SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark (Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED] |

For the fiscal year ended: December 31, 20062008

OR

o

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED] |

For the transition period from _________________ to _______________

Commission File No. 001-33059

Commission File No. 000-33059

Fuel Tech, Inc.

(Exact (Exact name of registrant as specified in its charter)

| Delaware | 20-5657551 |

| (State or other jurisdiction of incorporation of organization) | (I.R.S. Employer Identification Number) |

Fuel Tech, Inc.

512 Kingsland Drive27601 Bella Vista Parkway

Batavia,Warrenville, IL 60510-229960555-1617

630-845-4500

(Address and telephone number of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock $0.01 par value per share |

| The NASDAQ Stock Market, Inc |

(Title of Class) |

| (Name of Exchange on Which Registered) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes xNo o¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, non-accelerated filer or a non-accelerated filersmaller reporting company (as defined in rule 12b-2 under the Securities Exchange Act of 1934).

Large Accelerated Filer o Accelerated Filer x Non-accelerated Filer oLarge Accelerated Filer ¨ | Accelerated Filer x |

Non-accelerated Filer (Do not check if a smaller reporting company) ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o ¨No x

The aggregate market value of the voting stock held by non-affiliates of the registrant based on the average bid and asked prices of June 30, 20062008 was $200,262,000.$331,257,000. The aggregate market value of the voting stock held by non-affiliates of the registrant based on the average bid and asked prices of February 16, 200710, 2008 was $477,460,000.$196,181,000.

Indicate number of shares outstanding of each of the registered classes of Common Stock at February 16, 2007: 22,086,72810, 2009: 24,110,967 shares of Common Stock, $0.01 par value.

Documents incorporated by reference:

Certain portions of the Proxy Statement for the annual meeting of stockholders to be held in 20072009 are incorporated by reference in Parts II, III, and IV hereof.

TABLE OF CONTENTS

| | | | Page |

| | PART I | | |

| | | |

| Item 1. | Business | | 13 |

| Item 1A. | Risk Factors of the Business | | 69 |

| Item 1B. | Unresolved Staff Comments | | 710 |

| Item 2. | Properties | | 710 |

| Item 3. | Legal Proceedings | | 711 |

| Item 4. | Submission of Matters to a Vote of Security Holders | | 711 |

| | | |

| | PART II | | |

| | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchase of Equity Securities | | 812 |

| Item 6. | Selected Financial Data | | 1014 |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 1115 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | | 1822 |

| Item 8. | Financial Statements and Supplementary Data | | 1823 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 4445 |

| Item 9A. | Controls and Procedures | | 4445 |

| Item 9B. | Other Information | | 4445 |

| | | |

| | PART III | | |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | | 4546 |

| Item 11. | Executive Compensation | | 4647 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 4647 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | | 4647 |

| Item 14. | Principal AccountingAccountant Fees and Services | | 4647 |

| | | |

| | PART IV | | |

| | | |

| Item 15. | Exhibits and Financial Statement Schedules | | 4748 |

| | | |

| Signatures and Certifications | | 5051 |

TABLE OF DEFINED TERMS

TABLE OF DEFINED TERMS

Term | | Definition |

| | | |

| ABC | | American Bailey Corporation |

| | | |

| AIG | | Ammonia Injection Grid |

| | |

| CAAA | | Clean Air Act Amendments of 1990 |

| | |

| CAIR | | Clean Air Interstate Rule |

| | |

| CAVR | | Clean Air Visibility Rule |

| | | |

| CDT | | Clean Diesel Technologies, Inc. |

| | | |

| CFD | | Computational Fluid Dynamics |

| | | |

| Common Shares | | Shares of the Common Stock of Fuel Tech |

| | | |

| Common Stock | | Common Stock of Fuel Tech |

| | | |

| EPA | | Environmental Protection Agency |

| | | |

| EPRI | | Electric Power Research Institute |

| | | |

FUEL CHEM®® | | A trademark used to describe Fuel Tech’s fuel and flue gas treatment processes, including its TIFI™ Targeted In-Furnace Injection™ technology to control slagging, fouling, corrosion and a variety of sulfur trioxide-related issuesissues. |

| | | |

Fuel TechGSG | | Fuel Tech, Inc. and its subsidiariesGraduated Straightening Grid |

| | | |

| Investors | | The purchasers of Fuel Tech securities pursuant to a Securities Purchase Agreement as of March 23, 19981998. |

| | | |

| Loan Notes | | Nil Coupon Non-redeemable Convertible Unsecured Loan NotesNil-coupon, non-redeemable convertible unsecured loan notes of Fuel Tech |

| | | |

| NOx | | Oxides of nitrogen |

| | | |

NOxOUT CASCADE®® | | A trademark used to describe Fuel Tech’s combination of NOxOUT and SCRSCR. |

| | | |

NOxOUT®® Process | | A trademark used to describe Fuel Tech’s SNCR process for the reduction of NOxNOx. |

| | | |

NOxOUT-SCR®® | | A trademark used to describe Fuel Tech’s direct injection of urea as a catalyst reagentreagent. |

| | | |

NOxOUT ULTRA®® | | A trademark used to describe Fuel Tech’s process for generating ammonia for use as SCR reagentreagent. |

| | | |

| Rich Reagent Injection Technology (RRI) | | An SNCR-type process that broadens the NOx reduction capability of the NOxOUT Process at a cost similar to NOxOUT. RRI can also be applied on a stand-alone basis. |

| | | |

| SCR | | Selective Catalytic Reduction |

| | | |

| SIP Call | | State Implementation Plan Regulation |

| | | |

| SNCR | | Selective Non-Catalytic Reduction |

| | | |

| TCI™ Targeted Corrosion Inhibition™ | | A FUEL CHEM program designed for high-temperature slag and corrosion control, principally in waste-to-energy boilersboilers. |

| | | |

| TIFI™ Targeted In-Furnace Injection™ | | A proprietary technology that enables the precise injection of a chemical reagent into a boiler or furnace as part of a FUEL CHEM program. |

PART I

Forward LookingForward-Looking Statements

Statements in thisThis Annual Report on Form 10-K that are not historical facts, so-called "forward-lookingcontains “forward-looking statements,"” as defined in Section 21E of the Securities Exchange Act of 1934, as amended, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.1995 and reflect our current expectations regarding our future growth, results of operations, cash flows, performance and business prospects, and opportunities, as well as assumptions made by, and information currently available to, our management. We have tried to identify forward-looking statements by using words such as “anticipate,” “believe,” “plan,” “expect,” “intend,” “will,” and similar expressions, but these words are not the exclusive means of identifying forward-looking statements. These statements are based on information currently available to us and are subject to various risks, uncertainties, and other factors, including, but not limited to, those discussed herein under the caption “Risk Factors” that could cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these statements. Except as expressly required by the federal securities laws, we undertake no obligation to update such factors or to publicly announce the results of any of the forward-looking statements contained herein to reflect future events, developments, or changed circumstances or for any other reason. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including those detailed in Fuel Tech's filings with the Securities and Exchange Commission. See "Risk Factors of the Business"Factors" in Item 1A.

ITEM 1.1 - BUSINESS

As used in this Annual Report on Form 10-K, the terms “we,” “us,” “our,” “the Company,” and “Fuel Tech” refer to Fuel Tech, Inc. and our wholly-owned subsidiaries.

Fuel Tech

Fuel Tech, Inc. (“Fuel Tech”)(Fuel Tech) is a fully integrated company that uses a suite of advanced technologies to provide boiler optimization, efficiency improvement and air pollution reduction and control solutions to utility and industrial customers worldwide. Originally incorporated in 1987 under the laws of the Netherlands Antilles as Fuel-Tech N.V., Fuel Tech became domesticated in the United States on September 30, 2006, and continues as a Delaware corporation with its corporate headquarters at 512 Kingsland Drive, Batavia,27601 Bella Vista Parkway, Warrenville, Illinois, 60510-2299.60555-1617. Fuel Tech maintains an Internet web sitewebsite at www.ftek.comwww.ftek.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 are made available through our website as soon as reasonably practical after we electronically file or furnish the reports to the Securities and Exchange Commission. Also available on the Corporation’s website are the Company’s Corporate Governance Guidelines and Code of Ethics and Business Conduct, as well as the charters of the audit, compensation and nominating committees of the Board of Directors. All of these documents are available in print without charge to stockholders who request them. Information on our website is not incorporated into this report.

Fuel Tech's special focus is the worldwide marketing of its nitrogen oxide (“NOx”)(NOx) reduction and FUEL CHEM®® processes. The NOx reductionAir Pollution Control (APC) technology segment which includes the NOxOUT®, NOxOUT CASCADE®, NOxOUT ULTRA® and NOxOUT-SCR® processes, reduces NOx emissions in flue gas from boilers, incinerators, furnaces and other stationary combustion sources.sources by utilizing combustion optimization techniques and Low-NOx and Ultra Low-NOx burners; NOxOUT® and HERT™ High Energy Reagent Technology™ SNCR systems; systems that incorporate NOxOUT CASCADE®, NOxOUT ULTRA® and NOxOUT-SCR® processes; and Ammonia Injection Grids and the Graduated Straightening Grid (GSG). The FUEL CHEM technology segment improves the efficiency, reliability and environmental status of combustion units by controlling slagging, fouling corrosion, opacity, acid plume and loss on ignition,corrosion, as well as the formation of sulfur trioxide, ammonium bisulfate, particulate matter (PM2.52.5), carbon dioxide, NOx and NOxunburned carbon in fly ash through the addition of chemicals into the fuel or via TIFI™ Targeted In-Furnace Injection™ programs. Fuel Tech has other technologies, both commercialcommercially available and in the development stage, all of which are related to the NOxOUTAPC and FUEL CHEM processes or are similar in their technological base. Fuel Tech's business is materially dependent on the continued existence and enforcement of worldwide air quality regulations.

American Bailey Corporation

Ralph E. Bailey, Executive Chairman and Director of Fuel Tech, and Douglas G. Bailey, Deputy Chairman and Director of Fuel Tech, are shareholdersstockholders of American Bailey Corporation (“ABC”).(ABC), which is a related party. Please refer to Note 9 to the consolidated financial statements in this document.document for information about transactions between Fuel Tech and ABC. Additionally, see the more detailed information relating to this subject under the caption “Certain Relationships and Related Transactions” in Fuel Tech’s Proxy Statement, to be distributed in connection with Fuel Tech’s 20072009 Annual Meeting of Shareholders,Stockholders, which information is incorporated by reference.

NOx ReductionAir Pollution Control

Regulations and Markets

The U.S. air pollution control market is currently the primary driver in Fuel Tech’s NOx reduction technology segment. This market is dependent on air pollution regulations and their continued enforcement. These regulations are based on the Clean Air Act Amendments of 1990 (the “CAAA”), which require reductions in NOx emissions on varying timetables with respect to various sources of emissions. Under the SIP (StateState Implementation Plan)Plan (SIP) Call, a regulation promulgated under the Amendments (discussed further below), over 1,000 utility and large industrial boilers in 19 states were required to achieve NOx reduction targets by May 31, 2004.

In 1994, governors of 11 Northeastern states, known collectively as the Ozone Transport Region, signed a Memorandum of Understanding requiring utilities to reduce their NOx emissions by 55% to 65% from 1990 levels by May 1999. In 1998, the Environmental Protection Agency (“EPA”)(EPA) announced more stringent regulations. The Ozone Transport SIP Call regulation, designed to mitigate the effects of wind-aided ozone transported from the Midwestern and Southeastern U.S. into the Northeastern non-attainment areas, required, following the litigation described below, 19 states to make even deeper aggregate reductions of 85% from 1990 levels by May 31, 2004. Over 1,000 utility and large industrial boilers are affected by these mandates. Additionally, most other states with non-attainment areas arewere also required to meet ambient air quality standards for ozone by 2007.

Although the SIP Call was the subject of litigation, an appellate court of the D.C. Circuit upheld the validity of this regulation. This court’s ruling was later affirmed by the U.S. Supreme Court.

In February 2001, the U.S. Supreme Court, in a unanimous decision, upheld EPA’s authority to revise the National Ambient Air Quality Standard for ozone to 0.080 parts per million averaged through an eight-hour period from the current 0.120 parts per million for a one-hour period. This more stringent standard provided clarity and impetus for air pollution control efforts well beyond the then current ozone attainment requirement of 2007. In keeping with this trend, the Supreme Court, only days later, denied industry’s attempt to stay the SIP Call, effectively exhausting all means of appeal.

On December 23, 2003, the EPA proposed a new regulation affecting the SIP Call states by specifying more expansive NOx reduction. This rule, under the name “CleanClean Air Interstate Rule (CAIR),” was issued by the EPA on March 10, 2005. UnderCommencing in 2009, CAIR specifies that additional annual NOx reduction requirements werebe extended to most SIP-affected units in 28 eastern states, commencing in 2009. The Company expects an additional 300 utility boilers to be affected by this rule, which allowswhile permitting a cap and trade format similar to the SIP Call. The Company expects an additional 1,300 electric generating units using coal and other fuels to be affected by this rule. In an action related to CAIR, on June 15, 2005, the EPA issued the “CleanClean Air Visibility Rule (CAVR),” which is a nationwide initiative to improve federally preserved areas through reduction of NOx and other pollutants. CAVR expands the NOx reduction market to westernWestern states unaffected by CAIR or the SIP Call. Compliance begins in 2013 and the Company believes that CAVR will potentially affect an additional 50 utility230 western coal-fired electric-generating units. In addition, CAVR, along with the EPA rule for revised eight-hour ozone attainment, which was proposed on June 20, 2007, have the potential to impact thousands of boilers and a large number of industrial units in multiple industries.industries nationwide for units burning coal and other fuels starting in 2013.

On July 11, 2008, the U.S. District Court of Appeals for the District of Columbia Circuit vacated the CAIR regulations under the CAAA under the premise that the EPA exceeded its authority when the rule was created in 2005. The court found “more than several fatal flaws in the rule” but neither took issue with the concept that NOx emissions are to be controlled nor over the limits and thresholds established by CAIR. In vacating the rule in its entirety, the court remanded to EPA to promulgate a rule consistent with the court’s opinion. On September 24, 2008, the EPA filed a petition for the case to be reviewed by the full Court of Appeals, not just the three judge panel that issued the vacatur ruling in July 2008. On October 22, 2008, the EPA was granted a 15-day period to present a basis as to why the court should reconsider its decision. On December 23, 2008, the D.C. Circuit granted the EPA’s petition only to the extent that it remanded the case without vacatur for EPA to conduct further proceedings consistent with the court’s prior opinion. In summary, the court stated that “…allowing CAIR to remain in effect until it is replaced by a rule consistent with our opinion would at least temporarily preserve the environmental values covered by CAIR.” The court did not impose a particular schedule by which the EPA must alter CAIR. CAIR requires the affected states to be in year-round NOx emission compliance beginning January 1, 2009. While we cannot predict the ultimate outcome of this matter, and any unfavorable outcome could have a material adverse effect on our business, results of operations, cash flows, and financial position, the primary driver of CAIR, the Federal CAAA, including the associated National Ambient Air Quality Standards, is in effect and states must comply with this law.

Outside the United States, Fuel Tech also sells NOx control systems outside the United States, specifically in Europe.Europe and in the People's Republic of China (China). NOxOUT systems have long been sold in the traditional markets of Western Europe, but interest is growing in newer markets like Eastern Europe as well as Israel for complete NOx reduction programs on both new and existing boilers. Under European UnionEU Directives, certain waste incinerators and cement plants must be income into compliance with specified NOx reduction targets by 2008,the end of 2009, while certain power plants must be in compliance by 2010.2016.

Another foreign NOx control market representingChina also represents attractive opportunities for Fuel Tech isas the People's Republic of China (PRC). The Government's 11th Five-Year Economic Plangovernment has set pollution control and energy conservation and efficiency and savingsimprovements as the top two priorities. Fuel Tech has viable technologies to help achieve boththese objectives. While the PRCChina has taken an initial small stepsteps to reduce NOx emissions (by installing low NOx burners) on new electric utility units (principally low-NOx burners), and on-going research and demonstration projects will generateare generating cost performance data for use in tightening the standards in the near future. The PRC'sfuture, both for new and retrofit units. China’s dominant reliance on coal as an energy resource willis not expected to change in the foreseeable future. Clean air has been and will continue to be a pressing issue, especially with the PRC’s booming economy (8%-12% annual GDP increase),China’s robust economic growth, expected growth in power production (4%-5% average annual increase through 2020), and an increasingly expanded role in international events and organizations. The PRC isChina hosted the host of the upcoming 2008 Beijing Summer Olympics and will host the 2010 Shanghai World Expo. Fuel Tech has gained an enviableChina plans to address in a significant way the pollution control for the existing fleet of fossil plants in the Twelfth Five-Year Plan that takes effect in 2011. Our goal is to establish a leading market position in NOx control due toresulting from the national demonstration projects utilizing NOxOUT CASCADE technology at Jiangsu Kanshan (two new 600 megawatt units), NOxOUT SNCRSelective Non-Catalytic Reduction (SNCR) technology at Jiangyin Ligang (four new 600 megawatt units) and Inner Mongolia (two new 600 megawatt units), and NOxOUT ULTRA technology on two retrofit projects in Beijing. These projects are expected to showcaseshowcasing a wide spectrum of Fuel Tech capabilities for NOx emission control and help gainwith the intent of gaining immediate penetration within the market for new power units, nowand establishing Fuel Tech as well as withinthe leader for the larger market for retrofit units later.

The key market dynamic for this product line is the continued use of coal as the principal fuel source for global electricity production. Coal accounts for approximately 50% of all U.S. electricity generation. Coal’s share of global electricity generation is forecast to be approximately 45% by 2030. Major coal consumers include China, the United States and India.

Products

Fuel Tech’s NOx reduction technologies are installed worldwide on over 400450 combustion units, including utility, industrial and municipal solid waste applications. Products include customized NOx control systems and patented urea-to-ammonia conversion technology, which can provide safe reagent for use in Selective Catalytic Reduction (SCR) systems.

Fuel Tech's NOxOUT process is a Selective Non-Catalytic Reduction (“SNCR”) process that uses non-hazardous urea as the reagent rather than ammonia. The NOxOUT process on its own is capable of reducing NOx by up to 40% for utilities and by potentially significantly greater amounts for industrial units in many types of plants with capital costs ranging from $5 - $20/kw | · | Fuel Tech's NOxOUT process is a Selective Non-Catalytic Reduction (SNCR) process that uses non-hazardous urea as the reagent rather than ammonia. The NOxOUT process on its own is capable of reducing NOx by up to 25% - 50% for utilities and by potentially significantly greater amounts for industrial units in many types of plants with capital costs ranging from $5 - $20/kW for utility boilers and with total annualized operating costs ranging from $1,000 - $2,000/ton of NOx removed. |

Fuel Tech’s NOxOUT CASCADE process uses catalyst as an addition to the NOxOUT process to achieve performance similar to SCR. Based on demonstrations, capital costs for NOxOUT CASCADE systems, at $30 - $60/kw, are significantly less than that of SCRs, which can range as high as $300/kw, | · | Fuel Tech’s NOxOUT CASCADE process uses a catalyst in addition to the NOxOUT process to achieve performance similar to SCR. Capital costs for NOxOUT CASCADE systems can range from $30 - $75/kW which is significantly less than that of SCRs, which can cost $300/kW or more, while operating costs are competitive with those experienced by SCR systems. |

| · | Fuel Tech’s NOxOUT-SCR process utilizes urea as a catalyst reagent to achieve NOx reductions of up to 85% from smaller stationary combustion sources with capital and operating costs competitive with equivalently sized, standard SCR systems. |

Fuel Tech’s NOxOUT ULTRA system is designed to convert urea to ammonia safely and economically for use as a reagent in the SCR process for NOx reduction. In this fashion, Fuel Tech intends to participate in the SCR segment of the U.S. SIP Call and CAIR driven markets. Recent local hurdles in the ammonia permitting process have raised concerns regarding the safety of ammonia storage in quantities sufficient to supply SCR. In addition, as new power plants are constructed in the PRC during the next several years with SCR systems, Fuel Tech’s NOxOUT ULTRA process is believed to be a leading candidate | · | Fuel Tech’s NOxOUT ULTRA process is designed to convert urea to ammonia safely and economically for use as a reagent in the SCR process for NOx reduction. Recent local hurdles in the ammonia permitting process have raised concerns regarding the safety of ammonia storage in quantities sufficient to supply SCR. In addition, the Department of Homeland Security has characterized anhydrous ammonia as a Toxic Inhalation Hazard (TIH) commodity. This is contributing to new restrictions by rail carriers on the movement of anhydrous ammonia and to an escalation in associated rail transport and insurance rates. Overseas, new coal-fired power plants incorporating SCR systems are expected to be constructed at a rapid rate in China, and Fuel Tech’s NOxOUT ULTRA process is believed to be a market leader for the safe delivery of ammonia, particularly near densely populated cities, major waterways, harbors or islands, or where the transport of anhydrous or aqueous ammonia is a safety concern. |

| · | Fuel Tech has licensed the Rich Reagent Injection Technology from Reaction Engineering International and Electric Power Research Institute. The technology has been proven in full-scale field studies on cyclone-fired units to reduce NOx by 40% - 60%. The technology is a generic SNCR process, whose applicability is outside the temperature range of the NOxOUT process. The technology is seen as an add-on to Fuel Tech’s NOxOUT systems, thus potentially broadening the NOx reduction of the combined system to up to 60% with minimal additional capital requirement. |

Fuel Tech has sublicensed the Rich Reagent Injection Technology from Reaction Engineering International, which has a direct license from the Electric Power Research Institute. The technology has been proven in full-scale field studies on cyclone-fired units to reduce NOx by 25%-40%. The technology is a generic SNCR process, whose applicability is outside the temperature range of the NOxOUT process. The technology is seen as an add-on to Fuel Tech’s NOxOUT systems, thus potentially broadening the NOx reduction of the combined system to almost 55% with minimal additional capital requirement. | · | Under an exclusive licensing agreement with FGC Corporation, Fuel Tech sells flue gas conditioning systems incorporating FGC Corporation technology for utility applications in all geographies outside the United States and Canada. Flue gas conditioning systems improve the efficiency of particulate collectors, also known as electrostatic precipitators (ESP). These conditioning systems represent a far lower capital cost approach to improving ash particulate capture versus the alternative of installing larger ESPs or fabric filter technology to meet opacity levels. |

| · | As a result of the acquisitions of substantially all of the assets of Tackticks, LLC and FlowTack, LLC in the fourth quarter of 2008, Fuel Tech now provides process design optimization, performance testing and improvement, and catalyst selection services for SCR systems on coal-fired boilers. In addition, other related services, including start-ups, maintenance support and general consulting services for SCR systems, as well as ammonia injection grid design and tuning, to help optimize catalyst performance and catalyst management services to help optimize catalyst life, are now offered to customers around the world. Fuel Tech also specializes in both physical experimental models, which involve construction of scale models through which fluids are tested, and computational fluid dynamics models, which simulate fluid flow by generating a virtual replication of real-world geometry and operating inputs. We design flow corrective devices, such as turning vanes, ash screens, static mixers and our patent pending Graduated Straightening Grid. Our models help clients optimize performance in flow critical equipment, such as selective catalytic reactors in SCR systems, where the effectiveness and longevity of catalysts are of utmost concern. The Company’s modeling capabilities are also applied to other power plant systems where proper flow distribution and mixing are important for performance, such as flue gas desulphurization scrubbers, electrostatic precipitators, air heaters, exhaust stacks and carbon injection systems for mercury removal. |

Sales of the NOx reduction technologies were $46.4$44.4 million, $32.6$47.8 million and $14.6$46.4 million for the years ended December 31, 2008, 2007 and 2006, 2005 and 2004, respectively.

NOx Reduction Competition

Competition with Fuel Tech's NOx reduction suite of products canmay be expected from companies supplying urea SNCR systems, combustion modifications,modification products, SCR systems and ammonia SNCR as well as from other licensed market participants.systems. In addition, Fuel Tech experiences competition in the urea-to-ammonia conversion market.

Combustion modifications, including low NOxlow-NOx burners and over-fire-air systems, can be fitted to most types of boilers with cost and effectiveness varying with specific boilers. Combustion modifications may effect 20-50%yield up to 20% - 60% NOx reduction economically with capital costs ranging from $5$10 - $40/kw$20/kW and levelized total costs ranging from $300 - $1,500/ton of NOx removed. The modifications are designed to reduce the formation of NOx and are typically the first NOx reduction efforts employed. Such companies as Advanced Combustion Technology, Inc., Alstom, Foster Wheeler Corporation, The Babcock & Wilcox Company, Combustion Components Associates, Inc., Nalco Mobotec, Inc. and Babcock Power, Inc. are active competitors in the low-NOx burner business. On December 8, 2008, Fuel Tech announced that it had signed a definitive agreement to acquire substantially all of the assets of Advanced Combustion Technology, Inc. See Note 13, Subsequent Events, for more information regarding this acquisition.

Once NOx is formed, then the SCR process is an effective and proven method of control for the removal of NOx up to 90% of NOx.. SCR hassystems have a high capital cost ranging from $150 - $300/kwof $300+/kW on retrofit coal applications. Such companies as Alstom, The Babcock & Wilcox Company, Cormetech, Inc., Ceram Environmental, Inc.,Hitachi, Foster Wheeler Corporation, Peerless Manufacturing Company, and the Siemens WestinghouseBabcock Power, CorporationInc., are active SCR system providers, or providers of the catalyst itself.

The use of ammonia as the reagent for the SNCR process was developed by the ExxonMobil Corporation. Fuel Tech understands that the ExxonMobil patents on this process have expired. This process can reduce NOx by 30% - 70% on incinerators, but has limited applicability in the utility industry. Ammonia system capital costs range from $15$5 - $20/kw,kW, with annualized operating costs ranging from $1,000 - $3,000/ton of NOx removed. These systems require the use of storedeither anhydrous or aqueous ammonia, aboth of which are hazardous substance.substances.

Other NOx reduction competitors include Combustion Components Associates, whichInc. is a licensed implementer of our NOxOUT SNCR systems, and Reaction Engineering International, which sublicenses Rich Reagent Injection Technology to Fuel Tech.systems.

In addition to or in lieu of using the foregoing processes, certain customers willmay elect to close or deratede-rate plants, purchase electricity from third-party sources, switch from higher to lower NOx emittingNOx-emitting fuels or purchase NOx emission allowances.

Lastly, with respect to urea-to-ammonia conversion technologies, a competitive approach to Fuel Tech’s controlled urea decomposition system is available from Wahlco, Inc., which manufactures a system that hydrolyzes urea under high temperature and pressure.

FUEL CHEM

Product and Markets

The FUEL CHEM technology segment revolves around the unique application of specialty chemicals to improve the efficiency, reliability and environmental status of plants operating in the electric utility, industrial, pulp and paper, waste-to-energy, university and waste-to-energydistrict heating markets. FUEL CHEM programs are currently in place on over 5095 combustion units, treating a wide variety of solid and liquid fuels, including coal, heavy oil, biomass and municipal waste.

Central to the FUEL CHEM approach is the introduction of chemical reagents, such as magnesium hydroxide, to combustion units via in-body fuel application (pre-combustion) or via direct injection (post-combustion) utilizing Fuel Tech’s proprietary TIFI technology. By attacking performance-hindering problems, such as slagging, fouling corrosion, opacity, acid plume and loss on ignition (LOI),corrosion, as well as the formation of sulfur trioxide (SO33), ammonium bisulfate (ABS), particulate matter (PM2.52.5), carbon dioxide (CO22), NOx and NOx,unburned carbon in fly ash, the Company’s programs offer numerous operational, financial and environmental benefits to owners of boilers, furnaces and other combustion units.

The key market dynamic for this product line is the continued use of coal as the principal fuel source for global electricity production. Coal accounts for approximately 50% of all U.S. electricity generation, with U.S. government projections forecasting an increase to approximately 57% by 2030.generation. Coal’s share of global electricity generation is forecast to remain atbe approximately 41% through45% by 2030. Major coal consumers include the United States, the PRCChina and India.

The principal markets for this product line are electric power plants burning coals with slag- forming constituents. The slag-forming constituents aresuch as sodium, iron and high sulfur content.levels of sulfur. Sodium is typically found in the Powder River Basin (PRB) coals of Wyoming and Montana. Iron is typically found in coals produced in the Illinois Basin (IB) region. High sulfur content is typical of IB coals and certain Appalachian coals. High sulfur content can give rise to unacceptable levels of SO3SO3 formation in plants with SCR systems and flue gas desulphurization units (scrubbers).

The combination of slagging coals and SO33-related issues, such as “blue plume” formation, air pre-heater fouling and corrosion, SCR fouling and the proclivity to suppress certain mercury removal processes, represents attractive market potential for Fuel Tech.

Internationally, market opportunities exist in Europe and in the Asia-Pacific region, particularly the PRCChina and India, where high-slagging coals are fueling a large and growing fleet of power plants. To address the Chinese market, where particular emphasis is being placed on energy efficiency, Fuel Tech extended its exclusive teaming agreement with ITOCHU Hong Kong Ltd., a subsidiary of ITOCHU Corporation, through March 31, 2009. Working under this agreement, the first FUEL CHEM demonstration program in China was announced in January 2008 and a second demonstration program was announced in October 2008. In addition, Fuel Tech was awarded its first FUEL CHEM demonstration program in India in January 2008. TIFI initiatives aimed at energy efficiency improvements often result in reduced CO2 emissions, which potentially can potentially be monetized under provisions of the Kyoto Protocol.

A potentially large fuel treatment market exists in Mexico, where high-sulfur, low-grade fuel oil containing vanadium and nickel is the primary source for electricity production. The presence of these metallic constituents promotes slag build-up, and the fuel properties maycan result in acid gas and particulate emissions in local combustion units. Fuel Tech has successfully treated such units with its TIFI technology. To capitalize on this market opportunity, the Company signed a five-year license implementation agreement with Energy Marine Services, S.A. de C.V. (EMS), a private Mexican corporation, to implement our TIFI program for utility and end user customers in Mexico.

Sales of the FUEL CHEM products were $28.7$36.7 million, $20.3$32.5 million and $16.2$28.7 million for the years ended December 31, 2006, 20052008, 2007 and 2004,2006, respectively.

Competition

Competition for Fuel Tech's FUEL CHEM product line includes chemicals sold by specialty chemical and combustion engineering companies, such as GE Infrastructure, Ashland Inc., and Environmental Energy Services, Inc. No substantive competition currently exists for Fuel Tech's TIFI technology, which is designed primarily for slag control and SO33 abatement, but there can be no assurance that such lack of substantive competition will continue.

PLANT OPTIMIZATION SERVICESINTELLECTUAL PROPERTY

Fuel Tech uses its advanced engineering capabilities to support the sale of its NOx reduction and FUEL CHEM systems, particularly through the use of computational fluid dynamics (“CFD”) tools. These CFD tools assist in the prediction of the behavior of gas flows, thereby enhancing the design, marketing and saleThe majority of Fuel Tech’s NOx reduction systems and FUEL CHEM product applications. To further aid the accuracy and expediency with which process solutions could be designed and delivered to a customer, Fuel Tech internally developed a virtual reality-based visualization software for exploring model results and discovering complex process behaviors. Fuel Tech intends to capitalize on its unique capabilities via offering plant optimization services to its customer base, either in conjunction with the NOx reduction and FUEL CHEM systems or on a stand alone basis.

INTELLECTUAL PROPERTY

See Item 2 "Description of Property" for information on Fuel Tech's intellectual property and proprietary position, which are material to its business.

EMPLOYEES

Fuel Tech has 137 employees, 129 in North America and 8 in Europe. Fuel Tech enjoys good relations with its employees and is not a party to any labor management agreements.

ITEM 1A. RISK FACTORS OF THE BUSINESS

Investors in Fuel Tech should be mindful of the following risk factors relative to Fuel Tech's business.

(i)Lack of Diversification

Fuel Tech has two broad technology segments which provide advanced engineering solutions to meet the pollution control, efficiency improvement, and operational optimization needs of energy-related facilities worldwide. They are as follows:

· | The NOx reduction technology segment, which includes the NOxOUT, NOxOUT CASCADE, NOxOUT ULTRA and NOxOUT-SCR processes for the reduction of NOx emissions in flue gas from boilers, incinerators, furnaces and other stationary combustion sources, and |

· | The fuel treatment chemicals technology segment, which uses chemical processes, including TIFI Targeted In-Furnace Injection technology, to control slagging, fouling, corrosion, opacity, acid plume and loss on ignition, as well as the formation of sulfur trioxide, ammonium bisulfate, particulate matter (PM2.5), carbon dioxide and NOx in furnaces and boilers.

|

An adverse development in Fuel Tech's advanced engineering solution business as a result of competition, technological change, government regulation, or any other factor could have a significantly greater impact than if Fuel Tech maintained more diverse operations.

(ii)Competition

Competitionin the NOx control market will come from processes utilizing low-NOx burners, over-fire air, flue gas recirculation, ammonia SNCR, SCR and, with respect to particular uses of urea not infringing Fuel Tech's patents, urea (see Item 2 "Description of Property"). Competition will also come from business practices such as the purchase rather than the generation of electricity, fuel switching, closure or derating of units, and sale or trade of pollution credits. Utilization by customers of such processes or business practices or combinations thereof may adversely affect Fuel Tech's pricing and participation in the NOx control market if customers elect to comply with regulations by methods other than Fuel Tech's NOxOUT or NOxOUT CASCADE Processes. See above text under the captions "Products" and “NOx Reduction Competition.”

Competitionin the FUEL CHEM markets includes chemicals sold by specialty chemical and combustion engineering companies, such as GE Infrastructure, Ashland Inc. and Environmental Energy Services, Inc. As noted previously, no substantive competition currently exists for Fuel Tech's TIFI technology, which is designed primarily for slag control and SO3 abatement. However, there can be no assurance that such lack of substantive competition will continue.

(iii)Dependence on Regulations and Enforcement

Fuel Tech's business is significantly impacted by the regulatory environment surrounding the markets in which it serves. Fuel Tech’s business will be adversely impacted to the extent that regulations are repealed or amended to significantly reduce the level of required NOx reduction, or to the extent that regulatory authorities minimize enforcement. See also the text above under the caption “Regulations and Markets.”

(iv) Protection of Patents and Proprietary Rights

Fuel Tech holds licenses to or owns a number of patents and also has patents pending. There can be no assurance that pending patent applications will be granted or that outstanding patents will not be challenged or circumvented by competitors. Certain critical technology relating to Fuel Tech's products is protected by trademark and trade secret laws and by confidentiality and licensing agreements. There can be no assurance that such protection will prove adequate or that Fuel Tech will have adequate remedies for disclosure of its trade secrets or violations of its intellectual property rights. See Item 2 “Description of Property.”

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

ITEM 2. PROPERTIES

Fuel Tech’s products are generally protected by U.S. and non-U.S. patents. Fuel Tech owns 8887 granted patents worldwide and has seven13 patent applications pending in the United States and 2037 pending in non-U.S. jurisdictions. These patents and applications cover some 36 inventions, 23 associated with the NOx reduction business;business, eight associated with the FUEL CHEM business;business and five associated with non-commercialized technologies. Graduated Straightening Grid (GSG) technology was added into Fuel Tech’s inventions through the acquisition of substantially all of the assets of FlowTack. GSG improves flow distribution and direction to potentially improve SCR and CASCADE performance, and minimize flow-related erosion, dust accumulation and heat transfer problems. These inventions represent significant enhancements of the application and performance of the technologies. Further, Fuel Tech believes that the protection provided by the numerous claims in the above referenced patents or patent applications is substantial, and affords Fuel Tech a significant competitive advantage in its business. Accordingly, any significant reduction in the protection afforded by these patents or any significant development in competing technologies could have a material adverse effect on Fuel Tech’s business.

Apart from its intellectual property, the property ofEMPLOYEES

At December 31, 2008, Fuel Tech had 196 employees, 170 in North America, 15 in China and 11 in Europe. Fuel Tech enjoys good relations with its employees and is not material.a party to any labor management agreement.

ITEM 1A - RISK FACTORS

Investors in Fuel Tech should be mindful of the following risk factors relative to Fuel Tech's business.

| (i) | Lack of Diversification |

Fuel Tech has two broad technology segments that provide advanced engineering solutions to meet the pollution control, efficiency improvement, and operational optimization needs of energy-related facilities worldwide. They are as follows:

| - | The Air Pollution Control technology segment, which includes the NOxOUT, NOxOUT CASCADE, GSG, NOxOUT ULTRA and NOxOUT-SCR processes for the reduction of NOx emissions in flue gas from boilers, incinerators, furnaces and other stationary combustion sources; and |

| - | The FUEL CHEM technology segment, which uses chemical processes, including TIFI Targeted In-Furnace Injection technology, to control slagging, fouling and corrosion, as well as the formation of sulfur trioxide, ammonium bisulfate, particulate matter (PM2.5), carbon dioxide, NOx and unburned carbon in fly ash of furnaces and boilers. |

An adverse development in Fuel Tech's advanced engineering solution business as a result of competition, technological change, government regulation, or any other factor could have a significantly greater impact than if Fuel Tech maintained more diverse operations.

Competition in the Air Pollution Control market will come from competitors utilizing their own NOx reduction processes, including SNCR systems, low-NOx burners, over-fire air, flue gas recirculation, ammonia SNCR, SCR and, with respect to particular uses of urea not infringing Fuel Tech's patents, urea (see Item 1 "Intellectual Property"). Competition will also come from business practices such as the purchase rather than the generation of electricity, fuel switching, closure or de-rating of units, and sale or trade of pollution credits and emission allowances. Utilization by customers of such processes or business practices or combinations thereof may adversely affect Fuel Tech's pricing and participation in the NOx control market if customers elect to comply with regulations by methods other than the purchase of Fuel Tech's suite of Air Pollution Control products. See above text under the captions "Products" and “NOx Reduction Competition” in the Air Pollution Control segment overview.

Competition in the FUEL CHEM markets includes chemicals sold by specialty chemical and combustion engineering companies, such as GE Infrastructure, Ashland Inc. and Environmental Energy Services, Inc. As noted previously, no significant competition currently exists for Fuel Tech's patented TIFI technology, which is designed primarily for slag control and SO3 abatement. However, there can be no assurance that such lack of significant competition will continue.

| (iii) | Dependence on and Change in Air Pollution Control Regulations and Enforcement |

Fuel Tech's business is significantly impacted by and dependent upon the regulatory environment surrounding the electricity generation market. Our business will be adversely impacted to the extent that regulations are repealed or amended to significantly reduce the level of required NOx reduction, or to the extent that regulatory authorities delay or otherwise minimize enforcement of existing laws. Additionally, long-term changes in environmental regulation that threaten or preclude the use of coal or other fossil fuels as a primary fuel source for electricity production, based on the theory that gases emitted therefrom impact climate change through a greenhouse effect, and result in the reduction or closure of a significant number of fossil fuel-fired power plants, may adversely affect the Company's business, financial condition and results of operations. See also the text above under the caption “Regulations and Markets” in the Air Pollution Control segment overview. |

| (iv) | Protection of Patents and Proprietary Rights |

Fuel Tech holds licenses to or owns a number of patents for our products and processes. In addition, we also have numerous patents pending. There can be no assurance that pending patent applications will be granted or that outstanding patents will not be challenged or circumvented by competitors. Certain critical technology relating to our products is protected by trade secret laws and by confidentiality and licensing agreements. There can be no assurance that such protection will prove adequate or that we will have adequate remedies against contractual counterparties for disclosure of our trade secrets or violations of Fuel Tech’s intellectual property rights. See Item 1 “Intellectual Property.”

In 2007, we expanded our operations into China by establishing a wholly-owned subsidiary in Beijing. The Asia-Pacific region, particularly China and India, offers significant market opportunities for Fuel Tech as these nations look to establish regulatory policies for improving their environment and utilizing fossil fuels, especially coal, efficiently and effectively. The future business opportunities in these markets are dependent on the continued implementation of regulatory policies that will benefit our technologies, the acceptance of Fuel Tech’s engineering solutions in such markets, and the ability of potential customers to utilize Fuel Tech’s technologies on a cost-effective basis.

| (vi) | Product Pricing and Operating Results |

The onset of significant competition for either of the technology segments might have an adverse impact on product pricing and a resulting adverse impact on realized gross margins and operating profitability.

| (vii) | Raw Material Supply and Pricing |

The FUEL CHEM technology segment is reliant upon a long-term global supply of magnesium hydroxide. Any adverse change in the availability of supply for this chemical will likely have an adverse impact on our cost structure. On October 1, 2008 we entered into a Product Supply Agreement (“PSA”) with Martin Marietta Magnesia Specialties, LLC (MMMS) in order to assure the continuance of a stable supply from MMMS of magnesium hydroxide products for our requirements in the United States and Canada until December 31, 2013. Magnesium hydroxide products are a significant component of the FUEL CHEM programs. There can be no assurance that Fuel Tech will be able to obtain a stable source of magnesium hydroxide in markets outside the United States.

| (ix) | Customer Access to Capital Funds |

Uncertainty about current economic conditions in the United States and globally poses risk that Fuel Tech’s customers may postpone spending for capital improvement projects in response to tighter credit markets, negative financial news and/or decline in demand for electricity generated by combustion units, all of which could have a material negative effect on demand for the Fuel Tech’s products and services.

| (x) | Customer Concentration |

A small number of customers have historically accounted for a material portion of Fuel Tech’s revenues (see note 11 – Business Segment, Geographic and Quarterly Financial Data). There can be no assurance that Fuel Tech’s current customers will continue to place orders, that orders by existing customers will continue at the levels of previous periods, or that Fuel Tech will be able to obtain orders from new customers. The loss of one or more of our customers could have a material adverse effect on our sales and operating results.

ITEM 1B - UNRESOLVED STAFF COMMENTS

None

ITEM 2 - PROPERTIES

Fuel Tech and its subsidiaries operate from leased office facilities in Batavia,Warrenville, Illinois; Stamford, Connecticut; Durham, North Carolina; Gallarate, Italy and Gallarate, Italy.Beijing, China. Fuel Tech does not segregate any of its leased facilities by operating business segment. The terms of the twothree material agreements are as follows:

| · | The Batavia, Illinois building lease term, for approximately 18,000 square feet, runs from June 1, 1999 to May 31, 2009. Fuel Tech has the option to extend the lease term for two successive terms of five years each at market rates to be agreed upon between Fuel Tech and the lessor. |

| ·- | The Stamford, Connecticut building lease term, for approximately 7,000 square feet, runs from February 1, 2004 to January 31, 2010. The facility houses certain administrative functions such as Investor Relations, Benefit Plan Administration and certain APC sales functions. |

| - | The Beijing, China building lease term, for approximately 4,000 square feet, runs from September 1, 2007 to August 31, 2009. This facility serves as the operating headquarters for our Beijing Fuel Tech operation. Fuel Tech has the option to extend the lease term for one successive term of five years at a market rate to be agreed upon between Fuel Tech and the lessor. |

Please refer to Note 7 | - | The Durham, North Carolina building lease term, for approximately 16,000 square feet, runs from November 1, 2005 to April 30, 2014. This facility houses the former Tackticks and FlowTack operations. Fuel Tech has no option to extend the lease. |

In addition to the consolidated financial statementsabove, on November 30, 2007, Fuel Tech purchased an office building in Warrenville, Illinois, which has served as our corporate headquarters since June 23, 2008. This facility, with approximately 40,000 square feet of office space, was purchased for a further discussionapproximately $6,000,000 and subsequently built out and furnished for an additional cost of these arrangements.approximately $5,500,000. This facility will meet our growth requirements for the foreseeable future. Our prior headquarters, an 18,000 square foot location in Batavia, Illinois, remains under an operating lease until May 31, 2009. We have no plans to renew this lease.

ITEM 3.3 - LEGAL PROCEEDINGS

Fuel Tech has no pendingWe are from time to time involved in litigation incidental to our business. We are not currently involved in any litigation in which we believe an adverse outcome would have a material to its business.effect on our business, financial conditions, results of operations, or prospects.

ITEM 4.4 - SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

During the fourth quarter of 2006,2008, no matters were submitted to a vote of security holders.

PART II

ITEM 5.5 - MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASE OF EQUITY SECURITIES

Market

Fuel Tech's Common Shares have been traded since September 1993 on The NASDAQ Stock Market, Inc. The trading symbol is FTEK.

Prices

The table below sets forth the high and low sales prices during each calendar quarter since January 2005.2007.

2006 | | High | | Low | |

| Fourth Quarter | | $ | 27.44 | | $ | 14.40 | |

| Third Quarter | | | 16.45 | | | 10.07 | |

| Second Quarter | | | 18.80 | | | 11.15 | |

| First Quarter | | | 16.75 | | | 8.11 | |

| | | | | | | | |

2005 | | | | | | | |

| Fourth Quarter | | $ | 10.12 | | $ | 7.24 | |

| Third Quarter | | | 10.13 | | | 5.75 | |

| Second Quarter | | | 7.20 | | | 5.10 | |

| First Quarter | | | 6.85 | | | 4.60 | |

| 2008 | | High | | | Low | |

| Fourth Quarter | | $ | 18.95 | | | $ | 6.05 | |

| Third Quarter | | | 24.76 | | | | 14.52 | |

| Second Quarter | | | 27.16 | | | | 17.55 | |

| First Quarter | | | 22.94 | | | | 14.15 | |

| 2007 | | High | | | Low | |

| Fourth Quarter | | $ | 34.48 | | | $ | 16.89 | |

| Third Quarter | | | 35.85 | | | | 20.65 | |

| Second Quarter | | | 38.20 | | | | 21.65 | |

| First Quarter | | | 29.68 | | | | 22.54 | |

Dividends

Fuel Tech has not to datenever paid cash dividends on its Common Sharescommon stock and is not expectedhas no current plan to do so in the foreseeable future. The declaration and payment of dividends on the Common Stock are subject to the discretion of the Company’s Board of Directors. The decision of the Board of Directors to pay future dividends will depend on general business conditions, the effect of a dividend payment on our financial condition, and other factors the Board of Directors may consider relevant. The current policy of the Company’s Board of Directors is to reinvest earnings in operations to promote future growth.

Share Repurchase Program

Fuel Tech purchased no equity securities during the quarter and year ended December 31, 2008.

Holders

Based on information from Fuel Tech’sthe Company’s Transfer Agent and from banks and brokers, the Company estimates that, as of February 16, 2006, there were 305 registered holders of Fuel Tech’s Common Shares. Management believes that, on such date,24, 2009, there were approximately 15,92424,000 beneficial holders and 277 registered stockholders of Fuel Tech’s Common Shares.

Transfer Agent

The Transfer Agent and Registrar for the Common Shares is BNY Mellon InvestorShareowner Services, LLC, 480 Washington Boulevard, Jersey City, New Jersey 07310.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information for all equity compensation plans as of the fiscal year ended December 31, 2006, under which the securities of Fuel Tech were authorized for issuance:07310-1900.

Plan Category | | Number of Securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans excluding securities listed in column (a) | |

| | | (a) | | (b) | | (c) | |

| Equity compensation plans approved by security holders (1) | | | 2,414,200 | | $ | 13.02 | | | 866,000 | |

(1) | Includes Common Shares of Fuel Tech authorized for awards under Fuel Tech’s Incentive Plan, as amended through June 3, 2004. |

Performance Graph

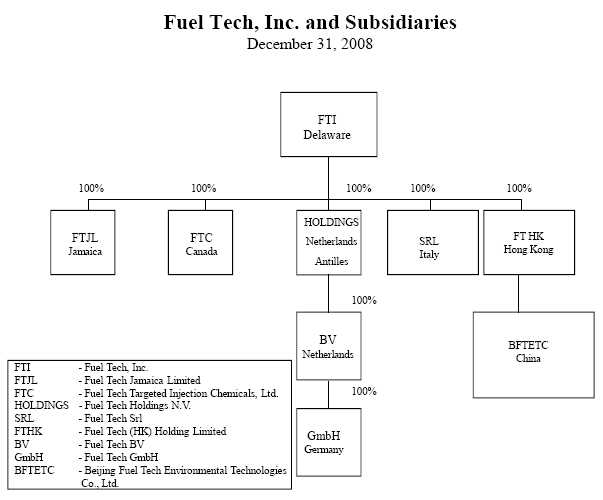

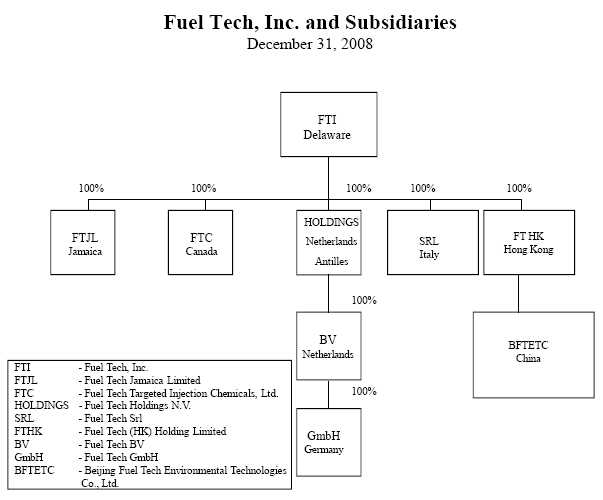

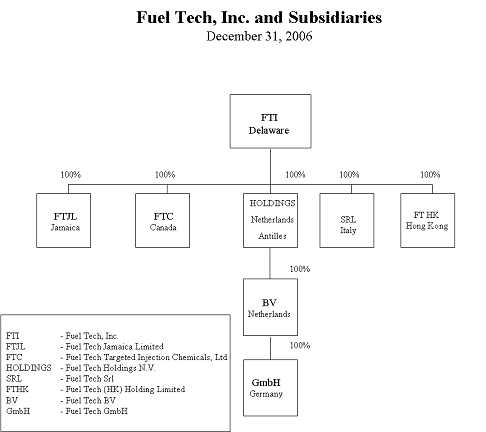

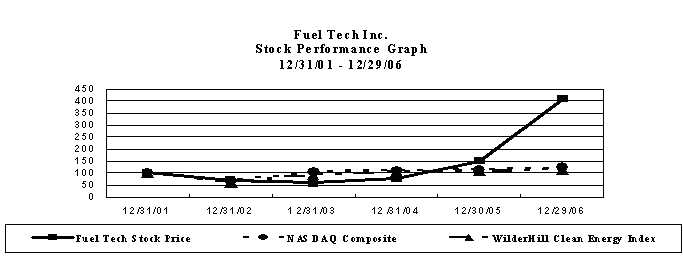

The following line graph compares (i) Fuel Tech’s total return to shareholdersstockholders per share of Common Stock for the five years ended December 31, 20062008 to that of (ii) the NASDAQ Composite index, and (iii) the WilderHill Clean Energy Index for the period December 31, 20012003 through December 31, 2006.2008.

ITEM 6.6 - SELECTED FINANCIAL DATA

Selected financial data are presented below as of the end of and for each of the fiscal years in the five-year period ended December 31, 2006.2008. The selected financial data should be read in conjunction with the audited consolidated financial statements as of and for the year ended December 31, 2006,2008, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”Operations” included elsewhere in this report and the schedules thereto.

| | | For the years ended December 31 | |

CONSOLIDATED STATEMENT of OPERATIONS DATA | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| (in thousands of U.S. dollars, except for share data) | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net sales | | $ | 75,115 | | $ | 52,928 | | $ | 30,832 | | $ | 35,736 | | $ | 32,627 | |

| Selling, general and administrative and other costs and expenses | | | 25,953 | | | 18,655 | | | 14,130 | | | 12,978 | | | 11,777 | |

| Operating income | | | 10,733 | | | 7,155 | | | 136 | | | 969 | | | 2,618 | |

| Net income | | | 6,826 | | | 7,588 | | | 1,572 | | | 1,120 | | | 3,057 | |

| | | | | | | | | | | | | | | | | |

| Basic income per Common Share | | $ | 0.32 | | $ | 0.38 | | $ | 0.08 | | $ | 0.06 | | $ | 0.16 | |

| Diluted income per Common Share | | $ | 0.28 | | $ | 0.33 | | $ | 0.07 | | $ | 0.05 | | $ | 0.14 | |

| Weighted-average basic shares outstanding | | | 21,491,000 | | | 20,043,000 | | | 19,517,000 | | | 19,637,000 | | | 19,350,000 | |

| Weighted-average diluted shares outstanding | | | 24,187,000 | | | 23,066,000 | | | 22,155,000 | | | 22,412,000 | | | 22,437,000 | |

| | | For the years ended December 31, | |

CONSOLIDATED STATEMENT of

OPERATIONS DATA | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| (in thousands of dollars, except for share and per-share data) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 81,074 | | | $ | 80,297 | | | $ | 75,115 | | | $ | 52,928 | | | $ | 30,832 | |

| Cost of sales | | | 44,345 | | | | 42,471 | | | | 38,429 | | | | 27,118 | | | | 16,566 | |

| Selling, general and administrative and other costs and expenses | | | 30,112 | | | | 27,087 | | | | 25,953 | | | | 18,655 | | | | 14,130 | |

| Operating income | | | 6,617 | | | | 10,739 | | | | 10,733 | | | | 7,155 | | | | 136 | |

| Net income | | | 3,602 | | | | 7,243 | | | | 6,826 | | | | 7,588 | | | | 1,572 | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic income per Common Share | | $ | 0.15 | | | $ | 0.33 | | | $ | 0.32 | | | $ | 0.38 | | | $ | 0.08 | |

| Diluted income per Common Share | | $ | 0.15 | | | $ | 0.29 | | | $ | 0.28 | | | $ | 0.33 | | | $ | 0.07 | |

| Weighted-average basic shares outstanding | | | 23,608,000 | | | | 22,280,000 | | | | 21,491,000 | | | | 20,043,000 | | | | 19,517,000 | |

| Weighted-average diluted shares outstanding | | | 24,590,000 | | | | 24,720,000 | | | | 24,187,000 | | | | 23,066,000 | | | | 22,155,000 | |

| | | December 31 | |

CONSOLIDATED BALANCE SHEET DATA | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| (in thousands of U.S. dollars, except for share data) | | | | | | | | | | | |

| | | | | | | | | | | | |

| Working capital | | $ | 38,715 | | $ | 19,590 | | $ | 11,292 | | $ | 10,973 | | $ | 13,930 | |

| Total assets | | | 65,660 | | | 44,075 | | | 23,828 | | | 21,598 | | | 25,869 | |

| Long-term obligations | | | 500 | | | 448 | | | 505 | | | 299 | | | 2,059 | |

| Total liabilities | | | 18,005 | | | 14,939 | | | 4,873 | | | 4,287 | | | 9,064 | |

| Shareholders' equity | | | 47,655 | | | 29,136 | | | 18,955 | | | 17,311 | | | 16,805 | |

| Net tangible book value per share | | $ | 1.83 | | $ | 1.12 | | $ | 0.70 | | $ | 0.61 | | $ | 0.64 | |

| | | December 31 | |

| CONSOLIDATED BALANCE SHEET DATA | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | | | | | | | | | | | | | | |

| (in thousands of dollars) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Working capital | | $ | 44,346 | | | $ | 45,143 | | | $ | 38,715 | | | $ | 19,590 | | | $ | 11,292 | |

| Total assets | | | 88,873 | | | | 87,214 | | | | 65,660 | | | | 44,075 | | | | 23,828 | |

| Long-term obligations | | | 1,389 | | | | 1,255 | | | | 500 | | | | 448 | | | | 505 | |

| Total liabilities | | | 15,056 | | | | 23,975 | | | | 18,005 | | | | 14,939 | | | | 4,873 | |

| Stockholders' equity (1) | | | 73,817 | | | | 63,239 | | | | 47,655 | | | | 29,136 | | | | 18,955 | |

Notes:

(1)Shareholders’ equity includes $277,000 principal amount of nil coupon non-redeemable perpetual loan notes. See Note 5 to the consolidated financial statements.

(2)Net tangible book value per share assumes full conversion of Fuel Tech’s nil coupon non-redeemable perpetual loan notes into shares of Fuel Tech’s Common Shares.

(3)Net tangible book value per share is defined as shareholders’ equity less intangible assets, divided by weighted average shares outstanding.

| (1) | Stockholders’ equity includes principal amount of nil coupon non-redeemable perpetual loan notes. See Note 5 to the consolidated financial statements. |

ITEM 7.7 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Background

Fuel Tech, Inc. (“Fuel Tech”) has two broad technology segments that provide advanced engineering solutions to meet the pollution control, efficiency improvement and operational optimization needs of energy-related facilities worldwide. They are as follows:

Nitrogen Oxide (“NOx”) ReductionAir Pollution Control Technologies

The Air Pollution Control technology segment focuses primarily on nitrogen oxide (“NOx”) reduction technology segment includes the NOxOUT, NOxOUT CASCADE, NOxOUT ULTRA and NOxOUT-SCR processes for the reduction of NOx emissionsemission reductions in flue gas from boilers, incinerators, furnaces and other stationary combustion sources.sources and includes the NOxOUT, NOxOUT CASCADE, GSG, NOxOUT ULTRA and NOxOUT-SCR processes. Fuel Tech distributes its products through its direct sales force, licensees and agents.

Fuel Treatment ChemicalsFUEL CHEM Technologies

The fuel treatment chemicalsFUEL CHEM technology segment uses chemical processes, including TIFI Targeted In-Furnace Injection technology, to control slagging, fouling corrosion, opacity, acid plume and loss on ignition,corrosion, as well as the formation of sulfur trioxide, ammonium bisulfate, particulate matter (PM2.52.5), carbon dioxide, NOx and NOxunburned carbon in fly ash in furnaces and boilers. Fuel Tech sells its fuel treatment chemicalsFUEL CHEM program through its direct sales force and agents to industrial and utility power-generation facilities. At December 31, 2008, FUEL CHEM programs were operating on over 95 combustion units around the world, treating a wide variety of solid and liquid fuels, including coal, heavy oil, biomass and municipal waste. The FUEL CHEM program improves the efficiency, reliability and environmental status of plants operating in the electric utility, industrial, pulp and paper, waste-to-energy, university and district heating markets and offers numerous operational, financial and environmental benefits to owners of boilers, furnaces and other combustion units.

The key market dynamic for both technology segments is the continued use of fossil fuels, especially coal, as the principal fuel source for global electricity production. Coal accounts for approximately 50% of all U.S. electricity generation, with U.S. government projections calling for an increase to approximately 57% by 2030.generation. Coal’s share of global electricity generation is forecast to remain atbe approximately 41% through45% by 2030. Major coal consumers include China, the United States the PRC and India.

Critical Accounting Policies and Estimates

The consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, which require Fuel Techus to make estimates and assumptions. Fuel Tech believesWe believe that of itsour accounting policies (see Note 1 to the consolidated financial statements), the following involvesinvolve a higher degree of judgment and complexity and are deemed critical. Fuel Tech discusses itsWe routinely discuss our critical accounting policies with the Company’s Audit Committee.

Revenue Recognition

Revenues from the sales of chemical products are recorded when title transfers, either at the point of shipment or at the point of destination, depending on the contract with the customer.

Fuel Tech uses the percentage of completion method of accounting for certain long-term equipment construction and license contracts that are sold within the nitrogen oxide reduction businessAir Pollution Control technology segment. Under the percentage of completion method, sales and gross profitrevenues are recognized as work is performed based on the relationship between actual construction costs incurred and total estimated costs at completion. Since the financial reporting of these contracts depends on estimates that are assessed continually during the term of the contract, recognized sales and profit are subject to revisions as the contract progresses to completion. Revisions in profitcompletion estimates are reflectedand contract values in the period in which the facts that givegiving rise to the revisionrevisions become known.known can influence the timing of when revenues are recognized under the percentage of completion method of accounting. Provisions are made for estimated losses on uncompleted contracts in the period in which such losses are determined. As of December 31, 2008 and December 31, 2007, Fuel Tech had no construction contracts in progress that were identified as loss contracts.

Fuel Tech’s constructionAPC contracts are typically six to twelve months in length. A typical contract will have three or four critical milestonesoperational measurements that, when achieved, serve as the basis for Fuel Techus to invoice the customer.customer via progress billings. At a minimum, the milestonesthese measurements will include the generation of engineering drawings, the shipment of equipment and the completion of a system performance test.

As part of most of its contractual project agreements, Fuel Tech will agree to customer-specific acceptance criteria that relate to the operational performance of the system that is being sold to the customer.sold. These criteria are determined based on mathematical modeling that is performed by Fuel Tech personnel, which is based on operational inputs that are provided by the customer. The customer will warrant that these operational inputs are accurate as they are specified in the binding contractual agreement. Further, the customer is solely responsible for the accuracy of the operating condition information; all performance guarantees and equipment warranties granted by Fuel Techus are void if the operating condition information is inaccurate or is not met.

Accounts receivable includes unbilled receivables, representing revenues recognized in excess of billings on uncompleted contracts under the percentage of completion method of accounting. At December 31, 2008 and December 31, 2007, unbilled receivables were approximately $5,552 and $16,813, respectively. Billings in excess of costs and estimated earnings on uncompleted contracts were $1,223 and $821 at December 31, 2008 and December 31, 2007, respectively. Such amounts are included in other accrued liabilities on the consolidated balance sheet.

Fuel Tech has installed over 400450 units with the technology and has never failed to meet a performance guarantee when the customer has provided the required operating conditions for the project. As part of the project implementation process, Fuel Tech willwe perform system start-up and optimization services that effectively serve as a test of actual project performance. Fuel Tech believesWe believe that this test, combined with the accuracy of the modeling that is performed, enables revenue to be recognized prior to the receipt of formal customer acceptance.

Allowance for Doubtful Accounts

Allowance for doubtful accounts

Fuel Tech, inIn order to control and monitor the credit risk associated with itsour customer base, reviewswe review the credit worthiness of customers on a recurring basis. Factors influencing the level of scrutiny include the level of business the customer has with Fuel Tech, the customer’s payment history and the customer’s financial stability. Representatives of Fuel Tech’sour management team review all past due accounts on a weekly basis to assess collectibility. At the end of each reporting period, the allowance for doubtful accounts balance is reviewed relative to management’s collectibility assessment and is adjusted if deemed necessary. Fuel Tech’sOur historical credit loss has been insignificant.

Assessment of potential impairmentsPotential Impairments of goodwillGoodwill and intangible assets

Intangible Assets

Effective January 1, 2002, Fuel Tech adopted FASB (FinancialFinancial Accounting Standards Board)Board (FASB) Statement No. 142, “Goodwill and Other Intangible Assets.”Assets” (SFAS 142). Under the guidance of this statement, goodwill and indefinite-lived intangible assets are no longer amortized, but rather are required to be reviewed annually or more frequently if indicators arise, for impairment. The evaluation of impairment involves comparing the current fair value of the business to the carrying value. Fuel Tech uses a discounted cash flow (DCF) model (DCF) to determine the current fair value of its two reporting units. A number of significant assumptions and estimates are involved in the application of the DCF model to forecast operating cash flows, including markets and market share, sales volumes and prices, costs to produce and working capital changes. Management considers historical experience and all available information at the time the fair values of its reporting units are estimated. However, actual fair values that could be realized in an actual transaction may differ from those used to evaluate the impairment of goodwill.

Fuel Tech reviews other intangible assets, which include a customer list, a covenantlists and relationships, covenants not to compete, and patent assets and acquired technologies, for impairment on a recurring basis or when events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. In the event the sum of the expected undiscounted future cash flows resulting from the use of the asset is less than the carrying amount of the asset, an impairment loss equal to the excess of the asset’s carrying value over its fair value is recorded. Management considers historical experience and all available information at the time the estimates of future cash flows are made, however, the actual cash values that could be realized may differ from those that are estimated.

Based upon the nature of the goodwill and other intangible assets recorded on the balance sheets as of December 31, 2008 and 2007, the Company believes that, in order for an impairment to occur, a series of material prolonged negative economic events would have to occur. These events would most likely be seen in economic indicators such as suppressed consolidated revenues or Common Stock price, reduced cash flows or declining APC order backlog.

Valuation allowanceAllowance for deferred income taxes

Deferred Income Taxes

Deferred tax assets represent deductible temporary differences and net operating loss and tax credit carryforwards. A valuation allowance is recognized if it is more likely than not that some portion of the deferred tax asset will not be realized.

At the end of each reporting period, Fuel Tech reviews the realizability of the deferred tax assets. As part of this review, Fuel Tech willwe consider if there are taxable temporary differences that could generate taxable income in the future, if there is the ability to carrybackcarry back the net operating losses or credits, if there is a projection of future taxable income, and if there are any tax planning strategies whichthat can be readily implemented.

Stock-Based Compensation

Fuel Tech recognizes compensation expense for employee equity awards in which the expense (net of tax) is recognized ratably over the requisite service period of the award. Fuel Tech utilizesWe utilize the Black-Scholes option-pricing model to estimate the fair value of awards. Determining the fair value of stock options using the Black-Scholes model requires judgment, including estimates for (1) risk-free interest rate -– an estimate based on the yield of zero-couponzero–coupon treasury securities with a maturity equal to the expected life of the option; (2) expected volatility -– an estimate based on the historical volatility of Fuel Tech’s Common Stock for a period equal to the expected life of the option; and (3) expected life of the option -– an estimate based on historical experience including the effect of employee terminations. If any of these assumptions differ significantly from actual, stock-based compensation expense could be impacted.

Recently Adopted Accounting Standards

In September 2006, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 108, “Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements,” (SAB 108). SAB 108 was issued to provide interpretive guidance on how the effects of the carryover or reversal of prior year misstatements should be considered in quantifying a current year misstatement. The provisions of SAB 108 were effective for Fuel Tech for its December 31, 2006 year-end. The adoption of SAB 108 had no impact on Fuel Tech’s consolidated financial statements.

On January 1, 2006, Fuel Tech adopted SFAS No. 123 (revised 2004), “Share-Based Payment”, (SFAS 123(R)), which requires the company to recognize compensation expense for stock-based compensation based on the grant date fair value. SFAS 123(R) revises SFAS No. 123, “Accounting for Stock-Based Compensation,” and supersedes Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees,” and related interpretations (APB 25). Fuel Tech elected the modified prospective application method for adoption, therefore prior period financial statements have not been restated. As a result of the implementation of 123(R), Fuel Tech recognized additional compensation expense of $1,805,000 ($1,268,000 after-tax) related to stock options. See the notes to the consolidated financial statements for additional information.

NewRecently Adopted Accounting PronouncementsStandards