UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2009

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the Transition Period from to

to  .

.

Commission File Number: 001-32384

MACQUARIE INFRASTRUCTURE COMPANY LLC

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 43-2052503 | ||

| (Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | ||

125 West 55th55th Street

New York, New York 10019

(Address of Principal Executive Offices)(Zip (Zip Code)

Registrant’s Telephone Number, Including Area Code:(212) 231-1000

Securities registered pursuantRegistered Pursuant to Section 12(b) of the Act:

Title of Each Class: | Name of Exchange on Which Registered: | ||

Macquarie Infrastructure Company | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrants are collectivelyregistrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yesýo No¨x

Indicate by check mark if the registrants are collectivelyregistrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes¨o Noýx

Indicate by check mark whether the registrantsregistrant (1) havehas filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants wereregistrant was required to file such reports), and (2) havehas been subject to such filing requirements for the past 90 days. Yesýx No¨o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yeso Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants’ knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨o

Indicate by check mark whether the registrants are collectivelyregistrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a non-accelerated filer.smaller reporting company. See definitionthe definitions of “large accelerated filer,” “accelerated filerfiler” and large accelerated filer”“smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer | Accelerated Filer | Non-accelerated Filer | Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yeso Nox

The aggregate market value of the outstanding shares of trust stock held by non-affiliates of Macquarie Infrastructure Company TrustLLC at June 30, 20062009 was $674,150,614$170,868,634 based on the closing price on the New York Stock Exchange on that date. This calculation does not reflect a determination that persons are affiliates for any other purposes.

There were 37,562,16545,292,913 shares of trust stock without par value outstanding at February 28, 2007.

DOCUMENTS INCORPORATED BY REFERENCE

The definitive proxy statement relating to Macquarie Infrastructure Company Trust’sLLC’s Annual Meeting of Shareholders for fiscal year ended December 31, 2009, to be held May 24, 2007,June 3, 2010, is incorporated by reference in Part III to the extent described therein.

| PART I | ||||||

Item 1. Business | 3 | |||||

Item Risk Factors | 23 | |||||

Item 1B. Unresolved Staff Comments | 37 | |||||

Item 2. Properties | 37 | |||||

Item 3. Legal Proceedings | 39 | |||||

Item 4. | Submission of Matters to a Vote of Security Holders | 39 | ||||

| PART II | ||||||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 40 | ||||

Item 6. Selected Financial Data | 42 | |||||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 45 | ||||

Item 7A. | Quantitative and Qualitative Disclosures | 94 | ||||

Item 8. | Financial Statements and Supplementary Data | 97 | ||||

Item 9. | Changes in and Disagreements | 153 | ||||

Item 9A. Controls and Procedures | 153 | |||||

Item 9B. Other Information | 155 | |||||

| PART III | ||||||

Item 10. | Directors and Executive Officers of the Registrant | 156 | ||||

Item 11. Executive Compensation | 156 | |||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 156 | ||||

Item 13. | Certain Relationships and Related Transactions | 156 | ||||

Item 14. Principal Accountant Fees and Services | 156 | |||||

| PART IV | ||||||

Item 15. | Exhibits, Financial Statement Schedules | 156 | ||||

i

FORWARD-LOOKING STATEMENTS

We have included or incorporated by reference into this report, and from time to time may make in our public filings, press releases or other public statements, certain statements that may constitute forward-looking statements. These include without limitation those under “Risk Factors” in Part I, Item 1A, “Legal Proceedings” in Part I, Item 3, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7, and “Quantitative and Qualitative Disclosures about Market Risk” in Part II, Item 7A. In addition, our management may make forward-looking statements to analysts, investors, representatives of the media and others. These forward-looking statements are not historical facts and represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and beyond our control. We may, in some cases, use words such as “project,” “believe,” “anticipate,” “plan,” “expect,” “estimate,” “intend,” “should,” “would,” “could,” “potentially,” or “may” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements.

In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we are identifying important factors that, individually or in the aggregate, could cause actual results to differ materially from those contained in any forward-looking statements made by us. Any such forward-looking statements are qualified by reference to the following cautionary statements.

Forward-looking statements in this report are subject to a number of risks and uncertainties, some of which are beyond our control, including, among other things:

Our actual results, performance, prospects or opportunities could differ materially from those expressed in or implied by the forward-looking statements. A description of risks that could cause our actual results to differ appears under the caption “Risk Factors” in Part I, Item 1A and elsewhere in this report. It is not possible to predict or identify all risk factors and you should not consider that description to be a complete discussion of all potential risks or uncertainties that could cause our actual results to differ.

In light of these risks, uncertainties and assumptions, you should not place undue reliance on any forward-looking statements. The forward-looking events discussed in this report may not occur. These forward-looking statements are made as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You should, however, consult further disclosures we may make in future filings with the Securities and Exchange Commission, or the SEC.

U.S. Dollar/Australian Dollar | U.S. Dollar/Pound Sterling | |||||||||||

Time Period | High | Low | Average | High | Low | Average | ||||||

| 2001 | 0.5552 | 0.5016 | 0.5169 | 1.4773 | 1.4019 | 1.4397 | ||||||

| 2002 | 0.5682 | 0.5128 | 0.5437 | 1.5863 | 1.4227 | 1.5024 | ||||||

| 2003 | 0.7391 | 0.5829 | 0.6520 | 1.7516 | 1.5738 | 1.6340 | ||||||

| 2004 | 0.7715 | 0.7083 | 0.7329 | 1.8950 | 1.7860 | 1.8252 | ||||||

| 2005 | 0.7974 | 0.7261 | 0.7627 | 1.9292 | 1.7138 | 1.8198 | ||||||

| 2006 | 0.7914 | 0.7056 | 0.7535 | 1.9794 | 1.7256 | 1.8294 | ||||||

Macquarie Infrastructure Company Trust areLLC is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia) and its obligations do not represent deposits with or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (MBL). MBL does not guarantee or of any Macquarie Group company and are subject to investment risk, including possible delaysotherwise provide assurance in repayment and loss of income and principal invested. Neither Macquarie Bank Limited nor any other member companyrespect of the Macquarie Group guarantees the performanceobligations of Macquarie Infrastructure Company Trust or the repayment of capital from Macquarie Infrastructure Company Trust.

PART I

Except as otherwise specified, “Macquarie Infrastructure Company Trust, a Delaware statutory trust that weCompany”, “MIC,” “the Company”, “we,” “us,” and “our” refer to as the trust, owns its businesses and investments through Macquarie Infrastructure Company LLC, a Delaware limited liability company, that we refer to as the company. Except as otherwise specified, “Macquarie Infrastructure Company,” “we,” “us,” and “our” refer to both the trust and the company and its subsidiaries together. References to our “shareholders” herein means holders of LLC interests. The company ownsholders of LLC interests are also the businesses located in the United States through a Delaware corporation, Macquarie Infrastructure Company Inc., or MIC Inc., and, during 2006, owned its businesses and investments located outsidemembers of the United States through Delaware limited liability companies.our company. Macquarie Infrastructure Management (USA) Inc., the company that we refer to as our Manager, is part of the Macquarie Group of companies. References to the Macquarie Group includemeans Macquarie BankGroup Limited and its respective subsidiaries and affiliates worldwide.

General

We own, operate and invest in a diversified group of infrastructure businesses primarily in the United States. We believe our infrastructure businesses, which provide basic services, have a sustainable and stable cash flow profile and offer the potential for capital growth. We offer investors an opportunity to participate directly in the ownership of infrastructure businesses, which traditionally have been owned by governments or private investors, or have formed part of vertically integrated companies. Our businesses which also constitute our operating segments and consist of the following:

The Energy-Related Businesses:

| (i) | a 50% interest in a bulk liquid storage terminal business (“International Matex Tank Terminals” or “IMTT”), which provides bulk liquid storage and handling services at ten marine terminals in the United States and two in Canada and is one of the largest participants in this industry in the U.S., based on capacity; |

| (ii) | a gas production and distribution business (“The Gas Company”), which is a full-service gas energy company, making gas products and services available in Hawaii; and |

| (iii) | a 50.01% controlling interest in a district cooling business (“District Energy”), which operates the largest such system in the U.S. and serves various customers in Chicago, Illinois and Las Vegas, Nevada. |

The Aviation-Related Business:an airport services business conducted through (“Atlantic Aviation;

On January 28, 2010, our airport parking business conducted through(“Parking Company of America Airports” or “PCAA”) entered into an asset purchase agreement and filed for protection under Chapter 11 of the Bankruptcy Code. We expect to complete the sale of the assets in the first half of 2010. This business is now a discontinued operation and is therefore separately reported in our consolidated financial statements and is no longer a reportable segment of the Company.

In 2007, we made an election to treat MIC as a corporation for federal income tax purposes. As a result, all investor tax reporting with respect to distributions made after December 31, 2006, and in all subsequent years, is based on our being a corporation for U.S. federal tax purposes and such reporting will be provided on Form 1099.

Our Manager

Our Manager is a member of the Macquarie Parking.

We have entered into a management services agreement with our Manager. Our Manager is responsible for our day-to-day operations and affairs and oversees the management teams of our operating businesses. Neither the trustThe Company neither has, nor the company have or will have, any employees. Our Manager has assigned, or seconded, to the company,Company, on a permanent and wholly dedicated basis, two of its employees to assume the offices of chief executive

officer and chief financial officer and seconds or makes other personnel available as required. The services performed for the companyCompany are provided at our Manager’s expense, includingand includes the compensation of our seconded personnel.

We pay our Manager a quarterly management fee based primarily on our market capitalization. In addition, to incentivize our Manager to maximize shareholder returns, we may pay performance fees. Our Manager can also earn a performance fee equal to 20% ofif the outperformance, if any, of quarterly total returnsreturn to our shareholders above(capital appreciation plus dividends) exceeds the quarterly total return of a weighted average of two benchmark indices, a U.S. utilities index and a European utilities index, weighted in proportion to our U.S. and non-U.S. equity investments. Currently, weWe currently do not have noany non-U.S. equity investments. The performance fee is equal to 20% of the difference between the benchmark return and the return for our shareholders. To be eligible for the performance fee, our Manager must deliver quarterly total shareholder returns for the quarter that are positive and in excess of any prior underperformance. Please see the management services agreement filed as an exhibit to this Annual Report on Form 10-K for the full terms of this agreement.

We believe that Macquarie Group’s demonstrated expertise and experience in the management, acquisition and funding of infrastructure businesses will provide us with a significant advantage in pursuing our strategy. Our Manager is part of Macquarie Group’s Capital Funds division. The Macquarie Capital Funds division manages a global portfolio of 110 businesses including toll roads, airports and airport-related infrastructure, ports, communications, media, electricity and gas distribution networks, water utilities, aged care, rail and ferry assets across 22 countries.

Industry

Infrastructure businesses provide basic, everydaytend to generate sustainable and growing long-term cash flows resulting from relatively inelastic customer demand and strong competitive positions of the businesses. Characteristics of infrastructure businesses include:

In addition to the benefits related to these characteristics, the revenues generated by our infrastructure businesses generally can be expected to keep pace with inflation. The price escalators built into the agreements with customers of contracted businesses, and the inflation and cost pass-through adjustments typically a part of pricing terms in user pays businesses or provided for by the regulatory process to regulated businesses, serve to insulate infrastructure businesses to a significant degree from the negative effects of inflation and commodity price risk. We also employ interest rate swaps in connection with our businesses’ floating rate debt to effectively fix our cash flows for the interest costs and hedge variability from interest rate changes.

We focus on the ownership and operation of infrastructure businesses in the following categories:

Strategy

The challenges posed by the economic conditions of the past 18 to 24 months have caused us to adopt a near-term strategy focused on reducing debt, improving operational performance and effectively deploying available growth capital. We believe that our focus on these elements is appropriate to ensuring that our businesses are well positioned to survive and grow regardless of the broader economic backdrop. This strategy included our decisions to sell a non-controlling interest in District Energy, repay our holding company level debt and reduce indebtedness at airports for parking facilities or fixed base operations (FBOs) or waterfront land near key portsAtlantic Aviation.

Over the medium term, subject to having access to external sources of entry for bulk liquid storage terminals;

Debt Reduction

We have two primary strategic objectives. First, we intend to grow our existing businesses. We intend to accomplish this by:

Operational Improvement

We intend to continue to seek opportunities to reduce expenses through rationalization of staffing and business process improvements. In addition, we are actively seeking opportunities to improve the marketing and organic growth of our businesses. We are prudently managing reinvestment in our businesses in the form of maintenance capital expenditures without compromising service levels or operational capabilities of these businesses. Executing this component of our strategy is expected to improve the generation of free cash flow by our businesses.

Growth Capital Expenditures

We have reinvested substantially all of the cash flows generated at IMTT in economically attractive growth opportunities, primarily additional storage capacity. We will continue to reinvest cash flow generated by this business in additional growth projects that we expect will also generate appropriate returns.

We have also reinvested a portion of the cash generated by each of District Energy and The Gas Company into projects that support customer acquisition. We will continue to reinvest in such opportunities in the future.

We intend to meet our contractual obligations with respect to the deployment of growth capital, such as our leasehold improvement obligations at Atlantic Aviation. We have sufficient committed financing to meet these expenditures. We expect that these projects will increase the amount of free cash flow generated by this business.

Our Businesses and Investments

We provide below information about our businesses and investments, including key financial information for each business. In previous filings, we disclosed operating income for each of our businesses who will be supportedas a measure of business segment profit or loss calculated in accordance with GAAP. Effective this reporting period, we are disclosing earnings before interest, taxes, depreciation and amortization (EBITDA) excluding non-cash items as defined by us. We believe EBITDA excluding non-cash items provides additional insight into the demonstrated infrastructure management expertise and experience of the Macquarie Group in the execution of this strategy.

Energy-Related Businesses

IMTT

Business Overview

We own 50% of International-Matex Tank Terminals, or IMTT. The 50% we do not allow them to finance these assets as efficiently as possible, d) regulatory pressures are causing an unbundling of vertically integrated product offerings, or e) they are seeking liquidity and redeployment of capital resources.

2006 | 2005 | 2004 | ||||||||

| Revenue | $ | 312.9 | $ | 201.5 | $ | 142.1 | ||||

| Operating income | 47.9 | 28.3 | 15.3 | |||||||

| Total assets | 932.6 | 553.3 | 410.3 | |||||||

| % of our consolidated revenue | 60.1 | % | 66.2 | % | 52.1 | % | ||||

2006 | 2005 | 2004 | |||||||

| Revenue | $ | 239.3 | $ | 250.6 | $ | 210.7 | |||

| Operating income | 51.0 | 44.5 | 33.5 | ||||||

| Total assets | 630.4 | 549.2 | 510.6 | ||||||

For the year endingended December 31, 2006,2009, IMTT generated approximately 52%43% of its terminal revenue and 50%approximately 42% of its terminal gross profit at its Bayonne, New Jersey facility which servicesin New York Harbor, and 34%Harbor. Approximately 41% of itsIMTT’s total terminal revenue and 42%approximately 48% of its terminal gross profit atwas generated by its St. Rose, Gretna, Avondale and Avondale, LouisianaGeismar facilities, which together service the lower Mississippi River region (with St. Rose as the largest contributor).

IMTT also owns two additional businesses: Oil Mop, an environmental response and spill clean-up business, and St. Rose Nursery, a nursery business.

The business generates approximately one halftable below summarizes the proportion of its revenue from spill clean-up, one quarter from tank cleaning and the balance from other activities including vacuum truck services, waste disposal and material sales to the spill clean-up sector. The underlying drivers of demand for spill clean-up services include shipping and oil and gas industry activity levels in the Gulf region, the aging of pipeline and other mid-stream petroleum infrastructure, the frequency of natural disasters and regulations regarding the standards of spill clean-up. Revenue generated by Oil Mop from spill clean-up tends to be highly variable depending on the frequency and magnitude of spills in any particular period.

| Proportion of Terminal Revenue from Major Commodities Stored | ||||||

| Petroleum/Asphalt | Chemical | Renewables/Vegetable & Animal Oil | Other | |||

| 58% | 29% | 9% | 4% | |||

Financial information for 100% of this business is as follows ($ in millions):

| As of, and for the Year Ended, December 31, | ||||||||||||

| 2009 | 2008 | 2007 | ||||||||||

| Revenue | $ | 346.2 | $ | 352.6 | $ | 275.2 | ||||||

| EBITDA excluding non-cash items | 147.7 | 136.6 | 89.0 | |||||||||

| Total assets | 1,064.8 | 1,006.3 | 862.5 | |||||||||

Bulk liquid storage terminals areprovide an essential link in the supply chain for most major liquid commodities that are transported in bulk. The ability of anysuch as crude oil, refined petroleum products and basic and specialized chemicals. In addition to renting storage tanks, bulk liquid storage terminal to increase itsterminals generate revenues by offering ancillary services including product transfer (throughput), heating and blending. Pricing for storage rates is principally driven by the balance between theand other services typically reflects local supply and demand for storage inas well as the locale that the terminal serves and thespecific attributes of theeach terminal in terms of dock water depth andincluding access to land baseddeepwater berths and connections to land-based infrastructure such as a pipeline, railroads, pipelines and road.

Both domestic and international factors influence demand for bulk liquid storage in the United States is fundamentally driven byStates. Demand for storage rises and falls according to local and regional consumption, which largely reflects the level of product inventories, which isunderlying economic activity over the medium term. In addition to these domestic forces, import and export activity also accounts for a functionmaterial portion of the volume of the stored products consumed and which in turn is largely driven by economic activity. Import and export levels of bulk liquid products are also important drivers of demand for domestic bulk liquid storage as imports and exportsbusiness. Shippers require storage for the staging, aggregation and/or break-updistribution of the products before and after shipment. An exampleThe extent of this is basic or commodity chemicals which are usedimport/export activity depends on macroeconomic trends such as feedstockcurrency fluctuations as well as industry-specific conditions, such as supply and demand balances in the productiondifferent geographic regions. The medium-term length of specialty chemical products. As a result of high natural gas pricesstorage contracts tends to offset short-term fluctuations in the United States, the cost of producing commodity chemicals that use natural gas as a feedstock (such as methanol) is now higher in the United States than the cost of importing such chemicals from countries with low cost natural gas. As a result domestic production of such chemicals has declined while imports have increased substantially, generating increased demand for bulk commodity chemical storage in both the United States.

Potential entrants into the bulk liquid storage terminal business face several substantial barriers. Strict environmental regulations, limited availability of waterfront land with the necessary access to land-based infrastructure, local community resistance to new fuel/chemical sites, and high capitalinitial investment costs represent substantial barriers toimpede the construction of

Strategy

The key components of these facilitiesIMTT’s strategy are well-located in key distribution centers for bulk liquid products, have deep water berths allowing large ships to dock without lightering and have access to road, rail and, in the case of Bayonne and St. Rose, pipeline infrastructure for onward distribution of stored product.

Flexibility: Operational flexibility is essential to make IMTT an attractive supplier of bulk liquid storage services in its key markets. Its facilities operate 24/7 providing shippers, refiners, manufacturers, traders and distributors with prompt access to a wide range of storage services. In each of its facilitiestwo key markets, IMTT’s scale ensures availability of sophisticated product handling and storage capabilities along with ancillary services such as heating and blending. IMTT continues to receiveimprove its facilities’ speed and distribute stored product from and to multiple modesflexibility of transportation at high speed. This includes continuing to investoperations by investing in dock, pipelineupgrades of its docks, pipelines and pumping infrastructure, and dredging to ensure that large ships and barges which represent the cheapest transport options, can deliver and receive stored product from IMTT’s facilities with fast turnaround to minimize shipping costs. As such investments create immediate value for customersfacility management systems.

Investment in the form of lower supply chain costs and increased logistical flexibility, the costs of such investments can usually be recovered quickly through storage rate increases. This is attractive given that such infrastructure investments have a long useful life and therefore result in a near permanent improvement in the capabilities of IMTT’s facilities and their long-term competitive position. Finally, IMTT intends to maintain its current high level of customer service.

Energy-Related Business: IMTT will also consider– (continued)

Locations

The following table summarizes the acquisition of storage facilities in markets outside of the key markets in which it currently operates and where IMTT believes that over the long term a favorable supply/demand balance will exist for bulk liquid storage or where IMTT believes that the performance of the facilities can be improved under its ownership.

| Facility | Land | Number of Storage Tanks in Service | Aggregate Capacity of Storage Tanks in Service | Number of Ship & Barge Berths in Service | ||||||||||||

| (Millions of Barrels) | ||||||||||||||||

| Facilities in the United States: | ||||||||||||||||

| Bayonne, NJ | Owned | 600 | 16.0 | 18 | ||||||||||||

| St. Rose, LA* | Owned | 205 | 13.4 | 16 | ||||||||||||

| Gretna, LA* | Owned | 56 | 2.0 | 5 | ||||||||||||

| Avondale, LA* | Owned | 82 | 1.1 | 4 | ||||||||||||

| Geismar, LA* | Owned | 34 | 0.9 | 3 | ||||||||||||

| Lemont, IL | Owned/Leased | 155 | 1.1 | 3 | ||||||||||||

| Joliet, IL | Owned | 71 | 0.7 | 2 | ||||||||||||

| Richmond, CA | Owned | 46 | 0.6 | 1 | ||||||||||||

| Chesapeake, VA | Owned | 23 | 1.0 | 1 | ||||||||||||

| Richmond, VA | Owned | 12 | 0.4 | 1 | ||||||||||||

| Facilities in Canada: | ||||||||||||||||

| Quebec City, Quebec(1) | Leased | 53 | 1.9 | 2 | ||||||||||||

| Placentia Bay, Newfoundland(2) | Leased | 6 | 3.0 | 2 | ||||||||||||

| Total | 1,343 | 42.1 | 58 | |||||||||||||

Facility | Land | Number of Storage Tanks in Service | Aggregate Capacity of Storage Tanks in Service | Number of Ship and Barge Docks in Service | ||||

| (millions of barrels) | ||||||||

Facilities in the United States: | ||||||||

| Bayonne, NJ | Owned | 478 | 15.4 | 18 | ||||

| St. Rose, LA | Owned | 174 | 11.7 | 16 | ||||

| Gretna, LA | Owned | 85 | 1.7 | 5 | ||||

| Avondale, LA | Owned | 86 | 1.0 | 4 | ||||

| Geismar, LA(1) | Owned | — | — | — | ||||

| Chesapeake, VA | Owned | 24 | 1.0 | 1 | ||||

| Lemont, IL | Owned/Leased | 145 | 0.9 | 3 | ||||

| Richmond, CA | Owned | 46 | 0.7 | 1 | ||||

| Richmond, VA | Owned | 12 | 0.4 | 1 | ||||

Facilities in Canada: | ||||||||

| Quebec City, Quebec(2) | Leased | 46 | 1.2 | 2 | ||||

| Placentia Bay, Newfoundland(3) | Owned | 6 | 3.0 | 2 |

| * | Collectively the “Louisiana” facilities. |

| (1) | Indirectly 66.7% owned and managed by IMTT. |

| (2) | Indirectly 20.1% owned and managed by IMTT. |

All facilities have marine access, all facilities have road access and, except for Richmond, Virginia and Placentia Bay, Newfoundland, all sites have rail access.

Bayonne, New Jersey.

The 16 million barrel storage terminal at Bayonne, New Jersey has its largestthe most storage capacity with 15.4 million barrels. It is locatedof any IMTT site. Located on the Kill Van Kull between New Jersey and Staten Island, and provides storage services tothe terminal occupies a strategically advantageous position in New York Harbor, or NYH. IMTT-Bayonne has a substantial share of the market for third-party petroleum and liquid chemical storage in NYH and isAs the largest third-partyindependent bulk liquid storage facility in NYH, by capacity. IMTT-Bayonne has expanded over a numbersubstantial market share for third-party storage of years by IMTT through progressive acquisitions of neighboring facilities.

NYH isserves as the main petroleum trading hub in the U.S. northeast. NYH isnortheast United States and the physical delivery point for the gasoline and heating oil futures contracts traded on NYMEX.New York Mercantile Exchange (NYMEX). In addition to waterborne shipments, products reach NYH is also the endpoint for thethrough major refined petroleum product pipelines from the U.S. gulfGulf region, where approximately half of U.S. domestic refining capacity is located. It isresides. NYH also serves as the starting point for refined petroleum product pipelines from the East coastlinked to the inland markets and theas a key port for U.S. refined petroleum product imports from outside of the United States.imports. IMTT-Bayonne has connections to the Colonial, Buckeye and Harbor refined petroleum product pipelines. It also haspipelines as well as rail and road connections. As a result, IMTT-Bayonne provides its customers with substantial logistical flexibility that is at least comparable with its competitors.flexibility.

Energy-Related Business: IMTT – (continued)

IMTT-Bayonne has the capability to aquickly load and unload the largest bulk liquid transport ships entering NYH. The U.S. Army Corp of Engineers or USACE, dredging program for(USACE) has dredged the Kill Van Kull and Newark Bay, the water depth in the channel passing IMTT-Bayonne’sthe IMTT-Bayonne docks isto 45 feet (IMTT has dredged some but not all of its docks to that depth) and we understand that the USACE is currently undertaking a project that will deepen this channel to 50 feet. Almost all of IMTT’s. Most competitors in NYH arehave facilities located on the southern reachesportion of the Arthur Kill (water depth of approximately 35 feet) and there are no plansforce large ships to transfer product through lightering (transferring cargo to barges at anchorage) before docking. This technique substantially increases the cost of which we are awareloading and unloading vessels. This competitive advantage for Bayonne may improve as the USACE has announced plans to dredge this bodythe Kill Van Kull to 50 feet (with no planned increase in the depth of water beyond its current depth. As a result, the water depth atsouthern portion of the docks of all of IMTT-Bayonne’s major competitors is substantially less than 45 feet. Thus, IMTT can handle large ships at full load without the needArthur Kill).

Demand for lightering which delays ships and is expensive. IMTT-Bayonne’s facility also has a large waterfront with a large number of generally uncongested docks, which reduces ship turnaround times and demurrage costs.

St. Rose/Gretna/Avondale/Gretna/Geismar Louisiana.

On the lower Mississippi River, IMTT currently operates four bulk liquid storage terminals (St. Rose, Gretna, Avondale Gretna and Geismar terminalsGeismar). With combined storage capacity of 17.4 million barrels, the four sites give IMTT substantial market share in storage for black oil, bulk liquid chemicals, and vegetable oils on the lower Mississippi RiverRiver.

The Louisiana facilities give IMTT a substantial presence in Louisiana have a combined storage capacity of 14.4 million barrels, with St. Rose as the largest with capacity of 11.7 million barrels. IMTT-St. Rose, individually and in combination with IMTT’s other

Demand for third-party bulk liquid storage inon the lower Mississippi isRiver has remained strong during the past several years, as illustrated by the level of capacity utilization at IMTT’sthe IMTT Louisiana facilities. For the three years ended December 31, 2006, on average2009, IMTT rented approximately 94%96% of the aggregate available storage capacity of IMTT’s Louisiana terminals was rented. Due to strong demand for storage capacity, IMTT has recently completed the construction of seven new storage tanksat St. Rose, Gretna, Avondale and is currently in the process of constructing a further eight new storage tanks with a total capacity of approximately 1.5 million barrels at its Louisiana facilities at a total estimated cost of approximately $39.0 million. It is anticipated that construction of these tanks will be completed in 2007. Rental contracts with initial terms of at least three years have been executed in relation to 11 of these tanks with the balance of the tanks to be used to service customers while their existing tanks are undergoing maintenance over the next five years. We anticipate that the new tanks will contribute approximately $6.4 million to IMTT’s terminal gross profit and EBITDA annually. At Geismar, a 570,000 barrel bulk liquid chemical storage and handling facility is under construction with capital committed to date of $160.0 million. Based on the current project scope and subject to certain minimum volumes of chemical products being handled by the facility, existing customer contracts are anticipated to generate terminal gross profit and EBITDA of at least $18.8 million per year. Completion of construction of the initial $160.0 million phase of the Geismar project is targeted for the first quarter of 2008. In the aftermath of Hurricane Katrina, construction costs in the region have increased and labor shortages have been experienced. Although a significant amount of the impact of Hurricane Katrina on construction costs has already been incorporated into the capital commitment plan, there could be further negative impacts on the cost of constructing the project (which may not be offset by an increase in its gross profit and EBITDA contribution) and/or the project construction schedule.

Competition

The competitive environment in which IMTT operates varies by terminal location. The principal competition for each of IMTT’s facilities comes from other third-party bulk liquid storage facilities located in the same regional market. Kinder Morgan, which owns three bulk liquid storage market.facilities in New Jersey and Staten Island, New York, represents IMTT’s major competitor in the New York Harbor storage market isNYH market. Kinder Morgan which has three storagealso owns facilities in the area. Kinder Morgan is also IMTT’s main competitor inalong the lower Mississippi River storage market.near New Orleans. In both the New York HarborNYH and Lowerlower Mississippi River markets, IMTT operates the largest third-party terminal by capacity. We believe that IMTT’s large share of the market for third-party bulk liquid storage in the New York Harbor and lower Mississippi regions,capacity which, combined with the capabilities of IMTT’s facilities, provides IMTT with a strong competitive position in both of these key bulk liquid storage markets.

IMTT’s minor facilities in Illinois, California and Virginia represent only a small proportion of available bulk liquid storage capacity in their respective markets and have numerous competitors with facilities of similar or larger size and with similar capabilities.

Secondary competition for IMTT’s facilities comes from bulk liquid storage facilities located in the same broad geographic region as IMTT’s terminals. For example, bulk liquid storage facilities located on the Houston Ship Channel provide a moderate level ofindirect competition for IMTT’s Louisiana facilities.

Customers

IMTT provides bulk liquid storage services principally to vertically integrated petroleum product producers petroleum productand refiners, chemical manufacturers, food processors and traders of bulk liquid petroleum, chemical and agricultural products. No single customer represented greater than 10% of IMTT’s total revenue for the year ended December 31, 2006.2009.

IMTT generally rents storage tanks are generally rented to customers under contracts with terms of onethree to five years. Pursuant to these contracts, customers generally pay for the capacity of the tank irrespective of whether they actually store product in the tank is actually used. Tank rentals areand the contracts generally payablehave no early termination provisions. Customers generally pay rental charges monthly andat rates are stated in terms of cents per barrel of storage capacity per month. Tank rental rates vary by commodity stored and by location. IMTT’s standard form of customer contract generally permits a certain number of free product movements into and out of the storage tank with charges for throughput aboveexceeding the prescribed levels. Where a customer is renting a tank that requiresIn cases where stored liquids require heating to prevent the stored product from becoming excessively viscous,keep viscosity at acceptable levels, IMTT generally charges the customer for the heating with such charges essentially reflecting a pass-through of IMTT’s cost. Heating charges are principally cover the cost of fuel used to produce steam. Pursuant to IMTT’s standard form of customer contract, tank rental rates, throughput rates and the rates for some other services are generally subject toincrease based on annual inflation increases. The productindices. Customers retain title to products stored in the tanks remains the property of the customer at all times and thereforehave responsibility for securing insurance against loss. As a result, IMTT takeshas no commodity price risk. The customerrisk related to the liquids stored in its tanks and has limited liability from product loss. IMTT is also responsible for ensuring appropriate care of products stored at its facilities and maintains adequate insurance against loss of the stored product.

Regulation

The rates that IMTT charges for theits services that it provides are not subject to regulation. However, IMTT’s operations are overseen by a number of regulatory bodies andoversee IMTT’s operations. IMTT must comply with numerous federal, state and local environmental, occupational health and safety, security, tax and planning statutes and regulations. These regulations require IMTT to obtain and maintain permits to operate its facilities and impose standards that govern the way IMTT operates its business. If IMTT does not comply with the relevant regulations, it could lose its operating permits andand/or incur fines and increased liability in the event of an accident.liability. As a result, IMTT has developed environmental and health and safety compliance functions which are overseen by the terminal managers at the terminal level and IMTT’s Director of Environmental, Health and Safety, Chief Operating Officer and Chief Executive Officer. While changes in environmental, health and safety regulations pose a risk to IMTT’s operations, such changes are generally phased in over time to manage the impact on industry.

The Bayonne New Jersey terminal, which has beenwas acquired and expanded over a 2226 year period, contains pervasive remediation requirements that were partially assumed at the time of purchase from the various former owners. One former owner retained environmental remediation responsibilities for a purchased site as well as sharing other remediation costs. These remediation requirements are documented in two memoranda of agreement and an administrative consent order with the State of New Jersey. Remediation efforts entail removal of the free product, soil treatment, repair/replacement of sewer systems, and the implementation of containment and monitoring systems. These remediation activities are estimatedexpected to span a period of ten to twenty years or more.

The Lemont terminal has entered into a consent order with the State of Illinois to remediate contamination at the site that pre-dated IMTT’s ownership. Remediation is also required as a result of the renewal of a lease with a government agency for a portion of the terminal. This remediation effort, including the implementation of extraction and monitoring wells and soil treatment, is estimated to span a period of ten to twenty years.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources” in Part II, Item 7 for discussion of the expected future capitalized cost of environmental remediation.

Management

The day-to-day operationoperations of IMTT’s terminals isare overseen by individual terminal managers who are responsible for all aspects of the operations at their respective sites. IMTT’s terminal managers have on average 2931 years experience in the bulk liquid storage industry and 1718 years service with IMTT.

Energy-Related Business: IMTT – (continued)

The IMTT head office is in New Orleans. The head officeOrleans provides the business with central management, performs support functions such as accounting, tax, finance, human resources, insurance, information technology and legal services and provides support for functions that have been partially de-centralized to the terminal level such as engineering and environmental and occupational health and safety regulatory compliance. IMTT’s senior management team, other than the terminal managers, have on average 2136 years experience in the bulk liquid storage industry and 2128 years service with IMTT.

The Board of IMTT Holdings consists of six members with three appointees each from Macquarie Terminal Holdings, LLC, our wholly owned subsidiary, and our co-shareholder. All decisions of the Board require majority approval, including the approval of at least one member appointed by Macquarie Terminal Holdings, LLC and one member appointed by our co-shareholder. The shareholders’ agreement to which we became a party at the time of our investment in IMTT contains a customary list of items that must be referred to the Board for approval.

The shareholders’ agreement is filed as an exhibit to this Annual Report on Form 10-K.

Employees

As atof December 31, 2006,2009, IMTT (excluding non-consolidated sites) had a total of 9541,022 employees, with 710 employed at the bulk liquid storage terminals, 106including 133 employed by Oil Mop, 64 employed by St. Rose Nursery and 74 employed at the head office in New Orleans.Mop. At the Bayonne terminal, 132 staff members142 employees are unionized, and52 of the employees are unionized at the Lemont terminal, 48 ofand Joliet terminals and 33 employees are unionized at the staff members are unionized.Quebec terminal. We believe employee relations at IMTT are good.

The Gas Company LLC, from k1 Ventures Limited. The cost of the acquisition, including working capital adjustments and transaction costs, was approximately $262.7 million. In addition, we incurred financing costs of approximately $3.3 million.

Business Overview

The Gas Company is Hawaii’s only government franchised full-service gas energy company, makingmanufacturing and distributing gas products and services available in Hawaii. The Hawaii market includes Hawaii’s approximateapproximately 1.3 million resident population and approximate 7.5 million annual visitors. TGC provides both regulated and unregulated gas distribution services on the state’s six primary islands.

The Gas customers range from residential customers, for which TGC has nearly all of the market, to a wide variety of commercial and wholesale customers.

The Gas Company’s two products, SNG and LPG, are relatively clean-burning fuels that produce lower levels of carbon emissions than other hydrocarbon fuels such as coal or oil. This is particularly important in Hawaii where heightened public awareness of environmental impact makes lower emission products attractive to customers.

SNG and LPG have a wide number of commercial and residential applications including water heating, drying, cooking, emergency power generation and tiki torches. LPG is also used as a fuel for specialty vehicles such as forklifts. Gas customers include residential customers and a wide variety of commercial, hospitality, military, public sector and wholesale customers.

Energy-Related Business: The Gas Company – (continued)

Financial information for this business is as follows ($ in millions):

| As of, and for the Year Ended, December 31, | ||||||||||||

| 2009 | 2008 | 2007 | ||||||||||

| Revenue | $ | 175.4 | $ | 213.0 | $ | 170.4 | ||||||

| EBITDA excluding non-cash items | 37.6 | 27.9 | 25.6 | |||||||||

| Total assets | 344.9 | 330.2 | 313.1 | |||||||||

| % of our consolidated revenue | 24.7 | % | 21.8 | % | 22.6 | % | ||||||

2006 | 2005 | |||||

| Revenue | $ | 160.9 | $ | 147.5 | ||

| Operating income | 16.6 | 20.5 | ||||

| Total assets(1) | 308.5 | 175.1 | ||||

| % of our consolidated revenue | 16.9 | % | N/A | |||

Strategy

The Gas Company’s long-term strategy is as at June 30, the financial year endto increase and diversify its customer base. The business intends to increase penetration of the residential, the expanding government (primarily military) and the tourism-related markets. The business prioralso intends to our acquisition.

As a second component of Hawaii’s population and economy to present opportunities for increasing TGC’s base of residential and commercial customers of both SNG and LPG. TGCits strategy, The Gas Company intends to take advantagediversify its sources of growthfeedstock and LPG to ensure reliable supply and to mitigate any potential cost increases to its customers. The Gas Company is exploring other clean and renewable energy alternatives that may be distributed using its existing infrastructure.

The Gas Company also recognizes the important role it plays in Hawaii’s tourismthe local community and real estate industries by pursuing new customeras a component of its strategy will focus on maintaining good relationships with hotel, restaurantregulators, governments and condominium developers and other similar commercial customers, as well as the growing residential market.

Products

While the long-term, we expect to invest in selected capital expenditures, such as those for improvements to TGC’s distribution system and increases in TGC’s LPG storage capacity. We believe that these capital expenditures will increase the reliability of TGC’s distribution system and will enhance TGC’s attractiveness as an alternative to Hawaii’s regulated electric utilities and other non-regulated LPG suppliers. Additionally, we intend to market TGC as an environmentally friendly alternative to electricity generation and as an established, reliable and cost-effective distributor of LPG.

Synthetic Natural Gas. TGC catalyticallyThe business converts a light hydrocarbon feedstock (currently naphtha) to SNG. The product is chemically similar in most respects to natural gas and has a similar heating value on a per cubic foot basis. TGCThe Gas Company has the only SNG manufacturing capability in Hawaii at its plant located on the island of Oahu.

Liquefied Petroleum Gas. LPG is a generic name for a mixture of hydrocarbon gases, typically propane and butane. Owing to chemical properties whichLPG liquefies at a relatively low pressure under normal temperature conditions. As a result, in LPG becoming liquid at atmospheric temperature and elevated pressure, LPG maycan be stored or transported more easily than natural or synthetic natural gas. LPG is typically transported usingin cylinders or tanks. Domestic and commercial applications of LPG are similar to those of natural gas and synthetic natural gas.

Utility Regulation

The Gas Company’s utility operations arebusiness is regulated by the Hawaii Public Utilities Commission, or HPUC, while TGC’sthe business’ non-utility operations are not regulated.business is not. The HPUC exercises broad regulatory oversight and investigative authority over all public utility companies doing business in the state of Hawaii.

Rate Regulation. The HPUC currently regulatesestablishes the rates that TGCThe Gas Company can charge its utility customers via cost of service regulation. The rate approval process is intended to ensure that a public utility has a reasonable opportunity to recover costs that are prudently incurred and earn a fair return on its investments, while protecting consumer interests.

Although the HPUC sets the base rate for the SNG and LPG sold by The Gas Company’s utility business, the business is permitted to pass through changes in its raw materials cost by means of a monthly fuel adjustment charge, or FAC. The adjustment protects the business’ earnings from volatility in feedstock commodity costs.

Energy-Related Business: The Gas Company – (continued)

The business’ utility rates are established by the HPUC in periodic rate cases typically initiated by TGC when it has the need to do so, which historically has occurred approximately every five years. TGCThe Gas Company. The business initiates a rate case by submitting a request to the HPUC for an increase in the rates based, for example, upon materially higher costs related to providing the service. Following initiation of the rate increase request by The HPUCGas Company and submission by the Hawaii Division of Consumer Advocacy or DCA, may also initiate a rate case, although such proceedings have been relatively rare in Hawaii and will generally only occur if the HPUC or DCA receive numerous complaints about the rates being charged or if there is a concern that TGC’s regulated operations may be earning a greater than authorized rate of return on investment for an extended period of time.

Other Regulations. The HPUC is statutorily requiredregulates all franchised or certificated public service companies operating in Hawaii; prescribes rates, tariffs, charges and fees; determines the allowable rate of earnings in establishing rates; issues guidelines concerning the general management of franchised or certificated utility businesses; and acts on requests for the acquisition, sale, disposition or other exchange of utility properties, including mergers and consolidations. When we acquired The Gas Company, we agreed to issue an interim decision on a rate case application within a certain time period, generally within 10 months following application, depending on the circumstances and subject to TGC’s compliance14 regulatory conditions with procedural requirements. In addition to formal rate cases, tariff changes and capital additions are also approved by the HPUC.

Competition

Depending upon the end-use, the business competes with electricity, diesel, solar energy, geo-thermal, wind, other gas providers and alternative energy sources. Hawaii’s electricity is generated by TGC as early as the third quarter of 2008four electric utilities and new rates, if approved, could be implemented as early as the second quarter of 2009. As permitted by the HPUC, increases in TGC’s gas feedstock costs since the last rate case have been passed through to customers via a monthly fuel adjustment charge.

Competition

UnregulatedNon-Utility Business. TGCThe Gas Company also sells LPG in an unregulated market inon the six primary islands of Hawaii. Of the largest 250 non-utility customers, over 90% have multi-year supply contacts with a weighted average life of almost three years expiring various years through 2013. There are two other wholesale companies and several small retail distributors that share the LPG market. The largest of these is AmeriGas. We believe TGCThe Gas Company believes it has a competitive advantage due tobecause of its established accountcustomer base, storage facilities, distribution network and reputation for reliable cost-effective service. Depending upon the end-use, the unregulated business also competes with electricity, diesel and solar energy providers. For example, both solar energy and gas are used for water heating in Hawaii. Historically, TGC’s sales have been stable and somewhat insulated from downturns in the economic environment and tourism activity. This business contributes approximately 40% of TGC’s revenue.

Fuel Supply, SNG Plant and Distribution System

Fuel Supply

The business obtains its LPG from foreign sources and raw feedstock for SNG production from twoeach of the Chevron and Tesoro oil refineries located on the island of Oahu andOahu. The Gas Company has LPG supply agreements with each refinery. The business purchases its LPG from foreign imports. TGC ownssources under foreign supply agreements and through spot-market purchases, if needed.

In January 2010, Chevron announced that it plans to reduce the dedicated pipelines, storagesize of its global oil refining business, although it has not made any decisions regarding its refinery in Hawaii. Chevron could decide to continue operating in Hawaii, cease operations entirely or convert a portion of its operations into a terminal for importation of energy products. Chevron’s Hawaii refinery supplies The Gas Company with over half of its total LPG purchases. The refinery also supplies the business’ competitors in the non-utility market.

Energy-Related Business: The Gas Company – (continued)

Any decision by Chevron regarding its operations in Hawaii could affect the business’ cost of LPG and infrastructuremay adversely impact its non-utility contribution margin and profitability. In an effort to handle thismitigate the risk of supply disruption and/or a potential increase in costs, the business is evaluating a number of alternatives, including additional shipments of foreign sourced product.

The business also obtains its feedstock and the resulting volumes of gas. LPG is supplied to TGC’s non-Oahu customers by barge.

SNG Plant and Distribution System (Utility Business)

The Gas Company manufactures SNG at its plant located west of the Honolulu business district. The SNG plant configuration is effectively two production units, for most major pieces of equipment, thereby providing redundancy and ensuring continuous and adequate supply. A propane air unit provides backup in the event of a SNG plant shutdown. The SNG plant operates continuously with only a 15% seasonal variation in production and operates well within its design capacity of 150,000 therms per day. We believe that as of December 31, 2006 the SNG plant has with an appropriate level of maintenance capital investment, an estimated remaining economic life of approximately 20 years and that theyears. The economic life of the plant is further extendablemay be extended with additional capital investment.

A 22-mile transmission linepipeline links the SNG plant to a distribution system that ends at Pier 38 in south Oahu. The pipeline is predominately sixteen-inch transmission piping and is utilized only on Oahu to move SNG from the plant toFrom Pier 38 near the financial district in Honolulu. This line also provides short-term storage for 45-thousand therms. Thereafter, a pipeline distribution system consisting of approximately 900 miles of transmission, distribution and service pipelines takes the gas to customers. Additionally, LPG is trucked and shipped by barge to holding tanks on Oahu and shipped by barge to the neighboring islands to bewhere it is distributed via pipelines to utility customers that are not connected to the Oahu SNG pipeline system. Approximately 90% of TGC’sthe business’ pipeline system is on Oahu.

Distribution System (Non-Utility Business)

The non-utility business serves gas on all six primary islands to customers that are not connected to the TGCbusiness’ utility pipeline system. The LPG, acquired frommajority of The Gas Company’s non-utility customers are on the two Oahu refineries and from foreign suppliers,neighboring islands. LPG is distributed to the neighboring islandislands by direct deliveries from overseas suppliers and by barge delivery. The business also owns the infrastructure to distribute LPG to its customers, utilizing two LPG-dedicated barges exclusively time-chartered by a third-party,such as harbor pipelines, trucks, several holding facilities and storage base-yards on Kauai, Maui and Hawaii.

Employees and Management

As of December 31, 2006, TGC2009, The Gas Company had 311306 employees, of which 209 were union employees.206 are unionized. The unionized employees are subject to a collective bargaining agreement became effective May 1, 2004 and endsthat expires on April 30, 2008. TGC and the Union have had2013. The business believes it has a good relationship with the union and there have been no major disruptions in operations due to labor matters for over thirty30 years. Management of TGCthe business is headquartered in Honolulu, Oahu with branch managersoffice management at operating locations.

Environmental Matters

Environmental Matters and Legal Proceedings

Environmental Compliance.Compliance: We believeThe business believes that TGCit is in compliance in all material respects with applicable state and federal environmental laws and regulations. With regard to hazardous waste, all TGC facilities are generally classified as conditionally exempt small quantity generators, which means they generate between zero and one hundred kilograms of hazardous waste in a calendar month. Under normal operating conditions, theits facilities do not generate hazardous waste. Hazardous waste, ifwhen produced, should poseposes little or no ongoing risk to the facilities from a regulatory standpoint because SNG and LPG dissipate quickly whenif released.

District Energy

Business Overview

Through December 22, 2009, District Energy Business

2006 | 2005 | 2004 | ||||||||

| Revenue | $ | 43.6 | $ | 43.4 | $ | 35.0 | ||||

| Operating income | 9.0 | 9.4 | 7.9 | |||||||

| Total assets | 236.1 | 245.4 | 254.0 | |||||||

| % of our consolidated revenue | 8.4 | % | 14.2 | % | 14.3 | % | ||||

Energy-Related Business: District Energy – (continued)

District Energy operates the largest district cooling system in the United States. The system currently serves approximatelyover 100 customers in downtown Chicago under long-term contracts in downtown Chicago and one customer outside the downtown area. Thermal Chicago has signed contracts with three additional customers that are expected to start

District Energy also owns a site-specific heating and cooling plant that serves a single customer in Chicago outside of the downtown area. This plant has the capacity to produce 4,900 tons of cooling and 58.258 million British Thermal Units, or BTUs, of heating per hour.

District Energy’s Las Vegas operation owns and operates a stand-alone facility that provides cold and hot water (for chilling and heating, respectively) and emergency electricity generation to several customers in Las Vegas, Nevada. The Las Vegas operation represented approximately 25% of the cash flows of District Energy in 2009. Approximately 65% of cash flows generated by the Las Vegas operation in 2009 were from a long-term contract to service a resort and casino including a hotel, convention and conference facility and an adjacent shopping complex. In early 2009, the operation began providing service to a shopping mallnew customer building that was constructed on the same property. This new customer began receiving full service in February 2010. All three Las Vegas Nevada. Services are provided to both customers under long-term contracts that expire in 2020 with 90% of cash flows generated from the contract with the resort and casino.

Financial information for 100% of the membership intereststhis business is as follows ($ in Macquarie District Energy Holdings, LLC, the holding company of our district energy business, from the Macquarie Group, for $67.0 million (including transaction costs) and assumed $120.0 million of senior debt that was used partially to finance the acquisition of Thermal Chicago and our interest in Northwind Aladdin.millions):

| As of, and for the Year Ended, December 31, | ||||||||||||

| 2009 | 2008 | 2007 | ||||||||||

| Revenue | $ | 48.6 | $ | 48.0 | $ | 49.5 | ||||||

| EBITDA excluding non-cash items | 20.8 | 21.1 | 5.5 | |||||||||

| Total assets | 234.8 | 227.1 | 232.6 | |||||||||

| % of our consolidated revenue | 6.8 | % | 4.9 | % | 6.6 | % | ||||||

Industry Overview

District energy is the provision ofsystems provide chilled water, steam and/or hot water to customers from a centralized plant through underground piping for cooling and heating purposes. A typical district energy customer is the owner/manager of a large office or residential building or facilities such as hospitals, universities or municipal buildings. District energy systems exist in most major North American and European cities and some have been in operation for over 100 years.

Strategy

District energyEnergy’s strategy is not, however, anto position the business in the market as the most efficient option for suburban areas whereand effective method of providing building cooling such that it attracts and connects new customers are widely dispersed.

Energy-Related Business: District Energy – (continued)

Growth: This business intends to grow revenue and profits by increasingmarketing its services to developers in the output capacity of Thermal Chicago’s plants in downtown Chicago market. Its value proposition is centered on high reliability, efficiency and adding new customersease of maintenance. The management team develops and maintains relationships with property developers, engineers, architects and city planners as a means of keeping District Energy and these attributes “top of mind” when they select among building cooling systems and services.

Business Management: The business focuses on minimizing the cost of electricity consumed per unit of chilled water produced by operating its plants to the system.maximize efficient use of electricity. These cost savings are passed through to its customers.

System Expansion: Since our acquisition in 2004, minor system modifications and expansion at the business’ plants have been made that increased total cooling capacity by approximately 3,00015,000 tons or 3%15%. We have also begun the expansion of one of our cooling plants and expect the project to be completed in 2007. We anticipate spending up to $8.1 million for system expansion over the next two years. This expansion, in conjunction with operational strategies and increases noted above,Projects currently under development will add approximately 16,000 tons of saleable capacity to the downtown cooling system. Approximately 6,700 tons of saleable capacity has been used in 2006 to accommodate four customers that converted from interruptible to continuous service.

Operations

Corrective maintenance is typically performed by qualified contract personnel and off-season maintenance is performed by a combination of plant staff and contract personnel.

Customers

District Energy currently serveserves approximately 100 customers in downtown Chicago and one outside the downtown area, and have signed contracts with three additional customers expected to begin service between 2007 – 2009. These constitute a diversearea. Its customer base consistingis diverse and consists of retail stores, office buildings, residential buildings, theaters and government facilities. Office and commercial buildings constitute approximately 70% of the customers.its customer base. No one customer accounts for more than eight percent10% of total contracted capacity and only three customers account for more than five percent of total contracted capacity each. capacity.

The top 20% of customers account for approximately 60% of contracted capacity.

Customers pay two charges to receive chilled water services: a fixed charge, or capacity charge, and a variable charge, or consumption charge. The capacity charge is a fixed monthly chargeamount based on the maximum amountnumber of tons of chilled water that we havethe business has contracted to make available to the customer at any point in time. The consumption charge is a variable chargeamount based on the volume of chilled water actually used during a billing period.

Contractual adjustments to the capacity charge and consumption charge occur periodically, typically annually, either based on changes in certain economic indices or, under some contracts, at a flat rate.annually. Capacity charges generally increase at a fixed rate or are indexed to the Consumer Price Index, or CPI, as a broad measure of inflation. Consumption charges arepayments generally indexed to changesincrease in line with a number of economic indices. These economic indices measure changes inthat reflect the costscost of electricity, labor and chemicals inother input costs relevant to the region in which we operate. Whileoperations of the indices used vary, consumption charges in 90%business. The largest and most variable direct expense of our contracts (by capacity) are indexedthe operation is electricity. District Energy passes through to indices weighted at least 50% to CPI, costs of labor and chemicals with the balance reflectingits customers changes in electricity costs. Upon evaluationThe business focuses on minimizing the cost of our contractual price adjustment options, we have implemented a methodologyelectricity consumed per unit of chilled water produced by operating its plants to fully recover the increase in electricity expenses caused by the deregulationmaximize efficient use of the Illinois power market. We believe that the terms of our customer contracts permit us to fully pass through the increase or decreases in our electricity costs.

Seasonality

Consumption revenue is higher in the summer months when the demand for chilled water is at its highest and approximatelyhighest. Approximately 80% of consumption revenue is received in the second and third quarters ofcombined each year.

Energy-Related Business: District Energy – (continued)

Competition

District Energy is not subject to substantial competitive pressures. Pursuant to customer contracts, customersCustomers are generally not allowed to cool their premises by means other than the chilled water service provided by our district energy business.

District Energy believes competition from an alternative district energy system in the Chicago downtown market is unlikely. There are significant barriers to entry including the considerable capital investment required, the need to obtain City of Chicago consent and the difficulty in obtaining sufficient customers given the number of buildings in downtown Chicago already committed under long-term contracts to the use of the system owned by us.

City of Chicago Use Agreement

The business is not subject to specific government regulation, but ourits downtown Chicago operations are operated subject tosystem operates under the terms of a Use Agreement with the City of Chicago. The Use Agreement establishes the rights and obligations of our district energy businessDistrict Energy and the City of Chicago for the utilization of certain public wayswith respect to its use of the City of Chicago for the operation of our district cooling system.public ways. Under the Use Agreement, we havethe business has a non-exclusive right to construct, install, repair, operate and maintain the plants, facilities and facilitiespiping essential in providing district cooling chilled water and related air conditioning service to customers.

Management

The day-to-day operations of our district energy businessDistrict Energy are managed by an operating managementa team located in Chicago, Illinois. OurThe management team has a broad range of experience that includes engineering, construction and project management, business development, operations and maintenance, project consulting, energy performance contracting, and retail electricity sales. The team also has significant financial and accounting experience.

The business is governed by a Board of Northwind Aladdin’s cash flows are generated fromdirectors on which we have three representatives and our co-shareholder has two. Although we control decisions that require a long-term contract with the resort and casino, with the balance from a contract with a shopping mall. The resort and casino in Las Vegas includes a hotel with over 2,500 rooms, a 100,000 square foot casino and a 75,000 square foot convention and conference facility. Additional buildings are being constructed on the property and the Northwind Aladdin plant has the capability to serve the buildings.

Employees

As of electricity. The plant is staffed 24 hours a day. The plant supplies district energy services to its customers via an underground pipe system.

Aviation-Related Business

Atlantic Aviation

Business Overview

The business, Atlantic Aviation FBO Inc., operates 72 fixed-based operations, or FBOs, at 68 airports and one heliport throughout the United States. Atlantic Aviation’s FBOs primarily provide fueling and fuel-related services, aircraft parking business is the largest providerand hangar services to owners/operators of off-airport parking servicesjet aircraft in the United States, measured by number of facilities, with 30 facilities comprising over 40,000 parking spaces and over 360 acres at 20 major airports across the United States, including sixgeneral aviation sector of the busiest commercial U.S. airports for 2006. Our airport parking business provides customers with 24-hour secure parking close to airport terminals, as well asair transportation via shuttle bus to and from their vehicles and the terminal. Operations are carried out on either owned or leased land

Aviation-Related Business: Atlantic Aviation – (continued)

Financial information for this business is as follows ($ in millions):

| As of and for the Year Ended, December 31, | ||||||||||||

| 2009 | 2008 | 2007 | ||||||||||

| Revenue | $ | 486.1 | $ | 716.3 | $ | 534.3 | ||||||

| EBITDA excluding non-cash items | 106.5 | 137.1 | 119.9 | |||||||||

| Total assets | 1,473.2 | 1,660.8 | 1,763.7 | |||||||||

| % of our consolidated revenue | 68.5 | % | 73.3 | % | 70.8 | % | ||||||

2006 | 2005 | 2004 | ||||||||

| Revenue | $ | 76.1 | $ | 59.9 | $ | 51.4 | ||||

| Operating income (loss)(1) | (10.1 | ) | 6.5 | 7.1 | ||||||

| Total assets | 283.5 | 288.8 | 205.2 | |||||||

| % of our consolidated revenue | 14.6 | % | 19.6 | % | 33.6 | % | ||||

Industry Overview

FBOs predominantly service the general aviation segment of $23.5 million for existing trademarksthe air transportation industry. General aviation includes corporate and domain names dueleisure flying and does not include commercial air carriers or military operations. Local airport authorities, the owners of the airport property, grant FBO operators the right to provide fueling and other services pursuant to a re-branding initiative.long-term ground lease. Fuel sales provide the majority of an FBO’s revenue and gross profit.

FBOs generally operate in environments with high barriers to entry. Airports often have limited physical space for additional FBOs. Airport authorities generally do not have an incentive to add additional FBOs unless there is a significant demand for additional capacity, as profit-making FBOs are more likely to reinvest in the airport and provide a broad range of services, thus attracting increased airport traffic. The increased traffic tends to generate additional revenue for the airport authority in the form of landing and fuel flowage fees. Government approvals and design and construction of a new FBO can also take significant time.

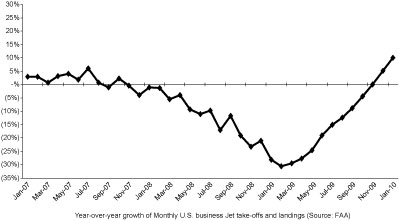

Demand for FBO services is driven by the level of general aviation aircraft activity and the number of take-offs and landings specifically. General aviation business jet take-offs and landings, declined by 17.3% in 2009 compared with 2008. According to flight data reported by the Federal Aviation Administration, or “FAA”, fourth quarter take-offs and landings were flat year-over-year and increased 1.9% over the third quarter of 2009. The number of aircraft operations is typically lower in the fourth quarter compared to the third quarter as a result of reduced business-related aircraft traffic in November and December.

Aviation-Related Business: Atlantic Aviation – (continued)

Despite improved access to general aviation resulting from an expansion of fractional and charter offerings and the challenges facing commercial aviation including potential mainline carrier consolidation and security-related delays, all of which strengthened the general aviation industry, FBO gross profit has been negatively affected by the economic downturn which resulted in a reduction in the volume of fuel sold. See “Risk Factors” in Part I, Item 1A.

Strategy

Atlantic Aviation is pursuing a strategy that has four principal components. The first component is to delever the business. The second day following our initial public offering, we acquired 100%component encompasses an overarching commitment to provide superior service to its customers. The third is to aggressively manage the business so as to minimize, to the extent possible, its operating expenses. The fourth component addresses organic growth of the ordinary sharesbusiness and focuses on leveraging the size of the Atlantic Aviation network and its information technology capabilities to identify marketing leads and implement cross-selling initiatives. These components are discussed in Macquarie Americas Parking Corporation,greater detail in the Operations andMarketingsections below.

Operations

The business has high-quality facilities and focuses on attracting customers who desire a high level of personal service. Fuel and fuel-related services generated 75% of Atlantic Aviation’s revenue and accounted for 63% of Atlantic Aviation’s gross profit in 2009. Other services, including de-icing, aircraft parking, hangar rental and catering, provided the balance. Fuel is stored in fuel tank farms and each FBO operates refueling vehicles owned or MAPC,leased by the FBO. The FBO either owns or has access to the fuel storage tanks to support its fueling activities. At some of Atlantic Aviation’s locations, services are also provided to commercial carriers. These may include refueling from the Macquarie Global Infrastructure Fund for cash considerationcarrier’s own fuel supplies stored in the carrier’s fuel farm, de-icing and/or ground and ramp handling services.

Atlantic Aviation buys fuel at the wholesale price and sells fuel to customers at a contracted price, or at a price negotiated at the point of $33.8 million (including transaction costs). At that time MAPCpurchase. While fuel costs can be volatile, Atlantic Aviation generally passes fuel cost changes through to customers and attempts to maintain and, when possible, grow a dollar-based margin per gallon of fuel sold. Atlantic Aviation also fuels aircraft with fuel owned approximately 83%by other parties and charges customers a service fee.

Atlantic Aviation has limited exposure to commodity price risk as it generally carries a limited inventory of jet fuel on its books and passes fluctuations in the wholesale cost of fuel through to its customers.

Atlantic Aviation is particularly focused on managing costs effectively. In light of the outstanding ordinary membership unitsrecent slowdown in Parking Companygeneral aviation activity, initiatives have been implemented that have reduced operating costs by more than $27.0 million per year. Atlantic Aviation will continue to evaluate opportunities to reduce expenses through, for example, more efficient purchasing and capturing synergies resulting from recent acquisitions.

Locations

Atlantic Aviation’s FBO facilities operate pursuant to long-term leases from airport authorities or local government agencies. The business and its predecessors have a strong history of America Airports Holdings LLC, or PCAA Holdings. In turn, PCAA Holdings owned approximately 51.9%successfully renewing leases, and have held some leases for over 40 years.