modest seasonal declines in production, there is no material effect on the demand for the majority of our products on a quarterly basis with the exception that our Power Generation segment normally experiences seasonal declines in the first quarter due to general declines in construction spending during this period and We have As a result of the current recessed economic conditions many of our order lead times have decreased significantly from lead times in prior years. While we have Our research and development program is focused on product improvements, innovations and cost reductions for our customers. We expense research and development expenditures, net of contract reimbursements, when incurred. Research and development expenses, net of contract reimbursements, were $362 million in 2009, $422 million in 2008 and $318 million in 2007. Contract reimbursements were $92 million in 2009, $61 million in 2008 and $52 million in 2007. For 2009 and 2008, approximately 42 percent, or $151 million, and approximately 27 percent, or $116 million, respectively, were directly related to compliance with 2010 EPA emissions standards. For 2007, 17 percent, or $55 million, was related to compliance with 2010 EPA emissions standards. In 2009, we reduced research, development and engineering expenses but continued to invest in critical technologies and products for 2010 and beyond. We will continue to Sustainability In 2009, we continued to be a leader in Product Environmental Compliance Our engines are subject to extensive statutory and regulatory requirements that directly or indirectly impose standards governing emissions and noise. Our products comply with all current emissions standards that the EPA Engine Certifications Federal and California regulations require manufacturers to report failures of emissions-related components to the EPA and CARB when the failure rate reaches a specified level. At higher failure rates, a product recall may be required. In Other Environmental Statutes and Regulations expected to be material in 2010. Except as follows, we believe we are in compliance in all material respects with laws and regulations applicable to our plants and operations. In the In addition, we have four other sites where we are working with governmental authorities on remediation projects. The costs for these remediation projects are not expected to be material. As of December 31, 2009, we employed approximately 34,900 persons worldwide. Approximately 13,200 of our employees worldwide are represented by various unions under collective bargaining agreements that expire between 2010 and 2014. For a discussion of the effects of our 2008 and 2009 restructuring actions on employment, see "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Note 3, "RESTRUCTURING AND OTHER CHARGES," to ourConsolidated Financial Statements in this Form 10-K. We file annual, quarterly and current reports, proxy statements and other information electronically with the Securities and Exchange Commission (the "SEC"). You may read and copy any document we file with the SEC at the SEC's public reference room at 100 F Street, N.E., Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for information on the public reference room. The SEC maintains an internet site that contains annual, quarterly and current reports, proxy and information statements and other information that issuers (including Cummins) file electronically with the SEC. The SEC's internet site is www.sec.gov. Our internet site is www.cummins.com. You can access our Investors and Media webpage through our internet site, by clicking on the heading "Investors and Media." We make available, free of charge, on or through our Investors and Media webpage, our proxy statements, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934 or the Securities Act of 1933, as amended, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. We also have a Corporate Governance webpage. You can access our Governance Documents webpage through our internet site, www.cummins.com, by clicking on the heading "Investors and Media," followed by the "Investor Relations" link and then the topic heading of "Governance Documents" within the "Corporate Governance" heading. Code of Conduct, Committee Charters and other governance documents are included at this site. Cummins Code of Conduct applies to all employees, regardless of their position or the country in which they work. It also applies to the employees of any entity owned or controlled by us. We will post any amendments to the Code of Conduct and any waivers that are required to be disclosed by the rules of either the SEC or the New York Stock Exchange LLC (NYSE), on our internet site. The information on Cummins internet site is not incorporated by reference into this report. In accordance with NYSE Rules, on May 21, 2009, we filed the annual certification by our CEO that, as of the date of the certification, he was unaware of any violation by the company of the NYSE's corporate governance listing standards. Following are the names and ages of the executive officers of Cummins Inc., their positions with us as of January 31, 2010, and summaries of their backgrounds and business experience: Our Chairman and Chief Executive Officer is elected annually by our Board of Directors and holds office until the first meeting of the Board of Directors following the annual meeting of the shareholders. Other officers are appointed by the Chairman and Chief Executive Officer, are ratified by our Board of Directors and hold office for such period as the Chairman and Chief Executive Officer or the Board of Directors may prescribe. Item 1A. Risk Factors Set forth below and elsewhere in this Annual Report on Form 10-K are some of the principal risks and uncertainties that could cause our actual business results to differ materially from any forward-looking statements contained in this Although the global economy showed mild signs of recovery in late 2009, a further downturn could materially adversely affect our results of operations, financial condition and cash flows again Although we began to see some signs of improvement in late 2009, the global economy remains fragile. The global economic recession that began in late 2008 and continued through 2009 had a significant adverse impact on our business, customers and suppliers. If the global economy were to take another significant downturn, depending upon the length, duration and severity of such a so-called "double-dip" recession, our results of operations, financial condition and cash flow would almost certainly be materially adversely affected again. Specifically, our revenues would likely decrease, we may be forced to consider further restructuring actions, we may need to increase our allowance for doubtful accounts, our days sales outstanding may increase and we could experience impairments to assets of certain of our businesses. The discovery of any significant problems with our new EPA compliant engine platforms in North America could materially adversely impact our results of operations, financial condition and cash flows. We have received EPA and CARB certification for our heavy-duty ISX15 and mid-range ISB6.7, ISC8.3 and ISL9 engines which went into commercial production in early 2010. Certification of these engines confirms that our 2010 engine line-up for on-highway applications meets the near zero emissions levels required for all engines manufactured in 2010. The launch of these new platforms, which includes the introduction of SCR technology, will impact a number of our operating segments and is We may need to write off significant investments in our new light-duty diesel engine platforms if customer commitments further deteriorate. We began development of a new light-duty diesel engine platform in July 2006 to be used in a variety of on- and off-highway applications. Since that time, and as of December 31, 2009, we have capitalized investments of approximately $216 million. Market uncertainty due to the global recession has resulted in some customers delaying or cancelling their vehicle programs, while others remain on schedule. If customer expectations or volume projections further deteriorate from our current levels and we do not identify new customers, we may need to recognize an impairment charge and write the asset down to net realizable value. We are vulnerable to supply shortages from single-sourced suppliers. For 2009, we single sourced approximately 70 to 80 percent of the Government regulation could adversely affect our business. Our engines are subject to extensive statutory and regulatory requirements governing emissions and noise, including standards imposed by the EPA, the European Union, state regulatory agencies, such as the Greenhouse gas legislation or regulation could adversely affect our business. There is growing consensus that some form of U.S. federal legislation and/or regulation may be forthcoming with respect to regulating manufacturers' greenhouse gas emissions. Any mandate or standard. We are Our products are exposed to variability in material and commodity costs. Our businesses establish prices with our customers in accordance with contractual time frames; however, the We are subject to We We also face risks arising from the imposition of exchange controls and currency devaluations. Exchange controls may limit our ability to convert foreign currencies into U.S. dollars or to remit dividends and other payments by our foreign subsidiaries or businesses located in or conducted within a country imposing controls. Currency devaluations result in a diminished value of funds denominated in the currency of the country instituting the devaluation. Further deterioration in the North American and European automotive industries could adversely impact our business. industry conditions have also adversely affected our supply base. Lower production levels for some of Significant declines in We sponsor both funded and unfunded domestic and foreign defined benefit pension and other retirement plans. Our pension expense and the required contributions to our pension plans are directly affected by the value of plan assets, the projected and actual rates of return on plan assets and the actuarial assumptions we use to measure our defined benefit pension plan obligations, including the discount rate at which future projected and accumulated pension obligations are discounted to a present value. We could experience increased pension expense due to a combination of factors, including the decreased investment performance of pension plan assets, decreases in the discount rate and changes in our assumptions relating to the expected return on plan assets. Significant declines in future financial and stock market conditions could cause material losses in our pension plan assets, which could result in increased pension expense in future years and adverse changes to our financial condition. We may be legally required to make contributions to our U.S. pension plans in the future, and these contributions could be material. In addition, if local legal authorities increase the minimum funding requirements for our pension plans outside the U.S., we could be required to contribute more funds. As we continue to Our business We face an inherent business risk of exposure to product liability claims in the event that our Our products are subject to recall for performance-related issues. Our products may be subject to recall for performance-related or safety-related issues. Product recalls subject us to harm to our reputation, loss of current and future customers, reduced revenue and product recall costs. Product recall costs are incurred when we decide, either voluntarily or involuntarily, to recall a product through a formal campaign to solicit the return of specific products due to a known or suspected performance issue. Our truck manufacturers and OEM customers may not continue to outsource their engine supply needs. Several of our engine customers, including PACCAR Inc., Volvo AB and Chrysler, are truck manufacturers or OEMs that manufacture engines for some of their own products. Despite their engine manufacturing abilities, these customers have historically chosen to outsource certain types of engine production to us due to the quality of our engine products, our emissions capability, our systems integration, their customers' preferences, their desire for cost reductions, their desire for eliminating production risks and their desire to maintain company focus. However, there can be no assurance that these customers will continue to outsource, or outsource as much of, their engine production in the future. Increased levels of OEM vertical integration could result from a number of factors, such as shifts in our customers' business strategies, acquisition by a customer of another engine manufacturer, the inability of third-party suppliers to meet product specifications and the emergence of low-cost production opportunities in foreign countries. Any significant reduction in the level of engine production outsourcing from our truck manufacturer or OEM customers could have a material adverse effect upon us. Our operations are subject to extensive environmental laws and Our plants and operations are subject to increasingly stringent environmental laws and regulations in all of the countries in which we operate, including laws and regulations governing air emissions, We Our net income includes significant equity, royalty and interest income from investees that we do not directly control. For 2009, we recognized $214 million of equity, royalty and interest income from investees. The majority of our equity, royalty and interest income from investees comes from our 13 unconsolidated North American distributors, and from two of our joint ventures in China, Dongfeng Cummins Engine Company, Ltd. ("DCEC") and Chongqing Cummins Engine Company, Ltd. ("CCEC"). Our equity ownership interests in our unconsolidated North American distributors generally range from 30 percent to We face reputational and legal risk from affiliations with foreign joint venture partners. Several of our joint venture partners are domiciled in areas of the Unanticipated changes in our tax provisions, the adoption of new U.S. tax legislation or exposure to additional income tax liabilities could adversely affect our profitability. We are subject to ongoing tax audits in various U.S. and foreign jurisdictions. Tax authorities may disagree with certain tax reporting positions taken by us and, as a result, assess additional taxes against us. We regularly assess the likely outcomes of these audits in order to determine the appropriateness of our tax provision. However, there can be no assurance that we will accurately predict the outcomes of these audits, and the President Obama's administration has recently announced proposals for new U.S. tax legislation that, We may As of December 31, 2009, we employed approximately 34,900 persons worldwide. Approximately 13,200 of our employees worldwide are represented by various unions under collective bargaining agreements that expire between 2010 and 2014. While we have no reason to believe that we will be impacted by work stoppages and other labor matters, there can be no assurance that future issues with our We face significant competition in the markets we The markets in which we operate are highly competitive. We compete worldwide with a number of other manufacturers and distributors that produce and sell similar products. Our products primarily compete on the basis of price, performance, fuel economy, speed of delivery, quality and customer support. There can be no assurance that our products will be able to compete successfully with the products of these other companies. discussion of the competitive environment in which each of our segments operates, see Item 1B. Unresolved Staff Comments None. Our In addition, engines and engine components are manufactured by joint ventures or independent licensees at manufacturing plants in the U.K., The principal distribution facilities used by our Distribution segment are located in the following locations: Our Corporate Headquarters are located in Columbus, Indiana. Additional marketing and operational headquarters are in the following locations: We are In June 2008, four of our sites in Southern Indiana, including our Technical Center, experienced extensive flood damage. We have submitted a claim for $237 million to our insurance carriers, which includes a claim for business interruption. Our insurance carriers have disputed certain aspects of our claim and each party has filed suit against the other. Although we believe that we should be insured against the full amount of such claim, there can be no assurance that we will Item 4. Submission of Matters to a Vote of Security Holders There were no matters submitted to a vote of our PART II Item 5. Market for (a) Our common stock, par value $2.50 per share, is listed on the NYSE under the symbol (b) Use of proceeds—not applicable. (c) The following information is provided pursuant to Item 703 of Regulation S-K: ISSUER PURCHASES OF EQUITY SECURITIES Period (a) Total (b) Average (c) Total Number of (d) Maximum October 2 - October 29, 2006 — $ — — 1,879,600 October 30 - November 26, 2006 214,835 101.54 214,600 1,665,000 November 27 - December 31, 2006 165,239 119.86 165,000 1,500,000 Total 380,074 109.50 379,600 September 28 - November 1, 2009 November 2 - November 29, 2009 November 30 - December 31, 2009 Total In December 2007, our Board of Directors authorized us During the fourth quarter of The following Performance Graph and related information shall not be deemed The following graph compares the cumulative total shareholder return on ASSUMES $100 INVESTED ON JAN. 01, 2005 Item 6. Selected Financial Data The selected financial information presented below for each of the five For the years ended December 31, 2006 2005 2004 2003(1) 2002(2) Millions, except per share Consolidated Statements of Earnings Data Net sales $ 11,362 $ 9,918 $ 8,438 $ 6,296 $ 5,853 Gross margin 2,595 2,186 1,680 1,123 1,045 Investee equity, royalty and other income 140 131 120 74 29 Interest expense 96 109 111 90 61 Dividends on preferred securities of subsidiary trust — — — 11 21 Earnings before cumulative effect of change in accounting principles 715 550 350 54 79 Net earnings 715 550 350 50 82 Net earnings per share before cumulative effect of change in accounting principles: Basic $ 15.02 $ 12.43 $ 8.30 $ 1.37 $ 2.06 Diluted 14.21 11.01 7.39 1.36 2.06 Net earnings per share: Basic $ 15.02 $ 12.43 $ 8.30 $ 1.28 $ 2.13 Diluted 14.21 11.01 7.39 1.27 2.13 Dividends declared per share 1.32 1.20 1.20 1.20 1.20 Consolidated Balance Sheet Data Cash and cash equivalents $ 840 $ 779 $ 611 $ 108 $ 224 Total assets 7,465 6,885 6,510 5,126 4,837 Long-term debt 647 1,213 1,299 1,380 999 Mandatorily redeemable preferred securities — — — — 291 Shareholders’ equity 2,802 1,864 1,401 949 841 For the years ended December 31, Net sales U.S. percentage of sales Non-U.S. percentage of sales Gross margin Research, development and engineering expenses Equity, royalty and interest income from investees Interest expense Net income(1) Net income attributable to Cummins Inc.(1)(2) Net earnings per share attributable to Cummins Inc.(3) Basic Diluted Cash dividends declared per share Cash flows from operations Capital expenditures At December 31, Cash and cash equivalents Total assets Long-term debt Total equity(4) Item 7. The following Other Commercial Commitments EXECUTIVE SUMMARY AND FINANCIAL HIGHLIGHTS We are a global power leader that designs, manufactures, distributes and services diesel and natural gas engines, electric power generation systems and engine-related component products, including filtration, Our reportable operating segments consist of the following: Engine, Power Generation, Components and Distribution. This reporting structure is organized according to the products and markets each segment and Our financial performance depends, in large part, on varying conditions in the markets we serve, particularly the on-highway, construction and general industrial markets. Demand in these markets tends to fluctuate in response to overall economic conditions and is particularly sensitive to changes in interest rate generally result in The global economic downturn in 2009 extensively challenged most of our businesses and the markets in which While we expect overall demand for most of our products to be weak in the first half of 2010, with some improvements in demand in emerging markets, the actions that we initiated in late 2008 and throughout 2009 will continue to enable us to navigate through the challenging economic environment and will position us to respond to market conditions when and where they improve. Our short term priorities remain: Table of Net Net sales Cost of sales Gross margin Operating expenses and income Selling, general and administrative expenses Research, development and engineering expenses Equity, royalty and interest income from investees Restructuring and other charges Other operating (expense) income, net Operating income Interest income Interest expense Other (expense) income, net Income before income taxes Income tax expense Net income Less: Net income attributable to noncontrolling interests Net income attributable to Cummins Inc. Diluted earnings per share attributable to Cummins Inc. Percent of sales Gross margin Selling, general and administrative expenses Research, development and engineering expenses 2009 vs. 2008 Net Sales Net sales decreased in all segments A more detailed discussion of sales by segment is presented in the "OPERATING SEGMENT RESULTS" section. Gross Margin Years ended December 31, 2006 2005 2004 Millions, except earnings per share Consolidated Results Net sales $ 11,362 $ 9,918 $ 8,438 Gross margin 2,595 2,186 1,680 Investee equity, royalty and other income 140 131 120 Operating earnings 1,131 894 539 Net earnings 715 550 350 Diluted earnings per share $ 14.21 $ 11.01 $ 7.39 Volume/Mix Price Production costs Warranty expense Material Costs Currency Other Total Selling, general and administrative expenses decreased primarily due to a decrease of $74 million in discretionary spending, in order to conserve cash, and a decrease of $71 million in compensation and related expenses. Compensation and related expenses include salaries, fringe benefits and variable compensation. Salaries and fringe benefits decreased due to severance actions taken throughout 2009. Overall selling, general and administrative expenses as a percentage of sales increased to 11.5 percent in 2009 from 10.1 percent in 2008, primarily due to the Research, Development and Engineering Expenses Research, development and engineering expenses decreased primarily due to a decrease in the number of Equity, Royalty and Interest Income from Investees Equity, royalty and interest income from investees decreased primarily due to the following changes in equity income: Dongfeng Cummins Engine Company, Ltd. (DCEC) Cummins MerCruiser Diesel, LLC (MerCruiser) These decreases were primarily due to lower demand as a result of the Other operating (expense) income was as follows: Flood damage gain (loss)(1) Royalty income Royalty expense Amortization of other intangibles (Loss) gain on sale of fixed assets Other, net Total other operating (expense) income, net Interest Income Years ended December 31, Change 2006 2005 Amount Percent Millions Net sales $ 11,362 $ 9,918 $ 1,444 15 % Cost of sales 8,767 7,732 1,035 13 % Gross margin 2,595 2,186 409 19 % Operating expenses and income Selling and administrative expenses 1,283 1,145 138 12 % Research and engineering expenses 321 278 43 15 % Investee equity, royalty and other income (140 ) (131 ) (9 ) 7 % Other operating expenses, net — — — NM Operating earnings 1,131 894 237 27 % Interest income (47 ) (24 ) (23 ) 96 % Interest expense 96 109 (13 ) 12 % Other (income) expenses, net (1 ) 11 (12 ) NM Earnings before income taxes and minority interests 1,083 798 285 36 % Provision for income taxes 324 216 108 50 % Minority interests in earnings of consolidated subsidiaries 44 32 12 38 % Net earnings $ 715 $ 550 $ 165 30 % Interest Expense Interest expense decreased primarily due to Other (Expense) Income, Net Other (expense) income was as Foreign currency loss(1) Bank charges Change in cash surrender value of corporate owned life insurance(2) Dividend income Other, net Total other (expense) income, net Income Tax Expense Our income Our effective tax rate for We expect our Noncontrolling Interests Noncontrolling interests eliminate the income or loss attributable to non-Cummins ownership interests in our Net Income Attributable to Outlook Near-Term: Many of the Long-Term: While there is uncertainty in the near-term market as a Years ended December 31, Change 2005 2004 Amount Percent Millions Net sales $ 9,918 $ 8,438 $ 1,480 18 % Cost of sales 7,732 6,758 974 14 % Gross margin 2,186 1,680 506 30 % Operating expenses and income Selling and administrative expenses 1,145 1,015 130 13 % Research and engineering expenses 278 241 37 15 % Investee equity, royalty and other income (131 ) (120 ) (11 ) 9 % Other operating expenses, net — 5 (5 ) 100 % Operating earnings 894 539 355 66 % Interest income (24 ) (12 ) (12 ) 100 % Interest expense 109 111 (2 ) 2 % Other expenses, net 11 8 3 38 % Earnings before income taxes and minority 798 432 366 85 % Provision for income taxes 216 56 160 NM Minority interests in earnings of consolidated subsidiaries 32 26 6 23 % Net earnings $ 550 $ 350 $ 200 57 % Net Sales Net sales increased in all segments A detailed discussion of Gross Margin Significant drivers of the change in gross margin were as follows: Price Volume/Mix Production costs Currency Warranty expense Material costs Other Total Gross margin increased by $384 million, and A more detailed discussion of Selling, General and Administrative Expenses Selling, general and administrative expenses increased primarily due to Research, Development and Engineering Expenses Research, development and engineering expenses increased significantly, primarily due to higher spending on development programs for future products including increased headcount, compensation and related expenses. North American Distributors Dongfeng Cummins Engine Company, Ltd. (DCEC) Royalty and interest income Chongqing Cummins Engine Company, Ltd. (CCEC) Shanghai Fleetguard Filter Co., Ltd. Tata Cummins Ltd. (TCL) MerCruiser Results from our North American distributors Other Operating (Expense) Income, Net Other operating (expense) income was Royalty income Gain on sale of fixed assets(1) Flood damage loss Royalty expense Amortization of other intangibles(2) Other, net Total other operating (expense) income, net Interest Income Interest income decreased primarily due to lower average cash balances in 2008 compared to 2007. Interest Expense Interest expense decreased primarily due to declining short-term interest rates and a benefit from our interest rate swap. Other (Expense) Income, Net Other (expense) income was as follows: Change in cash surrender value of corporate owned life insurance(1) Bank charges Foreign currency (losses) gains(2) Dividend income Other, net Total other (expense) income, net Income Tax Expense Our income tax Net Income Attributable to Cummins Inc. and Diluted Earnings Per Share Attributable to Cummins Inc. Net income attributable to Cummins Inc. and diluted earnings per share attributable to Cummins Inc. increased primarily due to higher volumes, improved margins, higher equity income and a lower effective tax rate. These 2009 Restructuring Actions In 2009, we executed restructuring actions in response to a reduction in orders in most of our U.S. and foreign markets due to the continuing deterioration in the global economy. We reduced our global workforce by approximately 1,000 professional employees. In addition, we took numerous employee actions at many of our manufacturing locations, including approximately 3,200 hourly employees, significant downsizing at numerous facilities and complete closure of several facilities and branch distributor locations. Employee termination and severance costs were recorded based on approved plans developed by the businesses and corporate management which specified positions to be eliminated, benefits to be paid under existing severance plans, union contracts or statutory requirements and the expected timetable for We incurred $2 million of restructuring expenses for lease terminations and $5 million of restructuring expenses for asset impairments in response to closures and downsizing noted above. During 2009, we recorded a total pre-tax restructuring charge of $85 million, comprising $90 million of charges related to 2009 actions net of the $3 million favorable change in estimate related to 2008 actions and the $2 million favorable change in estimate related to earlier 2009 actions, in "Restructuring and other charges" in ourConsolidated Statements of Income. These restructuring actions included: Workforce reductions Exit activities Other Changes in estimate Total restructuring charges Curtailment loss Total restructuring and other charges In addition, as a result of the restructuring actions described above, we also recorded a $14 million curtailment loss in our pension and other postretirement plans. See Note 12, "PENSION AND OTHER POSTRETIREMENT BENEFITS," to ourConsolidated Financial Statements for additional detail. At December 31, 2009, of the approximately 4,200 employees affected by this plan, all terminations were substantially complete. If the 2009 restructuring actions are successfully implemented, we expect the annualized savings from the professional actions to be approximately $50 million. Our charge related to the professional actions was approximately $30 million. Approximately 40 percent of the The 2009 Restructuring charges Cash payments for 2009 actions Noncash items Changes in estimates Translation Balance at December 31, 2009 We do not include restructuring and other charges in our operating segment results. The pre-tax impact of allocating restructuring and other charges to the segment results would have been as follows: Engine Power Generation Components Distribution Total restructuring charges 2008 Restructuring Actions We executed restructuring actions primarily in the form of voluntary and involuntary separation programs in the fourth quarter of 2008. These actions were in response to the continued deterioration in our U.S. businesses and most key markets around the world in the second half of 2008, as well as a reduction in orders in most U.S. and global markets for 2009. We reduced our worldwide professional workforce by approximately 650 employees, or 4.5 percent. We offered a voluntary retirement package to certain active professional employees in the U.S. based on a clearly defined set of criteria. We also took voluntary and involuntary actions which included approximately 800 hourly employees, the majority of which received severance benefits. The compensation packages contained salary and continuation of benefits, including health care, life insurance and outplacement services. The voluntary retirement package was accepted by approximately 150 employees. The remaining professional reductions of 500 employees were involuntary. The expenses recorded during the year ended December 31, 2008, included severance costs related to both voluntary and involuntary terminations. During 2008, we incurred a pre-tax charge related to the professional and hourly restructuring initiatives of approximately $37 million. Employee termination and severance costs were recorded based on approved plans developed by the businesses and corporate management which specified positions to be eliminated, benefits to be paid under existing severance plans or statutory requirements and the expected timetable for completion of the At December 31, 2008, of the approximately 1,450 employees affected by this plan, 1,250 had been terminated. All terminations were substantially complete as of December 31, 2009. We expect the 2008 restructuring actions to yield approximately $45 million to $50 million in annual savings from professional actions. Approximately 41 percent of the savings from the restructuring actions will be realized in cost of sales, 44 percent in selling, general and administrative expenses, and 15 percent in research, development and engineering expenses. The table below summarizes the balance of accrued restructuring expenses for 2008 actions, which were included in the balance of "Other accrued expenses" in ourConsolidated Balance Sheets as of December 31, 2009 and 2008: 2008 Restructuring charges Cash payments for 2008 actions Balance at December 31, 2008 2009 Cash payments for 2008 actions Change in estimate Balance at December 31, 2009 We do not include restructuring charges in the segment results. The pre-tax impact of allocating restructuring charges for the year ended December 31, 2008, would have been as follows: Engine Power Generation Components Distribution Total restructuring charges There were no material changes to the estimated savings, or periods under which we expect to recognize the savings, for the 2008 actions. Our reportable operating segments consist of the following: Engine, Power Generation, Components, and Distribution. This reporting structure is organized according to the products and markets each segment We use segment EBIT (defined as earnings before interest expense, taxes and The accounting policies of our operating segments are the same as those applied in basis that is consistent with the manner in which we internally disaggregate financial information to assist in making internal operating decisions. We have allocated certain common costs and expenses, primarily corporate functions, among segments differently than we would for stand-alone financial information prepared in accordance with Engine Power Components Distribution Non-segment Total Millions 2006 Net sales $ 7,511 $ 2,416 $ 2,281 $ 1,385 $ (2,231 ) $ 11,362 Investee equity, royalty and other income 67 12 7 54 — 140 Segment EBIT 733 220 107 144 (25 ) 1,179 2005 Net sales $ 6,657 $ 1,999 $ 2,000 $ 1,191 $ (1,929 ) $ 9,918 Investee equity, royalty and other income 80 9 8 34 — 131 Segment EBIT 582 145 89 107 (16 ) 907 2004 Net sales $ 5,424 $ 1,842 $ 1,783 $ 973 $ (1,584 ) $ 8,438 Investee equity, royalty and other income 80 6 9 25 — 120 Segment EBIT 328 60 84 79 (8 ) 543 Financial Years ended December 31, 2006 2005 2004 Millions Segment EBIT $ 1,179 $ 907 $ 543 Less: Interest expense 96 109 111 Earnings before income taxes and minority interests $ 1,083 $ 798 $ 432 External sales Intersegment sales Total sales Depreciation and amortization Research, development and engineering expenses Equity, royalty and interest income from investees Interest income Segment EBIT Segment EBIT as a percentage of net sales (2.2) percentage points (1.1) percentage points Engine Power Components Distribution Non-segment Millions Increase (decrease) 2004 Net sales $ (76 ) $ (35 ) $ 299 $ 117 $ (305 ) Investee equity, royalty and other income (16 ) (7 ) — 23 — Segment EBIT (11 ) (9 ) — 28 (8 ) Net assets (193 ) (3 ) 108 88 — Years ended December 31, Change 2006 2005 Amount Percent Net sales $ 7,511 $ 6,657 $ 854 13 % Investee equity, royalty and other income 67 80 (13 ) (16 )% Segment EBIT 733 582 151 26 % Segment EBIT as a 9.8 % 8.7 % 1.1 percentage points A summary and discussion of Engine segment net sales by market Years ended December 31, Change 2006 2005 Amount Percent Heavy-duty truck $ 2,498 $ 2,139 $ 359 17 % Medium-duty truck and bus 971 904 67 7 % Light-duty automotive 1,261 1,178 83 7 % Total on-highway 4,730 4,221 509 12 % Industrial 2,063 1,791 272 15 % Stationary power 718 645 73 11 % Total net sales $ 7,511 $ 6,657 $ 854 13 % Heavy-duty truck Medium-duty truck and bus Light-duty automotive and RV Total on-highway Industrial Stationary power Total sales A summary of unit shipments by engine classification (including unit shipments to Power Generation) follows: Years ended Change 2006 2005 Amount Percent Midrange 459,900 419,200 40,700 10 % Heavy-duty 123,400 107,600 15,800 15 % High-horsepower 16,300 14,400 1,900 13 % Total unit shipments 599,600 541,200 58,400 11 % Mid-range Heavy-duty High-horsepower Total unit shipments 2009 vs. 2008 Engine segment sales experienced deterioration across all major markets, versus 2008, as a result of the global economic downturn. The Total on-highway-related sales were 61 percent of total Engine segment sales, compared to 53 percent in 2008. Segment EBIT Engine segment EBIT decreased primarily due to lower gross margin and equity, royalty and interest income from investees which were partially offset by decreased selling, general and administrative expenses and decreased research, development and engineering expenses. Changes in Engine segment EBIT and EBIT as a percentage of sales were as follows: Gross margin Selling, general and administrative expenses Research, development and engineering expenses Equity, royalty and interest income from investees The decrease in gross margin was primarily 2008 vs. 2007 Net Sales Engine segment sales increased compared to 2007. The following are the primary drivers by market. Years ended Change 2005 2004 Amount Percent Net sales $ 6,657 $ 5,424 $ 1,233 23 % Investee equity, royalty and other income 80 80 — — Segment EBIT 582 328 254 77 % Segment EBIT as a percentage of net sales 8.7 % 6.0 % 2.7 percentage points Years ended Change 2005 2004 Amount Percent Heavy-duty truck $ 2,139 $ 1,700 $ 439 26 % Medium-duty truck and bus 904 693 211 30 % Light-duty automotive 1,178 1,129 49 4 % Total on-highway 4,221 3,522 699 20 % Industrial 1,791 1,380 411 30 % Stationary power 645 522 123 24 % Total net sales $ 6,657 $ 5,424 $ 1,233 23 % Years ended Change 2005 2004 Amount Percent Midrange 419,200 368,700 50,500 14 % Heavy-duty 107,600 87,200 20,400 23 % High-horsepower 14,400 12,100 2,300 19 % Total unit shipments 541,200 468,000 73,200 16 % These increases were partially offset by a 50 percent decline in units sold to Table of Total on-highway-related sales were 53 percent of total Engine segment sales in Years ended Change 2006 2005 Amount Percent Net sales $ 2,416 $ 1,999 $ 417 21 % Investee equity, royalty and other income 12 9 3 33 % Segment EBIT 220 145 75 52 % Segment EBIT as a percentage of net sales 9.1 % 7.3 % 1.8 percentage points Years ended Change 2006 2005 Amount Percent Midrange 29,200 21,300 7,900 37 % Heavy-duty 6,800 7,200 (400 ) (6 )% High-horsepower 9,300 8,300 1,000 12 % Total unit shipments 45,300 36,800 8,500 23 % Years ended Change 2005 2004 Amount Percent Net sales $ 1,999 $ 1,842 $ 157 9 % Investee equity, royalty and other income 9 6 3 50 % Segment EBIT 145 60 85 NM Segment EBIT as a percentage of net sales 7.3 % 3.3 % 4.0 percentage points Years ended Change 2005 2004 Amount Percent Midrange 21,300 16,800 4,500 27 % Heavy-duty 7,200 6,700 500 7 % High-horsepower 8,300 7,400 900 12 % Total unit shipments 36,800 30,900 5,900 19 % Years ended Change 2006 2005 Amount Percent Net sales $ 2,281 $ 2,000 $ 281 14 % Investee equity, royalty and other income 7 8 (1 ) (13 )% Segment EBIT 107 89 18 20 % Segment EBIT as a percentage of net sales 4.7 % 4.5 % 0.2 percentage points Gross margin Selling, general and administrative expenses Research, development and engineering expenses The increase in research, development and engineering expenses was the result of increased Years ended Change 2005 2004 Amount Percent Net sales $ 2,000 $ 1,783 $ 217 12 % Investee equity, royalty and other income 8 9 (1 ) (11 )% Segment EBIT 89 84 5 6 % Segment EBIT as a percentage of net sales 4.5 % 4.7 % (0.2) percentage points Years ended Change 2006 2005 Amount Percent Net sales $ 1,385 $ 1,191 $ 194 16 % Investee equity, royalty and other income 54 34 20 59 % Segment EBIT 144 107 37 35 % Segment EBIT as a percentage of net sales 10.4 % 9.0 % 1.4 percentage points Financial data for the Power Generation segment was as follows: External sales Intersegment sales Total sales Depreciation and amortization Research, development and engineering expenses Equity, royalty and interest income from investees Interest income Segment EBIT Segment EBIT as a percentage of net sales (3.8) percentage points (0.2) percentage points In 2009, the Power Generation segment reorganized its reporting structure to include the following businesses: commercial products, alternators, commercial projects, power electronics and consumer. Sales for our Power Generation segment by business (including 2008 and 2007 revised balances) were as follows: Commercial products Alternator Commercial projects Consumer Power electronics Total sales A summary of unit shipments used in power generation equipment by engine classification follows: Mid-range Heavy-duty High-horsepower Total unit shipments 2009 vs. 2008 Net Sales Power Generation segment sales decreased in most businesses, versus 2008, as the result of the global economic downturn. The following are the primary drivers by business. Segment EBIT Power Generation segment EBIT decreased primarily due to a lower gross margin, which was partially offset by decreases in selling, general and administrative and research, development and engineering expenses. Gross margin Selling, general and administrative expenses Research, development and engineering expenses Equity, royalty and interest income from investees The decrease in Net Sales Power Generation segment sales increased compared to 2007 primarily due to the These increases were partially offset by a significant sales decrease in our consumer business, primarily due to the softening U.S. economy. Segment EBIT Power Generation segment EBIT Years ended Change 2005 2004 Amount Percent Net sales $ 1,191 $ 973 $ 218 22 % Investee equity, royalty and other income 34 25 9 36 % Segment EBIT 107 79 28 35 % Segment EBIT as a percentage of net sales 9.0 % 8.1 % 0.9 percentage points Gross margin Selling, general and administrative expenses Research, development and engineering expenses The increase in gross margin was primarily due to significant price realization, increased volume and favorable product mix which were partially offset by increased material costs, including increased engine and commodity prices. The increase in selling, general and administrative expenses was primarily due to higher payroll costs and increases in the number of segment employees. Financial data for the Components segment was as follows: External sales Intersegment sales Total sales Depreciation and amortization Research, development and engineering expenses Equity, royalty and interest income from investees Interest income Segment EBIT Segment EBIT as a percentage of net sales (1.4) percentage points 0.2 percentage points Our Components segment includes the following businesses: filtration, turbochargers, emissions solutions and fuel systems. Sales for our Components segment by business were as follows: Filtration Turbochargers Emissions solutions Fuel systems Total sales 2009 vs. 2008 Net Sales Components segment sales for the year ended 2009 decreased in all businesses versus 2008 as the result of the global economic downturn. The following are the primary drivers by business. Segment EBIT Components segment EBIT decreased versus 2008, primarily due to a lower gross margin which was partially offset by decreased selling, general and administrative and research, development and engineering expenses. Changes in Components segment EBIT and EBIT as a percentage of sales were as follows: Gross margin Selling, general and administrative expenses Research, development and engineering expenses The decrease in gross margin was due to lower volumes for most markets, partially offset by implementation of severance programs. The decrease in selling, general and administrative and research, development and engineering expenses was primarily due to implementation of severance programs, closing certain facilities, decreased discretionary spending and decreased research and development spending. 2008 vs. 2007 Net Sales Components segment sales increased compared to 2007 primarily due to the following drivers. These increases were Segment EBIT Components segment EBIT increased primarily due to higher gross margins general and Gross margin Selling, general and administrative expenses Research, development and engineering expenses The increase in gross margin was primarily due to higher volumes in most of our businesses, manufacturing efficiencies achieved in all of our businesses in 2008 and price realization exceeding increased commodity costs, which was partially offset by Financial data for the Distribution segment was as follows: External sales Intersegment sales Total sales Depreciation and amortization Equity, royalty and interest income from investees Interest income Segment EBIT Segment EBIT as a percentage of net sales Sales for our Distribution segment by region were as follows: Asia Pacific Europe, Middle East and Africa North & Central America South America Total sales 2009 vs. 2008 Net Sales Distribution segment sales for 2009 decreased versus 2008, primarily due to the decline in power generation equipment and engine sales as a result of the global economic downturn and unfavorable foreign currency translation. Excluding the unfavorable currency impact and the net benefit resulting from full-year 2009 consolidated income from distributor acquisitions Segment EBIT Distribution segment EBIT decreased primarily due to lower gross margin, partially offset by decreased selling, general and administrative expenses Gross margin Gross margin, excluding acquisition(1) Selling, general and administrative expenses Equity, royalty and interest income from investees The decrease in gross margin was primarily due to lower sales volumes as a result of the In January 2010, we purchased an additional 50 percent ownership interest in Cummins Western Canada, bringing our total ownership interest to 80 percent. A new owner purchased the other 20 percent interest from the previous owner. The total accounting purchase price of the business is expected to be approximately $105 million to $110 million. Western Canada recorded revenues of $226 million and we recorded equity earnings of $11 million for the year ended December 31, 2009. 2008 vs. 2007 Net Sales Distribution segment sales increased compared to 2007 as a result of strong organic growth in all regions, mainly in Europe, the South Pacific and the Middle East. We had higher sales of $260 million from the acquisition of a majority ownership interest in three previously independent distributors. We had a favorable impact from foreign currency translation. The higher sales were led by increased sales volumes in power generation, parts and engine volumes, followed by service. Segment EBIT Distribution segment EBIT increased primarily due to higher margins which were partially offset by increased selling, general and administrative expenses. Changes in Distribution segment EBIT and EBIT as a percentage of sales were as follows: Gross margin Gross margin, excluding acquisitions(1) Selling, general and administrative expenses Equity, royalty and interest income from investees The increase in gross margin was primarily due to the increase in The table below reconciles the Total segment EBIT Non-segment EBIT(1) Total EBIT Less: Interest expense Income before income taxes Management's Assessment of Liquidity We believe our financial condition and liquidity remain strong despite the We assess our liquidity in terms of Years ended December 31, 2006 2005 2004 United States $ 5,719 50 % $ 4,832 49 % $ 4,363 52 % Asia/Australia 1,794 16 % 1,682 17 % 1,474 17 % Europe/CIS 1,633 14 % 1,406 14 % 1,145 14 % Mexico/Latin America 886 8 % 819 8 % 567 7 % Canada 743 7 % 728 7 % 549 6 % Africa/Middle East 587 5 % 451 5 % 340 4 % Total international 5,643 50 % 5,086 51 % 4,075 48 % Total consolidated net sales $ 11,362 100 % $ 9,918 100 % $ 8,438 100 % financing activities. Cash provided by operations is 2006 2005 2004 Millions Total debt $ 811 $ 1,367 $ 1,626 Less: cash, cash equivalents and marketable securities (935 ) (840 ) (673 ) Net debt $ (124 ) $ 527 $ 953 The maturity schedule of our existing long-term debt does not require significant cash outflows in the While the impact of the continued market volatility cannot be predicted, we believe our liquidity will provide us with the financial flexibility needed to We have considered the impact of ongoing market instability and credit availability in At this time, we are comfortable that the currently unused $1.07 billion credit capacity under our revolving credit facility is available to us. This assertion is based upon the fact that we drew upon our revolving credit facility, throughout the year, with a 2006 Millions Revolving credit facility $ 542 International credit facilities accessible by local entities 84 International credit facilities accessible by corporate treasury 39 Accounts receivable sales program 200 Total available credit capacity $ 865 2006 2005 $ in millions Current assets $ 4,488 $ 3,916 Current liabilities 2,399 2,218 Working capital $ 2,089 $ 1,698 Current ratio 1.87 1.77 Days’ sales in receivables 52 49 Inventory turnover 6.6 7.0 foreign currencies. We manage our worldwide cash requirements considering available funds among the many subsidiaries through which we conduct our business and the cost effectiveness with which those funds can be accessed. The repatriation of cash balances from certain subsidiaries could have adverse tax consequences; however, those balances are generally available without legal restrictions to fund ordinary business operations at the local level. We have and will continue to transfer cash from these subsidiaries to us and to other international subsidiaries when it is cost effective to do so. We fund our working capital with cash from operations and short-term borrowings when necessary. Various assets and liabilities, including short-term debt, can fluctuate significantly from month to month depending on short-term liquidity needs. As a result, working capital is a prime focus of management attention. Cash and cash equivalents Accounts and notes receivable Inventories Other current assets Current assets Accounts and loans payable Current portion of accrued warranty Other accrued expenses Current liabilities Working capital Current ratio Days' sales in receivables Inventory turnover Current assets increased primarily due to an increase in cash and cash equivalents, caused by management's efforts to conserve cash, reduce inventories and limit discretionary spending during the global recession (see Cash Flows below) and an increase in receivables. The increase in receivables was due to higher sales in global engine markets, higher sales in the fourth quarter of 2009 than in the fourth quarter of 2008 as a result of a temporary increase in engine (and related component) demand prior to the 2010 emissions standards change and the significant decrease in sales in the fourth quarter of 2008 as a result of the onset of the economic recession. These increases were partially offset by a decrease in inventories as a result of our efforts to reduce our working capital. Current liabilities decreased primarily due to a decline in other accrued expenses and accounts payable as a result of reduced purchasing volume and controls around discretionary spending. Cash and cash equivalents increased $504 million during the year ended December 2006 2005 2004 Millions Net cash provided by operating activities $ 840 $ 760 $ 614 Net cash used in investing activities (277 ) (212 ) (181 ) Net cash (used in) provided by financing activities (508 ) (372 ) 66 Effect of exchange rate changes on cash 6 (8 ) 4 Net increase in cash and cash equivalents $ 61 $ 168 $ 503 Net income Depreciation Equity in income of investees, net of dividends Pension expense, net of contributions Changes in: Receivables Inventory Accounts payable Accrued expenses Other, net Net cash provided by operating activities Net cash provided by operating activities Pensions The funded status of our pension plans is dependent upon a variety of variables and assumptions including return on invested assets, market interest rates and levels of voluntary contributions to the plans. Net cash provided by operating activities increased for the year ended December 31, 2008, compared to 2007, primarily due to decreased pension funding, increased net income as the result of increased sales and increased equity in earnings net of dividends, which was partially offset by unfavorable working capital fluctuations. The unfavorable working capital fluctuation was primarily due to an increase in inventory, which was primarily to support strong business growth while the decreases in accounts payable and accounts receivable were more reflective of early shutdowns in many of our manufacturing facilities at the close of 2008, as demand softened throughout the fourth quarter. The increase in accrued expenses was primarily due to an increase in warranty expense. Capital expenditures Investments in and advances to equity investees Acquisitions of businesses, net of cash acquired Proceeds from the sale of businesses Investments in marketable securities, net Other, net Net cash used in investing activities 2009 vs. 2008 Net cash used in investing activities decreased for the year ended December 31, 2009, compared to 2008, primarily due to decreased capital expenditures and lower investments in the acquisition of businesses which were partially offset by increased cash paid for investments in marketable securities and lower cash proceeds from the sale of a business. These decreases primarily occurred as a result of management's decision to conserve cash and maintain liquidity during the recession. Capital expenditures decreased as management tightened capital spending substantially across all business by limiting expenditures to critical projects and investments in development of new products. Despite the expected challenges in some of our markets in 2010, our financial position allows us the flexibility to increase capital expenditures for 2010 to approximately $400 million. 2008 vs. 2007 Net cash used in investing activities increased Proceeds from borrowings Payments on borrowings and capital lease obligations Net (payments) borrowings under short-term credit agreements Dividend payments on common stock Proceeds from sale of common stock held by employee benefits trust Repurchases of common stock Other, net Net cash used in financing activities Net cash used in financing activities Our total debt was $704 million as of Net cash used in financing activities Total debt as a Revolving Credit Agreement On June 30, 2008, we entered into a three-year revolving credit agreement with a syndicate of lenders. The credit agreement provides us with a $1.1 billion senior unsecured revolving credit facility, the proceeds of The credit facility matures on June 30, 2011. Amounts payable under our revolving credit facility will rank pro rata with all of our other unsecured, unsubordinated indebtedness. Up to $100 million under our credit facility is available for swingline loans denominated in U.S. dollars. Advances under the The credit agreement includes various covenants, including, among others, maintaining a leverage ratio of no more than 3.0 to 1.0 and In July 2006, the Board of Directors authorized us to acquire up to In December 2007, the Board of Directors authorized the acquisition of up to We announced in February 2009 that we had temporarily suspended our stock repurchase program to conserve cash. In the Quarterly Dividends In July 2008, our Board of First quarter Second quarter Third quarter Fourth quarter Total dividends paid to common Contractual Cash Obligations 2007 2008-2009 2010-2011 After 2011 Total Millions Loans payable $ 37 $ — $ — $ — $ 37 Long-term debt and capital lease obligations(1) 203 261 144 1,564 2,172 Operating leases 39 54 33 23 149 Capital expenditures 103 1 — — 104 Purchase commitments for inventory 483 — — — 483 Other purchase commitments 68 15 5 1 89 Joint venture funding commitments 48 23 — — 71 Pension funding(2) 235 — — — 235 Other postretirement benefits 56 112 109 235 512 Total $ 1,272 $ 466 $ 291 $ 1,823 $ 3,852 Other Commercial Commitments 2007 2008-2009 2010-2011 After 2011 Total Millions Standby letters of credit under revolving credit agreement $ 102 $ 6 $ — $ — $ 108 International and other domestic letters of credit 30 5 — — 35 Performance and excise bonds 23 11 2 — 36 Other guarantees 3 2 — 2 7 Total $ 158 $ 24 $ 2 $ 2 $ 186 A number of our contractual obligations and financing agreements, such as our revolving credit facility and our equipment sale-leaseback agreements have restrictive covenants and/or pricing modifications that may be triggered in the event of downward revisions to our corporate credit rating. There were no downgrades of our credit ratings in 2009 that have On March 10, 2008, Standard & Poor's (S&P) upgraded our senior unsecured debt ratings from "BBB-" to "BBB" and revised our outlook to stable citing our improved operating performance over the past several years, including during the expected emissions-related downturn in heavy-duty truck demand in 2007, combined with significant on- and off-balance sheet debt reduction, and increased business diversification. On June 17, 2008, Fitch upgraded our senior unsecured debt ratings from "BBB" to "BBB+" citing our recent market share gains and improving credit profile, including improvement in our geographic and business diversification. In the second quarter of 2009, Moody's Investor Service, Inc. and Fitch reaffirmed our credit ratings. Credit ratings are not recommendations to buy and are subject to change, and each rating should be evaluated independently of any other rating. In addition, we undertake no obligation to update disclosures concerning our credit ratings, whether as a result of new information, future events or otherwise. Our Senior Long- Moody's Investors Service, Inc. Stable Stable Loans payable Long-term debt and capital lease obligations(1) Operating leases Capital expenditures Purchase commitments for inventory Other purchase commitments Pension funding(2) Other postretirement benefits Total The contractual obligations reported above exclude our unrecognized tax benefits of $56 million, all of which is non-current, as of December 31, 2009. We are not able to reasonably estimate the period in which cash outflows relating to uncertain tax contingencies could occur. See Note 4, "INCOME TAXES," to theConsolidated Financial Statements for further details. Standby letters of credit under revolving credit agreement International and other domestic letters of credit Performance and excise bonds Guarantees and other commitments Total Sale of Accounts Receivable In In accordance with the provisions of various joint venture agreements, we may purchase Part Item Page 3 1 4 4 4 4 5 6 8 9 11 11 12 12 12 12 13 14 14 15 1A 16 1B 22 2 23 3 24 4 25 5 26 6 28 7 29 7A 67 8 70 9 142 9A 142 9B 142 10 142 11 142 12 143 13 143 14 143 15 143 70 144

1462Item 1.Table of Contents Business(“Cummins,” “the Company,” “the registrant,” “we,” “our,”and its consolidated subsidiaries are sometimes referred to in this annual report as "Cummins," the "Company," "we," "our," or “us”)"us."

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATIONand emissions solutions,exhaust aftertreatment, fuel systems, controls and air handling systems. We were founded in 1919 as one of the first manufacturers of diesel engines and are headquartered in Columbus, Indiana. We sell our products to Original Equipment Manufacturersoriginal equipment manufacturers (OEMs), distributors and other customers worldwide. We have long-standing relationships with many of the leading manufacturers in the markets we serve, including DaimlerChryslerAG (DaimlerChrysler), PACCAR Inc., International Truck and Engine Corporation (Navistar International Corporation), Volvo AB, CNH Global N.V., Tata Motors Ltd., Ford, Volkswagen, Dongfeng Motor Company, Komatsu and Scania AB. We serve our customers through a network of more than 550500 company-owned and independent distributor locations and approximately 5,0005,200 dealer locations in more than 160190 countries and territories.Our financial performance depends, in large part, on varying conditions in the markets we serve, particularly the on-highway, construction and general industrial markets. Demand in these markets tends to fluctuate in response to overall economic conditions and is particularly sensitive to changes in interest rate levels. OEM inventory levels, production schedules, work stoppages and changes in emission standards also impact our sales. Economic downturns in the markets we serve generally result in reduced sales, which affect our profits and cash flow.