SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

(Mark One) | |||

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the fiscal year ended January 31, 2015

For the fiscal year ended February 3, 2018

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from __________ to __________ | |||

Commission File No. 1-10299 | |||

(Exact name of registrant as specified in its charter) | |||

For the transition period from  to

to

Commission File No. 1-10299

(Exact name of Registrant as specified in its charter)

New York | 13-3513936 | |

(State or other jurisdiction of | (I.R.S. Employer Identification No.) |

incorporation or organization) | ||

330 West 34th Street, New York, New York | 10001 | |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (212) 720-3700

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, par value $0.01 | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.YesAct. Yesx☒No ☐ Noo

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.YesAct. Yes o☐ Nox☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yesxdays. Yes ☒ Noo☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yesx. Yes ☒Noo☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.o☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | Accelerated filer | Non-accelerated filer | Smaller reporting company | ||||

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes. Yes o☐ Nox☒

| The number of shares of the Registrant’s Common Stock, par value $0.01 per share, outstanding at March 16, 2015: | 139,649,989 | |||

| The aggregate market value of voting stock held by non-affiliates of the Registrant computed by reference to the closing price as of the last business day of the Registrant’s most recently completed second fiscal quarter, August 2, 2014, was approximately: | $ | 5,363,852,719 | * | |

The number of shares of the Registrant’s Common Stock, par value $0.01 per share, outstanding as of March 26, 2018: | 118,115,818 | |

The aggregate market value of voting stock held by non-affiliates of the Registrant computed by reference to the closing price as of the last business day of the Registrant’s most recently completed second fiscal quarter, July 29, 2017, was approximately: | $4,504,950,585* |

* | For purposes of this calculation only (a) all directors plus three executive officers and owners of five percent or more of the Registrant are deemed to be affiliates of the Registrant and (b) shares deemed to be “held” by such persons include only outstanding shares of the Registrant’s voting stock with respect to which such persons had, on such date, voting or investment power. |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement (the “Proxy Statement”) to be filed in connection with the Annual Meeting of Shareholders to be held on May 20, 2015:23, 2018: Parts III and IV.

PART I | |||||||

Item 1. |

| 1 | |||||

Item 1A. | 1 | ||||||

Item 1B. | 9 | ||||||

Item 2. |

| 9 | |||||

Item 3. | 9 | ||||||

Item 4. | 9 | ||||||

Item 4A. | 10 | ||||||

PART II | |||||||

Item 5. | 11 | ||||||

Item 6. | 13 | ||||||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 14 | |||||

Item 7A. | 35 | ||||||

Item 8. | 35 | ||||||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 74 | |||||

Item 9A. | 74 | ||||||

Item 9B. | 76 | ||||||

PART III | |||||||

Item 10. | 76 | ||||||

Item 11. | 76 | ||||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 76 | |||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 76 | |||||

Item 14. | 76 | ||||||

PART IV | |||||||

Item 15. | 77 | ||||||

| 78 | |||||||

| 79 | |||||||

PART I

General

Foot Locker, Inc., incorporated under the laws of the State of New York in 1989, is a leading global retailer of athletically inspired shoes and apparel, operating 3,423apparel. As of February 3, 2018, the Company operated 3,310 primarily mall-based stores, as well as stores in high-traffic urban retail areas and high streets, in the United States, Canada, Europe, Australia, and New Zealand as of January 31, 2015.Zealand. Foot Locker, Inc. and its subsidiaries hereafter are referred to as the “Registrant,” “Company,” “we,” “our,” or “us.” Information regarding the business is contained under the “Business Overview” section in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The Company maintains a website on the Internet atwww.footlocker-inc.com. The Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are available free of charge through this website as soon as reasonably practicable after they are filed with or furnished to the SEC by clicking on the “SEC Filings” link. The Corporate Governance section of the Company’s corporate website contains the Company’s Corporate Governance Guidelines, Committee Charters, and the Company’s Code of Business Conduct for directors, officers and employees, including the Chief Executive Officer, Chief Financial Officer, and Chief Accounting Officer. Copies of these documents may also be obtained free of charge upon written request to the Company’s Corporate Secretary at 112330 West 34th Street, New York, N.Y. 10120. The Company intends to promptly disclose amendments to the Code of Business Conduct and waivers of the Code for directors and executive officers on the Corporate Governance section of the Company’s corporate website.10001.

Information Regarding Business Segments and Geographic Areas

The financial information concerning business segments, divisions, and geographic areas is contained under the “Business Overview” and “Segment Information” sections in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Information regarding sales, operating results, and identifiable assets of the Company by business segment and by geographic area is contained under theSegment Information note in “Item 8. Consolidated Financial Statements and Supplementary Data.”

The service marks, trade names, and trademarks appearing in this report (except for Nike, Inc.)Jordan, adidas, and Puma) are owned by Foot Locker, Inc. or its subsidiaries.

Employees

The Company and its consolidated subsidiaries had 14,56715,141 full-time and 30,00134,068 part-time employees at January 31, 2015.as of February 3, 2018. The Company considers employee relations to be satisfactory.

Competition

Financial information concerning competition is contained under the “Business Risk” section in theFinancial Instruments and Risk Management note in “Item 8. Consolidated Financial Statements and Supplementary Data.”

Merchandise Purchases

Financial information concerning merchandise purchases is contained under the “Liquidity” section in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and under the “Business Risk” section in theFinancial Instruments and Risk Management note in “Item 8. Consolidated Financial Statements and Supplementary Data.”

Item 1A. Risk Factors

The statements contained in this Annual Report on Form 10-K (“Annual Report”) that are not historical facts, including, but not limited to, statements regarding our expected financial position, business and financing plans found in “Item 1. Business” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

1

Please also see “Disclosure Regarding Forward-Looking Statements.” Our actual results may differ materially due to the risks and uncertainties discussed in this Annual Report, including those discussed below. Additional risks and uncertainties that we do not presently know about or that we currently consider to be insignificant may also affect our business operations and financial performance.

Our inability to implement our long-range strategic long range plan may adversely affect our future results.

Our ability to successfully implement and execute our long-range plan is dependent on many factors. Our strategies may require significant capital investment and management attention, which may result in the diversion of these resources from our core business and other business issues and opportunities.attention. Additionally, any new initiative is subject to certain risks including customer acceptance of our products and renovated store designs, competition, product differentiation, and the ability to attract and retain qualified personnel.personnel, and our ability to successfully implement technological initiatives. If we cannot successfully execute our strategic growth initiatives or if the long-range plan does not adequately address the challenges or opportunities we face, our financial condition and results of operations may be adversely affected. Additionally, failure to meet marketshareholder expectations, particularly with respect to sales, operating margins, and earnings per share, would likely result in volatility in the market value of our stock.

The retail athletic footwear and apparel business is highly competitive.

Our athletic footwear and apparel operations compete primarily with athletic footwear specialty stores, sporting goods stores, department stores, discount stores, traditional shoe stores, mass merchandisers, and Internet retailers, many of which are units of national or regional chains that have significant financial and marketing resources. The principal competitive factors in our markets are selection of merchandise, customer experience, reputation, store location, quality, advertising, price, and customer service. Our success also depends on our ability to differentiate ourselves from our competitors with respect to a quality merchandise assortment and superior customer service.price. We cannot assure that we will continue to be able to compete successfully against existing or future competitors. Our expansion into markets served by our competitors, and entry of new competitors or expansion of existing competitors into our markets, could have a material adverse effect on our business, financial condition, and results of operations.

Although we sell an increasing proportion of our merchandise via the Internet, a significantsignificantly faster shift in customer buying patterns to purchasing athletic footwear, athletic apparel, and sporting goods via the Internet could have a material adverse effect on our business results. In addition, all of our significant suppliers operate retail stores and distribute products directly through the Internet and others may follow. Some of our suppliers currently operate retail stores and some have indicated that they intend to open additional retail stores. Should this continue to occur, and if our customers decide to purchase directly from our suppliers, it could have a material adverse effect on our business, financial condition, and results of operations.

The industry in which we operate is dependent upon fashion trends, customer preferences, product innovations, and other fashion-related factors.

The athletic footwear and apparel industry, especially at the premium end of the price spectrum, is subject to changing fashion trends and customer preferences. In addition, retailers in the athletic industry rely on their suppliers to maintain innovation in the products they develop. We cannot guarantee that our merchandise selection will accurately reflect customer preferences when it is offered for sale or that we will be able to identify and respond quickly to fashion changes, particularly given the long lead times for ordering much of our merchandise from suppliers. A substantial portion of our highest margin sales are to young males (ages 12 – 12–25), many of whom we believe purchase athletic footwear and athletic apparel as a fashion statement and are frequent purchasers. Our failure to anticipate, identify or react appropriately in a timely manner to changes in fashion trends that would make athletic footwear or athletic apparel less attractive to theseour customers could have a material adverse effect on our business, financial condition, and results of operations.

If we do not successfully manage our inventory levels, our operating results will be adversely affected.

We must maintain sufficient inventory levels to operate our business successfully. However, we also must guard against accumulating excess inventory. For example, we order most of our athletic footwear four to six months prior to delivery to our stores. If we fail to anticipate accurately either the market for the merchandise in our stores or our customers’ purchasing habits, we may be forced to rely on markdowns or promotional sales to dispose of excess or slow moving inventory, which could have a material adverse effect on our business, financial condition, and results of operations.

2

A change in the relationship with any of our key suppliers or the unavailability of our key products at competitive prices could affect our financial health.

Our business is dependent to a significant degree upon our ability to obtain exclusive product and the ability to purchase brand-name merchandise at competitive prices from a limited number of suppliers. In addition, our suppliers providewe have negotiated volume discounts, cooperative advertising, and markdown allowances with our suppliers, as well as the ability to negotiate returns ofcancel orders and return excess or unneeded merchandise. We cannot be certain that such terms with our suppliers will continue in the future.

The Company

We purchased approximately 8993 percent of itsour merchandise in 20142017 from itsour top five suppliers and expectswe expect to continue to obtain a significant percentage of itsour athletic product from these suppliers in future periods. Approximately 7367 percent of all merchandise purchased in 2017 was purchased from one supplier — Nike, Inc. (“Nike”). Each of our operating divisions is highly dependent on Nike;Nike: they individually purchased 4744 to 8473 percent of their merchandise from Nike.Nike during the year. Merchandise that is high profile and in high demand is allocated by our suppliers based upon their internal criteria. Although we have generally been able to purchase sufficient quantities of this merchandise in the past, we cannot be certain that our suppliers will continue to allocate sufficient amounts of such merchandise to us in the future. Our inability to obtain merchandise in a timely manner from major suppliers (particularly Nike) as a result of business decisions by our suppliers or any disruption in the supply chain could have a material adverse effect on our business, financial condition, and results of operations. Because of our strong dependence onthe high proportion of purchases from Nike, any adverse development in Nike’s reputation, financial condition or results of operations or the inability of Nike to develop and manufacture products that appeal to our target customers could also have an adverse effect on our business, financial condition, and results of operations. We cannot be certain that we will be able to acquire merchandise at competitive prices or on competitive terms in the future. These risks could have a material adverse effect on our business, financial condition, and results of operations.

We depend onare affected by mall traffic and our ability to secure suitable store locations.

Our

Many of our stores, especially in North America, are located primarily in enclosed regional and neighborhood malls. Our sales are dependent,affected, in part, onby the volume of mall traffic. Mall traffic may be adversely affected by, among other factors, economic downturns, the closing or continued decline of anchor department stores and/or specialty stores, and a decline in the popularity of mall shopping among our target customers. Further, any terrorist act, natural disaster, or public health or safety concern that decreases the level of mall traffic, or that affects our ability to open and operate stores in affected areas,such locations, could have a material adverse effect on our business.

To take advantage of customer traffic and the shopping preferences of our customers, we need to maintain or acquire stores in desirable locations such as in regional and neighborhood malls, anchored by major department stores.as well as high-traffic urban retail areas and high streets. We cannot be certain that desirable mall locations will continue to be available at favorable rates. Some traditional enclosed malls are experiencing significantly lower levels of customer traffic, driven by economic conditions as well as the closure of certain mall anchor tenants.

Several large landlords dominate the ownership of prime malls particularly in the United States, Canada, and Australia, and because of our dependence upon these landlords for a substantial number of our locations, any significant erosion of their financial condition or our relationships with these landlords wouldcould negatively affect our ability to obtain and retain store locations. Additionally, further landlord consolidation may negatively affect our ability to negotiate favorable lease terms.

We may experience fluctuations in, and cyclicality of, our comparable-store sales results.

Our comparable-store sales have fluctuated significantly in the past, on both an annual and a quarterly basis, and we expect them to continue to fluctuate in the future. A variety of factors affect our comparable-store sales results, including, among others, fashion trends, product innovation, promotional events, the highly competitive retail sales environment, economic conditions, timing of promotional events,income tax refunds, changes in our merchandise mix, calendar shifts of holiday periods, supply chain disruptions, and weather conditions. Many of our products represent discretionary purchases. Accordingly, customer demand for these products could decline in a recessionan economic downturn or if our customers develop other priorities for their discretionary spending. These risks could have a material adverse effect on our business, financial condition, and results of operations.

3

Economic or political conditions in other countries, including fluctuations in foreign currency exchange rates and tax rates may adversely affect our operations.

A significant portion of our sales and operating income for 20142017 was attributable to our operations in Europe, Canada, Australia, and New Zealand. As a result, our business is subject to the risks associated with doing business outside of the United States such as foreignlocal customer product preferences, political unrest, disruptions or delays in shipments, changes in economic conditions in countries in which we operate, foreign currency fluctuations, real estate costs, and labor and employment practices in non-U.S. jurisdictions that may differ significantly from those that prevail in the United States. In addition, because we and our suppliers havemanufacture a substantial amount of our products manufactured in foreign countries, our ability to obtain sufficient quantities of merchandise on favorable terms may be affected by governmental regulations, trade restrictions, and economic, labor, and other conditions in the countries from which our suppliers obtain their product.

Fluctuations in the value of the euro and the British Pound may affect the value of our European earnings when translated into U.S. dollars. Similarly our earnings in Canada, Australia, and New Zealand may be affected by the value of currencies when translated into U.S. dollars. Our operating results may be adversely affected by significant changesExcept for our business in these foreign currencies relative to the U.S. dollar. For the most part,United Kingdom (the “U.K”), our international subsidiaries transactconduct most of their business in their functional currency, other than in thelocal currency. Inventory purchases for our U.K., whose inventory purchases business are denominated in euro,euros, which could result in foreign currency transaction gains or losses.

Our products are subject to import and excise duties and/or sales or value-added taxes in many jurisdictions. Fluctuations in tax rates and duties and changes in tax legislation or regulation could have a material adverse effect on our results of operations and financial condition.

Significant developments stemming from the U.K.’s decision to withdraw from the European Union could have a material adverse effect on the Company.

The U.K. has voted in favor of leaving the European Union (“E.U.”), and such withdrawal (commonly referred to as “Brexit”) is scheduled to take effect over the next two years. This decision has created political and economic uncertainty, particularly in the U.K. and the E.U., and this uncertainty may last for several years. The pending withdrawal and its possible future consequences have caused and may continue to cause significant volatility in global financial markets, including in global currency and debt markets. This volatility could cause a slowdown in economic activity in the U.K., Europe or globally, which could adversely affect the Company's operating results and growth prospects. In addition, Brexit could lead to legal uncertainty and potentially divergent national laws and regulations as the U.K. determines which E.U. laws to replace or replicate, and those laws and regulations may be cumbersome, difficult or costly in terms of compliance. Any of these effects of Brexit, among others, could adversely affect our business, results of operations and financial condition.

Macroeconomic developments may adversely affect our business.business.

Our performance is subject to global economic conditions and the related impacteffects on consumer spending levels. Continued uncertainty about global economic conditions poses a risk as consumers and businesses may postpone spending in response to tighter credit, unemployment, negative financial news, and/or declines in income or asset values, which could have a material negative effect on demand for our products.

As a retailer that is dependent upon consumer discretionary spending, our results of operations are sensitive to changes in macroeconomic conditions. Our customers may have less money for discretionary purchases as a result of job losses, foreclosures, bankruptcies, increased fuel and energy costs, higher interest rates, higher taxes, reduced access to credit, and lower home prices. There is also a risk that if negative economic conditions persist for a long period of time or worsen, consumers may make long-lasting reductions to their discretionary purchasing behavior. values. These and other economic factors could adversely affect demand for our products, andwhich could adversely affect our financial condition and operating results.

Instability in the financial markets may adversely affect our business.

Any instability

Instability in the global financial markets could result in diminishedreduce availability of credit availability.to our business. Although we currently have a revolving credit agreement in place until January 27, 2017, and other than amounts used for standby letters of credit, do not have any borrowings under it,May 19, 2021, tightening of credit markets could make it more difficult for us to access funds, refinance our existing indebtedness, enter into agreements for new indebtedness, or obtain funding through the issuance of the Company’s securities. Other than insignificant amounts used for standby letters of credit, we do not have any borrowings under our credit facility.

4

We rely on a few key suppliers for a majority of our merchandise purchases (including a significant portion from one key supplier). The inability of these key suppliers to access liquidity, or the insolvency of key suppliers, could lead to their failure to deliver merchandise to us. Our inability to obtain merchandise in a timely manner from major suppliers could have a material adverse effect on our business, financial condition, and results of operations.

Material changes in the market value of the securities we hold may adversely affect our results of operations and financial condition.

At January 31, 2015,February 3, 2018, our cash and cash equivalents totaled $967$849 million. The majority of our investments were short-term deposits in highly-rated banking institutions. As of January 31, 2015, we had $537February 3, 2018, $669 million of our cash and cash equivalents were held in foreign jurisdictions.jurisdictions, almost half of which was held in U.S. dollars. We regularly monitor our counterparty credit risk and mitigate our exposure by making short-term investments only in highly-rated institutions and by limiting the amount we invest in any one institution. We continually monitor the creditworthiness of our counterparties. At January 31, 2015, almostFebruary 3, 2018, all of the investments were in institutions rated A or better from a major creditinvestment grade institutions. Despite an investment grade rating, agency. Despite those ratings, it is possible that the value or liquidity of our investments may decline due to any number of factors, including general market conditions and bank-specific credit issues.

Our U.S. pension plan trust holds assets totaling $613$639 million at January 31, 2015.February 3, 2018. The fair values of these assets held in the trust are compared to the plan’s projected benefit obligation to determine the pension funding liability. We attempt to mitigate funding risk through asset diversification, and we regularly monitor investment risk of our portfolio through quarterly investment portfolio reviews and periodic asset and liability studies. Despite these measures, it is possible that the value of our portfolio may decline in the future due to any number of factors, including general market conditions and credit issues. Such declines could have an impact onaffect the funded status of our pension plan and future funding requirements.

If our long-lived assets, goodwill or other intangible assets become impaired, we may need to record significant non-cash impairment charges.

We review our long-lived assets, goodwill and other intangible assets when events indicate that the carrying value of such assets may be impaired. Goodwill and other indefinite lived intangible assets are reviewed for impairment if impairment indicators arise and, at a minimum, annually. As of January 31, 2015,February 3, 2018, we had $157$160 million of goodwill; this asset is not amortized but is subject to an impairment test, which consists of either a qualitative assessment on a reporting unit level, or a two-step impairment test, if necessary. The determination of impairment losses arecharges is significantly affected by estimates of future operating cash flows and estimates of fair value. Our estimates of future operating cash flows are identified from our long-range strategic long-range plans, which are based upon our experience, knowledge, and expectations; however, these estimates can be affected by factors such factors as our future operating results, future store profitability, and future economic conditions, all of which can be difficult to predict accurately. Any significant deterioration in macroeconomic conditions could affect the fair value of our long-lived assets, goodwill, and other intangible assets and could result in future impairment charges, which would adversely affect our results of operations.

Our financial results may be adversely affected by tax rates or exposure to additional tax liabilities.

We are a U.S.-based multinational company subject to tax in multiple U.S. and foreign tax jurisdictions. Our provision for income taxes is based on a jurisdictional mix of earnings, statutory rates, and enacted tax rules, including transfer pricing. Significant judgment is required in determining our provision for income taxes and in evaluating our tax positions on a worldwide basis. Our effective tax rate could be adversely affected by a number of factors, including shifts in the mix of pretax results by tax jurisdiction, changes in tax laws or related interpretations in the jurisdictions in which we operate, and tax assessments and related interest and penalties resulting from income tax audits.

A substantial portion

Changes in tax laws and interpretations may affect our earnings negatively.

On December 22, 2017, the Tax Cuts and Jobs Act (H.R. 1) (the “Tax Act”) was signed into law. The Tax Act includes a number of our cash and investments is invested outsidechanges in existing tax law affecting businesses including, among other things, a reduction in the U.S. corporate income tax rate from 35 percent to 21 percent, disallowance of certain deductions that had previously been allowed, limitations on interest deductions, alteration of the United States.expensing of capital expenditures, adoption of a territorial tax system, assessment of a repatriation tax or “toll-charge” on undistributed earnings and profits of U.S.-owned foreign corporations, and introduction of certain anti-base erosion provisions.

5

In the fourth quarter of 2017, we recognized a provisional net tax expense of $99 million associated with the Tax Act; however, the ultimate effect on our financial condition and results of operations in 2018 and future years remains uncertain and may differ materially from our expectations due to the issuance of technical guidance regarding elements of the Tax Act and changes in interpretations and assumptions we have made with respect to the Tax Act. In addition, it is unclear how these U.S. federal income tax changes will affect state and local taxation, which often uses federal taxable income as a starting point for computing state and local tax liabilities. As we plan to permanently reinvest our foreign earnings outsidesuch, there may be material adverse effects resulting from the United States, in accordance with U.S. GAAP,Tax Act that we have not provided for U.S. federal and state income taxes or foreign withholding taxes that may result from future remittances of undistributed earnings of foreign subsidiaries. Recent proposals to reform U.S. tax rules may result in a reduction or elimination of the deferral of U.S. income tax on our foreign earnings, which could adversely affect our effective tax rate. Any of these changes could have an adverse effect on our results of operations and financial condition.yet identified.

The effects of natural disasters, terrorism, acts of war, and public health issues may adversely affect our business.

Natural disasters, including earthquakes, hurricanes, floods, and tornadostornadoes may affect store and distribution center operations. In addition, acts of terrorism, acts of war, and military action both in the United States and abroad can have a significant effect on economic conditions and may negatively affect our ability to purchase merchandise from suppliers for sale to our customers. Public health issues, such as flu or other pandemics, whether occurring in the United States or abroad, could disrupt our operations and result in a significant part of our workforce being unable to operate or maintain our infrastructure or perform other tasks necessary to conduct our business.business. Additionally, public health issues may disrupt, or have an adverse effect on, our suppliers’ operations, our operations, our customers, or customer demand. Our ability to mitigate the adverse impacteffect of these events depends, in part, upon the effectiveness of our disaster preparedness and response planning as well as business continuity planning. However, we cannot be certain that our plans will be adequate or implemented properly in the event of an actual disaster. We may be required to suspend operations in some or all of our locations, which could have a material adverse effect on our business, financial condition, and results of operations. Any significant declines in public safety or uncertainties regarding future economic prospects that affect customer spending habits could have a material adverse effect on customer purchases of our products.

Manufacturer compliance with our social compliance program requirements.

We require our independent manufacturers to comply with our policies and procedures, which cover many areas including labor, health and safety, and environmental standards. We monitor compliance with our policies and procedures using internal resources, as well as third-party monitoring firms. Although we monitor their compliance with these policies and procedures, we do not control the manufacturers or their practices. Any failure of our independent manufacturers to comply with our policies and procedures or local laws in the country of manufacture could disrupt the shipment of merchandise to us, force us to locate alternate manufacturing sources, reduce demand for our merchandise, or damage our reputation.

Complications in our distribution centers and other factors affecting the distribution of merchandise may affect our business.

We operate multiple distribution centers worldwide to support our businesses. In addition to the distribution centers that we operate, we have third-party arrangements to support our operations in the United States, Canada, Australia, and New Zealand. If complications arise with any facility or if any facility is severely damaged or destroyed, our other distribution centers may be unable to support the resulting additional distribution demands. We also may be affected by disruptions in the global transportation network such as a port strike,strikes, weather conditions, work stoppages or other labor unrest. These factors may adversely affect our ability to deliver inventory on a timely basis. We depend upon third-party carriers for shipment of a significant amount of merchandise. Anmerchandise; any interruption in service by these carriers for any reason could cause temporary disruptions in our business, a loss of sales and profits, and other material adverse effects.

Our freight cost is affected by changes in fuel prices through surcharges. Increases in fuel prices and surcharges, among and other factors, may increase freight costs and thereby increase our cost of sales.

We enter into diesel fuel forward and option contractsare subject to mitigate a portion of the risk associated with the variability caused by these surcharges.

Disruptions,technology risks including failures, or security breaches, of our information technology infrastructure or unauthorized disclosure of sensitive or confidential customer informationand cybersecurity risks which could harm our business, damage our reputation, and standing withincrease our customers.

costs in an effort to protect against such risks.Information technology is a critically important part of our business operations. We depend on information systems to process transactions, make operational decisions, manage inventory, operate our websites, purchase, sell and ship goods on a timely basis, and maintain cost-efficient operations.operations. There is a risk that we could experience a business interruption, theft of information, or reputational damage as a result of a cyber-attack, such as an infiltration of a data center or data leakage of confidential information, either internally or at our third-party providers. We may experience operational problems with our information systems as a result of system failures, system implementation issues, viruses, malicious hackers, sabotage, or other causes.

6

Our business involves the storage and transmission of customers’ personal information, such as consumer preferences and credit card information. We invest in security technology to protect the data stored by the Company, as well asus, including our data and business processes, against the risk of data security breaches and cyber-attacks. Our data security management program includes enforcement of standard data protection policies such as Payment Card Industry compliance. Additionally, we certify our major technology suppliers and any outsourced services through accepted security certification measures. We maintain and routinely test backup systems and disaster recovery, along with external network security penetration testing by an independent third party as part of our business continuity preparedness.

While we believe that our security technology and processes follow leading practices in the prevention of security breaches and the mitigation of cyber securitycybersecurity risks, given the ever-increasing abilities of those intent on breaching cyber securitycybersecurity measures and given the necessity of our reliance on the security procedures of third-party vendors, the total security effort at any point in time may not be completely effective. Any such security breaches and cyber incidents could adversely affect our business. Failure of our systems, including failures due to cyber-attacks that would prevent the ability of systems to function as intended, could cause transaction errors, loss of customers and sales, and negative consequences to us, our employees, and those with whom we do business. Any security breach involving the misappropriation, loss, or other unauthorized disclosure of confidential information by us could also severely damage our reputation, expose us to the risks of litigation and liability, increase operating costs associated with remediation, and harm our business. While we carry insurance that would mitigate the losses, such insurance may be insufficient to compensate us for potentially significant losses.

Risks associated with digital operations.

Our digital operations are subject to numerous risks, including risks related to the failure of the computer systems that operate our websites and mobile sites and their related support systems, computer viruses, cybersecurity risks, telecommunications failures, denial of service attacks, and similar disruptions. Also, we maywill require additional capital in the future to sustain or grow our digital commerce. Business riskscommerce business. Risks related to digital commerce include risksthose associated with credit card fraud, the need to keep pace with rapid technological change, Internet cyber security risks, risks of system failure or inadequacy, governmental regulation, and legal uncertainties with respect to Internet regulatory compliance, and collection of sales or other taxes by additional states or foreign jurisdictions.compliance. If any of these risks materializes,materialize, it could have a material adverse effect on our business.

Privacy and data security concerns and regulation could result in additional costs and liabilities.

The protection of customer, employee, and Company data is critical. The regulatory environment surrounding information security and privacy is demanding, with the frequent imposition of new and changing requirements. In addition, customers have a high expectation that we will adequately protect their personal information. Any actual or perceived misappropriation or breach involving this data could attract negative media attention, cause harm to our reputation or result in liability (including but not limited to fines, penalties or lawsuits), any of which could have a material adverse effect on our business, operational results, financial position and cash flows. Additionally, the E.U. adopted a comprehensive General Data Privacy Regulation (the “GDPR”), which will become fully effective in May 2018. The GDPR requires companies to satisfy new requirements regarding the handling of personal and sensitive data, including its use, protection and the ability of persons whose data is stored to correct or delete such data about themselves. Failure to comply with GDPR requirements could result in penalties of up to 4 percent of worldwide revenue. The GDPR and other similar laws and regulations, as well as any associated inquiries or investigations or any other government actions, may be costly to comply with, result in negative publicity, increase our operating costs, require significant management time and attention, and subject us to remedies that may harm our business, including fines or demands or orders that we modify or cease existing business practices.

The technology enablement of omni-channel in our business is complex and involves the development of a new digital platform and a new order management system in order to enhance the complete customer experience.

We continue to invest in initiatives designed to deliver a high-quality, coordinated shopping experience online, in-stores, and on mobile devices, which requires substantial investment in technology, information systems, and employee training, as well as significant management time and resources.Our omni-channel retailing efforts include the integration and implementation of new technology, software, and processes to be able to fulfill orders from any point within our system of stores and distribution centers, which is extremely complex and may not meet customer expectations for timely and accurate deliveries. These efforts involve substantial risk, including risk of implementation delays, cost overruns, technology interruptions, supply and distribution delays, and other issues that can affect the successful implementation and operation of our omni-channel initiatives.

7

If our omni-channel initiatives are not successful, or we do not realize the return on our omni-channel investments that we anticipate, our financial performance and future growth could be materially adversely affected.

Our reliance on key management.

Future performance will depend upon our ability to attract, retain, and motivate our executive and senior management team.teams. Our executive and senior management teamteams have substantial experience and expertise in our business and have made significant contributions to our recent growth and success. Our future performance depends to a significant extent both upon the continued services of our current executive and senior management team,teams, as well as our ability to attract, hire, motivate, and retain additional qualified management in the future. While we feel that we have adequate succession planning and executive development programs, competition for key executives in the retail industry is intense, and our operations could be adversely affected if we cannot retain and attract qualified executives.

Risks associated with attracting and retaining store and field associates.

Many

Our success depends, in part, upon our ability to attract, develop, and retain a sufficient number of thequalified store and field associates areassociates. The turnover rate in entry level or part-time positions which, historically, have had high rates of turnover.the retail industry is generally high. If we are unable to attract and retain quality associates, our ability to meet our growth goals or to sustain expected levels of profitability may be compromised. Our ability to meet our labor needs while controlling costs is subject to external factors such as unemployment levels, prevailing wage rates, minimum wage legislation, overtime regulations, and changing demographics.

We face risks arising

Changes in employment laws or regulation could harm our performance.

Various foreign and domestic labor laws govern our relationship with our employees and affect our operating costs. These laws include minimum wage requirements, overtime and sick pay, paid time off, work scheduling, healthcare reform and the Patient Protection and Affordable Care Act (“ACA”), unemployment tax rates, workers’ compensation rates, European works council requirements, and union organization. A number of factors could adversely affect our operating results, including additional government-imposed increases in minimum wages, overtime and sick pay, paid leaves of absence and mandated health benefits, and changing regulations from activity by the National Labor Relations Board or other agencies. At this time, there is uncertainty concerning whether the ACA will be repealed or what requirements will be included in a new law, if enacted. Complying with any new legislation and/or reversing changes implemented under the United States.

The National Labor Relations Board continually considers changes to labor regulations, many of whichACA could significantly affect the nature of labor relations in the United Statesbe time-intensive and how union electionsexpensive, and contract negotiations are conducted. The National Labor Relations Board’s current definition of a bargaining unit makes it possible for smaller groups of employees to organize labor unions.

Furthermore, recent regulations shorten the election process, significantly reducing the time between the filing of a petition and an election being held. These regulations and recent decisions could impose more labor relations requirements and union activity on our business conducted in the United States, thereby potentially increasing our costs, which could negativelymay affect our profitability.business.

Health care reform could adversely affect our business.

In 2010, Congress enacted comprehensive health care reform legislation which, among other things, includes guaranteed coverage requirements, eliminates pre-existing condition exclusions and annual and lifetime maximum limits, restricts the extent to which policies can be rescinded, and imposes new and significant taxes on health insurers and health care benefits. Due to the breadth and complexity of the health care reform legislation and the large number of eligible employees who currently choose not to participate in our plans, it is difficult to predict the overall effect of the statute and related regulations on our business over the coming years. Due to the health care law changes, some eligible employees who had historically not chosen to participate in our health care plans have found it more advantageous to participate in our plans effective January 1, 2015. Such changes include tax penalties to persons for not obtaining health care coverage and being ineligible for certain health care subsidies if an employee is eligible for health care coverage under an employer’s plan. If a larger number of eligible employees, who currently choose not to participate in our plans, choose to enroll over the next few years, it may significantly increase our health care coverage costs and negatively affect our financial results.

Legislative or regulatory initiatives related to global warming/climate change concerns may negatively affect our business.

There has been an increasing focus and significant debate on global climate change, including increased attention from regulatory agencies and legislative bodies. This increased focus may lead to new initiatives directed at regulating an as-yet unspecified array of environmental matters. Legislative, regulatory, or other efforts in the United States to combat climate change could result in future increases in taxes or in the cost of transportation and utilities, which could decrease our operating profits and could necessitate future additional investments in facilities and equipment. We are currently unable to predict the potential effects that any such future environmental initiatives may have on our business.

We may be adversely affected by regulatory and litigation developments.

We are exposed to the risk that federal or state legislation may negatively impactaffect our operations. Changes in federal or state wage requirements, employee rights, health care, social welfare or entitlement programs, such as health insurance, paid leave programs, or other changes in workplace regulation could increase our cost of doing business or otherwise adversely affect our operations. Additionally, we are regularly involved in various litigation matters, including class actions, and patent infringement claims, which arise in the ordinary course of our business. Litigation or regulatory developments could adversely affect our business operations and financial performance.

8

We operate in many different jurisdictions and we could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act and similar worldwide anti-corruption laws.

The U.S. Foreign Corrupt Practices Act (“FCPA”) and similar worldwide anti-corruption laws, including the U.K. Bribery Act of 2010, which is broader in scope than the FCPA, generally prohibit companies and their intermediaries from making improper payments to non-U.S.government officials for the purpose of obtaining or retaining business.

Our internal policies mandate compliance with these anti-corruption laws. Despite our training and compliance programs, we cannot be assured that our internal control policies and procedures will always protect us from reckless or criminal acts committed by our employees or agents.

Our continued expansion outside the United States, including in developing countries, could increase the risk of FCPA violations in the future. Violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our results of operations or financial condition.

Failure to fully comply with Section 404 of the Sarbanes-Oxley Act of 2002 could negatively affect our business, market confidence in our reported financial information, and the price of our common stock.

We continue to document, test, and monitor our internal controls over financial reporting in order to satisfy all of the requirements of Section 404 of the Sarbanes-Oxley Act of 2002; however, we cannot be assured that our disclosure controls and procedures and our internal controls over financial reporting will prove to be completely adequate in the future. Failure to fully comply with Section 404 of the Sarbanes-Oxley Act of 2002 could negatively affect our business, market confidence in our reported financial information, and the price of our common stock.

Item 1B. Unresolved Staff Comments

None.

The properties of the Company and its consolidated subsidiaries consist of land, leased stores, administrative facilities, and distribution centers. Gross square footage and total selling area for the Athletic Stores segment at the end of 20142017 were approximately 12.7313.30 and 7.487.71 million square feet, respectively. These properties, which are primarily leased, are located in the United States and its territories, Canada, various European countries, Australia, and New Zealand.

The Company

We currently operates sevenoperate five distribution centers, of which threetwo are owned and fourthree are leased, occupying an aggregate of 2.9 million square feet. Three distribution centers are located in the United States, threeone in Germany, and one in the Netherlands. The three locationslocation in Germany relate toserves as the central warehouse distribution centerscenter for the Runners Point Group store locations, as well as a distribution center for itsand Sidestep stores and their direct-to-customer business. During 2014, we opened a new distribution center in Germany which provides us with increased capacity that will enable us to support the planned growth of both the store and direct-to-customer businesses. This larger distribution center will also allow us to consolidate the other two locations in Germany in 2015.

We also own a cross-dock and manufacturing facility, and operate a leased warehouse in the United States, both of which support our Team Edition apparel business. The lease for our leased distribution center in Germany expires during 2019 and the Company is currently negotiating a lease extension for this facility.

We believe that all leases of properties that are material to our operations may be renewed, or that alternative properties are available, on terms not materially less favorable to us than existing leases.

Information regarding the Company’s legal proceedings is contained in theLegal Proceedings note under “Item 8. Consolidated Financial Statements and Supplementary Data.”

Item 4. Mine Safety Disclosures

Not applicable.

9

Item 4A. Executive Officers of the Registrant

Information

The following table provides information with respect to Executive Officers of the Company,all persons serving as executive officers as of March 30, 2015, is set forth below:

29, 2018, including business experience for the last five years.

Chairman, | |||

| President and Chief Executive Officer | Richard A. Johnson | ||

Executive Vice President and Chief Executive Officer — | Stephen D. Jacobs | ||

Executive Vice President and Chief Executive Officer — International | Lewis P. Kimble | ||

Executive Vice President and Chief Financial Officer | Lauren B. Peters | ||

Executive Vice President and Chief Information and Customer Connectivity Officer | Pawan Verma | ||

Senior Vice President and Chief Human Resources Officer | Paulette R. Alviti | ||

Senior Vice President and Chief Accounting Officer | Giovanna Cipriano | ||

Senior Vice President, General Counsel and Secretary | Sheilagh M. Clarke | ||

Senior Vice President — | W. Scott Martin | ||

Vice President, Treasurer | John A. Maurer | ||

Ken C. Hicks,

Richard A. Johnson, age 62, 60, has served as Executive Chairman of the Board since January 31, 2010. He served as PresidentMay 2016 and Chief Executive Officer from August 17, 2009 through November 30, 2014. Mr. Hicks is also a director of Avery Dennison Corporation.

Richard A. Johnson, age 57, has served as President and Chief Executive Officer since December 1, 2014. Mr. Johnson previously served as Executive Vice President and Chief Operating Officer from May 16, 2012 through November 30, 2014. He served as Executive Vice President and Group President from July 2011 to May 15, 2012; President and Chief Executive Officer of Foot Locker U.S., Lady Foot Locker, Kids Foot Locker, and Footaction from January 2010 to July 2011; President and Chief Executive Officer of Foot Locker Europe from August 2007 to January 2010; and President and Chief Executive Officer of Footlocker.com/Eastbay from April 2003 to August 2007.

Robert W. McHugh,

Stephen D. Jacobs, age 56,55, has served as Executive Vice President — Operations Support since July 2011. He served as Executive Vice President and Chief FinancialExecutive Officer-North America since February 2016. He previously served as Executive Vice President and Chief Executive Officer Foot Locker North Americafrom May 2009December 2014 through February 2016 and President and Chief Executive Officer of Foot Locker U.S., Lady Foot Locker, Kids Foot Locker, and Footaction from July 2011 to July 2011.November 2014.

Lewis P. Kimble, age59, has served as Executive Vice President and Chief Executive Officer-International since February 2016. Mr. Kimble previously served as President and Chief Executive Officer of Foot Locker Europe from February 2010 to February 2016.

Lauren B. Peters, age 53,56, has served as Executive Vice President and Chief Financial Officer since July 2011. She

Pawan Verma, age 41, has served as Executive Vice President, Chief Information and Customer Connectivity Officer since October 2017 and as Senior Vice President — Strategic Planningand Chief Information Officer from April 2002August 2015 to September 2017. From February 2013 to July 2011.2015, Mr. Verma served in various technology leadership roles at Target Corporation ranging from enterprise architecture, e-commerce, mobile and digital, with his most recent role at Target as Vice President - Digital Technology and API Platforms.

Paulette R. Alviti,age 44,47, has served as Senior Vice President and Chief Human Resources Officer since June 2013. From March 2010 to May 2013, Ms. Alviti served in various roles at PepsiCo, Inc.: SVP, with her most recent role as Senior Vice President and Chief Human Resources Officer Asia, Middle East, Africa (February to May 2013); SVP Global Talent Acquisition and Deployment (July 2012 to February 2013); and SVP — Human Resources (March 2010 to July 2012). From March 2008 to March 2010, sheAfrica.

Giovanna Cipriano, age 48, has served as VP — Human Resources of The Pepsi Bottling Group, Inc.Senior Vice President and Chief Accounting Officer since May 2009.

Sheilagh M. Clarke, age 55,58, has served as Senior Vice President, General Counsel and Secretary since June 1, 2014. She previously served as Vice President, Associate General Counsel and Assistant Secretary from May 2007 to May 31, 2014.

Jeffrey L. Berk,

W. Scott Martin, age 59,50, has served as Senior Vice President - Strategy and Store Development since October 2017 and as Senior Vice President — Real Estate since February 2000.

Peter D. Brown, age 60, hasfrom June 2016 to September 2017. Mr. Martin previously served as Senior Vice President, Store Development – Asia Pacific with Gap Inc. from June 2014 to June 2016. Prior to that role, he served in various roles at Starbucks Coffee Company: Director, Strategy Development, China, Asia Pacific and Chief Information Officer since February 2011. He served as Senior Vice President, Chief Information Officer and Investor Relations from September 2006Emerging Brands (July 2013 to February 2011.July 2014); Director, Global Store Development (June 2007 to July 2013).

Giovanna Cipriano, age 45, has served as Senior Vice President and Chief Accounting Officer since May 2009.

John A. Maurer, age 55,58, has served as Vice President, Treasurer and Investor Relations since February 2011. Mr. MaurerSeptember 2006. In addition to this role, he also served as the Vice President and Treasurerof Investors Relations from September 2006 to February 2011.2011 through March 2018.

There are no family relationships among the executive officers or directors of the Company.

10

PART II

Market for the Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Foot Locker, Inc. common stock (ticker symbol “FL”) is listed on The New York Stock Exchange as well as on the Börse Stuttgart stock exchange in Germany. As of January 31, 2015,February 3, 2018, the Company had 15,35313,244 shareholders of record owning 140,864,188119,829,023 common shares.

The following table provides for the period indicated, the intra-day high and low sales prices for the Company’s common stock:stock for the periods indicated below:

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

| 2014 | 2013 |

| 2017 |

| 2016 | |||||||||||||||||||||||

| High | Low | High | Low |

|

| High |

| Low |

| High |

| Low | ||||||||||||||||

| 1st Quarter | $ | 48.71 | $ | 36.65 | $ | 35.64 | $ | 31.30 |

| $ | 77.86 |

| $ | 65.88 |

| $ | 69.65 |

| $ | 58.17 | ||||||||

| 2nd Quarter | 52.07 | 46.20 | 37.70 | 32.61 |

|

| 77.71 |

|

| 44.59 |

|

| 62.45 |

|

| 50.90 | ||||||||||||

| 3rd Quarter | 58.40 | 47.90 | 37.85 | 31.91 |

|

| 51.29 |

|

| 29.89 |

|

| 69.61 |

|

| 56.80 | ||||||||||||

| 4th Quarter | 59.19 | 51.12 | 41.73 | 34.09 |

|

| 53.17 |

|

| 28.42 |

|

| 79.43 |

|

| 65.39 | ||||||||||||

During each of the quarters of 2014,2017, the Company declared a dividend of $0.22$0.31 per share. The Board of Directors reviews the dividend policy and rate, taking into consideration the overall financial and strategic outlook for our earnings, liquidity, and cash flow. On February 17, 2015,20, 2018, the Board of Directors declared a quarterly dividend of $0.25$0.345 per share to be paid on May 1, 2015.4, 2018. This dividend represents a 14an 11 percent increase over the Company’s previous quarterly per share amount.

The following table is a summary of our fourth quarter share repurchases:

| Date Purchased | Total Number of Shares Purchased(1) | Average Price Paid per Share(1) | Total Number of Shares Purchased as Part of Publicly Announced Program(2) | Approximate Dollar Value of Shares that may yet be Purchased Under the Program(2) | ||||||||||||

| Nov. 2, 2014 – Nov. 29, 2014 | 1,059,790 | (3) | $ | 55.92 | 1,059,790 | $ | 136,841,263 | |||||||||

| Nov. 30, 2014 – Jan. 3, 2015 | 862,663 | $ | 56.06 | 861,771 | $ | 88,527,414 | ||||||||||

| Jan. 4, 2015 – Jan. 31, 2015 | 419,584 | (3) | $ | 55.67 | 419,584 | $ | 65,167,625 | |||||||||

| 2,342,037 | $ | 55.93 | 2,341,145 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Approximate | |

|

|

|

|

|

| Total Number of |

| Dollar Value of | ||

|

| Total |

| Average | Shares Purchased as |

| Shares that may | |||

|

| Number |

| Price | Part of Publicly |

| yet be Purchased | |||

|

| of Shares |

| Paid Per | Announced |

| Under the | |||

Date Purchased |

| Purchased (1) |

| Share (1) | Program (2) |

| Program (2) | |||

Oct. 29 - Nov. 25, 2017 |

| 1,500,000 |

| $ | 30.96 |

| 1,500,000 |

| $ | 816,552,335 |

Nov. 26 - Dec. 30, 2017 |

| 1,333,433 |

|

| 43.87 |

| 1,323,930 |

|

| 758,463,867 |

Dec. 31 - Feb. 3, 2018 |

| — |

|

| — |

| — |

|

| 758,463,867 |

|

| 2,833,433 |

| $ | 37.04 |

| 2,823,930 |

|

|

|

(1) | These columns also reflect shares |

(2) | On February 14, 2017, the Board of Directors approved a 3-year, $1.2 billion share repurchase program extending through January 2020. Through |

On February 17, 2015, the Board of Directors approved a new 3-year, $1 billion share repurchase program extending through January 2018, replacing the Company’s previous $600 million program.

11

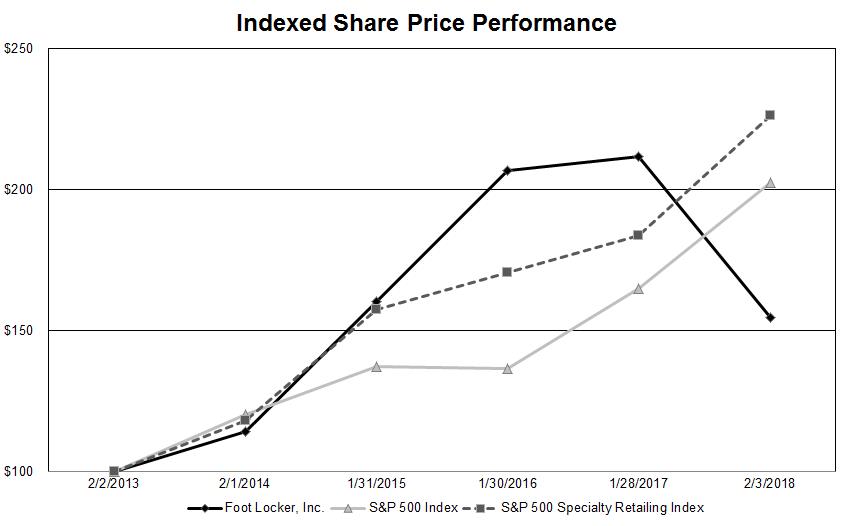

Performance Graph

The graph below compares the cumulative five-year total return to shareholders (common stock price appreciation plus dividends, on a reinvested basis) on Foot Locker, Inc.’s common stock relative to the total returns of the S&P 400500 Specialty Retailing Index and the Russell MidcapS&P 500 Index.

The following Performance Graph and related information shall not be deemed “soliciting material” or deemed to be filed with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

Indexed Share Price Performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2/2/2013 |

| 2/1/2014 |

| 1/31/2015 |

| 1/30/2016 |

| 1/28/2017 |

| 2/3/2018 | ||||||

Foot Locker, Inc. |

| $ | 100.00 |

| $ | 114.24 |

| $ | 160.33 |

| $ | 206.69 |

| $ | 211.63 |

| $ | 154.65 |

S&P 500 Index |

| $ | 100.00 |

| $ | 120.29 |

| $ | 137.39 |

| $ | 136.47 |

| $ | 164.93 |

| $ | 202.57 |

S&P 500 Specialty Retailing Index |

| $ | 100.00 |

| $ | 118.15 |

| $ | 157.66 |

| $ | 170.76 |

| $ | 183.70 |

| $ | 226.17 |

12

| 1/30/2010 | 1/29/2011 | 1/28/2012 | 2/2/2013 | 2/1/2014 | 1/31/2015 | |||||||||||||||||||

| Foot Locker, Inc. | $ | 100.00 | $ | 157.40 | $ | 234.19 | $ | 306.11 | $ | 341.90 | $ | 471.39 | ||||||||||||

| S&P 400 Retailing Index | $ | 100.00 | $ | 141.60 | $ | 170.80 | $ | 209.23 | $ | 234.04 | $ | 281.84 | ||||||||||||

| Russell Midcap Index | $ | 100.00 | $ | 129.27 | $ | 132.08 | $ | 153.77 | $ | 185.53 | $ | 207.66 | ||||||||||||

Item 6. Selected Financial Data

FIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA

The selected financial data below should be read in conjunction with the Consolidated Financial Statements and the Notes thereto and other information contained elsewhere in this report.

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

| ($ in millions, except per share amounts) | 2014 | 2013 | 2012(1) | 2011 | 2010 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

|

|

| 2017 (1) |

| 2016 |

| 2015 |

| 2014 |

| 2013 | ||||||||||||||||||||

| Summary of Operations | Summary of Operations | (in millions, except per share amounts) | |||||||||||||||||||||||||||||

| Sales | $ | 7,151 | 6,505 | 6,182 | 5,623 | 5,049 | Sales | $ | 7,782 |

| 7,766 |

| 7,412 |

| 7,151 |

| 6,505 | ||||||||||||||

| Gross margin | 2,374 | 2,133 | 2,034 | 1,796 | 1,516 | Gross margin |

| 2,456 |

| 2,636 |

| 2,505 |

| 2,374 |

| 2,133 | |||||||||||||||

| Selling, general and administrative expenses | 1,426 | 1,334 | 1,294 | 1,244 | 1,138 | Selling, general and administrative expenses |

| 1,501 |

| 1,472 |

| 1,415 |

| 1,426 |

| 1,334 | |||||||||||||||

| Impairment and other charges | 4 | 2 | 12 | 5 | 10 | ||||||||||||||||||||||||||

| Depreciation and amortization | 139 | 133 | 118 | 110 | 106 | Depreciation and amortization |

| 173 |

| 158 |

| 148 |

| 139 |

| 133 | |||||||||||||||

| Interest expense, net | 5 | 5 | 5 | 6 | 9 | ||||||||||||||||||||||||||

Litigation and other charges | Litigation and other charges |

| 211 |

| 6 |

| 105 |

| 4 |

| 2 | ||||||||||||||||||||

Interest (income) / expense, net | Interest (income) / expense, net |

| (2) |

| 2 |

| 4 |

| 5 |

| 5 | ||||||||||||||||||||

| Other income | (9 | ) | (4 | ) | (2 | ) | (4 | ) | (4 | ) | Other income |

| (5) |

| (6) |

| (4) |

| (9) |

| (4) | ||||||||||

| Net income | 520 | 429 | 397 | 278 | 169 | Net income |

| 284 |

| 664 |

| 541 |

| 520 |

| 429 | |||||||||||||||

| Per Common Share Data | Per Common Share Data |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

| Basic earnings | 3.61 | 2.89 | 2.62 | 1.81 | 1.08 | Basic earnings |

| 2.23 |

| 4.95 |

| 3.89 |

| 3.61 |

| 2.89 | |||||||||||||||

| Diluted earnings | 3.56 | 2.85 | 2.58 | 1.80 | 1.07 | Diluted earnings |

| 2.22 |

| 4.91 |

| 3.84 |

| 3.56 |

| 2.85 | |||||||||||||||

| Common stock dividends declared per share | 0.88 | 0.80 | 0.72 | 0.66 | 0.60 | Common stock dividends declared per share |

| 1.24 |

| 1.10 |

| 1.00 |

| 0.88 |

| 0.80 | |||||||||||||||

| Weighted-average Common Shares Outstanding | Weighted-average Common Shares Outstanding |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

| Basic earnings | 143.9 | 148.4 | 151.2 | 153.0 | 155.7 | Basic earnings |

| 127.2 |

| 134.0 |

| 139.1 |

| 143.9 |

| 148.4 | |||||||||||||||

| Diluted earnings | 146.0 | 150.5 | 154.0 | 154.4 | 156.7 | Diluted earnings |

| 127.9 |

| 135.1 |

| 140.8 |

| 146.0 |

| 150.5 | |||||||||||||||

| Financial Condition | Financial Condition |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

| Cash, cash equivalents, and short-term investments | $ | 967 | 867 | 928 | 851 | 696 | Cash, cash equivalents, and short-term investments | $ | 849 |

| 1,046 |

| 1,021 |

| 967 |

| 867 | ||||||||||||||

| Merchandise inventories | 1,250 | 1,220 | 1,167 | 1,069 | 1,059 | Merchandise inventories |

| 1,278 |

| 1,307 |

| 1,285 |

| 1,250 |

| 1,220 | |||||||||||||||

| Property and equipment, net | 620 | 590 | 490 | 427 | 386 | Property and equipment, net |

| 866 |

| 765 |

| 661 |

| 620 |

| 590 | |||||||||||||||

| Total assets | 3,577 | 3,487 | 3,367 | 3,050 | 2,896 | Total assets |

| 3,961 |

| 3,840 |

| 3,775 |

| 3,577 |

| 3,487 | |||||||||||||||

| Long-term debt and obligations under capital leases | 134 | 139 | 133 | 135 | 137 | Long-term debt and obligations under capital leases |

| 125 |

| 127 |

| 130 |

| 134 |

| 139 | |||||||||||||||

| Total shareholders’ equity | 2,496 | 2,496 | 2,377 | 2,110 | 2,025 | Total shareholders’ equity |

| 2,519 |

| 2,710 |

| 2,553 |

| 2,496 |

| 2,496 | |||||||||||||||

| Financial Ratios | Financial Ratios |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

| Sales per average gross square foot(2) | $ | 490 | 460 | 443 | 406 | 360 | Sales per average gross square foot (2) | $ | 495 |

| 515 |

| 504 |

| 490 |

| 460 | ||||||||||||||

| SG&A as a percentage of sales | 19.9 | % | 20.5 | 20.9 | 22.1 | 22.5 | SG&A as a percentage of sales |

| 19.3 | % | 19.0 |

| 19.1 |

| 19.9 |

| 20.5 | ||||||||||||||

| Earnings before interest and taxes (EBIT) | $ | 814 | 668 | 612 | 441 | 266 | |||||||||||||||||||||||||

| EBIT margin | 11.4 | % | 10.3 | 9.9 | 7.8 | 5.3 | |||||||||||||||||||||||||

| EBIT margin (non-GAAP)(3) | 11.4 | % | 10.4 | 9.9 | 7.9 | 5.4 | |||||||||||||||||||||||||

| Net income margin | 7.3 | % | 6.6 | 6.4 | 4.9 | 3.3 | Net income margin |

| 3.6 | % | 8.6 |

| 7.3 |

| 7.3 |

| 6.6 | ||||||||||||||

| Net income margin (non-GAAP)(3) | 7.3 | % | 6.6 | 6.2 | 5.0 | 3.4 | |||||||||||||||||||||||||

Adjusted net income margin (3) | Adjusted net income margin (3) |

| 6.6 | % | 8.4 |

| 8.2 |

| 7.3 |

| 6.6 | ||||||||||||||||||||

Earnings before interest and taxes (EBIT) (3) | Earnings before interest and taxes (EBIT) (3) | $ | 576 |

| 1,006 |

| 841 |

| 814 |

| 668 | ||||||||||||||||||||

EBIT margin (3) | EBIT margin (3) |

| 7.4 | % | 13.0 |

| 11.3 |

| 11.4 |

| 10.3 | ||||||||||||||||||||

Adjusted EBIT (3) | Adjusted EBIT (3) | $ | 762 |

| 1,012 |

| 946 |

| 816 |

| 676 | ||||||||||||||||||||

Adjusted EBIT margin (3) | Adjusted EBIT margin (3) |

| 9.9 | % | 13.0 |

| 12.8 |

| 11.4 |

| 10.4 | ||||||||||||||||||||

| Return on assets (ROA) | 14.7 | % | 12.5 | 12.4 | 9.4 | 5.9 | Return on assets (ROA) |

| 7.3 | % | 17.4 |

| 14.7 |

| 14.7 |

| 12.5 | ||||||||||||||

| Return on invested capital (ROIC)(3) | 15.0 | % | 14.1 | 14.2 | 11.8 | 8.3 | Return on invested capital (ROIC) (3) |

| 11.0 | % | 15.1 |

| 15.8 |

| 15.0 |

| 14.1 | ||||||||||||||

| Net debt capitalization percent(3), (4) | 43.4 | % | 42.5 | 37.2 | 36.0 | 39.0 | Net debt capitalization percent (3), (4) |

| 54.4 | % | 48.5 |

| 47.4 |

| 43.4 |

| 42.5 | ||||||||||||||

| Current ratio | 3.5 | 3.8 | 3.7 | 3.8 | 4.0 | Current ratio |

| 4.1 |

| 4.3 |

| 3.7 |

| 3.5 |

| 3.8 | |||||||||||||||

| Other Data | Other Data |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

| Capital expenditures | $ | 190 | 206 | 163 | 152 | 97 | Capital expenditures | $ | 274 |

| 266 |

| 228 |

| 190 |

| 206 | ||||||||||||||

| Number of stores at year end | 3,423 | 3,473 | 3,335 | 3,369 | 3,426 | Number of stores at year end |

| 3,310 |

| 3,363 |

| 3,383 |

| 3,423 |

| 3,473 | |||||||||||||||

| Total selling square footage at year end (in millions) | 7.48 | 7.47 | 7.26 | 7.38 | 7.54 | Total selling square footage at year end (in millions) |

| 7.71 |

| 7.63 |

| 7.58 |

| 7.48 |

| 7.47 | |||||||||||||||

| Total gross square footage at year end (in millions) | 12.73 | 12.71 | 12.32 | 12.45 | 12.64 | Total gross square footage at year end (in millions) |

| 13.30 |

| 13.12 |

| 12.92 |

| 12.73 |

| 12.71 | |||||||||||||||

(1) | 2017 represents the 53 weeks ended February |

(2) | Calculated as Athletic Store sales divided by the average monthly ending gross square footage of the last thirteen months. The computation for each of the years presented reflects the foreign exchange rate in |

(3) | These represent non-GAAP measures, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information and calculation. |

(4) | Represents total debt and obligations under capital leases, net of cash, cash equivalents, and short-term investments. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of OperationsBusiness OverviewFoot Locker, Inc., through its subsidiaries, operates in two reportable segments — Athletic Stores and Direct-to-Customers. The Athletic Stores segment is one of the largest athletic footwear and apparel retailers in the world, with formats that include Foot Locker, Lady Foot Locker, Kids Foot Locker, Champs Sports, Footaction, SIX:02, as well as the retail stores of Runners Point Group, including Runners Point and Sidestep. The Direct-to-Customers segment includes Footlocker.com, Inc. and other affiliates, including Eastbay, Inc., and the direct-to-customer subsidiary of Runners Point Group, which sell to customers through their Internet and mobile sites and catalogs.

The Foot Locker brand is one of the most widely recognized names in the markets in which the Company operates, epitomizing premium quality for the active lifestyle customer. This brand equity has aided the Company’s ability to successfully develop and increase its portfolio of complementary retail store formats, such as Lady Foot Locker, and Kids Foot Locker, as well as Footlocker.com, its direct-to-customer business. Through various marketing channels, including broadcast, digital, print, and various sports sponsorships and events, the Company reinforces its image with a consistent message — namely, that it is the destination for athletically inspired shoes and apparel with a wide selection of merchandise in a full-service environment.

Store Profile

| Square Footage | ||||||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||

| February 1, 2014 | Opened | Closed | January 31, 2015 | Relocations/ Remodels | Selling | Gross | ||||||||||||||||||||||

| Foot Locker US | 1,044 | 11 | 40 | 1,015 | 94 | 2,494 | 4,298 | |||||||||||||||||||||

| Foot Locker Europe | 604 | 13 | 14 | 603 | 40 | 846 | 1,839 | |||||||||||||||||||||

| Foot Locker Canada | 128 | — | 2 | 126 | 31 | 270 | 422 | |||||||||||||||||||||

| Foot Locker Asia Pacific | 92 | 3 | 4 | 91 | 4 | 125 | 204 | |||||||||||||||||||||

| Lady Foot Locker/SIX:02 | 257 | 8 | 52 | 213 | 51 | 299 | 501 | |||||||||||||||||||||

| Kids Foot Locker | 336 | 28 | 7 | 357 | 25 | 529 | 912 | |||||||||||||||||||||

| Footaction | 277 | 2 | 7 | 272 | 20 | 789 | 1,258 | |||||||||||||||||||||

| Champs Sports | 542 | 11 | 6 | 547 | 50 | 1,913 | 2,927 | |||||||||||||||||||||