related to the exchange of American Depositary Shares and common shares of Nabriva Austria for ordinary shares of Nabriva Ireland, which resulted in Nabriva Ireland, a new Irish holding company, becoming the ultimate holding company of Nabriva Austria (the predecessor registrant and former ultimate holding company) and its subsidiaries, which we refer to as the Redomiciliation Transaction. On October 19, 2017, Nabriva Austria was converted into a limited liability company under Austrian law and renamed Nabriva Therapeutics GmbH.

Unless the context requires otherwise, all references in this Annual Report to "Nabriva," "the Nabriva Group," "the Company," "we," "ours," "us," or similar terms on or prior to June 23, 2017 (the effective date of the Redomiciliation Transaction), refer to our predecessor, Nabriva Therapeutics AG, together with its subsidiaries.

Overview

Overview

We are a clinical stage biopharmaceutical company engaged in the research and development of novel anti-infective agents to treat serious infections, with a focus oninfections. We have two product candidates that have been submitted to the pleuromutilin class of antibiotics. We are developing our lead product candidate,U.S. Food and Drug Administration, or the FDA, for approval: lefamulin, to bepotentially the first pleuromutilin antibiotic available for systemicoral and intravenous (or IV) administration in humans. We are developing both intravenous, or IV, and oral formulations of lefamulinhumans, for the treatment of community-acquired bacterial pneumonia, or CABP and intend toCONTEPO, a potentially first-in-class epoxide antibiotic for IV use in the United States for complicated urinary tract infections, or cUTI. We may potentially develop lefamulin and CONTEPO for additional indicationsindications. Both lefamulin formulations and CONTEPO were granted Qualified Infectious Disease Product, or QIDP, and Fast Track designation by the FDA, enabling priority review of the New Drug Applications, or the NDAs by the FDA.

Lefamulin

Lefamulin is a semi-synthetic pleuromutilin antibiotic discovered and developed by our team with the potential to be first-in-class for IV and oral administration in humans. It inhibits the synthesis of bacterial protein, which is required for bacteria to grow by binding with high affinity and specificity at molecular targets that are different than other than pneumonia. We have completed a Phase 2 clinical trial of lefamulin for acute bacterial skin and skin structure infections, or ABSSSI.antibiotic classes. Based on the clinical results of lefamulin for ABSSSI, as well as its rapid tissue distribution, including substantial penetration into lung fluids and lung immune cells, we have initiatedfrom two pivotal, internationalglobal, Phase 3 clinical trials, ofwe believe lefamulin is well-positioned for use as first-line monotherapy for the treatment of moderateCABP due to severe CABP.

its novel mechanism of action, targeted spectrum of activity, resistance profile, achievement of substantial drug concentrations in lung tissue and fluid, availability of oral and IV formulations and a generally well-tolerated profile. We initiated the first of our Phase 3 trials, which we refer to as LEAP 1, in September 2015 and initiated the second trial, which we refer to as LEAP 2, in April 2016. These are the first clinical trials we have conducted withbelieve lefamulin represents a potentially important new treatment option for the treatment of CABP. Both trials are designedfive to follow draft guidance published bysix million adults in the United States diagnosed with CABP each year.

We submitted two NDAs to the FDA for the developmentoral and IV formulations of drugs for CABP and guidance from the European Medicines Agency, or EMA, for the development of antibacterial agents. Based on our estimates regarding patient enrollment, we expect to have top-line data from LEAP 1 in the third quarter of 2017. With respect to LEAP 2, based on current projections, we expect to complete patient enrollment in the fourth quarter of 2017, and we anticipate receiving top-line data for LEAP 2 in the first quarter of 2018. If the results of these trials are favorable, including achievement of the primary efficacy endpoints of the trials, we expect to submit applications for marketing approval for lefamulin for the treatment of CABP in December 2018. The FDA has granted us a Prescription Drug User Fee Act, or PDUFA, target action date of August 19, 2019 for lefamulin. We plan to submit a marketing authorization application for lefamulin in Europe in the first half of 2019. The two NDAs for lefamulin are supported by two pivotal, Phase 3 clinical trials (known as LEAP 1 and LEAP 2) that evaluated the safety and efficacy of IV and oral lefamulin compared to moxifloxacin in the treatment of adults with CABP, including the option to switch from IV to oral administration and a short course oral treatment with lefamulin. In both LEAP 1 and LEAP 2, lefamulin was demonstrated to be non-inferior to moxifloxacin, and met both the United StatesFDA and Europe in 2018. We believe that lefamulin is well suited for use as a first-line empiric monotherapyEuropean Medicines Agency, or EMA primary and secondary efficacy endpoints for the treatment of CABP because of its novel mechanism of action, spectrum of activity, including against multi-drug resistant pathogens, achievement of substantial drug concentrations in lung fluidsCABP. Lefamulin was also shown to be generally well-tolerated when administered both orally and lung immune cells, availability as both an IV and oral formulation and favorable safety and tolerability profile.

The U.S. Food and Drug Administration, or FDA, has designated each of the IV and oral formulations of lefamulin as a qualified infectious disease product, or QIDP, which provides for the extension of statutory exclusivity periods in the United States for an additional five years upon FDA approval of the product for the treatment of CABP and granted fast track designation to these formulations of lefamulin. Fast track designation is granted by the FDA to facilitate the development and expedite the review of drugs that treat serious conditions and fill an unmet medical need. The fast track designation for the IV and oral formulations of lefamulin will allow for more frequent interactions with the FDA, the opportunity for a rolling review of any new drug application, or NDA, we submit and eligibility for priority review and a shortening of the FDA’s goal for taking action on a marketing application from ten months to six months.

intravenously.

We believe that pleuromutilin antibiotics can help address the major public health threat posed by bacterial resistance, which the World Health Organization, or WHO, characterized in 20102017 as one of the three greatestbiggest threats to human health. Increasing resistance to antibiotics used to treat CABP is a growing concern and has become an issue in selecting the appropriate initial antibiotic treatment prior to determining the specific microbiological cause of the infection, referred to as empiric treatment. For example, the U.S. Centers for Disease Control and Prevention, or CDC, has classifiedStreptococcus pneumoniae, the most common respiratory pathogen, as a serious threat to human health as a result of increasing resistance to currently available antibiotics. In addition, the CDC recently reported on the growing evidence of widespread resistance to macrolides, widely used antibiotics that disrupt bacterial protein synthesis, inMycoplasma pneumoniae, a common cause of CABP that is associated with significant morbidity and mortality. Furthermore,Staphylococcus aureus, including methicillin-resistantS. aureus, or MRSA, which has also been designated as a serious threat to human health by the CDC,

has emerged as a more common cause of CABP in some regions of the world, and a possible pathogen to be covered with empiric therapy.

In recognition of the growing need for the development of new antibiotics, recent regulatory changes, including priority review and regulatory guidance enabling smaller clinical trials, have led to renewed interest from the pharmaceutical industry in anti-infective development. For example, the Food and Drug Administration Safety and Innovation Act became law in 2012 and included the Generating Antibiotic

Incentives Now Act, or the GAIN Act, which provides incentives, including access to expedited FDA review for approval, fast track designation and five years of potential data exclusivity extension for the development of new QIDPs.

As a result of increasing resistance to antibiotics and the wide array of potential pathogens that cause CABP, the current standard of care for hospitalized patients with CABP whose treatment is initiated in the hospital usually involves first-line empiric treatment with a combination of antibiotics (cephalosporins and macrolides) to address all likely bacterial pathogens or monotherapy with a fluoroquinolone antibiotic.respiratory fluoroquinolone. Combination therapy presents the logistical challenge of administering multiple drugs with different dosing regimens, with some drugs available only as IV, and increases the risk of drug-drug interactions and the potential for serious side effects. Fluoroquinolones are associated with safety and tolerability concerns, including a relatively high risk for developingClostridium difficile infections. In addition, infection and increasing rates of resistance for uropathogens. We believe these concerns have resulted in May 2016, thea decreasing use of fluoroquinolones and restriction of their use within a growing number of hospitals.

The FDA announcedhas communicated safety information about fluoroquinolones, advising that an FDA safety review has shown that fluoroquinolones, when used systemically, in the form of tablets, capsules and injectable, fluoroquinolones are associated with disabling and potentially permanent serious side effects thateffects. In December 2018, the FDA warned prescribers of an increase in the occurrence of rare but serious events of ruptures or tears in the main artery of the body, called the aorta. These tears, called aortic dissections, or ruptures of an aortic aneurysm can occur together. Theselead to dangerous bleeding or even death. Prior communications pertaining to the safety of fluoroquinolones occurred in July 2018 (significant decreases in blood sugar and certain mental health side effects), July 2016 (disabling side effects can involveof the tendons, muscles, joints, nerves, and central nervous system.system), May 2016 (restricting use for certain uncomplicated infections), August 2013 (peripheral neuropathy), and July 2008 (tendinitis and tendon rupture). The European Medicines Agency has also reviewed this class and have modified prescribing information restricting use, as well as outlining some of the safety risks.

Fluoroquinolones are typically administered in combination with other antibiotics, if community-acquired MRSA is suspected. In addition, many currently available antibiotic therapies are only available for IV administration and are prescribed for seven to 14fourteen days, meaning continued treatment requires prolonged hospitalization or a switch to a different antibiotic administered orally, with the attendant risk that the patient might respond differently.

Effective January 1, 2017, the Joint Commission & Center for Medicare and Medicaid Services, or CMS, began requiring all U.S. hospitals to have Antibiotic Management guidelines, also known as “Stewardship”"Stewardship" Committees, in place to identify antibiotics most appropriate and targeted to each individual patient’spatient's infection. Past efforts to “cast"cast the widest net possible”possible" with broad-spectrum antibiotics that affect many types of bacteria have caused problems, such asC. difficileinfections, by killing good bacteria or increased antibiotic resistance in other bacteria in different areas of the body. Additionally, in 2016, the Infectious DisesaseDiseases Society of America and the Society for Healthcare Epidemiology of America, or IDSA/SHEA, updated their Antibiotic Stewardship guidelines for antibiotic use. We believe that three key goals from these guidelines are applicable to the treatment of CABP:

- •

·Reduce the risk of antibiotics associated with a high risk ofC. difficile infections;·- •

- Increase use of oral antibiotics as a strategy to improve outcomes or decrease costs; and

· - •

- Reduce antibiotic therapy to the shortest effective duration.

Pleuromutilins are semi-synthetic compounds derived fromConsistent with the Antimicrobial Stewardship principles, we believe that lefamulin could be well suited as either a naturally occurring antibiotic and inhibit bacterial growth by binding to a specific site onfirst-line or second-line empiric monotherapy for the bacterial ribosome that is responsible for bacterial protein synthesis. We have developed an understandingtreatment of how to optimize characteristicsCABP patients in the hospital setting, outpatient-transition of care or in the pleuromutilin class, such as antimicrobial spectrum, potency, absorption following oral administration and tolerability, which in turn led to our selection and developmentcommunity setting, because of lefamulin, our lead product candidate. We have completed a Phase 2 clinical trial for ABSSSI in which IV lefamulin achieved a high cure rate against multi-drug resistant Gram-positive bacteria, including MRSA. In addition, in preclinical studies, lefamulin showed potent antibacterial activity against a variety of Gram-positive bacteria, Gram-negative bacteria and atypical bacteria, including multi-drug resistant strains.

The preclinical studies and clinical trials we have conducted to date suggest that lefamulin’sits novel mechanism of action, is responsiblecomplete spectrum of activity for the lackCABP pathogens, including against multidrug

resistant strains, achievement of bacterial resistance to lefamulin. As a result of the favorable safety and tolerability profile we have observedsubstantial drug concentrations in our clinical trials to date, we believe lefamulin has the potential to present fewer complications relative to the use of current therapies. Based on our research, we also believe that the availability of both IV and oral formulations of lefamulin, and an option to switch to oral treatment, could reduce the length of a patient’s hospital stay and the overall cost of care.

We have evaluated lefamulin in more than 440 patients and subjects in seventeen completed Phase 1 clinical trials and a Phase 2 clinical trial in ABSSSI. In our Phase 1 clinical trials, we have characterized the clinical pharmacology of the IV formulation of lefamulin and shown oral bioavailability of a tablet formulation of lefamulin with rapid tissue distribution, including substantial penetration into lung fluids and lung immune cells. In our Phase 2 clinical trial evaluatingcells, and flexibility as step down oral agent with both the safety and efficacy of two different doses of the IV formulation

of lefamulin administered over five to 14 days compared to the antibiotic vancomycin in patients with ABSSSI, the clinical success rate at test of cure, or TOC, for lefamulin was similar to that of vancomycin. Lefamulin has been well tolerated in all our clinical trials to date when administered by IV and oral routes. The frequencyformulations and favorable safety and tolerability profile.

CONTEPO

On July 24, 2018, we completed the acquisition of adverse events that we observed in our Phase 2 clinical trial in ABSSSI was similarZavante Therapeutics, Inc., or Zavante, a privately-held late clinical-stage biopharmaceutical company focused on developing novel therapies to improve the outcomes of hospitalized patients. Zavante's lead product candidate is CONTEPO™ (fosfomycin for patients treated with IV lefamulininjection, previously referred to as ZTI-01 and patients treated with vancomycin.ZOLYD).

Based on the clinical resultsWe submitted an NDA for marketing approval of lefamulinCONTEPO for the treatment of ABSSSI, as well as its rapid tissue distribution,cUTI including substantial penetration into the lung, we are evaluating lefamulin for the treatment of moderate to severe CABPAP in two international Phase 3 clinical trials. We are initially pursuing the development of lefamulin for CABP because of the limited development of new antibiotic classes for this indication over the past 15 years, our belief that there exists a significant unmet medical need for a first-line empiric monotherapy that addresses the growing development and spread of bacterial resistance, as well as recently clarified FDA guidance regarding the approval pathway. We initiated the first of these trials in September 2015 and the second trial in April 2016. We are also further characterizing the clinical pharmacology of lefamulin in several additional Phase 1 clinical trials.

We plan to pursue a number of additional opportunities for lefamulin, including beginning a development program for use in pediatric patients and potentially for the treatment of ABSSSI. In addition, as an antibiotic with potent activity against a wide variety of multi-drug resistant pathogens, including MRSA, we may explore development of lefamulin in other indications, including ventilator-associated bacterial pneumonia, or VABP, hospital-acquired bacterial pneumonia, or HABP, sexually transmitted infections, or STIs, osteomyelitis and prosthetic joint infections. Through our research and development efforts, we have also identified a topical pleuromutilin product candidate, BC-7013, which has completed a Phase 1 clinical trial.

We own exclusive, worldwide rights to lefamulin. Lefamulin is protected by issued patentsadults in the United States, Europeto the FDA in October 2018. The NDA submission is utilizing the 505(b)(2) regulatory pathway and Japan covering compositionis supported by a robust data package, including a pivotal Phase 2/3 clinical trial (known as ZEUS™), which met its primary endpoint of matter, whichstatistical non-inferiority to piperacillin/tazobactam in patients with cUTI, including AP. The FDA has granted us a Prescription Drug User Fee Act, or PDUFA target action date of April 30, 2019 for CONTEPO.

The prevalence of antibiotic-resistant bacteria is increasing and is considered a significant threat to global health. In particular, the CDC and the WHO consider antibiotic resistance to be an urgent and critical threat to human health. The prevalence of lactamase enzymes among Gram-negative pathogens threatens the usefulness of many beta -lactam antibiotics and has resulted in greater reliance on last line antibiotics, including carbapenems. Complicated urinary tract infections, or cUTIs, including acute pyelonephritis, or AP, are scheduledamong the most common infections due to expire no earlier than 2028. We also havemulti-drug resistant, or MDR bacteria, including carbapenem-resistant Enterobacteriaceae, or CRE, and are often healthcare-associated. Global mortality attributable to CRE infections has been granted patentsestimated in some studies to be over 20% and reflects the need for lefamulin relating to process and pharmaceutical crystalline salt formssafe, alternative, carbapenem-sparing options.

CONTEPO is a novel, potentially first-in-class investigational IV antibiotic in the United States whichwith a broad spectrum of Gram-negative and Gram-positive activity, including activity against most MDR strains such as extended-spectrum beta-lactamase-, or ESBL-producing Enterobacteriaceae. Intravenous fosfomycin has been approved for a number of indications and utilized for over 45 years in Europe to treat a variety of serious bacterial infections, including cUTIs. CONTEPO utilizes a new dosing regimen that optimizes its pharmacokinetics and pharmacodynamics. We believe these attributes, the extensive clinical experience worldwide and the positive efficacy and safety results from the Phase 2/3 clinical trial support CONTEPO as a first-line treatment for cUTIs, including AP, suspected to be caused by MDR pathogens. At least 20% of cUTIs are scheduled to expire no earlier than 2031.caused by MDR bacteria and limited treatment options are available in the U.S. In addition, we own a family of pending patent applications directednon-clinical data have shown that CONTEPO acts in combination with certain other antibiotics to pharmaceutical compositions of lefamulin, which if issued would be scheduled to expire no earlier than 2036.improve bacterial killing.

Our Strategy

Our goal is to become a fully integrated biopharmaceutical company focused on the research, development and commercialization of novel anti-infective products. The key elements of our strategy to achieve this goal are:

- •

·Complete Phase 3 clinical development of lefamulin for CABP. We are devoting a significant portion of our financial resources and business efforts to completing the clinical development of lefamulin for the treatment of CABP. We initiated two international Phase 3 clinical trials of lefamulin for the treatment of moderate to severe CABP. We initiated the first of these trials in September 2015 and the second trial in the April 2016. Based on our estimates regarding patient enrollment, we expect to have top-line data from LEAP 1 in the third quarter of 2017. With respect to LEAP 2, based on current projections, we expect to complete patient enrollment in the fourth quarter of 2017, and we anticipate receiving top-line data for LEAP 2 in the first quarter of 2018. If the results of these trials are favorable, including achievement of the primary efficacy endpoints of the trials, we expect to submit applications for marketing approval for lefamulin for the treatment of CABP in both the United States and Europe in 2018.·Maximize the commercial potential of CONTEPO for cUTI's and lefamulin forCABPCABP..We own exclusive, worldwide rights tolefamulin.lefamulin and US rights to CONTEPO and we have out licensed the rights to lefamulin in China. We expect that our initial target patient population for lefamulin will consist of patients with moderate to severeCABP.CABP and the initial target population for CONTEPO will be hospitalized patients with complicated urinary tract infections. If either or both CONTEPO or lefamulin receives marketing approval from the FDA,for the treatment of CABP,we plan to commercializeitthem in the United States with our own targetedhospitalsales and marketing organization that we plan toestablish.expand beyond its current levels. We believe both CONTEPO and lefamulin have innovative profiles which, if approved, would support their adoption in the

- •

·Pursue the continued development of lefamulin in additionalindicationsindications..Weplan to pursueare evaluating the cost and benefits of the continued development of lefamulin for indications in addition to CABP.For example, we are conductingPediatric oral formulation developmentactivities for lefamulin for useis ongoing, and we initiated a Phase 1 clinical trial in pediatric patientsand potentially for the treatment of ABSSSI. In addition, we are evaluating whether to pursue studies of lefamulininpatients with VABP or HABP.mid-2018. We believethat lefamulin’s product profile also provides the opportunitylefamulin has potential toexpand to other indications beyond pneumonia. For example, investigation of the tolerability of higher single doses of lefamulin could also support use of lefamulin for the treatment of STIs.treat acute bacterial skin and skin structure infection (ABSSSI), ventilator-associated bacterial pneumonia (VABP) or hospital-acquired bacterial pneumonia (HABP) and sexually transmitted infections (STIs). In addition, we may explore longer duration of treatment with lefamulin to support development of a treatment for osteomyelitis and prosthetic joint infections. We believe that lefamulin would be differentiated from other treatment options foreach ofthese potentialusesindications because oflefamulin’sits novel mechanism of action, spectrum of activity, including activity against multi-drug resistant pathogens, achievement of substantial concentrations in relevant tissues, availability as both an IV and oral formulation and favorable safety and tolerability profile.·- •

AdvancePursue the development ofother pleuromutilin product candidates and possibly compounds in other classesCONTEPO for a pediatric indication..We arecurrently focused on developing additional pleuromutilin product candidates through our deep understandingevaluating the continued development ofthis class of antibiotics. Our product candidate BC-7013 has completedCONTEPO for use in pediatric patients with cUTIs. In June 2018, we initiated a Phase 1,clinical trial. We believe that this pleuromutilin compound is well suited fornon-comparative, open-label study of thetopical treatmentpharmacokinetics and safety of avarietysingle dose ofGram-positive infections, including uncomplicated skin and skin structure infections, or uSSSIs. Furthermore, we own diverse librariesCONTEPO in pediatric subjects less than 12 years ofcompounds in other antibacterial classes, such as ß-lactams and acremonic acids, which are a potential basis for the discovery and development of novel antibacterial agents.age.

·- •

- Evaluate business development opportunities and potential

collaborationscollaborations..We may expand our product pipeline through opportunistically in-licensing or acquiring the rights to complementary products, product candidates and technologies for the treatment of a range of infectious diseases or other hospital-based products that could utilize our planned commercial infrastructure. We plan to evaluate the merits of entering into collaboration agreements with other pharmaceutical or biotechnology companies that may contribute to our ability to efficiently advance our product candidates, build our product pipeline,andconcurrently advance a range of research and developmentprograms.programs and leverage our commercial infrastructure. Potential collaborations may provide us with funding and access to the scientific, development, regulatory and commercial capabilities of the collaborators. We also plan to encourage local and international government entities and non-government organizations to provide additional funding and support for our development programs.We may expand our product pipeline through opportunistically in-licensing or acquiring the rights to complementary products, product candidates and technologies for the treatment of a range of infectious diseases.

United States for adult cUTI patients treaded in the hospital and CABP patients, respectively, treated as in-patients in a hospital setting. Lefamulin also has the opportunity to be adopted as outpatient transition of care from the hospital, which we believe represents a significant commercial opportunity. We believe that we will be able to effectively communicate lefamulin’sCONTEPO's and lefamulin's differentiating characteristics and key attributes to clinicians, and hospital pharmacies and payors with the goal of establishing favorable reimbursement as well as a favorable formulary status for lefamulin. If lefamulin receives marketing approval outsidein targeted hospitals. Outside the United States for the treatment of CABP, we expect to utilize a variety of types of collaboration, distribution and other marketing arrangements

with one or more third parties to commercialize lefamulin in such markets. We also are conducting pediatric formulationcurrently have a team of regional business directors and medical science liaisons in the field performing educational and market development activities, respectively. We initially plan to support clinical trials ofuse a targeted hospital-based sales force to promote both lefamulin for pediatric use for CABP.formulations and CONTEPO, if approved.

Our Product Development PipelineBackground

The following table summarizes the indications for which we are developing our product candidates and the status of development.

DEVELOPMENT STAGE

* We have initiated two international Phase 3 clinical trials of lefamulin for the treatment of moderate to severe CABP. However, we have not previously conducted any clinical trials of lefamulin specifically for CABP. Our completed Phase 2 clinical trial evaluated lefamulin in patients with ABSSSI. We have obtained input from the FDA and select European authorities, including reaching agreement with the FDA on a Special Protocol Assessment, or SPA, regarding the study design of our first Phase 3 clinical trial, in anticipation of submitting applications for marketing approval for lefamulin for the treatment of CABP in both the United States and Europe in 2018.

Background

Anti-Bacterial Market and Scientific Overview

Bacteria are broadly classified as Gram-positive or Gram-negative. Gram-positive bacteria possess a single membrane and a thick cell wall and turn dark-blue or violet when subjected to a laboratory staining method known as Gram’sGram's method. Gram-negative bacteria have a thin cell wall layered between an inner cytoplasmic cell membrane and a bacterial outer membrane and, as a result, do not retain the violet stain used in Gram’sGram's method. Antibiotics that are active against both Gram-positive

and Gram-negative bacteria are referred to as broad spectrum, while those that are active only against a select subset of Gram-positive or Gram-negative bacteria are referred to as narrow spectrum. Bacteria that cause infections are often referred to as bacterial pathogens. Because it often takes from 24 to 48 hours to definitively diagnose the particular bacterial pathogen causing an infection, the causative pathogen often remains unidentified and narrow spectrum antibiotics are not generally used as empiric monotherapy for first-line treatment of hospitalized patients with serious infections.

Since the introduction of antibiotics in the 1940s, numerous new antibiotic classes have been discovered and developed for therapeutic use. The development of new antibiotic classes and new antibiotics within a class is important because of the ability of bacteria to develop resistance to existing mechanisms of action of currently approved antibiotics. However, the pace of discovery and development of new antibiotic classes slowed considerably in the past few decades. The CDC estimates that the pathogens responsible for more than 70% of U.S. hospital infections are resistant to at least one of the antibiotics most commonly used to treat them. The CDC also estimated in 2013, based on data collected from evaluations performed between 2006 and 2011, that annually in the United States at least two million people become infected with bacteria that are resistant to antibiotics and at least 23,000 people die as a direct result of these infections.

Antibiotic resistance is primarily caused by genetic mutations in bacteria selected by exposure to antibiotics that do not kill all of the bacteria. In addition to mutated bacteria being resistant to the drug used for treatment, many bacterial strains can also become cross-resistant, meaning that they become resistant to multiple classes of antibiotics. As a result, the effectiveness of many antibiotics has declined, limiting physicians’physicians' options to treat serious infections and exacerbating a global health issue. For example, the WHO estimated in 2014 that people with infections caused by MRSA, a highly resistant form of bacteria, are 64% more likely to die than people with a non-resistant form of the infection. Resistance can increase the cost of healthcare because of the potential for lengthier hospital stays and more intensive care. Growing antibiotic resistance globally, together with the low level of investment in research and development, is considered one of the biggest global health threats. In 2010, the WHO stated that antibiotic resistance is one of the three greatest threats to human health. Partially in response to this threat, the U.S. Congress passed the GAIN Act in 2012, which provides incentives, including access to expedited FDA review for approval, fast track designation and five years of potential data exclusivity extension for the development of new QIDPs. Additional legislation is also being considered in the United States, including the Antibiotic Development to Advance Patient Treatment Act of 2013, which is intended to accelerate the development of anti-infective products, and the Developing an Innovative Strategy for Antimicrobial Resistant Microorganisms Act of 2014, which is intended to establish a new reimbursement framework to enable premium pricing of anti-infective products.

In 2009,2017, sales of antibiotics totaled approximately $42 billion globally. Although judicious use of antibiotics is important to reduce the rate of antibiotic resistance, this approach alone cannot fully address the threat from increasing antibiotic resistance. New antibiotics, and particularly new antibiotic classes, are needed to ensure the availability of effective antibiotic therapy in the future.

Community-Acquired Bacterial Pneumonia (CABP)

Market Overview

The WHO estimated in 2002 that there were approximately 450 million pneumonia cases reported per year worldwide, causing approximately 4.0 million deaths in 2002. According to an article published in 2011 in the peer-reviewed medical journal Therapeutic Advances in Respiratory Disease, the annual incidence of community-acquired pneumonia is between five and 11 cases per 1,000 people, with the incidence rate rising in elderly patients. In a study published in 2004 in the peer-reviewed medical journal Clinical Infectious Diseases in which more than 46,000 people in the state of Washington were monitored over three years, the incidence of CABP among those 65 to 69 years of age was 18.2 cases per 1,000 people per year and increased to 52.3 cases per 1,000 people per year in those over 85 years of age.

The U.S. National Center for Health Statistics estimated that between 1988 and 1994 there were approximately 5.6 million cases of pneumonia per year in the United States. More recently, based on our combined analysis of the CDC’sCDC's 2007 National Ambulatory Medical Care Survey, the National Hospital Ambulatory Medical Care Survey and 2013 data from the Healthcare Cost and Utilization Project we estimate that over 5.0 million adults are treated annually for CABP in the United States and that the majority of these adult CABP patients have their treatment initiated in a hospital, including

emergency departments. According to the Healthcare Cost and Utilization Project, or HCUP, in 2013, approximately 3.1 million adults sought treatment in a U.S. hospital for CABP. In addition, in 2013, approximately 2.4 million adults were admitted to U.S. hospitals for in-patient care with a diagnosis of CABP and approximately 700,000 adults were seen in an emergency department at U.S. hospitals for treatment of CABP and then released.

Additionally, in 2014, based on CDC data approximately 50,000 patients died from CABP in the United States. Based on data collected from July 1, 2012 through June 30, 2015, on the Medicare.gov Hospital Compare website, the current national rate of readmissions for Medicare pneumonia patients is 17.1%, which is the percentage of patients who have had a recent hospital stay that must return to a hospital for unplanned care within 30 days of being discharged. The national average death rate for Medicare pneumonia patients, excluding Medicare Advantage plan data, is 16.3%, which is the percentage of patients who die, for any reason, within 30 days of admission to a hospital.

Based on data from Arlington Medical Resources, or AMR,LexisNexis® Risk Solutions, a leading provider of medicalhealthcare data and analytics solutions, as well as analysis of data from US hospitals and other healthcare facilities, who reportedwe determined that the number of adult CABP patients who were treated with antibiotic treatment courses for CABP adult patientstherapy in hospitals in the United States exceeded 6.83.8 million for full-year 2015, we estimate2016. Our analysis of the LexisNexis data also indicates that approximately 5.32.4 million of these adult CABP coursespatients were fortreated as inpatients with IV/injectable antibiotics, forand we find that the majority of CABP patients enter the hospital inpatient setting following the initiation of antibiotic therapy during an Emergency Department (ED) visit. Additionally, our analyses show that approximately 1.4 million adult CABP patients

while approximately 1.5 million CABP oral were treated with antibiotic courses were prescribed for(IV or oral) in the ED or as hospital outpatients and subsequently released without hospital admission.

Additionally, approximately 1.4 million adult CABP patients were treated with antibiotic courses (IV or oral) in the ED or as hospital setting. Additionally, for the twelve months ending September 30, 2016, Source Health Solutions estimatesoutpatients and subsequently released without hospital admission. Furthermore, as a result of our market research in 2017-18, we believe that once adult CABP patients are released from ED stays or are discharged home from U.S. hospitals, approximately 4.2 million60-70%, receive antibiotic oral outpatient prescriptions are written annually foras continuation of their outpatient antibiotic treatment. RelativeAs hospitals look to minimize the total cost of care and duration of hospital stay for CABP patients toward improved outcomes, efficient transition of adult CABP inpatients to an oral antibiotic treatment as outpatient therapy can significantly reduce days of hospitalization and overall treatment cost.

IQIVA estimated that in 2017 approximately 6.62 million adult CABP outpatient oral antibiotic prescriptions that Health Source Solutions estimates are written over the same time-period, approximately 6 out of every 10 oral antibiotic prescriptions for adult CABP results as a transition of care from hospital-initiated treatment to outpatient therapy. The remaining CABP prescriptions originatepatients were actively treated with antibiotics from prescribers in community clinics, e.g. primary care offices and at other non-hospital based sites of urgent care. As a result, we believe that approximately 6 million CABP patients are treated with antibiotics in the United States on an annual basis and 6 out of every 10 adult CABP patients have treatment initiated in a hospital setting versus. the community setting.

Causes of CABP

Pneumonia can be caused by a variety of micro-organisms, with bacteria being the most common identifiable cause. CABP refers to bacterial pneumonia that is acquired outside of a hospital setting. Signs and symptoms of CABP include cough, fever, sputum production and chest pain. A number of different types of bacteria can cause CABP, including both Gram-positive and Gram-negative bacteria. Pneumonia that is caused by atypical bacterial pathogens often has different symptoms and responds to different antibiotics than pneumonia caused by pathogens referred to as typical bacteria. However, atypical bacteria are not uncommon. The most common bacterial pathogens noted in current treatment guidelines from the Infectious Diseases Society of America, or IDSA, for hospitalized CABP patients who are not in the intensive care unit areStreptococcus pneumoniae, Mycoplasma pneumoniae, Haemophilus influenzae, Chlamydophila pneumoniae, andLegionellaspecies. In addition, IDSA notes the emergence of resistance to commonly utilized antibiotics for CABP, specifically drug-resistant

S. pneumoniae and community-acquired MRSA, or CA-MRSA, as a major consideration in choosing empiric therapy. However, a majority of patients do not have a pathogen identified using routine diagnostic tests available to physicians.

Currently Available Treatment Options

In 2007, based on the most likely bacteria to cause CABP, IDSA and the American Thoracic Society, or ATS, recommend empiric treatment of hospitalized patients with CABP who do not require treatment in an intensive care unit with either:

- •

·a combination of a cephalosporin, an antibiotic that disrupts the cell wall of bacteria, plus a macrolide, an antibiotic that disrupts bacterial protein synthesis; or·- •

- monotherapy with a respiratory fluoroquinolone, an antibiotic that disrupts bacterial protein synthesis.

In the event CA-MRSA is suspected, these guidelines recommend that vancomycin, an antibiotic that disrupts the cell wall of bacteria, or linezolid, an antibiotic that disrupts bacterial protein synthesis, be used or added to the current regimen.

In addition, physicians need to be aware of the local susceptibility profiles of the common bacterial pathogens associated with CABP because of increasing resistance to first-line antibiotics. For example, rates of pneumococcal resistance to recommended first-line macrolides exceed 40% in some areas, while resistance inM. pneumoniae associated with severe disease has been recently reported by the CDC in the United States.

Limitations of Currently Available Treatment Options

When confronted with a new patient suffering from a serious infection caused by an unknown pathogen, a physician may be required to quickly initiate first-line empiric antibiotic treatment, often with a combination of antibiotics, to stabilize the patient prior to definitively diagnosing the particular bacterial infection. However, currently available antibiotic therapies for first-line empiric treatment of CABP suffer from significant limitations.

Bacterial Resistance and Spectrum of Activity

As a result of bacterial resistance, the effectiveness of many antibiotics has declined. For example, the CDC estimates that in 30% of severeS. pneumoniae cases, the bacterial pathogen is fully resistant to one or more clinically relevant antibiotics, with 44% of strains resistant to a macrolide in the United States. In addition, fluoroquinolone resistance inS. pneumoniae has increased from less than 0.5% to more than 3% of cases in some regions of North America, which parallels increased total fluoroquinolone prescriptions. Antibiotic resistance has a significant impact on mortality and contributes heavily to healthcare system costs worldwide. According to the CDC, cases of resistant pneumococcal pneumonia result in 32,000 additional doctor visits, approximately 19,000 additional hospitalizations and 7,000 deaths each year. These cases are associated with $96 million in excess medical cost per year in the United States. IDSA/ATS guidelines recommend empiric treatment that provides broad spectrum antimicrobial coverage. None of the currently available treatment options provides a spectrum of antibacterial coverage as a monotherapy that sufficiently covers all of the most common bacterial causes of CABP, including multi-drug resistant strains.

Difficult, Inconvenient and Costly Regimens

Currently available antibiotics used to treat CABP and other serious infections can be difficult, inconvenient and costly to administer. Physicians typically prefer IV administration for patients hospitalized with more serious illness to ensure adequate delivery of the drug rapidly. Many IV antibiotics are prescribed for seven to 14 days or more and patients can be hospitalized for much or all of this period or require in-home IV therapy. The diagnosis related group, or DRG, reimbursement

system often used in the U.S. hospital setting pays a fixed fee for an episode of CABP that may not fully compensate hospitals for the duration of hospitalized care. Prolonged IV treatment that extends the period of hospitalization may cause hospital costs to increase in excess of the fixed reimbursement fee, resulting in significant negative impact on healthcare institutions. In addition, to address all likely bacterial pathogens in a patient with a more serious illness, IDSA guidelines recommend using a combination of antibiotics. Combination therapy presents the logistical challenge of administering multiple drugs with different dosing regimens and increases the risk of drug-drug interactions. While IV treatment delivers the drug more rapidly than is possible orally, once a patient is stabilized, oral treatment with the same drug would allow for more convenient and cost-effective out-patient treatment. Because many commonly used antibiotics are only available in IV form, a switch to an oral therapy requires changing to a different antibiotic, which may be less effective for the patient.

Adverse Effects

Currently available antibiotic therapies can have serious side effects. These side effects may include severe allergic reaction, decreased blood pressure, nausea and vomiting, suppression of platelets, pain and inflammation at the site of injection, muscle, renal and oto-toxicities,oto-toxicity, optic and peripheral neuropathies and headaches. At times, these side effects may be significant and require discontinuation of therapy. As a result, some treatments require clinicians to closely monitor patients’patients' blood levels and other parameters, increasing the expense and inconvenience of treatment. This risk may be increased with combination therapy, which exposes patients to potential adverse effects from each of the antibiotics used in treatment. For example, fluoroquinolones are associated with tendon rupture and peripheral neuropathy. In addition, fluoroquinolones have been associated with an increased frequency ofC. difficile colitis, an overgrowth of a bacteria in the colon that produces a toxin that results in inflammation of the colon and repeated bouts of watery diarrhea. This has resulted in limitations on the use of fluoroquinolones in several countries. In November 2015, the FDA convened an Advisory Committee meeting to review the benefits and risks of fluoroquinolones in less severe indications, such as uncomplicated UTI, acute bacterial sinusitis and acute bacterial exacerbations of chronic bronchitis. Based on the committee’scommittee's recommendation, in July 2016, the FDA approved changes to the labels of fluoroquinolones to indicate that fluoroquinolones should be reserved for use in patients who have no other treatment options for the indications mentioned above, because the risk of these serious side effects generally outweighs the benefits in these patients. These changes included a requirement that a separate patient Medication Guide be given with each prescription that describes the safety issues associated with this class of drugs. In December 2018, an FDA review found that fluoroquinolone antibiotics can increase the occurrence of rare but serious events of ruptures or tears in the main artery of the body, called the aorta. These tears, called aortic dissections, or ruptures of an aortic aneurysm can lead to dangerous bleeding or even death. They can occur with fluoroquinolones for systemic use given by mouth or through an injection.

cUTIs

LefamulinMarket Overview

OverviewInfections due to a bacterial pathogen that is resistant to three or more antibiotic classes have become increasingly common and present a risk to our fight against infectious diseases and the management of complications in vulnerable patients. According to the CDC, more than two million hospital infections caused by bacteria resistant to one or more antibiotics occur every year in the United States, and over 23,000 patients with an antibiotic-resistant pathogen die each year.

We are developing lefamulinThe prevalence of antibiotic-resistant bacteria is increasing and is considered a significant threat to global health. In particular, the CDC and the WHO consider antibiotic resistance to be an urgent and critical threat to human health. The prevalence of Beta-lactamase enzymes among Gram-negative

pathogens threatens the first pleuromutilinusefulness of many Beta-lactam antibiotics and has resulted in greater reliance on last line antibiotics, including carbapenems.

CUTIs, including AP, are among the most common infections due to MDR bacteria, including CRE, and are often healthcare-associated. Global mortality attributable to CRE infections has been estimated in some studies to be over 20% and reflects the need for safe, alternative, carbapenem-sparing

Surveillance and epidemiological studies suggest that some traditional, first-line antibiotics may no longer be acceptable choices for early therapy. In one large-scale surveillance study, approximately one out of three patients hospitalized in the United States with cUTI, a complicated intra-abdominal infection, hospital-associated pneumonia, or a bloodstream infection did not receive timely effective antibiotic therapy, and this delay was associated with increased morbidity and mortality. The rate of antibiotic resistance appears to be two to four times higher in patients who were admitted to the hospital from a nursing home or were recently hospitalized. Antibiotic therapy within the past six months has also been identified as a risk factor for antibiotic resistance.

New classes of antibiotics that are effective against drug-resistant pathogens are needed for early, appropriate treatment of serious infections in hospitalized patients and to treat patients who have failed to respond to standard, first-line antibiotics due to acquired drug resistance.

For over 45 years, oral and IV formulations of fosfomycin have been used in the European Union, Africa, Asia, and South America, and an oral formulation of fosfomycin has been used in the United States and Canada for the treatment of a variety of indications. Oral fosfomycin is available in the United States as single-dose therapy for cystitis and is noted as an appropriate treatment option for cystitis in treatment guidelines by the Infectious Diseases Society of America and the CDC. However, oral administration of fosfomycin provides inadequate concentrations required for treatment of more serious infections due to its limited bioavailability and dose-limiting gastrointestinal tolerability.

Outside of the United States, IV fosfomycin is approved for patients with a variety of infections, often severe, including cUTI, bacteremia, osteomyelitis, nosocomial lower respiratory tract infections, surgical site infections, bone and joint infections, endocarditis, skin infections and bacterial meningitis. The efficacy and safety profile of IV fosfomycin has been established by more than 45 years of clinical use outside of the United States and has been evaluated in more than 60 clinical studies. Fosfomycin has retained highin vitro activity with a low and stable resistance profile, and continues to be suitable for use as a monotherapy for cUTI despite long term use.

Causes of cUTIs

cUTI is defined as a clinical syndrome characterized by pyuria and a documented microbial pathogen on culture of urine or blood, accompanied by local and systemic administrationsigns and symptoms, including fever, chills, malaise, flank pain, back pain or costo-vertebral angle pain or tenderness that occur in humans.the presence of a functional or anatomical abnormality of the urinary tract, or in the presence of catheterization. Indwelling urethral catheters account for 70% to 80% of cUTIs, or 1 million cases per year in the United States. Catheter-associated UTI is the most common cause of secondary bloodstream infections and is linked to increased morbidity and mortality. Patients with pyelonephritis, regardless of underlying abnormalities of the urinary tract, are considered a subset of patients with cUTI.

cUTI are usually caused by a greater variety of pathogens, with a greater likelihood of associated antimicrobial resistance, than uncomplicated UTIs, or uUTIs. Escherichia coli, or E. coli, is isolated in approximately 75% to 95% of uUTIs and approximately 50% of cUTIs and is the most common etiologic agent of cUTIs. Additional commonly-identified Gram-negative uropathogens include other Enterobacteriaceae (such as Klebsiella spp., Proteus spp., Enterobacter cloacae) and non-fermenting

Gram-negative bacilli (such as Pseudomonas aeruginosa, or P. aeruginosa, and Acinetobacter spp.). Gram-positive organisms, such as Enterococci and coagulase-negative Staphylococci, may also be contributing pathogens.

Limitations of Currently Available Treatment Options

We believe bacterial resistance against antimicrobials has created the need for more antibiotic treatment options, particularly among MDR, Gram-negative bacilli (including CRE, ESBL, producers, and MDR P. aeruginosa). Gram-negative antimicrobial resistance is particularly common among urinary tract pathogens. Enterobacteriaceae, including E. coli and Klebsiella pneumoniae, or K. pneumoniae, may acquire plasmids that encode ESBLs and confer resistance to third-generation cephalosporins and other broad-spectrum antibiotics. Third-generation cephalosporins and Beta-lactamase inhibitors, or BLIs, are also commonly ineffective against Enterobacteriaceae that generate AmpC enzymes.

The recent spread into hospitals of Enterobacteriaceae expressing emergent Beta-lactamases, including members of the serine carbapenemases and metallo-Beta-lactamases, endanger antibiotic options. The lack of available and effective antibiotic classes for these organisms has created an unmet medical need. For example, infections with CRE are difficult to treat, as there are limited treatment choices available. Mortality rates as high as 40% to 50% have been associated with CRE infections, making them a serious threat to public health. The available treatment choices are associated with serious potential toxicity, in the case of colistin and aminoglycosides, or concerns of allergy or hypersensitivity, in the case of Beta-lactams or penicillin derivatives.

Our Solution: CONTEPO for the Treatment of cUTI

- •

- CONTEPO is an IV formulation of fosfomycin and the sole member of the epoxide antibiotic class.

- •

- CONTEPO has a different mechanism of action than other IV antibiotics in the United States.

- •

- CONTEPO has a broad spectrum ofin vitro activity against a variety of clinically important MDR Gram-negative pathogens, including ESBL-producing Enterobacteriaceae, CRE, and Gram-positive pathogens, including methicillin-resistantStaphylococcus aureus, or MRSA, and vancomycin-resistant enterococci.

- •

- CONTEPO has demonstrated inin vitro studies additivity or synergy when used in combination with other classes of antibiotic agents in pre-clinical trials.

- •

- CONTEPO has a small molecular size, which may enable high levels of tissue penetration and facilitates renal elimination, both of which are important for treatment of cUTIs.

- •

- CONTEPO is supported by a long history of IV fosfomycin use outside the United States in a variety of indications, including cUTI.

- •

- CONTEPO has completed the ZEUS Study, a pivotal registrational Phase2/3 clinical trial in cUTI, achieving non-inferiority to an active comparator.

CONTEPO is a potentially first-in-class epoxide IV antibiotic in the United States with a broad spectrum of bactericidal Gram-negative and Gram-positive activity, including activity against many contemporary MDR strains that threaten hospitalized patients. IV fosfomycin has an extensive commercial history in markets outside the United States, where it has been used broadly for over 45 years to treat a variety of indications, including complicated urinary tract infections, bacteremia, pneumonia and skin infections.

CONTEPO works differently than other IV antibiotics approved in the United States. CONTEPO inhibits an early step in bacterial cell wall synthesis, so the cell wall lacks integrity and the bacteria die quickly. We believe that because of its different mechanism of action, we have not observed any cross resistance to date between CONTEPO and any of the existing classes of intravenous antibiotics. In addition, CONTEPO has demonstrated inin vitro studies an additive or synergistic antibacterial effect with other classes of antibiotics when used in combination therapy, and has been shown to restore susceptibility in resistant strains.

Our Product Development Pipeline

Lefamulin

Overview

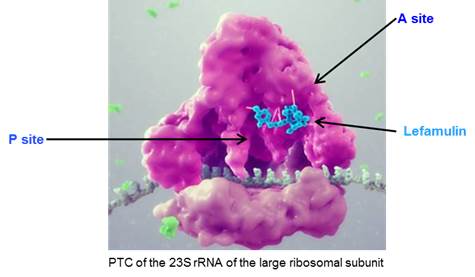

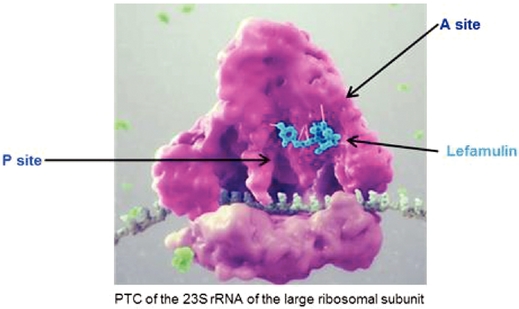

Lefamulin is a semi-synthetic derivative of the naturally occurring antibiotic, pleuromutilin, which was originally identified from a fungus calledPleurotus mutilismutilius. Lefamulin inhibits the synthesis of bacterial protein, which is required for bacteria to grow. Lefamulin acts by binding to the peptidyl transferase center, or PTC, on the bacterial ribosome in such a way that it interferes with the interaction of protein production at two key sites known as the “A”"A" site and the “P”"P" site, resulting in the inhibition of bacterial proteins and the cessation of bacterial growth. Lefamulin’sLefamulin's binding occurs with high affinity, high specificity and at molecular sites that are different than other antibiotic classes. We believe that lefamulin’slefamulin's novel mechanism of action is responsible for the lack of cross-resistance with other antibiotic classes that we have observed in our preclinical studies and clinical trials and a low propensity for development of bacterial resistance to lefamulin. The binding of lefamulin to the PTC on the bacterial ribosome is depicted in the graphic below.

We are developing both IV and oral formulations of lefamulin. We believe that lefamulin is well suited to be used empirically as monotherapy for the treatment of respiratory tract infections, such as CABP, because of its spectrum of antibacterial activity against both the typical and atypical pathogens causing CABP, including multi-drug resistant pathogens such as MRSA. In addition, in preclinical studies, lefamulin showed potent antibacterial activity against a variety of Gram-positive bacteria, Gram-negative bacteria and atypical bacteria, including multi-drug resistant strains. In preclinical studies and in Phase 1 clinical trials, lefamulin achieved substantial concentrations in the epithelial lining fluid, or ELF, of the lung, the site infected during pneumonia. Lefamulin also provides the ability to switch from IV to oral therapy and maintain therapy with the same active ingredient.antibacterial treatment. The efficacy of lefamulin in humans has been shown in a

We have completedproof-of-concept clinical Phase 3 trial with 207 patients with ABSSSI (acute bacterial skin and skin structure infections) comparing two lefamulin doses (100 mg and 150 mg i.v. q12 h) with vancomycin (³ 1 000 mg) over 5-14 days. This trial enrolled patients with severe skin and skin structure infections, excluding any patients with minor and uncomplicated infections. In total, 90.8 % of patients in the Modified Intent to Treat, or mITT population hadS. aureus infection; 69.1 % of patients had MRSA. There were consistent high response rates seen across all three treatment arms, across a wide range of clinical and microbiological outcomes. Furthermore, no development of resistance was observed for lefamulin or for vancomycin during the trial. Lefamulin treatment administered intravenously over 5 to 14 days was well tolerated. The types of treatment-emergent adverse events were consistent with a patient population under treatment for ABSSSI. Lefamulin prolonged the cardiac de- and repolarization duration but otherwise had a similar cardiac safety profile as vancomycin as assessed with standard 12-lead ECGs. The results of the clinical Phase 2 clinical trial in ABSSSI provided the first proof of lefamulinconcept for ABSSSI. Based on the clinical resultssystemic use of lefamulin for ABSSSI, as well as its rapid tissue distribution, including substantial penetration into lung fliuds and lung immune cells, we initiated two international, pivotal Phase 3 clinical trials of lefamulina pleuromutilin antibiotic for the treatment of moderate to severe CABP. These areserious bacterial infections in humans. Thereafter, the first clinical trials we have conducted with lefamulin for the treatment of CABP. We initiated the first of these trials in September 2015 and the second trial in April 2016. We designed these trials to follow draft guidance published by the FDA for the development of drugs for CABP and guidelines from the EMA for the development of antibacterial agents, as well as our SPA with the FDA regarding the study design of our first Phase 3 clinical trial. According to the draft FDA guidance and FDA feedback, either a Phase 3 clinical trial for CABP, supported by evidence of antibacterial activity accrued during a clinical development program for another indication, such as ABSSSI, orlefamulin progressed with completion of two Phase 3 clinical trials forin CABP may provide sufficient evidence(LEAP 1, LEAP 2). These trials demonstrated that lefamulin treatment, administered as IV only, IV to oral, and oral only regimens, was non-inferior to the standard of efficacy in CABP.

Based on our estimates regarding patient enrollment, we expect to have top-line data from LEAP 1 in the third quarter of 2017. With respect to LEAP 2, based on current projections, we expect to complete patient enrollment in the fourth quarter of 2017, and we anticipate receiving top-line data for LEAP 2 in the first quarter of 2018. If the results of these trials are favorable, including achievement of the primary efficacy endpoints of the trials, we expect to submit applications for marketing approval for lefamulincare moxifloxacin for the treatment of CABPadults with CABP. Each trial provided independent evidence of the treatment effect and safety in both the United States and Europe in 2018. We submitted to the FDA an investigational new drug application, or IND, for the IV formulation of lefamulin in September 2009 and an IND for the oral formulation of lefamulin in January 2015.this population with unmet medical need.

The FDA has designated each of the IV and oral formulations of lefamulin as a QIDP which provides for the extension of statutory exclusivity periods in the United States for an additional five years upon FDA approval of the product for the treatment of CABP and also granted fast track designationsdesignation to each of these formulations of lefamulin. Fast track designation is granted by the FDA to facilitate the development and expedite the review of drugs that treat serious conditions and fill an unmet medical need. The fast track designation for the IV and oral formulations of lefamulin will allow for more frequent interactions with the FDA, the opportunity for a rolling review of any NDAs, we submit and eligibility for priority review and a shortening of the FDA's goal for taking action on a marketing application from ten months to six months. Two NDAs for IV and oral formulations of lefamulin for treatment of CABP were submitted to the FDA December 19, 2018. We plan to submit a marketing authorization application for lefamulin in Europe in the first half of 2019.

We own exclusive, worldwide rights to lefamulin, other than our rights in China which were licensed to Sinovant. Lefamulin is protected by issued patents in the United States, Europe and Japan covering composition of matter, which are scheduled to expire no earlier than 2028. We also have been granted patents for lefamulin relating to process and pharmaceutical crystalline salt forms in the United States, which are scheduled to expire no earlier than 2031. In addition, we own a family of pending patent applications directed to pharmaceutical compositions of lefamulin, which if issued would be scheduled to expire no earlier than 2036.

Key Attributes of Lefamulin

We believe that the combination of the following key attributes of lefamulin, observed in clinical trials and preclinical studies, differentiates lefamulin from currently available antibiotics and make lefamulin well suited for use as a first-line or second-line empiric monotherapy for the treatment of CABP.

The preclinical studies and clinical trials we have conducted to date suggest that lefamulin's novel mechanism of action is responsible for the low risk of cross resistance observed with other antibiotic classes and a low propensity for development of bacterial resistance to lefamulin. As a result of the favorable safety and tolerability profile we have observed in our clinical trials to date, we believe lefamulin has the potential to present fewer complications relative to the use of current therapies. Based on our research, we also believe that the availability of both IV and oral formulations of

lefamulin, and an option to switch to oral treatment, could reduce the length of a patient's hospital stay and the overall cost of care.

BroadTargeted Spectrum of Activity for CABP Pathogens and Low Propensity for the Development of Bacterial Resistance

We expect lefamulin’slefamulin's spectrum of antibacterial activity against typical and atypical pathogens could eliminate the need to use a combination of antibiotics for the treatment of CABP. In our completed Phase 2 clinical trial, IV lefamulin achieved a high cure rate against multi-drug resistant Gram-positive bacteria, including MRSA. In addition, in preclinical studies, lefamulin showed activity against a variety of Gram-positive bacteria, includingS. pneumoniae andS. aureus, that are resistant to other classes of antibiotics, Gram-negative bacteria, includingH. influenzae andM. catarrhalis, and atypical bacteria, includingC. pneumoniae,M. pneumoniae andL. pneumophila. Included in lefamulin’slefamulin's spectrum of activity are all bacterial pathogens identified by IDSA as the most common causes of CABP for hospitalized patients who are not in the intensive care unit, as well as strains of the above listed bacteria that are resistant to other classes of antibiotics, including penicillins, cephalosporins, fluoroquinolones and macrolides.

Based on observations from our preclinical studies and clinical trials of lefamulin, as well as industry experience with pleuromutilins used in veterinarianveterinary medicine over the last 3039 years, we believe that lefamulin’slefamulin's novel mechanism of action is responsible for the lacklow risk of cross-resistance observed with other antibiotic classes and a low propensity for development of bacterial resistance to lefamulin.

Convenient Dosing Regimen; Potential for Switching from IV to Oral Treatment

We have developed both an IV and oral formulation of lefamulin, which we are utilizingutilized in our Phase 3 clinical trials of lefamulin for the treatment of CABP. The administration of lefamulin as a monotherapy avoids the need for the complicated dosing regimens typical of multi-drug cocktails. We believe the availability of both IV and oral administration, and an option to switch to oral treatment, would be more convenient for patients and could reduce the length of a patient’spatient's hospital stay and the overall cost of care. The potential reduction in the overall cost of care could be particularly meaningful to healthcare institutions, as the DRG reimbursement system pays a fixed fee for the treatment of CABP regardless of the length of hospital stay. We believe that our Phase 3 trial design will permit us to submit for approval of both IV

The efficacy and oral formulations of lefamulin, subject to obtaining favorable results, including achievement of the primary efficacy endpoints of the trials.

Favorable Safety and Tolerability Profile

We have evaluated lefamulin in over 440 subjects and patients in our completed Phase 1 and Phase 2 clinical trials. In these trials, lefamulin has exhibited a favorable safety and tolerability profile. In our Phase 2 clinical trial of lefamulin, no patient suffered any serious adverse events that were determined to be related to lefamulin, and safety and tolerability were comparable to vancomycin, the control therapy in the trial. In addition, no clinically significant change in electrocardiogram, or ECG, was measured, and no drug-related cardiovascular adverse events were reported. Furthermore, we believe the use of lefamulin as a monotherapy would present fewer potential complications relative to the use of multiple antibiotics as combination therapy. We are also continuing to evaluate the safety and tolerability of lefamulin in our Phase 3 clinical trials.

Phase 3 Clinical Trials

We are conducting aadult patients with CABP was shown in two pivotal clinical trial program of lefamulin for the treatment of CABP consisting of two international Phase 3 clinical trials. We initiated the first of these trials in September 2015 and the second

trial in April 2016. We designed these trials to comply with the guidelines of The International Conference on Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use, which are currently used as guidance by the FDA, and good clinical practices. We are conducting these trials at centers in the United States, Europe, Asia and selected countries in the southern hemisphere. We are currently enrolling patients in each of these clinical trials in several countries and are continuing with the regulatory steps necessary to initiate and conduct these trials, including submission of the trial protocol and relevant information about lefamulin to local regulatory authorities and ethics review committees in other countries.

First Phase 3 Clinical Trial

We designed our Phase 3 clinical trials (LEAP 1 and LEAP 2). The two trials were designed in accordance with US and EU regulatory guidelines and conducted in parallel from 2016 to follow2018. Design elements of the draft guidance published byPhase 3 clinical trials were broadly comparable. Both were global, multicenter, randomized, double-blind, active-controlled, non-inferiority studies to establish the efficacy and safety of lefamulin against the standard-of-care moxifloxacin in the treatment of adult subjects with CABP. In LEAP 1, subjects were treated with IV study drug and could be switched to oral study drug at the discretion of the Investigator after 3 full days (6 doses) of IV treatment if, in the opinion of the Investigator, pre-defined criteria were met. In LEAP 2, subjects were treated with lefamulin for five days (ten doses) compared to seven days of moxifloxacin (seven doses).

LEAP 1 (IV to Oral) Phase 3 Clinical Trial

In LEAP 1, a total of 551 subjects with Pneumonia Outcomes Research Team (PORT) Risk Class III to V who required IV antibiotic therapy as initial treatment for the current episode of CABP were randomized 1:1 to treatment with lefamulin 150 mg IV every 12 hours (n=276) or moxifloxacin 400 mg IV every 24 hours (n=275). Subjects could be switched from IV to oral study drug (lefamulin 600 mg orally every 12 hours or moxifloxacin 400 mg orally every 24 hours) at the discretion of the Investigator after three full days (six doses) of IV treatment if pre-defined criteria were met. If the

investigator determined that MRSA was a probable pathogen at Screening, adjunctive linezolid 600 mg IV every 12 hours was to be added to the moxifloxacin group and linezolid placebo was to be added to the lefamulin group.

The protocol defined different primary endpoints for the FDA for the development of drugs for CABP and guidance from the EMA to address regional differences in regulatory requirements for the development of antibacterial agents with the goal of positioning lefamulin as a first-line empiric monotherapy for the treatment of CABP. We reached agreement with the FDA in September 2015 on a SPA regarding the study design for our first Phase 3 clinical trial and obtained input from select European authorities in anticipation of submitting a new drug application with the FDA and a marketing authorization application, or MAA, with the EMA, in each case, for the treatment of CABP. In April 2016, we reached agreement with the FDA regarding an amendment to the SPA. We also plan to conduct a number of studies to support FDA approval of lefamulin, including studies in patients with hepatic insufficiency and renal impairment. If we complete the two Phase 3 clinical trials of lefamulin when we anticipate and obtain favorable results, we expect to submit an NDA to the FDA and an MAA to the EMA in 2018.

Our first Phase 3 clinical trial of lefamulin for the treatment of CABP is a multi-center, randomized, controlled, double-blind study comparing lefamulin to moxifloxacin, a fluoroquinolone antibiotic. Linezolid (or matching placebo for the lefamulin arm), can be added to treatment if an investigator suspects that a patient is infected with MRSA prior to randomization, as moxifloxacin is not approveddrugs to treat MRSA. This trial is designed to assessCABP. The FDA primary endpoint (EMA secondary endpoint) was the non-inferioritypercentage of lefamulin compared to moxifloxacin,subjects with an Early Clinical Response, or without linezolid. We expect the study population will include male and female patientsECR, of responder at least 18 years of age. Our study design targets the enrollment of approximately 550 patients, of which we expect a small proportion will require linezolid to be added.

Lefamulin will be dosed at 150 mg IV every 12 hours. The comparator drugs will be dosed according to their approved labeling, with moxifloxacin dosed at 400 mg IV daily and linezolid at 600 mg IV every 12 hours. Based on pre-defined criteria, investigators will have the option to switch patients to oral therapy96 ± 24-hours after three days (at least six doses) of IV study medication. Lefamulin will be administered orally as one 600 mg tablet every 12 hours, moxifloxacin at 400 mg daily and linezolid at 600 mg every 12 hours. Based on the pharmacokinetic profile of lefamulin, we expect oral dosing of one 600 mg tablet every 12 hours to have a similar therapeutic benefit as IV dosing of 150 mg every 12 hours.

All patients enrolled in this trial will be classified as Pneumonia Outcomes Research Team, or PORT, severity of at least 3 on a scale of 1 to 5, which corresponds to moderate to severe clinical disease. Patients who have previously taken no more than one dose of a short acting, potentially effective antibiotic for the treatment of the current CABP episode within 24 hours of receiving the first dose of study medication will be allowed to participate in the trial but will comprise only up to 25% of the total intent to treat, or ITT, population. Patients with confirmed S. aureus bacteremia will be discontinued from the trial. Investigators will obtain baseline Gram’s stain and culture of suitable specimens from the site of infection. Patients will be treated for a minimum seven days and a maximum of ten days.

We will assess patients between 72 and 120 hours from the start of treatment, at the end of treatment, or EOT, within 48 hours of administration of the final dose of study medication, at a TOC visit between five and ten days after administration of the final dose of study medication and at a telephone follow-up 30 days after administration of the first dose of study medication.

We will evaluate the following patient subsets:

· an ITT population consisting of all randomized patients regardless of whether they have received study medication;

· a modified intent to treat, or MITT, population consisting of all randomized subjects who receive any amount of study drug;

· a microbiological intent to treat, or microITT, population consisting of all subjects in the ITT population who have at least one baseline bacterial pathogen known to cause CABP, Legionella pneumophila from an appropriate microbiological specimen, or CABP caused by Mycoplasma pneumoniae or Chlamydophila pneumoniae;

· a clinically evaluable, or CE, population which is a subset of the ITT population that will include subjects who meet the criteria for CABP and who have received at least the pre-specified minimal amount of the intended dose of study drug and duration of treatment, do not have an indeterminate response based on the investigator’s assessment of clinical response at EOT for the CE-EOT population and at TOC for the CE-TOC population, did not receive concomitant antibacterial therapy, other than adjunctive linezolid, that is potentially effective against CABP pathogens (except in the case of clinical failure) from the first dose of study drug through the EOT visit for the CE-EOT population and through the TOC visit for the CE-TOC population, and for whom there are no other confounding factors that interfere with the assessment of the outcome; and

· a microbiologically evaluable, or ME, population consisting of all subjects who meet the criteria for inclusion in both the microITT, CE-EOT and ME-EOT populations or the CE-TOC and ME-TOC populations.

The primary efficacy endpoint for the trial for the FDA is the proportion of patients in the Intent-to-treat, or ITT, population for eachAnalysis Set. The EMA co-primary endpoints (FDA secondary endpoints) were the percentages of the lefamulin treatment group and the moxifloxacin treatment group who are alive, have improvement in at least two of the four cardinal symptoms of CABP as outlined in the current FDA guidance, have no worsening in any of the four cardinal symptoms of CABP and have not received a concomitant antibiotic (other than linezolid) for the treatment of CABP up through 120 hours after the first dose of lefamulin. This endpoint is also referred to as early clinical response. The four cardinal symptoms of CABP, as outlined in the current FDA guidance, are difficulty breathing, cough, production of purulent sputum and chest pain.

The primary efficacy endpoint for the EMA is the clinical success rate at the TOC visit for lefamulin in both the CE and MITT populations compared to moxifloxacin. Clinical success is based on the investigator’s assessment that a patient has clinically responded to lefamulin, which means that the patient has complete resolution or significant improvement of all local and systemic signs and symptoms of infection such that no additional antibiotic treatment is administered for the treatment of the current episode of CABP.

Key secondary efficacy and exploratory endpoints for our first Phase 3 clinical trial include the following:

· assessment of response for the primary efficacy outcome of early clinical response (the FDA primary endpoint) in the microITT population;

· assessment of response in each treatment groupsubjects with an investigator assessmentInvestigator's Assessment of clinical responseClinical Response (IACR) of success at TOC (the EMA primary endpoint) in the microITT and ME-TOC populations;

· assessmentTest of the microbiological response by pathogen for the microITT and ME-TOC populations at TOC; and

· assessment of all-cause mortality through day 28 in the ITT population.