Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)x

xANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year endedended: December 31, 2011

OR2012

oTRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Numberfile number: 1-31987

Hilltop Holdings Inc.

(Exact name of registrant as specified in its charter)

MARYLANDMaryland

| | 84-1477939 |

(State or other jurisdiction of

incorporation or organization)

| | (I.R.S. Employer

Identification No.)

|

200 Crescent Court, Suite 1330

| | |

200 Crescent Court, Suite 1330 Dallas, TexasTX | |

75201 |

(Address of principal executive offices) | | (zip code)Zip Code) |

(214) 855-2177

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o NoYes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o NoYes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x NoYes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site,Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x NoYes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | | Accelerated filer x |

| | |

Non-accelerated filer o |

(Do not check if a smaller reporting company)

| Smaller reporting company o |

(Do not check if smaller reporting company)

| | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o NoYes x No

The aggregateAggregate market value of the voting and non-voting common stock of the registrantequity held by non-affiliates, of the registrant, computed by reference to the price at which the common stock was last sold on the New York Stock Exchange on June 30, 2011,2012, was approximately $350$408 million. For the purposes of this computation, all officers, directors and 10% stockholders were deemed to be affiliates. This determination should not be construed as an admission that such officers, directors and 10% stockholders are affiliates. The number of shares of the registrant’s common stock outstanding at March 9, 201214, 2013 was 56,502,246.83,487,340.

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant’s definitive Proxy Statement pertaining to the 20122013 Annual Meeting of Stockholders, filed or to be filed not later than 120 days after the end of the fiscal year pursuant to Regulation 14A, is incorporated herein by reference into Part III.

Table of Contents

Table of ContentsTABLE OF CONTENTS

MARKET AND INDUSTRY DATA AND FORECASTS

Market and industry data and other statistical information and forecasts used throughout this Annual Report on Form 10-K (this “Annual Report”) are based on independent industry publications, government publications and reports by market research firms or other published independent sources. We have not sought or obtained the approval or endorsement of the use of this third-party information. Some data also is based on our good faith estimates, which are derived from our review of internal surveys, as well as independent sources. Forecasts are particularly likely to be inaccurate, especially over long periods of time.

Table of Contents

Unless the context otherwise indicates, all references in this Annual Report on Form 10-K to the “Company,” “Hilltop,” “HTH,” “we,” “us,” “our” or “ours” or similar words are to Hilltop Holdings Inc.(formerly known as Affordable Residential Communities Inc.) and its direct and indirect wholly-ownedwholly owned subsidiaries, references to “PlainsCapital” refer to PlainsCapital Corporation (a wholly owned subsidiary of Hilltop), references to the “Bank” refer to PlainsCapital Bank (a wholly owned subsidiary of PlainsCapital), references to “First Southwest” refer to First Southwest Holdings, LLC (a wholly owned subsidiary of the Bank) and its subsidiaries as a whole, references to “FSC” refer to First Southwest Company (a wholly owned subsidiary of First Southwest), references to “PrimeLending” refer to PrimeLending, a PlainsCapital Company (a wholly owned subsidiary of the Bank) and its subsidiaries as a whole and references to “NLASCO” refer to NLASCO, Inc. (a wholly owned subsidiary of Hilltop Holdings Inc.) and its subsidiaries as a whole. In addition, unless the context otherwise requires, references to “stockholders” are to the holders of our voting securities, which consist of our Common Stock, par value $0.01 per share..

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the documents incorporated by reference into this report include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act, as amended by the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included in this Annual Report on Form 10-K that address results or developments that we expect or anticipate will or may occur in the future, where statements are preceded by, followed by or include the words “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “approximately,” “intends,” “plans,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases, including such things as our business strategy, our financial condition, our litigation, our efforts to make strategic acquisitions, our revenue, our liquidity and sources of funding, our capital expenditures, our products, market trends, operations and business, expectations concerning mortgage loan origination volume, expectations concerning the hiring of additional mortgage bankers, anticipated changes in our revenues or earnings, the effects of government regulation applicable to our operations, expectations concerning deposit insurance premiums, the appropriateness of our allowance for loan losses and provision for loan losses, and the collectability of margin loans are forward-looking statements.

These forward-looking statements are based on our beliefs, assumptions and expectations of our future performance taking into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If an event occurs, or further changes, our business, business plan, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Certain factors that could cause actual results to differ include, among others:

·(1) changes in the acquisition market;default rate of our loans and risks associated with concentration in real estate related loans;

·our ability to find and complete strategic acquisitions with suitable merger or acquisition candidates or find other suitable ways in which to invest our capital;

·the adverse impact of external factors, such as(2) changes in general economic, market and business conditions in areas or markets where we compete;

(3) changes in the interest rates, inflationrate environment;

(4) cost and consumer confidence;availability of capital;

·

(5) changes in state and federal laws, regulations or policies affecting one or more of our business segments, including changes in regulatory fees, deposit insurance premiums, capital requirements and the conditionDodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”);

(6) our participation in governmental programs, including the Small Business Lending Fund (“SBLF”);

(7) severe catastrophic events in our geographic area;

(8) failure of capital markets;our insurance segment reinsurers to pay obligations under reinsurance contracts;

·actual outcome

(9) changes in key management;

(10) approval of the resolution of any conflict;new, or changes in, accounting policies and practices;

·

(11) our ability to use net operating loss carryforwardscarry forwards to reduce future tax payments;

·the impact of the tax code

(12) competition for our banking, mortgage origination, financial advisory and rules oninsurance segments from other banks and financial institutions as well as insurance companies, mortgage bankers, investment banking and financial advisory firms, asset-based non-bank lenders and government agencies; and

(13) our financial statements;

·failure of NLASCO, Inc.’s insurance subsidiariesability to maintain their respective A.M. Best ratings;

·failure to maintain NLASCO, Inc.’s current agents;

·lack of demand for insurance products;

·cost or availability of adequate reinsurance;

·changesuse excess cash in key management;

·severe catastrophic events in our geographic area;

·failure of NLASCO, Inc.’s reinsurers to pay obligations under reinsurance contracts;

·failure of NLASCO, Inc. to maintain sufficient reserves for losses on insurance policies;

·failure to successfully implement NLASCO, Inc.’s new information technology system; and

·failure of NLASCO, Inc. to maintain appropriate insurance licenses.an effective manner.

For a furthermore detailed discussion of these and other risksfactors that may affect our business and uncertainties that could cause the actual results to differ materially from those containedanticipated in ourthese forward-looking statements, please refersee Item 1A, “Risk Factors,” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” herein. We caution that the foregoing list of factors is not exhaustive, and new factors may emerge, or changes to “Risk Factors” in this report. Consequently, all of the foregoing factors may occur, that could impact our business. All subsequent written and oral forward-looking statements madeconcerning our business attributable to us or any person acting on our behalf are expressly qualified in this report are qualifiedtheir entirety by thesethe cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized, or even substantially realized, and that they will have the expected consequences to, or effects on, us and our business or operations. Forward-looking statements made in this report speak as of the date of this report or as of the date specifically referenced inabove. We do not undertake any such statement set forth in this report. Except as required by law, we undertake no obligation to update or revise any forward-looking statementsstatement, whether written or oral, relating to the matters discussed in this report.Annual Report except to the extent required by federal securities laws.

13

Table of Contents

PART I

ITEMItem 1. BUSINESSBusiness.

General Information

We are a holding company that is endeavoringhas endeavored, and continues to endeavor, to make opportunistic acquisitions or effect a business combination.combinations. In connection with thatthis strategy, on May 8, 2012 we are identifyingentered into a definitive agreement and evaluating potential targets across all industriesplan of merger with PlainsCapital Corporation, or the Merger Agreement, pursuant to which we acquired PlainsCapital Corporation on an ongoing basis. At December 31, 2011,November 30, 2012, or the Merger. Concurrent with the consummation of the Merger, we had approximately $533 million aggregate available cash and cash equivalents that may be used for this purpose. No assurances, however, can be given that we will be able to identify suitable targets, consummate acquisitions or effectbecame a combination or, if consummated, successfully integrate or operatefinancial holding company registered under the acquired business.Bank Holding Company Act of 1956 (as amended, the “Bank Holding Company Act”), as amended by the Gramm-Leach-Bliley Act of 1999 (the “Gramm-Leach-Bliley Act”).

On July, 29, 2011, we extended SWS Group, Inc, or SWS, a $50 million term loan, which bears interest at 8% per annum, is prepayable by SWS subjectPrior to certain conditions after three years, and has a maturitythe consummation of five years. SWS issued us a warrantthe Merger with PlainsCapital Corporation, our primary operations were to purchase 8,695,652 shares of SWS common stock, $0.10 par value per share, exercisable at a price of $5.75 per share subject to anti-dillution adjustments. If the warrant was fully exercised, we would own 17.4% of SWS. Additionally, we have purchased 1,475,387 shares of SWS common stock on the open market.

We also provide fire and homeowners insurance to low value dwellings and manufactured homes primarily in Texas and other areas of the south, southeastern and southwestern United States through our wholly-ownedwholly owned property and casualty insurance holding company, NLASCO, Inc., or NLASCO. We acquired NLASCO in January 2007. NLASCO operates through its wholly-ownedwholly owned subsidiaries, National Lloyds Insurance Company (NLIC),(“NLIC”) and American Summit Insurance Company (ASIC)(“ASIC”).

NLASCO targets underserved markets that require underwritingFollowing the Merger on November 30, 2012, our primary line of business is our wholly owned bank subsidiary, PlainsCapital Bank (the “Bank”). The Bank provides business and consumer banking services from offices located throughout central, north and west Texas. The Bank’s subsidiaries have specialized areas of expertise that many larger carriers have been unwilling to develop given the relatively small volume of premiums produced by local agents. Within these markets, NLASCO attempts to capitalize on its superior local knowledge to identify profitable underwriting opportunities. NLASCO believes that it distinguishes itself from competitors by delivering products that are not provided by many larger carriers, providing a high level of customer service and responding quickly to the needs of its agents and policyholders. NLASCO applies a high level of selectivity in the risks it underwrites and uses a risk-adjusted return approach to capital allocation, which NLASCO believes allows it to generate underwriting profits.

NLIC and ASIC carry a financial strength rating of “A” (Excellent) by A.M. Best. An “A” rating is the third highest of 16 rating categories used by A.M. Best. Many insurance buyers, agents and brokers use the ratings assigned by A.M. Best and other rating agencies to assist them in assessing the financial strength and overall quality of the companies from which they purchase insurance. This rating is intendedallow us to provide an independent opinionarray of an insurer’s ability to meet its obligations to policyholdersfinancial products and is not an evaluation directed at investors. This rating assignment is subject to the ability to meet A.M. Best’s expectationsservices such as to performancemortgage origination and capitalization on an ongoing basis, including with respect to management of liabilities for losses and loss adjustment expenses, and is subject to revocation or revision at any time at the sole discretion of A.M. Best.financial advisory services.

Our common stock is listed on the New York Stock Exchange, or NYSE, under the symbol “HTH.”

Our principal office is located at 200 Crescent Court, Suite 1330, Dallas, Texas 75201, and our telephone number at that location is (214) 855-2177. Our internet address is www.hilltop-holdings.com.

We currently are subject to the reporting requirements of the Exchange Act and, therefore, file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission, or the SEC. These filings, and amendments to these filings, may be accessed, free of charge, on the investor relations page of our website as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. Additionally, any materials that we file with, or furnish to, the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information regarding the operations of the SEC Public Reference Room. The SEC also maintains a website, www.sec.gov, which contains reports, proxy and information statements and other information regarding issuers, such as ourselves, that file electronically with the SEC. Our codes of conduct and ethics, including amendments to, and waivers of, those codes, our corporate governance guidelines, director independence criteria and board committee charters can be accessed, free of charge, on our website, as well. We will provide, at no cost, a copy of these documents upon request by telephone or in writing at the above phone number or address, attention: Investor Relations. The references to our website address do not constitute incorporation by reference of the information contained on our website into, and should not be considered a part of, this Annual Report on Form 10-K.

2

Table of Contents

In 2011, our Chief Executive Officer certified to the NYSE, pursuant to Section 303A.12 of the NYSE’s listing standards, and that he is unaware of any violation by us of the NYSE’s corporate governance listing standards.

Company Background

We were formed in 1998 under the name “Affordable Residential Communities Inc.” as a Maryland corporation that elected to be taxed as a real estate investment trust, or REIT. Until July 2007, we primarily engaged in the acquisition, renovation, repositioning and operation of all-age manufactured home communities, the retail sale and financing of manufactured homes, the rental of manufactured homes and other related businesses, including acting as agent in the sale of homeowners’ insurance and related products, to residents and prospective residents of those communities. Our primary operations previously were conducted through an operating partnership, in which we owned a general partnership interest.

On February 18, 2004, we completed our initial public offering, or IPO.offering. Through the year ended December 31, 2005, we operated as a fully integrated, self-administered and self-managed equity REIT for U.S. federal income tax purposes. In 2006, we revoked our election as a REIT for U.S. federal income tax purposes.

In January 2007, we acquired NLASCO. NLASCO was incorporated in Delaware in 2000, but its origins trace back to 1948 through one of its subsidiaries, NLIC.

On July 31, 2007, we sold substantially all of the operating assets used in our manufactured home communities business and our retail sales and financing business to American Residential Communities LLC. We intend to make opportunistic acquisitions with certain of the remaining proceeds from this transaction and, if necessary or appropriate, from additional equity or debt financing sources. In conjunction with this transaction, we transferred to the buyer the rights to the “Affordable Residential Communities” name, changed our name to Hilltop Holdings Inc., and moved our headquarters to Dallas, Texas.

On November 30, 2012, we acquired PlainsCapital Corporation through a plan of merger, whereby PlainsCapital Corporation became our wholly owned subsidiary.

We intend to make acquisitions with certain of the remaining proceeds from the American Residential Communities transaction and, if necessary or appropriate, from additional equity or debt financing sources.

4

Table of Contents

Following the completion of the sale of our manufactured home communities businesses, our current operations havethrough November 30, 2012 consisted solely of those of NLASCO and its subsidiaries. Therefore,Given the significant recent acquisition of PlainsCapital, the remainder of our discussion focuses onincludes details concerning the banking, mortgage origination and financial advisory operations of PlainsCapital and its subsidiaries, as well as the property and casualty insurance operations of NLASCO and its subsidiaries.

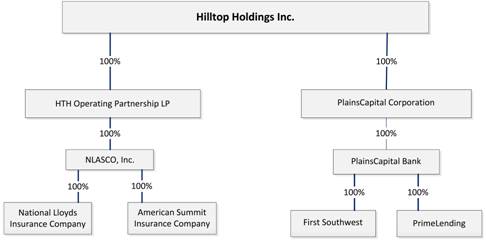

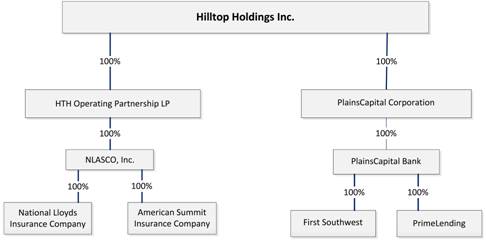

Insurance OperationsOrganizational Structure

Our organizational structure is comprised of two primary operating business units, NLASCO, Inc. (insurance) and PlainsCapital Corporation (financial services and products). Within the PlainsCapital unit are three primary wholly owned subsidiaries: PlainsCapital Bank, PrimeLending and First Southwest. Under U.S. GAAP, our business units are comprised of four reportable business segments: banking, mortgage origination, insurance and financial advisory. Prior to the Merger with PlainsCapital, Hilltop operated as a single segment through its insurance subsidiary, NLASCO, given the integrated monitoring, control and management of its fire and homeowners insurance business lines. The following provides additional details regarding our updated organizational structure at December 31, 2012.

Geographic Dispersion of our Businesses

At December 31, 2012, we had $4.7 billion in deposits. The following table summarizes the geographic dispersion of our deposit portfolio at December 31, 2012 (dollars in thousands).

| | West Texas (1) | | DFW (2) | | Central/South (3) | | Other (4) | | Total | |

Demand deposits | | $ | 160,158 | | $ | 103,241 | | $ | 53,999 | | $ | 81,277 | | $ | 398,675 | |

NOW accounts | | 57,127 | | 41,162 | | 7,948 | | 325 | | 106,562 | |

Money market deposit accounts | | 804,240 | | 1,181,915 | | 370,547 | | 407 | | 2,357,109 | |

Brokered money market deposit accounts | | — | | — | | — | | 263,193 | | 263,193 | |

Other savings deposits | | 46,455 | | 52,949 | | 80,635 | | 328 | | 180,367 | |

Time deposits | | 398,908 | | 689,480 | | 84,251 | | 2,793 | | 1,175,432 | |

Brokered time deposits | | — | | — | | — | | 219,123 | | 219,123 | |

Total deposits | | 1,466,888 | | 2,068,747 | | 597,380 | | 567,446 | | 4,700,461 | |

| | | | | | | | | | | |

Percentage of total deposits | | 31.2 | % | 44.0 | % | 12.7 | % | 12.1 | % | 100.0 | % |

| | | | | | | | | | | | | | | | |

(1)“West Texas” consists of deposits originated in Lubbock, Texas.

(2)“DFW” primarily consists of deposits originated in the Dallas/Fort Worth, Texas metroplex area.

(3)“Central/South” primarily consists of deposits originated in Austin, Texas and San Antonio, Texas.

(4)“Other” consists of deposits that are not managed on a regional basis.

5

Table of Contents

At December 31, 2012, we had $3.2 billion in loans held for investment. The following table summarizes the geographic dispersion of our loan portfolio at December 31, 2012 (dollars in thousands).

| | West Texas (1) | | DFW (2) | | Central/South (3) | | Other (4) | | Total | |

Commercial and industrial | | $ | 319,234 | | $ | 729,492 | | $ | 308,686 | | $ | 302,881 | | $ | 1,660,293 | |

Real estate | | 215,553 | | 609,596 | | 359,088 | | — | | 1,184,237 | |

Construction and land development | | 23,558 | | 156,379 | | 100,537 | | — | | 280,474 | |

Consumer | | 11,886 | | 10,906 | | 4,600 | | — | | 27,392 | |

Total loans | | 570,231 | | 1,506,373 | | 772,911 | | 302,881 | | 3,152,396 | |

| | | | | | | | | | | |

Percentage of total loans | | 18.1 | % | 47.8 | % | 24.5 | % | 9.6 | % | 100.0 | % |

| | | | | | | | | | | | | | | | |

(1)“West Texas” consists of loans originated from Lubbock, Texas.

(2)“DFW” primarily consists of loans originated in the Dallas/Fort Worth, Texas metroplex area.

(3)“Central/South” primarily consists of loans originated from Austin, Texas and San Antonio, Texas.

(4)“Other” consists of margin loans held by FSC and lease financing.

For the month of December 2012, approximately 60% of PrimeLending’s origination volume was concentrated in seven states (no other state had volume of 4% or more). The following table is a summary of the origination volume by state (in thousands).

| | | | % of | |

| | Volume | | Total | |

Texas | | $ | 275,739 | | 21.4 | % |

California | | 217,100 | | 16.9 | % |

North Carolina | | 78,881 | | 6.1 | % |

Virginia | | 56,387 | | 4.4 | % |

Maryland | | 55,870 | | 4.3 | % |

Tennessee | | 53,783 | | 4.2 | % |

Arizona | | 47,507 | | 3.7 | % |

All other states | | 501,688 | | 39.0 | % |

| | $ | 1,286,955 | | 100.0 | % |

We distribute our insurance products through a broad network of independent agents in 27 states and a select number of managing general agents, referred to as MGAs. The following table sets forth our total gross written premiums by state for the periods shown (in thousands).

| | Year Ended December 31, | |

| | | | % of | | | | % of | | | | % of | |

| | 2012 | | Total | | 2011 | | Total | | 2010 | | Total | |

Texas | | $ | 118,361 | | 69.5 | % | $ | 117,046 | | 73.0 | % | $ | 107,992 | | 74.8 | % |

Oklahoma | | 15,398 | | 9.0 | % | 10,804 | | 6.7 | % | 6,777 | | 4.7 | % |

Arizona | | 13,914 | | 8.2 | % | 12,376 | | 7.7 | % | 11,268 | | 7.8 | % |

Tennessee | | 10,527 | | 6.2 | % | 9,489 | | 5.9 | % | 8,562 | | 5.9 | % |

Georgia | | 5,454 | | 3.2 | % | 4,380 | | 2.7 | % | 3,297 | | 2.3 | % |

Louisiana | | 3,081 | | 1.8 | % | 2,973 | | 1.9 | % | 3,022 | | 2.1 | % |

Missouri | | 1,244 | | 0.7 | % | 1,170 | | 0.7 | % | 1,230 | | 0.9 | % |

Nevada | | 991 | | 0.6 | % | 1,015 | | 0.6 | % | 1,015 | | 0.7 | % |

All other states | | 1,231 | | 0.7 | % | 1,188 | | 0.7 | % | 1,205 | | 0.8 | % |

Total | | $ | 170,201 | | 100.0 | % | $ | 160,441 | | 100.0 | % | $ | 144,368 | | 100.0 | % |

FSC, a diversified investment banking firm and a registered broker-dealer, competes for business nation-wide. Over 70% of its public finance financial advisory revenues are from entities located in Texas.

6

Table of Contents

Business Segments

We operate in four business segments: banking, mortgage origination, insurance and financial advisory. For more financial information about each of these business segments, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” herein. See also Note 27 in the notes to our consolidated financial statements included under Item 8, “Financial Statements and Supplementary Data.”

Banking

The operations of the Bank comprise our banking segment. At December 31, 2012, our banking segment had $6.2 billion in assets and total deposits of $4.7 billion. The primary sources of our deposits are residents and businesses located in the Texas markets we serve.

Business Banking. Our business banking customers primarily consist of agribusiness, energy, health care, institutions of higher education, real estate (including construction and land development) and wholesale/retail trade companies. We provide these customers with extensive banking services, such as Internet banking, business check cards and other add-on services as determined on a customer-by-customer basis. Our treasury management services, which are designed to reduce the time, burden and expense of collecting, transferring, disbursing and reporting cash, are also available to our business customers. We offer these business customers lines of credit, equipment loans and leases, letters of credit, agricultural loans, commercial real estate loans and other loan products.

The table below sets forth a distribution of the banking segment’s business loans, by type, and all other loans at December 31, 2012 (dollars in thousands). The commercial and industrial loans category includes a $1.6 billion warehouse line of credit extended to PrimeLending, of which $1.3 billion was drawn at December 31, 2012. Amounts advanced against the warehouse line are included in the table below, but are eliminated from the consolidated balance sheet.

| | | | % of Total | |

| | Amount | | Loans | |

Loans: | | | | | |

Commercial and industrial | | $ | 2,649,158 | | 64.0 | % |

Real estate | | 1,184,885 | | 28.5 | % |

Construction and land development | | 280,474 | | 6.8 | % |

Total business loans | | 4,114,517 | | 99.3 | % |

| | | | | |

All other loans | | 27,392 | | 0.7 | % |

Total loans | | $ | 4,141,909 | | 100.0 | % |

Commercial and industrial loans are primarily made within our market areas in Texas and are underwritten on the basis of the borrower’s ability to service the debt from income. In general, commercial and industrial loans involve more credit risk than residential and commercial mortgage loans and, therefore, usually yield a higher return. The increased risk in commercial and industrial loans results primarily from the type of collateral securing these loans, which typically includes commercial real estate, accounts receivable, equipment and inventory. Additionally, increased risk arises from the expectation that commercial and industrial loans generally will be serviced principally from the operations of the business, and those operations may not be successful. Historical trends have shown these types of loans to have higher delinquencies than mortgage loans. As a result of the additional risk and complexity associated with commercial and industrial loans, such loans require more thorough underwriting and servicing than loans to individuals. To manage these risks, our policy is to attempt to secure commercial and industrial loans with both the assets of the borrowing business and other additional collateral and guarantees that may be available. In addition, depending on the size of the credit, we actively monitor certain fiscal measures of the borrower, including cash flow, collateral value and other appropriate credit factors. We also have processes in place to analyze and evaluate on a regular basis our exposure to industries, products, market changes and economic trends.

The Bank also offers term financing on commercial real estate properties that include retail, office, multi-family, industrial, warehouse and non-owner occupied single family residences. Commercial mortgage lending can involve high principal loan amounts, and the repayment of these loans is dependent, in large part, on a borrower’s on-going business operations or on income generated from the properties that are leased to third parties. As a general practice, the Bank requires its commercial mortgage loans to be secured with first lien positions on the underlying property, to generate adequate equity

7

Table of Contents

margins, to be serviced by businesses operated by an established management team, and to be guaranteed by the principals of the borrower. The Bank seeks lending opportunities where cash flow from the collateral provides adequate debt service coverage and/or the guarantor’s net worth is comprised of assets other than the project being financed.

The Bank offers construction financing for (i) commercial, retail, office, industrial, warehouse and multi-family developments, (ii) residential developments and (iii) single family residential properties. Loans to finance these transactions are generally secured by first liens on the underlying real property. We generally require that the subject property of a construction loan for commercial real estate be pre-leased. The Bank conducts periodic completion inspections, either directly or through an agent, prior to approval of periodic draws on these loans. Construction loans involve additional risks because loan funds are advanced upon the security of a project under construction, and the project is of uncertain value prior to its completion. Because of uncertainties inherent in estimating construction costs, the market value of the completed project and the effects of governmental regulation on real property, it can be difficult to accurately evaluate the total funds required to complete a project and the related loan-to-value ratio. As a result of these uncertainties, construction lending often involves the disbursement of substantial funds with repayment dependent, in part, on the success of the ultimate project rather than the ability of a borrower or guarantor to repay the loan. If the Bank is forced to foreclose on a project prior to completion, it may not be able to recover the entire unpaid portion of the loan. Additionally, it may be required to fund additional amounts to complete a project and may have to hold the property for an indeterminate period of time.

In addition to the real estate lending activities described above, a portion of the Bank’s real estate portfolio consists of single family residential mortgage loans typically collateralized by owner occupied properties located in its market areas. These residential mortgage loans are generally secured by a first lien on the underlying property and have maturities of five years or less. Longer term mortgage financing is provided for certain customers within the Bank’s private banking group. At December 31, 2012, the Bank had $199.1 million in one-to-four family residential loans, which represented 4.80% of its total loans held for investment.

Personal Banking. We offer a broad range of personal banking products and services for individuals. Similar to our business banking operations, we also provide our personal banking customers with a variety of add-on features such as check cards, safe deposit boxes, Internet banking, bill pay, overdraft privilege services, gift cards and access to automated teller machine (ATM) facilities throughout the United States. We offer a variety of deposit accounts to our personal banking customers including savings, checking, interest-bearing checking, money market and certificates of deposit.

We loan to individuals for personal, family and household purposes, including lines of credit, home improvement loans, home equity loans, credit cards and loans for purchasing and carrying securities. At December 31, 2012, we had $27.4 million of loans for these purposes, which are shown in the previous table as “All other loans.”

Wealth and Investment Management. Our private banking team personally assists high net worth individuals and their families with their banking needs, including depository, credit, asset management, and trust and estate services. We offer trust and asset management services in order to assist these customers in managing, and ultimately transferring, their wealth. Our wealth management services provide personal trust, investment management and employee benefit plan administration services, including estate planning, management and administration, investment portfolio management, employee benefit accounts and individual retirement accounts.

Mortgage Origination

Our mortgage origination segment operates through a wholly owned subsidiary of the Bank, PrimeLending. Founded in 1986, PrimeLending is a residential mortgage banker licensed to originate and close loans in all 50 states and the District of Columbia. At December 31, 2012, it operated from 280 locations in 42 states, originating approximately 21% of its mortgages from its Texas locations and approximately 17% of its mortgages from locations in California. The mortgage lending business is subject to seasonality, as we typically experience increased loan origination volume from purchases of homes during the spring and summer, when more people tend to move and buy or sell homes, and the overall demand for mortgage loans is driven largely by the applicable interest rates at any given time.

PrimeLending handles loan processing, underwriting and closings in-house. Mortgage loans originated by PrimeLending are funded through a warehouse line of credit maintained with the Bank. PrimeLending sells substantially all mortgage loans it originates to various investors in the secondary market, servicing released, although PrimeLending may retain servicing under certain conditions. As these mortgage loans are sold in the secondary market, PrimeLending pays down its warehouse line of credit with the Bank. Loans sold are subject to certain standard indemnification provisions with investors, including the repurchase of loans sold and the repayment of sales proceeds to investors under certain conditions.

8

Table of Contents

Our mortgage lending underwriting strategy, driven in large measure by secondary market investor standards, seeks to originate substantially only conforming loans. Our underwriting practices include:

·granting loans on a sound and collectible basis;

·obtaining a balance between maximum yield and minimum risk;

·ensuring that primary and secondary sources of repayment are adequate in relation to the amount of the loan; and

·ensuring that each loan is properly documented and, if appropriate, adequately insured.

In addition to its branch office network, PrimeLending, through PrimeLending Ventures, LLC, establishes “affiliated business arrangements” to originate residential mortgages for customers of referring business partners and for other customers not associated with business partners. At December 31, 2012, PrimeLending Ventures, LLC had two active affiliated business arrangements.

Since its inception in 1986, PrimeLending has grown from originating approximately $80 million in mortgage loans annually with a staff of 20 individuals to originating $13.7 billion in loans in 2012 with approximately 2,650 employees. PrimeLending offers a variety of loan products catering to the specific needs of borrowers seeking purchase or refinancing options, including 30-year and 15-year fixed rate conventional mortgages, adjustable rate mortgages, jumbo loans, and Federal Housing Administration (FHA) and Veteran Affairs (VA) loans. Mortgage loans originated by PrimeLending are secured by a first lien on the underlying property. PrimeLending does not currently originate subprime loans (which we define to be loans to borrowers having a Fair Isaac Corporation (FICO) score lower than 620 or that do not comply with applicable agency or investor-specific underwriting guidelines).

Insurance

The operations of NLASCO comprise our insurance segment. NLASCO specializes in providing fire and limited homeowners insurance for low value dwellings and manufactured homes primarily in Texas and other areas of the south, southeastern and southwestern United States. NLASCO has expanded itsNLASCO’s product line to includealso includes enhanced homeowners products offering higher coverage limits.limits with distribution restricted to select agents. NLASCO targets underserved markets thatthrough a broad network of independent agents in 27 states and a select number of MGAs, which require underwriting expertise that many larger carriers have been unwilling to develop given the relatively small volume of premiums produced by local agents. Within these markets, NLASCO attempts to capitalize on its superior local knowledge to identify profitable underwriting opportunities. NLASCO believes that it distinguishes itself from competitors by delivering products that are not provided by many larger carriers, providing a high level of customer service and responding quickly to the needs of its agents and policyholders. NLASCO applies a high level of selectivity in the risks it underwrites, which we believe will generate underwriting profits.

Ratings. Many insurance buyers, agents and brokers use the ratings assigned by A.M. Best and other rating agencies to assist them in assessing the financial strength and overall quality of the companies from which they purchase insurance. BothThe ratings for NLIC and ASIC carry a financial strength rating of “A” (Excellent) were affirmed by A.M. Best in April 2012. An “A” rating is the third highest of 16 rating categories used by A.M. Best.

The Insurance Industry

The property In evaluating a company’s financial and casualty insurance industry provides protection from pre-specifiedoperating performance, A.M. Best reviews a company’s profitability, leverage and liquidity, as well as its book of business, the adequacy and soundness of its reinsurance, the quality and estimated market value of its assets, the adequacy of its liabilities for losses and loss events, suchadjustment expenses (“LAE”), the adequacy of its surplus, its capital structure, the experience and competence of its management and its market presence. This rating assignment is subject to the ability to meet A.M. Best’s expectations as damage to propertyperformance and capitalization on an ongoing basis, and is subject to revocation or liability claims by third parties. Propertyrevision at any time at the sole discretion of A.M. Best. NLASCO cannot ensure that NLIC and casualty insurance can be broadly classified into two lines; personal lines, in which insurance is provided to individuals, and commercial lines, in which insurance is provided to business enterprises. In the U.S., personal and commercial insurance products are written in admitted and non-admitted markets, also known as the excess and surplus lines market. NLASCO provides insurance products in the personal line and the commercial line markets.

3

Table of ContentsASIC will maintain their present ratings.

In the admitted market, insurers are authorized by state insurance departments to doProduct Lines. NLASCO’s business insurance ratesis conducted in two product lines: personal lines and forms are generally highly regulated and coverage tends to be standardized. Within the admitted market, NLASCO focuses on underserved segments that do not fit into the standard underwriting criteria of national insurance companies due to several factors, such as type of business, location and the amount of premium per policy. This portion of the market tends to have limited competition. Therefore, NLASCO believes it has greater flexibility in pricing and product design relative to most admitted market risks.

commercial lines. The non-admitted market focuses on harder-to-place risks that admitted insurers typically do not write. In this market, risks are underwritten with more flexible policy forms and rates, resulting in more restrictive and expensive coverage. NLASCO writes in this market for itspersonal lines include homeowners, dwelling fire, homeowner,manufactured home, flood and mobile home business in Louisiana.

vacant policies. The propertycommercial lines include commercial, builders risk, builders risk renovation, sports liability and casualty insurance industry, historically, has been subject to cyclical fluctuations in pricing and availability of insurance coverage. “Soft” markets are often characterized by excess underwriting capital and involve intense price competition, erosion of underwriting discipline and poor operating performance. These market conditions usually lead to a period of diminished underwriting capacity after insurance companies exit unprofitable lines and exhibit greater underwriting discipline and increase premium rates. This latter market condition is called a “hard” market. The insurance market may not always be hard or soft; rather, it could be hard for one line of business and soft for another. The market at the start of 2012 is likely to be characterized as soft for property risks in NLASCO’s operating area; however, in coastal areas, due to the hurricane activity in recent years, those markets are considered hard.

Product Linesinland marine policies.

Personal and Commercial Lines

The NLASCO companies specialize in writing fire and homeowners insurance coverage for low value dwellings and manufactured homes. The vast majority of NLASCO’s property coverage is written on policies that provide actual cash value payments, as opposed to replacement cost. Under actual cash value policies, the insured is entitled to receive only the cost of replacing or repairing damaged or destroyed property with comparable new property, less depreciation. Additionally, most of NLASCO’s property policies exclude coverage for water and mold damage.

In 2010, NLASCO expanded its homeowners insurance products to include replacement cost coverage, which also includes limited water coverage. These new products are being marketed and sold primarily in various states; however, the primary market is Texas. The development and implementation of these new products has contributed to the premium growth at NLASCO in 2011.2011 and 2012.

NLASCO’s business is conducted with two product lines, its personal lines and its commercial lines. The personal lines include homeowners, dwelling fire, manufactured home, flood and vacant policies. The commercial lines include commercial, builders risk, builders risk renovation, sports liability and inland marine policies.

4

Table of Contents

Set forth below is certain financial data broken down by line of business (in millions):

| | For The Year Ended December 31, | |

| | 2011 | | 2010 | | 2009 | |

Gross Premiums Written | | | | | | | |

Personal lines | | $ | 151.7 | | $ | 136.5 | | $ | 129.5 | |

Commerical lines | | 8.7 | | 7.9 | | 6.7 | |

Total | | $ | 160.4 | | $ | 144.4 | | $ | 136.2 | |

| | | | | | | |

Net Operating income | | | | | | | |

Personal lines | | $ | 0.1 | | $ | 4.9 | | $ | 5.9 | |

Commerical lines | | — | | 2.3 | | 0.8 | |

Total | | $ | 0.1 | | $ | 7.2 | | $ | 6.7 | |

| | | | | | | |

Total Assets | | | | | | | |

Personal lines | | $ | 290.2 | | $ | 297.5 | | $ | 256.3 | |

Commerical lines | | 26.7 | | 27.4 | | 23.6 | |

Total | | $ | 316.9 | | $ | 324.9 | | $ | 279.9 | |

Geographic Markets

The following table sets forth NLASCO’s total gross written premiums by state for the periods shown (in millions):

| | For The Year Ended December 31, | |

| | 2011 | | 2010 | | 2009 | |

Gross Written Premiums | | | | | | | |

Texas - Flood | | $ | 6.1 | | $ | 5.9 | | $ | 5.9 | |

Texas - North | | 24.9 | | 26.2 | | 20.7 | |

Texas - South | | 30.6 | | 29.6 | | 34.4 | |

Texas - Central | | 16.0 | | 9.6 | | 9.4 | |

Texas - West | | 14.0 | | 15.5 | | 13.0 | |

Texas - Panhandle | | 7.3 | | 7.1 | | 6.8 | |

Texas - East | | 18.0 | | 14.1 | | 13.4 | |

| | | | | | | |

Texas - Total | | 116.9 | | 108.0 | | 103.7 | |

| | | | | | | |

Arizona | | 12.4 | | 11.3 | | 11.3 | |

Tennessee | | 9.5 | | 8.6 | | 7.8 | |

Oklahoma | | 10.8 | | 6.8 | | 5.1 | |

Georgia | | 4.4 | | 3.3 | | 1.6 | |

Louisiana | | 3.0 | | 3.0 | | 3.0 | |

Missouri | | 1.2 | | 1.2 | | 1.4 | |

Nevada | | 1.0 | | 1.0 | | 1.1 | |

All other states | | 1.2 | | 1.2 | | 1.2 | |

TOTAL | | $ | 160.4 | | $ | 144.4 | | $ | 136.2 | |

NLASCO underwrites insurance coverage primarily in Texas. It also underwrites in other states in the south and southwest regions.

5

Table of Contents

Distribution

NLASCO distributes its insurance products through a broad network of independent agents in 23 states and a select number of managing general agents, referred to as MGAs. NLASCO has a preference for doing business with agents that desire a long-term relationship that will result in mutual profitability and value for both parties. NLASCO believes that “relationship” agents are more oriented to the long-term and desire a meaningful relationship with their customers and the insurers they represent. NLASCO’s top ten agents accounted for only 10.8%, 9.9% and 9.9% of direct premiums written in 2011, 2010 and 2009, respectively, and as of December 31, 2011, the average tenure of the top 25 agencies was over 13 years.

Underwriting and Pricing

. NLASCO applies its regional expertise, underwriting discipline and a risk-adjusted, return-on-equity basedreturn-on-equity-based approach to capital allocation to primarily offer short-tail insurance products in its target markets. NLASCO’s

9

Table of Contents

underwriting process involves securing an adequate level of underwriting information from its independent agents, identifying and evaluating risk exposures and then pricing the risks it chooses to accept.

NLASCO employs a disciplined underwriting approach that incorporates the continuously refined stratification of its target markets to permit it to tailor its policies to individual risks and adopt pricing structures that will be supported in the applicable market. NLASCO utilizes underwriting principles and processes that reflect the knowledge and experience it has acquired during its 40-plus year history of underwriting risks. NLASCO believes that this comprehensive process capitalizes on its knowledge and expertise and results in better underwriting decisions.

Pricing levels are established by NLASCO’s senior management with the assistance of a consulting actuary. Pricing balances NLASCO’s return requirements along with the legal/regulatory environment in each particular geographic region. Management reviews pricing on an ongoing basis to monitor any emerging issues. NLASCO’s statistical database allows this analysis to be performedissues on a specific coverage or geographic territory. In 2011, ASIC increased premium rates in Arizona and NLIC increased rates in Georgia, Oklahoma, Texas and Tennessee.

Catastrophe ExposureExposure.

NLASCO maintains a comprehensive risk management strategy, which includes actively monitoring its catastrophe prone territories by zip code to ensure a diversified book of risks. NLASCO utilizes software and risk support from its reinsurance brokers to analyze its portfolio and catastrophe exposure. Biannually, NLASCO has its entire portfolio analyzed by its reinsurance broker who utilizes hurricane models to predict risk. Based on this information and management’s active role in risk management, NLASCO makes decisions on what geographic areas to write risks. Over the years, NLASCO has adjusted its business based on its perceived risk of catastrophe losses. For example, in 2005, ASIC withdrew from the Mississippi market to mitigate its catastrophe exposure in that area, and in 2006, it stopped writing new policies that cover wind damage along the seacoast of Louisiana. In 2009, NLASCO decided not to renew wind policies for properties within the Texas seacoast. All policies in coastal areas excluded wind by the end of February 2011.

In recent years, NLASCO’s catastrophe exposure primarily resulted from property policies in Cameron, Harris, Jefferson and Nueces Counties in Texas, which include the densely populated Houston metropolitan area and the cities extending from the northern tip to the southern point on the Texas Gulf Coast. All of this territory is exposed to potential wind storm activity from the Gulf of Mexico. By not renewing wind policies on the Texas seacoast, which is exposed to the majority of potential wind storm activity, NLASCO’s primary catastrophe exposure will be limited to property policies in Harris County. NLASCO also is exposed to hail and other catastrophic events in the Texas panhandle and plains states.

6

Table of Contents

Terrorism Risk Insurance Act of 2002, Terrorism Risk Insurance Extension Act of 2005 and Terrorism Risk Insurance Program Reauthorization Act of 2007Reinsurance.

On November 26, 2002, the Terrorism Risk Insurance Act of 2002 was enacted into Federal law and established the Terrorism Risk Insurance Program, or the Program. The Program is a Federal program that provides for a system of shared public and private compensation for insured losses resulting from acts of terrorism or war. The Program was scheduled to terminate on December 31, 2005. On December 22, 2005, the Terrorism Risk Insurance Extension Act of 2005 was enacted into Federal law, reauthorizing the Program through December 31, 2007, while reducing the Federal role under the Program. On December 26, 2007, the Terrorism Risk Insurance Program Reauthorization Act, or the Reauthorization Act, was enacted into Federal law, reauthorizing the Program through December 31, 2014 and implementing several changes to the Program.

In order for a loss to be covered under the Program, as presently constituted, aggregate industry losses of $100 million must be satisfied. Further, the losses must be the result of an event that is certified as an act of terrorism by the U.S. Secretary of the Treasury, Secretary of State and Attorney General. The original Program excluded from participation certain of the following types of insurance: Federal crop insurance, private mortgage insurance, financial guaranty insurance, medical malpractice insurance, health or life insurance, flood insurance and reinsurance. The 2005 Act exempted from coverage certain additional types of insurance, including commercial automobile, professional liability (other than directors and officers), surety, burglary and theft and farm-owners multi-peril. In the case of a war declared by Congress, only workers’ compensation losses are covered by the Program. The Program generally requires that all commercial property and casualty insurers licensed in the United States participate in the Program. Under the Program, a participating insurer is entitled to be reimbursed by the Federal government for a percentage of subject losses, after an insurer deductible, subject to an annual cap. The Federal reimbursement percentage was fixed by the Reauthorization Act at 85%. The deductible is calculated by applying the deductible percentage to the insurer’s direct earned premiums for covered lines. The deductible under the Program is fixed at 20%. NLASCO’s deductible under the Program was $1.6 million for 2011 and is estimated to be $1.6 million in 2012. The annual cap limits the amount of aggregate subject losses for all participating insurers to $100 billion. Once subject losses have reached $100 billion aggregate amount during a Program year, there is no additional reimbursement from the U.S. Treasury and an insurer that has met its deductible for the program year is not liable for any losses that exceed the $100 billion cap. When insured losses under the Program exceed the $100 billion cap, the insured losses are subject to pro-rata sharing based upon regulations promulgated by the U.S. Treasury. Additionally, under the Reauthorization Act, the timing of mandatory recoupment of the Federal reimbursement through policyholder surcharges was accelerated.

On December 14, 2009, two final rules with respect to the Program were published in the Federal Register. The first rule describes how the Treasury will calculate the amounts to be recouped from insurers and establishes procedures for insurers to use in collecting Federal Terrorism Policy Surcharges and remitting them to the Treasury. The second rule describes how the Treasury intends to determine the pro rata share of insurance losses under the Program when losses otherwise would exceed the annual monetary cap. NLASCO had no terrorism-related losses in 2011.

Reinsurance

NLASCO purchases reinsurance to reduce its exposure to liability on individual risks and claims and to protect against catastrophe losses. NLASCO’s management believes that less volatile, yet reasonable returns are in the long-term interest of NLASCO and, as a result, maintains a conservative reinsurance program. NLASCO generated direct premiums written totaling $154.3 million, net of flood policies, in 2011 and paid approximately $11.8 million in catastrophe reinsurance premiums prior to any reinstatement premiums.NLASCO.

Reinsurance involves an insurance company transferring, or ceding, a portion of its risk to another insurer, the reinsurer. The reinsurer assumes the exposure in return for a portion of the premium. The ceding of risk to a reinsurer does not legally discharge the primary insurer from its liability for the full amount of the policies on which it obtains reinsurance. Accordingly, the primary insurer remains liable for the entire loss if the reinsurer fails to meet its obligations under the reinsurance agreement, and as a result, the primary insurer is exposed to the risk of non-payment by its reinsurers.

We believe that NLASCO’s financial stability is substantially protected from catastrophic events through several excess of loss reinsurance contracts that combine to provide a mix of coverage against various types and combinations of catastrophe losses. As noted in the section titled “Risk Factors,” NLASCO is exposed to catastrophic losses that could exceed the limits of reinsurance and negatively impact its financial position and results of operations. The Company purchases catastrophe excess of loss reinsurance to a limit that exceeds the Hurricane 200-year return time as modeled by RMS Risk Link v. 11.0 and exceeds the Hurricane 500-year return time as modeled by AIR Classic v 13.0.

7

Table of Contents

In formulating its reinsurance programs, NLASCO believes that it is selective in its choice of reinsurers and considers numerous factors, the most important of which are the financial stability of the reinsurer, its history of responding to claims and its overall reputation. In an effort to minimize exposure to the insolvency of reinsurers, NLASCO evaluates the acceptability, and continuously monitors the financial condition, of each reinsurer. NLASCO enters into reinsurance agreements only with reinsurers that have an A.M. Best financial strength rating of “A- (Excellent)” (fourth highest of 16 categories) or better, or at least an “A” rating by Standard & Poors. If a reinsurer rating subsequently drops below “A- (Excellent),” NLASCO can cancel or replace the reinsurer. As of December 31, 2011, 100% of NLASCO’s paid loss recoverables were from reinsurers rated “A- (Excellent)” or better by A.M. Best. To further minimize exposure to reinsurer insolvency, NLASCO spreads reinsurance treaties among many reinsurers. NLASCO reviews retention levels each year to maintain a balance between the growth in surplus and the cost of reinsurance. NLASCO had no losses from unrecoverable reinsurance in 2011.

NLASCO’s ten largest net receivable balances from reinsurers as of, and for the year ended, December 31, 2011 were as follows (in millions):

| | Year Ended December 31, 2011 | |

| | A.M. Best | | | | Balances | | | | | |

| | Financial | | | | Due from | | Prepaid | | Net | |

| | Strength | | Ceded | | Reinsurance | | Reinsurance | | Receivable | |

| | Rating | | Premiums | | Companies | | Premiums | | Balance(1) | |

Federal Emergency Management Agency | | N/A | | $ | 6.1 | | $ | 1.1 | | $ | 5.1 | | $ | 6.2 | |

Endurance Specialty Insurance Ltd | | A | | — | | 3.3 | | — | | 3.3 | |

Ariel Reinsurance Company Limited | | A- | | 0.6 | | 1.1 | | — | | 1.1 | |

Platinum Underwriters Reinsurance, Inc. | | A | | 0.4 | | 2.4 | | — | | 2.4 | |

Munich Reinsurance America, Inc. | | A+ | | 1.1 | | 1.6 | | — | | 1.6 | |

MS Frontier Reinsurance Limited | | A | | 0.1 | | 1.6 | | — | | 1.6 | |

Arch Reinsurance Company | | A | | 1.4 | | 1.3 | | — | | 1.3 | |

Validus Reinsurance Ltd | | A | | — | | 1.2 | | — | | 1.2 | |

Paladin Catastrophe Management LLC | | A+ | | — | | 1.1 | | — | | 1.1 | |

Amlin AG | | A | | 0.7 | | 1.1 | | — | | 1.1 | |

| | | | | | | | | | | | | | | |

(1) The net receivable balance includes balances due from reinsurance companies, contingent commissions, prepaid reinsurance premiums and ceded contingent commissions, less balances due to reinsurance companies.

As of December 31, 2011, NLASCO had five layers of catastrophicpurchases catastrophe excess of loss reinsurance coverage up to $170 million of losses per event in excess of $1 million retentiona limit that exceeds the Hurricane 250-year return time as modeled by ASICRMS Risk Link v.11.0 and $8 million retentionexceeds the Hurricane 500-year return time as modeled by NLIC. The reinsurance from $8 million to $50 million loss is comprised of two layers of protection: $17 million in excess of $8 million loss; $25 million in excess of $25 million loss. The third layer provides coverage for $50 million in excess of $50 million loss; the fourth layer provides coverage of $50 million in excess of $100 million loss and the fifth layer provides coverage of $20 million in excess of $150 million loss. The fifth layer is not fully subscribed, with participants accounting for 79% of the total layer. Accordingly, NLASCO retains 21% of the losses in the fifth layer. NLIC and ASIC retain no participation in any of the other layers, beyond the first $8 million and $1.0 million, respectively.AIR Classic v.14.0.

As of January 1, 2012, the Company renewed its reinsurance contract for its first and second layers of reinsurance. Per the contract renewal, NLASCO changed its underlying coverage at ASIC to $6.5 million in excess of $1.5 million retention. The reinsurance in excess of $8 million is comprised of five layers of protection: $17 million in excess of $8 million retention; $25 million in excess of $25 million loss; $50 million in excess of $50 million loss; $50 million in excess of $100 million loss and $20 million in excess of $150 million loss. The fifth layer is not fully subscribed, with participants accounting for 79% of the total layer. NLIC and ASIC retain no participation in any of the layers, other than the first $8 million and $1.5 million retention, respectively. The projected premiums on these treaties for NLIC and ASIC are $10.1and $2.8 million, respectively, in 2012.

As of December 31, 2011, total retention for any one catastrophe that affects both NLIC and ASIC is limited to $8 million in the aggregate.

8

Table of Contents

In addition to the catastrophe reinsurance noted above, both NLIC and ASIC participate in an excess of loss program with General Reinsurance Corporation. The General Reinsurance Corporation program is limited to each risk with respect to property and liability in the amount of $800,000 for each of NLIC and ASIC. Each of NLIC and ASIC retain $200,000 in this program. On January 1, 2012, the program will limit each risk for property and liability in the amount of $775,000 for each NLIC and ASIC, with the retention increasing to $225,000.

Liabilities for Unpaid Losses and Loss Adjustment ExpensesExpenses.

NLASCO’s liabilities for losses and loss adjustment expenses include liabilities for reported losses, liabilities for incurred but not reported, or IBNR, losses and liabilities for loss adjustment expenses, or LAE, less a reduction for reinsurance recoverables related to those liabilities. The amount of liabilities for reported claims is based primarily on a claim-by-claim evaluation of coverage, liability, injury severity or scope of property damage, and any other information considered relevant to estimating exposure presented by the claim. The amounts of liabilities for IBNR losses and LAE are estimated on the basis of historical trends, adjusted for changes in loss costs, underwriting standards, policy provisions, product mix and other factors. Estimating the liability for unpaid losses and LAE is inherently judgmental and is influenced by factors that are subject to significant variation. Liabilities for LAE are intended to cover the ultimate cost of settling claims, including investigation and defense of lawsuits resulting from such claims. Based upon the contractual terms of the reinsurance agreements, reinsurance recoverables offset, in part, NLASCO’s gross liabilities.

Significant periods of time can elapse between the occurrence of an insured loss, the reporting of the loss to the insurer and the insurer’s payment of that loss. NLASCO’s liabilities for unpaid losses represent the best estimate at a given point in time of what it expects to pay claimants, based on facts, circumstances and historical trends then known. During the loss settlement period, additional facts regarding individual claims may become known and, consequently, it often becomes necessary to refine and adjust the estimates of liability.

The table below presents one-year development information on changes in the liability for losses and LAE and a reconciliation of liabilities on a direct premiums written and net premiums written basis for the twelve months ended December 31, 2011 and 2010 (in thousands):

| | 2011 | | 2010 | |

| | | | | |

Balance at January 1, | | $ | 58,882 | | $ | 33,780 | |

Less reinsurance recoverables | | (43,773 | ) | (21,102 | ) |

Net balance at January 1, | | 15,109 | | 12,678 | |

| | | | | |

Incurred related to: | | | | | |

Current Year | | 97,742 | | 69,044 | |

Prior Period | | (1,008 | ) | 1,899 | |

Total incurred | | 96,734 | | 70,943 | |

| | | | | |

Payments related to: | | | | | |

Current Year | | (83,266 | ) | (59,560 | ) |

Prior Year | | (8,825 | ) | (8,952 | ) |

Total payments | | (92,091 | ) | (68,512 | ) |

| | | | | |

Net balance at December 31, | | 19,752 | | 15,109 | |

Plus reinsurance recoverables | | 25,083 | | 43,773 | |

Balance at December 31, | | $ | 44,835 | | $ | 58,882 | |

The decrease in reserves for the twelve months ended December 31, 2011, as compared to the same period in 2010, of $14.0 million is due to a decrease in reinsurance recoverables of $18.7 million. Reinsurance recoverables decreased due to settling reserves and paying claims related to Hurricane Ike, Hurricane Dolly and the 2010 Arizona Storm. Incurred related to current year increased $28.7 million for the twelve months ended December 31, 2011, as compared to the same period in 2010, due to increases in frequency and severity of fire losses and wind and hail losses, as well as the effects of five storms that occurred in Texas in April and May 2011. Incurred amounts related to prior years indicate that we had favorable IBNR development as of December 31, 2010, resulting in a benefit in the twelve months ended December 31, 2011. This redundancy is due to favorable development on our homeowners and fire products for the 2008 and 2009 accident years, offset by unfavorable development for the 2010 accident year.

9

Table of Contents

For the twelve months ended December 31, 2011 and 2010, the reserve for losses and loss adjustment expenses includes amounts related to losses incurred prior to the purchase of NLASCO. All losses and payments related to events that occurred prior to the purchase of NLASCO were the responsibility of the sellers. In March 2011, we made a final settlement with the sellers and going forward all losses are the responsibility of the Company.

Loss Development

NLASCO estimates the aggregate amount of losses and LAE ultimately required to settle all claims for a given period. The following tables presentset forth the development of estimated liability for losses and LAE, net of reinsurance, for the years 2001 through 2010annual calendar year-end reserves of NLIC and ASIC.ASIC since 2003 and the subsequent development of these reserves through December 31, 2012. These tables present accident or policy year development data. The first line of the table shows, for the years indicated, net liability, including IBNR, as originally estimated. For example, as of December 31, 2002, NLIC estimated that $18.1 million would be a sufficient net liability to settle all unsettled claims retained by it that had occurred prior to December 31, 2002, whether reported or unreported. The next section of the table sets forth the re-estimates in later years of incurred losses, including payments, for the years indicated. For example, as indicated in that section of the table, the original net liability of $18.1 million was re-estimated to be $17.3 million at December 31, 2006 (four years later). The decreasechanges in the original estimate isare caused by a combination of factors, including: (1) claims being settled for amounts different than originally estimated; (2) the net liability being increased or decreased for claims remaining open as more information becomes known about those individual claims; and (3) more or fewer claims being reported after December 31, 20022003 than had occurred prior to that date. The bottom section of the table shows, by year, the cumulative amounts of net losses and LAE paid as of the end of each succeeding year. For example, with respect to the liability for net losses and LAE

10

Table of $18.1 million as of December 31, 2002, by the end of 2006 (four years later), $17.2 million had actually been paid in settlement of the claims.Contents

The “net cumulative redundancy (deficiency)” represents, as of December 31, 2011,2012, the difference between the latest re-estimated net liability and the net liability as originally estimated for losses and LAE retained by us. A redundancy means the original estimate was higher than the current estimate; and a deficiency means that the original estimate was lower than the current estimate. For example, as of December 31, 2011 and based upon updated information, NLIC re-estimated that the net liability that was established as of December 31, 2002 was $0.8 million redundant.

10

Table of Contents

The following tables are presented net of reinsurance recoverable.

National Lloyds Insurance Company

Analysis of Loss Reserve Development

(Dollars in Thousands)thousands)

| | Year Ended December 31, | | |

| | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | | Year Ended December 31, | |

| | | | | | | | | | | | | | | | | | | | | | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | |

Original Reserve* | | 18,141 | | 35,061 | | 33,951 | | 41,282 | | 47,684 | | 44,613 | | 65,592 | | 60,392 | | 55,482 | | 81,589 | | | $ | 35,061 | | $ | 33,951 | | $ | 41,282 | | $ | 47,684 | | $ | 44,613 | | $ | 65,592 | | $ | 60,392 | | $ | 55,482 | | $ | 81,589 | | $ | 87,943 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 year later | | 17,852 | | 32,887 | | 28,106 | | 36,332 | | 43,640 | | 44,064 | | 64,864 | | 62,337 | | 54,987 | | | | | 32,887 | | 28,106 | | 36,332 | | 43,640 | | 44,064 | | 64,864 | | 62,337 | | 54,987 | | 82,065 | | | |

2 years later | | 17,281 | | 32,559 | | 27,593 | | 40,391 | | 43,465 | | 44,134 | | 65,070 | | 62,014 | | | | | | | 32,559 | | 27,593 | | 40,391 | | 43,465 | | 44,134 | | 65,070 | | 62,014 | | 54,672 | | | | | |

3 years later | | 17,357 | | 31,614 | | 25,747 | | 41,231 | | 43,394 | | 43,950 | | 64,702 | | | | | | | | | 31,614 | | 25,747 | | 41,231 | | 43,394 | | 43,950 | | 64,702 | | 61,759 | | | | | | | |

4 years later | | 17,340 | | 31,030 | | 25,712 | | 39,735 | | 43,387 | | 43,788 | | | | | | | | | | | 31,030 | | 25,712 | | 39,735 | | 43,387 | | 43,788 | | 64,569 | | | | | | | | | |

5 years later | | 17,312 | | 31,088 | | 25,579 | | 39,699 | | 43,366 | | | | | | | | | | | | | 31,088 | | 25,579 | | 39,699 | | 43,366 | | 43,649 | | | | | | | | | | | |

6 years later | | 17,332 | | 31,072 | | 25,582 | | 39,675 | | | | | | | | | | | | | | | 31,072 | | 25,582 | | 39,675 | | 43,365 | | | | | | | | | | | | | |

7 years later | | 17,321 | | 31,066 | | 25,568 | | | | | | | | | | | | | | | | | 31,066 | | 25,568 | | 39,674 | | | | | | | | | | | | | | | |

8 years later | | 17,307 | | 31,056 | | | | | | | | | | | | | | | | | | | 31,054 | | 25,566 | | | | | | | | | | | | | | | | | |

9 years later | | 17,306 | | | | | | | | | | | | | | | | | | | | | 31,048 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net cumulative redundancy (deficiency) | | 835 | | 4,005 | | 8,383 | | 1,607 | | 4,318 | | 825 | | 890 | | (1,622 | ) | 495 | | | | | 4,013 | | 8,385 | | 1,608 | | 4,319 | | 964 | | 1,023 | | (1,367 | ) | 810 | | (476 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cumulative amount of net liability paid as of: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 year later | | 16,836 | | 30,867 | | 24,747 | | 32,871 | | 42,301 | | 42,478 | | 63,761 | | 59,977 | | 53,387 | | | | | 30,867 | | 24,747 | | 32,871 | | 42,301 | | 42,478 | | 63,761 | | 59,977 | | 53,387 | | 79,853 | | | |

2 years later | | 17,160 | | 30,818 | | 25,149 | | 34,625 | | 42,668 | | 43,245 | | 64,203 | | 60,517 | | | | | | | 30,818 | | 25,149 | | 34,625 | | 42,668 | | 43,245 | | 64,203 | | 60,517 | | 53,872 | | | | | |

3 years later | | 17,209 | | 30,875 | | 25,388 | | 36,157 | | 43,140 | | 43,495 | | 64,391 | | | | | | | | | 30,875 | | 25,388 | | 36,157 | | 43,140 | | 43,495 | | 64,391 | | 61,081 | | | | | | | |

4 years later | | 17,231 | | 30,989 | | 25,462 | | 39,533 | | 43,361 | | 43,563 | | | | | | | | | | | 30,989 | | 25,462 | | 39,533 | | 43,361 | | 43,563 | | 64,477 | | | | | | | | | |

5 years later | | 17,287 | | 31,026 | | 25,521 | | 39,646 | | 43,365 | | | | | | | | | | | | | 31,026 | | 25,521 | | 39,646 | | 43,365 | | 43,648 | | | | | | | | | | | |

6 years later | | 17,300 | | 31,030 | | 25,538 | | 39,674 | | | | | | | | | | | | | | | 31,030 | | 25,538 | | 37,674 | | 43,365 | | | | | | | | | | | | | |

7 years later | | 17,301 | | 31,029 | | 25,564 | | | | | | | | | | | | | | | | | 31,029 | | 25,564 | | 39,674 | | | | | | | | | | | | | | | |

8 years later | | 17,302 | | 31,051 | | | | | | | | | | | | | | | | | | | 31,051 | | 25,565 | | | | | | | | | | | | | | | | | |

9 years later | | 17,302 | | | | | | | | | | | | | | | | | | | | | 31,048 | | | | | | | | | | | | | | | | | | | |

|

* Including amounts paid in respective year.

11

Table of Contents

American Summit Insurance Company

Analysis of Loss Reserve Development

(Dollars in Thousands)thousands)

| | Year Ended December 31, | | |

| | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | | Year Ended December 31, | |

| | | | | | | | | | | | | | | | | | | | | | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | |

Original Reserve* | | 11,873 | | 6,235 | | 8,297 | | 11,041 | | 13,003 | | 9,351 | | 12,769 | | 9,773 | | 12,486 | | 14,829 | | | $ | 6,235 | | $ | 8,297 | | $ | 11,041 | | $ | 13,003 | | $ | 9,351 | | $ | 12,769 | | $ | 9,773 | | $ | 12,486 | | $ | 14,829 | | $ | 13,547 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 year later | | 11,983 | | 5,322 | | 7,388 | | 9,932 | | 13,014 | | 9,154 | | 12,009 | | 9,423 | | 13,153 | | | | | 5,322 | | 7,388 | | 9,932 | | 13,014 | | 9,154 | | 12,009 | | 9,423 | | 13,153 | | 14,126 | | | |

2 years later | | 11,963 | | 5,512 | | 6,999 | | 9,918 | | 12,998 | | 9,335 | | 11,943 | | 9,088 | | | | | | | 5,512 | | 6,999 | | 9,918 | | 12,998 | | 9,335 | | 11,943 | | 9,088 | | 12,974 | | | | | |

3 years later | | 11,554 | | 5,563 | | 6,859 | | 9,918 | | 13,435 | | 9,235 | | 11,880 | | | | | | | | | 5,563 | | 6,859 | | 9,918 | | 13,435 | | 9,235 | | 11,880 | | 9,023 | | | | | | | |

4 years later | | 11,749 | | 5,401 | | 6,772 | | 9,797 | | 13,216 | | 9,200 | | | | | | | | | | | 5,401 | | 6,772 | | 9,797 | | 13,216 | | 9,200 | | 12,048 | | | | | | | | | |

5 years later | | 11,775 | | 5,396 | | 6,714 | | 9,820 | | 13,195 | | | | | | | | | | | | | 5,396 | | 6,714 | | 9,820 | | 13,195 | | 9,197 | | | | | | | | | | | |

6 years later | | 11,799 | | 5,394 | | 6,787 | | 9,815 | | | | | | | | | | | | | | | 5,394 | | 6,787 | | 9,815 | | 13,188 | | | | | | | | | | | | | |

7 years later | | 11,804 | | 5,396 | | 6,743 | | | | | | | | | | | | | | | | | 5,396 | | 6,743 | | 9,812 | | | | | | | | | | | | | | | |

8 years later | | 11,833 | | 5,417 | | | | | | | | | | | | | | | | | | | 5,417 | | 6,730 | | | | | | | | | | | | | | | | | |

9 years later | | 11,821 | | | | | | | | | | | | | | | | | | | | | 5,417 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net cumulative redundancy (deficiency) | | 52 | | 818 | | 1,554 | | 1,226 | | (192 | ) | 151 | | 889 | | 685 | | (667 | ) | | | | 818 | | 1,567 | | 1,229 | | (185 | ) | 154 | | 721 | | 750 | | (488 | ) | 703 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cumulative amount of net liability paid as of: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 year later | | 10,909 | | 4,987 | | 6,566 | | 9,341 | | 12,429 | | 8,732 | | 11,560 | | 8,800 | | 12,390 | | | | | 4,987 | | 6,566 | | 9,341 | | 12,429 | | 8,732 | | 11,560 | | 8,800 | | 12,390 | | 13,511 | | | |