| ( X ) | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 20152017

oTRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| ( ) | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

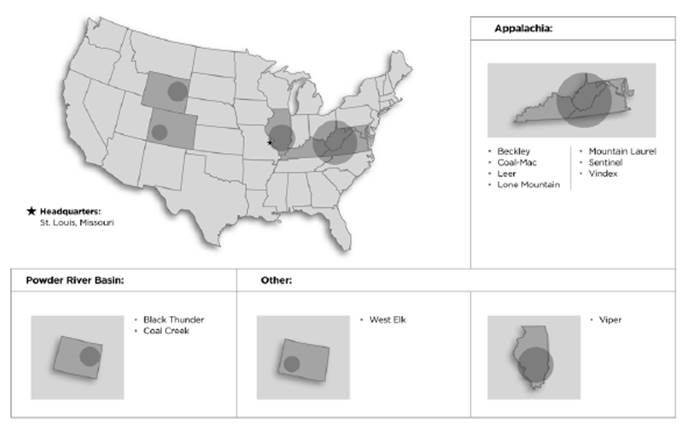

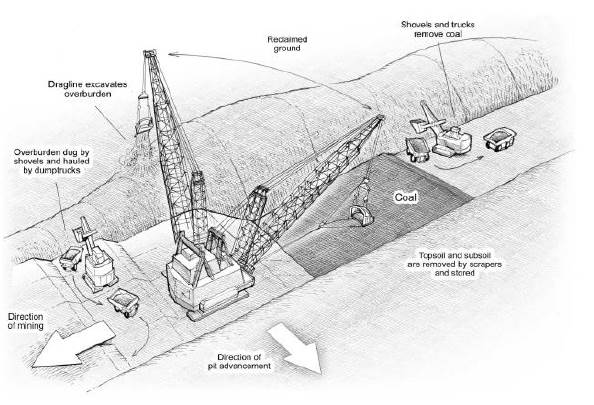

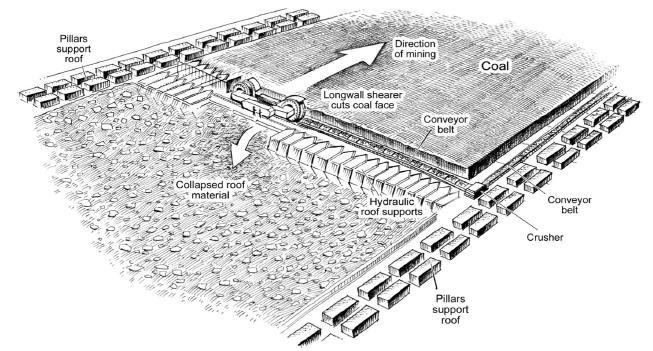

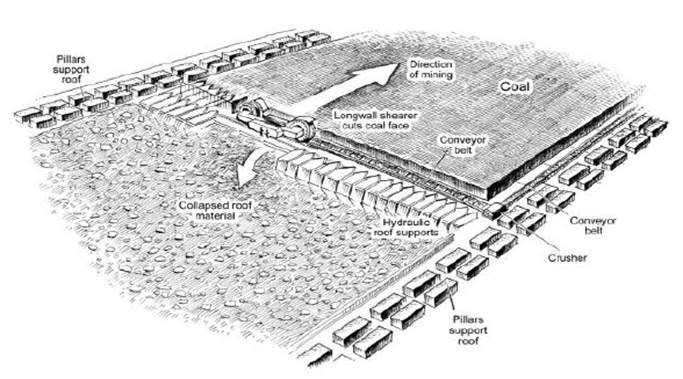

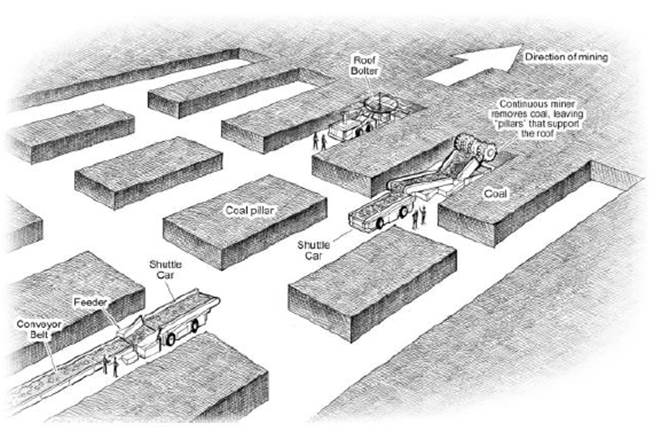

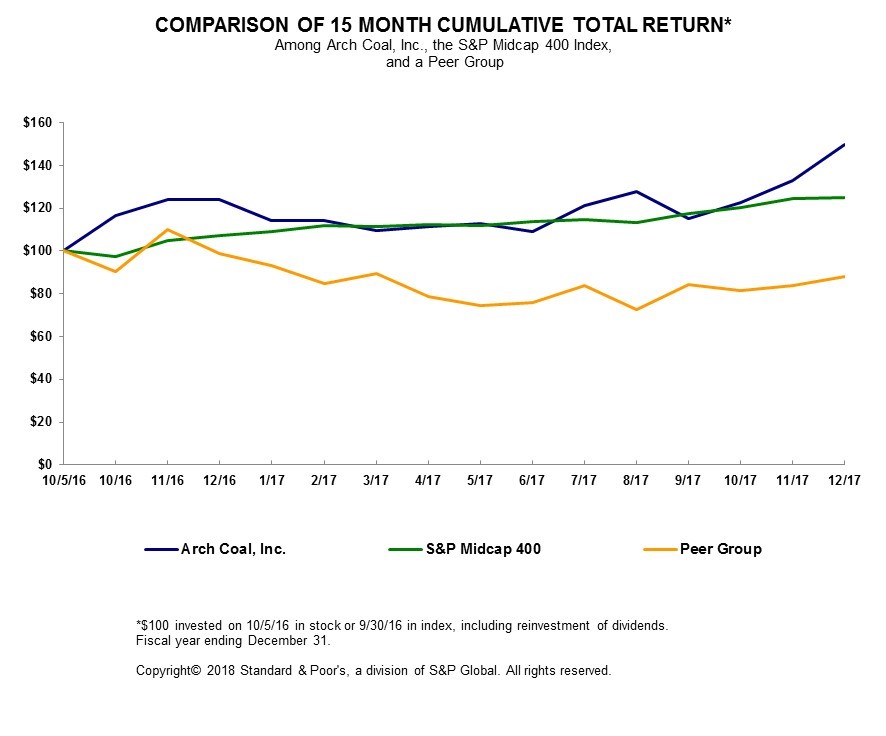

Name of Each Exchange on Which Registered Common Stock, $.01 par value We are one of the world’s largest coal producers. For the year ended December 31, We incorporate by reference the information about the geographical breakdown of our coal sales for the respective periods covered within this Form 10-K contained in Note 24 to the Consolidated Financial Statements. 2017 based on preliminary data. Actual Estimated Forecast Annual Sector 2010 2015 2016 2020 2040 2013 - 2040 (Tons, in millions) Electric power 975 747 746 694 677 (0.9 )% Other industrial 49 40 41 46 49 0.5 % Coke plants 21 19 17 21 18 (0.7 )% Residential/commercial 3 3 2 2 2 0.5 % *Total U.S. coal consumption 1,049 809 807 770 746 0.2 % Western bituminous coal has certain quality characteristics, especially its high heat content and low sulfur, that make this a desirable coal for domestic and international power producers. of the Consolidated Financial Statements. Captive Contract Mining Tons Sold(2)(3) Total Cost of Assigned Mining Complex Mines(1) Mines(1) Equipment Railroad 2013 2014 2015 2015 Reserves (Million tons) ($ millions) (Million tons) Powder River Basin: Black Thunder S — D, S UP/BN 100.7 101.2 99.5 $ 1,212.5 1,163.9 Coal Creek S — D, S UP/BN 8.5 9.4 7.8 146.6 153.7 Other: West Elk U — LW, CM UP 6.1 6.5 5.1 417.9 53.5 Viper U — CM — 2.2 2.2 2.1 99.8 37.2 Appalachia: Coal-Mac S — L, E NS/CSX 3.1 2.8 2.4 205.4 24.6 Lone Mountain U(3) — CM NS/CSX 2.0 1.9 1.6 256.2 10.2 Mountain Laurel U — L, LW, CM CSX 2.9 2.6 2.3 4.1 — Beckley U — CM CSX 1.1 1.0 0.9 — — Vindex S — L, E CSX 0.6 0.5 0.6 — — Sycamore No. 2 — U CM — 0.4 0.5 0.2 — — Sentinel U — CM CSX 1.0 1.1 0.9 — — Leer U — CM, LW CSX 0 2.7 2.9 463.2 40.1 Totals 128.6 132.4 126.3 $ 2,805.7 1,483.2 D = Dragline UP = Union Pacific Railroad U = Underground mine L = Loader/truck CSX = CSX Transportation S = Shovel/truck BN = Burlington E = Excavator/truck NS = Norfolk Southern Railroad LW = Longwall CM = Continuous miner HW = Highwall miner 2017. (In thousands) Europe $ 170,314 Asia 96,523 Central and South America 55,323 North America 40,315 Brokered Sales 32,848 Total $ 395,323 certain time period, the unaffected party may have the option to terminate the purchase or sale in whole or in part. Some contracts stipulate that this tonnage can be made up by mutual agreement or at the discretion of the buyer. Agreements between our customers and the railroads servicing our mines may also contain force majeure provisions. 2017. truck. third parties. leases and other miscellaneous obligations. Compliance with these laws has substantially increased the cost of coal mining for domestic coal producers. published the final revisions to the stream buffer zone rule in the Federal Register. The revisions However, on February 2, 2017, Congress voted to repeal the stream protection rule under the Congressional Review Act. President Trump signed the bill repealing the rule on February 16, 2017. decrease in the number of companies willing to issue surety bonds. Under the Black Lung Benefits Revenue Act of 1977 and the Black Lung Benefits Reform Act of 1977, each coal mine operator must secure payment of federal black lung benefits to claimants who are current and former employees and to a trust fund for the payment of benefits and medical expenses to claimants who last worked in the coal industry prior to July 1, 1973. The trust fund is funded by an excise tax on production of up to $1.10 per ton for coal mined in underground operations and up to $0.55 per ton for coal mined in surface operations. These amounts may not exceed 4.4% of the gross sales price. This excise tax does not apply to coal shipped outside the United States. In emitted by do so in a separate future action. dioxide and nitrous oxide, which could lead to non-attainment of PM2.5 and ozone NAAQS in downwind states (interstate transport), pursuant to a cap and trade program similar to the system now in effect for acid deposition control. In July 2008, in State of North Carolina v. EPA and consolidated cases, the future course of the Rule is unclear. plans by December 17, 2007, and the EPA issued a Finding of Failure to Submit plans on January 15, 2009 (74 Fed. Reg. 2392). The EPA had taken no enforcement action against states to finalize implementation plans and was slowly dealing with the state Regional Haze SIPs that were submitted, which resulted in the National Parks Conservation Association commencing litigation in the D.C. Circuit However, on January 18, 2018, EPA announced that it was revisiting the 2017 Regional Haze Rule revisions, and announced an intent to commence a new rulemaking. This proceeding may slow or even roll back certain Regional Haze requirements. nationally. extent the United States ultimately participates in these reductions (whether via the Paris Agreement or otherwise). created uncertainty over Clean Water Act jurisdiction and permitting requirements that could variously increase or decrease the cost and time we expend on Clean Water Act compliance. or sulfate could result in large treatment expenses for mine operators. of the Registrant Mr. Cochran has served as our Senior Vice President-Operations since August 2012. From May 2011 to August 2012, Mr. Cochran served as Group President of our western operations, which included Thunder Basin Coal Company, the Arch Western Bituminous Group, Arch of Wyoming and the Otter Creek development, and served as President and General Manager of Thunder Basin Coal Company from 2005 to April 2011. Prior to joining Arch Coal in 2005, Mr. Cochran spent 20 years with TXU Corporation. Mr. Cochran currently serves on the John T. Drexler Mr. Drexler has served as our Senior Vice President and Chief Financial Officer since John W. Eaves Mr. Eaves Robert G. Jones Mr. Jones has served as our Senior Vice President-Law, General Counsel and Secretary since 2008. Mr. Jones served as Vice President-Law, General Counsel and Secretary from 2000 to 2008. Allen R. Kelley Mr. Kelley was appointed Vice President-Human Resources in March 2014. From 2008 to March 2014, Mr. Kelley served as our Vice President-Enterprise Risk Management. From 2005 to 2008, Mr. Kelley served as our Director of Internal Audit. Prior to 2005, Mr. Kelley held various finance and accounting positions within the corporate and operations functions of Arch Coal, Inc. Paul A. Lang Mr. Lang was elected our President and Chief Operating Officer in April 2015. He has served as our Executive Vice President and Chief Operating Officer since April 2012 and as our Executive Vice President-Operations from August 2011 to April 2012. Mr. Lang served as Senior Vice President-Operations from 2006 through August 2011, as President of Western Operations from 2005 through 2006 and President and General Manager of Thunder Basin Coal Company from 1998 to 2005. Mr. Lang is a director of Deck S. Slone Mr. Slone has served as our Senior Vice President-Strategy and Public Policy since June 2012. Mr. Slone served as our Vice President-Government, Investor and Public Affairs from 2008 to June 2012. Mr. Slone served as our Vice President-Investor Relations and Public Affairs from 2001 to 2008. Mr. Slone is John A. Ziegler, Jr. Mr. Ziegler was appointed Chief Commercial Officer in March 2014. Mr. Ziegler served as our Vice President-Human Resources from April 2012 to March 2014. From October 2011 to April 2012, Mr. Ziegler served as our Senior Director-Compensation and Benefits. From 2005 to October 2011 Mr. Ziegler served as Vice President-Contract Administration, President of Sales, then finally Senior Vice President, Sales and Marketing and Marketing Administration. Mr. Ziegler joined Arch Coal in 2002 as Director-Internal Audit. Prior to joining Arch Coal, Mr. Ziegler held various finance and accounting positions with bioMerieux and Ernst & Young. Recoverable reserves designated for mining by a specific operation. Coal Btu A measure of the energy required to raise the temperature of one pound of water one degree of Fahrenheit. Coking coal Coal which, when burned, emits 1.2 pounds or less of sulfur dioxide per million Btus, requiring no blending or other sulfur dioxide reduction technologies in order to comply with the requirements of the Clean Air Act. Continuous miner A machine used in underground mining to cut coal from the seam and load it onto conveyors or into shuttle cars in a continuous operation. Dragline A large machine used in surface mining to remove the overburden, or layers of earth and rock, covering a coal seam. The dragline has a large bucket, suspended by cables from the end of a long boom, which is able to scoop up large amounts of overburden as it is dragged across the excavation area and redeposit the overburden in another area. Hard coal Coal of gross calorific value greater than 5700 kcal/kg on an ashfree but moist basis and further disaggregated into anthracite, coking coal and other bituminous coal. Lignite Coal One of two major underground coal mining methods, generally employing two rotating drums pulled mechanically back and forth across a long face of coal. Coal which, when burned, emits 1.6 pounds or less of sulfur dioxide per million Btus. Metallurgical coal A facility used for crushing, sizing and washing coal to remove impurities and to prepare it for use by a particular customer. Probable reserves Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. Proven reserves Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well established. The restoration of land and environmental values to a mining site after the coal is extracted. The process commonly includes “recontouring” or shaping the land to its approximate original appearance, restoring topsoil and planting native grass and ground covers. Recoverable reserves The amount of proven and probable reserves that can actually be recovered from the reserve base taking into account all mining and preparation losses involved in producing a saleable product using existing methods and under current law. Reserves That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. One of two major underground coal mining methods, utilizing continuous miners creating a network of “rooms” within a coal seam, leaving behind “pillars” of coal used to support the roof of a mine. Unassigned reserves Recoverable reserves that have not yet been designated for mining by a specific operation. fresh start accounting effective October 1, 2016. renewable energy sources to generate a certain percentage of power. There have been numerous proposals to establish a similar uniform, national standard although none of these proposals have been enacted to date. Possible advances in technologies and incentives, such as tax credits, to enhance the economics of renewable energy sources could make these sources more competitive with coal. Any reduction in the amount of coal consumed by electric power generators could reduce the price of coal that we mine and sell, thereby reducing our revenues and materially and adversely affecting our business and results of operations. areas and properties, and revenues and expenditures associated with our mining operations, may vary materially from estimates. Any inaccuracy in our estimates related to our reserves could result in decreased profitability from lower than expected revenues and/or higher than expected costs. pressures and uncertainties that may affect their ability to pay, including trade barriers, exchange controls and local economic and political conditions. from us. If any of those customers, particularly any of our three largest customers, was to significantly reduce the quantities of coal it purchases from us, or if we are unable to sell coal to those customers on terms as favorable to us, it may have an adverse impact on the results of our business. flow. operations. the market for our products. be a greenhouse gas, is a by-product of burning coal. Global climate issues, including with respect to greenhouse gases such as carbon dioxide and manner that may restrict our ability to efficiently and economically conduct our mining activities, any of which would materially reduce our production, cash flow and profitability. Liability under these laws is generally strict. Accordingly, we may incur liability without regard to fault or to the legality of the conduct giving rise to the conditions. attributes existing at the end of 2016. 2017: Total As Assigned Sulfur Content (lbs. Received Mining Method Past Reserve Recoverable per million Btus) Btus per Reserve Control Under- Estimates Reserves Proven Probable <1.2 1.2-2.5 >2.5 lb. (1) Leased Owned Surface ground 2013 2014 Wyoming 1,318 1,304 14 1,257 61 — 8,852 1,318 1,318 — 1,526 1,423 Montana — — — — — — — — — — — — — Colorado 53 50 3 53 — — 11,533 53 — — 53 84 65 Central App. 35 34 1 23 12 — 12,479 35 — 25 10 169 139 Northern App. 40 35 5 — 40 — 13,074 2 38 — 40 58 74 Illinois 37 22 15 — — 37 10,728 30 7 — 37 21 33 Total 1,483 1,445 38 1,333 113 37 9,195 1,438 45 1,343 140 1,858 1,734 Total Unassigned Sulfur Content Mining Method Recoverable (lbs. per million Btus) As Received Reserve Control Under- Reserves Proven Probable <1.2 1.2-2.5 >2.5 Btus per lb.(1) Leased Owned Surface ground Wyoming 480 397 83 428 52 — 9,653 370 110 305 175 Montana — — — — — — — — — — — Colorado 33 25 8 33 — — 11,220 33 — — 33 Central App. 59 50 9 20 26 13 12,522 11 48 41 18 Northern App. 144 70 74 — 142 2 12,961 1 143 — 144 Illinois 298 197 101 — — 298 11,137 65 233 4 294 Total 1,014 739 275 481 220 313 10,777 480 534 350 664 (1) $0.4 billion. is subject to publication and public comment. The BLM may consult with other governmental agencies during this process, including state and federal agencies, surface management agencies, Native American tribes or bands, the U.S. Department of Justice or others as needed. The public comment period for an analysis or impact statement typically occurs over a contained in Item 1A. “Risk Factors” for more information. subsidiaries prepare to mine such reserves. If defects in title or boundaries of undeveloped reserves are discovered in the future, control of and the right to mine such reserves could be adversely affected. You should see “A defect in title or the loss of a leasehold interest in certain property or surface rights could limit our ability to mine our coal reserves or result in significant unanticipated costs” contained in Item 1A, “Risk Factors” for more information. other capital priorities. 2015 March 31 June 30 September 30 December 31 Dividends per common share $ — $ — $ — $ — High 16.80 11.10 9.31 4.66 Low 8.20 3.40 1.05 0.84 2014 March 31 June 30 September 30 December 31 Dividends per common share $ 0.10 $ — $ — $ — High 48.20 51.80 36.70 28.60 Low 38.81 32.30 20.80 15.00 S&P Midcap 400 index and a customized peer group of three companies: Cloud Peak Energy Inc., Cnx Resources Corp and Westmoreland Coal Company. The graph assumes that the value of the investment in our common stock, the S&P Midcap 400 index, and in the peer group (including reinvestment of dividends) was $100 on October 5, 2016 and tracks it through December 31, 2017. Year Ended December 31 (In thousands, except per share data) 2015 2014 2013 2012 2011 (1) (3) (4) (5) Statement of Operations Data: Revenues $ 2,573,260 $ 2,937,119 $ 3,014,357 $ 3,768,126 $ 3,883,039 Mine closure and asset impairment costs 2,628,303 24,113 220,879 539,182 7,316 Goodwill impairment — — 265,423 330,680 — Acquisition and transition costs — — — — 47,360 Income (loss) from operations (2,865,063 ) (149,531 ) (663,141 ) (757,012 ) 343,061 Interest expense (397,979 ) (390,946 ) (381,267 ) (317,615 ) (230,186 ) Non-operating expenses (27,910 ) — (42,921 ) (23,668 ) (51,448 ) Income (loss) from continuing operations (2,913,142 ) (558,353 ) (745,228 ) (738,915 ) 89,015 Diluted earnings (loss) from continuing operations per common share $ (136.86 ) $ (26.31 ) $ (35.15 ) $ (34.97 ) $ 4.60 Net income (loss) attributable to Arch Coal (2,913,142 ) (558,353 ) (641,832 ) (683,955 ) 141,683 Basic earnings (loss) per common share $ (136.86 ) $ (26.31 ) $ (30.26 ) $ (32.36 ) $ 7.45 Diluted earnings (loss) per common share $ (136.86 ) $ (26.31 ) $ (30.26 ) $ (32.36 ) $ 7.42 Balance Sheet Data: Total assets $ 5,106,738 $ 8,429,723 $ 8,990,193 $ 10,006,777 $ 10,213,959 Working capital (4,361,009 ) 1,023,357 1,293,849 1,337,035 162,106 Current maturities of debt (2) 5,107,210 36,885 33,493 32,896 280,851 Long-term debt, less current maturities 30,953 5,123,485 5,118,002 5,085,879 3,762,297 Other long-term obligations 755,283 695,881 717,174 825,080 864,667 Noncurrent deferred income tax liability — 422,809 413,546 664,182 976,753 Arch Coal stockholders’ equity (1,244,289 ) 1,668,154 2,253,249 2,854,567 3,578,040 Common Stock Data: Dividends per share $ — $ 0.10 $ 1.20 $ 2.00 $ 4.30 Shares outstanding at year-end 21,446 21,227 21,228 21,225 21,167 Cash Flow Data: Cash provided by operating activities (44,367 ) (33,582 ) 55,742 332,804 642,242 Depreciation, depletion and amortization, including amortization of acquired sales contracts, net 370,534 405,561 438,247 500,319 444,518 Capital expenditures 119,024 147,286 296,984 395,225 540,936 Acquisitions of businesses, net of cash acquired — — — — 2,894,339 Net proceeds from the issuance of long term debt — (4,519 ) 623,511 1,942,685 1,906,306 Net proceeds from the sale of common stock — — — — 1,267,933 Payments to retire debt, including redemption premium — — 628,660 452,934 605,178 Net increase (decrease) in borrowings under lines of credit and commercial paper program — — — (481,300 ) 424,396 Dividend payments — 2,123 25,475 42,440 80,748 Operating Data: Tons sold 127,632 134,360 139,607 140,820 156,897 Tons produced 126,820 132,614 136,613 135,934 151,829 Tons purchased from third parties 1,287 1,182 2,925 4,327 5,557 Company on or prior to October 1, 2016. Bankruptcy Code companies. Year Ended December 31, 2015 2014 2013 Powder River Basin Tons sold (in thousands) 108,481 111,156 111,653 Coal sales per ton sold $ 13.15 $ 12.86 $ 12.44 Cost per ton sold $ 12.36 $ 12.58 $ 12.18 Operating margin per ton sold $ 0.79 $ 0.28 $ 0.26 Adjusted EBITDA (in thousands) $ 258,300 $ 197,920 $ 206,910 Appalachia Tons sold (in thousands) 11,926 14,484 14,224 Coal sales per ton sold $ 62.47 $ 68.77 $ 73.07 Cost per ton sold $ 69.19 $ 77.59 $ 81.27 Operating loss per ton sold $ (6.72 ) $ (8.82 ) $ (8.20 ) Adjusted EBITDA (in thousands) $ 82,837 $ 109,053 $ 88,883 Other Tons sold (in thousands) 7,225 8,720 8,422 Coal sales per ton sold $ 30.99 $ 30.78 $ 32.63 Cost per ton sold $ 27.83 $ 25.44 $ 26.95 Operating margin per ton sold $ 3.16 $ 5.34 $ 5.68 Adjusted EBITDA (in thousands) $ 17,044 $ 58,325 $ 91,642 period from October 2 through December 31, 2016. in the period. Year Ended December 31, 2015 revenues. Year Ended December 31, 2015 2014 Increase (Decrease) (In thousands) Coal sales $ 2,573,260 $ 2,935,181 $ (361,921 ) Tons sold 127,632 134,360 (6,728 ) Year Ended December 31, (Increase) Decrease 2015 2014 in Net Loss (In thousands) Cost of sales (exclusive of items shown separately below) $ 2,206,433 $ 2,566,193 $ 359,760 Depreciation, depletion and amortization 379,345 418,748 39,403 Amortization of acquired sales contracts, net (8,811 ) (13,187 ) (4,376 ) Change in fair value of coal derivatives and coal trading activities, net (1,583 ) (3,686 ) (2,103 ) Asset impairment and mine closure costs 2,628,303 24,113 (2,604,190 ) Losses from disposed operations resulting from Patriot Coal bankruptcy 116,343 — (116,343 ) Selling, general and administrative expenses 98,783 114,223 15,440 Other operating expense (income), net 19,510 (19,754 ) (39,264 ) Total costs, expenses and other $ 5,438,323 $ 3,086,650 $ (2,351,673 ) Powder River Basin. year ended December 31, 2015 total selling, general and administrative expenses consist primarily of compensation costs of $56.5 million, and professional services and usage and maintenance agreements of $25.8 million. miscellaneous revenues including royalties and net gains on asset sales of $22.2 million and net income from equity investments of $7.9 million. (Increase) Decrease Year Ended December 31, in Net Loss 2015 2014 $ (In thousands) Net loss resulting from early retirement of debt and debt restructuring $ (27,910 ) $ — $ (27,910 ) Consolidated Financial Statements, “ Year Ended December 31, Decrease 2015 2014 in Net Loss (In thousands) Provision for (benefit from) income taxes $ (373,380 ) $ 25,634 $ 399,014 2015. Year Ended December 31, 2014 2013 Increase (Decrease) (In thousands) Coal sales $ 2,935,181 $ 3,000,476 $ (65,295 ) Tons sold 134,360 134,300 60 Year Ended December 31, (Increase) Decrease 2014 2013 in Net Loss (In thousands) Cost of sales (exclusive of items shown separately below) $ 2,566,193 $ 2,663,136 $ 96,943 Depreciation, depletion and amortization 418,748 426,442 7,694 Amortization of acquired sales contracts, net (13,187 ) (9,457 ) 3,730 Change in fair value of coal derivatives and coal trading activities, net (3,686 ) 7,845 11,531 Asset impairment and mine closure costs 24,113 220,879 196,766 Goodwill impairment — 265,423 265,423 Selling, general and administrative expenses 114,223 133,448 19,225 Other operating income, net (19,754 ) (30,218 ) (10,464 ) Total costs, expenses and other $ 3,086,650 $ 3,677,498 $ 590,848 Decrease Year Ended December 31, in Net Loss 2014 2013 $ (In thousands) Net loss resulting from early retirement of debt and debt restructuring $ — $ (42,921 ) $ 42,921 Year Ended December 31, Increase 2014 2013 in Net Loss (In thousands) Provision for (benefit from) income taxes $ 25,634 $ (335,498 ) $ (361,132 ) Year Ended December 31, Increase 2014 2013 in Net Loss (In thousands) Income from discontinued operations, net of tax $ — $ 103,396 $ 103,396 logistics contracts. Year Ended December 31, 2015 2014 2013 Reported segment coal sales revenues $ 2,395,258 $ 2,693,898 $ 2,702,865 Coal risk management derivative settlements classified in “other income” (3,231 ) (5,958 ) (32,535 ) Transportation costs 181,233 247,241 330,146 Coal sales 2,573,260 2,935,181 3,000,476 Other revenues — 1,938 13,881 Revenues in the consolidated statements of operations $ 2,573,260 $ 2,937,119 $ 3,014,357 Year Ended December 31, 2015 2014 2013 Reported segment cost of coal sales $ 2,368,100 $ 2,743,182 $ 2,743,766 Diesel fuel risk management derivative settlements classified in “other income” (8,162 ) (6,789 ) (14,939 ) Transportation costs 181,233 247,241 330,146 Depreciation, depletion and amortization in reported segment cost of tons sold presented on separate line on statement of operations (373,299 ) (414,379 ) (418,736 ) Other (other operating segments, operating overhead, etc.) 38,561 (3,062 ) 22,899 Cost of sales in the consolidated statements of operations $ 2,206,433 $ 2,566,193 $ 2,663,136 Year Ended December 31, 2015 2014 2013 Reported Adjusted EBITDA from coal operations $ 358,181 $ 365,299 $ 387,435 EBITDA from discontinued operations — — 173,776 Corporate and other (108,064 ) (85,156 ) (135,289 ) Adjusted EBITDA 250,117 280,143 425,922 Income tax benefit (provision) 373,380 (25,634 ) 335,498 Interest expense, net (393,549 ) (383,188 ) (374,664 ) Depreciation, depletion and amortization (379,345 ) (418,748 ) (426,442 ) Amortization of acquired sales contracts, net 8,811 13,187 9,457 Asset impairment and mine closure costs (2,628,303 ) (24,113 ) (220,879 ) Losses from disposed operations resulting from Patriot Coal bankruptcy (116,343 ) — — Goodwill impairment — — (265,423 ) Other nonoperating expenses (27,910 ) — (42,921 ) Settlement of UMWA legal claims — — (12,000 ) Interest, depreciation, depletion and amortization classified as discontinued operations — — (70,380 ) Net loss $ (2,913,142 ) $ (558,353 ) $ (641,832 ) business; and other strategic opportunities. funds withdrawable from brokerage accounts. Year Ended December 31, 2015 2014 2013 (In thousands) Cash provided by (used in): Operating activities $ (44,367 ) $ (33,582 ) $ 55,742 Investing activities (180,341 ) (111,434 ) 125,445 Financing activities (58,742 ) (31,852 ) (54,710 ) Payments Due by Period 2016 2017-2018 2019-2020 after 2020 Total (Dollars in thousands) Long-term debt, including related interest $ 375,176 $ 2,508,000 $ 2,491,350 $ 1,033,547 $ 6,408,073 Operating leases 20,857 23,689 5,599 9,807 59,952 Coal lease rights 68,947 27,088 24,291 103,771 224,097 Coal purchase obligations — — — — — Unconditional purchase obligations 94,552 35,954 22,917 11,076 164,499 Total contractual obligations $ 559,532 $ 2,594,731 $ 2,544,157 $ 1,158,201 $ 6,856,621 Workers’ Reclamation Lease Compensation Obligations Obligations Obligations Other Total (Dollars in thousands) Self bonding $ 485,546 $ — $ — $ — $ 485,546 Surety bonds 155,291 49,372 19,534 6,659 230,856 Letters of credit 11,166 — 117,568 6,790 135,524 2017: retirement obligations are initially recorded at fair value, or the amount at which the obligations could be settled in a current transaction between willing parties. This involves determining the present value of estimated future cash flows on a mine-by-mine basis based upon current permit requirements and various estimates and assumptions, including estimates of disturbed acreage, reclamation costs and assumptions regarding equipment productivity. We estimate disturbed acreage based on approved mining plans and related engineering data. Since we plan to use internal resources to perform the majority of our reclamation activities, our estimate of reclamation costs involves estimating third-party profit margins, which we base on our historical experience with contractors that perform certain types of reclamation activities. We base productivity assumptions on historical experience with the equipment that we expect to utilize in the reclamation activities. In order to determine fair value, we discount our estimates of cash flows to their present value. We base our discount rate on the rates of treasury bonds with maturities similar to expected mine lives, adjusted for our credit standing. the plan participants. for themselves and their dependents. The salaried employee postretirement benefit plans are contributory, with retiree contributions adjusted periodically, and contain other cost-sharing features such as deductibles and coinsurance. 2016 2017 Tons $ per ton Tons $ per ton (in millions) (in millions) Powder River Basin Committed, Priced 69.8 $ 13.34 37.8 $ 13.84 Committed, Unpriced 4.8 9.0 Appalachia Committed, Priced Thermal 3.7 $ 54.36 2.1 $ 45.35 Committed, Unpriced Thermal — — Committed, Priced Metallurgical 1.9 $ 71.57 1.4 $ 77.03 Committed, Unpriced Metallurgical 0.7 0.7 Other Bituminous Committed, Priced 4.0 $ 32.15 3.3 $ 33.33 Committed, Unpriced — — 2018. Consolidated Financial Statements for additional information on the interest rate swaps. Fee Service 2015 2014 Audit(1) $ 2,327,680 $ 1,989,282 Audit-Related(2) 48,636 0 Tax(3) 6,500 14,500 All Other — 0 Restated Certificate of Incorporation of Arch Coal, Inc. 10.19 (incorporated Coal Lease Agreement dated as of March 31, 1992, among Allegheny Land Company, as lessee, and UAC and Phoenix Coal Corporation, as lessors, and related guarantee (incorporated herein by reference to the Current Report on Form 8-K filed by Ashland Coal, Inc. on April 6, 1992). Federal Coal Lease dated as of January 24, 1996 between the U.S. Department of the Interior and the Thunder Basin Coal Company (incorporated herein by reference to Exhibit 10.20 to Federal Coal Lease Readjustment dated as of November 1, 1967 between the U.S. Department of the Interior and the Thunder Basin Coal Company (incorporated herein by reference to Exhibit 10.21 to Federal Coal Lease effective as of May 1, 1995 between the U.S. Department of the Interior and Mountain Coal Company (incorporated herein by reference to Exhibit 10.22 to Federal Coal Lease dated as of January 1, 1999 between the Department of the Interior and Ark Land Company (incorporated herein by reference to Exhibit 10.23 to 10.26* 10.27* 10.30* Form of Performance Unit Contract (incorporated herein by reference to Exhibit 10.2 to 23.1 23.2 24.1 31.1 31.2 32.1 32.2 101 Interactive Data File (Form 10-K for the year ended December 31, a capital structure having carrying amounts not comparable with prior periods (Predecessor) as described in Notes 1 and 3. COSO criteria. The We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. Year Ended December 31, 2015 2014 2013 Revenues $ 2,573,260 $ 2,937,119 $ 3,014,357 Costs, expenses and other operating Cost of sales (exclusive of items shown separately below) 2,206,433 2,566,193 2,663,136 Depreciation, depletion and amortization 379,345 418,748 426,442 Amortization of acquired sales contracts, net (8,811 ) (13,187 ) (9,457 ) Change in fair value of coal derivatives and coal trading activities, net (1,583 ) (3,686 ) 7,845 Asset impairment and mine closure costs 2,628,303 24,113 220,879 Goodwill impairment — — 265,423 Losses from disposed operations resulting from Patriot Coal bankruptcy 116,343 — — Selling, general and administrative expenses 98,783 114,223 133,448 Other operating expense (income), net 19,510 (19,754 ) (30,218 ) 5,438,323 3,086,650 3,677,498 Loss from operations (2,865,063 ) (149,531 ) (663,141 ) Interest expense, net Interest expense (397,979 ) (390,946 ) (381,267 ) Interest and investment income 4,430 7,758 6,603 (393,549 ) (383,188 ) (374,664 ) Nonoperating expense Net loss resulting from early retirement of debt and debt restructuring (27,910 ) — (42,921 ) Loss from continuing operations before income taxes (3,286,522 ) (532,719 ) (1,080,726 ) Provision for (benefit from) income taxes (373,380 ) 25,634 (335,498 ) Loss from continuing operations (2,913,142 ) (558,353 ) (745,228 ) Income from discontinued operations, including gain on sale - net of tax — — 103,396 Net loss (2,913,142 ) (558,353 ) (641,832 ) Losses per common share Basic and diluted LPS- Loss from continuing operations $ (136.86 ) $ (26.31 ) $ (35.15 ) Basic and diluted LPS - Net loss $ (136.86 ) $ (26.31 ) $ (30.26 ) Basic and diluted weighted average shares outstanding 21,285 21,222 21,210 Dividends declared per common share $ — $ 0.10 $ 1.20 Year Ended December 31, 2015 2014 2013 Net loss $ (2,913,142 ) $ (558,353 ) $ (641,832 ) Derivative instruments Comprehensive income (loss) before tax (3,477 ) 3,102 (2,626 ) Income tax benefit (provision) 1,252 (1,117 ) 947 (2,225 ) 1,985 (1,679 ) Pension, postretirement and other post-employment benefits Comprehensive income (loss) before tax (5,592 ) (44,143 ) 77,201 Income tax benefit (provision) 2,011 15,891 (27,803 ) (3,581 ) (28,252 ) 49,398 Available-for-sale securities Comprehensive income (loss) before tax 1,185 (12,788 ) 10,190 Income tax benefit (provision) (435 ) 4,604 (3,710 ) 750 (8,184 ) 6,480 Total other comprehensive income (loss) (5,056 ) (34,451 ) 54,199 Total comprehensive loss $ (2,918,198 ) $ (592,804 ) $ (587,633 ) December 31, 2015 2014 Assets Current assets Cash and cash equivalents $ 450,781 $ 734,231 Short term investments 200,192 248,954 Restricted cash 97,542 5,678 Trade accounts receivable (net of allowance for doubtful accounts of $7.8 million and $0.2 million, respectively) 117,405 211,506 Other receivables 18,362 20,511 Inventories 196,720 190,253 Prepaid royalties 10,022 11,118 Deferred income taxes — 52,728 Coal derivative assets 8,035 13,257 Other current assets 104,723 54,515 Total current assets 1,203,782 1,542,751 Property, plant and equipment Coal lands and mineral rights 3,713,639 6,040,656 Plant and equipment 2,359,674 2,935,381 Deferred mine development 553,286 891,649 6,626,599 9,867,686 Less accumulated depreciation, depletion and amortization (3,007,570 ) (3,414,228 ) Property, plant and equipment, net 3,619,029 6,453,458 Other assets Prepaid royalties 23,671 66,806 Equity investments 201,877 235,842 Other noncurrent assets 58,379 130,866 Total other assets 283,927 433,514 Total assets $ 5,106,738 $ 8,429,723 Liabilities and Stockholders’ Equity (Deficit) Current liabilities Accounts payable $ 128,131 $ 180,113 Accrued expenses and other current liabilities 329,450 302,396 Current maturities of debt 5,107,210 36,885 Total current liabilities 5,564,791 519,394 Long-term debt 30,953 5,123,485 Asset retirement obligations 396,659 398,896 Accrued pension benefits 27,373 16,260 Accrued postretirement benefits other than pension 99,810 32,668 Accrued workers’ compensation 112,270 94,291 Deferred income taxes — 422,809 Other noncurrent liabilities 119,171 153,766 Total liabilities 6,351,027 6,761,569 Stockholders’ equity (deficit) Common stock, $0.01 par value, authorized 26,000 shares, issued 21,446 and 21,379 shares at December 31, 2015 and 2014, respectively 2,145 2,141 Paid-in capital 3,054,211 3,048,460 Treasury stock, at cost (53,863 ) (53,863 ) Accumulated deficit (4,244,967 ) (1,331,825 ) Accumulated other comprehensive income (1,815 ) 3,241 Total stockholders’ equity (deficit) (1,244,289 ) 1,668,154 Total liabilities and stockholders’ equity (deficit) $ 5,106,738 $ 8,429,723 Year Ended December 31, 2015 2014 2013 Operating activities Net loss $ (2,913,142 ) $ (558,353 ) $ (641,832 ) Adjustments to reconcile net loss to cash provided by operating activities: Depreciation, depletion and amortization 379,345 418,748 447,704 Amortization of acquired sales contracts, net (8,811 ) (13,187 ) (9,457 ) Prepaid royalties expensed 8,109 9,698 13,706 Deferred income taxes (367,210 ) 25,152 (263,099 ) Employee stock-based compensation expense 5,760 9,847 11,790 Gains on disposals and divestitures (2,270 ) (27,512 ) (120,321 ) Asset impairment and noncash mine closure costs 2,613,345 16,868 220,879 Goodwill impairment — — 265,423 Losses from disposed operations resulting from Patriot Coal bankruptcy 116,343 — — Amortization relating to financing activities 25,241 17,363 24,789 Net loss resulting from early retirement of debt and debt restructuring 27,910 — 42,921 Changes in: Receivables 98,212 (8,991 ) 62,881 Inventories (6,534 ) 41,548 44,635 Coal derivative assets and liabilities 973 5,449 3,606 Accounts payable, accrued expenses and other current liabilities (15,532 ) 41,680 (78,126 ) Asset retirement obligations 16,640 18,288 17,432 Pension, postretirement and other postemployment benefits 4,800 (25,347 ) 7,284 Other (27,546 ) (4,833 ) 5,527 Cash provided by (used in) operating activities (44,367 ) (33,582 ) 55,742 Investing activities Capital expenditures (119,024 ) (147,286 ) (296,984 ) Minimum royalty payments (5,871 ) (7,317 ) (14,947 ) Proceeds from sale-leaseback transactions — — 34,919 Proceeds from disposals and divestitures 2,191 62,358 433,453 Purchases of short term investments (246,735 ) (211,929 ) (213,726 ) Proceeds from sales of short term investments 290,205 205,611 194,537 Proceeds from sale of investments in equity investments and securities 2,259 9,464 — Investments in and advances to affiliates, net (11,502 ) (16,657 ) (15,260 ) Withdrawals (deposits) of restricted cash (91,864 ) (5,678 ) 3,453 Cash provided by (used in) investing activities (180,341 ) (111,434 ) 125,445 Financing activities Proceeds from term loan — — 294,000 Proceeds from issuance of senior notes — — 350,000 Payments to retire debt — (300 ) (628,660 ) Payments on term loan (19,500 ) (19,500 ) (17,250 ) Net payments on other debt (11,332 ) (5,395 ) (6,836 ) Debt financing costs — (4,519 ) (20,489 ) Dividends paid — (2,123 ) (25,475 ) Expenses related to debt restructuring (27,910 ) — — Other — (15 ) — Cash used in financing activities (58,742 ) (31,852 ) (54,710 ) Increase (decrease) in cash and cash equivalents (283,450 ) (176,868 ) 126,477 Cash and cash equivalents, beginning of period 734,231 911,099 784,622 Cash and cash equivalents, end of period $ 450,781 $ 734,231 $ 911,099 SUPPLEMENTAL CASH FLOW INFORMATION Cash paid during the year for interest $ 283,337 $ 361,727 $ 380,389 Cash refunded during the year for income taxes, net $ 4,138 $ 4,896 $ 18,741 Accumulated Treasury Other Common Paid-In Stock, at Accumulated Comprehensive Stock Capital Cost Deficit Income (Loss) Total (In thousands, except per share data) BALANCE AT JANUARY 1, 2013 $ 2,141 $ 3,026,823 $ (53,848 ) $ (104,042 ) $ (16,507 ) $ 2,854,567 Total comprehensive (loss) — — — (641,832 ) 54,199 (587,633 ) Dividends on common shares ($1.20 per share) — — — (25,475 ) — (25,475 ) Issuance of 39 shares of common stock under the stock incentive plan — restricted stock and restricted stock units, net of forfeitures 0 0 — — — — Employee stock-based compensation expense — 11,790 — — — 11,790 BALANCE AT DECEMBER 31, 2013 2,141 3,038,613 (53,848 ) (771,349 ) 37,692 2,253,249 Total comprehensive income (loss) — — — (558,353 ) (34,451 ) (592,804 ) Dividends on common shares ($0.10 per share) — — — (2,123 ) — (2,123 ) Treasury shares purchased 0 0 (15 ) — — (15 ) Employee stock-based compensation expense — 9,847 — — — 9,847 BALANCE AT DECEMBER 31, 2014 2,141 3,048,460 (53,863 ) (1,331,825 ) 3,241 1,668,154 Total comprehensive income (loss) — — — (2,913,142 ) (5,056 ) (2,918,198 ) Issuance of 64 shares of common stock under the stock incentive plan-restricted stock and restricted stock units, net of forfeitures 4 (9 ) (5 ) Employee stock-based compensation expense — 5,760 — — — 5,760 BALANCE AT DECEMBER 31, 2015 $ 2,145 $ 3,054,211 $ (53,863 ) $ (4,244,967 ) $ (1,815 ) $ (1,244,289 ) ” Deferred Mine Development Coal sales revenue related to incidental production during the development phase will be recorded as coal sales revenue with an offset to cost of coal sales based on the estimated cost per ton sold for the mine when the asset is in place for its intended use. payments. amortization of deferred financing fees related to outstanding debt, see Note 14 to the Consolidated Financial Statements, “Debt and Financing Arrangements.” recorded in other comprehensive income or loss. Amounts in other comprehensive income or loss are reclassified to earnings when the hedged transaction affects earnings and are classified in a manner consistent with the transaction being hedged. The Company formally documents the relationships between hedging instruments and the respective hedged items, as well as its risk management objectives for hedge transactions. periods disclosed within. Not Yet Effective statements. first quarter of 2018. the valuation, the fair value would be considered Level 3 in the fair value hierarchy. Year Ended 2013 Total Revenues $ 219,002 Income from discontinued operations before income taxes $ 32,167 Gain on sale 120,321 Less: income tax expense 49,092 Income from discontinued operations, including gain on sale - net of tax $ 103,396 Basic earnings per common share from discontinued operations $ 4.87 Diluted earnings per common share from discontinued operations $ 4.87 October 1, 2016; contractual interest during this time was Pension, Postretirement Accumulated and Other Post- Other Derivative Employment Available-for- Comprehensive Instruments Benefits Sale Securities Income (Loss) (In thousands) Balance at January 1, 2014 $ 565 $ 31,112 $ 6,015 $ 37,692 Unrealized gains 3,677 (22,516 ) (5,727 ) (24,566 ) Amounts reclassified from accumulated other comprehensive income (loss) (1,692 ) (5,736 ) (2,457 ) (9,885 ) Balance at December 31, 2014 2,550 2,860 (2,169 ) 3,241 Unrealized gains (losses) 3,903 (8,723 ) (3,333 ) (8,153 ) Amounts reclassified from accumulated other comprehensive income (loss) (6,128 ) 5,142 4,083 3,097 Balance at December 31, 2015 $ 325 $ (721 ) $ (1,419 ) $ (1,815 ) Details about accumulated Reclassifications Line Item in the 2015 2014 (in thousands) Derivative instruments $ 9,575 $ 2,643 Revenues (3,447 ) (951 ) Provision for (benefit from) income taxes $ 6,128 $ 1,692 Net of tax Pension, postretirement and other post-employment benefits Amortization of prior service credits $ 8,335 (1) $ 11,760 Amortization of net actuarial gains (losses) (16,369 )(1) (2,797 ) (8,034 ) 8,963 Total before tax 2,892 (3,227 ) Provision for (benefit from) income taxes $ (5,142 ) $ 5,736 Net of tax Available-for-sale securities $ (6,391 )(2) $ 3,838 Interest and investment income 2,308 (1,381 ) Provision for (benefit from) income taxes $ (4,083 ) $ 2,457 Net of tax Year Ended December 31, Description 2015 2014 2013 (In thousands) Coal lands and mineral rights $ 2,210,488 $ — $ 79,094 Plant and equipment 199,107 1,512 36,296 Deferred development 159,474 — 13,451 Prepaid royalties 41,990 15,356 1,104 Equity investments 21,325 — 28,947 Notes receivable — — 49,203 Inventories 66 — 12,765 Other (4,147 ) 7,245 19 Total $ 2,628,303 $ 24,113 $ 220,879 Operations: $74.1 million recorded in the first quarter related to the impairment of coal reserves and surface land in Kentucky that are being leased to a mining company that idled its mining operations; $3.4 million recorded in the first quarter related to the impairment on the portion of an advance royalty balance on a reserve base mined at the Company’s Mountain Laurel operation that will not be recouped; $2.9 million recorded in the first quarter related to an other-than-temporary-impairment charge on an available-for-sale security; a $38.0 million impairment recorded in the second quarter related to the Company’s equity investment in a brownfield bulk commodity terminal on the Columbia River in Longview, Washington as the Company relinquished its ownership rights in exchange for future throughput rights; $7.2 million of severance expense related to headcount reductions during the first half of the year; a $3.6 million curtailment charge related to the Company’s pension, postretirement health and black lung actuarial liabilities due to headcount reductions in the first half of the year. (In thousands) Balance at January 1, 2013 $ 265,423 Impairment (265,423 ) Balance at December 31, 2013 $ — 7. Losses from disposed operations resulting from Patriot Coal bankruptcy Court for the Eastern District of Virginia. Subsequently, on October 28, 2015, Patriot’s Plan of Reorganization was approved, including an authorization to reject their collective bargaining agreements and modify certain union-related retiree benefits. As a result of the Plan of Reorganization, the Company became statutorily responsible for retiree medical benefits pursuant to Section 9711 of the Coal Industry Retiree Health Benefit Act of 1992 for certain retirees of Magnum who retired prior to October 1, 1994. In addition, the Company 8. Inventories December 31, 2015 2014 (In thousands) Coal $ 85,043 $ 71,901 Repair parts and supplies 111,677 118,352 $ 196,720 $ 190,253 2016. December 31, 2015 Balance Sheet Gross Gross Classification Unrealized Unrealized Fair Short-Term Other Cost Basis Gains Losses Value Investments Assets (In thousands) Available-for-sale: U.S. government and agency securities $ 10,007 $ — $ (12 ) $ 9,995 $ 9,995 Corporate notes and bonds 190,496 — (299 ) 190,197 190,197 — Equity securities 3,938 668 (2,888 ) 1,718 — 1,718 Total Investments $ 204,441 $ 668 $ (3,199 ) $ 201,910 $ 200,192 $ 1,718 December 31, 2014 Balance Sheet Gross Gross Classification Unrealized Unrealized Fair Short-Term Other Cost Basis Gains Losses Value Investments Assets (In thousands) Available-for-sale: Corporate notes and bonds $ 253,590 $ — $ (4,636 ) $ 248,954 $ 248,954 $ — Equity securities 3,910 4,125 (2,890 ) 5,145 — 5,145 Total Investments $ 257,500 $ 4,125 $ (7,526 ) $ 254,099 $ 248,954 $ 5,145 The debt securities outstanding at December 31, Investee Knight DTA Millennium Tongue DKRW Tenaska Other Total Balance at January 1, 2013 $ 149,063 $ 15,462 $ 32,214 $ 14,697 $ 15,515 $ 15,264 $ — $ 242,215 Advances to (distributions from) affiliates, net (13,536 ) 3,644 6,476 4,004 — — 200 788 Equity in comprehensive income (loss) 17,279 (4,969 ) (2,796 ) (282 ) (1,832 ) — — 7,400 Impairment of equity investment — — — — (13,683 ) (15,264 ) — (28,947 ) Balance at December 31, 2013 152,806 14,137 35,894 18,419 — — 200 221,456 Advances to (distributions from) affiliates, net (12,603 ) 3,774 6,742 2,541 — — 3,600 4,054 Equity in comprehensive income (loss) 18,274 (4,173 ) (2,413 ) (220 ) — — (1,136 ) 10,332 Balance at December 31, 2014 158,477 13,738 40,223 20,740 — — 2,664 235,842 Advances to (distributions from) affiliates, net (29,862 ) 3,207 7,052 913 — — 330 (18,360 ) Equity in comprehensive income (loss) 22,977 (3,706 ) (9,686 ) (328 ) — — (1,278 ) 7,979 Impairment of equity investment — — — (21,325 ) — — — (21,325 ) Sale of equity investment — — — — — — (2,259 ) $ (2,259 ) Balance at December 31, 2015 $ 151,592 $ 13,239 $ 37,589 $ — $ — $ — $ (543 ) $ 201,877 Company recorded an impairment charge of $21.3 million representing the entire value of the Company’s investment in the project; the impairment charge is included on the line “Asset impairment and mine closure costs.” December 31, 2015 December 31, 2014 Assets Liabilities Net Total Assets Liabilities Net Total (In thousands) (In thousands) Acquired fair value $ 131,299 $ 166,697 $ 131,299 $ 166,697 Accumulated amortization (130,839 ) (151,354 ) (130,363 ) (134,988 ) Total $ 460 $ 15,343 $ (14,883 ) $ 936 $ 31,709 $ (30,773 ) Balance Sheet classification: Other current $ 460 $ 3,852 $ 462 $ 12,453 Other noncurrent $ — $ 11,491 $ 474 $ 19,256 $1.84. or purchases of coal or to the risk of changes in the fair value of a fixed price physical sales contract. Certain derivative contracts may be designated as hedges of these risks. (Tons in thousands) 2016 2017 Total Coal sales 480 — 480 Coal purchases 255 — 255 2018. December 31, 2015 December 31, 2014 Fair Value of Derivatives Asset Liability Asset Liability (In thousands) Derivative Derivative Derivative Derivative Derivatives Designated as Hedging Instruments Coal $ 4 $ (20 ) $ 6,535 $ (2,492 ) Derivatives Not Designated as Hedging Instruments Heating oil — diesel purchases 1,017 — 300 — Coal held for trading purposes, exchange traded swaps and futures 110,653 (104,814 ) 96,898 (93,272 ) Coal — risk management 3,912 (1,947 ) 8,510 (3,688 ) Natural gas 494 (247 ) — — Total 116,076 (107,008 ) 105,708 (96,960 ) Total derivatives 116,080 (107,028 ) 112,243 (99,452 ) Effect of counterparty netting (107,028 ) 107,028 (98,686 ) 98,686 Net derivatives as classified in the balance sheets $ 9,052 $ — $ 9,052 $ 13,557 $ (766 ) $ 12,791 December 31, 2015 2014 Net derivatives as reflected on the balance sheets Heating oil Other current assets $ 1,017 $ 300 Coal Coal derivative assets 8,035 13,257 Accrued expenses and other current liabilities — (766 ) $ 9,052 $ 12,791 The Company had a current asset for the right to reclaim cash collateral of Gain (Loss) Recognized in Other Gains (Losses) Reclassified from Other 2015 2014 2013 2015 2014 2013 Coal sales(1) $ 12,816 $ 10,842 (338 ) $ 18,635 $ 5,336 $ 3,664 Coal purchases(2) (6,718 ) (5,097 ) 526 (9,060 ) (2,693 ) (683 ) $ 6,098 $ 5,745 $ 188 $ 9,575 $ 2,643 $ 2,981 noted periods, respective periods. Gain (Loss) Recognized 2015 2014 2013 Coal — unrealized(3) $ (3,883 ) $ 430 $ (12,700 ) Coal — realized(4) $ 3,236 $ 5,956 $ 32,534 Heating oil — diesel purchases(4) $ (8,294 ) $ (7,848 ) $ (9,791 ) Heating oil — fuel surcharges(4) $ — $ (405 ) $ (947 ) Natural gas $ 878 $ — $ — Foreign currency $ (887 ) $ — $ — 13. Accrued Expenses and Other Current Liabilities December 31, 2015 2014 (In thousands) Payroll and employee benefits $ 58,423 $ 73,362 Taxes other than income taxes 104,755 114,598 Interest 119,785 30,384 Acquired sales contracts 3,852 12,453 Workers’ compensation 16,875 16,714 Asset retirement obligations 13,795 19,222 Other 11,965 35,663 $ 329,450 $ 302,396 December 31, 2015 2014 (In thousands) Term loan due 2018 ($1.9 billion and $1.93 billion face value, respectively) $ 1,875,429 $ 1,890,846 7.00% senior notes due 2019 at par 1,000,000 1,000,000 8.00% senior secured notes due 2019 at par 350,000 350,000 9.875% senior notes ($375.0 million face value) due 2019 365,600 363,493 7.25% senior notes due 2020 at par 500,000 500,000 7.25% senior notes due 2021 at par 1,000,000 1,000,000 Other 47,134 56,031 5,138,163 5,160,370 Less current maturities of debt 5,107,210 36,885 Long-term debt $ 30,953 $ 5,123,485 Debt Maturities Year 2016 $ 35,674 2017 30,484 2018 1,858,567 2019 1,731,317 2020 501,642 Thereafter 1,000,574 $ 5,158,258 Additionally, the Company incurred $24.2 million of legal fees and financial advisory fees associated with debt restructuring activities during 2015. During the year ended December 31, 2015 the Company wrote off $3.7 million of deferred financing costs related to the termination of the revolver facility. Year Ended December 31 2015 2014 2013 (In thousands) Current: Federal $ — $ — $ — State 3 25 (647 ) Total current 3 25 (647 ) Deferred: Federal (329,393 ) 18,535 (318,956 ) State (43,990 ) 7,074 (15,895 ) Total deferred (373,383 ) 25,609 (334,851 ) $ (373,380 ) $ 25,634 $ (335,498 ) Year Ended December 31 2015 2014 2013 (In thousands) Income tax provision (benefit) at statutory rate $ (1,150,283 ) $ (186,452 ) $ (378,463 ) Percentage depletion allowance (19,035 ) (12,692 ) (15,796 ) Goodwill — — 70,301 State taxes, net of effect of federal taxes (76,445 ) (3,903 ) (25,265 ) Change in valuation allowance 865,146 226,929 8,659 Other, net 7,237 1,752 5,066 $ (373,380 ) $ 25,634 $ (335,498 ) December 31, 2015 2014 (In thousands) Deferred tax assets: Net operating loss carryforwards $ 1,086,332 $ 871,848 Alternative minimum tax credit carryforwards 120,994 127,169 Reclamation and mine closure 121,276 114,430 Goodwill 38,671 50,072 Workers’ compensation 42,835 38,924 Share based compensation 22,612 30,283 Acquired sales contracts 17,466 26,833 Retiree benefit plans 16,996 22,913 Contract obligations — 15,693 Advance royalties 18,751 — Losses from disposed operations resulting from Patriot Coal bankruptcy 39,287 — Other, primarily accrued liabilities 45,303 64,503 Gross deferred tax assets 1,570,523 1,362,668 Valuation allowance (1,135,399 ) (270,251 ) Total deferred tax assets 435,124 1,092,417 Deferred tax liabilities: Plant and equipment 389,169 1,354,396 Deferred development 41,047 95,129 Investment in tax partnerships — 7,377 Other 4,706 5,533 Total deferred tax liabilities 434,922 1,462,435 Net deferred (asset) liability (202 ) 370,018 The future annual usage of NOLs and AMT credit will be limited under IRC section 382. (In thousands) Balance at January 1, 2013 $ 31,150 Additions based on tax positions related to the current year 1,199 Additions for tax positions of prior years 688 Reductions as a result of lapses in the statute of limitations (1,248 ) Balance at December 31, 2013 31,789 Additions based on tax positions related to the current year 2,920 Balance at December 31, 2014 34,709 Additions for tax positions of the current year 4,168 Balance at December 31, 2015 $ 38,877 ponds and water treatment. Year Ended December 31, 2015 2014 (In thousands) Balance at January 1 (including current portion) $ 418,118 $ 427,653 Accretion expense 33,680 32,909 Obligations of divested operations (334 ) (30,684 ) Adjustments to the liability from changes in estimates (28,570 ) 627 Liabilities settled (12,440 ) (12,387 ) Balance at December 31 $ 410,454 $ 418,118 Current portion included in accrued expenses (13,795 ) (19,222 ) Noncurrent liability $ 396,659 $ 398,896 2016. Fair Value at December 31, 2015 Total Level 1 Level 2 Level 3 (In thousands) Assets: Investments in marketable securities $ 201,910 $ 11,713 $ 190,197 $ — Derivatives 9,052 5,597 1,023 2,432 Total assets $ 210,962 $ 17,310 $ 191,220 $ 2,432 Liabilities: Derivatives $ — $ — $ — $ — Fair Value at December 31, 2014 Total Level 1 Level 2 Level 3 (In thousands) Assets: Investments in marketable securities $ 254,099 $ 5,145 $ 248,954 $ — Derivatives 13,557 9,026 1,491 3,040 Total assets $ 267,656 $ 14,171 $ 250,445 $ 3,040 Liabilities: Derivatives $ 766 $ — $ 766 $ — Year Ended December 31, 2015 2014 (In thousands) Balance, beginning of period $ 3,040 $ 4,946 Realized and unrealized losses recognized in earnings, net (8,602 ) (6,572 ) Included in other comprehensive income (1,341 ) — Purchases 13,541 5,288 Issuances (4,046 ) (622 ) Settlements (160 ) — Ending balance $ 2,432 $ 3,040 Net unrealized 2017. shares remains fixed. Weighted Average Aggregate Average Common Exercise Intrinsic Remaining Shares Price Value Life (In thousands) (years) Options outstanding at January 1 682 $ 198.41 Canceled (17 ) $ 151.72 Expired (10 ) $ 300.62 Options outstanding at December 31 655 $ 198.15 $ — 4.6 Options exercisable at December 31 488 $ 213.00 — 4.4 Unvested options at December 31 167 Year Ended 2013 Weighted average grant-date fair value per share of options granted $ 23.70 Assumptions (weighted average): Risk-free interest rate 0.65 % Expected dividend yield 2.30 % Expected volatility 66.7 % Expected life (in years) 4.5 Restricted Stock Restricted Stock Units Weighted Weighted Common Grant-Date Common Grant-Date Shares Fair Value Shares Fair Value (In thousands) (In thousands) Outstanding at January 1 2 $ 134.42 307 $ 60.53 Granted — — 169 12.84 Vested (2 ) 134.42 (66 ) 104.90 Canceled — — (21 ) 35.81 Outstanding at December 31 — — 389 33.69 2016. As of December 31, 2017, there was $32.4 million of unrecognized share-based compensation expense which is expected to be recognized over a weighted-average period of approximately three years. The table below reconciles changes in the occupational disease liability for the respective period. Year Ended December 31, 2015 2014 2013 (In thousands) Total occupational disease $ 15,199 $ 4,432 $ 6,137 Traumatic injury claims and assessments 16,781 19,924 21,089 Total workers’ compensation expense $ 31,980 $ 24,356 $ 27,226 assumptions used to determine the projected occupational disease obligation: December 31, 2015 2014 (In thousands) Occupational disease costs $ 90,836 $ 72,749 Traumatic and other workers’ compensation claims 38,309 38,256 Total obligations 129,145 111,005 Less amount included in accrued expenses 16,875 16,714 Noncurrent obligations $ 112,270 $ 94,291 balance and excess plans were amended to freeze new service credits for any new or active employee. Other Postretirement Pension Benefits Benefits 2015 2014 2015 2014 (In thousands) CHANGE IN BENEFIT OBLIGATIONS Benefit obligations at January 1 $ 353,736 $ 355,468 $ 36,098 $ 42,531 Service cost 9 21,478 866 1,649 Interest cost 14,604 17,070 1,904 1,841 Re-entry of former Magnum employees — — 85,843 — Plan amendments — (23 ) — — Curtailments — (25,787 ) — — Benefits paid (61,955 ) (53,974 ) (3,646 ) (3,431 ) Other-primarily actuarial loss (gain) (5,102 ) 39,504 (17,605 ) (6,492 ) Benefit obligations at December 31 $ 301,292 $ 353,736 $ 103,460 $ 36,098 CHANGE IN PLAN ASSETS Value of plan assets at January 1 $ 336,709 $ 347,952 $ — $ — Actual return on plan assets (1,679 ) 36,130 — — Employer contributions 424 6,601 3,646 3,431 Benefits paid (61,955 ) (53,974 ) (3,646 ) (3,431 ) Value of plan assets at December 31 $ 273,499 $ 336,709 $ — $ — Accrued benefit cost $ (27,793 ) $ (17,027 ) $ (103,460 ) $ (36,098 ) ITEMS NOT YET RECOGNIZED AS A COMPONENT OF NET PERIODIC BENEFIT COST Prior service credit (cost) $ — $ — $ 26,944 $ 21,972 Accumulated gain (loss) (16,769 ) (11,332 ) 11,313 9,125 $ (16,769 ) $ (11,332 ) $ 38,257 $ 31,097 BALANCE SHEET AMOUNTS Current liability $ (420 ) $ (767 ) $ (3,650 ) $ (3,430 ) Noncurrent liability $ (27,373 ) $ (16,260 ) $ (99,810 ) $ (32,668 ) $ (27,793 ) $ (17,027 ) $ (103,460 ) $ (36,098 ) Pension Benefits Other Postretirement Benefits Year Ended December 31, Year Ended December 31, 2015 2014 2013 2015 2014 2013 (In thousands) Service cost $ 9 $ 21,478 $ 27,065 $ 866 $ 1,649 $ 2,027 Interest cost 14,604 17,070 16,207 1,904 1,841 1,739 Curtailments — (25,368 ) 47 — — (5,444 ) Settlements 2,656 646 — — — — Expected return on plan assets (20,367 ) (23,756 ) (23,761 ) — — — Amortization of prior service credits — (257 ) (204 ) (8,335 ) (10,003 ) (10,621 ) Amortization of other actuarial losses 8,850 3,128 14,616 (2,109 ) (761 ) (252 ) Net benefit cost (credit) $ 5,752 $ (7,059 ) $ 33,970 $ (7,674 ) $ (7,274 ) $ (12,551 ) the remaining service attribution periods of the employees using the corridor method. Pension Benefits Other Postretirement Benefits 2015 2014 2015 2014 Discount rate 4.59 % 4.15 % 4.57 % 3.91 % Rate of compensation increase N/A N/A N/A N/A periods. Pension Benefits Other Postretirement Benefits 2015 2014 2013 2015 2014 2013 Discount rate 4.15% 5.08/ 4.23/ 4.14% 4.13/ 5.05% 3.91% 4.58% 3.64/ 4.58% Rate of compensation increase N/A N/A 3.39% N/A N/A N/A N/A Expected return on plan assets 7.00% 7.75% 7.75% N/A N/A N/A N/A periods. Total Level 1 Level 2 Level 3 2015 2014 2015 2014 2015 2014 2015 2014 (In thousands) Equity Securities:(A) U.S. small-cap $ 11,640 $ 16,512 $ 11,640 $ 16,512 $ — $ — $ — $ — U.S. mid-cap 28,524 46,481 10,979 17,301 17,545 29,180 — — U.S. large-cap 67,244 89,008 33,249 43,181 33,995 45,827 — — Non-U.S. 18,785 25,905 — — 18,785 25,905 — — Fixed income securities: — — — — — — — — U.S. government securities(B) 18,844 13,708 18,183 12,988 661 720 — — Non-U.S. government securities(C) 766 1,599 — — 766 1,599 — — U.S. government asset and mortgage backed securities(D) 1,056 830 — — 1,056 830 — — Corporate fixed income(E) 39,939 22,702 — — 39,939 22,702 — — State and local government securities(F) 5,725 8,005 — — 5,725 8,005 — — Other fixed income(G) 57,209 83,735 — — 57,209 83,735 — — Short-term investments(H) 3,898 6,818 — — 3,898 6,818 — — Other investments(I) 19,869 21,406 — — 1,234 3,336 18,635 18,070 Total $ 273,499 $ 336,709 $ 74,051 $ 89,982 $ 180,813 $ 228,657 $ 18,635 $ 18,070 (B) U.S. government securities includes agency and treasury debt. These investments are valued using dealer quotes in an active market. Other Pension Postretirement Benefits Benefits (In thousands) 2016 $ 19,164 $ 8,356 2017 20,320 8,341 2018 21,833 8,344 2019 21,341 8,281 2020 21,461 8,245 Next 5 years 106,953 38,178 $ 211,072 $ 79,745 computations: Operating Leases Royalties (In thousands) 2016 $ 20,857 $ 8,947 2017 17,277 13,991 2018 6,412 13,097 2019 3,448 12,295 2020 2,151 11,996 Thereafter 9,807 103,771 $ 59,952 $ 164,097 2016. 2015. 2015. Year Ended December 31, 2015 2014 2013 (In thousands) Europe $ 170,314 $ 277,565 $ 371,363 Asia 96,523 156,057 160,404 North America 40,315 78,445 80,322 Central and South America 55,323 20,496 55,493 Brokered Sales 32,848 79,354 154,442 Total $ 395,323 $ 611,917 $ 822,024 27. Segment Information Kentucky and Virginia. For further information on the divestiture, please see Note 5 to the Consolidated Financial Statements, “Divestitures.” PRB APP All Other Corporate, Consolidated Year Ended December 31, 2015 Revenues $ 1,448,440 $ 834,606 $ 290,214 $ — $ 2,573,260 Adjusted EBITDA 258,300 82,837 17,044 (108,064 ) 250,117 Depreciation, depletion and amortization 176,257 156,273 40,768 6,047 379,345 Amortization of acquired sales contracts, net (4,158 ) (4,653 ) — — (8,811 ) Total assets 1,648,916 843,583 310,949 2,303,290 5,106,738 Capital expenditures 22,535 20,599 11,135 64,755 119,024 Year Ended December 31, 2014 Revenues $ 1,490,377 $ 1,108,358 $ 338,384 $ — $ 2,937,119 Adjusted EBITDA 198,074 110,693 56,612 (85,236 ) 280,143 Depreciation, depletion and amortization 168,522 205,732 40,125 4,369 418,748 Amortization of acquired sales contracts, net (3,961 ) (9,433 ) 207 — (13,187 ) Total assets 1,772,230 3,379,834 339,809 2,937,850 8,429,723 Capital expenditures 44,305 23,638 12,993 66,350 147,286 Year Ended December 31, 2013 Revenues $ 1,482,812 $ 1,145,801 $ 385,744 $ — $ 3,014,357 Adjusted EBITDA 206,910 88,883 94,948 (138,595 ) 252,146 Depreciation, depletion and amortization 171,324 202,952 45,741 6,425 426,442 Amortization of acquired sales contracts, net (3,656 ) (10,364 ) 4,563 — (9,457 ) Total assets 1,841,835 3,971,764 402,922 2,773,672 8,990,193 Capital expenditures 9,784 167,759 23,122 96,319 296,984 Year Ended December 31, 2015 2014 2013 Adjusted EBITDA $ 250,117 $ 280,143 $ 252,146 Depreciation, depletion and amortization (379,345 ) (418,748 ) (426,442 ) Amortization of acquired sales contracts, net 8,811 13,187 9,457 Asset impairment costs (2,628,303 ) (24,113 ) (220,879 ) Goodwill impairment — — (265,423 ) Losses from disposed operations resulting from Patriot Coal bankruptcy (116,343 ) — — Settlement of UMWA legal claims — — (12,000 ) Interest expense, net (393,549 ) (383,188 ) (374,664 ) Nonoperating expense (27,910 ) — (42,921 ) Loss from continuing operations before income taxes $ (3,286,522 ) $ (532,719 ) $ (1,080,726 ) March 31 June 30 September 30 December 31 (a) (a) (a) (a) (In thousands, except per share data) Year Ended December 31, 2015 Revenues $ 677,005 $ 644,462 $ 688,544 563,249 Gross profit (loss) $ 14,256 $ (16,507 ) $ 47,275 (44,964 ) Asset impairment and mine closure costs $ — $ 19,146 $ 2,120,292 488,865 Loss from operations $ (19,712 ) $ (69,546 ) $ (2,236,772 ) $ (539,033 ) Net loss $ (113,195 ) $ (168,103 ) $ (1,999,476 ) $ (632,368 ) Diluted loss per common share $ (5.32 ) $ (7.93 ) $ (93.91 ) $ (29.70 ) March 31 June 30 September 30 December 31 (a) (a) (b) (a) (b) (a) (b) (In thousands, except per share data) Year Ended December 31, 2014 Revenues $ 735,971 $ 713,776 $ 742,180 $ 745,192 Gross profit (loss) $ (49,842 ) $ (6,350 ) $ (5,851 ) $ 32,264 Asset impairment and mine closure costs $ — $ 1,512 $ 5,060 $ 17,541 Loss from operations $ (73,123 ) $ (35,805 ) $ (35,300 ) $ (5,303 ) Net loss $ (124,140 ) $ (96,860 ) $ (97,218 ) $ (240,135 ) Diluted loss per common share $ (5.85 ) $ (4.57 ) $ (4.58 ) $ (11.31 ) Fresh Start Accounting Parent/Issuer Guarantor Non- Eliminations Consolidated (In thousands) Revenues $ — $ 2,573,260 $ — $ — $ 2,573,260 Costs, expenses and other Cost of sales (exclusive of items shown separately below) 22,378 2,186,804 — (2,749 ) 2,206,433 Depreciation, depletion and amortization 3,775 375,568 2 — 379,345 Amortization of acquired sales contracts, net — (8,811 ) — — (8,811 ) Change in fair value of coal derivatives and coal trading activities, net — (1,583 ) — — (1,583 ) Asset impairment and mine closure costs 15,437 2,612,866 — — 2,628,303 Losses from disposed operations resulting from Patriot Coal bankruptcy 116,343 — — — 116,343 Selling, general and administrative expenses 69,384 25,737 5,725 (2,063 ) 98,783 Other operating expense (income), net 5,869 13,021 (4,192 ) 4,812 19,510 233,186 5,203,602 1,535 — 5,438,323 Loss from investment in subsidiaries (2,574,565 ) — — 2,574,565 — Loss from operations (2,807,751 ) (2,630,342 ) (1,535 ) 2,574,565 (2,865,063 ) Interest expense, net Interest expense (478,432 ) (26,284 ) (4,916 ) 111,653 (397,979 ) Interest and investment income 27,510 82,881 5,692 (111,653 ) 4,430 (450,922 ) 56,597 776 — (393,549 ) Net loss resulting from early retirement of debt and debt restructuring (27,910 ) — — — (27,910 ) Loss from continuing operations before income taxes (3,286,583 ) (2,573,745 ) (759 ) 2,574,565 (3,286,522 ) Provision for (benefit from) income taxes (373,441 ) — 61 — (373,380 ) Net loss (2,913,142 ) (2,573,745 ) (820 ) 2,574,565 (2,913,142 ) Total comprehensive loss $ (2,918,198 ) $ (2,579,601 ) $ (820 ) $ 2,580,421 $ (2,918,198 ) Parent/Issuer Guarantor Non- Eliminations Consolidated (In thousands) Revenues $ — $ 2,937,119 $ — $ — $ 2,937,119 Costs, expenses and other Cost of sales (exclusive of items shown separately below) 3,016 2,566,572 — (3,395 ) 2,566,193 Depreciation, depletion and amortization 5,154 413,559 35 — 418,748 Amortization of acquired sales contracts, net — (13,187 ) — — (13,187 ) Change in fair value of coal derivatives and coal trading activities, net — (3,686 ) — — (3,686 ) Asset impairment and mine closure costs 3,642 20,471 — — 24,113 Selling, general and administrative expenses 79,902 29,739 6,626 (2,044 ) 114,223 Other operating income, net (4,480 ) (15,726 ) (4,987 ) 5,439 (19,754 ) 87,234 2,997,742 1,674 — 3,086,650 Loss from investment in subsidiaries (13,085 ) — — 13,085 — Loss from operations (100,319 ) (60,623 ) (1,674 ) 13,085 (149,531 ) Interest expense, net Interest expense (463,823 ) (26,137 ) (4,259 ) 103,273 (390,946 ) Interest and investment income 31,389 74,511 5,131 (103,273 ) 7,758 (432,434 ) 48,374 872 — (383,188 ) Loss from continuing operations before income taxes (532,753 ) (12,249 ) (802 ) 13,085 (532,719 ) Provision for (benefit from) income taxes 25,600 — 34 — 25,634 Net loss (558,353 ) (12,249 ) (836 ) 13,085 (558,353 ) Total comprehensive loss $ (592,804 ) $ (34,439 ) $ (836 ) $ 35,275 $ (592,804 ) Parent/Issuer Guarantor Non- Eliminations Consolidated (In thousands) Revenues $ — $ 3,014,357 $ — $ — $ 3,014,357 Costs, expenses and other — Cost of sales (exclusive of items shown separately below) 9,117 2,657,583 — (3,564 ) 2,663,136 Depreciation, depletion and amortization 5,949 420,458 35 — 426,442 Amortization of acquired sales contracts, net — (9,457 ) — — (9,457 ) Change in fair value of coal derivatives and coal trading activities, net — 7,845 — — 7,845 Asset impairment and mine closure costs 78,150 142,729 — — 220,879 Goodwill impairment — 265,423 — — 265,423 Selling, general and administrative expenses 88,820 39,825 7,038 (2,235 ) 133,448 Other operating income, net 4,209 (34,856 ) (5,370 ) 5,799 (30,218 ) 186,245 3,489,550 1,703 — 3,677,498 Loss from investment in subsidiaries (328,889 ) — — 328,889 — Income (loss) from operations (515,134 ) (475,193 ) (1,703 ) 328,889 (663,141 ) Interest expense, net Interest expense (449,614 ) (24,747 ) (4,214 ) 97,308 (381,267 ) Interest and investment income 30,285 68,248 5,378 (97,308 ) 6,603 (419,329 ) 43,501 1,164 — (374,664 ) Other non-operating expense Net loss resulting from early retirement of debt (42,921 ) — — — (42,921 ) Loss from continuing operations before income taxes (977,384 ) (431,692 ) (539 ) 328,889 (1,080,726 ) Provision for (benefit from) income taxes (335,552 ) — 54 — (335,498 ) Loss from continuing operations (641,832 ) (431,692 ) (593 ) 328,889 (745,228 ) Income from discontinued operations, net of tax — 103,396 — — 103,396 Net Loss (641,832 ) (328,296 ) (593 ) 328,889 (641,832 ) Total comprehensive income (loss) $ (587,633 ) $ (304,278 ) $ (593 ) $ 304,871 $ (587,633 ) Parent/Issuer Guarantor Non- Eliminations Consolidated (In thousands) Assets Cash and cash equivalents $ 337,646 $ 100,428 $ 12,707 $ — $ 450,781 Short term investments 200,192 — — — 200,192 Restricted cash — — 97,542 — 97,542 Receivables 12,463 3,153 124,581 (4,430 ) 135,767 Inventories — 196,720 — — 196,720 Other 83,017 38,794 969 — 122,780 Total current assets 633,318 339,095 235,799 (4,430 ) 1,203,782 Property, plant and equipment, net 7,747 3,610,869 — 413 3,619,029 Investment in subsidiaries 4,887,905 — — (4,887,905 ) — Intercompany receivables — 2,253,312 — (2,253,312 ) — Note receivable from Arch Western 675,000 — — (675,000 ) — Other 39,302 243,806 819 — 283,927 Total assets $ 6,243,272 $ 6,447,082 $ 236,618 $ (7,820,234 ) $ 5,106,738 Liabilities and Stockholders’ Equity (Deficit) Accounts payable $ 8,495 $ 119,633 $ 3 $ — $ 128,131 Accrued expenses and other current liabilities 162,268 170,575 1,037 (4,430 ) 329,450 Current maturities of debt 5,096,460 10,750 — — 5,107,210 Total current liabilities 5,267,223 300,958 1,040 (4,430 ) 5,564,791 Long-term debt — 30,953 — — 30,953 Intercompany payables 2,043,308 — 210,005 (2,253,313 ) — Note payable to Arch Coal — 675,000 — (675,000 ) — Asset retirement obligations 1,005 395,654 — — 396,659 Accrued pension benefits 12,390 14,983 — — 27,373 Accrued postretirement benefits other than pension 79,826 19,984 — — 99,810 Accrued workers’ compensation 24,247 88,023 — — 112,270 Deferred income taxes — — — — — Other noncurrent liabilities 59,976 58,847 348 — 119,171 Total liabilities 7,487,975 1,584,402 211,393 (2,932,743 ) 6,351,027 Stockholders’ equity (deficit) (1,244,703 ) 4,862,680 25,225 (4,887,491 ) (1,244,289 ) Total liabilities and stockholders’ equity (deficit) $ 6,243,272 $ 6,447,082 $ 236,618 $ (7,820,234 ) $ 5,106,738 Parent/Issuer Guarantor Non- Eliminations Consolidated (In thousands) Assets Cash and cash equivalents $ 572,185 $ 150,358 $ 11,688 $ — $ 734,231 Short term investments 248,954 — — — 248,954 Restricted cash — — 5,678 — 5,678 Receivables 9,656 15,933 211,043 (4,615 ) 232,017 Inventories — 190,253 — — 190,253 Other 89,211 41,455 952 — 131,618 Total current assets 920,006 397,999 229,361 (4,615 ) 1,542,751 Property, plant and equipment, net 10,470 6,442,623 2 363 6,453,458 Investment in subsidiaries 7,464,221 — — (7,464,221 ) — Intercompany receivables 2,021,110 — (2,021,110 ) — Note receivable from Arch Western 675,000 — — (675,000 ) — Other 131,884 300,058 1,572 — 433,514 Total assets $ 9,201,581 $ 9,161,790 $ 230,935 $ (10,164,583 ) $ 8,429,723 Liabilities and Stockholders’ Equity Accounts payable $ 23,394 $ 156,664 $ 55 $ — $ 180,113 Accrued expenses and other current liabilities 85,899 220,017 1,095 (4,615 ) 302,396 Current maturities of debt 27,625 9,260 — — 36,885 Total current liabilities 136,918 385,941 1,150 (4,615 ) 519,394 Long-term debt 5,084,839 38,646 — 5,123,485 Intercompany payables 1,817,755 — 203,355 (2,021,110 ) — Note payable to Arch Coal — 675,000 — (675,000 ) — Asset retirement obligations 981 397,915 — — 398,896 Accrued pension benefits 5,967 10,293 — — 16,260 Accrued postretirement benefits other than pension 4,430 28,238 — — 32,668 Accrued workers’ compensation 9,172 85,119 — — 94,291 Deferred income taxes 422,809 — — — 422,809 Other noncurrent liabilities 50,919 102,461 386 — 153,766 Total liabilities 7,533,790 1,723,613 204,891 (2,700,725 ) 6,761,569 Stockholders’ equity 1,667,791 7,438,177 26,044 (7,463,858 ) 1,668,154 Total liabilities and stockholders’ equity $ 9,201,581 $ 9,161,790 $ 230,935 $ (10,164,583 ) $ 8,429,723 Parent/Issuer Guarantor Non- Eliminations Consolidated (In thousands) Cash provided by (used in) operating activities $ (445,136 ) $ 314,535 $ 86,234 $ — $ (44,367 ) Investing Activities Capital expenditures (1,108 ) (117,916 ) — — (119,024 ) Additions to prepaid royalties — (5,871 ) — — (5,871 ) Proceeds from disposals and divestitures — 2,191 — — 2,191 Purchases of short term investments (246,735 ) — — — (246,735 ) Proceeds from sales of short term investments 290,205 — — — 290,205 Proceeds from sales of equity investments and securities — 2,259 — — 2,259 Withdrawals (deposits) of restricted cash — — (91,864 ) — (91,864 ) Investments in and advances to affiliates (913 ) (10,589 ) — — (11,502 ) Cash provided by (used in) investing activities 41,449 (129,926 ) (91,864 ) — (180,341 ) Financing Activities Payments on term loan (19,500 ) — — — (19,500 ) Net payments on other debt (2,692 ) (8,640 ) — — (11,332 ) Expenses related to debt restructuring (27,910 ) — — — (27,910 ) Transactions with affiliates, net 219,250 (225,899 ) 6,649 — — Cash provided by (used in) financing activities 169,148 (234,539 ) 6,649 — (58,742 ) Increase (decrease) in cash and cash equivalents (234,539 ) (49,930 ) 1,019 — (283,450 ) Cash and cash equivalents, beginning of period 572,185 150,358 11,688 — 734,231 Cash and cash equivalents, end of period $ 337,646 $ 100,428 $ 12,707 $ — $ 450,781 Parent/Issuer Guarantor Non- Eliminations Consolidated (In thousands) Cash provided by (used in) operating activities $ (324,688 ) $ 305,048 $ (13,942 ) $ — $ (33,582 ) Investing Activities Capital expenditures (2,700 ) (144,586 ) — — (147,286 ) Additions to prepaid royalties — (7,317 ) — — (7,317 ) Proceeds from disposals and divestitures 57,625 4,733 — — 62,358 Purchases of short term investments (211,929 ) — — — (211,929 ) Proceeds from sales of short term investments 205,611 — — — 205,611 Proceeds from sales of investments in equity securities 9,464 — — — 9,464 Withdrawals (deposits) of restricted cash — — (5,678 ) — (5,678 ) Investments in and advances to affiliates (2,541 ) (14,116 ) — — (16,657 ) Cash provided by (used in) investing activities 55,530 (161,286 ) (5,678 ) — (111,434 ) Financing Activities Payments on term loan (19,500 ) — — — (19,500 ) Net payments on other debt (1,258 ) (4,437 ) — — (5,695 ) Debt financing costs (2,219 ) — (2,300 ) — (4,519 ) Dividends paid (2,123 ) — — — (2,123 ) Other (15 ) — — — (15 ) Transactions with affiliates, net 67,125 (89,385 ) 22,260 — — Cash provided by (used in) financing activities 42,010 (93,822 ) 19,960 — (31,852 ) Increase (decrease) in cash and cash equivalents (227,148 ) 49,940 340 — (176,868 ) Cash and cash equivalents, beginning of period 799,333 100,418 11,348 — 911,099 Cash and cash equivalents, end of period $ 572,185 $ 150,358 $ 11,688 $ — $ 734,231 Parent/Issuer Guarantor Non- Eliminations Consolidated (In thousands) Cash provided by (used in) operating activities $ (632,060 ) $ 637,193 $ 50,609 $ — $ 55,742 Investing Activities Capital expenditures (3,320 ) (293,664 ) — — (296,984 ) Proceeds from disposals and divestitures — 433,453 — — 433,453 Proceeds from sales-leaseback transaction — 34,919 — — 34,919 Investments in and advances to affiliates (5,451 ) (10,321 ) — 512 (15,260 ) Purchases of short term investments (213,726 ) — — — (213,726 ) Proceeds from sales of short term investments 194,537 — — — 194,537 Additions to prepaid royalties — (14,947 ) — — (14,947 ) Change in restricted cash 3,453 — — — 3,453 Cash provided by (used in) investing activities (24,507 ) 149,440 — 512 125,445 Financing Activities Contributions from parent — 512 — (512 ) — Proceeds from term loan and senior notes 644,000 — — — 644,000 Payments to retire debt (628,660 ) — — — (628,660 ) Payments on term loan (17,250 ) — — — (17,250 ) Net payments on other debt (6,324 ) (512 ) — — (6,836 ) Debt financing costs (19,864 ) — (625 ) — (20,489 ) Dividends paid (25,475 ) — — — (25,475 ) Transactions with affiliates, net 838,160 (786,683 ) (51,477 ) — — Cash provided by (used in) financing activities 784,587 (786,683 ) (52,102 ) (512 ) (54,710 ) Increase in cash and cash equivalents 128,020 (50 ) (1,493 ) — 126,477 Cash and cash equivalents, beginning of period 671,313 100,468 12,841 — 784,622 Cash and cash equivalents, end of period $ 799,333 $ 100,418 $ 11,348 $ — $ 911,099 Additions (Reductions) Balance at Charged to Charged to Balance at Beginning of Costs and Other End of Year Expenses Accounts Deductions (a) Year (In thousands) Year ended December 31, 2015 Reserves deducted from asset accounts: Accounts receivable and other receivables $ 159 $ 7,683 $ — $ — $ 7,842 Current assets — supplies and inventory 6,625 431 — (b) 1,065 5,991 Deferred income taxes 270,251 865,148 — — 1,135,399 Year ended December 31, 2014 Reserves deducted from asset accounts: Accounts receivable and other receivables $ 775 $ — $ — $ 616 $ 159 Current assets — supplies and inventory 8,446 580 (76 )(b) 2,325 6,625 Deferred income taxes 43,322 226,929 — — 270,251 Year ended December 31, 2013 Reserves deducted from asset accounts: Accounts receivable and other receivables $ 1,043 $ 346 $ — $ 614 $ 775 Current assets — supplies and inventory 12,589 503 (2,274 ) 2,372 $ 8,446 Deferred income taxes 34,663 8,659 — — $ 43,322

Title of Each Class OTC Pinko¨o¨ No xo¨o¨oxor a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company,” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act.oxx¨o¨o¨o¨ No x20152017 was approximately $72.4 million.$1.7 billion.12, 201616, 2018 there were 21,446,23320,986,812 shares of the registrant’s common stock outstanding.