SECURITIES AND EXCHANGE COMMISSION

x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

| |

FOR THE FISCAL YEAR ENDED DECEMBER 31,

20082009

COMMISSION FILE NUMBER 333-90273

FIDELITY D & D BANCORP, INC.

COMMONWEALTH OF PENNSYLVANIA I.R.S. EMPLOYER IDENTIFICATION NO: 23-3017653

BLAKELY AND DRINKER STREETS

DUNMORE, PENNSYLVANIA 18512

TELEPHONE NUMBER (570) 342-8281

SECURITIES REGISTERED UNDER SECTION 12(b) OF THE ACT:

SECURITIES REGISTERED UNDER SECTION 12(g) OF THE ACT:

Common Stock, without par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o¨ No

x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No

o¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by references in Part III of this Form 10-K or any amendment to this Form 10-K. x Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One)

Large accelerated filer ¨o | | Accelerated filer ¨o |

| | |

Non-accelerated filer ¨o | | Smaller reporting company x |

(Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12B-2 of the Act). Yes o¨ No

xAggregate

The aggregate market value of the voting common stock held by non-affiliates of the registrant

equals $49,429,783,was $32,019,171 as of June 30,

2008,2009, based on

a marketthe closing price of

$29.25.$18.60. The number of shares of common stock outstanding as of February 28,

2009,2010, was

2,062,128.2,110,614.

DOCUMENTS INCORPORATED BY REFERENCE

Excerpts from the Registrant’s

20082009 Annual Report to Shareholders are incorporated herein by reference in response to Part I. Portions of the Registrant’s definitive Proxy Statement to be used in connection with the

20092010 Annual Meeting of Shareholders are incorporated herein by reference in partial response to Part II and Part III.

2009 Annual Report on Form 10-K

|

|

|

|

| | | |

| | | 3 |

| | | 5 |

| | | 11

10 |

| | | 11

10 |

| | | 12

11 |

| | | 12

11 |

| | | |

|

|

|

|

| | | |

| | | 12 |

| | | 15

14 |

| | | 16

15 |

| | | 47

46 |

| | | 48

47 |

| | | 81

84 |

| | | 81

84 |

| | | 82

84 |

| | | |

|

|

|

|

| | | |

| | | 82

84 |

| | | 82

85 |

| | | 82

85 |

| | | 82

85 |

| | | 83

85 |

| | | |

|

|

|

|

| | | |

| | | 83

85 |

| | | |

| | 86

88 |

| | 87

89 |

Certifications | | 91

93 |

Forward-Looking Statements

This

Certain of the matters discussed in this Annual Report on Form 10-K

contains a number ofmay constitute forward-looking statements

within the meaning of Section 27Afor purposes of the Securities Act of 1933, as amended,

or the Securities Act, and

Section 21E of the Securities Exchange Act of 1934, as amended,

or the Exchange Act. These statementsand as such may

be identified by the use of the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would”involve known and

similar terms and phrases, including references to assumptions. Forward-looking statements include risks and uncertainties.Forward-looking statements are based on various assumptions and analyses made by us in light of management’s experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate under the circumstances. These statements are not guarantees of future performance and are subject tounknown risks, uncertainties and other factors (many of which are beyond our control) that couldmay cause the actual results, performance or achievements of the Company to differbe materially different from future results, performance or achievements expressed or implied by such forward-looking statements. TheseThe words “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” and similar expressions are intended to identify such forward-looking statements.

The Company’s actual results may differ materially from the results anticipated in these forward-looking statements due to a variety of factors,

include,including, without

limitation, the following:· the timing and occurrence or non-occurrence of events may be subject to circumstances beyond our control;

· there may be increases in competitive pressure among financial institutions or from non-financial institutions;

· changes in the interest rate environment may reduce interest margins;

· changes in deposit flows, loan demand or real estate and investment securities values may adversely affect our business;

· changes in accounting principles, policies or guidelines may cause our financial condition to be perceived differently;

· general economic conditions, either nationally or locally in some or all areas in which we do business, or conditions in the securities markets or the banking industry may be less favorable than we currently anticipate;

· legislative or regulatory changes may adversely affect our business;

· technological changes may be more rapid, difficult or expensive than we anticipate;

· success or consummation of new business initiatives may be more difficult or expensive than we anticipate;

· acts of war or terrorism; or

· natural disaster.

Managementlimitation:

| § | the effects of economic deterioration on current customers, specifically the effect of the economy on loan customers’ ability to repay loans; |

| § | the costs and effects of litigation and of unexpected or adverse outcomes in such litigation; |

| § | governmental monetary and fiscal policies, as well as legislative and regulatory changes; |

| § | the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Financial Accounting Standards Board and other accounting standard setters; |

| § | the risks of changes in interest rates on the level and composition of deposits, loan demand, and the values of loan collateral, securities and interest rate protection agreements, as well as interest rate risks; |

| § | the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions operating in our market area and elsewhere, including institutions operating locally, regionally, nationally and internationally, together with such competitors offering banking products and services by mail, telephone, computer and the internet; |

| § | acquisitions and integration of acquired businesses; |

| § | the failure of assumptions underlying the establishment of reserves for loan and lease losses and estimations of values of collateral and various financial assets and liabilities; |

| § | volatilities in the securities markets; |

| § | deteriorating economic conditions |

| § | acts of war or terrorism; and |

| § | disruption of credit and equity markets. |

The Company cautions readers not to place undue reliance on forward-looking statements, which reflect analyses only as of the date of this

report. We havedocument. The Company has no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document.

Readers should review the risk factors described in

Item 1A, above,this document and

in other documents that we file

or furnish, from

time-to-timetime to time, with the

SEC,Securities and Exchange Commission, including quarterly reports

filed on Form 10-Q and any current reports

filed or furnished on Form 8-K.

ITEM 1:BUSINESS

Fidelity D & D Bancorp, Inc. (the Company) was incorporated in the Commonwealth of Pennsylvania, on August 10, 1999, and is a bank holding company, whose wholly-owned state chartered commercial bank is The Fidelity Deposit and Discount Bank (the Bank) (collectively, the Company). The Company is headquartered at Blakely and Drinker Streets in Dunmore, Pennsylvania.

3

Table of Contents

The Bank has offered a full range of traditional banking services since it commenced operations in 1903. The Bank has a personal and corporate trust department and also provides alternative financial and insurance products with asset management services. A full list of services provided by the Bank is detailed in the section entitled “Products and Services” contained within the 20082009 Annual Report to Shareholders, incorporated by reference. The service area is comprised of the Borough of Dunmore and the surrounding communities within Lackawanna and Luzerne counties in Northeastern Pennsylvania.

The banking business is highly competitive, and the profitability of the Company depends principally upon the Company’s ability to compete in its market area. Competition includes, among other sources, the following:

| ·

§ | local community banks | ·

§ | insurance companies |

| | | | |

| ·

§ | savings banks | ·

§ | money market funds |

| | | | |

| ·

§ | regional banks | ·

§ | mutual funds |

| | | | |

| ·

§ | credit unions | ·

§ | small loan companies |

| | | | |

| ·

§ | savings & loans | ·

§ | other financial service companies |

The Company has been able to compete effectively with other financial institutions by emphasizing technology and customer service, including local decision making on loans. These efforts enabled the Company to establish long-term customer relationships and build customer loyalty by providing products and services designed to address their specific needs.

There are no concentrations of loans that, if lost, would have a materially adverse effect on the continued business of the Company. The Company’s loan portfolio does not have a material concentration within a single industry or group of related industries that are vulnerable to the risk of a near-term severe impact. However, the Company’s success is dependent, to a significant degree, on economic conditions in Northeastern Pennsylvania, especially Lackawanna and Luzerne counties which the Company defines as its primary market area. The banking industry is affected by general economic conditions including the effects of inflation, recession, unemployment, real estate values, trends in national and global economies and other factors beyond the Company’s control. An economic recession or a delayed economic recovery over a prolonged period of time in the Company’s primary market area could cause an increase in the level of the Company’s non-performing assets and loan losses, and thereby cause operating losses, impairment of liquidity and erosion of capital. We cannot assure you that adverse changes in the local economy would not have a material effect on the Company’s future consolidated financial condition, results of operations and cash flows. Refer to Item 1A, “Risk Factors” for material risks and uncertainties that management believes affect the Company.

The Company had

196185 full-time equivalent employees on December 31,

2008,2009, which includes exempt officers,

exempt, non-exempt and part-time employees.

Federal and state banking laws contain numerous provisions that affect various aspects of the business and operations of the Company and the Bank. The Company is subject to, among others, the regulations of the Securities and Exchange Commission (the SEC) and the Federal Reserve Board (the FRB) and the Bank is subject to, among others, the regulations of the Pennsylvania Department of Banking and the Federal Deposit Insurance Corporation (the FDIC). Refer to Part II, Item 7 “Supervision and Regulation” for descriptions of and references to applicable statutes and regulations which are not intended to be complete descriptions of these provisions or their effects on the Company or the Bank. They are summaries only and are qualified in their entirety by reference to such statutes and regulations. Applicable regulations relate to, among other things:

| ·

§ | operations | ·

§ | consolidation |

| | | | |

| ·

§ | securities | ·

§ | reserves |

| | | | |

| ·

§ | risk management | ·

§ | dividends |

| | | | |

| ·

§ | consumer compliance | ·

§ | branches |

| | | | |

| ·

§ | mergers | ·

§ | capital adequacy |

4

Table of Contents

Annually, the Bank is examined by the Pennsylvania Department of Banking and/or the FDIC. The last examination was conducted by the Pennsylvania Department of BankingFDIC as of December 31, 2007.

2008.

The Company’s website address is http://www.bankatfidelity.com. The Company makes available through this website the annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports as soon as reasonably practical after filing with the SEC. You may read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090. The SEC also maintains an internet site that contains reports, proxy and information statements and other information about the Company at http://www.sec.gov.

The Company’s accounting policies and procedures are designed to comply with accounting principles generally accepted in the United States of America (GAAP). Refer to “Critical Accounting Policies,” which are incorporated by reference in Part II, Item 7.

An investment in the Company’s common stock is subject to risks inherent to the Company’s business. The material risks and uncertainties that management believes affect the Company are described below. Before making an investment decision, you should carefully consider the risks and uncertainties described below together with all of the other information included or incorporated by reference in this report. The risks and uncertainties described below are not the only ones facing the Company. Additional risks and uncertainties that management is not aware of or focused on or that management currently deems immaterial may also impair the Company’s business operations. This report is qualified in its entirety by these risk factors.

If any of the following risks actually occur, the Company’s financial condition and results of operations could be materially and adversely affected. If this were to happen, the value of the Company’s common stock could decline significantly, and you could lose all or part of your investment.

Risks Related to the Company’s Business

The Company’s business is subject to interest rate risk and variations in interest rates may negatively affect its financial performance.

Changes in the interest rate environment may reduce profits. The Company’s earnings and cash flows are largely dependent upon its net interest income. Net interest income is the difference between the interest earned on loans, securities and other interest-earning assets, and interest paid on deposits, borrowings and other interest-bearing liabilities. As prevailing interest rates change, net interest spreads are affected by the difference between the maturities and re-pricing characteristics of interest-earning assets and interest-bearing liabilities. In addition, loan volume and yields are affected by market interest rates on loans, and rising interest rates generally are associated with a lower volume of loan originations. An increase in the general level of interest rates may also adversely affect the ability of certain borrowers to pay the interest on and principal of their obligations. Accordingly, changes in levels of market interest rates could materially adversely affect the Company’s net interest spread, asset quality, loan origination volume and overall profitability.

The Company is subject to lending risk.

There are inherent risks associated with the Company’s lending activities. These risks include, among other things, the impact of changes in interest rates and changes in the economic conditions in the markets where the Company operates as well as those across the Commonwealth of Pennsylvania and the United States. Increases in interest rates and/or weakening economic conditions could adversely impact the ability of borrowers to repay outstanding loans or the value of the collateral securing these loans. The Company is also subject to various laws and regulations that affect its lending activities. Failure to comply with applicable laws and regulations could subject the Company to regulatory enforcement action that could result in the assessment of significant civil money penalties against the Company.

As of December 31, 2008, approximately 56% of the Company’s loan portfolio consisted of commercial,

Commercial, commercial real estate and real estate construction

loans. These types of loans are generally viewed as having more risk of default than residential real estate loans or consumer loans. These types of loans are also typically larger than residential real estate loans and consumer loans. Because

the Company’s loan portfolio contains a significant number of commercial, commercialthese loans generally have larger balances than residential real estate

loans and

constructionconsumer loans,

with relatively large balances, the deterioration of one or a few of these loans could cause a significant increase in non-performing loans. An increase in non-performing loans could result in a net loss of earnings from

5

Table of Contents

these loans, an increase in the provision for possible loan losses and an increase in loan charge-offs, all of which could have a material adverse effect on the Company’s financial condition and results of operations.

The Company’s allowance for possible loan losses may be insufficient.

The Company maintains an allowance for possible loan losses, which is a reserve established through a provision for possible loan losses charged to expense, that represents management’s best estimate of probable losses that have been incurred within the existing portfolio of loans. The allowance, in the judgment of management, is necessary to reserve for estimated loan losses and risks inherent in the loan portfolio. The level of the allowance reflects management’s continuing evaluation of industry concentrations; specific credit risks; loan loss experience; current loan portfolio quality; present economic, political and regulatory conditions and unidentified losses inherent in the current loan portfolio. The determination of the appropriate level of the allowance for possible loan losses inherently involves a high degree of subjectivity and requires the Company to make significant estimates of current credit risks and future trends, all of which may undergo material changes. Changes in economic conditions affecting borrowers, new information regarding existing loans, identification of additional problem loans and other factors, both within and outside of the Company’s control, may require an increase in the allowance for possible loan losses. In addition, bank regulatory agencies periodically review the Company’s allowance for loan losses and may require an increase in the provision for possible loan losses or the recognition of further loan charge-offs, based on judgments different than those of management. In addition, if charge-offs in future periods exceed the allowance for possible loan losses, the Company will need additional provisions to increase the allowance for possible loan losses. Any increases in the allowance for loan losses will result in a decrease in net income and capital and may have a material adverse effect on the Company’s financial condition and results of operations.

The Company may need or be compelled to raise additional capital in the future, but that capital may not be available when it is needed and on terms favorable to current shareholders.

Federal banking regulators require the Company and Bank to maintain adequate levels of capital to support their operations. These capital levels are determined and dictated by law, regulation and banking regulatory agencies. In addition, capital levels are also determined by the Company’s management and board of directors based on capital levels that they believe are necessary to support the Company’s business operations. The Company is evaluating its present and future capital requirements and needs, is developing a comprehensive capital plan and is analyzing capital raising alternatives, methods and options. Even if the Company succeeds in meeting the current regulatory capital requirements, the Company may need to raise additional capital in the near future to support possible loan losses during future periods or to meet future regulatory capital requirements.

Further, the Company’s regulators may require it to increase its capital levels. If the Company raises capital through the issuance of additional shares of its common stock or other securities, it would likely dilute the ownership interests of current investors and would likely dilute the per-share book value and earnings per share of its common stock. Furthermore, it may have an adverse impact on the Company’s stock price. New investors may also have rights, preferences and privileges senior to the Company’s current shareholders, which may adversely impact its current shareholders. The Company’s ability to raise additional capital will depend on conditions in the capital markets at that time, which are outside its control, and on its financial performance. Accordingly, the Company cannot assure you of its ability to raise additional capital on terms and time frames acceptable to it or to raise additional capital at all. If the Company cannot raise additional capital in sufficient amounts when needed, its ability to comply with regulatory capital requirements could be materially impaired. Additionally, the inability to raise capital in sufficient amounts may adversely affect the Company’s operations, financial condition and results of operations.

If we conclude that the decline in value of any of our investment securities is other than temporary, we will be required to write down the credit-related portion of the impairment of that security through a charge to earnings.

We review our investment securities portfolio at each quarter-end reporting period to determine whether the fair value is below the current carrying value. When the fair value of any of our investment securities has declined below its carrying value, we are required to assess whether the decline is other than temporary. If we conclude that the decline is other than temporary, we will be required to write down the credit-related portion of the impairment of that security through a charge to earnings. As of December 31, 2009, the book value of the Company’s pooled trust preferred securities was $18,794,000 with an estimated fair value of $5,242,000. Changes in the expected cash flows of these securities and/or prolonged price declines have resulted and may result in our concluding in future periods that there is additional impairment of these securities that is other than temporary, which would require a charge to earnings for the portion of the impairment that is deemed to be-credit-related. Due to the complexity of the calculations and assumptions used in determining whether an asset, such as pooled trust preferred securities, is impaired, the impairment disclosed may not accurately reflect the actual impairment in the future.

The Company is subject to environmental liability risk associated with lending activities.

A significant portion of the Company’s loan portfolio is secured by real property. During the ordinary course of business, the Company may foreclose on and take title to properties securing certain loans. In doing so, there is a risk that hazardous or toxic substances could be found on these properties. If hazardous or toxic substances are found, the Company may be liable for remediation costs, as well as for personal injury and property damage. Environmental laws may require the Company to incur substantial

expensesexpense and may materially reduce the affected property’s value or limit the Company’s ability to use or sell the affected property. In addition, future laws or more stringent interpretations or enforcement policies with respect to existing laws may increase the Company’s exposure to environmental liability. Although the Company has policies and procedures to perform an environmental review before initiating any foreclosure action on real property, these reviews may not be sufficient to detect all potential environmental hazards. The remediation costs and any other financial liabilities associated with an environmental hazard could have a material adverse effect on the Company’s financial condition and results of operations.

The Company’s profitability depends significantly on economic conditions in the Commonwealth of Pennsylvania and the local region in which it conducts business.

The Company’s success depends primarily on the general economic conditions of the Commonwealth of Pennsylvania and the specific local markets in which the Company operates. Unlike larger national or other regional banks that are more geographically diversified, the Company provides banking and financial services to customers primarily in Lackawanna and Luzerne

Counties.Counties in Northeastern Pennsylvania. The local economic conditions in these areas have a significant impact on the demand for the Company’s products and services as well as the ability of the Company’s customers to repay loans, the value of the collateral securing loans and the stability of the Company’s deposit funding sources. A significant decline in general economic conditions, caused by inflation, recession, acts of terrorism, an outbreak of hostilities or other international or domestic occurrences, unemployment, changes in securities markets or other factors could impact these local economic conditions and, in turn, have a material adverse effect on the Company’s financial condition and results of operations.

Currently, our Country is in a recession. The severity, depth and length of this recession is indeterminable. Job layoffs and eliminations continue to be announced throughout the United States, as well as locally. Reductions in the levels of income of both businesses and individual consumers could have a material impact on their ability to meet their loan payment obligations. This in turn could have a material adverse impact on the companies overall financial condition and earnings.

There is no assurance that the Company will be able to successfully compete with others for business.

The Company competes for loans, deposits and investment dollars with numerous regional and national banks and other community banking institutions, as well as other kinds of financial institutions and enterprises, such as securities firms, insurance companies, savings associations, credit unions, mortgage brokers and private lenders. Many competitors have substantially greater resources than the Company does, and operate under less stringent regulatory environments. The differences in resources and regulations may make it more difficult for the Company to compete profitably, reduce the rates

6

Table of Contents

that it can earn on loans and on its investments, increase the rates it must offer on deposits and other funds, and adversely affect its overall financial condition and earnings.

The Company is subject to extensive government regulation and supervision.

The Company, primarily through the Bank,

, is subject to extensive federal and state regulation and supervision. Banking regulations are primarily intended to protect depositors’ funds, federal deposit insurance funds and the banking system as a whole, not shareholders. These regulations affect the Company’s lending practices, capital structure, investment practices, dividend policy and growth, among other things. Federal or commonwealth regulatory agencies continually review banking laws, regulations and policies for possible changes. Changes to statutes, regulations or regulatory policies, including changes in interpretation or implementation of statutes, regulations or policies, could affect the Company in substantial and unpredictable ways. Such changes could subject the Company to additional costs, limit the types of financial services and products the Company may offer and/or increase the ability of non-banks to offer competing financial services and products, among other things. Failure to comply with laws, regulations or policies could result in sanctions by regulatory agencies, civil money penalties and/or reputation damage, which could have a material adverse effect on the Company’s business, financial condition and results of operations. While the Company has policies and procedures designed to prevent any such violations, there can be no assurance that such violations will not occur.

The Company’s controls and procedures may fail or be circumvented.

Management regularly reviews and updates the Company’s internal controls, disclosure controls and procedures, and corporate governance policies and procedures. Any system of controls, however well designed and operated, is based in part on certain assumptions and can provide only reasonable, not absolute, assurances that the objectives of the system are met. Any failure or circumvention of the Company’s controls and procedures or failure to comply with regulations related to controls and procedures could have a material adverse effect on the Company’s business, results of operations and financial condition.

New lines of business or new products and services may subject the Company to additional risks.

From time-to-time, the Company may implement new lines of business or offer new products and services within existing lines of business. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services the Company may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved and price and profitability targets may not prove feasible. External factors, such as compliance with regulations, competitive alternatives, and shifting market preferences, may also impact the successful implementation of a new line of business or a new product or service. Furthermore, any new line of business and/or new product or service could have a significant impact on the effectiveness of the Company’s system of internal controls. Failure to successfully manage these risks in the development and implementation of new lines of business or new products or services could have a material adverse effect on the Company’s business, results of operations and financial condition.

The Company’s ability to pay dividends depends primarily on dividends from its banking subsidiary, which is subject to regulatory limits.

The Company is a bank holding company and its operations are conducted by its subsidiary. Its ability to pay dividends depends on its receipt of dividends from its subsidiary. Dividend payments from its banking subsidiary are subject to legal and regulatory limitations, generally based on net profits and retained earnings, imposed by the various banking regulatory agencies. The ability of its subsidiary to pay dividends is also subject to its profitability, financial condition, capital expenditures and other cash flow requirements. There is no assurance that its subsidiary will be able to pay dividends in the future or that the Company will generate adequate cash flow to pay dividends in the future. The Company’s failure to pay dividends on its common stock could have a material adverse effect on the market price of its common stock.

7

Table of Contents

The Company’s future acquisitions could dilute your ownership and may cause it to become more susceptible to adverse economic events.

The Company may use its common stock to acquire other companies or make investments in banks and other complementary businesses in the future. The Company may issue additional shares of common stock to pay for future acquisitions, which would dilute your ownership interest in the Company. Future business acquisitions could be material to the Company, and the degree of success achieved in acquiring and integrating these businesses into the Company could have a material effect on the value of the Company’s common stock. In addition, any acquisition could require it to use substantial cash or other liquid assets or to incur debt. In those events, it could become more susceptible to economic downturns and competitive pressures.

The Company may not be able to attract and retain skilled people.

The Company’s success depends, in large part, on its ability to attract and retain key people. Competition for the best people in most activities engaged in by the Company can be intense and the Company may not be able to hire people or to retain them. The unexpected loss of services of one or more of the Company’s key personnel could have a material adverse impact on the Company’s business because of their skills, knowledge of the Company’s market, years of industry experience and the difficulty of promptly finding qualified replacement personnel. The Company has an employment agreement with its President and Chief Executive Officer.personnel.

The Company’s information systems may experience an interruption or breach in security.

The Company relies heavily on communications and information systems to conduct its business. Any failure, interruption or breach in security of these systems could result in failures or disruptions in the Company’s customer relationship management, general ledger, deposit, loan and other systems. While the Company has policies and procedures designed to prevent or limit the effect of the failure, interruption or security breach of its information systems, there can be no assurance that any such failures, interruptions or security breaches will not occur or, if they do occur, that they will be adequately addressed. The occurrence of any failures, interruptions or security breaches of the Company’s information systems could damage the Company’s reputation, result in a loss of customer business, subject the Company to additional regulatory scrutiny, or expose the Company to civil litigation and possible financial liability, any of which could have a material adverse effect on the Company’s financial condition and results of operations.

The Company continually encounters technological change.

The financial services industry is continually undergoing rapid technological change with frequent introductions of new technology-driven products and services. The effective use of technology increases efficiency and enables financial institutions to better serve customers and to reduce costs. The Company’s future success depends, in part, upon its ability to address the needs of its customers by using technology to provide products and services that will satisfy customer demands, as well as to create additional efficiencies in the Company’s operations. Many of the Company’s competitors have substantially greater resources to invest in technological improvements. The Company may not be able to effectively implement new technology-driven products and services or be successful in marketing these products and services to its customers. Failure to successfully keep pace with technological change affecting the financial services industry could have a material adverse impact on the Company’s business and, in turn, the Company’s financial condition and results of operations.

The Company is subject to claims and litigation pertaining to fiduciary responsibility.

From time-to-time, customers make claims and take legal action pertaining to the Company’s performance of its fiduciary responsibilities. Whether customer claims and legal action related to the Company’s performance of its fiduciary responsibilities are founded or unfounded, if such claims and legal actions are not resolved in a manner favorable to the Company, they may result in significant financial liability and/or adversely affect the market perception of the Company and its products and services as well as impact customer demand for those products and services. Any financial liability or reputation damage could have a material adverse effect on the Company’s business, which, in turn, could have a material adverse effect on the Company’s financial condition and results of operations.

Severe weather, natural disasters, acts of war or terrorism and other external events could significantly impact the Company’s business.

Severe weather, natural disasters, acts of war or terrorism and other adverse external events could have a significant impact on the Company’s ability to conduct business. Such events could affect the stability of the Company’s deposit base, impair the ability of borrowers to repay outstanding loans, impair the value of collateral securing loans, cause significant property damage, result in loss of revenue and/or cause the Company to incur additional expenses. Severe weather or natural disasters, acts of war or terrorism or other adverse external events may occur in the future. Although management has

8

Table of Contents

established disaster recovery policies and procedures, the occurrence of any such event could have a material adverse effect on the Company’s business, which, in turn, could have a material adverse effect on the Company’s financial condition and results of operations.

We currently have an Interim Chief Executive Officer while we search for a permanent Chief Executive Officer.

During the third quarter of 2009 our President and Chief Executive Officer resigned. As a result, the board of directors formed a CEO search committee and is currently conducting a search. While we expect to recruit a new CEO no later than the end of the second quarter of 2010, we cannot assure you that the process will be concluded by then. Further, until we find a permanent CEO, we may be unable to successfully manage and grow the business; and, our business, financial condition and profitability may suffer. We believe each member of our senior management team is important to our success and the unexpected loss of any of these persons could impair our day-to-day operations as well as our strategic direction.

Readers should review the risk factors described in other documents that we file or furnish, from time to time, with the Securities and Exchange Commission, including Annual Reports to Shareholders, Annual Reports filed on Form 10-K and other current reports filed or furnished on Form 8-K.

Risks Associated with the Company’s Common Stock

The Company’s stock price can be volatile.

Stock price volatility may make it more difficult for you to resell your common stock when you want and at prices you find attractive. The Company’s stock price can fluctuate significantly in response to a variety of factors including, among other things:

· Actual or anticipated variations in quarterly results of operations.

· Recommendations by securities analysts.

· Operating and stock price performance of other companies that investors deem comparable to the Company.

· News reports relating to trends, concerns and other issues in the financial services industry.

· Perceptions in the marketplace regarding the Company and/or its competitors.

· New technology used, or services offered, by competitors.

· Significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving the Company or its competitors.

· Failure to integrate acquisitions or realize anticipated benefits from acquisitions.

· Changes in government regulations.

· Geopolitical conditions such as acts or threats of terrorism or military conflicts.

| · | Actual or anticipated variations in quarterly results of operations. |

| · | Recommendations by securities analysts. |

| · | Operating and stock price performance of other companies that investors deem comparable to the Company. |

| · | News reports relating to trends, concerns and other issues in the financial services industry. |

| · | Perceptions in the marketplace regarding the Company and/or its competitors. |

| · | New technology used, or services offered, by competitors. |

| · | Significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving the Company or its competitors. |

| · | Failure to integrate acquisitions or realize anticipated benefits from acquisitions. |

| · | Changes in government regulations. |

| · | Geopolitical conditions such as acts or threats of terrorism or military conflicts. |

General market fluctuations, industry factors and general economic and political conditions and events, such as economic slowdowns or recessions, interest rate changes or credit loss trends, could also cause the Company’s stock price to decrease regardless of operating results.

The trading volume in the Company’s common stock is less than that of other larger financial services companies.

The Company’s common stock is listed for trading on the over-the-counter bulletin

board;board and the trading volume in its common stock is less than that of other larger financial services companies. A public trading market having the desired characteristics of depth, liquidity and orderliness depends on the presence in the marketplace of willing buyers and sellers of the Company’s common stock at any given time. This presence depends on the individual decisions of investors and general economic and market conditions over which the Company has no control. Given the lower trading volume of the Company’s common stock, significant sales of the Company’s common stock, or the expectation of these sales, could cause the Company’s stock price to fall.

An investment in the Company’s common stock is not an insured deposit.

The Company’s common stock is not a bank deposit and, therefore, is not insured against loss by the FDIC, any other deposit insurance fund or by any other public or private entity. Investment in the Company’s common stock is inherently risky for the reasons described in this “Risk Factors” section and elsewhere in this report and is subject to the same market forces that affect the price of common stock in any company. As a result, if you acquire the Company’s common stock, you may lose some or all of your investment.

The Company’s articles of incorporation and by-laws, as well as certain banking laws, may have an anti-takeover effect.

Provisions of the Company’s articles of incorporation and by-laws, federal banking laws, including regulatory approval requirements, could make it more difficult for a third party to acquire the Company, even if doing so would be perceived to be beneficial to the Company’s shareholders. The combination of these provisions effectively inhibits a non-negotiated merger or other business combination, which, in turn, could adversely affect the market price of the Company’s common stock.

Risks Associated with the Company’s Industry

Future governmental regulation and legislation could limit the Company’s future growth.

The Company is a registered bank holding company, and its subsidiary bank is a depository institution whose deposits are insured by the FDIC. As a result, the Company is subject to various regulations and examinations by various regulatory authorities. In general, statutes establish the corporate governance and eligible business activities for the Company, certain

9

Table of Contents

acquisition and merger restrictions, limitations on inter-company transactions such as loans and dividends, capital adequacy requirements, requirements for anti-money laundering programs and other compliance matters, among other regulations. The Company is extensively regulated under federal and state banking laws and regulations that are intended primarily for the protection of depositors, federal deposit insurance funds and the banking system as a whole. Compliance with these statutes and regulations is important to itsthe Company’s ability to engage in new activities and to consummate additional acquisitions.

In addition, the Company is subject to changes in federal and state tax laws as well as changes in banking and credit regulations, accounting principles and governmental economic and monetary policies. The Company cannot predict whether any of these changes may adversely and materially affect it. Federal and state banking regulators also possess broad powers to take supervisory actions as they deem appropriate. These supervisory actions may result in higher capital requirements, higher insurance premiums and limitations on the Company’s activities that could have a material adverse effect on its business and profitability. While these statutes are generally designed to minimize potential loss to depositors and the FDIC insurance funds, they do not eliminate risk, and compliance with such statutes increases the Company’s expense, requires management’s attention and can be a disadvantage from a competitive standpoint with respect to non-regulated competitors.

The earnings of financial services companies are significantly affected by general business and economic conditions.

The Company’s operations and profitability are impacted by general business and economic conditions in the United States and abroad. These conditions include short-term and long-term interest rates, inflation, money supply, political issues, legislative and regulatory changes, fluctuations in both debt and equity capital markets, broad trends in industry and finance, and the strength of the U.S. economy and the local economies in which the Company operates, all of which are beyond the Company’s control. Deterioration in economic conditions could result in an increase in loan delinquencies and non-performing assets, decreases in loan collateral values and a decrease in demand for the Company’s products and services, among other things, any of which could have a material adverse impact on the Company’s financial condition and results of operations.

Financial services companies depend on the accuracy and completeness of information about customers and counterparties.

In deciding whether to extend credit or enter into other transactions, the Company may rely on information furnished by or on behalf of customers and counterparties, including financial statements, credit reports and other financial information. The Company may also rely on representations of those customers, counterparties or other third parties, such as independent auditors, as to the accuracy and completeness of that information. Reliance on inaccurate or misleading financial statements, credit reports or other financial information could have a material adverse impact on the Company’s business and, in turn, the Company’s financial condition and results of operations.

Consumers may decide not to use banks to complete their financial transactions.

Technology and other changes are allowing parties to complete financial transactions that historically have involved banks through alternative methods. For example, consumers can now maintain funds that would have historically been held as bank deposits in brokerage accounts or mutual funds. Consumers can also complete transactions such as paying bills and/or transferring funds directly without the assistance of banks. The process of eliminating banks as intermediaries, known as “disintermediation,” could result in the loss of fee income, as well as the loss of customer deposits and the related income generated from those deposits. The loss of these revenue streams and the lower cost deposits as a source of funds could have a material adverse effect on the Company’s financial condition and results of operations.

The capital and credit markets have experienced unprecedented levels of volatility.

During 2008 the capital and credit markets experienced severe volatility and disruption. In the third and fourth quarters of 2008, the volatility and disruption reached unprecedented levels. This has continued into 2009 and the Country is presently in a recession. Reflecting concern about the stability of the financial markets generally and the strength of counterparties, many lenders and institutional investors have reduced, and in some cases ceased to provide, funding to borrowers, including other financial institutions. Although to date we have not suffered liquidity problems, we are part of the financial system and a systemic lack of available credit, a lack of confidence in the financial sector, increased volatility in the financial markets and reduced business activity could materially and adversely affect our business, financial condition and results of operations.

In response to the turmoil in the banking system and financial markets, the U.S. government has taken unprecedented actions, including the U.S. Treasury’s plan to inject capital and to purchase mortgage loans and mortgage-backed and other securities from financial institutions for the purpose of stabilizing the financial markets generally or particular financial institutions. There is no assurance that these government actions will achieve their purpose.

10

Table of Contents

The failure to help stabilize the financial markets and a continuation or worsening of the current financial market conditions could have a material adverse affect on our business, our financial condition, the financial condition of our customers, our common stock trading price, as well as our ability to access credit.

ITEM 1B:UNRESOLVED STAFF COMMENTS

None

None

ITEM 2: PROPERTIESPROPERTIES

As of December 31,

2008,2009, the Company operated

1211 full-service banking offices, of which four were owned and

eightseven were leased. None of the lessors of the properties leased by the Company are affiliated with the Company

or the Bank and all of the properties are located in the Commonwealth of Pennsylvania. The Company is headquartered at its

owner occupiedowner-occupied main branch located on the corner of Blakely and Drinker Streets in Dunmore, PA.

The following table provides information with respect to the principal properties from which the Bank conducts business:

Location |

| Owned / leased* |

| Type of use |

| Full service |

| Drive-thru |

| ATM |

Drinker & Blakely Sts.,

Dunmore, PA | | Owned | | Main Branch (1) (2) | | x | | x | | x |

| | | | | | | | | | |

111 Green Ridge St.,

Scranton, PA | | Leased | | Green Ridge Branch (2) | | x | | x | | x |

| | | | | | | | | | |

139 Wyoming Ave.,

Scranton, PA

| | Leased

| | Scranton Branch

| | x

| | | | x

|

| | | | | | | | | | |

1311 Morgan Hwy.,

Clarks Summit, PA | | Leased | | Abington Branch (3) | | x | | x | | x |

| | | | | | | | | | |

1232 Keystone Industrial Park Rd.,

Dunmore, PA | | Owned | | Keystone Industrial Park Branch | | x | | x | | x |

| | | | | | | | | | |

338 North Washington Ave.,

Scranton, PA | | Owned | | Financial Center Branch (4) | | x | | | | x |

| | | | | | | | | | |

4010 Birney Ave.,

Moosic, PA | | Leased | | Moosic Branch | | x | | x | | x |

| | | | | | | | | | |

801 Wyoming Ave.,

West Pittston, PA | | Leased | | West Pittston Branch | | x | | | | x |

| | | | | | | | | | |

1598 Main St.,

Peckville, PA | | Leased | | Peckville Branch | | x | | x | | x |

| | | | | | | | | | |

247 Wyoming Ave.,

Kingston, PA | | Leased | | Kingston Branch | | x | | x | | x |

| | | | | | | | | | |

511 Scranton-Carbondale Hwy., Eynon, PA | | Leased | | Eynon Branch | | x | | x | | x |

| | | | | | | | | | |

400 S. Main St.,

Scranton, PA | | Owned | | West Scranton Branch(2) | | x | | x | | x |

*All of the owned properties are free of encumbrances

(1) Executive and administrative, commercial lending, trust and asset management services are located at this facility. (2) This office has two automated teller machines (ATMs). (3) In addition, there is a banking facility located in the Clarks Summit State Hospital. The office is leased from the hospital under a lease-for-service-provided agreement with service limited to employees and patients of the hospital. (4) Executive, mortgage and consumer lending, finance and operational offices are located in this building. A portion of the building is leased to a non-related entity.11

Table of Contents

The Bank maintains several free-standing 24-hour ATMs located at the following locations in Pennsylvania:

· U.S. Mini Marts, Inc., 511 Main St., Childs

· Marywood University, 2300 Adams Ave., Nazareth and Regina Halls, Scranton

· Snö Mountain Ski Resort, 1000 Montage Mountain Rd., Moosic

· Shoppes at Montage, 1035 Shoppes Blvd., Moosic

| · | 139 Wyoming Ave., Scranton (former location of the Bank’s Scranton branch) |

| · | Marywood University, 2300 Adams Ave., Nazareth and Regina Halls, Scranton |

| · | Snö Mountain Ski Resort, 1000 Montage Mountain Rd., Moosic |

| · | Shoppes at Montage, 1035 Shoppes Blvd., Moosic |

During

2008,2009, the Company closed its

PittstonScranton branch office located at

403 Kennedy Blvd., Pittston.139 Wyoming Avenue, Scranton.

Other real estate owned includes all foreclosed properties listed for sale. Upon possession, foreclosed properties are recorded on the Company’s balance sheet at the lower of cost or fair value.

The nature of the Company’s business generates some litigation involving matters arising in the ordinary course of business. However, in the opinion of the Company after consulting with legal counsel, no legal proceedings are pending, which, if determined adversely to the Company or the Bank, would have a material effect on the Company’s undivided profits or financial condition. No legal proceedings are pending other than ordinary routine litigation incidental to the business of the Company and the Bank. In addition, to management’s knowledge, no governmental authorities have initiated or contemplated any material legal actions against the Company or the Bank.

No matter was submitted during the quarter ended December 31, 2008 to a vote of our security holders through solicitation of proxies or otherwise.

PART II

ITEM 5:MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The common stock of the Company is traded on the over-the-counter bulletin board under the symbol “FDBC.” Shareholders requesting information about the Company’s common stock may contact contact:

Salvatore R. DeFrancesco, Jr.,

Treasurer. Requests may be mailed to:Treasurer

Fidelity D & D Bancorp, Inc.

Blakely and Drinker

St.Sts.

The following table lists the quarterly cash dividends paid per share and the range of high and low bid prices for the Company’s common

stock.stock based on information obtained from on-line published sources. Such over-the-counter prices do not include retail mark-ups, markdowns or commissions:

| | 2008 | | | | 2007 | | | |

| | Prices | | Dividends | | Prices | | Dividends | |

| | High | | Low | | paid | | High | | Low | | paid | |

1st Quarter | | $ | 31.00 | | $ | 25.20 | | $ | 0.25 | | $ | 40.00 | | $ | 32.50 | | $ | 0.22 | |

2nd Quarter | | $ | 30.00 | | $ | 27.00 | | $ | 0.25 | | $ | 37.75 | | $ | 32.00 | | $ | 0.22 | |

3rd Quarter | | $ | 33.50 | | $ | 29.00 | | $ | 0.25 | | $ | 34.00 | | $ | 27.10 | | $ | 0.24 | |

4th Quarter | | $ | 28.75 | | $ | 21.75 | | $ | 0.25 | | $ | 34.00 | | $ | 27.00 | | $ | 0.25 | |

| | | 2009 Prices | | | Dividends | | | 2008 Prices | | | Dividends | |

| | | High | | | Low | | | paid | | | High | | | Low | | | paid | |

| 1st Quarter | | $ | 26.50 | | | $ | 19.50 | | | $ | 0.25 | | | $ | 31.00 | | | $ | 25.20 | | | $ | 0.25 | |

| 2nd Quarter | | $ | 24.00 | | | $ | 18.40 | | | $ | 0.25 | | | $ | 30.00 | | | $ | 27.00 | | | $ | 0.25 | |

| 3rd Quarter | | $ | 22.00 | | | $ | 18.35 | | | $ | 0.25 | | | $ | 33.50 | | | $ | 29.00 | | | $ | 0.25 | |

| 4th Quarter | | $ | 19.00 | | | $ | 14.60 | | | $ | 0.25 | | | $ | 28.75 | | | $ | 21.75 | | | $ | 0.25 | |

Dividends are determined and declared by the Board of Directors of the Company. The Company expects to continue to pay cash dividends in the future; however, future dividends are dependent upon earnings, financial condition, capital needs and other factors of the Company. For a further discussion of regulatory capital requirements see Note 14, “Regulatory

matters,”Matters”, contained within the notes to the consolidated financial

statements.statements, incorporated by reference in Part II, Item 8.

The Company has established a dividend reinvestment plan (DRP) for its shareholders. The plan

is designedprovides shareholders with a convenient and economical method of investing cash dividends payable upon their common stock and the opportunity to make

voluntary optional cash payments to purchase additional shares of the Company’s

common stock. Participants pay no brokerage commissions or service charges when they acquire additional shares of common stock

available at no transactional cost to our shareholders. Cash dividends, paid to shareholders who are enrolled inthrough the

DRP, are used toplan. The administrator may purchase shares directly from the Company,

or from shares that are available in the open

market.12

The Company had approximately

1,3231,307 shareholders

at February 28, 2009 and also at December 31,

2008.2009 and 1,287 shareholders as of February 28, 2010. The number of shareholders is the actual number of individual shareholders of record. Each security depository is considered a single shareholder for purposes of determining the approximate number of shareholders.

Securities authorized for issuance under equity compensation plans

The information required under this section is incorporated by reference herein, to the information presented in the Company’s definitive Proxy Statement for its

20092010 Annual Meeting of Shareholders to be filed with the SEC.

Purchases of equity securities by the issuer and affiliated purchasers

The following table summarizes the activity in the Company’s stock repurchase program during the fourth quarter of 2008:

| | (a) | | (b) | | (c) | | (d) | |

| | | | | | Total number of | | | |

| | | | | | shares (or units) | | Maximum number of | |

| | Total Number | | | | purchased as part as | | shares (or units) that may | |

| | of shares (or units) | | Average price paid | | publicly announced plans | | yet be purchased under the | |

Period | | purchased | | per share (or unit) | | or programs | | plans or programs | |

October 1, 2008

to

October 31, 2008 | | — | | $ | — | | — | | 37,000 | |

November 1, 2008

to

November 30, 2008 | | 2,000 | | 25.31 | | 2,000 | | 35,000 | |

December 1, 2008

to

December 31, 2008 | | — | | — | | — | | 35,000 | |

Total | | 2,000 | | $ | 25.31 | | 2,000 | | 35,000 | |

In the second quarter of 2008 the Company’s Board of Directors approved and publicly announced its intent to initiate a capital stock repurchase program covering up to 50,000 shares, or approximately 2.4% of its outstanding capital stock as of May 31, 2008. The Company has not made any purchases of its shares of capital that has not been publicly announced. Neither an expiration date nor a maximum dollar amount has been fixed to the program. The repurchases will be made from time-to-time in open-market transactions, subject to availability. The repurchased shares would become treasury stock and could be available for issuance under the Company’s various stock-based compensation, employee stock purchase and dividend reinvestment plans and for general corporate purposes. No repurchase program has expired or has been subject to a determination to terminate during the period covered by the above table. In December 2008, 2,745 shares were reissued by the Company to participants in the dividend reinvestment plan at a re-issue price of $26.81 per share.

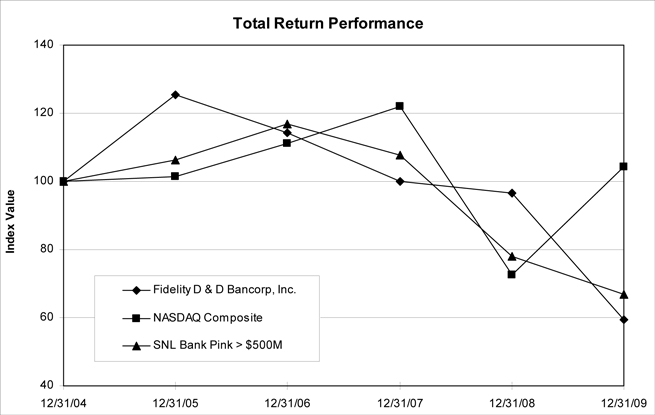

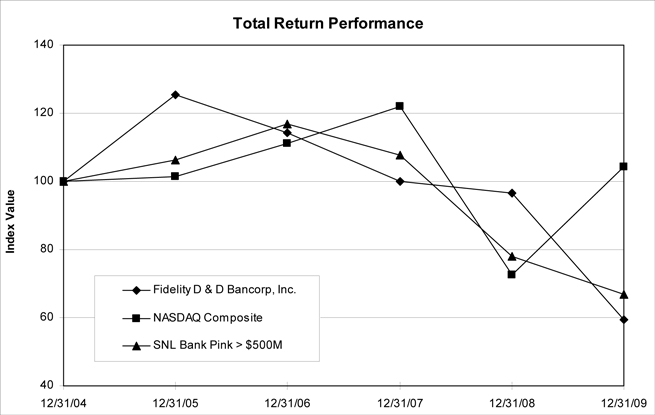

The following graph and table compare the cumulative total shareholder return on the Company’s common stock against the cumulative total return of the NASDAQ Composite and the SNL index of greater than $500 million in-asset banks traded on the OTC-BB and Pink Sheet (the SNL index) for the period of five fiscal years commencing January 1,

2004,2005, and ending December 31,

2008.2009. As of December 31, 2009, the SNL index consisted of 136 banks. The graph illustrates the cumulative investment return to shareholders, based on the assumption that a $100 investment was made on December 31,

2003,2004, in each of: the Company’s common stock, the NASDAQ Composite and the SNL index. All cumulative total returns are computed assuming the reinvestment of dividends into the applicable securities. The shareholder return shown on the graph and table below is not necessarily indicative of future performance:

| | | | Period Ending | |

| Index | | | 12/31/04 | | | 12/31/05 | | | 12/31/06 | | | 12/31/07 | | | 12/31/08 | | | 12/31/09 | |

| Fidelity D & D Bancorp, Inc. | | | 100.00 | | | 125.47 | | | 114.21 | | | 100.04 | | | 96.48 | | | 59.32 | |

| NASDAQ Composite | | | 100.00 | | | 101.37 | | | 111.03 | | | 121.92 | | | 72.49 | | | 104.31 | |

SNL > $500M OTC-BB and Pink Sheet Banks | | | 100.00 | | | 106.42 | | | 116.77 | | | 107.59 | | | 78.07 | | | 66.75 | |

Table of Contents

| | Period ending | |

Index | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 | | 12/31/07 | | 12/31/08 | |

Fidelity D & D Bancorp, Inc. | | 100.00 | | 93.95 | | 117.87 | | 107.30 | | 93.99 | | 90.64 | |

NASDAQ Composite | | 100.00 | | 108.59 | | 110.08 | | 120.56 | | 132.39 | | 78.72 | |

SNL > $500M OTC-BB and Pink Sheet Banks | | 100.00 | | 116.97 | | 124.48 | | 136.58 | | 125.85 | | 91.32 | |

14

Set forth below are our selected consolidated financial and other data. This financial data is derived in part from, and should be read in conjunction with, the Company’s consolidated financial statements and related footnotes:

| | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

Balance sheet data: | | | | | | | | | | | |

Total assets | | $ | 575,718,997 | | $ | 587,412,555 | | $ | 562,317,988 | | $ | 544,060,698 | | $ | 536,675,138 | |

Total investment securities | | 84,187,579 | | 122,984,160 | | 100,410,736 | | 97,678,573 | | 115,668,818 | |

Net loans | | 436,207,460 | | 421,424,379 | | 417,199,048 | | 403,144,095 | | 381,546,375 | |

Loans available-for-sale | | 84,000 | | 827,250 | | 122,000 | | 428,584 | | 576,378 | |

Total deposits | | 433,311,932 | | 425,708,361 | | 410,334,595 | | 379,498,640 | | 365,615,335 | |

Short-term borrowings | | 38,129,704 | | 39,656,354 | | 33,656,150 | | 28,772,997 | | 50,534,046 | |

Long-term debt | | 52,000,000 | | 62,708,677 | | 62,536,210 | | 83,704,188 | | 71,119,188 | |

Total shareholders’ equity | | 48,960,651 | | 55,191,294 | | 51,611,863 | | 48,846,029 | | 46,366,760 | |

| | | | | | | | | | | |

Operating data for the year ended: | | | | | | | | | | | |

Total interest income | | $ | 33,961,434 | | $ | 35,279,357 | | $ | 33,529,710 | | $ | 29,020,261 | | $ | 27,395,491 | |

Total interest expense | | 14,684,133 | | 17,660,075 | | 16,361,109 | | 11,720,986 | | 11,180,135 | |

Net interest income | | 19,277,301 | | 17,619,282 | | 17,168,601 | | 17,299,275 | | 16,215,356 | |

Provision (credit) for loan losses | | 940,000 | | (60,000 | ) | 325,000 | | 830,000 | | 2,150,000 | |

| | | | | | | | | | | |

Net interest income after provision (credit) for loan losses | | 18,337,301 | | 17,679,282 | | 16,843,601 | | 16,469,275 | | 14,065,356 | |

Other income | | 4,578,301 | | 5,205,215 | | 4,522,138 | | 4,150,502 | | 4,153,277 | |

Other operating expense | | 18,210,683 | | 16,636,760 | | 15,878,376 | | 14,561,968 | | 13,818,565 | |

| | | | | | | | | | | |

Income before provision for income taxes | | 4,704,919 | | 6,247,737 | | 5,487,363 | | 6,057,809 | | 4,400,068 | |

Provision for income taxes | | 1,068,971 | | 1,636,165 | | 1,362,080 | | 1,466,112 | | 1,035,594 | |

Net Income | | $ | 3,635,948 | | $ | 4,611,572 | | $ | 4,125,283 | | $ | 4,591,697 | | $ | 3,364,474 | |

| | | | | | | | | | | |

Per share data: | | | | | | | | | | | |

Net income per share, basic | | $ | 1.76 | | $ | 2.23 | | $ | 2.01 | | $ | 2.26 | | $ | 1.67 | |

Net income per share, diluted | | $ | 1.76 | | $ | 2.23 | | $ | 2.01 | | $ | 2.25 | | $ | 1.67 | |

Dividends declared | | $ | 2,068,680 | | $ | 1,921,533 | | $ | 1,801,361 | | $ | 1,624,263 | | $ | 1,610,423 | |

Dividends per share | | $ | 1.00 | | $ | 0.93 | | $ | 0.88 | | $ | 0.80 | | $ | 0.80 | |

Book value per share | | $ | 23.73 | | $ | 26.62 | | $ | 25.09 | | $ | 23.95 | | $ | 22.92 | |

Weighted-average number of shares outstanding * | | 2,068,851 | | 2,066,683 | | 2,047,975 | | 2,031,211 | | 2,013,798 | |

Number of shares outstanding at year-end * | | 2,062,927 | | 2,072,929 | | 2,057,433 | | 2,039,639 | | 2,023,529 | |

| | | | | | | | | | | |

Ratios: | | | | | | | | | | | |

Return on average assets | | 0.62 | % | 0.80 | % | 0.73 | % | 0.86 | % | 0.61 | % |

Return on average equity | | 6.81 | % | 8.65 | % | 8.31 | % | 9.64 | % | 7.51 | % |

Net interest margin | | 3.60 | % | 3.34 | % | 3.31 | % | 3.51 | % | 3.20 | % |

Efficiency ratio | | 72.98 | % | 71.61 | % | 71.67 | % | 65.99 | % | 64.45 | % |

Expense ratio | | 2.25 | % | 2.01 | % | 2.02 | % | 1.93 | % | 1.69 | % |

Allowance for loan losses to total loans | | 1.08 | % | 1.13 | % | 1.29 | % | 1.46 | % | 1.54 | % |

Dividend payout ratio | | 56.90 | % | 41.67 | % | 43.67 | % | 35.37 | % | 47.87 | % |

Equity to assets | | 8.50 | % | 9.40 | % | 9.18 | % | 8.98 | % | 8.64 | % |

Equity to deposits | | 11.30 | % | 12.96 | % | 12.58 | % | 12.87 | % | 12.68 | % |

* The number of shares and the weighted-average number of shares outstanding prior to 2006, have been adjusted to reflect the effect of a 10% stock dividend paid on February 15, 2006.

15

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| Balance sheet data: | | | | | | | | | | | | | | | |

| Total assets | | $ | 556,017,271 | | | $ | 575,718,997 | | | $ | 587,412,555 | | | $ | 562,317,988 | | | $ | 544,060,698 | |

| Total investment securities | | | 76,529,998 | | | | 84,187,579 | | | | 122,984,160 | | | | 100,410,736 | | | | 97,678,573 | |

| Net loans | | | 423,124,054 | | | | 436,207,460 | | | | 421,424,379 | | | | 417,199,048 | | | | 403,144,095 | |

| Loans available-for-sale | | | 1,221,365 | | | | 84,000 | | | | 827,250 | | | | 122,000 | | | | 428,584 | |

| Total deposits | | | 458,994,458 | | | | 433,311,932 | | | | 425,708,361 | | | | 410,334,595 | | | | 379,498,640 | |

| Short-term borrowings | | | 16,533,107 | | | | 38,129,704 | | | | 39,656,354 | | | | 33,656,150 | | | | 28,772,997 | |

| Long-term debt | | | 32,000,000 | | | | 52,000,000 | | | | 62,708,677 | | | | 62,536,210 | | | | 83,704,188 | |

| Total shareholders' equity | | | 45,674,547 | | | | 48,960,651 | | | | 55,191,294 | | | | 51,611,863 | | | | 48,846,029 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating data for the year ended: | | | | | | | | | | | | | | | | | | | | |

| Total interest income | | $ | 29,909,273 | | | $ | 33,961,434 | | | $ | 35,279,357 | | | $ | 33,529,710 | | | $ | 29,020,261 | |

| Total interest expense | | | 10,796,854 | | | | 14,684,133 | | | | 17,660,075 | | | | 16,361,109 | | | | 11,720,986 | |

| Net interest income | | | 19,112,419 | | | | 19,277,301 | | | | 17,619,282 | | | | 17,168,601 | | | | 17,299,275 | |

| Provision (credit) for loan losses | | | 5,050,000 | | | | 940,000 | | | | (60,000 | ) | | | 325,000 | | | | 830,000 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net interest income after provision (credit) for loan losses | | | 14,062,419 | | | | 18,337,301 | | | | 17,679,282 | | | | 16,843,601 | | | | 16,469,275 | |

| Other-than-temporary impairment | | | (3,300,094 | ) | | | (435,665 | ) | | | - | | | | - | | | | - | |

| Other income | | | 5,461,281 | | | | 5,013,966 | | | | 5,205,215 | | | | 4,522,138 | | | | 4,150,502 | |

| Other operating expense | | | 19,241,125 | | | | 18,210,683 | | | | 16,636,760 | | | | 15,878,376 | | | | 14,561,968 | |

| | | | | | | | | | | | | | | | | | | | | |

| (Loss) income before income taxes | | | (3,017,519 | ) | | | 4,704,919 | | | | 6,247,737 | | | | 5,487,363 | | | | 6,057,809 | |

| (Credit) provision for income taxes | | | (1,617,314 | ) | | | 1,068,971 | | | | 1,636,165 | | | | 1,362,080 | | | | 1,466,112 | |

| Net (loss) income | | $ | (1,400,205 | ) | | $ | 3,635,948 | | | $ | 4,611,572 | | | $ | 4,125,283 | | | $ | 4,591,697 | |

| | | | | | | | | | | | | | | | | | | | | |

| Per share data: | | | | | | | | | | | | | | | | | | | | |

| Net (loss) income per share, basic | | $ | (0.67 | ) | | $ | 1.76 | | | $ | 2.23 | | | $ | 2.01 | | | $ | 2.26 | |

| Net (loss) income per share, diluted | | $ | (0.67 | ) | | $ | 1.76 | | | $ | 2.23 | | | $ | 2.01 | | | $ | 2.25 | |

| Dividends declared | | $ | 2,078,171 | | | $ | 2,068,680 | | | $ | 1,921,533 | | | $ | 1,801,361 | | | $ | 1,624,263 | |

| Dividends per share | | $ | 1.00 | | | $ | 1.00 | | | $ | 0.93 | | | $ | 0.88 | | | $ | 0.80 | |

| Book value per share | | $ | 21.69 | | | $ | 23.73 | | | $ | 26.62 | | | $ | 25.09 | | | $ | 23.95 | |

| Weighted-average shares outstanding * | | | 2,080,507 | | | | 2,068,851 | | | | 2,066,683 | | | | 2,047,975 | | | | 2,031,211 | |

| Shares outstanding * | | | 2,105,860 | | | | 2,062,927 | | | | 2,072,929 | | | | 2,057,433 | | | | 2,039,639 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios: | | | | | | | | | | | | | | | | | | | | |

| Return on average assets | | | -0.25 | % | | | 0.62 | % | | | 0.80 | % | | | 0.73 | % | | | 0.86 | % |

| Return on average equity | | | -2.91 | % | | | 6.81 | % | | | 8.65 | % | | | 8.31 | % | | | 9.64 | % |

| Net interest margin | | | 3.71 | % | | | 3.60 | % | | | 3.34 | % | | | 3.31 | % | | | 3.51 | % |

| Efficiency ratio | | | 72.51 | % | | | 72.98 | % | | | 71.61 | % | | | 71.67 | % | | | 65.99 | % |

| Expense ratio | | | 2.37 | % | | | 2.25 | % | | | 2.01 | % | | | 2.02 | % | | | 1.93 | % |

| Allowance for loan losses to loans | | | 1.75 | % | | | 1.08 | % | | | 1.13 | % | | | 1.29 | % | | | 1.46 | % |

| Dividend payout ratio | | | N/M | ** | | | 56.90 | % | | | 41.67 | % | | | 43.67 | % | | | 35.37 | % |

| Equity to assets | | | 8.21 | % | | | 8.50 | % | | | 9.40 | % | | | 9.18 | % | | | 8.98 | % |

| Equity to deposits | | | 9.95 | % | | | 11.30 | % | | | 12.96 | % | | | 12.58 | % | | | 12.87 | % |

| * | The number of shares and the weighted-average number of shares outstanding prior to 2006, have been adjusted to reflect the effect of a 10% stock dividend paid on February 15, 2006. |

| ** | The result of this calculation is not meaningful. |

Table of Contents

ITEM 7:MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION ANDRESULTS OF OPERATIONS

Critical accounting policies

The presentation of financial statements in conformity with

U.S. GAAP requires management to make estimates and assumptions that affect many of the reported amounts and disclosures. Actual results could differ from these estimates.

A material estimate that is particularly susceptible to significant change relates to the determination of the allowance for loan losses. Management believes that the allowance for loan losses at December 31,

20082009 is adequate and reasonable. Given the subjective nature of identifying and valuing loan losses, it is likely that well-informed individuals could make different assumptions, and could, therefore calculate a materially different allowance value. While management uses available information to recognize losses on loans, changes in economic conditions may necessitate revisions in the future. In addition, various regulatory agencies, as an integral part of their examination process, periodically review the Company’s allowance for loan losses. Such agencies may require the Company to recognize adjustments to the allowance based on their judgment of information available to them at the time of their examination.

Another material estimate is the calculation of fair values of the Company’s investment securities. Except for the Company’s investment in corporate bonds, consisting of

pooled trust preferred

term securities,

marketfair values on the other investment securities are determined by prices provided by a third-party vendor, who is a provider of financial market data, analytics and related services to financial institutions. For the

pooled trust preferred

term securities, management was unable to obtain readily attainable and realistic pricing from market traders due to

a lack of active market participants and therefore management has determined

that the market for these securities

is currentlyto be inactive. In order to determine the

marketfair value of the

pooled trust preferred

term securities, management relied on the use of an income valuation approach (present value technique) that maximizes the use of relevant observable inputs and minimizes the use of unobservable inputs, the results of which are more representative of fair value than the market approach valuation technique used for the other investment securities.

Based on experience, management is aware that estimated fair values of investment securities tend to vary among valuation services. Accordingly, when selling investment securities,

managementprice quotes may

obtain price quotesbe obtained from more than one source. As described in Notes 1 and 3 of the consolidated financial statements, the

large majority of the Company’s investment securities are classified as available-for-sale (AFS). AFS securities are carried at fair value on the consolidated balance

sheet,sheets, with unrealized gains and losses, net of income tax, reported separately within shareholders’ equity through accumulated other comprehensive income (loss).

The fair value of residential mortgage loans, classified as AFS, is obtained from the Federal National Mortgage Association (FNMA) or the Federal Home Loan Bank (FHLB). Generally, the market to which the Company sells mortgages it originates for sale is restricted and price quotes from other sources are not typically obtained. On occasion, the Company may transfer loans from the loan and lease portfolio to loans AFS. Under these rare circumstances, pricing may be obtained from other entities and the loans are transferred at the lower of cost or market value and simultaneously sold. For a further discussion on the accounting treatment of AFS loans, see the section entitled “Loans available-for-sale,” contained within management’s discussion and analysis. As of December 31,

20082009 and

2007,2008, loans classified as AFS consisted of residential mortgages.

All significant accounting policies are contained in Note 1, “Nature of

operationsOperations and

summarySummary of

significant accounting policies,”Significant Accounting Policies”, within the notes to consolidated financial statements and incorporated by reference in Part II, Item 8.

The following discussion and analysis presents the significant changes in the financial condition and in the results of operations of the Company as of December 31,

20082009 and December 31,