(Mark one)

xANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (D) OF THE SECURITIESSECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

or

¨TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THESECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number: 0 - 16819

CREATIVE VISTAS, INC.

(Exact name of registrant as specified in its charter)

____________________________

Arizona (State or Other Jurisdiction of Incorporation or Organization) 2100 Forbes Street Unit 8-10 Whitby, Ontario, Canada (Address of Principal Executive Offices) | 86-0464104 (I.R.S. Employer Identification No.) L1N 9T3 (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 905-666-8676

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, No Par Value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YesYes o¨Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

YesYes o¨Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YesYes ¨xNo¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in the definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K.x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): Yes x No¨

Large Accelerated Filer¨ | Accelerated Filer¨ | |

Non-Accelerated Filer¨ | Smaller Reporting Companyx | |

| (Do not check if a smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $629,798 (8,991,121$179,822 (8,991,121 Shares at $0.07)$0.02).

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes¨No¨

At March 31, 2011,30, 2012, the number of shares outstanding of the registrant’s common stock, no par value (the only class of common stock), was 37,488,714.37,488,714.

| PART I | ||||

| Item 1. | Business | 1 | ||

| Item 1A. | Risk Factors | |||

| Item 1B. | Unresolved Staff Comments | |||

| Item 2. | Properties | |||

| Item 3. | Legal Proceedings | |||

| Item 4. | ||||

| PART II | 12 | |||

| Item 5. | Market for the Registrant's Common Equity Related Stockholder Matters and Issuer Purchases of Equity Securities | |||

| Item 6. | Selected Financial Data | |||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |||

| Item 7a. | Quantitative and Qualitative Disclosures about Market Risk | |||

| Item 8. | Financial Statements and Supplementary Data | |||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||

| Item 9a. | Controls and Procedures | |||

| Item 9b. | Other Information | |||

| PART III | ||||

| Item 10. | Directors, Executive Officers and Corporate Governance | |||

| Item 11. | Executive Compensation | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||

| Item 14. | ||||

| Item 15. | Exhibits and Financial Statement Schedules |

Forward-Looking Statements

Certain statements within this Form 10-K constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Creative Vistas, Inc. to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements are based on our current expectations and are subject to a number of risks, uncertainties and assumptions relating to our operations, financial condition and results of operations, including, among others, rapid technological and other changes in the marketmarkets we serve, our numerous competitors and the few barriers to entry for potential competitors, the seasonality and quarterly variations we experience in our revenue, our customer concentration, our uncertain revenue growth, our ability to attract and retain qualified personnel, our ability to expand our infrastructure and manage our growth, and our ability to identify, finance and integrate acquisitions, among others. If any of these risks or uncertainties materializes, or if any of the underlying assumptions prove incorrect, actual results may differ significantly from results expressed or implied in any forward-looking statements made by us. These and other risks are detailed in this Annual Report on Form 10-K and in other documents filed by us with the Securities and Exchange Commission. Creative Vistas, Inc. undertakes no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

PART I

| Item 1. | Business |

Corporate Background and Overview

Creative Vistas, Inc. (the “Company” or “we”) was incorporated in the state of Arizona on July 18, 1983. We are a leading provider of security-related technologies and systems. We also provide the deployment of broadband services to the commercial and residential market. We primarily operate through our subsidiariessubsidiary AC Technical Systems Ltd. (“AC Technical Systems”) and Iview Digital Video Solutions Inc. (“Iview DVSI”), to provide integrated electronic security-related technologies and systems. AC Technical Systems is responsible for all of our revenues in the security sector for 2010.2011. It provides its systems to various high profile clients including: government, school boards, retail outlets, banks, and hospitals. Iview DVSI is responsible for providing video surveillance product s and technologies to the market.

On December 31, 2005, we acquired Cancable Inc. (“Cancable”) through our wholly owned Delaware subsidiary, Cancable Holding Corp. (“Cancable Holding”). Cancable is in the business of providing the deployment and servicing of broadband technologies in both residential and commercial markets. Cancable has offices in Ontario, Canada. All related documents were disclosed in Form 8-K/A filed on January 6, 2006.In October 2007, we entered into an agreement, through our wholly ownedwholly-owned newly formed Ontario subsidiary, Cancable XL Inc. (“Cancable XL”), to acquire all of the issued and outstanding shares of capital stock and any other equity interests of XL Digital Services Inc. (“XL Digital”), an Ontario corporation. All related documents were disclosed in Form 8K8-K filed on October 17, 20 07.2007. Cancable Holding, Cancable Inc., Cancable XL Inc., XL Digital Services Inc. and Cancable, Inc. are together the “Cancable Group”.As described below, we disposed of Cancable Group in September 2011. In October 2009,2011, we incorporated OSS-IM View2300657 Ontario Inc. which is responsible for providing BI software. The current version of BI software manages data from over a million multi-faceted transactions for large field-services customers. Wireless and web enabled, the software provides automated intelligent decision-making for managing customer transactions, vehicles, technicians, supply chains, HR-related functions and other activities.

On September 16, 2011, the Company entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Cancable Holding and with Cancable and Dependable Hometech, LLC (“Purchaser”), pursuant to which the Company sold its equity interest in Cancable Holding to Purchaser for a consideration of US$1.00 on such date. In connection with such sale, we assigned certain of our liabilities and obligations to Cancable Holding, including (i) a secured term note of the Company dated February 13, 2006, for an original principal amount of US$8.25 million, which is currently held by Valens U.S. SPV I, LLC (“VUS”), Valens Offshore SPV I, Ltd. and PSource Structured Debt Limited (“PSource”), (ii) a secured term note of the Company dated June 24, 2008, for an original principal amount of US$800,000, which is currently held by VUS, and (iii) a secured term note of the Company dated June 24, 2008, for an original principal amount of US$1,700,000. which is currently held by Valens Offshore SPV II, Corp. (such holders of the term notes listed in clauses (i) to (iii), collectively, the “Holders”, and such term notes, collectively, the “Notes”). The aggregate outstanding amount owed under the Notes (including accrued and unpaid interest) was approximately US$9,800,000 as of September 16, 2011. The Holders also (a) terminated and cancelled all guarantees, security interest and other obligations of the Company and certain of its subsidiaries related to approximately US$1,500,000 of indebtedness owed to the Holders by certain other subsidiaries of the Company, (b) cancelled their warrants and options to purchase approximately 15,600,000 shares of common stock of the Company, as well as the stock of certain of the Company’s subsidiaries, and (c) terminated and cancelled all guarantees, security interest and other obligations of the Company and certain of its subsidiaries related to approximately US$5,100,000 of indebtedness owed to the Holders by Cancable Inc. and its subsidiaries. In addition, in connection with the sale of Cancable Holding to Purchaser, we assigned our rights in certain receivables owed to us by certain wholly-owned subsidiaries of Cancable Holding, totaling approximately US$4,800,000 as of September 16, 2011. The Holders are affiliates of Laurus Master Fund, Ltd. (“Laurus”).

Today, our operations are divided into two distinct operating segments: (a)we mainly focus on security and surveillance products and services, and (b) broadband deployment and provisioning services. Through AC Technical Systemsour technology integration team of engineers, we integrate various security related products to provide integrated security solutionsa single source solution to our commercialgrowing customer base. Through Cancable,Our design, engineering and XL Digital, we provide broadband deployment and provisioning services to residential and commercial markets.

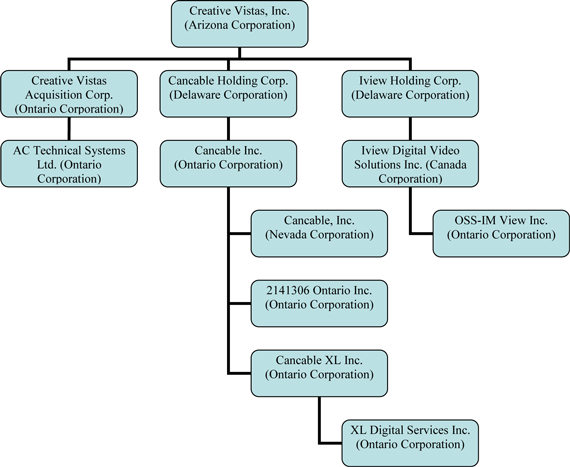

Our current corporate structure is as follows:

Security and Surveillance Products and Services

AC Technical Systems is focused on the electronic security segment of the security industry. Through our technology integration team of engineers, we integrate various security related products to provide single source solutions to our growing customer base. Our design, engineering and integration facilities are located in Ontario, Canada. We operate through our Iview DVSI subsidiary to build out Digital Video Management Systems (DVMS) to provide PC based video management systems to the surveillance market. Iview is a product company and sells to distributors and integrators in North America. Iview is in the early stages of building a strong consistent sales and marketing team to begin contributing revenues to us.

Industry Overview

We believe that the security industry is growing at a steady pace. There has been renewed focus on our industry since the events of September 11, 2001. The growth is spurred by the continuous evolution of new technologies and processes. We believe that the industry is growing for the following reasons:

| · | Increased global awareness due to the increased threats of terrorism; |

| · | Older security devices such as the VCR have become obsolete and new technologies have provided much more efficient systems at a better price; |

| · | Evolving digital technologies have started to replace antiquated analog technologies in the market space; |

| · | Expansion of budgets due to increased awareness of the need for security; |

| · | Increase in crime rates and shrinkage in the industry; |

| · | Integration of multiple devices has expanded the market for technically advanced integrators such as our firm; |

| · | Growing public concern about |

| · | Decreased cost of security technology. |

The security industry is highly fragmented with a large number of manufacturers, dealers, distributors, integrators and service groups. All of these parties provide part of the entire solution to the customer. Customers prefer a one-stop shop that provides them with the entire solution and also designs and customizes a solution that fits their needs. This solution may include custom design of hardware and software, along with highly sophisticated integration work. In most cases, the cost to the customer is higher when using a large number of parties as opposed to one efficient integrator. We believe that when many parties are involved in providing a solution to the customer, many needs of the customer may not be addressed. The amount of time a customer has to devote to buil dbuild multiple relationships as opposed to one relationship is substantial. There are also tendencies for different parties to “pass the blame” to the other party when it comes to technical and service issues with the project. As a result, the customer prefers dealing with one source that can handle all issues and be accountable for an entire project. There are a limited number of companies besides us that are capable of providing this entire integrated solution. Providing such a solution requires years of experience, infrastructure for performing all six core functions that we provide, access to technologies and a significant commitment to maintaining a satisfied customer.

A company that is implementing a new security system or enhancing an old system usually has to go through the following steps:

| · | Retain a consultant to appropriately outline its needs and design a system that satisfies those needs; |

| · | Once the design is complete, a tender is released whereby a number of invited system integrators bid on the required system; |

| · | System integrators work with various suppliers of hardware and software to meet the system requirements. They also engage these suppliers to complete subcomponents of the system; |

| · | When security systems have to be installed in multiple locations, the company may have to tender the system requirements to different system integrators from various regions; and |

| · | The customer, based on price and qualifications of the system integrator, will award the project to one or more system integrators. |

The process described above can cause a number of issues for clients including client frustrations with project delays, cost inefficiencies, incompatible systems and lack of vendor accountability. It also makes it very difficult for the customer to make changes to the system. In addition, a customer looking to implement security systems in multiple locations may have to hire multiple integrators and suppliers to integrate systems. This usually results in systems that are not consistent with each other. These systems may also not communicate efficiently with a central system. In addition, as security systems become more technologically advanced, an experienced engineering team is required to understand the needs of the customer and satisfy those needs by incorporating the most effi cientefficient technologies available into the security system. This may also include some development of hardware and software to customize and integrate the system. Most system integrators are not capable of development, as they do not have a research and development department. Also, the manufacturers of different subsystems are usually not willing to provide custom solutions on a project basis. Customers are realizing the sophistication required in order to provide a good security system and recognizing that their in-house personnel lack the skills and time necessary to coordinate their security projects.

Our Strategy

We have identified four key markets to target with our solution described below. These are 1) government 2) education 3) healthcare and 4) retail. We offer a one-stop-shop that provides a fully integrated technology based security system to meet the needs of the customer. We work to understand the needs of the customer and provide a custom solution to meet their needs. We expedite project completion, reduce costs to the customer, reduce manpower requirements of the customer and improve systems consistency in multiple locations.

We provide the following services:

| · | Consulting, audit, review and planning; |

| · | Engineering and design; |

| · | Customization, software development and interfacing; |

| · | System integration, installation and project management; |

| · | System training, technical support and maintenance; and |

| · | Ongoing maintenance, preventative maintenance and service and upgrades. |

We believe that the following key attributes provide us with a sustainable competitive advantage including:

| · | Experience and expertise in the security industry; |

| · | In-house research and development departments; |

| · | Dedicated service team; |

| · | Access to and experience in a variety of product mix; |

| · | Customized software and hardware products; |

| · | Strong references; and |

| · | Strong partnerships with suppliers and integrators. |

Our strategy for growth and expansion is to:

| · | Expand our network of technology partners; |

| · | Develop and maintain long-term relationships with clients; |

| · | Open regional offices in key areas to expand revenue and service; |

| · | Capitalize on our position as a leading provider of technologically advanced security systems; and |

| · | Expand our marketing and sales program within our key vertical markets. |

At the beginning of each new client relationship, we designate an account manager as the client service contact. This individual is the point person for communications between the client and us. The account manager usually has a number of years of experience in the industry and a good understanding of technologies and solutions that we provide. This person is also a trained salesperson who is able to build a long-term relationship with the customer. The account manager works with our project department, engineering department, marketing department, finance department and research and development department to provide an effective solution for the customer. Once the customer has engaged us to provide a solution, the engagement usually goes through one or more of the stages outlined below:

Consulting, audit, review and planning

We identify the client’s objectives and security system requirements. We then audit and review the client’s existing system. This audit of the existing system evaluates inventory counts and the existing infrastructure. Then we provide an audit report to outline current deficiencies and vulnerabilities. At this point, we design a system alternative to meet the needs of the customer. The alternative system is prioritized based on the needs of the customer. We also include an efficient cost model to ensure that the customer understands the cost of the system. We provide a Return On Investment (ROI) model where applicable. We also provide a preliminary project implementation plan that contains a graphical model of the client’s premises with exact outlines of equipment locations. Our comprehensive planning process helps the customer to properly budget for its needs on a long-term basis.

Engineering and design

The engineering and design process involves preparation of detailed project specifications and working drawings by a team of our design engineers. These drawings lay out the entire property and provide a detailed map of all security equipment and the methodologies used to integrate the system. The specification and drawings also outline any needs for custom software or hardware design services, systems designers and computer-aided design system operators. These specifications and drawings detail areas of high sensitivity, the layout of the main control room, and the placement of cameras, card readers, monitors, switches and other equipment.

Once our system design has been completed, we provide a complete list of components and recommendations. We highly recommend off-the-shelf non-proprietary components in order to ensure that the customer is not tied into one supplier. When off-the-shelf components are not available or are not compatible with each other, we design software or hardware to provide compatibility.

Customization, software development, interface

In many cases, the customer’s needs may not be completely satisfied by the equipment available in the market place. The customer may request features or equipment that are not readily available. For example, a financial institution may request us to take information from their transaction records and an Automatic Teller Machine (ATM), and then integrate that information with a Digital Video Recorder (DVR). This would allow them to review video of an individual who has processed a transaction on an ATM. Normally a financial institution requiring this information would have to go through tapes of data in order to find it. Such a bank would have to search all the transactions that occurred during a period of time and then, based on that information, go over tapes of video. ; Sometimes the video may not be available if the tapes are only held for a short period of time. Our firm’s integrated system makes this search process instantaneous. Our system allows a bank to search by a number of criteria including time, date, transaction, number and withdrawal amount. A bank can also have video associated with such a search instantly.

Many times we provide an interface to bring multiple technologies together. In one project, we integrated eleven different products into one system, thus allowing for a completely integrated system. This integrated system also has a very user-friendly interface that avoids having to deal with multiple monitors and Graphical User Interfaces (GUI).

System integration, installation, project management:

Once we determine that a project has passed through the consulting/audit, design/engineering and customization/software interfacing stage (if required) we can start the implementation of the system. During this stage, we provide the following:

| · | Detailed schedule of integration |

| · | List of components and labor assignments |

| · | Officially assign the project to one of our project managers |

| · | Production department starts procurement schedules |

| · | Construction draw date schedules |

| · | Progress billings and schedule site visits for quality control |

| · | Tests of final terminations and technology components in-house in order to avoid product failure on site |

| · | Hardware/software and network integration |

| · | Validation and testing |

| · | Final sign off and pass over to service department |

During this stage, the project manager manages the project and the projects are updated weekly to ensure that all components are working efficiently. During certain projects, the project manager may opt to use subcontractors to provide services that are not highly advanced technically. These services may include standard wiring and cabling. The customer is updated on the status of the project weekly. These updates may include Gantt charts. During this stage, many customers see the need for additional enhanced equipment, which increases the value of the contract to us.

System training, technical support, maintenance

When a project has been completed through system integration, the customer is provided with a complete training program. We train the customer on how to use the system and also provide them with manuals from manufacturers as well as training guides put together by us. Once the training is complete, the system will go on line and there is a transfer process to the service department from the projects department. Ongoing technical support and maintenance are provided by our dedicated service team.

Ongoing maintenance, preventative maintenance and service, upgrades:

This is the final stage of our process and it is an ongoing stage. We provide various types of maintenance contracts, which vary depending on the level of response required by the customer. We also provide a service plan suitable to the customer. If the customer does not require a service contract, we provide them with service on an incident by incident basis.

The entire six steps process continues for each customer. Once a project is complete, there are upgrades that are required. Depending on the value of the upgrades, they may initiate a new project. During every stage, an account manager is updated on the process. Account managers have regular meetings with the customers after projects are complete in order to help set budgets for the following years and also educate customers on new products and technologies that may be available in the market.

Research and Development

We have our own in-house research and development programs which are supported by the National Research Council of Canada. We may receive grants and tax credits for projects and product development if they qualify for the program. Our product development department develops new products and also enhances existing products. We have the capability to build various forms of hardware and software modules. Once a product is designed, the underlying technologies are used on an ongoing basis to enhance future projects and develop new products. This is one of the differentiating factors between our competitors and us. Our research and development expenses were approximately $670,000 in fiscal year 2011 and $860,000 in fiscal year 2010 and $590,000 in fiscal year 2009.2010. Expenses include engineering sa laries,salaries, costs of development tools and equipment. None of the expenses were borne directly by customers.

Warranties and Maintenance

We offer maintenance and service on all our products, including parts and labor, which range from one year to six years depending upon the type of product concerned and the type of contract signed by the customers. In addition, we provide a one-year warranty on equipment and a 90 day warranty on all installation projects completed by us. We receive the same warranty on equipment from our other external suppliers.

On non-warranty items, we perform repair services for our products sold at our main office in Ontario, Canada or at customer locations. For the years ended December 31, 20102011 and December 31, 2009,2010, our revenue from such service and maintenance activities was $1,409,400$1,393,800 and $1,471,500$1,409,400 respectively, and is included in service revenue in the accompanying consolidated statements of operations and comprehensive (loss).

Marketing

Our marketing activities are conducted on both national and regional levels. We obtain engagements through direct negotiation with clients, competitive bid processes, referrals and direct sales calls. Our marketing plan is deriveddeveloped with input from all our account managers and senior management. Our plan is to grow vertically within targeted markets where we have a superior level of expertise. Our marketing is very target specific. We market within our four key markets. We also find niche markets where our technologies can provide effective solutions to the customer. Some of our marketing activities include:

| · | Trade |

| · | Mailers |

| · | Direct sales calls |

| · | Web promotions |

| · | Seminars |

| · | Collaborations with manufacturers |

| · | Collaborations with consultants and architects |

We also collaborate with providers of complementary technologies and products who are not competitive with us. For example, there is a convergence of IT services and the security industry. We are evaluating the possibility of partnering with an IT services provider in order to provide our existing and potential customers with an expanded scope of services. We are also doing the same within the building automation industry as we see a convergence of building automation technologies and services with the security industry.

We are evaluating several opportunities to expand our operations via joint ventures and partnerships with regional and international companies that can provide us with additional expertise and an expanded presence. In addition, we are evaluating the possibility of acquiring similar businesses and expanding our operations.

Customers

We provide our products and services to customers in four markets:

| · | Government |

| · | Healthcare |

| · | Education |

| · | Retail |

We also provide our products and services to various other sectors including corporate facilities, mining, entertainment and the automobile industry through direct sales to end-users and through subcontracting agreements.

Backlog

Our backlog consists of written purchase orders and contract,contracts that we have received for product deliveries and engineering services that we expect to deliver or complete within 12 months. All of these orders and contracts are subject to cancellation at any time. As of December 31, 2010,2011, our backlog was approximately $2,000,000.

Competition

The security industry is highly fragmented and competitive. We compete with a number of different companies regionally and nationally. We have various different types of competitors including consultants, integrators, and engineering and design firms. Our main competitors include Siemens, ADT, Simplex, Intercon and Diebold. Our competitors also include equipment manufacturers and vendors that provide security services. Some of our competitors have greater name recognition and financial resources than we do. However, we believe that we have a well-respected name and are known for our quality work and technical expertise. We may face future competition from potential new entrants into the security industry and increased competition from existing competitors tha tthat may attempt to develop the ability to offer the full range of services offered by us. We cannot assure that we will be able to compete successfully in the future against existing or potential competitors.

Employees

As of December 31, 2010, Cancable has a staff of over 4002011,we have47 full time employees and A.C. Technical Systems has a staff of 47 employees.

The design and implementation of our equipment and the installation of our systems require substantial technical capabilities in many different disciplines from computer science to electronics with advanced hardware and software development. As a company, we encourage and provide training for new and existing technical personnel. In addition, we conduct training courses and also send our technical persons to various technical courses offered by manufacturers of various products. We have various incentive programs for our employees to improve their skills within all departments. These include reimbursements for training fees and raisessalary increases based on skill sets.

| ITEM 1A. | RISK FACTORS |

Described below are the material risks that we face. Our business, operating results or financial condition could be materially adversely affected by, and the trading price of our common stock could decline due to, any of these risks.

Competitive pressure from larger firms

The security industry is highly competitive. We compete with a number of large international firms, which have more extensive resources than we do. In addition, these competitors may have greater brand recognition, proprietary technologies and superior purchasing power as well as other competitive advantages.

Risks associated with budget constraints and cut back of customer spending:

We are dependent on large institutional and commercial customers and their budgets. If there are cut backs in budgets by itsour customers, it will adversely impact our revenues.

Risks associated with possible delays ofin construction schedules

We have contracted to provide security systems to a number of new buildings. Delays in construction of these buildings could potentially delay revenues being realized.

Supplier product failures

We do not currently manufacture our own products and must purchase products from others. It could adversely impact our relationships with our customers if there are delays in receiving products from suppliers or if there are defects in these products.

Contracts with government agencies may not be renewed or funded

Contracts with government agencies accountsaccount for some of our revenues. Many of these contracts are subject to annual review and renewal by the agencies and may be terminated at any time or on short notice. Each government contract is only valid if the agency appropriates enough funds for such contracts. Accordingly, we might fail to derive any revenue from sales to government agencies under a contract in any given future period. In addition, if government agencies fail to renew or terminate any of these contracts, it would adversely affect our business and results of operations.

We have a small number of customers from which we receive a large portion of our sales. Our experience has been that some of these substantial customers will be a source of significant sales in the succeeding year and some will not. Consequently, we are often required to replace one customer with one or more other customers in order to generate the same amount of sales. There can be no assurance that we will continue to be able to do so.

Key personnel losses

Competition for highly qualified technical personnel is intense and we may not be successful in attracting and retaining the necessary personnel, which would limit the rate at which we can develop products and generate sales. In particular, the departure of any of our senior management members or other key personnel could harm our business.

Intellectual property protection risks

Our intellectual property might not be protected. No new intellectual property has been acquired within the last three years. Despite our precautions, it may be possible for unauthorized third parties to copy our products or obtain and use information that we regard as proprietary to create products that compete against ours. If we fail to protect and preserve our intellectual property, we may lose an important competitive advantage. In addition, we may from time to time be served with claims from third parties asserting that our products or technologies infringe their intellectual property rights. If, as a result of any claims, we were precluded from using technologies or intellectual property rights, licenses to the disputed third-party technology or intellectual property rights might not be available on reason ablereasonable commercial terms, or at all. We may initiate claims or litigation against third parties for infringement of our proprietary rights or to establish the validity of our proprietary rights. Litigation, either as plaintiff or defendant, could result in significant expenses or divert the efforts of our technical and management personnel from productive tasks, whether or not the litigation is resolved in our favor. A successful claim against us, coupled with our failure to develop or license a substitute technology, could cause our business, financial condition and results of operations to be adversely affected.

We may not be able to increase our bonding

Many of our government contracts require that we obtain bonding. We may not be able to increase our bonding and, therefore, we may not be able to pursue larger projects as a primary contractor.

Fluctuation in quarterly results

Our quarterly results have varied over the past few years and will likely continue to do so. The results will vary based on the timing of the projects, construction schedules and customer budgets. Such fluctuations may contribute to volatility in the market price for our stock.

Lengthy sales cycle

The sale of our products and services frequently involves a significant commitment of resources to evaluate and propose a project. The approval process for our proposals usually involves multiple departments within our clients and may take several months. Accordingly, depending on the length of recording and processing time, a sale can take a prolonged period of time.

We may not be able to successfully make acquisitions or form partnerships as a means of fostering our growth

Our growth strategy involves successfully acquiring companies that will add value to our firm and also buildbuilding partnerships with companies who can complement our core competencies. We may not be successful in identifying or consummating transactions with such companies.

Continued need for additional financing

To implement our growth plan, we may need additional financing. We will need additional financing upon, but not limited to, any of the following events:

| · | Changes in operating plans |

| · | Lower than anticipated sales |

| · | Increased costs of expansion |

| · | Increase in competition relating to decrease in price |

| · | Increased operating costs |

| · | Potential acquisitions |

Additional financing may not be available on commercially reasonable terms or may not be available at all.

Because our directors own approximately 76% of our outstanding common shares, they could make and control corporate decisions that may be disadvantageous to minority shareholders

Our directors own approximately 76.0%76% of the outstanding common shares. Accordingly, they will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. The interests of our directors may differ from the interests of the other shareholders and thus result in corporate decisions that are disadvantageous to other shareholders.

Exchange rate fluctuations may have adverse effects on our revenues

A significant portion of our revenues and expenses are denominated in Canadian dollars. As a result, we will be exposed to currency exchange rate risk. Our reported earnings could fluctuate materially as a result of foreign exchange rate fluctuations.

Our substantial debt could adversely affect our financial position

Our substantial indebtedness could have important consequences to you.consequences. Our annual debt service requirements related to payments of principal on the net balance of our term notes ($16,551,128 at December 31, 2010) are $14,051,128 and $2,500,000note is $1,548,207 in 2011 and 2013 respectively.2012. In addition, interest on the notesnote is payable on a monthly basis. We also have a series of other notes payable totaling $1,500,000 as of December 31, 2010. The $1,500,000 promissory note included in other notes payable,2011, which were issued by Creative Vistas Acquisition to The Burns Trust and The Navaratnam Trust in connection with the acquisition of AC Technical, and which have no fixed term of repayment. The note payable was transferred to Malar Trust during Fiscal Year 2006 with the same payment term. The term notes are secured by substantially all of our assets.& #160; Interest on the term notes arenote is settled in cash. We do not currently have the ability to repay the notesnote in the event of a demand by the holder; accordingly, in the event we are unable to generate sufficient cash flow from our operations, we may face difficulties in servicing our substantial debt load. In such event, we could be forced to seek protection from our creditors, which could cause the liquidation of the Company in order to repay the secured debt. In any liquidation of us, the holders of our debt (including The Malar Trust), and, in all likelihood, our unsecured creditors would be required to be paid in full before any payments could be made to the holders of our common stock. In addition, our outstanding indebtedness could limit our ability to obtain any additional financing.

There is no active trading market in our securities

Effective February 23, 2011, our common stock became ineligible for quotation on the OTC Bulletin Board due to quoting inactivity pursuant to Rule 15c2-11 under the Securities Exchange Act of 1934, as amended. The Company’s common stock has been moved to OTC Link, which is operated by OTC Markets Group Inc. (formerly known as Pink OTC Markets Inc. or “Pink Sheets”). OTC Link is an electronic quotation system that displays quotes from broker dealersbroker-dealers for many over-the-counter securities. Although, our common stock is quoted on OTC Link, there is no active trading in the stock. A trading market may not develop and stockholders may not be able to liquidate their investment without considerable delay. If a market should develop, the price of our stock may be highly volatile.

Penny Stock regulations apply to our securities:

Our securities are subject to the “penny” stock regulation of Rule 15g-9 of the Securities Exchange Act of 1934. Rule 15g-9 of the Exchange Act is commonly referred to as the “penny stock” rule and imposes special sales practice requirements upon broker-dealers who sell such securities to persons other than established customers or accredited investors. A penny stock is any equity security with a market price less than $5.00 per share, subject to certain exceptions. Rule 3a51-1 of the Exchange Act provides that any equity security is considered a penny stock unless that security is: registered and traded on a national securities exchange and meets specified criteria set forth by the SEC; authorized for quotation in the National Association of Securities Dealers’ Automated Quotation System; issued by a reg isteredregistered investment company; issued with a price of five dollars or more; or issued by an issuer with net tangible assets in excess of $2,000,000. This rule may affect the ability of broker-dealers to sell our securities.

For transactions covered by Rule 15g-9, a broker-dealer must furnish to all investors in penny stocks a risk disclosure document, make a special suitability determination of the purchaser, and receive the purchaser’s written agreement to the transaction prior to the sale. In order to approve a person’s account for transactions in penny stocks, the broker-dealer must (i) obtain information concerning the person’s financial situation, investment experience, and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the person and that the person has sufficient knowledge and experience in financial matters to reasonably be expected to evaluate the transactions in penny stocks; and (iii) deliver to the person a written statement setting forth the bas isbasis on which the broker-dealer made the determination of suitability stating that it is unlawful to effect a transaction in a designated security subject to the provisions of Rule 15g-9(a)(2) unless the broker-dealer has received a written agreement from the person prior to the transaction. Such written statement from the broker-dealer must also set forth, in highlighted format immediately preceding the customer signature line, that the broker-dealer is required to provide the person with the written statement and the person should sign and return the written statement to the broker-dealer only if it accurately reflects the person’s financial situation, investment experience and investment objectives.

Losing our status as a Canadian Controlled Private Corporationcould adversely affect our financial position

:A Canadian Controlled Private Corporation (“CCPC”) is a corporation that is not controlled by a non-Canadian entity. If, in the future, more than 50% of the voting shares of AC Technical are owned by a non-Canadian entity, such as by Laurus exercising its rights under the Share Pledge Agreement, we would lose our status as a CCPC. Unless a company is a CCPC, it is not eligible for certain Canadian research and development tax credits. As a non-CCPC, the maximum Canadian research and development tax credits are 20% (for both Federal and Provincial Canadian taxes) of total eligible research and development expenditures. AC Technical is presently entitled to claim the maximum credits available to CCPCs of 41.5% (for both Federal and Provincial Canadian taxes) of the total eligible expenditures. During Fiscal Year 2010,2011, this e xtraextra 21.5% totaled approximately $200,000.

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission ("SEC"). Copies of this Annual Report on Form 10-K and each of our other periodic and current reports, and amendments to all such reports, that we file or furnish pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge on our website (http://www.creativevistasinc.com/) as soon as reasonably practicable after the material is electronically filed with, or furnished to, the SEC. The information contained on our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this Annual Report on Form 10-K.

In addition, you may read and copy any document we file with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. Our SEC filings are also available to the public at the SEC's web site at http://www.sec.gov, which contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

Not applicable – None.

| ITEM 2. | PROPERTIES |

Our office is located at 2100 Forbes Street, Units 8-10, Whitby, Ontario, Canada L1N 9T3. The premises, which were purchased in 2002, consist of approximately 5,900 square feet on the ground floor and 2,200 square feet on the second floor. Additionally, we have another major office location at 2321 Fairview St. Burlington, Ontario L7R 2E3 which services the Cancable Group. The premises, which were rented in 2003, consist of approximately 7,600 square feet. We believe that these offices arethe office is adequate for our present purposes and planned expansion. Furthermore, we believe these offices arethis office is in good condition and adequately covered by insurance.

| ITEM 3. | LEGAL PROCEEDINGS |

None.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable

| 11 |

PART II

ITEM 5.MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is quoted at the present time on the Pink Sheets website (www.pinksheets.com) under the symbol “CVAS” (prior to February 23, 2011, our common stock was quoted on the OTC Bulletin Board).The. The security is subject to Section 15(g) and Rule 15g-9 of the Securities Exchange Act of 1934, commonly referred to as the penny stock rule. See “Risk Factors—Penny Stock.Stock regulations apply to our securities.” The following table shows the range of bid prices per share of common stock on the OTC Bulletin Board or OTC Link, as reported by Pink Sheets LLC,appropriate, for the periods indicated. These quotations represent prices between dealers, do not include retail mark-ups, mark-downs or commissions, and do not necessarily represent actual transactions.

Quarter ended: | Low Bid Price | High Bid Price | ||||||

| March 31, 2009 | $ | 0.08 | $ | 0.30 | ||||

| June 30, 2009 | $ | 0.08 | $ | 0.16 | ||||

| September 30, 2009 | $ | 0.08 | $ | 0.20 | ||||

| December 31, 2009 | $ | 0.06 | $ | 0.18 | ||||

| March 31, 2010 | $ | 0.07 | $ | 0.11 | ||||

| June 30, 2010 | $ | 0.07 | $ | 0.09 | ||||

| September 30, 2010 | $ | 0.07 | $ | 0.01 | ||||

| December 31, 2010 | $ | 0.00 | $ | 0.00 | ||||

| Quarter ended: | Low Bid Price | High Bid Price | ||||||

| March 31, 2010 | $ | 0.07 | $ | 0.11 | ||||

| June 30, 2010 | $ | 0.07 | $ | 0.09 | ||||

| September 30, 2010 | $ | 0.07 | $ | 0.01 | ||||

| December 31, 2010 | $ | 0.01 | $ | 0.05 | ||||

| March 31, 2011 | $ | 0.03 | $ | 0.04 | ||||

| June 30, 2011 | $ | 0.02 | $ | 0.04 | ||||

| September 30, 2011 | $ | 0.02 | $ | 0.08 | ||||

| December 31, 2011 | $ | 0.01 | $ | 0.10 | ||||

Our securities may not qualify for listing on NasdaqNASDAQ or any other national exchange. Even if our securities do qualify for listing, we may not be able to maintain the criteria necessary to ensure continued listing. Our failure to qualify our securities or to meet the relevant maintenance criteria after such qualification may result in the discontinuance of the inclusion of our securities on a national exchange. In such event, trading, if any, in our securities may then continue in the non-Nasdaq,non-NASDAQ, over-the-counter market so long as we continue to file periodic reports with the SEC and there remain sufficient qualified market makers in our securities. As a result, a stockholder may find it more difficult to dispose of, or to obtain accurate quotations as to the market value of, our securities.

As of March 14, 20112012 there were 264 holders of our Common Stock. We have 37,488,714 outstanding shares of Common Stock.

For information regarding securities authorized for issuance under equity compensation plans (pursuant to Item 201(d) of Regulation S-K), please see the information provided under Item 12 of this Form 10-K, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of the financial condition and results of operations should be read in conjunction with the consolidated financial statements and related notes thereto. The following discussion contains certain forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those discussed therein.herein. Factors that could cause or contribute to such differences include, but are not limited to, risks and uncertainties related to the need for additional funds, the rapid growth of the operations and our ability to operate profitably a number of new projects. Except as required by law, we do not intend to publicly release the results of any revisions to those forward-looking statements that may be made to reflect any future events or circumsta nces.

Overview and Recent Developments

Creative Vistas, Inc. (“Creative Vistas”, the “Company”, “we”, “us”, or “our”) is a leading provider of security-related technologies and systems. We primarily operate through our subsidiary AC Technical Systems Ltd. (“AC Technical Systems”) to provide integrated electronic security-related technologies and systems. AC Technical Systems is responsible for all of our revenues in the security sector for 2011. It provides its systems to various high profile clients including: government, school boards, retail outlets, banks, and hospitals.

On September 16, 2011, the Company entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Cancable Holding Corp. (“Cancable Holding”) and with Cancable and Dependable Hometech, LLC (“Purchaser”), pursuant to which we sold our equity interest in Cancable Holding to Purchaser for a consideration of US$1.00 on such date. In connection with such sale, we assigned certain of our liabilities and obligations to Cancable Holding, including (i) a secured term note of the Company dated February 13, 2006, for an original principal amount of US$8.25 million, which is currently held by Valens U.S. SPV I, LLC (“VUS”), Valens Offshore SPV I, Ltd. and PSource Structured Debt Limited (“PSource”), (ii) a secured term note of the Company dated June 24, 2008, for an original principal amount of US$800,000, which is currently held by VUS, and (iii) a secured term note of the Company dated June 24, 2008, for an original principal amount of US$1,700,000. which is currently held by Valens Offshore SPV II, Corp. (such holders of the term notes listed in clauses (i) to (iii), collectively, the “Holders”, and such term notes, collectively, the “Notes”). The aggregate outstanding amount owed under the Notes (including accrued and unpaid interest) was approximately US$9,800,000 as of September 16, 2011. The Holders also (a) terminated and cancelled all guarantees, security interest and other obligations of the Company and certain of its subsidiaries related to approximately US$1,500,000 of indebtedness owed to the Holders by certain other subsidiaries of the Company, (b) cancelled their warrants and options to purchase approximately 15,600,000 shares of common stock of the Company, as well as the stock of certain of the Company’s subsidiaries, and (c) terminated and cancelled all guarantees, security interest and other obligations of the Company and certain of its subsidiaries related to approximately US$5,100,000 of indebtedness owed to the Holders by Cancable Inc. and its subsidiaries. In addition, in connection with the sale of Cancable Holding to Purchaser, we assigned our rights in certain receivables owed to us by certain wholly-owned subsidiaries of Cancable Holding, totaling approximately US$4,800,000 as of September 16, 2011. The Holders are affiliates of Laurus Master Fund, Ltd. (“Laurus”).

Today, we mainly focus on security and surveillance products and services. Through our technology integration team of engineers we integrate various security related products to provide a single source solution to our growing customer base. Our design, engineering and integration facilities are located in Ontario, Canada.

Results of Operations

Comparison of Year Ended December 31, 2010 to2011

with Year Ended December 31, 2009

Discontinued Operations

During 2011, we discontinued certain operations. In accordance with FASB ASC 360, our consolidated financial information presents the net effect of discontinued operations separate from the results of our continuing operations. During the year ended December 31, 2011, we recognized a gain from discontinued operations of approximately $12,624,500.

Revenue

: SalesDirect Expensesexpenses (excluding depreciation)

Project cost

Selling expenseexpenses: Selling expense was $911,500expenses were $903,500 or 2.3%12.5% of revenues for the year ended December 31, 20102011 compared to $905,600with $911,500 or 2.3%12.7% of revenues for the same period in 2009. Selling expenses were mainly related to AC Technical segment.2010. Salaries and commissioncommissions to salespersons for Fiscal Year 2010 wasfiscal year 2011 were $395,200 compared with $396,300 compared to $432,900 for Fiscal Year 2009. The decrease was mainly due to the decrease in revenue on which commissions are based. The advertisingfiscal year 2010. Advertising and promotion and trade show expenses were $145,600 in fiscal year 2011 compared with $159,200 in Fiscal Year 2010 compared to $134,800 for Fiscal Year 2009.fiscal year 2010.

General and administrative expenses

: General and administrative expenses wereDepreciation

: Total depreciation of property plant and equipment wasAmortization of Intangible Assets

Interest and other Expenses

Income taxes

: No income taxes were paid and/or owed during the year ended December 31,Loss

from operations:Net loss from continuing operations: Net loss from continuing operations for the year ended December 31, 20102011 was $1,007,400 compared to operatingwith $1,680,700 the same period in 2010. Net loss of $500,400from continuing operations for the year ended December 31, 2009.2011 was lower, due primarily to the decrease in financing expenses and other reasons described above.

Net income/loss: Net income for the year ended December 31, 2011 was $11,617,100 compared with a net loss of $618,800 for the same period in 2010. The net income for the year ended December 31, 2011 includes income from discontinued operations of $451,500 and a gain on disposal of discontinued operations of $12,173,000. The Company’s operating loss was $478,900 for the year ended December 31, 2011 compared with an operating loss of $931,300 for the year ended December 31, 2010. The year-over-year increasedecrease in operating incomeloss primarily reflected a focused cost reduction program acrossreflects the Companydecrease in amortization of intangible assets and an increase in revenue.

Liquidity and Capital Resources

Since our inception, we have financed our operations through bank debt, loans and equity from our principals, loans from third parties and funds generated by our business. At December 31, 2010,2011, we had $2,030,707$906,982 in cash. We believe that cash from operations and our credit facilities with Laurus will continue to be adequate to satisfy our ongoing working capital needs asneedsas we do not expect Laurus to demand acceleration of the loansloan extended to the Company.. We do not currently have the ability to repay the notesnote in the event of a demand by the holder. Furthermore, we granted a security interest to Laurus and its related entities in substantially all of our assets and, accordingly, in the event of any default under our agreements with Laurus and its related entities, they could conceivably attempt to foreclose on our assets, which could cause us to terminate our operations. During Fiscal Year 2011,fiscal year 2012, our primary objectives in managing liquidity and cash flows will be to ensure financial flexibility to support growth and entry into new markets and improve inventory management and to accelerate the collection of accounts receivable.

In addition, we have introduced cost cutting initiatives within the Administration, Project and Selling departments to improve efficiency and also to improve cash flow. We have also increased our rates for services provided by AC Technical to improve gross margins. This is in line with our competitors. Finally, we expect to realize additional benefits from our research and development efforts within the next 12 months as we start to introduce our own line of customized products to the industry. These products and technologies are expected to improve gross margins. We plan to seek additional capital in the future to fund operations, growth and expansion including through additional equity or debt financing or credit facilities. We have had early stage discussions with investors about potential investment in our com panycompany at a future datedate; however, no assurance can be made that such financing would be available, and if available that it would be on terms acceptable to us.

Net Cash Used in Operating Activities

. Net cash used by operating activities amounted toBalance sheet as at December 31, 2010 to2011 compared with December 31, 2009

Accounts Receivable

Our accounts receivable decreased to $3,039,700$895,200 as of December 31, 20102011 from $4,292,100$1,129,900 as of December 31, 2009. Accounts receivable of Cancable as at December 31, 2010 was $1,909,800 compared to $2,959,800 as at December 31, 2009. The decrease was attributable to the timing of payment by our customers. Accounts receivable of the AC Technical segment was $1,207,800 as at December 31, 2010 compared to $1,269,200 as of December 31, 2009.2010. The decrease was mostly due to the timing of payment by our customers.

Inventory

Inventory on hand on December 31, 20102011 decreased to $692,900$375,000 compared to $789,000with $477,000 as of December 31, 2009. Inventory2010. The decrease was mainly due to the decrease in contract revenue during the fourth quarter of the AC Technical segment was $476,900 compared to $440,225 as of December 31, 2009. Inventory at the Cancable segment was decreased to $215,900 as at December 31, 2010 from $261,200 as at December 31, 2009. There was no material fluctuation of the balances.

Accounts Payable and Accrued Liabilities

Accounts payable and accrued liabilities decreased to $3,990,900$1,257,300 as of December 31, 20102011 compared to $4,555,300with $1,748,600 as of December 31, 2009.2010. The balance for the AC Technical segment was $1,096,400 as of December 31, 2010 compared to $1,146,300 as of December 31, 2009. Accounts payable for Cancable Group was $2,242,300 as at December 31, 2010 compared to $3,029,000 as at December 31, 2009. The decrease in the balance was mainly due to the decrease in purchases of material in the last three months of the year and the timing of payments to our suppliers.

Deferred Revenue

Deferred revenue increaseddecreased to $60,800 at December 31, 2011 compared with $110,500 at December 31, 2010 compared to the balance of $84,500 as at December 31, 2009.2010. This increasedecrease was mainly due to the timing of payments by our customers. Deferred revenue primarily relates to payments associated with the contracts where revenue is recognized on a percentage of completion basis.

Net Cash providedUsed by (used in) Investing Activities

Net cash used forin investing activities was $124,200$527,900 for the twelve monthsyear ended December 31, 2010,2011, compared to $83,200 receivedwith $1,018,300 used in investing activities for the twelve months ended December 31, 2009. The total purchase2010. Purchases of property and equipment of the Company was $131,000were $4,600 for the twelve months endingended December 31, 2010 2011 and $131,100$6,400 for the year ended December 31, 2009.

Net Cash Provided by (used(Used in) Financing Activities

Recent Accounting Pronouncements

–Off Balance Sheet Arrangements

None

DISCUSSION OF CRITICAL ACCOUNTING ESTIMATES

Critical accounting estimates are those that management deems to be most important to the portrayal of our financial condition and results of operations, and that require management’s most difficult, subjective or complex judgments, due to the need to make estimates about the effects of matters that are inherently uncertain. We have identified our critical accounting estimates which are discussed below.

Accounts receivable allowances are determined using a combination of historical experience, current information and management judgment. Actual collections may differ from our estimates.

We derive revenues from contract revenue and services revenue, which include assistance in implementation, integration, customization, maintenance, training and consulting. We recognize revenue for contractcontracts and services in accordance with Statement of Position (SOP) 81-1, “Accounting for Certain Construction Type and Certain Production Type Contracts,” and SEC Staff Accounting Bulletin (SAB) 104, “Revenue Recognition,” and EITF Issue 00-21 Accounting for Revenue Arrangements with Multiple Deliverables. Contract revenue consists of fees generated from installation of security systems. Services revenue consists of fees generated by providing monitoring services, preventive maintenance and technical support, product maintenance and upgrades. Monitoring services and preventive maintenance and technical support are generally provided under contracts for terms varying from one to six years. A customer typically prepays monitoring services, preventive maintenance and technical support fees for an initial period. The related revenue is deferred and generally recognized over the term of such initial period. Rates for product maintenance and upgrades are generally provided under time and material contracts. Revenue for these services is recognized in the period in which the services are provided.

We record inventory at the lower of cost and net realizable value. Cost is determined on a first-in, first-out basis. We write down our inventoryrecord a reserve for obsolescence, and excess inventories based on assumptions about future demand and market conditions. The business environment in which we operate is subject to customer demand. If actual market conditions are less favorable than those estimated, additional material inventory write-downwrite-downs may be required. A 10% increase in inventory reserve would increase expenses by $0.1 million.

For issuance of equity instruments for services, we record all stock-based compensation as an expense in the financial statements, and that such cost be measured at the grant date fair value of the award. We record the grant date fair value of stock-based compensation awards as an expense over the vesting period of the related stock options. In order to determine the fair value of the stock options on the date of grant, we use the Black-Scholes-Merton option-pricing model. Inherent in this model are assumptions related to expected stock-price volatility, option life, risk-free interest rate and dividend yield. Although the risk-free interest rates and dividend yield are less subjective assumptions, typically based on factual data derived from public sources, the expected stock-price volatility, forfeiture rate and option life assumptio nsassumptions require a greater level of judgment which make them critical accounting estimates. We use an expected stock-price volatility assumption that is based on historical volatilities of our common stock and we estimate the forfeiture rate and option life based on historical data related to prior option grants.

Commitments

We have entered into contracts for certain consulting services providing for monthly payments and are required to repay the principal of our convertibleterm notes and promissory notes due to Laurus and other parties. In addition, we have also entered into operating leases for our vehicles, computer and office equipment.vehicles. The total minimum annual payments for the next five years and thereafter are as follows:

Payment due by Period | ||||||||||||||||||||||||||||

Total | 2011 | 2012 | 2013 | 2014 | 2015 | Thereafter | ||||||||||||||||||||||

| Term notes | $ | 16,551,128 | $ | 14,051,128 | $ | - | $ | 2,500,000 | $ | - | $ | - | $ | - | ||||||||||||||

| Note payable to related parties | 1,500,000 | - | - | - | - | - | 1,500,000 | |||||||||||||||||||||

| Capital leases* | 3,822,062 | 1,813,382 | 1,989,358 | 19,322 | - | - | - | |||||||||||||||||||||

| Operating leases | 1,247,259 | 590,237 | 459,635 | 197,387 | - | - | - | |||||||||||||||||||||

| Commitments related to consulting agreements | 1,210,000 | 605,000 | 605,000 | - | - | - | - | |||||||||||||||||||||

| $ | 24,330,449 | $ | 17,059,747 | $ | 3,053,993 | $ | 2,716,709 | $ | - | $ | - | $ | 1,500,000 | |||||||||||||||

| Payment due by period | ||||||||||||||||||||

| Term notes | Notes payable to related parties | Commitments related to consulting agreements | Operating leases for vehicles | Total | ||||||||||||||||

| 2012 | $ | 1,548,207 | $ | - | $ | 458,300 | $ | 15,000 | $ | 2,021,507 | ||||||||||

| 2013 | - | - | - | - | - | |||||||||||||||

| 2014 | - | - | - | - | - | |||||||||||||||

| 2015 | - | - | - | - | - | |||||||||||||||

| 2016 | - | - | - | - | - | |||||||||||||||

| Thereafter | - | 1,500,000 | - | - | 1,500,000 | |||||||||||||||

| Total | $ | 1,548,207 | $ | 1,500,000 | $ | 458,300 | $ | 15,000 | $ | 3,521,507 | ||||||||||

The figures in the above table except with respect to capital leases do not include interest costs.

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

Not applicable.

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

INDEX TO FINANCIAL STATEMENTS

Creative Vistas, Inc.

Consolidated Financial Statements

For the years ended December 31, 20102011 and 2009

| Report of Independent Registered Public Accounting Firm | F-1 | |

| Balance Sheets | F-2 | |

| Statements of Operations and Other Comprehensive Income (Loss) | F-3 | |

| Statement of Stockholders’ (Deficiency) | F-4 | |

| Statements of Cash Flows | F-5 | |

| Notes to Financial Statements | F-6 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Stockholders and Board of Directors

Creative Vistas, Inc

.We have audited the accompanying consolidated balance sheets of Creative Vistas, Inc. as of December 31, 20102011 and 2009,2010, and the related consolidated statements of operations and comprehensive income (loss), stockholders’ (deficiency) and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States)States of America). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence su pportingsupporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Creative Vistas, Inc. as of December 31, 2011 and 2010, and 2009, andthe results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered recurring losses from continuing operations and has working capital and stockholder deficiencies. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to this matter are also discussed in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Kingery & Crouse, PA

Certified Public Accountants

Tampa, Florida

March 30, 2011

| Creative Vistas, Inc. | ||||||||

| Consolidated Balance Sheets | ||||||||

| December 31 | 2010 | 2009 | ||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash and bank balances | $ | 2,030,707 | $ | 2,441,204 | ||||

| Accounts receivable, net of allowance for doubtful accounts $253,714 (2009-$213,862) | 3,039,739 | 4,292,071 | ||||||

| Income tax recoverable | 180,000 | 257,142 | ||||||

| Inventory, net | 692,881 | 789,005 | ||||||

| Prepaid expenses | 372,507 | 347,048 | ||||||

| Total current assets | 6,315,834 | 8,126,470 | ||||||

| Property and equipment, net of depreciation and amortization | 4,407,739 | 6,669,553 | ||||||

| Deposits | 228,434 | 282,359 | ||||||

| Deferred financing costs, net | 225,107 | 384,521 | ||||||

| Intangible assets, net | 56,316 | 284,286 | ||||||

| Deferred income taxes | 37,430 | 36,879 | ||||||

| $ | 11,270,860 | $ | 15,784,068 | |||||

| Liabilities and Stockholders’ (Deficiency) | ||||||||

| Current Liabilities | ||||||||

| Bank indebtedness | $ | 650,744 | $ | 1,960,057 | ||||

| Accounts payable | 1,470,157 | 1,916,270 | ||||||

| Accrued salaries and benefits | 1,170,546 | 1,223,357 | ||||||

| Accrued commodity taxes | 320,664 | 194,258 | ||||||

| Accrued liabilities | 1,029,508 | 1,221,435 | ||||||

| Current portion of obligation under capital leases | 1,487,460 | 1,501,106 | ||||||

| Deferred income | 110,485 | 84,502 | ||||||

| Deferred income taxes | 25,858 | 25,858 | ||||||

| Current portion of term notes | 14,051,128 | 1,750,000 | ||||||

| Total current liabilities | 20,316,550 | 9,876,843 | ||||||

| Term notes | 1,702,218 | 13,913,252 | ||||||

| Notes payable to related parties | 1,500,000 | 1,500,000 | ||||||

| Obligation under capital lease, net of current portion | 1,899,524 | 3,543,801 | ||||||

| Due to related parties | 230,870 | 219,876 | ||||||

| 25,649,162 | 29,053,772 | |||||||

| Stockholders’ (deficiency) | ||||||||

| Share capital | ||||||||

| Preferred stock no par value, 50,000,000 shares authorized, none issued or outstanding | ||||||||

| Common stock, no par value; 100,000,000 shares authorized | ||||||||

| Common stock | 6,555,754 | 6,555,754 | ||||||

| Additional paid-in capital | 14,314,354 | 14,158,942 | ||||||

| Accumulated (deficit) | (33,638,922 | ) | (32,957,115 | ) | ||||

| Accumulated other comprehensive (losses) | (1,609,488 | ) | (1,027,285 | ) | ||||

| (14,378,302 | ) | (13,269,704 | ) | |||||

| $ | 11,270,860 | $ | 15,784,068 | |||||

| Creative Vistas, Inc. | ||||||||

| Consolidated Balance Sheets | ||||||||

| December 31 | 2011 | 2010 | ||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash and bank balances | $ | 906,982 | $ | 1,779,345 | ||||

| Accounts receivable, net of allowance | ||||||||

| for doubtful accounts $117,392 (2010-$143,414) | 895,193 | 1,129,942 | ||||||

| Income tax recoverable | 235,294 | 180,000 | ||||||

| Inventory, net | 374,997 | 476,968 | ||||||

| Prepaid expenses | 8,205 | 14,765 | ||||||

| Current assets of discontinued operations | - | 2,734,814 | ||||||

| Total current assets | 2,420,671 | 6,315,834 | ||||||

| Property and equipment, net of depreciation | 718,155 | 790,874 | ||||||

| Deposits | 19,608 | 22,500 | ||||||

| Deferred financing costs, net | - | 2,157 | ||||||

| Deferred income taxes | 37,203 | 37,430 | ||||||

| Noncurrent assets of discontinued operations | - | 4,102,065 | ||||||

| $ | 3,195,637 | $ | 11,270,860 | |||||

| Liabilities and Stockholders’ (Deficiency) | ||||||||

| Current Liabilities | ||||||||

| Bank indebtedness | $ | - | $ | 255,312 | ||||

| Accounts payable | 1,056,892 | 1,478,673 | ||||||

| Accrued salaries and benefits | 86,756 | 56,984 | ||||||

| Accrued commodity taxes | 35,300 | 67,230 | ||||||

| Other accrued liabilities | 78,395 | 145,717 | ||||||

| Deferred income | 60,810 | 110,485 | ||||||

| Deferred income taxes | 25,858 | 25,858 | ||||||

| Term note payable | 1,548,207 | 8,902,374 | ||||||

| Current liabilities of discontinued operations | - | 9,273,917 | ||||||

| Total current liabilities | 2,892,218 | 20,316,550 | ||||||

| Notes payable to related parties | 1,500,000 | 1,500,000 | ||||||

| Due to related parties | 226,343 | 230,870 | ||||||

| Noncurrent liabilities of discontinued operations | - | 3,601,742 | ||||||

| 4,618,561 | 25,649,162 | |||||||

| Stockholders' (Deficiency) | ||||||||

| Share capital | ||||||||

| Preferred stock no par value, 50,000,000 shares authorized, none issued or outstanding | ||||||||

| Common stock, no par value; 100,000,000 shares authorized 37,488,714 shares issued and outstanding at December 31, 2011 and 2010 | 6,555,754 | 6,555,754 | ||||||

| Additional paid-in capital | 14,338,226 | 14,314,354 | ||||||

| Accumulated (deficit) | (22,021,782 | ) | (33,638,922 | ) | ||||

| Accumulated other comprehensive (loss) | (295,122 | ) | (1,609,488 | ) | ||||

| (1,422,924 | ) | (14,378,302 | ) | |||||

| $ | 3,195,637 | $ | 11,270,860 | |||||

The accompanying notes are an integral part of these financial statements.