PART I

Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. These statements also relate to the Kaspien Holdings Inc.’s (“the Company’s”) future prospects, developments and business strategies. The statements contained in this document that are not statements of historical fact may include forward-looking statements that involve a number of risks and uncertainties.

We have used the words “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, “mission”, “vision” and similar terms and phrases, including references to assumptions, in this document to identify forward-looking statements. These forward-looking statements are made based on management’s expectations and beliefs concerning future events and are subject to uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond the Company’s control, that could cause actual results to differ materially from those matters expressed in or implied by these forward-looking statements. The following factors are among those that may cause actual results to differ materially from the Company’s forward-looking statements.statements:

continued operating losses;

the ability of the Company to satisfy its liabilities and to continue as a going concern;

maintaining Kaspien’s relationship with Amazon;

continued revenue declines;

decline in the Company’s stock price;

the limited public float and trading volume for our Common Stock;

new product introductions;

advancements in technology;

dependence on key employees, the ability to hire new employees and pay competitive wages;

the Company’s level of debt and related restrictions and limitations;

future cash flows;

vendor terms;

interest rate fluctuations;

access to third party digital marketplaces;

adverse publicity;

product liability claims;

changes in laws and regulations;

breach of data security;

increase in Amazon Marketplace fulfillment and storage fees;

limitation on our acquisition and growth strategy as a result of our inability to raise necessary funding;

the Company’s ability to meet the continued listing standards of the NASDAQ; and

the other matters set forth under Item 1A “Risk Factors,” Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and other sections of this Annual Report on Form 10-K.

The reader should keep in mind that any forward-looking statement made by us in this document, or elsewhere, pertains only as of the date on which we make it. New risks and uncertainties come up from time-to-time and it is impossible for us to predict these events or how they may affect us. In light of these risks and uncertainties, you should keep in mind that any forward-looking statements made in this report or elsewhere might not occur.

1

In addition, the preparation of financial statements in accordance with accounting principles generally accepted in the United States (“GAAP”) requires us to make estimates and assumptions. These estimates and assumptions affect:

the reported amounts and timing of revenue and expenses,

the reported amounts and classification of assets and liabilities, and

the disclosure of contingent assets and liabilities.

Actual results may vary from our estimates and assumptions. These estimates and assumptions are based on historical results, assumptions that we make, as well as assumptions by third parties.

2

| Item 1. | BUSINESS |

Company Background

Kaspien Holdings IncInc. (f/k/a Trans World Entertainment Corporation) (“Kaspien”), which, together with its consolidated subsidiaries, is referred to herein as the “Company”, “we”, “us” and “our”, was incorporated in New York in 1972. We own 100% of the outstanding Common Stock of Kaspien Inc. See below for additional information.

Five core principles guide us:

| • | We are partner obsessed. Our customers are our partners. Every decision is focused on building mutually beneficial relationships that deliver results. |

| • | We are insights driven. We make data actionable. Our curiosity drives us to discover opportunities early and often. |

| • | We create simplicity. We challenge the status quo. We take the complicated and simplify it. |

| • | We take ownership. We make things happen. We hold ourselves accountable and have a bias for action. |

| • | We empower each other. We welcome and learn from diverse experiences. Our empathy ignites innovation and empowers meaningful change. |

Business Overview

| • | Retail business model: We buy inventory and use our expertise, technology, and services to generate revenue through marketplace transactions. Kaspien provides account management, brand communication, listings management, data reporting, joint business planning, and comprehensive marketing support services. Our target partners are enterprise-level large growth brands that derive margins based on pricing. |

| • | Agency business model: We use our expertise, technology, and services to manage our partners’ marketplace presence through channel management with no inventory position. Kaspien provides support services for account management, media planning, media analytics, search strategy, business planning, and data reporting. Our target partners in this space range from medium size to enterprise-level brands. We derive margin based on a retainer plus a percentage of transactions and/or specific service fees. |

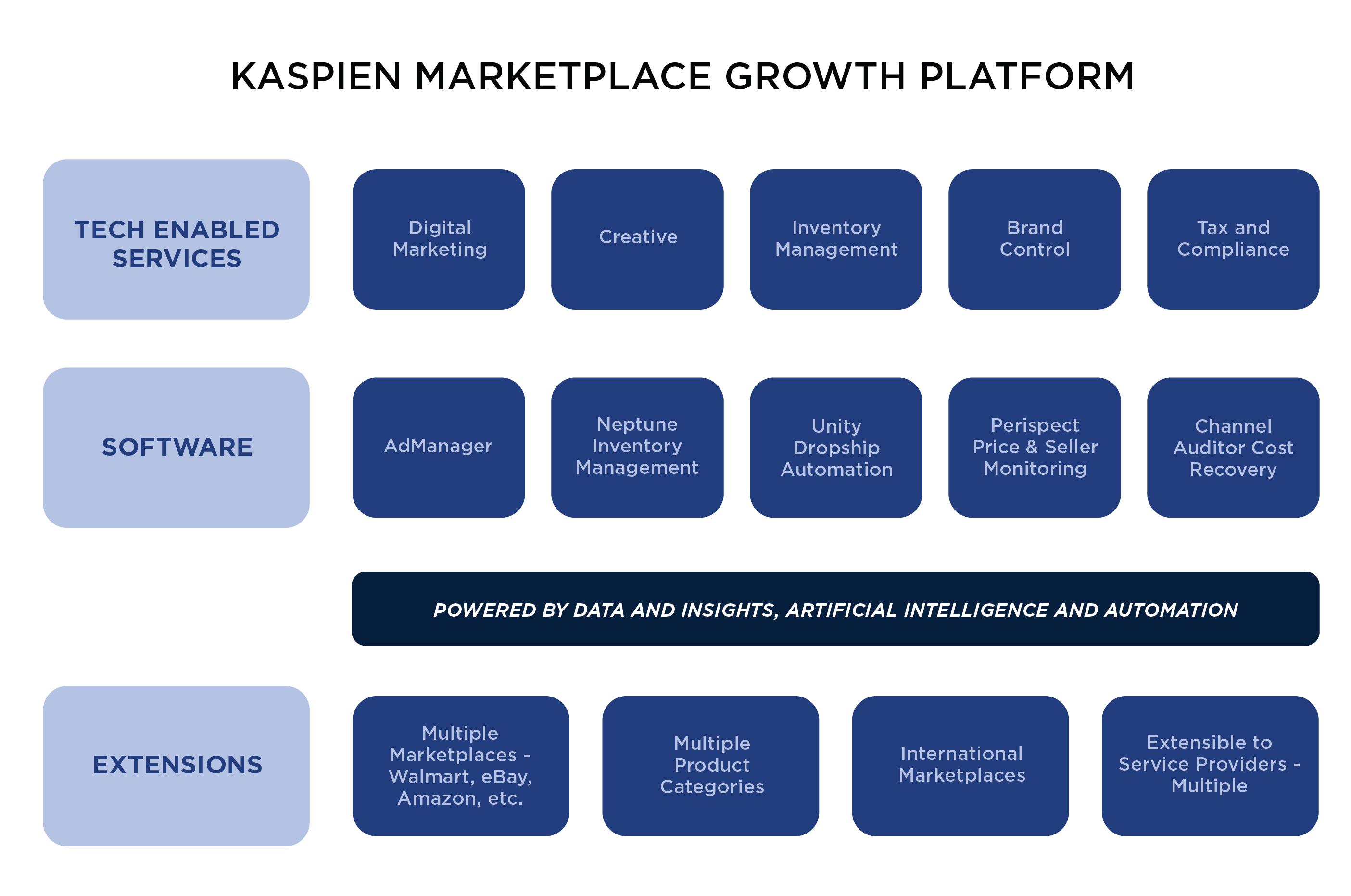

Kaspien provides all the software and services required to drive brand growth and achieve a brand’s online goals on Amazon.com, Walmart.com, and Target.com through multiple business models—namely, Retail and Agency services. We are a technology-enabled services company built to drive marketplace growth. A high-level overviewvisualization of the Kaspien platformour business model is shown in Figure 1 below:below.

3

Partners

Kaspien views all brandour retail customers ofas our platform as partners and defines them under this nomenclature.partners. Our partners include brands, suppliers, distributors, liquidators, and affiliates such as venture capital firms and marketing agencies, as well as other industry brand aggregators.distributors. Our market sectorscategories of focus include but are not limited to: Pets/Baby, Pets & Sporting Goods, Tools/Office/Outdoors, and Health & Personal Care and Home/Kitchen/Grocery.Care. In fiscal 2020,2022, these top categories madeaccounted for approximately 68%83% of our total revenue. We organizeTo accelerate the growth of our operationsbusinesses, we have defined an operating model by category, developingsegmenting our businesses into teams, with a deep understandingsingle-threaded leader or “Partner Success Manager” runs. A cross-functional team, including a marketing specialist and subject matter expertise in these areas, powering our platform to drive better results across these category focal points.a buyer, supports each Partner Success Manager, collectively called a “business POD.”

Kaspien uses its proprietary data platformleading online tools to identify brands that would be good strategic fits for its services. We utilize content marketing to strengthen its visibility within the e-commerce industry. The Company’s public relations efforts consist of press releases, articles in industry publications, and articles on its website to build its brand. In addition, we regularly run advertisements on popular ad platforms such as Google, Facebook, TwitterKaspien also has an aggressive business development outreach program and LinkedIn to bring leads into its sales funnels.

attends several industry tradeshows annually.In addition, Kaspien recently adopted a brand acquisition strategy whereby we will deploy capital to acquire certain strategic brands, bring them onto our platform, increasing the scale of such brands.

The Kaspien platform can be leveraged and engaged in threevia two primary differentand distinct business models.

Retail-as-a-Service (“RaaS”):Retail Partnership:We own the inventory. We sell it.

Agency-as-a-Service(“AaaS”):Agency Partnership: Partner owns the inventory. We sell it.

Software-as-a-Service (“SaaS”): Partner owns inventoryPrimary Agency services include:In this model, Kaspien provides partners access to software through its platform of proprietary technology to empower partners to self-manage their marketplace channel. Kaspien charges a subscription feeCost recovery and receives a percentage of the transaction.case managementThe “Agency as a Service” and “Software as a Service” models are collectively called “Subscriptions.” The software products and tech-enabled services that form subscriptions are as follows:Inventory & supply chain management

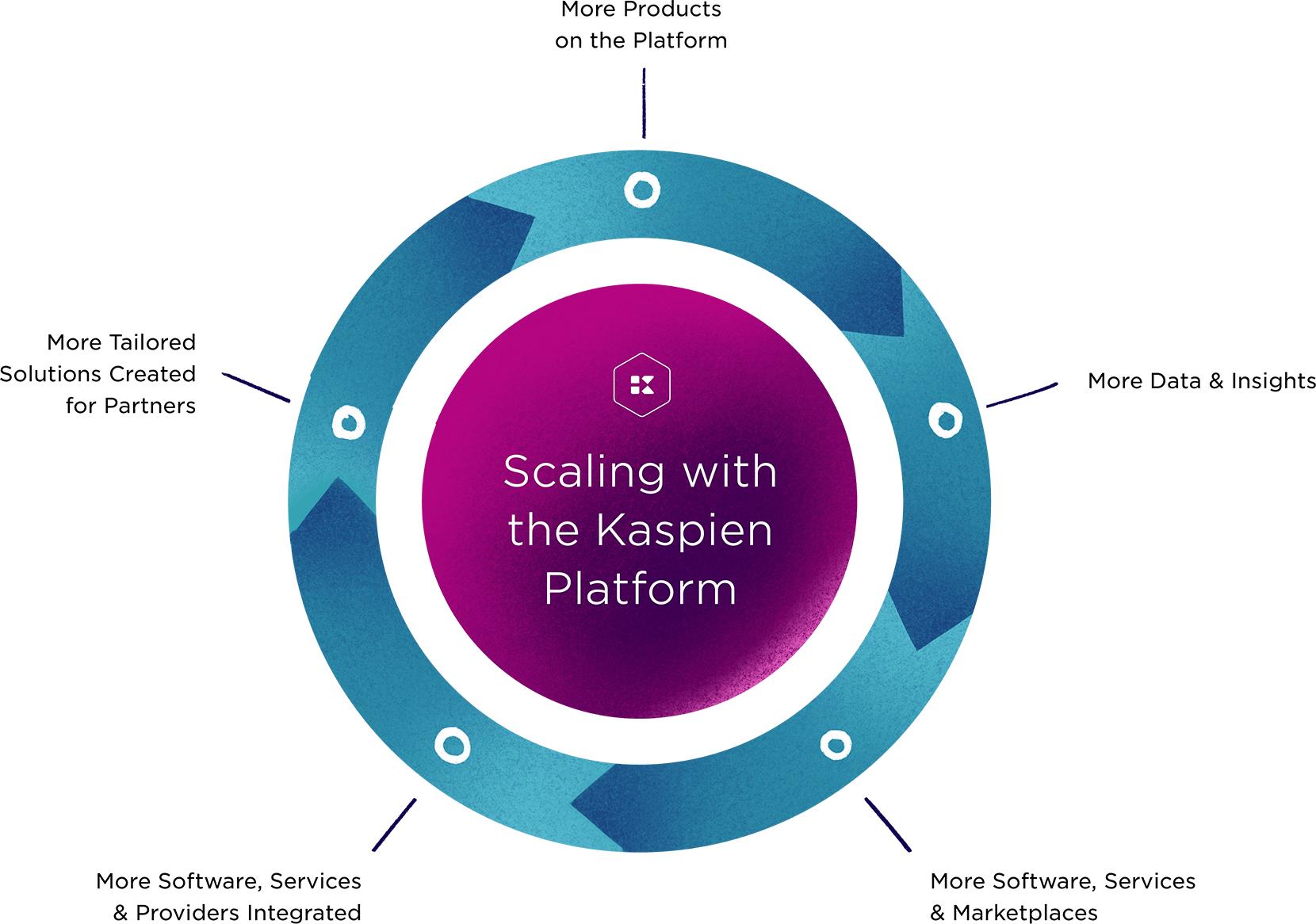

While used for different models, the platform is designed to benefit from network effects. The more partners on our platform, the more data and insights it can collect. The more insights it gets, more products and services it can serve its partners and more marketplace integrations it can support. The more marketplace providers that can be integrated, the greater the number of possible partners to engage in our services.

4

According to emarketer.com, worldwide e-commerce sales in 2020 were $4.3 trillion, up 27.6% from 2019. Total worldwide retail sales declined 3.0% to $23.9 trillion. Worldwide e-commerce growth is projected to increase 14.3% in 2021. Although the growth will slow, e-commerce penetration14.6% of total global retail continues to rise and is predicted to be 19.5% of total retail.sales, the same level as 2021.

Our focus on the platform and subscriptions services has fueled strong growth in our subscription services, growing our partner base by 214% from 42 to 132 partners within our subscription platform. Our annual recurring revenue (“ARR”) in our subscriptions business grew by 181% from $0.7 million to $1.8 million from fiscal year 2019 to fiscal year 2020.

Employee health and safety in the workplace is one of the Company’s core values. The COVID-19 pandemic has underscored the importance of keeping employees safe and healthy. In response to the COVID-19 pandemic, the Company has taken actions aligned with the World Health Organization and the Centers for Disease Control and Prevention in an effort to protect the Company’s workforce so they can more safely and effectively perform their work. These actions include shutting down its headquarters for some months during 2020, wearing facemasks in common areas in the office, and allowing employees to work from home.

In addition, Kaspien regularly runs advertisements on popular ad platforms such as Google, Facebook, Twitter and LinkedIn to bring leads into its sales funnels.

During the third quarter of 2019, based on recurring losses from operations, the Company pursued several strategic initiatives towards its strategy of shifting its focus solely to the operation of Kaspien, improving profitability and meeting future liquidity needs and capital requirements. The following initiatives were completed during the first quarter of 2020:

The sale of the For Your Entertainment (fye) business;

The establishment of a new secured $25 million revolving credit facility (the “New Credit Facility”) with Encina Business Credit, LLC (“Encina”);

6

The execution of a separate subordinated loan agreement for Kaspien (the “Subordinated Loan”); and

The receipt by Kaspien of loan proceeds pursuant to the Paycheck Protection Plan (the “PPP Loan”) under the Coronavirus Aid, Relief, and Economic Security Act.

Notwithstanding the foregoing, the ability of the Company to meet its liabilities and to continue as a going concern is dependent on improved profitability, the continued implementation of the strategic initiative to reposition Kaspien as a platform of software and services and the availability of future funding and overcoming the impact of the COVID-19 pandemic.funding.

7We have substantial indebtedness, which could adversely affect our business.

We have a significant amount of debt and we may continue to incur additional debt in the future. As of January 28, 2023, the Company had borrowings of $8.8 million under our credit facility with Eclipse. We also had borrowings of $5.3 million under our Subordinated Debt facility, with interest accruing at the rate of twelve percent (12%) per annum and compounded on the last day of each calendar quarter by becoming a part of the principal amount. In addition, we have $4.5 million under our Subordinated Debt Facility, with interest accruing at the rate of fifteen percent (15%) per annum and compounded on the last day of each calendar quarter by becoming a part of the principal amount. Substantially all of our assets, including the capital stock of Kaspien is pledged to secure our indebtedness. This leverage also exposes us to significant risk by limiting our flexibility in planning for, or reacting to, changes in our business (whether through competitive pressure or otherwise), our industry and the economy at large. In addition, our ability to make payments on, or repay or refinance, such debt, and to fund our operating and capital expenditures, depends largely upon our future operating performance. Our future operating performance, to a certain extent, is subject to general economic, financial, competitive, regulatory and other factors that are beyond our control.

As of January 30, 2021, the Company had borrowings of $6.3 million under its credit facility with Encina.

8

8

The

If weWe do not currently meet the continued listing standards of the NASDAQ, and as a result our Common Stock could be delisted from trading, which could limit investors’ ability to make transactions in our Common Stock and subject us to additional trading restrictions.

9

On August 4, 2020,The Nasdaq Capital Market under Nasdaq Listing Rule 5550(a)(2). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company receivedhas been provided a letter from the Listing Qualifications staffperiod of The Nasdaq Stock Market (“Nasdaq”) notifying the Company that it was not in180 calendar days, or until June 12, 2023, to regain compliance. In order to regain compliance with the minimum stockholders’ equity requirement (the “Stockholders’ Equity Requirement”) for continued listing onclosing bid price rule, the Nasdaq Capital Market. Nasdaq Listing Rule 5550(b)(1) requires listed companies to maintain stockholders’ equityclosing bid price of the Company’s common stock must be at least $2.5 million and as$1.00 for a minimum of August 4, 2020, the Company did not meet the alternative compliance standards relating to the market value of listed securities or net income from continuing operations.

On January 22, 2021, the Company received written notice from the Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”) stating that the Company’s market value of listed securities was greater than $35 million for ten consecutive business days from January 4, 2021 to January 21, 2021. Accordingly,during the compliance period. If the Company does not regain compliance during the initial compliance period, the Company may be eligible for additional time to regain compliance. If the Company is not eligible, the Company expects that at that time the NASDAQ will provide written notice to the Company that the Company’s common stock will be subject to delisting.

11

The COVID-19 pandemic has adversely affected and may continue to adversely affect the economies and financial markets worldwide, resulting in an economic downturn that could impact our business, financial condition and results of operations. As a result, our ability to fund through public or private equity offerings, debt financings, and through other means at acceptable terms, if at all, may be disrupted, in the event our financing needs for the foreseeable future are not able to be met by our New Credit Facility, balances of cash, cash equivalents and cash generated from operations.

14In addition, the continuation of the COVID-19 pandemic and various governmental responses in the United States has adversely affected and may continue to adversely affect our business operations, including our ability to carry on business development activities, restrictions in business-related travel, delays or disruptions in our on-going projects, and unavailability of the employees of the Company or third parties with whom we conduct business, due to illness or quarantines, among others. Our business was negatively impacted by disruptions in our supply chain, which limited our ability to source merchandise, and limits on products fulfillment placed by Amazon. For example, we may be unable to launch new products, replenish inventory for existing products, ship into or receive inventory in our third-party warehouses in each case on a timely basis or at all. During the fourth quarter of 2020 and first quarter of 2021, we have experienced production and shipment delays for certain of our products that could result in stock outs on the Amazon marketplace resulting in a decrease of net revenue. The extent to which COVID-19 could impact our business will depend on future developments, which are highly uncertain and cannot be predicted with confidence, and will depend on many factors, including the duration of the outbreak, the effect of travel restrictions and social distancing efforts in the United States and other countries, the scope and length of business closures or business disruptions, and the actions taken by governments to contain and treat the disease. As such, we cannot presently predict the scope and extent of any potential business shutdowns or disruptions. Possible effects may include, but are not limited to, disruption to our customers and revenue, absenteeism in our labor workforce, unavailability of products and supplies used in our operations, shutdowns that may be mandated or requested by governmental authorities, and a decline in the value of our assets, including various long-lived assets.

Loyalty Memberships and Magazine Subscriptions Class ActionRetailer Agreement Dispute

In the event the Court of Appeals reinstates the case, the Company believes it has meritorious defenses to the plaintiffs’ claims and will vigorously defend the action.

Store Manager Class ActionsThere are two pending class actions. The first, Spack v. Trans World Entertainment Corp. was originally filed in the District of New Jersey, April 2017 (the “Spack Action”). The Spack Action alleges that the Company misclassified Store Managers (“SMs”) as exempt nationwide. It also alleges that Trans World improperly calculated overtime for Senior Assistant Managers (“SAMs”) nationwide, and that both SMs and SAMs worked “off-the-clock.” It also alleges violations of New Jersey and Pennsylvania State Law with respect to calculating overtime for SAMs. The second, Roper v. Trans World Entertainment Corp., was filed in the Northern District of New York, May 2017 (the “Roper Action”). The Roper Action also asserts a nationwide misclassification claim on behalf of SMs. Both actions were consolidated into the Northern District of New York, with the Spack Action being the lead case.

The Company has reached a settlement with the plaintiffs for both store manager class actions, which has received approval from the court. The Company reserved $0.4 million for the settlement as of January 30, 2021. Notices of the settlement have been issued to class members, and the settlement claims process is currently ongoing.

On April 15, 2021, the reported sale priceThe notice has no immediate impact on the Common Stock onlisting of the NASDAQ Capital Market was $26.91. On August 15, 2019, the Company completed a 1-for-20 reverse stock split of outstanding Common Stock. All closing prices reflect the reverse stock split.

On March 18, 2021, the Company closed an underwritten offering of 416,600 shares ofCompany’s common stock, of the Company, at a pricewhich will continue to the public of $32.50 per share.trade on The gross proceeds of the offering were approximately $13.5 million, prior to deducting underwriting discounts and commissions and estimated offering expenses.Nasdaq Capital Market. The Company intends to usemonitor its closing bid price for its common stock between now and June 12, 2023 and will consider available options to resolve the net proceeds fromCompany’s noncompliance with the offering for general corporate purposes, including working capital to implement its strategic plans focused on brand acquisition, investments in technology to enhance its scalable platform and its core retail business.minimum bid price requirement, as may be necessary.

Not required under the requirements of a Smaller Reporting Company.

FYE Transaction

On February 20, 2020, the Company consummated the sale of substantially all of the assets and certain of the liabilities relating to fye to a subsidiary of Sunrise Records pursuant to an Asset Purchase Agreement dated January 23, 2020, by and among the Company, Record Town, Inc., Record Town USA LLC, Record Town Utah LLC, Trans World FL LLC, Trans World New York, LLC, 2428392 Inc., and Sunrise Records.

Following the FYE Transaction, Kaspien is the Company’s only operating segment.

Impact of COVID-19

To date, as a direct result of COVID-19, most of our employees are working remotely. The full extent to which the COVID-19 pandemic will directly or indirectly impact our business, results of operations and financial condition, including expenses, reserves and allowances, and employee-related amounts, will depend on future developments that are highly uncertain, including as a result of new information that may emerge concerning COVID-19 and the actions taken to contain or treat it, as well as the economic impact on local, regional, national and international customers and markets, which are highly uncertain and cannot be predicted at this time. Management is actively monitoring this situation and the possible effects on its financial condition, liquidity, operations, industry, and workforce. Given the daily evolution of the COVID-19 outbreak and the response to curb its spread, currently we are not able to estimate the effects of the COVID-19 outbreak to our results of operations, financial condition, or liquidity.

In response to the rapidly evolving COVID-19 pandemic, we activated our business continuity program, led by our Executive Team in conjunction with Human Resources, to help us manage the situation. In mid-March of 2020, we transitioned our corporate office staff to work 100% remotely. This process was aided through the implementation of a flexible work from home policy rolled out to the organization in fiscal 2019, having a companywide communication platform for instant messaging and video conferencing, and cloud-based critical business applications. However, while our business is not dependent on physical office locations nor travel, having a 100% remote workforce does present increased operational risk. Our leadership team believes we have the necessary controls in place to mitigate these impacts and allow the team to continue to operate effectively remotely as long as required by State guidelines.

While e-commerce has largely benefited from the closure of brick-and-mortar locations as consumer spending has been pushed online to marketplaces such as Amazon and Walmart, the industry nor our organization has been immune to the impact to our supply chains. For instance, in March 2020, Amazon reduced replenishment in their fulfillment centers to essential items which limited a significant percentage of SKUs carried by Kaspien and a number of Kaspien’ partners shut their warehouses or suffered limited processing capacity due to COVID-19. While Amazon has since lifted restrictions and the leadership team executed contingency plans to mitigate the adverse impact from these restrictions, this highlights the fluid nature of COVID-19 across supply chains.

Additionally, since the beginning of the pandemic, tens of millions of Americans have lost their jobs, significantly increasing the risk of near-term economic contraction in the United States that may affect e-commerce sales. The risk of another wave or increased numbers of positive COVID-19 cases also presents further risk to supply chains. Leadership is actively monitoring the situation and potential impacts on its financial condition, liquidity, operations and workforce but the full extent of the impact is still highly uncertain.

15

Selling,Selling, General and Administrative Expenses. The following table sets forth a year-over-year comparison of the Company’s SG&A expenses:

Asset Impairment Charges. During fiscal 2019, the Company fully impaired its vendor relationships, and the Company recognized an impairment loss of $0.8 million.

During fiscal 2020, based on the Company’s evaluation of new information that occurred in the current financial reporting period, the Company recorded an income tax benefit of $3.5 million related to the recognition of previously unrecognized income tax benefits pursuant to ASC 740-10-25, Accounting for Income Taxes – Recognition. Prior to the current financial reporting period, the Company had accrued the liabilities for unrecognized income tax benefits, including accrued interest and penalties related to tax positions created by the fye business. As a result of the FYE Transaction and a reorganization of the Company’s corporate structure, the Company will not utilize the tax attributes attributable to the tax positions and the corporate entities associated with the tax positions have been liquidated.

Loss From Discontinued Operations. For fiscal 2019, the Company recognized a loss from discontinued operations of $44.4 million related to the FYE Transaction.

See Note 2 to the Consolidated Financial Statements for more information on the loss from discontinued operations.

During the third quarter of fiscal 2019, in response to recurring losses from operations, the expectation of continuing operating losses, and uncertainty with respect to any available future funding, the Company pursued several strategic initiatives towards its strategy of shifting its focus solely to the operation of Kaspien, improving profitability and meeting future liquidity needs and capital requirements. Initiatives completed during the first quarter of fiscal 2020 include:

The sale of the For Your Entertainment (fye) business;The establishment of a new secured $25 million revolving credit facility with Encina:The execution of a separate subordinated loan agreement for Kaspien, Inc. (the “Subordinated Loan”); andThe receipt by Kaspien, Inc. of loan proceeds pursuant to the Paycheck Protection Plan under the Coronavirus Aid, Relief, and Economic Security Act.

18

Off-Balance Sheet Arrangements. The Company has no off-balance sheet arrangements as defined by Item 303 (a) (4)used $6.3 million of Regulation S-K.the proceeds to pay down its Credit Facility.

19

Contingent Value Rights Agreement (the “Second CVR Agreement”) pursuant to which Alimco received additional contingent value rights (“Additional CVRs”) representing the contractual right to receive cash payments from the Company in an amount equal, in the aggregate, to 9.0% of the proceeds received by the Company in respect of certain distributions by the Company or Kaspien; recapitalizations or financings of the Company or Kaspien (with appropriate carve out for trade financing in the ordinary course); repayment of intercompany indebtedness owing to the Company by Kaspien; or sale or transfer of any stock of the Company or Kaspien.

During fiscal 2019, the Company concluded, based on continued operating losses for the Kaspien that a triggering event had occurred, and pursuant to FASB ASC 360, Property, Plant, and Equipment, an evaluation of the Kaspien fixed assets and intangible assets for impairment was required. For fiscal 2019, intangible assets related to vendor relationships were fully impaired resulting in the recognition of asset impairment charges of $0.8 million.

20

21

Report of Independent Registered Public Accounting Firm

We evaluated the appropriateness and consistency of management’s methods and assumptions used in the identification, recognition, and measurement of the inventory costs and reserves in considering applicable generally accepted accounting standards.

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors

Kaspien Holdings Inc.

Opinion on the Consolidated Financial StatementsWe have audited, before the effects of the adjustments to retrospectively apply the changes in accounting described in Note 1 – Nature of Operations and Summary of Significant Accounting Policies (Segment Information) and Note 2 – Discontinued Operations, the consolidated balance sheet of Kaspien Holdings Inc. (f/k/a Trans World Entertainment Corporation) and subsidiaries (the Company) as of February 1, 2020, the related consolidated statements of operations, comprehensive loss, shareholders’ equity, and cash flows for the fiscal year ended February 1, 2020, and the related notes (collectively, the consolidated financial statements). The 2020 consolidated financial statements before the effects of the adjustments described in Note 1 – Nature of Operations and Summary of Significant Accounting Policies (Segment Information) and Note 2 – Discontinued Operations are not presented herein. In our opinion, the consolidated financial statements, before the effects of the adjustments to retrospectively apply the changes in accounting described in Note 1 – Nature of Operations and Summary of Significant Accounting Policies (Segment Information) and Note 2 – Discontinued Operations, present fairly, in all material respects, the financial position of the Company as of February 1, 2020, and the results of its operations and its cash flows for the fiscal year ended February 1, 2020, in conformity with U.S. generally accepted accounting principles.We were not engaged to audit, review, or apply any procedures to the adjustments to retrospectively apply the changes in accounting described in Note 1 – Nature of Operations and Summary of Significant Accounting Policies (Segment Information) and Note 2 – Discontinued Operations and, accordingly, we do not express an opinion or any other form of assurance about whether such adjustments are appropriate and have been properly applied. Those adjustments were audited by other auditors.Going ConcernThe accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company continues to experience recurring losses and negative cash flows from operations that raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 1. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.Basis for OpinionThese consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. Our audit included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audit provides a reasonable basis for our opinion./s/ KPMG LLP

We served as the Company’s auditor from 1994 to 2020.Albany, New York

June 15, 2020

Previously, the Company also operated fye, a chain of retail entertainment stores and e-commerce sites, www.fye.com and www.secondspin.com. On February 20, 2020, the Company consummated the sale of substantially all of the assets and certain of the liabilities relating to fye to a subsidiary of 2428391 Ontario Inc. o/a Sunrise Records (“Sunrise Records”) pursuant to an Asset Purchase Agreement (as amended, the “Asset Purchase Agreement”) dated January 23, 2020, by and among the Company, Record Town, Inc., Record Town USA LLC, Record Town Utah LLC, Trans World FL LLC, Trans World New York, LLC, 2428392 Inc., and Sunrise Records. (the “FYE Transaction”).

Effects of COVID-19: As reflected in the discussion below, the impact of the COVID-19 pandemic and actions taken in response to it had varying effects on our 2020 results of operations. Higher net sales reflect increased demand, particularly as people are staying at home, including for household staples and other essential and home products, partially offset by fulfillment network capacity and supply chain constraints. Other effects include increased fulfillment costs and cost of sales as a percentage of net sales, primarily due to the impact of lower productivity and costs to maintain safe workplaces.

We expect the effects of fulfillment network capacity and supply chain constraints and increased fulfillment costs and cost of sales as a percentage of net sales to continue into all or portions of 2021. However, it is not possible to determine the duration and scope of the pandemic, including any recurrence, the actions taken in response to the pandemic, the scale and rate of economic recovery from the pandemic, any ongoing effects on consumer demand and spending patterns, or other impacts of the pandemic, and whether these or other currently unanticipated consequences of the pandemic are reasonably likely to materially affect our results of operations.

Also, as a direct result of COVID-19, most of our employees are working remotely. The full extent to which the COVID-19 pandemic will directly or indirectly impact our business, results of operations and financial condition, including expenses, reserves and allowances, and employee-related amounts, will depend on future developments that are highly uncertain, including as a result of new information that may emerge concerning COVID-19 and the actions taken to contain or treat it, as well as the economic impact on local, regional, national and international customers and markets, which are highly uncertain and cannot be predicted at this time. Management is actively monitoring this situation and the possible effects on its financial condition, liquidity, operations, industry, and workforce. Given the daily evolution of the COVID-19 outbreak and the response to curb its spread, currently we are not able to estimate the effects of the COVID-19 outbreak to our results of operations, financial condition, or liquidity.

As of June 15, 2020, the issuance date of the Company’s consolidated financial statements for the fiscal year ended February 1, 2020, the Company had concluded there was substantial doubt about its ability to continue as a going concern. The completed initiatives and transactions as described below have alleviated the substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements for the fiscal year ended January 30, 202128, 2023 were prepared on the basis of a going concern which contemplates that the Company will be able to realize assets and discharge liabilities in the normal course of business. The ability of the Company to meet its liabilities and to continue as a going concern is dependent on improved profitability, the strategic initiatives for Kaspien and the availability of future funding. Based on recurring losses from operations, negative cash flows from operations, the expectation of continuing operating losses for the foreseeable future, and uncertainty with respect to any available future funding, the Company has concluded that there is substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of these uncertainties.this uncertainty. New Credit Facility

The commitments by the lenders under the New Credit Facility are subject to borrowing base and availability restrictions. Up to $5.0 million of the New Credit Facility may be used for the making of swing line loans.

As of January 30, 2021, the Company had borrowings of $6.3 million under the New Credit Facility. Peak borrowings under the New Credit Facility during fiscal 2020 were $12.4 million. As of January 30, 2021, the Company had no outstanding letters of credit. The Company had $5.0 million available for borrowing under the New Credit Facility as of January 30, 2021.

Previously, the Company had an amended and restated its revolving credit facility (“Credit Facility”) with Wells Fargo. As of February 1, 2020, the Company had borrowings of $13.1 million under the Credit Facility. Peak borrowings under the Credit Facility during fiscal 2019 were $35.9 million. As of February 1, 2020, the Company had no outstanding letters of credit. The Company had $12 million available for borrowing under the Credit Facility as of February 1, 2020.

On February 20, 2020, in conjunction with the FYE Transaction, the Company fully satisfied its obligations under the Credit Facility through proceeds received from the sale of the fye business and borrowings under the New Credit Facility, as further discussed above, and the Credit Facility is no longer available to the Company.

Subordinated Debt Agreement

During fiscal 2019, the Company concluded, based on continued operating losses that a triggering event had occurred, and pursuant to FASB ASC 360, Property, Plant, and Equipment, an evaluation of the Company’s fixed assets and intangible assets for impairment was required. For fiscal 2019, intangible assets related to vendor relationships were fully impaired resulting in the recognition of asset impairment charges of $0.8 million

RetailAgency as a service revenue is primarily commission fees for services paid on a periodic basis with an additional fee based on percentage of gross merchandise value generated. The commissions earned from these arrangements are recognized when the services are rendered on a periodic basis with additional fees recognized as revenue is generated.

Software as a serviceSoftware as a service revenue primarily includes a subscription fee with an additional fee based on a percentage of gross merchandise value generated. The subscription fee earned from these arrangements are recognized when the services are rendered on a periodic basis with additional fees recognized as revenue is generated.

Change in Reportable Segments

As a result of the sale of the fye business on February 20, 2020, further disclosed in Note 2, the Company’s previously reported fye segment is no longer in operation, and theThe Company now operates as a single reporting segment. The impact of the sale of the fye business on the Company’s operating segments, and reportable segments was reflected in the Company’s consolidated financial statements as of February 1, 2020. Prior year segment information was reclassified to conform to the reporting structure change.Note 2. Discontinued Operations

On February 20, 2020, the Company consummated the sale of substantially all of the assets and certain of the liabilities relating to fye to a subsidiary of Sunrise Records pursuant to an Asset Purchase Agreement dated January 23, 2020, by and among the Company, Record Town, Inc., Record Town USA LLC, Record Town Utah LLC, Trans World FL LLC, Trans World New York, LLC, 2428392 Inc., and Sunrise Records.

The results for fye were previously reported in the fye segment. Certain corporate overhead costs and segment costs previously allocated to fye for segment reporting purposes did not qualify for classification within discontinued operations and have been reallocated to continuing operations.

The following table summarizes the major line items for fye that are included in the income from discontinued operations, net of tax line item in the Consolidated Statements of Income:

The following table summarizes the carrying amounts of major classes of assets and liabilities of discontinued operations for each of the periods presented:

The cash flows related to discontinued operations have not been segregated and are included in the Consolidated Statements of Cash Flows. The following table summarizes the cash flows for discontinued operations that are included in the Consolidated Statements of Cash Flows:

Note 3. Sale of fye business

On February 20, 2020, the Company consummated the sale of substantially all of the assets and certain of the liabilities relating to fye to a subsidiary of Sunrise Records pursuant to an Asset Purchase Agreement dated January 23, 2020, by and among the Company, Record Town, Inc., Record Town USA LLC, Record Town Utah LLC, Trans World FL LLC, Trans World New York, LLC, 2428392 Inc., and Sunrise Records. The following table reconciles the assets sold to and liabilities assumed by Sunrise to cash proceeds received:

The Company did not recognize a gain/loss upon the sale of the fye business as the assets of fye were impaired to the fair value of the assets as of February 1, 2020.

In August 2018, the FASB issued ASU 2018-14, “Compensation—Retirement Benefits—Defined Benefit Plans—General (Subtopic 715-20): Disclosure Framework— Changes to the Disclosure Requirements for Defined Benefit Plans”, which removes certain disclosures that are no longer cost beneficial and also includes additional disclosures to improve the overall usefulness of the disclosure requirements to financial statement users. This standard will be effective for public entities for fiscal years beginning after December 15, 2020, however early adoption is permitted. We are currently evaluating the impact of this new standard on the consolidated financial statements.

In December 2019, the FASB issued ASU 2019-12, “Simplifying the Accounting for Income Taxes” (Topic 740), which simplifies the accounting for income taxes by eliminating certain exceptions to the guidance in ASC 740 related to the approach for intra-period tax allocation, the methodology for calculating income taxes in an interim period and the recognition of deferred tax liabilities for outside basis differences. The standard also simplifies aspects of the enacted changes in tax laws or rates. This standard will be effective for public entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2020, however early adoption is permitted. We are currently evaluating the impact of this new standard on the consolidated financial statements.

DeterminingThe determination of the fair value of intangible assets acquired in a reporting unit requiresbusiness acquisition, including the useCompany’s acquisition of significantKaspien in 2016, is subject to many estimates and assumptions, including revenue growth rates, operating margins, discount rates, and future market conditions, among others. Other long-livedassumptions. Our identifiable intangible assets are reviewed for impairment if circumstances indicate that the carrying amount may not be recoverable.

During fiscal 2019, the Company fully impaired its vendor relationships and the Company recognized an impairment lossresulted from our acquisition of $0.8 million.

The Company continues to amortizeKaspien consist of technology and trade names and trademarks that have finite lives.

Identifiabletradenames. As of October 30, 2021, the intangible assets as of January 30, 2021 consisted of the following:were fully amortized.

The changes in net intangibles from February 2, 2019 to February 1, 2020 were as follows:

The remaining amortization expense will be recognized in fiscal 2021, at which time all of the other intangible assets will be fully amortized.

New Credit Facility

The commitments by the lenders under the New Credit Facility are subject to borrowing base and availability restrictions. Up to $5.0 million of the New Credit Facility may be used for the making of swing line loans.

As of January 30, 2021, the Company had borrowings of $6.3 million under the New Credit Facility. Peak borrowings under the New Credit Facility during fiscal 2020 were $12.4 million. As of January 30, 2021, the Company had no outstanding letters of credit. The Company had $5.0 million available for borrowing under the New Credit Facility as of January 30, 2021.

Previously, the Company had an amended and restated its revolving credit facility (“Credit Facility”) with Wells Fargo. As of February 1, 2020, the Company had borrowings of $13.1 million under the Credit Facility. Peak borrowings under the Credit Facility during fiscal 2019 were $35.9 million. As of February 1, 2020, the Company had no outstanding letters of credit. The Company had $12 million available for borrowing under the Credit Facility as of February 1, 2020.

On February 20, 2020, in conjunction with the FYE Transaction, the Company fully satisfied its obligations under the Credit Facility through proceeds received from the sale of the fye business and borrowings under the New Credit Facility, as further discussed above, and the Credit Facility is no longer available to the Company.

Subordinated Debt Agreement

The following table summarizes the warrant activity:

During fiscal 2019, the Company recognized approximately $40,000 in expenses for deferred shares issued to non-employee directors. There were no exercises of non-restricted stock options during fiscal 2020 and fiscal 2019.

Prior to June 1, 2003, the Company had provided the Board of Directors with a noncontributory, unfunded retirement plan (“Director Retirement Plan”) that paid retired directors an annual retirement benefit. The final payments due under the director retirement plan were made in fiscal 2020.

(1) Amount adjusted to reflect impact of discontinued operations.

(1) Amount adjusted to reflect impact of discontinued operations.

The Tax Cuts and Jobs Act also repeals the Corporation Alternative Minimum Tax (“AMT”) for tax years beginning after December 31, 2017. Any AMT carryover credits became refundable starting in the 2018 tax year, and any remaining credit will be fully refundable in 2021.

Prior to the consummation of the FYE Transaction, the Company leased its 181,300 square foot distribution center/office facility in Albany, New York from an entity controlled by the estate of Robert J. Higgins, its former Chairman and largest Loss from fye business in the Statement of Operations. On February 20, 2020, as part of the FYE Transaction, the Company assigned the rights and obligations of the lease to the acquiror.

48

Common Stock Purchase Warrant (“Alimco Warrant”), pursuant to which the Company issued warrants to purchase up to 320,000 shares of Common Stock to Alimco, subject to adjustment in accordance with the terms of the Alimco Warrant, at an exercise price of $0.01 per share. All such warrants were outstanding as of April 28, 2023;

On April 11, 2019, the plaintiffs voluntarily dismissed their lawsuit. On May 8, 2019, twoall of the plaintiffs from the dismissed lawsuitparties’ claims is scheduled for September 18, 2023.

proceeds (10.35% for Alimco, 1.90% for Kick-Start, and 7.64% for RJHDC) received by the Company in respect of certain intercompany indebtedness owing to it by Kaspien and/or its equity interest in Kaspien. The Company does not anticipate these contingencies being met in Fiscal 2022.Store Manager Class Actions

There are two pending class actions. The first, Spack v. Trans World Entertainment Corp. was originally filedOn March 2, 2022, the Company entered into a Contingent Value Rights Agreement (the “Second CVR Agreement”) with the Tranche B Lender under the Subordinated Loan Agreement, pursuant to which the Tranche B Lender received contingent value rights (“Second CVRs”) representing the contractual right to receive cash payments from the Company in an amount equal, in the Districtaggregate, to 9.0% of New Jersey, April 2017 (the “Spack Action”). The Spack Action alleges thatthe proceeds received by the Company misclassified Store Managers (“SMs”) as exempt nationwide. It also alleges thatin respect of certain distributions by the Company improperly calculated overtime for Senior Assistant Managers (“SAMs”) nationwide, and that both SMs and SAMs worked “off-the-clock.” It also alleges violations of New Jersey and Pennsylvania State Law with respect to calculating overtime for SAMs. The second, Roper v. Trans World Entertainment Corp., was filed in the Northern District of New York, May 2017 (the “Roper Action”). The Roper Action also asserts a nationwide misclassification claim on behalf of SMs. Both actions were consolidated into the Northern District of New York, with the Spack Action being the lead case.

The Company has reached a settlement with the plaintiffs for both store manager class actions, which has received preliminary approval from the court. The Company reserved $0.4 million for the settlement as of February 1, 2020. Notices of the settlement have been issued to class members, and the settlement claims process is currently ongoing. A final settlement approval hearing has been set by the court for April 14, 2021.

Note 15. Basic and Diluted Loss Per Share

Basic loss per share is calculated by dividing net loss by the weighted average common shares outstanding for the period. Diluted loss per share reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercisedKaspien; recapitalizations or converted into Common Stock or resulted in the issuance of Common Stock (net of any assumed repurchases) that then shared in the earningsfinancings of the Company or Kaspien (with appropriate carve out for trade financing in the ordinary course); repayment of intercompany indebtedness owing to the Company by Kaspien; or sale or transfer of any stock of the Company or Kaspien.

The following represents basic and diluted loss per share for continuing operations, loss from discontinued operations and net loss for the respective periods:

Note 17. Subsequent Events

On March 18, 2021 the Company completed the closing of an underwritten offering of 416,600 shares of common stock of the Company, at a price to the public of $32.50 per share. The gross proceeds of the offering were approximately $13.5 million, prior to deducting underwriting discounts and commissions and estimated offering expenses. The Company intends to use the net proceeds from this offering for general corporate purposes, including working capital to implement its strategic plans focused on brand acquisition, investments in technology to enhance its scalable platform and its core retail business.

*101.INS XBRL Instance Document

53

attends several industry tradeshows annually.

Partnership Models

In this model, Kaspien buys inventory and sells itinventory on marketplaces such as Amazon, Walmart, Target,Amazon.com, Walmart.com and eBayTarget.com as a third-party seller. Additionally, Kaspien supports private label “dropship”and dropship integrations with various suppliers and distributors as well as incubates its own brands. At the end of fiscal 2019,distributors. Kaspien had a total of six (6)has also developed four incubated brands – Jumpoff Jo, Brilliant Bee, Big Betty, and Domestic Corner, Coy Beauty, Max Threads and Keto. In RaaS, our business model is the same as that of a wholesale retailer. During fiscal 2020, revenue per partner increased 40% to $237,000 from $169,000 in fiscal 2019.

Corner.

Corner.

In this model, Kaspien serves as an extension of aour partner’s e-commerce team, providing full service and managed services in the areas of inventory management, marketing management, creative services, content optimization, brand control, tax,protection, compliance protection, fee recovery, and other marketplace growth services. Kaspien charges a subscription feeretainer and receives a small percentage of the revenue generated.

Ad management

Brand protection and sells it.seller tracking

Dropship automation

Creative services

As of January 30, 2021,28, 2023, we had 825 partners across our portfolio of external brand partners, including nearly 693over 100 active retail partners and 13212 subscriptions partners. The Company’s subscriptions partner base increased 207% compared to fiscal year 2019.

4

Technology and Integrations

The Company’s marketplace platformknowledge and expertise is a one stop shop insights driven platform built upon over a decadeon fifteen years of selling data and constantly evolving marketplace selling data.experience. The platform includescompany utilizes a variety of automated and artificial intelligent, data scienceintelligence powered solutions spanning acrosssupporting brand protection services, logistics and supply chain optimization, automated pricing, advertising marketing management, creativebudget forecasting, campaign bid automation, dayparting, and content services, tax and compliance services, among others. This is all accessible through the Kaspien platform and can be leveraged through a managed service or a software as a service model.much more.

The platformCompany uses an insight driveninsight-driven approach to digital marketplace retailing using both proprietary and licensed software. Using data collected from marketplaces, optimal inventory thresholds and purchasing trends are calculated within its advanced inventory management software developed in-house. Kaspien also has proprietaryleverages best in class software related to automate pricing, advertisement management, marketplace seller tracking, and channel auditing.

Additionally, the Kaspien platform can be extended to our business and servicepartners with enterprise-level software providers that are synergistic to Kaspien. This enables a network of partner integrations that can be extended and expanded upon. The Kaspien platform has formed strategic relationships and partnerships with these other listed marketplace service providers, including Deliverr andNetSuite to power our ERP, MyFBAPrep in thefor their logistics and fulfillment space, TaxCloud, a tax services provider, VantageBP, anetwork, IPSecure for brand protection, agency, Levin Consulting, an electronics specialty retailer,Seller Investigators and Charge Guard for fee recovery services, Helium10 for keyword research, Vantage for content optimization, and many others.

Business Environment

Digital marketplaces allow consumers to shop from a variety ofvarious merchants in one place and have become an integral part of many brand manufacturers’ businesses.

According to the U.S. Census Bureau, total U.S. e-commerce sales in 20202022 were $792$1.0 billion, up 32.4%7.7% from 2019 as the coronavirus pandemic and nationwide lockdowns pushed shoppers to rely on internet retailers for their consumer needs. Total retail sales in 2020 increased 3.4% from the prior year. As a result,2021. e-commerce sales ended the year accounting for 14% of all U.S. retail sales, up from 11% in 2019.

In the United States, we sell on marketplaces that represent greater than 50% of national e-commerce visits and sales (Amazon.com,including Amazon.com US, Amazon.com CA, Walmart.com, eBay.com, Target.com, Google.com, Sears.com, jet.com, Pricefalls.com, Overstock.com, Wish.com). Internationally, we sell on marketplaces in the U.K. (Amazon.uk), Germany (Amazon.de), Canada (Amazon.ca) and India (Amazon.in). In 2021, Kaspien intends to begin selling its services in Japan and Mexico.Target.com.

Competition and Strategic Positioning

Kaspien operates in a category within e-commerce called “Marketplace Growth Software and Services”. Businesses in this category provide services to brands and other sellers to facilitate growth on marketplaces. The market is very fragmented, and most providers are focusedfocus on only a few focus areas where sellers have support needs.need support. Subcategories in this market include:include Account and Marketing Services, Supply Chain and Logistics Providers, Manufacturers and Product Suppliers, Legal Services and Accounting, Tax and Financial Services. In theThe Account and Marketing Services subcategory divides services are further divided into retail services,and agency services and software services. This is analogous to our business models – Retail as a Service, Agency as a Service and Software as a Service.Agency.

Kaspien positions itself asis a comprehensive and fully customizable platformoffering of software and services tailored towardstoward online marketplace growth. KaspienKaspien’s core focus is on the Account and Marketing Services subcategory, andwhich competes in this subcategory with Software Providers, Agencies, and Retailers.

Revenue Distribution

Kaspien’s primary source of revenue is through its “Retail as a Service”Retail business, specifically as a third-party seller on the Amazon US marketplace. Retail revenues represented 98.6% of total revenue in fiscal 2022, the same level as fiscal 2021. In fiscal 2020,2022, the share of our retail revenues generated from our Amazon US business was 86%94.8%, as compared to 91%93.3% in fiscal 2019.2021. Our international retail business grew from 3.2%represented 2.5% of retail sales in fiscal 2022 compared to 3.9% in fiscal year 2019 to 4.8% in fiscal year 2020.2021. The remaining retail revenue is generated from other marketplaces, including Amazon International, Walmart, eBayAmazon.com CA, Walmart.com, eBay.com, and Target+.Target.com.

Kaspien focuses on a broad array ofvarious categories, including pet supplies,pets and sporting goods, tools/office/outdoors,baby, tools / office / outdoor, health & personal care, and home/kitchen/grocery.home / kitchen. In fiscal year 2020,2022, these categories represented approximately 68%83% of our total revenue. Kaspien organizesanalyzes our operations by category, developing a deep understanding and subject matter expertise in these areas, enabling us to drive better results across these categories.

5

Human Capital

As of January 30, 2021,28, 2023, the Company employed approximately 136 people, of whom approximately 130 were employed on a80 full-time basis.people. At the end of fiscal 2020,2022, the Company had department heads in the areas of marketing, supply chain, private label, business development, account management, human resources, accounting, FP&A, warehouse operations, compliance, product management, data, and engineering. technology. Employee levels are managed to align with the pace of business, and management believes it has sufficient human capital to operate its business successfullysuccessfully.

The Company believes that its success depends on the ability to attract, develop, retainattracting, developing, retaining, and incentivize ourincentivizing new and existing and new employees, consultants, and key personnel.employees. It also believes that theits employees' skills, experience, and industry knowledge of its key personnel significantly benefits its operationsbenefit the operation, performance, and performance.competitiveness within the industry. The principal purposes of equity and cash incentive plans are to attract, retain, and reward personnel through theby granting of stock-based and cash-based compensation awards,awards. This results in order to increasea best-in-class employee experience, which ultimately increases shareholder value and the success of our company by motivating such individuals to perform to the best of their abilities and achieve our objectives.

Customer Acquisition

Kaspien engages its partners through a combination of brand building, inbound digital marketing, and outbound sales as well as usingtechniques, and its proprietary data platform to identify brands that would be a strategic fit for its services. Kaspien utilizes tradeshows and content marketing to strengthen its visibility within the industry. Kaspien’s public relations efforts consist of press releases, articles in industry publications, and articles on its website to build its brand.

Trademarks

The trademark Kaspien is registered with the U.S. Patent and Trademark Office and is owned by Kaspien. We believe that our rights to this trademark is adequately protected. We hold no material patents, licenses, franchises, or concessions; however, our established trademark is essential to maintaining our competitive position.

Available Information

The Company’s headquarters are located at 2818 N. Sullivan Road, Suite 130, Spokane Valley, WA 99216, and its telephone number is (855)-300-2710. The Company’s corporate website address is www.kaspien.com. The Company makes available, free of charge, its Exchange Act Reports (Forms 10-K, 10-Q, 8-K and any amendments thereto) on its web site as soon as practical after the reports are filed with the Securities and Exchange Commission (“SEC”). The public may read and copy any materials the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. This information can be obtained from the site http://www.sec.gov. The Company’s Common Stock, $0.01 par value, is listed on the NASDAQ Capital Market under the trading symbol “KSPN”.

6

| Item 1A. | RISK FACTORS |

The following is a discussion of certain factors, which could affect the financial results of the Company.

Risks Related to Our Business

If we cannot successfully implement our business strategy our growth and profitability could be adversely impacted.

Our future results will depend, among other things, on our success in implementing our business strategy.

There can be no assurance that we will be successful in further implementing our business strategy or that the strategy, including the completed initiatives, will be successful in sustaining acceptable levels of sales growth and profitability. In addition,Based on recurring losses from operations, negative cash flows from operations, the proceedsexpectation of continuing operating losses for the foreseeable future, and uncertainty with respect to any available future funding, the Company has concluded that there is substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from the PPP Loan are subject to audit and there is a riskoutcome of repayment.this uncertainty.

Continued increases in Amazon Marketplace fulfillment and storage fees could have an adverse impact on our profit margin and results of operations.

The Company utilizes Amazon’s Freight by Amazon (“FBA”) platform to store their products at the Amazon fulfillment center and to pack and distribute these products to customers. If Amazon continues to increase its FBA fees, our profit margin could be adversely affected.

Our business depends on our ability to build and maintain strong product listings on e-commerce platforms. We may not be able to maintain and enhance our product listings if we receive unfavorable customer complaints, negative publicity, or otherwise fail to live up to consumers’ expectations, which could materially adversely affect our business, results of operations and growth prospects.

Maintaining and enhancing our product listings is critical in expanding and growing our business. However, a significant portion of our perceived performance to the customer depends on third parties outside of our control, including suppliers and third-party delivery agents as well as online retailers such as Amazon and Walmart. Because our agreements with our online retail partners are generally terminable at will, we may be unable to maintain these relationships, and our results of operations could fluctuate significantly from period to period. Because we rely on third parties to deliver our products, we are subject to shipping delays or disruptions caused by inclement weather, natural disasters, labor activism, health epidemics or bioterrorism. We may also experience shipping delays or disruptions due to other carrier-related issues relating to their own internal operational capabilities. Further, we rely on the business continuity plans of these third parties to operate during pandemics, like the COVID-19 pandemic, and we have limited ability to influence their plans, prevent delays, and/or cost increases due to reduced availability and capacity and increased required safety measures.

Customer complaints or negative publicity about our products, delivery times, or marketing strategies, even if not accurate, especially on blogs, social media websites and third-party market sites, could rapidly and severely diminish consumer view of our product listings and result in harm to our brands. Customers may also make safety-related claims regarding products sold through our online retail partners, such as Amazon, which may result in an online retail partner removing the product from its marketplace. We have from time to time experienced such removals and such removals may materially impact our financial results depending on the product that is removed and length of time that it is removed. We also use and rely on other services from third parties, such as our telecommunications services, and those services may be subject to outages and interruptions that are not within our control.

7

A change in one or more of the Company’s partners’ policies or the Company’s relationship with those partners could adversely affect the Company’s results of operations.

The Company is dependent on its partners to supply merchandise in a timely and efficient manner. If a partner fails to deliver on its commitments, whether due to financial difficulties or other reasons, the Company could experience merchandise shortages that could lead to lost sales.

Historically, the Company has not experienced difficulty in obtaining satisfactory sources of supply and management believes that it will continue to have access to adequate sources of supply. No individualThe Company had one partner exceeded 10%that represented 20.4% of purchasesnet revenue in fiscal 2020.2022.

Our revenue is dependent upon maintaining our relationship with Amazon and failure to do so, or any restrictions on our ability to offer products on the Amazon Marketplace, could have an adverse impact on our business, financial condition and results of operations.

The Company generates substantially all of its revenue through the Amazon Marketplace. Therefore, we depend in large part on our relationship with Amazon for growth. In particular, we depend on our ability to offer products on the Amazon Marketplace. We also depend on Amazon for the timely delivery of products to customers. Any adverse change in our relationship with Amazon, including restrictions on the ability to offer products or termination of the relationship, could adversely affect our continued growth and financial condition and results of operations.

We have a significant amount of debt and we may continue to incur additional debt in the future. As of January 28, 2023, the Company had borrowings of $8.8 million under our credit facility with Eclipse. We also had borrowings of $5.3 million under our Subordinated Debt facility, with interest accruing at the rate of twelve percent (12%) per annum and compounded on the last day of each calendar quarter by becoming a part of the principal amount. In addition, we have $4.5 million under our Subordinated Debt Facility, with interest accruing at the rate of fifteen percent (15%) per annum and compounded on the last day of each calendar quarter by becoming a part of the principal amount. Substantially all of our assets, including the capital stock of Kaspien is pledged to secure our indebtedness. This leverage also exposes us to significant risk by limiting our flexibility in planning for, or reacting to, changes in our business (whether through competitive pressure or otherwise), our industry and the economy at large. In addition, our ability to make payments on, or repay or refinance, such debt, and to fund our operating and capital expenditures, depends largely upon our future operating performance. Our future operating performance, to a certain extent, is subject to general economic, financial, competitive, regulatory and other factors that are beyond our control.

The terms of our asset-based revolving credit agreement and subordinated debt agreement impose certain restrictions on us that may impair our ability to respond to changing business and economic conditions, which could have a significant adverse impact on our business. Additionally, our business could suffer if our ability to acquire financing is reduced or eliminated.

On February 20, 2020, Kaspien entered into a Loan and Security Agreement (the “Loan Agreement”) with Encina,Eclipse, as administrative agent, under which the lenders committed to provide up to $25 million in loans under a three-year,four-year, secured revolving credit facility (the “New Credit“Credit Facility”). On March 30, 2020, we entered into a Subordinated Loan and Security Agreement (the “Subordinated Loan Agreement”) with the lenders party thereto from time to time (the “Lenders”) and TWEC Loan Collateral Agent, LLC (“Collateral Agent”), as collateral agent for the Lenders, pursuant to which the Lenders made a $5.2 million secured term loan (the “Subordinated Loan”) to Kaspien. We subsequently amended the Subordinated Loan to add an additional $5.0 million secured term loan.

Among other things, the Loan Agreement limitsand Subordinated Loan Agreement limit Kaspien’s ability to incur additional indebtedness, create liens, make investments, make restricted payments or specified payments and merge or acquire assets. The Loan Agreement also requires Kaspien to comply with a financial maintenance covenant.

The Loan Agreement and Subordinated Loan Agreement contains customary events (including our Subordinated Debt) of default, including, but not limited to, payment defaults, breaches of representations and warranties, covenant defaults, cross-defaults to other obligations, customary ERISA defaults, certain events of bankruptcy and insolvency, judgment defaults, the invalidity of liens on collateral, change in control, cessation of business or the liquidation of material assets of the borrowers and guarantors under the New Credit Facility taken as a whole, the occurrence of an uninsured loss to a material portion of collateral and, in the case of the Credit Facility, failure of the obligations under the New Credit Facility to constitute senior indebtedness under any applicable subordination or intercreditor agreements, including our Subordinated Debt.

8

Risks Related to Information Technology and Intellectual Property

Breach of data security could harm our business and standing with our customers.

The protection of our partner, employee and business data is critical to us. Our business, like that of most companies, involves confidential information about our employees, our suppliers and our Company. We rely on commercially available systems, software, tools and monitoring to provide security for processing, transmission and storage of all such data, including confidential information. Despite the security measures we have in place, our facilities and systems, and those of our third-party service providers, may be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming or human errors, or other similar events. Unauthorized parties may attempt to gain access to our systems or information through fraud or other means, including deceiving our employees or third-party service providers. The methods used to obtain unauthorized access, disable or degrade service, or sabotage systems are also constantly changing and evolving, and may be difficult to anticipate or detect. We have implemented and regularly review and update our control systems, processes and procedures to protect against unauthorized access to or use of secured data and to prevent data loss. However, the ever-evolving threats mean we must continually evaluate and adapt our systems and processes, and there is no guarantee that they will be adequate to safeguard against all data security breaches or misuses of data. Any security breach involving the misappropriation, loss or other unauthorized disclosure of customer payment card or personal information or employee personal or confidential information, whether by us or our vendors, could damage our reputation, expose us to risk of litigation and liability, disrupt our operations, harm our business and have an adverse impact upon our net sales and profitability. As the regulatory environment related to information security, data collection and use, and privacy becomes increasingly rigorous, with new and changing requirements applicable to our business, compliance with those requirements could also result in additional costs. Further, if we are unable to comply with the security standards established by banks and the credit card industry, we may be subject to fines, restrictions and expulsion from card acceptance programs, which could adversely affect our retail operations.

Our hardware and software systems are vulnerable to damage, theft or intrusion that could harm our business.

Any failure of our computer hardware or software systems that causes an interruption in our operations or a decrease in inventory tracking could result in reduced net sales and profitability. Additionally, if any data intrusion, security breach, misappropriation or theft were to occur, we could incur significant costs in responding to such event, including responding to any resulting claims, litigation or investigations, which could harm our operating results.

Our inability or failure to protect our intellectual property rights, or any claimed infringement by us of third-party intellectual rights, could have a negative impact on our operating results.

Our trademark, trade secrets and other intellectual property, including proprietary software, are valuable assets that are critical to our success. The unauthorized reproduction or other misappropriation of our intellectual property could cause a decline in our revenue. In addition, any infringement or other intellectual property claim made against us could be time-consuming to address, result in costly litigation, cause product delays, require us to enter into royalty or licensing agreements or result in our loss of ownership or use of the intellectual property.

Risks Related to Human Capital

Loss of key personnel or the inability to attract, train and retain qualified employees could adversely affect the Company’s results of operations.

The Company believes that its future prospects depend, to a significant extent, on the services of its executive officers. Our future success will also depend on our ability to attract and retain qualified key personnel. The loss of the services of certain of the Company’s executive officers and other key management personnel could adversely affect the Company’s results of operations.

9

In addition to our executive officers, the Company’s business is dependent on our ability to attract, train and retain qualified team members. Our ability to meet our labor needs while controlling our costs is subject to external factors such as unemployment levels, health care costs and changing demographics. If we are unable to attract and retain adequate numbers of qualified team members, our operations and support functions could suffer. Those factors, together with increased wage and benefit costs, could adversely affect our results of operations.

We may face difficulties in meeting our labor needs to effectively operate our business.

We are heavily dependent upon our labor workforce. Our compensation packages are designed to provide benefits commensurate with our level of expected service. However, we face the challenge of filling many positions at wage scales that are appropriate to the industry and competitive factors. We also face other risks in meeting our labor needs, including competition for qualified personnel and overall unemployment levels, and increased costs associated with complying with regulations relating to COVID-19.levels. Changes in any of these factors, including a shortage of available workforce, could interfere with our ability to adequately service our customers and could result in increasing labor costs.

Our business could be adversely affected by increased labor costs, including costs related to an increase in minimum wage and health care.

Labor is one of the primary components in the cost of operating our business. Increased labor costs, whether due to competition, unionization, increased minimum wage, state unemployment rates, health care, or other employee benefits costs may adversely impact our operating expenses. Additionally, there is no assurance that future health care legislation will not adversely impact our results or operations.

Risks Related to Ownership of Our Common Stock.