VALLON PHARMACEUTICALS,

| Page No. | |||||||||

ITEM 5. | |||||||||

ITEM 9A. | |||||||||

ITEM 10. | |||||||||

ITEM | |||||||||

ITEM 12. | |||||||||

ITEM | |||||||||

ITEM 14. | |||||||||

ITEM 15. | |||||||||

SPECIAL

Although•our history of losses and need for additional capital to fund our operations, our inability to obtain additional capital on acceptable terms, or at all, our ability to continue as a going concern, and our need to liquidate if we believe that we havefail to obtain adequate funding, which could result in our stockholders receiving no value for their investment;

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you

This Annual Report includes trademarks and registered trademarks of Vallon Pharmaceuticals, Inc. Products or service names of other companies mentioneddocuments that we reference in this Annual Report and have filed with the U.S. Securities and Exchange Commisstion (the SEC) as exhibits to the Annual Report with the understanding that our actual future results, levels of activity, performance, and events and circumstances may be trademarks or registered trademarks of their respective owners.

materially different from what we expect.

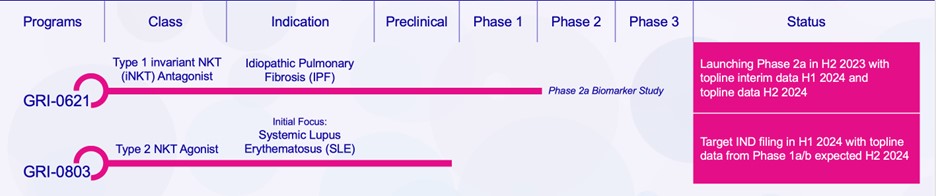

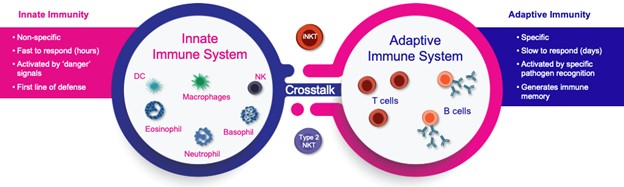

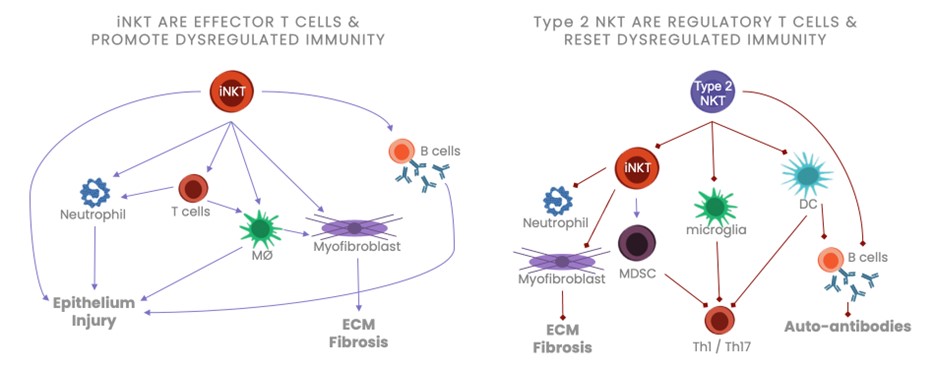

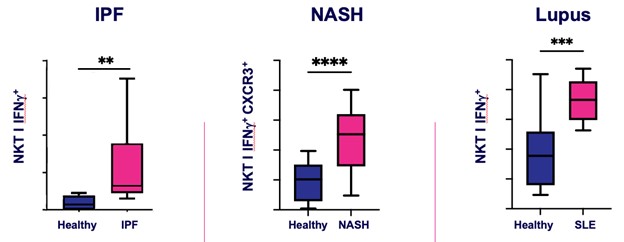

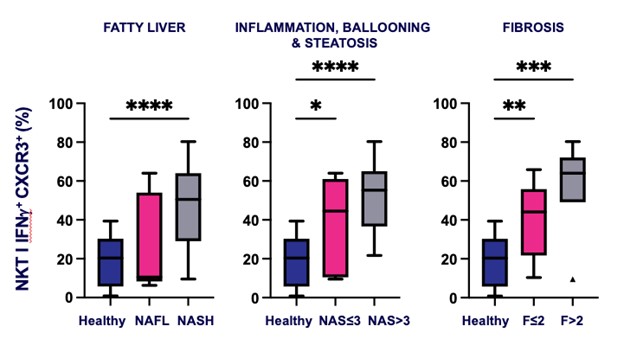

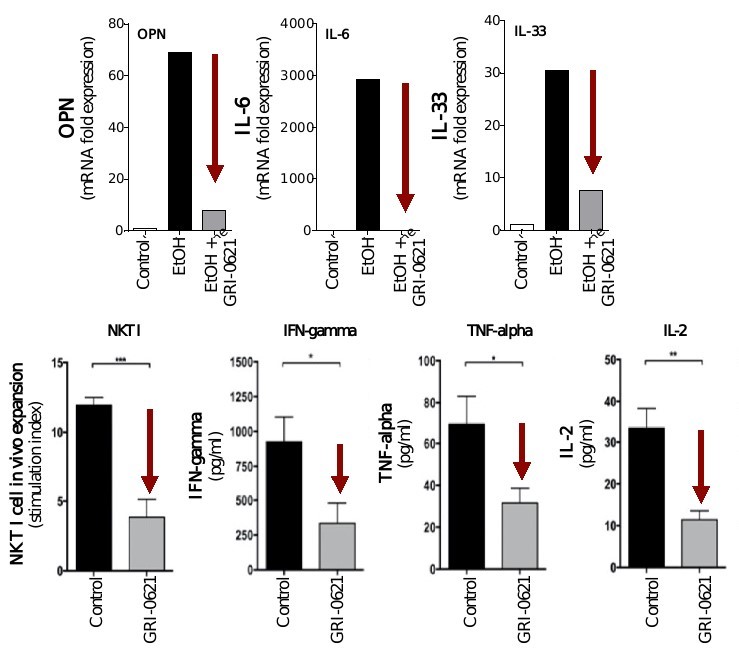

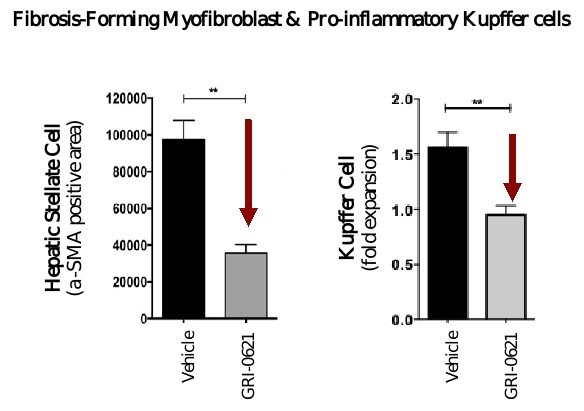

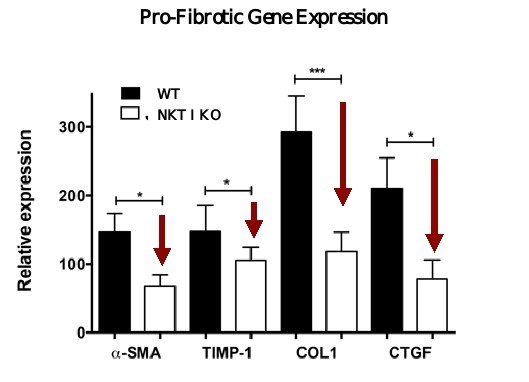

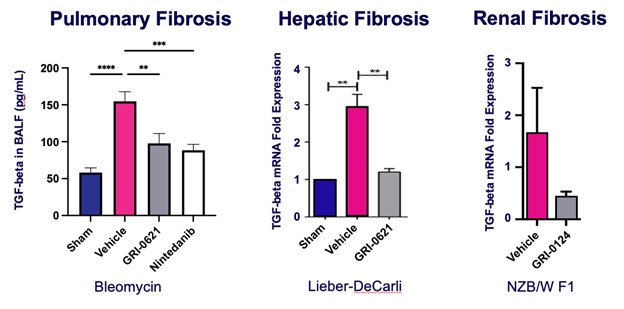

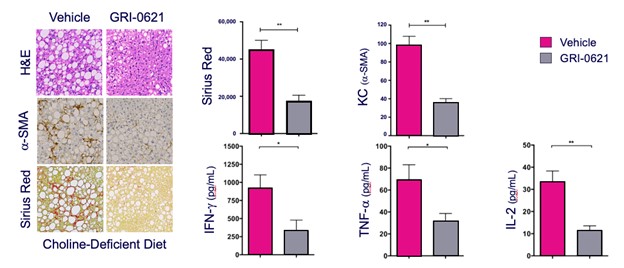

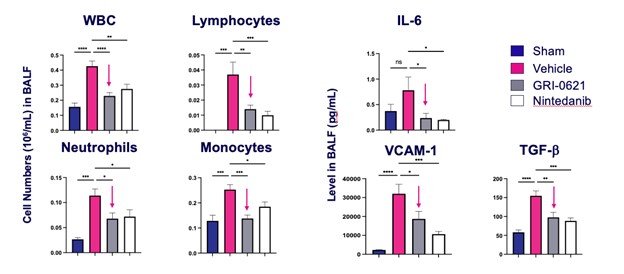

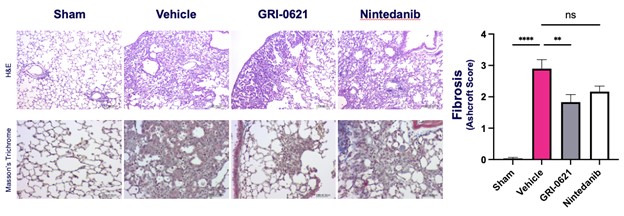

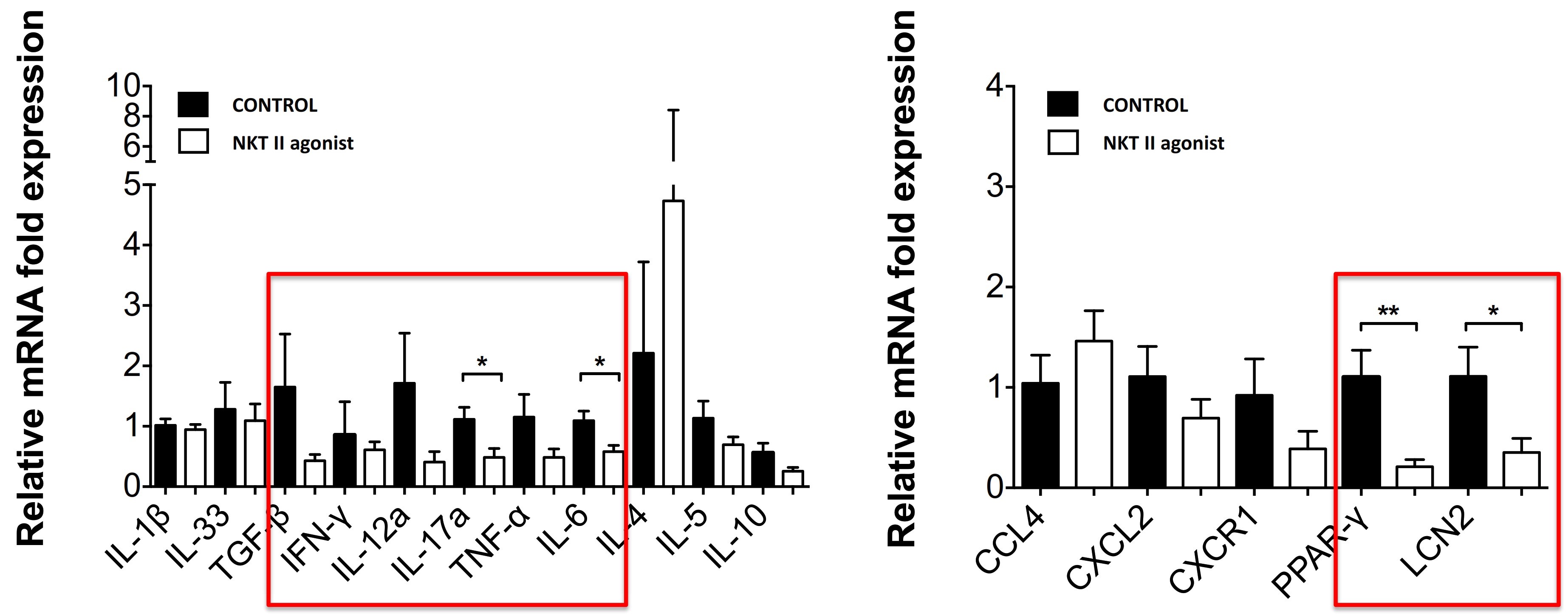

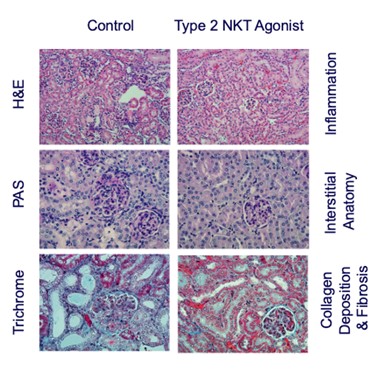

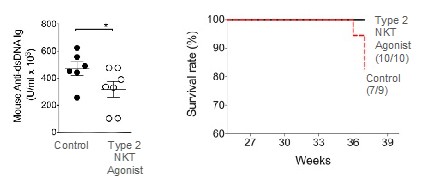

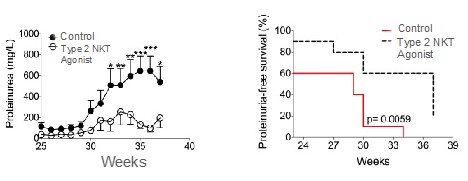

records conducted by researchers at the Mayo Clinic and presented in 2019 found that the adoption of pirfenidone and nintedanib by IPF patients was approximately 10% for each therapy, supporting the earlier observation that the majority of IPF patients are not actively being treated. Despite this, total worldwide sales of pirfenidone and nintedanib in 2019 were over $1.2 billion and $1.6 billion, respectively. proprietary technology and information commercially or strategically important to our business. We Brand patent. The penalties.primarily focused on discovering, developing, and commercializing innovative therapies that target serious diseases associated with dysregulated immune responses leading to inflammatory, fibrotic, and autoimmune disorders. Our goal is to be an industry leader in developing therapies to treat these diseases and to improve the developmentlives of patients suffering from such diseases.commercializationgamma selective agonist, that is approved in the United States for topical treatment of proprietary biopharmaceutical products.psoriasis and acne. As of December 31, 2023, it has been evaluated in over 1,700 patients as an oral product for up to 52-weeks. We are developing prescription drugs for central nervous system (“CNS”) disorders and our current focus is the development of drugs with lower potential for abuse than currently available drugs. Our clinical-stage product currently under development is Abuse-Deterrent Amphetamine Immediate-Release (“ADAIR”), a proprietary, abuse-deterrent oral formulation of immediate-release (short-acting) dextroamphetamineGRI-0621 for the treatment of attention-deficit/hyperactivity disorder (“ADHD”)severe fibrotic lung diseases such as idiopathic pulmonary fibrosis (IPF), a life-threatening progressive fibrotic disease of the lung that affects approximately 140,000 people in the United States, with up to 40,000 new cases per year in the United States. Some estimate that IPF affects 3 million people globally. While there are currently two approved therapies for the treatment of lung fibrosis, neither has been associated with improvements in overall survival, and narcolepsy.both therapies have been associated with significant side effects leading to poor therapeutic adherence. In preliminary data from our trials to date with GRI-0621, and earlier trials with oral tazarotene, we have observed GRI-0621 to be well-tolerated and to inhibit iNKT cell activity in subjects. We and others have shown that activated iNKT are upregulated in IPF, primary sclerosing cholangitis (PSC), non-alcoholic steatohepatitis (NASH), alcoholic liver disease (ALD), systemic lupus erythematosus disease (SLE), multiple sclerosis (MS), ulcerative colitis (UC) patients, as well as other indications. In these patients activated iNKT cells are correlated with more severe disease. The U.S. Food and Drug Administration (FDA) has cleared our IND application for GRI-0621 for the treatment of IPF and we plan to evaluate GRI-0621 in a randomized, double-blind, multi-center Phase 2a biomarker study, for which we commenced enrollment in December 2023. We expect topline results from this trial to be available in the second half of 2024.

5 million Americans abuse60% of patients dosed with nintedanib have diarrhea and approximately 14% experience elevated levels of liver enzymes. Approximately 30% of patients treated with pirfenidone have skin rash, and approximately 9% experience photosensitivity, both of which can lead to dose reductions or discontinuations. Both agents have some efficacy in patients with more advanced disease, but high rates of discontinuations due to adverse events in these frailer patients limit their use. A survey of 290 physicians published by a third party in 2017 found that over half of IPF patients are not being treated with either agent for multiple reasons, including physicians not having sufficient confidence in clinical benefit and concerns about safety. A retrospective cohort analysis of prescription ADHD stimulants annually.intendare developing GRI-0621 as an oral gel capsule formulation to develop ADAIR for registration throughtreat IPF patients. GRI-0621 is differentiated from current IPF therapies because it is designed to reset the Section 505(b)(2) approval pathway, which we expectdysfunctional immune response driving disease by inhibiting the activity of iNKT cells, as opposed to obviate the need for large Phase 2 and Phase 3 efficacy and safety studies. See the sections entitled “Business — Section 505(b)(2) Pathway” and “Business — Clinical Development” in this Annual Report for more information regarding Section 505(b)(2)targeting a symptom of the FDCA. Althoughdisease that is downstream of the dysregulated immune response. GRI-0621 has been evaluated as an oral formulation in approximately 1,700 psoriasis, acne, and liver disease patients and in those patient populations and studies, the molecule was well tolerated with typical reported adverse events associated with hypervitaminosis A (headache, back pain, foot pain, cheilitis, hyperglycemia, arthralgia, myalgia, joint disorder, nasal dryness, dry skin, rash, and dermatitis).

doesregarding the design of NASH clinical studies. In this limited number of patients, GRI-0621 was observed to be well tolerated and showed improvements in liver function tests, serum CK-18, and in iNKT cell activity, however, the study was underpowered to meet its endpoints with statistical significance. Adverse events were generally mild and consistent with RARb g agonism (see table below).ALL-CAUSE PLACEBO (n=4) GRI-0621 4.5mg (n=4) GRI-0621 6.0mg (n=5) SERIOUS TEAEs 0 0 0 GRADE 1 TEAEs 0 0 0 GRADE 2 TEAEs 0 0 0 GRADE 3/4/5 TEAEs 0 0 0 TREATMENT RELATED CHELITIS 0 0 0 NASEAU 0 0 0 DRY SKIN 0 0 0 PURITIS 0 0 0 HEADACHE 0 0 0 MYLAGIA 0 0 0 HYPERTENSION 0 0 1* GASTROENTERITIS 0 0 0 TONSILITIS 0 0 1* CREATINE PHOSPHOKINASE 0 0 0 LACTATE DEHYDROGENASE 0 0 0 POTASSIUM 0 0 0 approveown manufacturing facilities for producing any preclinical study or clinical trial product supplies. We rely on a limited number of suppliers for drug product and engage a single manufacturer to produce our formulated GRI-0621 drug usingproduct for clinical studies, as is standard industry practice in early to mid-stage clinical development. If these suppliers are unable to supply to us in the Section 505(b)(2) pathway until submissionquantities we require, or at all, or otherwise default on their supply obligations to us, we may not be able to obtain alternative supplies from other suppliers on acceptable terms, in a timely manner, or at all. In addition, if we are required to change manufacturers for any reason, we will be required to verify that the new manufacturer maintains facilities and acceptanceprocedures that comply with quality standards and with all applicable regulations and guidelines. We will also need to verify, such as through a manufacturing comparability study, that any new manufacturer or manufacturing process will produce our product candidate according to the specifications previously submitted to the FDA or another regulatory authority. We may be unsuccessful in demonstrating the comparability of clinical supplies which could require the conduct of additional clinical trials. The delays associated with the verification of a new drug application (“NDA”), based on discussions heldmanufacturer could negatively affect our ability to develop product candidates in a timely manner or within budget.FDA at a pre-IND meeting in January 2017 and the minutes from such meeting,IPFbelieve the Section 505(b)(2) regulatory pathway is appropriate andcommenced enrollment for our Phase 2a trial. This trial will be acceptablea twelve-week, multicenter, multinational, randomized, placebo-controlled trial in approximately 36 patients with IPF. A 4.5 mg dose will be compared to the FDA. We expectplacebo over twelve weeks of treatment in subjects with a confirmed diagnosis of IPF on background therapy. Subjects will complete a screening visit to request additional labeling basedevaluate their medical history, present condition, laboratory assessments, comorbidities, and concomitant medications. Based on studies that demonstrate the abuse-deterrent characteristicsthese findings, subjects will be randomly assigned to one of the producttwo treatment arms: 4.5 mg of GRI-0621 or placebo in a 2:1 randomization. Weekly visits out to twelve weeks will evaluate safety, pharmacokinetics, and efficacy/mechanism of action of GRI-0621 as they relate to snorting, and possibly IV injection. While dextroamphetamine is approvedassessed by the activation of iNKT cells from both blood at weeks 6 and 12 and bronchi-alveolar lavage fluid at week 12. As a secondary endpoint, various biomarkers will also be evaluated to support theour reformulation, ADAIR,in designing the registration program moving forward.not. Prescription drug abuse is a large and growing problemthe most common type of lupus, affecting between 160,000 - 200,000 patients in the United States, and globally.We filed our Investigational New Drug (“IND”as many as 24,000 people in the United States are diagnosed with the disease each year. SLE predominantly affects women and often starts between the ages of 15 and 44. SLE is an autoimmune disease in which the immune system attacks its own tissues, causing widespread inflammation and tissue damage in the affected organs. It can affect the joints, skin, brain, lungs, kidneys, and blood vessels. There is no cure for lupus, but medical interventions and lifestyle changes can help control it. While people of all races can have the disease, African American women have a three-times higher number of new cases than white, non-Hispanic women. African American women tend to develop the disease at a younger age than white, non-Hispanic women and develop more serious and life-threatening complications. It is also more common in women of Hispanic, Asian and Native American descent. Adherence to treatment regimens is often a problem, especially among young women of childbearing age. Because SLE treatment may require the use of strong immunosuppressive medications that can have serious side effects, female patients must stop taking the medication before and during pregnancy to protect unborn children from harm.applicationan antibody that targets B lymphocyte stimulator, for ADAIRthe treatment of mild to moderate SLE in June 2018combination with standard therapy, providing additional clinical validation of the therapeutic benefit of B cell-targeted therapy for autoimmune diseases. However, the modest therapeutic benefit of Benlysta® and delayed onset of disease intervention indicate the INDneed for additional therapeutic strategies to inhibit overactive B cells. In 2021, the first-in-class type 1 interferon receptor antibody, anifrolumab, the first new drug for the disease in a decade, was clearedapproved for adults with moderate to severe disease who are receiving standard therapy.July 2018. Subsequently,conjunction with complement-mediated injury owing to pathogenic antibodies.

have successfully completedrequire, or at all, or otherwise default on their supply obligations to us, we may not be able to obtain alternative supplies from other suppliers on acceptable terms, in a timely manner, or at all. In addition, if we are required to change manufacturers for any reason, we will be required to verify that the new manufacturer maintains facilities and procedures that comply with quality standards and with all applicable regulations and guidelines. We will also need to verify, such as through a manufacturing comparability study, that any new manufacturer or manufacturing process will produce our product candidate according to the specifications previously submitted to the FDA or another regulatory authority. We may be unsuccessful in demonstrating the comparability of clinical supplies which could require the conduct of additional clinical trials. The delays associated with the verification of a new manufacturer could negatively affect our ability to develop product candidates in a timely manner or within budget.pivotal bioequivalence studytrial upon completion of ADAIRthe toxicology program for GRI-0803. Assuming positive results, we anticipate filing an IND in the first half of 2024. The Single Ascending Dose (SAD) trial will be run in healthy volunteers. Up to six doses will be evaluated in cohorts of 12 subjects with 10 receiving a dose of GRI-0803 and a Phase 1 food effect study.two receiving placebo. The bioequivalence study enrolled 24safety in each cohort will be evaluated with an Independent Safety Review Board (ISRB) along with the GRI clinical management. After completion of the first cohort, subsequent cohorts will begin within two weeks of dosing the previous cohort. Pharmacokinetics and safety will be the primary endpoint of the SAD trial. The completion of this trial should take approximately three months from when the first cohort is dosed.food effect study enrolled 22 subjects. Both studies were conducted by Altasciences, a contract research organization (“CRO”).In 2019, we conducted a Phase 1 proof-of-concept intranasal human abuse potential study designedtwo highest doses will be completed in patients with SLE. Safety and multi-dose pharmacokinetics will be the primary endpoint of thecompare ADAIR when insufflated (snorted) as compared to the reference comparator, crushed immediate release dextroamphetamine sulfate tablets. The study enrolled 16 subjects and was conducted at a single site by BioPharma Services, a CROcomplete with experience conducting similar trials. The study measured the pharmacokinetic levels of dextroamphetamine of the two compounds when snorted, the subjective “drug-liking” of the two drugs, and the willingness of recreational drug users to take each product again. Thetopline results of this study demonstrated that as compared to standard dextroamphetamine, ADAIR, when snorted, demonstrated an attenuated pharmacokinetic profile and lower drug liking and other abuse liability scores, using standard measures for human abuse potential studies. We have used the results of this proof of concept abuse study to design a larger intranasal abuse study that we will conduct prior to seeking approval of ADAIR. We designed the study to follow the model usedavailable late in intranasal abuse studies that have been conducted for abuse deterrent opioids and following guidance issued by the FDA for such studies. We began enrollment of subjects in this pivotal abuse study during the fourth quarter of 2020.We recently completed2024.preclinical embryofetal study which showed no evidencestrong emphasis on proprietary products. While we believe that our technology, the expertise of developmental effectsour management team, clinical capabilities, research and no clinical observations other than those associateddevelopment experience and scientific knowledge provide us with competitive advantages, we face increasing competition from many different sources, including biotechnology and biopharmaceutical companies, academic institutions, governmental agencies, and public and private research institutions. Any product candidates that we successfully develop and commercialize will compete with existing therapies and new therapies that may become available in the pharmacological effects of dextroamphetamine. Wefuture.conducting a 13-week preclinical toxicology study on the final formulation of ADAIR. We also plan to conduct additional preclinical studies of unintended routes of administration such as IV and intranasal administration.On January 6, 2020, Vallon entered into a license agreement with Medice, who is affiliated with one of our principal stockholders, Salmon Pharma, and represented by one member of our board of directors, which grants Medice an exclusive license, with the right to grant sublicenses, to develop, use, manufacture, market and sell ADAIR throughout Europe. Medice currently markets several ADHD products in Europe and is the ADHD market leader in Europe based on branded prescription market share. Medice is responsible for obtaining regulatory approval of ADAIR in the licensed territory. Under the license agreement, Medice paid Vallon a minimal upfront payment and will pay milestone payments of up to $6.3 million in the aggregate upon first obtaining regulatory approval to market and sell ADAIR in any country, territory or region in the licensed territory and upon achieving certain annual net sales thresholds. Medice will also pay tiered royalties on annual net sales of ADAIR at rates in the low double-digits. The initial term of the license agreement will expire five years after the date on which Medice first obtains regulatory approval in any country, territory or region in the licensed territory.We plan to develop other abuse-deterrent products that have potential for abuse in their current forms, beginning withpursuing the development of an abuse deterrent formulation of Ritalin® (“ADMIR”), for which we are conducting formulation development work.The U.S. market for ADHD treatment was estimated to be approximately $9 billion annually, which accounted for over 80% of the global ADHD market in 2019, and the European Union (“EU”) market for ADHD treatment was estimated to be approximately $700 million annually. We plan to target the U.S. ADHD market once we receive FDA approval of ADAIR, followed by the EU market for ADHD with our partner, Medice, who is affiliated with one of our principal stockholders, Salmon Pharma, and represented by one member of our board of directors, once regulatory approval has been granted in the EU.The ADAIR assets were acquired by us on June 22, 2018 pursuant to the terms and conditions of the Amended and Restated Asset Purchase Agreement with Arcturus Therapeutics, Ltd. (“Arcturus”), and Amiservice Development Ltd., dated as of June 22, 2018 (the “Asset Purchase Agreement”). In exchangeproducts for the ADAIR assets, we issued 843,750 sharestreatment of our common stock to Arcturus, which comprised 30% of our then-outstanding common stock on a fully diluted basis.Reverse SplitOn February 10, 2021, the Company filed a certificate of amendment to its amended and restated certificate of incorporation with the Secretary of State of the State of Delaware, which effected a one-for-40 reverse stock split (the “reverse split”) of its issued and outstanding shares of common stock at 11:59 PM Eastern Time on that date. As a result of the reverse split, every 40 shares of common stock issued and outstanding were reclassified into one share of common stock. No fractional shares were issued in connection with the reverse split and any fractional shares were rounded up to the nearest whole share.The reverse split did not change the par value of the common stockconditions GRI is also targeting, or the authorized number of shares of common stock. The reverse split affected all stockholders uniformly and did not alter any stockholder’s percentage interest in equity. All outstanding options and other securities entitling their holders to purchase or otherwise receive shares of common stock have been adjusted as a result of the reverse split, as required by the terms of each security. The number of shares available to be awarded under the Company’s 2018 Equity Incentive Plan have also been appropriately adjusted.All share and per share amounts contained in this Annual Report on Form 10-K give retroactive effect to the reverse split.Our Strategy and PipelineStimulant abuse is a large and growing public health challenge, yet the immediate-release segment of the ADHD market is entirely devoid of any abuse-deterrent products. We intend to address this need by through our abuse-deterrent pharmaceutical products, such as ADAIR and other products we opt to pursuemay target in the future, including ADMIR. IPF, SLE, MS, UC, PSC and NASH. While we know of no other companies currently in clinical development targeting NKT cells as a method of treating any of the above conditions, companies that we are aware of that are targeting the treatment of these diseases include large companies with significant financial resources such as:following table summarizeskey competitive factors affecting the success of our current product candidate portfolio:

Our near-term strategic milestones include:· seeking the necessary regulatory approvals to complete the clinical development of ADAIRcandidates are likely to be efficacy, safety, cost, and convenience. Many of our competitors, either alone or with their collaborators, have significantly greater resources, established presence in the market, expertise in research and development, manufacturing, preclinical and clinical testing, obtaining regulatory approvals and reimbursement and marketing approved products than we do. These competitors also compete with us in recruiting and retaining qualified scientific, sales, marketing, and management personnel, establishing clinical trial sites and patient registration for the treatment of ADHD and, if successful, file for marketing approval in the United States and other territories;·preparing to commercialize ADAIR by establishing independent distribution capabilities or in conjunction with other biopharmaceutical companies in the United States and other key markets, such as the license agreement with Medice;· commencing development of other abuse-deterrent products such as ADMIR; and·continuing our business development activities and seek partnering, licensing, merger and acquisition opportunities or other transactions to further develop our pipeline and drug-development capabilities and take advantage of our financial resources for the benefit of increasing stockholder value.Section 505(b)(2) PathwayNDAs for most new drug products are based on two adequate and well-controlled clinical trials, which must contain substantial evidence of the safety and efficacy of the proposed new product. These applications are submitted under Section 505(b)(1) of the FDCA. The FDA is, however, authorized to approve an alternative type of NDA under Section 505(b)(2) of the FDCA. This type of application allows the applicant to rely, in part, on the FDA’s previous findings of safety and efficacy for a similar product, or published literature. Specifically, Section 505(b)(2) applies to an NDA for a drug for which the investigations to show whether the drug is safe and effective and relied upon by the applicant for approval of the application “were not conducted by or for the applicant and for which the applicant has not obtained a right of reference or use from the person by or for whom the investigations were conducted.”Thus, Section 505(b)(2) authorizes the FDA to approve an NDA based in part on safety and effectiveness data that were not developed by the applicant. Section 505(b)(2) may provide an alternate and potentially more expeditious pathway to FDA approval for new or improved formulations or new uses of previously approved products. If the Section 505(b)(2) applicant can establish that reliance on the FDA’s previous approval is scientifically appropriate, the applicant may eliminate the need to conduct certain preclinical studies or clinical trials of the new product. The FDA may also require companies to perform additional studies or measurements to support the change from the approved product. The FDA may then approve the new drug candidate for all or some of the label indications for which the referenced product has been approved, as well as in acquiring technologies complementary to, or necessary for, any new indication sought byour programs. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. Additional mergers and acquisitions may result in even more resources being concentrated in our competitors.Section 505(b)(2) applicant.expect thatseek to obtain and maintain, patent rights intended to cover the technologies incorporated into, or used to produce, our clinical trials described undertherapeutic candidates, the section entitled “Business — Clinical Development” will provide sufficient data to support an NDA filing with the FDA.Prescription Stimulant Abusecompositions of matter of our therapeutic candidates and MisuseAbusetheir methods of use and MisuseStimulants are among the most widely abused substances. This classmanufacture, asdrugs includes amphetamines and methylphenidate. Both of these substances are placed in Schedule II of the U.S. Controlled Substances Act (“CSA”) and the rules and regulation of the U.S. Drug Enforcement Administration (“DEA”), which is reserved for drugs that carry the highest risk of abuse and dependence that have been approved for medicinal use.While the most severe public health and societal problems related to stimulants result from abuse of illicitly manufactured stimulants including methamphetamine, and various synthetic stimulants, prescription stimulants are also widely misused and abused for non-medical uses.·Abuse — means the harmful or hazardous use of psychoactive substances, including alcohol and illicit drugs, and may include misusing a prescribed drug, through snorting, smoking or injecting, that is meant to be administered orally, to “get high” or produce “euphoria.”·Misuse — means the use of a substance or drug for a purpose not consistent with legal or medical guidelines. For example, ADHD medication may be misused through taking high dosages of the drug to enhance alertness and counteract fatigue and sleepiness in order to meet occupational demands, increase alertness while driving, or improve academic performance. Misuse and/or abuse can produce severe adverse consequences, and on rare occasions also death, and contributes to diversion of medicines from prescribed users, as illicit marketing. Furthermore, nonmedical use of prescription stimulants, even for the intent of occasional enhancement of alertness and performance, canother inventions that are important to our business. We also leadseek to more harmful patterns of use of stimulants and other addictive substances.PrevalenceAccording to a 2017 report by the National Survey on Drug Use and Health (the “NSDUH”) over 5 million individuals ages 12 yearsobtain strategic or oldercommercially valuable patent rights in the United States misused prescription stimulants in the previous year. This figure has been rising over time and this represents approximately 2%other jurisdictions.the U.S. population in that age group. Rates of misuse of prescription stimulants increase from age 12proprietary products and peak at age 21, where an estimated 10% of the population reported misuse of prescription stimulants, before declining in older adults.Harmful Effects of Stimulant AbuseAcuteAcute stimulant intoxication may result in a number of cardiovascular-related adverse events, including chest pain, myocardial infarction, palpitations, arrhythmias, thromboembolism, tachycardia, sinus bradycardia, ventricular premature depolarization, ventricular tachycardia degeneration (resulting in the need for defibrillation), asystole, peripheral vascular abnormalities, and/or sudden death from respiratory or cardiac arrest, as well as other adverse eventsrelated methods, such as strokes, seizures, pneumothorax, headaches,methods of use, we have filed patent applications representing six patent families. As of February 15, 2024, our patent estate included 12 issued United States patents, 2 United States pending non-provisional patent applications, 65 issued foreign patents and tinnitus. Acute stimulant intoxication is also associated16 foreign patent applications currently pending in various foreign jurisdictions.several psychiatric symptoms, including rambling speech, transient ideas, paranoid thoughts, auditory hallucinations, tactile hallucinations,claims directed to GRI-0621, and psychosis.High dosagesrelated methods of amphetamines and other stimulants can lead to aggressive or violent behavior (which may lead to self-harm or harm to others), intense temporary anxiety resembling panic disorder, or generalized anxiety disorder or mania, as well as paranoid thoughts and psychotic episodes that resemble schizophrenia. Taking extremely high doses of stimulants may also result in dangerously high body temperatures, irregular heartbeat, cardiovascular problems, and seizures.ChronicExtended abuse of stimulants can lead to psychological symptoms, such as hostility or paranoid psychosis. In addition to health status, the consequences of such substance use impact the individuals using drugs, their families and society at large, with severe repercussions possible at both the individual and public health level resulting from the chronic abuse and/or misuse of stimulants, such as teenage pregnancy, domestic violence, motor vehicle accidents, crime, poor work performance, and impaired personal relationships. Stimulant misuse is also correlated with a higher risk for substance use, with some evidence suggesting greater severity relative to controls, although it remains unclear whether the misuse of controlled medications precedes other substance use behaviors.Long-term stimulant abuse can lead to stimulant use disorder, which may be characterized by chaotic behavior, social isolation, aggressive behavior, and sexual dysfunction. Individuals exposed to amphetamine-type stimulants have been reported to develop stimulant use disorder in as rapidly as one week.Furthermore, individuals may increase their stimulant use in an effort to increase the euphoria, energy, and social and vocational interactions that they feel while using the medications. Individuals may crushsame to treat diseases, e.g. inflammatory conditions. Three United States and snort20 foreign patents (Australia, Brazil, Canada, China, Europe (validated in nine countries), Hong Kong, Japan, South Korea, Mexico, and Russia) were granted in this family. Patent applications in this family are pending in multiple jurisdictions, including, for example, the European Patent Organization, China, Japan, and Korea. Patents in this patent family are expected to expire in 2032, absent any patent term adjustments or inject the stimulants in orderextensions.produce even greater effects. Tolerance will develop with repeated use,GRI-0803 and individuals often increase the frequency and amountrelated methods of use in order to achieve a similar sense of euphoria.Once tolerance has developed, individuals may experience withdrawal symptoms (hypersomnia, increased appetite, and dysphoria) if they try to stop using the medication. Stimulant withdrawal can leadsame to depression, suicidal thoughts, irritability, anhedonia, emotional lability, and disturbances in attention and concentration. There may be temporary depressive symptoms that may meet the criteria for major depressive episode. The effects of withdrawal often lead individuals to abuse the medications again.About ADHD and Existing Treatment OptionsADHD Condition and ImpactADHD is defined as a persistent pattern of inattention and/or hyperactivity-impulsivity that interferes with functioning or development. ADHD causes significant impairment during a patient’s childhood, and throughout the patient’s lifespan, as well as increased morbidity, mortality and psychosocial adversity.Once believed to only affect children, ADHD is now known to persist into adolescence and adulthood in a sizeable number of cases. The following table illustrates how the nature of ADHD symptoms changes with age:ChildrenAdolescentsAdultsHyperactiveEasily distractedShifts activitiesAggressiveInattentiveEasily boredLow frustration toleranceImpatientImpulsiveApproximately 50-60% of adults who suffered from ADHD as children continue to have symptoms of the disorder as adults, with over 90% experiencing inattention symptoms and about 35% experiencing hyperactivity-impulsivity symptoms. As the majority of sufferers of ADHD age, their symptoms tend toward impatience, restlessness, boredom, and low concentration levels away from the more aggressive hyperactivity and impulsive behavior evident in children.Although the definitive causes of ADHD are still unclear, current research suggests that ADHD is caused by an interaction between environmental factors and genetic predispositions. Biologic factors that reportedly increase the risk of having ADHD include maternal smoking, drug or alcohol abuse during pregnancy, brain injury, and exposure to toxins.ADHD is believed to be one of the most under-diagnosed and under-treated mental health conditions facing children and adults. ADHD increases health risks, adverse social externalities and economic costs as illustrated in the following table. Despite the disorder being highly treatable, most adults with ADHD remain undiagnosed and untreated.The following table illustrates the effects on society when ADHD remains untreated:Healthcare SystemPatientFamilyIncreased ER visitsIncreased criminal activityIncreased divorce/separationIncreased car accidentsIncreased incarcerationMore sibling fightsSchool and OccupationSocietyEmployerHigh rates of expulsionSubstance use disorders:Increased parental absenteeism andHigh drop-out ratesHigher risk and earlier onsetlower productivityLower occupational statusLess likely to quit in adulthoodExisting Treatment OptionsCurrent management of ADHD frequently includes a combination of educational support, behavioral interventions, and pharmacotherapy. The current standard of care is the stimulant class of medications including immediate- and extended-release methylphenidate and amphetamine. Amphetamine products comprise the majority of the U.S. ADHD market and immediate-release amphetamines are the fastest growing segment of such market.Stimulant products represent more than 90% of prescriptions of ADHD products in the United States.MethylphenidateAmphetamine(Approx. 30%)(Approx. 60%)Immediate-ReleaseRitalin®Dexedrine®(Approx. 40%)Adderall®Extended-ReleaseConcerta®Adderall XR®(Approx. 50%)Ritalin LA® Vyvanse® Immediate-release (or short-acting) tablets and capsules release the active ingredient within a short period of time, such as 30 minutes and demonstrate efficacy that lasts for four to six hours. The patents covering most of these formulations have expired and most of these medications are now available in generic forms.Extended-release (or long acting) tablets and capsules release the active ingredient at a sustained and controlled release rate over the course of the day, typically demonstrating efficacy for 10 to 14 hours. Some of these are currently covered by patents and are not available in generic form.The four highest-selling drugs for the treatment of ADHD in 2019 on a worldwide basis are shown below: 2019 Global Sales

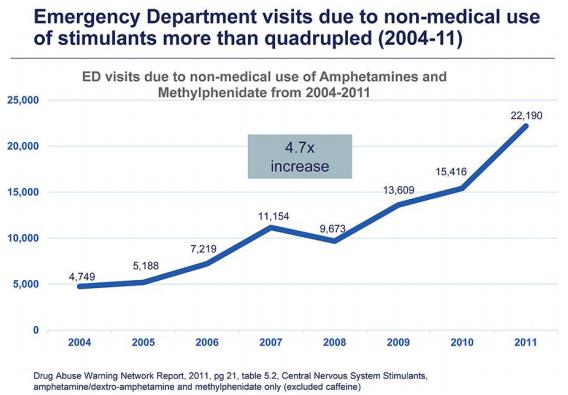

(in millions)Vyvanse® $ 2,514 Concerta® $ 696 Strattera® $ 243 Adderall XR® $ 223 As of 2019, the two best-selling medications were Vyvanse® and Concerta®, which are both extended-release stimulants. These and other extended-release stimulants are prescribed for both adults and children. For children in particular, the long-acting formulation is preferred because it eliminates the need for the child to take several doses during the school day.Despite the popularity of the long-acting drugs, we believe there is a growing market opportunity for immediate-release treatments among children and adults with ADHD. For instance, some patients taking the extended-release drugs benefit from the addition of a short-acting stimulant taken in the evening to supplement the medication given earlier in the day. This allows the patient to alleviate their ADHD symptoms for an evening meeting or class, without keeping the patient awake all night. In addition, the immediate-release products can be useful when evaluating whether an individual will be able to tolerate a particular stimulant or respond to a dosage titration.Finally, some individuals with ADHD prefer to manage their symptoms with medication only on an as-needed basis, and the immediate-release formulations give the patient more flexibility with the dosing frequency. For instance, many patients experience varying degrees of side effects to stimulant medication, including headaches, jitteriness, irritability, sleep problems, and decreased appetite, and some report that stimulants decrease their creativity and spontaneity. For these reasons, many adults — who now comprise more than 50% of the U.S. prescriptions for ADHD medication — prefer the short-acting formulations. Therefore, although short-acting stimulants are only approved for use in children and adolescents, part of our long-term plan involves seeking approval for use of short-acting stimulants in adults as well.ADHD MarketAccording to IQVIA (formerly, IMS Health), the U.S. market for ADHD treatment was estimated to be approximately $9 billion annually, which accounted for over 80% of the global ADHD market in 2019. The difference in market sizes between the U.S. and other countries is driven by different rates of diagnosis and treatment, different pricing, and the number of available brand name medications (non-U.S. markets are dominated by generic drugs). Global prevalence rates of the disease are estimated to be approximately 8-10% of school-aged children and approximately 4-5% of the adult population. Adult diagnosis and treatment, which has grown at approximately 10% annually over the last few years, is forecasted to grow in the near future due to increased disease awareness and less sociological stigmatization towards the condition. In thetreat diseases. Three United States the rate of treatment with prescription medications is approximately 70%and nine foreign patents (Canada, Europe (validated in childrenseven countries), and 45%Hong Kong) were granted in adults. In 2019, over 75 million prescriptions were filledthis family. Patent applications in this family are pending in the United States and European Patent Organization. Patents in this patent family are expected to expire in 2032, absent any patent term adjustment or extension.approved ADHD medications, whereas less than 44 million prescriptions were filled in 2009. The U.S. market is projected to continue to grow in mid-single digits, driven by an increased prescription rate for adult ADHD. The growth of immediate-release amphetamines averaged over 7% annually from 2014-19 and is projected to continue to grow faster than the overall ADHD market in the foreseeable future. In 2019, 28 million prescriptions were filledexample, in the United States, for immediate-release stimulants, suchUnited Arab Emirates, Brazil, China, Japan, Russia, Canada, Hong Kong and South Korea. Patents in this patent family are expected to expire in 2035, absent any patent term adjustment or extension.Adderallwe develop new technologies and Ritalin. Immediate release amphetamine stimulants,therapeutic candidates. As our business evolves, we may, among other activities, file additional patent applications in pursuit of our intellectual property strategy, to adapt to competition or to seize potential opportunities.segmentlaws of the countries in which they are obtained. In most countries in which we file, the patent term is 20 years from the earliest date of filing of a non-provisional patent application. However, the term of United States patents may be extended for delays incurred due to compliance with the FDA requirements or by delays encountered during prosecution that are primarily targeting, currently represent approximately 30%caused by the United States Patent and Trademark Office (USPTO). For example, the Hatch-Waxman Act, permits a patent term extension for FDA-approved drugs of up to five years beyond the expiration of the ADHD medications market (prescriptions and patients) and continue to gain market share.international ADHD marketlength of the patent term extension is projected to grow at a faster rate than the U.S. market in part because disease recognition and acceptance is expected to increase in both Japan and Europe. The estimated growth rate for the non-U.S. markets is also higher duerelated to the recent launcheslength of major ADHD drugstime the drug is under regulatory review. Patent extension cannot extend the remaining term of a patent beyond a total of 14 years from the date of product approval, and only one patent applicable to an approved drug may be extended. Similar provisions are available in Europe and other jurisdictions to extend the term of a patent that covers an approved drug. In the future, if and when our therapeutic candidates receive FDA approval, we expect to apply for patent term extensions on patents covering those therapeutic candidates. We intend to seek patent term extensions in any jurisdiction where these are available and where we also have already been marketeda patent that may be eligible; however there is no guarantee that the applicable authorities, including the USPTO and FDA, will agree with our assessment of whether such extensions should be granted, and even if granted, the length of such extensions.Vyvanse and Intuniv.Potential for AbuseStimulant abuse is unique and challenging because the abuse and addiction risks of stimulants are not restricted to those who are prescribed the medications. Published data reports that stimulants are almost twice as likely to be diverted (i.e., given away or sold) as other scheduled medications, such as opioid, sleep or anxiety medications. It has been reported that between 25-60% of teenagers and college students with ADHD have been approached at some point to give away or sell their prescription stimulants and over 60% of college students with ADHD admit to having diverted their ADHD prescription medication.Approximately 90% of those who misuse/abuse stimulants do so with prescription amphetamines based on data from the NSDUH.The number of emergency room visits associated with non-medical use of prescription stimulants increased more than four-fold from 2004 to 2011, according to the Drug Abuse Warning Network (“DAWN”), and most of this increase was associated with amphetamine-based prescription stimulants.

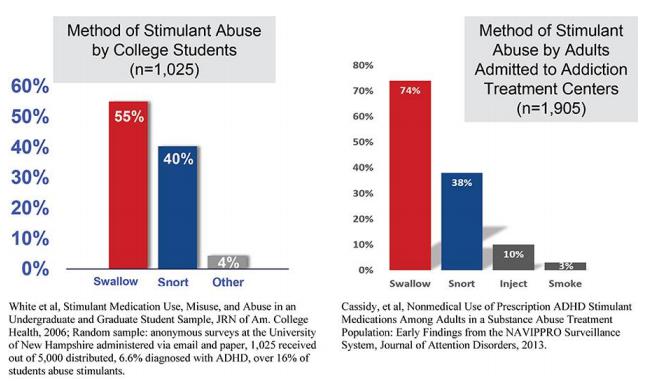

Speed of onset and route of administration has been accepted as being important in evaluating the potential for abuse of certain medications, such as stimulants.In general, the oral route is associated with lower abuse liability because of slower absorption rates and slower onset of effects compared to other routes of administration. Inhalation, snorting, and intravenous (“IV”) injection of drugs are associated with far more rapid absorption and faster onset of effects when compared to oral ingestion. In general, oral use of stimulants results in the slowest rate of absorption, while snorting is relatively faster; smoking and IV injection of stimulants evoke even more rapid absorption and more intense and rapid physiological and subjective responses. Published studies report that 40% or more of people who misuse or abuse prescription stimulants, do so by IV injection or snorting. These methods of abuse drive a more rapid increase in dopamine levels that drive the subjective, or re-enforcing effects of these drugs. Consequently, these abuse routes are thought to bring the abuser one step closer to addiction and dependence. In addition, the quick entry of the drug into the bloodstream increases the risk of chest pain, rapid / irregular heartbeat, heart attack, seizures, hallucinations, hostile/aggressive behavior, suicidal thoughts and behaviors, and stroke.

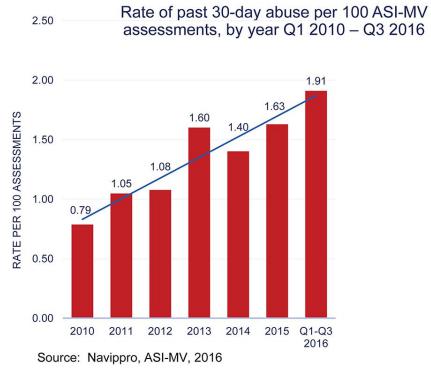

Immediate-release stimulants, including amphetamines, are more prone to abuse than extended-release stimulants and are the fastest growing market in the ADHD market in recent years. Amphetamine tablets are easy to crush into a powder suitable for snorting, or mixing with water and injecting. On the other hand, long-acting stimulant capsules are abused less frequently because they contain a combination of immediate-release and extended-release beads with different release profiles that are difficult to crush into a form that can be snorted, smoked, or mixed with water and injected.The rate of amphetamine use disorders doubled between 2010 and 2016:

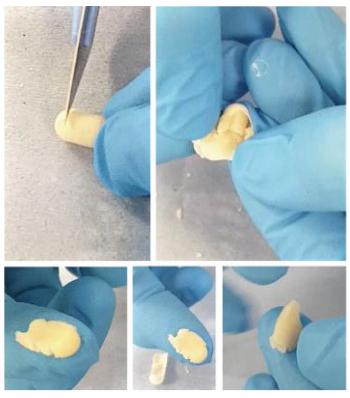

Amphetamine forms molecules that are highly soluble in lipids, which are then rapidly transported to the brain through the blood-brain barrier. Routes of administration that deliver the drug directly into the bloodstream and bypass the digestive system (i.e., snorting, smoking, and IV injection) would be expected to cause faster onset of psychoactive effects. Therefore, reducing the risk of abuse via snorting, smoking, and injection is a potential public health goal because the speed of the absorption of stimulants is an important determinant of a product’s abuse potential, as is the case for opioids, and is also related to the overall potential risks of the drug product.Many people who use amphetamines and other stimulants for recreational use prefer routes of administration that provide rapid onset of effects. In order to achieve its maximum pharmacologic effect, the largest quantity of drug must be delivered into the CNS in the shortest possible time. For instance, a published study found that the reinforcing properties of methylphenidate occur when the drug elicits a large and fast dopamine increase but has only therapeutic properties when there is a slow, steady-state increase in dopamine caused by the drug. This leads drug abusers to progress from relatively safe methods of self-administration, such as oral ingestion of marketed doses of stimulants, to increasingly higher dosages and more dangerous routes of administration, such as smoking, snorting, and injecting.Our SolutionsADAIRStimulant abuse is large and growing public health challenge, yet the immediate-release segment of the ADHD market is entirely devoid of any abuse-deterrent products. This unmet need led to the design of ADAIR as an oral formulation of an immediate-release dextroamphetamine. This included the development and in vitro testing of multiple formulations, followed by the selection of the optimal, proprietary formulation of ADAIR that is intended to introduce certain barriers to abuse of immediate-release dextroamphetamine.ADAIR is an oral, semi-solid, liquid-filled, hard gelatin capsule of dextroamphetamine sulfate, the active ingredient. This formulation resists manipulation and preparation for snorting, and provides meaningful barriers to injection — demonstrated through a set of abuse-deterrence studies conducted in collaboration with M.W. Encap Limited, an affiliate of Lonza Group AG.

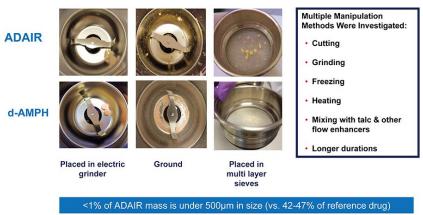

After subjecting ADAIR to grinding, crushing, or cutting the capsule following thermal pre-treatment, minimal quantities of particles could appreciably pass through a 500 micrometer (“µm”) filter (a particle size deemed suitable for snorting). In contrast, 42-47% of the physically manipulated immediate-release dextroamphetamine reference tablet could pass through a 500 µm filter, suggesting that it could be readily crushed and snorted.

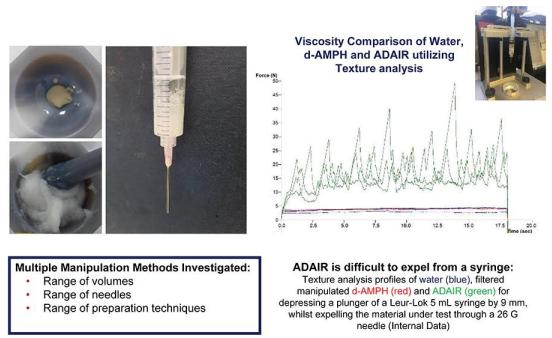

We also subjected ADAIR to multiple forms of manipulation, but none of those yielded ADAIR particles that could be easily expelled from a syringe. ADAIR mixed in water yielded a viscous, cloudy material, which was usually impossible, and at other times difficult, to syringe. Texture analysis demonstrated that the force required to push the plunger with a manipulated ADAIR-filled syringe is far greater than that with manipulated immediate-release dextroamphetamine reference tablet.

In comparison with the immediate-release dextroamphetamine reference tablet, ADAIR demonstrated reduced syringe-ability across a range of volumes of water (2, 5, and 10 milliliters), needle gauges (26, 23, 20, and 18 gauge), in ambient or hot water, and when passed through a cigarette filter.We believe these studies demonstrate that, as compared to the immediate-release dextroamphetamine reference tablet, ADAIR could display deterrence properties against abuse through snorting or IV injection.Our abuse-deterrent formulation may not meaningfully discourage oral ingestion to enhance occupational or academic performance, or misuse; however, depending on the properties of the formulation, an abuse-deterrent formulation could reduce the risks of adverse effects by anyone who would attempt to abuse it by snorting, smoking, or injecting, and reduce the contribution of prescription stimulants to problems associated with stimulant abuse.In addition, the general pharmacologic rationale for abuse-deterrent stimulants is similar to the rationale of abuse-deterrent opioids used to treat and manage pain as described in the FDA 2015 Guidance on Abuse-Deterrent Opioid. The FDA clearly articulated the rationale for the development of abuse-deterrent technologies, as well as cited its limitations, in its 2015 Guidance, pp. 1-2:Prescription opioid products are an important component of modern pain management. However, abuse and misuse of these products have created a serious and growing public health problem. One potentially important step towards the goal of creating safer opioid analgesics has been the development of opioids that are formulated to deter abuse. FDA considers the development of these products a high public health priority. Because opioid products are often manipulated for purposes of abuse by different routes of administration or to defeat extended-release (ER) properties, most abuse-deterrent technologies developed to date are intended to make manipulation more difficult or to make abuse of the manipulated product less attractive or less rewarding. It should be noted that these technologies have not yet proven successful at deterring the most common form of abuse — swallowing a number of intact capsules or tablets to achieve a feeling of euphoria. Moreover, the fact that a product has abuse-deterrent properties does not mean that there is no risk of abuse. It means, rather, that the risk of abuse is lower than it would be without such properties. Because opioid products must in the end be able to deliver the opioid to the patient, there may always be some abuse of these products.Although ADAIR is very difficult to manipulate into a form that can be snorted, it is not impossible to do so. In order to conduct human abuse studies, Vallon hired a third-party drug laboratory that was able to develop a time- consuming and laborious process to convert ADAIR into a form that could be insufflated. The medical literature reports that recreational abusers of prescription medications are typically not willing to spend more than a few minutes preparing a drug for misuse or abuse and our own research with recreational stimulant users documented that they would not be willing to spend more than 10-12 minutes preparing a drug like ADAIR for snorting. In addition, although ADAIR is difficult to solubilize into a form that can be injected, sophisticated drug abusers may be able to develop methods to manipulate ADAIR into a form that can be injected.Regulatory communications regarding the application of abuse-deterrent technologies for prescription stimulants continue to emerge. In 2014, Janet Woodcock, M.D., Director, Center for Drug Evaluation and Research, stated that the FDA encourages the development of abuse-deterrent formulations for controlled substances, while also noting that the science surrounding abuse-deterrent technology is relatively new. In public meetings, FDA officials have made comments related to interest in the application of abuse-deterrent technologies for stimulants, as well as other drugs of abuse. In practice, the FDA engages with sponsors of abuse-deterrent formulations on a product-by-product basis, sometimes requiring an abuse-deterrent assessment as part of the development to inform approval and labeling processes by the FDA. In September 2019, the FDA issued a Federal Register notice to seek public comment on the development and evaluation of abuse deterrent formulations (ADF) of ADHD stimulants and whether such products could play a role in addressing public health concerns related to prescription stimulant misuse and abuse signaling their interest in this field.Lastly, based on market research conducted by us in conjunction with U.S. health insurers, who collectively manage over 100 million covered lives, a strong majority of insurers are receptive of the ADAIR product concept and indicate that they would be willing to have ADAIR, if approved, placed on their prescription drug formulary and to reimburse the costs for ADAIR through their respective health insurance plans. In addition, the continuing and heightened publicity surrounding the national opioid epidemic continues to result in heightened sensitivity by many health care professionals to prescribe, and pharmacies to dispense, medications with the potential for abuse.Development of ADMIRADMIR is an abuse deterrent formulation of Ritalin for which we are conducting formulation development work. We have developed several prototype formulations that we are continuing to refine. If our formulation development work is successful, we anticipate requesting a pre-IND meeting with the FDA and filing an IND in 2021. ADMIR is designed to have abuse deterrent properties that are similar to ADAIR.Clinical DevelopmentWe aim to be the first company to introduce a proprietary abuse-deterrent immediate-release dextroamphetamine drug to the market and leverage our agility, flexibility, and know-how to utilize such a positiondeveloping. The processes for the benefit of patients, physicians, and our community.We filed our Investigational New Drug (“IND”) application for ADAIR in June 2018 and the IND was cleared in July 2018. Subsequently, we have successfully completed three Phase 1 clinical studies.Phase 1 Bioequivalence StudyIn December 2018, we completed a Phase 1 pivotal bioequivalence study of ADAIR, which was conducted by Altasciences. The study enrolled 24 subjects, who were dosed with 10 mg of ADAIR and reference dextroamphetamine orally on a single occasion for each study drug. There were no serious adverse events (“SAEs”) during the study. The primary objective of the study was to evaluate and compare the pharmacokinetics (“PK”) of ADAIR capsules to dextroamphetamine tablets under fasting conditions. The secondary objectives of the study were to evaluate the safety and tolerability of the test and reference formulations in healthy subjects. The study met the primary endpoint demonstrating bioequivalence and met the secondary endpoints.Food Effect StudyIn December 2018, we completed a Phase 1 food effect study of ADAIR, which was conducted by Altasciences. The study enrolled 22 subjects who were dosed with 10 mg of ADAIR orally twice, once when subjects were fasting and once when they had been fed. One SAE (miscarriage) was reported during the study. A 33-year-old African American female subject had an unplanned pregnancy reported one week after the last study drug dose. The miscarriage occurred at pregnancy day 35. The investigator considered the SAE possibly related to drug treatment. However, because of the timing, background incidence, and risk factors (including age and race), we concluded that this SAE was unlikely to be related to the study drug.The primary objective of this study was to evaluate and compare the PK of d-amphetamine from an abuse-deterrent capsule formulation of dextroamphetamine sulfate when dosed under fasting and fed conditions. The secondary objective was to evaluate the safety and tolerability of the investigational product in healthy subjects. The study met both the primary and secondary endpoints.Human Abuse Proof of Concept StudyI n November 2019, we completed a Phase 1 proof-of-concept intranasal human abuse potential study designed to compare ADAIR when insufflated (snorted) as compared to the reference comparator, crushed immediate release dextroamphetamine sulfate tablets. The study was conducted by BioPharma Services and enrolled 16 subject who received one dose of ADAIR and reference dextroamphetamine administered intranasally each at a dose of 30 mg. The primary objective was to assess safety and tolerability of manipulated ADAIR and crushed dextroamphetamine sulfate IR (“DEX”), when administered intranasally to non-dependent, recreational stimulant users. The secondary objectives were to evaluate and compare the PK profiles of ADAIR and DEX when administered intranasally to non-dependent, recreational stimulant users. The exploratory objectives of this study were to assess and compare abuse liability of ADAIR and DEX when administered intranasally to non- dependent, recreational stimulant to users. There were no SAEs in connection with this trial. The study met the primary, secondary and exploratory endpoints.The results of this study demonstrate that as compared to DEX, ADAIR, when snorted, demonstrated an attenuated pharmacokinetic profile and lower drug liking and other abuse liability scores, using standard measures for human abuse potential studies.We have used the results of this proof of concept abuse study to design a larger intranasal abuse study that we will conduct prior to seeking approval of ADAIR. We designed the study to follow the model used in intranasal abuse studies that have been conducted for abuse deterrent opioids and following guidance issued by the FDA for such studies.Preclinical Studies and Other Clinical Development PlansWe recently completed a preclinical embryofetal study which showed no evidence of developmental effects and no clinical observations other than those associated with the pharmacological effects of dextroamphetamine. We are currently conducting a 13-week preclinical toxicology study on the final formulation of ADAIR. We also plan to conduct additional preclinical studies of unintended routes of administration such as IV and intranasal administration.We plan to develop other abuse-deterrent products that have potential for abuse in their current forms, beginning with the development of an abuse deterrent formulation of Ritalin® (“ADMIR”), for which we are conducting formulation development work.We expect that our clinical trials described above will provide sufficient data to support an NDA filing with the FDA.Government Regulation and Product ApprovalClinical trials, the drug approval process, and the marketing of drugs are intensively regulatedobtaining regulatory approvals in the United States and in all major foreign countries. countries, along with subsequent compliance with applicable statutes and regulations, require the expenditure of substantial time and financial resources.(“FDCA”),(FDCA) and related regulations. Drugs are also subject to other federal, state, and local statutes andits implementing regulations. Failure to comply with the applicable U.S. regulatoryUnited States requirements at any time during the product development process, approval process or after approval, may subject an applicant to a variety of administrative or judicial sanctions. These sanctions could include the impositionbrought by the FDA Institutional Review Board (“IRB”)and the Department of a clinical hold on trials,Justice (DOJ), or other governmental entities, such as the FDA’s refusal to approve pending applications or supplements,NDAs, withdrawal of an approval, imposition of a clinical hold, issuance of warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement or civil penalties and/or criminal prosecution. Any agency or judicial enforcement action could have a material adverse effect on us.The FDA and comparable regulatory agencies in state and local jurisdictions and in foreign countries impose substantial requirements upon the clinical development, manufacture and marketing of biopharmaceutical products. These agencies and other federal, state, and local entities regulate research and development activities and the testing, manufacture, quality control, safety, effectiveness, labeling, storage, distribution, record keeping, approval, advertising, and promotion of ADAIR or any other product we develop in the future.The FDA’s policies may change, and additional government regulations may be enacted that could prevent or delay regulatory approval of any candidate drug product or approval of new disease indications or label changes. We cannot predict the likelihood, nature or extent of adverse governmental regulation that might arise from future legislative or administrative action, either in the United States or abroad.Marketing Approvaldrugsdrug may be marketed in the United States generally involves the following:· laboratory and animal tests;·submission of an IND application, which must become effective before clinical trials may begin;·adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed drug for its intended use or uses;·pre-approval inspection of manufacturing facilities and clinical trial sites; and·FDA approval of an NDA which must occur before a drug can be marketed or sold.��The testing and approval process requires substantial timepreclinical studies, such as laboratory tests, potentially animal studies and financial resources,formulation studies, in compliance with FDA regulations for Good Laboratory Practices (GLPs) and we cannot be certain that any approvals will be granted on a timely basis if at all.We will need to successfully complete additional clinical trials in order to be in a position to submit an NDA to the FDA. Future trials may not begin or be completed on schedule, if at all. Trials can be delayed for a variety of reasons, including delays in:·obtaining regulatory approval to commence a study;

other applicable regulations;·reaching agreement with third-party clinical trial sites and vendors and their subsequent performance in conducting accurate and reliable studies on a timely basis;·obtaining institutional review board approval to conduct a study at a prospective site;

We must reach an agreement with the FDA on the proposed protocols for our future clinical trials in the United States. A separate •submission to the FDA of an IND, which must become effective before human clinical trials may begin;

ADAIR

ADAIR was specifically designed Similarly, an IRB can suspend or terminate approval of a clinical trial if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the product candidate has been associated with unexpected serious harm to limit abusepatients.

manufacturing facilities for the new product to determine whether the manufacturing processes and facilities comply with cGMPs. The development plan for ADAIR isFDA will not approve the product unless it determines that the manufacturing processes and facilities are in compliance with cGMPs and are adequate to conductassure consistent production of the product within required specifications.

An NDA would be filed to the FDA only after achieving successnevertheless may accept the data in eachsupport of an NDA if the above milestonesstudy was conducted in accordance with GCPs and any additional milestonesthe FDA is able to validate the data through an on-site inspection, if deemed necessary. Although the FDA generally requests that marketing applications be supported by some data from domestic clinical trials, the FDA may request.

Asaccept foreign data as the sole basis for marketing approval if (1) the foreign data are applicable to the United States population and United States medical practice, (2) the studies were performed by clinical investigators with similarrecognized competence, and (3) the data may be considered valid without the need for an on-site inspection or, if the FDA considers the inspection to be necessary, the FDA is able to validate the data through an on-site inspection or other appropriate means.

15

Finally, the FDA may designate a product for priority review if it is a drug that treats a serious condition and, if approved, would provide a significant improvement in safety or effectiveness. The FDA determines at the time that the marketing application is submitted, on a case-by-case basis, whether the proposed drug represents a significant improvement in treatment, prevention or diagnosis of disease when compared with other available therapies. Significant improvement may be illustrated by evidence of increased effectiveness in the treatment of a condition, elimination or substantial reduction of a treatment-limiting drug reaction, documented enhancement of patient compliance that may lead to improvement in serious outcomes, or evidence of safety and effectiveness in a new subpopulation. A priority review designation is intended to direct overall attention and resources to the evaluation of such applications, and to shorten the FDA’s goal for taking action on a marketing application from ten months to six months for an NDA for a new molecular entity from the date of filing.

Any products

The FDA may request, or we may propose, to implement a risk management program to educate physicians and parents or patients of appropriate use of ADAIR, and to monitor the real-world use and reports of abuse of ADAIR following its approval. Such risk management programs are common with many medications with abuse potential including many approved ADHD products.

Labeling, Marketing and Promotion

The FDA closely regulates the labeling, marketing, and promotion of drugs. While doctors are free to prescribe any drug approved by the FDA for any use, a company can only make claims relating to theproduct’s safety and efficacy of a drug that are consistent with FDA approval and may only actively market a drug only for the particular use and treatment approved by the FDA. effectiveness after commercialization.

Pediatric Research Equity Act

The Pediatric Research Equity Act (“PREA”) amended the FDCA to authorize the FDA to require certain research into drugs used in pediatric patients. The intent of the PREA is to compel sponsors whose drugs have pediatric applicability to study those drugs in pediatric populations, rather than ignoring pediatric indications for adult indications that could be more economically desirable. The Secretary of Health and Human Services may defer or waive these requirements under specified circumstances. The FDA may decide that an NDA will bespecific approved only following completion of additional pediatric studies.

Anti-Kickback and False Claims Laws

In the United States, the research, manufacturing, distribution, sale and promotion of drug products and medical devices are potentially subject to regulation by various federal, state and local authorities in addition to the FDA, including the Centers for Medicare & Medicaid Services, other divisions of the U.S. Department of Health and Human Services (e.g., the Office of Inspector General), the U.S. Department of Justice, state Attorneys General, and other state and local government agencies. For example, sales, marketing, and scientific/educational grant programs must comply with the Anti-Kickback Statute, the False Claims Act, as amended, the privacy regulations promulgated under HIPAA, and similar state laws. Pricing and rebate programs must comply with the Medicaid Drug Rebate Program requirements of the Omnibus Budget Reconciliation Act of 1990, as amended, and the Veterans Health Care Act of 1992, as amended. If products are made available to authorized users of the Federal Supply Schedule of the General Services Administration, additional laws and requirements apply. All of these activities are also potentially subject to federal and state consumer protection and unfair competition laws.

In the United States, we are subject to complex laws and regulations pertaining to healthcare “fraud and abuse,” including, but not limited to, the Anti-Kickback Statute, the federal False Claims Act, and other state and federal laws and regulations. The Anti-Kickback Statute makes it illegal for any person, including a prescription drug manufacturer (or a party acting on its behalf) to knowingly and willfully solicit, receive, offer, or pay any remuneration that is intended to induce the referral of business, including the purchase, order, or prescription of a particular drug, for which payment may be made under a federal healthcare program, such as Medicare or Medicaid.

The federal civil False Claims Act prohibits, among other things, any person or entity from knowingly presenting, or causing to be presented, a false or fraudulent claim for payment to or approval by the federal government or knowingly making, using or causing to be made or used a false record or statement material to a false or fraudulent claim to the federal government. A claim includes “any request or demand” for money or property presented to the U.S. government. Violations of the False Claims Act can result in very significant monetary penalties and treble damages. The federal government is using the False Claims Act, and the accompanying threat of significant liability, in its investigation and prosecution of pharmaceutical companies throughout the country, for example, in connection with the promotion of products for unapproved uses and other sales and marketing practices. The government has obtained multi-million and multi-billion-dollar settlements under the False Claims Act in addition to individual criminal convictions under applicable criminal statutes. In addition, the federal civil monetary penalties statute imposes penalties against any person or entity that, among other things, is determined to have presented or caused to be presented a claim to a federal health program that the person knows or should know is for an item or service that was not provided as claimed or is false or fraudulent. Given the significant size of actual and potential settlements, it is expected that the government will continue to devote substantial resources to investigating healthcare providers’ and manufacturers’ compliance with applicable fraud and abuse laws.

The federal Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), also created new federal criminal statutes that prohibit knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program, including private third-party payors and knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services. Similar to the Anti-Kickback Statute a person or entity does not need to have actual knowledge of these statutes or specific intent to violate them in order to have committed a violation.

There are also an increasing number of state laws that require manufacturers to make reports to states on pricing and marketing information. Many of these laws contain ambiguities as to what is required to comply with the laws. In addition, a similar federal requirement Section 6002 of the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act (the “Affordable Care Act”) commonly referred to as the “Physician Payments Sunshine Act” requires manufacturers to track and report to the federal government certain payments and “transfers of value” made to physicians and teaching hospitals, as well as ownership and investment interests held by physicians and their immediate family members, made in the previous calendar year. There are a number of states that have various types of reporting requirements as well. These laws may affect our sales, marketing, and other promotional activities by imposing administrative and compliance burdens on us. In addition, given the lack of clarity with respect to these laws and their implementation, our reporting actions could be subject to the penalty provisions of the pertinent state, and soon federal, authorities.

Patient Protection and Affordable Health Care Act

In March 2010, the Affordable Care Act was enacted, which includes measures that have or will significantly change the way health care is financed by both governmental and private insurers. The fees, discounts, and other provisions of this law are expected to have a significant negative effect on the profitability of pharmaceuticals.

This legislation is expected to impact the scope of healthcare insurance, the insurance refunds from the insurance companies and possibly also on the costs of medical products.

Other Regulations

We are also subject to numerous federal, state and local laws relating to such matters as safe working conditions, manufacturing practices, environmental protection, fire hazard control, and disposal of hazardous or potentially hazardous substances. We may incur significant costs to comply with such laws and regulations now or in the future.

Manufacturing

We do not currently own or operate any manufacturing facilities and we do not have any experiencein accordance with commercial-scale manufacturing. We currently rely, and expect to continue to rely for the foreseeable future, on a third-party manufacturer to produce our product candidates for preclinical and clinical testing, as well as for commercial manufacture if our product candidates receive marketing approval.

Although we do not have a long-term commercial supply arrangement in place with any of our contract manufacturers, it is our goal to contract with at least one manufacturer in the United States for the commercial supply of ADAIR for the U.S. market.

Our third-party manufacturers, their facilities, and all pharmaceutical products used in our clinical trials are required to comply with cGMP.cGMPs. The cGMP regulationscGMPs include requirements relating to the organization of personnel, buildings and facilities, equipment, control of components and drug product containers and closures, production and process controls, packaging and labeling controls, holding and distribution, laboratory controls, records and reports and returned or salvaged products. TheDrug manufacturers and other entities involved in the manufacture and distribution of approved drugs are required to register their establishments with the FDA and some state agencies and are subject to periodic unannounced inspections by the FDA for compliance with cGMPs and other laws. Changes to the manufacturing facilities for our productsprocess are strictly regulated and, depending on the significance of the change, may require prior FDA approval before being implemented. FDA regulations also require investigation and correction of any deviations from cGMPs and impose reporting and documentation requirements upon the sponsor and any third-party manufacturers. Accordingly, manufacturers must meet, and continue to meet, cGMP requirementsexpend time, money, and FDA satisfaction before any product is approvedeffort in production and we can manufacture commercial products. Contract manufacturers often encounter difficulties involving production yields,quality control to maintain compliance with cGMPs and other aspects of quality control and quality assurance,assurance.

Salessuch applications, a generic manufacturer must rely on the preclinical and Marketing

We retain advisorsclinical testing previously conducted for a drug product previously approved under an NDA, known as the reference listed drug (RLD).

Medice License Agreement

Onsales and distribution of our products, if approved, either directly or through distribution partners. Whether or not we obtain FDA approval for a product candidate, we must obtain the requisite approvals from regulatory authorities in foreign countries or economic areas, such as the EU, Canada, and the United Kingdom, among other foreign countries, before we may commence clinical trials or market products in those countries or areas. The foreign regulatory approval process includes all of the risks associated with the FDA approval described above, and the time required to obtain approval in other countries and jurisdictions might differ from and be longer than that required to obtain FDA approval. Some foreign jurisdictions have a drug product approval process similar to that in the United States, which requires the submission of a clinical trial application much like the IND prior to the commencement of clinical studies. In Europe, for example, a clinical trial application (CTA) must be submitted to each country’s national health authority and an independent ethics committee, much like the FDA and IRB, respectively. Once the CTA is approved in accordance with a country’s requirements, clinical trial development may proceed. To obtain regulatory approval of a medicinal product candidate under EU regulatory systems, we would be required to submit a Marketing Authorisation Application (MAA), which is similar to the NDA, except that, among other things, there are country-specific document requirements. For countries outside of the EU, such as countries in Eastern Europe, Latin America or Asia, and recently the United Kingdom, the requirements governing the conduct of clinical trials, product approval, pricing and reimbursement vary from country to country. Regulatory approval in one country or jurisdiction does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one country or jurisdiction may negatively impact the regulatory process in others. Moreover, some nations may not accept clinical studies performed for United States approval to support approval in their countries or require that additional studies be performed on natives of their countries. In addition, in certain foreign markets, the pricing of drug products is subject to government control and reimbursement may in some cases be unavailable or insufficient. If we fail to comply with applicable foreign regulatory requirements, we may be subject to, among other things, fines, suspension or withdrawal of regulatory approvals, product recalls, seizure of products, operating restrictions, and criminal prosecution.