UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20142017

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-54884

CHINA UNITED INSURANCE SERVICE, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation) | 30-0826400 | |

|

|

7F, No. 311 Section 3

Nan-King East Road

Taipei City, Taiwan

(Address of principal executive offices, with zip code)

+8862-87126958

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | None |

Securities registered under Section 12(g) of the Act:

| Title of each class | Common Stock, par value of $0.00001 | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨No x

Yes¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Yes¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Yesx No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yesx No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company,” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer¨ | Accelerated filer | x | |

| Non-accelerated filer¨ | |||

| Smaller reporting company ¨ | |||

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, asbased upon the closing sale price of the registrant’s common stock on June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter was $246,865,397.$120,755,943.

As of March 15, 2015,14, 2018, there were 29,100,50329,452,669 shares of common stock issued and outstanding, and 1,000,000 preferred shares issued and outstanding.

TABLE OF CONTENTS

| 2 |

EXPLANATORY NOTE REGARDING RESTATEMENT

On January 23, 2018, the Audit Committee of the Board of Directors of China United Insurance Service, Inc., based on the recommendations of the company’s management and after consultation with, Simon & Edward LLP, our independent registered public accounting firm, concluded that our consolidated financial statements as of and for the years ended December 31, 2016 and 2015, and as of and for each of the interim periods ended March 31, 2017, June 30, 2017 and September 31, 2017 should no longer be relied upon.

Within this report, we have included restated audited results as of and for the years ended December 31, 2016 and 2015, as well as restated unaudited condensed consolidated financial information for the quarterly periods as of and for the interim periods ended March 31, 2017, June 30, 2017 and September 31, 2017, which we refer to as the Restatement. Our consolidated financial statements as of and for the years ended December 31, 2016 and 2015 included in this Annual Report on Form 10-K (the “Restated Audited Financial Statements”) have been restated from the consolidated financial statements included on our Annual Report on Form 10-K for the year ended December 31, 2016 and for the year ended December 31, 2015 (the “Original Audited Financial Statements”).

The Restatement corrects a material error related to the accounting for the acquisition of Genius Holdings Financial Limited (the “GHFL Acquisition”) in 2015 The GHFL Acquisition has been accounted for as the acquisition of a business but, upon further analysis, we have come to the conclusion that it would be more accurately accounted for as an asset acquisition. Our independent registered accounting firm has concurred with this revised approach.

The Company has determined that this change in accounting for the GHFL Acquisition had the impact set forth below as of and for the years ended December 31, 2015 and 2016 and for the interim periods ended March 31, 2017, June 30, 2017 and September 30, 2017 (the “Restated Periods”) on the following key balance sheet and income statement line items included in the financial statements for each of the Restated Periods, which the Company believes are of particular significance for investors. Please note that the Key Balance Sheet Items in each of the Restated periods set forth below changed as a result of the restatement, while Key Statement of Operations and Other Comprehensive Income (Loss) Items were affected by the Restatement only with respect to 2015 results, all subsequent Restated Periods remaining unchanged.

| 3 |

Key Balance Sheet Items

Goodwill:Reported Goodwill as of the end of each annual and interim reporting period (December 31, 2015 and 2016 and March 31, 2017, June 30, 2017 and September 30, 2017) of $2,071,491 has been restated to total $31,651 as at each such date, representing a reduction of $2,039840 (or 98.5%).

Total Assets: Reported Total Assets as of December 31, 2015 of $39,401,816 has been restated to total $37,361,976 as at such date, representing a reduction of $2,039,840 (or 5.2%); while reported Total Assets as of December 31, 2016 of $51,407,543 has been restated to total $49,367,703 as at such date, representing a reduction of $2,039,840 (or 4.0%). Reported Total Assets as of March 31, 2017 of $49,227,142 has been restated to total $47,187,302 as at such date, representing a reduction of $2,039,840 (or 4.1%), reported Total Assets as of June 30, 2017 of $48,983,681 has been restated to total $46,943,841 as at such date, representing a reduction of $2,039,840 (or 4.2%); and reported Total Assets as of September 30, 2017 of $51,132,862 has been restated to total $49,093,022 as at such date, representing a reduction of $2,039,840 (or 4.0%).

Retained Earnings: Reported Retained Earnings as of December 31, 2015 of $1,808,665 has been restated to total $(231,175) as at such date, representing a reduction of $2,039,840 (or 112.8%); while reported Retained Earnings as of December 31, 2016 of $3,286,562 has been restated to total $1,246,722 as at such date, representing a reduction of $2,039,840 (or 61.2%). Reported Retained Earnings as of March 31, 2017 of $4,152,250 has been restated to total $2,112,410 as at such date, representing a reduction of $2,039,840 (or 49.1%), reported Retained Earnings as of June 30, 2017 of $5,804,053 has been restated to total $3,764,213 as at such date, representing a reduction of $2,039,840 (or 35.1%); and reported Retained Earnings as of September 30, 2017 of $6,663,807 has been restated to total $4,623,967 as at such date, representing a reduction of $2,039,840 (or 30.6%).

Stockholders’ Equity Attributable to Parent’s Shareholders: Reported Stockholders’ Equity Attributable to Parent’s Shareholders as of December 31, 2015 of $11,671,676 has been restated to total $9,631,836 as at such date, representing a reduction of $2,039,840 (or 17.5%); while reported Stockholders’ Equity Attributable to Parent’s Shareholders as of December 31, 2016 of $14,575,988 has been restated to total $12,536,148 as at such date, representing a reduction of $2,039,840 (or 14.0%). Reported Stockholders’ Equity Attributable to Parent’s Shareholders as of March 31, 2017 of $16,701,244 has been restated to total $14,661,404 as at such date, representing a reduction of $2,039,840 (or 12.2%), reported Stockholders’ Equity Attributable to Parent’s Shareholders as of June 30, 2017 of $18,721,318 has been restated to total $16,681,478 as at such date, representing a reduction of $2,039,840 (or 10.9%); and reported Stockholders’ Equity Attributable to Parent’s Shareholders as of September 30, 2017 of $20,077,289 has been restated to total $18,037,449 as at such date, representing a reduction of $2,039,840 (or 10.2%).

Key Statement of Operations and Other Comprehensive Income (Loss) Items

General and Administrative Expense: Reported General and Administrative Expense for the year ended December 31, 2015 of $12,675,171 has been restated to total $14,715,011, representing an increase of $2,039,840 (or 16.1%); while reported General and Administrative Expense or the year ended December 31, 2016 of $13,852,277 as restated remained unchanged as at such date. Reported General and Administrative Expense for the interim periods ended March 31, 2017, June 30, 2017 and September 30, 2017 of $3,352,440, $7,006,304 and $10,714,341, respectively, as restated each remained unchanged as at such date.

Net Income (Loss): Reported Net Income for the year ended December 31, 2015 of $2,701,125 has been restated to total $661,285, representing a reduction of $2,039,840 (or 75.5%); while reported Net Income for the year ended December 31, 2016 of $5,019,583 as restated remained unchanged. Reported Net Income for the interim periods ended March 31, 2017, June 30, 2017 and September 30, 2017 of $2,020,799, $4,509,827 and $6,486,964, respectively, as restated each remained unchanged as at such date.

Net Income (Loss) Attributable to Parent’s Shareholders: Reported Net Income (Loss) Attributable to Parent’s Shareholders for the year ended December 31, 2015 of $1,077,927 has been restated to total $(961,913), representing a reduction of $2,039,840 (or 189.2%); while reported Net Income for the year ended December 31, 2016 of $2,892,155 as restated remained unchanged. Reported Net Income Attributable to Parent’s Shareholders for the interim periods ended March 31, 2017, June 30, 2017 and September 30, 2017 of $1,336,345, $3,324,733 and $4,632,380, respectively, as restated each remained unchanged as at such date.

Earnings per Share: Reported Earnings per Share (Basic) for the year ended December 31, 2015 of $0.037 has been restated to $(0.033); while reported Earnings per Share (Basic) for the year ended December 31, 2016 of $0.098 as restated remained unchanged as at such date. Reported Earnings per Share (Diluted) for the year ended December 31, 2015 of $0.035 has been restated to $(0.033); while reported Earnings per Share (Basic) for the year ended December 31, 2016 of $0.095 as restated remained unchanged as at such date. Reported Earnings per Share (Basic) and reported Earnings per Share (Diluted) for the interim periods ended March 31, 2017, June 30, 2017 and September 30, 2017 of $0.045 and $0.044, $0.113 and 0.109, and 0.157 and $0.152, respectively, as restated each remained unchanged as at such date.

| 4 |

All applicable amounts relating to this Restatement have been reflected in the consolidated financial statements and disclosed in the notes to the consolidated financial statements in this 2017 Form 10-K. For discussion of the restatement adjustments, see Item 8 of Part II, “Financial Statements and Supplementary Data—Note 27—Restatement” and “Note 28—Quarterly Financial Data (Unaudited)”. Additionally, see Item 1A of Part I, “Risk Factors”, Item 6 of Part II, “Selected Financial Data”, and Item 7 of Part II, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

In addition, we have identified material weaknesses related to our internal control over financial reporting for the year ended December 31, 2017. Disclosure related to these matters are included in Part II, Item 9A of this Form 10-K.

We believe that presenting all of this information regarding the Restated Periods in this Annual Report allows investors to review all pertinent data in a single presentation. We have not filed amendments to (i) our Quarterly Reports on Form 10-Q for the three interim periods ended March 31, 2017, June 30, 2017 and September 30, 2017 or for the comparable interim periods in 2015 or 2016, or (ii) our Annual Report on Form 10-K for the years ended December 31, 2015 or 2016 (collectively, the “Affected Reports”). Accordingly, investors should rely only on the financial information and other disclosures regarding the Restated Periods in this Annual Report on Form 10-K, and not on the Affected Reports or any reports, earnings releases or similar communications relating to those periods.

| 5 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This annual report contains forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward- looking statements. These risks and uncertainties include, but are not limited to, the factors described under Item 1 “Description of Business,” Item 1A “Risk Factors” and Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward- looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. In addition, you are invited to pay particular attention to the effect of the Restatement of our previously issued financial statements for the years ended December 31, 2015 and 2016 and each of the interim periods of 2017, as described in Item 8 of Part II, “Financial Statements and Supplementary Data—Note 27—Restatement” and “Note 28—Quarterly Financial Data (Unaudited)” to the restated financial statements, and any claims, investigations, or proceedings arising as a result; and well as our ability to remediate the material weaknesses in our internal controls over financial reporting described in Item 9A of this Annual Report and our ability to maintain effective internal controls and procedures in the future.

Forward-looking statements represent our estimates and assumptions only as of the date of this annual report. You should read this annual report and the documents that we reference in this annual report, or that we filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

OTHER PERTINENT INFORMATION

References in this annual report to “we,” “us,” “our” and the “Company” and words of like import refer to China United Insurance Service, Inc., its subsidiaries and variable interest entities.

References to China or the PRC refer to the People’s Republic of China (excluding Hong Kong, Macao and Taiwan). References to Taiwan refer to Republic of China.

Unless context indicates otherwise, reference to the “Company” in this annual report refers to China United Insurance Service, Inc. and its subsidiaries. Reference to “AHFL” refers to the combined operations of Action Holdings Financial Limited and its Taiwan Subsidiaries (defined below). Reference to “Anhou” refers to the combined operations of Law Anhou Insurance Agency Co., Ltd. and its subsidiaries.

Our business is conducted in Taiwan and China using New Taiwanese Dollars (“NT$”), the currency of Taiwan, Hong Kong Dollars (“HK$”), the currency of Hong Kong, and RMB, the currency of China, respectively, and our financial statements are presented in United States dollars (“USD”, “US$” or “$”). In this annual report, we refer to assets, obligations, commitments and liabilities in our financial statements in USD. These dollar references are based on the exchange rate of NT$, HK$ and RMB to USD, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of USD which may result in an increase or decrease in the amount of our obligations (expressed in USD) and the value of our assets, including accounts receivable (expressed in USD).

| 6 |

Corporate History and Structure Overview

China United Insurance Service, Inc. (“China United,” “CUIS,” or the “Company”)Our Company is a Delaware corporation organized on June 4, 2010 by Mao Yi Hsiao, a Taiwanese citizen, and iswas quoted on the OverOTCQB® Venture Market (“OTCQB”). We provide our customers life insurance and property and casualty insurance intermediary and related services. We operate our Taiwan business primarily through Law Insurance Broker Co., Ltd. (“Law Broker”) and our PRC business primarily through Law Anhou Insurance Agency Co., Ltd. (“Anhou”).

Law Broker

The history of our Company dates back to 1992, when Law Broker was established on October 9, 1992.

Law Enterprise Co., Ltd. (“Law Enterprise”), a company limited by shares and incorporated under the Counter Bulletin Boardlaws of Taiwan, holds 100% interest in Law Broker, a company limited by shares and incorporated under the laws of Taiwan on October 9, 1992. Law Enterprise used to operateanother two subsidiaries during the past three fiscal years, namely Law Risk Management & Consultant Co., Ltd. (“OTCBB”Law Management”), a company limited by shares and incorporated under the laws of Taiwan on December 5, 1987, and Law Insurance Agent Co., Ltd., a company limited by shares and incorporated under the laws of Taiwan on June 3, 2000 (“Law Agent”, collectively with “Law Enterprise”, “Law Broker” and “Law Management”, the “Taiwan Subsidiaries”, each a “Taiwan Subsidiary”). The Company’s operating companiesAs Law Management and Law Agent are not in Taiwanactive operation, they were dissolved on April 20, 2016 and China. Unless context indicates otherwise, reference to the “Company” throughout this annual report refers to China United and its subsidiaries. Reference to April 12, 2016, respectively.

Acquisition of AHFL

Action Holdings Financial Limited (“AHFL”), refers was incorporated in British Virgin Islands with limited liability on April 30, 2012. AHFL holds 65.95% interest in Law Enterprise and certain of our other subsidiaries as more fully described below.

On August 24, 2012, an acquisition agreement (the “AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the combined operationsAHFL Acquisition Agreement, our Company acquired 100% interest in AHFL and its subsidiaries in Taiwan and our Company agreed to pay NT$15.0 million ($500,815) on or prior to March 31, 2013 and NT$7.5 million ($250,095) subsequent to March 31, 2013 in cash in two installments. In addition, our Company agreed to (i) issue 8,000,000 shares of common stock of our Company to the shareholders of AHFL; (ii) issue 2,000,000 shares of common stock of our Company to certain employees of Law Broker; and (iii) create an employee stock option pool, consisting of available options, exercisable for up to 2,000,000 shares of common stock of our Company. Upon closing of the transaction, we acquired 100% interest in AHFL and its subsidiaries in Taiwan.

On March 14, 2013, an Amendment to the AHFL Acquisition Agreement (the “First Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the First Amendment to AHFL Acquisition Agreement, (i) the deadline for cash payment under the AHFL Acquisition Agreement was extended to March 31, 2015; and (ii) in lieu of the 2,000,000 employee stock option pool, our Company agreed to create an employee stock pool consisting of up to 4,000,000 shares of the common stock of our Company, among which 2,000,000 shares shall be solely granted to employees of Law Broker, and the remaining 2,000,000 shares shall be granted to employees of affiliated entities of our Company (including Law Broker employees).

On March 13, 2015, a second Amendment to the AHFL Acquisition Agreement (the “Second Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the Second Amendment to AHFL Acquisition Agreement, the deadline for cash payment under the AHFL Acquisition Agreement was further extended to March 31, 2016.

On February 17, 2016, a third Amendment to the AHFL Acquisition Agreement (the “Third Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the Third Amendment to AHFL Acquisition Agreement, on or prior to June 30, 2016, (i) our Company committed to complete the listing of our Company’s shares in a major capital market, where the net proceeds raised through such public offering financing shall be at least $10.0 million; (ii) our Company committed to distribute the cash payment in the amount of NT$22.5 million, on a pro rata basis, to the selling shareholders of AHFL and issue 5,000,000 common shares to its Taiwan Subsidiaries. Referenceselected employees pursuant to Anhou refersits employee stock/option plan, and (iii) failure to timely complete either of the above-mentioned criteria shall be deemed as a material breach of our Company under Article 8 of the Acquisition Agreement, whereby the non-breaching party shall be entitled to terminate the Acquisition Agreement and unwind the Acquisition of AHFL by us and restore the status quo of our Company and the selling shareholders of AHFL as if the said acquisition had never happened.

On August 8, 2016, a fourth Amendment to the combined operationsAHFL Acquisition Agreement (the “Fourth Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AnhouAHFL named therein. Pursuant to the Fourth Amendment to AHFL Acquisition Agreement, (i) the Third Amendment to AHFL Acquisition Agreement was terminated with immediate effect on August 8, 2016, and its subsidiaries.(ii) our Company agreed to pay to the selling shareholders of AHFL NT$15.0 million on or prior to March 31, 2017 and NT$4.8 million on July 21, 2016. On July 21, 2016, our Company arranged for the payment of NT$4.8 million to the selling shareholders of AHFL.

| 7 |

On March 12, 2017, a fifth Amendment to the Acquisition Agreement (the “Fifth Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the Fifth Amendment to AHFL Acquisition Agreement, our Company agreed to distribute the cash payment in the amount of NT$15 million to the selling shareholders of AHFL named therein on or prior to March 31, 2019.

Acquisition of GHFL

Genius Holdings Financial Limited (“GHFL”) is a wholly owned subsidiary of AHFL. On February 13, 2015, our Company, AHFL and Mr. Chwan Hau Li, being the selling shareholder of GHFL, entered into an acquisition agreement (the “GHFL Acquisition Agreement”). Pursuant to the GHFL Acquisition Agreement, our Company agreed to issue 352,166 fully paid and non-assessable shares of AHFL common stock (the “AHFL Shares”) together with a granted put option for 352,166 shares of common stock of our Company (the “Put Option”), in exchange for 704,333 shares of common stock of GHFL, being all of the issued and outstanding capital stock of GHFL. The Put Option may be exercised within six months of the closing date of the acquisition and the selling shareholder of GHFL would exchange the AHFL Shares as consideration for the exercise of the Put Option. Subsequent to the acquisition, GHFL became a wholly-owned subsidiary of our Company. GHFL holds 100% issued and outstanding shares of Genius Investment Consultant Co., Ltd. (“Taiwan Genius”), a company limited by shares and incorporated under the laws of Taiwan, which in turn holds approximately 15.64% issued and outstanding shares of Genius Insurance Broker Co., Ltd. (“Genius Broker”), a company limited by shares and incorporated under the laws of Taiwan. Both GHFL and Taiwan Genius have no substantive business operation other than the holding of shares of its subsidiary. Genius Broker is primarily engaged in broker business across Taiwan. Mr. Chwan Hau Li was the sole shareholder of GHFL and he is a director and shareholder of our Company. On March 31, 2015, Mr. Chwan Hau Li exercised the Put Option, pursuant to which, 352,166 shares of AHFL held by Mr. Chwan Hau Li were transferred back to our Company as the consideration for 352,166 shares of common stock of our Company, which were issued to Mr. Chwan Hau Li on April 29, 2015.

On February 17, 2016, our Company, AHFL and Mr. Chwan Hau Li entered into an Amendment 2 to the GHFL Acquisition Agreement (the “Second Amendment to GHFL Acquisition Agreement”), pursuant to which our Company agreed to complete the listing of our Company in a major capital market on or prior to February 28, 2016 where the net proceeds raised through such public offering financing shall be at least $10.0 million.

On August 8, 2016, our Company, AHFL and Mr. Chwan Hau Li entered into an Amendment 3 to the GHFL Acquisition Agreement (the “Third Amendment to GHFL Acquisition Agreement”), pursuant to which, the Second Amendment to GHFL Acquisition Agreement was terminated.

Anhou

On July 12, 2010, ZLI Holdings Limited (“CU Hong Kong”), a wholly owned Hong Kong-based subsidiary of China United,our Company, was originally founded by China United, on July 12, 2010 underestablished in Hong Kong laws.Kong. On October 20, 2010, CU Hong Kong foundedZhengzhou Zhonglian Hengfu Consulting Co., Ltd., a wholly foreign owned enterprise Zhengzhou ZhonglianHengfu Consulting Co., Ltd. (“CU WFOE”), a wholly owned subsidiary of CU Hong Kong, was established in Henan province of the PRC. On January 16, 2011, our Company issued 20,000,000 shares of common stock to several non-U.S. persons for their investment of $300,000 in CU WFOE. The issuance was made pursuant to an exemption from registration contained in Regulation S under the Securities Act of 1933, as amended.

Law Anhou Insurance Agency Co., Ltd. (“Anhou”, formerly known as Zhengzhou Anhou Insurance Agency Co., Ltd.), the predecessor entity of Anhou, was founded in Henan province of the PRC on October 9, 2003. Anhou provides insurance agency services in the PRC. On November 26, 2013, Anhou changed its name into Law Anhou Insurance Agency Co., Ltd. and obtained its new business license. On December 18, 2013, Anhou obtained its new Professional Insurance Agency License from local bureau of China Insurance Regulatory Commission (“CIRC”) which reflects its new name.

On September 26, 2013, several new PRC individual investors, namely Wang Yanyan, Chen Zhaohui, Yue Jing, Hou Weizhe, Zhang Yong, Chen Li (“Anhou New Investors”) and the original shareholders of Anhou, namely, Zhu Shuqin, Wei Qun, Fang Qunlei and Chen Yanxia (“Anhou Original Shareholders”) entered into a shareholders resolution of Anhou, pursuant to which, Anhou Original Shareholders and Anhou New Investors agreed to increase the registered capital of Anhou to RMB50 million ($8,165,895), among which, Wang Yanyan would invest RMB10 million ($1,633,179), accounting for 20%, Chen Zhaohui would invest RMB10 million ($1,633,179), accounting for 20%, Yue Jing would invest RMB7.5 million ($1,224,871), accounting for 15%, HouWeizhe would invest RMB5 million ($816,589), accounting for 10%, Zhang Yong would invest RMB4.5 million ($734,930), accounting for 9%, and Chen Li would invest RMB3 million ($489,949), accounting for 6%, of the registered capital of Anhou.

Due to PRC legal restrictions on foreign ownership and investment in the insurance agency businesses in China, particularly those based on qualifications as well as capital requirements of the investors,investors. Able Capital Holding Co., Ltd., a limited liability company established and registeredwith limited liability in Hong Kong, delegated four PRC individuals, namely Yanyan Wang, Yanyan,Zhaohui Chen, Zhaohui,Weizhe Hou Weizhe and Yong Zhang, Yong, to invest in Anhou on its behalf.

On October 24,September 26, 2013, Yanyan Wang, Zhaohui Chen, Jing Yue, Weizhe Hou, Yong Zhang, Li Chen (“Anhou completedNew Investors”) and Shuqin Zhu, Qun Wei, Qunlei Fang and Yanxia Chen (“Anhou Original Shareholders”) agreed to increase the registration with local Administration Industryregistered capital of Anhou to RMB50 million, among which, (i) Yanyan Wang agreed to invest RMB10 million, accounting for 20% of registered capital in Anhou, (ii) Zhaohui Chen agreed to invest RMB10 million, accounting for 20% of registered capital in Anhou, (iii) Jing Yue agreed to invest RMB7.5 million, accounting for 15% of registered capital in Anhou, (iv) Weizhe Hou agreed to invest RMB5 million, accounting for 10% of registered capital in Anhou, (v) Yong Zhang agreed to invest RMB4.5 million, accounting for 9% of registered capital in Anhou, and Commerce (“AIC”) on the above-mentioned(vi) Li Chen agreed to invest RMB3 million, accounting for 6% of registered capital increase. The new business license was issued toin Anhou, on October 25, 2013.respectively.

The registered capital increase of Anhou iswas in response to the promulgations of certain regulations by the China Insurance Regulatory Commission (“(“CIRC”). On April 27, 2013, CIRC issued the Decision on Revising the Provisions of the Supervision and Administration of Specialized Insurance Agencies (the “Decision on Revising the Agency Provisions”), pursuant to which, CIRC has mandated any insurance agency established subsequent to the Decision on Revising the Agency Provisions to meet a minimum registered capital requirement of RMB50 million ($8,165,890).million. On May 16, 2013, CIRC issued Notice for Further Clarification on Related Issues of Access to Professional Insurance Intermediary Market (the “Notice”“2013 Notice”), pursuant to which, professional insurance agencies established prior to the issuance of the Decision on Revising the Agency Provisions, with registered capital less than RMB50 million, ($8,165,890), can continue operation of their existing business within the provinces where they have the registered office or branch office, but shall not set up any new branches in any province where they do not have the registered office or any branch office.

Prior to the capital increase, Anhou, a professional insurance agency with a PRC nationwide license, has a registered capital in the amount of RMB10 million ($1,633,178). The branch offices of Anhou were all in Henan province. To better implement itsthe expansion strategies of our Company, Anhou increased its registered capital to RMB50 million ($8,165,890) to meet the requirement of CIRC so that it canis able set up new branches in any province beyond its current operations in Mainland China.the PRC.

| 8 |

On October 24, 2013, Anhou Original Shareholders entered into share transfer agreements (the “Share Transfer Agreements”) withtransferred their interests in Anhou to Changrong Hu, Changrong, a PRC citizen (“Mr. Hu”Hu,” together with Anhou New Investors, “Anhou Existing Shareholders”), respectively. Under the Share Transfer Agreements, Anhou Original Shareholders transferred all of their equity interests in Anhou to Mr. Hu for an aggregate transfer priceconsideration of RMB10 million ($1,633,178).million. Mr. Hu is currently the legal representative, General Manager and the sole director of Anhou.

On October 24, 2013,November 17, 2016, Li Chen transferred his interests in Anhou completed the share transfer registration with the local AIC. At the endto Chunyan Lu for an aggregate consideration of October 2013, Anhou completed its filing with local CIRC with respect to its previously-conducted share transfer and capital increase.RMB3 million.

Anhou’s wholly owned subsidiary

Sichuan Kangzhuang Insurance Agency Co., Ltd. (“Sichuan Kangzhuang”), a wholly owned subsidiary of Anhou, was foundedestablished with limited liability on September 4, 2006 in Sichuan province of the PRC, and it provides insurance agency services in the PRC. On August 23,September 6, 2010, atshareholders of Sichuan Kangzhuang’s general meeting of shareholders, its shareholders voted for transferring all ofKangzhuang transferred their equity interestsinterest in Sichuan Kangzhuang to Anhou for RMB532,622 ($83,444). On September 6, 2010,an aggregate consideration of RMB532,622. For the equity transfer agreements were signed betweenpurpose of procuring certain economic benefits and enabling a centralized control over the business operations in Sichuan province, the Company commenced the dissolution process of Sichuan Kangzhuang, a wholly owned subsidiary of Anhou and each shareholderset up a branch office of Anhou in Sichuan province. Accordingly, Sichuan Kangzhuang had filed a dissolution application to the local Bureau of Administration and Commerce and made a public announcement published in local newspaper in October 2017. On June 22, 2017, the Sichuan Branch of Anhou obtained its business license to conduct insurance agency business. As of this date, Sichuan Kangzhuang is undergoing tax closure procedure, which involves multiple rounds of communication with the relevant tax authorities before obtaining the official approval for tax deregistration.Mr. Wen Yuan Hsu, the general manger of Sichuan Kangzhuang. Anhou has complied with allKangzhuang is the general manager of the applicable laws and regulations with respect to its holding 100% equity interests in Sichuan Kangzhuang.branch office of Anhou.

Jiangsu Law Insurance Brokers Co., Ltd. (“Jiangsu Law” collectively), a wholly owned subsidiary of Anhou, was established with Anhou, Sichuan Kangzhuang, the “Consolidated Affiliated Entities”, each a “Consolidated Affiliated Entity”) was foundedlimited liability on September 19, 2005 in Jiangsu province of the PRC. Jiangsu Law is allowedlicensed to provide insurance brokerage services. On August 12, 2010, at Jiangsu Law’s general meeting of shareholders, its shareholders voted for transferring all of their shareholdings to Anhou for RMB518,000 ($81,153). On September 28, 2010, Anhou and the shareholders of Jiangsu Law entered into an equity transfer agreements were signed between Anhou and each individual shareholder of Jiangsu Law.agreements. Pursuant to Provisions on the Supervision and Administration of Insurance Brokerage Institutions,Institution, effective on October 1, 2009, if an insurance brokerage entity fails to bring its registered capital to no less than RMB10,000,000 ($1,566,661) on or prior to October 1, 2012, the China Insurance Regulatory Commission (“CIRC”)CIRC or its local counterpart, as applicable, may determine not to extend the insurance brokerage license. To meet such minimum registered capital requirement, on February 11, 2011, Anhou invested RMB4.82 million ($755,131) in Jiangsu Law to increase the registered capital to RMB10 million ($1,566,661). Anhou has complied with all of the applicable laws and regulations with respect to its holding 100% equity interests in Jiangsu Law.million.

On January 16, 2011, China United issued 20,000,000 shares of common stock, $0.00001 par value per share, to several non-US persons for their investment of $300,000 in cash in the Company’s subsidiaries. The issuance was made pursuant to an exemption from registration contained in Regulation S under the Securities Act of 1933, as amended. The consideration was paid to the account of CU Hong Kong by May 6, 2011. All $300,000 was contributed into the bank account of CU WFOE as registered capital.Our Consolidated Affiliated Entities

Due to PRC legal restrictions on foreign ownership and investment in insurance agency and brokerage businesses in China, especially those on qualifications as well as capital requirement of the investors, we operate our PRC business primarily through our ConsolidatedAnhou, Sichuan Kangzhuang and Jiangsu Law (collectively, the “Consolidated Affiliated Entities in China.Entities”, each a “Consolidated Affiliated Entity”). We do not hold equity interests in our Consolidated Affiliated Entities. However, through the VIE Agreements (as described in more details(defined as below) with Anhou and its shareholders,, we effectively control, and are able to derive substantially all of thesubstantial economic benefits from, these Consolidated Affiliated Entities. On January 19, 2015, the Ministry of Commerce of China (“MOFCOM”) published a draft version of a proposed Foreign Investment Law (the “Draft Foreign Investment Law”) with an explanatory note. MOFCOM has requested comments from the public on the Draft Foreign Investment Law by February 17, 2015, which, once promulgated, will replace and integrate the three existing laws over foreign investment, however, how these changes will affect entities currently operating in China, particularly foreign controlled variable interest entities, is not entirely clear. See “Risks Related to Our Corporate Structure in the PRC”.

Our Consolidated Affiliated Entities in China are variable interest entities through which all of our insurance services in China are operated. It is through theThese VIE Agreements that we havegive us effective control of theover our Consolidated Affiliated Entities which allowsin China and allow us to consolidate the financial results of theour Consolidated Affiliated Entities in our financial statements. If Anhou and its shareholders fail to perform their obligations under the VIE Agreements, we could be limited in our ability to enforce the VIE Agreements that give us effective control. Furthermore, if we are unable to maintain effective control of our Consolidated Affiliated Entities, we would not be able to continue to consolidate the Consolidated Affiliated Entities’ financial results with our financial results. During each of the fiscal years ended June 30, 2011 and 2012, 100% of our revenues in our consolidated financial statements were derived from our Consolidated Affiliated Entities. For the year ended June 30, 2013, the first fiscal year after the acquisition of AHFL together with its Taiwan Subsidiaries, 92.66% and 7.34% of our revenues in our consolidated financial statements were derived from our Taiwan Subsidiaries and Consolidated Affiliated Entities, respectively. During the six months ended December 31, 2013, 93.72% and 6.28% of our revenues in our consolidated financial statements were derived from our Taiwan Subsidiaries and Consolidated Affiliated Entities, respectively. For the year ended December 31, 2014, 93.55% and 6.45% of our revenues in our consolidated financial statements were derived from our Taiwan Subsidiaries and Consolidated Affiliated Entities, respectively.

On January 17, 2011, CU WFOE, Anhou and Anhou Original Shareholders entered into a series of agreements known as variable interest agreements (the “Old VIE Agreements”) pursuant to which CU WFOE has executedexercises effective control over Anhou through these contractual arrangements.Anhou. As a result of the capital increase and the share transfer described above, on October 24, 2013, CU WFOE, Anhou and Anhou Existing Shareholders entered into a series of variable interest agreements (the “VIE Agreements”), including Power of Attorneys, Exclusive Option Agreements, Share Pledge Agreements, in the same form as the previous Old VIE Agreements, other than the change of shareholder names and their respective shareholdings. The Old VIE Agreements were terminated by and among CU WFOE, Anhou and Anhou Original Shareholders on the same date. Thedate, except that the Exclusive Business Cooperation Agreement executed by and between CU WFOE and Anhou on January 17, 2011 remains in full effect. The VIE Agreements now in effect included:include:

| An |

| a Power of Attorney, |

| an Option Agreement, |

| a Share Pledge Agreement, |

| 9 |

Please refer to “Item 13. Certain Relationships and Related Transactions, and Director Independence” for further information on the VIE Agreements.

PFAL

Prime Financial Asia Ltd. (“PFAL”) is a re-insurance broker company incorporated in Hong Kong. On April 23, 2014, AHFL and Chun Kwok Wong (“Mr. Wong”) entered into a Capital Increase Agreement, pursuant to which Mr. Wong agreed to increase PFAL’s registered capital from HK$500,000 to HK$1,470,000 and AHFL agreed to contribute HK$1,530,000 to PFAL’s registered capital. Upon the completion of capital increase on April 30, 2014, Mr. Wong and AHFL own 49% and 51% of PFAL’s equity interest, respectively.

On August 7, 2015, Max Key Investment Ltd. (“MKI”) was incorporated with limited liability in the British Virgin Islands. On August 15, 2015, Prime Management Consulting (Nanjing) Co., Ltd. (“PTC Nanjing”) was incorporated with limited liability in Nanjing province of the PRC. On September 3, 2015, Prime Asia Corporation Limited. (“PTC Taiwan”), a company limited by shares, was incorporated in Taiwan. Each of MKI, PTC Nanjing and PTC Taiwan is a wholly owned subsidiary of PFAL.

As a holding company with no business other than holding equity interest of our operating subsidiary, CU WFOE in China and Law Broker in Taiwan, we rely principally on dividends to be paid by CU WFOE in China and Law Broker in Taiwan. CU WFOE, being the exclusive service provider to Anhou, relies on the service fees to which it is entitled from Anhou. Pursuant to the Exclusive Cooperation Agreement (the “Cooperation Agreement”) between CU WFOE and Anhou, CU WFOE has the right to collect 90% of the net profits of Anhou. As Anhou is still operating at a loss, Anhou has not paid anybeen paying service fees according to CU WFOE yet and CU WFOEthe Cooperation Agreement, but has not paid any dividend to usCU WFOE to date. We expectAs of December 31, 2017, Anhou to makewas operating at a profit, beginning inbut since Anhou remains a growing company that requires financial resources to support further expansion, the fiscal year ending December 31, 2016, when it should start to pay service fees to CU WFOE, although there candividend payment will be no assurance that Anhou will become profitable by that time or ever.decided later on depending on the financial circumstances. Our capability to receive dividends from CU WFOE, convert them into USD and make the repatriation out of China is subject to the applicable PRC restrictions on the payment of dividends by PRC companies, laws and regulations on foreign exchange and restrictions on foreign investment. Law Broker, beingFor the only operating entity foryear ended December 31, 2015, 88.45%, 10.71% and 0.84% of our revenues in our consolidated financial statements were derived from our Taiwan business, is primarily focused on lifeSubsidiaries, Consolidated Affiliated Entities and propertyPFAL, respectively. For the year ended December 31, 2016, 87.52%, 12.10% and 0.38% of our revenues in our consolidated financial statements were derived from our Taiwan Subsidiaries, Consolidated Affiliated Entities and PFAL, respectively. For the year ended December 31, 2017, 85.31%, 14.37% and 0.32% of our revenues in our consolidated financial statements were derived from our Taiwan Subsidiaries, Consolidated Affiliated Entities and PFAL, respectively. Revenues in our consolidated financial statements are composed of commissions earned from insurance brokerage and agency business. Through yearscompanies according to the terms of operation, Law Broker has become one of the leadingeach insurance brokerage firmscompany service agreement, as well as revenues earned in Taiwan and has expanded its business across Taiwan, with 27 sales and service outlets (including the headquarters) and 2,182 employees and insurance sales professionals.

On February 26, 2014, Anhou completed the registration of the change of its registered address to Room 1906-1910, No. 215 Jiangdong Middle Road, Jianye District, Nanjing, Jiangsu Provinceassociation with the local AICStrategic Alliance Agreement with AIATW.

Reclassification of Jiangsu Province. The new business license was issued to Anhou on February 26, 2014. Anhou obtained the Professional Insurance Agency License issued by Jiangsu Bureau of CIRC on April 21, 2014. Anhou has completed the registration of the share pledge with local AIC. Anhou’s previous headquarters located at Building 4K, Hesheng Plaza, No. 26 Yousheng South Road, Jinshui District, Zhengzhou, Henan province, has been registered as the Henan branch office of Anhou and it obtained the Professional Insurance Agency License issued by Henan Bureau of CIRC on January 3, 2014 and the business license issued by local AIC on January 9, 2014.

Anhou owns 100% equity interest in both Sichuan Kangzhuang and Jiangsu Law. The shareholders of Anhou are Hu Changrong, Wang Yanyan, Chen Zhaohui, Yue Jing, Hou Weizhe, Zhang Yong and Chen Li. All of these shareholders are PRC citizens and do not hold any shares in the Company. Pursuant to the VIE Agreements, CU WFOE becomes the primary beneficiary of Anhou and only leaves Anhou shareholders nominal value therein.Shares

On January 28, 2011, theour Company increased the number of authorized shares from 30,000,000 shares of common stock to 100,000,000 shares of common stock and 10,000,000 shares of preferred stock. On July 2, 2012, the Boardour board of Directorsdirectors and stockholders of the Company approved, in connection with a reclassification of 1,000,000 issued and outstanding shares of common stock (the “Reclassified Shares”), par value $0.00001 per share held by MaoMr. Yi Hsiao Mao (“Mr. Mao”) into 1,000,000 shares of Series A Convertible Preferred Stock, par value $0.00001 per share (the “Series A Preferred Stock”) on a share-for-share basis (the “Reclassification”), the issuance of 1,000,000 shares of Series A Preferred Stock to Mr. Mao and cancellation of 1,000,000 common stock held and submitted by Mr. Mao pursuant to the Reclassification. All of the 1,000,000 shares of Series A Preferred Stock are reclassified from the 1,000,000 common stock held by Mr. Mao and no additional consideration has been paid by Mr. Mao in connection with the Reclassification. Each holder of common stock shall be entitled to one vote for each share of common stock held of record by such holder as of the applicable record date on any matter that is submitted to a vote of the stockholders of theour Company; while each holder of Series A Preferred Stock shall be entitled to ten votes for each share of Series A Preferred Stock held of record by such holder as of the applicable record date on any matter that is submitted to a vote of the stockholders of theour Company.

2017 Long Term Incentive Plan

On August 8, 2014, Mr. Lo Chung Mei (“Mr. Lo”), who had been serving asMay 12, 2017, the Company’s Chief Executive Officer, resigned from his position with the Company. Following the resignation of Mr. Lo, the Company’s Board of Directors appointed Mr. Mao as the Company’s Chief Executive Officer.

On August 24, 2012, the Company acquired all of the issued and outstanding shares of AHFL, a limited liability company (“LLC”2017 Long Term Incentive Plan (the “2017 Plan”) incorporated under the laws of British Virgin Islands on April 30, 2012, together with its subsidiaries in Taiwan. Subsequent to the acquisition, AHFL becomes a 100% subsidiary of the Company. On August 5, 2013, AHFL, Taiwan Branch (“AHFLTW”) was established with registered capital of NT$100,000.

AHFL holds 65.95% of the issued and outstanding shares of Law Enterprise Co., Ltd. (“Law Enterprise”), a company limited by shares incorporated under the laws of Taiwan on January 30, 1996. Law Enterprise holds (i) 100% Law Insurance Broker Co., Ltd. (“Law Broker”), a company limited by shares incorporated in Taiwan on October 9, 1992; (ii) 97.84% of Law Risk Management & Consultant Co., Ltd. (“Law Management”), a company limited by shares incorporated in Taiwan on December 5, 1987; and (iii) 96% of Law Insurance Agent Co., Ltd. (“Law Agent” collectively with “Law Enterprise”, “Law Broker” and “Law Agent”, the “Taiwan Subsidiaries”, each a “Taiwan Subsidiary”), a LLC incorporated in Taiwan on June 3, 2000.

Law Enterprise acts as a holding company of its operating subsidiaries in Taiwan. Law Broker primarily engages in insurance brokerage and insurance agency service business across Taiwan, while Law Management and Law Agent are not in active operation. We operate our Taiwan business primarily through Law Broker.

In the fourth quarter of 2014, the shareholders of the Law Management and Law Agent made the resolution to dissolve Law Management and Law Agent, respectively, because those companies have not been in operation. The dissolution of Law Management and Law Agent was approved by the Taiwan Government on November 26, 2014 and on January 13, 2015, respectively. In accordance withshareholders at the law in Taiwan,2017 Annual Meeting of Stockholders of China United Insurance Service, Inc. Up to 10,000,000 shares of our Common Stock may be granted under the liquidator was appointed by the shareholders2017 Plan (the “Share Pool”), provided that 2,000,000 shares of the Law Management and Law Agent and the liquidator shall complete the liquidation process no later than six months from the appointment date. Both Law Management and Law Agent are under the process of liquidation.

On April 23, 2014, AHFL entered into a capital increase agreement (the “Agreement”) with Wong Chun Kwok Johnny (“Mr. Wong”), the owner of Prime Financial Asia Ltd. (PFAL) whichShare Pool is a re-insurance broker company residing in Hong Kong. Upon the Agreement, Mr. Wong would increase PFAL’s registered capital from HK$500,000 ($64,424)reserved for issuance to HK$1,470,000 ($189,404), and AHFL would contribute HK$1,530,000 ($197,133)eligible participants providing services to PFAL’s registered capital. Upon the completion of capital increase by both parties, Mr. Wong and AHFL would own 49% and 51% of PFAL’s equity interest, respectively. The transaction was completed on April 30, 2014.

On February 13, 2015, the Company and AHFL entered into an acquisition agreement (the “Acquisition Agreement”) with Mr. Li Chwan Hau, the selling shareholder of GeniusAction Holdings Financial Limited (the “Selling Shareholder”), a company with limited liability incorporated under the lawsand its subsidiaries. Eligibility to participate is open to officers, directors and employees of, British Virgin Islands (“GHFL”), to issue 352,166 fully paid and non-assessable shares of AHFL Common Stock (“AHFL Shares”) together with an granted put option for 352,166 shares of common stockother individuals (including sales agents who are exclusive agents of the Company (“Put Option”), in exchangeor its subsidiaries or derive more than 50% of their income from those entities) who provide bona fide services to or for, 704,333 sharesus or any of common stockour subsidiaries. Given that metrics for evaluating performance goals are rather complex and exhaustive, and that the Company’s management and Board of GHFL, being allDirectors are still working to develop a series of reward policies that specify various performance target levels and the size of the issued and outstanding capital stockaward or payout of GHFL. The Put Option may be exercised within six months of the closing date of the acquisition and the Selling Shareholder would exchange the AHFL Shares as consideration for the exercise of the Put Option. Subsequentperformance shares with respect to the acquisition, GHFL will become a wholly-owned subsidiary of the Company. GHFL holds 100% issued and outstanding shares of Genius Investment Consultant Co., Ltd. (“Taiwan Genius”), a limited company incorporatedeach different target level attained, no awards were granted under the laws of Taiwan, which in turn holds approximately 15% issued and outstanding shares of Genius Insurance Broker Co., Ltd. (“Genius Broker”), a company limited by shares incorporated under the laws of Taiwan. Both GHFL and Taiwan Genius have no substantive business operation other than the holding of shares of its subsidiary. Genius Broker is primarily engaged in broker business across Taiwan. The acquisition price may be further adjusted on the fourth anniversary of the closing date of the acquisition and depending on the earnings per share of GHFL during the fiscal years of 2014 through 2017 subject to other terms and conditions therein. Mr. Li Chwan Hau is the sole shareholder of GHFL and a director and shareholder of the Company. On February 13, 2015, the acquisition was completed, the Selling Shareholder transferred 100% shares in GHFL to AHFL. The Put Option has not been exercised by the Selling ShareholderPlan as of March 15, 2015.December 31, 2017.

On January 17, 2014, the board of directors of the Company approved a change in our fiscal year end from June 30 to December 31.

Please refer to the chart below for detailed information of the Company’s shareholders who serve as a director or officer of the Company, the Company’s subsidiaries, or the Consolidated Affiliated Entities.

| 10 |

See “Related Party Transactions” for further information on our contractual arrangements with these parties.

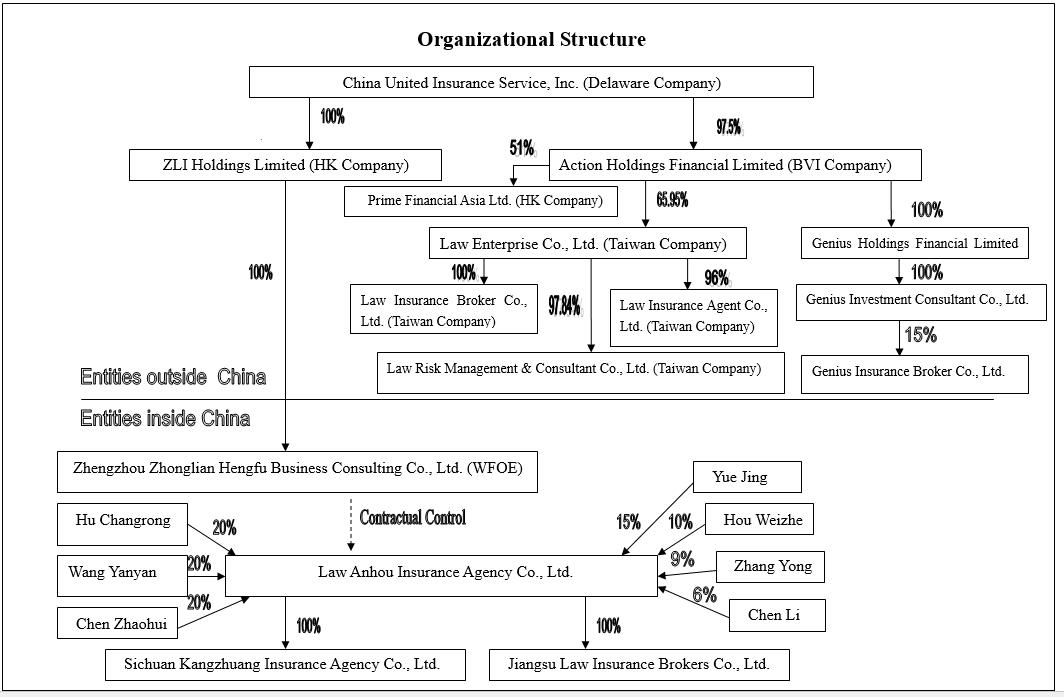

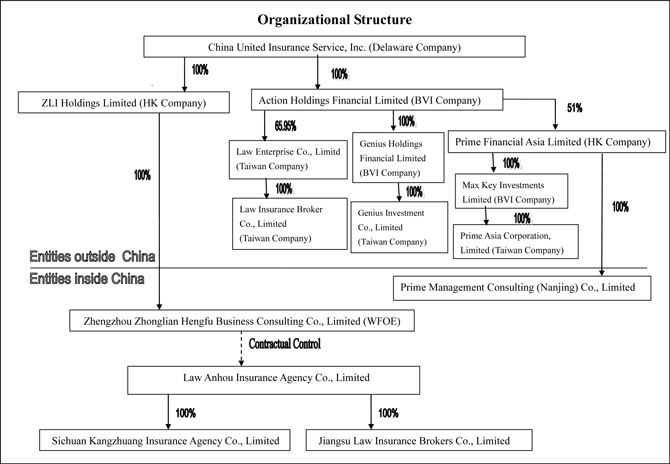

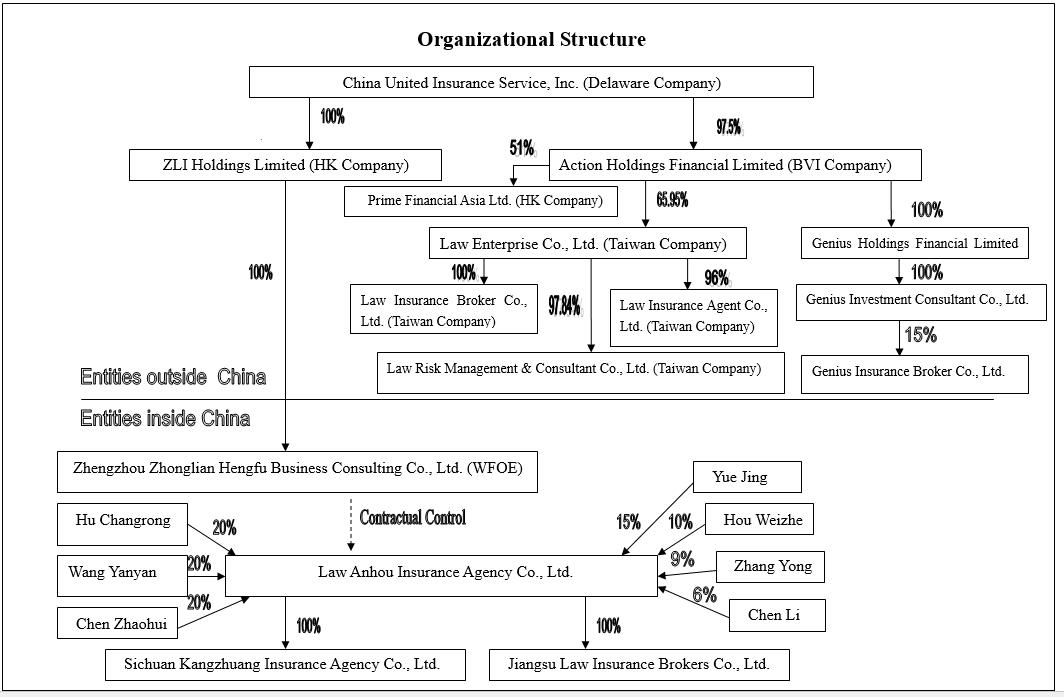

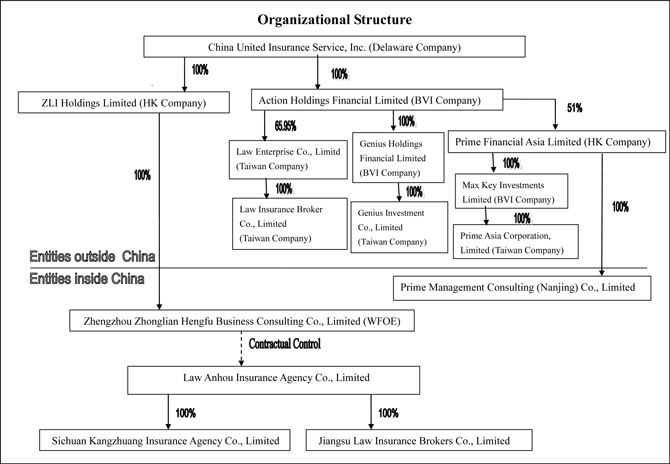

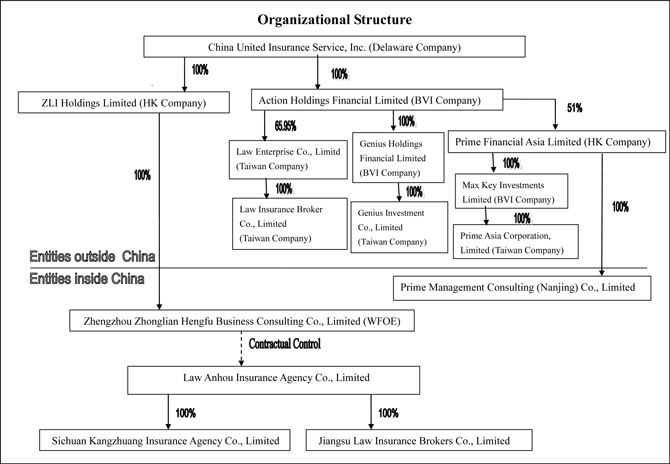

The following flow chart illustrates our Company’s organizational structure:structure as of March 14, 2018:

Products and Services

Law Broker and Anhou market and sell to customers two broad categories of insurance products: life insurance products and property and casualty insurance products, both focused on meeting the particular insurance needs of individuals. The insurance products that Law Broker and Anhou sell are underwritten by some of the leading insurance companies in Taiwan and China, respectively.

Through Anhou’s wholly-owned insurance brokerage firm Jiangsu Law, it also closely interacts with insurance companies and actively locates and introduces the right customers in Anhou’s database matching the insurance products offered by such insurance companies to them.

Law Broker and Anhou are compensated primarily by commissions and fees paid by insurance companies, typically based on a percentage of the premium paid by the insured or a percentage of the amount recovered from insurance companies. Commission and fee rates generally depend on the type of insurance products, the particular insurance company.

Life Insurance Products

Law Broker

The life insurance products Law Broker distributes can be broadly classified into the categories set forth below. Due to constant product innovation by insurance companies, some of the insurance products Law Broker distributes combine features of one or more of the categories listed below. Total net revenues from life insurance products distributed by Law Broker in the 2017 fiscal year was approximately $55.96 million, accounted for 94.33 %approximately 93.43% of Law Broker’s total net revenues inand approximately 76.81% of our total net revenues for the fiscal year ended December 31, 2014. Total net revenues from life insurance products distributed by Law Broker accounted for 94.39% of CUIS’ total net revenues of life insurance iin the fiscal year ended December 31, 2014.2017, respectively.

| · | Individual Whole Life Insurance.The individual whole life insurance products Law Broker distributes provide insurance for the insured person’s entire life in exchange for the periodic payment of fixed premiums over a pre-determined period, generally ranging from six to 20 years, or until the insured reaches a certain age. The face amount of the policy or, for some policies, the face amount plus accumulated |

| · | Individual Term Life Insurance.The individual term life insurance products Law Broker distributes provide insurance for the insured for a specified time period or until the attainment of a certain age, in return for the periodic payment of fixed premiums over a pre-determined period, generally ranging from six to 20 years. Term life insurance policies generally expire without value if the insured survives the coverage period. |

| 11 |

| · | Individual Health Insurance.The individual health insurance products Law Broker distributes pay the insured amount of reasonable hospitalization cost, or certain death benefit in case of the death of the insured, due to |

| · |

| · |

| · | Foreign Currency |

| · | Travel Accident |

| 12 |

The life insurance products Law Broker distributed in the fiscal year ending December 31, 20142017 were primarily underwritten by, in alphabetical order, AIA International Limited Taiwan Branch, Farglory Life Insurance Co., Ltd., CTBCFubon Life Insurance Co., Ltd., Shin Kong Life Insurance Co., Ltd., FubonTaiwan Life Insurance Co., Ltd. and AIA International Limited,TransGlobe Life Insurance Inc. Among them, Farglory Life Insurance Co., Ltd., Taiwan Branch.Life Insurance Co., Ltd., and TransGlobe Life Insurance Inc. accounted for approximately 25.41%, 12.45%, and 11.18% of our total net revenues in the fiscal year ending December 31, 2017, respectively.

Anhou

The life insurance products Anhou distributes can be broadly classified into the categories set forth below. Due to constant product innovation by insurance companies, some of the insurance products Anhou distributes combine features of one or more of the categories listed below. Total net revenues from life insurance products in the 2017 fiscal year was approximately 9.67 million, accounted for 80.8%approximately 92.33% of Anhou’s total net revenues inand approximately 13.27% of our total net revenues for the fiscal year ending December 31, 2014.

Total net revenues from life insurance products distributed by Anhou accounted for approximately 5.61% of CUIS’ total net revenues of life insurance products in the fiscal year ending December 31, 2014.2017, respectively.

| · | Individual Whole Life Insurance.The individual whole life insurance products Anhou distributes provide insurance for the insured person’s entire life in exchange for the periodic payment of fixed premiums over a pre-determined period, generally ranging from five to 20 years, or until the insured reaches a certain age. The face amount of the policy or, for some policies, the face amount plus accumulated |

| · | Individual Term Life |

| · | Individual Endowment Life |

| · | Individual |

| · | Individual Health Insurance.The individual health insurance products Anhou distributes primarily consist of |

| 13 |

The life insurance products Anhou distributed in the fiscal year ending December 31, 20142017 were primarily underwritten by, Taikang Life Insurance Company, YINGDA TAIHEin alphabetical order, Aegon THTF Life Insurance Co., Ltd., SunshineAVIVA Life Insurance Group Corporation Limited,Co., Ltd., Funde Sino Life Insurance Co., Ltd. and AVIVA Life, Huaxia Insurance Co., Ltd., and Taikang Life Insurance Company. None of these insurance company partners accounted for more than 10% of our total net revenues for the year ended December 31, 2017.

In addition to the periodic premium payment schedules described above, most of the individual life insurance products we distribute also allow the insured to choose to make a single, lump-sum premium payment at the beginning of the policy term. If a periodic payment schedule is adopted by the insured, a life insurance policy can generate periodic payment of fixed premiums to the insurance company for a specified period of time. This means that once Anhou or Law Broker sells a life insurance policy with a periodic premium payment schedule, they will be able to derive commission and fee income from that policy for an extended period of time, sometimes up to 25 years. Because of this feature and the expected sustainedsustainable growth of life insurance sales in China and Taiwan, we have focused significant resources ever since the incorporationinception of Anhou and Law Broker on developing our capability to distribute individual life insurance products with periodic payment schedules. We expect that sales of life insurance products will continuouslycontinue to be our primary source of revenue in the next several years.

Property and Casualty Insurance Products

Law Broker

Law Broker’s main property and casualty insurance products are automobile insurance, casualty insurance, and liability insurance. Law Broker commenced sale of automobile insurance, casualty insurance and liability insurance business in August 2003. Total net revenues from property and casualty insurance products in the 2017 fiscal year was approximately $3.93 million, accounted for 5.67%approximately 6.57% of Law Broker’s total net revenues and approximately 5.40% of our total net revenues in the fiscal year ending December 31, 2014.2017, respectively.

| 14 |

Total net revenues from property and casualty insurance products distributed by Law Broker accounted for 81.42% of CUIS’ total net revenues of property and casualty insurance products in the fiscal year ending December 31, 2014.

The property and casualty insurance products Law Broker distributes can be further classified into the following categories:

| · | Automobile Insurance.Law Broker distributes both standard automobile insurance policies and supplemental policies, which we refer to as riders. The standard automobile insurance policies Law Broker sells generally have a term of one year and cover damages caused to the insured vehicle by collision and other traffic accidents, falling or flying objects, fire, explosion and natural disasters. Law Broker also sells standard third party liability insurance policies, which cover bodily injury and property damage caused by an accident involving an insured vehicle to a person not in the insured vehicle. The riders Law Broker distributes cover additional losses, such as liability to passengers, losses arising from vehicle theft and robbery, broken glass and vehicle body scratches. |

| · | Casualty |

| · | Liability Insurance. |

The property and casualty insurance products Law Broker distributed in the fiscal year ending December 31, 20142017 were primarily underwritten by, in alphabetical order, Fubon Insurance Co., Ltd., Zurich Insurance Company, ACE Insurance Company, Union Insurance Company and TaianHotai Insurance Co., Ltd., Shinkong Insurance Co., Ltd., TLG Insurance Co., Ltd. and Union Insurance Company. None of these insurance company partners accounted for more than 10% of our total net revenues for the year ended December 31, 2017.

| 15 |

Anhou

Anhou’s main property and casualty insurance products are automobile insurance and commercial property insurance. Anhou commenced its sale of commercial property insurance in 2009 and had developed its automobile insurance business since 2010. Total net revenues from property and casualty insurance products distributed by Anhou in the 2017 fiscal year was approximately $0.8 million, accounted for 19.2%approximately 7.67% of Anhou’s total net revenues inand approximately 1.10% of our total net revenues for the fiscal year ending December 31, 2014.

Total net revenues from property and casualty insurance products distributed by Anhou accounted for 18.58% of CUIS’ total net revenues of property and casualty insurance products in the fiscal year ending December 31, 2014.2017.

The property and casualty insurance products Anhou distributes can be further classified into the following categories:

| · | Automobile Insurance.Automobile insurance is the largest segment of property and casualty insurance in the PRC in terms of gross written premiums. Anhou distributes both standard automobile insurance policies and supplemental policies, which we refer to as riders. The standard automobile insurance policies Anhou sells generally have a term of one year and cover damages caused to the insured vehicle by collision and other traffic accidents, falling or flying objects, fire, explosion and natural disasters. Anhou also sells standard third party liability insurance policies, which cover bodily injury and property damage caused by an accident involving an insured vehicle to a person not in the insured vehicle. The riders Anhou distributes cover additional losses, such as liability to passengers, losses arising from vehicle theft and robbery, broken glass and vehicle body scratches. |

| · | Commercial Property Insurance.The commercial property insurance products Anhou distributes include basic, comprehensive and all risk policies. Basic commercial property insurance policies generally cover damage to the insured property caused by fire, explosion and thunder and lightning. Comprehensive commercial property insurance policies generally cover damage to the insured property caused by fire, explosion and certain natural disasters. All risk commercial property insurance policies cover all causes of damage to the insured property not specifically excluded from the policies. |

The property and casualty insurance products Anhou distributed in the fiscal year ending December 31, 20142017 were primarily underwritten by, PICC Property and Casualty Co., Ltd.,in alphabetical order, China Pacific Insurance (Group) Co., Ltd., Ping AnLife Property and Casualty Insurance Co., Ltd., China Life Property &CasualtyPacific (Group) Co., Ltd., Huatai P&C Insurance Co., Ltd., PICC Property and FubonCasualty Co., Ltd., and Tianan Property& Casualty Insurance Co., Ltd. .None of these insurance company partners accounted for more than 10% of our total net revenues for the year ended December 31, 2017.

Strategic Alliance with AIATW

On June 10, 2013, AHFL entered into a Strategic Alliance Agreement (the “Alliance Agreement”) with AIA International Limited Taiwan Branch (“AIATW”). The, the purpose of the Alliance Agreementwhich is to promote life insurance products provided by AIATW within the territory ofin Taiwan by insurance agency companies or insurance brokerage companies affiliated with AHFL or CUIS. The original term of the Alliance Agreement iswas from April 15,June 1, 2013 to AugustMay 31, 2018. Pursuant to the terms of the Alliance Agreement, AIATW shallwas required to pay AHFL an Execution Feeexecution fee of $8,367,947$8,326,700 (NT$ 250,000,000). The fee will to be recorded as revenue upon fulfilling sales target over the next five years. As of September 23, 2013, AHFL hashad received $8,367,947$8,326,700 (NT$250,000,000) from AIATW under the Alliance Agreement. Pursuant to the Alliance Agreement, AHFL iswas entitled to the payment of the execution fee, subject to certain terms and conditions therein, including the satisfaction of the performance targets and the threshold 13-month persistency ratio. The Execution Feeexecution fee may be required to be recalculated if certain performance targets are not met by AHFL.

On September 30, 2014, AHFL entered into an Amendment to Strategic Alliance Agreement (the “Amendment”“First Amendment to Alliance Agreement”) with AIATW.

Pursuant to the First Amendment to Alliance Agreement, the expiration date of the Strategic Alliance Agreement has beenwas extended from May 31, 2018 to December 31, 2020. In addition, both AHFL and AIATW agreeagreed to adjust certain terms and conditions set forth in the Strategic Alliance Agreement, including the downward adjustment of the performance targets as well as the mechanism and formula calculating the Execution Feeexecution fee to be refunded, if any.

In addition,On January 6, 2016, AHFL agreedentered into an Amendment 2 to refrain from selling, pledging or transferring more than 30% of its holdings in Law Broker. If such sale of Law Broker securities does take place, AIATW may unilaterally terminate the Strategic Alliance Agreement. Upon such a termination, the Execution Fee shall be recalculated based on formulas providedAgreement (the “Second Amendment to Alliance Agreement”) with AIATW to further revise certain provisions in the Alliance Agreement.Agreement and the previous amendment entered into by and between AHFL and AIATW.

Pursuant to the Second Amendment to Alliance Agreement, the expiration date of the Alliance Agreement was extended from May 31, 2018 to December 31, 2021, and the effect of the Alliance Agreement during the period from October 1, 2014 to December 31, 2015 was suspended. In addition, both AHFL and AIATW agree to adjust certain terms and conditions set forth in the Alliance Agreement, among which: (i) expand the scope of services to be provided by AHFL to AIATW to include, without limitation, assessment and advice on suitability of cooperative partners, advice on product strategies suitable for promotion channel development, advice on promotion/sales channel improvement, advice on promotion channel marketing and strategic planning, and promotion channel talent training; and (ii) remove certain provisions related to performance milestones and refund of execution fees. On March 15, 2016, AHFL unilaterally issued a confirmation letter to AIATW (the “2016 Letter”), where it emphasized its commitment to achieve certain sales targets within a specific time frame and covenanted to refund a certain portion of execution fees calculated based on the formula therein upon failure to achieve such sales target, as applicable.

On June 14, 2017, AHFL entered into an Amendment 3 (the “Third Amendment”) to the Alliance Agreement with AIATW to further revise certain provisions in the Alliance Agreement and the previous amendments to the Alliance Agreement entered into by and between AHFL and AIATW.

| 16 |

Pursuant to the Third Amendment, except for the first contract year (April 15, 2013 to September 30, 2014), the sales targets for the remaining contract term under the Alliance Agreement shall be changed by reference to (i) the amount of the value of new business (“VONB”) and (ii) the 13-month persistency ratio as set forth therein, provided that to the extent any underlying insurance contract is revoked, invalid or terminated and premiums is refunded to such policyholder, the amount of the related VONB shall be correspondingly reduced. Both AHFL and AIATW agreed to calculate the business promotion fees (equivalent to the “execution fee” referred above) to be returned in case of failure to achieve the sales targets or the fees to be increased in case of exceeding the sales targets, as the case may be, based on two formulas specified in the Third Amendment. The primary factor under formula one focuses on the annual and/or accumulated achievement rate(s), while the primary factor under formula two focuses on the 13-month persistency ratio(s), subject to terms and conditions therein. The expanded scope of services to be provided by AHFL to AIATW as set forth in Section 4 of New Second Amendment is removed under the Third Amendment as well.

On June 14, 2017, with AIATW's consent, the 2016 Letter was revoked in order to conform to the latest terms and conditions regarding the cooperation between AHFL and AIATW as set forth in the Third Amendment.

Online Business

In recent years, the online insurance business has experienced rapid growth. Many insurance companies, portal websites and professional insurance intermediaries have begun launching its e-commerce platforms, providing real-time information to consumers and allowing consumers to directly complete transactions online. Law Broker began developing its online platform in 2016, and became the first brokerage company to receive formal approval from the Financial Supervisory Commission of Taiwan (“FSC”) to commence online business on May 9, 2016. The platform, SARAcares (website: https://www.saracares.com.tw), was launched on January 26, 2017. It offers a broad range of insurance products underwritten by multiple insurance companies, policy comparison features, and post-sale services that are backed by our online service staffs and nationwide sales network. As required by the relevant laws and regulations regarding e-commerce provided by the FSC, Law Broker obtained the ISO 27001 certification of Information Security Management System (ISMS) and BS 10012 certification of Personal Information Management System on June 20, 2017. Our online business in Taiwan is still at a nascent stage with the majority of the sales still being completed by off-line agents.

Unified Operating Platform

Law Broker has its own self-developedself-constructed a Unified Operating Platform.Platform, an information technology infrastructure that serves to enhance operational, sales processes, and administrative efficiency. Since Law Broker’s establishment in 1992, it has successfully implemented the following components of its operating platform across its branch offices in Taiwan through a hub center located in Taipei:

| · | A centralized |

| · | A centralized client relations management system, that manages and analyzes client interactions to drive sales growth; |

| · | An integrated administrative and information system, that increases the management efficiency among the subsidiaries, branches and sales departments; |

| · | A centralized and computerized accounting and financial management system, that |

| · | A human resources management and |

| · | An |

Through years of operation, the

The Unified Operating Platform has proved to be an efficient and streamlined operating system which contributeshas contribute to the successful expansion and growth of Law Broker into one of the leading insurance brokerage companies in Taiwan, with 2730 sales and service outlets (including the headquarter)headquarters) across Taiwan and 2,1822,609 employees and insurance sales professionals.professionals as of December 31, 2017.

In accordance with our growth strategy in China, Anhou has made significant effort to adapt the Unified Operating Platform utilized by Law Broker to better meet the operational need in China. Since September 2010, Anhou has successfully implemented the tailored operating platform across the PRC subsidiaries through a hub center located in Nantong, Jiangsu province. We expect that this tailored operating platform will make selling easier for sales agents in China, facilitate standardized business and financial management, enhance risk control and increase operational efficiency for the PRC subsidiaries.

Anhou has tailored and refined the platform on the basis of Law Broker’s well-developed operating platform in Taiwan and believes that it is difficult for our competitors in China, particularly new market entrants, to reproduce a similar platform without substantial financial resources, time and operating experience.

Because the various systems, policies and procedures under both of operating platforms utilized by Law Broker and Anhou can be rolled out quickly as we enter new regions or make acquisitions, we believe we can expand our distribution network rapidly and efficiently while maintaining the quality of our services.

Distribution and Service Network and Marketing

Since Law Broker’s establishment in 1991,1992, it has devoted substantial resources into building up its distribution and service network. Law Broker currently has 2730 sales and service outlets spread across Taiwan (including the headquarter)headquarters), among which, 610 are located in the northern region, 13 are located in the central region, 65 are located in the southern region and 2 are located in the eastern region. As of December 31, 2014,2017, Law Broker had 1,635 full-time sales professionals, 394 part-time2,414 sales professionals and 153195 administrative staff.staff members.

The following table sets forth some additional information of Law Broker’s distribution and service network by region as of December 31, 2014, broken down by the four regions:2017:

| Number of Full-time | Number of Full-time | Number of Part-time | ||||||||||

| Province | Number of Sales and Service Outlets | Sales Professionals | Sales Professionals | |||||||||

| Northern region | 6 | 414 | 97 | |||||||||

| Southern region | 6 | 358 | 100 | |||||||||

| Central region | 13 | 830 | 187 | |||||||||

| Eastern region | 2 | 33 | 10 | |||||||||

| Total | 27 | 1,635 | 394 | |||||||||

| 17 |

| Region | Number of Sales and Service Outlets | Number of Sales Professionals | ||||||

| Northern region (including the headquarter) | 10 | 703 | ||||||

| Southern region | 5 | 507 | ||||||

| Central region | 13 | 1,162 | ||||||

| Eastern region | 2 | 42 | ||||||

| Total | 30 | 2414 | ||||||

Law Broker markets and sells life insurance products, property and casualty insurance products directly to the targeted customers through the sales professionals, who are independent contractors, not its employees.