U.S.UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

FORM 10-K10 – K

(Mark One)

| x | ANNUAL REPORT |

For Fiscal Year Ended: the fiscal year endedDecember 31, 20112012

OR

| ¨ | TRANSITION REPORT |

For the transition period from ______________________ to ______________________

Commission file number: 333-149850File Number:000-54645

EASTERN RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 45-0582098 | |

| (State or other jurisdiction of | incorporation) | ( |

1610 Wynkoop Street, Suite 400, Denver, CO 80202 (Address of principal executive offices)

| ||

Issuer'sRegistrant’s telephone number:number, including area code(917) 687-6623(303) 893-2334

Securities registered underpursuant to Section 12(b) of the Act:None

Securities registered underpursuant to Section 12(g) of the Act:None Common Stock, $0.001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Ruleby rule 405 of the Securities Act.

Yes¨ Nox

Indicate by check markcheckmark if the registrant is not required to file reports pursuant to section 13 or 15(d) of the Exchange Act from their obligations under those Sections. Yes¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act.Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes¨x No¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulationregistration S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant'sthe registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Partpart III of this Form 10-K or any amendment to this Form 10-K.x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of the “large accelerated filer,” “accelerate“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large | Accelerated | Non-accelerated filer ¨ | Smaller reporting companyx | |||

(Do not check if a smaller Reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Nox

As of June 30, 2011,2012, there were 20,629,000198,550,000 shares of the registrant's common stock, par value $0.00001,$0.001, issued and outstanding. Of these, 9,123,00018,550,000 shares were held by non-affiliates of the registrant. The aggregate market value of securities held by non-affiliates was $0$17,662,500 as registrant’s common stock does not presently trade.

DOCUMENTS INCORPORATED BY REFERENCE

None.None

TABLE OF CONTENTS

PAGE | ||||

| Forward Looking statements | 1 | |||

| PART I | ||||

| ITEM 1. | ||||

| ITEM | ||||

| ITEM | ||||

| 37 | ||||

| Properties. | 37 | |||

| ITEM 3. | Legal proceedings. | 39 | ||

| ITEM 4. | Mine safety disclosures. | 39 | ||

| PART II | ||||

| ITEM 5. | Market for registrant’s common equity, related stockholder matters and issuer purchases of equity securities. | 40 | ||

| ITEM 6. | Selected financial data. | 43 | ||

| ITEM 7. | Management’s discussion and analysis of financial condition and results of operations. | 43 | ||

| ITEM 7A. | Quantitative and qualitative disclosures about market risk. | 54 | ||

| ITEM 8. | Financial statements and supplementary data. | 54 | ||

| ITEM 9. | Changes in and disagreements with accountants on accounting and financial disclosure. | 54 | ||

| ITEM 9A. | Controls and procedures. | 54 | ||

| ITEM 9B. | Other information. | 56 | ||

| PART III | ||||

| ITEM 10. | Directors, executive officers and corporate governance. | 56 | ||

| ITEM 11. | Executive compensation. | 60 | ||

| ITEM 12. | Security ownership of certain beneficial owners and management and related stockholder matters. | 63 | ||

| ITEM 13. | Certain relationships and related transactions, and director independence. | 65 | ||

| ITEM 14. | Principal accounting fees and services. | 69 | ||

| PART IV | ||||

| ITEM 15. | 70 | |||

| Glossary of Relevant Mining Terms | 75 | |||

| SIGNATURES | ||||

| i |

FORWARD-LOOKING STATEMENTS

Except for historical information, this reportThis Current Report contains forward-looking statements, within the meaning of federal securities laws. Such forward-looking statements involve risks and uncertainties, including, among other things, statements regarding our business strategy, future revenues and anticipated costs and expenses. Such forward-looking statements include, among others, those statements including the words “expects,” “anticipates,” “intends,” “believes” and similar language. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussedwithout limitation, in the sections “Business,captioned “Description of Business,” “Risk Factors”Factors,” and “Management’s Discussion and Analysis of Financial Condition and ResultsPlan of Operations.Operations,” You should carefully reviewand elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to exploration programs, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the SEC, and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

In addition to the specific statements referenced above and the factors identified under “Item 1A. Risk Factors” in this Current Report below, other uncertainties that could affect the accuracy of our forward-looking statements include:

| § | The effect of government regulations on our business; |

| § | Our ability to secure additional capital; |

| § | Unexpected changes in business and economic conditions, including the rate of inflation; |

| § | Changes in interest rates and currency exchange rates; |

| § | Timing and amount of production, if any; |

| § | Technological changes in the mining industry; |

| § | Our costs; |

| § | Changes in exploration and overhead costs; |

| § | Access and availability of materials, equipment, supplies, labor and supervision, power and water; |

| § | Results of current and future feasibility studies; |

| § | The level of demand for our products; |

| § | Changes in our business strategy, plans and goals; |

| § | Interpretation of drill hole results and the geology, grade and continuity of mineralization; |

| § | The uncertainty of mineralized material estimates and timing of development expenditures; |

| § | Commodity price fluctuations; |

| § | Operational and environmental risks associated with the mining industry; and |

| § | Lack of clear title to some of our mineral prospects. |

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, insufficient cash flows and resulting illiquidity, our inability to expand our business, government regulations, lack of diversification, volatility in the price of gold, zinc, silver, lead and copper, increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this AnnualReport appears in the section captioned “Risk Factors” and elsewhere in this Report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise.

Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and in other documents which we may file from time to time with the Securities and Exchange Commission. YouCommission (the “SEC”).

EXPLANATORY NOTE

We were incorporated as Eastern Resources, Inc., in Delaware on March 15, 2007. Prior to the Merger (as defined below), our business was to engage in the acquisition, production and distribution of independent films.

As used in this Current Report, unless otherwise stated or the context clearly indicates otherwise, the term “ESRI” refers to Eastern Resources, Inc., before giving effect to the Merger, the term “MTMI” refers to Montana Tunnels Mining, Inc., a Delaware corporation, the term “EGI” refers to Elkhorn Goldfields, Inc., a Montana corporation, and the terms “Company,” “we,” “us,” and “our” refer to Eastern Resources, Inc., and its wholly-owned subsidiaries, including MTMI and EGI, after giving effect to the Merger.

On April 6, 2012, (i) MTMI Acquisition Corp., a Delaware corporation formed on February 27, 2012 and a wholly-owned subsidiary of ESRI (“MTMI Acquisition Sub”), merged with and into MTMI, a wholly-owned subsidiary of Elkhorn Goldfields LLC, a Delaware limited liability company (“EGLLC”), with MTMI as the surviving corporation and (ii) EGI Acquisition Corp., a Montana corporation formed on February 27, 2012 and a wholly-owned subsidiary of ESRI (“EGI Acquisition Sub”), merged with and into EGI, a wholly-owned subsidiary of EGLLC, with EGI as the surviving corporation (collectively, the “Merger”). As a result of the Merger and the Split-Off (as defined below), ESRI discontinued its pre-Merger business and acquired the business of MTMI and EGI, and will continue the existing business operations of MTMI and EGI as a publicly-traded company under the name Eastern Resources, Inc.

As a result of the Merger, EGLLC became the parent of the Company holding 180,000,000 shares of our Common Stock and 10,000,000 shares of our Series A Preferred Stock.

| 2 |

PART I

ITEM 1. BUSINESS.

Overview

Montana Tunnels Mining, Inc., a Delaware corporation (“MTMI”), was formed in 1998 to own and operate the Montana Tunnels gold-zinc-silver-lead open pit mining operation (the “Montana Tunnels Mine”). The Montana Tunnels Mine has been in operation since 1987. Elkhorn Goldfields, Inc., a Montana corporation (“EGI”), was formed in 1998 and owns the Elkhorn Project, which includes the Golden Dream Mine – a planned gold-copper underground mining operation (“Golden Dream Mine”). Prior to the Merger, MTMI and EGI were wholly-owned subsidiaries of Elkhorn Goldfields, LLC, a Delaware limited liability company (“EGLLC”). EGLLC is a mining holding company and is owned by the private equity investment funds that are cautionedmanaged by Black Diamond Financial Group LLC, a Delaware limited liability company (“Black Diamond”).

Ownership Structure

Black Diamond is owned and managed by Patrick Imeson and Eric Altman and is the manager of Black Diamond Holdings, LLC (“BDH”). In addition to their roles, through Black Diamond, in managing BDH, Messrs. Imeson and Altman also serve as board members, advisors, officers and, occasionally, as employees of the companies that are owned by BDH. Black Diamond receives a management fee from BDH and is entitled to a percentage of BDH’s distributions after BDH’s investors receive the return of their invested capital.

BDH is owned by about 40 accredited investors, primarily investment funds. Approximately 53% of BDH is owned by Michael Feinberg either directly or through trusts, family members or his partnership with Patrick Imeson in MFPI Partners, LLC, a Delaware limited liability company whose sole members are Michael Feinberg and Patrick Imeson (“MFPI”). Additionally, Patrick Imeson and Eric Altman own about 5% of BDH.

EGLLC is currently greater than 99% owned by BDH, however convertible debt and warrant holders have the right to convert or exercise warrant rights into approximately 25% of EGLLC. Prior to the Merger, EGLLC owned 100% of EGI and MTMI and had no other operating activities. EGLLC’s officers consisted of Patrick Imeson, Eric Altman and Robert Trenaman. After the Merger, EGLLC owns 180,000,000 shares of Common Stock and 10,000,000 shares of Series A Preferred Stock of the Company, and the officers of EGLLC include only Patrick Imeson and Eric Altman.

EGLLC was formed to provide oversight, direction and financing for the mining companies that BDH invested in. Now that the ownership of MTMI and EGI has been transferred to us, EGLLC has determined that it will not initiate any additional operating activities. This will avoid conflict with us being that Black Diamond has been the manager of EGLLC and has now signed a management services agreement with us (discussed below). EGLLC will use the proceeds received from the dividends on our Series A Preferred Stock or sale of our Common Stock and Series A Preferred Stock to place undue reliancepay its trade payables, accrued interest and debt obligations. Once this is completed, EGLLC expects to distribute its holdings of our Common Stock and Series A Preferred Stock to its members and to dissolve EGLLC as a legal entity. The dissolution of EGLLC will not impact the relationship between the Company and its operating subsidiaries, MTMI and EGI. However, dissolution of EGLLC may impact our beneficial ownership. As indicated in the notes to the beneficial ownership table on page 63 of this Current Report, Michael Feinberg, one of our directors, indirectly beneficially owns approximately fifty percent (50%) of the membership interests in EGLLC while Patrick Imeson, our Chief Executive Officer and Chairman, indirectly beneficially owns approximately three and one-half percent (3.5%) of the membership interests in EGLLC. The majority of the remaining interests in EGLLC is held by investment funds through BDH. Upon dissolution of EGLLC, these beneficial owners will become direct owners of our Capital Stock.

Furthermore, of the convertible debt and warrants that may convert and be exercised into approximately 25% of EGLLC, 40% of those securities are owned by MFPI, 32% are owned by other investors that directly or indirectly own BDH and 28% are owned by investors that have no affiliation with BDH.

Certain of the Secured Lenders (defined below) that are also indirect holders of BDH are either direct or indirect holders of some of these conversion rights. These Secured Lenders hold conversion rights, either directly or indirectly, by an exchange provision included in their loans to MFPI whereby the Secured Lenders have the option to exchange the loans to MFPI for the convertible debt held by MFPI issued by EGLLC. These rights would provide the Secured Lenders the rights to convert and exchange into 17% of EGLLC. Both the direct and indirect obligations are reflected in the Push-Down Debt, Interest, and Redeemable Obligation disclosures in the financial statements of the Company.

The Secured Lenders consist of eight groups, either as individuals or through trusts that they control. Upon conversion and exercise of their exchange rights in MFPI, each of the eight groups would have a beneficial ownership of less than 4% of the Company, except for Jane B. Vilas who would own approximately 10.79% of EGLLC, and, thus approximately 9.8% of the Common Stock and 10.79% of the Series A Preferred Stock of the Company, through trusts and partnerships that she controls or may beneficially own.

Corporate History

Pegasus Gold Inc., a Province of British Columbia corporation (“Pegasus”), had operations in Montana, Nevada and Australia. Pegasus commenced operations at the Montana Tunnels Mine in 1987. In January 1998, due to struggling mine operations external to the Montana Tunnels Mine, Pegasus was unable to service approximately $238 million in debt and filed for bankruptcy under Chapter 11 of the United States Bankruptcy Code. Under the reorganization plan, Pegasus incorporated a holding company named Apollo Gold Inc., a Delaware corporation, and Apollo Gold Inc. became the owner/operator of the Montana Tunnels Mine.

During the second quarter of 2002, Apollo Gold Inc. was acquired by a Toronto Stock Exchange listed company – Nevoro Gold Inc. – which, upon closing of the acquisition, changed its name to Apollo Gold Corporation (“Apollo”) and traded publicly on the forward-lookingToronto Stock Exchange as such.

On July 28, 2006, EGLLC earned a 50% interest in the Montana Tunnels Mine and related assets by providing $14,250,000 to establish a joint venture with Apollo to remediate the “L” Pit and put the Montana Tunnels Mine back into production. Montana Tunnels Mine is an open pit mine. Each pit expansion shell is named in alphanumeric order. The “L” Pit was the south and west wall layback. Before that was the “K” Pit which was the east wall layback.

In July 2006, EGLLC established, and owned 100% of, Elkhorn Tunnels, LLC to facilitate the joint venture with Apollo. The “L” pit was completed mining in November 2008. In June 2009, Apollo advised EGLLC that it intended to market its position in the joint venture. EGLLC optioned to purchase Apollo’s interest which it exercised in the fall of 2009 and paid $250,000 as the first installment on the purchase. In February 2010, EGLLC and Apollo renegotiated the form of payment and the terms of the purchase of Apollo’s 50% interest in MTMI was modified to include the $250,000 cash already paid plus an assignment to Apollo of EGLLC’s interest in a certain loan and mortgage on a property owned by an unrelated mining company. Elkhorn Tunnels, LLC was dissolved following EGLLC’s completion of its acquisition of the remaining interest in MTMI.

EGI is the owner and operator of the Golden Dream Mine located at 2725-A Elkhorn Road, Boulder, Montana. The mine is located near the historic town of Elkhorn which dates back to the 1870s. The Golden Dream Mine is located about 15 air miles south east of the Montana Tunnels Mine and the over-the-road distance between the mines is approximately 35 miles. EGI was purchased by Calim Private Equity, LLC from Elkhorn Gold Mining Corporation, a Canadian corporation, in October 2000. Calim Private Equity, LLC, a private equity company, later created EGLLC and assigned its 100% interest in EGI to EGLLC.

Significant Developments

On April 6, 2012, ESRI, MTMI Acquisition Sub, EGI Acquisition Sub, MTMI, EGI and EGLLC entered into the Merger Agreement, which closed on the same date, and pursuant to which (i) MTMI Acquisition Sub merged with and into MTMI with MTMI as the surviving corporation and (ii) EGI Acquisition Sub merged with and into EGI with EGI as the surviving corporation. MTMI and EGI became wholly-owned subsidiaries of ESRI.

Pursuant to the Merger, the Company ceased to engage in the acquisition, production and distribution of independent films and acquired the business of MTMI and EGI to engage in exploration and production activities in the precious metals mining industry, as a publicly-traded company under the name Eastern Resources, Inc.

At the closing of the Merger, (i) each of the 100 shares of MTMI’s common stock issued and outstanding immediately prior to the closing of the Merger was converted into 45,000,000 shares of common stock, par value $0.001 per share (“Common Stock”), and 5,000,000 shares of Series A preferred stock, par value $0.001 per share (“Series A Preferred Stock” and, together with the Common Stock, the “Capital Stock”), of the Company and (ii) each of the 100 shares of EGI’s common stock issued and outstanding immediately prior to the closing of the Merger was converted into 45,000,000 shares of Common Stock and 5,000,000 shares of Series A Preferred Stock. As a result, an aggregate of 90,000,000 shares of our Common Stock 10,000,000 shares of our Series A Preferred Stock were issued to EGLLC, as the sole stockholder of each of MTMI and EGI. MTMI and EGI did not have any stock options or warrants to purchase shares of their capital stock outstanding at the time of the Merger.

The Merger Agreement contained customary representations and warranties and pre- and post-closing covenants of each party and customary closing conditions. Breaches of the representations and warranties will be subject to customary indemnification provisions, subject to specified aggregate limits of liability.

The Merger was treated as a recapitalization of the Company for financial accounting purposes. MTMI and EGI will be considered the acquirers for accounting purposes, and the historical financial statements of ESRI before the Merger will be replaced with the historical combined financial statements of MTMI and EGI before the Merger in all future filings with the SEC.

The parties took all actions necessary to ensure that the Merger was treated as a tax-free exchange under Section 368(a) of the Internal Revenue Code of 1986, as amended.

The issuance of shares of Common Stock and Series A Preferred Stock to holders of MTMI’s and EGI’s capital stock in connection with the Merger was not registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemption from registration provided by Section 4(2) of the Securities Act, which speak onlyexempts transactions by an issuer not involving any public offering, and Regulation D promulgated by the SEC under that section. These securities may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirement.

As a result of the Merger, EGLLC became the parent of the Company holding 180,000,000 shares of our Common Stock and 10,000,000 shares of our Series A Preferred Stock.

Accounting Treatment; Change of Control

The Merger was accounted for as a “reverse merger,” and MTMI and EGI were deemed to be the acquirers in the reverse merger. Consequently, the assets and liabilities and the historical operations that were reflected in the financial statements prior to the Merger are those of MTMI and EGI and were recorded at the historical cost basis of MTMI and EGI, and the consolidated financial statements after completion of the Merger include the assets and liabilities of MTMI and EGI, historical operations of MTMI and EGI and operations of the Company and its subsidiaries from the closing date of the Merger. As a result of the issuance of the shares of Common Stock and Series A Preferred Stock pursuant to the Merger, a change in control of the Company occurred as of the date of consummation of the Merger.

The Company continues to be a “smaller reporting company,” as defined under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), following the Merger.

| 5 |

Property Interests and Mining Claims

Montana Tunnels Mine

MTMI is an integrated mining company which is seeking to recommence mining and milling operations at the Montana Tunnels Mine. Currently, MTMI’s operations are limited to care and maintenance functions. MTMI’s staff engineers, in association with outside independent mining consultants, have designed a mine plan around the “M” Pit deposit of the Montana Tunnels Mine incorporating a proven reserve of 27.6 million tons and a probable reserve of 10.1 million tons (a ton is equal to 2,000 pounds) of ore (the “M” Pit Mine Plan”), as documented in the Montana Tunnels Technical Report dated November 2010 (the “Nov. 2010 MTTR”). Table 21.3 M-Pit Production Schedule below:

Expected Activity for Nine Year M-Pit Deposit Life of Mine

(Subject to financing, the anticipated startup of development is scheduled for autumn 2013, with completion of the M-Pit Mine Plan scheduled for autumn 2021.)

| M-Pit Totals | ||||

| Estimated Tons to be Moved | ||||

| Ore | 20,166,779 | |||

| Lowgrade Ore | 17,562,688 | |||

| Waste - Rock | 136,143,834 | |||

| Waste - Alluvium | - | |||

| Rehandle/Other/Topsoil | 6,304,696 | |||

| Total Estimated Tons to be Moved | 180,177,997 | |||

| Estimated Tons to be Milled | 37,820,640 | |||

| Grade: Au (oz/ton) | 0.0129 | |||

| Ag (oz/ton) | 0.2180 | |||

| Pb (%) | 0.1640 | |||

| Zn (%) | 0.4730 | |||

| Estimated Production (Gross) | ||||

| Gold (oz) | 487,886 | |||

| Silver (oz) | 8,244,900 | |||

| Lead (oz) | 124,051,699 | |||

| Zinc (oz) | 357,783,254 | |||

| Estimated Production Payable Sold | ||||

| Gold (oz) | 346,681 | |||

| Silver (oz) | 4,651,964 | |||

| Lead (oz) | 87,971,673 | |||

| Zinc (oz) | 238,955,526 | |||

Source: Montana Tunnels Technical Report – Table 21.3 (page 113)

| 6 |

Aerial view of the existing open pit Mine at the Montana Tunnels Site.

History of the Montana Tunnels Mine

To a large extent, mining activity developed and settled much of Montana during the 1860s and 1870s, including the historic “Wickes-Corbin” silver district in which the current Montana Tunnels Mine is centrally located. The Wickes-Corbin district thrived from the 1860s into the early 1890s, at which time the U.S. Government repealed the Sherman Silver Purchase Act (1893) sending silver prices plummeting and spelling the eventual demise of many silver producing mining camps, including the Wickes-Corbin camp.

In the early 1980s, with the price of silver trading at $50 per ounce on the LME, many historic silver camps were re-examined employing modern exploration techniques. It was during this report. We undertake no obligation to publicly release any revisionsperiod that the Montana Tunnels deposit – a named derived from the boring of two exploratory tunnels driven into the deposit in the early 1900s – was discovered. By 1986 Pegasus had commenced development of the Montana Tunnels Mine and construction of a 15,000 ton per day milling facility.

View of the Montana Tunnels Milling Facility, Crushing Facility and Administrative offices.

The open pit mine is located to the forward-looking statements or reflect events or circumstances after the datetop and left of this document.photograph.

Since the commencement of production at Montana Tunnels Mine in early 1987, the mine has produced, under its previous owners, 99.6 million tons of ore containing 1.7 million ounces of gold, 30.9 million ounces of silver, 551,400 tons of zinc and 202,800 tons of lead, as reported through public filings of the parent companies. All metals mined at the Montana Tunnels Mine were sold prior to 2010.

The table below sets forth the Montana Tunnels Mine production history from 1987 to 2009.

Montana Tunnels Technical Report - November 2010

Table 1.1 Montana Tunnels Production History (Page 2)

| Mill Tons | Au | Oz Au | Ag | Oz Ag | Pb | Tons Pb | Zn | Tons Zn | ||||||||||||||||||||||||||||

| Year | 000's | oz Au/t | 000's | oz Ag/t | 000's | % | 000's | % | 000's | |||||||||||||||||||||||||||

| 1987 | 2,018 | 0.0198 | 39.9 | 0.485 | 979.7 | 0.377 | 7.6 | 0.923 | 18.6 | |||||||||||||||||||||||||||

| 1988 | 3,982 | 0.0228 | 90.7 | 0.430 | 1,711.4 | 0.281 | 11.2 | 0.788 | 31.4 | |||||||||||||||||||||||||||

| 1989 | 4,047 | 0.0204 | 82.5 | 0.488 | 1,974.5 | 0.250 | 10.1 | 0.674 | 27.3 | |||||||||||||||||||||||||||

| 1990 | 4,149 | 0.0184 | 76.2 | 0.451 | 1,872.8 | 0.222 | 9.2 | 0.627 | 26.0 | |||||||||||||||||||||||||||

| 1991 | 4,271 | 0.0185 | 78.9 | 0.428 | 1,829.7 | 0.233 | 10.0 | 0.638 | 27.2 | |||||||||||||||||||||||||||

| 1992 | 4,573 | 0.0199 | 91.2 | 0.441 | 2,014.9 | 0.217 | 9.9 | 0.609 | 27.9 | |||||||||||||||||||||||||||

| 1993 | 5,045 | 0.0173 | 87.5 | 0.440 | 2,218.5 | 0.195 | 9.8 | 0.542 | 26.4 | |||||||||||||||||||||||||||

| 1994 | 5,411 | 0.0185 | 100.3 | 0.323 | 1,746.5 | 0.240 | 13.0 | 0.555 | 30.0 | |||||||||||||||||||||||||||

| 1995 | 5,474 | 0.0202 | 110.8 | 0.314 | 1,716.4 | 0.200 | 11.0 | 0.582 | 31.8 | |||||||||||||||||||||||||||

| 1996 | 5,467 | 0.0167 | 91.4 | 0.274 | 1,497.9 | 0.186 | 10.2 | 0.509 | 27.8 | |||||||||||||||||||||||||||

| 1997 | 5,145 | 0.0194 | 100.0 | 0.242 | 1,245.3 | 0.224 | 11.5 | 0.576 | 29.6 | |||||||||||||||||||||||||||

| 1998 | 4,833 | 0.0188 | 91.0 | 0.207 | 998.8 | 0.189 | 9.1 | 0.686 | 33.2 | |||||||||||||||||||||||||||

| 1999 | 5,078 | 0.0174 | 88.2 | 0.225 | 1,142.7 | 0.203 | 10.3 | 0.614 | 31.2 | |||||||||||||||||||||||||||

| 2000 | 5,384 | 0.0145 | 77.9 | 0.375 | 2,020.5 | 0.177 | 9.5 | 0.481 | 25.9 | |||||||||||||||||||||||||||

| 2001 | 5,424 | 0.0168 | 91.0 | 0.281 | 1,525.2 | 0.182 | 9.9 | 0.552 | 29.9 | |||||||||||||||||||||||||||

| 2002 | 2,881 | 0.0156 | 45.0 | 0.238 | 684.9 | 0.167 | 4.8 | 0.470 | 13.5 | |||||||||||||||||||||||||||

| 2003 | 4,695 | 0.0157 | 73.5 | 0.202 | 947.4 | 0.193 | 9.1 | 0.440 | 20.6 | |||||||||||||||||||||||||||

| 2004 | 5,394 | 0.0096 | 51.7 | 0.318 | 1,713.0 | 0.138 | 7.4 | 0.374 | 20.2 | |||||||||||||||||||||||||||

| 2005 | 4,955 | 0.0130 | 64.3 | 0.190 | 939.8 | 0.155 | 7.7 | 0.337 | 16.7 | |||||||||||||||||||||||||||

| 2006 | 1,427 | 0.0077 | 11.0 | 0.169 | 240.4 | 0.097 | 1.4 | 0.201 | 2.9 | |||||||||||||||||||||||||||

| 2007 | 3,971 | 0.0123 | 49.0 | 0.221 | 876.4 | 0.197 | 7.8 | 0.466 | 18.5 | |||||||||||||||||||||||||||

| 2008 | 4,510 | 0.0144 | 64.9 | 0.175 | 788.0 | 0.221 | 10.0 | 0.629 | 28.4 | |||||||||||||||||||||||||||

| 2009 | 1,430 | 0.0100 | 14.3 | 0.176 | 251.0 | 0.160 | 2.3 | 0.442 | 6.3 | |||||||||||||||||||||||||||

| Totals | 99,563 | 0.0164 | 1,671.4 | 0.300 | 30,935.6 | 0.200 | 202.8 | 0.540 | 551.4 | |||||||||||||||||||||||||||

The deposit type to be exploited at the Montana Tunnels Mine is precious and base metal mineralization (gold, silver, zinc and lead) occurring as disseminated and veined sulfides internal to a volcanic diatreme. Through the mining and treatment of the Montana Tunnels deposit, the mine will produce (i) gold, (ii) silver, (iii) zinc and (iv) lead. Minor amounts of other metals are also contained within the deposit but not of marketable quantities.

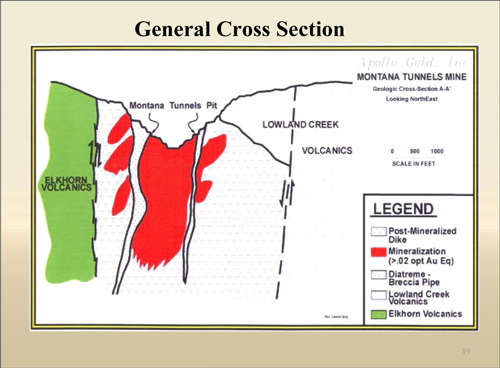

Cross section cartoon depicting the Montana Tunnels deposit showing current Pit development.

OPERATIONS SUMMARY

Mission. MTMI is an integrated mining company focused on the exploration, development and mineral extraction of the Montana Tunnels Mine. MTMI has produced gold, silver, zinc and lead from the Montana Tunnels Mine starting in 1987. Although we believe that extracting the remaining deposit will be more than ample to provide sufficient mineral resources to establish a mine plan to continue profitable mining and milling operations on the current target at Montana Tunnels Mine for approximately 9 years, there is no guarantee that the Montana Tunnels Mine operation will ever be profitable.

The Operations. Upon the planned recommencing of operations, the Montana Tunnels Mine will be a fully integrated open-pit mine and concentrating facility. The goal in any successful metal mining operation is to take a lower concentration of metals per ton of rock – raw ore – and upgrade the valuable metal content per ton – while minimizing the loss of that metal content – thereby improving, or “concentrating” the value per ton.

This process is generally done in three steps – (1) mining, (2) beneficiation (concentration) and (3) smelting.

1. Planned Mining Operations at the Montana Tunnels Mine.There will be four distinct stages to planned production mining at the Montana Tunnels Mine upon recommencement of mining operations – (i) drilling, (ii) blasting, (iii) loading and (iv) hauling.

| (i) | Drilling – Following directions provided by the engineering, geological and technical staff, workers will drill 6.75-inch diameter holes to depths of usually 20 feet on what are called “benches” using rotary percussion drills. Samples of the rock retrieved form these drill holes are planned to be taken for analysis at the onsite assay lab to determine the ore value component of the rock to ensure, once the rock is blasted, that ore is being taken to the concentrator and waste is taken to the waste areas. |

| (ii) | Blasting – Once the planned drilling is completed on a “bench”, the drilled out holes will be filled with ANFO explosive (ammonium nitrate/fuel oil mixture) and, following a detonation pattern, will be blasted. |

| (iii) | Loading – The blasted rock material will be loaded by 21 yard shovels or by 13 yard front-end loaders into waiting haul trucks. |

| (iv) | Hauling – It is planned to use a fleet of haul trucks capable of hauling between 85 to 150 tons of ore or waste material per load to work in unison with the loaders to quickly remove the blasted rock to the crushing facility, in the case of ore or, in the case of waste, to the waste rock dump for eventual reclamation. Once the blasted material is removed, the next cycle of drilling will commence again. |

2. Beneficiation Operations at Montana Tunnels. Beneficiation is the act of crushing and separating ore into valuable substances by any of a variety of techniques so that metal can be recovered at a profit. Montana Tunnels Mine beneficiation plant is rated at 15,000 tons per day and consists of three distinct stages – (i) crushing, (ii) grinding and (iii) flotation & filtration.

| (i) | Crushing – Upon the planned recommencement of operations, ore grade material from the mine is planned on being delivered to the crushing circuit where primary and secondary “jaw crushers”, used in series, will crush the rock to between 5” and 7” in size. Certain ore, which may be too large to enter the mouth of the jaw crusher, will be broken into smaller size using pneumatic rock breakers which will enable the rock to enter the jaw crusher. The crushed rock is planned to be stored on the “coarse ore stockpile” to await entry into the grinding circuit. |

| (ii) | Grinding – Upon planned recommencement of operations, ore from the coarse ore stockpile would be fed via apron feeders onto conveyor belts and delivered the to a semi-autogenous grinding mill where it would be mixed with water and 5” steel balls and ground to create coarse slurry. This slurry will discharge from the semi-autogenous mill and, dependent upon size, will be either sent to a cone crusher if oversized, or sent to the ball mill for further size reduction. The oversized material, once treated by the cone crusher, would then re-enter the semi-autogenous mill for additional grinding before being directed to the ball mill for additional size reduction. |

The ground ore material/slurry from the ball mill would be pumped to the gravity circuit where gravity cyclones(funnel-shaped devices that separate particles entering the funnel by density), Knelson concentrators(machines that utilize the principles of a centrifuge to enhance gravitational force experienced by feed particles to effect separation based on particle density), sluices (troughs with riffles in the bottom that provide a lodging place for heavy or dense material such as gold)and separating tables would work to separate the coarse gold-silver particles from the slurry. This gold-silver concentrated product would be smelted onsite to produce doré bullion bars or flats.

Material passes from the gravity circuit to hyrocyclones where it is once again separated. The oversized material from this separation would report back to the ball mill for further grinding while the fine slurry or pulp material would be pumped to the lead flotation circuit to commence the flotation and filtration process.

|  |

Montana Tunnels Semi-Autogenous Mill (left) and Ball Mill (right).

| (iii) | Flotation and filtration – The flotation circuit is made up of a series of large tanks, or cells, with each cell containing an agitator and air blower. There is a set of cells for concentrating the lead minerals and an independent set of cells for concentrating the zinc minerals. |

The process for concentrating the minerals occurs as the mineralized pulp enters the first in this series of tanks. Upon planned recommencement of operations it is at this point that two reagents – a frothing reagent and a collecting reagent – are added to the pulp. These reagents would create the conditions within the tanks to compel the lead and lead-associated minerals to attach to “bubbles” created by the frothing reagent mixed with air from the air blower. These mineral-ladened bubbles would be collected through this series of cells, cleaned, thickened and filtered using a drum filter to make a final lead concentrate. Historically, the Montana Tunnels Mine lead concentrates would contain 50% to 55% lead, 2.0 to 3.5 ounces per ton gold and 20 to 50 ounces per ton silver. Moisture content has been between 8% and 10%.

After the pulp exits the final lead cell, reagents would again be introduced to the pulp which would activate the zinc minerals to attach to bubbles. As with the lead circuit, these zinc-ladened bubbles would be collected, cleaned, thickened and filtered – this time using a pressure filter – to make a final zinc concentrate. The Montana Tunnels Mine final zinc concentrate traditionally have contained 52% to 56% zinc, 0.1 to 0.3 ounces per ton gold, 5 to 20 ounces per ton silver with a moisture content of between 8% and 10%.

Finally, with this pulp denuded of minerals it would be pumped toa designed approved and built area for storing the treated waste fraction of an ore or the “Tailings Impoundment Area” for eventual reclamation.

| 12 |

Schematic of planned Montana Tunnels beneficiation operations

3. Smelting and Refining of the Montana Tunnels Mine Products. We project that for the Life of Mine of the “M” Pit deposit, annual production of lead concentrate will be 16,000 tons and annual production of zinc concentrate will be approximately 46,000 tons, based upon historical production and the Nov. 2010 MTTR. Smelting of these concentrates has traditionally been carried out at a smelter facility in Trail, British Columbia, Canada which is owned by mining conglomerate Teck Corp. While we anticipate competitively shopping for alternative smelter facilities, we have identified Teck Corp. as the best situated smelting facility for the Montana Tunnels Mine.

From the Montana Tunnels Mine, it is planned that lead and zinc concentrates would be loaded separately into over-the-road haul trucks and delivered to railheads near Helena, Montana. From there, the concentrate products are planned to be delivered to Teck Corp.’s lead and zinc smelter approximately 400 miles via rail from Helena, Montana where they would be smelted and refined into saleable lead and zinc products. MTMI currently does not have a smelter contract with Teck Corp. or any other smelter.

A third product that would be planned on being produced from the Montana Tunnels Mine is gold doréflats (a mold of semi-pure alloy consisting of gold and silver created at the mine site). Historically, between 8% and 12% of the gold recovered at Montana Tunnels has reported to the gravity circuit and has been smelted onsite intodoréflats. In the past, thesedoréflats have been refined into gold bars by Johnson Matthey Inc.’s refining facility in Salt Lake City, Utah.

Montana Tunnels Mine “M” Pit Expansion

In December 2008, Montana Tunnels Mine was placed into a care and maintenance operational mode at the completion of the “L” Pit permit. The newly permitted “M” Pit will be an expansion of the existing “L” Pit to enable the Company to continue to mine an additional 37.8 million tons of ore as an extension to the same ore body that has been previously mined since the inception of the Montana Tunnels Mine operation. The expansion plan will “layback” or expand the perimeter of the current pit making it wider, and making an additional 7.0 years of ore available to be mined from the bottom of the expanded pit.

| 13 |

We have completed ore-delineation drilling beneath the current pit elevation and have identified proven reserves and probable reserves of the “M” Pit expansion as detailed separately in the table below:

Proven Reserves and Probable Reserves

Montana Tunnels Technical Report

Montana Tunnels Mining, Inc.

| Grade | ||||||||||||||||||||||||

| Pit Design | Classification | Tons | Gold | Silver | Lead | Zinc | ||||||||||||||||||

| M – Pit | Proven | 27,673,000 | 0.0129 | 0.212 | 0.164 | % | 0.487 | % | ||||||||||||||||

| M – Pit | Probable | 10,105,000 | 0.0129 | 0.211 | 0.160 | % | 0.434 | % | ||||||||||||||||

Gold and Silver grades in ounces per ton, Lead and Zinc grades as percentage mineral content.

| · | No mine dilution or mining recovery has been incorporated in reserve estimates. |

| · | The cutoff grade or “economic limit” used to define the “M” Pit reserves is material with a combined $9.00 per ton value. |

| · | Metallurgical Recovery: |

| Metal | Gold | Silver | Lead | Zinc | ||||||||||||

| Mill Recovery | 79.9 | % | 73.7 | % | 86.0 | % | 84.7 | % | ||||||||

In 2004, MTMI commenced the process of permitting the “M” Pit expansion by filing a major amendment to the Montana Tunnels Operating Permit #00113 to expand the open pit and process ores from the “M” Pit mine design. An updated Environmental Impact Statement was completed and Records of Decisions to mine and process the “M” Pit were finally received in November 2008, subject to the addition of approximately $16 million to the current $18 million of reclamation bonds pledged by MTMI with the Montana Department of Environmental Quality (“MDEQ”). The reclamation bond can be in the form of cash, surety bond, letter of credit, company-owned land or a combination of any of these subject to the approval of the MDEQ.

The “M” Pit Mine Plan calls for an 18 to 24 month period of pit expansion development in which 53 million tons of waste rock will be removed to access the ore below the waste rock. The “M” Pit Mine Plan is contingent on the Company obtaining the capital required to begin the expansion development. The Company will seek to obtain funding from debt and the capital markets. If the Company is unable to secure acceptable terms from these markets the expansion development will begin only when the cash flow from the Golden Dream Mine (discussed below) can support the capital needs of the Plan.

Although we believeexpect that some fringe ores will be encountered during the pit expansion, this ore will be stockpiled during the pit expansion phase. Only after primary ores are being mined from the pit on a continuous and sufficient basis to maintain continuous operation of the concentrator, will ore processing through the concentrator begin. It is planned that this will occur approximately 18 to 20 months after commencement of “M” Pit expansion development. Cash flow is expected to begin the month after the concentration mill is restarted.

Currently, MTMI has eight staff individuals working at the mine site conducting care and maintenance of the mine. This team also supports operations at the Golden Dream Mine (see discussion below). These individuals occupy the key positions in management, engineering, environmental, human resources and accounting. Upon financing, MTMI will quickly increase the number of full-time hourly employees to approximately 160 and 190 individuals. Being within commuting distance from Montana’s capital city – Helena – and the major mining communities of Butte and Whitehall should allow for a quick filling of these hourly positions. In August 2006, when MTMI re-commenced operations, it took approximately 4 weeks to hire 125 qualified mine equipment operators and mechanics. In August 2006, the unemployment rate in Montana was 3.3%. As of December 2012, unemployment in Montana was approximately 5.6%, according to the United States Department of Labor, Bureau of Labor Statistics.

The existing Montana Tunnels Mine mining equipment has been in use since the early-to-mid 1990s and, as such, now is prone to maintenance costs and associated downtime. We plan to use the existing mining fleet at Montana Tunnels Mine augmented with new equipment as it becomes available. The existing and new planned equipment are listed in the tables below:

| Existing Equipment Description | Size | Quantity | ||

| Caterpillar 5230 Hydraulic Front Shovel | 21 cubic yard | 2 | ||

| Caterpillar 992 Loader | 13.5 cubic yard | 3 | ||

| Caterpillar 785 Truck | 150 ton | 12 | ||

| Caterpillar 777 Truck | 85 ton | 2 | ||

| Caterpillar D9N Bulldozer | 370 Horsepower | 2 | ||

| Ingersoll-Rand DN45E Drill | 6.75 inch hole | 3 | ||

| Caterpillar 16-G Motor Grader | 16 foot blade | 2 | ||

| Caterpillar 950 F11 Loader | 1 | |||

| Caterpillar 325B Excavator | 1 |

Existing Montana Tunnels Mining Equipment

| New Equipment Description | Size | Quantity | ||

| Shovel – Terex, Komatsu, Caterpillar | 20 cubic yard | 2 | ||

| Caterpillar 993K Loader | 15 cubic yard | 1 | ||

| Caterpillar 785D Truck | 150 ton | 9 | ||

| Caterpillar D10T Bulldozer | 1 | |||

| Caterpillar D9T Bulldozer | 1 | |||

| Caterpillar D25KS Drill | 2 | |||

| Caterpillar 16-M Motor Grader | 10.1 foot blade base | 2 | ||

| Light Plant | 4 | |||

| Lube Truck | 2 | |||

| Stemming Truck | 1 | |||

| Caterpillar 777D/Water Truck | 1 |

New Equipment planned for Montana Tunnels Mine “M” Pit expansion

As described above under the beneficiation section, the existing Montana Tunnels Mine concentrating and processing facility equipment consists of a number of components used in the crushing, grinding, flotation and filtration of gold, zinc, silver, lead and copper ores. In April 2009, the MTMI concentrator was turned off in a systematic way over a period of three weeks to ensure that recommencement of the facility would be seamless. All components of the MTMI concentrating facility are intact and the only piece of equipment contemplated to be replaced is the zinc pressure filter. Replacement of this component will be carried out in conjunction with the restart of the MTMI concentrating facility.

The Montana Tunnels Mine operation has been through several phases of exploration, development and production since the mid-1980s. Through this quarter century of operational experience, our management team has acquired the skills and knowledge to accurately plan and project development and operations timelines and costs.

The operational and cost components with the greatest influence relate to: (i) grade of the ore; (ii) mill recoveries; (iii) development and mining costs; and (iv) smelting and outside treatment costs. The grade of Montana Tunnels Mine “M” Pit has been delineated to standards employing defined requirements as set by the mining industry.

Historical – 1988 through 2009 – Montana Tunnels Mine mill recoveries for each of the payable metals are compiled in the table below (mill recovery is a calculation showing the percentage of recovered metals by analyzing the grade of pre-processed rock (heads) and comparing that with the grade of the same post-processed rock (tails)):

| Metal | Gold | Silver | Lead | Zinc | ||||||||||||

| Mill Recovery | 79.9 | % | 73.7 | % | 86.0 | % | 84.7 | % | ||||||||

Montana Tunnels Mine Historical Mill Recoveries (1988 through 2009)

MTMI’s engineering and management staff have projected development and operating costs combining a mix of the planned new equipment and existing equipment applying each particular piece of equipment’s operating specifications.

Over the 20-plus years of operations at Montana Tunnels Mine, various smelting and outside treatment options have been explored and utilized. Because of its relative proximity and its smelter payment terms, the most appropriate smelter for Montana Tunnels’ zinc and lead concentrates, found to date, is Teck Corp.’s Trail, B.C. Smelter. World benchmark smelter treatment charges are established annually between miners and smelters for both zinc and lead concentrates.

The Elkhorn Project and Golden Dream Mine

The Golden Dream Mine lies within the boundaries of EGI’s Elkhorn Project approximately 35 road miles to the south-east of the Montana Tunnels Mine. The Elkhorn Project consists of a collection of patented and unpatented mineral claims totaling approximately 4,500 acres.

Similar to the area in which the Montana Tunnels Mine is located, the area in which the Golden Dream Mine is located was extensively explored and settled during the 1870s through the 1890s. The present ghost town of Elkhorn, which lays just outside the Elkhorn Project property boundaries, once boosted a population in excess of 2,000 people in the 1880s. The major operating mine during this period was the Elkhorn Mine, a silver-lead mine, but several smaller silver, gold and copper mines were also being worked in the area. By 1894, the town’s population had diminished to 600 people and mining activity – due in large part to the collapse in silver prices – steadily declined through the 1890s.

During the early 1980s reconnaissance exploration started on the Elkhorn Project. Over the next decade extensive core drilling, analysis, planning and design work was carried out by Gold Fields Corp. (NYSE: GFI) and Santa Fe Pacific Gold Corp (“Santa Fe”) on the Elkhorn Project. In 1997 Newmont Corp (NYSE: NEM) acquired Santa Fe thereby creating the opportunity for EGI to acquire the Elkhorn Project.

At the time EGI acquired the Elkhorn Project from Newmont in 1998, exploration work and reports completed by Santa Fe Pacific Gold Corporation had reported mineralized material containing 1.653 million ounces of gold located within four deposits on the Elkhorn Project – Carmody, Gold Hill, East Butte and Golden Dream. Currently, no proven reserve exists on any claim within Elkhorn Project and all work being carried out by the Company is exploratory in nature.

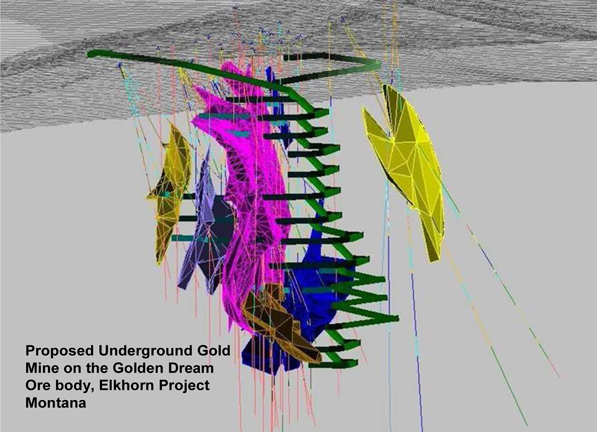

During EGI’s ownership of the Elkhorn Project it has focused its ore delineation drilling, analysis, design, planning and permitting on the Golden Dream deposit. EGI staff engineers have outlined in an internal feasibility study of the Golden Dream deposit a probable underground mineral reserve of 1.17 million tons containing 258,000 ounces of gold and 8.3 million pounds of copper and designed a Mine Plan around this probable reserve as depicted below in computer-generated Mine Plan model.

| 16 |

Computerized schematic of the proposed Golden Dream Mine showing planned tunnels (green shaded tick bands) and actual drill holes.

The colored blocks represent estimated mineral deposits but do not represent actual location of grade minerals.

Unlike the Montana Tunnels Mine, the Golden Dream Mine is an underground mine with tunnels being approximately 14 feet high and 14 feet wide. The solid green bands in the above computer model represent the tunnels accessing the initial ore and the various other ore levels. It will be through these tunnels that the expectations reflectedmined ore will be transported to the surface and then transported by haul trucks to the Montana Tunnels Mill Facility for processing (once the Montana Tunnels Mill Facility is up and running). We note that the colored blocks representing mineral deposits in the computer model above are only estimates, based on our exploratory information, and do not represent the actual location or grade of minerals expected to be found in this mine. Prior to the restart of the Montana Tunnels Mine Facility the ore may be shipped to other regional mills for processing.

Production mining is planned to be undertaken using two different methods – cut-and-fill and sub-level stopping. The cut-and-fill method is planned to be utilized on the upper levels of the Golden Dream Mine which are more oxidized or weathered.

Although the cut-and-fill method of mining is more expensive on a per ton basis, it is used in mining situations where waste rock, or country rock, around the ore to be mined is weaker and subject to falling in and diluting the ore. In the cut-and-fill mining method, ore is mined or “cut” along strike by driving a tunnel to remove the ore. This “cut” is then backfilled with cemented “fill” and another cut in the ore is driven alongside or above the cemented fill. The cemented backfill provides additional support to the country rock. Utilizing this mining method in the oxidized portions of the Golden Dream Mine should reduce dilution to the ore and provide a stable pillar that will not collapse or subside as the deeper sub-level areas are opened and mined.

As the mine reaches a depth below the first 150 feet of ore, the country rock turns from an oxidized, or weathered, material to a more solid, competent rock. At this point it is planned that production mining will move from the cut-and-fill method to a sub-level stopping method. In the sub-level mining method, two drifts are driven, one at the top and one at the bottom of a block of ore 45 to 60 feet thick. Holes can then be drilled between the two levels and loaded with explosives and the ore blasted out. The mined out areas remaining from this procedure would be backfilled with loose rock or cemented backfill, if needed, for ground support.

The broken ore from either method of mining would be planned to be loaded into underground haul trucks and transported to the surface where it will be transferred into 30 ton covered over-the-road haul trucks and transported to the Montana Tunnels Mill Facility for processing (once the Montana Tunnels Mill Facility is up and running). Prior to the restart of the Montana Tunnels Mine Facility the ore may be shipped to other regional mills for processing.

Whereas in an open-pit operation the general goal is to move material for the lowest cost per ton – a bulk mining exercise – the general goal in an underground operation is to move fewer tons of material with the highest grade – an ore control exercise. Using the geologic model determined by core drilling analysis, staff engineers and geologists completed a production model and associated financial pro-forma employing capital and operating costs, mill recoveries and outside smelting and refining charges.

The current Golden Dream Mine Plan extends only to a depth of approximately 850 feet below surface. Drill intercepts by the prior owners of the Elkhorn Project have intersected ore grade mineralization on the Golden Dream deposit to depths of 1,400 feet below surface. EGI has also completed drilling and analysis laterally along the Golden Dream Mine deposit mineralized structure with encouraging results.

In addition to the mineralization in and around the Golden Dream Mine deposit, EGI and the property’s predecessors have completed drilling on the other mineralized deposits on the Elkhorn Project, namely Gold Hill, East Butte, and Carmody. The current Elkhorn Project probable reserves are outlined in the table below:

| Deposit | Classification | Tons | Gold oz/ton | Copper % | Gold Ounces | |||||||||||

| Golden Dream | Probable | 1,171,000 | 0.221 | 0.406% | 258,872 | |||||||||||

| Gold Hill | Mineralized Material | - | - | Not Assayed | - | |||||||||||

| East Butte | Mineralized Material | - | - | Not Assayed | - | |||||||||||

| Carmody | Mineralized Material | - | - | Not Assayed | - | |||||||||||

| Sub-total | 1,171,000 | 258,872 | ||||||||||||||

| · | Reserve estimates include a 1% deletion of ore tons and a 10% dilution of zero valued tons. |

| · | Gold cut-off grade using $850 per ounce of gold and $2.50 per pound of copper was 0.125 ounces per ton. |

| · | Metallurgical Recovery: |

| Golden Dream | Mill Recoveries Applied | |||||||

| Ores | Gold | Copper | ||||||

| Oxide | 91 | % | 0 | % | ||||

| Pyrrotite | 84 | % | 95 | % | ||||

| Magnetite | 91.5 | % | 65 | % | ||||

| 18 |

Golden Dream Project Underground Development

During the third quarter of 2011, EGI commenced development of the Golden Dream deposit. As of April 1st, 2013, EGI has developed approximately 650 feet of 14’ X 14’ main underground access tunnel and 350 feet of 12’ X 12’ underground ore access tunnel to reach a specific level of the ore body. We are currently working on completing underground and surface water treatment and disposal infrastructure pursuant to our Operating Permit and, upon completion of this work and subject to financing we will recommence development of the next stage at the decline into the lower level ore zones.

Golden Dream Main Access Decline (September 2011) during the development stage

Company’s Two-Boom Jumbo working in 6500 level ore access ramp at Golden Dream Deposit (November 2011) during

the development stage

| 19 |

Trench being completed for Golden Dream water disposal (January 2012). During the development stage

Golden Dream Main Access Decline and Mine shop buildings in background

Golden Dream Mine plant and equipment.

The Golden Dream operation, which is fully permitted and bonded for mining operations of between 500 and 1,000 tons per day, commenced an exploration decline in July, 2011. The current operation consists of a Caterpillar 800 KW diesel power generator set (s/n DWB00131) which provides power to the underground and surface facilities. An electric 990 CFM EPE200 Compressor (s/n FF2606U06048) provides compressed air for drilling and other mine and surface functions (air pumps, cleaning drill holes, etc.). Fresh air is supplied via a 40 Horsepower electric fan.

The decline is supported by an Oldenburg Cannon diesel/electric two boom Jumbo Drill (s/n 202760) and two Load-Haul-Dumps (Wagner ST-3.5 s/n DAO4P0755 and Eimco 903 (4 yard) s/n 903-0364). Additional support for bolting and screening is supplied by a Minecat 100 LPC Tractor with mancarrier/loader (s/n 1F100E6201). A 26 ton Tamrock EDJ-426/30 underground Truck (s/n 1470) allows for material to be removed from the workings to the surface waste dump areas.

The surface is supported by a Caterpillar IT38 front-end loader with forks (s/n 7B500825) as well as any other required surface equipment (excavators, graders and plows) which is provided by the Montana Tunnels Mine operation.

Pursuant to the Operating Permit, water from the underground workings is treated for both nitrates – through a “component-constructed” bio-reactor – and for arsenic – through a Bayoxide E33 Media Arsenic Treatment Plant. Treated water discharging from these forward-looking statementstreatment centers is allowed to leach into the ground, pursuant to our permit, along leach lines.

The Golden Dream has back-up/emergency power supplied by a Caterpillar XQ225 Generator Set (s/n 8JJ00370), back-up/emergency compressed air supplied by a Sullair 375 CFM Compressor (s/n 004-135353). Jackleg drills can be placed into service if the Jumbo goes down for any length of time. All equipment is either owned outright by the Company or is being rented with a purchase option.

| 20 |

DESCRIPTION OF PROPERTIES

Montana Tunnels Mine, Jefferson City, Montana

The Montana Tunnels Mine is an open pit poly-metallic mine located about five miles west of Jefferson City, Montana and operated between 1987 and 2009. The mine is located in the historic “Wickes-Corbin” mining district in Section 8 of Township 7 North, Range 4 West, with approximate latitude of 46° 22’ and longitude 112° 8’. The administrative offices are located at 270 Montana Tunnels Road, Jefferson City, Montana. Electrical power to the mine site is supplied by Montana Power via overhead power lines. Typical power demand during planned operations is 10,000Kw.

The total land area controlled by the Montana Tunnels Mine is 9,293 acres consisting of 2,404 acres of wholly or partially owned Patented Mineral Claims1, 45 acres of leased Patented Mineral Claims, 2,584 acres of fee land, and 4,260 acres of Unpatented Mineral Claims.

The area encompassed in MTMI’s M-Pit Permit Boundary and outlying facilities is 2,385 acres of which greater than 90% is privately owned by MTMI. Within this Permit Boundary 332 acres are designated for the M-Pit Mine open-pit area and perimeter of which greater than 99% is overlain by private property wholly owned by MTMI. Within the M-Pit Mine open-pit area lays one 0.3 acre Unpatented Mineral Claim (MF-1) and three leased Patented Mineral Claims (Mineral Survey numbers 6758, 6634 and 6640).The leases were entered into in March, 2004 requiring the Company to pay the annual real estate taxes; In addition, the Company is obligated to annual payments to the lessor. The lease has no expiration date as long as the lessor is not in default of the lease, which is the current status. The three leased Patented Mineral Claims carry a 4.5% Net Smelter royalty but overlie minor amounts of mineralization and insignificant royalty payments are anticipated when this area is eventually mined.

In October and November, 2008 MTMI was granted positive Records of Decisions by the lead government regulating agencies – the Montana Department of Environmental Quality ("MDEQ") and the Bureau of Land Management (“BLM”) – approving a major amendment – the M-Pit Expansion Plan – to Operating Permit #00113, subject to the placement of a Reclamation Bond pursuant to the approved Mining and Reclamation Plan.

| 21 |

Elkhorn Project – The Golden Dream Mine, Boulder, Montana

The Elkhorn Project consists of four known gold and gold-copper mineral deposits which we are planning to operate using underground mining methods. The property is located 22 miles southeast of Helena, Montana and occupies portions of Sections 9, 10, 11, 14, 15 and 16 in Township 6 North, Range 3 West with approximate latitude of 45° 15’ and longitude of 111° 55’. The administrative offices are located at 2725-A Elkhorn Road, Boulder, Montana. Electrical power to the mine is currently supplied via 800 Kw generator set.

The Elkhorn Project consists of 236 Unpatented Mineral Claims encompassing approximately 4,000 acres and 35 wholly or partially owned Patented Mineral Claims encompassing an additional 573 acres.

In 2007 EGI applied for a Mine Operating Permit to allow for the extraction of between 500 and 1,000 tons per day from an underground mine located on its 100% owned Golden Dream Mineral Claim (US Mineral Survey #7176). The Company’s application sought a Mine Permit boundary consisting of 382.5 acres of Patented Mineral Claims surrounding the Golden Dream Claim. Approximately 40% of the Patented Mineral Claims contained within the Mine Permit boundary are subject to a Mining Lease Agreement with Mt. Heagan Development Inc. whereby EGI leases the Mineral Claims from Mt. Heagan subject to a “3% Net Return royalty from any ores, mineral or other products removed” from the Mineral Claims covered under the terms of the Agreement. EGI pays to Mt. Heagan an “advanced minimum royalty” of $5,000 per month which is “creditable and recoupable” against any production royalty payments. The remaining 60% of the Patented Mineral Claims contained within the Mine Permit Boundary are 100% owned by EGI.

In July, 2008 the Company was granted an Operating Permit by the lead government regulating agency, Montana Department of Environmental Quality (“MDEQ”), subject to the placement of a Reclamation Bond pursuant to the approved Mining and Reclamation Plan. In November 2011, upon EGI posting the necessary Reclamation Bond in the amount of $591,474, the MDEQ approved the Golden Dream Operating Permit #00173.

Employees

As of December 31, 2012, we had 11 full-time employees, one full time consultant, and one part-time employee, including our executive officers. We believe the relationship we have with our employees is good. In 2013 we anticipate the need to hire additional technical, mining and administrative personnel. Although demand for quality staff is high in the mining industry, we believe we will be able to fill these positions in a timely manner.

| 22 |

Compliance with Government and Environmental Regulation

The Company’s mining, processing operations and exploration activities are subject to various laws and regulations governing the protection of the environment (federal regulator is the Bureau of Land Management (“BLM”) and state regulator is the MDEQ, exploration (BLM and MDEQ), mine safety, development and production (federal regulator is the Mine Safety and Health Administration (“MSHA”), exports, taxes, labor standards, occupational health (MSHA), waste disposal (BLM and MDEQ), toxic substances, water rights (federal regulator is the Department of Natural Resources and Conservation (“DNRC”), explosives (federal regulator is the Bureau of Alcohol, Tobacco, Firearms and Explosives (“ATF”) and other matters. New laws and regulations, amendments to existing laws and regulations or more stringent implementation of existing laws and regulations could have a material adverse impact on the Company, increase costs, cause a reduction in levels of, or suspension of, production and/or delay or prevent the development of new mining properties.

The Company believes it is currently in compliance in all material respects with all applicable environmental laws and regulations. Such compliance requires significant expenditures and increases mine development and operating costs. Mining is subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Environmental liability may result from mining activities conducted by others prior to the Company’s ownership of a property. To the extent the Company is subject to uninsured environmental liabilities, the payment of such liabilities would reduce the Company’s otherwise available earnings and could have a material adverse effect on the Company. Should the Company be unable to fully fund the cost of remedying an environmental problem, it might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy, which could have a material adverse effect on the Company. In addition, the Company does not have coverage for certain environmental losses and other risks as such coverage cannot be purchased at a commercially reasonable cost.

Licenses and Permits

The Company’s operations require licenses and permits from various governmental authorities. The Company believes it holds all material licenses and permits required under applicable laws and regulations and believes it is presently complying in all material respects with the terms of such licenses and permits. However, such licenses and permits are subject to change in various circumstances. There can be no guarantee that the Company will be able to obtain or maintain all necessary licenses and permits that may be required to explore and develop its properties, commence construction or operation of mining facilities and properties under exploration or development or to maintain continued operations that economically justify the cost.

Competition

Because the life of a mine is limited by its mineral reserves, the Company is continually seeking to replace and expand its reserves through the exploration of existing properties as well as through acquisitions of interests in new properties or of interests in companies which own such properties. The Company encounters competition from other mining companies in connection with the acquisition of properties and with the engaging and maintaining of qualified industry experienced personnel. This competition may increase the cost of acquiring suitable properties and retaining qualified industry experienced personnel.

ITEM 1A. RISK FACTORS.

Our business is to engage in exploration and production activities in the precious minerals mining industry, which is a highly speculative activity. An investment in our securities involves a high degree of risk. You should not invest in our securities if you cannot afford to lose your entire investment. In deciding whether you should invest in our securities, you should carefully consider the following information together with all of the other information contained in this Current Report. Any of the following risk factors can cause our business, prospects, financial condition or results of operations to suffer and you to lose all or part of your investment.

| 23 |

RISKS RELATED TO OUR BUSINESS AND FINANCIAL CONDITION

Estimates of mineralized material are based on reasonableinterpretation and assumptions thereand may yield less mineral production under actual conditions than is currently estimated.

There are numerous uncertainties inherent in estimating quantities of mineralized material such as gold, zinc, lead, copper and silver, including many factors beyond our control and no assurance can be given that the recovery of mineralized material will be realized. In general, estimates of mineralized material are based upon a number of risksfactors and uncertainties that could cause actual results to differ materially from such forward-looking statements.

All references in this Form 10-K toassumptions made as of the “Company,” “Eastern,” “we,” “us” or “our” are to Eastern Resources, Inc. and its wholly owned subsidiary, Buzz Kill, Inc.

PART Idate on which the estimates were determined, including:

| § | the judgment of the engineers preparing the estimates; |

| § | estimates of future metals prices and operating costs; |

| § | the quality and quantity of available data; |

| § | the interpretation of that data; and |

| § | the accuracy of various mandated economic assumptions, all of which may vary considerably from actual results. |

Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We were formed ascannot assure you that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a Delaware corporation on March 15, 2007 for the purpose of producing full length independent feature films. Since inception, we have been engaged in the production of our first independent, full-length feature film entitledBuzzKill. We are currently engaged in efforts to secure appropriate distribution for this film.

Business Strategy

Our plan of operations is to create and produce independent films that appeal to demographically diverse groups. We plan to acquire unique properties, both dramatic and factual, from a broad spectrum of independent writers, directors, and producers. Each project will become an independent production company created as a subsidiary of Eastern Resources, Inc. We plan to fund the projects and acquire and maintain ownership of the films with the goal of building a film library with rights to DVD, book and other reproductive media for sale to the public.

The Film Industry in General

The film industry includes about 9,000 companies with combined annual revenue of $50 billion. Large companies include Walt Disney, Sony Pictures, MGM, Paramount, Twentieth Century Fox, Universal and Warner Brothers. These “studios” are generally part of larger media companies. The industry is highly concentrated as the 50 largest companies account for approximately 80 percent of industry revenue. There are also independent production companies, and a large number of companies that provide services to the industry, including creative talent, equipment, technical expertise, and various technicalproperty into production and distribution services.

The film making business may broadly be segmented into three phases: Pre-production (or Design Phase), Production and Post-production. Pre-production is the planning phase, which includes budgeting, casting, finding the right location, set and costume design and construction, and scheduling. Production is the actual making of the film. The number of people involved in the production phase can vary from a few, for a documentary film, to hundreds, for a large studio feature film. It is during this phase that the actual filming is done. Post-production activities take place in editing rooms and recording studios, where the film is shaped into its final form.

Generally, even before the film starts production, marketing personnel develop the marketing strategy for the release. They estimate the demand for the film and the audience to whom it will appeal, develop an advertising plan, and decide where and when to release the work. Advertising workers, or unit publicists, write press releases and short biographies of actors and directors for newspapers and magazines. They may also set up interviews or television appearances for the stars or director to promote the film. Sales representatives sell the finished product. Many production companies hire staff or independent companies to distribute, lease and sell their films to theater owners and television networks.

The Rise of Independent Film

While independent films have been around for decades, dating back to B-movies and poverty-row production companies, it was not until the late 1980’s that independent films entered into the forefront of our movie culture. Over the last 20 years, we believe that there has been a significant shift in American film-going audiences toward edgier, foreign and more non-traditional stories and storytelling, indicated by the record-breaking box office sales of notable independent films, such asY Tu Mamá Tabién,Monsoon Wedding,Kissing Jessica Stein andAdaptation. Box office returns for independent films in 2004-2008 were at an unprecedented high and have continued to rise, claiming an increasing market share and representing approximately 35% of total 2009 domestic box office revenue. Each of the top 10 specialized films in 2004 grossed more than $10 million, and the trend continued in 2005 and 2006 with such titles asCrash,Little Miss Sunshine andThank You For Smoking. The most remarkable recent example of the potential success of independent film is the 2009 sleeper mega-hit, “Paranormal Activity”, which cost $15,000 to produce and has grossed in excess of $150 million in worldwide box office. This figure does not include future earning potential via ancillary distribution windows. Not surprisingly,Paranormal Activity 2 is already in development, slated for a 2012 release. Moreover, encouraged by the film’s colossal success, Paramount Pictures launched a new arm devoted solely to producing micro-budget films with a production ceiling of $100,000. A more conventional example of potential independent film success is the 2009 Sam Rockwell vehicle, “Moon”, which more than recouped its $5 million production cost solely through domestic box office returns.