PART II

| MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

On December 21, 2015 ourOur common stock began tradingtrades on the NYSE American. The trading symbol of our common stock is “TPHS”.

The following table summarizes the quarterly high and low sales prices per share of the common stock as reported in the NYSE American for the years ended December 31, 2017 and December 31, 2016, respectively.

| For the Year Ended December 31, 2017 | For the Year Ended December 31, 2016 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter | $ | 9.97 | $ | 6.65 | $ | 7.18 | $ | 5.25 | ||||||||

| Second Quarter | $ | 7.71 | $ | 6.56 | $ | 8.05 | $ | 6.36 | ||||||||

| Third Quarter | $ | 7.50 | $ | 6.53 | $ | 10.37 | $ | 6.91 | ||||||||

| Fourth Quarter | $ | 7.59 | $ | 6.70 | $ | 10.13 | $ | 8.77 | ||||||||

Outstanding Common Stock and Holders

As of March 15, 2018,29, 2024, we had 36,984,75370,736,447 shares issued and 31,554,64363,793,850 shares outstanding and there were approximately 177134 record holders of our common stock.

Dividends

No dividends were paid during either of the years ended December 31, 2017 and December 31, 2016.

Recent Sales of Unregistered Securities

None.

In accordance with the terms of the employment agreement between us and Matthew Messinger, our President and Chief Executive Officer, on December 29, 2017, Mr. Messinger was granted 30,000 restricted stock unit awards (the “RSU Awards”). The issuance of the RSU Awards was exempt from registration pursuant to Section 4(a)(2) of the Securities Act.

Issuer Purchases of Equity Securities

None.

Item 6. (RESERVED)

We did not repurchase any stock during the year ended December 31, 2017.

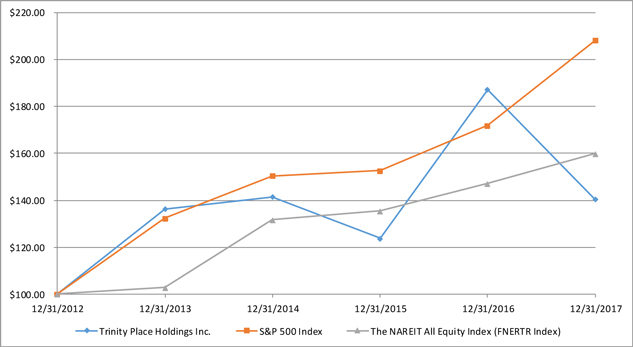

Performance Graph

The following graph is a comparison of the cumulative return of our shares of common stock from January 1, 2013 through December 31, 2017, the Standard & Poor’s 500 Index (the “S&P 500 Index”) and the FTSE National Association of Real Estate Investment Trusts’ (“NAREIT”) All Equity Index, a peer group index. The graph assumes that $100 was invested on January 1, 2013 in our shares of common stock, the S&P 500 Index and the NAREIT All Equity Index and assumes the reinvestment of all dividends (if applicable), and that no commissions were paid. There can be no assurance that the performance of our shares will continue in line with the same or similar trends depicted in the graph below.

| 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 | 12/31/2017 | |||||||||||||||||||

| Trinity Place Holdings Inc. | $ | 100.00 | $ | 136.36 | $ | 141.41 | $ | 123.83 | $ | 187.27 | $ | 140.40 | ||||||||||||

| S&P 500 Index | $ | 100.00 | $ | 132.39 | $ | 150.51 | $ | 152.59 | $ | 171.84 | $ | 208.14 | ||||||||||||

| The NAREIT All Equity Index (FNERTR Index) | $ | 100.00 | $ | 102.86 | $ | 131.68 | $ | 135.40 | $ | 147.09 | $ | 159.85 | ||||||||||||

The following table sets forth our selected financial data and should be read in conjunction with our Financial Statements and notes thereto included in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8, “Financial Statements and Supplementary Data” in this Annual Report on Form 10-K.

The below selected financial data does not include any information prior to February 10, 2015 as we were reporting on the liquidation basis of accounting during the periods prior to February 10, 2015. Under the liquidation basis of accounting, assets are stated at their net realizable value, liabilities are stated at their net settlement amount and estimated costs over the period of liquidation are accrued to the extent reasonably determinable. Our accounting basis reverted to the going concern basis of accounting on February 10, 2015, resulting in all remaining assets and liabilities at that date being adjusted to their net book value less an adjustment for depreciation and/or amortization calculated from the date we entered liquidation through the date we emerged from liquidation. Accordingly, this change in accounting basis resulted in a decrease in the reporting basis of the respective assets and liabilities. Also on November 12, 2015, our Board of Directors approved a change to our fiscal year end from the Saturday closest to the last day of February to a December 31 calendar year end, effective with the year ended December 31, 2015. The period that resulted from this change is March 1, 2015 to December 31, 2015. Because the bases of accounting are non-comparable to each other as well as due to the change in our fiscal year, we are not reporting selected financial data for the periods prior to February 10, 2015.

| For the Year Ended December 31, 2017 | For the Year Ended December 31, 2016 | For the Period March 1, 2015 to December 31, 2015 | For the Period February 10, 2015 to February 28, 2015 | |||||||||||||

| (In thousands, except per share amounts) | ||||||||||||||||

| Statement of Operations Data | ||||||||||||||||

| Total revenues | $ | 1,862 | $ | 1,856 | $ | 841 | $ | 43 | ||||||||

| Total operating expenses | 11,081 | 9,034 | 7,583 | 346 | ||||||||||||

| Operating loss | (9,219 | ) | (7,178 | ) | (6,742 | ) | (303 | ) | ||||||||

| Equity in net loss of unconsolidated joint venture | (1,057 | ) | (308 | ) | - | - | ||||||||||

| Interest income (expense), net | 215 | 42 | (246 | ) | (40 | ) | ||||||||||

| Interest expense - amortization of deferred finance costs | - | (98 | ) | (63 | ) | (17 | ) | |||||||||

| Reduction of claims liability | 1,043 | 132 | 557 | - | ||||||||||||

| Loss before gain on sale of real estate and taxes | (9,018 | ) | (7,410 | ) | (6,494 | ) | (360 | ) | ||||||||

| Gain on sale of real estate | 3,853 | - | - | - | ||||||||||||

| Tax benefit (expense) | 3,144 | (26 | ) | (67 | ) | (2 | ) | |||||||||

| Net loss available to common stockholders | $ | (2,021 | ) | $ | (7,436 | ) | $ | (6,561 | ) | $ | (362 | ) | ||||

| Loss per share - basic and diluted | $ | (0.07 | ) | $ | (0.29 | ) | $ | (0.32 | ) | $ | (0.02 | ) | ||||

| Weighted average number of common shares - basic and diluted | 30,451 | 25,439 | 20,518 | 20,016 | ||||||||||||

| Balance Sheet Data (in thousands) | December 31, 2017 | December 31, 2016 | December 31, 2015 | February 28, 2015 | ||||||||||||

| Real estate, net | $ | 76,269 | $ | 60,384 | $ | 42,638 | $ | 31,121 | ||||||||

| Investment in unconsolidated joint venture | 12,533 | 13,939 | - | - | ||||||||||||

| Total assets | 121,015 | 85,601 | 86,571 | 78,258 | ||||||||||||

| Loans payable, net | 36,167 | 48,705 | 39,615 | 39,323 | ||||||||||||

| Total stockholders' equity | 67,290 | 28,025 | 24,966 | 5,201 | ||||||||||||

| Cash Flow Data (in thousands) | For the Year Ended December 31, 2017 | For the Year Ended December 31, 2016 | For the Period March 1, 2015 to December 31, 2015 | For the Period February 10, 2015 to February 28, 2015 | ||||||||||||

| Cash flows (used in) provided by: | ||||||||||||||||

| Operating activities | $ | (4,640 | ) | $ | (14,842 | ) | $ | (7,034 | ) | $ | (114 | ) | ||||

| Investing activities | (9,726 | ) | (26,214 | ) | (6,278 | ) | (511 | ) | ||||||||

| Financing activities | 24,961 | 7,561 | 27,615 | - | ||||||||||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion related to our consolidated financial statements should be read in conjunction with the financial statements appearing in Item 8 of this Annual Report on Form 10-K. A detailed discussion of the results of operations for the year ended December 31, 2022 compared to the year ended December 31, 2021 is not included herein and can be found in the Management's Discussion and Analysis section in the 2022 Annual Report on Form 10-K filed with the SEC on March 31, 2023.

Overview

Overview

Trinity Place Holdings Inc. (“Trinity”, “we”, “our”, or “us”) isWe are a real estate holding, investment, development and asset management company. Our business is primarily

Prior to acquire, invest in, own, manage, develop or redevelop and sell real estate assets and/or real estate related securities.

Transactions, Development and Other Activities During 2017

77 Greenwich

Environmental remediation and demolition was completed in the third quarter of 2017, and excavation and foundation work has begun. On December 22, 2017, we entered into a $189.5 million construction loan agreement. We will draw down proceeds available to us as costs related to the construction are incurred for 77 Greenwich over the next few years, in addition to equity already funded by us and future contributions by the SCA. In conjunction with the closing of the construction loan, we repaidRecapitalization Transactions on February 14, 2024, our real estate assets and related liabilities were held by the Company, indirectly through wholly-owned subsidiaries, and following the Recapitalization Transactions, our real estate assets and related liabilities are held through TPHGreenwich, which is owned 95% by the Company, with an affiliate of the lender under the Company’s Corporate Credit Facility owning a 5% interest in, fulland acting as manager of, such entity. These real estate assets include (i) 77 Greenwich, (ii) 237 11th, and (iii) the outstanding balance, including accrued interest,Paramus Property. See Item 2. Properties above for a more detailed description of these properties. We also control a variety of intellectual property assets focused on the consumer sector, a legacy of our loan from Sterling National Bank in the aggregate amountpredecessor, Syms. In addition, we also had approximately $316.6 million of $40.1 million. The balance outstanding under this new construction loan agreement was $32.3 millionfederal NOLs at December 31, 20172023, as well as approximately $318.3 million of various state and $36.5 million atlocal NOLs, which can be used to reduce our future taxable income and capital gains.

Recapitalization Transactions

On February 28, 2018.

Through a wholly-owned subsidiary,14, 2024, we also entered into an agreement withconsummated the SCA, whereby we will construct a school that will be sold to the SCA as part of our condominium development at the 77 Greenwich property. Pursuant to the agreement, the SCA will pay us $41.5 million which has been allocated to land and reimburse us for the costs associated with constructing the school (including a construction supervision fee of approximately $5.0 million). Payments for construction will be madeRecapitalization Transactions contemplated by the SCA toStock Purchase Agreement between the general contractor in installments as construction on their condominium progresses. Payments forCompany, the landCompany Investor and development fee will be received starting in January 2018 through September 2019. Upon Substantial Completion, as defined, the SCA shall purchase the school condominium unit. We are required to substantially complete construction of the school by September 6, 2023. To secure our obligations, the 77 Greenwich property has been ground leased to the SCA and leased back to us until title to the school is transferred to the SCA. We have also guaranteed certain obligations with respect to the construction. The condominium apartments along with the subway improvements are currently scheduled to be completed by year end 2020.

Although there can be no assurances, we currently anticipate that the proceeds available under the construction loan, together with equity funded by us to date and future contributions by the SCA, will be sufficient to finance the construction and development of 77 Greenwich without us making any further equity contributions.

Acquisitions and Divestitures

On September 8, 2017, we entered into an agreementJV Investor, pursuant to which we acquired an option to purchase a newly built 105-unit, 12 story apartment building located at 237 11th Street, Brooklyn, New York(i) the Company Investor purchased 25,112,245 shares of common stock for a purchase price of $81.0 million. We exercised$0.30 per share, (ii) the option on March 9, 2018. We paid an initial deposit of $8.1 million upon enteringCompany and the JV Investor entered into the agreement. The purchase price will be funded through acquisition financing and cash on hand. Following the closing andJV Operating Agreement, pursuant to which the JV Investor was appointed the initial manager of, and acquired a separate agreement, an affiliatefive percent (5%) interest in, TPHGreenwich, as described in more detail in “Item 1. Business”, and which JV continues to own, indirectly, all of the seller may continue to managereal property assets and promote the 237 11th Street property for a limited period and an affiliate of such manager will have the ability to receive an additional payment based on the performanceliabilities of the propertyCompany, and (iii) TPHGreenwich entered into the Asset Management Agreement with the TPH Manager, our wholly-owned subsidiary, pursuant to which TPHGreenwich hired the TPH Manager to act as it relates to revenues and concessions and other expenses during such period, which is currently estimated to be up to approximately 1%initial asset manager for TPHGreenwich for an annual management fee, as described in

23