| Mississippi | 64-0862173 | |||||||

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |||||||

| 6480 U.S. Hwy. 98 West, Suite A | ||||||||

| Hattiesburg, Mississippi | 39402 | |||||||

| (Address of principal executive offices) | (Zip Code) |

| Issuer’s telephone number: | (601) 268-8998 | |||||||

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on | ||||||||||||

Which Registered | ||||||||||||||

| Common Stock, $1.00 par value | FBMS | The | ||||||||||||

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-Kx

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes¨ Nox

company

o Emerginggrowth company

o$776.6 million.

| Auditor Firm PCAOB ID: 686 | Auditor Name: FORVIS, LLP | Auditor Location: Jackson, MS | ||||||

| Page | ||||||||

In April 2013, we completed our first post-recession acquisition withGeorgia. We believe the purchase of First National Bank of Baldwin County, which resulted in our strategic entry into the south Alabama market. In July 2014 we completed our acquisition of Bay Bank, previously headquartered in Mobile, Alabama. The conversion and integration of these acquisitions have been successful to date, and we are optimistic that this marketthese markets will continue to contribute to our future growth and success. Also in 2014In addition, we established ade novo branch in Baton Rouge, Louisianacontinue to experience organic loan growth by continuing to strengthen our relationships with existing clients and a loan production office in Slidell, Louisiana.

creating new relationships.

We paid an aggregate purchase price for Gulf Coast of $2.3 million, consisting of 89,591 shares of our common stock, in exchange for all of the outstanding equity securities of Gulf Coast. System integration for both acquisitions was completed during the second quarter of 2017.

As of December 31, 2017, we had 415 full-time employees and 8 part-time employees, and as of March 13, 2018, we had 481 full-time employees and 6 part-time employees.

Atlanta.

Market Areas

Bank.

Recent Developments

Under the terms of the agreement, holders of Sunshine common stock will receive, at the election of each Sunshine shareholder, either (i) $27.00 in cash, or (ii) 0.93 of a share of First Bancshares’ common stock, provided that the total mix of merger consideration is fixed at 75% stock and 25% cash. The aggregate transaction consideration is valued at approximately $32.1 million.

At December 31, 2017, Sunshine had approximately $201 million in total consolidated assets, $168 million in total consolidated loans, $143 million in total consolidated deposits and $22 million in stockholder’s equity.

On March 1, 2018, we completed our merger (the “Southwest Merger”) with Southwest Banc Shares, Inc. (“Southwest”), the holding company of First Community Bank. Southwest was mergedHSBI with and into the Company, with the Company as the surviving corporation, and, immediately thereafter, First CommunityHeritage Southeast Bank was("Heritage Bank"), HSBI's wholly-owned subsidiary, merged with and into The First (collectively with the Southwest Merger referred to as the “Mergers”).Bank. The Company issued 1,134,010 sharespaid a total consideration of Company common stock valued at approximately $36,004,818 as of March 1, 2018, plus $24$221.5 million in cash, to the Southwestformer HSBI shareholders as consideration forin the Southwest Merger. Each outstanding shareacquisition, which included approximately 6,920,909 shares of the Company’sCompany's common stock, remained outstanding and was unaffected by the Mergers.

At December 31, 2017, Southwest had consolidated assetsapproximately $16 thousand in cash in lieu of $401 million, loans of $281 million, deposits of $354 million, and shareholders’ equity of $37 million.

fractional shares.

Deposit Services. We offer a full range of deposit services that are typically available in most banks and savings institutions, including checking accounts, NOW accounts, savings accounts, and other time deposits of various types, ranging from daily money market accounts to longer-term certificates of deposit. The transaction accounts and time certificates are tailored to our principal market areas at rates competitive to those offered by other banks in these areas. All deposit accounts are insured by the FDICFederal Deposit Insurance Corporation (“FDIC”) up to the maximum amount allowed by law. We solicit these accounts from individuals, businesses, associations, and organizations, and governmental authorities. In addition, we offer certain retirement account services, such as Individual Retirement Accounts (IRAs).

and health savings accounts.

We also compete with numerous financial and quasi-financial institutions for deposits and loans, including providers of financial services over the internet.internet, and financial technology, or fintech companies. Recent technology advances and other changes have allowed parties to effect financial transactions that previously required the involvement of banks. For example, consumers can maintain funds in brokerage accounts or mutual funds that would have historically been held as bank deposits. Consumers can also complete transactions such as paying bills and transferring funds directly without the assistance of banks.

These nontraditional financial service providers have been successful in developing digital and other products and services that effectively compete with traditional banking services, but are in some cases subject to fewer regulatory restrictions than banks and bank holding companies, allowing them to operate with greater flexibility and lower cost structures. Although digital products and services have been important competitive features of financial institutions for some time, the COVID-19 pandemic has accelerated the move toward digital financial services products and we expect that trend to continue.

We

Beginning with the enactmentexamined institution. The results of the Financial Institutions Reform, Recoveryexamination are confidential. Supervision and Enforcement Actregulation of 1989banks, their holding companies and followingaffiliates is intended primarily for the protection of depositors and customers, the Deposit Insurance Fund ("DIF") of the FDIC, and the U.S. banking and financial system rather than holders of our capital stock.

Bank Holding Company Regulation

The Company is subject to extensive regulation by the Board of Governors of the Federal Reserve System (the “Federal Reserve”) pursuant to the Bank Holding Company Act, of 1956, as amended (the “Bank Holding Company Act”("BHC Act"). We file quarterly reportsAs such, we are subject to comprehensive supervision, and other information withregulation by the Federal Reserve. We file reports with the SECReserve and are subject to its regulation with respectregulatory reporting requirements. Federal law subjects bank holding companies, such as the Company, to our securities, financial reporting and certain governance matters. Our securities are listedparticular restrictions on the Nasdaq Global Market,types of activities in which they may engage, and to a range of supervisory requirements and activities, including regulatory enforcement actions for violations of laws and regulations.

The Company is registered withthe safety and soundness of insured depository institutions, state banking regulators, the Federal Reserve, and separately the FDIC as the insurer of bank deposits, have the authority to compel or restrict certain actions on our part if they determine that we have insufficient capital or other resources, or are otherwise operating in a bank holding company and has electedmanner that may be deemed to be treated as a financial holding company under the Bank Holding Company Act. As such, the Companyinconsistent with safe and itssound banking practices. Under this authority, our bank regulators can require us or our subsidiaries areto enter into informal or formal supervisory agreements, including board resolutions, memoranda of understanding, written agreements and consent or cease and desist orders, pursuant to which we would be required to take identified corrective actions to address cited concerns and to refrain from taking certain actions.

The

The Bank Holding Company Act requires every

The Federal Reserve has adopted capital adequacy guidelines for use in its examination and regulation of bank holding companies and financial holding companies. The regulatory capitalvoting stock of a bank holding company or financial holding company under applicablea bank that a person may acquire without the prior approval of banking regulators. Under the federal capital adequacy guidelines is particularly importantChange in Bank Control Act and the regulations thereunder, a person or group must give advance notice to the Federal Reserve’s evaluationReserve before acquiring control of the overall safety and soundness of theany bank holding company, such as the Company, or financial holding company and are important factors considered bybefore acquiring control of any state member bank, such as The First. Upon receipt of such notice, the Federal Reserve may approve or disapprove the acquisition. The Change in evaluating any applications made by suchBank Control Act creates a rebuttable presumption of control if a member or group acquires a certain percentage or more of a bank holding companycompany’s or bank’s voting stock. As a result, a person or entity generally must provide prior notice to the Federal Reserve. If regulatory capital falls below minimum guideline levels,Reserve before acquiring the power to vote 10% or more of our outstanding common stock. The overall effect of such laws is to make it more difficult to acquire a financial holding company may lose its status as a financialbank holding company and a bank holding companyby tender offer or banksimilar means than it might be to acquire control of another type of corporation. Consequently, shareholders of the Company may be denied approvalless likely to benefit from the rapid increases in stock prices that may result from tender offers or similar efforts to acquire or establish additional banks or non-bank businesses orcontrol of other companies. Investors should be aware of these requirements when acquiring shares of our stock.

A financial holding company that becomes aware that it or a subsidiary bank has ceased to be well capitalized or well managed must notify the Federal Reserve and enter into an agreement to cure the identified deficiency. If the deficiency is not cured timely, the Federal Reserve may order the financial holding company to divest its banking operations. Alternatively, to avoid divestiture, a financial holding company may cease to engage in the financial holding company activities that are unrelated to banking or otherwise impermissible for a bank holding company. See “Capital Requirements” below for more information.

The Gramm-Leach-Bliley Act of 1999 established a comprehensive framework that permits affiliations among qualified bank holding companies, commercial banks, insurance companies, securities firms, and other financial service providers by revising and expanding the Bank Holding Company Act framework to permit a holding company to engage in a full range of financial activities through a financial holding company.

Federal Reserve Oversight

The Company is required to give the Federal Reserve prior written notice of any purchase or redemption of its outstanding equity securities if the gross consideration for the purchase or redemption, when combined with the net consideration paid for all such purchases or redemptions during the preceding 12 months, is equal to 10% or more of the Company’s consolidated net worth. The Federal Reserve may disapprove such a transaction if it determines that the proposed redemption or stock purchase would constitute an unsafe or unsound practice, would violate any law, regulation, Federal Reserve order or directive or any condition imposed by, or written agreement with, the Federal Reserve.

The Federal Reserve has issued its “Policy Statement on Cash Dividends Not Fully Covered by Earnings” (the “Policy Statement”) which sets forth various guidelines that the Federal Reserve believes a bank holding company should follow in establishing its dividend policy. In general, the Federal Reserve stated that bank holding companies should pay dividends only out of current earnings. The Federal Reserve also stated that dividends should not be paid unless the prospective rate of earnings retention by the holding company appears consistent with its capital needs, asset quality and overall financial condition.

The Company is required to file annual and quarterly reports with the Federal Reserve, and such additional information as the Federal Reserve may require pursuant to the Bank Holding Company Act. The Federal Reserve may examine a bank holding company or any of its subsidiaries.

Source of Strength Doctrine

Under the Dodd-Frank Act, bank holding companies must be well-capitalized and well-managed to engage in interstate transactions. In the past, only the subsidiary banks were required to meet those standards. The Federal Reserve Board’s “source of strength doctrine” has now been codified, mandating that bank holding companies such as the Company serve as a source of strength for their subsidiary banks, such that the bank holding company must be able to provide financial assistance in the event the subsidiary bank experiences financial distress.

Capital Requirements

Federal banking regulators have adopted a system using risk-based capital guidelines to evaluate the capital adequacy of banks and bank holding companies that is based upon the 1988 capital accord of the Bank for International Settlements’ Basel Committee on Banking Supervision (the “Basel Committee”), a committee of central banks and bank regulators from the major industrialized countries that coordinates international standards for bank regulation. Under the guidelines, specific categories of assets and off-balance-sheet activities such as letters of credit are assigned risk weights, based generally on the perceived credit or other risks associated with the asset. Off-balance-sheet activities are assigned a credit conversion factor based on the perceived likelihood that they will become on-balance-sheet assets. These risk weights are multiplied by corresponding asset balances to determine a “risk weighted” asset base which is then measured against various measures of capital to produce capital ratios.

An organization’s capital is classified in one of two tiers, Core Capital, or Tier 1, and Supplementary Capital, or Tier 2. Tier 1 capital includes common stock, retained earnings, qualifying non-cumulative perpetual preferred stock, minority interests in the equity of consolidated subsidiaries, a limited amount of qualifying trust preferred securities and qualifying cumulative perpetual preferred stock at the holding company level, less goodwill and most intangible assets. Tier 2 capital includes perpetual preferred stock and trust preferred securities not meeting the Tier 1 definition, mandatory convertible debt securities, subordinated debt, and allowances for loan and lease losses. Each category is subject to a number of regulatory definitional and qualifying requirements.

The Basel Committee in 2010 released a set of international recommendations for strengthening the regulation, supervision and risk management of banking organizations, known as Basel III. In July 2013, the Federal Reserve published final rules for the adoption of the Basel III regulatory capital framework (the “Basel III Capital Rules”). The Basel III Capital Rules became effective for us on January 1, 2015, with certain transition provisions phasing in over a period ending on January 1, 2019. The Basel III Capital Rules established a new category of capital measure, Common Equity Tier 1 capital, which includes a limited number of capital instruments from the existing definition of Tier 1 Capital, as well as raised minimum thresholds for Tier 1 Leverage capital (100 basis points), and Tier 1 Risk-based capital (200 basis points).

The Basel III Capital Rules established the following minimum capital ratios: 4.5 percent CET1 to risk-weighted assets; 6.0 percent Tier 1 capital to risk-weighted assets; 8.0 percent total capital to risk-weighted assets; and 4.0 percent Tier 1 leverage ratio to average consolidated assets. In addition, the Basel III Capital Rules also introduced a minimum “capital conservation buffer” equal to 2.5% of an organization’s total risk-weighted assets, which exists in addition to these new required minimum CET1, Tier 1, and total capital ratios. The “capital conservation buffer,” which must consist entirely of CET1, is designed to absorb losses during periods of economic stress. The Basel III Capital Rules provide for a number of deductions from and adjustments to CET1, which include the requirement that mortgage servicing rights, deferred tax assets arising from temporary differences that could not be realized through net operating loss carrybacks and significant investments in non-consolidated financial entities be deducted from CET1 to the extent that any one such category exceeds 10% of CET1 or all such categories in the aggregate exceed 15% of CET1.

The Company and The First elected in 2015 to exclude the effects of accumulated other comprehensive income items included in stockholders’ equity from the determination of regulatory capital under the Basel III Capital Rules. Based on estimated capital ratios using Basel III definitions, the Company and The First currently exceed all capital requirements of the new rule, including the fully phased-in conservation buffer.

Certain regulatory capital ratios of the Company and The First, as of December 31, 2017, are shown in the following table:

| Capital Adequacy Ratios | ||||||||||||||||

| Regulatory | ||||||||||||||||

| Minimums | ||||||||||||||||

| Regulatory | to be Well | The First | ||||||||||||||

| Minimums | Capitalized | Bancshares, Inc. | The First | |||||||||||||

| Common Equity Tier 1 risk-based capital ratio | 4.50 | % | 6.50 | % | 14.2 | % | 14.5 | % | ||||||||

| Tier 1 risk-based capital ratio | 6.00 | % | 8.00 | % | 14.9 | % | 14.5 | % | ||||||||

| Total risk-based capital ratio | 8.00 | % | 10.00 | % | 15.5 | % | 15.1 | % | ||||||||

| Leverage ratio | 4.00 | % | 5.00 | % | 11.7 | % | 11.4 | % | ||||||||

The essential difference between the leverage capital ratio and the risk-based capital ratios is that the latter identify and weight both balance sheet and off-balance sheet risks. Tier 1 capital generally includes common equity, retained earnings, qualifying minority interests (issued by consolidated depository institutions or foreign bank subsidiaries), accounts of consolidated subsidiaries and an amount of qualifying perpetual preferred stock, limited to 50% of Tier 1 capital. In calculating Tier 1 capital, goodwill and other disallowed intangibles and disallowed deferred tax assets and certain other assets are excluded. Tier 2 capital is a secondary component of risk-based capital, consisting primarily of perpetual preferred stock that may not be included as Tier 1 capital, mandatory convertible securities, certain types of subordinated debt and an amount of the allowance for loan losses (limited to 1.25% of risk weighted assets).

The risk-based capital guidelines are designed to make regulatory capital requirements more sensitive to differences in risk profiles among banks and bank holding companies, to take into account off-balance sheet exposure and to minimize disincentives for holding liquid assets. Under the risk-based capital guidelines, assets are assigned to one of four risk categories: 0%, 20%, 50% and 100%. For example, U.S. Treasury securities are assigned to the 0% risk category while most categories of loans are assigned to the 100% risk category. Off-balance sheet exposures such as standby letters of credit are risk-weighted and all or a portion thereof are included in risk-weighted assets based on an assessment of the relative risks that they present. The risk-weighted asset base is equal to the sum of the aggregate dollar values of assets and off-balance sheet items in each risk category, multiplied by the weight assigned to that category.

Prompt Corrective Action and Undercapitalization

The FDICIA established a system of prompt corrective action regulations and policies to resolve the problems of undercapitalized insured depository institutions. Under this system, insured depository institutions are ranked in one of five capital categories as described below. Regulators are required to take mandatory supervisory actions and are authorized to take other discretionary actions of increasing severity with respect to insured depository institutions in the three undercapitalized categories. The five capital categories for insured depository institutions under the prompt corrective action regulations consist of:

The prompt corrective action regulations provide that an institution may be downgraded to the next lower category if its regulator determines, after notice and opportunity for hearing or response, that the institution is in an unsafe or unsound condition or has received and not corrected a less-than-satisfactory rating for any of the categories of asset quality, management, earnings or liquidity in its most recent examination.

Federal bank regulatory agencies are required to implement arrangements for prompt corrective action for institutions failing to meet minimum requirements to be at least adequately capitalized. FDICIA imposes an increasingly stringent array of restrictions, requirements and prohibitions as an organization’s capital levels deteriorate. A bank rated "adequately capitalized" may not accept, renew or roll over brokered deposits. A "significantly undercapitalized" institution is subject to mandated capital raising activities, restrictions on interest rates paid and transactions with affiliates, removal of management and other restrictions. The OCC has only very limited discretion in dealing with a "critically undercapitalized" institution and generally must appoint a receiver or conservator (the FDIC) if the capital deficiency is not corrected promptly.

Under the Federal Deposit Insurance Act (“FDIA”), “critically undercapitalized” banks may not, beginning 60 days after becoming critically undercapitalized, make any payment of principal or interest on their subordinated debt (subject to certain limited exceptions). In addition, under Section 18(i) of the FDIA, banks are required to obtain the advance consent of the FDIC to retire any part of their subordinated notes. Under the FDIA, a bank may not pay interest on its subordinated notes if such interest is required to be paid only out of net profits, or distribute any of its capital assets, while it remains in default on any assessment due to the FDIC.

Federal bank regulators may set capital requirements for a particular banking organization that are higher than the minimum ratios when circumstances warrant. Federal Reserve and OCC guidelines provide that banking organizations experiencing significant growth or making acquisitions will be expected to maintain strong capital positions substantially above the minimum supervisory levels, without significant reliance on intangible assets. Concentration of credit risks, interest rate risk (imbalances in rates, maturities or sensitivities) and risks arising from non-traditional activities, as well as an institution’s ability to manage these risks, are important factors taken into account by regulatory agencies in assessing an organization’s overall capital adequacy.

The OCC and the Federal Reserve also use a leverage ratio as an additional tool to evaluate the capital adequacy of banking organizations. The leverage ratio is a company’s Tier 1 capital divided by its average total consolidated assets. A minimum leverage ratio of 3.0% is required for banks and bank holding companies that either have the highest supervisory rating or have implemented the appropriate federal regulatory authority’s risk-adjusted measure for market risk. All other banks and bank holding companies are required to maintain a minimum leverage ratio of 4.0%, unless a different minimum is specified by an appropriate regulatory authority. In order to be considered well capitalized the leverage ratio must be at least 5.0%.

Our Bank’s leverage ratio was 11.4% at December 31, 2017 and, as a result, it is currently classified as “well capitalized” for purposes of the OCC’s prompt corrective action regulations.

The risk-based and leverage capital ratios established by federal banking regulators are minimum supervisory ratios generally applicable to banking organizations that meet specified criteria, assuming that they otherwise have received the highest regulatory ratings in their most recent examinations. Banking organizations not meeting these criteria are expected to operate with capital positions in excess of the minimum ratios. Regulators can, from time to time, change their policies or interpretations of banking practices to require changes in risk weights assigned to our Bank's assets or changes in the factors considered in order to evaluate capital adequacy, which may require our Bank to obtain additional capital to support existing asset levels or future growth or reduce asset balances in order to meet minimum acceptable capital ratios.

Additional Regulatory Issues

In June 2010, the Federal Reserve, the OCC and the FDIC issued joint guidance on executive compensation designed to help ensure that a banking organization’s incentive compensation policies do not encourage imprudent risk taking and are consistent with the safety and soundness of the organization. In addition, the Dodd-Frank Act required those agencies, along with the SEC, to adopt rules to require reporting of incentive compensation and to prohibit certain compensation arrangements. The objective of the guidance is to assure that incentive compensation arrangements (i) provide incentives that do notthe agencies determine to encourage excessive risk-taking, (ii) are compatible with effective internal controls and risk management and (iii) are supported by strong corporate governance, including oversightinappropriate risks by the board of directors.institution. The banking agencies issued proposed rules in 2011 and previously issued guidance on sound incentive compensation policies. In 2016, the Federal Reserve and the FDICbanking agencies also proposed rules that would, depending upon the assets of the institution, directly regulate incentive compensation arrangements and would require enhanced oversight and recordkeeping. As of December 31, 2017,2023, these rules have not been implemented.

We have undertaken efforts to ensure that our incentive compensation plans do not encourage inappropriate risks, consistent with three key principles-that incentive compensation arrangements should appropriately balance risk and financial rewards, be compatible with effective controls and risk management, and be supported by strong corporate governance.

Capital Adequacy Ratios | |||||||||||||||||||||||||||||

| Regulatory Minimums | Regulatory Minimums to be Well Capitalized | Minimum Capital Required Basel III Fully Phased-In | The First Bancshares, Inc. | The First | |||||||||||||||||||||||||

| Common Equity Tier 1 risk-based capital ratio | 4.5 | % | 6.5 | % | 7.0 | % | 12.1 | % | 13.8 | % | |||||||||||||||||||

| Tier 1 risk-based capital ratio | 6.0 | % | 8.0 | % | 8.5 | % | 12.5 | % | 13.8 | % | |||||||||||||||||||

| Total risk-based capital ratio | 8.0 | % | 10.0 | % | 10.5 | % | 15.0 | % | 14.8 | % | |||||||||||||||||||

| Leverage ratio | 4.0 | % | 5.0 | % | 4.0 | % | 9.7 | % | 10.7 | % | |||||||||||||||||||

Stress Testing

The Dodd-Frank Act requires stress testing of certain bank holding companies and banks that have more than $10 billion but less than $50 billion of consolidated assets (“medium-sized companies”). Additional stress testing is required for banking organizations having $50 billion or more of assets. Becauseregulatory minimums plus the consolidated assets of the Companyapplicable capital conservation buffer.

Company Participation in Legislative and Regulatory Initiatives

The Congress, Treasury Department and the federal banking regulators, including the FDIC, have taken broad action since early September 2008 to address volatility in the U.S. banking system. In October 2008, the Emergency Economic Stabilization Act of 2008 (“EESA”) was enacted. The EESA authorized the Treasury Department to purchase from financialFederal Reserve has indicated that depository institutions and their holding companies upshould generally pay dividends only out of current operating earnings. Further, under Mississippi law, The First must obtain the non-objection of the Commissioner of the Mississippi Department of Banking and Consumer Finance prior to $700 billion in mortgage loans, mortgage-related securities and certain other financial instruments, including debt and equity securities issued by financial institutions and their holding companies in a troubled asset relief program (“TARP”). The purpose of TARP was to restore confidence and stabilitypaying any dividend to the U.S. banking systemCompany.

On February 6, 2009, as partregulation by the Mississippi Department of Banking and Consumer Finance. As a member bank of the CPP, the Company entered into a Letter Agreement and Securities Purchase Agreement (collectively, the “Purchase Agreement”) with the Treasury Department, pursuant to which the Company sold (i) 5,000 shares of the Company’s Fixed Rate Cumulative Perpetual Preferred Stock, Series UST (the “CPP Preferred Stock”) and (ii) a warrant (the “Warrant”) to purchase 54,705 shares of the Company’s Common Stock for an exercise price of $13.71 per share. On September 29, 2010, after successfully obtaining CDFI certification, the Company exited the CPP by refinancing its CPP funding into lower-cost CDCI funding and also accepted additional CDCI funding. In connection with this transaction, the Company retired its CPP Preferred Stock and issued to the Treasury Department 17,123 shares of the Company’s Fixed Rate Cumulative Perpetual Preferred Stock, Series CD (the “CDCI Preferred Stock”). Including refinanced funding and newly obtained funding, the Company’s total CDCI funding was $17,123,000.

The America Reinvestment and Recovery Act of 2009 (“ARRA”) contained expansive new restrictions on executive compensation for financial institutions and other companies participating in the TARP. As long as the Treasury continued to hold equity interests in the Company issued under the TARP, the Company monitored its compensation arrangements, modified such compensation arrangements, agreed to limit and limit its compensation deductions, and took such other actions as were necessary to comply with the standards discussed below. On December 6, 2016, the Company repurchased all 17,123 shares of its CDCI Preferred Shares from Treasury at fair market value. Therefore, as of December 6, 2016, the Company no longer had any obligations under TARP or the ARRA. However, as part of its repurchase obligations with the Treasury, the Company agreed to maintain its CDFI certification status for a period of two years. The eligibility requirements provide that the Company must:

• Have a primary mission of promoting community development;

• Provide both financial and educational services;

• Serve and maintain accountability to one or more defined target markets;

• Maintain accountability to a defined market; and

• Be a legal, non-governmental entity at the time of application (with the exception of Tribal governmental entities)

The First, A National Banking Association

OCC Regulation. The First operates as a national banking association incorporated under the laws of the United States and subject to supervision, inspection and examination by the OCC. The OCC regulates or monitors virtually all areas of The First’s operations, including security devices and procedures, adequacy of capitalization and loan loss reserves, loans, investments, borrowings, deposits, mergers, issuances of securities, payment of dividends, interest rates payable on deposits, interest rates or fees chargeable on loans, establishment of branches, corporate reorganizations, maintenance of books and records, and adequacy of staff training to carry on safe lending and deposit gathering practices. The OCC imposes limitations on The First’s aggregate investment in real estate, bank premises, and furniture and fixtures.Federal Reserve System, The First is required by the OCC to prepare quarterly reports onhold stock in its financial condition anddistrict Federal Reserve Bank in an amount equal to conduct an annual audit6% of its financial affairs in compliancecapital stock and surplus (half paid to acquire stock with minimum standards and procedures prescribed by the OCC.

Safe and Sound Banking Practices; Enforcementremainder held as a cash reserve). Banks and bank holding companies are prohibited from engaging in unsafe and unsound banking practices. Bank regulatorsMember banks do not have broad authority to prohibit and penalize activities of bank holding companies and their subsidiaries which represent unsafe and unsound banking practices or which constitute violations of laws, regulations or written directives of or agreements with regulators. Regulators have considerable discretion in identifying what they deem to be unsafe and unsound practices and in pursuing enforcement actions in response to them.

Under FDICIA, all insured institutions must undergo regular on-site examinations by their appropriate banking agency. The cost of examinations of insured depository institutions and any affiliates may be assessed by the appropriate agency against each institution or affiliate as it deems necessary or appropriate. Insured institutions are required to submit annual reports to the FDIC and the appropriate agency. FDICIA also directs the FDIC to develop with other appropriate agencies a method for insured depository institutions to provide supplemental disclosure of the estimated fair market value of assets and liabilities, to the extent feasible and practicable, in any balance sheet, financial statement, report of condition, or any other report of any insured depository institution. FDICIA also requires the federal banking regulatory agencies to prescribe, by regulation, standards for all insured depository institutions and depository institution holding companies relating, among other things, to: (i) internal controls, information systems, and audit systems; (ii) loan documentation; (iii) credit underwriting; (iv) interest rate risk exposure; and (v) asset quality.

National banks and their holding companies which have been chartered or registered or undergone a change in control within the past two years or which have been deemed by the OCC orover the Federal Reserve Board, respectively, toSystem as a result of owning the stock and the stock cannot be troubled institutions must give the OCCsold or the Federal Reserve Board, respectively, thirty days prior noticetraded.

Deposit Insurance.The FDIC establishes rates for the payment of premiums by federally insured banks and thrifts for deposit insurance. Deposits in The First are insured by the FDIC up to a maximum amount (generally $250,000 per depositor, subject to aggregation rules). The DIF is maintained by the FDIC for commercial banksapplicable limits, and, thrifts and funded with insurance premiums from the industry that are used to offset losses from insurance payouts when banks and thrifts fail. Since 1993, insured depository institutions like The First have paid for deposit insurance under a risk-based premium system. Assessments are calculated based on the depository institution’s average consolidated total assets, less its average amount of tangible equity.

Transactions With Affiliates and Insiders.The First is subject to Section 23A of the Federal Reserve Act, which places limits on the amount of loans to, and certain other transactions with, affiliates, as well as on the amount of advances to third parties collateralized by the securities or obligations of affiliates. The aggregate of all covered transactions is limited in amount, as to any one affiliate, to 10% of The First's capital and surplus and, as to all affiliates combined, to 20% of The First's capital and surplus. Furthermore, within the foregoing limitations as to amount, each covered transaction must meet specified collateral requirements.

accordingly, The First is also subject to Section 23Bcertain FDIC regulations and the FDIC has backup examination authority and some enforcement powers over The First.

Change in ControlWith certain limited exceptions, the BHCAspecified amounts. In addition, any transaction between The First and the Change in Bank Control Act, together with regulations promulgated thereunder, prohibit a personCompany or company or a group of persons deemedany affiliate are required to be “acting in concert” from, directly or indirectly, acquiring more than 10% (5% if the acquirer is a bank holding company) of any class of our voting stock or obtaining the ability to control in any manner the election of a majority of our directors or otherwise direct the management or policies of our company without prior notice or application to and the approval of the Federal Reserve.

Dividends.The principal source of funds from which we pay cash dividends are the dividends received from our bank subsidiary, The First. Federal banking laws also place similar restrictions on certain extensions of credit by insured banks, such as The First, to their directors, executive officers and regulations restrictprincipal shareholders.

Interstate Branching and Acquisitions.National banks are required by the National Bank Act to adhere to branch office banking laws applicable to state banks in the states in which they are located. Formerly, under the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994, a bank’s ability to branch into a particular state was largely dependent upon whether the state “opted in” to de novo interstate branching. Under the Dodd-Frank Act, de novo interstate branching by national banks is permitted if, under the laws of the state where the branch is to be located, a state bank chartered in that state would be permitted to establish a branch. Further, a bank headquartered in one state is authorized to merge with a bank headquartered in another state, as long as neither of the states have opted out of such interstate merger authority, and subject to any state requirement that the target bank shall have been in existence and operating for a minimum period of time, not to exceed five years and certain deposit market-share limitations. Under current Mississippi, Alabama, Louisiana and Florida law, The First may open branches or acquire existing banking operations throughout these states with the prior approval of the OCC. The Dodd-Frank Act permits out of state acquisitions by bank holding companies (subject to veto by new state law), interstate branching by banks if allowed by state law, interstate merging by banks, and de novo branching by national banks if allowed by state law. All branching in which The First may engage remains subject to regulatory approval and adherence to applicable legal and regulatory requirements.

Community Reinvestment Act.The Community Reinvestment Act (the “CRA”) requires depository institutions to assist in meeting the credit needs of their market areas consistent with safe and sound banking practice. Under the Community Reinvestment Act, each depository institution is required to help meet the credit needs of its market areas by, among other things, providing credit to low- and moderate-income individuals and communities. Depository institutions are periodically examined for compliance with the CRA and are assigned ratings. In order for a financial holding company to commence new activity permitted by the BHCA, each insured depository institution, subsidiarythe claims of depositors of the financialinstitution, including the claims of the FDIC as subrogee of insured depositors, and certain claims for administrative expenses of the FDIC as a receiver, will have priority over other general unsecured claims against the institution, including those of the parent bank holding company mustcompany.

USA Patriot Act. In 2001,soundness compliance plans.

Office of Foreign Assets Control.

them on the condition that (1) the customer obtain or provide some additional credit, property, or services from or to the bank or bank holding company or their subsidiaries or (2) the customer not obtain some other credit, property, or services from a competitor, except to the extent reasonable conditions are imposed to assure the soundness of the credit extended. A bank may, however, offer combined-balance products and may otherwise offer more favorable terms if a customer obtains two or more traditional bank products. The law also expressly permits banks to engage in other forms

Other Regulatory Matters

Risk-retention rules. Under the final risk-retention rules, banks that sponsor the securitization of asset-backed securities and residential-mortgage backed securities are required to retain 5% of any loan they sell or securitize, except for mortgages that meet low-risk standards to be developed by regulators.

Changes to federal preemption. The Dodd-Frank Act created a new independent supervisory body, the Consumer Financial Protection Bureau (the “CFPB”) that is housed within the Federal Reserve. The CFPB is the primary regulator for federal consumer financial statutes. State attorneys general are authorized to enforce new regulations issued by the CFPB. Although the application of most state consumer financial laws to The First will continue to be preempted under the National Bank Act, OCC determinations of such preemption are made on a case-by-case basis. As a result, it is possible that state consumer financial laws enacted in the future may be held to apply to our business activities. The cost of complying with any such additional laws could have a negative impact on our financial results.

Mortgage Rules. During 2013, the CFPB finalized a series of rules related to the extension of residential mortgage loans by banks. Among these rules are requirements that a bank make a good faith determination that a borrower has the ability to repay a mortgage loan prior to extending such credit, a requirement that certain mortgage loans provide for escrow payments, new appraisal requirements, and specific rules regarding how loan originators may be compensated and the servicing of residential mortgage loans. The implementation of these new rules began in January 2014.

Volcker Rule. In December 2013, the Federal Reserve, the FDIC, the OCC, the Commission, and the Commodity Futures Trading Commission issued the “Prohibitions And Restrictions On Proprietary Trading And Certain Interests In, And Relationships With, Hedge Funds And Private Equity Funds,” commonly referred to as the Volcker Rule, which regulates and restricts investments which may be made by banks. The Volcker Rule was adopted to implement a portion of the Dodd-Frank Act and new Section 13 of the Bank Holding Company Act, which prohibits any banking entity from engaging in proprietary trading or from acquiring or retaining an ownership interest in, or sponsoring or having certain relationships with, a hedge fund or private equity fund (“covered funds”), subject to certain exemptions.

Debit Interchange Fees

Interchange fees, or “swipe” fees, are fees that merchants pay to credit card companies and card-issuing banks such as The First for processing electronic payment transactions on their behalf. The maximum permissible interchange fee that an issuer may receive for an electronic debit transaction is the sum of 21 cents per transaction and 5 basis points multiplied by the value of the transaction, subject to an upward adjustment of 1 cent if an issuer certifies that it has implemented policies and procedures reasonably designed to achieve the fraud-prevention standards set forth by the Federal Reserve.

In addition, the legislation prohibits card issuers and networks from entering into exclusive arrangements requiring that debit card transactions be processed on a single network or only two affiliated networks, and allows merchants to determine transaction routing. Due to the Company’s size, the Federal Reserve rule limiting debit interchange fees has not reduced our debit card interchange revenues.

Summary

The foregoing is a brief summary of certain statutes, rules and regulations affecting the Company and The First. It is not intended to be an exhaustive discussion of all statutes and regulations having an impact on the operations of such entities.

Increased regulation generally has resulted in increased legal and compliance expense.

Finally, additional bills may be introduced in the future in the U.S. Congress and state legislatures to alter the structure, regulation and competitive relationships of financial institutions. It cannot be predicted whether and in what form any of these proposals will be adopted or the extent to which the business of the Company and The First may be affected thereby.

Effect of Governmental Monetary and Fiscal Policies

Making or continuing an investment in securities, including

Risk Factors Associated Withwith Our Business

financial results or liquidity.

Additionally, adverse

operations.

On January 1, 2021, the Company adopted Accounting Standards Update ("ASU") 2016-13, Financial Instruments - Credit Losses ("ASC 326"). The First makes various assumptionsFinancial Accounting Standards Board (the “FASB”) issued ASC 326 to replace the incurred loss model for loans and judgments aboutother financial assets with an expected loss model and requires consideration of a wider range of reasonable and supportable information to determine credit losses. In accordance with ASC 326, the collectability ofCompany has developed an allowance for credit losses (“ACL”) methodology effective January 1, 2021, which replaces its loan portfolio based on a number of factors. We maintain anprevious allowance for loan losses whichmethodology. The ACL is a reserve established throughvaluation account that is deducted from loans’ amortized cost basis to present the net amount expected to be collected on the loans. Loans are charged-off against the allowance when management believes the uncollectibility of a loan balance is confirmed. Expected recoveries do not exceed the aggregate of amounts previously charged-off and expected to be charged-off.

operations.

At present the Company’s one-year interest rate sensitivity position is asset sensitive. As with most financial institutions, the Company’s results of operations are affected by changes in interest rates and the Company’s ability to manage this risk. The difference between interest rates charged on interest-earning assets and interest rates paid on interest-bearing liabilities may be affected by changes in market interest rates, changes in relationships between interest rate indices, and/or changes in the relationships between long-term and short-term market interest rates. A change in this difference might result in an increase in interest expense relative to interest income, or a decrease in the Company’s interest rate spread.

Certain changes in interest rates, inflation, or the financial markets could affect demand for our products and our ability to deliver products efficiently.

Loan originations, and therefore loan revenues, could be adversely impacted by rising interest rates.Increases in market interest rates can have negative impacts on our business, including reducing our customers' desire to borrow money from us or adversely affecting their ability to repay their outstanding loans by increasing their debt service obligations through the periodic reset of adjustable interest rate loans. If our borrowers’ ability to repay their loans is impaired by increasing interest payment obligations, our level of non-performing assets would increase, producing an adverse effect on operating results. Asset values, especially commercial real estate as collateral, securities or other fixed rate earning assets, can decline significantly with relatively minor changes in interest rates.Conversely, falling rates could increase prepayments within our loan and securities portfolio lowering interest earnings from those assets. An unanticipated increase in inflation could cause operating costs related to salaries and benefits, technology, and supplies to increase at a faster pace than revenues.

Additionally, our management considers a wide range of factors about the security issuer and uses its reasonable judgment in evaluating the cause of the decline in the estimated fair value of the security and in assessing the prospects for recovery. Inherent in management’s evaluation of the security are assumptions and estimates about the operations of the issuer and its future earnings potential. Impairments to the carrying value of our investment securities may need to be taken in the future, which wouldcould have a material adverse effect on our results of operations and financial condition.

The full impact

Increased economic activity expected to result from the decrease in tax rates on businesses generally could spur additional economic activity that would encourage additional borrowing. At the same time, some customers may elect to use their additional cash flow from lower taxes to fund their existing levels of activity, decreasing borrowing needs. The eliminationimplementation of the federalInflation Reduction Act of 2022 ("IRA"), could significantly impact our business in the form of greater than expected income tax deductibility of business interest expense for a significant numberand taxes payable. Such changes may also negatively impact the financial condition of our customers effectively increasesand/or overall economic conditions. Further, future regulatory reforms that could include a heightened focus and scrutiny on BSA/AML related compliance, expansion of consumer protections, the costregulation of borrowingloan portfolios and makes equitycredit concentrations to borrows impacted by climate changes, increased capital and liquidity requirements and limitations or hybrid funding relatively more attractive. Thisadditional taxes on share repurchases and dividends, could increase our costs and impact our business.

We may be required to pay additional insurance premiums to the FDIC, which could negatively impact earnings.

Pursuant to the Dodd-Frank Act, the limit on FDIC coverage has been permanently increased to $250,000, causing the premiums assessed to

In addition, as the regulatory environment related to information security, data collection and use, and privacy becomes increasingly rigorous, with new and constantly changing requirements applicable to our business, compliance with those requirements could also result in additional costs.

We must maintain effective internal control over financial reporting.

Management regularly monitors, reviews and updates our disclosure controls and procedures, including our internal control over financial reporting. Any system of controls, however well designed and operated, is based in part on certain assumptions and can provide only reasonable, assurances that the controls will be effective. Any failure or circumvention of our controls and procedures or failure to comply with regulations related to controls and procedures could have a material adverse effect on our business, results of operations and financial condition.

Failure to achieve and maintain an effective internal control environment could prevent us from accurately reporting our financial results, preventing or detecting fraud, or providing timely and reliable financial information pursuant to our reporting obligations, which could have a material adverse effect on our business, financial condition, and results of operations.

Our business is susceptible to fraud.

We may fail to realize the anticipated cost savings and other financial benefits of recent acquisitions in the First Community Bank Acquisition and Sunshine Community Banktimeframe we expect, or at all.

The First, First Community Bank, and Sunshine Community Bank have historically operated independently. The successacquisition of the mergers of First Community Bank and Sunshine Community Bank into The First will depend, in part,HSBI on our ability to successfully combine the businesses of The First, First Community Bank, and Sunshine Community Bank. To realize these anticipated benefits, The First expects to integrate First Community Bank’s and Sunshine Community Bank’s businesses with its own businesses. We may face significant challenges in integrating both First Community Bank’s and Sunshine Community Bank’s operations into our operations in a timely and efficient manner and in retaining key personnel from these two banks.January 1, 2023. Achieving the anticipated cost savings and financial benefits of the mergers will depend, in part, on whether we can successfully integrate these businesses.businesses with and into the business of The First. It is possible that the integration process could result in the loss of key employees, the disruption of each company’s ongoing businesses or inconsistencies in standards, controls, procedures, and policies that adversely affect our ability to maintain relationships with clients, customers, depositors, and employees or to achieve the anticipated benefits of the merger.mergers. In addition, the integration of certain operations following the mergers has required and will continue to require the dedication of significant management resources, which may temporarily distract management’s attention from the day-to-day business of the combined company. Any inability to realize the full extent of, or any of, the anticipated cost savings and financial benefits of the mergers, as well as any delays encountered in the integration process, could have an adverse effect on the business and results of operations of the combined company.

In addition, Sunshine’s shareholders must approve the transaction before the acquisition of Sunshine Community Bank can be completed, and such shareholder approval may not be received. Failure to complete the acquisition could

We willcontinue to incur significant transaction and merger-related costs in connection with the acquisition of Southwest and First Community Bank and the pending acquisition of Sunshine and Sunshine Community Bank.

our recent acquisitions.

the price of our common stock. You may not receive dividends on our common stock. more information. “FBMS.” the Board of Directors and applicable regulatory requirements, the Company expects to continue its policy of paying regular cash dividends on a quarterly basis. A discussion of certain limitations on the ability of The this report. Period Total Average Total Number of Maximum May Yet Be Purchased The following provides a narrative discussion and analysis of The First Bancshares’ financial condition as of December 31, 2023 and 2022 and results of operations for the years ended December 31, discussed more fully under Part II - Item 8. Financial Statements and Supplementary Data - Note B - Summary of Significant Accounting Policies and Note C Business Combinations of this report. Goodwill is discussed more fully under Part II - Item 8. Financial Statements and Supplementary Data - Note B - Summary of Significant Accounting Policies of this report. 2022 to $75.5 million for the same period ended December 31, 2023. compared to 2021. non-interest expense. Consolidated net interest income was approximately 2021. Income/ Expenses Yield/ Rate Average Balance Income/ Expenses Yield/ Rate Average Balance Income/ Expenses Yield/ Rate 2017 versus 2016 Increase (decrease) due to 2016 versus 2015 Increase (decrease) due to Within Three Months After Three Through Twelve Months Within One Year Greater Than One Year or Nonsensitive Within Three Months After Three Through Twelve Months Within One Year Greater Than One Year or Nonsensitive Within Three Months After Three Through Twelve Months Within One Year Greater Than One Year or Nonsensitive The following tables depict, for the periods indicated, certain information related to interest rate sensitivity in net interest income and market value of Net Interest Income at Risk Market Value of Equity Change in Interest % Change Bank Policy Limit % Change from Base Bank Policy Limit Net Interest Income at Risk Market Value of Equity % Change Policy Limit % Change from Base Policy Limit Net Interest Income at Risk Market Value of Equity % Change Policy Limit % Change from Base Policy Limit equity: individually assessed loans. Loans are charged-off against the allowance when management believes the uncollectibility of a loan balance is confirmed. Expected recoveries do not exceed the aggregate of amounts previously charged-off and expected to be charged-off. The greater past due and still accruing interest. At December 31, credit marks in the Cadence Bank Branches loans acquired for the year ended December 31, 2022. 2022. indicated. expected income tax to be paid to taxing authorities. The Company also recognizes deferred tax for future income/deductible amounts resulting from differences in the financial statement and tax bases of assets and liabilities. this report. In the context of this discussion, a "real estate mortgage loan" is defined as any loan, other than loans for construction purposes, secured by real estate, regardless of the purpose of the loan. The Company follows the common practice of financial institutions in the Company’s market area of obtaining a security interest in real estate whenever possible, in addition to any other available collateral. This collateral is taken to reinforce the likelihood of the ultimate repayment of the loan and tends to increase the magnitude of the real estate loan portfolio component. Generally, the Company limits its loan-to-value ratio to 80%. Management attempts to maintain a conservative philosophy regarding its underwriting guidelines and believes it will reduce the risk elements of its loan portfolio through strategies that diversify the lending mix. 2023. Investment Securities. The investment securities portfolio is a significant component of the Expected maturities may differ from contractual maturities because issuers may have the right to call or prepay obligations. total deposits was 1.57% and 1.09% during 2023 compared to 0.37% and 0.26% in 2022. Average cost of interest bearing deposits increased 120 basis points to 1.57% at December 31, 2023 compared to 0.37% during the same time period in 2022. Average cost of total deposits increased 83 basis points to 1.09% at December 31, 2023 compared to 0.26% during the same time period in 2022. The higher average market interest rates. Average cost of interest-bearing deposits and total deposits remained unchanged at December 31, 2022 compared to 2021. The Company's brokered deposits were 1.8% of deposits at December 31, 2023. are set to mature one year from their issuance date. to be three-month term SOFR plus 3.39% plus a tenor spread adjustment of 0.026161%), payable quarterly in arrears. As provided in the Notes due 2033, under specified conditions the interest rate on the Notes due 2033 during the applicable floating rate period may be determined based on a rate other than Three-Month Term SOFR. The Company is entitled to redeem the Notes due 2033, in whole or in part, on any interest payment date on or after May 1, 2028, and to redeem the Notes due 2033 at any time in whole upon certain other specified events. 2021. The prompt corrective action rules have been modified to include the common equity Tier 1 capital ratio and to increase the Tier 1 capital ratio requirements for the various thresholds. For example, the requirements for the Company to be considered well-capitalized under the rules include a 5.0% leverage ratio, a 6.5% common equity Tier Under this guidance banking institutions with a CETI, Tier 1 Capital Ratio and Total Risk Based Capital above the minimum regulatory adequate capital ratios but below the capital conservation buffer will face constraints on their ability to pay dividends, repurchase equity and pay discretionary bonuses to executive officers, based on the amount of the shortfall. Capital Resources The As of December 31, 2023, the target federal funds rate was 5.25% to 5.50%. To identify areas of potential exposure to interest rate changes, we utilize commercially available modeling software to perform earnings simulations and calculate the Company’s market value of portfolio equity under varying interest rate scenarios every month. The model imports relevant information for the Company’s financial instruments and incorporates The economic value (or “fair value”) of financial instruments on the Company’s balance sheet will also vary under the interest rate scenarios previously discussed. The difference between the projected fair value of the Company’s financial assets and the fair value of its financial liabilities is referred to as the economic value of equity (“EVE”), and changes in EVE under different interest rate scenarios are effectively a gauge of the Company’s longer-term exposure to interest rate risk. Fair values for financial instruments are estimated by discounting projected cash flows (principal and interest) at projected replacement interest rates for each account type, while the fair value of non-financial accounts is assumed to equal their book value for all rate scenarios. An economic value simulation is a static measure utilizing balance sheet accounts at a given point in time, and the measurement can change substantially over time as the characteristics of the Company’s balance sheet evolve and interest rate and yield curve assumptions are updated. Audit Committee 2022 2021 (LOSS) 2021 Common Stock Preferred Stock Stock Warrants Additional Paid-in Capital Retained Earnings Accum- ulated Other Compre- hensive Income (Loss) Treasury Stock CASH FLOWS Common Stock Preferred Stock Stock Warrants Additional Paid-in Capital Retained Earnings Accum- ulated Other Compre- hensive Income (Loss) Treasury Stock CASH FLOWS Common Stock Preferred Stock Stock Warrants Additional Paid-in Capital Retained Earnings Accum- ulated Other Compre- hensive Income (Loss) Treasury Stock 2023, 2022 AND 2021 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Federal Reserve System through the Federal Reserve Bank of Atlanta. The charter conversion and name change are expected to have only a minimal impact on the Bank’s clients, and deposits will continue to be insured by the Federal Deposit Insurance Corporation up to the applicable limits. eliminated in consolidation. AFS securities are placed on nonaccrual status at the time any principal to interest payments become 90 days delinquent or if full collection of interest or principal becomes uncertain. Accrued interest for a security placed on nonaccrual is reversed against interest income. There was no accrued interest related to AFS securities reversed against interest income for the years ended December 31, 2023, 2022, and 2021. Gain and losses on the sales are determined using the adjusted cost of the specific security sold. HTM securities are placed on nonaccrual status at the time any principal to interest payments become 90 days delinquent or if full collection of interest or principal becomes uncertain. Accrued interest for a security placed on nonaccrual is reversed against interest income. There was no accrued interest related to HTM securities reversed against interest income for the years ended December 31, 2023, 2022, and 2021. Sale (LHFS) Premises and equipment are stated at cost, less accumulated depreciation. The depreciation policy is to provide for depreciation over the estimated useful lives of the assets using the straight-line method. Repairs and maintenance expenditures are charged to operating expenses; major expenditures for renewals and betterments are capitalized and depreciated over their estimated useful lives. Upon retirement, sale, or other disposition of property and equipment, the cost and accumulated depreciation are eliminated from the accounts, and any gains or losses are included in operations. Building and related components are depreciated using the straight-line method with useful lives ranging from 10 to 39 years. Furniture, fixtures, and equipment are depreciated using the straight-line (or accelerated) method with useful lives ranging from 3 to 10 years. existence of events or circumstances leads to a determination that is more likely than not the fair value is less than the carrying amount, including goodwill. If, based on the evaluation, it is determined to be more likely than not that the fair value is less than the carrying value, then goodwill is tested further for impairment. The goodwill impairment loss, if any, is measured as the amount by which the carrying amount of the reporting unit, including goodwill, exceeds its fair value. Subsequent increases in goodwill value are not recognized in the consolidated financial statements. The Commercial/Retail Bank segment of the Company is the only reporting unit for Gross Carrying Amount Accumulated Amortization Net Carrying Amount Gross Carrying Amount Accumulated Amortization Net Carrying Amount 2022: purchased and repurchase agreements. There were no anti-dilutive common stock equivalents excluded in the calculations. Net Income (Numerator) Shares (Denominator) Per Share Amount Net Income (Numerator) Shares (Denominator) Per Share Amount Net Income (Numerator) Shares (Denominator) Per Share Amount stockholders. 2021. Company's consolidated financial statements. consolidated financial statements. Company's consolidated financial statements. Non-PCD loans are acquired that have experienced no or insignificant deterioration in credit quality since origination. The difference between the fair value and outstanding balance of the non-PCD loans is recognized as an adjustment to interest income over the lives of the loan. Florida panhandle. stock. The Company on credit marks from the loans acquired from Beach Bank. Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Estimated Fair Value Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Estimated Fair Value Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Estimated Fair Value Amortized Cost Estimated Fair Value Amortized Cost Estimated Fair Value Fair Value Gross Unrealized Losses Fair Value Gross Unrealized Losses Fair Value Gross Unrealized Losses Fair Value Gross Unrealized Losses Fair Value Gross Unrealized Losses Fair Value Gross Unrealized Losses 2022. The Percent of Total Percent of Total 2022, respectively. % of loans to total loans Current The following tables Past Due Days Past Due 90 Days or deemed to possess average to superior credit quality, requiring no more than normal attention. (In thousands) December 31, 2017 Real Estate Commercial follows: lease payments over the lease term. In 2023, the Bank had available $147.3 million to pay dividends. Amount Amount Amount in 2026. The Company expects to fully utilize the net operating losses. 2019. 2021. 2021. Upon the acquisition of Iberville Bank, Southwest Banc Shares, Inc., FMB Banking Corporation, and SWG, the Bank assumed deferred compensation agreements with directors and employees. At December 31, 2023. such options. These options had a weighted average exercise price of $29.23 and were fully vested upon acquisition. DEBT 649,607 at December 31, 2021. Commitments to extend credit and letters of credit include some exposure to credit loss in the event of nonperformance of the customer. Commitments to extend credit are agreements to lend to a customer as long as there is no violation of any condition established in the contract. Standby letters of credit are conditional commitments issued by the Bank to guarantee the performance of a customer to a third party. The credit policies and procedures for such commitments are the same as those used for lending activities. Because these instruments have fixed maturity dates and because a number expire without being drawn upon, they generally do not present any significant liquidity risk. No significant losses on commitments were incurred during the Loans securities and Level 3 for accrued interest receivable related to loans. Level 2 classification. follows: RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE Financial Statement Schedules: /s/ Valencia M. WilliamsonWithcompletion of the acquisitions of First Community Bank and Sunshine Community Bank, the market price ofperiod in which such impairment is determined to exist. Any such charge could have a material adverse effect on our common stock may be affected by factors different from those historically affecting our independent operations through The First.The historic businesses of each of The First, First Community Bank, and Sunshine Community Bank differ in important respects, and accordingly, the results of operationsoperations.·actual or anticipated quarterly fluctuations in our operating results, financial condition or asset quality; ·changes in financial estimates or the publication of research reports and recommendations by financial analysts or actions taken by rating agencies with respect to us or other financial institutions; ·failure to declare dividends on our common stock from time to time; ·failure to meet analysts’ revenue or earnings estimates; ·failure to integrate acquisitions or realize anticipated benefits from acquisitions; ·strategic actions by us or our competitors, such as acquisitions, restructurings, dispositions or financings; ·fluctuations in the stock price and operating results of our competitors or other companies that investors deem comparable to us; ·future sales of our common stock or other securities;·proposed or final regulatory changes or developments; ·anticipated or pending regulatory investigations, proceedings, or litigation that may involve or affect us; ·reports in the press or investment community generally relating to our reputation or the financial services industry; ·domestic and international economic and political factors unrelated to our performance; ·general market conditions and, in particular, developments related to market conditions for the financial services industry; 23·adverse weather conditions, including floods, tornadoes and hurricanes; and ·geopolitical conditions such as acts or threats of terrorism or military conflicts.Deposit Insurance Fund,DIF, or any other governmental agency or instrumentality, or any private insurer, and are subject to investment risk, including the possible loss of principal.share value.24loans a bank may make to its parent company. Under certain conditions, dividends paid to us bypay from The First are subject to approval by the OCC. A national bank may not pay dividends from its capital. All dividends must be paid out of undivided profits then on hand, after deducting expenses, including reservesFirst. See “Item 1. Business – Regulation and Supervision” included herein for losses and bad debts. In addition, a national bank is prohibited from declaring a dividend on its shares of common stock until its surplus equals its stated capital, unless the bank has transferred to surplus no less than one-tenth of its net profits of the preceding two consecutive half-year periods (in the case of an annual dividend). The approval of the OCC is required if the total of all dividends declared by a national bank in any calendar year exceeds the total of its net profits for that year combined with its retained net profits for the preceding two years, less any required transfers to surplus. In addition, under The Federal Deposit Insurance Corporation Improvement Act of 1991, the banks may not pay a dividend if, after paying the dividend, the bank would be undercapitalized.ITEM 1B.UNRESOLVED STAFF COMMENTScompany’sBoard of Directors’ Role in Oversight of Cybersecurity ThreatsHwyHighway 98 West in Hattiesburg, Mississippi. As of year-end, we had 43110 full service banking and financial servicesservice offices, and one motor bank facility as well as fourand five loan production offices. We lease the Hardy Court Branch, the Gulfport Downtown Branch, the Pascagoula Branch, the Ocean Springs Branch, the Fairhope Branch, the Bayley’s Corner Branch, the Theodore Branch, the Dauphin Island Branch, the Baton Rouge Branch,offices across Mississippi, Alabama, Florida, Georgia and the Pensacola Downtown Branch, which comprise ten of our full services banking and financial services offices. We also lease the Brandon, the Madison, the Ocean Springs and the Slidell loan production offices.Louisiana. Management ensures that all properties, whether owned or leased, are maintained in suitable condition.ITEM 4.MINE SAFETY DISCLOSURES25ITEM 5.MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIESOurtradesare traded on the Nasdaq Global Marketglobal market under the ticker symbol “FBMS”. The following table sets forth the high and low sales price of the Company’s common stock as reported on the NASDAQ Global Market. These prices do not reflect retail mark-ups, mark-downs or commissions. Cash High Low Dividends Sale Sale Paid 2017 4th quarter $ 34.35 $ 29.95 $ 0.0375 3rd quarter 30.35 26.35 0.0375 2nd quarter 28.65 27.225 0.0375 1st quarter 30.60 27.125 0.0375 2016 4th quarter $ 28.50 $ 17.10 $ 0.0375 3rd quarter 19.55 16.99 0.0375 2nd quarter 17.72 15.50 0.0375 1st quarter 18.50 15.32 0.0375 1,9614,618 record holders of the Company’s common stock at March 13, 2018February 21, 2024 and 12,339,49231,227,881 shares outstanding.PaymentDividendsprincipal sourcesFirsts to pay dividends to the Company and the ability of funds to the Company to pay dividends are the dividends received from The First, National Banking Association, Hattiesburg, Mississippi. Consequently, dividends are dependent upon The First’s earnings, capital needs, regulatory policies, as well as statutoryon its common stock is set forth in Part 1 – Item 1. Business – Supervision and regulatory limitations. Federal and state banking laws and regulations restrict the amountRegulation of dividends and loans a bank may make to its parent company. Approval by the Company’s regulators is required if the total of all dividends declared in any calendar year exceed the total of its net income for that year combined with its retained net income of the preceding two years.periodquarter ended December 31, 2017.2023.Period Total

Number of

Shares

PurchasedAverage

Price Paid

Per ShareTotal Number of

Shares Purchased as

Part of Publicly

Announced Plans or

ProgramsMaximum Number of

Shares that May Yet

Be Purchased Under

the Plans or Programs (in thousands) (a)October — $ — — $ 50,000 November — — — 50,000 December 856 26.91 — 50,000 Total 856 (b) $ 26.91 — Current Program

Number of

Shares

Purchased

Price Paid

Per Share

Shares Purchased

as Part of Publicly

Announced Plans or

Programs

Number of

Shares that

Under the

Plans or

Programs 1st Quarter 2017 10,403 $ 27.65 - - 2nd Quarter 2017 1,464 28.65 - - 3rd Quarter 2017 - - - - 4th Quarter 2017 - - - - Total 11,867 (a) $ 28.15 - - (a)Represents shares withheld by the Company in order to satisfy employee tax obligations for vesting of restricted stock awards.

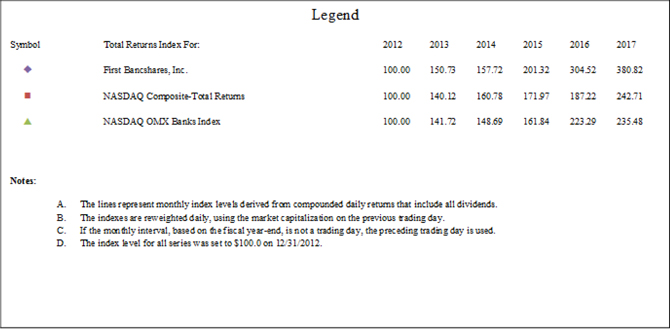

(a)On February 28, 2023, the Company announced that its Board of Directors authorized a new share repurchase program (the "2023 Repurchase Program"), pursuant to which the Company may purchase up to an aggregate of $50.0 million in shares of the Company's issued and outstanding common stock. The 2023 Repurchase Program expired on December 31, 2023.2620112018 and the reinvestment of dividends thereafter, to that of the common stocks of United States companies reported in the Nasdaq Composite-Total Returns Index and the common stocks of the Nasdaq OMX Banks Index. The Nasdaq OMX Banks Index contains securities of Nasdaq- listedNasdaq-listed companies classified according to the Industry Classification Benchmark as Banks.banks. They include banks pro-vidingproviding a broad range of financial services, including retail banking, loans and money transmissions.

27

Legend Symbol Total Returns Index For: 2018 2019 2020 2021 2022 2023

First Bancshares, Inc. 100.00 118.55 104.82 133.07 112.80 106.66

NASDAQ Composite-Total Returns 100.00 136.69 198.10 242.03 163.28 236.17