SECURITIES AND EXCHANGE COMMISSION

FORM

10-K(Mark One)

10-K/AAmendment No. 3

x | | | | | |

(Mark One) |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the fiscal year ended August 31, 20202022 |

¨ | | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transition period from _____________ to _____________ |

SEC File No. 024-10557

SHIFTPIXY, INC.

(Exact name of registrant as specified in its charter)

(Exact name of registrant as specified in its charter) |

Wyoming | | 47-4211438 | | | | | | | | | | | | |

| Wyoming | | 47-4211438 | |

| (State of incorporation or organization) | | (I.R.S. Employer Identification No.) | |

| | | | |

501 Brickell Key Drive, | 13450 W Sunrise Blvd, Suite 300, Miami,650, Sunrise, FL 33131 | | 9261833323 | |

| (Address of principal executive offices) | | (Zip Code) | |

Registrant’s telephone number:(888) 798-9100 Securities to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

| Common Stock, par value $0.0001 per share | | Trading

Symbol(s)

| | The NASDAQ Stock Market LLC | |

| Title of each class registered | | PIXY | | Name of each exchange on which

each class is registered | |

Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ oNo x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ oNo x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes xNo ¨o Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes xNo ¨o Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ¨o | Accelerated filer | ¨o |

| Non-accelerated filer | x | Smaller reporting company | x |

| Emerging growth company | x | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨o Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. §7262(b)) by the registered public accounting firm that prepared or issued its audit report. xo Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes ¨ oNo xThe

As of February 28, 2022, the aggregate market value

(based on the Nasdaq quoted closing price of $85.10) of the

voting and non-voting common

equitystock held by non-affiliates

by reference to the price at which the common equity was last sold as of the

last business day of the registrant’s most recently completed second fiscal quarter ($7.33 on February 28, 2020)registrant was approximately

$3,682,000.$39.87 million.

The number of outstanding shares of Registrant’s Common Stock, $0.0001 par value, was

20,902,1469,671,196 shares as of

November 30, 2020.December 12, 2022.

| | | | | | | | | | | | | | |

| Auditor Name | | Auditor Location | | Auditor Firm ID |

| Marcum LLP | | New York, NY | | (PCAOB NO 688) |

Explanatory Note

The purpose of this Amendment No. 3 (the “Amendment”) to the Annual Report on Form 10-K of ShiftPixy, Inc. (the “Company”) for the year ended August 31, 2022 (the “Original Form 10-K”) is to re-file certain certifications. In connection with the filing of this Amendment, the Company is also updating its principal executive offices address and including with this Amendment a currently dated consent of the Company’s independent registered public accounting firm. Except as otherwise set forth in this Explanatory Note, no other information included in the Original Form 10-K is amended or changed by this Amendment.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This Annual Report on Form 10-K

("Form 10-K"), the other reports, statements, and information that we have previously filed or that we may subsequently file with the Securities and Exchange Commission (“SEC”), and public announcements that we have previously made or may subsequently make, contain “forward-looking statements” within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, which statements involve substantial risks and uncertainties. Unless the context is otherwise, the forward-looking statements included or incorporated by reference in this Form 10-K and those reports, statements, information and announcements address activities, events or developments that ShiftPixy, Inc. (referred to throughout this

Annual ReportForm 10-K as “we,” “us,” “our,” the

“ Company”“Company” or “ShiftPixy”), expects or anticipates will or may occur in the future. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this Form 10-K include, but are not limited to, statements about:

| · | our future financial performance, including our revenue, costs of revenue and operating expenses; |

| · | our ability to achieve and grow profitability; |

| · | the sufficiency of our cash, cash equivalents and investments to meet our liquidity needs; |

| · | our predictions about industry and market trends; |

| · | our ability to expand successfully internationally; |

| · | our ability to manage effectively our growth and future expenses; |

| · | our estimated total addressable market; |

| · | our ability to maintain, protect and enhance our intellectual property; |

| · | our ability to comply with modified or new laws and regulations applying to our business; |

| · | the attraction and retention of qualified employees and key personnel; |

| · | the effect that the novel coronavirus disease (“COVID-19”) or other public health issues could have on our business and financial condition and the economy in general; and |

| · | our ability to be successful in defending litigation brought against us. |

•our future financial performance, including our revenue, costs of revenue and operating expenses;

•our ability to achieve and grow profitability;

•the sufficiency of our cash, cash equivalents and investments to meet our liquidity needs;

•our predictions about industry and market trends;

•our ability to expand successfully internationally;

•our ability to manage effectively our growth and future expenses, including our growth and expenses associated with our sponsorship of various special purpose acquisition companies;

•our estimated total addressable market;

•our ability to maintain, protect and enhance our intellectual property;

•our ability to comply with modified or new laws and regulations applying to our business;

•the attraction and retention of qualified employees and key personnel;

•the effect that the novel coronavirus disease (“COVID-19”) or other public health issues could have on our business and financial condition and the economy in general; and

•our ability to be successful in defending litigation brought against us.

We caution you that the forward-looking statements highlighted above do not encompass all of the forward-looking statements made in this Form 10-K.

We have based the forward-looking statements contained in this Form 10-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section of this Form 10-K entitled “Risk Factors” and elsewhere. Moreover, we operate in a very competitive and challenging environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Form 10-K. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

The forward-looking statements made in this Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Form 10-K to reflect events or circumstances after the date of this reportForm 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements

and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, other strategic transactions or investments we may make or enter into.

The risks and uncertainties we currently face are not the only ones we face. New factors emerge from time to time, and it is not possible for us to predict which will arise. There may be additional risks not presently known to us or that we currently believe are immaterial to our business. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. If any such risks occur, our business, operating results, liquidity and financial condition could be materially affected in an adverse manner. The industry and market data contained in this

reportForm 10-K are based either on our management’s own estimates or, where indicated, independent industry publications, reports by governmental agencies or market research firms or other published independent sources and, in each case, are believed by our management to be reasonable estimates. However, industry and market data are subject to change and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. We have not independently verified market and industry data from third-party sources. In addition, consumption patterns and customer preferences can and do change. As a result, you should be aware that market share, ranking and other similar data set forth herein, and estimates and beliefs based on such data, may not be verifiable or reliable.

Item 1.

Description of Business

We were incorporated under the laws of the State of Wyoming on June 3, 2015. Our principal executive office is located at 501 Brickell Key Drive, Suite 300, Miami, FL 33131, and our telephone number is (888) 798-9100. Our website address is www.shiftpixy.com. Our website does not form a part of this Form 10-K and listing of our website address is for informational purposes only.

Business Overview

Our market focus is to use

We are a traditional staffing services business model, coupled with developed technology, to address underserved markets containing predominately lower wage employees with high turnover, including the light industrial, services, and food and hospitality markets. In addition, we have begun to expand our services into other industries that utilize higher paid employees on a temporary or part-time basis, including the medical/nurse staffing industry. human capital management ("HCM") platform.We provide payroll and related employment tax processing, human resources and employment compliance, employment related insurance, payroll, and operational employment administrative services solutions for our business clients (“clients” or “operators”) and shift work or “gig” opportunities for worksite employees (“WSEs” or “shifters”). As consideration for providing these services, we receive administrative or processing fees as a percentage of a client’s gross payroll. The level of our administrative fees is dependent on the services provided to our clients which ranges from basic payroll process and fileprocessing to a full suite of human resources information systems ("HRIS") technology.Our primary operating business metric is gross billings, consisting of our clients’ fully burdened payroll taxes andcosts, which includes, in addition to payroll, tax returns, provide workers’ compensation insurance premiums, employer taxes, and provide employee benefits. benefits costs.

Our goal is to be the best online fully-integrated workforce solution and employer services support platform for lower-wage workers and employment opportunities.We have built an application and desktop capable marketplace solution that allows for workers to access and apply for job opportunities created by our clients and to provide traditional back-office services to our clients as well as real-time business information for our clients’ human capital needs and requirements.

We have designed our business platform to evolve to meet the needs of a substantialchanging workforce and a changing work environment. We believe our approach and robust technology will benefit from the observed demographic workplace shift away from traditional employee/employer relationships towards the increasingly flexible work environment that is characteristic of the gig economy. We believe this change in approach began after the 2008 financial crisis and is currently being driven by the labor shortage created out of the COVID-19 economic crisis.We also believe that a significant problem underpinning the lower wage labor crisis is the sourcing of workers and matching temporary or gig workers to short-term job opportunities.

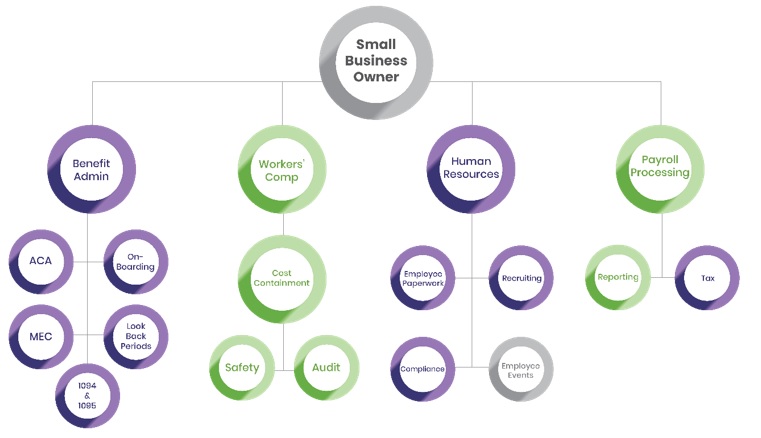

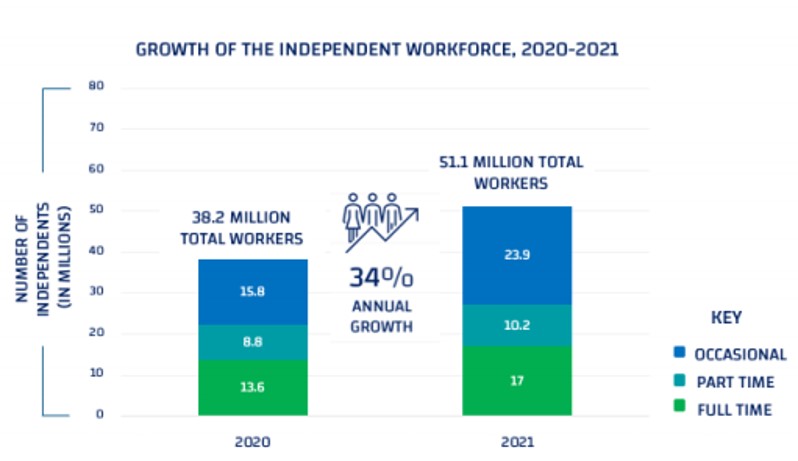

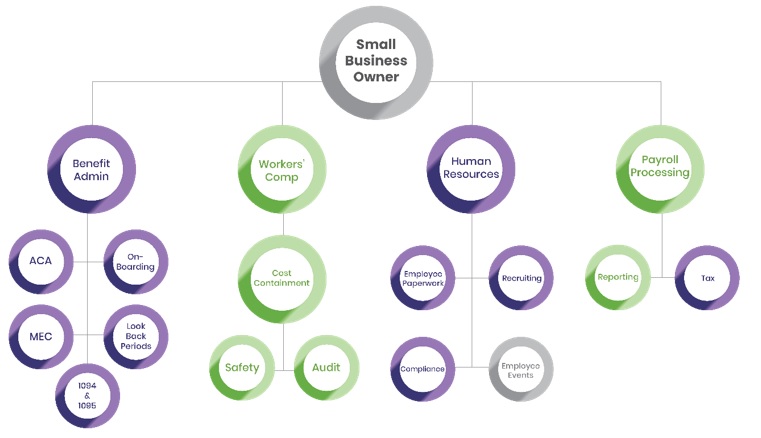

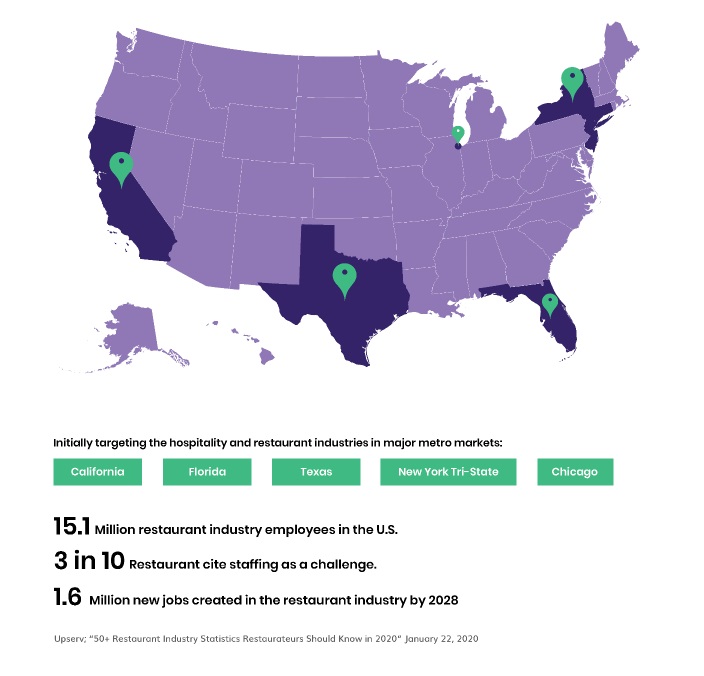

Figure 1

We have built our business on a recurring revenue model since our inception in 2015.

For Fiscal 2020, we processed approximately $186.2 million in total payroll billings, which includes $120.7 million attributableOur initial market focus has been to

clients transferredmonetize a traditional staffing services business model, coupled with developed technology, to

Vensure Employer Services, Inc. (“Vensure”),address underserved markets containing predominately lower wage employees with high turnover, including the light industrial, food service, restaurant, and

therefore included in our discontinued operations related to the Vensure Asset Sale (defined below). When these discontinued operations are excluded, we processed over $65 million in payroll billings. We expect to continue to experience significant customer growth; however, we have experienced operating losses to date, including approximately $35 million of operating losses for the last two fiscal years combined, as we have invested in both our technology solutions as well as the back-office operations required to service a large employee base under our staffing model.hospitality markets.

Although we have recently expanded into other industries, as noted

above,below, for our

currentfiscal year ended August 31, 2022 (“Fiscal 2022"), our primary focus

continues to bewas on clients in the restaurant and hospitality industries,

traditionally market segments

withtraditionally characterized by high employee turnover and low pay rates. We believe that these industries will be better served by our

Human Resources Information System (“HRIS”)HRIS technology platform and related mobile

smartphone application

which providethat provides payroll and human resources tracking for our

clients. The use of our HRIS platform should provide our clients

with real-time human capital business intelligence and we believe will result in lower operating costs, improved customer experience, and revenue

growth acceleration.growth. All of our clients enter into service agreements with us or

one of our

wholly owned subsidiary, ReThink Human Capital Management, Inc. (“ReThink”).Our revenues for Fiscal 2020 primarily consisted of administrative fees calculated as a percentage of gross payroll processed, payroll taxes due on WSEs billed to the client and remitted to the applicable taxation authority, and workers’ compensation premiums billed to the client for which we facilitate workers’ compensation coverage. Our costs of revenues consisted of accrued and paid payroll taxes and our costswholly-owned subsidiaries to provide the workers’ compensation coverage including premiums and loss reserves. A significant portion of our assets and liabilities is for our workers’ compensation reserves. Our cash balances related to these reserves are carried as assets and our estimates of projected workers’ compensation claims are carried as liabilities. Since Fiscal 2019, we have provided a self-funded workers’ compensation policy for up to $500,000 and purchased reinsurance for claims in excess of $500,000. We actively monitor and manage our clients’ and WSEs’ workers’ compensation claims, which we believe allows us to provide a lower cost workers’ compensation option for our clients than they would otherwise be able to purchase on their own.

As of August 31, 2020, the Company had 78 clients with over 3,100 WSEs, and processed payroll of over $65 million during Fiscal 2020, an increase of nearly 61% over Fiscal 2019 after adjusting for Fiscal 2019 terminations. Of these WSEs, approximately 95% represent workers in the restaurant industry. In addition, as of August 31, 2020, there were an additional 38,000 inactive WSEs in our HRIS technology platform who are available for gig opportunities.

services.

The COVID-19 pandemic has had a significant impact upon and delayed our expected growth, which we have observed through a decrease in our billed customers and WSEs beginning in mid-March 2020, when the State of California first implemented “lockdown” measures. Significantly, substantially all of our February 29, 2020 billed WSEs worked for clients located in Southern California, and many of these clients were required to furlough or layoff employees or, in some cases, completely close their operations. However, during the six month period beginning March 1, 2020, (immediately before the COVID-19 pandemic had widespread impact throughout the economy), and through the end of Fiscal 2020, (as the pandemic took hold), we continued to close new customer opportunities. The combination of our sales efforts and the opportunities our services provide to businesses impacted by the COVID-19 pandemic resulted in additional business opportunities for new client location additions, but our WSE billings per client location decreased as many clients were shut down, or reduced staffing during the quarter ended May 31, 2020. For the month of May 2020, our billed client count decreased to 81 clients, but client locations increased by 24% to over 300 client locations compared to the month of February 2020. The Southern California economy experienced a modest recovery in June and through mid-July. On July 13, 2020, the Governor of the State of California re-implemented certain COVID-19 related lockdown restrictions in most of the counties in the state, including those located in Southern California where most of our clients reside. Since that time, the fluid nature of the pandemic has resulted in the issuance of additional health orders by county health authorities, resulting in uneven patterns of business openings and closings throughout the state but due to the fluid nature of the pandemic, we are unable to evaluate fully the probable impact of this lockdown development on our overall customer base.

We believe that our

business will be impacted based upon the negative effect on those clients that rely more heavily upon in-person dining to the extent that in-person dining restrictions are required. We observed this through the loss of several restaurant clients during our fiscal quarter ended August 31, 2020, of which two closed their doors due to the pandemic.In July 2020, we signed our first healthcare client, representing a potential gain of 8,000 WSEs, and began to onboard these WSEs in late July and into August on a very limited basis. We expect these new healthcare WSEs to earn an average of 2 to 3 times more than the average restaurant WSE we have typically onboarded in the past, which should yield higher gross profits per healthcare WSE compared to a restaurant or other lower-wage worker.

Despite the impact of the pandemic and the churn of the economic recovery and restrictions, for the fourth quarter of Fiscal 2020, quarterly billings increased 23.7% over the quarterly billings for the pre-pandemic second fiscal quarter ending February 29, 2020. We saw quarterly and monthly declines in billings for the third fiscal quarter with substantial recovery in the fourth quarter and continuing into the first two months of the quarter ending November 30, 2020. For the month of August, our monthly billings increased 24.4% over our May 2020 monthly billings and, for the month of October, our unaudited gross monthly billings increased nearly 55% over the May 2020 levels. We ended October 2020 with 90 clients, 744 client locations, (many of which are single person healthcare locations), and nearly 3,500 billed WSEs. As we continue into Fiscal 2021, we believe that our business will continue to be impacted based upon the negative effect on those clients that rely more heavily upon in-person dining, but due to the fluid nature of the pandemic, as noted above, we are unable to evaluate fully its probable impact on our overall customer base as of the date of this Form 10-K.

We believe that our customer value proposition is to provide a combination of overall net cost savings to our clients, for which they are willing to pay increased administrative fees that offset the clientcosts of the services we provide, as follows:

| · |

•Payroll tax compliance and management services |

| · | Governmental HR compliance such as for Patient Protection and Affordable Care Act (“ACA”) compliance requirements |

| · | Reduced client workers’ compensation premiums or enhanced coverage |

| · | Access to an employee pool of potential applicants to reduce turnover costs |

| · | Offset by increased administrative fee cost to the client payable to us |

Our Company founders and management believeservices

•Governmental HR compliance such as for Patient Protection and Affordable Care Act (“ACA”) compliance requirements;

•Reduced client workers’ compensation premiums or enhanced coverage;

•Access to an employee pool of potential qualified applicants to reduce turnover costs;

•Ability to fulfill temporary worker requirements in a “tight” labor market with our intermediation (“job matching”) services; and

•Reduced screening and onboarding costs due to access to an improved pool of qualified applicants who can be onboarded through a highly efficient, and virtually paperless technology platform.

Our management believes that providing this baseline business, coupled with aour technology solution, to address additional concerns such as employee scheduling and turnover, provides a unique, cost effectivevalue-added solution to the HR compliance, staffing, and scheduling problems that businesses face. Our next goal, currently underway, isOver the past twenty-four months, in the face of the COVID-19 and post COVID-19 pandemic,we have instituted various growth initiatives described below that are designed to matchaccelerate our revenue growth. These initiatives include the needsmatching of small businesses with paying “gigs” withtemporary job opportunities between workers and employers under a fully compliant and lower cost staffing solution.solution through our HRIS platform. For this solution to be effective, we need to acquireobtain a significant number of WSEs in concentrated geographic areas to providefulfill our clients with a variety of solutions for their unique staffing needs and to facilitate the employmentclient-WSE relationship.

Managing, recruiting, and scheduling a large numberhigh volume of low wagelow-wage employees can be both difficult and expensive. TheHistorically, the acquisition and recruiting of such an employee population is highlyhas been a labor intensive and costlyexpensive process in part due to high onboarding costs and maintenance costscomplex issues surrounding such matters as tax information capture or I-9 verification. Early in our history, we evaluated these costs and determinedfound that proper process flows that are automated with blockchain and cloud technology, and coupled with access to lower cost workers’ compensation policies resulting from economies of scale, could result in a profitable and low-cost scalable business model.

Over the past four years, we have invested heavily in a robust, cloud-based HRIS platform in order to: | · | reduce WSE management costs, |

| · | automate new WSE and client onboarding, and |

| · | provide additional value-added services for our business clients resulting in additional revenue streams to us. |

Beginning in 2017, we

•reduce client WSE management costs;

•automate new WSE and client onboarding;

•accumulate a large pool of qualified WSEs across multiple geographical markets;

•facilitate the intermediation (job matching) of WSEs with job opportunities; and

•supply additional value-added services for our clients that generate additional revenue streams for us.

We began to develop our HRIS database andplatform in 2017, including our front-end desktop and mobile phonesmartphone application to facilitate easier WSE and client onboarding processes, as well as to providedeliver additional client functionality, and the opportunityprovide enhanced opportunities for WSEs to find shift work. Beginning in March 2019, we transitioned the development of our mobile smartphone application from a third partythird-party vendor in houseto an in-house development team and launched in 2019.an early version of the application several months later. As of August 31, 2019, we had completed the initial launch usingof our mobile applications developed by the third party vendorapplication and begunwe started to provide some of the HRIS and application services to select legacy customers on a testpilot project basis. OurDuring our fiscal year ended August 31, 2021 ("Fiscal 2021"), our in-house engineers along with a new third party vendor, are continuingcontinued to implement additional HRIS functionality in employee fulfillment, delivery gigand scheduling services, and “gig” intermediation services and scheduling through our mobile phonesmartphone application. During Fiscal year ended August 31, 2022 ("Fiscal 2022"), our technology development efforts focused on supporting our growth initiatives with features such as bulk on-boarding, job matching intermediation, and qualified candidate pool vertical market integrations.We see these technology-based services as having potential to generate multiple potentialstreams of revenue drivers with limited additional costs.from a variety of different markets.

Our cloud-based HRIS platform captures, holds, and processes HR and payroll information for our clients and WSEs through an

easy to useeasy-to-use customized

front endfront-end interface coupled with a secure, remotely hosted database. The HRIS system can be accessed by either a desktop computer or an

easy to use electroniceasy-to-use mobile

smartphone application designed with HR workflows in mind. Once fully implemented, we expect to reduce the time, expense, and error rate for onboarding our

clientclients’ employees into our HRIS ecosystem.

OnceUpon being onboarded,

the client employeesthese WSEs are

included as our WSEs and are includedlisted as available for shift work within our business ecosystem. This allows our HRIS platform to serve as

both a gig marketplace for WSEs

for our opportunities and

also allows for

client businessesclients to better manage their staffing needs.

We see our technology platform and our ability to process gig workers as fully compliant W-2 employees as a key competitive advantage and differentiator to our market competitors that will facilitate expansion of our HCM services beyond our current concentration in low-wage restaurant employees and healthcare workers. We are completing added features that we expect to generate new revenue streams over the near future by expanding our product offerings, increasing our client customer and WSE counts, and maximizing the revenues and profits generated per existing WSE.We further believe that our accumulation of a significant number of WSEs on our platform, whether currently billed or not, will facilitate additional growth initiatives with the potential to generate significant value for our shareholders, as described below.

Beginning in January 2020, we operated under a traditional staffing services business model, coupled with developed technology, to address underserved markets in the restaurant and hospitality industries, predominately consisting of lower wage employees with high turnover. At the same time, we continued our prior efforts to expand our services into other industries that utilize higher paid employees on a temporary or part-time basis, including the healthcare staffing industry. Our go-to-market approach was to use an inside sales force to market our services directly to clients to manage their human capital requirements and to form strategic relationships with business associations to gather WSEs. Until the COVID-19 pandemic, this approach was effective and resulted in substantial growth. However, the COVID-19 pandemic changed the landscape in HCM due to reduced employment in our core restaurant and hospitality markets.

During late Fiscal 2022, we reevaluated our prior growth initiatives and decided to change our focus considering the new market conditions. As part of our plan, we identified several growth initiatives designed to fully leverage our HRIS platform during our the second half of Fiscal 2022 and Fiscal 2023. These growth initiatives are focused on: (i) The expanded go-to-market strategy focused on building a national account portfolio managed by a newly-formed regional team of senior sales executives singularly focused on sustained quarterly revenue growth and gross profit margin expansion; and (ii) launching ShiftPixy Labs in Fiscal 2023 to create affiliated high growth restaurant opportunities through a fully immersive customer experience.

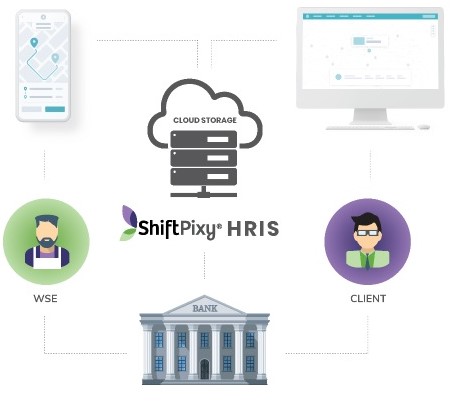

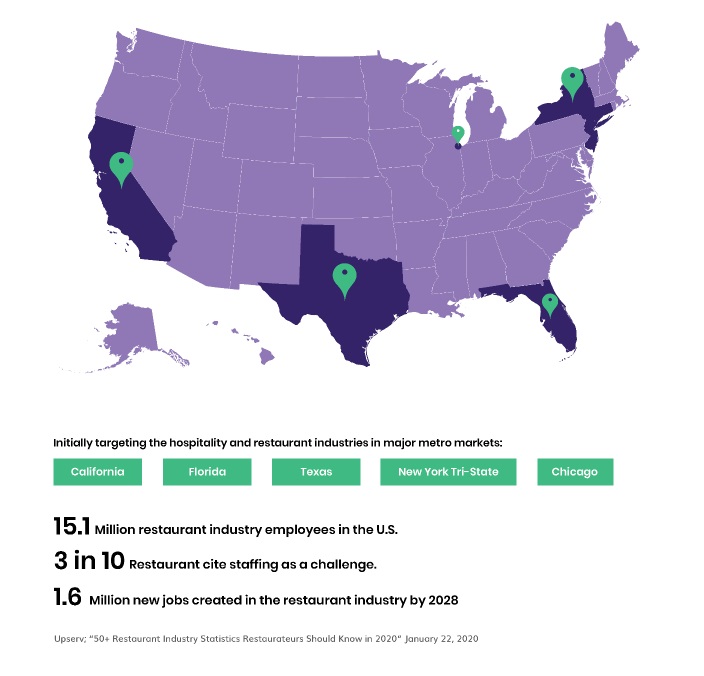

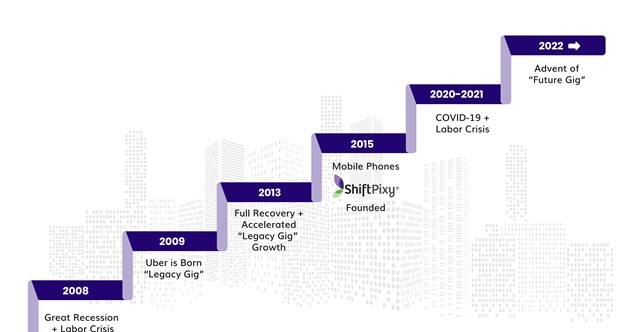

Figure 2

We have built a substantial business on a recurring revenue model since our inception in 2015. Prior to Fiscal 2021, all of our billings consisted of gross employee payroll along with employer payroll taxes, workers’ compensation, and administrative fees, which we collectively refer to as payroll billings. Under our HCM business, our revenue excludes gross employee payroll as required by our accounting policy under US GAAP, thus our revenue presentation is net. In late Fiscal 2021, we began to bill under a staffing service model (“Staffing”).Staffing billings consist of qualified WSEs provided though a wide range of staffing solutions billed to clients as a markup from gross employee payroll where revenues are recognized gross (thereby inclusive of gross employee payroll) as a principal in accordance with our accounting policies under US GAAP.

Figure 3

Our core business is to provide regular payroll processing services to clients under an employment administrative services (“EAS”) model in addition to individual services, such as payroll tax compliance, workers’ compensation insurance coverage related services, and employee HR compliance management. In addition, in November 2019, we launched our employee onboarding function and employee scheduling functionsfunctionalities to our customers inthrough our mobile smartphone application. With the full commercial launch of our mobile application software in the future,In Fiscal 2021, we expectbegan to provide additional services including “white label” food delivery functionality.Figure 1

operate under a direct staffing business model.

Our core EAS are typically provided to our clients for one-year renewable terms. As of the date of this Form 10-K, we have not had any material revenues or billings generated within our HRIS from additional services. We expect that our future service offerings, including technology-based services provided through our HRIS system and mobile application,platform, will provide for additional revenue streams and

support cost reductions for existing and future clients. We expect that our future services will be offered through “a la carte” pricing via customizable on-line contracts.Theonline contracts under our HCM services model as well as through our direct staffing business model.

Our staffing services are typically provided to our clients under recurring revenue contracts with one of our subsidiaries.

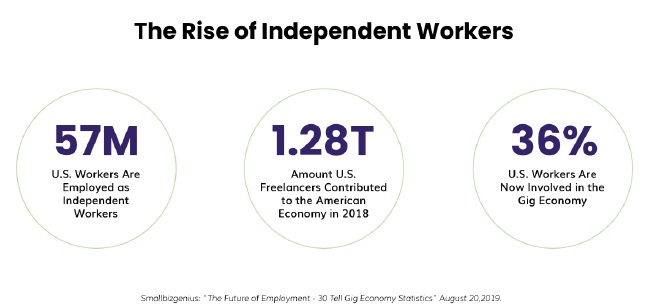

We intend to use our growth initiatives to leverage our expansion by entering into client services agreements ("CSAs") with national account at regional levels and the various restaurant brands that we are working to launch through ShiftPixy Labs.As such, these growth initiatives are expected to increase our core staffing services billings, revenues, gross profit, and operating leverage organically. We may also support our growth by performing new business acquisitions. Further, the new Gig Economy has grown dramatically in recent years, and is projectedgiven rise to continue to grow well into the future. According to various industry publications, as of 2019, 41.1 million workers in the United States were self-employed, (a number expected to grow to 52% by 2023), while, according to data published by Statista, an estimated 25.66 to 28.28 million U.S. workers were employed only part-time during 2019. Further, per various industry reports, as of 2019, 24% of U.S. workers were using on-line platforms in connection with their work, including 38% of the millennials in the workforce. We are targeting employers of this population of part-time, computer savvy workers through our business model and technology.The new Gig Economy has created legal issuescontroversy regarding the classification of many workers as independent contractors or employees. In addition,“independent contractors”, rather than traditional employees, while the rising trend of predictive scheduling creates logistical issues for our clients regardingclients’ management of their workers’ schedules. We provide solutions to businesses struggling with these compliance issues primarily by absorbing our clients’ workers, whom we refer to as WSEs but are also referred to(as well as “shift workers,” “shifters,” “gig workers,” or “assigned employees.”employees”). WSEs are included under our corporate employee umbrella as traditional employees who receive W-2s and are entitled to participate in a full array of benefits that we handle certain employment-related compliance responsibilities for our clientsprovide as part of our services.services for our clients. This arrangement benefits WSEs by providing additional work opportunities through access to our clients. WSEs further benefit from employee status and access to benefits through our benefit plan offerings, including minimum essential health insurance coverage plans and 401(k) plans, as well as enjoying the protections of workers’ compensation coverage. For providing these services, once our platform is fully functional and commercialized, we expect to bill annual gross wages of $20,000 per WSE, yielding a gross profit of $1,200 per restaurant and hospitality WSE each year.

Technological Solution

| | | | | | | | |

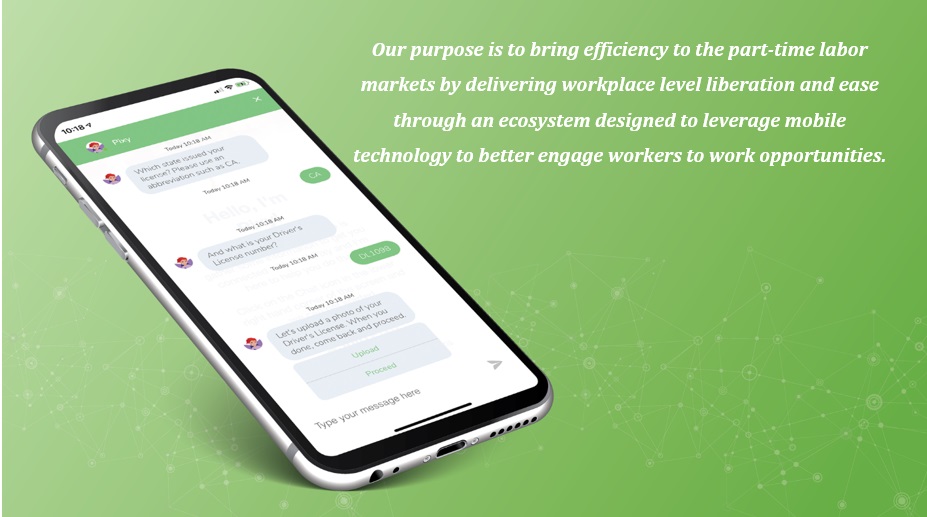

At the heart of our EAS solution is a secure, cloud-based HRIS databaseplatform accessible by a desktop or mobile device through which our WSEs will be able tocan onboard in an speedy, efficient and paperless manner, and then find available shift work at our client locations. ThisWe believe that this solution solves a problemaddresses effectively the dual issues of finding available shift work for both theassisting WSEs seeking additional work and clients looking to fill open shifts. For new WSEs,We believe that the mobile application includes an easy to use WSEeasy-to-use onboarding functionality which we believeembedded in our HRIS platform will increase our pool of WSEs and provide a deep bench of worker talent for our business clients. The onboarding feature of our software enables us to capture all application process related data regarding our assigned employees and to introduce employees to and integrate them into the ShiftPixy Ecosystem.“ShiftPixy Ecosystem”. The mobile application features a chatbot that leverages artificial intelligence to aid in gathering the data from workers via a series of questions designed to capture all required information, including customer specific and governmental information. Final onboarding steps requiring signatures can also be prepared from the HRIS onboarding module. | | Figure 2

4 |

| |

Our HRIS platform consists of a closed proprietary operating and processing information system that provides a tool for businesses needing staffing flexibility to schedule existing employees and to post open schedule slots to be filled by an available pool of shift workers (the “ShiftPixy Ecosystem”). The ShiftPixy Ecosystem provides the following benefits for our clients:

In

1.Compliance: While our clients retain responsibility for compliance with labor and employment laws to the extent that such compliance depends upon their exclusive control over the worksite, we assume responsibility for a substantial portion of our clients’ wage and hour regulatory obligations through our role as legal employer of the WSEs. The ShiftPixy Ecosystem allows us to assist our clients in fulfilling their compliance obligations by providing a qualified pool of potential applicants as shift workers who are our legal employees.This serves to lessen the regulatory and compliance burden on our clients’ management, allowing them to focus more on the management of their business and less on legal issues.

2.Improved staffing fulfillment, recruiting, and retention: We believe that utilization of our HRIS platform reduces the impact of high WSE turnover, which is a consistent problem across the markets we serve.A significant issue at the end of Fiscal 2021 and part of Fiscal 2022 was the limited availability of WSEs in a “tight” labor market.Our platform provides an attractive avenue for pre-screened WSE applicants to find permanent positions that meet their needs through access to the ShiftPixy Ecosystem, which we believe results in a deeper potential labor pool for our clients to

address their human capital needs.We also can function as a “flex” employer for WSEs who may be working full or part-time for other employers but want to have an additional source of income.

3.Cost Savings: The payroll and related costs associated with WSEs such as workers’ compensation and benefits are consolidated and charged, in effect, in conjunction with the shifters’ applicable rates of pay, allowing our clients to fund the employment related costs as the services are incurred, thereby avoiding various lump sum employment-related costs. We believe that our clients typically experience reductions in overhead costs related to HR compliance, payroll processing, WSE turnover and related costs, and elimination of non-compliance fines and related penalties, although the amount of cost savings realized varies from client to client. We exploit economies of scale in purchasing employer related solutions such as workers’ compensation and other benefits, which allows us to provide human capital services at a lower cost than we believe most businesses otherwise can typically staff a particular position.

4.Improved human capital management: Through access to our HRIS platform and our pool of human capital, our clients can scale up or down more rapidly, making it easier for them to contain and manage operational costs. We charge a fixed percentage on wages that allows our clients to budget and plan more accurately and efficiently without worrying about missteps arising from a wide range of legal and compliance issues for which we assume responsibility.

During Fiscal 2019, we implemented additional functionality to provideadded a scheduling component to our software, whichapplication that enables eachour client worksites to schedule workers and to identify shift gaps that need to be filled. We utilizeuse artificial intelligence (“AI”) to maintain schedules and fulfillment, using an active methodology to engage and move people to action. We began usingIncluded in this functionality at the end of Fiscal 2019 on a test basis.One of the final phases of our initial platform consists ofscheduling component is our “shift intermediation” functionality, which is designed to enable our WSEs to receive information regarding and to accept available shift work opportunities at multiple worksite locations. Our embedded AI is designed to monitor and accelerate the matching of WSEs with gig work opportunities.

Our system monitors the capabilities of each WSE based on their work experience, needs, and training and provides messaging to clients and WSEs.The intermediation functionality becomes useful onlysystem matches worker requirements such as hours, position, and pay rate with client requirements such as experience, pay offered, hours offered and both employee and employer ratings.Similar to the extent that we have meaningful numbers ofway gig drivers are matched with gig riders through a smartphone app, our gig client opportunities are matched with WSEs for improved open job fulfillment.We believe this job fulfillment automation, using our HRISplatform, provides real-time human capital information to our clients and client shift opportunities in the same geographic region.is a significant product differentiation feature. We continued our customer testing efforts and rollout during Fiscal 2020 and added significant functionality to our HRIS platform through Fiscal 2021 and Fiscal 2022, including: (i) scheduling and time and attendance components; (ii) a “white label” customer ordering application geared to QSRs;Quick Service Restaurants (“QSRs”); and (iii) customer loyalty tracking and remarketing capabilities. We expect all of these features, including shift intermediation, to be available for commercial distribution to our clients during Fiscal 2021.

Our goal is to have a mature and robust hosted cloud basedcloud-based HRIS platform coupled with a seamless and technically sophisticated mobile smartphone application that will act as both a revenue generation system as well as a “viral” customerclient acquisition engine through the combination of the scheduling, delivery, and intermediation features and interactions. We believe that once a critical mass of clients and WSEs is achieved, additionalmore shift opportunities will be created in the food service, hospitality, and other industries.industries we serve. Our approach to achieving this critical mass is currently focused on marketing our services to restaurant owners and franchisees, focusing on specific brands and geographic locations. build a national staffing footprint.

We expect these initiatives to be key drivers in supplying a significant number of WSEs across a national footprint and achieving the critical mass necessary for our technology to beflourish.The development and integration of these vertical markets as well as the configurations needed for bulk onboarding of WSEs was the primary focus of our technical team during Fiscal 2021 and Fiscal 2022.

COVID-19 Pandemic Impact

The COVID-19 pandemic has provided both business setbacks and business opportunities. Our growth trajectory was muted by the economic impacts of the COVID-19 pandemic on our core business clients, primarily restaurants and nurse staffing organizations supplying health services not related to COVID-19.

The COVID-19 pandemic has significantly impacted and delayed our expected growth, which we saw initially through a functiondecrease in our billed customers and WSEs beginning in mid-March 2020, when the State of both geography, suchCalifornia first implemented “lockdown” measures. Substantially all of our billed WSEs as of February 29, 2020, worked for clients located in Southern California, and were primarily in the QSR industry. Many of these clients were required to furlough or lay off employees or, in some cases, completely shutter their operations. For our clients serviced prior to the March 2020 pandemic lockdown, we experienced an approximate 30% reduction in business levels within six weeks after the first lockdown commenced. Early in the pandemic, the combination of our sales efforts and the tools that our services provide to businesses impacted by the COVID-19 pandemic resulted in additional business opportunities for viral adoptionnew client location additions, as did the fact that many of our clients received Payroll Protection Plan loans ("PPP Loans") under the CARES Act, which supported their businesses and payroll payments during in-store lockdowns. Nevertheless, during the quarter ended May 31, 2020, our WSE billings per client location decreased as many of our clients were forced to cease operations or reduce staffing. On July 13, 2020, the Governor of

the State of California re-implemented certain COVID-19 related lockdown restrictions in most of the counties in the state, including those located in Southern California where most of our clients were located. The mercurial nature of the pandemic led to recurring lockdowns through the issuance of additional orders by state and county health authorities that yielded uneven patterns of business openings and closings throughout our clients’ markets, which also experienced significant lockdowns beginning in late November 2020 and through the year-end holiday season as a spike in COVID-19 cases was observed.

The negative impact of these lockdowns on our business and operations continued through our third quarter of Fiscal 2021 in a see-saw pattern, with some improvement observed after the removal of many restrictions in California and elsewhere from March through June 2021, only to be followed by the reimplementation of restrictions in the face of the pandemic resurgence fueled by the spread of the Delta variant of the virus. While the availability of PPP Loans to our clients mitigated the negative impact on our business during the initial stages of the pandemic, we believe that the failure of the government to renew this program exacerbated the deleterious impact of subsequent restrictions and lockdowns on our financial results for Fiscal 2021.

We have observed, however, some degree of business recovery in late Fiscal 2021 and in Fiscal 2022 as the success in vaccination efforts have fueled our clients' business recoveries.

We have also experienced increases in our workers’ compensation reserve requirements, and we expect additional workers’ compensation claims to be made by furloughed employees. We also expect additional workers’ compensation claims to be made by WSEs required to work by their employers during the COVID-19 pandemic. On May 4, 2020, the State of California indicated that workers who became ill with COVID-19 would have a potential claim against workers’ compensation insurance for their illnesses. These additional claims, to the extent they materialize, could have a material impact on our workers’ compensation liability estimates.

Opportunity

Shortly after the beginning of the pandemic, once it became clear that the business interruption would be prolonged and more extensive than originally contemplated, our management team began to make adaptations to our business strategy to capitalize on the pandemic related disruptions and what we believed to be the opportunities that would arise during a recovery. We realized that the COVID-19 pandemic created an employment shock that required a revised strategy and opened up opportunities to capitalize on a disrupted market. Our growth initiatives were created out of the changes underway in the early part of the pandemic and included new go-to-market strategies, and new service lines.

We see our opportunities to be multi-faceted.Our business strategy is to monetize our HRIS platform within observed and expected disruptions to the human capital market.We have designed our customer engagement to be agilein meeting the needs of a disrupted workforce and a rapidly changing work environment. The Company was founded, in part, with the goal to be properly positioned with a valuable service offering for the human capital marketplace and thereby ready to capitalize on the next wave of disruption.

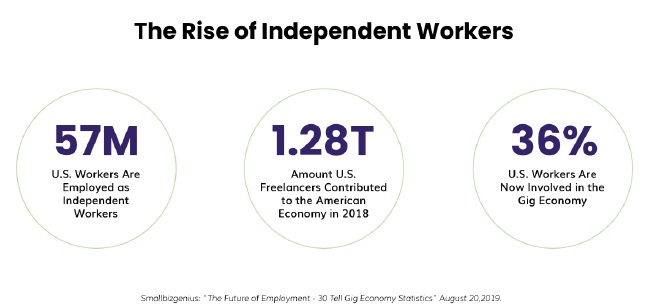

According to an article from Forbes dated July 21, 2022 (“3 Reasons Businesses Are Tapping Into The Gig Economy”), The gig economy is booming and business leaders are taking note. From the C-suite on down, Mercer’s 2022 Global Talent Trends report shows that gig is becoming a favored strategy, with six in 10 executives embracing this work model. The increase in preference for gig workers is not surprising considering the exponential growth the gig economy has seen in recent months. Ballooning by 30% during the pandemic, the gig workforce is now on track to surpass the full-time workforce in size by 2027. This phenomenon has prompted changes in business strategies that will assist organizations as they battle labor shortages, inflation, and prepare for the future of work.

According to an article from Zippia dated September 22, 2022 ("23 essential gig economy statistics 2022")

•At least 59 million American adults participated in the gig economy over 2020, roughly to 36% of the U.S. workforce.

•16% of U.S adults have earned money through an online gig platform at some point in their lives, and 9% earned income from online gig work in 2021.

•Wages and participation for gig workers grew by 33% in 2020.

•Gig workers contributed around $1.21 trillion to the U.S. economy in 2020, which is roughly 5.7% of the total U.S. GDP.

•By 2023, experts predict that 52% of the American workforce will have spent some time participating in the gig economy.

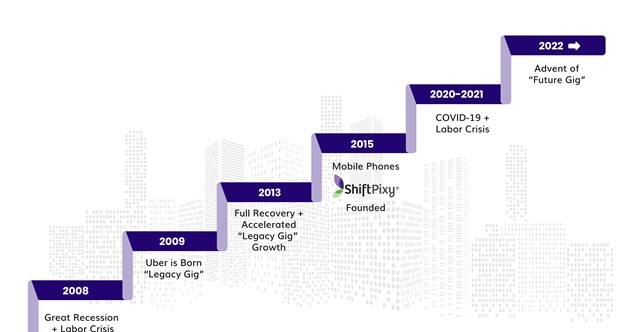

We have observed the following pattern in the development of the gig economy over the past fifteen years:

Figure 5

Each economic crisis creates chaos and disruption along with significant opportunities once recovery ensues. Our veteran management team has observed and learned from the technological and economic trends of the past 25 years, along with the resultant changes to the human capital markets, including the dot.com bubble, post 9/11 economic shocks, and the two more recent financial crises: the 2008 “Great Recession” and the 2020 COVID-19 crisis.We observed the creation of an entirely new approach to part time “gig” work after the 2008 economic crisis with the rise of companies that eschewed the traditional employer-employee relationship in favor of an “independent contractor” model, and which primarily focused on driver and delivery services.The resultant employment opportunities typically produced lower paying jobs that required a lower level of skill and expertise, and often deprived workers of health and welfare benefits that are typical, and often required, in the traditional employer-employee relationship.We call these early gig worker companies, like Uber and Postmates, “Legacy Gig” companies, which emerged in large numbers after the Great Recession.These companies experienced significant growth within five years of the 2008 crisis by capitalizing on a combination of factors, including the economic recovery itself, the companies’ ability to find a technological solution for the desire of the workforce to find more flexible work options, and the growing proliferation and sophistication of mobile smartphones.While these Legacy Gig providers have enjoyed great success, they are now facing significant pushback from regulatory authorities from their decision to embrace the independent contractor business model, which is under attack as a means of depriving employees of significant benefits and protections while evading traditional employer tax obligations.

The lessons learned from the Legacy Gig providers and the demographic shifts underpinning their success gave rise to the founding of ShiftPixy.In 2015, our founders Pixy evaluated the Legacy Gig businesses and believed that there was a need in the marketplace for a lower wage “gig” service provider to treat its workers as employees, with all of the traditional benefits and protections that employees have historically enjoyed, while also providing the flexibility that is the hallmark of the gig economy.The ShiftPixy Ecosystem and our HRIS platform were designed and continue to be enhanced with this goal in mind.The launch of ShiftPixy in 2015 coincided with the widespread adoption of smartphones throughout the population, making the marriage of WSEs and business on a distributed network on a grand scale possible.

Our business plan at inception was premised upon our belief that gig workers would eventually migrate away from an independent contractor to a more traditional employee/employer relationship that nonetheless provides the range of flexibility and choice commonly desired by workers in the gig economy.We also recognized a gap in the marketplace where traditional HR service providers were not providing a comprehensive services suite for gig workers on a level comparable to that typically provided to higher wage or salaried employees.We also came to recognize the likelihood that governmental regulators and tax

authorities would ultimately object to the prevalent use of independent contractors by private businesses as a means to avoid paying certain taxes and avoid providing traditional employment benefits to their workers, and we believe that recent actions by federal, state and local governments have proved our predictions to be accurate.Therefore, as our business plan has evolved, we have avoided an independent contractor model, which we do not believe to be sustainable, in favor of a staffing model through which we employ our clients’ WSEs and provide them with a full range of traditional benefits.

Figure 6

Our purpose is to bring efficiency to the part-time labor markets by delivering workplace level liberation and

Our purpose is to bring efficiency to the part-time labor markets by delivering workplace level liberation andMore recently, there have been significant workplace shocks due to the COVID-19 pandemic. Increasingly and as is well documented in news media, those companies employing lower wage employees are experiencing significantly increased employee turnover and higher recruiting costs. We believe that the broader employment marketplace is undergoing a fundamental shift towards a new “Future Gig” workplace and further believe that ShiftPixy is well positioned to capitalize on the combination of a near term economic recovery and the longer-term demographic shift of younger and lower paid workers to a temporary and flexible work environment, as was seen with the early gig service provider business models. The financial markets have already recognized this opportunity in the growth and high value of companies focusing on the higher end salary or contract employment for professionals or creative personnel (as contractors and employees) and lower pay scale workers (as contractors) as well as significant investment in third party delivery. We believe that our commitment to a full employment staffing model, through which our WSEs are provided with a range of traditional employment benefits, uniquely positions us to attract Future Gig workers to our HRIS platform and the ShiftPixy Ecosystem.

Third party delivery constitutes an important part of our overall strategy to supply our clients with highly qualified WSEs at an affordable price while allowing them to regain control over their brands.Throughout the pandemic, many of our clients were forced to cede control over their brands to large third-party delivery services such as Postmates and UberEats to ensure their survival.The result was not only a dissipation of profits, but also a loss of control over the delivery experience and, in many cases, a decline in customer loyalty and goodwill.We believe that QSRs require more control over the delivery experience to ensure their future success which, in turn, requires more flexibility that can only be achieved through digital engagement.Our technology platform is designed with this goal in mind, focusing on real-time business intelligence for human capital while also providing additional key data capture that is critical to QSR success.

We also have observed the substantial investment that has been made in “ghost” kitchens, which is causing significant changes to the restaurant industry.Ghost kitchens, or cooking facilities that produce food only for delivery with no dine-in or customer facing areas, could create a $1 trillion global opportunity by adoption2030, according to a Euromonitor virtual webinar presented by Euromonitor’s Global Food and Beverage Lead Michael Schaefer. The firm predicts cheaper, faster and more reliable delivery could help this segment capture 50% of drive-thru service ($75 billion), 50% of takeaway foodservice ($250 billion), 35% of

ready meals ($40 billion), 30% of packaged cooking ingredients ($100 billion), 25% of dine-in foodservice ($450 billion), and 15% of packaged snacks ($125 billion).We believe that our existing relationships withQSRs provide us with unique insight into the vulnerabilities and opportunities created by this third-party consumer disruption, and the primary work of ShiftPixy Labs is devoted to maximizing the monetization of this disruption through the creation and optimization of new vertical markets and opportunities, with the goal of creating additional shareholder value.

We believe that the combination of these demographic shifts, marketplace upheaval, and the COVID-19 pandemic’s impact on how workers find work and employers seek WSEs creates a multitude of opportunities for companies like ShiftPixy. We anticipate that a second generation of gig employment companies that are utilizing lower wage employees will experience rapid growth within

franchise brands.three years following the end of the COVID-19 economic crisis. We also believe that the innovations occurring within the restaurant industry will dramatically change the way restaurants operate. We have designed our business strategy to this end and believe that our HRIS platform is well positioned for the rapid growth that we expect as we meet these changes within the marketplaces we serve.

Overview

Our current primary market focusproducts and services are designed primarily to help from the small to large sized businesses thrive in the gig economy by providing a cost-effective, legally compliant means to fulfill their staffing needs. As noted above, the worldwide trend toward a gig economy has been fueled largely by the widespread adoption of smartphones, which provide the technological means for remote office workers to move away from the traditional centralized workplace.

Indeed, according to a March 2021 Statista article, over 95 % of 18-to 30-year-old workers use a smartphone. This, in turn, has led to a significant disruption of the traditional employer-employee relationship, with supply management firm Ardent Partners reporting as far back as 2016 that nearly 42% of the world’s total workforce was considered “non-employee”, which includes temporary staff, gig workers, freelancers, and independent contractors.

We have designed our mobile application to take full advantage of this fundamental shift to the gig economy, which has been fueled by the near universal adoption of smartphones. Our initial marketing efforts focused on small and medium sized businesses struggling to find and maintain workers in the food servicegig economy. In particular, we have targeted the restaurant and hospitality industries, was chosen based on our understanding of the issues and challenges facing Quick Service Restaurants (“QSRs”), including fast food franchises and local restaurants. To this end, we have chosen to invest in two key features of our mobile application consisting of: i) scheduling functionality, which is designed to enhance the client’s experience through scheduling of employees and reducing the impact ofare characterized by high turnover and ii) delivery functionality, which is designedoften use independent contractors to increase revenues through “in house” delivery fulfillment, thereby reducing delivery costs.One of the most recent significant developments in the food and hospitality industry is the rapid rise of third-party restaurant delivery providers such as Uber EatsTM, GrubHubTM, and DoorDashTM. These providers have successfully increased QSR revenue in many local markets by providing food delivery to a wide-scale audience using contract delivery drivers. We have observed two significant issues impacting our clients and third-party delivery providers that are increasingly being reported in the news media. The first issue is the large revenue share typically being paid to third-party delivery providers as delivery fees. These additional costs erode the profit for the QSRs from additional sales made through the delivery channel. The second issue is that our QSR customers have encountered logistical problems with food deliveries - late deliveries, cold food, missing accessories, and unfriendly delivery people. This has caused significant “brand erosion” and has caused these clients to reconsider third-party delivery. | | Figure 3

|

We provide a solution to the third-party delivery issues. We designed our HRIS platform to manage food deliveries by the QSRs using internal personnel and a customized “white label” mobile application. Our recently released delivery feature links this “white label” delivery ordering system to our delivery solution, thereby freeing the QSR to have their own brand showcasing an ordering mobile application but retaining similar back-office delivery technology including scheduling, ordering, and delivery status pushed to a customer’s smart phone. Our technology and approach to human capital management provides a unique window into the daily demands of QSR operators and the ability to extend our technology and engagement to enable this self-delivery proposition. Our new driver management layer for operatorsperform less than full-time gig engagements, primarily in the ShiftPixy Ecosystem will allow clients to use their own team members to deliver a positive customer experience. Our mobile application already provides the HR compliance, management and insurance solutions necessary to support a delivery option and create a turnkey self-delivery opportunity for the individual QSR operator. Our solution saves delivery costs to the QSR client and allows them to retain the customer information and quality control over the food delivery. We are marketing this solution to our clients under the ZiPixy brand.

The first phaseform of this component of our platform is the driver onboarding functionality, which was completed in 2019 by the initial third party vendor. The enhanced features under development will “micro meter” the essential commercial insurance coverages required by our operator clients on a delivery-by-delivery basis (workers’ compensation and auto coverages) which has been a significant barrier for some QSRs to provide their own delivery services. We began using the “delivery features” of our mobile application for selected customers on a trial basis in the fourth quarter of Fiscal 2019 and are continuing to work toward full deployment of this solution, with wide-scale commercial rollout expected during Fiscal 2021.

shift work.

A significant problem for smallthese businesses, particularlyalong with many others in the food service industry, such as QSRs,a wide variety of industries, involves compliance with employment related regulations imposed by federal, state and local governments. Requirements associated with workers’ compensation insurance, and other traditional employment compliance issues, including the employer mandate provisions of the ACA, create compliance challenges and increased costs. The compliance challenges are often complicated by “workaround” solutions thatto which many employers resort to in order to avoid characterizing employees as “full-time” and requires increased compliancein an often futile attempt to avoid fines and penalties. As of the date of this Form 10-K, the United States Congress has considered but not passed legislation replacing the ACA, with the exception

We believe that

the individual mandate provision was removed in 2017. Despite the removal of the individual mandate, employers still face regulatory issues and overhead costs for which we believe our services

areand HRIS platform provide a cost-effective,

solution.Other regulation is prevalent atfully compliant solution for small businesses facing increasingly complex regulations and related litigation governing the stateclassification and local levels.use of independent contractors. Recently in California, where most of our WSEs currently reside, legislation was passed that more clearly defines gig workers foremployed by Legacy Gig companies such as Lyft orand Uber as employees rather than their previous classification as independent contractors. Wecontractors, which we believe that legislation such as this iswas a direct governmental response to a considerable loss of tax revenue derived from the gig companies’ contract employees.categorizing these WSEs as independent contractors. In November 2020, California voters passed Proposition 22, which nominally had the effect of repealing this legislation and restoring independent contractor status with respect to “app-based drivers.” Nevertheless, Proposition 22 also instituted various labor and wage policies that are specific to app-based drivers and their employers that do not apply to other independent contractors, including: (i) minimum wage requirements; (ii) working hours limitations; (iii) requiring companies to pay healthcare subsidies under certain circumstances; and (iv) requiring companies to provide or make available occupational accident insurance and accidental death insurance to their app-based drivers. We believe that within the next few years, there is an increasing likelihood that workers in other states and municipalities will have to be treatedimpose similar mandates in a manner more similar to traditional employees than independent contractors,the near future, which will likely include, at a minimum, wage and benefit provisions similar to those guaranteed by Proposition 22.

Figure 7

Source: 11th Annual State of Independence in America, Data Highlights & Preview | August 2021 MBO Partners

Prior Focus and Marketing Efforts

Our business model provides a solution to this likely regulatory change by absorbing workers for these types of gig economy companies as our employees, eliminating anysignificantly limiting the risk of litigation, fines and other worker misclassification problems forrelated issues.Our early market focus was on the food service and hospitality industries, based primarily upon our understanding of the issues and challenges facing QSRs. Some of the key features incorporated in our mobile smartphone application to address these typeschallenges include: (i) scheduling and intermediation functionality, which is designed to enhance the client’s experience through easy WSE scheduling and reducing turnover impact, and (ii) delivery functionality, which is designed to increase revenues through “in house” delivery fulfillment, thereby reducing delivery costs while creating a better customer experience and elevated engagement.

One of gig economy companiesthe most recent significant developments in the food and hospitality industry has been the rapid rise of third-party restaurant delivery Legacy Gig providers such as Uber EatsTM, GrubHubTM, and DoorDashTM.These providers have facilitated an increase in QSR sales in many local markets by providing food delivery to the extent they becomea wide-scale audience using independent contractor delivery drivers. Nevertheless, we have observed two significant issues negatively impacting our clients.Figure 4

The worldwide trend toward a gig economy isclients as a result of their increased reliance upon third party delivery providers that have been widely reported. The first issue is the market adoption of smart phoneslarge revenue share typically being paid to third-party delivery providers as delivery fees. These additional costs erode QSR profits that would otherwise be generated by additional sales made through the delivery channel.

The second issue is that our QSR clients have encountered logistical problems with food deliveries, including late deliveries, cold food, missing accessories, and mobile telephones,unfriendly delivery people.This has caused significant “brand erosion”, causing these clients to reconsider third-party delivery.

While some larger chain restaurants have mitigated these additional costs and remote office workersrisks by moving away fromto either a centralized food fulfillment center (commissary) or a “ghost” kitchen solution for their third-party delivery system, our clients typically lack the traditional office or factory workplace. For our target WSE audience, as of February 2019, over 92 % of 18-30-year-old workers have, or use, a smart phone. This development has created opportunitiesresources to follow this example.Our ShiftPixy Labs growth initiative, (described in more detail, below), focuses on addressing this issue for companies catering tothese smaller QSR operators through the use of these devices.our technology.Our HRIS platform allows our QSR clients to manage food deliveries in a cost-effective manner by using their own WSEs, (for whom we serve as the legal employer), through a customized “white label” mobile application. Our delivery feature links this “white label” delivery ordering system to our delivery solution, thereby freeing our clients to showcase their brands throughout the mobile ordering process while retaining back-office delivery functionality on a par with that offered by the Legacy Gig providers, including scheduling, ordering, and delivery status pushed to a customer’s smart phone. The first development phase of this aspect of our platform focused on driver onboarding functionality, which we completed during our fiscal year ended August 31, 2019 ("Fiscal 2019"). Additional features currently under development or already implementedallow us to “micro meter” the essential commercial insurance coverages required by our operator clients on a delivery-by-delivery basis (workers’ compensation and auto coverages), thereby overcoming a significant obstacle encountered by QSRs seeking to provide their own delivery services without relying on a Legacy Gig provider.

Our technology platform and approach to human capital management also provides a unique window into the daily demands of QSR operators, giving us the ability to extend our technology and engagement to optimize this self-delivery proposition. We

have designedexpect our most recent enhancements to our driver management layer for operators in the ShiftPixy Ecosystem to allow our clients to use their own team members to control the delivery process from start to finish, yielding a more positive customer experience. We believe that our mobile application

already provides the HR compliance, management and insurance solutions necessary to

utilizesupport a delivery option and create a turnkey self-delivery opportunity for the

smartphone adoption to create an easy to use on-boarding tool for potential employees. The migration towards a gig economy trend is also significant. According to a 2016 study conducted by Ardent partners, nearly 42% of the world’s total workforce is now considered ‘non-employee,’ which includes contingent/contract workers, temporary staff, gig workers, freelancers, professional services, and independent contractors. Our initial focus in the marketing of our product to the larger gig economy is to small and medium sized businesses with high worker turnover such as the restaurant and hospitality industries that have high turnover and often contract with independent contractor workers to perform less than full-time gig engagements, primarily in the form of shift work.individual QSR operator.

The impact of the COVID-19 pandemic on our marketing efforts, along with its broader impact on the gig economy, and gig workers appears to be mixed. According to Thea recent report issued by AppJobs through its Future Work Institute, which conducts research on the gig economy, the pandemic has causedfueled an increase in global demand for certain jobsremote services such as delivery, online surveys and market research, while there has been a 36% drop inthe demand for other jobs that requirepositions requiring entry into the home, such as house-sitting, babysitting and cleaning. Similarly,cleaning, has declined by 36%.Our experience with the bulk of our clients during the height of the pandemic largely confirms this research.Specifically, we observed a significant decline in our food and hospitality billed WSEs located in our Southern California markets during mid-March 2020, which coincided with the shutdown of many of our QSR clients’ dining locations. Nevertheless, our number of WSEsWe began to reboundexperience some recovery in early May 2020, as various lockdown measures were relaxed and many restaurant operators created “work-around” solutions to new health and safety regulations, including improved takeout and delivery, as well as limited in-person dining. We believeThe reimplementation of lockdowns from November 2020 through February 2021 negatively impacted our WSE billings, although this was tempered somewhat by the receipt of COVID-19 related government payments such as the PPP Loan program.As of August 31, 2022, we have seen a recovery and it is clear to us that our HRIS platform provides long-term benefitsthe commercial landscape in the restaurant industry has moved towards a mix between restaurant delivered meals compared to our clients that will outlast the COVID-19 pandemic. in-person dining.Our ShiftPixy Labs initiative is largely designed to address this shift in demand.

We do not believe that the post-pandemic employment environment will decrease the migration of workers towards a gig economy, and we expect that the demand for services that match those workers with gig opportunities will continue to increase.

Figure

5

8

Market expansion

We view our ability to capture and utilize information pertaining to our target demographic to be integral to our future expansion and revenue growth.Although our clients were principally concentrated in Southern California as of the end of Fiscal 2022, we believe that our expanded go-to-market strategy focused on building a national account portfolio managed by a newly-formed regional team of senior sales executives and ShiftPixy Labs initiatives have the potential, if successful, to result in the addition of a significant number of WSEs to the ShiftPixy ecosystem, covering a truly national footprint.Our current technology efforts are devoted to ensuring that our HRIS platform has the capacity to take full advantage of this projected future growth, which we believe is likely to result from the following factors:

1.Large Potential Markets.

Restaurant and Hospitality:Current statistics show that there are over 15.1 million WSEs in the restaurant and hospitality industries – representing over $300 billion of annual revenues – who are overwhelmingly working on a part-time basis. At our current monetization rate per WSE, this represents an annual gig economy revenue opportunity of over $9 billion per year for the United States. We believe that our ShiftPixy Labs initiative will position us to take full advantage of growth opportunities within this industry segment.