UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,, D.C.20549 D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20122013

OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 0-53965

GRAHAM ALTERNATIVE INVESTMENT

FUND I LLC

(Exact name of registrant as specified in its charter)

| DELAWARE | 20-4897069 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

c/o GRAHAM CAPITAL MANAGEMENT, L.P.

40 Highland Avenue

Rowayton, CT 06853

(Address of principal executive offices) (zip code)

Paul Sedlack

Graham Capital Management, L.P.

40 Highland Avenue

Rowayton, CT 06853

(203) 899-3400

(Name, address, including zip code, and telephone number, including area code,

of agent for service)

Copies to:

Christopher Wells

Proskauer Rose LLP

11 Times Square

New York, NY10036NY 10036

| Securities to be registered pursuant to Section 12(b) of the Act: | None | |

| Securities to be registered pursuant to Section 12(g) of the Act: | Blended Strategies Portfolio: Units of Interests | |

| (Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to section 13 or section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this form 10-K þ.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated file or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes o No þ

Units of the Systematic Strategies Portfolio and the Blended Strategies Portfolio with an aggregate value of $39,052,950 and $225,385,271, respectively,$112,648,921 were outstanding and held by non-affiliates as of June 30, 2012.2013.

As of February 28, 2013, 236,498.777 Units of the Systematic Strategies Portfolio were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

| Item 1: BUSINESS |

GRAHAM ALTERNATIVE INVESTMENT FUND I LLC

General Development of Business

Graham Alternative Investment Fund I LLC (“GAIF I”), is a Delaware limited liability company,Series Limited Liability Company established through an amendment to the certificate of formation, effective March 28, 2013. Prior to March 28, 2013, GAIF I was organized as a Delaware Limited Liability Company which was formed on May 16, 2006. GAIF I was formed to enable U.S. taxable investors to achieve long-term capital appreciation through professionally managed trading in both U.S. and foreign markets, primarily in futures contracts, forward currency and metals contracts, spot currency contracts and associated derivative instruments such as options and swaps. GAIF I commenced operations on August 1, 2006.

Investors in GAIF I may invest in eitherany or bothall of twothree different portfolios, the Blended Strategies Portfolio, the Systematic Strategies Portfolio, or the SystematicDiscretionary Strategies Portfolio. The Blended Strategies Portfolio uses a systematic trading program and a discretionary trading program. The Systematic Strategies Portfolio uses solely a systematic program. The Discretionary Strategies Portfolio uses solely a discretionary trading program. The Blended Strategies Portfolio units of interest are the only ones registered under the Securities Act of 1934, as amended, and the financial information and statements contained herein are solely with respect to that Portfolio.

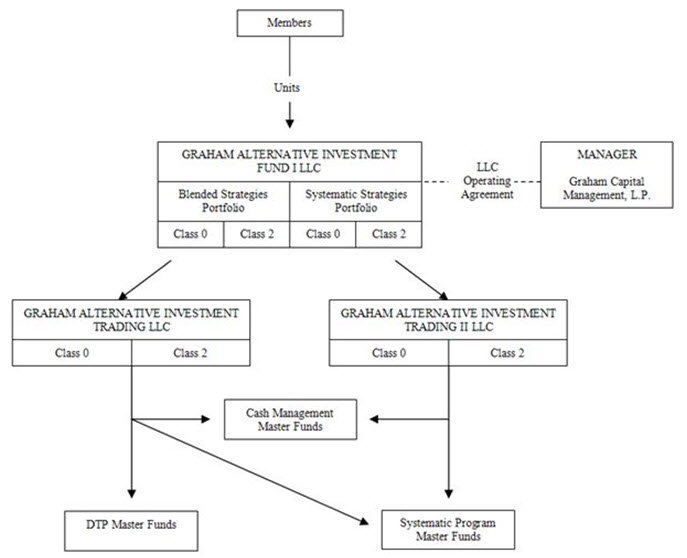

GAIF I invests substantially all of its assets into twothree feeder funds each of which in turn invests substantially all of its assets in one or more master funds. Assets invested in the Blended Strategies Portfolio will be invested by GAIF I in Graham Alternative Investment Trading LLC (“GAIT”) and , assets invested in the Systematic Strategies Portfolio will be invested by GAIF I in Graham Alternative Investment Trading II LLC (“GAIT II”), and assets invested in the Discretionary Strategies Portfolio will be invested by GAIF I in Graham Alternative Investment Trading III LLC (“GAIT III”), each of which is a Delaware limited liability company (the “Feeder Funds”). For the purposes of this report,registration statement, the term “Fund” shall include each of GAIF I, the Feeder Funds and the master funds in which they invest, unless the context implies otherwise. Graham Capital Management, L.P. (the “Manager”) is the Fund’s manager and the investment advisor to the Fund.

The investment objective of each portfolio of the Fund is to achieve long-term capital appreciation through professionally managed trading in both U.S. and foreign markets, primarily in futures contracts, forwards contracts, spot currency contracts and associated derivative instruments such as options and swaps. The Fund seeks profit opportunities in the global financial markets, including interest rates, foreign exchange, global stock indices and energy, metals and agricultural futures, as a professionally managed multi-strategy investment vehicle.

Each portfolio of the Fund consists of multiple trading strategies of the Manager, which the Manager has combined in an effort to diversify the investment exposure of each portfolio and to make the performance returns of each portfolio less volatile and more consistently profitable. The Manager seeks to combine in each portfolio investment strategies that trade in different markets and display relatively low correlation to each other. Through such composition, the Manager aims to provide each portfolio with the potential to make profits and have strong risk-adjusted returns in both rising and falling markets and during both expanding and recessionary economic cycles. In discretionary programs, a trader determines trades subjectively based on personal assessment of trading data and trading experience, while in systematic programs, trades are based almost entirely on computerized mathematical models. The Fund, at all times, will look primarily to commodity interests as its principal intended source of gains and anticipates that at all times commodity interests will present the Fund’s primary risk of loss, and the Fund will not acquire any financial instrument or enter into any financial transaction if to do so would cause the Fund to look to securities as its principal intended source of gains or anticipate that securities will present the Fund’s primary risk of loss. Examples of the types of instruments that the Fund may trade by market include, but are not limited to:

Global fixed income: U.S. Treasury futures, Eurodollar futures and Japanese government bond futures

Global stock indices: futures contracts on the Russell 2000, S&P 500 and TOPIX

Foreign exchange: forward contracts on the British pound, Euro,euro, Japanese yen and Swiss franc

Energy: futures contracts on heating oil, natural gas and crude oil

Agriculture and Softs: futures contracts on cotton, feeder cattle, lean hogs and soybeans

Metals: futures or forward contracts on aluminum, copper and gold

1

The Manager believes strongly in the importance of its ongoing research activities, particularly in the development of new trading programs, and expects to develop additional trading systems for the Fund and to modify the systems currently in use for the Fund over time. The Manager also seeks to add new trading strategies to its discretionary programs and to modify such strategies over time. There is no maximum number of trading programs that the Manager may see fit to include in either the Blended Strategies Portfolio, the Systematic Strategies Portfolio, or the SystematicDiscretionary Strategies Portfolio, and the Manager may increase or decrease the number of programs included in each portfolio over time. The Manager continually updates and modifies its trading programs, and may make such additions or deletions of trading programs to either the Blended Strategies Portfolio, the Systematic Strategies Portfolio, or the SystematicDiscretionary Strategies Portfolio at any time– such as changes in the leverage of, or in the asset allocations to, any of the Fund’s trading programs – in its sole discretion. The Fund is not required to provide prior, or any, notice of any such changes to investors.

Under the Limited Liability Company Agreement of GAIF I (the “Company Agreement”), the Manager has complete and exclusive responsibility for management and administration of the affairs of GAIF I. The Manager is currently registered as a commodity pool operator (“CPO”) and commodity trading advisor (“CTA”) with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National Futures Association (“NFA”). The Manager is also registered as a Registered Investment Advisor with the Securities and Exchange Commission (the “SEC”). GAIF I is not required to be, and is not, registered under the Investment Company Act of 1940, as amended. Investors purchasing units of interests (the “Units”) in GAIF I have no rights to participate in the management of the Fund. Units are sold through dealers that are not affiliated with the Fund or the Manager.

Pursuant to the Company Agreement, GAIF I’s term will end upon the first to occur of the following:

December 31, 2050; |

the withdrawal (voluntary or involuntary), bankruptcy or an assignment for the benefit of creditors or dissolution of the Manager; or |

any date prior to December 31, 2050 on which the Manager elects to dissolve GAIF I. |

GAIF I’s business constitutes only one segment for financial reporting purposes (i.e., a speculative commodity pool). GAIF I does not engage in sales of goods or services.

As of February 28, 2013,2014, the aggregate Net Asset Value (as defined below under “Allocation of Profit and Loss”) of the Units in GAIF I was $174,646,449.$90,522,795. GAIF I operates on a calendar fiscal year.

Narrative Description of Business

| (i) | General |

GAIF I offers foursix classes (each a “Class”) of Units, being Class 0 Units and Class 2 Units of the Blended Strategies Portfolio, and Class 0 Units and Class 2 Units of the Systematic Strategies Portfolio, and Class 0 and Class 1 Units of the Discretionary Strategies Portfolio. As further described below under “Fees,” Class 0, Class 1, and Class 2 Units of each portfolio differ only as to their applicable fees. Subscriptions for Units of any Class may be accepted by GAIF I as of the first business day of each month upon written notice of at least three business days prior to the last business day of the preceding month, and on such other notice and dates as the Manager may permit in its sole and absolute discretion.

Units of each Class of each portfolio are offered at their Net Asset Value per Unit as of the end of each month. The minimum initial investment for Class 0 Units is $50,000 (this Class is primarily for “wrap fee programs”) and the minimum additional investment is $5,000. Wrap fee programs bundle the various services provided to a client by a broker or financial advisor in a single fee arrangement rather than charging the client fees for specific transactions. The minimum initial investment for Class 1 and Class 2 Units is $50,000 and the minimum additional investment is $5,000. GAIF I will be continuously offered and has no limit on the maximum aggregate amount of subscriptions that may be contributed to it.

2

Capital contributions by a single subscriber for any Class of Units, upon acceptance of the subscriber as a member, represent a single interest in GAIF I for that subscriber’s respective Class of Units. A Unit of each Class reflects a member’s interest in GAIF I’s net assets with respect to the Class of Units owned by the member. Although separate Classes of Units in a portfolio are offered, all capital contributions to a particular portfolio are pooled by GAIF I and invested in GAIT, GAIT II, or GAIT II,III as applicable. Units may be purchased only by investors who qualify as accredited investors under Regulation D of the Securities Act of 1933 as amended (the “Securities Act”(“Securities Act��). The principal differences among the separate Classes of Units within the same portfolio are their fees. Holders of Units, regardless of which Class of a portfolio they hold, participate pro rata in the profits and losses of that portfolio in proportion to the Net Asset Value of the Class and have identical rights, as members, under the Company Agreement.

3

| (ii) | The Manager |

The Manager was organized in May 1994 as a Delaware limited partnership. The general partner of the Manager is KGT, Inc., a Delaware corporation of which Kenneth G. Tropin is the sole director and sole shareholder. KGT, Inc. became a listed Principal of the Manager effective July 27, 1994. The Manager has been registered as a CPO and CTA under the Commodity Exchange Act (“CEA”) and has been a member of the NFA since July 27, 1994. As of March 1, 2013,2014, the Manager has approximately 233 employees226 personnel and manages assets of over $8$7 billion. The Manager’s principal office is located at 40 Highland Avenue, Rowayton, Connecticut 06853 and its telephone number is (203) 899-3400. An affiliate of the Manager, Graham Capital LLP, has an office in London, Englandlocated at 55 Baker Street, London W1U 8EW.England.

| (iii) | The Trading Program |

The Fund offers twothree separate portfolios, each representing a different investment program: the Blended Strategies Portfolio, the Systematic Strategies Portfolio, and the SystematicDiscretionary Strategies Portfolio. The Manager strives to combine various trading strategies within each portfolio in order to diversify the investment exposure of each portfolio and reduce its dependence on any single trading strategy. The Manager also seeks trading strategies that have low correlation to each other in an effort to make the performance returns of each portfolio, so far as is practicable, less volatile and more consistently profitable. The Manager’s Investment Committee, which is comprised of Kenneth G. Tropin, Pablo Calderini, Paul Sedlack, Robert E. Murray, Pablo Calderini, William Pertusi, Barry S. Fox, Jeff Baisley andBrian Douglas, Thomas P. Schneider, and James A. Madeiros makes decisions with respect to the selection of strategies traded on behalf of the Fund.

Biographical information regarding the members of the Investment Committee is set forth below.

Kenneth G. Tropin, 5960, is the Chairman and the founder of the Manager. In May 1994, he founded the Manager and became an Associated Person and Principal effective July 27, 1994. Mr. Tropin is responsible for the overall management of the organization, including the investment of its proprietary trading capital.

Pablo Calderini, 48,49, is the President and Chief Investment Officer of the Manager and among other things, is responsible for the management and oversight of the discretionary trading business and portfolio managers at the Manager. He joined the Manager in August 2010 and became an Associated Person and Principal of the Manager effective August 13, 2010. Prior to joining the Manager, Mr. Calderini worked at Deutsche Bank from June 1997 to July 2010 where he held positions of increasing responsibility, most recently the Global Head of Equity Proprietary Trading. Mr. Calderini commenced his career at Deutsche Bank as Global Head of Emerging Markets. During his tenure at Deutsche Bank, Mr. Calderini also helped manage several groups across the fixed income and equity platforms, including the Global Credit Derivatives Team. Mr. Calderini received a B.A. in Economics from Universidad Nacional de Rosario in 1987 and a Masters in Economics from Universidad delCemadel Cema in 1988, each in Argentina.

Paul Sedlack, 5253, is the Chief ExecutiveOperating Officer, Vice Chairman, and the General Counsel of the Manager. He joined the Manager in June 1998 and became an Associated Person of the Manager effective November 20, 1998 and a Principal on August 21, 1998. He oversees the operation of the finance and administration departments and is also responsible for all legal and compliance matters. Mr. Sedlack received a J.D. from CornellLawSchoolCornell Law School in 1986 and an M.B.A. in Finance in 1983 and B.S. in Engineering in 1982 from State University of New York at Buffalo.

Robert E. Murray, 5253, is the Chief OperatingExecutive Officer of the Manager and is responsible for the management and oversight of client services, quantitative trading, and technology and risk management at the Manager. He joined the Manager in June 2003 and became an Associated Person and Principal of the Manager effective June 27, 2003. Mr. Murray received a Bachelor’s Degree in Finance from GeneseoStateUniversityGeneseo State University in 1983.

William Pertusi, 5253, is the Chief Risk Officer of the Manager, responsible for identifying, monitoring and acting upon financial risks relative to financial returns in the Manager’s diverse trading strategies. He became an Associated Person of the Manager effective July 24, 2006 and a Principal on November 28, 2006. Prior to joining the Manager in April 2006, Mr. Pertusi held the positions of Director and Risk Manager at SAC Capital Advisors LLC, an investment management firm, from July 2004 to April 2006. From July 2002 to July 2004, he was employed as a Portfolio Manager at SAC specializing in Mortgage Backed Securities. Mr. Pertusi was an associated person of SAC from June 2003 to June 2006 and a principal from June 2003 to May 2005. Mr. Pertusi received a B.S. in Electrical Engineering from LehighUniversityLehigh University in 1983, an M.B.A. from Harvard in 1987, and an M.S. in Mathematics from FairfieldUniversityFairfield University in 2006.

4

Barry S. Fox, 4950, is Director of Research of the Manager. He became an Associated Person of the Manager effective November 10, 2000 and a Principal on November 15, 2007. Mr. Fox joined the Manager in August 2000.2000 as a portfolio manager and developed several quantitative trading programs. In May 2005, he joined the Manager’s Research Department, and in October 2005 was appointed Co-Associate Director of Research. Mr. Fox was appointed Director of Research in April 2007. Mr. Fox received a B.S. in Business Administration from State University of New York at Buffalo in 1986.

Thomas P. Schneider, 5051, is an Executive Vice President and the Chief Trader of the Manager. He joined the Manager in June 1994 and became an Associated Person of the Manager effective September 12, 1994 and a Principal on November 30, 1995. He is responsible for managing the Manager’s quantitative futures and foreign exchange trade execution, including all of its core and short term quantitative trading strategies, and developing and maintaining relationships with independent executing brokers and futures commission merchants (“FCMs”). Mr. Schneider graduated from the University of Notre Dame in 1983 with a B.B.A. in Finance and received his Executive M.B.A. from the University of Texas at Austin in 1997.

James A. Medeiros, 40, is a Senior Managing Director of the Manager responsible for the firm’s Investor Relations group. He joined the Manager in July 2009 and became an Associated Person of the Manager effective July 21, 2009 and a Principal on February 7, 2013. Prior to joining the Manager, Mr. Medeiros was a member of the Investor Relations group at Moore Capital Management, L.P., a hedge fund manager, from August 2003 to July 2009, where he managed relationships with a wide variety of institutional and private clients. Mr. Medeiros received a Bachelor of Science from the Edmund A. Walsh School of Foreign Service at Georgetown University in 1996, and received an M.B.A. from the Wharton School at the University of Pennsylvania in 2003.

The discretionary traders for any discretionary investment strategy selected to trade on behalf of the Fund make the trading decisions for that discretionary strategy. The Manager has developed sophisticated proprietary software to study optimal portfolio weighting strategies and the effect of specific markets on the performance, risk, correlation and volatility characteristics of each of its trading strategies. As a result, the weighting or leverage that a trading strategy uses in each market may change to address changes in market conditions. With such software, the Manager devotes considerable attention to risk management at the portfolio level in an effort to ensure balance between markets and that the overall leverage used by each portfolio is consistent with the Manager’s overall views on risk. The Manager’s objective in forming the investment program of each portfolio is to provide the portfolio with significant potential for capital appreciation in both rising and falling markets and during expanding or recessionary economic cycles. Currently, the Blended Strategies Portfolio allocates 50% of its assets to the Manager’s Discretionary Trading Program (“DTP”) and 50% of its assets to the Manager’s Systematic Trading Program (“K4D”), but the Manager may alter these allocations to DTP and the K4D Program at any time within its sole discretion. The Systematic Strategies Portfolio allocates 100% of its assets to the Manager’s K4D Program, but the Manager may over time add other systematic trading programs to the Systematic Strategies Program. The Discretionary Strategies Portfolio allocates 100% of its assets to the Manager’s Discretionary Strategies Program.

The Fund will trade actively in both U.S. and foreign markets, primarily on major futures exchanges as well as the inter-bank cash currency and swaps markets. The Fund also engages in exchange for physical (EFP) transactions, which involve a privately negotiated and simultaneous exchange of a futures position for a corresponding position in the underlying physical commodity, and the Fund may use other derivatives in addition to swaps. The Manager may also trade other financial instruments as it endeavors to achieve superior results for investors and enhanced portfolio diversification. The Manager reserves the right in extraordinary market conditions to reduce leverage and portfolio risk if it feels in its sole discretion that it is in the potential best interest of the Fund. While such actions are anticipated to occur very infrequently, no assurance can be given that the Manager’s actions will enhance performance or that any efforts by the Manager to achieve portfolio diversification will be successful.

5

The Manager expects to add additional trading strategies and programs to each portfolio and to modify the strategies currently in use for each portfolio over time, and may in the future offer other portfolios.portfolios. There is no maximum number of strategies and programs that the Manager may see fit to include in the Fund or each portfolio, and the Manager may increase or decrease the number of strategies and programs included in the Fund or each portfolio over time or increase the number of markets or contracts that are traded on behalf of the Fund or each portfolio. The Manager may make such additions or deletions of trading programs to the Fund or each portfolio at any time and may make such additions, deletions or any other changes, such as changes in the leverage of, or in the asset allocations to, any of the Fund’s trading strategies and programs, in its sole discretion and without prior notice to members.

In constructing a portfolio, the Manager employs various risk management protocols. The Manager conducts risk analysis and employs risk management controls at various levels of the Fund, including portfolio risk, strategy risk, market risk and execution risk. The objectives of its risk management approach are to measure a portfolio’s quantitative and qualitative exposures to the risks identified, formulate appropriate policies and procedures in an effort to prudently manage overall risk, monitor compliance with the Manager’s risk policies and procedures and report identified and measured risks to the Manager’s Risk Committee.

Effective testing, reporting and review are critical elements of the Manager’s risk management process. Daily stress testing is performed to evaluate a strategy’s risk exposure. Daily reporting of Value-at-Risk (VaR), plus intraday reporting of net gains or losses for each strategy, enables the risk management team and the Manager’s Investment Committee to observe the strategy’s adherence to its investment profile as well as market exposure. VaR is a probabilistic measure of the amount of loss, often referred to as the threshold, that a portfolio of investments will experience over a specified time period. For example, the Manager utilizes a one day 97.5% VaR, which means that in respect of the portfolio that it is analyzing it expects the portfolio to experience a loss in excess of VaR on approximately 1 out of every 40 days. Finally, each strategy is formally reviewed by the Investment Committee on a monthly basis.

As part of its efforts to manage risk, the Manager limits the size and structure of positions taken on behalf of each Portfolio so that they comply with various risk parameters, both those defined by the Manager and, with respect to the DTP, those defined by each of the individual discretionary traders for the Fund’s underlying trading strategies.

The Fund currently employs a master-feeder structure for its individual trading programs such that each portfolio’s trading program may, but will not necessarily in all cases, be conducted through one or more master funds. Each of the master funds is managed by one or more employees of the Manager. The master funds were organized by the Manager in order to facilitate the management of various funds and accounts managed by the Manager using in whole or in part the same trading program. The Fund, alternatively, may trade its individual trading programs through one or more managed accounts in the Fund’s name.

Discretionary Trading Program

The Manager has been trading discretionary programs since February 1998. Discretionary programs, unlike systematic programs which are based almost entirely on computerized mathematical models, determine trades subjectively on the basis of a trader’s personal assessment of trading data and trading experience. Although the Manager has had over a decade of experience trading various discretionary programs, DTP itself commenced trading as of August 2008. DTP seeks to invest in various global macro markets that are highly liquid. DTP consists of several of the Manager’s leading discretionary strategies traded by employees of the Manager that focus on the global fixed income, stock index, currency, energy, commodity and metals markets, but over time it may participate in any other liquid market that is available as the Manager deems appropriate.

6

The Manager’s discretionary programs have generally displayed a significant degree of non-correlation with traditional and other alternative investments, including with the Manager’s own quantitative investment programs. In its composition of DTP, the Manager will seek an investment portfolio that continues to offer such non-correlation and that provides diversification to other investments. DTP may take both long and short positions and thus may generate successful performance results in both rising and declining markets. The holding periods of its positions may range, depending on the individual trading strategies, from just a few hours to months, such that DTP may potentially profit in markets that exhibit either short-term moves or long-term trends. As with its systematic investment programs, the Manager may add or delete trading strategies or trading markets in DTP or alter their individual weightings or leverage as it deems appropriate, and no notice will be given to investors of such allocation changes; in addition, discretionary strategies that have previously traded on behalf of the Fund may be included in DTP. The Manager may make such allocation changes based on a proprietary allocation model, its assessment of market conditions or the availability of additional discretionary trading strategies, in its discretion.

Using a proprietary asset allocation model, the Manager’s Investment Committee determines the appropriate strategies for a portfolio and the weighting of each in the portfolio. At the individual strategy level, the Manager works closely with each discretionary trader to design an appropriate investment profile, including return objective and volatility level. Through continuous monitoring and an active dialogue with every discretionary trader, the Manager seeks to identify and minimize any deviations from the investment profile. In addition, the Manager has implemented a uniform set of risk guidelines for all discretionary traders designed to reduce a strategy’s downside risk potential. The Manager has developed a trade execution and reporting infrastructure designed to minimize the risk of errors. For example, where appropriate, trades are manually checked for accuracy by the Manager’s Middle Office staff and are subject to additional cross checking using computerized means. Each discretionary trader’s positions must adhere to established risk management guidelines and position limits, which are regularly monitored by the Manager’s Risk Management team.

The Manager subjects the trading of all its discretionary traders to a risk monitoring regime that includes a set of defined drawdown limits and a series of risk measurements. Draw down limits are used as a risk management tool to enforce risk reduction on a discretionary portfolio if the discretionary trader is experiencing losses and has not yet reduced overall risk levels. The Manager generally defines a draw down as losses experienced over a specified period of time, expressed as a percentage of net assets at the beginning of the period. The Manager imposes daily, monthly, and overall draw down limits for all discretionary portfolios. There is a daily move that requires a prompt report to the risk manager, a monthly peak to trough drawdown that likely leads to risk reduction, and a total peak to trough drawdown that likely leads to risk reduction. There is also a drawdown limit where the Manager’s Investment Committee would meet to consider closing a given program. Further, the Manager conducts a daily risk process measuring VaR and reviewing stress tests for all its portfolios, including the aggregate of those portfolios comprising the Fund. The Manager evaluates the validity of VaR as a risk management tool by comparing the number of instances that profit and loss exceeded expected parameters over various time frames. In addition, the Manager runs an extensive series of stress tests, including historical scenarios as well as specific foreign exchange, equity and interest rate shocks.

In addition to the risk monitoring procedures employed by the Manager, each discretionary trader trading on behalf of a discretionary strategy for the Fund has established his or her own proprietary risk measures and parameters. These generally include measures of first order sensitivities (i.e., the sensitivity of the portfolio to a change in a parameter of the underlying instruments) to the most relevant risk factors for a given book (for example, the dollar value of a basis point in the case of interest rate products), measurement of stress loss in extreme market events, or the use of explicit stop loss points. When individual limits on any of these are breached, the discretionary trader likely will reduce risk even if within the Manager’s guidelines.

The descriptions contained herein of DTP should not be understood as in any way limiting its investment activities. In addition, the Fund may engage in investment strategies and programs not described herein that the Manager considers appropriate.

7

Systematic Trading Program

The Manager’s systematic investment programs employ various quantitatively based systems that are designed to participate selectively in potential profit opportunities that can occur in a diverse number of U.S. and international markets. Such systems generally are based on computerized mathematical models and rely primarily on technical (i.e., historic price and volume data) rather than fundamental (i.e., general economic, interest rate and industrial production data) information as the basis for their trading decisions. The systems establish positions in markets where the price action of a particular market signals the computerized systems that a potential move in prices is occurring. The systems are designed to analyze mathematically the recent trading characteristics of each market and to statistically compare such characteristics to the historical trading patterns of the particular market. The systems also employ proprietary risk management and trade filter strategies that seek to benefit from price moves while reducing risk and volatility exposure.

Each systematic investment program of the Manager incorporates trading strategies developed by the Manager’s research department. While the Manager’s systematic investment programs have employed long-term systematic strategies from their inception, the programs may also include trend systems with varying time horizons as well as high frequency trading systems, counter-trend trading systems and trading systems that do not seek to identify or follow price trends at all. For example, high frequency trading systems, counter-trend systems, non-trend systems and other strategies may add value attributable to their low correlation to the Manager’s trend systems, reducing volatility and risk. Importantly, high frequency trading systems, counter-trend systems, non-trend systems and other strategies may generate successful performance results in trading range type markets where there are few long-term trends.

The Manager believes strongly in the importance of research and development of new trading strategies and expects to develop additional trading systems and strategies and to modify the systems currently in use in its systematic programs over time in its ongoing efforts to keep pace with changing market conditions. As an example of such efforts, the Manager has incorporated a proprietary risk model within its K4D program to systematically adjust the program’s exposure based on proprietary factors that assess prices, correlation and volatility in the near term. The decision to add or subtract systems or strategies from any investment program shall be at the Manager’s sole discretion. The Manager anticipates that the range of trading strategies comprising the K4D program will continue to grow and evolve over time.

In connection with the Fund’s systematic trading, the Manager may employ discretion in determining the leverage and timing of trades for new accounts and the market weighting and participation. In unusual or emergency market conditions, the Manager may also utilize discretion in establishing positions or liquidating positions or otherwise reducing portfolio risk where the Manager believes, in its sole discretion, that it is in the potential best interest of the Fund to do so. As an example of the Manager’s use of discretion, in response to the significant disruption in the general markets caused by the financial crisis, over the course of the fourth quarter of 2008 the Manager increasingly reduced, by up to approximately 50%, the portfolio risk of its trading systems. As a result of this use of discretion, the Fund’s trading activities generated less profit during that period than would have been the case if portfolio risk had not been reduced. While such actions are anticipated to occur very infrequently, no assurance can be given that the Manager’s discretionary actions in these programs will enhance performance, and in fact such actions may cause the Fund to experience losses that it otherwise might not have incurred if the Manager had not intervened.

The K4D Program includes the first system that the Manager developed, which began trading client accounts in 1995. It utilizes multiple computerized trading models and offers broad diversification in both financial and non-financial markets, trading in approximately 100 global markets. On a daily basis, the computer models analyze the recent price action, the relative strength and the risk characteristics of each market and compare statistically the quantitative results of this data to years of historical data on each market. The K4D Program’s original systematic strategy is primarily long-term in nature, but the program also includes short-term and intermediate-term trend-following as well as momentum and other non-trend following strategies.

8

The investment objectives and methods summarized above represent the Manager’s current intentions. Depending on conditions in the financial and securities markets and the economy in general, the Manager may pursue other objectives, employ other investment techniques or purchase any type of financial instrument that it considers appropriate and in the best interests of the Fund, whether or not described in this section.

| (iv) | Use of Proceeds |

JPMorgan Chase Bank N.A. serves as the Fund’s banker for purposes of receiving subscription funds, disbursing redemption payments and processing cash transactions not directly related to the Fund’s portfolio.

Bank of America, N.A. serves as the Fund’s banker for transactions on behalf of each portfolio. A significant portion of the Fund’s assets may be held by Bank of America, N.A. in addition to the futures clearing brokers utilized on behalf of the Fund as well as OTC counterparties. The Fund may also hold excess funds not required for trading in bank accounts at Bank of America, N.A. or elsewhere. The Manager, in its discretion, may change the brokerage and custodial arrangements described herein without notice to investors.

GAIF I currently has no direct arrangement with any futures commission broker; rather each master fund that trades on behalf of the Fund may have its separate clearing arrangements with a futures broker. At present, Credit Suisse Securities (USA) LLC, Merrill Lynch, Pierce Fenner& Smith Incorporated(the successor to Bank of America Securities LLC as futures broker after Bank of America’s merger with Merrill LynchIncorporated, and Co.), and Barclay’s Capital Inc. are the primary futures clearing brokers for the master funds, but neither the Fund nor the master funds are required or under any contractual obligation to continue to employ them as futures clearing brokers (together with additional or replacement clearing brokers the Manager may select from time to time without notice to investors, the “Futures Brokers”). The Manager is authorized to determine the Futures Broker (or the counterparty, if concerning a foreign currency or swap transaction) to be used for each portfolio transaction for the Fund. The Manager is not affiliated with any futures commission merchant or broker-dealer.

Each Futures Broker will obtain, safe-keep and maintain custody of all of the Fund’s fully paid assets held by it in a customer account identified on the books of the Futures Broker as belonging to the Fund and segregated from the broker’s own proprietary positions. All of the Fund’s assets, funds, securities and other property held by each Futures Broker are held as security or collateral for the Fund’s obligations to the broker. The margin levels required to initiate or maintain open positions are established from time to time by each Futures Broker and applicable regulatory authorities. Each Futures Broker may close out positions, purchase securities, or cancel orders for the Fund’s account at any time it deems necessary for its protection, generally without the consent of or notice to the Fund.

Agreements with Futures Brokers in general provide that the broker will not be liable in connection with the execution, clearing, handling, purchasing, or selling of commodities, or other property, or other action, except for negligence or misconduct on the broker’s part. Such agreements also may provide that the Futures Broker will be indemnified and held harmless by the Fund from and against any loss, claim, or expense (including attorney’s fees) incurred by the broker in connection with it acting or declining to act for the Fund, and that the Fund will fully reimburse the broker for any legal or other expenses (including the cost of any investigation and preparation) which the broker may incur in connection with any claim, action, proceeding, or investigation arising out of or in connection with the agreement or the transactions contemplated thereunder.

9

In addition to trading in the Interbank market for foreign exchange, the Fund currently trades on all the major U.S. futures exchanges and may also trade on, but is not limited to, the following foreign exchanges:

Bolsa de Mercadorias and Futuros

Eurex Exchange

EURONEXT/London International Financial Futures and Options Exhcnage

EURONEXT/Paris MONEP

European Options Exchange

Hong Kong Exchanges and Clearing Ltd.

Intercontinental Exchange

London Metal Exchange Ltd.

Montreal Exchange

Osaka Securities Exchange

Singapore Exchange Ltd.

South African Exchange

Stockholm Stock Exchange

Sydney Futures Exchange Ltd.

Tokyo Commodity Exchange

Tokyo Financial Exchange

Tokyo Stock Exchange

In connection with such trading on foreign exchanges, the Fund’s assets may be deposited by the futures brokers with foreign brokers or banks. Although these foreign brokers or banks are subject to local regulation in their jurisdiction, the protections afforded by foreign regulatory bodies and rules may differ significantly from those afforded by United States regulators and rules.

The Fund expects to earn interest on cash not required to be posted as margin for its trading. Cash not required by the Fund’s investment programs for trading is currently invested by the Manager in a separate cash management master fund, Graham Cash Assets LLC (“Cash Assets”), managed by the Manager. The Fund pays the Manager no additional fees for managing the Fund’s assets in Cash Assets. It is currently anticipated that on average between 70% and 90% of the assets of each portfolio will be invested in Cash Assets. Various investment funds managed by the Manager and other entities affiliated with the Manager may invest in Cash Assets and each such entity bears its proportional share of the operating expenses of Cash Assets. Cash Assets may pay some third-party fees to unaffiliated custodians or managers in connection with the management of its portfolio, which fees will effectively be borne pro rata by all investment vehicles that invest in Cash Assets. Cash Assets may deposit a portion of its assets in an interest bearing bank account with Bank of America N.A. or other banks or in brokerage accounts, or it may purchase securities which are direct obligations of or obligations guaranteed as to principal or interest by the United States (e.g. U. S. Treasury Bills), or other securities issued or guaranteed by corporations in which the United States has a direct or indirect interest (e.g., U.S. government agency securities) which have been designated pursuant to section 3(a)(12) of the Securities Exchange Act of 1934 as amended (the “exchange Act”) as exempted securities. The Fund may invest in other cash management master funds managed by the Manager in the future or it may manage its cash directly either through deposit accounts at banks or by purchasing those types of securities described above that are currently purchased by Cash Assets.

10

The Manager determines, in its sole and absolute discretion, the amount of distributions, if any, to be made by the Fund. It is expected that dividends ordinarily will not be paid and that all portfolio earnings will be retained for reinvestment (subject to the redemption privilege).

Fees

| (i) | Advisory Fee |

Pursuant to the Company Agreement, each Class of the Blended Strategies Portfolio and Systematic Strategies Portfolio of the Fund pays the Manager an advisory fee (the “Advisory Fee”) at an aggregate annual rate equal to 2%1.75% of the Net Asset Value of such Class. Each Class of the Discretionary Strategies Portfolio of the Fund pays the Manager an Advisory Fee of 2.25%. For purposes of calculating the Advisory Fee, the Net Asset Value of each Class equals the total fair market value of the assets of the Fund attributable to that Class less the liabilities of the Fund attributable to that Class. Profits and losses are allocated among the Classes in proportion to their respective Net Asset Values (before accrual of the Brokerage and Sponsor FeesFee and the Incentive Allocation set forth below). The Advisory Fee is payable monthly in arrears calculated as of the last business day of each month (before giving effect to any redemptions as of the last business day of the month and subscriptions as of the beginning of the next business day, and before deduction or accrual of fees payable to the Manager and the Incentive Allocation). If the Company Agreement is terminated as of a date other than the last business day of a month, the Advisory Fee will be prorated through the termination date.

| (ii) |

| Sponsor Fee |

Each Class 0 of the Fund pays the Manager a sponsor fee (the “Sponsor Fee”) at an annual rate of 1%0.75% of its Net Asset Value, each Class 1 of the Fund pays the Manager a Sponsor fee at an annual rate of 1.75% of its Net Asset Value, and each Class 2 of the Fund pays the Manager a Sponsor Fee and an annual rate of 2.75% of its Net Asset Value, in each case payable monthly in arrears, determined in the same manner as the Advisory Fee.

11

| Incentive Allocation |

Each Class of Blended Strategies Portfolio and the Systematic Strategies Portfolio of the Fund bears a quarterly Incentive Allocation, payable to the Manager as of the end of each calendar quarter, equal to 20% of the net profits of the Class for the quarter, subject to a “loss carryforward” provision. Each Class of Discretionary Strategies Portfolio of the Fund bears a quarterly Incentive Allocation, payable to the Manager as of the end of each calendar quarter, equal to 25% of the net profits of the Class for the quarter, subject to a “loss carryforward” provision. The loss carryforward provision generally provides that the Manager will not receive an Incentive Allocation in respect of the Class for a calendar quarter to the extent that the Class experiences net loss since the last calendar quarter for which an Incentive Allocation was earned and such loss has not been recouped through subsequent net profits. The Incentive Allocation is calculated and paid as follows: At the end of each calendar quarter, the Incentive Allocation is deducted from the Net Asset Value of each Class and credited to the Capital Account of the Manager in the Feeder Funds, in an amount equal to 20% of New High Net Trading Profits (as defined below) with respect to each class of the Blended Strategies Portfolio and the Systematic Strategies Portfolio for such Classperiod, and in an amount equal to 25% of New High Net Trading Profits with respect to each class of the Discretionary Strategies Portfolio for such period. “New High Net Trading Profits” for any Class for any quarter shall mean the Net Capital Appreciation (which includes unrealized gains and losses and interest income and expense, less all accrued debts, liabilities and obligations of the Class (but before any accrual for the Incentive Allocation) for such period) for the quarter minus the Carryforward Loss (as defined below), if any, as of the beginning of the quarter, for such Class. The “Carryforward Loss” shall be increased as of the end of each calendar quarter by the amount of any Net Capital Depreciation with respect to such Class during the quarter then ended, and shall be decreased (but not below zero) as of the end of each calendar quarter by the amount of any Net Capital Appreciation with respect to such Class during the quarter then ended. In addition, the Carryforward Loss for a Class for any calendar quarter shall be proportionately reduced effective as of the date of redemption of any Units of such Class by multiplying (i) the Carryforward Loss for such Class immediately prior to such redemption by (ii) the ratio that the amount of assets redeemed from such Class bears to the Net Assets of such Class immediately prior to such redemption. The Carryforward Loss of a Class must be recouped before any subsequent Incentive Allocation can be made to the Manager. The Incentive Allocation is also accrued and allocable on the date of redemption with respect to any Units that are redeemed on any date not the end of a calendar quarter, as if the date of redemption were the end of a calendar quarter and the Incentive Allocation shall only be deducted with respect to such redeemed Units.

A portion of any of the above fees (including the Incentive Allocation) may be paid by the Manager to third parties as compensation for offering or selling activities in connection with the Fund.

| Reporting The Fund is required to furnish annual reports to its members containing financial statements examined by the Fund’s independent registered public accounting firm. The Fund is also required to provide members with monthly performance updates. Item 1A: RISK FACTORS |

All investments risk the loss of capital. No guarantee or representation is made that either portfolio of the Fund will achieve its investment objective. An investment in the Fund is speculative and involves certain considerations and risk factors that prospective investors should consider before subscribing. The practices of leverage and derivatives trading and other investment techniques, which the Fund expects to employ, can, in certain circumstances, result in significant losses. Under certain circumstances, an investment in the Fund involves the risk of a substantial loss of such investment. Investors should be able to bear the loss of their entire investment in the Fund, and their investment in the Fund should not be their sole significant investment.

Past performance is not necessarily indicative of future results.

Class 0 of the Fund has been operating since August 1, 2006, and Class 2 since November 1, 2007 with respect to its original portfolio, now the Blended Strategies Portfolio. Moreover, DTP became a part of the Blended Strategies Portfolio as of August 2008. The Systematic Strategies Portfolio commenced actual trading as of January 1, 2009. The Discretionary Strategies Portfolio commenced actual trading as of June 1, 2013. There can be no assurance that eitherany portfolio of the Fund will achieve its investment objective.

12

Futures and Options Trading Is Speculative and Volatile. Futures and options prices are highly volatile. Such volatility may lead to substantial risks and returns, generally much larger than in the case of equity or fixed-income investments. Price movements for futures are influenced by, among other things: changing supply and demand relationships; weather; agricultural, trade, fiscal, monetary, and exchange control programs and policies of governments; macro political and economic events and policies; changes in national and international interest rates and rates of inflation; currency devaluations and revaluations; and emotions of other market participants. None of these factors can be controlled by the Fund and no assurance can be given that the Manager’s advice will result in profitable trades for a participating customer or that a customer will not incur substantial losses. With respect to the Blended Strategies Portfolio and the Discretionary Strategies Portfolio, the master funds included in DTP may purchase and write options. The purchaser of an option is subject to the risk of losing the entire purchase price of the option, while the writer of an option is subject to an unlimited risk of loss, namely the risk of loss resulting from the difference between the premium received for the option and the price of the futures contract or other asset underlying the option which the writer must purchase or deliver upon exercise of the option. Thus, an investment in the Fund is suitable only for those investors with speculative capital who understand the risks of futures and options markets.

The Fund’s Trading Is Highly Leveraged, Which May Result in Substantial Losses for the Fund. The Fund trades futures and options on a leveraged basis due to the low margin deposits normally required for trading. As a result, a relatively small price movement in a contract may result in immediate and substantial gains or losses for the Fund. For example, $3,000 in margin may be required to hold a U.S. Treasury futures contract with a face value of $100,000. If the value of the contract were to decline by 3%, the entire margin deposit would be lost.

Market Illiquidity May Cause Less Favorable Trade Prices. Futures trading at times may be illiquid. Most United States commodity exchanges limit price fluctuations in certain commodity interest prices during a single day by means of “daily price fluctuation limits” or “daily limits.” The daily limit, which is set by most exchanges for all but a portion of the expiration month, imposes a floor and a ceiling on the prices at which a trade may be executed, as measured from the last trading day’s close. While these limits were put in place to lessen margin exposure, they may have certain negative consequences for the Fund’sFund��s trading. For example, once the price of a particular contract has increased or decreased by an amount equal to the daily limit, thereby producing a “limit-up” or “limit-down” market, positions in the contract can neither be taken nor liquidated unless traders are willing to effect trades at or within the limit. Contract prices in various commodities have occasionally moved the daily limit for several consecutive days with little or no trading. Similar occurrences could prevent the Fund from promptly liquidating unfavorable positions, subjecting the Fund to substantial losses.

In Times of Market Stress, the Fund May Not Be Able to Diversify Its Portfolio. Where the markets are subject to exceptional stress, trading strategies and programs may become less diversified and more highly correlated as the stress may cause diverse and otherwise unrelated markets all to act in a similar manner. Efforts by the Manager to diversify the Fund’s trading strategies and investment exposure may not succeed in protecting the Fund from significant losses in the event of severe market disruptions.

The Fund Is Subject to Speculative Position Limits, Which May Limit the Fund’s Ability to Generate Profits or Result in Losses. The CFTC and various exchanges impose speculative position limits on the number of futures positions a person or group may hold or control in particular futures. Most physical delivery and many financial futures and option contracts are subject to speculative position limits. The CFTC has established position limits with respect to contracts for corn, oats, wheat, soybeans, soybean oil, soybean meal, and cotton. In other markets, the relevant exchanges are required to determine whether and to what extent limits should apply. For purposes of complying with speculative position limits, the Fund’s outright futures positions will be required to be aggregated with any futures positions owned or controlled by the Manager or any principal of the Manager. As a result, the Fund may be unable to take positions in particular futures or may be forced to liquidate positions in particular futures, which could limit the ability of the Fund to earn profits or cause it to experience losses.

13

Trading on Non-U.S. Exchanges Presents Greater Risks to the Fund than Trading on U.S. Exchanges. Unlike trading on U.S. commodity exchanges, trading on non-U.S. commodity exchanges is not regulated by the CFTC and may be subject to greater risks than trading on U.S. exchanges. For example, some non-U.S. exchanges are “principals’ markets” in which no common clearing facility exists and a trader may look only to the broker for performance of the contract. In addition, unless the Fund hedges against fluctuations in the exchange rate between the U.S. dollar (in which Units are denominated) and other currencies in which trading is done on non-U.S. exchanges, any profits that the Fund might realize in trading could be reduced or eliminated by adverse changes in the exchange rate, or the Fund could incur losses as a result of those changes.

The Unregulated Nature of the Over-The-Counter Markets Creates Counterparty Risks that Do Not Exist in Futures Trading on Exchanges. Forward markets, including foreign currency markets, offer less protection against defaults in trading than is available when trading occurs on an exchange. Forward contracts are not guaranteed by an exchange or clearing house, and, therefore, a non-settlement or default on the contract would deprive the Fund of unrealized profits or force the Fund to cover its commitment to purchase and resale, if any, at the current market price.

Additional risks of the forward markets include: (i) the forward markets are generally not regulated by any U.S. or foreign governmental authorities; (ii) there are generally no limitations on daily price moves in forward transactions; (iii) speculative position limits are not applicable to forward transactions although the counterparties with which the Fund may deal may limit the size or duration of positions available as a consequence of credit considerations; (iv) participants in the forward markets are not required to make continuous markets in forward contracts; and (v) the forward markets are “principals’ markets” in which performance with respect to a forward contract is the responsibility only of the counterparty with which the trader has entered into a contract (or its guarantor, if any), and not of any exchange or clearing house. As a result, the Fund will be subject to the risk of inability or refusal to perform with respect to such contracts on the part of the counterparties with which the Fund trades. Because the Fund trades foreign exchange contracts substantially with Bank of America, N.A., it is at risk with respect to the creditworthiness and trading practices of Bank of America, N.A. as the counterparty to its contracts.

The Fund Has Credit Risk with respect to its Futures Brokers. The CEA requires a U.S. broker to segregate all funds received from such broker’s customers in respect of regulated futures transactions from such broker’s proprietary funds. If the broker were not to do so to the full extent required by law, the assets of the Fund might not be fully protected in the event of the bankruptcy of the broker. In the event of the broker’s bankruptcy, the Fund would be limited to recovering only a pro rata share of all available funds segregated on behalf of the broker’s combined customer accounts, even though certain property specifically traceable to the Fund (for example, U.S. Treasury bills deposited by the Fund) was held by the broker. In addition, in the event of bankruptcy or insolvency of an exchange or an affiliated clearing house, the Fund might experience a loss of funds deposited through its broker as margin with an exchange or affiliated clearing house, the loss of unrealized profits on its open positions, and the loss of funds owed to it as realized profits on closed positions. If the Fund retains brokers that are not subject to U.S. regulation, its funds deposited with those brokers might not be segregated.

The Unregulated Nature of the Swaps and Derivatives Markets Creates Counterparty Risks that Do Not Exist in Futures Trading on Exchanges. The Fund may enter into swap contracts and related derivatives agreements with various counterparties. Certain swaps and other forms of derivatives instruments currently are not guaranteed by an exchange or its clearing house or regulated by any U.S. or foreign governmental authorities. Consequently, there are no requirements with respect to record keeping, financial responsibility or segregation of customer funds and positions. The default of a party with which the Fund has entered into an unclearedOTC swap or other derivative may result in the loss of unrealized profits and force the Fund to cover its resale commitments, if any, at the then current market price. It may not be possible to dispose of or close out aan OTC swap or other derivative position without the consent of the counterparty, and the Fund may not be able to enter into an offsetting contract in order to be able to cover its risk.

14

The Fund Has Credit and Market Risks With Respect to Its Cash Management. The Fund currently invests all assets not required for trading in Cash Assets, which in turn presently holds deposits in bank accounts or invests broadly in U.S. government or agency securities. With respect to its cash deposited in bank accounts, although the bank accounts themselves may be insured by the United States Federal Deposit Insurance Corporation, the balances in such accounts will be largely uninsured, as the maximum amount of insurance available to such accounts will not be material relative to the balances that are expected to be maintained in the accounts. With respect to its investment in U.S. government or agency securities, Cash Assets currently intends to hold them until they mature. Some of these securities may not mature for a year or longer. If Cash Assets were forced to sell some of its securities in the open market before they mature to meet unanticipated redemption requests (whether from the Fund or other entities affiliated with the Manager), the market value of the securities at such time may be below their principal face amount, causing a loss for Fund investors. In addition, if interest rates rise, the interest rate that Cash Assets pays its investors (including the Fund) will not fully reflect the new rates because its pre-existing investments are still yielding interest at lower rates.

The Fund May Also Borrow Money to Support its Trading, Which Could Increase the Level of Volatility in its Performance and Expose the Fund to Greater Losses. In addition to the leverage implicit in trading futures, the Fund may borrow money from brokers or their affiliates and other lenders. A significant portion of the funds borrowed by the Fund may be obtained from brokerage entities in the form of margin loans collateralized by assets held in the Fund’s brokerage account with such brokerage firms. The Fund does not have any limits on borrowing or leverage.

The Fund Relies on Key Individuals. The Fund relies exclusively on the Manager for the management of its investment portfolio, and the Manager relies significantly on the services of its founder, Kenneth G. Tropin. There could be adverse consequences to the Fund in the event that the Manager ceases to be available to devote its services to the Fund. There could be adverse consequences to the Fund if Mr. Tropin ceases to be available to devote his services to the Manager. In the event that the CFTC suspended the registration of the Manager, the Manager would be unable to manage the business of the Fund. Should the Manager’s registration be suspended, termination of GAIF I might result.

The Fund May Be Terminated at Any Time. Unforeseen circumstances, including substantial losses, the retirement or loss of key personnel of the Manager, the withdrawal of the Manager or the decision of the Manager not to continue to manage the Fund, could cause the Fund to terminate prior to its stated termination date of December 31, 2050. Early termination of the Fund could disrupt an investor’s overall investment portfolio plan resulting in the loss of some or all of its investment.

There is no Secondary Market for the Units, Therefore Investors Should Consider Their Investment in the Fund to be Illiquid. It is not anticipated that an active secondary market will develop in the Units. Units are not registered so as to permit a public offering under the securities laws of any jurisdiction. The Units will not be transferable without the consent of the Manager (which may be granted on such terms as it determines or withheld). Moreover, there are limitations on the ability of an investor to require the Fund to redeem Units. Consequently, the Units will be illiquid investments.

The Fund Does Not Anticipate Paying Dividends or Making Distributions, Therefore an Investment in the Fund is Not Appropriate for Investors Seeking Current Income. Since the Fund does not presently intend to pay dividends or other distributions, an investment in the Fund may not be suitable for investors seeking current returns for financial or tax planning purposes.

Taxes Will Be Imposed on You Regardless of Cash Distributions. U.S. taxable investors in the Fund must recognize for federal income tax purposes their pro rata share of the taxable net income of the Fund, regardless of whether such investors requested a partial redemption from the Fund to cover their tax liabilities. An investment in the Fund may generate taxable income for a member even though the value of the member’s interest in the Fund has declined. A member may have to use personal funds to pay the income tax owed on the income or gain allocated to the member. Sufficient information may not be available in time for the member to determine accurately an amount to redeem to pay taxes for a given fiscal year.

15

Investors Do Not Have the Protections Provided to a Regulated Mutual Fund. Fund. Although the Fund may be considered similar to an investment company, it is not required to, and does not intend to, register as such under the Investment Company Act of 1940, as amended (the “Investment Company Act”). Accordingly, certain provisions of the Investment Company Act (which, among other things, require investment companies to have a certain number of disinterested directors and regulate the relationship between the adviser and the investment company) will not be applicable.

Interests in the Fund have not been and will not be registered under the Securities Act, in reliance upon an exemption available under Regulation D under the Securities Act. Accordingly, interests in the Fund will be offered only to investors that, among other requirements, are accredited investors within the meaning of Regulation D.

Impact of Recent Financial Industry Regulation is Uncertain but May Impact the Fund’s Operations. The Dodd-Frank Wall Street Reform and Consumer Protection Act contains a number of new provisions intended to limit systemic risk in the financial services industry. The act’s provisions seek to increase regulatory oversight and supervision of both bank and nonbank entities in the financial services sector. Under the act, Federal regulators have been tasked to develop rules designed to effect the act’s purposes, and in many respects this rulemaking is expected to be extensive. While certain provisions of the act are in effect, the rulemaking process is not complete and as such theThe effect of such rulemaking on the financial services industry is as yet not fully capable of being known. In particular as it relates to the Fund’s operations, the act tasks the SEC and the CFTC to draft rules bearing on the over-the-counter derivatives market designed to address capital and margin requirements, mandatory clearing, the operation of execution facilities and data repositories, business conduct standards for swap dealers, and transparency for transactional information. Mandatory clearing of such instruments has only recently gone in to effect, and it remains to be seen what the long-term impact ofIt is not clear at this time how these rules will be onalter the operation of the markets in which the Fund operates or onaffect the operations of the Fund.

The Trading Programs Used by Each Portfolio May Be Changed Without Notice to Investors. The Manager continuously updates and changes its trading programs as a result of its ongoing research efforts and in response to changing market conditions. The Manager also expects to develop and implement new trading programs from time to time. The Manager may make additions or deletions of trading programs used by either the Blended Strategies Portfolio, the Systematic Strategies Portfolio, or the SystematicDiscretionary Strategies Portfolio at any time, and may make additions, deletions or any other changes to its trading programs used by either portfolio – such as changes in the amount of leverage of, or in the allocations of assets to, any of the trading programs used by either portfolio – at any time as determined by the Manager in its sole discretion. The Manager is not required to provide prior, or any, notice to investors of any such changes. As a result, the descriptions of the trading programs of each portfolio in the Fund’s offering materials may not at any particular time fully or accurately describe the trading programs being used by each portfolio.

Conflicts of Interest

Performance Based and other Fund Compensation Could Expose the Fund to Greater Risks. The Manager could receive substantial compensation in the event it generates net profits for the Fund. Such compensation arrangements may provide an incentive for the Manager to effectuate larger and more risky transactions than would be the case in the absence of such arrangements. The Manager may receive compensation with respect to unrealized appreciation of Fund assets as well as with respect to realized gains from the trading of Fund assets. The fees and incentive allocation payable to the Manager were not the subject of arms’ length negotiation. In addition, investors that acquire Units of any Class with a Net Asset Value below a previous high water mark might benefit at the expense of pre-existing investors where those Units increase in value but are not yet subject to an Incentive Allocation because the Class as a whole still has aggregate carried forward losses.

16

The Manager Manages Other Accounts. The Manager acts as general partner or trading manager to investment funds and other managed accounts that have investment objectives and methodologies similar to those of the Fund. As of March 1, 2013,2014, the Manager acts as general partner or trading manager to 24 investment funds or managed accounts to which outside investors contribute capital, including the Funds. Of these, 24 investment funds or managed accounts, 17 employ a systematic trading program identical to, or substantially similar to, that traded for the Systematic Strategies Portfolio and 7 employ a discretionary trading program similar to DTP, differing primarily in that they trade securities. The Manager may also receive higher fees for managing certain of these accounts. The Manager and its principals may trade for their own accounts in the same markets in which the Fund trades and such accounts may take positions that are opposite, or ahead of, positions taken for the Fund. Fund investors will not be permitted to inspect the records of such proprietary accounts or the written policies related to such trading. The Manager and its principals also may manage other accounts in the future. All of the above accounts may compete with the Fund for the same positions. All of the foregoing accounts may be aggregated for purposes of determining applicable position limits, and may take the same or different positions as the Fund.

With respect to the discretionary strategies traded for DTP, all of the Manager’s trading for each discretionary strategy is conducted through a single master fund for each such strategy or substrategy.sub strategy. This structure eliminates the need for trade allocation procedures, which would otherwise be the case if trading for each strategy was conducted for multiple accounts. The Manager closely reviews the capacity levels of each master fund traded for DTP to ensure that all funds that utilize DTP or a trading program similar to DTP can invest in the master funds at the levels designated by the Investment Committee. To date, the master funds have not experienced capacity limits that would impact the operations of the funds that invest in them; however, no assurance can be given that in the future one or more master funds will not experience capacity limits, which would require the Manager to limit the participation of one or more funds in the affected master funds.

With respect to the Manager’s systematic trading programs, the Manager may place block orders with brokers on behalf of multiple accounts, including the Fund. Accounts in which the Manager and its principals have an interest may be included with client accounts in block orders. One or more of the accounts may receive more favorable fills and some less favorable fills because a block order may be executed at different prices. Unless an average price of split fills is allocated to an order or unless fills are allocated according to a non-discretionary computer-based allocation methodology, split fills generally are allocated to accounts on a “high to low” basis. Accounts are ranked based on commencement of trading, and the highest split fill prices on both buy and sell transactions are allocated to the highest ranked accounts. Any advantage a high ranked account enjoys on the sell order generally is offset by a disadvantage on the buy order. Consistent application of this non-discretionary allocation methodology satisfies regulatory requirements of objectivity and fairness such that no account or group of accounts receives consistently favorable or unfavorable treatment. Allocations made according to this methodology will be deemed equitable even though under certain market conditions a trade may be more favorable to some accounts than others.

The Manager may enter into side agreements with specific investors in the Fund providing for different fees, redemption rights, access to information about the Fund’s investments or other matters relating to an investment in the Fund.

The Master–Feeder Structure Underlying the Fund’s Trading May Create Operating Inefficiencies for the Fund. All trading attributable to the Fund is currently conducted through the master funds organized and managed by the Manager, through a so-called “master-feeder” fund structure. AllA portion of the subscription proceeds received from investors ordinarily is invested by the Fund in the master funds, including Cash Assets, in each case with limited liability to the Fund. A separate master fund then invests in global fixed income, foreign exchange and other markets pursuant to each of the investment programs managed by the Manager.

17

Other investment funds and managed accounts structured to meet the needs of various U.S. and non-U.S. investors, including various proprietary accounts of the Manager, also may invest in each master fund, including Cash Assets. The units of such investors in any master fund may be in conflict in a number of respects, including, without limitation, as to the tax consequences and capital utilization with regard to any master fund’s transactions. For example, each master fund’s transactions may provide investors subject to U.S. income taxation with different after-tax returns than those of non-U.S. and tax-exempt investors. Also, each master fund may borrow to increase the efficiency of its capital utilization, but in so doing may incur borrowing charges at a rate that exceeds the rate at which the Fund earns interest income on its available cash. Such borrowing, with its attendant additional cost, serves to stabilize the master funds’ financing arrangements and offers various other advantages to their investors. At the same time, such borrowing may disproportionately benefit more leveraged investors in the master funds (including proprietary accounts of the Manager) over less leveraged investors (potentially including the Fund).

The foregoing list of risk factors and conflicts of interest does not purport to be a complete enumeration or explanation of the risks or conflicts involved in an investment in the Fund. Prospective investors should consult with their own advisors before deciding to subscribe for Units.

Allocation of Profit and Loss