•economic, political and market conditions and fluctuations, including inflation, interest rate and foreign currency risk inherent in U.S. and international operations;operations, and geopolitical instability;

•the performance and reliability of our technology and technology of third parties;parties on which we rely;

•any significant errorsystems failures or errors in our operational processes;

•our ability to continue to generate cash and manage our indebtedness; and

•adverse changes that may occur in the litigation or regulatory areas, or in the securities markets generally.generally, or increased regulatory oversight domestically or internationally.

Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the uncertainty and any risk related to forward-looking statements that we make. These risk factors are discussed under the caption “Item"Item 1A. Risk Factors,”Factors" in this Annual Report on Form 10-K. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. You should carefully read this entire Annual Report on Form 10-K, including “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,”Operations” and the consolidated financial statements and the related notes. Except as required by the federal securities laws, we undertake no obligation to update any forward-looking statement, release publicly any revisions to any forward-looking statements or report the occurrence of unanticipated events. For any forward-looking statements contained in any document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

iv

PART I

Item 1.Business

Overview

Nasdaq Inc. is a leading providerglobal technology company serving the capital markets and other industries. Our diverse offerings of trading, clearing, marketplace technology, regulatory, securities listing, informationdata, analytics, software and publicservices enable clients to optimize and private company services. Our global offerings are diverseexecute their business vision with confidence.

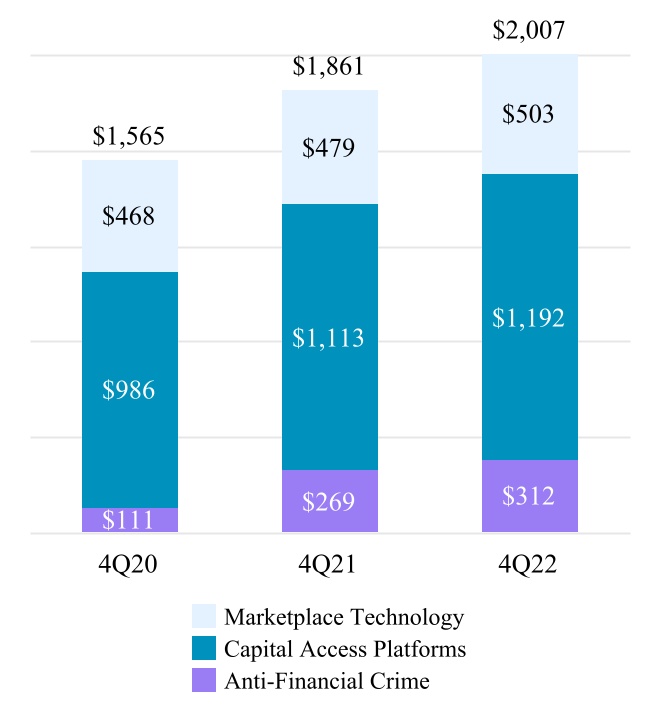

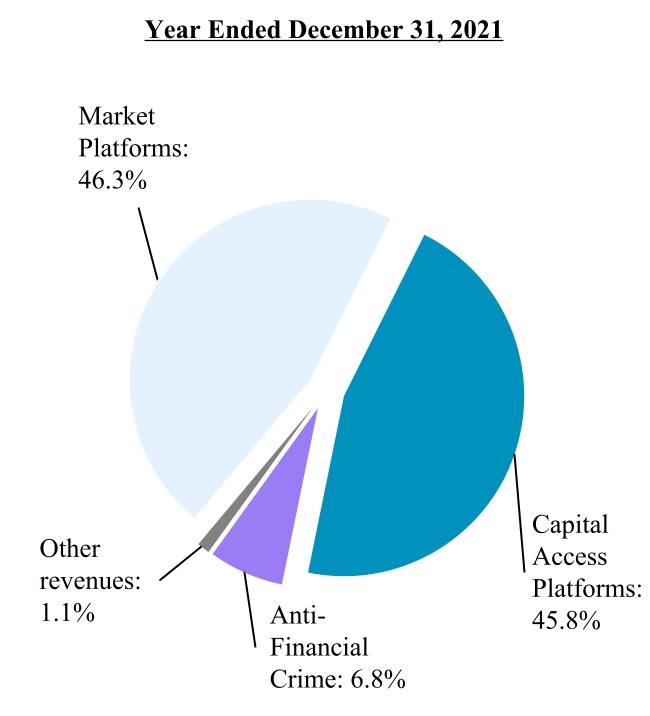

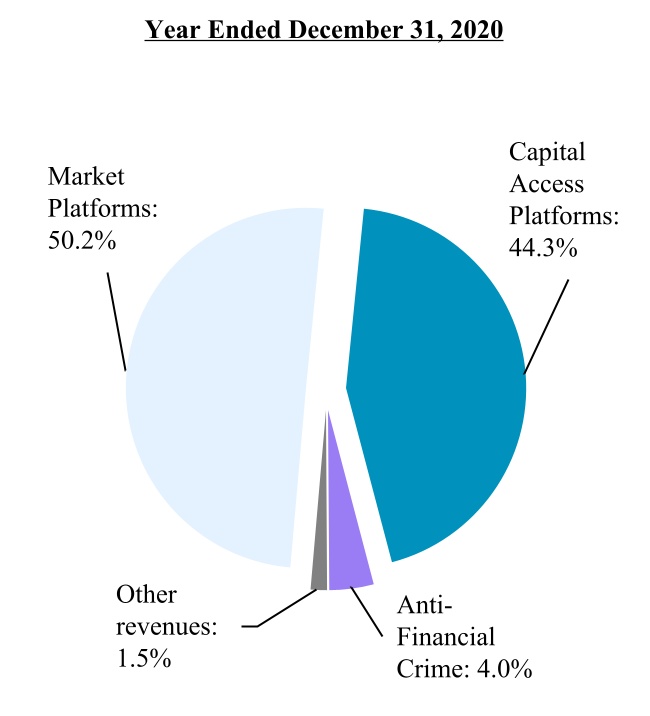

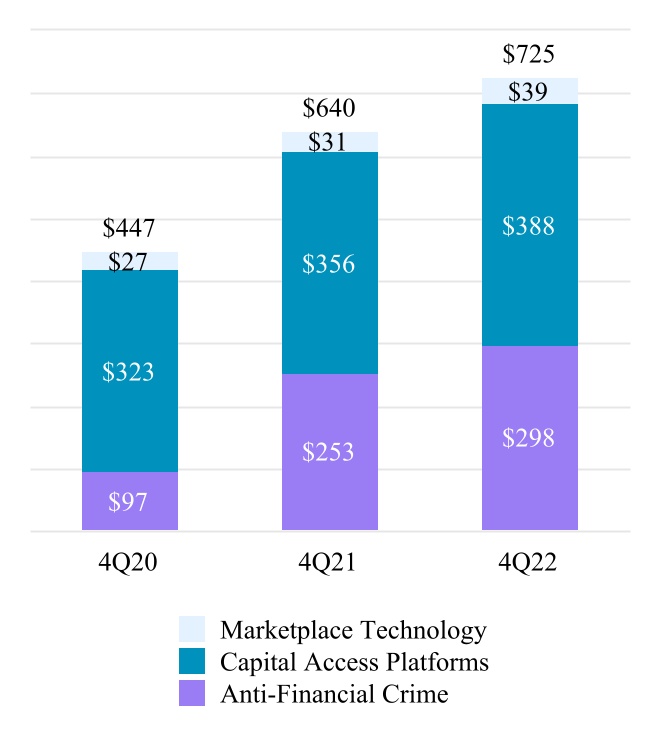

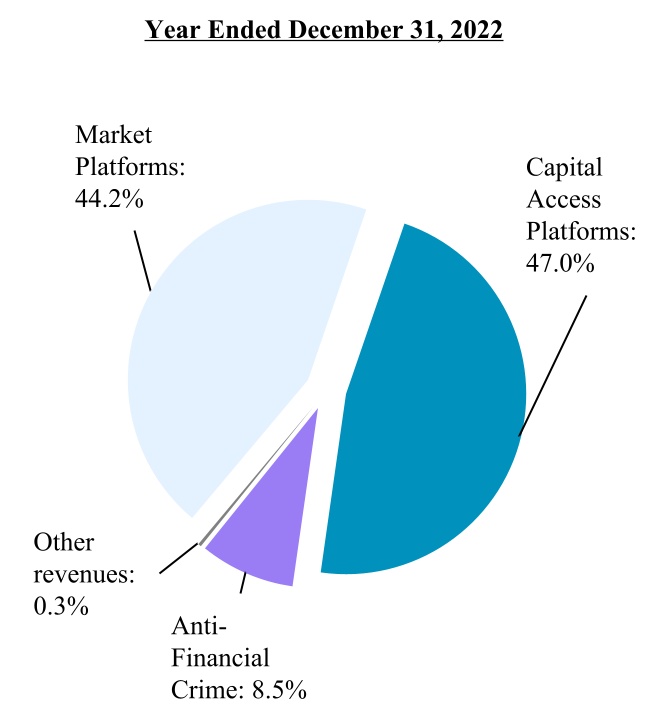

We manage, operate and include trading and clearing across multiple asset classes, trade management services, data products, financial indexes, capital formation solutions, corporate solutions, and market technologyprovide our products and services. Our technology powers markets across the globe, supporting equity derivative trading, clearingservices in three business segments: Market Platforms, Capital Access Platforms and settlement, cash equity trading, fixed income trading, trading surveillance and many other functions.Anti-Financial Crime.

History

Nasdaq was founded in 1971 as a wholly-owned subsidiary of FINRA. Beginning in 2000, FINRA restructured and broadened ownership in Nasdaq by selling shares to FINRA members, investment companies and issuers listed on The Nasdaq Stock Market. In connection with this restructuring, FINRA fully divested its ownership of Nasdaq in 2006, and The Nasdaq Stock Market became fully operational as an independent registered national securities exchange in 2007. In 2006, Nasdaq also reorganized its operations into a holding company structure.

In February 2008, Nasdaq and OMX AB combined their businesses.businesses, and we changed our corporate name to The NASDAQ OMX Group, Inc. This transformational combination resulted in the expansion of our business from a U.S.-based exchange operator to a global exchange company offering technology that powers our own exchanges and markets as well as many other marketplaces around the world. In connection with this acquisition, we changed our corporate name to TheWe operated as the NASDAQ OMX Group Inc. We operated under this name until we rebranded our business as Nasdaq, Inc. in 2015.

Growth Strategy

To enable success in addition to growing organically,the evolving global financial system, we have executed multiple acquisitionsestablished our purpose, vision, and value proposition together with a focused growth strategy:

Our Purpose: We advance economic progress for all.

Our Vision: We will be the trusted fabric of the world’s financial system.

Our Value Proposition: We deliver world-leading platforms that have expanded our operations globallyimprove the liquidity, transparency and increasingly diversified our product and service offerings. integrity of the global economy.

Our most recent significant acquisitions include ISE in 2016 and eVestment in 2017.

Strategy: In 2017, Nasdaq completedwe set a review of its strategy for long-term growth. We examined key macroeconomic, regulatory and technology trends, consulted with our clients about short- and long-termtrends in their businesses and assessed the competitive landscape. We identified the following key trends that we believe will shape our future opportunities.

In 2022, we announced a new organizational structure which aligns our businesses more closely with the special marketplace platform businessesfoundational shifts that are coredriving the evolution of the global financial system. In order to Nasdaq,amplify our strategy, we aligned the Company more closely with evolving client needs. As a result, we have identified three new reporting segments, Market Platforms, Capital Access Platforms and Anti-Financial Crime, which align to reduce capital and resources in areas that are not as strategicour new divisional structure.

By aligning our business segments against these secular trends, we aim to deliver more for our clients and do not haveincrease growth across our key pillars of liquidity, transparency and integrity:

•Liquidity: Within our Market Platforms division, we continue to modernize markets by utilizing technology to maximize the liquidity of the global economy. New technologies, including cloud, blockchain, machine learning and artificial intelligence, present significant growthopportunities to further enhance market resiliency and scalability and make markets even more accessible. We believe that these technologies will enable more opportunities for market participants and new asset classes to be integrated across markets globally. We brought our markets and market-related technology businesses together, aligning complementary capabilities to capture the potential within Nasdaq.these technologies can unlock in our industry. By utilizing the division’s position at the center of markets, we believe that Market Platforms will be at the forefront of the financial system’s evolution and will play a critical role in advancing the modernization of markets across geographies and asset classes.

•Transparency: Our Capital Access Platforms division is uniquely placed to help clients navigate the increasing complexity of the evolving financial system through access to capital and transparency which enables economic growth. With over 10,000 corporate clients and 5,000 clients across the investment management ecosystem, Nasdaq is a trusted partner to aid the corporate and investment communities in making more informed decisions. Leveraging the insights and capabilities across our listings, advisory, data, index, and analytics teams, we believe that Capital Access Platforms will serve as a bridge between the investor and corporate communities, focused on enhancing the client experience by providing efficient routes to capital, delivering more holistic, actionable insights and intelligence, modernizing workflows, and navigating the climate and ESG landscape.

Products and Services

Our Market ServicesPlatforms segment delivers world leading platforms that improve the liquidity, transparency and integrity of the global economy by architecting and operating the world's best markets.

Our Market Platforms segment includes our Equity Derivative Trading Services and Clearing, Cash Equity Trading, FICC and Trade Management ServicesMarketplace Technology businesses.

Trading and ClearingServices

We provide trading services in North America and Europe. In the U.S., we operate six electronic options exchanges in the U.S.:exchanges: Nasdaq PHLX, The Nasdaq Options Market, Nasdaq BX Options, Nasdaq ISE, Nasdaq GEMX and Nasdaq MRX. These exchanges facilitate the trading of equity, options, ETF, options, index options and foreign currency options. Together, ourOur combined options market share in 2022 represented the largest share of the U.S. market for multiply-listed options on equities and ETFs.multi-listed equity options. Our

options trading platforms provide trading opportunities to both retail investors, algorithmic trading firms and market makers, who tend to prefer electronic trading, and institutional investors, who typically pursue more complexrequire high touch services to execute their trades, which are often performed on our trading strategies and often trade on the floor.floor in Philadelphia.

Trading Services also includes revenues from U.S. Tape plans. The plan administrators sell quotation and last sale information for all transactions, whether traded on The Nasdaq Stock Market or other exchanges, to market participants and to data distributors, whothen provide the information to subscribers. After deducting costs, the plan administrators distribute the tape revenues to the respective plan participants based on a formula required by Regulation NMS that takes into account both trading and quoting activity.

In addition,Canada, we operate an exchange with three independent markets for the trading of Canadian-listed securities.securities: Nasdaq Canada CXC, Nasdaq Canada CX2 and Nasdaq Canada CXD.

In 2022, we began migrating our North American markets to the AWS cloud-computing platform in a phased approach as part of a partnership to build the foundation of new capital markets. During the fourth quarter, we successfully completed the migration of Nasdaq MRX to the cloud. We believe the shift to cloud-based markets will provide our exchanges with more security, greater reliability, better scalability and the ability to quickly power up computing resources. This will, in turn, enable Nasdaq to provide its clients access to cloud-based capabilities, including virtual connectivity services, market analytics and machine learning, at a lower cost.

In Europe, we operate exchanges in Tallinn (Estonia), Riga (Latvia) and Vilnius (Lithuania) as Nasdaq operatesBaltic and exchanges in Stockholm (Sweden), Copenhagen (Denmark), Helsinki (Finland), and Reykjavik (Iceland). We also operate exchanges in Tallinn (Estonia), Riga (Latvia) and Vilnius (Lithuania). together with the clearing operations of Nasdaq Clearing, as Nasdaq Nordic.

Collectively, the Nasdaq Nordic and Nasdaq Baltic exchanges offer trading in cash equities, depository receipts, warrants, convertibles, rights, fund units and ETFs.ETFs, as well as trading and clearing of derivatives and clearing of resale and repurchase agreements. Our platform allows the exchanges to share the same trading system, which enables efficient cross-border trading and settlement, crosscross-exchange membership and a single source for Nordic data products. Settlement and registration of cash equity trading takes place in Sweden, Finland, Denmark and IcelandDenmark via the local central securities depositories. In addition, Nasdaq owns twoa central securities depositoriesdepository that provideprovides notary, settlement, central maintenance and other services in the Baltic countries and Iceland.

the trading and clearing of Nordic fixed income derivatives in a unique market structure. Buyers and sellers agree to trades in fixed income derivatives through bilateral negotiations and then report those trades to Nasdaq Clearing for CCP clearing.Clearing. Nasdaq Clearing acts asoffers central counterparty clearing services for fixed-income options and futures and interest rate swaps. Nasdaq Clearing also operates a clearing service for the counterparty to bothresale and repurchase agreement market.

2

In June 2021, we sold our U.S. Fixed Income business, which included an electronic platform for the buyer and seller.trading of U.S. Treasuries.

Nasdaq Commodities is the brand name for Nasdaq’s worldwide suite ofEuropean commodity-related products and services.services such as trading and clearing. Nasdaq Commodities’ offerings include oil,derivatives in power, natural gas and carbon emission markets, tankerseafood and dry cargo freight, seafood derivatives, iron ore, electricity certificates and clearing services.certificates. These products are listed on two of Nasdaq’s derivatives exchanges.Nasdaq Oslo ASA, except for seafood, which is listed on Fish Pool, a third-party platform.

Nasdaq Oslo ASA which is authorized by the Norwegian Ministry of Finance and supervised by the Norwegian Financial Supervisory Authority, is the commodity derivatives exchange for European products and freight.products. All trades with Nasdaq Oslo ASA are subject to clearing with Nasdaq Clearing, which is a CCP authorized under EMIR by the SFSA to conductoffers central counterparty clearing operations.services for commodities options and futures.

We also operate NFX, whichown a majority stake in Puro.earth, a Finnish-based leading platform for carbon removal. Puro.earth offers engineered carbon removal instruments that are verified and tradable through an open, online platform. Puro.earth’s marketplace capabilities add to our suite of ESG-focused technologies and workflow solutions and give our clients further resources to successfully achieve their ESG objectives.

In addition to our trading and clearing services business and our carbon market offering, in September 2022, we announced our planned launch of a new digital assets business to power the digital asset ecosystem. The launch underpins Nasdaq’s ambition to advance and help facilitate broader institutional participation in digital assets by providing trusted and institutional-grade solutions, focused on enhanced custody, liquidity and integrity. Nasdaq Digital Assets will initially develop an advanced custody solution. Nasdaq’s offering is a U.S. based designated contract market authorized by the CFTC. NFX currently lists cash-settled energy derivatives based on key energy benchmarks including oil, natural gas and U.S. power. All trades with NFX are subject to clearingregulatory approval in applicable jurisdictions. Additionally, we expanded our anti-financial crime technology with OCC.new coverage for the cryptocurrency ecosystem, including a comprehensive suite of crypto-specific fraud detection capabilities discussed below in “Anti-Financial Crime.”

Marketplace Technology comprises our trade management services and market technology businesses.

Our trade management services business provides market participants with a wide variety of alternatives for connecting to and accessing our markets for a fee. Shifting connectivity from proprietary networks to third-party networks has significantly reduced technology and network costs and increased our systems’ scalability while maintaining performance and reliability.

Our marketplaces may be accessed via a number of different protocols used for quoting, order entry, trade reporting DROP functionality and connectivity to various data feeds. We also offer thelaunched WorkX in 2021, an upgraded version of Nasdaq ACT Workstation, a browser-based,web-based, front-end interface that allows market participants to view data, utilize risk management tools, and enter orders, quotessubmit and review trade reports. WorkX enables a seamless workflow and enhanced trade intelligence. All Workstation users were migrated to WorkX in 2022. In addition, we offer a variety of add-on compliance tools to help firmsmarket participants comply with regulatory requirements.

We provide co-locationcolocation services to market participants, whereby we offer firms may lease cabinet space and power to house their own equipment and servers within our data centers. These participants are charged monthly fees for cabinet space, connectivity and support. Additionally, we offer a number of wireless connectivity routesofferings between select data centers using millimeter wave and microwave technology.

We also earn revenues from annual and monthly exchange membership and registration fees.

back-office systems, which allowallowed customers to entirely or partly outsource their company’s back-office functions.

Our market technology business is a leading global technology solutions provider and partner to exchanges, clearing organizations, central securities depositories, real-time updatingregulators, banks, brokers, buy-side firms and communicationcorporate businesses, and powers over 120 market infrastructure operators and new market clients in more than 55 countries. Our solutions can handle a wide array of assets, including but not limited to cash equities, equity derivatives, currencies, various interest-bearing securities, commodities, energy products and digital currencies. Our solutions can also be used in the creation of new asset classes by non-capital markets customers, including those in insurance liabilities securitization, cryptocurrencies and sports wagering, as discussed further below.

Nasdaq’s market technology is utilized by leading markets in the U.S., Europe and Asia as well as emerging markets in the Middle East, Latin America, and Africa.

During 2022, we continued to build out our SaaS business portfolio by extending and migrating our current offerings to SaaS, where we added 11 new SaaS customers. Our market technology business has evolved from its origins serving the capital markets, as we have leveraged NFF, our flexible and modular architecture technology that provides next generation capital markets capabilities in an open and agile environment, to develop our SaaS platform and offerings. We expect to continue to expand adoption of this SaaS model by our clients in the future.

For market infrastructure operators, which include exchanges, regulators, clearinghouses and central securities depositories, we provide and deliver mission-critical solutions across the trade lifecycle via the SocietyNFF, which is designed to cover all aspects of a market operator’s needs, from trading and clearing to risk management, market surveillance, index development, data, management, testing and quality assurance.

3

Recently, we have seen a growing demand for Worldwide Interbank Financial Telecommunication (SWIFT) to deposit banks.

Numerous market technology projects involve complex delivery management and systems integration. Through our integration services, we can assume responsibility for projects that involve migration to a new system and websites. Our solutions, including our Nasdaq IR Insight platform, allow investor relations officers to manage their investor relations programs using a varietythe establishment of toolsentirely new marketplaces. We also offer operation and support for the applications, systems platforms, networks and other components included in an information to understand their investor base, manage meetings and read research, consensus estimates and news while meeting corporate governance and disclosure requirements.

Capital Access Platforms

Our Capital Access Platforms segment delivers liquidity, transparency and integrity to the corporate issuer and investment community by empowering our clients to effectively navigate the capital markets, achieve their sustainability goals, and drive governance excellence. As we operate in the center of their communications programs.

Our European listing customers include companies, funds and governments. Customers issue securities in the form of cash

Data Products& Listing Services

Our Data Products business sellsU.S. and distributes historical and real-time quote and trade information to the sell-side, the buy-side, retail online brokers, proprietary trading shops, other venues, internet portals and data distributors. OurEuropean data products enhance transparency of market activity within our exchanges and provide critical information to professional and non-professional investors globally. Our Data business sells and distributes historical and real-time market data to sell-side customers, the institutional investing community, retail online brokers, proprietary trading firms, and other venues, as well as internet portals and data distributors.

We collect, process, and create information and earn revenues as a distributor of our own, as well as select third-party, content. We provide varying levels of quote and trade information to our customersmarket participants and to data distributors who in turn provide subscriptions for this information. Our systems enable distributors to gain access to our market depth, index values, mutual fund valuation, order imbalances, market sentiment and other analytical data.

We distribute this proprietary market information to both market participants and non-participants through a number of proprietary products, including Nasdaq TotalView, our flagship market depth quote product. TotalView shows subscribers quotes, orders and total anonymous interest at every displayed price level in The Nasdaq Stock Market for Nasdaq-listed securities and critical data for the opening, closing, halt and IPO crosses. We also offer TotalView products for our Nasdaq BX, Nasdaq PSX Nasdaqand Nordic markets. We also offer Nordic Equity TotalView, Nordic Derivatives TotalView and Nordic Fixed Income and otherTotalView for Nordic markets.

We operate several other proprietary services and data products to provide market information, including Nasdaq Basic, a low cost alternative to the industry Level 1 feed Ultrafeed,and Nasdaq Canada Basic, a normalizedlow cost alternative to other high speed, and consolidatedpriced data feed offering.feeds. We also provide a plethora ofvarious other data, including data relating to our 6 U.S. equities and options exchanges and Nordic equities, derivatives, fixed income, futures and U.S. futures, Nordic commodities, U.S. Treasuries,commodities.

Additionally, our Nasdaq Cloud Data Service provides a flexible and efficient method of delivery for real-time exchange data and other financial information. Data is made available through a suite of application programming interfaces, or APIs, allowing for the integration of data from disparate sources and a reduction in time to market for customer-designed applications. The API is highly scalable and can support the delivery of real-time exchange data.

We operate a variety of listing platforms around the world to provide multiple global indexescapital raising solutions for public companies. Companies listed on our markets represent a diverse array of industries including, among others, healthcare, consumer products, telecommunication services, information technology, financial services, industrials and global mutual funds.

energy. Our Data Products business also includes revenues from U.S. tape plans. The plan administrators sell quotation and last sale information for all transactions in Nasdaq-listed securities, whether traded onmain listing markets are The Nasdaq Stock Market or other exchanges, to market participants and to data distributors, who

Companies seeking to list securities on The Nasdaq Stock Market may do so on one of the three market tiers: The Nasdaq Global Select Market, The Nasdaq Global Market, or The Nasdaq Capital Market. To qualify, companies must meet minimum listing requirements, including specified financial and corporate governance criteria. Once listed, companies must maintain rigorous listing and corporate governance standards.

4

As of December 31, 2022, a total of 4,230 companies listed securities on The Nasdaq Stock Market, with 1,566 listings on The Nasdaq Global Select Market, 1,298 on The Nasdaq Global Market and 1,366 on The Nasdaq Capital Market.

We seek new listings from companies conducting IPOs, including SPACs, and direct listings as well as companies looking to switch from alternative exchanges. The 2022 new listings were comprised of the following:

| IPOs | 161 | ||||

| Switches from the New York Stock Exchange LLC, or NYSE, and the NYSE American LLC, or NYSE American | 14 | ||||

| Upgrades from OTC | 46 | ||||

| ETPs and Other Listings | 145 | ||||

| Total | 366 | ||||

| The Nasdaq Stock Market IPO win rates: | |||||

| 2022 total | 89 | % | |||

| Operating companies | 92 | % | |||

| SPACs | 86 | % | |||

During 2022, we had 14 new listings resulting from companies switching their listings from NYSE or NYSE American to join The Nasdaq Commodities, for the following classesStock Market. Together with companies that transferred additional securities to The Nasdaq Stock Market during 2022, an aggregate of assets: cash equities, bonds, derivatives and commodities. We provide varying levels of quote and trade information$36 billion in global equity market capitalization switched to market participants and to data distributors, who in turn provide subscriptions for this information. Significant European data products include Nordic Equity TotalView, Nordic Derivative TotalView, and Nordic Fixed Income TotalView, Level 2, Analytics and Fixings.The Nasdaq Stock Market.

We also provide index data products basedoffer listings on the exchanges that comprise Nasdaq indexes. Index data productsNordic and Nasdaq Baltic. For smaller companies and growth companies, we offer access to the financial markets through the Nasdaq First North alternative marketplaces. As of December 31, 2022, a total of 1,251 companies listed securities on our Nordic and Baltic exchanges.

Our European listing customers include companies, funds and governments. Customers issue securities in the form of cash equities, depository receipts, warrants, ETPs, convertibles, rights, options, bonds or fixed-income related products. In 2022, a total of 63 new companies listed on our Global Index Data Service, which delivers real-time index values throughout the trading day,Nordic and Global Index Watch/Global Index File Delivery Service, which delivers weightings and components data, corporate actions and a breadth of additional data.Baltic exchanges. In addition, 12 companies upgraded their listings from Nasdaq First North to Nasdaq Main Market.

Index Licensing and Services

Our Index Licensing and Services business is a leading index provider that develops and licenses Nasdaq brandedNasdaq-branded indexes associated derivatives and financial products. We also provide custom calculation services for third-party clients. License fees for our trademark licenses vary by product based on a percentage of underlying assets, dollar value of a product issuance, number of products or number of contracts traded. We also license cash-settled options, futures and options on futures on our indexes.

As of December 31, 2017, we had 3242022, 379 ETPs licensed to Nasdaq’slisted on 26 exchanges in over 20 countries tracked a Nasdaq index and accounted for $315 billion in AUM. This includes approximately $85 billion in ETP AUM, or 27% of the total AUM that tracked our smart beta indexes which had $167 billion of assets under management.during this same time period. Our flagship index, the Nasdaq-100 Index, includes the top 100 non-financial securitiescompanies listed on The Nasdaq Stock Market.Market, and is tracked by more than 100 ETPs worldwide, and had nearly $200 billion in assets tracking the index as of December 31, 2022.

We also operate theprovide index data products based on Nasdaq indexes. Index data products include our Global Index Family,Data Service, which includes more than 40,000 indexes. The family consists of

Workflow & Insights

Our Workflow & Insights business includes our analytics and corporate solutions businesses.

Our analytics business provides asset managers, investment consultants and institutional asset owners with information and analytics to make data-driven investment decisions, deploy their resources more productively, and provide liquidity solutions for private funds. Through our eVestment and Solovis solutions, we provide a suite of December 31, 2017, therecloud-based solutions that help institutional investors and consultants conduct pre-investment due diligence, and monitor their portfolios post-investment. The eVestment platform also enables asset managers to efficiently distribute information about their firms and funds to asset owners and consultants worldwide.

5

Through the Solovis platform, endowments, foundations, pensions and family offices transform how they collect and aggregate investment data, analyze portfolio performance, model and predict future outcomes, and share meaningful portfolio insights with key stakeholders. The Nasdaq Fund Network and Nasdaq Data Link are $70 billionadditional platforms in assets underour suite of investment data analytics offerings and data management in ETPs that tracktools. Nasdaq smart beta indexes.

Our corporate solutions business serves both public and private companies and organizations through our Investor Relations Intelligence, Governance Solutions and ESG Solutions products. Our public company clients can be companies listed on our exchanges or other U.S. and global exchanges. Our private company clients include a diverse group of securities,organizations ranging from family-owned companies, government organizations, law firms, privately held entities, and various non-profit organizations to hospitals and healthcare systems. We help organizations enhance their ability to understand and expand their global shareholder base, improve corporate governance, and navigate the evolving ESG landscape through our suite of advanced technology, analytics, and consulting services. We also advise clients on a range of governance and sustainability-related issues.

Our Investor Relations Intelligence offerings include a global team of expert consultants that deliver advisory services including Equity Surveillance & Shareholder Analysis, Investor Engagement and Perception Studies, as well as cloud-enabled tradingan industry-leading platform, Nasdaq IR Insight®, to investor relations professionals and clearing.executive teams. These solutions allow investor relations officers and executives to better manage their investor relations programs, understand their investor base, target new investors, manage meetings and consume key data such as investor profiles, equity research, consensus estimates and news.

Our ESG Solutions includes our ESG Advisory practice and our ESG software offering. Our ESG Advisory practice helps companies analyze, assess and action best practices to attract long-term capital. Our ESG Software offering includes OneReport, a SaaS solution, that helps organizations navigate corporate responsibility for projects involving migrationframeworks, manage information capture and response process, and deliver ESG data to a new system and the establishment of entirely new marketplaces. We also offer operation and support for the applications, systems platforms, networksratings agencies and other components included instakeholders. In June 2022, we acquired Metrio Software Inc., or Metrio, a turn-key information technologycloud-based solution as well as advisory services.that helps firms manage ESG data, perform greenhouse gas emissions calculations and accounting, and optimize granular data collection, report publication and dashboarding against targets. Both solutions support audit and assurance requirements.

Anti-Financial Crime

Our Risk & SurveillanceAnti-Financial Crime segment delivers leading platforms that improve the integrity and transparency of the financial world by providing SaaS solutions include: SMARTS, which isfor fraud detection, anti-money laundering, and trade and market surveillance.

The financial services industry has seen a managed servicegrowing demand for products and services focused on anti-financial crime. Our FRAML solution provides a cloud-based platform to help detect, investigate, and report money laundering and financial fraud to more than 2,300 financial institutions in North America.

Our surveillance solutions include a SaaS platform designed for banks, brokers and other market participants to assist them in complying with market rules, regulations and internal market surveillance policies;policies and TradeGuard, which isserves more than 170 clients. We also provide a suite of products that offersolution to regulators and exchanges with a real-time, multi-tiered risk solution that integrates pre-, at-robust platform to manage cross-market, cross-asset and on-trade risk management, including margining. multi-venue surveillance. This offering powers surveillance for more than 50 exchanges and 15 regulators.

In 2017,2022, we acquired Sybenetix, a leading surveillance provider that combines behavioral analyticsexpanded our anti-financial crime technology with new capabilities and cognitive computing with financial markets expertise. We expectcoverage for the addition of Sybenetix to our Risk & Surveillance suite of solutions to allowdigital assets ecosystem, allowing us to bring

Enablers, Differentiators and compliance software and services to help companies track, measure and manage key organizational risks.Competition

Technology

Technology plays a key role in ensuring the growth, reliability and regulation of financial markets. We have established a technology risk program to considerevaluate the resiliency of critical systems, including risks associated with cybersecurity. This program is focused on (i) identifying areas for improvement in systems, and (ii) implementing changes and upgrades to technology and processes to minimize future risk. We have continued our focus on improving the security of our technology with an emphasis on employee awareness through training, targeted phishing education campaigns, and new tool deployment for our securities operations team. See “Item 1A. Risk Factors,” in this Annual Report on Form 10-K for further discussion.

6

Nasdaq's shift to utilizing and deploying cloud infrastructure continued during 2022. In the fourth quarter of 2022, we migrated Nasdaq MRX to the cloud, which is the first exchange moved to an exclusively cloud-enabled infrastructure and the first exchange solely in the cloud of any regulated public market in the world. We believe that migrating our exchanges to the cloud, through our partnership with AWS, our preferred cloud provider, will result in improved performance and increased flexibility for our customers. We expect to move additional North American markets to the cloud with AWS during the next several years. The shift to cloud-based markets will enable Nasdaq Financial Framework isto provide its clients access to cloud-based capabilities, including virtual connectivity services, market analytics and machine learning, at a lower cost. We also expect to leverage the cloud-based infrastructure for our market technology clients, assisting such clients in developing their own platforms and customizing their offerings for their local, rapidly changing industry dynamics.

To facilitate the exchange migration to AWS, Nasdaq will also leverage its Fusion technology platform. Fusion positions Nasdaq’s approachNorth American and European markets to manage, operate and deploy a common platform that can be used across our nine Nasdaq derivative markets, while enabling our markets for cloud deployment.

We continue to utilize NFF for delivering end-to-end solutions forto market infrastructure operators, buy-side firms, sell-side firms and other non-financial markets.markets in addition to also supporting Nasdaq's own internal trading systems. The framework consists of a single operational core platform that ties together Nasdaq’s portfolio of functionality across the trade lifecycle, in an open framework whereby exchanges, clearinghouses, CSDscentral securities depositories, and other entities can easily integrate Nasdaq’s business applications with each other, as well as other third-party solutions. In addition to being able to integrate a broad range of business functions, the Nasdaq Financial FrameworkNFF enables end users to leverage recent technology developments, such as blockchain and machine learning.developments.

Competitive Strengths

We are a global, client-focused technology company with expertise in key global regions to support our markets,markets. We deploy robust technology services, disaster recovery capabilities and operations centers. In 2017,have developed a leading anti-financial crime and corporate and investor franchise. Our business segments complement each other and we believe that our strong competitive position in large, high-growth markets positions us for sustained growth.

A Unique Value Proposition

We operate leading platforms that can improve the liquidity, transparency, and integrity of the global economy, allowing us to:

•Develop efficient and reliable technologies to facilitate and protect the financial system across asset classes;

•Empower our clients to effectively navigate the capital markets, achieve their sustainability goals, and maintain corporate governance excellence; and

•Provide data, tools and insights that drive sound decision making.

Technological Strength

The strength and resiliency of our technology, enhanced by our Marketplace Technology business, in meeting the advancing demands of our global customer base is vital to the continued success of our business and distinguishes us from our competitors.

A Focus on Client Needs Across the Global Financial Ecosystem

We strive to migrate systemsserve a diverse range of clients that participate across the global financial ecosystem, including:

•Brokers and Traders - Helping brokers and traders to our facilityconfidently plan, optimize and execute their business vision.

•Market Participants - Providing market participants with access to liquidity and enabling them to efficiently consume, monitor, analyze, and capitalize on real-time market changes.

•Listed Companies - Enabling companies to access capital markets effectively and manage stakeholders.

•Investors and Asset Managers - Offering products and services to assist investors and asset managers in Chicago, as well as addedoptimizing their portfolios and consolidated locations asofferings.

•Market Infrastructure Operators - Assisting market infrastructure operators in increasing efficiency, meeting customer needs, and growing revenue.

•Banks and Financial Institutions - Providing safety and integrity through a resultsuite of acquisitionstrade surveillance and product enhancements.cloud-native anti-financial crime solutions.

Competition

Market ServicesPlatforms

We face intense competition in North America and Europe in businesses that comprisefor our MarketTrading Services segment.businesses. We seek to provide market participants with greater functionality, trading system stability speed of execution,and performance, high levels of customer service, and efficient pricing. In both North America

and Europe, our competitors include other exchange operators, operators of non-exchange (less-heavily regulated) trading systems and banks and brokerages that operate their own internal trading pools and platforms.

7

In the U.S., our options markets in the U.S. includecompete with exchanges operated by:by Cboe Global Markets, Inc., or CBOE;Cboe, Miami International Holdings, Inc., or Miami; andMIAX, Intercontinental Exchange, Inc., or ICE. Registered exchanges competing with ourICE, and BOX Options Market. In cash equities markets in the U.S. include, we compete with exchanges operated by CBOECboe, ICE, MIAX, The Investors Exchange, Members Exchange and ICE. In addition to competition from these exchanges in equities, weLong Term Stock Exchange. We also face competition from ATSs, and other less-heavily regulated broker-owned systems, some of which are also known as “dark pools,” and other less-heavily regulated broker-owned trade facilitation systems, as well as from other types of OTC trading. In Canada, our cash equities exchange competes with exchanges such as the Toronto Stock Exchange, or TSX, and other marketplaces.

In Europe, our cash equities markets in Europe includecompete with exchanges operated by: CBOE;such as Euronext N.V.;, Deutsche Börse A.G.; andAG, London Stock Exchange Group plc, or LSE. We also intensely compete withLSE, and many MTFs such as that operated byCboe, Turquoise Global Holdings Limited.and Aquis. Our competitors in the trading and clearing of options and futures on European equities include: theinclude Eurex, Group companies, or Eurex;Cboe, ICE Futures Europe;Europe and the MTF operated by Turquoise Global Holdings Limited.London Clearing House, or LCH. In addition, to competition from these exchanges and MTFs in equities markets in Europe, we face competition from other broker-owned systems, some of which are also known asdark pools, Systematic Internalizers, or SIs, and from other types of OTC trading. Competition among exchanges for trading European equity derivatives tends to occur where there is competition in the trading of the underlying equities. In addition to exchange-based competition, we face competition from OTC derivative markets.

The implementation of MiFID II and MiFIR over the next several years is expected to lead tohas resulted in further competitive pressure on our European trading business. MTFsSIs are already attracting a significant share of electronically matched volume. With the regulatory environment likely to become more favorable to alternative trading venues, we expect such venues tovolume and compete aggressively for the trading of equity securities listed on our Nordic exchanges. ElectronicDifferent bilateral trading systems pursuing block business will also remain active in Europe. We also expect trading on Systematic InternalizersRegulators are continuously monitoring the market structure and have, in a series of consultations, asked for input regarding suggested changes to increase markedly as volume migrates from other types of trading venues. In responding to current and potential competition, we constantly review our pricing and product offerings.MiFID II.

and services are subject to relentless competitive pressure from OTC dealers as well as exchanges. Our suite of commodity-related productsEuropean exchanges and services is in many cases designed to challenge the more established players.clearinghouses.

Our Trade Management ServicesMarketplace Technology business includes our trade management services and market technology businesses. Our trade management services business competes with other exchange operators, extranet providers, and data center providers.

Traditionally, exchanges and exchange-related businesses would internally develop technology, sometimes aided by consultants. However, this model has gradually changed as many operators have recognized the cost-savings made possible by buying technology from third parties. As a result, two types of competitors have emerged in our Corporate Solutions business, competition is varied and can be fragmented. For our Investor Relations services business, there are many regional competitors and relatively few global providers. Othermarket technology business: exchange operators and technology providers unaffiliated with exchanges. These organizations make available a range of off-the-shelf technology, including trading, clearing, settlement, depository and information dissemination, and offer customization and operation expertise. Market conditions in market technology are partneringevolving rapidly, which makes continuous investment and innovation a necessity. Our partnership with firmsAWS enables us to compete with other companies that have capabilitiesare developing cloud-based exchanges and market technology offerings.

Capital Access Platforms

Our Data business includes proprietary data products. Proprietary data products are made up exclusively of data derived from each exchange’s systems. Competition in this areathe data business is intense and seeking to acquire relevant assets in orderis influenced by rapidly changing technology and the creation of new product and service offerings.

The sale of our proprietary data products is under competitive threat globally from alternative exchanges and trading venues that offer similar products. Our data business competes with other exchanges and third-party vendors to provide investor relations servicesinformation to customers alongside listing services. The competitive landscape formarket participants. Examples of our Boardcompetitors in proprietary data products are ICE, Cboe, TSX, and Dow Jones & Leadership business varies by customer sector and geography. Most participants offer software-as-a-service solutions that are supported by a data center strategy. Some firms offer specialized services that focus on a single niche sector. The larger players often offer additional services. Customers frequently seek single-source providers that are able to address a broad range of needs within a single platform. The competitive landscape for our Public Relations Solutions business includes large providers of traditional wire services, full-service providers, which offer wire distribution along with audience targeting, monitoring and analytics services, and a large number of regional and niche providers. In our Digital Media Services business, competition is fragmented and includes firms that address enterprise buyers, offering them either managed or self-service capabilities.Company.

Our Listing Services business in both the U.S. and Europe provides a means of facilitating capital formation through public capital markets. There are competing ways of raising capital, and we seek to demonstrate the benefits of listing shares on anour exchange. Our primary competitor for larger company stock share listings in the U.S. is NYSE. The Nasdaq Stock Market also competes with NYSE American for listing of shares of smaller companies. Bats BZX Exchange, Inc. competes for ETP listings. The Nasdaq Stock Market competes with local and international markets located outside the U.S. for listings of equity securities of both U.S. and non-U.S. companies that choose to list (or dual-list) outside of their home country. For example, The Nasdaq Stock Market competes for listings with exchanges in Europe and Asia, such as LSE and The Stock Exchange of Hong Kong Limited. Additionally, we face competition from private equity firms that may elect to keep their portfolio companies as private companies.

8

The Listings Services business in Europe is characterized by a large number of exchanges competing for new or secondary listings. Each country has one or more national exchanges, which are often the first choice of companies in each respective country. For those considering an alternative, competing European exchanges that frequently attract many listings from outside their respective home countries include LSE, Euronext N.V. and Deutsche Börse A.G.AG. In addition to the larger exchanges, companies seeking capital or liquidity from public capital markets are able to raise capital without a regulated

market listing and can consider trading their shares on smaller markets and quoting facilities.

Our Index Licensingbusiness offers Nasdaq-branded indexes and Services businessfinancial products and faces competition from providers of various competing financial indexes. For example, there are a number of indexes that aim to track the technology sector and thereby compete with the Nasdaq-100 Index and the Nasdaq Composite Index. We face competition from investment banks, dedicated index providers, markets and other product developers.developers, including S&P Dow Jones Indices, MSCI and FTSE Russell.

Anti-Financial Crime

For our Anti-Financial Crime segment, which includes solutions for fraud detection, anti-money laundering or AML and trade and market surveillance, settlement, depositorycompetitors include core banking solution providers ranging from small to large independent solution providers, FinTech start-ups and information dissemination,in-house custom builds. We compete against enterprise solution providers and offer customizationpoint solutions for clients with larger AUM. Competitors also include companies that serve multiple industries in addition to financial services with generalized solutions, such as business intelligence tools, data integrators, investigation platforms and operation expertise.software covering the boarder compliance lifecycle. Recently, there has been an increase of FinTech start-ups shifting into the surveillance, fraud detection and AML space offering highly-specialized solutions for advanced data analytics, artificial intelligence and machine learning technology. The anti-financial crime and surveillance offerings compete on a number of factors, including but not limited to, increased workflow efficiency, quality of the data, quality of alerts and pricing.

Intellectual Property

We believe that our intellectual property assets are important for maintaining the competitive differentiation of our products, systems, software and services, enhancing our ability to access technology of third parties and maximizing our return on research and development investments.

To support our business objectives and benefit from our investments in research and development, we actively create and maintain a wide array of intellectual property assets, including patents and patent applications related to our innovations, products and services; trademarks related to our brands, products and services; copyrights in software and creative content; trade secrets; and through other intellectual property rights, licenses of various kinds and contractual provisions. We enter into confidentiality and invention assignment agreements with our employees and contractors, and utilize non-disclosure agreements with third parties with whom we conduct business in order to secure and protect our proprietary rights and to limit access to, and disclosure of, our proprietary information.

We own, or have licensed, rights to trade names, trademarks, domain names and service marks that we use in conjunction with our operations and services. We have registered many of our most important trademarks in the U.S. and in foreign countries. For example, our primary “Nasdaq” mark is a registered trademark that we actively seek to protect in the U.S. and in over 50 other countries worldwide.

9

Over time, we have accumulated a robust portfolio of issued patents in the U.S. and in many other jurisdictions across the world. We currently hold rights to patents relating to certain aspects of our products, systems, software and services, but we primarily rely on the innovative skills, technical competence and marketing abilities of our personnel. No single patent is in itself core to the operations of Nasdaq or any of its principal business areas.

Corporate Venture PracticeProgram

Environmental, Social and Governance Matters

Nasdaq is committed to further advancing our longer-term ESG strategy, advocacy and oversight. We continue to engage with internal and external stakeholders at all levels on ESG matters. During 2022, we deepened our corporate and community ESG efforts, including furthering our commitment to greater sustainability and climate change awareness.

The Nominating & ESG Committee has formal responsibility and oversight for ESG policies and programs and receives regular reporting on key ESG matters and initiatives. Our Corporate ESG Steering Committee serves as the central coordinating body for our ESG strategy; it is co-chaired by executive leaders and comprised of geographically diverse representatives from multiple business units.

We continued to be committed to carbon neutrality, and for the fifth consecutive year, achieved that goal across all business operations through the purchase of green power, carbon offsets, and renewable energy certificates. We were named to the Dow Jones Sustainability North America Index for the seventh consecutive year andreceived recognition from the Bloomberg Gender-Equity Index and The Human Rights Campaign’s Corporate Equality Index. In addition, Nasdaq’s ESG scores improved across multiple rating agencies during 2022, including four significant sustainability rating upgrades:

•MSCI: a two-tier rating increase to “AA,” from our “BBB” rating in the prior year, placing Nasdaq in MSCI’s “Leaders” category.

•CDP:a score improvement to an “A” from the prior year’s “B”, earning us a place on CDP’s “A List” for climate disclosures and actions.

•EcoVadis: status upgrade to “Gold Medal,” a recognition reserved for the top 5% of all rated companies, as compared to our “Silver Medal” status in the prior year.

•2022 S&P Corporate Sustainability Assessment (CSA): a score of 60, representing an 20% year-over-year score increase, placing Nasdaq in the 95th percentile of our industry group.

In 2022, Nasdaq also continued to be a signatory to the United Nations Global Compact and the United Nations Principles of Responsible Investment and became a signatory to the World Economic Forum Stakeholder Capitalism Metrics.

While our business operations account for a comparatively small environmental impact, we focus our environmental efforts on several key areas, including the way we use energy resources, manage our workspaces, engage our value chain and conduct business travel. Through these efforts, we seek to lessen the environmental impact of our organization by reducing atmospheric carbon emissions and managing water and waste associated with business operations. Nasdaq has approved near-term and long-term science-based emissions reduction targets with the Science Based Targets initiative, or SBTi. In 2022, the SBTi verified Nasdaq’s 2050 net-zero science-based target.

Nasdaq has obtained the LEED Platinum certification for our New York headquarters office in Times Square, which complements the LEED Gold certification for our 10th Floor Client Experience Center, our space for client events in our New York headquarters.We also achieved LEED Gold certifications for our new Greensboro, North Carolina office and existing office locations in Copenhagen, Reykjavik, San Francisco, Stockholm, Umeå, Vilnius and Washington, D.C. We continue to look for additional opportunities to transition to green offices across the globe as part of our strategy to reduce office operation-related emissions.

We help companies of all ESG maturity levels through our robust combination of technology, tools, data, insights and capital market solutions.During 2022, we maintained, and continued to expand, our portfolio of ESG services and solutions for our clients and stakeholders, including:

•the Nasdaq ESG Advisory Program, which pairs companies with ESG consulting expertise to help them analyze, assess and enact ESG program best practices with the goals of attracting long-term capital and enhancing value;

•the Nasdaq OneReport platform, which helps clients streamline the data gathering process under various frameworks for sustainability reporting and provides data to ratings agencies;

10

•the Metrio platform, which provides tools to address corporate issuers’ expanding ESG data collection, analytics, and reporting needs;

•the Nasdaq Sustainable Bond Network, which connects issuers and investors in sustainable, green and social bonds, and provides access to detailed information and impact data, allowing investors to make more informed decisions;

•the Nasdaq ESG Data Hub, which connects investors with expert led ESG data sets from leading providers across a wide spectrum of areas, including gender diversity, carbon emissions and climate risk, providing detailed and tangible intelligence on companies’ ESG profiles;

•the Nasdaq ESG Data Portal, which now includes ESG-related data from more than 630 Nordic companies;

•the Nasdaq ESG Footprint, a tool that helps both institutional and retail investors analyze the impact of their portfolios;

•the eVestment ESG Questionnaire, which provides a standard approach to ESG reporting thereby allowing for greater transparency into how ESG strategies work, providing deeper ESG data for allocator consumption, and enabling asset managers to better articulate their approach to ESG; and

•Puro.earth, a leading marketplace for carbon removal, which we believe will address the growing demand for carbon removal by corporations, as well as enable new carbon removal methodologies as technologies evolve.

In 2022, we requested our existing leading suppliers by spend to attest to our updated Supplier Code of Ethics. The Supplier Code of Ethics, which is available on our website, encourages our suppliers and vendors to adopt sustainability and environmental practices in line with our published Environmental Practices Statement, to promote a diverse and inclusive workforce and to engage diverse-owned business in their supply chain. Additionally, our new suppliers are required to attest to the Supplier Code of Ethics in connection with the commencement of their engagement.

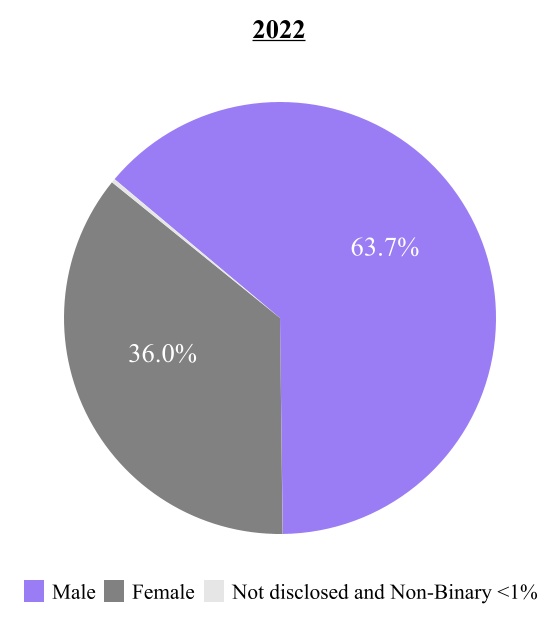

Effective August 8, 2022, Nasdaq’s new listing rule requires companies listed on our U.S. exchange to publicly disclose consistent, transparent diversity statistics regarding their board of directors using a standardized template. Companies are also required to choose whether to meet recommended board diversity objectives or disclose their reasons for not doing so under new listing rules effective in 2023, 2025 and 2026 (depending on the company’s listing tier and board size). The diversity rules are currently being challenged by two advocacy groups in the U.S. Court of Appeals for the Fifth Circuit.

For more information regarding our ESG efforts in 2022, both internally and externally, please see the section entitled “Human Capital Management” below and our Proxy Statement.

Regulation

We are subject to extensive regulation in the U.S., Canada and Europe.

U.S. Regulation

U.S. federal securities laws establish a system of cooperative regulation of securities markets, market participants and listed companies. SROs conduct the day-to-day administration and regulation of the nation’s securities markets under the close supervision of, and subject to extensive regulation, oversight and enforcement by, the SEC. SROs, such as national securities exchanges, are registered with the SEC.

This regulatory framework applies to our U.S. business in the following ways:

National Securities Exchanges. SROs in the securities industry are an essential component of the regulatory scheme of the Exchange Act responsible for providing fair and orderly markets and protecting investors. The Exchange Act and the rules thereunder, as well as each SRO’s own rules, impose on the SROs many regulatory and operational responsibilities on SROs, including the day-to-day responsibilities for market and broker-dealer oversight. Before it may permit the registration of a national securities exchange as an SRO, the SEC must determine, among other things, that the exchange has a set of rules that is consistent with the requirements of the Exchange Act. Moreover, an SRO is responsible for enforcing compliance by its members, and persons associated with its members, with the provisions of the Exchange Act, the rules and regulations thereunder, and the rules of the SRO, including rules and regulations governing the business conduct of its members.

Nasdaq currently operates three cash equity, and six options markets and one corporate bond market in the U.S. We operate The Nasdaq Stock Market, and The Nasdaq Options Market and the Corporate Bond Market pursuant to The Nasdaq Stock Market’s SRO license; Nasdaq BX and Nasdaq BX Options pursuant to Nasdaq BX’s SRO license; Nasdaq PSX and Nasdaq PHLX pursuant to Nasdaq PHLX’s SRO license; and Nasdaq ISE, Nasdaq GEMX and Nasdaq MRX, each of which operates an options market under theirits own SRO license. As SROs, each entity has separate rules pertaining

to its broker-dealer members and listed companies.companies, as applicable. Broker-dealers that choose to become members of our exchanges are subject to the rules of those exchanges.

All of our U.S. national securities exchanges are subject to SEC oversight, as prescribed by the Exchange Act, including periodic and special examinations by the SEC. Our exchanges also are potentially subject to regulatory or legal action by the SEC or other interested parties at any time in connection with alleged regulatory violations. We also are subject to Section 17 of the Exchange Act, which imposes record-keeping requirements, including the requirement to make records available to the SEC for examination. We have been subject to a number of routine reviews and inspections by the SEC or external auditors in the ordinary course, and we have been and may in the future be subject to SEC enforcement proceedings. To the extent such actions or reviews and inspections result in regulatory or other changes, we may be required to modify the manner in which we conduct our business, which may adversely affect our business.business, operating results and financial condition.

11

Section 19 of the Exchange Act provides that our exchanges must submit to the SEC proposed changes to any of the SROs’ rules, practices and procedures, including revisions to provisions of our certificate of incorporation and by-laws that constitute SRO rules. The SEC will typically publish such proposed changes for public comment, followingafter which the SEC may approve or disapprove the proposal, as it deems appropriate. SEC approval requires a finding by the SEC that the proposal is consistent with the requirements of the Exchange Act and the rules and regulations thereunder. Pursuant to the requirements of the Exchange Act, our exchanges must file with the SEC, among other things, all proposals to change their pricing structure.

Nasdaq conducts real-time market monitoring, certain equity surveillance not involving cross-market activity, most options surveillance, rulemaking, enforcement and membership functions through our Nasdaq Regulation department. We review suspicious trading behavior discovered by our regulatory staff, and depending on the nature of the activity, may refer the activity to FINRA for further investigation. Pursuant to regulatory services agreements between FINRA and our SROs, FINRA provides certain regulatory services to our markets, including thesome regulation of trading activity and surveillance and investigative functions. Nevertheless, we have a direct regulatory role in conductingIn 2019, Nasdaq received SEC approval to reclaim from FINRA the responsibility and opportunity to bring enforcement actions against member firms for violating certain real-time market monitoring, certain equity surveillance not involving cross-market activity, most options surveillance, most rulemaking and some membership functions through our MarketWatch department. We refer suspicious trading behavior discovered by our regulatory staff to FINRA for further investigation.Nasdaq exchange rules governing conduct on the Nasdaq exchanges. Our SROs retain ultimate regulatory responsibility for all regulatory activities performed under regulatory agreements by FINRA, and for fulfilling all regulatory obligations for which FINRA does not have responsibility under the regulatory services agreements.

In addition to its other SRO responsibilities, The Nasdaq Stock Market, as a listing market, also is responsible for overseeing each listed company’s compliance with The Nasdaq Stock Market’s financial and corporate governance standards. Our listing qualifications department evaluates applications submitted by issuers interested in listingseeking to list their securities on The Nasdaq Stock Market to determine whether the quantitative and qualitative listing standards have been satisfied. Once securities are listed, the listing qualifications department monitors each

issuer’s on-going compliance with The Nasdaq Stock Market’s continued listing standards.

Broker-dealer regulation. Nasdaq’s broker-dealer subsidiaries are subject to regulation by the SEC, the SROs and the various state securities regulators. Nasdaq operates three broker-dealers: Nasdaq Execution Services, LLC, or NFSTX, LLC, and Nasdaq Capital Markets Advisory LLC. Each broker-dealer is registered with the SEC, a member of FINRA and registered in the U.S. states and territories required by the operation of its business.In addition, we own a minority interest in NPM Securities.

Nasdaq Execution Services currently operates as our routing broker for sending orders from Nasdaq’sNasdaq's U.S. cash equity and options exchanges to other venues for execution. Execution Access LLC, or Execution Access, operates as the broker-dealer for our fixed income business, including Nasdaq Fixed Income’sNFSTX is a registered ATS for U.S. Treasury securities. NPM Securities, LLC operatesand acts as an ATS involving primary andintermediary to facilitate secondary transactions in unregistered securities (i.e., securities not listed on acertain funds (both registered securities exchange andor not registered under Section 12the Investment Company Act of the Exchange Act)1940), including acting as the buyer’sbusiness development companies, certain closed-end funds and seller’s agent to facilitate private placement and mutual funds’ (including closed-end and interval funds’) transactions on the ATS. SMTX, LLC, or SMTX, also operates as a broker-dealer for NPM and acts as intermediary in connection with private non-capital raising transactions. Finally, Nasdaq Capital Markets Advisory LLC, orreal estate investment funds. Nasdaq Capital Markets Advisory acts as a third-party advisor to privately-held or publicly-traded companies during IPOs and various other offerings.

The SEC, FINRA and the exchangesSROs adopt, rules and examine broker-dealers and require strict compliance with, their rules and regulations.regulations applicable to broker-dealers. The SEC, SROs and state securities commissions may conduct administrative proceedings which can result in censures, fines, the issuance of cease-and-desist orders or the suspension or expulsion of a broker-dealer, its officers or employees. The SEC and state regulators may also institute proceedings against broker-dealers seeking an injunction or other sanction. The SEC and SRO rules cover many aspects of a broker-dealer’s business, including capital structure and withdrawals, sales methods, trade practices among broker-dealers, use and safekeeping of customers’ funds and securities, record-keeping, the financing of customers’ purchases, broker-dealer and employee registration and the conduct of directors, officers and employees. All broker-dealers have an SRO that is assigned by the SEC as the broker-dealer’s DEA.Designated Examining Authority. The DEADesignated Examining Authority is responsible for examining a broker-dealer for compliance with the SEC’s financial responsibility rules. FINRA is the current DEADesignated Examining Authority for Nasdaq Execution Services, Execution Access, NPM Securities, SMTX and Nasdaq Capital Markets Advisory.each of our broker-dealer subsidiaries.

As of December 31, 2017, Nasdaq Execution Services, Execution Access, NPM Securities, SMTX and Nasdaq Capital

Regulatory contractual relationships with FINRA.Our SROs have signed a series of regulatory service agreements covering the services FINRA provides to the respective SROs. Under these agreements, FINRA personnel act as our agents in performing the regulatory functions outlined above, and FINRA bills us a fee for these services. These agreements have enabled us to reduce our headcount while ensuring that the markets for which we are responsible are properly regulated. However, we have reduced the scope of services provided by FINRA under these regulatory services agreements and are performing certain of those regulatory functions directly. In addition, our SROs retain ultimate regulatory responsibility for all regulatory activities performed under these agreements by FINRA.

Exchange Act Rule 17d-2 permits SROs to enter into agreements, commonly called Rule 17d-2 agreements, approved by the SEC with respect to enforcement of common rules relating to common members. Our SROs have entered into several such agreements under which FINRA assumes regulatory responsibility for specifics covered by the agreement, including:

•agreements with FINRA covering the enforcement of common rules, the majority of which relate to the regulation of common members of our SROs and their members;FINRA;

12

•joint industry agreements with FINRA covering responsibility for enforcement of insider trading rules;

•joint industry agreement with FINRA covering enforcement of rules related to cash equity sales practices and certain other non-market related rules; and

•joint industry agreement covering enforcement of rules related to options sales practices.

Regulation NMS and Options Intermarket Linkage Plan. We are subject to Regulation NMS for our cash equity markets, and our options markets have joined the Options Intermarket Linkage Plan. These are designed to facilitate the routing of orders among exchanges to create a national market system as mandated by the Exchange Act. One of the principal purposes of a national market system is to assure that brokers may execute investors’ orders at the best market price. Both Regulation NMS and the Options Intermarket Linkage Plan require that exchanges avoid trade-throughs, locking or crossing of markets and provide market participants with electronic access to the best prices among the markets for the applicable cash equity or options order.

In addition, Regulation NMS requires that every national securities exchange on which an NMS stock is traded and every national securities association act jointly pursuant to one or more national market system plans to disseminate consolidated information, including a national best bid and national best offer, on quotations for transactions in NMS stocks, and that such plan or plans provide for the dissemination of all consolidated information for an individual NMS stock through a single plan processor.

The UTP Plan was filed with and approved by the SEC as a national market system plan in accordance with the Exchange Act and Regulation NMS to provide for the collection,

consolidation and dissemination of such information for Nasdaq-listed securities. The Nasdaq Stock Market serves as the processor for the UTP Plan pursuant to a contract that was extended for a five-yeartwo-year term beginning inthrough October 2015.2023. The Nasdaq Stock Market also serves as the administrator for the UTP Plan. As the processor, The Nasdaq Stock Market performs and discharges regulatory functions and responsibilities that are necessary for the members of the UTP Plan to discharge the regulatory functions related to the operation of a national market system that have been delegated to them under the Exchange Act and Regulation NMS. To fulfill its obligations as the processor, The Nasdaq Stock Market has designed, implemented, maintained, and operated a data processing and communications system, hardware, and software and communications infrastructure to provide processing for the UTP Plan. As the administrator, The Nasdaq Stock Market manages the distribution of market data, the collection of the resulting market data revenue, and the dissemination of that revenue to plan members.members in accordance with the terms of the UTP Plan and of Regulation NMS.

In May 2020, the SEC adopted an order to require changes to the governance of securities information processors. In June 2020, we and several other exchanges petitioned the U.S. Court of Appeals for the District of Columbia Circuit, or the Court of Appeals, to review the SEC’s governance order. In July 2022, the Court of Appeals vacated portions of the governance order that would have provided voting rights to persons other than SROs. At this time, the SEC has not directed implementation of the remaining portions of the governance order, but may do so in the future.

In December 2020, the SEC adopted a rule to modify the infrastructure for the collection, consolidation and dissemination of market data for exchange-listed national market stocks, or NMS data. The rule changes include, among other things, requiring exchanges to add more “core data” to the securities information processors, including partial depth-of-book, certain odd-lot quotations/transactions, auction, regulatory, and administrative data; eliminating central, official consolidators of tape plans and enabling multiple competing consolidators to register to aggregate and disseminate core data; and authorizing persons to purchase and aggregate core data directly from the exchanges for their own use. In May 2022, the Court of Appeals rejected a challenge to the rule brought by Nasdaq and several other exchanges. In September 2022, the SEC disapproved fees proposed by Nasdaq and other exchanges to implement the rule but did not direct exchanges to take further action to implement the rule. Accordingly, a schedule for implementing the rule has not been imposed by the SEC, and we are not certain of the timing, or the impact, of these new rules on our business or role as a securities information processor.

Regulation SCI. Regulation SCI is a set of rules designed to strengthen the technology infrastructure of the U.S. securities markets. Regulation SCI applies to national securities exchanges, operators of certain ATSs, market data information providers and clearing agencies, subjecting these entities to extensive new compliance obligations, with the goals of reducing the occurrence of technical issues that disrupt the securities markets and improving recovery time when disruptions occur.We implemented an inter-disciplinary program to ensure compliance with Regulation SCI. NewWe have also created Regulation SCI policies and procedures, were created,updated internal policies and procedures, were updated, and developed an information technology governance program was rolled out to ensure compliance.

Regulation of Registered Investment Advisor Subsidiary. Our subsidiary DWANDW is an investment advisor registered with the SEC under the Investment Advisors Act of 1940. In this capacity, DWANDW is subject to oversight and inspections by the SEC. Among other things, registered investment advisors like DWANDW must comply with certain disclosure obligations, advertising and fee restrictions and requirements relating to client suitability and custody of funds and securities. Registered investment advisors are also subject to anti-fraud provisions under both federal and state law.

13

CFTC Regulation. We also operate NFX, a designated contract market under the Commodity Exchange Act that is subject to regulatory oversight by the CFTC, an independent agency with the mandate to regulate commodity futures and options markets in the U.S. The National Futures Association provides regulatory services to NFX pursuant to a regulatory services agreement.

The Dodd-Frank Wall Street Reform and Consumer Protection Act also has resulted in increased CFTC regulation of our use of certain regulated derivatives products, as well as the operations of some of our subsidiaries outside the U.S. and their customers.

Canadian Regulation

Regulation of Nasdaq Canada and its three markets is performed by the Canadian Securities Administrators, an umbrella organization of Canada’s provincial and territorial securities regulators. OperatingAs a recognized exchange in Ontario, Nasdaq Canada must comply with the terms and conditions of its exchange recognition order. While exempt from exchange recognition in each jurisdiction in Canada other than Ontario where Nasdaq Canada carries on business, Nasdaq must also comply with the terms and conditions of an exemption order granted by the other jurisdictions in order to maintain its exemptive status. Oversight of the exchange is performed by Nasdaq Canada’s lead regulator, is the Ontario Securities Commission. As an approved ATS,

Nasdaq Canada is subject to the Marketplace Rules (National Instrument 21-101 and National Instrument 23-101),several national marketplace related instruments which includeset out requirements for marketplace operations, trading rules and managing electronic trading risk. Exchange terms and conditions include but are not limited to, requirements for governance, regulation, rules and rulemaking, fair access, transparency of operations, systemsconflict management and confidentiality of trading information. As an ATS, Nasdaq Canada is also a member of the Investment Industry Regulatory Organization of Canada and must comply with its dealer member rules. In December 2017, Nasdaq Canada received approval from the Ontario Securities Commission to become recognized as an exchange under the Securities Act of Ontario effective on March 1, 2018.financial viability.

European Regulation

Regulation of our markets in the European Union and the European Economic Area focuses on issuesmatters relating to financial services, listing and trading of securities, clearing and settlement of securities and commodities, as well as issues related to market abuse. In mid-2012, EMIR, a regulation relating to CCP services and OTC derivatives transactions, was adopted. As a consequence of EMIR, Nasdaq Clearing, like other European CCPs, applied to reauthorize its CCP operations. Nasdaq Clearing was the first European CCP to be authorized as EMIR-compliant when the SFSA approved its application as a CCP under EMIR in 2014.