| (i) | ||

| Revise Item | ||

| 1 (Business) and Item | ||

| Condition and Results of |

| Revise Item | ||

| Data) and Item | ||

| (iii) | Revise Item 9A (Controls and Procedures) to clarify that internal control procedures relating to Icon were not evaluated as a part of management’s review of internal controls over financial reporting as of March 31, 2008. |

| Revise Item 15(c) (Financial Statements Required by Regulation S-X) to include the Consolidated Income Statement for the fiscal year ending March 31, 2006, and the Report of independent registered public accounting firm with respect to Eyston Company Limited (the Hong Kong Joint Venture) as required by Regulation S-X. |

Except as described above, no other amendments are being made to the Company’s Annual Report on Form 10-K, filed on July 8, 2008. This Form 10-K/A does not reflect events occurring after the July 8, 2008 filing of our Annual Report on Form 10-K or modify or update the disclosures contained in the Annual Report in any way other than required to include such conformed information as described above.

PART I

ITEM1. | BUSINESS |

General

Universal Security Instruments, Inc. (“we” or “the Company”) designs and markets a variety of popularly-priced safety products consisting primarily of smoke alarms, carbon monoxide alarms and related products. Most of our products require minimal installation and are designed for easy installation by the consumer without professional assistance, and are sold through retail stores. We also market products to the electrical distribution trade through our wholly-owned subsidiary, USI Electric, Inc. (“USI Electric”). The electrical distribution trade includes electrical and lighting distributors as well as manufactured housing companies. Products sold by USI Electric usually require professional installation.

In 1989 we formed a limited liability company under the laws of Hong Kong, as a joint venture with a Hong Kong-based partner to manufacture various products in the Peoples Republic of China (the “Hong Kong Joint Venture”). We currently own a 50% interest in the Hong Kong Joint Venture and are a significant customer of the Hong Kong Joint Venture (46.38%(68.9% and 49.60%46.4% of its sales during fiscal 20072008 and 20062007 respectively), with the balance of its sales made to unrelated customers worldwide.

We import all of our products from various foreign suppliers. For the fiscal year ended March 31, 2007,2008, approximately 65.04%80.0% of our purchases were imported from the Hong Kong Joint Venture and 4.90% of our purchases were imported from our Canadian subsidiaries.Venture.

Our sales for the year ended March 31, 20072008 were $35,823,575$33,871,362 compared to $28,894,101$32,934,388 for the year ended March 31, 2006,2007, an increase of approximately 23.98%2.8%. We reported net income from continuing operations of $5,533,258$2,824,749 in fiscal 2008 compared to income from continuing operations of $6,093,366 in fiscal 2007, compared to net incomea decrease of $4,600,352 in fiscal 2006, an increase of 20.28%53.6%. Included in the fiscal 2007 results are $4,200,921 in sales and a $570,961 net loss by our newly acquired Canadian operations.

The Company was incorporated in Maryland in 1969. Our principal executive office is located at 7-A Gwynns Mill Court, Owings Mills, Maryland 21117, and our telephone number is 410-363-3000. Information about us may be obtained from our website www.universalsecurity.com.www.universalsecurity.com. Copies of our Annual Report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, are available free of charge on our website as soon as they are filed with the Securities and Exchange Commission (SEC) through a link to the SEC’s EDGAR reporting system. Simply select the “Investor Relations” menu item, then click on the “SEC Filings” link. The SEC’s EDGAR reporting system can also be accessed directly at www.sec.govwww.sec.gov.

Safety Products

We market a line of residential smoke alarms under the trade names “USI Electric” and “UNIVERSAL” both of which are manufactured by the Hong Kong Joint Venture.

Our line of smoke alarms consists of battery, electrical and electrical with battery backup alarms. Our products contain different types of batteries with different battery lives, and some with alarm silencers. The smoke alarms marketed to the electrical distribution trade also include hearing impaired and heat alarms with a variety of additional features. We also market outdoor floodlights under the name “Lite Aide(TM),” carbon monoxide alarms, door chimes and ground fault circuit interrupter (GFCI) units.

Our wholly-owned subsidiary, USI Electric. Inc., focuses its sales and marketing efforts to maximize safety product sales, especially smoke alarms and carbon monoxide alarms manufactured by our Hong Kong Joint Venture and marketed to the electrical distribution and retail trade.

Import Matters

We import all of our products. As an importer, we are subject to numerous tariffs which vary depending on types of products and country of origin, changes in economic and political conditions in the country of manufacture, potential trade restrictions and currency fluctuations. We have attempted to protect ourselfourselves from fluctuations in currency exchange rates to the extent possible by negotiating commitments in U.S. dollars.

Our inventory purchases are also subject to delays in delivery due to problems with shipping and docking facilities, as well as other problems associated with purchasing products abroad. Substantially all of our safety products, including products we purchase from our Hong Kong Joint Venture, are imported from the People’s Republic of China. Mechanical steel tubing manufactured for us by Icon is imported by land transport from Canada.

- 3 - -

Sales and Marketing; Customers

We sell our products to various customers, and our total sales market can be divided generally into threetwo categories; sales by the Company, and sales by our USI Electric subsidiary, and sales by Icon.subsidiary.

The Company markets our products to retailers, including wholesale distributors, chain, discount, television retailers and home center stores, catalog and mail order companies and to other distributors (“retailers”). Our products have historically been retailed to “do-it-yourself” consumers by these retailers. We do not currently market any significant portion of our products directly to end users.

The Company’s retail sales are made directly by our employees and by approximately 17 independent sales organizations who are compensated by commissions. Our agreements with these sales organizations are generally cancelable by either party upon 30 days notice. We do not believe that the loss of any one of these organizations would have a material adverse effect upon our business. Sales which are made directly by us are effected by our officers and full-time employees, seven of whom are also engaged in sales, management and training. Sales outside the United States are made by our officers and through exporters, and amounted to less than 5.0%0.3% of total sales in the fiscal years ended March 31, 20072008 and 2006.2007.

Our USI Electric subsidiary markets our products to the electrical distribution trade (primarily electrical and lighting distributors and manufactured housing companies). USI Electric has established a national distribution system with 12 regional stocking warehouses throughout the United States which generally enables customers to receive their orders the next day without paying for overnight freight charges. USI Electric engages sales personnel from the electrical distribution trade and has engaged 27 independent sales organizations which represent approximately 230 sales representatives, some of which have warehouses where USI Electric products are maintained by our sales representatives for sale.

We also market our products through our own sales catalogs and brochures, which are mailed directly to trade customers, and our website. Our customers, in turn, may advertise our products in their own catalogs and brochures and in their ads in newspapers and other media. We also exhibit and sell our products at various trade shows, including the annual National Hardware Show.

Our Icon Canadian subsidiary markets its EMT conduit, other manufactured tubing products and related security products to the electrical distribution trade utilizing its internal sales force and independent representatives.

Hong Kong Joint Venture

We have a 50% interest in the Hong Kong Joint Venture which has manufacturing facilities in the People’s Republic of China, for the manufacturing of certain of our electronic and electrical products.

We believe that the Hong Kong Joint Venture arrangement will ensure a continuing source of supply for a majority of our safety products at competitive prices. During fiscal year 2007, 65.04%2008, 80.0% of our total inventory purchases were made from the Hong Kong Joint Venture. The products produced by the Hong Kong Joint Venture include smoke alarms and carbon monoxide alarms. Changes in economic and political conditions in China or any other adversity to the Hong Kong Joint Venture will unfavorably affect the value of our investment in the Hong Kong Joint Venture and would have a material adverse effect on the Company’s ability to purchase products for distribution.

Our purchases from the Hong Kong Joint Venture represented approximately 46%68.9% of the Hong Kong Joint Venture’s total sales during fiscal 20072008 and 50%46% of total sales during fiscal 2006,2007, with the balance of the Hong Kong Joint Venture’s sales being primarily made in Europe and Australia, to unrelated customers. The Hong Kong Joint Venture’s sales to unrelated customers arewere $9,378,242 in fiscal 2008 and $22,065,702 in fiscal 2007 and $12,506,135 in fiscal 2006.2007. Please see Note D of the Financial Statements for a comparison of annual sales and earnings of the Hong Kong Joint Venture.

- 4 - -

Discontinued Operations

In October 2006, we formed 2113824 Ontario, Inc., an Ontario corporation, as a wholly-owned subsidiary of the Company for the purpose of acquiring a two-thirds interest in two Canadian corporations, International Conduits, Ltd. (Icon) and Intube, Inc. (Intube). Icon and Intube are based in Toronto, Canada and manufacture and distribute electrical mechanical tubing (EMT) steel conduit. Icon also sells home safety products, primarily purchased from the Company, in the Canadian market. The primary purpose of the Icon and Intube acquisition was to expand our product offerings to include EMT steel conduit, and to provide this product and service to the commercial construction market. On April 2, 2007, Icon and Intube were merged under the laws of Ontario to form one corporation.

At the time of our investment in Icon, we projected that our established U.S. sales network would allow us to increase sales of EMT to U.S. customers. Despite our efforts, Icon suffered continuing losses, and we were not successful in increasing Icon’s sales in the face of competition and a downturn in the housing market. On January 29, 2008, Icon received notice from CIT Financial, Ltd. (CIT Canada), Icon’s principal and secured lender, that Icon was in default under the terms of the Credit Agreement dated June 22, 2007 between Icon and CIT Canada and demanding immediate payment of all of Icon’s obligations to CIT Canada under the Credit Agreement. On February 11, 2008, the assets of Icon were placed under the direction of a court appointed receiver.

The assets held in receivership related to the discontinued Canadian operations were adjusted to net realizable value based on management’s estimates. The process of completing the liquidation of Icon’s assets is continuing and the Company believes the process will continue into the second quarter of our 2009 fiscal year. Accordingly, the actual impairment charges actually incurred could differ based on the actual results of the liquidation process.

The results of Icon for the fiscal year ended March 31, 2008 and for the six month period from the date of acquisition (October 1, 2006) to March 31, 2007 have been restated and are presented in our financial statements as the results of discontinued operations, and certain prior year amounts have been restated in order to conform with the current year’s presentation.

Other Suppliers

Certain private label products not manufactured for us by the Hong Kong Joint Venture are manufactured by other foreign suppliers. We believe that our relationships with our suppliers are good. We believe that the loss of our ability to purchase products from the Hong Kong Joint Venture would have a material adverse effect on the Company. The loss of any of our other suppliers would have a short-term adverse effect on our operations, but replacement sources for these other suppliers could be developed.

Competition

In fiscal year 2007,2008, sales of safety products accounted for substantially all of our total sales. In the sale of smoke alarms, we compete in all of our markets with First Alert Firex and Walter Kidde Safety.Portable Equipment, Inc. In the sale of GFCI units, we compete in all our markets with Leviton Manufacturing Co., Inc., Pass & Seymour, Inc., Cooper Wiring Devices and Hubbell, Inc. All of these companies have greater financial resources and financial strength than we have. We believe that our safety products compete favorably in the market primarily on the basis of styling, features and pricing.

The safety industry in general involves changing technology. The success of our products may depend on our ability to improve and update our products in a timely manner and to adapt to new technological advances.

Employees

As of March 31, 2007, including the employees or our consolidated Canadian subsidiaries,2008, we had 3419 employees, 1614 of whom are engaged in administration and sales, and the balance of whom are engaged in product development, manufacturing and servicing. Our employees are not unionized, and we believe that our relations with our employees are satisfactory.

Fiscal Year Ended March 31, 2007 | |||||||

| First Quarter | High | $ | 24.45 | ||||

| Low | $ | 17.75 | |||||

| Second Quarter | High | $ | 26.93 | ||||

| Low | $ | 20.97 | |||||

| Third Quarter | High | $ | 30.25 | ||||

| Low | $ | 20.47 | |||||

| Fourth Quarter | High | $ | 35.04 | ||||

| Low | $ | 25.80 | |||||

Fiscal Year Ended March 31, 2006 | |||||||

| First Quarter | High | $ | 14.63 | ||||

| Low | $ | 9.00 | |||||

| Second Quarter | High | $ | 14.63 | ||||

| Low | $ | 11.25 | |||||

| Third Quarter | High | $ | 14.25 | ||||

| Low | $ | 12.01 | |||||

| Fourth Quarter | High | $ | 18.12 | ||||

| Low | $ | 12.34 |

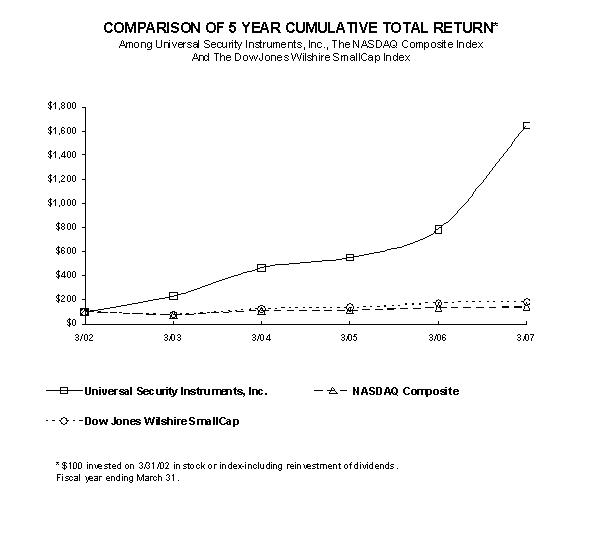

Total Return Analysis | |||||||||||||||||||

| 3/31/2002 | 3/31/2003 | 3/31/2004 | 3/31/2005 | 3/31/2006 | 3/31/2007 | ||||||||||||||

Universal Security Instruments, Inc. | $ | 100.00 | $ | 230.00 | $ | 462.16 | $ | 552.07 | $ | 785.59 | $ | 1,650.45 | |||||||

Nasdaq Composite | $ | 100.00 | $ | 72.11 | $ | 109.76 | $ | 111.26 | $ | 132.74 | $ | 139.65 | |||||||

Dow Jones Wilshire SmallCap | $ | 100.00 | $ | 75.37 | $ | 124.70 | $ | 134.62 | $ | 169.50 | $ | 182.73 | |||||||

| Year Ended March 31, | ||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | ||||||||||||

Statement of Operations Data: | ||||||||||||||||

| Net sales | $ | 35,823,575 | $ | 28,894,101 | $ | 23,465,443 | $ | 17,201,116 | $ | 15,953,883 | ||||||

| Income before equity in earnings of Hong Kong Joint Venture and income taxes | 3,008,597 | 2,394,258 | 765,742 | 429,716 | 279,615 | |||||||||||

| Net income | 5,533,258 | 4,600,352 | 3,417,854 | 2,571,026 | 2,400,318 | |||||||||||

| Per common share: | ||||||||||||||||

| Net income | - | |||||||||||||||

| Basic | 2.31 | 2.06 | 1.60 | 1.27 | 1.25 | |||||||||||

| Diluted | 2.23 | 1.89 | 1.46 | 1.12 | 1.15 | |||||||||||

| Weighted average number of common shares outstanding | ||||||||||||||||

| Basic | 2,398,284 | 2,228,908 | 2,136,599 | 2,022,461 | 1,924,585 | |||||||||||

| Diluted | 2,484,606 | 2,432,705 | 2,352,632 | 2,300,275 | 2,082,327 | |||||||||||

Balance Sheet Data: | ||||||||||||||||

| Total assets | 36,195,468 | 20,358,603 | 16,049,948 | 11,098,916 | 8,382,043 | |||||||||||

| Long-term debt (non-current) | 168,062 | - | - | - | 7,224 | |||||||||||

| Working capital (1) | 10,177,983 | 9,911,628 | 6,317,231 | 4,200,170 | 2,377,688 | |||||||||||

| Current ratio (1) | 1.90:1 | 4.60:1 | 3.00:1 | 3.21:1 | 2.26:1 | |||||||||||

| Shareholders’ equity | 24,671,881 | 17,606,569 | 12,897,668 | 9,198,273 | 6,493,415 | |||||||||||

| Quarter Ended | |||||||||||||

| June 30, | September 30, | December 31, | March 31, | ||||||||||

| 2007 | |||||||||||||

| Net sales | $ | 8,038,437 | $ | 8,018,088 | $ | 8,620,893 | $ | 11,146,157 | |||||

| Gross profit | 2,780,517 | 2,607,922 | 2,795,342 | 2,492,889 | |||||||||

| Net income | 1,577,468 | 1,416,204 | 1,712,883 | 826,703 | |||||||||

| Net income per share - basic | 0.68 | 0.59 | 0.70 | 0.34 | |||||||||

| Net income per share - diluted | 0.62 | 0.57 | 0.70 | 0.34 | |||||||||

| 2006 | |||||||||||||

| Net sales | $ | 6,923,810 | $ | 7,119,100 | $ | 7,353,597 | $ | 7,497,594 | |||||

| Gross profit | 2,048,954 | 2,278,838 | 2,549,300 | 2,580,060 | |||||||||

| Net income | 889,770 | 1,162,695 | 1,456,809 | 1,091,078 | |||||||||

| Net income per share - basic | 0.40 | 0.52 | 0.65 | 0.49 | |||||||||

| Net income per share - diluted | 0.37 | 0.48 | 0.60 | 0.44 | |||||||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Forward-Looking Statements

When used in this discussion and elsewhere in this Annual Report on Form 10-K, the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made, and readers are advised that various factors, including the Risk Factors discussed elsewhere in this Annual Report and other risks, could affect our financial performance and could cause our actual results for future periods to differ materially from those anticipated or projected. We do not undertake and specifically disclaim any obligation to update any forward-looking statements to reflect occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

General

We are in the business of marketing and distributing safety and security products which are primarily manufactured through our 50% owned Hong Kong Joint Venture. InFrom October 2006 through January 2008, we also were engaged in the third quartermanufacture and distribution of fiscal 2007, we expandedEMT steel conduit through Icon, our business with the acquisition of ourmajority-owned Canadian EMT conduit subsidiary. Our financial statements detail our sales and other operational results only, and report the financial results of the Hong Kong Joint Venture using the equity method. Accordingly, the following discussion and analysis of the fiscal years ended March 31, 2008, 2007 2006 and 20052006 relate to the operational results of the Company and its consolidated subsidiaries only (including our new Canadian EMT conduit business), and includes the Company’s equity share of earnings in the Hong Kong Joint Venture. A discussion and analysis of the Hong Kong Joint Venture’s operational results for these periods is presented below under the heading “Hong Kong Joint Venture.”

Discontinued Canadian Operations

In October 2006, we formed 2113824 Ontario, Inc., an Ontario corporation, as a wholly-owned subsidiary of the Company for the purpose of acquiring a two-thirds interest in two Canadian corporations, International Conduits, Ltd. (Icon) and Intube, Inc. (Intube). Icon and Intube are based in Toronto, Canada and manufacture and distribute electrical mechanical tubing (EMT) steel conduit. Icon also sells home safety products, primarily purchased from the Company, in the Canadian market. The primary purpose of the Icon and Intube acquisition was to expand our product offerings to include EMT steel conduit, and to provide this product and service to the commercial construction market. On April 2, 2007, Icon and Intube were merged under the laws of Ontario to form one corporation.

In June 2007, Icon entered into a credit agreement with CIT Financial, Ltd. to provide a term loan and a line of credit facility. These loans are secured by all of the assets of Icon and by the corporate guarantees of the Company and our USI Electric subsidiary.

As a result of continuing losses at Icon, we undertook an evaluation of the goodwill from our acquisition of Icon to determine whether the value of the goodwill has been impaired in accordance with FAS No. 142, “Goodwill and Other Intangible Assets”. Based on that evaluation, we determined that the value of the goodwill from our acquisition of Icon was impaired, and we recognized an impairment charge of US$1,926,696 for the goodwill as of December 31, 2007. The impairment has been recorded in discontinued operations in the consolidated statements of operations.

At the time of our investment in Icon, we projected that our established U.S. sales network would allow us to increase sales of EMT to U.S. customers. Despite our efforts, Icon suffered continuing losses, and we were not successful in increasing Icon’s sales in the face of competition and a weakening U.S. dollar. On January 29, 2008, Icon received notice from CIT Financial, Ltd. (CIT Canada), Icon’s principal and secured lender, that Icon was in default under the terms of the Credit Agreement dated June 22, 2007 between Icon and CIT Canada and demanding immediate payment of all of Icon’s obligations to CIT Canada under the Credit Agreement. On February 11, 2008, the assets of Icon were placed under the direction of a court appointed receiver, and the operations of Icon were suspended. Accordingly, the assets and liabilities of Icon are classified as assets held in receivership in our consolidated balance sheet. Our consolidated financial statements and the related note disclosures reflect the operations of Icon as discontinued operations for all periods presented.

- 6 - -

As a result of Icon’s receivership and the steps taken to liquidate Icon’s assets, we have written down the non cash assets of Icon to their estimated net realizable value as of March 31, 2008. At March 31, 2008, the assets of Icon held by the receiver consist of cash of $823,550, trade accounts receivable (net of allowance for doubtful accounts of $249,962) of $371,793, inventories (net of allowance for excess and obsolete inventory of $500,000) of $817,022, and prepaid expenses of $6,811, amounting to total current assets of $2,019,176. Property, plant and equipment with a book value of $4,387,536 is shown net of a an impairment charge of $3,555,981 at a contractual sales value of $831,555. The total value of assets net of applicable allowances and impairment reserves at March 31, 2008 is $2,850,731.

At March 31, 2008, the liabilities of Icon held by the receiver include trade accounts payable to unsecured creditors of $3,208,548, secured notes payable to CIT Financial, Ltd. of $4,478,826 and other secured amounts payable of $136,076. The total liabilities of Icon at March 31, 2008 are $7,823,450.

As noted above, the assets held for sale related to the discontinued Canadian operations were adjusted to net realizable value based on management’s estimates. The process of completing the liquidation of Icon’s assets is continuing and the Company believes the process will continue into the second quarter of our 2009 fiscal year. Accordingly, the actual impairment charges actually incurred could differ based on the actual results of the liquidation process.

We anticipate that Icon’s obligations will be settled in the Ontario receivership action during the Company’s fiscal year ending March 31, 2009. As a result of the settlement of Icon’s obligations, we expect that the Company will record a gain of between $3,750,000 and $4,250,000 due to the characterization of debt abatement caused by the difference between Icon’s total obligations and the net proceeds of the liquidation of Icon’s assets.

The results of Icon for the fiscal year ended March 31, 2008 and for the six month period from the date of acquisition (October 1, 2006) to March 31, 2007 have been restated and are presented in our financial statements as the results of discontinued operations, and certain prior year amounts have been restated in order to conform with the current year’s presentation.

Comparison of Results of Operations for the Years Ended March 31, 2008, 2007 2006 and 20052006

Sales. In fiscal year 2007,2008, our net sales increased by $6,929,474 (23.98%$936,974 (2.8%), from $32,934,388 in fiscal 2007 to $33,871,362 in fiscal 2008. Sales to the electrical distribution trade through our USI Electric subsidiary decreased to $15,178,930, principally due to decreased volume from the U.S. residential construction trade (from approximately $19,916,690 in 2007) and also due to our inability to import GFCI devices because the manufacturer has not yet received certifications for mandated changes to the devices. The Company increased its sales to retail and wholesale customers in the fiscal year ended March 31, 2008 to $18,692,432 from $13,017,698 at March 31, 2007, principally as a result of sales to a national home improvement retailer. This increase resulted from higher sales volume despite lower contractual pricing to the national home improvement retailer customer.

In fiscal year 2007, sales increased by $4,040,287 (13.9%) from $28,894,101 in fiscal 2006 to $35,823,575$32,934,388 in fiscal 2007. Sales to the electrical distribution trade through our USI Electric subsidiary decreased to $19,916,690, principally due to decreased volume from the U.S. residential construction trade (from approximately $21,260,000 in 2006). The Company increased its sales to retail and wholesale customers in the fiscal year ended March 31, 2007 to $11,705,964$13,017,698 from $7,634,030 at March 31, 2006, principally as a result of sales to a national home improvement retailer. Consolidated netThis increase resulted from higher sales include net sales of our Canadian subsidiary of $4,200,921.

Gross Profit. Gross profit margin is calculated as net sales less cost of goods sold expressed as a percentage of net sales. Our gross profit margin for the fiscal year ended March 31, 20072008 was 29.80%23.2% compared to 32.73%31.6% and 31.19%32.7% in fiscal 20062007 and 2005,2006, respectively. The decreasedecreases in 2008 and 2007 gross margins isfrom the respective prior years are attributed to lower gross margins on retailour increased sales to a national home improvement retailer and toour lower gross profit realized by our Canadian operations,margins on those sales, and due to significantly lower GFCI sales as further explained below. The increase in gross margin in the fiscal year ended March 31, 2006 over 2005 reflects variations in the mix of products sold and is a function of higher sales, since certain fixed costs do not increase at the same rate as sales.previously indicated.

- 7 - -

Interest Income and Expense. Interest expense for fiscal 2008 increased to $46,349 from $0 in fiscal 2007 primarily due to the timing of activity in our line of credit. Interest expense for fiscal 2007 increaseddecreased to $73,517$0 from $48,999 in fiscal 2006 primarily due to increased borrowing. Interest expense for fiscal 2006 decreased to $48,999 from $85,521the timing of activity in fiscal 2005 primarily due to less borrowing.our line of credit .. The majority of the Company’s cash balances are maintained on deposit with the Company’s factor and earn interest at the factor’s prime rate of interest minus 3%. During the fiscal year ended March 31, 2007,2008, the Company earned interest of $22,023$16,155 on these deposits and $9,668$21,991 on these deposits for the year ended March 31, 2007. The company earned interest of $21,991 for the year ended March 31, 2007 compared to net interest expense of $39,331 in fiscal 2006.

Income Taxes.For the fiscal year ended March 31, 2008, we generated a net operating loss for federal and state income tax purposes of approximately $3,320,000. The loss was generated principally as a result of the impairment of the Company’s investment in and notes and accounts receivable due from the discontinued Canadian subsidiary. Furthermore, we generated foreign tax credits of $132,439 for the fiscal year ended March 31, 2008. We will elect to carry our net operating loss of forward to offset future taxable income. In addition, we have foreign tax credits of approximately $388,744 available to offset future taxes.

During the fiscal year ended 2007, the Company offset the payment of taxes on $3,265,940 of taxable income with the difference between the option price and the exercise price recognized as an employment expense for federal income tax purposes related to employee stock options. For book purposes, this benefit has been treated as an addition to paid-in capital. In addition, the Company offset a portion of its federal taxes of approximately $731,395 with foreign tax credits available as a result of foreign taxes paid on the repatriated earnings of the Hong Kong Joint Venture. The Company hasAt March 31, 2007, we had a foreign tax credit carryforward of $190,887 available to offset future taxes at March 31, 2007.taxes. After application of the deductions and credits identified above, the Company haswe had a net tax liability for federal and state income tax purposes of approximately $337,000.$337,000 with respect to our 2007 fiscal year. The deductions and the income tax credits for foreign income taxes paid resulted in an effective income tax rate of approximately 19.28% for the fiscal year ended March 31, 2007.

Net income also was impacted byIncome. We reported a net loss from our Canadian subsidiary of $570,961. Although no assurances can be given, management believes that actions which Icon is now taking$5,568,914 for fiscal 2008 compared to increase capacity, together with sales efforts by Iconnet income of $5,533,258 for fiscal year 2007 and the Company, will have a positive impact on Icon’s financial results in future periods.

Financial Condition, Liquidity and Capital Resources

Our cash needs are currently met by funds generated from operations and from our Factoring Agreement with CIT Group, which supplies both short-term borrowings and letters of credit to finance foreign inventory purchases. The maximum we may borrow under this Agreement is $7,500,000. Based on specified percentages of our accounts receivable and inventory and letter of credit commitments, at March 31, 2007,2008, our maximum borrowing availability under this Agreement is $6,751,563.$5,200,000. Any outstanding principal balance under this Agreement is payable upon demand. The interest rate on the Factoring Agreement, on the uncollected factored accounts receivable and any additional borrowings is equal to the prime rate of interest charged by the factor which, as of March 31, 2007,2008, was 8.25%6.0%. Any borrowings are collateralized by all our accounts receivable and inventory. During the year ended March 31, 2007,2008, working capital (computed as the excess of current assets over current liabilities) increaseddecreased by $266,355,$7,210,068, from $9,911,628$14,678,615 on March 31, 2006,2007, to $10,177,983$7,468,547 on March 31, 2007.2008. This decrease in working capital is due to the decrease in working capital of the discontinued operations of the Canadian subsidiary amounting to $10,332,091, primarily relating to impairment charges recognized and the new debt related to the Canadian operations, offset by an increase in the working capital of the continuing operations of $3,122,023.

Our operating activities usedprovided cash of $3,169,647$2,349,563 for the year ended March 31, 2007.2008. For the fiscal year ended March 31, 2006,2007, operating activities providedused cash of $1,776,297. This decrease$3,372,328. The decreased use of $4,945,944cash by operating activities was primarily due to increasesan increase in deferred tax assets and a reduction in accounts receivable, inventorypayable and prepaidaccrued expenses, generated by U.S. operations associated with sales to a national home improvement retailer and associated with the Canadian operations, and to the decreased earnings of our Hong Kong Joint Venture. These decreasesuses were partially offset by increasesdecreases in accounts payablereceivable and accrued expenses associated with the Canadian operations.amounts due from factor and decreases in inventories.

Our investing activities used cash of $1,139,562$543,962 during fiscal 2007 and provided cash2008 principally as a result of $1,091,358 during fiscal 2006. This decrease resulted primarily from our acquisitionthe change in net assets of the discontinued operations of the Canadian operationssubsidiary and our subsequent purchasesused cash of machinery and equipment to be utilized in the Canadian operations, partially offset by distributions from the Hong Kong Joint Venture.$1,402,959 during fiscal 2007. During 2007,2008, as in prior years, the Company offset a portion of its distributions from the Hong Kong Joint Venture with amounts due by the Company to the Hong Kong Joint Venture for the purchase of safety products.Venture. The Company offset $250,000 during fiscal 20072008 and $458,940$250,000 during fiscal 20052007 of trade amounts due by it to the Hong Kong Joint Venture in lieu of cash distributions. The Company discloses these payments as a non-cash transaction in its statement of cash flows.

Financing activities in 20072008 provided the Company with cash of $1,566,188. Borrowings of $2,254,966 from our factor provided a portion of the cash used to repay $2,333,036 of debt acquired in the acquisition of the Canadian subsidiaries.$1,976,693. Our net debt repayment was offset by cash provided from the issuance of common stock from the exercise of employee stock options of $585,658$126,678 and the tax benefit of $92,935 associated with the deduction of employment expense related thereto. Financing activities in 20062007 provided cash of $98,549$1,782,152 which was primarily from the exercise of employee stock options.options (and the related tax benefit) and borrowings from our factor.

Hong Kong Joint Venture

The financial statements of the Hong Kong Joint Venture are included in this Form 10-K beginning on page JV-1. The reader should refer to these financial statements for additional information. There are no material Hong Kong -– US GAAP differences in the Hong Kong Joint Venture’s accounting policies.

In fiscal year 2007,2008, sales of the Hong Kong Joint Venture were $41,151,055$30,144,148 compared to $24,811,790$41,151,055 and $25,899,630$24,811,790 in fiscal years 2007 and 2006, and 2005, respectively. The decrease in sales for 2008 was primarily due to decreased sales to non-affiliated customers in Europe. The increase in sales for the 2007 period from the 2006 period was primarily due to increased sales to non-affiliated customers. The decrease in sales for the 2006 period from the 2005 period was primarily due to lower sales to unrelated third parties partially offset byand higher sales to the Company.

Net income was $8,377,365$3,270,926 for fiscal year 20072008 compared to net income of $4,160,935$8,377,365 and $5,005,886$4,160,935 in fiscal years 20062007 and 2005,2006, respectively. The increasedecrease in the current fiscal year is primarily due to increaseddecreased sales volume. Net income for the fiscal year ended March 31, 2006 was decreased by the establishment of a reserve of approximately $535,000 for previously capitalized costs associated with the Hong Kong Joint Venture’s application for listing on the Hong Kong Stock Exchange during the fourth quarter and for the fiscal year ended March 31, 2006. The increase in income for the year ended March 31, 2006 was due primarilyvolume to price increases initiated during the year.unrelated third parties.

Gross margins of the Hong Kong Joint Venture for fiscal 20072008 decreased to 33.42%25.1% from 34.69%33.4% in the prior fiscal year. The primary reason for this decrease was due to variation in product mix. The primary reason for the change in product mix is attributed to the large volume of lower margin sales to the Company designed for the U.S. retail market. At March 31, 2006,2007, the Hong Kong Joint Venture’s gross margin increaseddecreased to 34.69%33.4% from 33.55%34.7% at March 31, 2005.2006. The primary reason for this increasedecrease was higherlower gross margins attributedon sales to price increases initiated during the year.Company for the U.S. retail market.

Selling, general and administrative expenses of the Hong Kong Joint Venture were $4,408,855, $4,789,424 $4,269,714 and $3,495,678$4,269,714 for fiscal years 2008, 2007 2006 and 2005,2006, respectively. As a percentage of sales, these expenses were 12%14.6%, 17%12% and 13%17% for fiscal years 2008, 2007 2006 and 2005,2006, respectively. The increasedecrease in dollars of selling, general and administrative expenses for the year ended March 31, 20062008 was due principally to higher costs, increaseda reduction in management bonuses and legal expense and the expensing of approximately $535,000 of costs previously capitalized associated with the Hong Kong Joint Venture’s application for listing on the Hong Kong Stock Exchange.fees.

Interest expense net of interest income was $52,181$26,932 for fiscal year 2007,2008, compared to $34,130$52,181 and $30,666$34,130 in fiscal years 20062007 and 2005,2006, respectively. The increase in interest expense net of interest income for 20072008 was due to a decrease in investments. The increase from 20052006 to 20062007 is due to variations in the amount of investments in bonds during that fiscal period.

- 9 - -

Cash needs of the Hong Kong Joint Venture are currently met by funds generated from operations. During fiscal year 2007,2008, working capital increased by $5,558,281$1,501,104 from $1,826,756 on March 31, 2006 to $7,385,037 on March 31, 2007.2007 to $8,886,141 on March 31, 2008.

Contractual Obligations and Commitments

The following table presents, as of March 31, 2007,2008, our significant fixed and determinable contractual obligations to third parties by payment date. Further discussion of the nature of each obligation is included in Note F to the consolidated financial statements.

Payment due by period | ||||||||||||||||

Less than | 1-3 | 3-5 | More than | |||||||||||||

Total | 1 year | years | years | 5 years | ||||||||||||

| Operating lease obligations | $ | 765,737 | $ | 312,830 | $ | 452,907 | $ | - | $ | - | ||||||

| Capital lease obligations | 269,737 | 101,675 | 146,621 | 21,441 | - | |||||||||||

| Notes payable | 231,625 | 231,625 | - | - | - | |||||||||||

| Note payable - factor | 2,254,966 | 2,254,966 | - | - | - | |||||||||||

| $ | 3,522,065 | $ | 2,901,096 | $ | 599,528 | $ | 21,441 | $ | - | |||||||

| Payment due by period | ||||||||||||||||||||

| Less than | 1-3 | 3-5 | More than | |||||||||||||||||

| Total | 1 year | years | years | 5 years | ||||||||||||||||

| Operating lease obligations | $ | 160,793 | $ | 68,771 | $ | 62,267 | $ | 29,755 | $ | - | ||||||||||

| Guaranteed obligations of discontinued operations to CIT | 4,478,834 | 4,478,824 | - | - | - | |||||||||||||||

Critical Accounting Policies

Management’s discussion and analysis of our consolidated financial statements and results of operations are based upon our Consolidated Financial Statement included as part of this document. The preparation of these consolidated financial statements requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosures of contingent assets and liabilities. On an ongoing basis, we evaluate these estimates, including those related to bad debts, inventories, income taxes, impairment of long-lived assets, and contingencies and litigation. We base these estimates on historical experiences and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily available from other sources. Actual results may differ from these estimates under different assumptions or conditions.

We believe that the following critical accounting policies affect management’s more significant judgments and estimates used in the preparation of its consolidated financial statements. For a detailed discussion on the application on these and other accounting policies see Note A to the consolidated financial statements included in this Annual Report. Certain of our accounting policies require the application of significant judgment by management in selecting the appropriate assumptions for calculating financial estimates. By their nature, these judgments are subject to an inherent degree of uncertainty and actual results could differ from these estimates. These judgments are based on our historical experience, terms of existing contracts, current economic trends in the industry, information provided by our customers, and information available from outside sources, as appropriate. Our critical accounting policies include:

In accordance with Statement of Financial Accounting Standards No. 94, the financial statements of the Company’s Canadian subsidiary, International Conduits, Ltd. (Icon), are not consolidated with the financial statements of the Company. As a result of the February 11, 2008 court appointed receivership of Icon’s assets, we no longer controlled Icon as of that date. Accordingly, the accounts and operations of Icon in our consolidated financial statements are presented as assets and liabilities held in receivership and as the results of discontinued operations.

Our revenue recognition policies are in compliance with Staff Accounting Bulletin No. 104, “Revenue Recognition in Financial Statements”Statements��� issued by the Securities and Exchange Commission. Revenue is recognized at the time product is shipped and title passes pursuant to the terms of the agreement with the customer, the amount due from the customer is fixed and collectibilitycollectability of the related receivable is reasonably assured. We established allowances to cover anticipated doubtful accounts and sales returns based upon historical experience.

Inventories are valued at the lower of market or cost. Cost is determined on the first-in first-out method. We have recorded a reserve for obsolescence or unmarketable inventory equal to the difference between the cost of inventory and the estimated market value based upon assumptions about future demand and market conditions. Management reviews the reserve quarterly.

We currently have a foreign tax credit carryforward and deferred tax assets resulting from deductible temporary differences, which will reduce taxable income in future periods. We had previously provided a valuation allowance on the deferred tax assets associated with the future tax benefits such as foreign tax credits, foreign net operating losses, capital losses and net operating losses. A valuation allowance is required when it is more likely than not that all or a portion of a deferred tax asset will not be realized. Forming a conclusion that a valuation allowance is not needed is difficult when there is negative evidence such as cumulative losses and losses in recent years. Cumulative losses weigh heavily in the overall assessment. As a result of management’s assessment, the allowance previously provided to offset tax benefits associated with net operating loss carryforwards and other deferred tax assets at March 31, 2007 has been reduced to zero.

- 10 - -

We are subject to lawsuits and other claims, related to patents and other matters. Management is required to assess the likelihood of any adverse judgments or outcomes to these matters, as well as potential ranges of probable losses. A determination of the amount of reserves required, if any, for these contingencies is based on a careful analysis of each individual issue with the assistance of outside legal counsel. The required reserves may change in the future due to new developments in each matter or changes in approach such as a change in settlement strategy in dealing with these matters.

Recently Issued Accounting Pronouncements

Business Combinations: In December 2007, FASB issued SFAS No. 141(R), “Business Combinations,” (“SFAS No. 141(R)”), which replaces SFAS No. 141 and issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements,” (“SFAS No. 160”), an amendment of Accounting Research Bulletin No. 51. These two new standards will change the accounting for and the reporting for business combination transactions and noncontrolling (minority) interests in the consolidated financial statements, respectively. SFAS No. 141(R) will change how business acquisitions are accounted for and will impact financial statements both on the acquisition date and in subsequent periods. SFAS No. 160 will change the accounting and reporting for minority interests, which will be re-characterized as noncontrolling interests and classified as a component of equity. These two standards will be effective for the Company for financial statements issued for fiscal years beginning after December 31, 2008.

Fair Value Measurements: In September 2007, FASB issued Statement of Financial Accounting Standards No. 157, Fair Value Measurement (SFAS 157). This standard clarifies the principle that fair value should be based on the assumptions that market participants would use when pricing an asset or liability. Additionally, it establishes a fair value hierarchy that prioritizes the information used to develop those assumptions. SFAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007.2008. The Company has not yet determined the impact that the implementation of SFAS 157 will have on its results of operations or financial condition.

The Fair Value Option for Financial Assets and Financial Liabilities: In February 2007, the2008, FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities, including an amendment of FASB Statements No. 115 (SFAS No. 159). SFAS No. 159 permits entities to choose, at specified election dates, to measure eligible items at fair value (the “fair value option”). A business entity shall report unrealized gains and losses on items for which the fair value option has been elected in earnings at each subsequent reporting period. This accounting standard is effective as of the beginning of an entity’s first fiscal year that begins after November 15, 2007.2008. The effect, if any, of adopting SFAS No. 159 on the Company’s financial position and results of operations has not been finalized.

The financial statements and supplementary data required by this Item 8 are included in the Company’s Consolidated Financial Statements and set forth in the pages indicated in Item 15(a) of this Annual Report.

- 11 - -

We maintain a system of disclosure controls and procedures that is designed to provide reasonable assurance that information, which is required to be disclosed by us in the reports that we file or submit under the Securities and Exchange Act of 1934, as amended (“Exchange Act”), is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the Securities and Exchange Commission, and is accumulated and communicated to management in a timely manner. Our Chief Executive Officer and Chief Financial Officer have evaluated this system of disclosure controls and procedures as of the end of the period covered by this annual report, and believehave concluded that the system is effective. During

Management’s Annual Report on Internal Control over Financial Reporting

Our management, including our Chief Executive Officer and Chief Financial Officer, is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Rules 13a-15(f) and 15d-15(f) under the third quarter of fiscal 2007, we acquired Icon and Intube. Management is assessing the system of internal controls at the acquired subsidiaries.Exchange Act. Our internal control over financial reporting duringis a process designed to provide reasonable assurance regarding the most recent fiscal year hasreliability of financial reporting and the preparation of our financial statements for external reporting purposes in accordance with U.S. generally accepted accounting principles (GAAP). Internal control over financial reporting includes those policies and procedures that: (i) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with US GAAP, and that the Company’s receipts and expenditures are being made only in accordance with authorizations of management and directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the financial statements. Because of its inherent limitations, internal control over financial reporting may not been materially affected,prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are reasonably likelysubject to be materially affected.the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with policies or procedures may deteriorate.

Management (with the participation of our Chief Executive Officer and Chief Financial Officer) conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework in Internal Control — Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, management concluded that the Company’s internal control over financial reporting was effective as of March 31, 2008.

Effective February 11, 2008, the assets, liabilities and operations of Icon were placed in receivership. Accordingly, internal control procedures relating to the unconsolidated Canadian subsidiary were not evaluated as a part of management’s review of internal control over financial reporting as of March 31, 2008.

Management is aware that there is a lack of segregation of duties at the Company due to the small number of employees dealing with general administrative and financial matters. However, at this time management has decided that considering the employees involved and the control procedures in place, the risks associated with such lack of segregation are insignificant and the potential benefits of adding employees to clearly segregate duties do not justify the expenses associated with such increases. Management will periodically review this situation.

There have been no changes in our internal control over financial reporting during the fourth quarter of fiscal 2008 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

(a)1. Financial Statements.

| Page | ||

| Report of Independent Registered Public Accounting Firm | F-1 | |

| Consolidated Balance Sheets as of March 31, | F-2 | |

| Consolidated Statements of | F-3 | |

| Consolidated Statements of Shareholders’ Equity for the Years Ended March 31, 2008, 2007 | F-4 | |

| Consolidated Statements of Cash Flows for the Years Ended March 31, 2008, 2007 | F-5 | |

| Notes to Consolidated Financial Statements | F-6 |

(a)3. Exhibits required to be filed by Item 601 of Regulation S-K.

| 23.1 | Consent of |

| Consent of Grant Thornton LLP (Hong Kong)* | ||

| 31.1 | Rule 13a-14(a)/15d-14(a) Certification of Chief Executive Officer* | |

| 31.2 | Rule 13a-14(a)/15d-14(a) Certification of Chief Financial Officer* | |

| 32.1 | Section 1350 Certifications (incorporated by reference to Exhibit |

*Filed herewith

(c)Financial Statements Required by Regulation S-X.

Separate financial statements of the Hong Kong Joint Venture

| Report of Independent Registered Public Accounting Firm | |

| Consolidated Income Statement | |

| Consolidated Balance Sheet | |

| Balance Sheet | |

| Consolidated Statement of Changes in Equity | |

| Consolidated Cash Flow Statement | |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| UNIVERSAL SECURITY INSTRUMENTS, INC. | ||

February 13, 2009 | By: | /s/ | ||||

| Harvey B. Grossblatt | ||||||

| Harvey B. Grossblatt | ||||||

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of Universal Security Instruments, Inc.

We have audited the accompanying consolidated balance sheets of Universal Security Instruments, Inc. and subsidiaries (the Company) as of March 31, 20072008 and 2006,2007, and the related consolidated statements of income,operations, shareholders' equity, and cash flows for each of the three years in the period ended March 31, 2007.2008. Our audits of the basic financial statements included the financial statement schedule listed in the index appearing under Item 15(a)(2). These financial statements and financial statement schedule are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements and financial statement schedule based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Universal Security Instruments, Inc. and subsidiaries as of March 31, 20072008 and 2006,2007, and the results of their operations and their cash flows for each of the three years in the period ended March 31, 2007,2008, in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note A to the Notes to Consolidated Financial Statements, the Company adopted Financial Interpretation No. 48, “Accounting for Uncertainty in Income Taxes,” effective April 1, 2007.

/s/ GRANT THORNTON LLP

Baltimore, Maryland

July 11, 20073, 2008

F-1

UNIVERSAL SECURITY INSTRUMENTS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| March 31 | |||||||

| 2007 | 2006 | ||||||

ASSETS | |||||||

| CURRENT ASSETS | |||||||

Cash and cash equivalents | $ | 240,545 | $ | 3,015,491 | |||

Accounts receivable: | |||||||

Trade less allowance for doubtful accounts of $15,000 at March 31, 2007 and 2006 | 2,555,895 | 1,106,435 | |||||

Employees | 22,073 | 23,656 | |||||

| 2,577,968 | 1,130,091 | ||||||

Amount due from factor | 7,158,597 | 4,259,131 | |||||

Inventories, net of allowance for obsolete inventory of $40,000 at March 31, 2007 and 2006 | 11,318,734 | 4,062,086 | |||||

Prepaid expenses | 237,666 | 196,863 | |||||

| TOTAL CURRENT ASSETS | 21,533,510 | 12,663,662 | |||||

| DEFERRED TAX ASSET | 808,566 | 476,384 | |||||

| INVESTMENT IN HONG KONG JOINT VENTURE | 9,072,284 | 7,140,859 | |||||

| PROPERTY AND EQUIPMENT - NET | 3,030,060 | 62,212 | |||||

| GOODWILL | 1,732,562 | - | |||||

| OTHER ASSETS | 18,486 | 15,486 | |||||

| TOTAL ASSETS | $ | 36,195,468 | $ | 20,358,603 | |||

LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||

| CURRENT LIABILITIES | |||||||

| Note payable - factor | $ | 2,254,966 | $ | - | |||

| Notes payable - other | 231,625 | - | |||||

| Current portion of lease obligation | 74,394 | - | |||||

Accounts payable | 6,777,283 | 1,604,845 | |||||

Accrued liabilities: | |||||||

Litigation reserve | 703,193 | 556,787 | |||||

Payroll and employee benefits | 622,083 | 243,197 | |||||

| Commissions and other | 691,981 | 347,205 | |||||

| TOTAL CURRENT LIABILITIES | 11,355,525 | 2,752,034 | |||||

| LONG-TERM OBLIGATIONS | |||||||

| Long-term portion of lease obligation | 168,062 | - | |||||

| COMMITMENTS AND CONTINGENCIES | - | - | |||||

| Minority Interest | - | - | |||||

| SHAREHOLDERS’ EQUITY | |||||||

Common stock, $.01 par value per share; authorized 20,000,000 shares; issued and outstanding 2,475,612 and 2,258,409 shares at March 31, 2007 and March 31, 2006, respectively | 24,756 | 22,584 | |||||

Additional paid-in capital | 13,214,025 | 11,571,939 | |||||

Retained earnings | 11,545,304 | 6,012,046 | |||||

| Other comprehensive loss | (112,204 | ) | - | ||||

| TOTAL SHAREHOLDERS’ EQUITY | 24,671,881 | 17,606,569 | |||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 36,195,468 | $ | 20,358,603 | |||

The accompanying notes are an integral part of these consolidated financial statements | |||||||

| Years Ended March 31 | ||||||||||

| 2007 | 2006 | 2005 | ||||||||

| Net sales | $ | 35,823,575 | $ | 28,894,101 | $ | 23,465,443 | ||||

| Cost of goods sold | 25,146,905 | 19,436,949 | 16,145,615 | |||||||

| GROSS PROFIT | 10,676,670 | 9,457,152 | 7,319,828 | |||||||

| Research and development expense | 296,534 | 246,875 | 277,540 | |||||||

| Selling, general and administrative expense | 7,290,469 | 6,776,688 | 6,191,025 | |||||||

| Loss on foreign currency transactions | 29,576 | - | - | |||||||

| Operating income | 3,060,091 | 2,433,589 | 851,263 | |||||||

| Other income (expense): | ||||||||||

| Interest expense | (73,517 | ) | (48,999 | ) | (85,521 | ) | ||||

| Interest income | 22,023 | 9,668 | - | |||||||

| (51,494 | ) | (39,331 | ) | (85,521 | ) | |||||

| INCOME BEFORE EQUITY IN EARNINGS OF AFFILIATES | 3,008,597 | 2,394,258 | 765,742 | |||||||

| Equity in earnings of Hong Kong Joint Venture | 3,845,960 | 2,109,594 | 2,370,975 | |||||||

| Net income before income taxes and minority interest | 6,854,557 | 4,503,852 | 3,136,717 | |||||||

| Minority interest | - | - | - | |||||||

| Provision for income tax expense (benefit) | 1,321,299 | (96,500 | ) | (281,137 | ) | |||||

| NET INCOME | $ | 5,533,258 | $ | 4,600,352 | $ | 3,417,854 | ||||

| Net income per share: | ||||||||||

| Basic | $ | 2.31 | $ | 2.06 | $ | 1.60 | ||||

| Diluted | $ | 2.23 | $ | 1.89 | $ | 1.45 | ||||

| Shares used in computing net income per share: | ||||||||||

| Basic | 2,398,284 | 2,228,908 | 2,136,599 | |||||||

| Diluted | 2,484,606 | 2,432,705 | 2,352,632 | |||||||

The accompanying notes are an integral part of these consolidated financial statements | ||||||||||

| March 31 | ||||||||

| 2008 | 2007 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 3,863,784 | $ | - | ||||

| Accounts receivable: | ||||||||

| Trade less allowance for doubtful accounts of $15,000 at March 31, 2008 and 2007 | 146,022 | 1,226,917 | ||||||

| Employees and recoverable taxes | 282,083 | 22,073 | ||||||

| Receivable from Hong Kong Joint Venture | 115,656 | 65,801 | ||||||

| 543,761 | 1,314,791 | |||||||

| Amount due from factor | 5,600,408 | 7,158,597 | ||||||

| Inventories, net of allowance for obsolete inventory of $40,000 at March 31, 2008 and 2007 | 5,357,488 | 8,705,316 | ||||||

| Prepaid expenses | 206,197 | 141,577 | ||||||

| Assets held in receivership | 2,850,731 | 8,881,921 | ||||||

| TOTAL CURRENT ASSETS | 18,422,369 | 26,202,202 | ||||||

| DEFERRED TAX ASSET | 1,914,136 | 756,424 | ||||||

| INVESTMENT IN HONG KONG JOINT VENTURE | 9,986,579 | 9,072,284 | ||||||

| PROPERTY AND EQUIPMENT – NET | 130,347 | 146,072 | ||||||

| OTHER ASSETS | 15,486 | 18,486 | ||||||

| TOTAL ASSETS | $ | 30,468,917 | $ | 36,195,468 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Note payable – factor | $ | - | $ | 2,254,966 | ||||

| Accounts payable | 777,342 | 779,192 | ||||||

| Accounts payable – Hong Kong Joint Venture | 1,687,950 | 3,020,091 | ||||||

| Accrued liabilities: | ||||||||

| Litigation reserve | 401,592 | 703,193 | ||||||

| Payroll and employee benefits | 158,057 | 622,083 | ||||||

| Commissions and other | 105,431 | 621,513 | ||||||

| Liabilities held in receivership | 7,823,450 | 3,522,549 | ||||||

| TOTAL CURRENT LIABILITIES | 10,953,822 | 11,523,587 | ||||||

| LONG-TERM OBLIGATIONS | ||||||||

| Long-term obligation - other | 91,160 | - | ||||||

| COMMITMENTS AND CONTINGENCIES | - | - | ||||||

| SHAREHOLDERS’ EQUITY | ||||||||

| Common stock, $.01 par value per share; authorized 20,000,000 shares; issued and outstanding 2,487,867 and 2,475,612 shares at March 31, 2008 and March 31, 2007, respectively | 24,879 | 24,756 | ||||||

| Additional paid-in capital | 13,453,378 | 13,214,025 | ||||||

| Retained earnings | 5,890,023 | 11,545,304 | ||||||

| Other comprehensive income (loss) | 55,655 | (112,204 | ) | |||||

| TOTAL SHAREHOLDERS’ EQUITY | 19,423,935 | 24,671,881 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 30,468,917 | $ | 36,195,468 | ||||

Common Stock | |||||||||||||||||||

Shares | Amount | Additional Paid-In Capital | Retained Earnings | Other Comprehensive Income | Total | ||||||||||||||

| Balance at March 31, 2004 | 2,070,528 | $ | 20,705 | $ | 11,183,393 | ($2,005,825 | ) | - | $ | 9,198,273 | |||||||||

| Fractional shares unissued from 4-for-3 split | (173 | ) | (2 | ) | - | - | - | (2 | ) | ||||||||||

| Issuance of common stock from the exercise of employee stock options | 132,375 | 1,324 | 270,551 | (332 | ) | - | 271,543 | ||||||||||||

| Stock issued in lieu of directors’ fees | 1,267 | 13 | 9,990 | (3 | ) | - | 10,000 | ||||||||||||

| Net income | - | - | - | 3,417,854 | - | 3,417,854 | |||||||||||||

| Balance at March 31, 2005 | 2,203,997 | $ | 22,040 | $ | 11,463,934 | $ | 1,411,694 | - | $ | 12,897,668 | |||||||||

| Issuance of common stock from the exercise of employee stock options | 53,805 | 538 | 98,011 | - | - | 98,549 | |||||||||||||

| Stock issued in lieu of directors’ fees | 607 | 6 | 9,994 | - | - | 10,000 | |||||||||||||

| Net income | - | - | - | 4,600,352 | - | 4,600,352 | |||||||||||||

| Balance at March 31, 2006 | 2,258,409 | $ | 22,584 | 11,571,939 | $ | 6,012,046 | - | $ | 17,606,569 | ||||||||||

| Issuance of common stock from the exercise of employee stock options | 217,203 | 2,172 | 583,486 | - | - | 585,658 | |||||||||||||

| Net income | - | - | - | 5,533,258 | - | - | |||||||||||||

| Effect of currency translation | - | - | - | - | (112,204 | ) | - | ||||||||||||

| Comprehensive income | - | - | - | - | - | 5,421,054 | |||||||||||||

| Tax benefit from exercise of stock options | - | - | 1,058,600 | - | - | 1,058,600 | |||||||||||||

| Balance at March 31, 2007 | 2,475,612 | $ | 24,756 | $ | 13,214,025 | $ | 11,545,304 | $ | (112,204 | ) | $ | 24,671,881 | |||||||

The accompanying notes are an integral part of these consolidated financial statements

F-2

UNIVERSAL SECURITY INSTRUMENTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

| Years Ended March 31 | ||||||||||||

| 2008 | 2007 | 2006 | ||||||||||

| Net sales | $ | 33,871,362 | $ | 32,934,388 | $ | 28,894,101 | ||||||

| Cost of goods sold – acquired from Joint Venture | 20,765,906 | 17,399,943 | 15,355,190 | |||||||||

| Cost of goods sold - other | 5,235,400 | 5,105,129 | 4,081,759 | |||||||||

| GROSS PROFIT | 7,870,056 | 10,429,316 | 9,457,152 | |||||||||

| Research and development expense | 364,510 | 296,502 | 246,875 | |||||||||

| Selling, general and administrative expense | 6,124,213 | 6,546,609 | 6,776,688 | |||||||||

| Operating income | 1,381,333 | 3,586,205 | 2,433,589 | |||||||||

| Other income (expense): | ||||||||||||

| Interest expense | (46,349 | ) | - | (48,999 | ) | |||||||

| Interest income | 16,155 | 21,991 | 9,668 | |||||||||

| 30,194 | 21,991 | (39,331 | ) | |||||||||

| INCOME BEFORE EQUITY IN EARNINGS OF JOINT VENTURE | 1,351,139 | 3,608.196 | 2,394,258 | |||||||||

| Equity in earnings of Hong Kong Joint Venture | 1,985,845 | 3,845,960 | 2,109,594 | |||||||||

| Income from continuing operations before income taxes | 3,336,984 | 7,454,156 | 4,503,852 | |||||||||

| Provision for income tax expense (benefit) | 512,235 | 1,360,790 | (96,500 | ) | ||||||||

| INCOME FROM CONTINUING OPERATIONS | 2,824,749 | 6,093,366 | 4,600,352 | |||||||||

| Discontinued operations | ||||||||||||

| Loss from operations of the discontinued Canadian subsidiary (including impairment loss of $9,013,990 in 2008) | (10,242,663 | ) | (590,139 | ) | - | |||||||

| Income tax benefit – discontinued operations | 1,849,000 | 30,031 | - | |||||||||

| Loss from discontinued operations | (8,393,663 | ) | (560,108 | ) | - | |||||||

| NET (LOSS) INCOME | $ | (5,568,914 | ) | $ | 5,533,258 | $ | 4,600,352 | |||||

| Income (loss) per share: | ||||||||||||

| Basic – from continuing operations | $ | 1.14 | $ | 2.54 | $ | 2.06 | ||||||

| Basic – from discontinued operations | $ | (3.38 | ) | $ | (0.23 | ) | $ | - | ||||

| Basic – net (loss) income | $ | (2.24 | ) | $ | 2.31 | $ | 2.06 | |||||

| Diluted – from continuing operations | $ | 1.13 | $ | 2.45 | $ | 1.89 | ||||||

| Diluted – from discontinued operations | $ | (3.35 | ) | $ | (0.23 | ) | $ | - | ||||

| Diluted – net (loss) income | $ | (2.23 | ) | $ | 2.23 | $ | 1.89 | |||||

| Shares used in computing net income per share: | ||||||||||||

| Basic | 2,484,192 | 2,398,284 | 2,228,908 | |||||||||

| Diluted | 2,502,017 | 2,484,606 | 2,432,705 | |||||||||

The accompanying notes are an integral part of these consolidated financial statements

F-3

UNIVERSAL SECURITY INSTRUMENTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Common Stock | ||||||||||||||||||||||||

Shares | Amount | Additional Paid-In Capital | Retained Earnings | Other Comprehensive Income | Total | |||||||||||||||||||

| Balance at April 1, 2005 | 2,203,997 | $ | 22,040 | $ | 11,463,934 | $ | 1,411,694 | - | $ | 12,897,668 | ||||||||||||||

| Issuance of common stock from the exercise of employee stock options | 53,805 | 538 | 98,011 | - | - | 98,549 | ||||||||||||||||||

| Stock issued in lieu of directors’ fees | 607 | 6 | 9,994 | - | - | 10,000 | ||||||||||||||||||

| Net income | - | - | - | 4,600,352 | - | 4,600,352 | ||||||||||||||||||

| Balance at March 31, 2006 | 2,258,409 | $ | 22,584 | 11,571,939 | $ | 6,012,046 | - | $ | 17,606,569 | |||||||||||||||

| Issuance of common stock from the exercise of employee stock options | 217,203 | 2,172 | 583,486 | - | - | 585,658 | ||||||||||||||||||

| Stock based compensation | 29,411 | 29,411 | ||||||||||||||||||||||

| Comprehensive income: | - | - | - | - | - | |||||||||||||||||||

| Effect of currency translation | - | - | - | - | (112,204 | ) | - | |||||||||||||||||

| Net income | - | - | - | 5,533,258 | - | 5,421,054 | ||||||||||||||||||

| Tax benefit from exercise of stock options | - | - | 1,029,189 | - | - | 1,029,189 | ||||||||||||||||||

| Balance at March 31, 2007 | 2,475,612 | $ | 24,756 | $ | 13,214,025 | $ | 11,545,304 | $ | (112,204 | ) | $ | 24,671,881 | ||||||||||||

| Recognition of uncertain tax provisions | (86,367 | ) | (86,367 | ) | ||||||||||||||||||||

| Issuance of common stock from the exercise of employee stock options | 12,255 | 123 | 126,555 | - | - | 126,678 | ||||||||||||||||||

| Stock based compensation | 19,863 | 19,863 | ||||||||||||||||||||||

| Comprehensive income: | - | - | - | - | - | |||||||||||||||||||

| Effect of currency translation | - | - | - | 167,859 | - | |||||||||||||||||||

| Net loss | - | - | - | (5,568,914 | ) | - | (5,401,055 | ) | ||||||||||||||||

| Tax benefit from exercise of stock options | - | - | 92,935 | - | - | 92,935 | ||||||||||||||||||

| Balance at March 31, 2008 | 2,487,867 | $ | 24,879 | $ | 13,453,378 | $ | 5,890,023 | $ | 55,655 | $ | 19,423.935 | |||||||||||||

F-4

UNIVERSAL SECURITY INSTRUMENTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

| Years Ended March 31, | ||||||||||||

| 2008 | 2007 | 2006 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||||

| OPERATING ACTIVITIES | ||||||||||||

| Net (loss) income | $ | (5,568,914 | ) | $ | 5,533,258 | $ | 4,600,352 | |||||

| Adjustments to reconcile net income to net cash used in operating activities: | ||||||||||||

| Operations of discontinued subsidiary | 7,904,780 | (167,374 | ) | - | ||||||||

| Depreciation and amortization | 46,503 | 39,449 | 28,338 | |||||||||

| Stock based compensation | 19,863 | 29,411 | ||||||||||

| Stock issued to directors in lieu of fees | - | - | 10,000 | |||||||||

| Increase in deferred taxes | (1,157,711 | ) | (280,040 | ) | (124,604 | ) | ||||||

| Earnings of the Hong Kong Joint Venture | (1,985,845 | ) | (3,845,960 | ) | (2,109,594 | ) | ||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Decrease (increase) in accounts receivable and amounts due from factor | 2,329,219 | (3,084,166 | ) | (958,878 | ) | |||||||

| Decrease (increase) in inventories | 3,347,828 | (4,643,230 | ) | 772,400 | ||||||||

| (Increase) decrease in prepaid expenses | (64,620 | ) | 55,286 | (51,469 | ) | |||||||

| (Decrease) increase in accounts payable and accrued expenses | (2,524,540 | ) | 2,994,038 | (400,248 | ) | |||||||

| Decrease (increase) in other assets | 3,000 | (3,000 | ) | - | ||||||||

| NET CASH PROVIDED (USED IN) BY OPERATING ACTIVITIES | 2,349,563 | (3,372,328 | ) | 1,766,297 | ||||||||

| INVESTING ACTIVITIES: | ||||||||||||

| Cash distributions from Joint Venture | 1,071,549 | 1,914,535 | 1,100,216 | |||||||||

| Purchase of equipment | (30,778 | ) | (123,309 | ) | (8,858 | ) | ||||||

| Activities of discontinued subsidiary | (1,584,733 | ) | (3,194,185 | ) | - | |||||||

| NET CASH (USED IN) PROVIDED BY INVESTING ACTIVITIES | (543,962 | ) | (1,402,959 | ) | 1,091,358 | |||||||

| FINANCING ACTIVITIES: | ||||||||||||

| Activities of discontinued subsidiary | 4,012,046 | (2,087,661 | ) | - | ||||||||

| Borrowing from factor | - | 2,254,966 | - | |||||||||

| Principal payment of notes payable | (2,254,966 | ) | - | - | ||||||||

| Proceeds from issuance of common stock from exercise of employee stock options | 126,678 | 585,658 | 98,549 | |||||||||

| Tax benefit from exercise of stock options | 92,935 | 1,029,189 | - | |||||||||

| NET CASH PROVIDED BY FINANCING ACTIVITIES | 1,976,693 | 1,782,152 | 98,549 | |||||||||

| Effects of exchange rate on cash | 81,490 | (22,356 | ) | - | ||||||||

| INCREASE (DECREASE) IN CASH | 3,863,784 | (3,015,491 | ) | 2,956,204 | ||||||||

| Cash at beginning of period | - | 3,015,491 | 59,287 | |||||||||

| CASH AT END OF PERIOD | $ | 3,863,784 | $ | - | $ | 3,015,491 | ||||||

| Supplemental information: | ||||||||||||

| Interest paid | $ | 30,194 | $ | 23,750 | $ | 48,999 | ||||||

| Income taxes paid | $ | 227,000 | $ | 109,500 | $ | 50,320 | ||||||

| Non-cash investing transactions: | ||||||||||||

| Issuance of 455 shares in 2007 and 950 shares in 2006 in lieu of directors’ fees and accrued compensation | $ | - | $ | - | $ | 10,000 | ||||||

| Offset of trade payables due the Hong Kong Joint Venture in lieu of cash distributions | $ | 250,000 | $ | 250,000 | $ | - | ||||||

| Years Ended March 31, | ||||||||||

| 2007 | 2006 | 2005 | ||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||

| OPERATING ACTIVITIES | ||||||||||

| Net income | $ | 5,533,258 | $ | 4,600,352 | $ | 3,417,854 | ||||

Adjustments to reconcile net income to net cash used in operating activities: | ||||||||||

| Depreciation and amortization | 150,972 | 28,338 | 34,048 | |||||||

| Stock issued to directors in lieu of fees | - | 10,000 | 10,000 | |||||||

| (Increase) in deferred taxes | (318,227 | ) | (124,604 | ) | (294,881 | ) | ||||

| Earnings of the Hong Kong Joint Venture | (3,845,960 | ) | (2,109,594 | ) | (2,485,302 | ) | ||||

| Changes in operating assets and liabilities: | ||||||||||

| (Increase) in accounts receivable and amounts due from factor | (3,187,222 | ) | (958,878 | ) | (1,204,719 | ) | ||||

| (Increase) decrease in inventories | (5,430,731 | ) | 772,400 | (1,966,836 | ) | |||||

| Decrease (increase) in prepaid expenses | 28,079 | (51,469 | ) | (38,342 | ) | |||||

| Increase (decrease) in accounts payable and accrued expenses | 3,903,184 | (400,248 | ) | 1,430,096 | ||||||

| Increase in other assets | (3,000 | ) | - | - | ||||||

| NET CASH (USED IN) PROVIDED BY OPERATING ACTIVITIES | (3,169,647 | ) | 1,766,297 | (1,098,082 | ) | |||||

| INVESTING ACTIVITIES: | ||||||||||

| Cash distributions from Joint Venture | 1,914,535 | 1,100,216 | 727,167 | |||||||

| Purchase of equipment | (1,130,474 | ) | (8,858 | ) | (22,307 | ) | ||||

| Acquisition of subsidiaries, net of cash acquired | (1,923,623 | ) | - | - | ||||||

| NET CASH (USED IN) PROVIDED BY INVESTING ACTIVITIES | (1,139,562 | ) | 1,091,358 | 704,860 | ||||||

| FINANCING ACTIVITIES: | ||||||||||

| Borrowing from factor | 2,254,966 | - | - | |||||||

| Principal payment of notes payable | (2,333,036 | ) | - | - | ||||||

| Principal payments of lease obligations | - | - | (7,224 | ) | ||||||

| Proceeds from issuance of common stock from exercise of employee stock options | 585,658 | 98,549 | 271,543 | |||||||

| Tax benefit from exercise of stock options | 1,058,600 | - | - | |||||||

| NET CASH PROVIDED BY FINANCING ACTIVITIES | 1,566,188 | 98,549 | 264,319 | |||||||

| Effects of exchange rate on cash | (31,925 | ) | - | - | ||||||

| (DECREASE) INCREASE IN CASH | (2,774,946 | ) | 2,956,204 | (128,903 | ) | |||||

| Cash at beginning of period | 3,015,491 | 59,287 | 188,190 | |||||||

| CASH AT END OF PERIOD | $ | 240,545 | $ | 3,015,491 | $ | 59,287 | ||||

| Supplemental information: | ||||||||||

| Interest paid | $ | 73,517 | $ | 48,999 | $ | 85,521 | ||||

| Income taxes paid | $ | 109,500 | $ | 50,320 | $ | 17,000 | ||||

| Non-cash investing transactions: | ||||||||||

Issuance of 455 shares in 2006 and 950 shares in 2005 in lieu of directors’ fees and accrued compensation | $ | - | $ | 10,000 | $ | 10,000 | ||||

| Offset of trade payables due the Hong Kong Joint Venture in lieu of cash Distributions | $ | 250,000 | $ | - | $ | 458,940 | ||||

The accompanying notes are an integral part of these consolidated financial statements | ||||||||||

The accompanying notes are an integral part of these consolidated financial statements

F-5

UNIVERSAL SECURITY INSTRUMENTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE A -– NATURE OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES