We compete with many domestic and foreign companies in developing our technology and products, including biotechnology, medical device, and pharmaceutical companies. Many current and potential competitors have substantially greater financial, technological, research and development, marketing, and personnel resources. There is no assurance that our competitors,

will not succeed in developing alternativesuccessfully develop or introduce new products that are

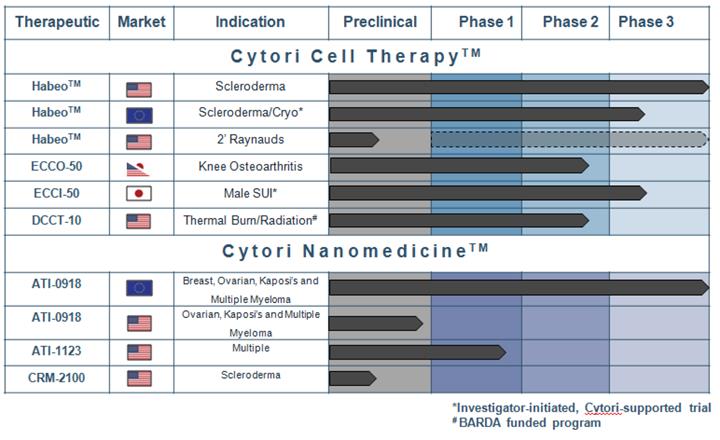

more effective, easierless costly or offer better results than those of our competitors, or offer purchasers of our products payment and other commercial terms as favorable as those offered by our competitors. In addition, competitors may seek to develop alternative formulations of or technological approaches to our product candidates and/or alternative cell therapy or drug delivery technologies that address our targeted indications.Cytori Cell Therapy: Cytori Cell Therapy may face competition from cell therapies derived from autologous or allogeneic tissue sources such as adipose tissue, bone marrow and cord blood, and processed using alternative approaches, methods and technologies such as cryopreserved, cultured, expanded, manual, non-enzymatic, selectively isolated cell therapies, and other therapeutic approaches including those administered using oral, subcutaneous, topical and intravenous routes. If approved for the treatment of hand dysfunction and/or Raynaud’s Phenomenon in scleroderma patients, Habeo Cell Therapy will likely compete against other products and product candidates. Johns Hopkins University, in collaboration with Allergan, recently completed and reported results from a Phase III clinical trial evaluating injection of Botox into the hands of patients with scleroderma-associated Raynaud’s Syndrome. Further, Corbus Pharmaceuticals is conducting a Phase II clinical trial evaluating Resunab (JBT-101) in patients with diffuse cutaneous systemic sclerosis and has reported positive topline results showing a clear signal of clinical benefit. University of Pittsburgh, in collaboration with the NIAMS, is conducting a Phase II clinical trial evaluating Lipitor’s (atorvastatin) effect on blood vessel function and Raynaud symptoms in patients with early diffuse systemic sclerosis. Primus Pharmaceuticals is sponsoring a U.S. multi-center clinical trial to evaluate Diosmiplex in patients with Raynaud’s disease. Covis Pharmaceuticals has completed a Phase 2 clinical trial to evaluate Vascana in patients with Raynaud’s Phenomenon secondary to Connective Tissue Disease. Apricus Biosciences has completed a Phase 2 clinical trial for Vascana in patients with Raynaud’s Phenomenon secondary to systemic sclerosis. Stanford University, in collaboration with United Therapeutics, is sponsoring a Phase 2 clinical trial evaluating oral Orenitram (treprostinil) for the treatment of Calcinosis in patients with systemic sclerosis. Bayer is a collaborator in a Phase 2 clinical trial evaluating Adempas (riociguat) in patients with scleroderma-associated digital ulcers. Bristol-Myers Squibb and NIAID are collaborators in a Phase 2 clinical trial evaluating Abatacept in patients with diffuse cutaneous systemic sclerosis. Invtiva Pharma is sponsoring a Phase 2 clinical trial evaluating IVA337 in patients with diffuse cutaneous systemic sclerosis. The Catholic University of Korea is sponsoring a clinical trial evaluating autologous stromal vascular fraction injected into the fingers of patients with systemic sclerosis. Sanofi is sponsoring a Phase 2 clinical trial evaluating SAR156597 in patients with diffuse systemic sclerosis. Hoffman-La Roche is sponsoring Phase 3 clinical trials evaluating Actemra (tocilizumab) in patients with systemic sclerosis. Most of these studies use the primary and secondary outcome measures as used in our STAR clinical trial.

Our Cytori Cell Therapy may also face competition from lower price alternative cell therapies, including manually processed, or “home brewed” ADRCs that are harvested and used to treat patients for a wide range of indications. There are hundreds of stromal vascular fraction, or SVF, clinics within the United States alone, that purport to offer cell therapy treatments for ailments ranging from facial rejuvenation to stroke. Though FDA has indicated that it intends to regulate this “home brew” industry, if it fails to do so, then companies without FDA approvals may continue to offer cell therapy treatments on an “off-label,” unapproved basis at substantially

lower prices then we intend to command. Similar clinics existing in every other market in which we intend to compete. Further, it is possible that positive STAR or SCLERADEC II clinical data, if possible, could be used by our cheaper cost competitors to tout their own cell therapy offerings, which could significantly harm our business.

Cytori Nanomedicines: We may face competition for our ATI-0918 asset (which is intended for the treatment of breast and ovarian cancers, multiple myeloma, and Kaposi’s sarcoma) from multiple drug classes including antiretrovirals, chemotherapies, corticosteroids, histone deacetaylase inhibitors, hormone therapies, immunotherapies, and targeted therapies, as well as companies seeking approvals in Europe or the United States for their pegylated liposomal doxorubicin products. In particular, if a competitor is first to the European market with an EMA-approved generic liposomal doxorubicin that is bioequivalent to Caelyx, our projections and market assumptions for our ATI-0918 would have to be materially altered and our business could be harmed. Taiwan Liposome Company has reported their intent to file a Marketing Authorization Application, or MAA, with the EMA in the first half of 2017 for its generic Doxisome (TLC177) product which is ahead of our schedule for submitting our MAA for ATI-0918. In the United States, we may face competition for ATI-0918 from multiple generic formulations of pegylated liposomal doxorubicin. Sun Pharma’s Lipodox product is currently approved in the United States and both Taiwan Liposome Company (Doxisome) and Actavis have reported that they have filed ANDAs with the FDA. Shanghai F-Z (Libaoduo) and Dr. Reddy’s Labs are conducting ongoing bioequivalence studies versus Lipodox which they may decide to use or more economical than thoseto support FDA submissions for approval of their pegylated liposomal doxorubicin products.

Companies that currently have active development programs for nanoparticle-docetaxel products that may be future competitors for our ATI-1123asset include:

Adocia’s DriveIn nanoparticle-docetaxel product candidate, which we have developed or areis in the processpreclinical stage;

Cristal Therapeutics’ CriPac nanoparticle-docetaxel, which is currently being evaluated in a Phase 1 clinical trial for the treatment of developing, or that would render our products obsoletesolid tumors; and non-competitive. In general, we may not be able to prevent others from developing and marketing competitive products similar to ours or

Oasmia’s Docecal, a formulation of docetaxel combined with a patented nanoparticle-based technology, XR17, which perform similar functions.

Competitors may have greater experience in developing therapies or devices, conducting clinical trials, obtaining regulatory clearances or approvals, manufacturing and commercialization. It is possible that competitors may obtain patent protection, approval, or clearance from the FDA or achieve commercialization earlier than we can, any of which could have a substantial negative effect on our business. Compared to us, many of our potential competitors have substantially greater:

research and development resources and experience, including personnel and experience;

product development, clinical trial and regulatory resources and experience;

sales and marketing resources and experience;

manufacturing and distribution resources and experience;

name, brand and product recognition; and

resources, experience and expertise in prosecution and enforcement of intellectual property rights.

As a result of these factors, our competitors may obtain regulatory approval of their products more quickly than we are able to or may obtain patent protection or other intellectual property rights that limit or block us from developing or commercializing our product candidates. Our competitors may also develop products that are more effective, more useful, better tolerated, subject to fewer or less severe side effects, more widely prescribed or accepted or less costly than ours and may also be more successful than we are in manufacturing and marketing their products. If we are unable to compete effectively with the marketed therapeutics of our competitors or if such competitors are successful in developing products that compete with any of our product candidates that are approved, our business, results of operations, financial condition and prospects may be materially adversely affected.

Our clinical trials may fail to demonstrate acceptable levels of safety and efficacy for Habeo Cell Therapy or any of our other product candidates, which could prevent or significantly delay their regulatory approval and commercialization.

Clinical testing of our products is a long, expensive and uncertain process, and the failure or delay of a clinical trial can occur at any stage. Many factors, currently known and unknown, can adversely affect clinical trials and the ability to evaluate a product candidate’s efficacy. During the course of treatment, patients can die or suffer other adverse events for reasons that may or may not be related to the proposed product being tested. Even if initial results of preclinical and nonclinical studies or clinical trial results are promising, we may obtain different results in subsequent trials or studies that fail to show the desired levels of safety and efficacy, or we may not obtain applicable regulatory approval for a variety of other reasons. For instance, the investigator-initiated 12-patient, open-label SCLERADEC I trial investigating use of Habeo Cell Therapy for hand complications of scleroderma, sponsored by the Assistance Publique Hôpitaux de Marseille, or AP-HM, located in Marseille, France, has reported strong clinical data suggesting safety and efficacy of a single treatment of Habeo Cell Therapyout to three years after treatment. However, there can be no assurances that our current STAR clinical trial or AP-HM’s currently enrolling SCLERADEC II clinical trial will be successful. These trials are testing broader human use of Habeo Cell Therapy in blinded, randomized, placebo-controlled trial settings, as opposed to SCLERADEC I’s open-label, single arm, uncontrolled, unblinded format. Many companies in our industry have suffered significant setbacks in advanced clinical trials, despite promising results in earlier trials. If our Phase III STAR clinical trial and the Phase III Cytori-supported SCLERADEC II clinical trial do not meet their primary endpoints, we will likely be unable to obtain regulatory approval for our Habeo Cell Therapy, and may be forced to abandon our scleroderma development program, which would severely affect our business.

Further, with respect to the conduct and results of clinical trials generally, in the United States, Europe, Japan and other jurisdictions, the conduct and results of clinical trials can be delayed, limited suspended, or otherwise adversely affected for many reasons, including, among others:

clinical results may not meet prescribed endpoints for the studies or otherwise provide sufficient data to support the efficacy of our product candidates;

clinical and nonclinical test results may reveal side effects, adverse events or unexpected safety issues associated with the use of our product candidates;

lack of adequate funding to continue the clinical trial, including the incurrence of unforeseen costs due to enrollment delays, requirements to conduct additional trials and studies and increased expenses associated with the services of our contract research organizations, or CROs, and other third parties;

inability to design appropriate clinical trial protocols;

slower than expected rates of subject recruitment and enrollment rates in clinical trials;

regulatory review may not find a product safe or effective enough to merit either continued testing or final approval;

regulatory review may not find that the data from preclinical testing and clinical trials justifies approval;

regulatory authorities may require that we change our studies or conduct additional studies which may significantly delay or make continued pursuit of approval commercially unattractive;

a regulatory agency may reject our trial data or disagree with our interpretations of either clinical trial data or applicable regulations;

the cost of clinical trials required for product approval may be greater than what we originally anticipate, and we may decide to not pursue regulatory approval for such a product;

a regulatory agency may identify problems or other deficiencies in our existing manufacturing processes or facilities or the existing processes or facilities of our collaborators, our contract manufacturers or our raw material suppliers;

a regulatory agency may change its formal or informal approval requirements and policies, act contrary to previous guidance, adopt new regulations or raise new issues or concerns late in the approval process;

a product candidate may be approved only for indications that are narrow or under conditions that place the product at a competitive disadvantage, which may limit the sales and marketing activities for such products or otherwise adversely impact the commercial potential of a product; and

a regulatory agency may ask us to put a clinical study on hold pending additional safety data; (and there can be no assurance that we will be able to satisfy the regulator agencies’ requests in a timely manner, which can lead to significant uncertainty in the completion of a clinical study).

In addition, Cytori Cell Therapy is currently the subject of a number of investigator-initiated trials, including the SCLERADEC II clinical trial in France and the ADRESU clinical trial in Japan. While these investigator-initiated trials are useful to help enhance awareness and use of our cell therapy technologies and products, and to identify potential therapeutic targets, there are also associated risks. We do not control the design and conduct of these trials, thus any data integrity issues or patient safety arising out of any of these trials would be beyond our control, yet could adversely affect our reputation and damage the clinical and commercial prospects for our Cytori Cell Therapy product candidates.

We also face clinical trial-related risks with regard to our reliance on other third parties in the performance of many of the clinical trial functions, including CROs, that help execute our clinical trials, the hospitals and clinics at which our trials are conducted, the clinical investigators at the trial sites, and other third party service providers. Failure of any third-party service provider to adhere to applicable trial protocols, laws and regulations in the conduct of one of our clinical trials could adversely affect the conduct and results of such trial (including possible data integrity issues), which could seriously harm our business.

Our success depends in substantial part on our ability to obtain regulatory approvals for Habeo Cell Therapy and ATI-1123. However, we cannot be certain that we will receive regulatory approval for these product candidates or our other product candidates.

We have only a limited number of product candidates in development, and our business depends substantially on their successful development and commercialization. Our product candidates will require development, regulatory review and approval in multiple jurisdictions, substantial investment, access to sufficient commercial manufacturing capacity and significant marketing efforts before we can generate any revenues from sales of our product candidates. The research, testing, manufacturing, labeling, approval, sale, marketing and distribution of drug products are subject to extensive regulation by the FDA and other regulatory authorities in the United States and other countries, whose regulations differ from country to country.

We are not permitted to market our product candidates in the United States until we receive approval from the FDA, or in any foreign countries until we receive the requisite approval from the regulatory authorities of such countries (including centralized marketing authorization from the European Medicines Agency), and we may never receive such regulatory approvals. Obtaining regulatory approval for a product candidate is a lengthy, expensive and uncertain process, and may not be obtained. Any failure to obtain regulatory approval of any of our product candidates would limit our ability to generate future revenues (and any failure to obtain such approval for all of the indications and labeling claims we deem desirable could reduce our potential revenue), would potentially harm the development prospects of our product candidates and would have a material and adverse impact on our business.

Even if we successfully obtain regulatory approvals to market our product candidates, our revenues will be dependent, in part, on our ability to commercialize such products as well as the size of the markets in the territories for which we gain regulatory approval. If the markets for our product candidates are not as significant as we estimate, our business and prospects will be harmed

Regarding to our two current lead commercialization candidates, Habeo Cell Therapy and ATI-0918:

Though we believe that Habeo Cell Therapy will be regulated as an Advanced Therapeutic Medicinal Product, or ATMP, in Europe, it is possible that the EMA instead provides a medical device classification for Habeo Cell Therapy, in which case we will be unable to avail ourselves of the orphan drug designation granted to us covering use of Cytori Cell Therapy for systemic sclerosis, and will instead compete with other medical device manufacturers purporting to offer cellular therapeutics competitive with ours (and possibly at much lower price points than we currently contemplate for our therapy). Any classification of Cytori Cell Therapy as a medical device could make it difficult for us to identify pharmaceuticals companies willing to help us commercialize this product offering in Europe, and could also deter medical device companies from partnering with us given potential pricing and competitive concerns.

If Habeo Cell Therapy is classified as an ATMP in Europe, then we will be required to comply with applicable cGMP requirements, as interpreted and implemented at the national level in each country, which would take longer and cost more to get to market than if Habeo Cell Therapy were classified as a medical device, and would in turn increase the costs of commercializing Habeo Cell Therapy in these countries. Further, potential pharmaceutical

| | partners may be wary of the medical device component of our cell therapy. These commercialization hurdles could increase the difficulties in finding suitable partners to help us commercialize this product offering in Europe. |

The EMA has approved eight ATMPs in Europe to date, with application review periods ranging from approximately thirteen to thirty-five months. This wide range in review periods makes it difficult to predict whether and on what timeframe our Habeo Cell Therapy would receive EMA approval, if at all.

Given the novelty of our cellular therapeutics technology, we anticipate that we may face regulatory hurdles in other jurisdictions outside of the United States and Europe that could delay regulatory approval and commercial launch of Habeo Cell Therapy.

The reference drugs for ATI-0918, which are currently Lipodox® in the United States and Caelyx® in Europe, may change.

Though Azaya previously completed a European ATI-0918 60-patient bioequivalence trial, the EMA has not confirmed the adequacy of the trial for purposes of determining bioequivalence of ATI-0918 to Caelyx®. It is possible that the EMA could require us to conduct another bioequivalency trial for ATI-0918, which would cause us to incur significant delays and additional costs and expense and would materially and adversely affect our business.

Though it is our intent to expeditiously pursue regulatory review of ATI-0918 in Europe through submission of a marketing authorization application, or MAA, to the EMA, prior to submission of this application we must first conduct and complete certain activities, including chemistry, manufacturing and controls, or CMC, activities, for inclusion in the application, and we cannot guarantee that we will successfully complete these activities.

We intend to seek scientific advice from the EMA regarding required elements of the MAA before we submit the MAA, and if the EMA’s scientific advice requires us to conduct substantive additional work (including possible provision of substantial additional data or information), our submission of the MAA could be materially delayed, which in turn would materially push back our anticipated launch date for ATI-0918 in Europe.

If we are unable to satisfy the EMA’s requirements to issuance of the marketing authorization for ATI-0918, we will not be able to launch ATI-0918 in Europe, and our business would be materially harmed.

If a product candidate is not approved in a timely fashion on commercially viable terms, or if development of any product candidate is terminated due to difficulties or delays encountered in the regulatory approval process, it could have a material adverse effect on our business, and we will become more dependent on the development of other proprietary products and/or our ability to successfully acquire other products and technologies. There can be no assurance that any product candidate will receive regulatory approval in a timely manner, or at all.

If our products candidate and technologies receive regulatory approval but do not achieve broad market acceptance, especially by physicians, the revenues that we generate will be limited.

The commercial success of any of our approved products or technologies will depend upon the acceptance of these products and technologies by physicians, patients and the medical community. The degree of market acceptance of these products and technologies will depend on a number of factors, including, among others:

acceptance by physicians and patients of the product as a safe and effective treatment;

any negative publicity or political action related to our or our competitors’ products or technologies;

the relative convenience and ease of administration;

the prevalence and severity of adverse side effects;

demonstration to authorities of the pharmacoeconomic benefits;

demonstration to authorities of the improvement in burden of illness;

limitations or warnings contained in a product’s approved labeling;

payers’ level of restrictions and/or barriers to coverage;

the clinical indications for which a product is approved;

availability and perceived advantages of alternative treatments;

the effectiveness of our or any current or future collaborators’ sales, marketing and distribution strategies; and

pricing and cost effectiveness.

Our Celution technology and products compete against cell-based therapies derived from alternate sources, such as bone marrow, umbilical cord blood and, potentially, embryos. DoctorsSome of our competitors with products based on these other cell-based therapies have substantially greater financial, human and technical resources than we do. In addition, some of them have approved products with therapeutic claims, established revenues and broad market recognition. Physicians historically are slow to adopt new technologies like ours regardless of the perceived merits when older technologies, as the current standard of care, continue to be supported by established providers. Overcoming such inertia often requires very significant marketing expenditures or definitive product performance and/or pricing superiority.

We face similar competitive pressures with our Cytori Nanomedicine product candidates. As a generic liposomal encapsulation of doxorubicin, ATI-0918, if approved and launched commercially, will potentially compete against Caelyx and Myocet® (manufactured by Teva) in Europe, and against Lipodox® in the United States. These existing competitive liposomal doxorubicin products have been on the market for many years, have gained widespread physician acceptance and are marketed by competitors with substantially greater resources than we have. Further, our ATI-1123 product candidate, if developed and commercialized, would compete against a number of established docetaxel drugs, including Taxotere® (Sanofi S.A.) and numerous existing generic docetaxel products.

We expect physicians’ inertia and skepticism to also be a significant barrier as we attempt to gain market penetration with our future products. We believe we will continue to need to finance lengthy time-consuming clinical studies to provide evidence of the medical benefit of our products and resulting therapies in order to overcome this inertia and skepticism particularly in reconstructive surgery, cell preservation, osteoarthritis, scleroderma, cardiovascular indicationsskepticism.

Overall, our efforts to educate the medical community on the benefits of any of our products or technologies for which we obtain marketing approval from the FDA or other regulatory authorities and others.

*gain broad market acceptance may require significant resources and may never be successful. If our products and technologies do not achieve an adequate level of acceptance by physicians, pharmacists and patients, we may not generate sufficient revenue from these products to become or remain profitable.Many potential applications of our technologyproduct candidates are pre-commercialization,pre-commercial, which subjects us to development and marketing risks

Werisks.Our products candidates are in a relatively early stageat various stages of the path to commercialization with many of our products. We believe that our long-term viability and growth will depend in large part on our ability to develop commercial quality cell processing devices and useful procedure-specific consumables, and to establish the safety and efficacy of our therapies through clinical trials and studies. With our Cytori Cell Therapy, we are pursuing new approaches for therapies for osteoarthritis, scleroderma, burns, soft tissue defects, reconstructive surgery, preservation of stem and regenerative cells for potential future use, and other conditions. There is no assurance that our development programs will be successfully completed or that required regulatory clearances or approvals will be obtained on a timely basis, if at all.

There is no proven path for commercializing Cytori Cell Therapy in a way to earn a durable profit commensurate with the medical benefit. Although we began to commercialize our reconstructive surgery products in Europe and certain Asian markets, and our cell banking products in Japan, Europe, and certain Asian markets in 2008, additional market opportunities for many of our products and/or services may not materialize for a number of years.

development. Successful development and market acceptance of our products is subject to developmental risks, including risk of negative clinical data from current and anticipated trials, failure of inventive imagination, ineffectiveness, lack of safety, unreliability, manufacturing hurdles, failure to receive necessary regulatory clearances or approvals, high commercial cost, preclusion or obsolescence resulting from third parties’ proprietary rights or superior or equivalent products, competition from copycat products and general economic conditions affecting purchasing patterns. There iscan be no assurance that we or our partners will successfully develop and commercialize Cytori Cell Therapy,our product candidates, or that our competitors will not develop competing technologies that are less expensive or superior. Failure to successfully develop and market Cytori Cell Therapyour product candidates would have a substantial negative effect on our results of operations and financial condition.

Regarding our cell therapy products, we believe that our long-term viability and growth will depend in large part on our ability to establish the safety and efficacy of our cell therapies through clinical trials and studies. Though we generate revenues from commercial sales of our Celution products, there is no proven path for commercializing Cytori Cell Therapy in a way to earn a durable profit commensurate with the medical benefit. We have been engaged for a number of years in commercial sales of our Celution devices and consumable kits in Japan Europe and certain Asian markets, and our cell banking products in Japan, Europe, and certain Asian markets, but we have not achieved significant growth due in significant part to our inability thus far to obtain therapeutic, on-label use that is reimbursed by payers. Thus, we do not expect the market for our products to appreciably increase until we have positive clinical data from a validated, Phase III, controlled, randomized trial that reports safety and efficacy of our cellular therapeutic in a discrete disease state or condition. However, there can be no assurance that one or more clinical trials of our cell therapy product candidates will yield positive results.

Regarding our Cytori Nanomedicine program, our ATI-0918 generic drug candidate is pre-commercial. Our ATI-0918 bioequivalence trial results and accompanying manufacturing and other data are subject to review and feedback by the EMA prior to our submission of our marketing authorization application, or MAA, to the EMA. There can be no assurances that the EMA will view the results of the bioequivalence trial favorably. Further, we are required to complete certain manufacturing, drug stability and other activities before we submit our MAA to the EMA. There can be no assurance that the EMA will deem our MAA sufficient grant us marketing authorization within the timelines we currently project, or at all.

Our ATI-1123 drug candidate is in early clinical stages and is subject to all of the attendant risks of an early-stage drug. Should we wish to commercialize ATI-0918 in the United States, we believe we will need to conduct a clinical trial to demonstrate bioequivalence to the then-current reference drug in the United States (currently Lipodox®). Any such bioequivalency trial would be time and resource intensive, would take years to complete at considerable expense, and could ultimately fail to demonstrate ATI-0918’s bioequivalence to the reference drug. Also, we intend to find a partner to develop our ATI-1123 drug candidate, but and if we are unsuccessful in doing so, our ATI-1123 development program could be delayed or suspended.

If we or any party to a key collaboration, partnershiplicensing, development, acquisition or similar arrangement fails to perform material obligations under our agreements,such arrangement, or any other collaboration agreement, or if such agreements arearrangement is terminated for any reason, there could be an adverse effect on our business could significantly suffer

.We have entered intoare currently party to certain licensing, collaboration and acquisition agreements under which we may make or receive future payments in the form of milestone payments, maintenance fees, and royalties.royalties and/or minimum product purchases. We are dependent on our collaborators to commercialize Cytori Cell Therapy in certain countries and in ordercertain indications for us to realize any financial benefits from these collaborations. Our collaborators may not devote the attention and resources to such efforts to be successful. In addition, in the event that a party fails to perform under a key collaboration agreement, or if a key collaboration agreement is terminated, the reduction in anticipated revenues could delay or suspend our commercialization efforts in certain countries. Specifically, the termination of a key collaboration agreement by one of our collaborators could materially impact our ability to enter into additional collaboration agreements with new collaborators on favorable terms.

Risks relating to our current material collaborations (excluding our BARDA partnership, which is discussed below in these “Risk Factors”) include the following:

18Under our asset purchase agreement with Azaya, we are required to use commercial reasonable efforts to develop our ATI-0918 and ATI-1123 drug candidates, and we have future milestone, earn-out and other payments to Azaya tied to our commercialization and sale activities for these drug candidates. If we are unsuccessful in our efforts to develop our ATI-0918 and ATI-1223 drug assets, or if Azaya and we were to enter into a dispute over the terms of our agreement, then our business could be seriously harmed.

TableLorem Vascular, is our exclusive licensee for our Cytori Cell Therapy products in all fields of Contents

use in China, Hong Kong, Singapore, Malaysia and Australia under the terms of the Lorem Agreement. Lorem Vascular is responsible for commercializing our Cytori Cell Therapy products in these territories. Lorem Vascular is relatively new company with no previous operating history, and has yet to generate meaningful revenues in its licensed territories. There can be no assurance that Lorem Vascular will be able to generate meaningful revenues in its licensed territories in the future. We are in ongoing discussions with Lorem Vascular regarding the terms of our collaboration, including the structure of the Lorem Agreement. If we are unable to agree with Lorem Vascular on revised terms to our collaboration, our relationship with them could suffer. A dispute may arise between us and Lorem Vascular that could lead to arbitration or other adversarial proceedings. Any such proceedings could cause significant diversion of management time and attention, cause us significant expense, and could potentially result in an outcome adverse to us. Further, any such dispute could negatively affect our ability to realize any sales or royalty revenues from Lorem Vascular’s commercial activities in the territories under its exclusive license. Even if we successfully restructure or otherwise revise our agreement with Lorem Vascular, there can be no assurance that Lorem Vascular will be able to successfully commercialize our Celution products in China or in the other territories subject to its license. Further, if Lorem Vascular fails to comply with any regulations applicable to its development, marketing and sale of our products, there can be no assurance that regulators would not try to hold us responsible for such activities.Pursuant to the Bimini Agreement, we have, among other things, granted Bimini an exclusive, worldwide license to use and sell our Cytori Cell Therapy products in the alopecia (hair loss) field. Cytori and Bimini granted certain licenses to each other, and have certain license, royalty and other payment obligations under the Bimini agreement, as well as certain supply, development and non-competition obligations. If we and Bimini were to enter into a dispute regarding the terms of our agreement, our business could be harmed.

*

If we or our distributors or collaborators fail to comply with regulatory requirements applicable to the development, manufacturing, and marketing of our products, regulatory agencies may take action against us or them, which could significantly harm our business

business.Our products and product candidates, along with the clinical development process, the manufacturing processes, post-approval clinical data, labeling, advertising and promotional activities for these products, are subject to continual requirements and review by the FDA and state and foreign regulatory bodies. Regulatory authorities subject a marketed product, its manufacturer and the manufacturing facilities to continual review and periodic inspections. We, our distributors and collaborators, and our and their respective contractors, suppliers and vendors, will be subject to ongoing regulatory requirements, including complying with regulations and laws regarding advertising, promotion and sales of products, required submissions of safety and other post-market information and reports, registration requirements, Clinical Good Manufacturing Practices (cGMP) regulations (including requirements relating to quality control and quality assurance, as well as the corresponding maintenance of records and documentation), and the requirements regarding the distribution of samples to physicians and recordkeeping requirements. Regulatory agencies may change existing requirements or adopt new requirements or policies. We, our distributors and collaborators, and our and their respective contractors, suppliers and vendors, may be slow to adapt or may not be able to adapt to these changes or new requirements.

Failure to comply with regulatory requirements may result in any of the following:

restrictions on our products or manufacturing processes;

withdrawal of the products from the market;

voluntary or mandatory recall;

suspension or withdrawal of regulatory approvals;

suspension or termination of any of our ongoing clinical trials;

refusal to permit the import or export of our products;

refusal to approve pending applications or supplements to approved applications that we submit;

imposition of civil or criminal penalties.

*We must rely on the performance of Lorem Vascular for the commercialization of our products in China, Hong Kong, Singapore, Malaysia and Australia

Lorem Vascular is the exclusive licensee for our products in China, Hong Kong, Singapore, Malaysia and Australia, and while we will are supportive of their efforts, they are responsible for obtaining regulatory approvals, market development and sales in these countries. Lorem Vascular is also a relatively new company and as such will be required to develop the expertise, personnel and relationships in each of these countries required to successfully market and sell our products. We cannot guarantee that Lorem Vascular will make the investments required to be successful in these countries. We cannot guarantee that the necessary regulatory approvals can be obtained, and we cannot guarantee that our products will be successful in these markets even if advantageous market regulatory approvals are obtained. In the absence of obtaining regulatory approvals required by applicable Chinese governmental entities such as the National Health and Family Planning Commission of the People’s Republic of China, Lorem Vascular may be unable to fully penetrate the Chinese market, and may be materially limited in its ability to sell our products. We believe that Lorem Vascular will be required to better understand the regulatory landscape in China and the conditions under which our technology may be successfully sold. However, no assurance can be given that Lorem Vascular will be able to successfully navigate any challenges presented by these regulations, or implement or successfully achieve a reasonable near or long-term regulatory or commercial strategy for China. Any such challenges could adversely affect Lorem Vascular’s ability to penetrate the market, grow sales, and satisfy its product purchase minimums under our agreement with them.

Further, we are in discussions with Lorem Vascular to appropriately restructure our agreement with them. If we are unable to agree with Lorem Vascular on revised terms to our agreement, our relationship with them could suffer. A dispute may arise between us and Lorem Vascular that could lead to diversion of management time and attention and cause us to realize little if any sales or royalty revenues from sales activities in the territories under our exclusive license with Lorem Vascular . Even if we successfully restructure our agreement with Lorem Vascular, there can be no assurance that Lorem Vascular will be able to successfully grow its Celution business in China. Further, to the extent Lorem fails to comply with any regulations applicable to its marketing and commercialization of our products, we cannot assure you that regulators might not try to hold us responsible for such activities if they believe we somehow facilitated or were otherwise responsible for Lorem’s actions.

If we are unable to successfully partner with other companies to commercialize our therapeutic offerings, our business could materially suffer

We intend to enter into strategic partnerships/collaborations to commercialize our indications, as we do not have the financial, human or other resources necessary to introduce and sell our therapeutic offerings in all of the geographies that we are targeting. We expect that our partners would provide regulatory and reimbursement/pricing expertise, sales and marketing resources, and other expertise and resources vital to the success of our product offerings in their territories. We further expect that these partnerships would include upfront cash payments to us in return for the rights to sell our products in specified territories, as well as downstream revenues in the form of milestone payment and royalties. If we are unable to identify suitable partners for our indications, including our lead ECCS-50 hand scleroderma indication, or if we are required to enter into agreements with such partners on unfavorable terms, our business and prospects could materially suffer. We are currently prioritizing our efforts to find a strategic partner for our hand scleroderma therapy (ECCS-50) in the EU. The EU regulatory environment is complicated, and our technology approach is novel. We cannot guarantee that the European Medicines Agencies and national competent authorities in the EU will grant regulatory approval for ECCS-50 on acceptable terms, if at all, nor can we guarantee that reimbursement agencies and other third party payers in the EU will grant us favorable reimbursement for our ECCS-50 product offering. These commercialization risks could affect prospective partners’ or collaborators’ willingness to enter into partnering arrangements on terms acceptable to us. See risk factors below for further discussion regarding regulatory and market risks associated with our products.

To the extent any of our customers fail to use our products in compliance with applicable regulations, regulators could try to hold us responsible if they believe we facilitated or were otherwise somehow responsible for our customer's non-compliance

non-compliance.We currently sell our Celution Cell Therapy products in many markets. Manynumerous markets outside of thesethe United States for research and commercial use. These markets have different, and in some cases, less burdensome, regulatory schemes applicable to our products.products than in the United States. To the extent any of our customers, whether inside or outside the U.S., use or further market our products for unapproved uses in their home market or in other markets or in a way that does not otherwise comply with applicable laws, there is a risk that regulators could try to hold us responsible for any such non-compliance. For example, we sell products to customers outside the U.S. To the extent any of our customersUnited States, use or further market our products in their home market or in other markets in a way that does not comply with applicable local regulations, regulators could try to hold us responsible if they believe we facilitated or were otherwise responsible for the customerscustomer’s actions. While we take measures in an effort to protect us against these types of risks, we cannot ensure you that such measures would prevent us from becoming subject to any such claims.

We and our products are subject to extensive regulation, and the requirements to obtain regulatory approvals in the United States and other jurisdictions can be costly, time-consuming and unpredictable. If we or our partners are unable to obtain timely regulatory approval for our product candidates, our business may be substantially harmed.

Cytori Cell Therapy: Our Celution system family of products and components of the Stemsource cell banks, must receive regulatory clearances or approvals from the FDA and from foreign regulatory bodies prior to commercial sale in those jurisdictions. Our Cytori Cell Therapy platform, including the Celution device, Celase and Intravase reagents, and consumable kits, is subject to

stringent government regulation in the United States by the FDA under the Federal Food, Drug and Cosmetic Act, and by the EMA and other regulatory agencies outside of the United States under their respective regulatory regimes.

The regulatory process for our cell therapy products can be lengthy, expensive, and uncertain. Before any new medical device may be introduced to the U.S. market, the manufacturer generally must obtain FDA clearance or approval through either the 510(k) pre-market notification process or the lengthier pre-market approval, or PMA, process. It generally takes from three to 12 months from submission to obtain 510(k) pre-market clearance, although it may take longer. Approval of a PMA could take four or more years from the time the process is initiated. The 510(k) and PMA processes can be expensive, uncertain, and lengthy, and there can be no assurance of ultimate clearance or approval. Our Celution®products under development today and in the foreseeable future will be subject to the lengthier PMA process. Securing FDA clearances and approvals may require the submission of extensive clinical data and supporting information to the FDA. Failure to comply with applicable requirements can result in application integrity proceedings, fines, recalls or seizures of products, injunctions, civil penalties, total or partial suspensions of production, withdrawals of existing product approvals or clearances, refusals to approve or clear new applications or notifications, and criminal prosecution.

For us to market our products in Europe, Canada, Japan and certain other non-U.S. jurisdictions, we need to obtain and maintain required regulatory approvals or clearances and must comply with extensive regulations regarding safety, manufacturing processes and quality. These regulations, including the requirements for approvals or clearances to market, may differ from the FDA regulatory scheme. International sales also may be limited or disrupted by political instability, price controls, trade restrictions and changes in tariffs. Additionally, fluctuations in currency exchange rates may adversely affect demand for our products by increasing the price of our products in the currency of the countries in which the products are sold.

Medical devices are also subject to post-market reporting requirements for deaths or serious injuries when the device may have caused or contributed to the death or serious injury, as well as for certain device malfunctions that would be likely to cause or contribute to a death or serious injury if the malfunction were to recur. If safety or effectiveness problems occur after the product reaches the market, the FDA may take steps to prevent or limit further marketing of the product. Additionally, the FDA actively enforces regulations prohibiting marketing and promotion of devices for indications or uses that have not been cleared or approved by the FDA. While we believe that our current activities are in compliance with FDA regulations relating to marketing and promotion, if regulators were to determine that our commercialization efforts, or those of our distributors, collaborators or customers, involve improper marketing and promotion of our products in violation of FDA regulations, our business could be substantially negatively affected.

There can be no assurance that we will be able to obtain the necessary 510(k) clearances or PMA approvals to market and manufacture our other products in the United States for their intended use on a timely basis, if at all. Delays in receipt of or failure to receive such clearances or approvals, the loss of previously received clearances or approvals or failure to comply with existing or future regulatory requirements could have a substantial negative effect on our results of operations and financial condition. In addition, there can be no assurance that we will obtain regulatory approvals or clearances in all of the other countries where we intend to market our products, or that we will not incur significant costs in obtaining or maintaining foreign regulatory approvals or clearances, or that we will be able to successfully commercialize current or future products in various foreign markets. Delays in receipt of approvals or clearances to market our products in foreign countries, failure to receive such approvals or clearances or the future loss of previously received approvals or clearances could have a substantial negative effect on our results of operations and financial condition.

Cytori Nanomedicines: The worldwide regulatory process for our Cytori Nanomedicines drug candidates can be lengthy and expensive, with no guarantee of approval.

Before any new drugs may be introduced to the U.S. market, the manufacturer generally must obtain FDA approval through either an abbreviated new drug application, or ANDA, process for generic drugs off patent that allow for bioequivalence to an existing reference listed drug, or RLD, or the lengthier new drug approval, or NDA, process, which typically requires multiple successful Phase III clinical trials to generate clinical data supportive of safety and efficacy along with extensive pharmacodynamic and pharmacokinetic preclinical testing to demonstrate safety. Our lead drug product under development (ATI-0918) is eligible ANDA process, while our ATI-1123 drug candidate is subject to the significantly lengthier NDA process. Approval of an ANDA could take four or more years from the time the process is initiated due to the requirement for clinical trials. NDA drugs could take significantly longer due to the additional preclinical requirements along with the typical requirement for two successful Phase III clinical studies.

In Europe, as in the United States, there are two regulatory steps to complete before a drug candidate is approved to be marketed in the European Union. These two steps are clinical trial application and marketing authorization application. Clinical trial applications are approved at the member state level, whereas marketing authorization applications are approved at both the member state and centralized levels. Both ATI-0918 and ATI-1123 will follow the centralized procedure for EMA regulatory approval. The centralized procedure allows the applicant to obtain a marketing authorization that is valid throughout the EU. Similar to the FDA process, the EMA centralized process requires bioequivalence data for generic drug candidates such as ATI-0918, and robust clinical data for non-generic drug candidates like ATI-01123 similar to clinical data required for NDA drug candidates.

There are numerous risks arising out of the regulation of our ATI-0918 and ATI-1123 drug candidates include the following:

Market acceptance

We can provide no assurances that our current and future oncology drugs will meet all of the stringent government regulation in the United States, by the FDA under the Federal Food, Drug and Cosmetic Act, and/or in international markets such as Europe, by the EMA under its Medicinal Products Directive, or Japan, by Japan’s Pharmaceuticals and Medical Devices Agency and Ministry of Health, Labor and Welfare under the Japanese Pharmaceutical Affairs Law.

We intend to seek regulatory of our ATI-0918 drug candidate via abbreviated approval processes referred to as bioequivalence or BE, approved under an abbreviated new drug application, or ANDA. There are no assurances that these abbreviated processes are or will be available in markets outside of the United States, or where available, that we will successfully obtain regulatory approvals via such abbreviated processes.

It is required for ANDA and BE drug candidates that there is a reference listed drug, or RLD, with which the drug candidate must demonstrate equivalence. There are no assurances that the reference drug for ATI-0918 will be the same in all territories or countries, which could require different and unique BE clinical studies for some territories where we currently intend to commercialize ATI-0918. Changes in the RLD may result in the nullification of BE clinical studies and can result in significant delays in the regulatory process as BE clinical studies may need to be repeated for jurisdictions that no longer recognize the reference drug utilized in BE clinical studies.

Our Cytori Nanomedicines drug candidates, if approved, will still be subject to post-market reporting requirements for deaths or serious injuries when the drug may have caused or contributed to the death or serious injury, or serious adverse events. There are no assurances that our drug products will not have safety or effectiveness problems occurring after the drugs reach the market. There are no assurances that regulatory authorities will not take steps to prevent or limit further marketing of the drug due to safety concerns.

It is possible that the new legislation in our priority markets, such as the newly enacted CURES Act in the United States, will yield additional regulatory requirements for therapeutic drugs for our Cytori Nanomedicine drug candidates (the FDA’s interpretation and implementation of the CURES Act has yet to be published).

Changing, new and/or emerging government regulations may adversely affect us.

Cytori Cell Therapy: Government regulations can change without notice. Given the fact that we operate in various international markets, our access to such markets could change with little to no warning due to a change in government regulations that suddenly up-regulate our product(s) and create greater regulatory burden for our cell therapy and cell banking technology products.

Our ability to receive regulatory approvals for our Cytori Cell Therapy products and to sell into foreign markets is complex, due in part to by the nature of our Celution platform and manufacturing process. The platform consists of our Celution device that processes the patient’s own adipose (fat) tissue to create a heterogeneous mixture of regenerative cells. In the United States, this heterogeneous mixture of cells is subject to classification as a drug, but the FDA has made the determination that our Cytori Cell Therapy will be regulated as a Class III PMA medical device. However, foreign regulatory bodies must assess our particular platform and manufacturing process to make their own determination whether our Cytori Cell Therapy product candidates should receive medical device or drug classifications. For example, the European Commission has granted orphan drug designation for the use of Cytori Cell Therapy (currently branded as Habeo Cell Therapy) in treatment of system sclerosis. The EMA has not made a determination whether it would classify Habeo Cell Therapy as an ATMP or a medical device. Though we believe that Habeo Cell Therapy will be classified by the EMA as an ATMP, we cannot guarantee that the EMA will not arrive at a different determination at such time that we ask a determination to be made. Regardless of the EMA’s ultimate determination, we will also be required to comply with the particular regulatory requirements of each of the member states of the European Economic Area (comprised of 28 European Union, or EU, member states plus Iceland, Liechtenstein, and Norway) with respect to our cell therapy offerings, a process which we anticipate will require considerable time, effort and expense. We expect that regulatory bodies in other jurisdictions will engage in similar analyses of our Cytori Cell Therapy, and we cannot predict then outcomes of these analyses.

In Japan, the Japanese Diet recently passed the Act regarding Ensuring of Safety of Regenerative Medicine, or the Regenerative Medicine Law, and the revisions to the Pharmaceutical Affairs Law as applied to drugs, medical devices and regenerative medicine. The Regenerative Medicine Law initially caused some confusion for regenerative companies operating in Japan, but we believe that this law, as currently implemented, benefits Cytori and its customers by allowing an expedited path for our customers in Japan to obtain licenses under the Regenerative Medicine Law to treat patients with Cytori Cell Therapy. However, we cannot be certain that the Regenerative Medicine Law will not be repealed or that current interpretations and implementation of the Regenerative Medicine Law will not change in a manner adverse to our business. Further, we currently import and sell our products in Japan under Class I notifications that we obtained several years ago. However, at the request of Japanese regulators, we are in the process of obtaining Class III approvals for our Celution device and consumable kits. Though we are pursuing these Class III

approvals process without any anticipated interruption to our commercial activities, it is possible that other jurisdictions in which we currently sell may require similar heightened regulatory approvals but with potential restrictions on our ability to market and sell our Cytori Cell Therapy products in such territories during the application process and review period for the required regulatory approval(s).

Any regulatory review committees and advisory groups and any contemplated new guidelines may lengthen the regulatory review process, require us to perform additional studies, increase our development costs, lead to changes in regulatory positions and interpretations, delay or prevent approval and commercialization of our product candidates or lead to significant post-approval limitations or restrictions. As we advance our product candidates, we will be required to consult with these regulatory and advisory groups, and comply with applicable guidelines. If we fail to do so, we may be required to delay or discontinue development of our product candidates. Delay or failure to obtain, or unexpected costs in obtaining, the regulatory approval necessary to bring a product candidate to market could decrease our ability to generate sufficient revenue to maintain our business. Divergence in regulatory criteria for different regulatory agencies around the globe could result in the repeat of clinical studies and/or preclinical studies to satisfy local territory requirements, resulting in the repeating of studies and/or delays in the regulatory process. Some territories may require clinical data in their indigenous population, resulting in the repeat of clinical studies in whole or in part. Some territories may object to the formulation ingredients in the final finished product and may require reformulation to modify or remove objectionable components; resulting in delays in regulatory approvals. Such objectionable reformulations include, but are not limited to, human or animal components, BSE/TSE risks, banned packaging components, prohibited chemicals, banned substances, etc. There can be no assurances that FDA or foreign regulatory authorities will accept our pre-clinical and/or clinical data.

Due to the fact that there are new and emerging cell therapy and cell banking regulations that have recently been drafted and/or implemented in various countries around the world, the application and subsequent implementation of these new and emerging regulations have little to no precedence. Therefore, the level of complexity and stringency is not known and may vary from country to country, creating greater uncertainty for the international regulatory process.

Anticipated or unanticipated changes in the way or manner in which the FDA or other regulators regulate products or classes/groups of products can delay, further burden, or alleviate regulatory pathways that were once available to other products. There are no guarantees that such changes in the FDA’s or other regulators’ approach to the regulatory process will not deleteriously affect some or all of our products or product applications.

Cytori Nanomedicines: Our nanotechnology technology is also subject to government regulations that are subject to change. Our lead product, ATI-0918 is regulated under bioequivalence rules that rely on a reference listed drug, or RLD, for equivalence in the United States and other jurisdictions. Government agencies can change the reference listed drug or reference drug without notice. These changes in the RLD could invalidate clinical studies and require the initiation of new technologyclinical studies for determining equivalence to a newly assigned RLD. Furthermore, bioequivalence studies may need to be repeated in certain foreign entities as some governments may require additional confirmatory studies in their patient populations. These additional requirements could result in additional clinical studies or delays in the regulatory process. Other risks with the RLD criteria are in the criteria for demonstrating bioequivalence. Bioequivalence criteria may not be identical in all geographical regions, resulting in the requirement for new bioequivalence studies to demonstrate equivalence to a more stringent standard. Additionally, bioequivalence criteria rely on the products being “off patent” in the territory. Patent expiration dates may vary in different regions which may result in bioequivalence regulatory pathways being delayed in some territories. Current regulatory pathways such as oursthe abbreviated new drug application, or ANDA, pathway, of we are currently relying on, are subject to change and may cease to be viable regulatory pathways in the future.

Our pipeline oncology products, such as ATI-1123, are being developed under existing government criteria, which are subject to change in the future. Clinical and/or pre-clinical criteria in addition to cGMP manufacturing requirements may change and impose additional regulatory burdens. Clinical requirements are subject to change which may result in delays in completing the regulatory process. Divergence in regulatory criteria for different regulatory agencies around the globe could result in the repeat of clinical studies and/or preclinical studies to satisfy local jurisdictional requirements, which would significantly lengthen the regulatory process and increase uncertainty of outcome. Some jurisdictions may require clinical data in their indigenous population, resulting in the repeat of clinical studies in whole or in part. Some jurisdictions may object to the formulation ingredients in the final finished product and may require reformulation to modify or remove objectionable components; resulting in delays in regulatory approvals. Such objectionable reformulations include, but are not limited to, human or animal components, bovine spongiform encephalopathy/ transmissible spongiform encephalopathy risks, banned packaging components, prohibited chemicals, banned substances, etc. There can be difficult to obtain

no assurance that the FDA or foreign regulatory authorities will accept our pre-clinical and/or clinical data. We may have difficulty obtaining appropriate and sufficient pricing and reimbursement for our cell therapy products.

New and emerging cell therapy and cell banking technologies, such as those provided by the Cytori Cell Therapy family of products, may have difficulty or encounter significant delays in obtaining market acceptancehealth care reimbursement in some or all countries around the world due to the novelty of our cell therapy and cell banking technologies.technology and subsequent lack of existing reimbursement

schemes/pathways. Therefore, the market adoptioncreation of our Cytori Cell Therapy and cell banking technologiesnew reimbursement pathways may be slowcomplex and lengthy with no assurances that significant market adoptionsuch reimbursements will be successful. The lack of market adoptionhealth insurance reimbursement or reduced or minimal market adoption of our cell therapy and cell banking technologiesreimbursement pricing may have a significant impact on our ability to successfully sell our cell therapy and cell banking technology product(s) into a countrycounty or region.

Future clinical trial results may differ significantly fromregion at pricing that is profitable and that adequately compensates Cytori for its development costs, which would negatively impact our expectations

Whileoperating results. Habeo Cell Therapy, our lead indication, is intended to treat hand manifestations of systemic scleroderma, which is a rare, or orphan, disease. As such, we have proceeded incrementally with our previous clinical trials in an effortanticipate that Habeo Cell Therapy will be priced to gauge the risks of proceeding with larger and more expensive trials, such as in previous cardiac trials in Europe, and our ATHENA I and ATHENA II feasibility trial in heart failure due to ischemic heart disease, we cannot guarantee that we will not experience negative results in larger and much more expensive clinical trials than we have conducted to date. Poor results, unanticipated events or other complicationsreflect its orphan status in our clinical trials could result in substantial delays in commercialization, substantial negative effects on the perception of our products, and substantial additional costs. These risks are increased by our reliance on third parties in the performance of many of the clinical trial functions, including the clinical investigators, hospitals, CROs, and other third party service providers.

Our product candidates may not receive regulatory approvals or their development may be delayedprior target markets for a variety of reasons, including unsuccessful clinical trials, regulatory requirements or safety concerns

Clinical testing of our products is a long, expensive and uncertain process, and the failure or delay of a clinical trial can occur at any stage. Even if initial results of preclinical and nonclinical studies or clinical trial results are promising, we may obtain different results in subsequent trials or studies that fail to show the desired levels of safety and efficacy, or we may not obtain applicable regulatory approval for a variety of other reasons. Clinical trials for any of our products could be unsuccessful, which would delay or prohibit regulatory approval and commercialization of the product.this indication. In the United States and other jurisdictions, regulatory approval canin Europe, we anticipate that this pricing will be delayed, limited or not grantedsupported by Habeo Cell Therapy meeting primary endpoints from the STAR and SCLERADEC II clinical trials. Further, in Europe, we expect that Habeo Cell Therapy will be classified as an ATMP with orphan drug status, and if we are the first ATMP approved for many reasons,this indication in Europe, we will receive certain benefits, including among others:

market exclusivity (subject to certain caveats). Status as an approved ATMP with orphan drug designation could provide us with a strong platform from which to seek higher reimbursement. However, the level of reimbursement Habeo Cell Therapy will receive will be directly related to the quantity and quality of clinical results may not meet prescribed endpoints for the studies or otherwise provide sufficient data to support the efficacy ofevidence reported by these STAR and SCLERADEC II clinical trials. It is possible that our products;

clinical and nonclinical test results may reveal side effects, adverse events or unexpected safety issues associated with the use of our products;

regulatory review may not find a product safe or effective enough to merit either continued testing or final approval;

regulatory review may not find that the data from preclinical testing and clinical trials justifies approval;

regulatory authorities may require that we change our studies or conduct additional studies which may significantly delay or make continued pursuit of approval commercially unattractive;

a regulatory agency may reject our trial data or disagree with our interpretations of either clinical trial data are sufficient to support regulatory approval of Habeo Cell Therapy, but not sufficient to support pricing at a level that makes Habeo Cell Therapy attractive to potential partners or applicable regulations;

to make it economically viable for us to directly commercialize Habeo Cell Therapy. Further, if the

cost ofSTAR and SCLERADEC II clinical trials

required for productare not successful, we may not be in a position to seek regulatory approval

may be greater than what we originally anticipate,at all, and we may

decidebe required to

suspend or abandon our Habeo Cell Therapy commercialization efforts.Our European managed access program for Habeo Cell Therapy may not pursue regulatory approvalbe successful, which in turn could adversely affect our Habeo Cell Therapy commercialization efforts.

Our managed access program, or MAP (also known as early access program or named patient program), is intended to provide access in select countries across Europe, the Middle East and Africa, or EMEA, to our Habeo Cell Therapy for suchpatients with impaired hand function due to scleroderma in advance of anticipated commercialization of Habeo Cell Therapy. Our MAP will has faced and will continue to face numerous challenges, including the following:

In most countries, patient access to Habeo Cell therapy will be provided on an ‘individual’ patient basis where physicians will make an application to their Competent Authority in each country on a product;patient-by-patient basis. This imposes a significant administrative burden on participating physicians, and requires them to navigate a process with which they are oftentimes unfamiliar.

In certain countries, hospitals and/or patients will be required to pay a regulatory agency may identify problems or other deficiencies in our existing manufacturing processes or facilities, or the existing processes or facilitiesportion of our collaborators,procedure fees under our contract manufacturers or our raw material suppliers;

a regulatory agency may change its formal or informal approval requirements and policies, act contrary to previous guidance, adopt new regulations or raise new issues or concerns late in the approval process;

a product candidate may be approved only for indications that are narrow or under conditions that place the product at a competitive disadvantage, whichMAP. This payment obligation may limit the salesnumber of hospitals and marketing activitiespatients who can afford to participate in our MAP.

Because Cytori is targeting an orphan indication in scleroderma where there is an established need for such products effective therapies, regulators in Europe have been willing to allow an approval trial based on limited data from the 12-patient, investigator initiated SCLERADEC I pilot trial. The lack of robust Phase II clinical data has also proven to be a hurdle to MAP acceptance. We believe that positive results from the STAR clinical trial and/or otherwise adversely impact the commercial potential of a product; or

a regulatory agency may ask the company to put aSCLERADEC II clinical study on hold pending additional safety data;trial will help drive interest in our MAP, but there is no guarantee that either trial will achieve positive results.

Orphan drug designation may not ensure that we will enjoy market exclusivity in a particular market, and if we fail to obtain or maintain orphan drug designation or other regulatory exclusivity for some of our product candidates, our competitive position would be harmed.

A product candidate that receives orphan drug designation can benefit from potential commercial benefits following approval. Under the companyU.S. Orphan Drug Act, the FDA may designate a product candidate as an orphan drug if it is intended to treat a rare disease or condition, defined as affecting a patient population of fewer than 200,000 in the United States, or a patient population greater than 200,000 in the United States where there is no reasonable expectation that the cost of developing the drug will be recovered from sales in the United States. In the European Union, or EU, the EMA’s Committee for Orphan Medicinal Products, or COMP, grants orphan drug designation to promote the development of products that are intended for the diagnosis, prevention or treatment of a life-threatening or chronically debilitating condition affecting not more than 10,000 persons in the EU. Currently, this designation provides market exclusivity in the U.S. and the European Union for seven years and ten years, respectively, if a product is the first such product approved for such orphan indication. This market exclusivity does not, however, pertain to indications other than those for which the drug was specifically designated in the approval, nor does it prevent other types of drugs from receiving orphan designations or approvals in these same indications. Further, even after an orphan drug is approved, the FDA can subsequently approve a drug with similar chemical structure for the same condition if the FDA concludes that the new drug is clinically superior to the orphan product or a market shortage occurs. In the EU, orphan exclusivity may be reduced to six years if the drug no longer satisfies the original designation criteria or can be lost altogether if the marketing authorization holder consents to a second orphan

drug application or cannot supply enough drug, or when a second applicant demonstrates its drug is “clinically superior” to the original orphan drug.

In April 2016, the European Commission, acting on the positive recommendation from the COMP, issued orphan drug designation to a broad range of Cytori Cell Therapy formulations when used for the treatment of systemic sclerosis. In November 2016, the U.S. FDA Office of Orphan Products Development granted us an orphan drug designation for cryopreserved or centrally processed ECCS-50 (Habeo) for scleroderma. Either or both of such orphan drug designations may fail to result in or maintain orphan drug exclusivity upon approval, which would harm our competitive position.

We generate 71% of our sales revenues from Japan, with 76% of those revenues generated by sales to four customers and 49% of these revenues generated by sales to one customer. This concentration of sales in one territory, and to one small group of customers in Japan, makes us vulnerable to the loss of our key customers and to adverse changes in the Japanese market.

In 2016, we generated approximately $3.3 million in sales revenues in Japan, representing 71% of our overall global sales revenues. 76% of the Japan sales revenues were from four key customers, and 49% of these sales revenues were from one key customer. We expect a relatively small number of customers to account for a majority of our revenues for the foreseeable future. This concentration of sales in one country, and in a small subset of customers within such country, represents a risk to our business. Our existing business in Japan, and our prospects for further growth of product sales in Japan, are subject to a number of risks, including the following:

Existing laws and regulations pertaining to our business, including the Act regarding Ensuring of Safety of Regenerative Medicine, or the Regenerative Medicine Law, passed in 2013, may be repealed, or implemented, amended or superseded, in a manner that is adverse to our business;

Macroeconomic conditions in Japan may deteriorate, thus weakening demand for our cell therapy products, which are used in self-pay procedures in Japan;

Japanese regulatory authorities may take unexpected actions with respect to our cell therapy products, including with respect to required regulatory clearances and approvals in Japan, that could cause us to suspend or curtail our cell therapy sales operations in Japan;

Quality issues could arise, requiring product recalls or other actions that could cause us reputational damage and lost sales;

One or more of our key customers in Japan may decide to acquire competitive products, adopt other technological or therapeutics approaches to the conditions they treat, or otherwise reduce or cease their purchases of our products;

Our Cytori Cell Therapy product trials may not achieve statistical significance and thus could diminish the perceived value and efficacy of our technology; and

Our relatively small team in Japan may not be able to manage the needs of a growing business, and we may not able to hire and retain existing or new employees necessary to maintain and expand our business in Japan.

Further, a loss of one or more of our key customers, a dispute or disagreement with one of these key customers, a significant deterioration in the financial condition of one of these key customers, or a significant reduction in the amount of our products ordered by any key customer could adversely affect our revenue, results of operations and cash flows.

If we experience an interruption in supply from a material sole source supplier, our business may be harmed

We acquire some our components and other raw materials from sole source suppliers. If there is an interruption in supply of our raw materials from a sole source supplier, there can be no assurance that we will be able to obtain adequate quantities of the raw materials within a reasonable time or at commercially reasonable prices. Interruptions in supplies due to pricing, timing, availability or other issues with our sole source suppliers could have a negative impact on our ability to manufacture products and product candidates, which in turn could adversely affect commercial sales of our commercially available Cytori Cell Therapy products, delay our development and commercialization efforts and cause us to potentially breach our supply or other obligations under our agreements with certain other counterparties.