Portions of the registrant’s Proxy Statement relating to the 2017 Annual Meeting of Stockholders to be held on June 15, 2017, are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2016.

TIGER X MEDICAL, INC.FORM 10-K ANNUAL REPORTFOR THE YEAR ENDED DECEMBER 31, 2013

TABLE OF CONTENTS

| Page | ||

| ||

PART I | ||

Item 1. | 1 | |

Item 1A. |

| |

Item 1B. |

| |

Item 2. |

| |

Item 3. |

| |

Item 4. |

| |

PART II | ||

Item 5. |

| |

Item 6. |

| |

Item 7. |

|

|

Item 7A. |

| |

Item 8. |

| |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

Item 9A. |

| |

Item 9B. |

| |

PART III | ||

Item 10. |

| |

Item 11. |

| |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence |

|

Item 14. |

| |

PART IV | ||

Item 15. |

| |

| ||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any and all statements contained in this Annual Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Annual Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development of our cell therapy systems, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the SEC and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation:

● | our ability to obtain regulatory approval for our cell therapy systems; |

● | market acceptance of our cell therapy systems; |

● | the benefits of our cell therapy systems versus other products; |

● | our ability to successfully sell and market our cell therapy systems; |

● | competition from existing technologies or products or new technologies and products that may emerge; |

● | the implementation of our business model and strategic plans for our business and our cell therapy systems; |

● | the scope of protection we are able to establish and maintain for intellectual property rights covering our cell therapy systems; |

● | estimates of our future revenue, expenses, capital requirements and our need for additional financing; |

● | our financial performance; |

● | developments relating to our competitors and the healthcare industry; and |

● | other risks and uncertainties, including those listed under the section titled “Risk Factors.” |

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report to conform these statements to actual results or to changes in our expectations.

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K and have filed with the SEC as exhibits to this Annual Report on Form 10-K with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect. We qualify all forward-looking statements by these cautionary statements.

PART I

ITEM 1. Business

OverviewBUSINESS

Our History

We were incorporated as NAM Corporation in Delaware on January 12, 1994 and subsequently changed our name to clickNsettle.com, Inc., then Cardo Medical, Inc., then Tiger X Medical, Inc. ("Tiger X" or, and finally BioCardia, Inc. on October 26, 2016 in connection with the "Company")merger of our wholly-owned subsidiary, Icicle Acquisition Corp., formerly known as Cardo Medical,with and into BioCardia Lifesciences, Inc., (which was named BioCardia, Inc. prior to the merger). We previously operated as an orthopedic medical device company specializing in designing, developing and marketing high performance reconstructive joint devices and spinal surgical devices. Prior to the merger with BioCardia Lifesciences, Inc., our board of directors determined to discontinue operations in this area and seek a new business opportunity. As discussed below, in January 2011 we entered into an asset purchase agreement to sell substantially all of our assets in the Reconstructive Division to Arthrex, Inc ("Arthrex"). We completed the salea result of the Reconstructive Division assets duringmerger, we acquired the second quarterbusiness of 2011. Additionally,BioCardia Lifesciences, Inc. as described below.

On October 24, 2016, pursuant to an Agreement and Plan of Merger dated August 22, 2016, or the Merger Agreement, by and among the Company, Icicle Acquisition Corp., a Delaware corporation, and BioCardia Lifesciences, Inc., a merger was consummated pursuant to which BioCardia Lifesciences, Inc. became our wholly owned subsidiary such merger referred to herein as the Merger. As of immediately following the Merger, we completedhad aggregate cash of $24.0 million with which to pursue the saleoperations and business opportunity of substantially allBioCardia Lifesciences, Inc.

Pursuant to the Merger Agreement, each share of BioCardia Lifesciences, Inc. capital stock issued and outstanding immediately preceding the Merger, including shares of BioCardia Lifesciences, Inc. common stock underlying outstanding preferred stock and convertible notes, were converted into the right to receive 19.3678009 shares, or the Exchange Ratio, of the assets in the Spine Division in April 2011. Our current operations consist of the collection and management of our royalty income earned in connection with the Asset Purchase Agreement with Arthrex and seeking a joint venture partner or buyer for the remaining intellectual property owned by the Company. The Company is also evaluating future investment opportunities and uses for its cash.

On June 10, 2011, the Company filed an amendment to its Certificate of Incorporation with the Secretary of State of Delaware for the purpose of changing its name to Tiger X Medical, Inc. The amendment was effective as of June 10, 2011.

We are headquartered in Los Angeles, California. OurCompany’s common stock, is quoted on the National Association of Securities Dealers, Inc.'s, Over-the-Counter Bulletin Board, or the OTC Bulletin Board with a trading symbol of CDOM.OB.

Nature of Business

After the sale of substantially all of our Reconstructive Division assets and our Spine Division assets, our ongoing operations consist of the collection and management of our royalty income earnedpar value $0.001 per share. Additionally, pursuant to the termsMerger Agreement, upon consummation of the Asset Purchase Agreement with Arthrex, as well as continuing to promote our former products sold to Arthrex and seek a joint venture partner or buyer forMerger, the remaining intellectual property that we own. We are evaluating future investment opportunities and uses for our cash. We may in the future elect to acquire another entity or invest the net proceeds from the sale of the Reconstructive Division assets and/or our Spine Division assets in such manner as is determined by our Board of Directors and management.

Patents

We have five issued patents related to intervertebral stabilizers that were not sold as part of the sale of substantiallyCompany assumed all of BioCardia Lifesciences, Inc. options outstanding immediately prior to the Reconstructive Division assets andMerger at the Spine Division assets.same Exchange Ratio.

Product Liability and Insurance

We are subjectAll references to potential product liability risks stemming from our design, marketing and sale of orthopedic implants and surgical instrumentation that were part of the Reconstructive Division assets and Spine Division assets sold by us during 2011. We currently maintain product liability tail insurance inshare amounts that we believe are typical for companies of comparable size.

Employees

As of December 31, 2013, other than Andrew Brooks who serves as our Chief Executive Officer and Acting Chief Financial Officer, and who receives no salary for such positions, we have no full time employees.

1

Our business, financial condition, results of operations, cash flows and prospects, and the prevailing market price and performance of our common stock, may be adversely affected by a number of factors, including the matters discussed below. Certain statements and information set forth in this Annual Report on Form 10-K have been retroactively adjusted to reflect the impact of the Exchange Ratio.

In connection with the Merger, BioCardia Lifesciences, Inc. was determined to be the accounting acquirer, and consequently, the assets and liabilities and the historical operations reflected in the financial statements prior to the Merger are those of BioCardia Lifesciences, Inc. and are recorded at their historical cost basis. The financial statements after completion of the Merger include the assets and liabilities of the Company and its subsidiary from the effective time of the Merger. Please refer to Note 3 in the consolidated financial statements for the accounting treatment for the Merger.

Our principal executive offices are located at 125 Shoreway Road, Suite B, San Carlos, CA 94070. Our telephone number is (650) 226-0120. Our website address iswww.biocardia.com. Information contained in our website is not incorporated by reference into this Annual Report, and should not be considered to be a part of this Annual Report.

Company Overview

We are a clinical-stage regenerative medicine company developing novel therapeutics for cardiovascular diseases with large unmet medical needs. Our lead therapeutic candidate is the CardiAMP Cell Therapy System, or CardiAMP. CardiAMP provides an autologous cell therapy for the treatment of heart failure that develops after a heart attack. We are actively enrolling and treating patients at three clinical sites in our U.S. Food and Drug Administration, or FDA, approved Phase III pivotal Investigational Device Exemption, or IDE, trial for CardiAMP in ischemic systolic heart failure. The Department of Health & Human Services Centers for Medicare & Medicaid Services, or CMS, has also approved the CardiAMP IDE for purposes of Medicare coverage. We anticipate enrolling up to 260 patients at up to 40 clinical sites by the end of 2018 and obtaining top-line data with one year patient follow-up in 2019. If our Phase III pivotal trial is successful, we believe we will be the first company to reach the market with a cell-based therapy to treat heart failure. In parallel, in 2017 we expect to submit a second IDE to FDA for the CardiAMP cell therapy in a second related cardiac indication of post myocardial infarction.

Our second therapeutic candidate is the CardiALLO Cell Therapy System, or CardiALLO, an allogenic culture expanded cell therapy derived from bone marrow cells. We anticipate preparation of an Investigational New Drug, or IND, application for submission to the FDA for a Phase II trial for CardiALLO for the treatment of heart failure that develops after a heart attack. This IND is expected to have improved Chemistry Manufacturing Controls in the IND relative to our previous co-sponsored investigations.

We are committed to applying our expertise in the fields of autologous and allogeneic cell-based therapies to improve the lives of patients with cardiovascular conditions. Autologous cell therapies use autologous cells, which means the patient’s own cells, while allogeneic cell therapies use allogeneic cells, which means cells from a third party donor.

Market Overview

Heart failure is a clinical condition in which the output of blood from the heart is insufficient to meet the metabolic demands of the body. In 2015, the American Heart Association, or AHA, report on heart disease statistics estimated that there are 5.7 million Americans over the age of 20 that have heart failure. Heart failure is increasingly prevalent due to the aging population and the increase in major cardiovascular risk factors, including obesity and diabetes. The AHA also estimates that one in five adults will develop heart failure after the age of 40. During heart failure progression, the heart steadily loses its ability to respond to increased metabolic demand, and mild exercise soon exceeds the heart’s ability to maintain adequate output. Towards the end stage of the disease, the heart cannot pump enough blood to meet the body’s needs at rest. At this stage, fluids accumulate in the extremities or in the lungs making the patient bedridden and unable to perform the activities of daily living. The long-term prognosis associated with heart failure is approximately 50% mortality at five years following the initial diagnosis.

Hospitalizations for heart failure are expensive, and the risk of death increases with each recurrent heart failure-related hospitalization. In 2014, the Journal of the American College of Cardiology reported that the one- and six-month readmission rates after heart failure-related hospitalization are close to 25% and 50%, respectively. In 2010, the AHA estimated that the direct and indirect cost of heart failure in the United States was $39 billion, half of which was related to repeated hospitalizations, and by 2030 the total cost of heart failure in the United States is projected to increase to $70 billion. There is growing pressure on hospitals to reduce readmissions for heart failure.

Heart failure is classified in relation to the severity of the symptoms experienced by the patient. The most commonly used classification system, established by the New York Heart Association, or NYHA, is as follows:

• | Class I (mild): patients experience no or very mild symptoms with ordinary physical activity; |

• | Class II (mild): patients experience fatigue and shortness of breath during moderate physical activity; |

• | Class III (moderate): patients experience shortness of breath during even light physical activity; and |

• | Class IV (severe): patients are exhausted even at rest. |

Despite guideline-directed therapies employing a wide range of pharmacologic, device, and surgical options, many patients deteriorate over time and develop advanced heart failure symptoms that cannot be effectively managed by existing medical therapies. At the end stage of heart failure, current treatment options include heart transplant surgery or implantation of a left ventricular assist device, or LVAD, a battery operated mechanical circulatory device used to partially or completely replace the function of the left ventricle of the heart. LVADs are used for patients awaiting a heart transplant or as a destination therapy for patients with NYHA Class IV heart failure who may never receive a heart transplant. Both of these end-stage treatment options require invasive open-chest surgery and can cost in excess of $150,000 per procedure, as reported by the Journal of Heart and Lung Transplantation.

There are approximately 2.9 million NYHA Class II and Class III heart failure patients, of which we estimate approximately 60% are patients with ischemic systolic heart failure. Of this subset of 1.7 million patients, we estimate that approximately 70%, or over 1.2 million patients, will have a cell potency score sufficient to qualify for treatment with CardiAMP.

Bone marrow derived cell-based therapy has been shown to have the potential to restore cardiac function. In the past decade, intramyocardial delivery of bone marrow derived cell-based therapies in preclinical and clinical studies of heart failure has predominantly resulted in benefits, such as improvement in ventricular function, reduction in infarct size and increase in myocardial perfusion. An infarct is an area of dead tissue resulting from failure of blood supply, and myocardial perfusion is blood flow to heart tissue.

Recent systematic review and meta-analysis of the scientific literature from 23 randomized controlled trials prior to 2013, covering more than 1,200 participants, was published by Fisher in Circulation Research in January 2015. The review found evidence that bone marrow cell treatment, including intramyocardial delivery of bone marrow cells, has improved left ventricle ejection fraction, or LVEF, and chronic ischemic heart disease. The authors of the review found evidence for a potential beneficial clinical effect in terms of mortality and performance status after at least one year post-treatment in people who suffer from chronic ischemic heart disease and heart failure. Results in heart failure trials indicate that bone marrow derived cell-based therapy leads to a reduction in deaths and readmission to hospital and improvements over standard treatment as measured by tests of heart function. This review concluded that further research is required to confirm the results.

Published scientific papers provide clinical support for efficacy from randomized controlled clinical trials of intramyocardial delivery of bone marrow derived cells in closely related clinical conditions of chronic myocardial ischemia, diastolic heart failure, and subacute myocardial infarction.

Bone marrow cell homing to the heart is part of the body’s natural repair process. After a heart attack or an acute injury to the heart, cells from bone marrow are known to home to the heart. For example, a population of bone marrow cells with a cell surface marker of CD34+ has certain receptors, including CXC-4 and CXC-7 receptors, that home to the SDF-1 ligand, which is activated in injured heart tissue. In the event of heart failure, the heart is believed to have fewer of these homing signals and a decreased ability to stimulate or recreate this signaling process, leading to a lower likelihood of heart tissue repair. A number of other bone marrow derived cells with unique cell surface markers have also been shown to have beneficial effects in animal models of heart failure and are under clinical investigation today.

To date, the research community has proposed three main mechanisms of action to explain the regenerative potential of bone marrow derived cells:

endothelial cell and myocyte growth through cell transdifferentiation, which means that a bone marrow cell becomes another cell type in the heart;

stimulation of endogenous cardiac stem cells for niche reconstruction, which means that a bone marrow cell stimulates the production of stem cells in the heart, which subsequently become a specific cell type in the heart; and

paracrine effects through the release of cytokines and growth factors leading to anti-apoptotic effects and angiogenesis, which means that proteins produced by the bone marrow cells stimulate beneficial reparative effects in the heart such as reduced inflammation, cell survival and the formation of new vascular networks.

There is increasing belief in the research community that the efficacy of bone marrow derived cells may reside in synergistic effects of two or more mechanisms of action promoting cardiac regeneration.

Product Overview

BioCardia is developing two comprehensive biotherapeutic candidates for cardiac regenerative medicine, with an initial focus on heart failure resulting from a heart attack:

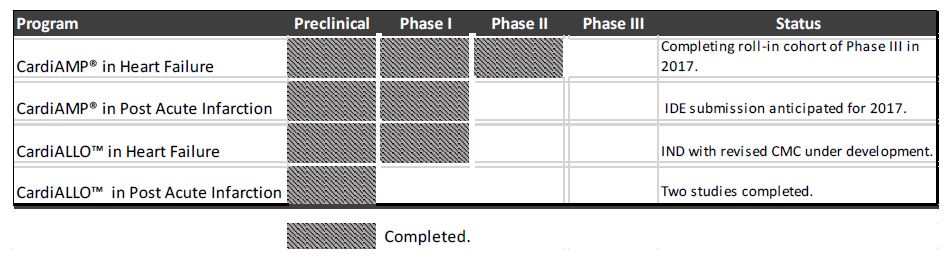

CardiAMP—autologous minimally processed bone marrow cells from a patient’s own cells, with an FDA accepted Phase III pivotal trial. As of December 31, 2016, 62 patients have been treated in our Phase I and Phase II trials in ischemic heart failure and post-acute infarction; and |

CardiALLO—allogeneic culture expanded mesenchymal bone marrow cells from a universal donor for use in multiple unrelated patients, entering Phase II development. To date, 94 patients have been treated in CardiALLO related mesenchymal stem cell Phase I and Phase II trials. The development stage for these programs is provided below. Cell-Based Therapy Product Pipeline |

CardiAMP Cell Therapy System

CardiAMP is our lead therapeutic program. CardiAMP for the treatment of heart failure, is a comprehensive investigational therapeutic treatment that is expected to be comprised of (i) a cell potency screening test, (ii) a point of care cell processing platform, and (iii) a biotherapeutic delivery system. CardiAMP has the potential to be the first comprehensive therapeutic treatment utilizing a patient’s own cells for the treatment of ischemic systolic heart failure, which is heart failure that develops after a heart attack. In the screening process with the anticipated companion diagnostic, the physician extracts a small sample of the patient’s bone marrow in an outpatient procedure performed under local anesthesia. The clinic sends the sample to a centralized diagnostic lab, which tests for identified biomarkers from which we generate a potency assay score for the patient. During the treatment, a clinician harvests and then prepares the patient’s own bone marrow mononuclear cells, or autologous cells, using our point of care cell processing platform, which a cardiologist then delivers into the heart using our proprietary biotherapeutic delivery system. We designed the entire procedure to be performed in approximately 60 to 90 minutes, which we believe is substantially faster than alternative cell-based therapies in development. The patient then leaves the hospital the same or next day.

CardiAMP is believed to be the first therapeutic candidate to enter a clinical program with a bone marrow derived cell-based therapy for ischemic systolic heart failure patients who are not actively ischemic. It is also potentially the first therapeutic candidate to use a companion diagnostic, the CardiAMP potency assay, to identify patients who are likely responders to treatment with autologous cells. We also believe it is the first therapeutic candidate to initiate a Phase III pivotal trial in the United States for heart failure using point of care cell processing to isolate the bone marrow mononuclear cells, the first pivotal cardiac cell therapy to be regulated under an IDE, and the first cell therapy IDE to have national reimbursement approval from CMS.

CardiAMP Preclinical Experience

Extensive preclinical data with bone marrow mononuclear cells and media in which they have been incubated in animal models of heart disease have shown compelling results. Rats treated with media from cells showed reduced fibrotic scar at 28 days, increased microvascular density in central infarct and border zones, and demonstrated enhanced cardiac function. Swine studies have shown that there is a dose response relationship, with higher doses of bone marrow mononuclear cells resulting in reduced fibrosis and increased microvascular change in infarcted myocardium 60 days after treatment. The highest dose tested in this series of 200 million cells, with >20 million cells per segment, resulted in the highest capillary density and the least fibrosis. This is the dosage delivered in the CardiAMP Phase II trial, and to be delivered in the Phase III pivotal trial.

CardiAMP Phase I Study: Transendocardial Autologous Marrow Cells in Myocardial Infarction

The CardiAMP Phase I Transendocardial Autologous Marrow Cells in Myocardial Infarction or TABMMI trial enrolled 20 patients with ischemic systolic heart failure in an open label safety trial of bone marrow cells delivered with the Helix biotherapeutic delivery system at a dosage of 100 million cells. Results showed improvement in cardiac function as measured by left ventricular ejection fraction, improved exercise tolerance, and superior survival as compared to historical controls. The Phase I TABMMI study was submitted to the Argentine Administración Nacional de Medicamentos, Alimentos y Technología Médica.

In our TABMMI Phase I trial of CardiAMP cells, we enrolled 20 patients with previous evidence of having had a heart attack and who presented with a low ejection fraction of less than or equal to 40% and greater than or equal to 20%. Baseline evaluations included informed consent, history and physical examination, electrocardiogram, 24-hour Holter monitoring, echocardiography, routine blood tests and exercise tolerance testing. Reduced regional heart wall motion was coincident with the diseased coronary vessel in each patient. A total of 20 patients with heart failure (NYHA Class I, II and III) each received three to ten transendocardial infusions of cells using our Helix biotherapeutic delivery system in an open-label dose-escalation two cohort trial. Dosage administration ranged from 30 million to 130 million autologous bone marrow derived mononuclear cells, with an average of 96 million cells.

Bone marrow cells delivered in TABMMI demonstrated an excellent safety profile in this heart failure population, with no treatment related toxicities observed. The 20 patients who received CardiAMP cells, demonstrated improvements from baseline to both six-month and 12-month follow-up across a number of parameters important in heart failure, including statistically and clinically significant improvements in left ventricular, or LV, function (ejection fraction).

The results of the study demonstrated statistically significant functional improvements in echocardiographic measured heart function at both six- and 12-months follow-up compared to baseline. A total of 12 adverse events were observed in six patients, although none were related to the investigational delivery or cell transplantation procedure. The complete results of the 20 patients at two-year follow-up have been published by in the journal Eurointervention in 2011.

CardiAMP Phase II Trial: Transendocardial Autologous Cells in Heart Failure Trial (TAC-HFT)

In our co-sponsored Phase II Transendocardial Autologous Cells in Heart Failure Trial, patients with ischemic systolic heart failure were randomized on a one to one basis into two double-blind, placebo-controlled trials: TACHFT-BMC and TACHFT-MSC. The IND for the TACHFT trial was filed with the FDA Center for Biologics Evaluation and Research in 2008 by the University of Miami, the co-sponsor of the trial.

In the safety dose escalation roll-in cohort stage of the study, eight patients received treatment with either CardiAMP cells, or autologous bone marrow mesenchymal cells, or MSC, at dosages of 100 million or 200 million cells. In the randomized, placebo-controlled efficacy stage of the study, 29 patients received treatment with either CardiAMP cells or placebo and 30 patients received treatment with either MSCs or placebo. The mode of administration was 10 intramyocardial infusions per patient using our Helix biotherapeutic delivery system into the myocardium adjacent to and into the infarcted tissue. All subjects had ischemic systolic heart failure (NYHA Class I, II or III).

TACHFT-BMC found CardiAMP cells to be safe at both dosages (100 million and 200 million cells) and that treated patients had increased their functional capacity, improved quality of life, symptoms and key markers of cardiac function predictive of survival, such as end systolic volume, or ESV. The TACHFT-BMC trial included a single dose of CardiAMP cells with a follow up observation period of 12 months. The Phase II, randomized, placebo-controlled study met its primary safety endpoint and demonstrated statistically significant and clinically meaningful improvements in secondary efficacy endpoints of functional capacity, as measured by the six minute walk distance (6MW), and in quality of life, as measured by the Minnesota Living with Heart Failure Questionnaire score.

A summary of the findings is below:

• | high-dose CardiAMP cells (200 million cells) met the primary TACHFT-BMC safety endpoint with 0% treatment emergent major adverse cardiac events at 30 days, and demonstrated an excellent safety profile at 12 months with fewer clinical events in the treated group; |

patients treated with CardiAMP cells, when compared to placebo, showed statistically and clinically significant improvements in functional capacity as measured by the six minute walk test and in quality of life as measured by the MLHF Questionnaire;

benefit in preventing clinical events such as hospitalizations was confirmed at one year following treatment, although not at the level of statistical significance; and

benefit in clinical outcomes was supported by improvement in patients’ cardiac function, although not at the level of statistical significance.

Results at one year follow-up of the placebo controlled TAC-HFT BMC trial were published by Wong Po Foo et al in 2015 following a pooled analysis by Heldman et al in JAMA in 2013.

★ Heldman AW, et al Transendocardial Mesenchymal Stem Cells and Mononuclear Bone Marrow Cells for Ischemic Cardiomyopathy The TAC-HFT Randomized Trial JAMA.2013.282909. | ||

| ★ Wong Po Foo et al., The transendocardial autologous cells in ischemic heart failure trial bone marrow mononuclear cells (TAC-HFT-BMC) randomized placebo controlled blinded study, Regenerative Medicine 2015, 10(7s), S169. |

CardiAMP Phase III PivotalIDETrial

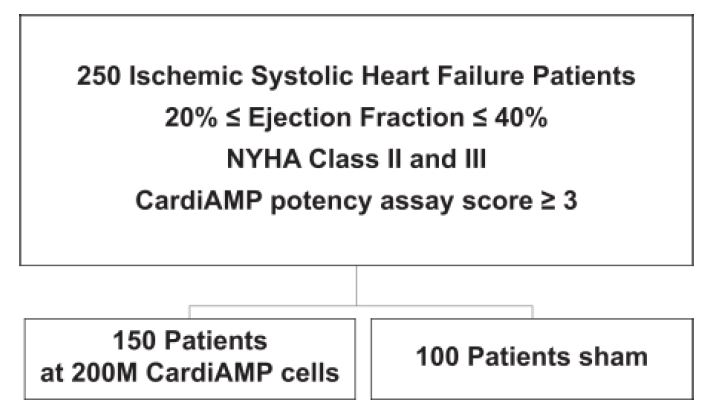

We designed the current Phase III pivotal trial to confirm the results of our Phase II TACHFT-BMC trial which showed that a high dose (200 million) of bone marrow cells improved functional capacity and quality of life. The Phase III pivotal trial is anticipated to serve as the basis for potential regulatory approval in the United States. The Phase III trial design excludes NYHA Class I patients and will include our CardiAMP potency assay and CardiAMP point of care cell processing platform, all of which we believe are improvements over our Phase II trial that should enhance the probability of regulatory approval. The primary endpoint will be superiority with respect to functional capacity as measured by the six minute walk test at one-year post-procedure. The inclusion criteria will include:

ages 21-90;

NYHA Class II or Class III heart failure classification;

chronic ischemic left ventricular dysfunction;

ejection fraction greater than or equal to 20% but less than or equal to 40%; and

a cell potency score greater than or equal to three as measured by the CardiAMP potency assay.

The Phase III pivotal trial is approved by FDA to enroll up to 260 patients, including an optional 10 patient roll-in cohort, at up to 40 U.S. clinical sites, with a 3:2 randomization of 250 patients to either treatment or sham control. In the sham control procedure, the clinician performs the entire therapy other than delivery of the CardiAMP cells. Centers are actively enrolling patients and we anticipate obtaining top line data in 2019.

CardiAMP Phase IIIrandomizedpivotal trial design accepted by FDA

We believe the remaining clinical efficacy risk is modest in light of the Phase I and II data in hand, and broader literature which supports CardiAMP as a therapeutic candidate. CardiAMP has the potential to significantly benefit patients who have limited options, and provide a cost-effective therapy to help reduce the substantial heart failure hospitalization and care costs.

Previous IDE clinical trials that led to FDA approval of Cardiac Resynchronization Therapy (CRT) devices for the treatment of heart failure followed the same IDE regulatory pathway that CardiAMP will follow and had similar endpoints to the proposed CardiAMP Heart Failure IDE trial. CRT is intended for patients that are NYHA III and IV versus the CardiAMP trial of NYHA II and III. Results from 5 out of 6 randomized pivotal CRT trials showed both smaller improvements in functional capacity as measured by the six minute walk test and smaller improvement in quality of life than the CardiAMP Phase II results. Although the benefits with CRT were less than observed in CardiAMP placebo controlled Phase II trial, these results for the permanently implantable CRT devices were sufficient to obtain FDA approval.

Our FDA accepted Phase III pivotal trial is designed to provide the primary support for the safety and efficacy of CardiAMP. The primary endpoint is functional capacity, as measured by the six minute walk test. Based on the results achieved in the Phase II trial, our Phase III pivotal trial is designed to have more than 90% probability of achieving a positive result with statistical significance. Statistical significance denotes the mathematical likelihood that the results observed are real and not due to chance.

We are also exploring the continued development of CardiAMP for post-acute myocardial infarction and intend to submit an IDE for this indication to the FDA in 2017. In the future, BioCardia may explore the development of CardiAMP for additional indications such as chronic myocardial ischemia and heart failure with preserved ejection fraction, or cardiac function as measured by the outbound blood pumped out of the heart with each heartbeat.

CardiALLO Cell Therapy System

Our second therapeutic candidate is the CardiALLO Cell Therapy System, or CardiALLO. CardiALLO is an allogeneic “off the shelf” mesenchymal stem cell product candidate that may be an alternative for patients who are not optimal candidates for CardiAMP. We anticipate preparation of an Investigational New Drug, or IND, application for submission to the FDA for a Phase II trial for CardiALLO for the treatment of ischemic systolic heart failure.

CardiALLO uses culture expanded allogeneic bone marrow derived MSCs for the treatment of ischemic systolic heart failure. We believe this therapy presents the advantages of an “off the shelf” therapy that does not require tissue harvesting or cell processing.

CardiALLO Preclinical Experience

Preclinical work with expanded MSCs in swine has been performed with our collaborators at three universities. Early studies showed cells could be efficiently delivered and tracked in the heart using iron oxide incubation techniques with magnetic resonance imaging. Immunohistochemistry stains also detailed that cells could be identified in the hearts after delivery. Randomized swine studies demonstrated that bone marrow derived mesenchymal stem cells, could be safely injected by using our Helix biotherapeutic delivery system three days after myocardial infarction. Cellular transplantation resulted in long-term engraftment, reduction in scar formation and near-normalization of cardiac function. As an additional finding, transplanted cells derived from an allogeneic donor were not rejected by the recipient, a major practical advance for the potential widespread application of this therapy. Studies have also been performed evaluating a variety of delivery strategies. Together, these findings supported that the direct injection of cellular grafts into damaged myocardium is safe and effective in the peri-infarct period.

CardiALLO related Phase I /II Studies: POSEIDON, TAC-HFT-MSC, and TRIDENT

We have co-sponsored three clinical trials for MSCs for the treatment of ischemic systolic heart failure. In substantially similar trial designs, the POSEIDON Phase I/II trial compared autologous MSCs to allogeneic MSCs, the TACHFT-MSC Phase II trial compared autologous MSCs to placebo, and the TRIDENT Phase II compared allogenic MSCs at different doses. The first two trials shared common arms of autologous MSCs, enabling a bridge to placebo, leading us to conclude that allogeneic MSC therapy is superior to placebo. The IND for the TACHFT trial was filed with the FDA Center for Biologics Evaluation and Research in 2008 by the University of Miami, our co-sponsor for the trial. The POSEIDON trial was submitted by amendment under the same IND filed for the TACHFT study, and was co-sponsored by the University of Miami, the National Institutes of Health and us. The results from both of these studies can be submitted to the FDA in support of an IND for CardiALLO. The TRIDENT trial was also submitted by amendment to the same IND and continues to follow patients.

POSEIDON Phase I/II, TACHFT-MSC Phase II, and TRIDENT Phase I/II trials, inform and support our clinical efforts for CardiALLO. We are developing an optimized formulation and dosage strategy of CardiALLO cells for a planned clinical trial which we intend to initiate after we complete enrollment in the CardiAMP Phase III pivotal trial.

Additional data on these programs is available as two of these clinical studies have been published by Hare et al in JAMA in 2012 and Heldman et al in JAMA in 2013.

★ | Heldman AW, et al Transendocardial Mesenchymal Stem Cells and Mononuclear Bone Marrow Cells for Ischemic Cardiomyopathy The TAC-HFT Randomized Trial JAMA.2013.282909. |

★ | Hare JM, et al. Comparison of Allogeneic vs Autologous Bone Marrow–Derived Mesenchymal Stem Cells Delivered by Transendocardial Injection in Patients With Ischemic Cardiomyopathy, The POSEIDON Randomized Trial, JAMA. 2012;308(22). |

CardiALLO Development

CardiALLO is being advanced with an anticipated improved cell production strategy to be detailed in the Chemistry Manufacturing and Controls (CMC) of the IND in development. We believe the new CMC will reduce the likelihood of immune response to transplanted allogenic cells further, may enhance efficacy, and will enable commercial scale up and global distribution. CardiALLO will require more extensive clinical development than CardiAMP, beginning with a Phase II trial that follows previous work, to confirm the results with the modified cell culture and dosage strategy.

We anticipate performing our own CMC development work in BioCardia laboratories to accelerate the effort and secure additional intellectual property, and in parallel develop an agreement with an established academic institution to culture and supply the MSC cells for CardiALLO clinical development. We expect to confirm the safety and efficacy of MSCs in our target patient population in a Phase II randomized controlled study. We expect the CardiALLO Phase II trial to enroll patients with control, low dose and high dose groups using the Helix biotherapeutic delivery system and the same inclusion criteria as the CardiAMP Phase III pivotal trial. We intend to begin enrolling the CardiALLO trial after the CardiAMP trial completes enrollment. In the United States, CardiALLO is expected to be regulated by the FDA as a biologic combination product with our Helix biotherapeutic delivery system.

Both CardiAMP and CardiALLO therapeutic programs have safety and efficacy support from completed clinical studies. The two therapeutic candidates provide compelling and synergistic approaches to replicating the natural response of bone marrow cells to cardiac injury. CardiAMP harnesses the potential of autologous minimally processed bone marrow cells, using a companion diagnostic to identify patients most likely to benefit from the therapy. CardiALLO utilizes younger universal donor mesenchymal stem cells and may be appropriate for patients who are not optimal candidates for the CardiAMP therapy.

Cell Processingand Cell DeliveryProduct Platforms |

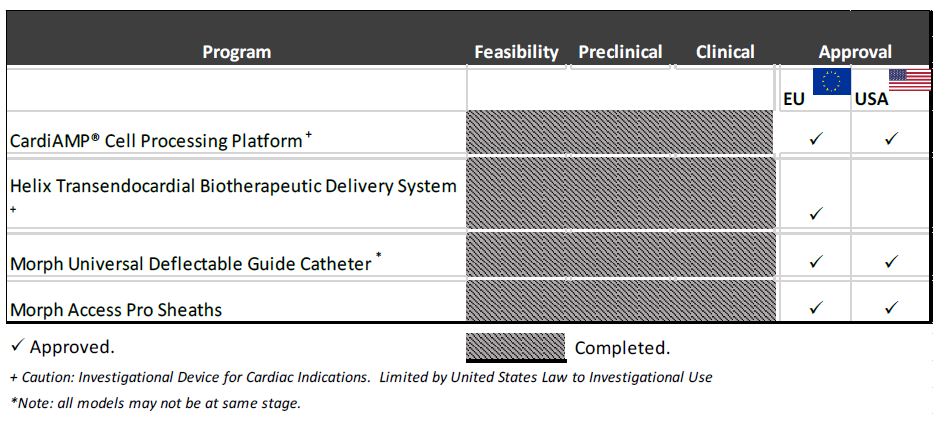

BioCardia has developed and secured exclusive rights to enabling cell processing and cell delivery products, which are used as part of our CardiAMP and CardiALLO therapies, and which we believe validate our approach and development expertise: (i) the CardiAMP cell processing platform, (ii) the Helix transendocardial biotherapeutic delivery system, and (iii) our Morph vascular access products.

• | CardiAMP cell processing platform—processes bone marrow aspirate at the point of care to concentrate mononuclear cells and prepare the dosage form. We expect the CardiAMP cell processing platform to be approved in the United States for ischemic systolic heart failure as part of CardiAMP. The platform is currently cleared for use in the United States and in European Union for the preparation of a cell concentrate from bone marrow and is under investigational use for the treatment of heart failure. |

• | Helix biotherapeutic delivery system—delivers therapeutics into the heart muscle with a penetrating helical needle from within the heart. This is a leading delivery platform in the field, which has increased safety and performance. We expect Helix to be approved in the United States as part of CardiAMP. The system is CE marked for commercial use in Europe and is under investigational use in the United States as part of our CardiAMP and CardiALLO development programs. We believe the Helix biotherapeutic system is the world’s safest and most efficient platform for cardiac therapeutic delivery and has been used in more than 280 clinical procedures. The Helix biotherapeutic delivery system is designed to be used in any catheterization laboratory in the world without the need for additional capital equipment. | |

| We supply our Helix biotherapeutic delivery system to selected partners developing other cell gene and protein therapeutic programs. These programs provide additional data, intellectual property rights, and opportunities to participate in the development of combination products for the treatment of cardiac diseases. |

• | Morph vascular access products— provides enhanced control for Helix in biotherapeutic delivery and for other common interventions. We have secured all necessary approvals in the United States and Europe. Currently there are six Morph product model numbers approved for commercial sale in the United States via a 510(k) clearance and three in Europe under CE mark. The Morph products are valued by physicians performing difficult vascular procedures worldwide and they have been used in more than 10,000 clinical procedures to date. |

Business Strategy

We are committed to applying our expertise in the fields of autologous and allogeneic cell-based therapies to improve the lives of patients with cardiovascular conditions. We are pursuing the following business strategies:

• | Complete Phase III pivotal trial of CardiAMP for patients with ischemic systolic heart failure. We have initiated our 260 patient CardiAMP Phase III pivotal trial with optional 10 patient roll-in cohort. Based on the results of the Phase II trial, the Phase III pivotal trial will focus on patients with NYHA Class II or III ischemic systolic heart failure, and the primary endpoint will be functional capacity as measured by the six minute walk test. The trial will use the CardiAMP potency assay to target patients most likely to benefit from our treatment. This trial has begun treating patients and is expected to have top-line trial results in 2019. |

• | Obtain FDA approval and commercialize CardiAMP using a highly-targeted cardiology sales force in the United States.Heart failure patients are primarily treated at leading hospitals and medical centers of excellence by a select group of cardiologists and heart failure specialists. Once we obtain FDA approval, we plan to use a targeted sales force focused on these particular physicians. We believe cardiologists, heart failure specialists and interventional cardiologists are typically early adopters of innovative biotherapeutic products, devices and technologies. We believe that CardiAMP will be adopted first by leading cardiologists and heart failure specialists at high-volume U.S. hospitals and medical centers, and progressively by a broader segment of the market. We anticipate using strategic or distribution partners to serve other geographies. |

• | Advance our CardiALLO program for the treatment of ischemic systolic heart failure.CardiALLO has the potential to benefit patients for whom CardiAMP is not optimal due to the lower potency of their bone marrow cells. CardiALLO allogeneic culture-expanded bone marrow derived cells, or CardiALLO cells, have performed well in a head to head trial with autologous mesenchymal bone marrow cells. This therapy may present advantages for patients or physicians who wish to avoid bone marrow aspiration, and our development work builds on our clinical development capabilities established through our CardiAMP program. This program positions us to provide therapy to patients ineligible for CardiAMP. |

• | Expand CardiAMP and CardiALLO into additional cardiac indications. CardiAMP and CardiALLO have potential therapeutic benefits for multiple cardiovascular indications in addition to ischemic systolic heart failure. We and our clinical collaborators have been gathering data on the application of CardiAMP cells to post-acute myocardial infarction, and in the future we may investigate the use of CardiAMP and CardiALLO cells for additional indications such as chronic myocardial ischemia and heart failure with preserved ejection fraction. Compelling clinical results have been published for the application of cell-based formulations similar to CardiAMP cells in each of these diseases. |

• | Continue to partner our Helix biotherapeutic delivery system for use with other biotherapeutics.We plan to continue to make our Helix biotherapeutic delivery system available for use by qualified partners seeking to advance their own biotherapeutic candidates for similar indications. |

Manufacturing

The CardiAMP cell processing platform is manufactured for us by our partner Biomet Biologics. We currently manufacture our Helix biotherapeutic delivery system and Morph vascular access products in our San Carlos, California facility using components we source from third party suppliers. The last FDA inspection of our facility in 2016 issued one observation under form 483s which has been addressed to the FDA’s satisfaction. Our last inspection by our European notified body in February 2017 reported one major and four minor observations, which we are currently addressing.

Sales and Marketing

Our sales and marketing strategy is to market CardiAMP and CardiALLO, if approved by the FDA, for potential heart failure indications using a dedicated direct sales model focused on selected cardiologists and heart failure specialists. These physicians are typically affiliated with leading hospitals and medical centers and we believe that they tend to have well-established referral networks of interventional cardiologists and cardiac catheterization laboratories. We believe they represent a concentrated customer base suitable to a specialist care sales model. We believe that CardiAMP and CardiALLO will be adopted first by leading cardiologists and heart failure specialists at high-volume U.S. hospitals and medical centers, and progressively by a broader segment of the market. Cardiologists, heart failure specialists, and interventional cardiologists, have a history of early adoption of innovative products and technologies, in part because the rate of innovation in this sector has been sustained, and in part because of the large unmet medical needs of heart failure patients.

Competition

The biotechnology and pharmaceutical industries in which we operate are subject to rapid change and are characterized by intense competition to develop new technologies and proprietary products. We face potential competition from many different sources, including larger and better-funded companies. While we believe that CardiAMP’s unique strategy provides us with competitive advantages, particularly given that CardiAMP is designed to be administered in a safe and short procedure, we have identified several companies which are active in the advancement of cell-based and gene-based therapy products in the heart failure arena. Not only must we compete with other companies that are focused on cell-based therapy treatments, any products that we may commercialize will have to compete with existing therapies and new therapies that may become available in the future.

Some of the companies currently developing cell-based and gene-based therapies for cardiac indications include CapriCor Therapeutics, Celyad, CellProthera, Juventas Therapeutics, Mesoblast, Vericel, Uniqure, some of which are in the clinical stages of development with their product candidates.

However, these competitors may require delivery platforms for their own therapeutic programs. Because the clinical need is so large and our biotherapeutic delivery products have potential to enable multiple biotherapeutics, we view these companies also as potential collaborators and partners. To date, we have entered into agreements to provide our biotherapeutic delivery system to four of these firms for various pre-clinical and clinical studies. One is active in the clinic today. None of these relationships are believed to be material to our business at this time.

Intellectual Property

We strive to protect and enhance the proprietary technologies that we believe are important to our business, and seek to obtain and maintain patents for any patentable aspects of our therapeutic candidates or products, including our anticipated companion diagnostic, their methods of use and any other inventions that are important to the development of our business. Our success will depend significantly on our ability to obtain and maintain patent and other proprietary protection for commercially important technology, inventions and know-how related to our business, defend and enforce our patents, maintain our licenses to use intellectual property owned by third parties, preserve the confidentiality of our trade secrets and operate without infringing the valid and enforceable patents and other proprietary rights of third parties. We also rely on know-how, continuing technological innovation and in-licensing opportunities to develop, strengthen, and maintain our proprietary position in the fields targeted by our therapeutic candidates.

We have a large patent portfolio of issued and pending claims covering methods of use for CardiAMP, CardiALLO, Helix and Morph as well as design and elements of our manufacturing processes. As of December 31, 2016, we had developed or secured rights to over 20 patent families that included rights to over 75 U.S. patents with issued or patent pending applications. We have sole ownership of the patents that we consider to be material, other than the patents that we license exclusively from Biomet Biologics, LLC. We have also pursued international protection for some of these U.S. patents where appropriate. Our issued U.S. patents expire between 2017 and 2031, without taking into consideration patent term extension. We maintain trade secrets covering a significant body of know-how and proprietary information related to our core therapeutic candidates, biotherapeutic delivery systems and technologies. As a result, we believe our intellectual property position provides us with substantial competitive advantages for the commercial development of novel therapeutics for cardiovascular diseases.

U.S. Regulatory Protection for CardiAMP and CardiALLO

In addition to patent and trade secret protection, we may receive a 12-year period of regulatory exclusivity from the FDA upon approval of CardiAMP and CardiALLO pursuant to the Biologics Price Competition and Innovation Act. The exclusivity period, if granted, will run from the time of FDA approval. This exclusivity period, if granted, will supplement the intellectual property protection discussed above, providing an additional barrier to entry for any competitor seeking approval for a bio-similar version of the CardiAMP or CardiALLO cell therapy systems.

In addition, it is possible to extend the patent term of one patent covering CardiAMP and CardiALLO following FDA approval. This patent term extension, or PTE, is intended to compensate a patent owner for the loss of patent term during the FDA approval process. If eligible, we may use a PTE to extend the term of one of the patents discussed above beyond the expected expiration date.

Trademarks

We have registered our name, logo and the trademarks “BioCardia,” “CardiAMP,” “CardiALLO,” and “Morph” in the United States. We have registered the trademarks “CardiAMP” and “CardiALLO” for use in connection with a biological product, namely, a cell-based therapy product composed of bone marrow derived cells for medical use. We also have rights to use the “Helix” trademark in the United States. We have registered Morph for use in connection with steerable vascular access technology. We intend to pursue additional registrations in markets outside the United States where we plan to sell our therapies and products.

Patent Term

The term of individual patents and patent applications will depend upon the legal term of the patents in the countries in which they are obtained. In most countries, the patent term is 20 years from the date of filing of the patent application (or parent application, if applicable). For example, if an international Patent Cooperation Treaty, or PCT, application is filed, any patent issuing from the PCT application in a specific country expires 20 years from the filing date of the PCT application. In the United States, however, if a patent was in force on June 8, 1995, or issued on an application that was filed before June 8, 1995, that patent will have a term that is the greater of 20 years from the filing date, or 17 years from the date of issue.

Under the Hatch-Waxman Act, the term of a patent that covers an FDA-approved drug, biological product may also be eligible for PTE. PTE permits restoration of a portion of the patent term of a U.S. patent as compensation for the patent term lost during product development and the FDA regulatory review process if approval of the application for the product is the first permitted commercial marketing of a drug or biological product containing the active ingredient. The patent term restoration period is generally one-half the time between the effective date of an IND and the submission date of a BLA plus the time between the submission date of a BLA and the approval of that application. The Hatch-Waxman Act permits a PTE for only one patent applicable to an approved drug, and the maximum period of restoration is five years beyond the expiration of the patent. A PTE cannot extend the remaining term of a patent beyond a total of 14 years from the date of product approval, and a patent can only be extended once, and thus, even if a single patent is applicable to multiple products, it can only be extended based on one product. Similar provisions may be available in Europe and certain other foreign jurisdictions to extend the term of a patent that covers an approved drug. When possible, depending upon the length of clinical trials and other factors involved in the filing of a BLA, we expect to apply for PTEs for patents covering our therapeutic candidates and products and their methods of use. For additional information on PTE, see “Government Regulation.”

Proprietary Rights and Processes

We may rely, in some circumstances, on proprietary technology and processes (including trade secrets) to protect our technology. However, these can be difficult to protect. We seek to protect our proprietary technology and processes, in part, by entering into confidentiality agreements with those who have access to our confidential information, including our employees, consultants, scientific advisors and contractors. We also seek to preserve the integrity and confidentiality of our proprietary technology and processes by maintaining physical security of our premises and physical and electronic security of our information technology systems. While we have confidence in these individuals, organizations and systems, agreements or security measures may be breached, and we may not have adequate remedies for any breach. In addition, our proprietary technology and processes may otherwise become known or be independently discovered by competitors. To the extent that our employees, consultants, scientific advisors, contractors, or any future collaborators use intellectual property owned by others in their work for us, disputes may arise as to the rights in related or resulting know-how and inventions. For this and more comprehensive risks related to our proprietary technology and processes, please see “Risk Factors—Risks Related to our Intellectual Property.”

License Agreement with Biomet Biologics, LLC

In October 2012, we entered into a license and distribution agreement with Biomet Biologics, LLC under which we obtained an exclusive, nontransferable, worldwide distribution right, patent license and trademark license to a point of care cell processing platform. Under the terms of the agreement, we are obligated to pay a royalty based on the price of the disposables in the CardiAMP cell processing platform for the duration of the agreement. We expect the royalty payments to Biomet Biologics, LLC for the licensed product to amount to a low or mid-single digit percentage of the expected price that we will charge for CardiAMP. The agreement has a term of 10 years or the time the last patent pursuant to the agreement expires, whichever is later. The agreement may be terminated by Biomet Biologics, LLC for a failure by us to meet any milestone requirements, including minimum purchase requirements, as well as by either party upon 30 days prior written notice in the event of a breach of any material term by the other party. We have the right to terminate the agreement upon 90 days prior written notice in the event the safety, efficacy or comparative effectiveness of the product is insufficient to meet our commercial needs.

Technology Access Program for Biotherapeutic Delivery Systems

Our preclinical work with partners and collaborators generally takes place under arrangements where we secure access to data, reports, and a non-exclusive license to delivery technology improvement inventions.

Clinical Research Agreements for Biotherapeutic Delivery Systems

Our clinical work with partners generally takes place under arrangements where we secure access to data, reports, and a non-exclusive license to technology improvement inventions. Financial terms of each agreement are anticipated to cover our costs and provide milestone payments. We hope to generate sales if any of our partners are successful with commercializing their products with our delivery platform.

Regulation

Biological products, including cell-based therapy products, and medical devices are subject to regulation under the Federal Food, Drug, and Cosmetic Act, or FD&C Act, and the Public Health Service Act, or PHS Act, and other federal, state, local and foreign statutes and regulations. Both the FD&C Act and the PHS Act and their corresponding regulations govern, among other things, the testing, manufacturing, safety, purity, potency, efficacy, labeling, packaging, storage, record keeping, distribution, reporting, advertising and other promotional practices involving biological products. FDA acceptance must be obtained before clinical testing of an investigational biological and medical device begins, and each clinical trial protocol for a cell-based therapy product is submitted to and reviewed by the FDA. FDA approval must be obtained before marketing of biological and/or medical devices. The process of obtaining regulatory approvals and the subsequent compliance with applicable federal, state, local and foreign statutes and regulations require the expenditure of substantial time and financial resources and we may not be able to obtain the required regulatory approvals on a timely basis, or at all. To date, the FDA has never approved for commercial sale a cell-based therapy product intended to treat the heart.

Within the FDA, the Center for Biologics Evaluation and Research, or CBER, regulates cell-based therapy products. For products that use medical devices, including diagnostics, to deliver cell therapies, CBER works closely with the FDA’s Center for Devices and Radiological Health, or CDRH.

U.S. Biological Product Development Process

Our CardiALLO therapeutic candidate will be regulated in the United States as a biological product. The process required by the FDA before a biological product may be tested and marketed in the United States generally involves the following:

• | completion of nonclinical laboratory tests and animal studies according to good laboratory practices, or GLP, regulations and applicable requirements for the humane use of laboratory animals or other applicable regulations; |

submission to the FDA of an IND application, which must become effective before human clinical trials may begin and must be updated annually or when significant changes are made;

approval by an independent Institutional Review Board, or IRB, or ethics committee at each clinical site before the trial begins;

performance of adequate and well-controlled human clinical trials according to the FDA’s regulations, commonly referred to as good clinical practices, or GCPs, and any additional requirements for the protection of human research subjects and their health information, to establish the safety, purity and potency of the proposed biological product for its intended use;

Preparation of and submission to the FDA of a biologics license application, or BLA, for marketing approval, after completion of all pivotal clinical trials;

satisfactory completion of an FDA Advisory Committee review, if applicable;

a determination by the FDA within 60 days of its receipt of a BLA to file the application for review;

satisfactory completion of an FDA inspection of the manufacturing facility or facilities where the biological product is produced to assess compliance with GMP, to assure that the facilities, methods and controls are adequate to preserve the biological product’s identity, strength, quality and purity and, if applicable, the FDA’s current good tissue practices, or GTPs, for the use of human cellular and tissue products;

potential FDA audit of the nonclinical study and clinical trial sites that generated the data in support of the BLA; and

FDA review and approval, or licensure, of the BLA for particular indications for use in the United States, which must be updated annually when significant changes are made.

The testing and approval process requires substantial time, effort and financial resources, and we cannot be certain that any approvals for our therapeutic candidates or product candidates will be granted on a timely basis, if at all. Before testing any biological product candidate, including a cell-based therapy product, in humans, the product candidate enters the preclinical testing stage. Preclinical tests, also referred to as nonclinical studies, include laboratory evaluations of product chemistry, toxicity and formulation, as well as animal studies to assess the potential safety and activity of the product candidate. The conduct of the preclinical tests must comply with federal regulations and requirements including GLPs.

The clinical trial sponsor must submit the results of the preclinical tests, together with manufacturing information, analytical data, any available clinical data or literature and a proposed clinical protocol, to the FDA as part of the IND. Some preclinical testing may continue even after the IND is submitted. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA places the trial on a clinical hold within that 30-day time period. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. The FDA may also impose clinical holds on a biological product candidate at any time before or during clinical trials due to safety concerns or non-compliance. If the FDA imposes a clinical hold, trials may not recommence without FDA authorization and then only under terms authorized by the FDA. Accordingly, we cannot be sure that submission of an IND will result in the FDA allowing clinical trials to begin, or that, once begun, issues will not arise that suspend or terminate such trials.

Clinical trials involve the administration of the biological product candidate to healthy volunteers or patients under the supervision of qualified investigators, generally physicians not employed by or under the trial sponsor’s control. Clinical trials are conducted under protocols detailing, among other things, the objectives of the clinical trial, dosing procedures, subject selection and exclusion criteria, and the parameters to be used to monitor subject safety, including stopping rules that assure a clinical trial will be stopped if certain adverse events should occur. Each protocol and any amendments to the protocol must be submitted to the FDA as part of the IND. Clinical trials must be conducted and monitored in accordance with the FDA’s regulations comprising the GCP requirements, including the requirement that all research subjects provide informed consent. Further, each clinical trial must be reviewed and approved by an independent institutional review board, or IRB, at or servicing each institution at which the clinical trial will be conducted. An IRB is charged with protecting the welfare and rights of trial participants and considers such items as whether the risks to individuals participating in the clinical trials are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the form and content of the informed consent that must be signed by each clinical trial subject or his or her legal representative and must monitor the clinical trial until completed. Clinical trials also must be reviewed by an institutional biosafety committee, or IBC, a local institutional committee that reviews and oversees basic and clinical research conducted at that institution. The IBC assesses the safety of the research and identifies any potential risk to public health or the environment.

For purposes of BLA approval, human clinical trials are typically conducted in three sequential phases that may overlap or be combined:

• | Phase I. The biological product is initially introduced into healthy human subjects and tested for safety. In the case of some products for severe or life-threatening diseases, especially when the product may be too inherently toxic to ethically administer to healthy volunteers, the initial human testing is often conducted in patients with the disease or condition. These studies are designed to test the safety, dosage tolerance, absorption, metabolism and distribution of the investigational product in humans, the side effects associated with increasing doses and, if possible, to gain early evidence on effectiveness. |

• | Phase II. The biological product is evaluated in a limited patient population with a specified disease or condition to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance, optimal dosage and dosing schedule. Multiple Phase II clinical trials may be conducted to obtain information prior to beginning larger and more expensive Phase III clinical trials. |

• | Phase III. Clinical trials are undertaken to further evaluate dosage, clinical efficacy, potency, and safety in an expanded patient population at geographically dispersed clinical trial sites, to provide statistically significant evidence of clinical efficacy and to further test for safety. These clinical trials are intended to establish the overall risk/benefit ratio of the product and provide an adequate basis for product approval and labeling. |

Post-approval clinical trials, sometimes referred to as Phase IV clinical trials, may be required by the FDA or voluntarily conducted after initial marketing approval to gain more information about the product, including long-term safety follow-up.

During all phases of clinical development, regulatory agencies require extensive monitoring and auditing of all clinical activities, clinical data, and clinical trial investigators. Annual progress reports detailing the results of the clinical trials must be submitted to the FDA. Written IND safety reports must be promptly submitted to the FDA, the NIH and the investigators for serious and unexpected adverse events, any findings from other studies, tests in laboratory animals orin vitro testing that suggest a significant risk for human subjects, or any clinically important increase in the rate of a serious suspected adverse reaction over that listed in the protocol or investigator brochure. The sponsor must submit an IND safety report within 15 calendar days after the sponsor determines that the information qualifies for reporting. The sponsor also must notify the FDA of any unexpected fatal or life-threatening suspected adverse reaction within seven calendar days after the sponsor’s initial receipt of the information. Phase I, Phase II and Phase III clinical trials may not be completed successfully within any specified period, if at all. The FDA or the sponsor or its data safety monitoring board may suspend a clinical trial at any time on various grounds, including a finding that the research subjects or patients are being exposed to an unacceptable health risk, including risks inferred from other unrelated trials. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the biological product has been associated with unexpected serious harm to patients.

Human cell-based therapy products are a new category of therapeutics. Because this is a relatively new and expanding area of novel therapeutic interventions, there can be no assurance as to the length of the trial period, the number of patients the FDA will require to be enrolled in the trials in order to establish the safety, efficacy, purity and potency of human cell-based therapy products, or that the data generated in these trials will be acceptable to the FDA to support marketing approval.

Concurrently with clinical trials, companies usually complete additional animal studies and must also develop additional information about the physical characteristics of the biological product as well as finalize a process for manufacturing the product in commercial quantities in accordance with GMP requirements. To help reduce the risk of the introduction of adventitious agents with use of biological products, the PHS Act emphasizes the importance of manufacturing control for products whose attributes cannot be precisely defined. The manufacturing process must be capable of consistently producing quality batches of the product candidate and, among other things, the sponsor must develop methods for testing the identity, strength, quality, potency and purity of the final biological product. Additionally, appropriate packaging must be selected and tested and stability studies must be conducted to demonstrate that the biological product candidate does not undergo unacceptable deterioration over its shelf life.

U.S. Review and Approval Processes

After the successful completion of clinical trials of a biological product, FDA approval of a BLA must be obtained before commercial marketing of the biological product. The BLA must include results of product development, laboratory and animal studies, human trials, information on the manufacture and composition of the product, proposed labeling and other relevant information. The FDA may grant deferrals for submission of data or full or partial waivers. The testing and approval processes require substantial time and effort and there can be no assurance that the FDA will accept the BLA for filing and, even if filed, that any approval will be granted on a timely basis, if at all.

Under the Prescription Drug User Fee Act, or PDUFA, as amended, each BLA must be accompanied by a significant user fee. The FDA adjusts the PDUFA user fees on an annual basis. PDUFA also imposes an annual product fee for biological products and an annual establishment fee on facilities used to manufacture prescription biological products. Fee waivers or reductions are available in certain circumstances, including a waiver of the application fee for the first application filed by a small business. Additionally, no user fees are assessed on BLAs for products designated as orphan drugs, unless the product also includes a non-orphan indication.

Within 60 days following submission of the application, the FDA reviews a BLA submitted to determine if it is substantially complete before the agency accepts it for filing. The FDA may refuse to file any BLA that it deems incomplete or not properly reviewable at the time of submission and may request additional information. In this event, the BLA must be resubmitted with the additional information. The resubmitted application also is subject to review before the FDA accepts it for filing. Once the submission is accepted for filing, the FDA begins an in-depth substantive review of the BLA. The FDA reviews the BLA to determine, among other things, whether the proposed product is safe and potent, or effective, for its intended use, and has an acceptable purity profile, and whether the product is being manufactured in accordance with GMP to assure and preserve the product’s identity, safety, strength, quality, potency and purity. The FDA may refer applications for novel biological products or biological products that present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions. During the biological product approval process, the FDA also will determine whether a Risk Evaluation and Mitigation Strategy, or REMS, is necessary to assure the safe use of the biological product. If the FDA concludes a REMS is needed, the sponsor of the BLA must submit a proposed REMS. The FDA will not approve a BLA without a REMS, if required.

Before approving a BLA, the FDA will inspect the facilities at which the product is manufactured. The FDA will not approve the product unless it determines that the manufacturing processes and facilities are in compliance with GMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, before approving a BLA, the FDA will typically inspect one or more clinical sites to assure that the clinical trials were conducted in compliance with IND trial requirements and GCP requirements. To assure GMP and GCP compliance, an applicant must incur significant expenditure of time, money and effort in the areas of training, record keeping, production, and quality control.

Notwithstanding the submission of relevant data and information, the FDA may ultimately decide that the BLA does not satisfy its regulatory criteria for approval and deny approval. Data obtained from clinical trials are not always conclusive and the FDA may interpret data differently than we interpret the same data. If the agency decides not to approve the BLA in its present form, the FDA will issue a complete response letter that describes all of the specific deficiencies in the BLA identified by the FDA. The deficiencies identified may be minor, for example, requiring labeling changes, or major, for example, requiring additional clinical trials. Additionally, the complete response letter may include recommended actions that the applicant might take to place the application in a condition for approval. If a complete response letter is issued, the applicant may either resubmit the BLA, addressing all of the deficiencies identified in the letter, or withdraw the application.