UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-KFORM 10-K/A

Amendment No. 1

ANNUAL REPORT

PURSUANT TO SECTIONSSECTION 13 OR 15(d)

OF THE SECURITIES AND EXCHANGE ACT OF 1934

(Mark One)

(Mark One) | | |

Rx |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2006 |

OR

| | For the fiscal year ended December 31, 2006

| |

| o | Or

|

£ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition periodTransition Period from _____________ to ____________ |

Commission File Number000-26648

Commission file number: 000-26648eXegenics Inc.

eXegenics Inc.

(Exact name of registrant as specified in its charter)

Delaware

| 75-2402409

|

(State or other jurisdiction of

| (I.R.S. Employer

|

incorporation or organization)

| Identification No.)

|

| | |

1250 Pittsford-Victor Rd

Delaware | 14534

| 75-2402409 |

Pittsford, NY

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

(Zip Code)

| | |

4400 Biscayne Blvd, Suite 900 | | |

| Miami, Florida | | 33137 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:code(305) 575-6015

(585) 218-4375

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

| |

|

| Title of Each Class | | Name of each exchangeEach Exchange on which registeredWhich Registered |

| N/A | | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 Par Value Per Sharepar value $.01 per share

(Title of Class)

Indicate by checkmark ifcheck mark in the registrant is a well knownwell-known seasoned issuer, as defined in Rulerule 405 of the Securities Act. Yes o£ No Tx

Indicate by checkmark ifcheck mark in the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.act. Yes o£ No Tx

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes xT No £o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained herein, and will not be contained, to the best of registrant’sthe registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. 10-K Yes o£

Indicate by checkmarkcheck mark whether the registrant is a large, accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check One).of 1934.

Large accelerated filer Largeo Accelerated Filer o£ Non- Accelerated Filer £Non-accelerated Filer Tx

Indicate by check markcheckmark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2).12-b-2 of the Act) Yes oT No x£

The aggregate market value of the registrant’s voting common equity held by non-affiliates of the registrant on June 30, 2006 was $5,575,734 based on the last sale price as reported by OTC Bulletin Board.

As of March 15, 2007 the registrant had 36,550,369 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement relating to its 2007 Annual Meeting of Stockholders, which will be subsequently filed, with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates, are incorporated by reference into Part III of this Form 10-K where indicated.

EXEGENICS INC.EXPLANATORY STATEMENT

This Form 10-K/A is being filed as Amendment No. 1 to the Annual Report on Form 10-K

For of eXegenics Inc. (the “Company”) for the Fiscal Year Endedfiscal year ended December 31, 2006, for the purpose of adding information under Items 10, 11, 12, 13 and 14 of Part III.

TABLE OF CONTENTS

PART I:

| | Page

|

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995 | |

Item 1. | Business | 5-6 |

Item 1A. | Risk Factors | 6-9 |

Item 1B. | Unresolved Staff Comments | 9 |

Item 2. | Properties | 9 |

Item 3. | Legal Proceedings | 10 |

Item 4. | Submission of Matters to a Vote of Security Holders | 10 |

| | Executive Officers of the Registrant | 10-11 |

PART II:

| | | |

Item 5. | Market for Registrant's Common Equity, Related Stockholder | 11-13 |

| | Matters and Issuer Purchases of Equity Securities | |

Item 6. | Selected Financial Data | 14Page No. |

Item 7.PART III | Management's Discussion and Analysis of Financial Condition | 15-19 |

| | and Results of Operations | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 20 |

Item 8. | Financial Statements and Supplementary Data | 20 |

Item 9. | Changes in and Disagreements with Accountants on Accounting | 20 |

| | and Financial Disclosure | |

Item 9A. | Controls and Procedures | 20 |

Item 9B. | Other Information | 20 |

PART III:

| | |

Item 10. | | | | | | |

| Item 10 | | | 21 | | 1 | |

Item 11. | Executive Compensation | 21 | | | | |

Item 12.11 | | | | | 10 | |

| | | | | | |

| Item 12 | | | 21 | | | |

| | and Related Stockholder Matters | 21 | | | | |

Item 13.13 | | | 21 |

Item 14. | Principal Accountant Fees and Services | | 19 | |

PART IV:

| | | | | | |

Item 15.14 | | | | | 21 | |

| | | | | | |

| PART IV | | | | | | |

| | | | | | |

| Item 15 | | | 22-26 | | 22 | |

| EX-31.1 Section 302 CEO Certification |

| EX-31.2 Section 302 CAO Certification |

| EX-32.1 Section 906 CEO Certification |

| EX-32.2 Section 906 CAO Certification |

“SAFE HARBOR” STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify such forward-looking statements by the words “expects”, “intends,” “plans,” “projects,” “believes,” “estimates,” “likely,” “goal,” “assume” and similar expressions. In the normal course of business, eXegenics Inc. (“eXegenics” or the “Company”), in an effort to help keep its stockholders and the public informed about the Company may, from time to time, issue such forward-looking statements, either orally or in writing. Generally, these statements relate to business plans strategies or opportunities, and/or projected or anticipated benefits or other consequences of such plans, strategies, or opportunities, including anticipated revenues or earnings. eXegenics bases the forward-looking statements on its current expectations, estimates and projections. eXegenics cautions you that these statements are not guarantees of future performance and involve risks, uncertainties and assumptions that eXegenics cannot predict. In addition, eXegenics has based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Therefore, the actual results of future events described in such forward-looking statements in this Annual Report, or elsewhere, could differ materially from those stated in such forward-looking statements. Among the factors that could cause actual results to differ materially are the risks and uncertainties discussed in this Annual Report, including, without limitation, the risk factors described in “Item 1A. Risk Factors” of this Report.

-i-

Item 10. Directors, Executive Officers and Corporate Governance.References in this Report on Form 10-K to “we,” “our”, “us”, “its”, the “Company” or “eXegenics” refer to eXegenics Inc., unless the context specifically requires otherwise.

Disclosures setThe following table sets forth in this Report on Form 10-K are qualified by the section captioned “Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995” and other cautionary statements set forth elsewhere in this Report.

PART I

Item 1. Business

General

eXegenics Inc., a Delaware corporation, currently has no business operations. Previously, eXegenics was engaged in the research, creation and development of drugs for the treatment and prevention of cancer and infectious diseases. It was formerly known as Cytoclonal Pharmaceutics, Inc. Historically, eXegenics operated as a drug discovery company, exploiting new enabling technologies to advance and shorten the new drug development cycle. Commencing in 2003, eXegenics began terminating its research and related activities. Since then, all ofinformation concerning our scientific staff and administrative positions have been eliminated and all of our research and development activities have been terminated. As such, eXegenics is a holding company with a portfolio of marketable securities and no operations. The principal offices of the Company are located at: 1250 Pittsford-Victor Road, Building 200, Suite 280, Pittsford, New York.

Since the termination of operations, the board of directors of eXegenics and management have been focused on redeploying the remaining residual assets of eXegenics. The board established a committee - the Business Opportunities Search Committee - to study strategic direction and identify potential business opportunities. The objective of eXegenics is to redeploy its assets and actively pursue new business opportunities.

On February 9, 2007, eXegenics completed its sale of 19,440,491 shares of eXegenics common stock, constituting approximately 51% of the issued and outstanding shares of eXegenics capital stock, on a fully diluted basis, to a small group of investors. The stock sale was made pursuant to the terms of a previously announced stock purchase agreement dated August 14, 2006, as amended as of November 30, 2006. The investors paid eXegenics an aggregate purchase price of $8,613,000 at the closing, which is subject to adjustment based on eXegenics stockholders’ equity at the closing. The proceeds from the stock sale provide eXegenics with working capital that can be used to create future operational and business opportunities.

Insurance

In addition to rights to indemnification provided to eXegenics’executive officers and directors, under our certificate of incorporation, as amended, our bylaws and under the Delaware General Corporation Law (“DGCL”), we have entered into indemnification agreements with certain of our former officers and directors. The indemnification agreements provide such officers and directors with a specific contractual rights as toincluding their indemnification rights under our charter documents and the DGCL for indemnification and the advancement of expenses, and require eXegenics to maintain directors’ and officers’ liability insurance at the levels of coverage in placeages, as of the date the agreement(s) was entered into, for a period of six years after the individual ceases to be an officer or director of the Company. There can be no assurance that we will be able to maintain or increase our insurance coverage in the future on acceptable terms or that any claims against us will not exceed the amount of such coverage.

Patents and Trademarks

Historically, it was the Company’s practice to obtain protection, where possible, on its intellectual property and other proprietary rights, including protection of its products, processes and technologies, and to license such processes and technologies to generate royalties. During fiscal 2006, 2005 and 2004, eXegenics received no revenues under any of its licensing agreements, and it does not anticipate any royalty payments under these licensing agreements in the near future, including revenues from its Intellectual Property Assignment Agreement with NLC Pharma, Inc.

Research and Development

Since termination of its business operations, eXegenics has not sponsored research or development or new products or technologies.

Financial Information About Industry Segments

eXegenics has no business operations and did not have any significant business operations during its fiscal years ended December 31, 2006, 2005 and 2004. See eXegenics Statements of Operations contained in the Company’s financial statements contained in this Report on Form 10-K.

Liquidity and Capital Resources

At December 31, 2006 we had cash, cash equivalents and investments of approximately $8,596,000. Our future capital needs are uncertain. The Company may or may not need additional financing in the future to fund subsequently identified transactions and/or business opportunities. In the event it is determined that additional financing is necessary, there can be no assurances that such financing will be available or, if available, on favorable terms.

Employees

At December 31, 2006, the Company had no employees. Both our interim chief executive officer and our chief financial officer provide services to the Company as independent contractors.

Item 1A. Risk Factors

Risks that could adversely affect eXegenics’ financial condition, or its future business plans, strategies or opportunities, or its future operations are outlined below. Any of the risks in this Report or in eXegenics’ other filings with the Securities and Exchange Commission (the “SEC”) could materially adversely affect eXegenics’ financial condition, or its future business plans, strategies or opportunities, or its future operations. Additional risks and uncertainties not presently known to eXegenics or that are currently believed to be immaterial also may adversely affect eXegenics' financial condition, or its future business plans, strategies or opportunities, or its future operations.

eXegenics may not be able to successfully consummateproposed acquisitions or integrate acquired businesses.

The Business Opportunities Search Committee of the Board of Directors of eXegenics is charged with, among other things, identifying and evaluating business opportunities. If eXegenics were to pursue one or more strategic acquisitions, its failure to consummate or, if consummated, to successfully integrate and/or realize contemplated revenues, could adversely affect the Company’s financial condition.

eXegenics pursuit of business opportunities may subject it to numerous risks, including the following:

April 30, 2007:

· | the benefits of any potential business opportunity not materializing as planned or not materializing within the time periods or to the extent anticipated; | | | | | |

· | the possibility that eXegenics will pay more than the value it derives from any potential business opportunity; |

· | difficulties in the integration and assimilation of the operations, technologies, products and personnel of any acquired business; |

· | the diversion of management’s attention from other potential business opportunities; |

· | the availability of favorable acquisition financing; |

· | the potential loss of key employees and/or clients of any acquired business; |

· | the assumption of unknown liabilities, indemnities and potential disputes with the sellers; and |

· | risks of entering markets in which eXegenics has no or limited direct prior experience. |

Business opportunities pursued by eXegenics may involve a high degree of business and financial risk, which can result in substantial losses to eXegenics. There is generally going to be no publicly available information about the companies that eXegenics may evaluate and pursue, and eXegenics’ management will rely significantly on the diligence of eXegenics’ employees, agents and advisors to obtain and analyze information. If eXegenics is not able to identify all material information about these companies, among other factors, eXegenics may fail to receive the value it had anticipated. In addition, these businesses may have short operating histories, narrow product lines, small market shares and less experienced management than their competition and may be more vulnerable to customer preferences, market conditions, loss of key personnel, or economic downturns.

Further, acquisitions may require the use of significant amounts of cash, resulting in the inability to use those funds for other business opportunities or purposes. Acquisitions using our capital stock could have a dilutive effect, and could adversely affect the market price of our common stock.

No minimum guidelines have been established with respect to any particular industry that eXegenics may enter, or criteria with respect to any particular business that eXegenics may engage in a transaction, accordingly, we cannot provide you with risks that may be specific to a particular industry, transaction or business.

The Business Opportunities Search Committee has evaluated numerous potential acquisition or merger candidates for eXegenics, which included companies in a diverse group of industries, including medical devices, entertainment, banking and software development. Further, eXegenics has not established any criteria, including a specific length of operating history or a specified level of earnings, assets, and/or net worth, which it will require a company to have achieved, or without which eXegenics would not consider a transaction with such business entity. eXegenics may enter into a transaction with an entity engaged in a highly regulated business or in a business with unique operating risks; or, eXegenics may enter into a transaction with an entity having: no significant operating history, losses, limited or no potential for immediate earnings, limited assets, negative net worth or other negative characteristics. Our inability to advise you of particular risks associated with an industry or business opportunities, for example, environmental or health risks, competitive risks, or regulatory risks, and how they might impact our financial condition or future business opportunities or prospects is, itself, a risk.

eXegenics future success will depend, in part, in its ability to attract and retain highly skilled employees.

Our future success will depend, in part, on our ability to attract, retain and motivate highly skilled employees. Competition for highly skilled employees exists, and we may be unable to attract, integrate or retain the proper numbers of sufficiently qualified personnel that we may need in the future. To the extent that we are unable to hire and retain skilled employees in the future, our financial condition and our future business opportunities and operations will likely suffer.

Transactions may result in unfavorable tax treatment to eXegenics.

Federal and state tax consequences will, in all likelihood, be major considerations in any business opportunity we may pursue. Currently, such transactions may be structured so as to result in tax-free treatment to both companies, pursuant to various federal and state tax provisions. While eXegenics intends to structure any transaction so as to minimize the federal and state tax consequences to the Company, there can be no assurance that such business opportunity will meet the statutory requirements of a tax-free reorganization or that the parties will obtain the desired tax-free treatment. A non-qualifying reorganization could result in the imposition of both federal and state taxes which may have an adverse effect on both parties to the transaction and their shareholders.

Certain of eXegenics’ charter provisions and Delaware law may prevent or deter potential business opportunities.

eXegenics certificate of incorporation, as amended, bylaws, stockholders rights agreement, and certain provisions of Delaware law contain provisions that may have the effect of discouraging, delaying or preventing eXegenics from pursuing potential business opportunities that a stockholder might consider favorable. The anti-takeover effect of these provisions may also have an adverse effect on the public trading price of eXegenics common stock.

The Sarbanes-Oxley Act of 2002

Since the enactment of the Sarbanes-Oxley Act of 2002 and the SEC’s implementing regulations of the same (collectively, the “Sarbanes-Oxley Act”), companies that have securities registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including eXegenics, are subject to enhanced and more transparent corporate governance standards, disclosure requirements and accounting and financial reporting requirements. The Sarbanes-Oxley Act, among other things, (i) requires • a public company, with securities listed on an exchange (eXegenics securities are not currently listed on an exchange, but are quoted on the Over-the-Counter Bulletin Board), to establish and maintain audit committees, comprised solely of independent directors, which committee must be empowered to, among other things, engage, supervise and discharge the company’s auditors; • that a public company’s financial statements be certified by the principal executive and principal financial officers of such company; • increased and quicker public disclosure - real time -obligations by the company and its directors and executive officers, including disclosure of off-balance sheet transactions and accelerated reporting of transactions in company stock; (ii) prohibits personal loans to company directors and officers, except certain loans made by insured financial institutions on nonpreferential terms and in compliance with other bank regulatory requirements; and (iii) creates or provides for various new and increased civil and criminal penalties for violations of the securities laws.

Achieving and maintaining compliance with the Sarbanes-Oxley Act and the SEC’s implementing rules and regulations increases eXegenics use of outside legal and accounting advisors and, accordingly, increases eXegenics’ expenses related to such advisors, as well as increased time spent by eXegenics’ management in maintaining and evaluating continued compliance with the requirements of the Sarbanes-Oxley Act and SEC rules and regulations.

Our failure to adequately protect our intellectual property rights could result in our loss of such rights.

Prior to the termination of its research and development programs, eXegenics’ policy was to protect its intellectual property and other proprietary rights, including its technology. Subsequent to termination of its drug discovery operations, eXegenics has not been diligent in maintaining those protections and, as a result, some or all of our rights in our intellectual property, including our proprietary technology and other proprietary interests, may be subject to challenge, and we may lose our interests in or rights to certain intellectual property, including our proprietary technologies, that later turn out to be important to the Company in the future.

eXegenics common stock price may be volatile, which could result in substantial losses for our stockholders

The market price of shares of eXegenics common stock has been and is likely to continue to be highly volatile and may be significantly affected by factors such as the following:

· | announcements we make concerning new business development activities; |

· | actual or anticipated fluctuations in our financial condition and future operations and operating results; |

· | changes in the economic and political conditions in the United States and abroad;

|

· | terrorist attacks, war or the threat of terrorist attacks and war; |

· | regulatory developments in the United States and foreign countries; |

· | our common stock being quoted on the OTC Bulletin Board; and |

· | price and volume fluctuations in the stock market. |

A significant portion of our voting power is concentrated and, as a result, our other stockholders’ ability to influence corporate matters may be limited.

The Frost Group owns approximately 41% of our voting stock. Accordingly, the Frost Group will have significant influence over the management and affairs of eXegenics and over all matters requiring stockholder approval, including the election of directors and significant corporate transactions, such as a merger or other sale of eXegenics or its assets, for the foreseeable future. This concentrated control limits the ability of our other stockholders to influence corporate matters and, as a result, The Frost Group may take actions that eXegenics other stockholders do not view as beneficial.

We may have conflicts of interest with The Frost Group.

Conflicts of interest may arise between The Frost Group and us in a number of areas, including business combinations. The Frost Group has investments in a variety of companies and may present one or more of these companies as business opportunities to us. Three of the members of The Frost Group are members of, and represent a majority of, our board of directors. We cannot guarantee that any conflicts that may arise will be resolved in a matter that is favorable to us. Additionally, even if we do resolve such conflicts, the resolution may be less favorable to us than it would be if we were dealing with an unaffiliated third party.

We have a large number of authorized but unissued shares of common stock that may be issued in connection with business combinations or otherwise without stockholder approval.

As previously referenced, our Business Opportunities Search Committee, is charged with identifying and evaluating business opportunities. We are authorized to issue 225,000,000 shares of common stock, of which 36,550,369 shares are currently issued and outstanding and 1,568,240 shares are reserved for issuance upon conversion of our Series A preferred stock and upon exercise of outstanding options and warrants. In addition, we are authorized to issue up to 10,000,000 shares of preferred stock, of which 4,000,000 shares are designated Series A preferred stock, 983,240 of which are issued and outstanding, and an additional 30,000 shares are designated Series B preferred stock, none of which are issued and outstanding. Our authorized, but unissued and unreserved shares of capital stock are available to us for issuance from time to time for acquisitions or to raise capital. Whether or not any future issuance of shares would be submitted for stockholder vote depends upon whether stockholder approval would be required by applicable law and/or applicable stock exchange rules. The eXegenics board of directors intends to only seek approval of the eXegenics stockholders with respect to any future issuances of shares of eXegenics capital stock to the extent required by applicable law and/or applicable stock exchange rules. Any future issuances of shares of our capital stock would likely dilute the percentage ownership of the stockholders in eXegenics.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

Our corporate offices are located at 1250 Pittsford-Victor Road, Building 200, Suite 280, Pittsford, New York 14534 and consist of approximately 500 square feet of office space. The Company sublets this office space from RFG Associates, a general partnership in which John A. Paganelli, our chairman and interim chief executive officer of the Company, is a partner. Monthly rent is $625 and the sublease may be terminated by either party upon thirty (30) days notice. eXegenics paid an aggregate of $10,000 in rent expenses in fiscal 2006.

Item 3. Legal Proceedings.

As previously reported by eXegenics in its quarterly report on Form 10-Q filed November 14, 2006, during the fourth quarter of fiscal 2006, the Company reached agreement with its former president and chief executive officer (Dr. Ronald Goode) in connection with a limited recourse note and pledge agreement entered into with Dr. Goode in May 2001 in connection with Dr. Goode’s subscription for shares of eXegenics common stock. The amount of the note was $300,000 plus 4.71% interest payable on a semi-annual basis. Dr. Goode had failed to make the semi-annual interest payments since May 2005, and failed to pay the principal due May 2006. On October 30, 2006, the Company reached agreement with Dr. Goode concerning the cancellation of the subscription agreement and note in consideration for the assignment to the Company of the 100,000 shares of eXegenics common stock underlying Dr. Goode’s subscription. As a result, the subscription receivable of $101,000 was eliminated and an offsetting amount was deducted from additional paid in capital.

Labidi Proceeding.

On October 5, 2005, in the matter brought by Abdel Hakim Labidi (one of our former employees) against the Company, a jury ruled in favor of Dr. Labidi determining that the Company converted certain biological research materials owned by Dr. Labidi, and the Company committed theft of biological materials owned by Dr. Labidi. The jury awarded Dr. Labidi a total of $600,000. The Company is reviewing this matter to determine the validity of appealing the decision of the jury. The final amount due by the Company to Dr. Labidi under such judgment is likely to be between $638,000 and $750,000; however the Company has recorded a provision of $638,000 in the financial statements.

Other than the Labidi matter, eXegenics is not currently aware of any other legal proceedings and no such proceedings are known to be contemplated by any governmental authorities. eXegenics maintains general liability insurance coverage in amounts deemed to be adequate by the Board of Directors.

Item 4. Submission of Matters to a Vote of Security Holders

No matters were submitted to a vote of security holders during the fourth quarter of fiscal 2006.

Executive Officers of the Registrant

Set forth below are the names of the persons currently serving as a executive officers, their ages, their offices in the Company, if any, their principal occupations or employment for the past five years, and the names of other public companies in which such persons hold directorships.

| Name | | Age | | Position withTitle |

| Phillip Frost, M.D. | | | 70 | | | Chief Executive Officer and Chairman of the CompanyBoard |

| Dale Pfost, Ph.D. | | | 50 | | | President |

| Samuel J. Reich | | | 32 | | | Executive Vice President |

| Denis O’Shaughnessy, Ph.D. | | | 56 | | | Senior Vice President of Clinical Development |

| Adam Logal | | | 29 | | | Executive Director of Finance, Chief Accounting Officer, Treasurer & Secretary |

| John A. Paganelli | | | 72 | | | Director Chairman of the Board, Interim Chief Executive Officer, and Secretary |

Dr. David F. HostelleyA. Eichler | | 67 | 36 | | Chief Financial Officer | Director |

| Michael Reich | | | 63 | | | Director |

| Jane H. Hsiao, Ph.D., MBA | | | 59 | | | Director |

| Steven D. Rubin | | | 46 | | | Director |

| Robert Baron | | | 66 | | | Director |

| Richard A. Lerner, M.D. | | | 68 | | | Director |

| Melvin L. Rubin, M.D. | | | 75 | | | Director |

John A. Paganelli, Interim Chief Executive Officer, SecretaryPhillip Frost, M.D.Dr. Frost became the CEO and Chairman of our board of directors after consummation of the our acquisition of Acuity Pharmaceuticals Inc. and Froptix Corporation on March 27, 2007 (referred to as the “Acquisition”). Dr. Phillip Frost was named the Vice Chairman of the Board of DirectorsTeva Pharmaceutical Industries, Limited (“Teva”) in January 2006 when Teva acquired IVAX Corporation (“IVAX”). Dr. Frost had served as Chairman of the board of directors and Chief Executive Officer of IVAX Corporation since 1987. Dr. Frost was named Chairman of the Board of Ladenburg Thalmann & Co., Inc., an American Stock Exchange-listed investment banking and securities brokerage firm, in July 2006 and has been a director of Ladenburg Thalmann since March 2005. He serves on the Board of Regents of the Smithsonian Institution, a member of the Board of Trustees of the University of Miami, a Trustee of each of the Scripps Research Institutes, the Miami Jewish Home for the Aged, and the Mount Sinai Medical Center and is Vice Chairman of the Board of Governors of the American Stock Exchange. Dr. Frost is also a director of Protalix BioTherapeutics, Inc., an American Stock Exchange-listed biotech pharmaceutical company, Continucare Corporation, an American Stock Exchange-listed provider of outpatient healthcare and home healthcare services, Northrop Grumman Corp., a New York Stock Exchange-listed global defense and aerospace company, Castle Brands, Inc., an American Stock Exchange-listed developer and marketer of alcoholic beverages, and Cellular Technical Services, Inc., a public company with no ongoing operations.

Dale Pfost, Ph.D.Dr. Dale Pfost became our President after consummation of the Acquisition on March 27, 2007. Previously, Dr. Pfost served as the President, CEO and Chairman of Acuity Pharmaceuticals and was one of the members of the founding management team from 2003 through

-1-

March 2007. Dr. Pfost served as President, CEO and Chairman of Orchid BioSciences from 1996 through 2002 and was the founding CEO. From 1988 until 1996 Dr. Pfost served as President, CEO and Managing Director of Oxford GlycoSciences, where he was the founding CEO. Dr. Pfost was the founder and President of Infitek, Inc. from 1982 through 1984 until it was acquired by SmithKline Beckman where Dr. Pfost served in varying levels of increasing responsibilities through 1988.

Samuel J. Reich.Mr. Samuel Reich became our Executive Vice President after consummation of the Acquisition on March 27, 2007. Prior to joining us, Mr. Reich served as Executive Vice President, Research and Development and was a co-founder of Acuity. Mr. Reich co-founded Acuity in 2002 where he served in capacities of increasing responsibility from 2002 to March 2007. Prior to founding Acuity, Mr. Reich was a doctoral candidate at the University of Pennsylvania Medical School, where his doctoral research involved recognizing and pioneering the opportunity in RNAi therapeutics for treating ophthalmic diseases from 2001 until 2002.

John A. Paganelli. Paganelli.Mr. Paganelli has served as our Interim Chief Executive Officer and secretary sincefrom June 29, 2005 through the consummation of the Acquisition, and Chairman of the eXegenics Boardour board of Directors sincedirectors from December 2003.2003 through the consummation of the Acquisition. Mr., Paganelli served as President and Chief Executive Officer of Transamerica Life Insurance Company of New York from 1992 to 1997. Since 1987, Mr. Paganelli has been a partner in RFG Associates, a financial planning organization. Mr. Paganelli is the Managing Partner of Pharos Systems Partners, LLC, a company formed to raise capital to purchase the controlling interest in Pharos Systems International, a software development company. Mr. Paganelli is Chairman of the Board of Pharos Systems International. He was Vice President and Executive Vice President of PEG Capital Management, an investment advisory organization, from 1987 until 2000. From 1980 to January 2003, Mr. Paganelli was an officer and director-shareholder of Mike Barnard Chevrolet, Inc., an automobile dealership. Mr. Paganelli was on the Board of Directors of Mid Atlantic Medical Services, Inc. from 1999 until 2005. Mid Atlantic was listed on the New York Stock Exchange and through its wholly owned subsidiaries is in the business of selling various forms of health insurance. Mr. Paganelli was also on the Board of Directors of Mid Atlantic'sAtlantic’s subsidiary, MAMSI Life and Healthy Insurance Company. Mr. Paganelli holds an A.B. from Virginia Military Institute. In 2005 Mid Atlantic Medical Services, Inc. was acquired by UnitedHealth Group, Inc.

Denis O’Shaughnessy, Ph.D., Dr. Denis O’Shaughnessy became our Senior Vice President of Clinical Development upon consummation of the Acquisition on March 27, 2007. Prior to joining us, Dr. O’Shaughnessy served as Senior Vice President of Clinical Development for Acuity from October 2006 to March 2007. From 2005 to October 2006, Dr. O’Shaughnessy was an independent clinical research consultant. From 2000 to 2005, Dr. O’Shaughnessy was a founding member of Eyetech Pharmaceuticals and served as Senior Vice President of Clinical Development. From 1990 to 2000 Dr. O’Shaughnessy was employed by Hoffmann-La Roche with increasing levels of responsibility, most recently as Director of Clinical Operations. From 1980 through 1990, Dr. O’Shaughnessy served at several pharmaceutical companies in various roles of increasing responsibility most recently as Head of Clinical Research for Celltech Ltd.

Adam Logal. Mr. Logal became our Executive Director of Finance and Chief Accounting Officer after consummation of the Acquisition on March 27, 2007. Prior to joining the Company, Mr.

-2-

David F. Hostelley,Logal served in various finance capacities at Nabi Biopharmaceuticals, most recently as Sr. Director, Accounting and Reporting. From March 2006 to June 2006, Mr. Logal served as Interim Chief Financial Officer, Chief Accounting Officer and Treasurer and from November 2002 to June 2006 Mr. Logal served in various roles of increasing responsibility within the Finance Department. Prior to Nabi Biopharmaceuticals, Mr. Logal served from May 2001 to November 2002 as a tax accountant at Spherion Corporation, a recruiting and staffing company. From November 2000 to May 2001, Mr. Logal served as a staff accountant for Dunn & Co., CPAs PA, a public accounting firm.

Board of Directors

David F. Hostelley. Mr. HostelleyJane H. Hsiao, Ph.D., MBA.Dr. Hsiao has served as our chief financial officera director of the Company since July 1, 2005.February 2007. Dr. HostelleyHsiao served as the Vice Chairman-Technical Affairs of IVAX from 1995 to January 2006, when Teva acquired IVAX. Dr. Hsiao served as IVAX’s Chief Technical Officer since 1996, and as Chairman, Chief Executive Officer and President of IVAX Animal Health, IVAX’s veterinary products subsidiary, since 1998. From 1992 until 1995, Dr. Hsiao served as IVAX’s Chief Regulatory Officer and Assistant to the Chairman. Dr. Hsiao served as Chairman and President of DVM Pharmaceuticals from 1998 through 2006 and is also a Certified Public Accountant licenseddirector of Protalix BioTherapeutics, Inc., an American Stock Exchange-listed biotech pharmaceutical company, and Cellular Technical Services Company, Inc., a public company with no ongoing operations.

Steven D. Rubin.Mr. Rubin has served as a director of the Company since February 2007. Mr. Rubin served as the Senior Vice President, General Counsel and Secretary of IVAX from August 2001 until September 2006. Prior to joining IVAX, Mr. Rubin was Senior Vice President, General Counsel and Secretary with privately held Telergy, Inc., a provider of business telecommunications and diverse optical network solutions, from early 2000 to August 2001. In addition, he was with the Miami law firm of Stearns Weaver Miller Weissler Alhadeff & Sitterson from 1986 to 2000, in the statesCorporate and Securities Department. Mr. Rubin had been a shareholder of Ohiothat firm since 1991 and New York. In 1984 he earned his Ph.D. in management while a lecturer in the MBA Program of Baldwin-Wallace College. He currently lectures in Accounting and Management for Myers University, Cleveland, Ohio.

He has structured numerous acquisitions in the fields of printing, oil and gas development, private schools, insurance agencies, hotels, manufacturing, debit card issuance, health clubs and service entities. In his capacity of trainer in the field of Project Management, Dr. Hostelley has taught the executives of: Ford Motor Company, Westinghouse, National Fuel Gas, General Electric, Stromberg-Carlson, Doehler-Jarvis, Marvin Windows, Progressive Insurance, EDI Engineering, Sun Exploration, Tennessee Valley Authority, SPX Corporation, The Venezuelan Oil Ministry, Ford Museum in Greenfield Village, and Trans Ohio Savings and Loan. He has lectured in South Africa, Venezuela, Canada, and the United States.

He is now serving as interim president and board member of Organetix, Inc., (Symbol OGTX.OB); and as a board member and CFO of DSI Direct Sales, Inc. (Symbol DSDI.STET).director since 1998. Mr. HostelleyRubin currently serves on the Executive Committeeboard of directors of Dreams, Inc., a vertically integrated sports licensing and products company.

David A. Eichler. Mr. Eichler became a director of the Cleveland ChapterCompany after the consummation of the Muscular Dystrophy Association.Acquisition on March 27, 2007. Mr. Eichler is a Managing Director of Psilos Group, a New York-based venture capital firm specializing in healthcare investments. Mr. Eichler joined Psilos in 1999 and focuses on investments in the specialty pharmaceutical, medical technology, healthcare services and healthcare IT sectors. Mr. Eichler has served on the board of directors of several Psilos portfolio companies, and has extensive experience as an advisor to senior management on M&A, financial restructuring and capital raising transactions. Mr. Eichler has been a director of Acuity since 2004 and also currently serves as Chairman of Caregiver Services, Inc., a leading provider of in-home care services. Prior to joining Psilos, Mr. Eichler was an investment banker at Wasserstein Perella & Co. where he was a member of the firm’s Healthcare Group.

Michael Reich. Mr. Michael Reich became a director of the Company after the consummation of the Acquisition on March 27, 2007. Mr. Michael Reich is a proprietor of a commercial property development company. Previously, Mr. Reich was chief executive officer of Cosrich, Inc., a manufacturer of popularly priced cosmetics and toiletries, including numerous well known brands.

-3-

Mr. Reich’s area of expertise is in operations, finance and marketing. Prior to the Acquisition, Mr. Reich had been a board member of Acuity since 2003. Michael Reich is the uncle of Samuel Reich, the Company’s Executive Vice President.

PART II

Item 5. MarketRobert A. Baron.Mr. Baron has served on our board of directors since 2003. Previously, Mr. Baron served as the President of Cash City, Inc. from 1999 to 2003. Cash City is a payday advance and check cashing business. From 1997 to 1999 Mr. Baron was the President of East Coast Operations for Registrant’s Common Equity, Related Stockholder MattersCSS/TSC, Inc., a distributor of blank t-shirts and Issuer Repurchasesfleece and accessories and a subsidiary of Equity Securities

Common Stock

eXegenicsTultex, Inc., a publicly held company. From 1986 to 1997, Mr. Baron was the chairman of T shirt City, Inc., a privately held company. From 1993 to 1997, Mr. Baron was a member of the board of directors of Suburban Bank Corp. When Mr. Baron was on Suburban’s board, its common stock was traded on NASDAQ. Mr. Baron is quotedalso a director of Hemobiotech, Inc., a development stage biopharmaceutical company, and Andover Medical, Inc., a medical equipment distributor.

Richard A. Lerner, M.D.Dr. Lerner became a director of the Company after the consummation of the Acquisition on March 27, 2007. Dr. Lerner has been President of The Scripps Research Institute, a private, non-profit biomedical research organization, since 1986. Dr. Lerner is a member of numerous scientific associations, including the National Academy of Science and the Royal Swedish Academy of Sciences. Dr. Lerner serves as director of Kraft Foods, Inc. He is also on the Over-the-Counter Bulletinboard of directors for Xencor and Intra-Collular Therapies, two privately held biotechnology companies, and serves on the scientific advisory board of Dyadic, a biotechnology company.

Melvin L. Rubin, M.D.Dr. Rubin became a director of the Company after the consummation of the Acquisition on March 27, 2007. Dr. Rubin is member of the faculty at the University of Florida Department of Ophthalmology where he holds the titles of Professor and Chairman Emeritus of Ophthalmology and Shaler Richardson Eminent Scholar Emeritus. He has been a member of the University of Florida Department of Ophthalmology faculty since 1963. He has served national ophthalmology on the board of directors and as president of the American Academy of Ophthalmology (“AAO”) and later, president of the Foundation of the AAO. He has also been trustee and president of the Association for Research in Vision and Ophthalmology, and on the board of directors and chairman of the American Board of Ophthalmology.

CORPORATE GOVERNANCE

Corporate Governance Policy

We will regularly monitor developments in the area of corporate governance and review our processes and procedures in light of such developments. In those efforts, we review Federal laws affecting corporate governance, such as the Sarbanes-Oxley Act of 2002. In addition, in anticipation of our application to list our shares of common stock on the American Stock Exchange (the “AMEX”), we also review applicable rules of the AMEX.

Board of Directors Meetings

Our business, property and affairs are managed under the trading symbol EXEG.direction of our board of directors. Members of our board of directors are kept informed of our business through discussions with our Chairman and Chief Executive Officer, President, Chief Accounting Officer and other officers and

-4-

employees, by reviewing materials provided to them and by participating in meetings of our board of directors and its committees.

Our board of directors met 14 times during 2006: 4 of which were at regularly scheduled meetings and 10 of which were at special meetings. During 2006, the committees of our board of directors held a total of 4 meetings. Each director attended at least 75% of the total number of meetings of the board of directors and each committee of the board on which such director served.

Independence Determination

Our board of directors will observe all applicable criteria for independence established by the AMEX and other governing laws and applicable regulations. No director is deemed to be independent unless our board of directors determines that the director has no relationship which would interfere with the exercise of independent judgment in carrying out his or her responsibilities as a director. Our board of directors has determined that the following directors are independent as determined by listing standards of the AMEX and other applicable regulations: Robert Baron, David A. Eichler, Richard A. Lerner, M.D., Michael Reich and Melvin L. Rubin, M.D.

In making this determination, the board of directors considered all relevant factors, including the fact that Michael Reich is the uncle of Samuel Reich, the Company’s Executive Vice President.

Standing Committees of the Board of Directors

Our board of directors maintains several standing committees, including an audit committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (Exchange Act), a compensation committee, and a nominating and governance committee. These committees and their functions are described below. Our board of directors may also establish various other committees to assist it in its responsibilities.

Our board of directors has adopted a written charter for each of its standing committees. The full text of each charter is available on our website at http://www.opko.com.

The following table shows the high and low bid quotations for eXegenics common stock, on a per share basis, duringcurrent members (indicated by an “X” or “Chair”) of each full quarterly period within the two most recent fiscal years, as quoted on the OTCBB. Such prices reflect inter-dealer quotations, without adjustment for any retail markup, markdown or commission and may not necessarily represent actual transactions.

| | | High | | Low | |

2006: | | | | | |

| First Quarter | | $ | 0.46 | | $ | 0.39 | |

| Second Quarter | | | 0.45 | | | 0.38 | |

| Third Quarter | | | 1.09 | | | 0.38 | |

| Fourth Quarter | | | 0.99 | | | 0.72 | |

2005: | | | | | | | |

| First Quarter | | $ | 0.45 | | $ | 0.32 | |

| Second Quarter | | | 0.47 | | | 0.35 | |

| Third Quarter | | | 0.44 | | | 0.36 | |

| Fourth Quarter | | | 0.46 | | | 0.39 | |

On March 15, 2007 the last sale price of our common stock was $2.40.standing board committees:

| | | | | | |

| | | | | | Corporate |

| | | | | | Governance and |

| | Audit | | Compensation | | Nominating |

| Phillip Frost, M.D. | | — | | — | | — |

| Jane H. Hsiao, Ph.D., MBA | | — | | — | | — |

| Robert Baron | | X | | — | | X |

| David A. Eichler | | Chair | | X | | — |

| Richard A. Lerner, M.D. | | | | Chair | | X |

| John A. Paganelli | | — | | — | | — |

| Michael Reich | | X | | — | | — |

| Melvin L. Rubin, M.D. | | — | | X | | Chair |

| Steven D. Rubin | | — | | — | | — |

-5-

Audit Committee

StockholdersOur audit committee oversees our corporate accounting and financial reporting processes. Our audit committee:

| • | | evaluates the qualifications, independence and performance of our registered independent public accounting firm; |

|

| • | | determines the engagement of our registered independent public accounting firm; |

|

| • | | approves the retention of our registered independent public accounting firm to perform any proposed permissible non-audit services; |

|

| • | | ensures the rotation of the partners of our registered independent public accounting firm on our engagement team as required by law; |

|

| • | | reviews our systems of internal controls established for finance, accounting, legal compliance and ethics; |

|

| • | | reviews our accounting and financial reporting processes; |

|

| • | | provides for effective communication between our board of directors, our senior and financial management and our independent auditors; |

|

| • | | discusses with management and our independent auditors the results of our annual audit and the review of our quarterly financial statements; |

|

| • | | reviews the audits of our financial statements; |

|

| • | | implements a pre-approval policy for certain audit and non-audit services performed by our registered independent public accounting firm; and |

|

| • | | reviews and approves any related party transactions that we are involved in. |

At March 15 2007, there were approximately 153 holdersOur audit committee is comprised of recordMessrs. Eichler, Reich and Baron. Our board of directors has determined that Mr. Eichler is an “audit committee financial expert” as currently defined under the SEC’s rules implementing Section 407 of the Sarbanes-Oxley Act of 2002. We believe that the composition and functioning of our common stock.

Dividends

We have never declared nor paid any cash dividends on our common stock. We currently anticipate that we will retain any future earnings to fund future business opportunities. Accordingly, we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

Recent Sales of Unregistered Securities

As previously reported by eXegenics in its current report on Form 8-K dated February 9, 2007, and subsequent to the end of fiscal 2006, on February 9, 2007, the Company sold 19,440,491 shares of its common stock, constituting approximately 51%audit committee complies with all applicable requirements of the issued and outstanding sharesSarbanes-Oxley Act of eXegenics capital stock, on a fully diluted basis, to a small group of investors. The stock sale was made pursuant to2002, the terms of a previously announced stock purchase agreement dated August 14, 2006, as amended as of November 30, 2006. The investors paid eXegenics an aggregate purchase price of $8.6 million at the closing. The purchase price is subject to a downward adjustment based upon the stockholders equity of eXegenics on the date of closing. In addition, on February 9, 2007, the Company issued 50,000 shares of eXegenics common stock to each of John A. Paganelli, our Interim Chief Executive Officer, Secretary and Chairman of the Board of Directors of eXegenics, and Robert Baron, a director of eXegenics in consideration of their service to the Business Opportunities Search Committee of the eXegenics Board. The shares were issued pursuant to stock grants approved by the stockholders of eXegenics. The shares of eXegenics common stock were offered and sold in reliance upon an exemption from registration under Section 4(2) of the Securities Act for “transactions by an issuer not involving a public offering” and Rule 506 or Regulation D of the Securities Act.

Issuer Purchases of Equity Securities.

As previously reported by eXegenics in its quarterly report on Form 10-Q filed November 14, 2006, during the fourth quarter of fiscal 2006, the Company reached agreement with its former president and chief executive officer (Dr. Ronald Goode) in connection with a limited recourse note and pledge agreement entered into with Dr. Goode in May 2001 in connection with Dr. Goode’s subscription for shares of eXegenics common stock. The amount of the note was $300,000 plus 4.71% interest payable on a semi-annual basis. Dr. Goode failed to make the semi-annual interest payments since May 2005, and principal due May 2006. On October 30, 2006, the Company reached agreement with Dr. Goode concerning the cancellation of the subscription agreement and note in consideration for the assignment to the Company of the 100,000 shares of eXegenics common stock underlying Dr. Goode’s subscription. As a result, the subscription receivable of $101,000 was eliminated and an offsetting amount was deducted from additional paid in capital.

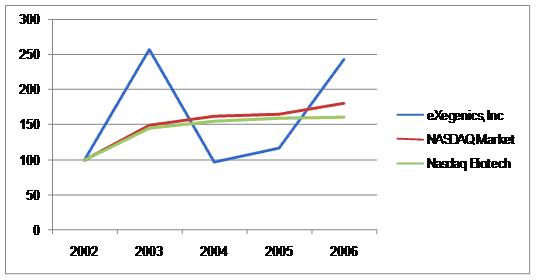

PERFORMANCE GRAPH(1)

The following table compares the annual percentage change in our cumulative total stockholder return on our common stock during a period commencing on December 31, 2002 and ending on December 31, 2006 (as measured by dividing (A) the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment,AMEX and the difference between our share price atSEC’s rules and regulations, including those regarding the end and the beginning of the measurement period; by (B) our share price at the beginning of the measurement period) with the cumulative total return of the Nasdaq Stock Market (US) Index and a peer group, the Nasdaq Biotech Index, during such period. We have not paid any dividends on our common stock, and we do not include dividends in the representationindependence of our performance. The stock price performance shown on the graph below is not necessarily indicative ofaudit committee members. We intend to comply with future price performance and only reflects eXegenics’ relative stock price for the period from December 31, 2002 through December 31, 2006.

PERFORMANCE GRAPH

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG EXEGENICS INC.,

THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE NASDAQ BIOTECH INDEX, OUR PEER GROUP

| | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | |

| EXEGENICS INC | | $ | 100.00* | | $ | 257.14 | | $ | 97.14 | | $ | 117.14 | | $ | 242.86 | |

| NASDAQ Market Index (US) | | $ | 100.00* | | $ | 150.01 | | $ | 162.89 | | $ | 165.13 | | $ | 180.85 | |

| Nasdaq Biotech Index | | $ | 100.00* | | $ | 145.75 | | $ | 154.68 | | $ | 159.06 | | $ | 160.69 | |

* | | $100 invested on 12/31/02 in stock or index-including reinvestment of dividends. Fiscal year ending December 31. |

(1) The information contained in this section - Performance Graph - will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, exceptrequirements to the extent that eXegenics specifically incorporates it by reference. Further,they become applicable to us.

On April 25, 2007, the information contained in this section Performance Graph - shall not be deemed to be “soliciting material”board of directors amended and restated the Company’s Audit Committee Charter.

Compensation Committee

Our compensation committee administers the compensation program for our executive officers. Our compensation committee reviews and either approves, on behalf of the board of directors, or to be “filed” with the Securities and Exchange Commission or subject to Regulation 14A or 14C orrecommends to the liabilitiesboard of section 18directors for approval, (i) annual salaries, bonuses, and other compensation for our executive officers, and (ii) individual equity awards for our employees and executive officers. Our compensation committee also oversees our compensation policies and practices.

-6-

Our compensation committee also performs the following functions related to executive compensation:

| • | | coordinates the board of directors’ role in establishing performance criteria for executive officers; |

|

| • | | annually evaluates each of our executive officers’ performance; |

|

| • | | reviews and approves the annual salary, bonus, stock options and other benefits, direct and indirect, of our executive officers, including our Chief Executive Officer; |

|

| • | | reviews and recommends new executive compensation programs; · annually reviews the operation and efficacy of our executive compensation programs; |

|

| • | | periodically reviews that executive compensation programs comport with the compensation committee’s stated compensation philosophy; |

|

| • | | establishes and periodically reviews policies in the area of senior management perquisites; |

|

| • | | reviews and recommends to the board of directors the appropriate structure and amount of compensation for our directors; |

|

| • | | reviews and approves material changes in our employee benefit plans; |

|

| • | | administers our equity compensation and employee stock purchase plans; and |

|

| • | | reviews the adequacy of the compensation committee and its charter and recommends any proposed changes to the board of directors not less than annually. |

In deciding upon the appropriate level of compensation for our executive officers, the compensation committee regularly reviews our compensation programs relative to our strategic objectives and emerging market practice and other changing business and market conditions. In addition, the compensation committee also takes into consideration the recommendations of our Chief Executive Officer concerning compensation actions for our other executive officers and any recommendations of compensation consultants. The primary role of consultants is to provide objective data, analysis and advice to the compensation committee. In providing data and recommendations to the compensation committee, our consultants work with our Chief Executive Officer and management to obtain information needed to carry out its assignments.

Our compensation committee is comprised of Dr. Rubin, Dr. Lerner and Mr. Eichler. We believe that the composition and functioning of our compensation committee complies with all applicable requirements of the ExchangeSarbanes-Oxley Act exceptof 2002, the AMEX and the SEC’s rules and regulations, including those regarding the independence of our compensation committee members. We intend to comply with future requirements to the extent that eXegenics specifically requests that such information be treated as soliciting material or specifically incorporates it by reference into a filing under the Securities Act or the Exchange Act.they become applicable to us.

Item 6. Selected Financial Data

The following selected financial data of eXegenics should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Continuing Operations” and the Company’s financial statements and the notes to those statements and other financial information appearing elsewhere in this Report on Form 10-K.

eXegenics Inc.

SELECTED FINANCIAL DATA

| | | Year Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| Statement of Operations Data | | | | | | | | | | | |

| Revenue | | $ | — | | $ | — | | $ | — | | $ | 13,000 | | $ | 562,000 | |

| Research and development | | | — | | | — | | | — | | | 154,000 | | | 3,948,000 | |

| General and administrative expenses | | | 1,117000 | | | 1,438,000 | | | 2,051,000 | | | 2,938,000 | | | 4,770,000 | |

| Expenses related to strategic redirection | | | — | | | — | | | — | | | 653,000 | | | 864,000 | |

| Merger, tender offers and consent solicitation expenses | | | — | | | — | | | — | | | 2,233,000 | | | 2,010,000 | |

| Operating loss | | | (1,117,000 | ) | | (1,438,000 | ) | | (2,051,000 | ) | | (5,965,000 | ) | | (11,030,000 | ) |

| Gain on disposition | | | — | | | — | | | — | | | — | | | 4,000 | |

| Gain on sale of investments (net) | | | — | | | 1,064,000 | | | — | | | — | | | — | |

| Interest income | | | 469,000 | | | 190,000 | | | 127,000 | | | 174,000 | | | 686,000 | |

| Interest expense | | | — | | | (2,000 | ) | | (2,000 | ) | | (2,000 | ) | | (18,000 | ) |

| Loss before tax benefit and cumulative effect of a change in accounting principle | | | (648,000 | ) | | (186,000 | ) | | (1,926,000 | ) | | (5,793,000 | ) | | (10,358,000 | ) |

| Tax benefit | | | — | | | — | | | — | | | — | | | — | |

| Net Loss | | | (648,000 | ) | | (186,000 | ) | | (1,926,000 | ) | | (5,793,000 | ) | | (10,358,000 | ) |

| Preferred Stock | | | | | | | | | | | | | | | | |

| Dividend | | | (238,000 | ) | | (234,000 | ) | | (223,000 | ) | | (207,000 | ) | | (169,000 | ) |

| Net loss attributable to common stockholders | | $ | (886,000 | ) | $ | (420,000 | ) | $ | (2,149,000 | ) | $ | (6,000,000 | ) | $ | (10,527,000 | ) |

| Basic and diluted loss per common share | | $ | (0.04 | ) | $ | (0.03 | ) | $ | (0.13 | ) | $ | (0.38 | ) | $ | (0.67 | ) |

| | | December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| Balance Sheet Data | | | | | | | | | | | |

| Total assets | | $ | 8,752,000 | | $ | 9,000,000 | | $ | 10,071,000 | | $ | 11,342,000 | | $ | 17,515,000 | |

| Working capital | | | 8,079,000 | | | 8,723,000 | | | 9,829,000 | | | 10,296,000 | | | 15,924,000 | |

| Stockholders’ equity | | $ | 8,079,000 | | $ | 8,723,000 | | $ | 9,832,000 | | $ | 10,304,000 | | $ | 16,074,000 | |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with, and is qualified in its entirety by, the financial statements and the notes thereto included with this Report on Form 10-K. This “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this Report contains certain forward-looking statements as that term is defined in the Private Securities Litigation Reform of 1995. Such statements are based on management’s current expectations and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. When used herein, the words “anticipate,” “believe,” “estimate,” “expect” and similar expressions as they relate to our management or us are intended to identify such forward-looking statements. Our actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Historical operating results are not necessarily indicative of the trends in operating results for any future period.

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates, including those related to investments, intangible assets, income taxes, contingencies and litigation. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Overview

eXegenics currently has no business operations. eXegenics was formerly known as Cytoclonal Pharmaceutics, Inc. and was involved in the research, creation and development of drugs for the treatment and prevention of cancer and infectious diseases. Historically, eXegenics operated as a drug discovery company, exploiting new enabling technologies to advance and shorten the new drug development cycle. Commencing in 2003, eXegenics began terminating its research and related activities. Since then, all of our scientific staff and administrative positions have been eliminated and all of our research and development activities have been terminated. As such, eXegenics is a holding company with a portfolio of marketable securities and no operations.

Since the termination of operations,April 25, 2007, the board of directors amended and restated the Company’s Compensation Committee Charter.

Corporate Governance and Nominating Committee

Our corporate governance and nominating committee’s responsibilities include the selection of eXegenicspotential candidates for our board of directors. It also makes recommendations to our board of

-7-

directors concerning the structure and management have been focused on redeploying the remaining residual assets of eXegenics. The board established a committee - the Business Opportunities Search Committee - to study strategic direction and identify potential business opportunities. The objective of eXegenics is to redeploy its assets and actively pursue new business opportunities.

On February 9, 2007, eXegenics completed its sale of 19,440,491 shares of eXegenics common stock, constituting approximately 51%membership of the issuedother board committees and outstanding sharesconsiders director candidates recommended by others, including our Chief Executive Officer, other board members, third parties and shareholders. Our nominating and governance committee is comprised of eXegenics capital stock, on a fully diluted basis, to a small group of investors. The stock sale was made pursuant to the terms of a previously announced stock purchase agreement dated August 14, 2006, as amended as of November 30, 2006. The investors paid eXegenics an aggregate purchase price of $8,613,000 at the closing, which is subject to adjustment based on eXegenics stockholders’ equity at the closing. The proceeds from the stock sale provide eXegenics with working capital that can be used to create future operationalDr. Rubin, Dr. Lerner and business opportunities.

Critical Accounting Policies

We believe the following critical accounting policies affect management’s more significant judgments and estimates used in the preparation of our financial statements.

eXegenics considers all non-restrictive, highly liquid short-term investments purchased with an original maturity of three months or less to be cash equivalents. Investments consist of equity securities and are classified as available for sale and reported at their fair values. The realized gains and losses from these investments are reported in current earnings. Unrealized gains and losses from these securities are reported as a separate component of stockholders’ equity and excluded from current earnings.

In May 2005, the FASB issued Statement of Financial Statement Accounting Standards No. 154, “Accounting Changes and Error Corrections-a replacement of APB Opinion No. 20 and FASB Statement No. 3” (“SFAS 154”). This Statement replaces APB Opinion No. 20, “Accounting Changes,” and FASB Statement No. 3, “Reporting Accounting Changes in Interim Financial Statements.” SFAS 154 requires retrospective application to prior periods’ financial statements for changes in accounting principle, unless it is impractical to determine either the period-specific effects or the cumulative effect of the change. SFAS 154 also requires that a change in depreciation, amortization, or depletion method for long, non-financial assets be accounted for as a change in accounting estimate effected by a change in accounting principle. SFAS 154 is effective for accounting changes and corrections of errors made in fiscal years beginning after December 15, 2005. The Company believes that adoption of the provisions of SFAS 154 will not have a material effect on the Company’s financial condition.

In July 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109” (FIN 48), which clarifies the accounting and disclosure for uncertainty in tax positions, as defined. FIN 48 seeks to reduce the diversity in practice associated with certain aspects of the recognition and measurement related to accounting for income taxes. The Company does not expect the interpretation will have a material impact on its financial condition.

In September 2006, the FASB issued statement No. 157, “Fair Value Measurements”, (SFAS 157). SFAS 157 defines fair value, establishes a framework for measuring fair value in accordance with accounting principles generally accepted in the United States, and expands disclosures about fair value measurements. SFAS 157 is effective for fiscal years beginning after November 15, 2007, with earlier application encouraged. Any amounts recognized upon adoption as a cumulative effect adjustment will be recorded to the opening balance of retained earnings in the year of adoption. The Company has not yet determined the impact of this Statement on its financial condition.

We record a valuation allowance to reduce our deferred tax assets to the amount that is more likely than not to be realized. While we have considered future taxable income and ongoing prudent and feasible tax planning strategies in assessing the need for the valuation allowance, in the event we were to determine that we would be able to realize deferred tax assets in the future in excess of its net recorded amount, an adjustment to the net deferred tax asset would increase income in the period such determination was made. Likewise, should we determine that we would not be able to realize all or part of our net deferred tax asset in the future, an adjustment to the net deferred tax asset would be charged to income in the period such determination was made.

Results of Operations

Fiscal Year Ended December 31, 2006 Compared to Fiscal Year Ended December 31, 2005

Revenues

We recognized $0 from license, research and development revenues during fiscal 2006 and 2005. There was no license, research and development revenue as a result of eXegenics exit from the drug discovery business and termination of related research and development activities. There were no operations in 2006.

Research and Development Expenses

We incurred research and development expenses of $0 during fiscal 2006 and fiscal 2005. This was a result of eXegenics exist from the drug discovery business and termination of related research and development activities.

General and Administrative Expenses

General and administrative expenses for fiscal 2006 were $1,117,000 compared to $1,438,000 for fiscal 2005, a decrease of $321,000 or 22%. General and administrative expenses decreased primarily as a result of the reduction in payroll and related expenses. Significant variances in fiscal 2006, compared to fiscal 2005, were as follows: headcount related expenses, primarily salaries, travel and entertainment, health insurance, employee relations and office expenses declined by $288,000; investor and public relations expense declined by $5,000; insurance, primarily directors and officers liability insurance expense declined by $78,000; audit fees declined by $49,000; leased equipment expenses declined by $46,000; board of director travel expenses declined by $4,000 and miscellaneous expenses declined $86,000. The decrease in general and administrative expenses was partially offset by the following: a $180,000 increase in legal expenses (primarily attributable to the increase in the reserve for on ongoing litigation with Dr. Labidi), an increase in professional consulting fees of $25,000 and a $30,000 increase in board of director compensation.

Merger, Tender Offers and Consent Solicitation Expenses

In 2006 and 2005, we incurred no expenses related to failed merger, tender offers and consent solicitation activities. In 2006, in anticipation of the transactions completed by the Stock Purchase Agreement previously discussed, eXegenics incurred approximately $56,000 in legal, accounting and other related costs.

Expenses Related to Terminating the Drug Discovery Operations

As a result of our decision to terminate our drug discovery operations, in fiscal 2006 and 2005 we incurred no costs associated with expenses from terminated operations. No expenses were recognized in 2006 or 2005 for eXegenics’ strategic redirection.

Interest Income

Interest income for fiscal 2006 was $469,000 as compared to $190,000 for fiscal 2005, an increase of $279,000 or 68%. The increase in interest income was due to higher interest rates.

Other Income and Expenses

Other Income and expenses was $0 during fiscal 2006 and a profit of $1,062,000 during fiscal 2005. The decrease was due to the appreciation and sale, by eXegenics of Javelin Pharmaceuticals, Inc. common stock in 2005.

Net Loss

We incurred net losses of $648,000 during fiscal 2006 and $186,000 during fiscal 2005. The increase in net loss of $462,000 or 60% is a result of the aforementioned sale of investments in 2005. Net loss per common share for fiscal 2006 was $0.04 and for fiscal 2005 was $0.03.

Results of Operations

Fiscal Year Ended December 31, 2005 Compared to Fiscal Year Ended December 31, 2004

Revenues

We recognized $0 from license, research and development revenues during fiscal 2005 and 2004. There was no license, research and development revenue as a result of eXegenics exit from the drug discovery business and termination of related research and development activities. There were no operations in 2005.

Research and Development Expenses

We incurred research and development expenses of $0 during fiscal 2005 and fiscal 2004. This was a result of eXegenics exit from the drug discovery business and termination of related research and development activities.

General and Administrative Expenses

General and administrative expenses for fiscal 2005 were $1,438,000 compared to $2,051,000 for fiscal 2004, a decrease of $613,000 or 42%. General and administrative expenses decreased primarily as a result of the termination of drug discovery operations. Significant variances in fiscal 2005, compared to fiscal 2004, were as follows: professional consulting fees declined by $60,000; headcount related expenses, primarily salaries, travel and entertainment, health insurance, employee relations and office expenses declined by $210,000; investor and public relations expense declined by $44,000; insurance, primarily directors and officers liability insurance expense declined by $435,000, primarily as a result of a change in insurance carriers; tax expense, mainly franchise tax, declined by $49,000; legal fees declined by $61,000; leased equipment declined by $60,000; board of directors fees and travel expenses declined by $110,000; and audit fees declined by $35,000. The increase of $250,000 is for the reserve established in connection with the lawsuit with Dr. Labidi, which reserve reflects a reasonable estimate of eXegenics’ obligations to pay under the judgment; and an increase of $201,000 for the allowance recorded against the subscriptions receivable reflects eXegenics uncertainty as to its collectability.

Merger, Tender Offers and Consent Solicitation Expenses

In 2005 and 2004, we recognized an aggregate of $0 in expenses related to merger, tender offers and consent solicitation activities.

Expenses Related to Terminating the Drug Discovery Operations

As a result of our decision to terminate our drug discovery operations, in fiscal 2005 and 2004 we incurred $0 and $5,000, respectively, in costs associated with expenses from terminated operations. Cash disbursements made during fiscal 2004 against a previously established restructuring reserve included $90,000 for severance payments, $87,000 for terminated operating lease obligations, and $16,000 for equipment and facilities relocation. No expenses were recognized in 2005 and 2004 for eXegenics’ strategic redirection.

Interest Income

Interest income for fiscal 2005 was $190,000 as compared to $127,000 for fiscal 2004, an increase of $63,000 or 50%. The increase in interest income was due to higher interest rates and increased investable balances resulting from the appreciation in value and ultimate sale of Javelin Pharmaceuticals, Inc. common stock.

Other Income and Expenses

Other Income and expenses was a profit of $1,062,000 during fiscal year 2005 and $2,000 during fiscal year 2004. The increase was due to the appreciation and sale by eXegenics of Javelin Pharmaceuticals, Inc. common stock.

Net Loss

We incurred net losses of $186,000 during fiscal 2005 and $1,926,000 during fiscal 2004. The decrease in net loss of $1,740,000 or 90% is a result of the aforementioned sale of investments. Net loss per common share for fiscal 2005 was $0.03 and for fiscal 2004 was $0.13.

Liquidity and Capital Resources