FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

New Jersey | 52-1273725 | |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification Number) |

(Title of Class)

Title of each class | Name of each exchange on which registered | |

| Common Stock, no par value | NASDAQ |

Large Accelerated Filer | Accelerated Filerx | Non-Accelerated¨ | Small Reporting Company |

February 28, 2014

Common Stock, no par value: 16,290,70016,369,012 shares

| Page | |||||

| PART I | |||||

Item 1. | Business | 3 | ||||

| Item 1A. | Risk Factors | 18 | ||||

| Item 1B. | Unresolved Staff Comments | 25 | ||||

Item 2.

| Properties | 25 | ||||

Item 3. | Legal Proceedings | 26 | ||||

Item 3A. | Executive Officers of the Registrant | 27 | ||||

Item 4.

| Mine Safety Disclosures | 28 | ||||

PART II | ||||||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 29 | ||||

Item 6. | Selected Financial Data | 30 | ||||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 33 | ||||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 65 | ||||

Item 8. | Financial Statements and Supplementary Data: | F-1 | ||||

| F-2 | ||||||

| Center Bancorp, Inc. and Subsidiaries: | ||||||

| Consolidated Statements of Condition | F-4 | |||||

| Consolidated Statements of Income | F-5 | |||||

| Consolidated Statements of Comprehensive Income | F-6 | |||||

| Consolidated Statements of Changes in Stockholders’ Equity | F-7 | |||||

| Consolidated Statements of Cash Flows | F-8 | |||||

| Notes to Consolidated Financial Statements | F-9 | |||||

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 66 | ||||

Item 9A. | Controls and Procedures | 66 | ||||

Item 9B. | Other Information | 69 | ||||

PART III | ||||||

Item 10. | Directors, Executive Officers and Corporate Governance | 70 | ||||

Item 11. | Executive Compensation | 70 | ||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 70 | ||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 70 | ||||

| Item 14. | Principal Accounting Fees and Services | 70 | ||||

PART IV | ||||||

| ||||||

Item 15. | Exhibits, | 71 | ||||

| Signatures | ||||||

| 74 | ||||||

i

| 2 | ||

The

| 3 | ||

During 2001 and 2003, the Corporation formed statutory business trusts, which exist for the exclusive purpose of (i) issuing trust securities representing undivided beneficial interests in the assets of a trust; (ii) investing the gross proceedsowns some of the trust securities in junior subordinated deferrable interest debentures (subordinated debentures) of the Corporation; and (iii) engaging in only those activities necessaryreal estate loans. All subsidiaries mentioned above are directly or incidental thereto. These subordinated debentures and the related income effects are not eliminated in the consolidated financial statements as the statutory business trusts are not consolidated in accordance with Financial Accounting Standards Board (“FASB”) FASB ASC 810-10 (previously FASB interpretation No. 46(R), “Consolidation of Variable Interest Entities.” Distributions on the subordinated debenturesindirectly wholly owned by the subsidiary trusts have been classified as interest expense in the Consolidated Statements of Income.

The Corporation, issued $10.3 million of subordinated debentures in 2001 and $5.2 million of subordinated debentures in 2003. On December 18, 2006,except that the Corporation redeemed $10.3 millionowns less than 100 percent of subordinated debentures and dissolved Center Bancorp, Inc. Statutory Trust I. At December 31, 2010, the $5.2 millionpreferred stock of these securities still outstanding were includedthe REIT subsidiary. A REIT must have 100 or more shareholders to quality as a componentREIT. The REIT has issued less than 20 percent of Tierits outstanding non-voting preferred stock to individuals, primarily bank personnel and directors.

During 2002,2012, the Bank established two investment subsidiariesassumed all of the deposits and certain other liabilities and acquired certain assets of Saddle River Valley Bank, a New Jersey State-chartered bank, pursuant to hold portionsthe terms of its securities portfolio. At December 2007, under a planPurchase and Assumption Agreement, dated as of liquidation adopted byFebruary 1, 2012, among the Bank, oneSaddle River Valley Bank and Saddle River Valley Bancorp. This purchase and assumption was in keeping with the Bank’s strategy to expand its base of operations into Northern New Jersey.

The Bank, through its subsidiary, Center Financial Group LLC, provides financial services, including brokerage services, insurance and annuities, mutual funds and financial planning. In the fourth quarter of 2007, the Corporation formed a title insurance partnership, Center Title LLC, with Progressive Title Company in Parsippany, New Jersey to provide title services in connection with the closing of real estate transactions. In January 2008, the Corporation formed a title insurance partnership, Union Title LLC, with Elite Title Abstract of West Caldwell, New Jersey to provide title services in connection with the closing of real estate loan transactions. Our partnerships with both title companies were liquidated during December, 2009.

| 4 | ||

Bank liquidated this business.

On November 9, 2007, the FRB approved the Parent Corporation’s application to become a Financial Holding Company. A Financial Holding Company may perform the following activities: insurance underwriting, securities dealing and underwriting, financial and investment advisory services, merchant banking and issuing or selling security interests in bank-eligible assets. Financial Holding Companies may also engage in any other activity that the FRB determines to be financial in nature or incidental to financial activities after consultation with the Secretary of the Treasury. A Financial Holding Company may also engage in any non-financial activity that the FRB determines is complementary to a financial activity and does not pose a substantial risk to the safety or soundness of depository institutions or the financial system. As of December 31, 2009 the Parent Corporation officially rescinded its status as a financial services holding company as a result of the discontinuation of its title insurance activities.

ratios and Community Reinvestment Act ratings and anti-money laundering policies are generally prerequisites to obtaining federal regulatory approval to make acquisitions. The policy of the FRB provides that a bank holding company is expected to act as a source of financial strength to its subsidiary bank and to commit resources to support the subsidiary bank in circumstances in which it might not do so absent that policy.

| 5 | ||

| • | Minimum Capital Requirements. The Dodd-Frank Act requires new capital rules and the application of the same leverage and risk-based capital requirements that apply to insured depository institutions to most bank holding companies. In addition to making bank holding companies subject to the same capital requirements as their bank subsidiaries, these provisions (often referred to as the Collins Amendment to the Dodd-Frank Act) were also intended to eliminate or significantly reduce the use of hybrid capital instruments, especially trust preferred securities, as regulatory capital. The Dodd-Frank Act also requires banking regulators to seek to make capital standards countercyclical, so that the required levels of capital increase in times of economic expansion and decrease in times of economic contraction. See “New Capital Rules” for a description of new capital requirements adopted by U.S. federal banking regulators in 2013 and the treatment of trust preferred securities under such rules. |

| • | Basel III.On July 9, 2013, the Office of the Comptroller of the Currency approved a final rule revising regulatory capital rules applicable to national banks, implementing Basel III. This rule redefines Tier 1 capital as two components (Common Equity Tier 1 and Additional Tier 1), creates a new capital ratio (Common Equity Tier 1 Risk-based Capital Ratio) and implements a capital conservation buffer. It also revises the prompt corrective action thresholds and makes changes to risk weighs for certain assets and off-balance-sheet exposures. Banks are required to transition into the new rule beginning on January 1, 2015, although, based on the Corporation’s capital levels and balance sheet composition at September 30, 2013, the Corporation does not believe implementation of the new rule will have a material impact on the Corporation’s capital needs; however, due to the complexity of the rules, the Corporation will continue to evaluate the impact of these changes to our regulatory capital of Center Bancorp and Union Center National Bank. This statement regarding the impact of the new regulations constitutes a forward-looking statement under the Private Securities Litigation Reform Act of 1995. Actual results could differ materially from this statement as a result of various factors, including modifications to the new regulations that may be adopted prior to the effective dates of the new regulations. | |

| • | The Consumer Financial Protection Bureau (“Bureau”). The Dodd-Frank Act created the Bureau within the Federal Reserve. The Bureau is tasked with establishing and implementing rules and regulations under certain federal consumer protection laws with respect to the conduct of providers of certain consumer financial products and services. The Bureau has rulemaking authority over many of the statutes governing products and services offered to bank consumers. In addition, the Dodd-Frank Act permits states to adopt consumer protection laws and regulations that are more stringent than those regulations promulgated by the Bureau and state attorneys general are permitted to enforce consumer protection rules adopted by the Bureau against state-chartered institutions. The Consumer Financial Protection Bureau has examination and enforcement authority over all banks and savings institutions with more than $10 billion in assets. Institutions with $10 billion or less in assets, such as the Bank, will continue to be examined for compliance with the consumer laws by their primary bank regulators. |

| 6 | ||

| • | Deposit Insurance. The Dodd-Frank Act makes permanent the $250,000 deposit insurance limit for insured deposits. Amendments to the Federal Deposit Insurance Act also revise the assessment base against which an insured depository institution’s deposit insurance premiums paid to the Deposit Insurance Fund (“DIF”) will be calculated. Under the amendments, the assessment base will no longer be the institution’s deposit base, but rather its average consolidated total assets less its average tangible equity during the assessment period. Additionally, the Dodd-Frank Act makes changes to the minimum designated reserve ratio of the DIF, increasing the minimum from 1.15 percent to 1.35 percent of the estimated amount of total insured deposits and eliminating the requirement that the FDIC pay dividends to depository institutions when the reserve ratio exceeds certain thresholds. In December 2010, the FDIC increased the designated reserve ratio to 2.0 percent. |

| • | Shareholder Votes . The Dodd-Frank Act requires publicly traded companies like Center Bancorp to give shareholders a non-binding vote on executive compensation and so-called “golden parachute” payments in certain circumstances. The Dodd-Frank Act also authorizes the SEC to promulgate rules that would allow shareholders to nominate their own candidates using a company’s proxy materials. |

| • | Transactions with Affiliates. The Dodd-Frank Act enhances the requirements for certain transactions with affiliates under Section 23A and 23B of the Federal Reserve Act, including an expansion of the definition of “covered transactions” and increasing the amount of time for which collateral requirements regarding covered transactions must be maintained. These requirements became effective during 2011. |

| • | Transactions with Insiders. Insider transaction limitations are expanded through the strengthening of loan restrictions to insiders and the expansion of the types of transactions subject to the various limits, including derivative transactions, repurchase agreements, reverse repurchase agreements and securities lending or borrowing transactions. Restrictions are also placed on certain asset sales to and from an insider to an institution, including requirements that such sales be on market terms and, in certain circumstances, approved by the institution’s board of directors. These requirements became effective during 2011. |

| • | Enhanced Lending Limits. The Dodd-Frank Act strengthened the previous limits on a depository institution’s credit exposure to one borrower which limited a depository institution’s ability to extend credit to one person (or group of related persons) in an amount exceeding certain thresholds. The Dodd-Frank Act expanded the scope of these restrictions to include credit exposure arising from derivative transactions, repurchase agreements, and securities lending and borrowing transactions. |

| • | Compensation Practices. The Dodd-Frank Act provides that the appropriate federal regulators must establish standards prohibiting as an unsafe and unsound practice any compensation plan of a bank holding company or other “covered financial institution” that provides an insider or other employee with “excessive compensation” or compensation that gives rise to excessive risk or could lead to a material financial loss to such firm. In June 2010, prior to the Dodd-Frank Act, the bank regulatory agencies promulgated theInteragency Guidance on Sound Incentive Compensation Policies , which set forth three key principles concerning incentive compensation arrangements: |

| 7 | ||

The Federal Reserve Board has issued Regulation W, which codifies prior regulations under Sections 23A and 23B of the Federal Reserve Act and interpretative guidance with respect to affiliate transactions. Regulation W incorporates the exemption from the affiliate transaction rules but expands the exemption to cover the purchase of any type of loan or extension of credit from an affiliate. Affiliates of a bank include, among other entities, the bank’s holding company and companies that are under common control with the bank. The Parent Corporation is considered to be an affiliate of the Bank. In general, subject to certain specified exemptions, a bank or its subsidiaries are limited in their ability to engage in “covered transactions” with affiliates:

In addition,

| 8 | ||

required to maintain a leverage ratio of 3% plus an additional cushion of at least 100 to 200 basis points. The Parent Corporation’s leverage ratio was 9.909.69 percent at December 31, 2010.

2013.

The OCC has established higher minimum capital ratios for the Bank effective as of December 31, 2009: Tier 1 Risk-Based Capital of 10.0 percent, Total Risk-Based Capital of 12.0 percent and Tier 1 Leverage Capital of 8.0 percent. At December 31, 2010, the Bank’s capital ratios were all above the minimum levels required.

| 9 | ||

Basel II also would set capital requirements for operational risk and refine the existing capital requirements for market risk exposures. The Corporation is not required to comply with the advanced approaches of Basel II.

For banks inFederal Reserve Board, the United States, amongFDIC and the most significantComptroller of the Currency adopted final rules (the “New Rules”), which implement certain provisions of Basel III concerningand the Dodd-Frank Act. The New Rules replace the general risk-based capital arerules of the following:

| · | Common Equity Tier 1 Capital Ratio of 4.5% (this is a new concept and requirement, and is referred to as the “CET1”); |

| · | Tier 1 Capital Ratio (CET1 capital plus “Additional Tier 1 capital”) of 6.0%; and |

| · | Total Capital Ratio (Tier 1 capital plus Tier 2 capital) of 8.0%. |

| 10 | ||

| · | CET1 of 7%; |

| · | Tier 1 Capital Ratio of 8.5%; and |

| · | Total Capital Ratio of 10.5%. |

The Basel III provisions on liquidity include complex criteria establishing the LCR and NSFR. Although Basel III is described as a “final text,” it is subject to the resolution of certain issues and to further guidance and modification, as well as to adoption by United States banking regulators, including decisions as to whether and to what extent it will apply to United States banks that are not large, internationally active banks.

| 11 | ||

Under current regulations,up to at least the FDIC utilizes a risk-based assessment system that imposesstandard maximum deposit insurance premiums based upon a risk matrix that takes into account a bank’s capital levelamount of $250,000 per depositor at each separately chartered FDIC-insured depository institution, and supervisory rating, known as a “CAMEL rating.” The assessment rate(ii) funds deposited in IOLTAs will no longer be insured under Section 343 of the Dodd-Frank Act, but because IOLTAs are fiduciary accounts, they generally qualify for an individual institution is determined according to a formula basedpass-through coverage on a weighted average of the institution’s individual CAMELS component ratings plus six financial ratios. Well-capitalized institutions (generally those with CAMELS composite ratings of 1 or 2) are grouped in Risk Category I and their initial assessment base rate for deposit insurance is set at an annual rate of between 12 and 16 basis points. The initial base assessment rate for institutions in Risk Categories II, III, and IV is set at annual rates of 22, 31 and 50 basis points, respectively. These base rates are then adjusted to a final assessment rate based on an institution’s brokered deposits, secured liabilities and unsecured debt. In 2010 the Bank recognized a total of $1.8 million in FDIC expense of the $5.7 million assessments prepaid in 2009.

On May 22, 2009, the Board of Directors of the FDIC adopted a final rule imposing a special assessment on the entire banking industry. The special assessment was calculated as five basis points times each insured depository institution’s assets minus Tier 1 capital, as reported in the report of condition as of June 30, 2009 and would not exceed ten times the institution’s assessment base for the second quarter of 2009 risk-based assessment. This special assessment, which totaled $1.2 million, was remitted by the Bank on September 30, 2009.

per-client basis.

three basis points. Any prepaid assessment in excess of the amounts that are subsequently determined to be actually due to the FDIC by June 30, 2013, willwere required to be returned to the institution at that time.

In November 2010, As of December 31, 2013 the Bank recognized a total of $5.4 million in FDIC expense of the $5.7 million assessments prepaid on December 30, 2009, and received a refund of $334,000 in May of 2013.

The Company paid $1.1 million in total FDIC assessments in 2013, as compared to $1.2 million in 2012.

| · | allows bank holding companies meeting management, capital, and Community Reinvestment Act standards to engage in a substantially broader range of non-banking activities than previously was permissible, including insurance underwriting and making merchant banking investments in commercial and financial companies; if a bank holding company elects to become a financial holding company, it files a certification, effective in 30 days, and thereafter may engage in certain financial activities without further approvals; |

| · | allows insurers and other financial services companies to acquire banks; |

| · | removes various restrictions that previously applied to bank holding company ownership of securities firms and mutual fund advisory companies; and |

| · | establishes the overall regulatory structure applicable to bank holding companies that also engage in insurance and securities operations. |

The Modernization Act also modified other financial laws, including laws related to financial privacy and community reinvestment.

The Gramm-Leach-Bliley Financial Modernization Act of 1999 became effective in early 2000. The Modernization Act:

The Modernization Act also modified other financial laws, including laws related to financial privacy and community reinvestment.

Under the Community Reinvestment Act (“CRA”), as implemented by OCC regulations, a national bank has a continuing and affirmative obligation consistent with its safe and sound operation to help meet the credit needs of its entire community, including low and moderate income neighborhoods. The CRA does not establish specific lending requirements or programs for financial institutions nor does it limit an institution’s discretion to develop the types of products and services that it believes are best suited to its particular community, consistent with the CRA. The CRA requires the OCC, in connection with its examination of a national bank, to assess the bank’s record of meeting the credit needs of its community and to take such record into account in its evaluation of certain applications by such bank.

| 12 | ||

In response to the events of September 11, 2001, the

| · | All financial institutions must establish anti-money laundering programs that include, at a minimum: (i) internal policies, procedures, and controls; (ii) specific designation of an anti-money laundering compliance officer; (iii) ongoing employee training programs; and (iv) an independent audit function to test the anti-money laundering program. |

| · | The Secretary of the Department of Treasury, in conjunction with other bank regulators, is authorized to issue regulations that provide for minimum standards with respect to customer identification at the time new accounts are opened. |

| · | Financial institutions that establish, maintain, administer, or manage private banking accounts or correspondent accounts in the United States for non-United States persons or their representatives (including foreign individuals visiting the United States) are required to establish appropriate, specific and, where necessary, enhanced due diligence policies, procedures, and controls designed to detect and report money laundering. |

| · | Financial institutions are prohibited from establishing, maintaining, administering or managing correspondent accounts for foreign shell banks (foreign banks that do not have a physical presence in any country), and will be subject to certain record keeping obligations with respect to correspondent accounts of foreign banks. |

| · | Bank regulators are directed to consider a holding company’s effectiveness in combating money laundering when ruling on Federal Reserve Act and Bank Merger Act applications. |

The United States Treasury Department has issued a number of implementing regulations which address various requirements of the USA PATRIOT Act and are applicable to financial institutions such as the Bank. These regulations impose obligations on financial institutions to maintain appropriate policies, procedures and controls to detect, prevent and report money laundering and terrorist financing and to verify the identity of their customers.

The SOA generally applies to all companies, both U.S. and non-U.S., that file or are required to file periodic reports with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934 (the “Exchange Act”).

The SOA includes specific disclosure requirements and corporate governance rules, requires the SEC and securities exchanges to adopt extensive additional disclosure, corporate governance and other related rules and mandates further studies of certain issues by the SEC. The SOA addresses, among other matters:

In response to recent unprecedented market turmoil, EESA was enacted on October 3, 2008. EESA authorizes the U.S. Treasury Departmentpreferred stock (the “treasury”“TARP Preferred Stock”) to provide upthe United States Treasury pursuant to $700 billion in funding for the financial services industry. Pursuant to the EESA, the Treasury was initially authorized to use $350 billion for theCongress’ Troubled Asset Relief Program (“TARP”). Of this amount,

| 13 | ||

| Relative Increase in QSBL to Baseline | Dividend Rate (for each of the 2nd – 10th Dividend Periods) | ||

| 0% or less | 5 | % | |

| More than 0%, but less than 2.5% | 5 | % | |

| 2.5% or more, but less than 5% | 4 | % | |

| 5% or more, but less than 7.5% | 3 | % | |

| 7.5% or more, but less than 10% | 2 | % | |

| 10% or more | 1 | % |

| 0% or less | 7 | % | |

| More than 0%, but less than 2.5% | 5 | % | |

| 2.5% or more, but less than 5% | 4 | % | |

| 5% or more, but less than 7.5% | 3 | % | |

| 7.5% or more, but less than 10% | 2 | % | |

| 10% or more | 1 | % |

| 14 | ||

Participants in the TARP Capital Purchase Program were required to accept several compensation-related limitations associated with this Program. In January 2009, five executive officers of the Corporation agreed in writing to accept the compensation standards in existence at that time under the Capital Purchase Program and thereby cap or eliminate some of their contractual or legal rights. The provisions agreed to were as follows:

During the CPP Covered Period, the Corporation is not permitted to take federal income tax deductions for compensation paid to the senior executive officers in excess of $500,000 per year, subject to certain exceptions.

On February 17, 2009, the American Recovery and Reinvestment Act of 2009 (the “Stimulus Act”) was enacted. The Stimulus Act contains several provisions designed to establish executive compensation and governance standards for financial institutions (such as the Corporation) that received or will receive financial assistance under TARP. In certain instances, the Stimulus Act modified the compensation-related limitations contained in the TARP Capital Purchase Program; in addition, the Stimulus Act created additional compensation-related limitations and directed the Treasury to establish standards for executive compensation applicable to participants in TARP. In their January 2009 agreements, the Corporation’s executives did not waive their rights with respect to the provisions implemented by the Stimulus Act; other employees now covered by these provisions were not asked and did not agree to waive their rights. The compensation-related limitations applicable to the Corporation which have been added or modified by the Stimulus Act are as follows, which provisions are expected to be included in standards established by the Treasury:

The Dodd-Frank Act, which was signed into law on July 21, 2010, will have a broad impact on the financial services industry, including significant regulatory and compliance changes. Many of the requirements called for in the Dodd-Frank Act will be implemented over time and most will be subject to implementing regulations over the course of several years.

Among other things, the Dodd-Frank Act:

While it is difficult to predict at this time what specific impact the Dodd-Frank Act and the yet to be written implementing rules and regulations will have on the Corporation, management expects that at a minimum the Corporation’s operating and compliance costs will increase, and our interest expense could increase.

From time to time proposals are made in the U.S. Congress and before various bank regulatory authorities, which would alter the policies of and place restrictions on different types of banking operations. It is impossible to predict the impact, if any, of potential legislative trends on the business of the Parent Corporation and the Bank.

of the Bank’s net profits for that year combined with the retained profits for the two preceding years. The Bank’s current MOU provides that the Bank cannot declare a dividend without the prior approval of the OCC.

| 15 | ||

the SBLF Preferred Stock, or repurchase shares of any such stock, only if after payment of such dividends or repurchase of such shares, the Parent Corporation’s Tier 1 Capital would be at least equal to the so-called Tier 1 Dividend Threshold, excluding any subsequent net charge-offs and any redemption of the SBLF Preferred Stock.

Certain lending authorities are granted to loan officers based upon each officer’s position and experience. However, large dollar loans and lending lines are reported to and are subject to the approval of the Bank’s loan committees and/or board of directors. Either the Chairman of the Board or President chairs the loan committees.

| 16 | ||

| Loan Category | Loan-to-Value Limit | |||

| Raw Land | 65 | % | ||

| Land Development | 75 | % | ||

| Commercial, Multifamily and Other Non-residential construction | 80 | % | ||

| Construction: One to Four Family Residential | 85 | % | ||

| Improved Property (excluding One to Four Family Residential) | 85 | % | ||

| Owner-Occupied One to Four Family and Home Equity* | 90 | % | ||

| * | For a permanent mortgage or home equity loan on owner occupied one to four family residential property with |

The risk elements identified by the Corporation include non-performing loans, loans past due ninety days or more as to interest or principal payments but not placed on a non-accrual status, potential problem loans, other real estate owned, net, and other non-performing interest-earning assets.

| 17 | ||

As described under “Item 1 — Business — Regulation of Bank Subsidiary,” the Bank is subject to a MOU with the OCC, pursuantstringent capital requirements which could require us to which it has agreedseek capital at times when capital may be expensive or unavailable to take various actions to improve the Bank’s capital position and profitability. The OCC has also established higher minimum capital ratios for the Bank than the regulatory minimums. While management is committed to addressing and resolving the issues raised by the OCC and has initiated corrective actions to comply with various requirements of the MOU, no assurances can be given that the OCC will find the Bank’s compliance plan satisfactory, or that the Bank will not be subject to further supervisory action by the OCC. us.

| · | we potentially face increased regulation of our industry and compliance with such regulation may increase our costs and limit our ability to pursue business opportunities; |

| · | customer demand for loans secured by real estate could be reduced due to weaker economic conditions, an increase in unemployment, a decrease in real estate values or an increase in interest rates; |

| · | the process we use to estimate losses inherent in our credit exposure requires difficult, subjective and complex judgments, including forecasts of economic conditions and how these economic conditions might impair the ability of our borrowers to repay their loans; |

| · | the level of uncertainty concerning economic conditions may adversely affect the accuracy of our estimates which may, in turn, impact the reliability of the process; |

| · | the value of the portfolio of investment securities that we hold may be adversely affected; and |

| 18 | ||

| · | inflation; |

| · | recession; |

| · | a rise in unemployment; |

| · | tightening money supply; and |

| · | domestic and international disorder and instability in domestic and foreign financial markets, among other things. |

Changes in the interest rate environment may reduce profits. We expect that we will continue to realize income from the differential or “spread” between the interest we earn on loans, securities and other interest-earning assets, and the interest we pay on deposits, borrowings and other interest-bearing liabilities. Net interest spreads are affected by the difference between the maturities and repricing characteristics of interest-earning assets and interest-bearing liabilities. Changes in levels of market interest rates could materially and adversely affect our net interest spread, asset quality, levels of prepayments and cash flows as well as the market value of our securities portfolio and overall profitability.

| 19 | ||

regional and community banks to reduce their exposure to the risks of other banks. In addition, many of the larger correspondent lenders have reduced or even eliminated federal funds lines for their correspondent customers. Furthermore, regional and community banks generally have less access to the capital markets than do the national and super-regional banks because of their smaller size and limited analyst coverage. Any decline in available funding could adversely impact our ability to originate loans, invest in securities, meet our expenses, or fulfill obligations such as repaying our borrowings or meeting deposit withdrawal demands, any of which could have a material adverse impact on our liquidity, business, results of operations and financial condition.

As a result of our participation in the U.S. Treasury’s Capital Purchase Program, our ability to declare or pay dividends on any of our capital stock is subject to restrictions. Specifically, we are unable to declare dividend payments on common, junior preferred orpari passu preferred shares if we are in arrears in the payment of dividends on the Preferred Shares. Further, until the third anniversary of the investment or when all of the Preferred Shares have been redeemed or transferred, we are not permitted to increase the cash dividends on our common stock without the U.S. Treasury’s approval. Additionally, our ability to repurchase our shares of outstanding common stock is restricted. The U.S. Treasury’s consent generally is required for us to make any stock repurchase until the third anniversary of the investment by the U.S. Treasury unless all of the Preferred Shares have been redeemed or transferred. Further, common, junior preferred orpari passu preferred shares may not be repurchased if we are in arrears in the payment of dividends on the Preferred Shares. These restrictions, as well as the dilutive effect of the warrants that we issued to the U.S. Treasury as part of the Capital Purchase Program, may have a negative effect on the market price of our common stock.

Pursuant to the terms by which we participated in the U.S. Treasury’s Capital Purchase Agreement and the terms of the American Recovery and Reinvestment Act of 2009, we and several of our senior employees are subject to substantial limitations on executive compensation and are subject to corporate governance standards imposed pursuant to that Act. Such requirements may adversely affect our ability to attract and retain senior officers and employees who are critical to the operation of our business.

The documents that we executed with the U.S. Treasury when it purchased our Preferred Shares allow it to unilaterally change the terms of the Preferred Shares or impose additional requirements on the Corporation if there is a change in law. These changes or additional requirements could restrict our ability to conduct business, could subject us to additional cost and expense or could change the terms of the Preferred Shares to the detriment of our common shareholders. While it may be possible for us to redeem the Preferred Shares in

the event that the U.S. Treasury imposes any changes or additional requirements that we believe are detrimental, there can be no assurances that our federal regulator will approve such redemption or that we will have the ability to implement such redemption, especially in light of regulatory requirements imposed upon financial institutions seeking to redeem TARP securities.

| 20 | ||

| 21 | ||

| · | loan delinquencies may increase; |

Further deterioration

| · | problem assets and foreclosures may increase; |

| · | demand for our products and services may decline; and |

| · | collateral for loans made by Union Center National Bank may decline in value, in turn reducing Union Center National Bank’s clients’ borrowing power, among other things. |

| 22 | ||

| · | potential exposure to unknown or contingent liabilities of banks and businesses we acquire; |

| · | exposure to potential asset quality issues of the acquired bank or related business; |

| · | difficulty and expense of integrating the operations and personnel of banks and businesses we acquire; and |

| · | the possible loss of key employees and customers of the banks and businesses we acquire |

| 23 | ||

On July 21, 2010, President Obama signed the Dodd-Frank Act into law.

While it is difficult to predict at this time what specific impact the Dodd-Frank Act newly written implementing rules and regulations and yet to be written implementing rules and regulations will have on us, we expect that at a minimum our operating and compliance costs will increase, and our interest expense could increase.

| 24 | ||

The following table sets forth certain information regarding the Bank’s leased locations.

Branch Location | Term | |

356 Chestnut Street, Union, New Jersey | Term expires in 2028 | |

Career Center Branch located in Union High School, Union, New Jersey | Term expires | |

300 Main Street, Madison, New Jersey | Term expires May 31, 2016 and is subject to renewal at the Bank’s option | |

2933 Vauxhall Road, Vauxhall, New Jersey | Term | |

545 Morris Avenue, Summit, New Jersey | Term expires | |

| Ely Place, Boonton, New Jersey | Term expires August 29, 2021, and is subject to renewal at the Bank’s option | |

71 E. Allendale Road, Saddle River, New Jersey | Term expires May 31, 2032 unless sooner terminated or extended by the Bank | |

| Route 202 and Allerman Road Oakland, New Jersey | Term expires April 30, 2028 and is subject to renewal at the Bank’s option | |

12 E. Palisade Avenue, Englewood, New Jersey | Term expires July 31, 2022 and is subject to renewal at the Bank’s option | |

344 Nassau Street, Princeton, New Jersey | Term expires May 31, 2016 and is subject to renewal at the Bank’s option | |

171 East Saddle River Road Saddle River, New Jersey | Term expired December 31, 2013, month to month |

| 25 | ||

data center until 2010. During the second quarter of 2010, the Corporation entered into a lease of its former operations facility under a direct financing lease. The lease has a 15 year term with no renewal options. According to the terms of the lease, the lessee has an obligation to purchase the property underlying the lease in either year seven, (7), ten (10) or fifteen (15) at predetermined prices for those years as provided in the lease. The structure of the minimum lease payments and the purchase prices as provided in the lease provide an inducement to the lessee to purchase the property in year seven (7).

In December 2009, the Corporation took steps to terminate a participation agreement with another New Jersey bank at December 31, 2009. Under the terms of the agreement, the participation ended on December 31, 2009, and, in the Corporation’s view, the lead bank is required to repurchase the remaining balance. The lead bank questioned our enforcement of the participation agreement. Therefore, the Corporation filed suit in Superior Court of New Jersey Chancery Division in Morris County, New Jersey, for the return of the outstanding principal.

Union Center has instituted a suit against Highlands State Bank (“Highlands”) in the Superior Court of New Jersey (Docket No. MRS-C-189-09). This litigation relates to a participating interest in a construction loan originated by Highlands. This loan was closed, and the participating interest (85%) was acquired, in 2007. Various causes of action are pleaded in this litigation by both parties, including claims for recovery of damages. The primary claim prosecuted by Union Center seeks a judicial determination that the Participation Agreement executed with Highlands was properly terminated in accordance with its terms on December 31, 2009 and that Highlands is obligated to return the unpaid balance of the loan funds advanced by Union Center during its participation in the loan. The primary claim presented by Highlands is that Union Center’s participation in the loan must continue until it is ultimately retired, which will probably result in a substantial loss that it is claimed must be shared by Union Center. This litigation is in its early stages. The initial pleadings have been filed and the discovery phase will now begin. As of December 31, 2010 no significant progress has been made regarding a decision resulting from the discovery or depositions taken during 2010.

There are no other significant pending legal proceedings involving the Corporation other than those arising out of routine operations. operations, and those arising in connection with the Merger.

| 26 | ||

Name and Age | Officer Since | |||

Business Experience | ||||

| Anthony C. Weagley Age – | 1996 the Parent Corporation 1985 the Bank | President and Chief Executive Officer of the Parent Corporation | ||

| Mark S. Cardone Age – | 2001 the Parent Corporation 2001 the Bank | Vice President of the Parent Corporation and Senior Vice President & Branch Administrator of the Bank (2001 – Present) | ||

| Joseph D. Gangemi Age – | 2008 the Parent Corporation 2004 the Bank | Vice President and Assistant Portfolio Manager of the Parent Corporation and the Bank (December 31, 2010 – Present) | ||

| John Bailey Age – 59 | 2013 the Bank |

James W. Sorge Age – 61 | ||||

| 2010 the Parent Corporation 2010 the Bank | Vice President and Compliance Officer of the Parent Corporation and Senior Vice President and Compliance Officer of the Bank (March 2010 – Present); Vice President and Director, PNC Global Investment Servicing (May 2008 – March 2010); Vice President, BSA/AML/OFAC Officer, Yardville National Bank (June 2005 – April 2008) |

| 27 | ||

Name and Age | Officer Since | Business Experience | ||

| George J. Theiller Age – | 2009 the Parent Corporation 2005 the Bank | Vice President and Senior Auditor of the Parent Corporation and Senior Vice President and Senior Auditor of the Bank (December 2009 – Present); Vice President and Senior Auditor of the Bank (April 2005 – December 2009) | ||

| Francis R. Patryn Age – | 2006 the Parent Corporation 2006 the Bank | Vice President and Chief Financial Officer of the Parent Corporation and Senior Vice President, Chief Financial Officer of the Bank (May 31, 2013 – Present); Vice President, Chief Financial Officer and Comptroller of the Parent Corporation and Vice President and Chief Financial Officer and Comptroller of the Bank (November 2010 – March 28, 2011); Vice President and Comptroller of the Bank (October 2006 – March 28, 2011 and March 28, 2011 to May 31, 2013) | ||

| Arthur M. Wein Age – 63 | 2009 the Parent Corporation 2009 the Bank | Vice President and Chief Operating Officer of the Parent Corporation and Senior Vice President and Chief Operating Officer of the Bank (October 2009 – Present); Vice President and Business Development Officer of the Summit Region of the Bank (April 2009 – October 2009); President and Chief Executive Officer of UTZ Technologies, Inc. (manufacturer of thick film hybrid screens) (December 2003 – March 2009) |

| 28 | ||

was $18.76.

| Common Stock Price | ||||||||||||||||||||||||||||||||

| 2010 | 2009 | Common Dividends Declared | ||||||||||||||||||||||||||||||

| High Bid | Low Bid | High Bid | Low Bid | 2010 | 2009 | |||||||||||||||||||||||||||

| Fourth Quarter | $ | 8.11 | $ | 7.30 | $ | 9.20 | $ | 7.36 | $ | 0.03 | $ | 0.03 | ||||||||||||||||||||

| Third Quarter | 7.67 | 7.05 | 10.16 | 7.53 | 0.03 | 0.03 | ||||||||||||||||||||||||||

| Second Quarter | 9.07 | 6.94 | 9.15 | 6.88 | 0.03 | 0.03 | ||||||||||||||||||||||||||

| First Quarter | 9.09 | 8.31 | 8.50 | 6.43 | 0.03 | 0.09 | ||||||||||||||||||||||||||

| Total | $ | 0.12 | $ | 0.18 | ||||||||||||||||||||||||||||

| Common Stock Price | |||||||||||||||||||

| 2013 | 2012 | Common Dividends Declared | |||||||||||||||||

| High | Low | High | Low | 2013 | 2012 | ||||||||||||||

| Fourth Quarter | $ | 19.67 | $ | 13.96 | $ | 11.93 | $ | 10.89 | $ | 0.075 | $ | 0.055 | |||||||

| Third Quarter | 15.24 | 12.95 | 11.99 | 10.82 | 0.075 | 0.055 | |||||||||||||

| Second Quarter | 13.23 | 11.50 | 11.25 | 9.75 | 0.075 | 0.055 | |||||||||||||

| First Quarter | 12.82 | 11.62 | 10.45 | 9.50 | 0.055 | 0.030 | |||||||||||||

| Total | $ | 0.280 | $ | 0.195 | |||||||||||||||

As noted elsewhere herein, on January 9, 2009, as part of the U.S. Department of the Treasury’s Troubled Asset Relief Program (“TARP”), the Parent Corporation entered into an agreement with the U.S. Treasury (the “Stock Purchase Agreement”) pursuant to which (i) the Parent Corporation issued and sold, and the U.S. Treasury purchased, 10,000 shares (the “Preferred Shares”) of the Company’s Fixed Rate Cumulative Perpetual Preferred Stock, Series A, having a liquidation preference of $1,000 per share for an aggregate purchase price of $10 million in cash, and (ii) the Parent Corporation issued to the U.S. Treasury a ten-year warrant (the “Warrant”) to purchase up to 173,410 shares of the Parent Corporation’s common stock at an exercise price of $8.65 per share. As a result of the successful completion of the Rights Offering in October 2009, the number of shares underlying the warrant held by the U.S. Treasury was reduced to 86,705 sharesduring 2013 or 50 percent of the original 173,410 shares. Until the third anniversary of the issuance of the Preferred Shares, the consent of the U.S. Treasury will be required for any increase in the dividends on the Parent Corporation’s common stock or for any stock repurchases unless the Preferred Shares have been redeemed in their entirety or the U.S. Treasury has transferred the Preferred Shares to third parties. See “Dividends” below for additional restrictions on the payment of dividends.

preferred stock ifIn addition, capital guidelines and other regulatory requirements may further limit the Parent Corporation issues additional series of preferred stock) ifCorporation’s and the Parent Corporation is in arrears in the payment of dividendsBank’s ability to pay dividends. See “Item 1 – Business – Supervision and Regulation –New Capital Rules.”

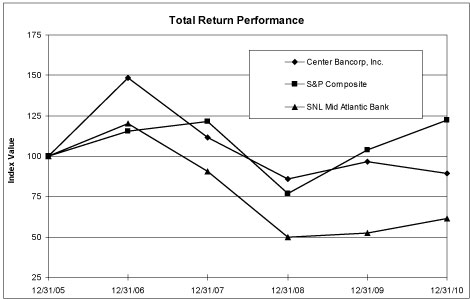

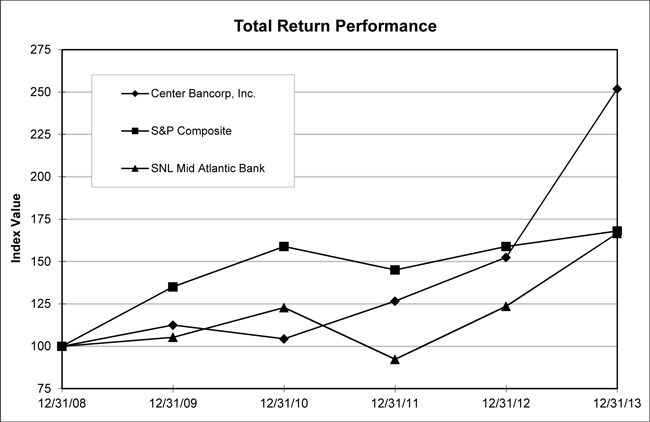

Set forth belowfollowing page is a line graph presentation comparing the cumulative stockholder return on the Parent Corporation’s common stock, on a dividend reinvested basis, against the cumulative total returns of the Standard & Poor’s Composite and the SNL Mid-Atlantic Bank Index for the period from January 1, 20062009 through December 31, 2010.

| 29 | ||

| Fiscal Year Ending | ||||||||||||||||||||||||

| Company/Index/Market | 12/31/2005 | 12/31/2006 | 12/31/2007 | 12/31/2008 | 12/31/2009 | 12/31/2010 | ||||||||||||||||||

| Center Bancorp, Inc. | 100.00 | 148.38 | 111.68 | 85.74 | 96.47 | 89.46 | ||||||||||||||||||

| S&P Composite | 100.00 | 115.33 | 121.64 | 76.97 | 103.96 | 122.30 | ||||||||||||||||||

| SNL Mid-Atlantic Bank Index | 100.00 | 120.02 | 90.76 | 50.00 | 52.63 | 61.40 | ||||||||||||||||||

| Fiscal Year Ending | |||||||||||||||||||

| Company/Index/Market | 12/31/2008 | 12/31/2009 | 12/31/2010 | 12/31/2011 | 12/31/2012 | 12/31/2013 | |||||||||||||

| Center Bancorp, Inc. | 100.00 | 112.51 | 104.33 | 126.63 | 154.44 | 251.89 | |||||||||||||

| S&P Composite | 100.00 | 135.05 | 158.89 | 145.05 | 158.88 | 168.03 | |||||||||||||

| SNL Mid-Atlantic Bank Index | 100.00 | 105.27 | 122.81 | 92.26 | 123.59 | 166.59 | |||||||||||||

| 30 | ||

| Years Ended December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (Dollars in Thousands, Except per Share Data) | ||||||||||||||||||||

| Summary of Income | ||||||||||||||||||||

| Interest income | $ | 48,714 | $ | 51,110 | $ | 49,894 | $ | 52,129 | $ | 53,325 | ||||||||||

| Interest expense | 14,785 | 22,645 | 24,095 | 30,630 | 28,974 | |||||||||||||||

| Net interest income | 33,929 | 28,465 | 25,799 | 21,499 | 24,351 | |||||||||||||||

| Provision for loan losses | 5,076 | 4,597 | 1,561 | 350 | 57 | |||||||||||||||

| Net interest income after provision for loan losses | 28,853 | 23,868 | 24,238 | 21,149 | 24,294 | |||||||||||||||

| Other income | 2,472 | 3,906 | 2,644 | 4,372 | 633 | |||||||||||||||

| Other expense | 24,099 | 23,057 | 19,473 | 24,598 | 24,358 | |||||||||||||||

| Income before income tax expense | 7,226 | 4,717 | 7,409 | 923 | 569 | |||||||||||||||

| Income tax expense (benefit) | 222 | 946 | 1,567 | (2,933 | ) | (3,329 | ) | |||||||||||||

| Net income | $ | 7,004 | $ | 3,771 | $ | 5,842 | $ | 3,856 | $ | 3,898 | ||||||||||

| Net income available to common stockholders | $ | 6,423 | $ | 3,204 | $ | 5,842 | $ | 3,856 | $ | 3,898 | ||||||||||

| Statement of Financial Condition Data | ||||||||||||||||||||

| Investments | $ | 378,080 | $ | 298,124 | $ | 242,714 | $ | 314,194 | $ | 381,733 | ||||||||||

| Total loans | 708,444 | 719,606 | 676,203 | 551,669 | 550,414 | |||||||||||||||

| Goodwill and other intangibles | 16,959 | 17,028 | 17,110 | 17,204 | 17,312 | |||||||||||||||

| Total assets | 1,207,385 | 1,195,488 | 1,023,293 | 1,017,645 | 1,051,384 | |||||||||||||||

| Deposits | 860,332 | 813,705 | 659,537 | 699,070 | 726,771 | |||||||||||||||

| Borrowings | 212,855 | 269,253 | 268,440 | 218,109 | 206,434 | |||||||||||||||

| Stockholders’ equity | 120,957 | 101,749 | 81,713 | 85,278 | 97,613 | |||||||||||||||

| Dividends | ||||||||||||||||||||

| Cash dividends | $ | 1,852 | $ | 2,434 | $ | 4,675 | $ | 4,885 | $ | 4,808 | ||||||||||

| Dividend payout ratio | 28.83 | % | 75.97 | % | 80.02 | % | 126.69 | % | 123.35 | % | ||||||||||

| Cash Dividends Per Share(1) | ||||||||||||||||||||

| Cash dividends | $ | 0.12 | $ | 0.18 | $ | 0.36 | $ | 0.36 | $ | 0.34 | ||||||||||

| Earnings Per Share(1) | ||||||||||||||||||||

| Basic | $ | 0.43 | $ | 0.24 | $ | 0.45 | $ | 0.28 | $ | 0.28 | ||||||||||

| Diluted | $ | 0.43 | $ | 0.24 | $ | 0.45 | $ | 0.28 | $ | 0.28 | ||||||||||

| Weighted Average Common Shares Outstanding(1) | ||||||||||||||||||||

| Basic | 15,025,870 | 13,382,614 | 13,048,518 | 13,780,504 | 13,959,684 | |||||||||||||||

| Diluted | 15,027,159 | 13,385,416 | 13,061,410 | 13,840,756 | 14,040,338 | |||||||||||||||

| Operating Ratios | ||||||||||||||||||||

| Return on average assets | 0.59 | % | 0.31 | % | 0.58 | % | 0.38 | % | 0.37 | % | ||||||||||

| Average stockholders’ equity to average assets | 9.38 | % | 7.66 | % | 8.28 | % | 9.33 | % | 9.21 | % | ||||||||||

| Return on average stockholders’ equity | 6.30 | % | 4.02 | % | 7.03 | % | 4.09 | % | 4.04 | % | ||||||||||

| Return on average tangible stockholders’ equity(2) | 7.44 | % | 4.91 | % | 8.86 | % | 5.00 | % | 4.93 | % | ||||||||||

| Book Value | ||||||||||||||||||||

| Book value per common share(1) | $ | 6.83 | $ | 6.32 | $ | 6.29 | $ | 6.48 | $ | 7.02 | ||||||||||

| Tangible book value per common share(1)(2) | $ | 5.79 | $ | 5.15 | $ | 4.97 | $ | 5.17 | $ | 5.77 | ||||||||||

| Non-Financial Information | ||||||||||||||||||||

| Common stockholders of record | 592 | 605 | 640 | 679 | 717 | |||||||||||||||

| Full-time equivalent staff | 159 | 160 | 160 | 172 | 214 | |||||||||||||||

| Years Ended December 31, | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| (Dollars in Thousands, Except per Share Data) | ||||||||||||||||||||

| Summary of Income | ||||||||||||||||||||

| Interest income | $ | 57,268 | $ | 55,272 | $ | 51,927 | $ | 48,714 | $ | 51,110 | ||||||||||

| Interest expense | 11,082 | 11,776 | 12,177 | 14,785 | 22,645 | |||||||||||||||

| Net interest income | 46,186 | 43,496 | 39,750 | 33,929 | 28,465 | |||||||||||||||

| Provision for loan losses | 350 | 325 | 2,448 | 5,076 | 4,597 | |||||||||||||||

| Net interest income after provision for loan losses | 45,836 | 43,171 | 37,302 | 28,853 | 23,868 | |||||||||||||||

| Other income | 6,851 | 7,210 | 7,478 | 2,472 | 3,906 | |||||||||||||||

| Other expense | 25,278 | 25,197 | 23,443 | 24,099 | 23,057 | |||||||||||||||

| Income before income tax expense | 27,409 | 25,184 | 21,337 | 7,226 | 4,717 | |||||||||||||||

| Income tax expense | 7,484 | 7,677 | 7,411 | 222 | 946 | |||||||||||||||

| Net income | $ | 19,925 | $ | 17,507 | $ | 13,926 | $ | 7,004 | $ | 3,771 | ||||||||||

| Net income available to common stockholders | $ | 19,784 | $ | 17,226 | $ | 13,106 | $ | 6,423 | $ | 3,204 | ||||||||||

| Statement of Financial Condition Data | ||||||||||||||||||||

| Investments available for sale | $ | 323,070 | $ | 496,815 | $ | 414,507 | $ | 378,080 | $ | 298,124 | ||||||||||

| Investments held to maturity | 215,286 | 58,064 | 72,233 | — | — | |||||||||||||||

| Loans held for sale | — | 1,491 | 1,018 | 333 | — | |||||||||||||||

| Total loans | 960,943 | 889,672 | 754,992 | 708,111 | 719,606 | |||||||||||||||

| Allowance for loan losses | 10,333 | 10,237 | 9,602 | 8,867 | 8,711 | |||||||||||||||

| Goodwill and other intangible assets | 16,828 | 16,858 | 16,902 | 16,959 | 17,028 | |||||||||||||||

| Total assets | 1,673,082 | 1,629,765 | 1,432,738 | 1,207,385 | 1,195,488 | |||||||||||||||

| Deposits | 1,342,005 | 1,306,922 | 1,121,415 | 860,332 | 813,705 | |||||||||||||||

| Borrowings | 146,000 | 146,000 | 161,000 | 212,855 | 269,253 | |||||||||||||||

| Stockholders’ equity | 168,584 | 160,691 | 135,916 | 120,957 | 101,749 | |||||||||||||||

| Dividends | ||||||||||||||||||||

| Cash dividends on Common Stock | $ | 4,254 | $ | 2,778 | $ | 1,955 | $ | 1,800 | $ | 2,434 | ||||||||||

| Dividend payout ratio | 21.50 | % | 16.13 | % | 14.92 | % | 28.02 | % | 75.97 | % | ||||||||||

| Cash Dividends Per Share | ||||||||||||||||||||

| Cash dividends | $ | 0.280 | $ | 0.195 | $ | 0.12 | $ | 0.12 | $ | 0.18 | ||||||||||

| Earnings Per Share | ||||||||||||||||||||

| Basic | $ | 1.21 | $ | 1.05 | $ | 0.80 | $ | 0.43 | $ | 0.24 | ||||||||||

| Diluted | $ | 1.21 | $ | 1.05 | $ | 0.80 | $ | 0.43 | $ | 0.24 | ||||||||||

| Weighted Average Common Shares Outstanding | ||||||||||||||||||||

| Basic | 16,349,204 | 16,340,197 | 16,295,761 | 15,025,870 | 13,382,614 | |||||||||||||||

| Diluted | 16,385,692 | 16,351,046 | 16,314,899 | 15,027,159 | 13,385,416 | |||||||||||||||

| Operating Ratios | ||||||||||||||||||||

| Return on average assets | 1.22 | % | 1.14 | % | 1.05 | % | 0.59 | % | 0.31 | % | ||||||||||

| Average stockholders’ equity to average assets | 10.10 | % | 9.73 | % | 9.83 | % | 9.38 | % | 7.66 | % | ||||||||||

| Return on average stockholders’ equity | 12.08 | % | 11.69 | % | 10.73 | % | 6.30 | % | 4.02 | % | ||||||||||

Return on average tangible stockholders’ equity(1) | 13.45 | % | 13.18 | % | 12.33 | % | 7.44 | % | 4.91 | % | ||||||||||

| Book Value | ||||||||||||||||||||

| Book value per common share | $ | 9.61 | $ | 9.14 | $ | 7.63 | $ | 6.83 | $ | 6.32 | ||||||||||

Tangible book value per common share(1) | $ | 8.58 | $ | 8.11 | $ | 6.60 | $ | 5.79 | $ | 5.15 | ||||||||||

| Non-Financial Information | ||||||||||||||||||||

| Common stockholders of record | 514 | 551 | 563 | 592 | 605 | |||||||||||||||

| Full-time equivalent staff | 166 | 178 | 163 | 159 | 160 | |||||||||||||||

| 31 | ||

| Tangible book value per common share, which is a non-GAAP financial measure, is computed by dividing stockholders’ equity less preferred stock, goodwill and other intangible assets by common shares outstanding. The following table provides certain related reconciliations between Generally Accepted Accounting Principles (“GAAP”)measures (stockholders’ equity and book value per common share) and the related non-GAAP financial measures (tangible stockholders’ equity and tangible book value per common share): |

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (Dollars in Thousands, Except per Share Data) | ||||||||||||||||||||

| Common shares outstanding | 16,289,832 | 14,572,029 | 12,991,312 | 13,155,784 | 13,910,450 | |||||||||||||||

| Stockholders’ equity | $ | 120,957 | $ | 101,749 | $ | 81,713 | $ | 85,278 | $ | 97,613 | ||||||||||

| Less: Preferred Stock | 9,700 | 9,619 | — | �� | — | — | ||||||||||||||

| Less: Goodwill and other intangible assets | 16,959 | 17,028 | 17,110 | 17,204 | 17,312 | |||||||||||||||

| Tangible Stockholders’ Equity | $ | 94,298 | $ | 75,102 | $ | 64,603 | $ | 68,074 | $ | 80,301 | ||||||||||

| Book value per common share | $ | 6.83 | $ | 6.32 | $ | 6.29 | $ | 6.48 | $ | 7.02 | ||||||||||

| Less: Goodwill and other intangible assets | 1.04 | 1.17 | 1.32 | 1.31 | 1.25 | |||||||||||||||

| Tangible Book Value per Common Share | $ | 5.79 | $ | 5.15 | $ | 4.97 | $ | 5.17 | $ | 5.77 | ||||||||||

All per common share amounts reflect all prior stock splits and dividends.

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||

| (Dollars in Thousands, Except per Share Data) | ||||||||||||||||

| Common shares outstanding | 16,369,012 | 16,347,915 | 16,332,327 | 16,289,832 | 14,572,029 | |||||||||||

| Stockholders’ equity | $ | 168,584 | $ | 160,691 | $ | 135,916 | $ | 120,957 | $ | 101,749 | ||||||

| Less: Preferred Stock | 11,250 | 11,250 | 11,250 | 9,700 | 9,619 | |||||||||||

| Less: Goodwill and other intangible assets | 16,828 | 16,858 | 16,902 | 16,959 | 17,028 | |||||||||||

| Tangible Common Stockholders’ Equity | $ | 140,506 | $ | 132,583 | $ | 107,764 | $ | 94,298 | $ | 75,102 | ||||||

| Book value per common share | $ | 9.61 | $ | 9.14 | $ | 7.63 | $ | 6.83 | $ | 6.32 | ||||||

| Less: Goodwill and other intangible assets | 1.03 | 1.03 | 1.03 | 1.04 | 1.17 | |||||||||||

| Tangible Book Value per Common Share | $ | 8.58 | $ | 8.11 | $ | 6.60 | $ | 5.79 | $ | 5.15 | ||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (Dollars in Thousands) | ||||||||||||||||||||

| Net income | $ | 7,004 | $ | 3,771 | $ | 5,842 | $ | 3,856 | $ | 3,898 | ||||||||||

| Average stockholders’ equity | $ | 111,136 | $ | 93,850 | $ | 83,123 | $ | 94,345 | $ | 96,505 | ||||||||||

| Less: Average goodwill and other intangible assets | 16,993 | 17,069 | 17,158 | 17,259 | 17,378 | |||||||||||||||

| Average Tangible Stockholders’ Equity | $ | 94,143 | $ | 76,781 | $ | 65,965 | $ | 77,086 | $ | 79,127 | ||||||||||

| Return on average stockholders’ equity | 6.30 | % | 4.02 | % | 7.03 | % | 4.09 | % | 4.04 | % | ||||||||||

| Add: Average goodwill and other intangible assets | 1.14 | .89 | 1.83 | 0.91 | 0.89 | |||||||||||||||

| Return on Average Tangible Stockholders’ Equity | 7.44 | % | 4.91 | % | 8.86 | % | 5.00 | % | 4.93 | % | ||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| (Dollars in Thousands) | ||||||||||||||||||||

| Net income | $ | 19,925 | $ | 17,507 | $ | 13,926 | $ | 7,004 | $ | 3,771 | ||||||||||

| Average stockholders’ equity | $ | 165,025 | $ | 149,714 | $ | 129,838 | $ | 111,136 | $ | 93,850 | ||||||||||

| Less: Average goodwill and other intangible assets | 16,842 | 16,879 | 16,930 | 16,993 | 17,069 | |||||||||||||||

| Average Tangible Stockholders’ Equity | $ | 148,183 | $ | 132,835 | $ | 112,908 | $ | 94,143 | $ | 76,781 | ||||||||||

| Return on average stockholders’ equity | 12.08 | % | 11.69 | % | 10.73 | % | 6.30 | % | 4.02 | % | ||||||||||

| Add: Average goodwill and other intangible assets | 1.37 | 1.49 | 1.61 | 1.14 | 0.89 | |||||||||||||||

| Return on Average Tangible Stockholders’ Equity | 13.45 | % | 13.18 | % | 12.33 | % | 7.44 | % | 4.91 | % | ||||||||||

| 32 | ||

| 33 | ||

The Corporation has adopted the provisions of FASB ASC 350-10-05, (previously SFAS No. 142, “Goodwill and Other Intangible Assets”), which requires that goodwill be reported separate from other intangible assets in the Consolidated Statements of Condition and not be amortized but tested for impairment annually or more frequently if impairment indicators arise for impairment. No impairment charge was deemed necessary for the years ended December 31, 20102013, 2012 and 2009.

| 34 | ||

2013.

favorable asset quality profile. Earnings for 2010 were positively impacted by growth in net interest income, and spread expansion through bothprimarily from an increase in the average balance sheet improvements andof earning assets of $108.8 million, which was partially offset by a decline of 13 basis points in yield. The decline in yield on earning assets was somewhat offset by a decline of 8 basis points from a lower cost of funds as compared to 2009 and reductions in other real estate owned, marketing expenses and occupancy expenses. These improvements were somewhat offset by higher loan loss provisions as well as higher salaries and employee benefits, FDIC insurance, professional and consulting fees and computer expenses. Other expense for2012.

The Corporation previously announced a strategic outsourcing agreement with Fiserv to provide core account processing services, which is consistent with the Corporation’s other strategic initiatives to streamline operations, reduce operating overhead and allow the Corporation to focus on core competencies of customer service and product development. This coupled with previously initiated cost reduction plans are intended to improve operating efficiencies, business and technical operations. The core processing transition was consummated duringNet interest margins reflected improvement in the fourth quarter of 2009. Additionally,2012, as prior action on reducing the consolidationcost of the Corporation’s branch office on 392 Springfield Avenue in Summit, New Jerseyfunds coupled with offsetting compression primarily as result of a continued high liquidity pool carried during the first quarter of 2009 into its new office on 545 Morris Avenue in Summit, New Jersey resulted in improved efficiencyperiods took root and increased customer service.

For the twelve months ended December 31, 2010, total salaries and benefits increased by $850,000 or 8.6 percentstarted to $10.8 million primarily attributable to additions to official staff and merit increases for existing staff of approximately $720,000 and increased medical insurance expense of $130,000.

The decreased tax rate resulted in part from the measurement and reassessment of the technical merits which led the Corporation to conclude that its position of the recognition of $2.6 million on a previously unrecognized tax benefit was sustainable. This in turn resulted in recognition of tax benefits previously unrecognized due to changes in the Corporation’s business entity structure during 2007 and into 2008 offset by a higher proportion of taxable income versus tax-exempt income in 2010 versus 2009. The decreased tax rate benefit was offset, in part, due to the surrender of Bank Owned Life Insurance Policies resulting in a $633,000 income tax expense in 2010.

abate further compression..

| 35 | ||

our Englewood office, we are working to solidify and expand the service relationship with our new customers. We remain excited by the potential to create incremental shareholder value from our strategic growth. We believe that this type of sequential earnings performance demonstrates the Corporation’s commitment to achieving meaningful growth in earnings performance, an essential component of providing consistent and favorable long-term returns to our shareholders. However, while we continue to see an improvement in balance sheet strength and core earnings performance, we still remain cautious about the credit stability of the broader markets.

climate and continues to maintain a conservative credit culture. At December 31, 2013, the Corporation had $202.3 million in overall undisbursed loan commitments, which includes largely unused commercial lines of credit, home equity lines of credit and available usage from active construction facilities. Included in the overall undisbursed commitments are the Corporation's "Approved, Accepted but Unfunded" pipeline, which includes approximately $35.7 million in commercial and commercial real estate loans and $2.3 million in residential mortgages expected to fund over the next 90 days.

$11.3 million or 0.940.31 percent at December 31, 2009.2012. The increasedecrease in non-performing assets from December 31, 20092012 was primarily attributable toachieved notwithstanding the addition of three largeseveral new residential loans (totaling approximately $0.3 million) and commercial loans (totaling approximately $1.7 million) into non-performing status. This was more than offset by decreases from pay-downs and an increase in troubled debt restructurings.

pay offs of $2.9 million, total charge-offs of $272,000, and the return to performing status of $0.4 million, while $220,000 was moved within the non-performing asset category from non-accrual to OREO.

Deposit growth was strong in 2010, reflective of customers’ desire for safety and liquidity and flight to quality in light of the financial crisis. At December 31, 2010, total deposits for the Corporation were $860.3 million. Non-interest-bearing core deposits, a low cost source of funding, continue to be a key funding source. At December 31, 2010, this source of funding amounted to $144.2from $10.2 million or 13.4 percent of total funding sources and 16.8 percent of total deposits.

Certificates of deposit $100,000 and greater decreased to 13.9 percent of total deposits at December 31, 2010 from 17.82012.

2013, decreased by $11.4 million or 10.3 percent from December 31, 2012.

| 36 | ||

2012, as an increase in retained earnings was offset only in part by the increased asset base in 2013.

The Corporation announced an increase in its common stock buyback program on September 28, 2007 and June 26, 2008, under which the Parent Corporation was authorized to purchase up to 2,039,731 shares of Center Bancorp’s outstanding common stock. As ofearnings.

1,386,863 shares under the program at an average cost of $11.44 per share. As repurchases are now restricted pursuant to the Parent Corporation’s participation in TARP there were no repurchases during 2010. See Item 5 of this Annual Report on Form 10K.

The following sections discuss the Corporation’s Results of Operations, Asset and Liability Management, Liquidity and Capital Resources.

2011.

| 37 | ||

| 2010 | 2009 | 2008 | ||||||||||||||||||||||||||||||||||

| Amount | Increase (Decrease) from Prior Year | Percent Change | Amount | Increase (Decrease) from Prior Year | Percent Change | Amount | Increase (Decrease) from Prior Year | Percent Change | ||||||||||||||||||||||||||||

| (Dollars in Thousands) | ||||||||||||||||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||||||||||||

| Investments | $ | 11,059 | $ | (3,279 | ) | (22.9 | ) | $ | 14,338 | $ | (67 | ) | (0.47 | ) | $ | 14,405 | $ | (4,850 | ) | (25.19 | ) | |||||||||||||||

| Loans, including fees | 37,200 | 449 | 1.22 | 36,751 | 641 | 1.78 | 36,110 | 2,583 | 7.70 | |||||||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | 0 | 0 | 0.00 | 0 | (113 | ) | (100.00 | ) | 113 | (491 | ) | (81.29 | ) | |||||||||||||||||||||||

| Restricted investment in bank stocks | 568 | 37 | 6.97 | 531 | (63 | ) | (10.61 | ) | 594 | 45 | 8.20 | |||||||||||||||||||||||||

| Total interest income | 48,827 | (2,793 | ) | (5.41 | ) | 51,620 | 398 | 0.78 | 51,222 | (2,713 | ) | (5.03 | ) | |||||||||||||||||||||||

| Interest expense: | ||||||||||||||||||||||||||||||||||||

| Deposits | 6,006 | (6,302 | ) | (51.20 | ) | 12,308 | (979 | ) | (7.37 | ) | 13,287 | (7,548 | ) | (36.23 | ) | |||||||||||||||||||||

| Borrowings | 8,779 | (1,558 | ) | (15.07 | ) | 10,337 | (471 | ) | (4.36 | ) | 10,808 | 1,013 | 10.34 | |||||||||||||||||||||||

| Total interest expense | 14,785 | (7,860 | ) | (34.71 | ) | 22,645 | (1,450 | ) | (6.02 | ) | 24,095 | (6,535 | ) | (21.34 | ) | |||||||||||||||||||||

| Net interest income on a fully tax-equivalent basis | 34,042 | 5,067 | 17.49 | 28,975 | 1,848 | 6.81 | 27,127 | 3,822 | 16.40 | |||||||||||||||||||||||||||

| Tax-equivalent adjustment | (113 | ) | 397 | (77.84 | ) | (510 | ) | 818 | (61.60 | ) | (1,328 | ) | 478 | (26.47 | ) | |||||||||||||||||||||

| Net interest income | $ | 33,929 | $ | 5,464 | 19.20 | $ | 28,465 | $ | 2,666 | 10.33 | $ | 25,799 | $ | 4,300 | 20.00 | |||||||||||||||||||||

| 2013 | 2012 | 2011 | ||||||||||||||||||||||||||

| Amount | Increase (Decrease) from Prior Year | Percent Change | Amount | Increase (Decrease) from Prior Year | Percent Change | Amount | Increase (Decrease) from Prior Year | Percent Change | ||||||||||||||||||||

| (Dollars in Thousands) | ||||||||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||||

| Investment available-for-sale | $ | 13,833 | $ | (1,234) | (8.19) | $ | 15,067 | $ | 1,018 | 7.25 | $ | 14,049 | $ | 2,990 | 27.04 | |||||||||||||

| Investment held-to-maturity | 5,275 | 2,562 | 94.43 | 2,713 | 743 | 37.72 | 1,970 | 1,970 | 100.00 | |||||||||||||||||||

| Loans, including fees | 40,281 | 1,360 | 3.49 | 38,921 | 2,601 | 7.16 | 36,320 | (880) | (2.37) | |||||||||||||||||||

| Other interest-bearing deposits | 2 | (6) | (75.00) | 8 | 8 | — | — | — | — | |||||||||||||||||||

| Restricted investment in bank stocks | 407 | (45) | (9.96) | 452 | (12) | (2.59) | 464 | (104) | (18.31) | |||||||||||||||||||

| Total interest income | 59,798 | 2,637 | 4.61 | 57,161 | 4,358 | 8.25 | 52,803 | 3,976 | 8.14 | |||||||||||||||||||

| Interest expense: | ||||||||||||||||||||||||||||

| Deposits | 5,219 | (189) | (3.49) | 5,408 | (112) | (2.03) | 5,520 | (486) | (8.09) | |||||||||||||||||||

| Borrowings | 5,863 | (505) | (7.93) | 6,368 | (289) | (4.34) | 6,657 | (2,122) | (24.17) | |||||||||||||||||||

| Total interest expense | 11,082 | (694) | (5.89) | 11,776 | (401) | (3.29) | 12,177 | (2,608) | (17.64) | |||||||||||||||||||

| Net interest income on a tax-equivalent basis | 48,716 | 3,331 | 7.34 | 45,385 | 4,759 | 11.71 | 40,626 | 6,584 | 19.34 | |||||||||||||||||||

| Tax-equivalent adjustment | (2,530) | (641) | 33.93 | (1,889) | (1,013) | (115.64) | (876) | (763) | 675.22 | |||||||||||||||||||

| Net interest income | $ | 46,186 | $ | 2,690 | 6.18 | $ | 43,496 | $ | 3,746 | 9.42 | $ | 39,750 | $ | 5,821 | 17.16 | |||||||||||||

Historically, the most significant component of the Corporation’s earnings has been net interest income, which is the difference between the interest earned on the portfolio of earning assets (principally loans and investments) and the interest paid for deposits and borrowings, which support these assets. There were several factors that affected net interest income during 2010,2013, including the volume, pricing, mix and maturity of interest-earning assets and interest-bearing liabilities and interest rate fluctuations.

| 38 | ||

margin.

interest bearing deposits of $36.4 million partially offset by decreases in borrowings of $10.5 million.

Increased average investment volume in 2012 was funded primarily by the increased deposit growth. Average interest-bearing liabilities increased by $168.3 million, due primarily to an increase in interest bearing deposits of $201.7 million partially offset by decreases in borrowings of $33.4 million.

| 39 | ||

| 2010/2009 Increase (Decrease) Due to Change in: | 2009/2008 Increase (Decrease) Due to Change in: | |||||||||||||||||||||||

| Average Volume | Average Rate | Net Change | Average Volume | Average Rate | Net Change | |||||||||||||||||||

| (Dollars in Thousands) | ||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||

| Investment securities: | ||||||||||||||||||||||||

| Taxable | $ | 700 | $ | (2,813 | ) | $ | (2,113 | ) | $ | 3,553 | $ | (1,355 | ) | $ | 2,198 | |||||||||

| Non-Taxable | (1,122 | ) | (44 | ) | (1,166 | ) | (2,463 | ) | 86 | (2,377 | ) | |||||||||||||

| Loans, net of unearned discount | 1,002 | (553 | ) | 449 | 3,864 | (3,223 | ) | 641 | ||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | (0 | ) | (0 | ) | (0 | ) | (56 | ) | (57 | ) | (113 | ) | ||||||||||||

| Restricted investment in bank stocks | (12 | ) | 49 | 37 | 25 | 24 | 49 | |||||||||||||||||

| Total interest-earning assets | 568 | (3,361 | ) | (2,793 | ) | 4,923 | (4,525 | ) | 398 | |||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||

| Money market deposits | 54 | (749 | ) | (695 | ) | (545 | ) | (1,298 | ) | (1,843 | ) | |||||||||||||

| Savings deposits | 286 | (1,110 | ) | (824 | ) | 1,017 | 483 | 1,500 | ||||||||||||||||

| Time deposits | (1,905 | ) | (2,262 | ) | (4,167 | ) | 3,648 | (3,050 | ) | 598 | ||||||||||||||

| Other interest-bearing deposits | 309 | (925 | ) | (616 | ) | 204 | (1,438 | ) | (1,234 | ) | ||||||||||||||

| Borrowings and subordinated debentures | (709 | ) | (849 | ) | (1,558 | ) | (463 | ) | (8 | ) | (471 | ) | ||||||||||||

| Total interest-bearing liabilities | (1,965 | ) | (5,895 | ) | (7,860 | ) | 3,861 | (5,311 | ) | (1,450 | ) | |||||||||||||

| Change in net interest income | $ | 2,533 | $ | 2,534 | $ | 5,067 | $ | 1,062 | $ | 786 | $ | 1,848 | ||||||||||||

| 2013/2012 Increase (Decrease) Due to Change in: | 2012/2011 Increase (Decrease) Due to Change in: | ||||||||||||||||||

| Average Volume | Average Rate | Net Change | Average Volume | Average Rate | Net Change | ||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||

| Investment securities: | |||||||||||||||||||

| Available for sale | |||||||||||||||||||

| Taxable | $ | (742) | $ | 287 | $ | (455) | $ | 1,294 | $ | (2,368) | $ | (1,074) | |||||||

| Non-Taxable | (839) | 60 | (779) | 1,770 | 322 | 2,092 | |||||||||||||

| Held to maturity | |||||||||||||||||||

| Taxable | 143 | 233 | 376 | 335 | (320) | 15 | |||||||||||||

| Non-Taxable | 2,662 | (476) | 2,186 | 702 | 26 | 728 | |||||||||||||

| Loans, net of unearned discount | 4,320 | (2,960) | 1,360 | 5,296 | (2,695) | 2,601 | |||||||||||||

| Other interest-bearing deposits | (6) | — | (6) | 8 | — | 8 | |||||||||||||

| Restricted investment in bank stocks | (7) | (38) | (45) | (3) | (9) | (12) | |||||||||||||

| Total interest-earning assets | 5,531 | (2,894) | 2,637 | 9,402 | (5,044) | 4,358 | |||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||

| Money market deposits | 173 | 11 | 184 | 767 | (220) | 547 | |||||||||||||

| Savings deposits | (18) | (66) | (84) | 54 | (292) | (238) | |||||||||||||

| Time deposits | (160) | (159) | (319) | (347) | (26) | (373) | |||||||||||||

| Other interest-bearing deposits | 76 | (46) | 30 | 277 | (325) | (48) | |||||||||||||

| Borrowings and subordinated debentures | (409) | (96) | (505) | (1,236) | 947 | (289) | |||||||||||||

| Total interest-bearing liabilities | (338) | (356) | (694) | (485) | 84 | (401) | |||||||||||||

| Change in net interest income | $ | 5,869 | $ | (2,538) | $ | 3,331 | $ | 9,887 | $ | (5,128) | $ | 4,759 | |||||||

The increase in the volume of loans in 2010 primarily reflected increases in commercial and commercial real estate loans. 2013.

| 40 | ||

interest-earning assets created a $4.5 million reduction to interest income as compared with a contribution of $4.9 million attributable to volume increases, principally loans.

The Federal Open Market Committee (“FOMC”) kept the Federal Funds target rate at zero to 0.25 percent throughout 2010.2013. This action by the FOMC allowed the Corporation to reduce liability costs throughout 2010.

2013.

as the flight to quality continued as depositors sought the safety of FDIC insurance.

2013.

2012.

2011.

2012.

| 41 | ||

| Years Ended December 31, | ||||||||||||||||||||||||||||||||||||||||

| 2010 | 2009 | 2008 | ||||||||||||||||||||||||||||||||||||||

| (Tax-Equivalent Basis) | Average Balance | Income/ Expense | Yield/ Rate | Average Balance | Income/ Expense | Yield/ Rate | Average Balance | Income/ Expense | Yield/ Rate | |||||||||||||||||||||||||||||||

| (Dollars in Thousands) | ||||||||||||||||||||||||||||||||||||||||

| ASSETS | ||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||||

| Investment securities:(1) | ||||||||||||||||||||||||||||||||||||||||

| Taxable | $ | 305,927 | $ | 10,726 | 3.51 | % | $ | 289,414 | $ | 12,839 | 4.44 | % | $ | 211,185 | $ | 10,529 | 4.99 | % | ||||||||||||||||||||||

| Non-taxable | 5,880 | 333 | 5.66 | % | 25,677 | 1,499 | 5.84 | % | 67,890 | 3,876 | 5.71 | % | ||||||||||||||||||||||||||||

| Loans, net of unearned income:(2) | 708,425 | 37,200 | 5.25 | % | 692,562 | 36,751 | 5.31 | % | 622,533 | 36,110 | 5.80 | % | ||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | — | — | — | — | — | — | % | 4,047 | 113 | 2.79 | % | |||||||||||||||||||||||||||||

| Restricted investment in bank stocks | 10,293 | 568 | 5.52 | % | 10,526 | 531 | 5.04 | % | 10,104 | 594 | 5.88 | % | ||||||||||||||||||||||||||||