UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20222023

OR

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ForFor the transition period from ______ to _____

Commission File Number: 001-39965

ON24, INC.

(Exact Namename of Registrantregistrant as Specifiedspecified in its Charter)charter)

| | | | | |

| Delaware | 94-3292599 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

50 Beale Street, 8th Floor, San Francisco, CA | 94105 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (415) 369-8000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | ONTF | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act). Yes ¨ No x.

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ¨ | | Accelerated filer | x |

| Non-accelerated filer | ¨ | | Smaller reporting company | ¨ |

| | | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b) ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant based upon the closing sale price on the New York Stock Exchange as of June 30, 2022,2023, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $361 million.$246 million.

As of March 3, 2023,5, 2024, the registrant had 47,430,26441,674,056 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the 20222024 Annual Stockholders’ Meeting, which the registrant expects to file with the Securities and Exchange Commission within 120 days of December 31, 2022,2023, are incorporated by reference into Part III (Items 10, 11,12, 13 and 14) of this Annual Report on Form 10-K.

Table of Contents | | | | | | | | |

| | Page |

| |

| | |

| | |

| Item 1. | | |

| Item 1A | | |

| Item 1B | | |

| Item 1C | | |

| Item 2 | | |

| Item 3 | | |

| | |

| | |

| | |

| Item 5 | | |

| Item 6 | | |

| Item 7 | | |

| Item 7A | | |

| Item 8 | | |

| Item 9 | | |

| Item 9A | | |

| Item 9B | | |

| Item 9C | | |

| | |

| | |

| Item 10 | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| | |

| Item 15. | | |

| Item 16. | | |

| | |

| | |

| | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or this Report, contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. The forward-looking statements are contained principally in, but not limited to, the sections titled “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts”, “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements include, but are not limited to, statements about:about

•our ability to grow our revenue;

•our ability to attract new customers and expand sales to existing customers.

•fluctuation in our performance, our history of net losses and any increases in our expenses;

•competition and technological development in our markets and any decline in demand for our solutions or generally in our markets;

•adverse general economic and market conditions and spending on sales and marketing technology;

•our ability to expand our sales and marketing capabilities and otherwise manage ourachieve growth;

•the impact of the COVID-19 pandemic and future variantsresumption of the virusin-person marketing activities on our customer growth rate, which has declined in recent periods and may decline in future periods compared to 2022, as the impact of COVID-19 lessens and our customers and their users increasingly resume in-person marketing activities;rate;

•disruptions, interruptions, outages or other issues with our technology or our use of third-party services, data connectors and data centers;

•the impact of the security incident involving ransomware that we experienced or any other cybersecurity-related attack, significant data breach or disruption of the information technology systems or networks on which we rely;

•our sales cycle, our international presence and our timing of revenue recognition from our sales;

•interoperability with other devices, systems and applications;

•compliance with data privacy, import and export controls, customs, sanctions and other laws and regulations;

•intellectual property matters, including any infringements of third-party intellectual property rights by us or infringement of our intellectual property rights by third parties; and

•the market for, trading price of and other matters associated with our common stock.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We discuss these risks in greater detail in the section entitled “Risk Factors” and elsewhere in this Report. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of this Report. You should read this Report completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

PART I

Item 1. Business.

Overview

Our mission is to transform the way businesses drive revenue and customer engagement through data-rich digital experiences.

We provide a leading, cloud-based intelligent engagement platform for digital engagement that deliverscombines best-in-class experiences with personalization and content, to enable sales and marketing organizations to capture and act on connected insights for revenue growth through interactive webinar experiences, virtual event experiences and multimedia content experiences.at scale. Our platform’s portfolio of interactive personalized and content-richhyper-personalized digital experience products creates and captures actionable, real-time data at scale from millions of professionals every month to provide businesses with buying signals and behavioral insights to efficiently convert prospects into customers.

Similar to what has taken place in the business-to-consumer, or B2C, market, our platform for digitalintelligent engagement empowers business-to-business, or B2B, companies with insights to better personalize their engagement. Large social media platforms have been successful at leveraging experiences and insights of consumers on their platforms to enable B2C companies to effectively understand their potential consumers. While these have been effective in the B2C market, B2B companies often lack deep insights about prospective customers to effectively understand and engage them.

Businesses today primarily use automatedtraditional sales and marketing solutions, such as digital advertising and email, for marketing. While these automatedtraditional solutions reach large numbers of prospective customers, they have generally failed to deepen customer engagement because they were designed with the simple purpose of pushing marketing messages in one direction – from the business to the prospective customer. As a result, marketing at scale has become synonymous with spam, which is often ignored by prospective customers and can even undermine the customer relationship. At the same time, prospective customers prefer to do their own research by accessing digital marketing resources before consulting with a salesperson to make a purchasing decision.

For most businesses to succeed, we believe their sales and marketing strategies must evolve fromhave digital engagement powered by the eralatest technology. With the launch of automation to the era of engagement. Weour intelligent engagement platform that includes our new AI-powered Analytics and Content Engine (“ACE”) in January 2024, we are strategically positioned to help businesses and their sales and marketing organizations make this transition. Our platform provides an innovative way both to scale digital marketing and deepen prospective customer engagement. We believe our opportunity to help businesses convert digital engagement into revenue will continue to grow over time as industries modernize their sales and marketing processes. As our customers create more ON24 content-rich experiences, they gathergain more connected insights through gathering more data directly from prospective customers, which we refer to as first-person data, to help them create a multiplier effect that strengthens their ability to convert prospective customers and generate revenue.

As of December 31, 2022,2023, we had 1,9901,784 customers. No single customer contributed more than 10% of our total revenue for the year ended December 31, 2023, 2022 2021 and 2020.2021.

Industry Trends

B2B sales and marketing has shifted away from traditional approaches, such as “cold calling,” “snail mail,” industry networking events and in-office visits, to more scalable, digital-based approaches. Going forward, B2B sales interactions between suppliers and buyers are expected to increasingly occur in digital channels. As they transition to digital-based approaches, businesses are struggling to achieve deep levels of personalized engagement and interactivity. The most common digital marketing tactics that businesses use to operate sales and marketing programs at scale require them to make suboptimal tradeoffs: either annoy their customers with spam, which is frequently ineffective, or use third-party providers to run more expensive marketing campaigns that still may not be engaging or personalized to a prospective customer’s business needs. This has led to frustration and poor returns from digital sales and marketing investments.

The imperative to optimize digital sales and marketing investments to drive revenue conversion has become more important as businesses accelerate digital transformation and AI innovation initiatives. We believe this digital transformation has fundamentally changed the way businesses engage with their prospective customers, leading to an increased need for innovative methods of B2B engagement at scale and leverage AI to improve sales effectiveness and drive faster revenue growth. The following key trends are impacting sales and marketing strategies today:

•Personalized and interactive digital customer engagement at scale is the new imperative. The ability to engage with large numbers of prospective customers and customers cost-effectivelyin a cost effective manner is crucial. As businesses broadly embrace digital transformation and AI initiatives, they are standardizing onusing cloud-based platforms to transformmodernize their sales and marketing strategies. Increased focus on next-generation digital marketing solutions offers our customers an opportunity to drive personalized and interactive prospective customer engagement at scale by aggregating a significant amount of insights on prospective customers. It also enables our customers to make productivity gains through the assistance of AI. This enables businesses to optimize sales and marketing campaigns and drive revenue growth.

•Democratization of content has led prospective customers to self-educate. Ineffective marketing tactics coupled with broad availability of relevant content across multiple channels have shifted the mindset of B2B prospective customers. Because prospective customers are now self-educating by accessing information on products and brands in advance of purchasing decisions, marketers must adapt by identifying and providing relevant content to their prospective customers earlier in the sales process. We believe this will necessarily shift greater investment into content-rich, interactive platforms for digitalintelligent engagement and away from low-touch marketing automation strategies. We also believe that this increasing need for content to enable prospective customers to self-educate will make it necessary for sales and marketing functions to produce content as efficiently and quickly as possible, therefore increasing the benefit of generative AI.

•Traditional automated marketing approaches are increasingly ineffective. TraditionalautomatedMany traditional marketing tactics have limited effectiveness at engaging prospective customers because they are generic, intrusive and irrelevant. Having a limited understanding of a prospective customer’s intent and interest leads to largely ineffective, impersonal marketing, wasted sales and marketing investment and frustrated prospective customers.

•Data privacy requirements are constraining automated digital marketing. Data privacy has become a fundamental area of focus for regulatory bodies given the digital transformation initiatives taking place and the plethora of spam used today. As privacy laws continue to expand and evolve, this puts pressure on traditionally automated methods of marketing at scale that have traditionally been highly dependent on information obtained from third parties. As a result, we believe there will beis increased focus on engaging with customers directly and driving engagement through first partyfirst-party insights and integrations.

The new norms of digital transformation and targeting self-educating prospective customers have accelerated the need for cloud platforms that deliver personalized and interactive customer engagement at scale to drive revenue.revenue as well as enable AI-assisted efficiencies.

Limitations of Traditional Approaches to Customer Engagement at Scale

BusinessesMany businesses have struggled to adapt their marketing strategies for the era of digital engagement where interactions with prospective customers happen online.customers. Traditional marketing tactics and general-purpose communication platforms suffer from many limitations, including:

•Failure to create content-rich, interactive experiences for prospective customers. As prospective customers increasingly self-educate, creating personalized, content-rich and interactive experiences is critical to generate engagement. Typical online sales and marketing strategies are built upon one-way communication from the marketer to their prospective customers, offering no opportunity for developing a meaningful exchange nor empowering prospective customers to dictate their own buying process.

•Limited opportunity for engagement, resulting in less prospective customer data. Highly engaging and interactive experiences generate valuable signals about prospective customers’ buying intentions that can inform the sales process and improve efficiency. To be able to capture and respond to those buying signals, businesses need the ability to track, record, contextualize and analyze prospective customer behavior in real-time. While in-person events, such as business conferences, can sometimes create engaging experiences, they do not allow for the automated and efficient collection of first-person data and are expensive to organize. General-purpose online meeting tools can enable businesses to reach many people at once, but they lack the engagement, analytics and first-person data that are needed to drive revenue. Meanwhile, traditional marketing automation tools collect only superficial data such as click rates that deliver limited understanding into what prospective customers want, what messages are resonating and how to more deeply engage and inform prospective customers that are seeking to learn more.

•Ineffective insights to convert prospects into customers. Insights about prospective customers are onlyprimarily valuable to businesses to the extent that they help convert prospects into customers. Providing contextualized and easy to access information to sales teams in real-time can materially improve their efficiency and improve revenue conversion. Technologies such as general purpose communicationsgeneral-purpose meeting and collaboration tools have provided convenient alternatives to hosting physical meetingsin-person events but were not designed to easily integrate into the broader sales and marketing systems that businesses use, and thus these tools have limited use in connecting real-time customer interaction with a business’s broader sales and marketing strategies.

•Inability to utilize behavioral insights to dynamically personalize content. By gaining insights into their prospective customers’ behavior and engagement, businesses are able tocan understand and measure the performance of their digital experiences. This understanding provides critical intelligence to optimize the subsequent creation and delivery of other digital experiences.experiences as well as leverage AI. Traditional approaches typically fail to utilize customer behaviors to dynamically adjust content and enable content personalization.

•In-person events are resource intensive and exist in a discrete moment. A business conference exists in a discrete moment in time, is expensive, and cannot be re-created. In these scenarios, businesses only have one opportunity to engage with prospective customers at scale, and their return on investment is limited. Furthermore, the expectation in today’s new market dynamic is that all events have a digital component and that audiences are able to choose how they engage.

Our Platform and Key Differentiators

Our leading cloud-based platform for digitalintelligent engagement enables businesses to convert customer engagement into revenue through interactive webinarby combining best-in-class experiences virtual event experienceswith personalization and multimedia content, experiences that are backed by analyticsto enable sales and an ecosystem of third-party integrations.marketing organizations to capture and act on connected insights at scale.

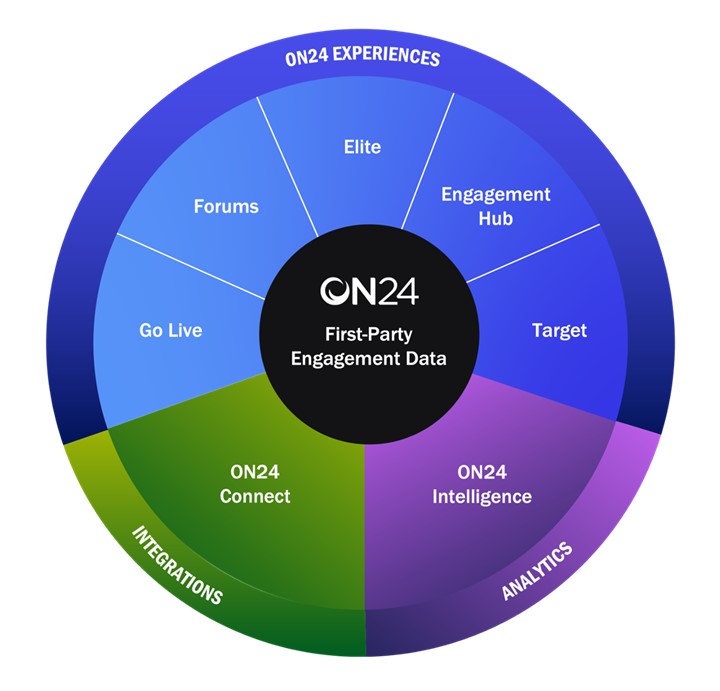

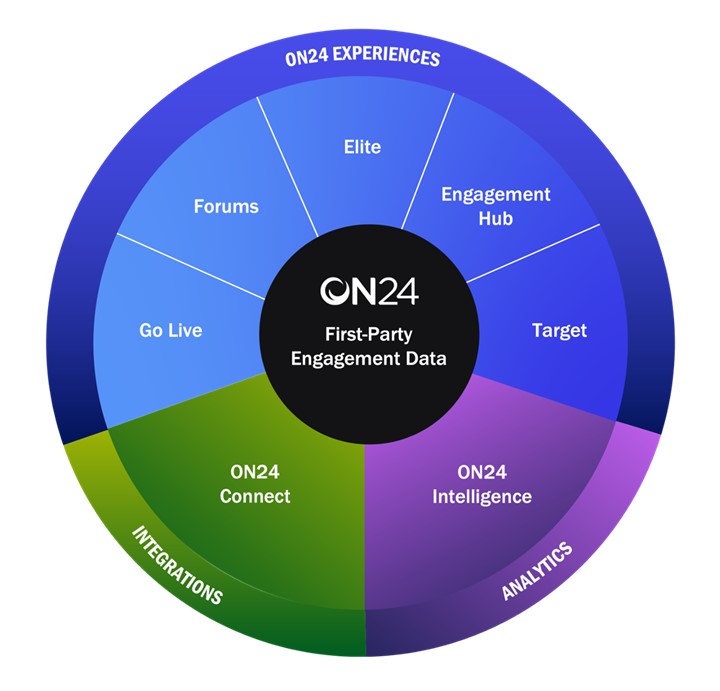

Our portfolio of ON24 Core Platform Experience products include:

•ON24 Elite: live, interactive webinar experience that engages prospective customers in real-time and can also be made available in an on-demand format.

•ON24 Breakouts: live breakout room experience that facilitates networking, collaboration and interactivity between users.

•ON24 Forums: live, interactive experience that facilitates video-to-video interaction between presenters and audiences.

•ON24 Go Live: live, interactive video event experience that enables presenters and attendees to engage face-to-face in real-time and can also be made available in an on-demand format.

•ON24 Engagement Hub: always-on, rich multimedia content experience that prospective customers can engage in anytime, anywhere.

•ON24 Target: personalized and curated, rich landing page experience that engages specific segments of prospective customers to drive a desired action.

Our ON24 Core Platform Experience products are backed by our solutions, including:

•ON24 Intelligence: analytics backbone that captures first-person data to power the insights, benchmarking reporting and artificial intelligence and machine learning, or AI/ML, enginereporting within our platform.

•ON24 AI-powered ACE: enables hyper-personalization at scale across ON24 experiences, uses generative AI to automatically create content and videos to feed ongoing nurture streams and provides an advanced set of intelligent analytics.

•ON24 Connect: ecosystem of third-party application integrations.

•ON24 Services and Platform Support: a portfolio of professional services that provide consulting and support for product and platform adoption.

Our non-Core Platform Experience product includes:is:

•ON24 Virtual Conference: live, large scale, managed virtual event experience that engages prospective customers in real-time and can also be made available in an on-demand format. With the return of large-scale in-person events, we are seeing less demand for this managed-service product. Accordingly, we are deemphasizing this product. As such, we do not consider ON24 Virtual Conference as part of our Core Platform going forward.Platform.

We believe the key differentiators of our platform are:

•Designed to drive interactive, personalized customer experiences. Our platform was built to power a new kind of customer engagement – highly interactive real-time digital experiences that can scale engagement from hundreds to thousands ofengage prospective customers simultaneously.at scale, while delivering a personalized experience to specific audience segments. Unlike spam, which is often ignored, our digital experiences engage prospective customers with tailored content and encourage them to ask questions and learn about a business’sbusiness’ products and offerings more broadly. This real-time interaction is the foundation of our modernintelligent engagement platform and aligns with how B2B prospective customers are seeking to self-educate.

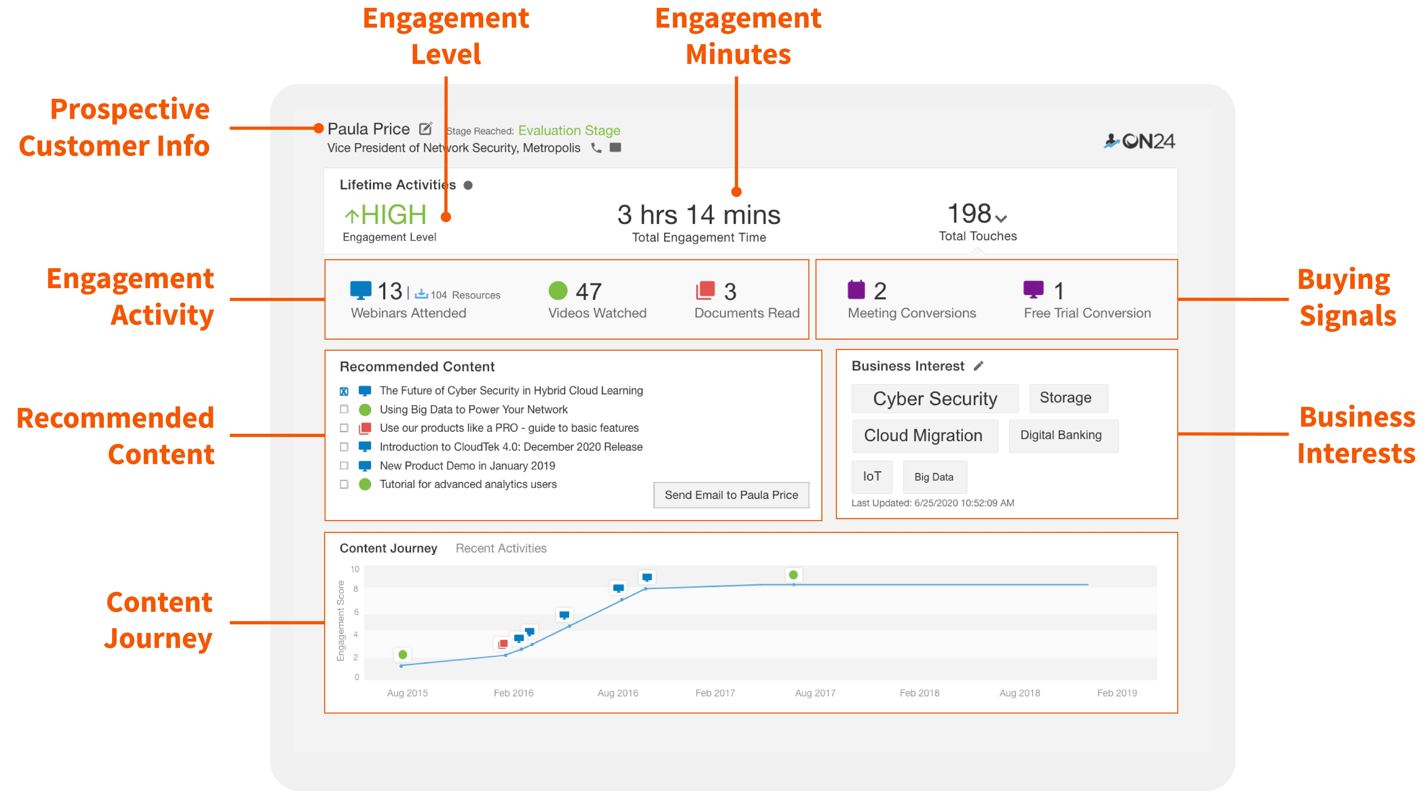

•Interactive customer engagement creates highly valuable customer insight data. Unlike more traditional approaches, creating and measuring customer engagement and interaction is at the center of our platform. Through our products, our customers can create interactive experiences that foster active engagement with their prospective customers and gather data in real time. This enables our customers to obtain rich, valuable insights and predictive analytics as well as integrate the resulting data and insights into their business applications.

•Prospective customer insights drive more efficient conversion of pipeline to revenue. The customer engagement and interaction data gathered through our platform enables businesses to derive deep insights about prospective customer behavior. These insights can drive higher-quality pipeline, provide opportunities to use AI for better performance and resource efficiency and ultimately better revenue conversion for our customers. Through our ecosystem of integrations with third-party marketing automation, customer relationship management, or CRM, and business intelligence, or BI, platforms, our customers can leverage insights derived through our platform to more intelligently engage with prospective customers in real-time.customers.

•Flywheel effect drives continuous optimization. Years of capturing engagement insights have provided us with a deep understanding of how to best design digital experiences that engage prospective customers and generate more impactful revenue conversion. The more of our content-rich experiences that our customers create for their prospective customers to engage with, the more first-person data that our customers are able tocan collect in return.return, creating a flywheel effect. By leveraging AI/ML,AI, especially generative AI, our platform enables businesses to use this data to derive highly relevant and deep insights that fuel AI-drivenAI-generated content generation, personalizedand videos, enable hyper-personalized segmentation at scale, and provide enhanced analytics and reporting and dynamic content recommendations. These AI/ML-drivenAI-driven innovations further strengthen the engagement, levels of experiences,while saving time and resources, enhancing the quality of the interaction data and insights derived through our platform. This combination of rich prospective customer data and AI/ML becomes a flywheel for better content creation, improved customer experiences, greater customer intelligence and enhanced revenue conversion.

•Experiences that can be repurposed and continuously drive engagement to maximize return on investment. Our customers are able tocan continuously drive results because ON24 digitallive experiences remain interactive and can continue to engage their prospective customersgenerate first-party insights well after the initial live event ends. The experiences created through our platformdate on which they are designed with persistent interactivity which givesdelivered. In addition, our customers the ability to engagecan automatically turn their prospective customers in either a live or on-demand experience.experience content into new written and video content using generative AI. This flexibility makes it possible to repurpose and reuse digital experiences many times over with no incremental cost.

Our Competitive Strengths

We believe that we have significant competitive strengths that will enable us to extend our market leadership position, including:

•Category defining platform for customer engagement at scale. We created one of the first cloud platforms for businesses to deliver interactive, data drivendata-driven webinar experiences, virtual event experiences and multimedia content experiences. We believe we have a first-mover advantage because our proprietary and proven platform has enabled our customers to build effective systems for digital engagement that generate high return on investment.

•Cloud-based system of engagement. Our cloud-based platform powersenables our customers with several key marketing capabilities: creating digital experiences, deploying them at scale, collecting numerous data points on their prospective customers, repurposing experiences into AI-generated written and video content and leveraging this data to further personalize subsequent experiences. Consolidating these services onto one platform allows our customers to gather a more cohesive understanding of their prospective customers and take more targeted actions to more effectively convert prospects into customers. As a result, businesses no longer need to rely on a combination of standalone products.

•Broad, rich dataset and AI/MLAI capabilities power valuable insights. Our platform enables highly interactive experiences, giving our customers access to behavioral data that signals buying intent. By leveraging our AI/MLAI capabilities, our customers can derive valuable and actionable insights in order to optimize their sales and marketing strategies. For example, with our AI-powered ACE, we help our customers understand what features of a digital experience drive the most engagement with prospective customers and heatmap key moments of an experience that had the greatest impact on audiences. Based on those key moments, AI-powered ACE can automatically create short-form video clips that feed ongoing nurture streams. Our customers can also use our platform to benchmark themselves against others in their industry to understand where they can improve as well as to synthesize lifetime behavior on our platform into an easy-to-use business interest report. They can also use our AI-driven content generation to automatically create promotional content. In addition, our customers can more effectively reach their prospects and customers by leveraging our AI/ML capabilities to dynamically personalize digital experiences for particular customers based on their prior behavior and interactions on our platform.

•Enterprise grade,Enterprise-grade, highly scalable cloud platform. Our cloud-based platform has been developed to enable enterprise-grade scalability. This includes options and features to enable our customers to make privacy and compliance choices that align to their needs as well as integrations with a broad ecosystem of third-party applications. Our platform is available in over 20 languages and can be utilized seamlessly across multinational sales and marketing organizations. Our customers are able tocan use our platform to engage their prospective customers in multiple regions by supporting different streaming protocols, multilingual translation and closed captioning.

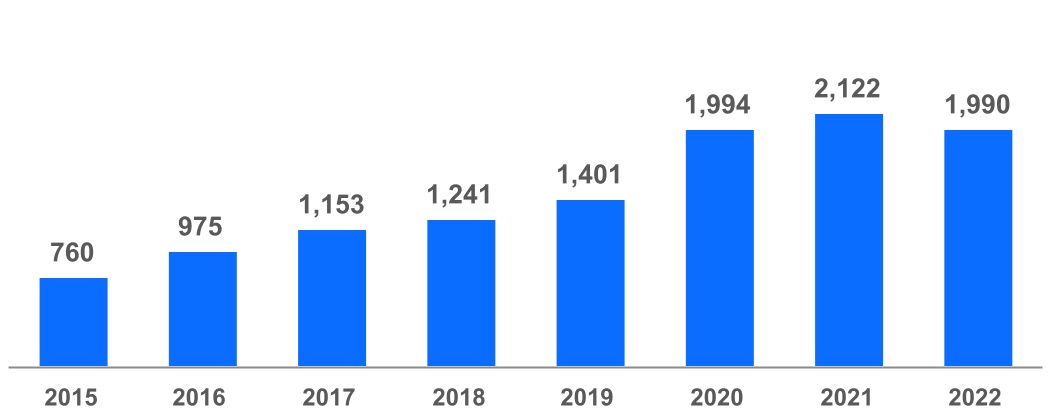

•Broad base of customers across verticals. We have a large and diverse set of customers across a broad set of industries. While our customer base decreased in 2022 compared to 2021, our customer base has grown significantly since 2015, from approximately 760 customers asverticals, including technology, manufacturing, life sciences, financial services and professional services. As of December 31, 2015 to 1,990 customers as of December 31, 2022.2023, we had 1,784 customers. We intend to leverage our land and expand model to further penetrate customers across these verticals.

•Superior, dedicated customer service. Our solutions are designed to be easy to use, featuring drag-and-drop and other similar tools simplifying implementation by our customers. We offer technical support, chat support and live webinar experience emergency support that is available to our customers 24/7. Our platform support and customer success teams are organized into a “follow the sun model” to ensure consistent and reliable service across the globe.

Our Market Opportunity

We estimate the current total addressable market, or TAM, for our solutions is approximately $46$44 billion worldwide annually. We calculate our TAM by initially estimating the total number of companies that our platform and products can support in the United States across separate bands measured by number of employees: Enterprise, which includes companies with more than 2,000 employees, and Commercial, which includes companies with less than 2,000 employees, which we further divide into Mid-Market companies with 200-1,999 employees, and small and midsize, or SMB, companies with 1-199 employees, using data from the U.S. Census Bureau for 2019.2020. We then apply an average annual value to the companies in each band. This value was calculated using internally generated data for annual recurring revenue, or ARR, as of December 31, 20222023 for the top 25% of our customers by ARR that subscribe to two or more of our products, within each of the Enterprise and Mid-Market bands, and the top 25% by ARR of all our customers within the SMB band. We believe these calculations are representative of the current potential spend on our solutions by customers and prospective customers. We multiplied the total number of companies within each band by the calculated annual value for that band. The aggregate calculated value represents the current annual estimated market opportunity in the United States of $23approximately $22 billion. We believe the market opportunity for our solutions outside the United States is at least as large.

Our Growth Strategy

While we are currently operating in a challenging macro-economic environment, we intend to drive the growth of our business over time and the adoption of our solutions by executing the following strategies:

•Drive new customer acquisition. We believe that our market is still relatively underpenetrated and that through scaling our sales force over time and through specialized and aligned sales teams focused on the Enterprise and Commercial markets globally, we can acquire new customers across the substantial Commercial market.customers.

•Expand within existing customers. Our land and expand model is expected to drive expansion of new subscriptions within our existing customer base by selling subscriptions to additional parts of existing customers’ organizations, expanding into new regional divisions and upselling new solutions. In addition to expanding with our customers through use cases in the marketing and sales organizations, we plan to develop newexpand within our customers through use cases for applications for our platform, including partner training and employee recruiting and forms of indirect marketing, such as education,partner enablement and training, healthcare professional engagement in pharma and life sciences; member enrollment and benefits programs.broker enablement in commercial and health insurance; and continuing professional education and certification for professional services.

•Continue to increase attachmentsmultiproduct adoption and develop new solutions for specific use cases. We expect our business to grow both through increasing attachments formultiproduct adoption of existing solutions and selling our existing customers new solutions that we develop in the future. For example, we have developed a differentiated feature set for our customers that use our platform to conduct online continuing education programs and issue accredited certifications. Our ecosystem of third-party integrations includes business applications in specific industries. We plan to continually develop new solutions that are powered with the newest technology such as AI to enhance the functionality of our platform and products, improve our customers’ experiences and drive engagement with their prospective customers.

•Expand into new regions. We believe the expansion of our platform in international markets is a significant opportunity. We plan to continue tomay in the future evaluate expansion opportunities for our solutions internationally, both in countries where we currently operate and countries where we do not yet sell subscriptions to our solutions.

•Identify and pursue inorganic growth opportunities. We plan to opportunistically evaluate and acquire complementary businesses, products, services or technologies that expand our platform, add different categories of experiences and support new use cases for our customers. We believe well-selected acquisitionsinorganic growth opportunities may add significant value to our platform and expand the ability of our customers to gather engagement data to help them convert their prospective customers into revenue.

Our Solutions

Our platform gives businesses the ability to use digital engagementintelligently engage prospects and customers to drive revenue growth through interactivehyper-personalized experiences, data-driven analytics and solutions that integrate into a large number of business systems, predominantly marketing automation, CRM and BI platforms. With digital engagementfirst-party data and insights at the core, our platform’s experience, data and integration layers power a portfolio of experience products and solutions that includeincludes ON24 Elite, ON24 Forums, ON24 Go Live, ON24 Breakouts, ON24 Engagement Hub and ON24 Target,Target. In addition, we offer our customers ON24 Intelligence and ON24 Connect.Connect solutions as well as ON24 AI-powered ACE. We also offer ON24 Virtual Conference, which is not part of our Corea non-Core Platform Experience products suite.product.

The following graphic depicts our platform:

ON24 Experience Products

Our platform’s experience products contain a robust set of capabilities that make it simple for our customers to build, design, manage and scale live, interactive webinar experiences, large-scale virtual event experiences, rich multimedia content hub experiences and personalized content experiences. Any business user can use our platform; no code or technical expertise is required.

We have designed our experiences to be equally easy for our customers’ audiences of prospective customers to access and guide their own self-education process. Our customers’ audiences of prospective customers can choose to engage with multiple points of interaction and content resources within an ON24 Experience and move seamlessly through a variety of ON24 Experiences. To further remove friction, audience members do not need any downloads or plug-ins, can use any web browser and can access experiences from a desktop, mobile or tablet device.

ON24 Core Platform Experience Products

Live Experiences: ON24 Elite

ON24 Elite gives our customers a high-impact, cost-efficient, digitally native way to engage hundreds and thousands of their prospective customers simultaneously.

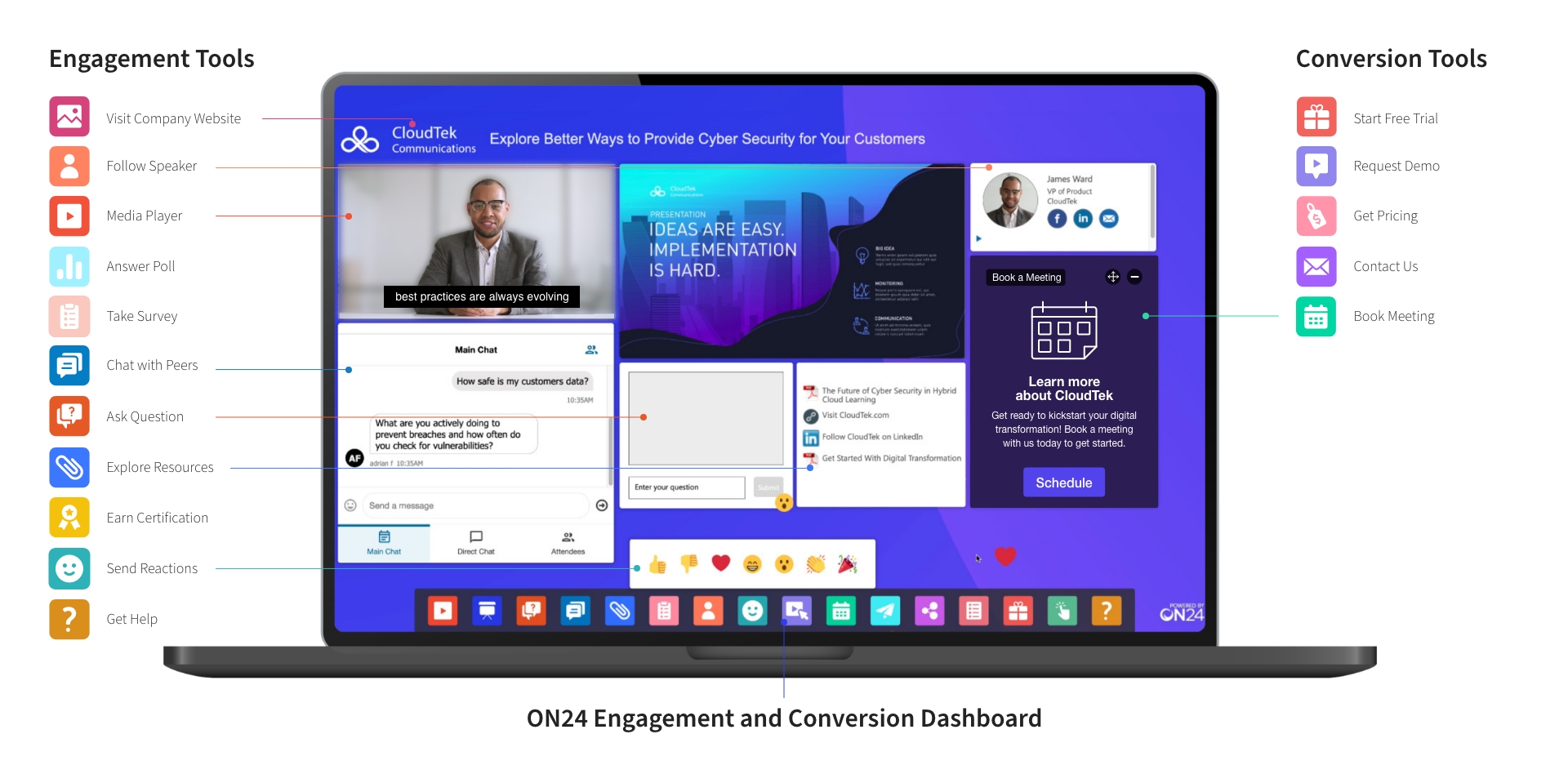

An ON24 interactive webinar experience is fully customizable and enables our customers to combine a video or audio-based presentation with supporting slide materials, video clips or screen-sharing alongside dynamic interactions including live question and answer messaging, group chats, real-time surveys and polls, and additional content resources. Our customers can drive high-intent calls-to-action for their prospective customers to book a sales meeting or request a demo. Through ON24 AI-powered ACE, our customers can personalize calls-to-action, content and messaging for specific audience segments.

Through ON24 Elite, interactive webinar experiences can be delivered in multiple formats, including a scheduled live experience featuring a livestreamed presentation or pre-recorded presentation, which we refer to as simulive because it is designed to simulate a livestreamed presentation, or an on-demand experience featuring a pre-recorded presentation. No matter the format, all two-way interactivity remains dynamic and continues to drive engagement in real-time. Our platform also provides automated captioning inside interactive webinar experiences that can be transcribed and translated into 10 languages in real-time. That transcription can then be edited and auto-translated in more than 60 languages for pre-recorded, simulive or on-demand presentations.

ON24 Elite’s flexible format and modular composition makes it easy to scale a webinar program, run multiple interactive experiences across different sales and marketing functions or for different audience segments, and repurpose and replay content and syndicate experiences to different regions. To enhance the re-use of content, our platform enables our customers to create templates and clone and edit interactive webinar experiences.

We provide a separate interface for presenters called ON24 Elite Studio, which acts as the production environment for our customers to produce real-time interactive webinar experiences, livestream or record multimedia presentations, and engage with customers in real-time during an ON24 Experience.

Live Experiences: ON24 Breakouts

ON24 Breakouts expanded the functionality and interactivity of webinars built with ON24 Elite. This product enables users to have a face-to-face virtual conversation with their customers during or after the main webinar experience ends, facilitating attendee networking, enabling relationship-building and virtual selling opportunities.

Live Experiences: ON24 Forums

ON24 Forums provides an interactive, video-based experience for smaller moderated discussions bringing two-way, face-to-face networking and audience participation together in a fully branded experience. This product is ideal for executive engagement, expert-led trainings and professional advisory groups, enabling users to create high-touch virtual events at scale, capture interactions and integrate engagement data into business systems. Through AI-powered ACE, our customers can personalize calls-to-action, content and messaging for specific audience segments.

Live Experiences: ON24 Go Live

ON24 Go Live offers an all-in-one, easy-to-use video event experience optimized for networking and audience participation. This product is designed for single or multi-day events enabling users to deliver live keynote presentations, host multiple breakout sessions with video-based discussions, and create exhibit halls and a networking lounge. Optimized for audience networking and participation, this product includes multiple formats for two-way engagement, including event-level chat, in-session chat, polls and video-to-video breakout discussions.

Always-On Experiences: ON24 Engagement Hub

ON24 Engagement Hub is an online resource portal product that our customers use to provide rich content experiences for their prospective customers to find, consume and engage with interactive webinar experiences and other multimedia marketing content, such as videos and whitepapers, in a single online destination.

Through AI-powered ACE, our customers can personalize calls-to-action, content and messaging for specific audience segments. With out-of-the-box features that include branding, search, categorization, website embedding and pre-set content layouts, ON24 Engagement Hub provides a simple and efficient way for our customers to seamlessly publish, curate and promote their interactive webinar experiences alongside other marketing content that they upload and host inside our platform.

Personalized Experiences: ON24 Target

ON24 Target is a personalized marketing product that gives our customers the ability to easily build, curate and disseminate interactive webinar and video experiences and other multimedia content to distributed audience segments with relevant messaging, offerings and calls-to-action.

Additional features across our ON24 Core Platform Experience products

Our ON24 Experience products include the following tools to enable our customers to produce professionally designed experiences, drive ongoing engagement and conversion, and host, manage and organize content.

•ON24 Experience Builder: Our customers use our drag-and-drop interface; pre-set layouts, custom templates, and a library of stock images to rapidly produce professionally designed and branded experiences without any need for website or code development.

•ON24 Engagement and Conversion Tools: Our platform contains a library of more than 20 interactivity tools that Through AI-powered ACE, our customers can use to drive ongoing engagementpersonalize calls-to-action, content and conversion with their prospective customers, enabling them to interact with hundreds and thousands of individual prospective customers simultaneously. Examples of ON24 Engagement and Conversion Tools include the ability to book a sales meeting, request a product demo, ask question and answers in real-time, and engage with supplemental resources such as downloadable white papers or external webpages.

•ON24 Media Manager: Our customers use ON24 Media Manager to host, manage and organize all marketing content, including interactive webinar experiences, videos and whitepapers, in a single location.messaging for specific audience segments.

ON24 Intelligence

ON24 Intelligence is the analytics backbone that runs across our platform and provides our customers with first-person data, analytics, benchmarking and reporting within our platform. These insights and reports are available to all of our customers and measure analytics at the account-level, for each platform experience, for each hosted content asset and for each prospective customer who engages with an experience on our platform. Our customers are able tocan easily understand the overall performance of their ON24 experiences in a dashboard-level view and make comparisons to industry benchmarks for future improvement. We also include AI capabilities within ON24 Intelligence.

ON24 Engagement and Prospect Analytics

The ON24 engagement and prospect analytics are powered by our proprietary algorithms and our AI/MLAI capabilities. The prospect analytics measure engagement levels of individual prospective customers to enable our customers to report, qualify, prioritize and score their prospective customers’ intent to make a purchase. Our engagement analytics tools provide our customers the ability to report, measure and compare the engagement levels of their ON24 Experiences and multimedia assets hosted on our platform both in aggregate and individually.

10

ON24 Advanced Analytics

ON24 Advanced Analytics provides our customers with an additional set of pre-configured reports that enable customers to understand their most engaged prospective customers, provide a view of where prospective customers are in the sales funnel, and give analysis across poll and survey responses. Our customers are also able to use ON24 Advanced Analytics to run customized reports within our platform.

ON24 AI/ML EngineAI-powered ACE

Our flagship AI product is ON24 AI/ML engine leveragesAI-powered ACE which helps our customers scale their hyper-personalized experiences, automatically create content and videos to feed ongoing nurture streams and provides an advanced set of intelligent analytics.

ON24 AI Capabilities

Our AI capabilities also leverage the data collected by or on behalf of our customers through our platform to enableallow for better prediction of which content will drive the mostaudience engagement for individual prospects and personalization of experiences for customer segments, thus driving further interaction data and creating a continuous network effect of higher customer engagement that leads to the ability to deliver content that is optimized to drive more engagement.segments.

Our platform hasuses AI technologies, including generative AI, natural language processing and machine learning, to enable the following AI/ML-powered capabilities:

•The ability to dynamically deliver personalized content recommendations;

•Embedded generative AI that automatically creates written content and videos to feed ongoing nurture streams;

•Embedded generative AI copywriting assistant tool to scale and optimizehelp with promotional content;

•Enable sales to act on prospects’ unique topical interests with a “Business Interest Cloud” report;

•Surface immediate audience feedback from live experiences with a “Key Moments” report, providing marketers with deep links to promote more targeted experiences;

•Deliver dynamic, personalized content recommendations;a heatmap report of “Key Moments” that identifies the most engaging segments of a live experience and automatically creates snackable video highlights;

•Predictive engagement levels for our customers’ prospective customers;

•Automated transcription of audio and video into text, making it searchable and accessible;

•Automated translation of transcripts into multiple languages for global audience reach;

•Q&A bot, to answer routine support questions in ON24 Elite Studio;during live webinar experiences; and,

•Platform audience and presenter load predictions, to help deploy operational resources and provide oversight.

ON24 Connect

ON24 Connect is an ecosystem of third-party application integrations and APIs that enable the first-person insights generated by ON24 Intelligence to be extracted and leveraged across our customers’ business systems for more intelligent sales and marketing.

APIs

Our broad set of APIs enable our customers, partners and a select set of third-party developers to use ON24 Intelligence in their business applications. We also provide our APIs to a select set of businesses to build applications for our portfolio of ON24 Experience products.

Marketing Automation, CRM and BI Platform Integrations

Through our ecosystem of third-party integrations, our customers can seamlessly integrate their first-person engagement data with other business systems, predominantly marketing automation, CRM and BI platforms, including integrations with Adobe Marketo Engage, Oracle Marketing Cloud (Eloqua), Salesforce CRM, Salesforce Marketing Cloud, (Pardot),Salesforce Pardot, Veeva and HubSpot.

ON24 Non-Core Experience Product

Live Experiences: ON24 Virtual Conference

ON24 Virtual Conference is built to host large-scale online events and provide a single source for measurement and analytics.

Our ON24 Virtual Conference powers multi-session virtual event experiences that can be scheduled as live events and maintained as ongoing on-demand events or in an immersive training content library. Simulating an in-person conference, trade show or training center, ON24 Virtual Conference houses multiple tracks of interactive webinar-based keynotes and breakout sessions powered by ON24 Elite alongside participant networking, virtual breakout meetings and virtual vendor booths.

All interactions across the ON24 Virtual Conference and within the individual ON24 Elite-powered webinar-based sessions are captured and unified, providing a powerful set of event analytics.

With the return of large-scale in-person events, we are seeing less demand for ON24 Virtual Conference and we are deemphasizinghave deemphasized this product. As such, we do not consider ON24 Virtual Conference as part of our Core Platform going forward.Platform.

Our Technology and Infrastructure

Our platform and products have been developed to enable enterprise-grade scalability, performance and reliability, designed to address all the complexities that come with live, interactive engagement with large audiences of prospective customers. Our platform has two main parts: a web application stack, and a streaming infrastructure stack, running on two co-located data centers in the United States and one in the European Union (EU). We also utilize public-cloud providers as part of our infrastructure.

Our web application stack processes requests from web browsers and APIs. Our streaming infrastructure stack processes live signal acquisition from our customers, encodes it, and delivers it to audiences via a redundant set of content delivery networks. The streaming infrastructure stack is designed to accept inputs from our customers on a wide variety of devices, combine them into an online virtual bridge, and to incorporate controls into the ON24 Elite Studio experience for presenters. The bridged signal is then encoded and distributed to diverse global audiences, who can access it as part of an online experience on desktop and mobile devices. This presentation contains video along with other interactive components, all synchronized and controlled by our customers. We continue to transition more of our capabilities to a hybrid cloud infrastructure, which we believe will enhance our platform’s flexibility and scalability.

We built our platform and products to address the robust performance demanded by large, multinational enterprises in the following ways:

•Performance and scalability: Our Cloud and Network Operations team runs this application in three data centers. This configuration has proven both scalable and cost effective. Our application architecture allows us to independently scale the systems that handle heavier loads, with a lightweight load-balancers routing traffic to additional machines as needed. With leading enterprise components, we expect our architecture to scale readily without any significant change as our business expands.

•Privacy and compliance: Our platform includes features and options designed to support compliance with the EU General Data Protection Regulation, or GDPR, the UK GDPR, the California Consumer Privacy Act, or CCPA, the California Privacy Rights Act, or CPRA, and other privacy laws, and provides options and features to enable customers to make privacy and compliance choices that align to their needs and relevant legal requirements. For example, our platform enables customers to implement tailored notice and consent language, customize registration forms and obtain consent for marketing and other processing activities. In addition, our flexible APIs allow businesses to build solutions to automate compliance with certain data subject requests.

•Security: We conduct regular penetration tests, web vulnerability scans, and code reviews to enhance the security of our platform.platform in accordance with our cybersecurity program as discussed in more detail under “Item 1C. Cybersecurity” herein.

Our Customers

Our customer base consists of a diverse set of businesses from fast-growing start-ups to established Fortune 100 enterprises that span a number of industries where B2B sales and marketing is mission critical. As of December 31, 2022,2023, approximately 20%22% of the Fortune 1000500 are ON24 customers. The primary industries we serve include technology, financial services, life sciences, manufacturing and professional services, among others. All of these industries are undergoing a digital transformation, and, as a result, we see opportunities for growth in product adoption, attachments and revenue across all verticals fueling both our customer acquisition and land and expand strategies. No single customer contributed more than 10% of our total revenue for the year ended December 31, 2023, 2022 2021 and 2020.2021.

Sales and Marketing

We primarily sell our products through direct sales, which comprises field and inside sales personnel. Our sales organization is comprised of market-centric teams focusing on Enterprise and Commercial customers segmented by employee headcounts. Our field sales organization is specialized to execute our land and expand strategy and primarily focuses on Enterprise and Commercial customers while our inside sales team specializes in driving further adoption of ON24 products to our existing customers as well as sourcing new customers.

Our-go-to-market strategy consists of four key components, including acquiring and expanding wallet share within large accounts, focusing on the Commercial market, driving increased product attachments through continued customer innovation, and expanding into new geographies to drive continued international growth. We are also building the ON24 Partner Network, an ecosystem of solution and technology partners, to further support growth.

Marketing

We have built an efficient and impactful go-to-market engine by using the ON24 platform as the foundation of our marketing strategy. Due to the deep engagement and actionable data generated by our interactive digital experiences, we are able to quickly qualify leads, provide our sales team with personalized insights and accelerate our highest priority buyers to our sales team.

Our marketing team focuses on inbound and outbound marketing through our industry-leading content and resources and by sharing customer best practices. We use multiple marketing tactics to build brand awareness and generate demand, including media communications, user conferences, digital marketing, partner co-marketing, product marketing and customer marketing. We track and measure our marketing costs and results closely across all channels to support our efforts to optimize marketing channels that drive our sales pipeline.

Customer Success

We believe that our highly responsive and effective support and education are an extension of our brand and are core to building and maintaining user trust. Our global customer success team is closely embedded with our customers and supports their day-to-day usage of our platform, including advising on best practices and providing technical support, services, and training. Our platform support team offers technical support, chat support and live webinar experience emergency support that is available to our customers 24/7. Our portfolio of services provides consulting, support for platform, and product and event adoption as well as support for experience management, monitoring and production. Our training team oversees onboarding, training, certification and a knowledge center.

Our global support team is based in 5 regional offices and is available 24/7 via in-product and presenter chat support. We have a data-driven process and well-established operations in place that proactively monitor our customers’ platform adoption, utilization and success. This approach enables us to efficiently scale our customer success operations as our customer base grows.

Research and Development

Our research and development team are responsible for the design, development, testing, and delivery of new products, platform capabilities, product features and platform integrations, connectors and APIs. We release major platform upgrades once per quarterregularly with minor upgrades released as needed. Research and development employees are locatedbased primarily in our San Francisco headquarters, and we also contract with remote U.S.-based and offshore workers.

Competition

Our industry is highly competitive and fragmented. We compete for customers with a number of different types of companies that offer a variety of products and services, including meeting tools, webinar software, virtual event software, video portal software, content management software, physical events, physical event software and digital marketing tools. Our competitors vary in size and in the breadth and scope of the products and services they offer. Many of our current and potential competitors have larger customer bases, greater brand recognition and significantly greater financial, marketing and other resources than we have. Our solutions face competition. For example, a number ofseveral web-based meeting, webinar, and virtual event software products are offered by companies such as Zoom, LogMeIn, Intrado, Microsoft, Cisco, Cvent, Adobe, RingCentral, Notified and Hopin.Kaltura. Many of these products have significantly lower prices. Although many of these companies do not currently offer products withare limited in their ability to deliver both real-time engagement features that gatherand the types and extent of actionable data that we gather, many of these companies have significantly greater resources and may be able to introduce similar products in the future. Additionally, we operate in a market characterized by an increasingwhich has experienced a rapid increase in the number of new and competitive entrants.entrants in the recent past and may again in the future. As we introduce new solutions, and with the introduction of new technologies, products and market entrants, we expect competition to intensify in the future.intensify.

We believe the principal competitive factors in our markets are:

•functionality in providing rich, interactive digital experiences;

•ability to gather near real-time data insights for marketers;insights;

•breadth of functionality within a single platform;platform, including AI capabilities;

•ease of use and reliability;

•cloud-based architecture;

•scalability;

•security, privacy and compliance;

•integration into leading marketing automation, CRM and BI platforms; and

•global, always available customer service and support.

We believe we compete favorably with respect to each of these factors.

Intellectual Property

We primarily rely, and expect to continue to rely, on a combination of patent, trade secret and domain name protection, trademark and copyright laws, as well as confidentiality and license agreements with our employees, consultants and third parties, to protect our intellectual property and proprietary rights. In the United States and abroad, as of December 31, 2022,2023, we had 1819 issued patents and 2726 pending patent applications, the earliest of which expires in 2027. We pursue the registration of our domain names, trademarks and service marks in the United States and in certain locations outside the United States. Our trademarks and service marks include our name and logo, as well as various marketing slogans. We maintain a policy requiring our employees, contractors, consultants and other third parties to enter into confidentiality and proprietary rights agreements to control access to our proprietary information.

These laws, procedures and restrictions provide only limited protection, and any of our intellectual property rights may be challenged, invalidated, circumvented, infringed or misappropriated.

Regulatory Considerations

The legal environment of Internet-based businesses is evolving rapidly in the United States and elsewhere. The manner in which existing laws and regulations are applied in this environment, and how they will relate to our business in particular, both in the United States and internationally, is often unclear. For example, we sometimes cannot be certain which laws will be deemed applicable to us given the global nature of our business, including with respect to such topics as data privacy and security, pricing, credit card fraud, advertising, taxation, content regulation and intellectual property ownership and infringement.

Businesses use our platform to engage with and market to their prospects and customers. In doing so, these businesses: (a) upload, broadcast, collect and store data and content within our platform, subject to relatively few general restrictions imposed by us, aside from the technical capabilities and limitation inherent in our platform, (b) use tools and reports available in our platform to access analytics and insights about attendees, experiences and content, and (c) personalize content and experiences to prospects and customers. This presents potential compliance challenges to our business and operations because we do not control customer content and information practices within our platform. Thus, we cannot ensure that information collection and processing by or on behalf of customers, within our platform, complies with applicable privacy, data protection and other laws. Similarly, we cannot ensure that customer content and use of our platform does not infringe or violate rights of privacy or intellectual property rights. At the same time, given the developing and varied nature of privacy and intellectual property laws globally, we cannot guarantee that ON24 would never be

subject to potential or actual claims or enforcement actions associated with customer content or use of our platform. Thus, both in the United States and internationally, we must monitor and take steps to respond to a host of legal, compliance and risk issues regarding the data stored and processed by customers on our platform. These include, without limitation, the following:

Privacy, Data Protection and Security

Businesses use our platform to facilitate better engagement with their customers and prospects, derive insights about content and usage, and provide more meaningful and targeted experiences and content. These capabilities rely on collection and processing of information from and about customers and prospects that interact with the business or its content on our platform. As a result, compliance with laws and regulations regarding data privacy, AI, cybersecurity, data protection, data breaches, and the collection, processing, storage, transfer and use of personal data, which we refer to as privacy laws, are critical to our compliance and risk strategy. Globally, numerous jurisdictions have passed or are actively considering new or amended privacy laws. As a result, privacy laws are increasing in number, enforcement, and fines and other penalties. Beyond legislative developments, decisions by courts and regulatory bodies relating to privacy laws can also have a significant impact on us and other businesses that operate across international jurisdictions.

In some cases, privacy laws apply directly to both ON24 and our customers and in other cases our customers pass through compliance obligations and requirements to us contractually. Further, under some privacy laws, ON24 may be considered a “processor” or a “service provider” and our customers a “controller” or “business,” while other privacy laws may not clearly distinguish between such roles. In all cases, however, ON24 must monitor, respond to and address privacy laws and related compliance, whether to ensure its own compliance or enable compliant use of its platform by ON24 customers. In general, our failure to adequately safeguard data adequately, address privacy compliance, or comply with our security and privacy commitments to customers could subject us, not only to contractual liability to customers and direct liability under privacy laws, but also to reputational harm and regulatory investigations or enforcement actions under U.S. (federal and state) and international laws and regulations relating to consumer protection and unfair business practices. More particularly, certain privacy law developments could have significant impacts to our platform and business. For example, privacy laws that restrict the use of personal information for marketing purposes or the tracking of individuals’ online activities (such as the EU’s proposed ePrivacy Regulation and the California Consumer Privacy Act)CCPA), could expose us to additional regulatory burdens or necessitate changes to our platform or certain features. In addition, certain countries have passed or are considering passing laws that impose data localization requirements or cross border data transfer restrictions on certain data. As with most cloud-based solutions, restrictions on the transfer of platform data outside of the originating jurisdiction pose particular challenges that could result in additional costs or otherwise impact platform use.

With the evolving legal landscape, the scope, interpretation and enforcement of privacy laws could change and new or amended laws may take effect. As a result, the associated burdens and compliance costs on us and our platform could increase in the future. Although we continue to monitor and respond to privacy legal developments and have invested in addressing major privacy law developments (such as the GDPR, CCPA and the CCPA)CPRA), it is not possible for us to predict with certainty the effect of these developments on our platform and business.

Copyrights

U.S. and international copyright and trademark laws protect the rights of third parties from infringement of their intellectual property. Our customers and their users can generally use our platform to upload and present a wide variety of content. We maintain a copyright infringement policy and respond to takedown requests by third-party intellectual property right owners that might result from content uploaded to our platform. As our business expands to other countries, we must also respond to regional and country-specific intellectual property considerations, including takedown and cease-and-desist notices in foreign languages, and we must build infrastructure to support these processes. The Digital Millennium Copyright Act, or DMCA, also applies to our business. This statute provides relief for claims of circumvention of copyright-protected technologies but includes a safe harbor that is intended to reduce the liability of online service providers for listing or linking to third-party websites or hosting content that infringes copyrights of others. The copyright infringement policies that we have implemented for our platform are intended to satisfy the DMCA safe harbor.

Employees and Human Capital

As of December 31, 2022,2023, we had 640462 full-time employees. Of these employees, 487366 are based in the United States and 15396 are based in international locations. The members of our management team and our board of directors come from diverse backgrounds, and we seek to attract and recruit diverse, talented, experienced and motivated employees. In order to develop and improve our platform, we must invest in attracting, developing and retaining key talent. We monitor our progress with human capital metrics such as turnover, time to fill open roles and rate of internally developed talent. Our brand, market position, reputation for innovation and culture support our ability to recruit and retain talented employees across our departments.

Corporate Information

ON24, Inc. was incorporated as a Delaware corporation on January 8, 1998 under the name “NewsDirect, Inc.” Our principal executive offices are located at 50 Beale Street, 8th Floor, San Francisco, California 94105, and our telephone number is (415) 369-8000. Our website address is www.on24.com. Information contained on, or that can be accessed through, our website is not part of and is not incorporated by reference into this Report, and you should not consider information on our website to be part of this Report.

We own various U.S. federal trademarks and unregistered trademarks, including our company name, logo and solution names and other trade or service marks. All other trademarks or trade names referred to in this Report are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Report are referred to without the symbols ® and ™, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

Available Information

We maintain a website at www.on24.com, where we make available, free of charge, our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and other reports or documents filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, as soon as reasonably practicable after we file them with or furnish them to the Securities and Exchange Commission, or the SEC. Investors and others should note that we announce material financial and other information to our investors using our investor relations website (https://investors.on24.com), SEC filings, press releases, public conferences or conference calls, webcasts and other meetings. We encourage investors, the media and others interested in our company to review this information. We also use social media channels, including those of our Chief Executive Officer, Sharat Sharan, to communicate with our customers and the public generally about our company, our services, the industry and other issues. It is possible that the information we post on social media could be deemed to be material information. Therefore, we encourage investors, the media, and others interested in our company to review the information we post on social media channels.

Item 1A. Risk Factors.

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this report, including our consolidated financial statements and related notes, as well as in our other filings with the SEC, in evaluating our business and before investing in our common stock. The occurrence of any of the events or developments described below could materially and adversely affect our business, financial condition, results of operations, and growth prospects. In such an event, the market price of our common stock could decline, and our stockholders may lose all or part of their investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations.

Summary of Risk Factors

Our business is subject to a number of risks and uncertainties, including those risks discussed at-length below. You should read these risks before you invest in our common stock.

•our ability to grow our revenue;

•our ability to attract new customers and expand sales to existing customers;

•fluctuation in our performance, our history of net losses and any increases in our expenses;

•competition and technological development in our markets and any decline in demand for our solutions or generally in our markets;

•adverse general economic and market conditions and spending on sales and marketing technology;

•our ability to expand our sales and marketing capabilities and otherwise manage ourachieve growth;

•the impact of the COVID-19 pandemic and future variantsresumption of the virusin-person marketing activities on our customer growth rate, which has declined in recent periods and may decline in future periods compared to 2022, as the impact of COVID-19 lessens and our customers and their users increasingly resume in-person marketing activities;rate;

•disruptions, interruptions, outages or other issues with our technology or our use of third-party services, data connectors and data centers;

•the impact of the security incident involving ransomware that we experienced or any other cybersecurity-related attack, significant data breach or disruption of the information technology systems or networks on which we rely;

•our sales cycle, our international presence and our timing of revenue recognition from our sales;

•interoperability with other devices, systems and applications;

•compliance with data privacy, import and export controls, customs, sanctions and other laws and regulations;

•intellectual property matters, including any infringements of third-party intellectual property rights by us or infringement of our intellectual property rights by third parties; and

•the market for, trading price of and other matters associated with our common stock.

Risks Related to Our Business and Our Industry

We have not consistently sustained ourOur revenue growth rate has decreased in recent years following a period of rapid growth, and we may not be able to increase our revenue in future periods.

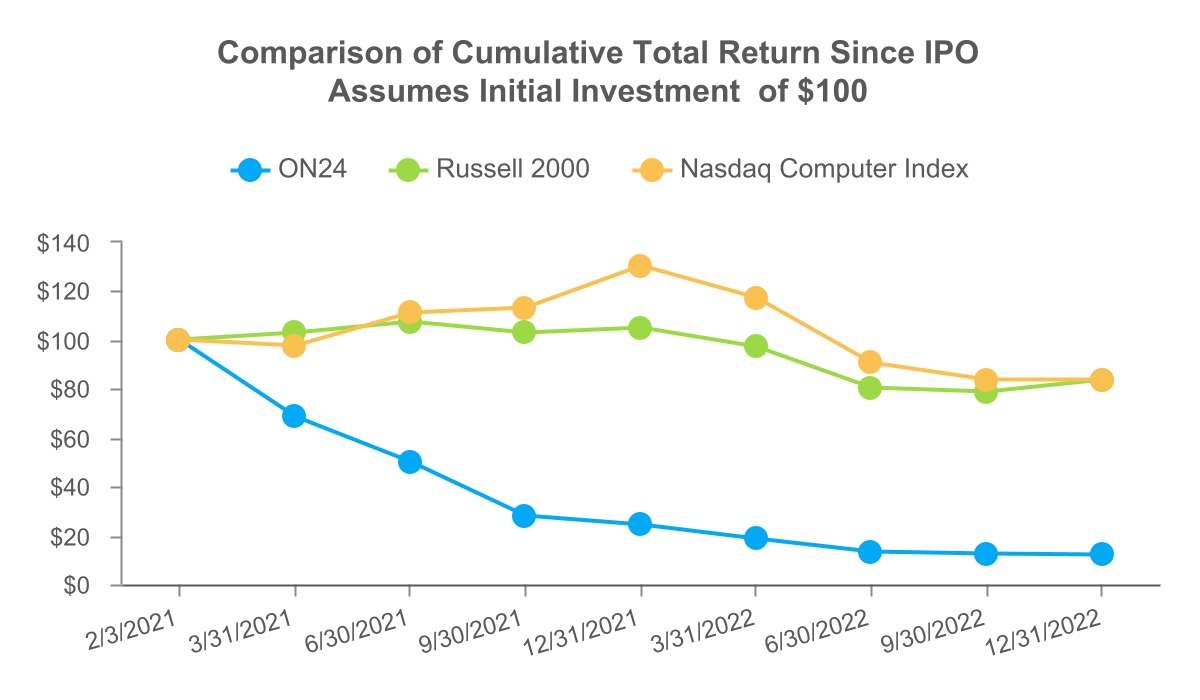

We have grown rapidly in prior periods, particularly in 2021 and 2020. For example, for full years 2021 and 2020, our revenue was $203.6 million and $156.9 million, respectively, representing annual growth of 30% and 76% in 2021 and 2020, respectively. Our revenue growth rate has decreased in these prior periods, particularlyrecent years following a period of rapid growth. Although we experienced significant revenue growth in 2020 was significantly impacted by increased demand forand 2021, including a revenue increase of 30% in 2021 compared to 2020, in subsequent years we have seen declines. In 2022 our platform and products following the onset of the COVID-19 pandemic and resulting precautionary measures. While some of our subscriptions have multi-year terms, most have terms of one year. Customers may not renew their subscriptions at the same rate, may decrease their usage of our solutions or may not purchase subscriptions for additional solutions, if they renew at all. For example, as subscription terms expired throughout 2021 and early 2022 for customers who subscribed during the beginning of the pandemic, many customers did not renew their subscriptions or decreased their usage of our solutions, which we believe reflects the lessening impact of COVID-19 on demand as well as other factors. Our revenue in 2022 decreased 6% compared to 2021.2021 and in 2023 our revenue decreased 14% compared to 2022. The decreases reflect a number of factors including reduced budgets for our customers, the reduced impact of COVID-19 which resulted in customers doing more in-person marketing and competitive dynamics. If our revenue does not increase in future periods, our business, financial condition and results of operations could be harmed. Furthermore, if we cannot attract new customers to our platform or our existing customers do not continue their subscriptions, our business, financial condition and results of operations would be harmed.