UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K10-K/A

(Amendment No. 1)

(Mark One)

x☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D)15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20172020

OR

¨☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D)15(d) OF THE SECURITIES EXCHANGE ACT OF1934

For the transition period from __________[ ] to __________

[ ]

Commission File Number:file number 001-38025

MATLIN & PARTNERS ACQUISITION CORPORATIONU.S. WELL SERVICES, INC.

(Exact name of registrant as specified in its charter)

Delaware | | 81-1847117 |

(State or other jurisdiction of

| | (I.R.S. Employer incorporation or |

organization) | | (I.R.S. Employer

Identification Number) No.) |

585 Weed Street

New Canaan, CT1360 Post Oak Boulevard, Suite 1800, Houston, TX

| | 0684077056 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:(203) 864-3144

code (832) 562-3730

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class: each class | Trading Symbol(s) | Name of Each Exchangeeach exchange on Which Registered: which registered |

Common Stock,CLASS A COMMON SHARES $0.0001, par value $0.0001 per share WARRANTS | USWS USWSW | The NASDAQ StockCapital Market LLC |

Warrants to purchase one-half of one share of Common Stock | | The NASDAQ StockCapital Market LLC |

Units, each consisting of one share of Common Stock and one Warrant | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Sectionsection 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐Yes ¨☑Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. ☐Yes ¨☑Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☑Yesx☐No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☑Yesx☐ No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, , a smaller reporting company, or an emerging growth company. See definitionthe definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”company,” and “emerging"emerging growth company”company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer¨ | ☐ | | Accelerated filer¨ | ☐ |

| | |

| Non-accelerated filerx | ☑ | | Smaller reporting company¨ | ☑ |

Emerging growth company | ☑ | | | |

Emerging growth companyx

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐Yes ☒☑No¨

AsThe aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant computed as of June 30, 2017, the2020 (the last business day of the registrant’s most recentlyrecent completed second fiscal quarter,quarter) based on the aggregate market valueclosing price of the Class A common stock outstanding, other than shares held by persons who may be deemed affiliates of the registrant, computed by reference to the closing sales price for the common stock on June 30, 2017, as reported on the Nasdaq Capital Market was $313.6 million.

$21,639,925.

As of March 28,2, 2021, the registrant had 83,600,445 shares of Class A Common Stock and 2,296,525 shares of Class B Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required to be disclosed in Part III of this report is incorporated by reference from the registrant’s definitive proxy statement or an amendment to this report, which will be filed with the SEC not later than 120 days after the end of the fiscal year covered by this report.

EXPLANATORY NOTE

This Amendment No. 1 to the Annual Report on Form 10-K/A (this “Amendment”) amends the Annual Report on Form 10-K of U.S. Well Services, Inc. (the “Company,” “we,” “us” or “our”) for the year ended December 31, 2020, as filed with the Securities and Exchange Commission (“SEC”) on March 11, 2021 (the “Original Form 10-K”). This Amendment restates the Company’s previously issued consolidated financial statements as of and for the years ended December 31, 2020, 2019 and 2018, there were 32,500,000 sharesand for the interim periods within the years ended December 31, 2020 and 2019 (collectively, the “Affected Periods”). The correction to the financial statements made in connection with the restatement involves only non-cash adjustments.

On April 12, 2021, the Staff of the SEC (the “SEC Staff”) issued a public statement entitled “Staff Statement on Accounting and Reporting Considerations for Warrants issued by Special Purpose Acquisition Companies (“SPACs”)” (the “SEC Staff Statement”). In the SEC Staff Statement, the SEC Staff expressed its view that certain terms and conditions common to SPAC warrants may require the warrants to be classified as liabilities of the entity measured at fair value, with changes in fair value each reporting period in earnings, as opposed to being treated as equity. Following the issuance of the SEC Staff Statement, on May 11, 2021, the Audit Committee of our Board of Directors, after considering the recommendation of and consultation with management and Company’s independent registered public accounting firm, concluded that the Company’s previously issued audited consolidated financial statements included in the Company’s previously filed Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q for the Affected Periods should be restated to reflect the impact of the SEC Staff Statement and accordingly, should no longer be relied upon. Similarly, any previously furnished or filed reports, related earnings releases, investor presentations and similar communications of the Company describing the Company’s financial results for the Affected Periods should no longer be relied upon.

The Company issued public warrants and private placement warrants (collectively, the “public and private placement warrants”) in connection with its initial public offering in November 2018. Additionally, the Company issued warrants to certain institutional investors in connection with its private placement of Series A Preferred Stock on May 24, 2019 (the “Series A warrants,” and together with the public and private placement warrants, the “warrants”). The Company accounted for the warrants as equity based on its initial evaluation of the accounting treatment for the warrants and believed its positions to be appropriate at those times. As a result of the SEC Staff Statement, the Company has determined that the warrants should be classified as liabilities measured at fair value upon issuance, with subsequent changes in fair value reported in the Company’s consolidated statements of operations each reporting period pursuant to Accounting Standards Codification Topic 815, Derivatives and Hedging.

The change in accounting for the warrants did not have any impact on the Company’s previously reported revenues, operating income, or non-GAAP financial measures, Adjusted EBITDA and Adjusted EBITDA margin, for any of the Affected Periods.

The Company is amending and restating, in this Amendment, its financial statements for the following periods:

| • | audited consolidated financial statements as of and for the years ended December 31, 2020, 2019 and 2018; |

| • | unaudited interim financial information as of and for the three months ended March 31, 2020 and 2019; |

| • | unaudited interim financial information as of and for the three and six months ended June 30, 2020 and 2019; and |

| • | unaudited interim financial information as of and for the three and nine months ended September 30, 2020 and 2019, in each case to reflect the change in accounting treatment (collectively, the “Restatement”). |

This Amendment presents the Original Form 10-K, amended and restated with modifications as necessary to reflect the Restatement. The following items have been amended to reflect the Restatement:

| • | Part I, Item 1A. Risk Factors. |

| • | Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

| • | Part II, Item 8. Financial Statements and Supplementary Data. |

| • | Part II, Item 9A. Controls and Procedures. |

| • | Part IV, Item 15. Exhibits, Financial Statement Schedules. |

In addition, in accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended, the Company is also including with this Amendment currently dated certifications of the Company’s Class A common stock, par value $0.0001 per share,Chief Executive Officer and Principal Financial Officer (attached as Exhibits 31.1, 31.2, 32.1, and 32.2).

Refer to Note 2 to the Notes to the Consolidated Financial Statements included in Part II, Item 8 of this Amendment for additional information on the Restatement and the related financial statement effects.

Refer to Part II, Item 9A. “Controls and Procedures” of this Amendment for a discussion of management’s consideration of our disclosure controls and procedures, internal control over financial reporting, and the identified material weakness in our internal control over financial reporting related to the accounting for a significant and unusual transaction related to the warrants.

The Company has not amended its previously filed Annual Reports on Form 10-K for the years ended December 31, 2019 or 2018 or its previously filed Quarterly Reports on Form 10-Q for the interim periods within the years ended December 31, 2020 and 2019. The financial information that has been previously filed or otherwise reported in such previously filed reports is superseded by the information in this Amendment, and the financial statements and related financial information contained in such previously filed reports should no longer be relied upon.

In order to preserve the nature and character of the registrant (“Class A common stock”) and 8,125,000 sharesdisclosures set forth in the Original Form 10-K, this Amendment speaks as of the Company’s Class F common stock, par value $0.0001 (the “Class F common stock”) issueddate of the filing of the Original Form 10-K and outstanding.the disclosures contained in this Amendment have not been updated to reflect events occurring subsequent to that date, other than those associated with the Restatement as described above. Among other things, forward-looking statements made in the Original Form 10-K have not been revised to reflect events that occurred or facts that became known to the Company after the filing of the Original Form 10-K, and such forward looking statements should be read in their historical context.

MATLIN & PARTNERS ACQUISITION CORPORATION

TABLE OF CONTENTS

Unless otherwise stated in this annual report

Cautionary Note Regarding Forward Looking Statements

This Annual Report on Form 10-K references to:

“we,” “us,” “company” or “our company” are to Matlin & Partners Acquisition Corporation, a Delaware corporation;

“public shares” are to shares of our Class A common stock sold(“Annual Report”) contains “forward-looking statements” as part of the unitsdefined in our initial public offering (whether they are purchased in our initial public offering or thereafter in the open market);

“warrants” are to our warrants sold as part of the units in our initial public offering (whether they are purchased in our initial public offering or thereafter in the open market) and the private placement warrants;

“public stockholders” are to the holders of our public shares, including our sponsor, directors and officers to the extent our sponsor, officers or directors purchase public shares, provided that our sponsor’s status as a “public stockholder” shall only exist with respect to such public shares;

“initial stockholders” are to holders of our founder shares prior to our initial public offering (or their permitted transferees);

“management” or our “management team” are to our officers and directors;

“sponsor” are to Matlin & Partners Acquisition Sponsor LLC, a Delaware limited liability company and an affiliate of David J. Matlin, our Chairman and Chief Executive Officer;

“MatlinPatterson” are to MatlinPatterson Global Advisers LLC, an affiliate of David J. Matlin, our Chairman and Chief Executive Officer;

“founder shares” are to shares of our Class F common stock initially purchased by our sponsor in a private placement prior to our initial public offering and the shares of our Class A common stock issued upon the automatic conversion thereof at the time of our initial business combination;

“common stock” are to our Class A common stock and our Class F common stock; and

“private placement warrants” are to the warrants issued to our sponsor and Cantor Fitzgerald in a private placement simultaneously with the closing of our initial public offering.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report, including, without limitation, statements under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” includes forward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements usually relate to future events, conditions and anticipated revenues, earnings, cash flows or the Exchange Act. Theseother aspects of our operations or operating results. All statements, other than statements of historical information, should be deemed to be forward-looking statements. Forward-looking statements can beare often identified by the use of forward-looking terminology, including the words such as “believes,” “estimates,” “anticipates,” “expects,” “intends,” “estimates,” “projects,” “anticipates,” “will,” “plans,” “may,” “will,“should,” “potential,“would,” “projects,” “predicts,” “continue,“foresee,” or “should,” or, in each case, theirthe negative or other variations or comparable terminology. There can be no assurancethereof. The absence of these words, however, does not mean that actual results will not materially differ from expectations. Suchthese statements include, but are not limited to, any statements relating to our ability to consummate any acquisition or other business combination and any other statements that are not statements of current or historical facts.forward-looking. These statements are based on management’s current expectations, but actual results may differ materially due to various factors, including, but not limited to:

● | our ability to complete our initial business combination; |

| |

● | our success in retaining or recruiting, or changes required in, our officers, key employees or directors following our initial business combination; |

| |

● | our officers and directors allocating their time to other businesses and potentially having conflicts of interest with our business or in approving our initial business combination, as a result of which they would then receive expense reimbursements; |

| |

● | our potential ability to obtain additional financing to complete our initial business combination; |

| |

● | our pool of prospective target businesses; |

| |

● | failure to maintain the listing on, or the delisting of our securities from, Nasdaq or an inability to have our securities listed on Nasdaq or another national securities exchange following our initial business combination; |

| |

● | the ability of our officers and directors to generate a number of potential investment opportunities; |

| |

● | our public securities’ potential liquidity and trading; |

| |

● | the lack of a market for our securities; |

| |

● | the use of proceeds not held in the trust account or available to us from interest income on the trust account balance; or |

| |

● | our financial performance. |

The forward-looking statements contained in this report are based on our current expectations, beliefs and beliefsassumptions concerning future developments and business conditions and their potential effectseffect on us. FutureWhile management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us may notwill be those that we have anticipated. Theseanticipate.

All our forward-looking statements involve a number of risks and uncertainties (some of which are significant or beyond our control) and other assumptions that maycould cause actual results to differ materially from our historical experience and our present expectations or performanceprojections. Known material factors that could cause actual results to bediffer materially different from those expressed or implied by thesecontemplated in the forward-looking statements. These risksstatements include those set forth in “Item 1A. Risk Factors” and uncertainties include, but areelsewhere in this Annual Report. We caution you not limited to those factors described underplace undue reliance on any forward-looking statements, which speak only as of the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.date hereof. We undertake no obligation to publicly update or revise any of our forward-looking statements after the date they are made, whether as a resultbecause of new information, future events, or otherwise, except as may beto the extent required under applicable securities laws. These risks and others described under “Risk Factors” may not be exhaustive.by law.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this report. In addition, even if our results or operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements contained in this report, those results or developments may not be indicative of results or developments in subsequent periods.

PART I

Item 1. Business.

BUSINESS Overview

We are one of the pioneer companies in developing the electric hydraulic fracturing industry. We are based in Houston, Texas and provide our services to oil and natural gas exploration and production (“E&P”) companies in the United States. We are one of the first companies to develop and commercially deploy electric-powered hydraulic fracturing technology (“Clean Fleet®”), which we believe is an industry-changing technology. Our Clean Fleet® technology has a blank check company incorporateddemonstrated track record for successful commercial operation, with over 18,750 electric frac stages completed since the first Clean Fleet® was deployed in March 2016July 2014. Our Clean Fleet® technology is supported by a robust intellectual property portfolio, consisting of 38 granted patents and an additional 189 pending patents. We believe that the following characteristics of the Clean Fleet® technology provide the Company with a distinct competitive advantage:

| • | Industry Leading Environmental Profile |

| • | Enhanced Wellsite and Community Safety Profile |

| • | Superior Operational Efficiency Profile |

Currently, we provide our services in the Appalachian Basin, the Eagle Ford, and the Permian Basin. We have demonstrated the capability to expeditiously deploy our fleets to new oil and gas basins when requested by customers. Our customers include Apache Corporation, Marathon Oil, Range Resources, Shell, BP, and other leading E&P companies.

Company Formation

On February 21, 2012, U.S. Well Services, LLC (“USWS LLC”) was formed as a Delaware corporationlimited liability company and subsequently grew organically from one diesel powered hydraulic fracturing fleet (“Conventional Fleets”) in April 2012 to 14 available fleets representing 684,545 hydraulic horsepower (“HHP”); five of which utilize our patented electric-powered hydraulic fracturing technology (the “Clean Fleet®”).

As part of a corporate restructuring in February 2017, all of the outstanding equity interest of USWS LLC was acquired by a newly formed entity, USWS Holdings, LLC (“USWS Holdings”), a Delaware limited liability company that was formed for the purposes of effecting the corporate restructuring and that had no operations of its own. USWS Holdings was acquired by U.S. Well Services, Inc. (f/k/a Matlin & Partners Acquisition Corporation, or “MPAC”) on November 9, 2018, as discussed further under Business Combination herein.

Business Combination

On March 10, 2016, MPAC was incorporated in Delaware as a special purpose acquisition company for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or other similar business combination with one or more businesses, which we refer to throughout this report as our initial business combination. We are currently in the process of identifying potential business combination targets.

Our management team is led by David J. Matlin, our Chairman and Chief Executive Officer. Mr. Matlin is also co-founder, Chief Executive and Chief Investment Officer of MatlinPatterson Global Advisers LLC, or MatlinPatterson, which he co-founded in 2002. Mr. Matlin is also the Chief Executive Officer (since January 2015) and a managing principal (since December 2012) of MatlinPatterson Asset Management L.P. whose operating joint venture affiliates manage non-distressed credit strategies.

Prior to forming MatlinPatterson, Mr. Matlin was a Managing Director at Credit Suisse and head of its Global Distressed Securities Group since its inception in 1994. Mr. Matlin was also a Managing Director and a founding partner of Merrion Group, L.P. Mr. Matlin currently serves on the board of directors of Flagstar Bank FSB, a federally chartered savings bank, Flagstar Bancorp, Inc., a savings and loan holding company He also serves on the board of directors of Orthosensor Inc. and Pristine Surgical LLC, both medical device manufacturers.

Under Mr. Matlin’s leadership and management, MatlinPatterson’s three distressed-for-control private equity funds, with nearly $9 billion in aggregate capital commitments, have invested more than $7.6 billion in 43 portfolio companies controlled by MatlinPatterson. ‘‘Control’’ means the ability to exercise control or substantial influence through significant board representation, substantial equity ownership, shareholder agreements and similar agreements and structures. At Credit Suisse, from 1994 to 2001, the Global Distressed Securities Group under Mr. Matlin’s supervision and management pursued both distressed-for-control and non-control distressed and special situation investing, and invested more than $4.4 billion in 261 portfolio companies, of which 37 were in distressed-for-control investments. During this period at Credit Suisse and MatlinPatterson, Mr. Matlin and individuals under his supervision have served on the board of directors of more than 51 companies, eight of which have been public, and all of which were directly related to investments made by Credit Suisse and MatlinPatterson, and have provided advice and assistance in a broad array of initiatives.

Our management team also includes Peter Schoels and Greg Ethridge.

Peter Schoels, one of our directors, also serves as Managing Partner of MatlinPatterson. Mr. Schoels is also a managing principal of MatlinPatterson Asset Management L.P. and its operating joint venture affiliates. Prior to joining MatlinPatterson, he was a Vice President of the Credit Suisse Global Distressed Securities Group, investing in North America, Latin America, and Europe. Prior to joining Credit Suisse, Mr. Schoels was a Director of Finance and Strategy of Itim Group Plc. Previously, Mr. Schoels was Manager of Mergers and Acquisitions for Ispat International NV, now ArcelorMittal, which specialized in buying distressed steel assets globally. Mr. Schoels serves on the board of directors of Flagstar Bank FSB, Flagstar Bancorp, Inc.. and Crescent Communities, LLC, a multi-asset class real estate developer.

Greg Ethridge, our President, also serves as Senior Partner of MatlinPatterson. Prior to joining MatlinPatterson, Mr. Ethridge was a principal in the Recapitalization and Restructuring group at Broadpoint Capital, Inc. where he moved his team from Imperial Capital. Mr. Ethridge was a founding member of the corporate finance advisory practice for Imperial Capital LLC in New York. Prior to Imperial Capital, Mr. Ethridge was a principal investor at Parallel Investment Partners LP (formerly part of Saunders, Karp and Megrue) executing recapitalizations, buyouts and growth equity investments for middle market companies. Previously, Mr. Ethridge was an associate in the Recapitalization and Restructuring Group at Jefferies and Company, Inc. where he executed corporate restructurings and leveraged finance transactions, and before that he was a crisis manager at Conway, Del Genio, Gries & Co. in New York. Mr. Ethridge serves as a director of Crescent Communities, LLC and Advantix Systems Ltd.

We believe that we will derive significant benefit from our management team which we believe has distinctive experience in identifying and acquiring businesses that are underperforming or distressed and/or are operating in industries undergoing dislocation. We intend to focus our efforts on seeking and completing an initial business combination with a company that has an enterprise value of between $1 billion and $1.8 billion, although a target entity with a smaller or larger enterprise value may be considered. While we may pursue an acquisition opportunity in any sector, the global decline in commodity prices since 2014 as well as the quickly changing regulatory environment have led to severe dislocation in the commodity and specialty chemicals, exploration and production, metals and mining, materials, power generation, transportation and infrastructure, refining, financial institutions, specialty lending, healthcare and insurance sectors. Our initial focus will be to pursue underperforming companies in these sectors as potential candidates for a business combination.

Significant Activities Since Inception

businesses. On March 15, 2017, weMPAC consummated ourits initial public offering (the “IPO”), following which its shares began trading on the Nasdaq Capital Market (“Nasdaq”).

On November 9, 2018, MPAC acquired USWS Holdings (the “Transaction”) pursuant to a Merger and Contribution Agreement, dated as of 32,500,000 units,includingJuly 13, 2018 (as amended, the partial exercise“Merger and Contribution Agreement”). The Transaction was accounted for as a reverse recapitalization. Under this method of accounting, USWS Holdings is treated as the acquirer and MPAC is treated as the acquired party.

In connection with the closing of the underwriter’s over-allotment optionTransaction, MPAC changed its name to U.S. Well Services, Inc. (“USWS Inc.”) and its trading symbols on Nasdaq from “MPAC,” and “MPACW,” to “USWS” and “USWSW”.

Pursuant to the Merger and Contribution Agreement, on November 9, 2018, USWS Inc. issued Class A common stock to certain members of 2,500,000 units. USWS Holdings in exchange for their interests in USWS Holdings and Class B common stock to certain

members of USWS Holdings who retained their interests in USWS Holdings.

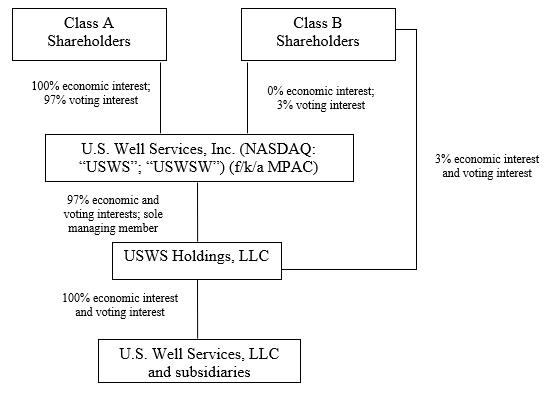

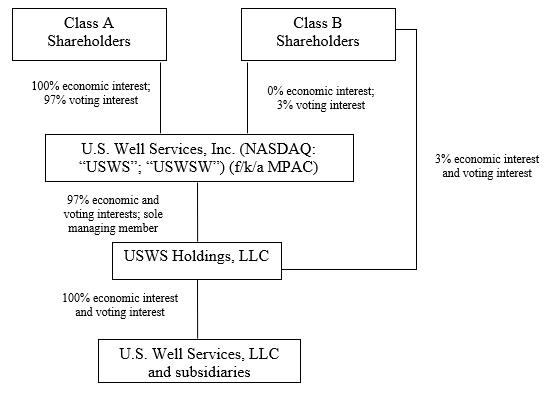

Following the completion of the Transaction, the Company was organized as an “Up-C” structure, meaning that substantially all the Company’s assets and operations are held and conducted by USWS LLC. The Company’s only assets are equity interests representing 97% ownership of USWS Holdings as of December 31, 2020. The Transaction did not include a tax receivable agreement.

Organizational Structure

The following diagram illustrates the ownership structure of the Company as of December 31, 2020:

Each share of Class B common stock has no economic rights in USWS Inc. but entitles its holder to one vote on all matters to be voted on by shareholders generally. Holders of Class A common stock and Class B common stock vote together as a single class on all matters presented to our shareholders for their vote or approval, except as otherwise required by applicable law. We do not intend to list the Class B common stock on any exchange.

Under the Amended and Restated Limited Liability Company Agreement of USWS Holdings, each share of Class B common stock of USWS Inc., together with one unit consistedof USWS Holdings and subject to certain limitations, is exchangeable (the "Exchange Right") for one share of Class A common stock of USWS Inc. or, at the Company's election, the cash equivalent to the market value of one share of Class A common stock of USWS Inc. The exchange is subject to conversion rate adjustments for stock splits, stock dividends, reclassifications, and one warrantother similar transactions. In addition, upon a change in control of USWS Inc., USWS Inc. has the right to purchase one sharerequire each holder of USWS Holdings units (other than USWS Inc.) to exercise its Exchange Right with respect to some or all of such holder's USWS Holdings units. An exchange of Class A Common Stock. Each whole warrant entitles the holder to purchase one-halfB common stock of one share of Class A Common Stock at an exercise price of $5.75 per half share. The units were sold in our initial public offering at an offering price of $10.00 per unit, generating gross proceeds of $325.0 million (before underwriting discounts and commissions and offering expenses). SimultaneouslyUSWS Inc., together with the consummationcorresponding one unit of our initial public offering, we completed a private placement of 15,500,000 warrants at a price of $0.50 per warrant, issued to our sponsor and representative of the underwriters for our initial public offering, generating total proceeds of $7.75 million.USWS Holdings, will result in both being cancelled.

A total of $325 million of the net proceeds from our initial public offering (including the partial over-allotment) and the private placement with the sponsor and the representative were deposited in a trust account established for the benefit of the Company’s public stockholders. Operations

Our units began trading on March 10, 2017 onoperations are organized into a single business segment, which consists of hydraulic fracturing services, and we have one reportable geographical business segment, the NASDAQ Capital Market under the symbol MPACU. Commencing on April 28, 2017, the securities comprising the units began separate trading. The units, common stock, and warrants are trading on the NASDAQ Capital Market under the symbols “MPACU,” “MPAC” and “MPACW,” respectively. United States.

Services

Business StrategyWe provide hydraulic fracturing services to E&P companies. Hydraulic fracturing services are performed to enhance the production of oil and natural gas from formations with low permeability and restricted flow of hydrocarbons. Our customers benefit from our expertise in fracturing of horizontal and vertical oil and natural gas-producing wells in shale and other unconventional geological formations.

The process of hydraulic fracturing involves pumping a pressurized stream of fracturing fluid — typically a mixture of water, chemicals, and proppant — into a well casing or tubing to cause the underground mineral formation to fracture or crack. Fractures release trapped hydrocarbon particles and provide a conductive channel for the oil or natural gas to flow freely to the wellbore for collection. The propping agent, or proppant, becomes lodged in the cracks created by the hydraulic fracturing process, “propping” them open to facilitate the flow of hydrocarbons from the reservoir to the well.

Our strategy is to identify and acquire a business that is misvalued or underperforming in an industry impacted by market dislocation or regulatory uncertainty and whose market value and operating results we believe can be positively affected by our management team. The MatlinPatterson affiliated membersfleets consist of our management team have an aggregate of over 60 years of experience setting and implementing strategies to grow revenues and improve profitability, including: engaging in capital marketsmobile hydraulic fracturing units and other restructuring activities, evaluating, changing or enhancing management when appropriate, pursuing acquisitionauxiliary heavy equipment to perform fracturing services. We have two designs for our hydraulic fracturing units: (1) Our legacy conventional fleets, which are powered by diesel fuel and divestiture opportunities,utilize traditional internal combustion engines, transmissions, and craftingradiators and (2) our next-generation Clean Fleet®technology, which replaces the traditional engines, transmissions, and radiators with electric motors powered by electricity created by turbine generators. Both designs utilize high-pressure hydraulic fracturing pumps mounted on trailers. We refer to the group of pump trailers and other initiatives, whether through board control or influence or substantial equity ownership of portfolio companies over which MatlinPatterson or Credit Suisse’s Global Distressed Securities Group (while under Mr. Matlin’s management) exercised control.equipment necessary to perform a typical fracturing job as a “fleet,” and the personnel assigned to each fleet as a “crew.”

While underperformance can result from many factors we expectOur Clean Fleet® equipment also allows us to initially focus on targets that underperforming aspursue business opportunities outside of the upstream oil and gas sector. We offer power generation services, leasing turbine generators and ancillary power generation equipment under short or long-term arrangements, along with skilled personnel, to provide peaking power and other power generation needs to customers in a resultvariety of market conditions driven by commodity supply/demand imbalances or periodsindustries and markets. Although this has not been a material source of regulatory uncertainty surrounding future business activities. Specifically,revenue for us historically, we believe that targets in or with exposure to the commodity and specialty chemicals, exploration and production, metals and mining, materials, power generation transportationservices represent an attractive avenue for future growth.

Clean Fleet® Technology

Our Clean Fleet® combines natural gas turbine generators with electric motors and infrastructure, refining, financial institutions, specialty lending, healthcareexisting industry equipment to provide fracturing services with numerous advantages over conventional fleets. Our Clean Fleet® technology is a proven technology that has been in commercial operations since July 2014, making us a leading provider of electric-powered hydraulic fracturing services. Our Clean Fleet® technology is supported by a robust intellectual property portfolio. We have been granted, or have received notice of allowance, for 38 patents and insurance sectors provide a large opportunity set followinghave an additional 189 patents pending.

We believe Clean Fleet® technology provides the global commodity downturn that began in 2014 and the uncertain regulatory environment. Our management believes that increasing leverage, a lack of access to capital markets and regulatory uncertainty have caused many private companies in these sectors to be misvalued and underappreciated. Based on our management team’s experience at MatlinPatterson, we believe that these trends create excellent opportunities for an organization with our strategy and our management’s core competencies. However, we may pursue a business combinationCompany with a company that is misvalued due to other factors such as lackdistinct competitive advantage over our competitors because of strategic direction, an overly burdensome or unsustainable capital structure, an inability to fund capital needs, litigation and corporate fraud.the following characteristics:

| 2• | Industry Leading Environmental Profile – Clean Fleet® technology offers superior emissions performance as compared to traditional diesel-powered hydraulic fracturing equipment. |

In order to execute our business strategy, we intend to:

Utilize the management team’s extensive sourcing network to identify underperforming companies and assets: Our management team has an extensive sourcing network to identify a promising target business that is underperforming, likely due to dislocated market conditions, which have been overlooked or rejected by other investors.

Assemble a team of industry and financial experts: For each potential transaction, we intend to assemble a team of industry and financial experts to supplement our management’s efforts to identify and resolve key issues facing a company. We intend to a construct an operating and financial reorganization plan which optimizes the potential to grow shareholder value. With extensive experience investing in troubled businesses, we expect that our management will be able to demonstrate to the target business and its stakeholders that we have the resources and expertise to lead the combined company through complex and often turbulent market conditions and provide the strategic and operational direction necessary to stabilize and grow the business in order to maximize cash flows and improve the overall strategic prospects for the business.

Conduct rigorous research and analysis: Performing disciplined, bottom-up fundamental research and analysis is core to our strategy, and we intend to conduct extensive due diligence to evaluate the impact that a transaction may have on a target business.

Acquire the target company at an attractive price relative to our view of intrinsic value: Combining rigorous bottom-up analysis as well as input from industry and financial experts, the management team intends to develop its view of the intrinsic value of a potential business combination. In doing so, the management team will evaluate future cash flow potential, relative industry valuation metrics and precedent transactions to inform its view of intrinsic value, with the intention of creating a business combination at an attractive price relative to its view of intrinsic value.

Implement operational and financial structuring opportunities: Our management team has the ability to structure and execute a business combination that will provide the combined business with a capital structure that will support the growth in shareholder value and give it the flexibility to grow organically and/or through strategic acquisitions or divestitures. We intend to also develop and implement strategies and initiatives to improve the business’s operational and financial performance and create a platform for growth.

Seek strategic acquisitions and divestitures to further grow shareholder value: The management team intends to analyze the strategic direction of the company and evaluate non-core asset sales to create financial and/or operational flexibility for the company to engage in organic or inorganic growth. Specifically, the management team intends to evaluate opportunities for industry consolidation in the company’s core lines of business as well as opportunities to vertically or horizontally integrate with other industry participants.

Following our initial business combination, we intend to evaluate opportunities to enhance shareholder value, including developing and implementing corporate strategies and initiatives to provide financial and operational runway such that the company can improve profitability and long-term value. In doing so, the management team anticipates evaluating corporate governance, assessing and possibly replacing management, opportunistically accessing capital markets and other opportunities to enhance liquidity, identifying acquisition and divestiture opportunities, and properly aligning management and board incentives with growing shareholder value.

| 3• | Reduced Fuel Costs – Clean Fleet® technology uses electric motors to drive its frac pumps instead of internal combustion engines and transmissions used on traditional, diesel-powered fracturing equipment. Clean Fleet®’s electric motors are powered by mobile turbine generators that can use natural gas produced and conditioned in the field (“Field Gas”), compressed natural gas (“CNG”), liquefied natural gas (“LNG”) or diesel as a fuel source. Our customers typically provide Field Gas or CNG to fuel Clean Fleet®’s turbine generators, which offers a significant cost savings relative to purchasing diesel fuel to power traditional fracturing equipment in the current market environment. |

| • | Enhanced Wellsite and Community Safety Profile – Clean Fleet® offers superior safety benefits relative to traditional diesel-powered fracturing fleets for both workers at the wellsite and inhabitants of nearby communities. |

| • | Lower Cost of Ownership – We believe Clean Fleet® offers the best cost of ownership of any commercially available hydraulic fracturing technology. Also, Clean Fleet® uses long-lived components such as electric motors, switchgears, and turbine generators that we estimate will be capable of operating for more than 15 years, while traditional diesel- |

| | powered fracturing fleets can be expected to operate for less than five years before requiring major component replacements. |

| • | Superior Operational Efficiency Profile – Clean Fleet® technology allows us to garner operational efficiencies that are difficult to achieve with traditional diesel-powered fracturing technology. By eliminating moving parts associated with internal combustion engines and transmissions, as well as eliminating the need for preventative maintenance activities such as oil filter changes, we are able to reduce maintenance-related downtime. Additionally, the ability of our Clean Fleet® technology to automatically capture and transmit vast amounts of operational, logistical, and environmental data provide us with insights that offer opportunities for continuous improvements in our operational efficiencies. |

Competitive Strengths

We are leveragingbelieve that the following sources of competitive strength in seekingstrengths will position us to achieveprovide high-quality service to our business strategy:customers and create value for our stockholders:

Experienced Management Team with Expertise in a Broad Array of Sectors and Geographies —Since his days as an investment manager within Credit Suisse beginning in 1994, and continuing thereafter at MatlinPatterson in 2002, David J. Matlin, our Chief Executive Officer, has built a unique track record by investing more than $14 billion in underperforming or distressed businesses across | • | Proprietary Clean Fleet® technology. We are a market leader in electric fracturing technology, with five all-electric hydraulic fracturing fleets. Our fleets utilizing Clean Fleet® technology provide substantial cost savings by replacing diesel fuel with natural gas and offer considerable operational, safety and environmental advantages. Clean Fleet® technology offers superior operational efficiency resulting from reduced non-productive time due to repairs, maintenance and failures associated with diesel-powered engines and transmissions. Additionally, Clean Fleet® technology can substantially reduce emissions of air pollutants and noise from the wellsite. With an increasing focus on ESG and increasing returns by our customers, we believe that adoption of this technology in the near term will materially increase and allow us to continue to significantly expand our market share over the next several years. |

| • | Strong, employee-centered culture. Our employees are critical to our success and are a key source of our competitive advantage. We continuously invest in training and development for our employees, and as a result, we can provide consistent, high-quality service and safe working conditions for both employees and customers. |

| • | Track record for safety. Safety is a critical element of our operations. We focus on providing customers with the highest quality of service by employing a trained and motivated workforce that is rigorously focused on safety. We continuously review safety data and work to develop and implement policies and procedures that ensure the safety and wellbeing of our employees, customers, and the communities in which we operate. Our field operators are empowered to stop work and question the safety of a situation or task performed. We use specialized technology to improve safety for our truck drivers and employ measures to mitigate the risk of respirable silica dust exposure on the wellsite. We believe our record of safe operations makes us an attractive partner for both our customers and our employees. Additionally, we have taken proactive measures to safeguard the physical health of our employees in response to the COVID-19 pandemic. Employees capable of working from home were mandated to do so until conditions improve making it safe for their return on a voluntary basis, and all individuals entering a Company facility or work location are required to undergo a screening process. |

| • | Strong customer relationships supported by contracts and dedications. We have cultivated strong relationships with a diverse group of customers because of the quality of our service, safety performance and ability to work with customers to establish mutually beneficial service agreements. Our contracts and dedications provide customers with certainty of service pricing, allowing them to efficiently budget and plan the development of their wells. Additionally, our contracts and dedications allow us to maintain higher utilization of our fleet and generate revenue and cash flow through industry cycles. We believe our relationships and the structure of our contracts and dedications position us to continue to build long-term partnerships with customers and support stable financial performance. |

| • | Modern, high-quality equipment and rigorous maintenance program. Our hydraulic fracturing fleets consist of modern, well-maintained equipment. We invest in high-quality equipment from leading original equipment manufacturers. Moreover, we take proactive measures to maintain the quality of our equipment, using specialized equipment to monitor frac pump integrity and our proprietary FRAC MD® data analytics platform to support preventative maintenance efforts. We believe the quality of our equipment is critical to our ability to provide high quality service to our customers. |

| • | Ability to leverage uncorrelated, growing markets. We own a significant portfolio of high-quality power generation assets consisting of mobile turbine generators and related equipment. These assets offer us the opportunity to serve customers in areas such as disaster recovery, power and utility services and other markets that are not correlated to the oil and gas industry. |

| • | Proven, cycle-tested management team. Our management team has a proven track record for building and operating oilfield service companies. As a result of our strategy, we have grown the business organically. Our operating and commercial teams have significant industry experience and longstanding relationships with our clients. We believe our management team’s experience and relationships position us to generate business and create value for stockholders. Additionally, our management team’s rapid response to the COVID-19 pandemic enabled us to maintain adequate liquidity and develop operational procedures allowing for business continuity during a turbulent market environment. |

Customer Concentration

Our customers include a broad arrayrange of sectors including materials, chemicals, metals, mining, energy, financials, healthcare, real estateleading E&P companies. For the year ended December 31, 2020, Apache Corporation, Shell, Marathon, Range, and insurance, among others. The MatlinPatterson affiliated membersEQT each comprised greater than 10% of our management team, including David J. Matlin, Peter Schoels and Greg Ethridge, have an aggregate of over 60years of experience in investing and financing, both in the private equity business as well as public market securities. We believe our management team’s diverse sector experience represents a significant competitive strength in achieving our acquisition strategy.

consolidated revenues.

Access to Investment Opportunities —Our management team has extensive long-term relationships with company owners, executives, stakeholders, industry experts, consultants, professionalsSuppliers

We purchase a wide variety of raw materials, parts and financial intermediaries. This network has providedcomponents that are manufactured and supplied for our management team with proprietary deal flow, especially in instances of significant capital structure complexity, business underperformance, or market dislocation.operations. We believe these relationships will provide us with attractive acquisition opportunities. We also intend tocurrently rely on a limited number of suppliers from which we procure major equipment components used to maintain, build, or upgrade our management team’s reputation and history of identifying and securing acquisition opportunities in the materials, chemicals, metals, energy, financials, healthcare, real estate and insurance sectors operating in market conditions driven by commodity supply/demand imbalances or periods of regulatory uncertainty.custom Clean Fleet® hydraulic fracturing equipment. In addition, some of these components have few suppliers and long lead times to acquire. Historically, we anticipate that target business candidates will be broughthave generally been able to obtain the equipment, parts and supplies necessary to support our attention from various other sources, including investment market participants and large enterprises seeking to divest non-core assets or divisions.

Despite the acquisition experience of our management team, none of our officers or directors has had direct experience with special purpose acquisition companies. Any past experience of MatlinPatterson or our management team is notoperations on a guarantee either: (i)timely basis. While we believe that we will be able to locate a suitable candidate for our initial business combination; or (ii)make satisfactory alternative arrangements in the event of any results with respect to any initial business combinationinterruption in the supply of these materials and/or equipment by one of our suppliers, we may consummate. You should not rely onalways be able to do so. In addition, certain materials for which we do not currently have long-term supply agreements could experience shortages and significant price increases in the historical recordfuture. As a result, we may be unable to mitigate any future supply shortages and our results of MatlinPatterson’s or our management team’s performance as indicative of our future performance.operations, prospects and financial condition could be adversely affected.

Acquisition CriteriaCompetition

The markets in which we operate are very competitive. We have identifiedprovide services in various geographic regions across the following general criteria and guidelines that we believe are consistent with our acquisition philosophyUnited States, and our management’s experiencecompetitors include many large and are important in evaluating prospective target businesses. We use these criteria and guidelines in evaluating acquisition opportunities, but we may decide to enter into our initial business combination with a target business that does not meet these criteria and guidelines. We intend to seek to acquire companies that we believe:

Are underperforming as a result of market conditions driven by commodity supply/demand imbalances or periods of regulatory uncertainty surrounding future business activities. Specifically, we believe that targets in or with exposure to the commodity and specialty chemicals, exploration and production, metals and mining, materials, power generation, transportation and infrastructure, refining, financial institutions, specialty lending, healthcare and insurance sectors provide a large opportunity set following the global commodity downturn that began in 2014 and the uncertain regulatory environment. Our management believes that increasing leverage, a lack of access to capital markets and regulatory uncertainty have caused many private companies in these sectors to be misvalued and underappreciated.

Exhibit intrinsic value that is being underappreciated or misvalued as a result of financial, operational or industry conditions that would be considered abnormal or transitory based on our industry specific due diligence and experience. For a potential target business, this process will include, among other things, a detailed review and analysissmall oilfield service providers, including some of the company’s capital structure, quality of earnings, potential for operationallargest integrated service companies. Our hydraulic fracturing services compete with large, integrated companies such as Halliburton Company and balance sheet improvements, corporate governance, customers, material contracts, and industry background and trends.

Are in need of additional strategic and managerial guidance to enhance or shift the company’s position within its industry, accelerate growth within that industry or refocus management on the core value proposition of the target company. We believe that we are well-positioned to evaluate and improve a company’s growth prospects and help it realize the opportunities to create shareholder value following the consummation of a business combination.

Will offer attractive risk-adjusted equity returns for our shareholders. We seek to acquire a target on terms and in a manner that leverages our experience in distressed investing. Financial returns will be evaluated based on free cash flow generation, an ability to achieve cost savings, an ability to stabilize operations, creating a platform for organic and/or inorganic growth, and an ability to achieve earnings growth. Each of these factors will be weighed against any identifiable downside risks that are often inherent in underperforming or distressed companies.

These criteria are not intended to be exhaustive. Any evaluation relating to the merits of a particular initial business combination may be based, to the extent relevant, on these general guidelinesSchlumberger Limited as well as other considerations,companies including Evolution Well Services, Calfrac Well Services Ltd., FTS International Inc., Liberty Oilfield Services Inc., NexTier Oilfield Solutions Inc., Patterson-UTI Energy Inc., ProPetro Services Inc., and RPC Inc. In addition, our industry is highly fragmented, and we compete regionally with a significant number of smaller service providers. Although several of our larger competitors have announced their intention to develop or adopt new electric hydraulic fracturing technologies, we believe that only U.S. Well Services, Inc. and one privately owned competitor are currently offering all-electric hydraulic fracturing services.

We believe that the principal competitive factors in the markets we serve are technical expertise, equipment capacity, workforce competency, efficiency, safety record, reputation, experience, and criteria thatprice. Additionally, projects are often awarded on a bid basis, which tends to create a highly competitive environment.

Cyclical Nature of Industry

We operate in a cyclical industry. The key factor driving demand for our management teamservices is the level of well completions by E&P companies, which in turn depends largely on the current and anticipated economics of new well completions. Global supply and demand for oil and the domestic supply and demand for natural gas are critical in assessing industry outlook. Demand for oil and natural gas is cyclical and subject to large, rapid fluctuations. E&P companies tend to increase capital expenditures in response to increases in oil and natural gas prices, which generally results in greater revenues and profits for oilfield service companies like us. Increased E&P capital expenditures ultimately lead to greater production, which historically has resulted in increased supplies and reduced prices which in turn tend to reduce demand for oilfield services. For these reasons, the results of our operations may deem relevant. In the eventfluctuate from quarter to quarter and from year to year, and these fluctuations may distort comparisons

of results across periods.

Insurance

Although we maintain insurance coverage of types and amounts that we find an opportunity that is more compellingbelieve to us thanbe customary in the opportunities described above,industry, we would pursue such opportunity. However, we have not established any particular parameters as to when we might turn our attention to opportunities that are not underperformingfully insured against all risks, either because insurance is not available or distressed and/or not operating in an industry undergoing a periodbecause of dislocation. In the event that we decidehigh premium costs relative to enter into our initial business combination with a target business that does not meet the above criteria and guidelines, we will disclose that the target business does not meet the above criteria in our stockholder communications related to our initial business combination, which would beperceived risk. Further, insurance rates have in the formpast been subject to wide fluctuation and changes in coverage could result in less coverage, increases in cost or higher deductibles and retentions. Liabilities for which we are not insured, or which exceed the policy limits of tender offer documents or proxy solicitation materials that we would file with the SEC.their applicable insurance, could have a material adverse effect on our business and financial condition.

Value Creation PhilosophyEnvironmental and Occupational Health and Safety Regulations

Our acquisition strategyoperations are subject to stringent laws and regulations governing the discharge of materials into the environment or otherwise relating to environmental protection, and occupational health and safety. Numerous federal, state, and local governmental agencies issue regulations that often require difficult and costly compliance measures that could carry substantial administrative, civil and criminal penalties and may result in permit revocations or modifications, operational disruptions, or injunctive obligations for noncompliance. These laws and regulations may, for example, restrict the types, quantities and concentrations of various substances that can be released into the environment, limit or prohibit construction or drilling activities on certain lands lying within wilderness, wetlands, ecologically or seismically-sensitive areas and other protected areas, or require action to prevent or remediate pollution from current or former operations. Moreover, it is not uncommon for neighboring landowners and other third parties to identify, acquirefile claims for personal injury and after our initial business combination, to build a companyproperty damage allegedly caused by the release of hazardous substances, hydrocarbons, or other waste products into the environment. Changes in an industry that is experiencing distress due to a temporarily dislocated market that is adversely affecting its financial or operating results, its ability to access the capital markets efficiently or at all or in other ways. Our management team will continually analyze the global financial markets for signs of financial distress in industry sectors, geographic regionsenvironmental, health and individual companies,safety laws and they have an extensive network of professional contactsregulations occur frequently, and any changes in the distressed sectorlaws or regulations or the interpretation thereof that provides themresult in more stringent and costly requirements could materially adversely affect our operations and financial position. We have not experienced any material adverse effect from compliance with informationthese requirements. This trend, however, may not continue in the future.

Below is an overview of some of the more significant environmental, health and significant proprietary deal flow. These contacts are familiar with our management team’s investment criteria and reorganization capabilities, and include bankruptcy lawyers, restructuring accountants, reorganization investment bankers and management turn-around consultants. Also, because our management team has historically employed two primary approaches to gaining control of companies; that is, (i) accumulating deeply discounted securities and other obligations of distressed companies as an initial step towards acquiring a controlling or influential ownership interest, generally through the conversion of debt to equity, and (ii) directly acquiring significant ownership stakes in businesses or injecting capital into businesses as a means of acquiring control, they also have relationships with many securities broker-dealers on a worldwide basis. We believe these extensive and long-standing relationships will provide us with broad access to potential businessessafety requirements with which we must comply. Our customers’ operations are subject to similar laws and regulations. Any material adverse effect of these laws and regulations on our customers’ operations and financial position may wish to combine.also have an indirect material adverse effect on our operations and financial position.

Deal OriginationWaste Handling. We handle, transport, store and dispose of wastes that are subject to the Resource Conservation and Recovery Act (“RCRA”) and comparable state laws and regulations, which impose requirements regarding the generation, transportation, treatment, storage, disposal and cleanup of hazardous and nonhazardous wastes. With federal approval, the individual states administer some or all the provisions of RCRA, sometimes in conjunction with our own, more stringent requirements. Although certain petroleum production wastes are exempt from regulation as hazardous wastes under RCRA, such wastes may constitute “solid wastes” that are subject to the less stringent requirements of nonhazardous waste provisions.

Drawing on their experience at MatlinPatterson, our management team is tapping four major sources of deal flow: (i) directly identifying potentially attractive undervalued situations through primary research into industriesAdministrative, civil, and companies; (ii) receiving information from our management team’s global contacts about potentially attractive situations; (iii) contact from securities broker-dealers’ research, sales, trading or investment banking department offering or identifying businesses experiencing dislocation; or (iv) inbound opportunities from a company or existing stakeholders seeking a combination. We may pay referral fees or other compensation to the sources mentioned in (ii) and (iii) above.

Evaluating Situations and Circumstances

We analyze the characteristics of each particular potential combination to better understand (i) the source of the company’s underperformance; (ii) the stakeholders that would welcome a business combination and (iii) the factors that will affect the company’s ability to successfully turnaround its financial and operating performance.

Source of Underperformance. We identify the source of a company’s financial distress, whether it be abnormal moves and/or volatility in commodity prices, substantial financial leverage, loss of a large customer, unforeseen litigation, ineffective management, disruptive technological innovation or new regulatory requirements, among others, to guide the company through the process by which the underperformancecriminal penalties can be remedied. As an example, a company that is misvalued dueimposed for failure to substantial leverage may have a healthy underlying business, but needs to ‘‘de-lever’’ through the infusion of new equity capital to retire outstanding debt. By comparison, a company that loses a significant customer will have substantially reduced cash flow which may create issues for its underlying business that need to be addressed through management changes and improved operations. These comparisons are often blurred for these types companies as they often display elements of each. Determining the magnitude of these specific issues provides information that can be used to evaluate the most likely course of action the company will take, thereby allowing us to take advantage of the investment opportunity.

Stakeholders. We also identify stakeholder constituencies, as well as their legal, financial and strategic positions and objectives, to anticipate potential issues that may impact a potential business combination. Stakeholders may range from priority creditors, secured creditors, senior creditors, junior creditors, subordinated creditors, trade creditors, preferred shareholders, shareholders, intercompany creditors, customers, suppliers, litigants, management, employees, unions and regulatory authorities. Recognizing the relationships between these constituencies will be critical to determining the process, timeline, and effectiveness of a business combination. Different stakeholders can play an important role, and predicting the behavior of individual stakeholders can provide important insights into any process. This also provides the management team an opportunity to partnercomply with certain stakeholders to effect change on the organization to improve the prospects of the company.

External Factors. We take into account external factors that may affect the prospects of an underperforming or distressed company, including the jurisdiction in which the company is domiciled, the current and expected regulatory environment, political influences and the state of the financial markets. Materials companies, for example, may lack access to traditional capital markets due to abrupt swings in a particular commodity that industry participants either produce or use as an input to its manufacturing process. The lack of traditional means for raising capital provides an opportunity for value-oriented investors, such as us to be the provider of capital on beneficial terms.

Direct Involvement Post-Merger

After the initial business combination, our management team intends to apply a rigorous approach to enhancing shareholder value, including evaluating the experience and expertise of incumbent management and making changes when appropriate, examining opportunities for revenue enhancement, cost savings, operating efficiencies and strategic acquisitions and divestitures, and accessing the financial markets to optimize the company’s capital structure. Our management team intends to pursue post-merger initiatives through participation on the board of directors, through direct involvement with company operations and/or calling upon a stable of former managers and advisors when necessary.

• Corporate Governance and Oversight. Actively participating as board members can include many activities ranging from monthly or quarterly board meetings, chairing standing (compensation, audit or investment committees) or special committees, to replacing or supplementing company management teams when necessary, adding outside directors with industry expertise, providing guidance on strategic and operational issues including revenue enhancement opportunities, cost savings, operating efficiencies as well as reviewing and testing annual budgets, reviewing acquisitions and divestitures, and assisting in the accessing of capital markets to further optimize financing costs and fund expansion. As active members on the board of directors of the company, our management team members intend to evaluate the suitability of the incumbent organization leaders. While not a pre-requisite, in their MatlinPatterson capacities, our management team members have replaced a significant percentage of its portfolio companies’ incumbent management teams in its private equity funds.waste handling requirements. Moreover, the management teamEnvironmental Protection Agency (“EPA”) or state or local governments may adopt more stringent requirements for the handling of nonhazardous wastes or re-categorize some nonhazardous wastes as hazardous for future regulation. Indeed, legislation has on occasion, inserted themselves into interim or full-time management roles when necessary.

• Direct Operational Involvement. The management team members, though ongoing board service, intend to actively engage with company management to effect change in an organization. These activities may include: (i) establishing an agenda for management and instilling a sense of accountability and urgency; (ii) aligning the interest of management with growing shareholder value; (iii) providing strategic planning and management consulting assistance; (iv) establishing measurable key performance metrics and accretive internal processes; and (v) right-sizing costs. These skill sets, will be integral to shareholder value creation.

• Access to Portfolio Company Managers and Advisors. Over their combined over 60 year history of investing in and controlling businesses, our management team members have developed strong professional relationships with former portfolio company managers and advisors through its private equity vehicles. When appropriate, we intend to bring in outside directors, managers or consultants to assist in corporate governance and operational turnaround activities. The use of supplemental advisors should provide additional resources to management to address time intensive issues that may be delaying an organization from realizing its full potential shareholder returns.

Our Acquisition and Investment Process

As illustrated in the diagram below, in evaluating a prospective target business, we have conducted and will continue to conduct a thorough due diligence review which will encompass, among other things, meetings with incumbent management and employees, document reviews, inspection of facilities, as well as a review of financial, operational, legal and other information which will be made available to us. We also utilize our operational and capital planning experience.

We are not prohibited from pursuing an initial business combination with a company that is affiliated with our sponsor, officers or directors. In the event we seek to complete our initial business combination with a company that is affiliated with our sponsor, officers or directors, we, or a committee of independent and disinterested directors, will obtain an opinion from an independent investment banking firm that is a member of FINRA, or from an independent accounting firm, that our initial business combination is fair to our company from a financial point of view. MatlinPatterson and its affiliates have four portfolio companies in or exposed to the chemical, financial institutions and energy sectors, which are among the sectors we intend to initially target. We do not currently intend to pursue any of such portfolio companies.

If members of our management team acquire public shares or warrants, they may have a conflict of interest in determining whether a particular target business is an appropriate business with which to effectuate our initial business combination. Further, each of our officers and directors may have a conflict of interest with respect to evaluating a particular business combination if the retention or resignation of any such officers and directors was included by a target business as a condition to any agreement with respect to our initial business combination. Certain of the members of our management team are employed by MatlinPatterson. MatlinPatterson isbeen proposed from time to time made aware of potential business opportunities, one or more of whichin Congress to re-categorize certain oil and natural gas exploration, development, and production wastes as hazardous wastes. Several environmental organizations have also petitioned the EPA to modify existing regulations to re-categorize certain oil and natural gas exploration, development, and production wastes as hazardous. Any such changes in these laws and regulations could have a material adverse effect on our capital expenditures and operating expenses. Although we may desire to pursue, for a business combination.

Each of our officers and directors presently has, and any of them in the future may have, additional fiduciary or contractual obligations to another entity pursuant to which such officer or director is or will be required to present a business combination opportunity to such entity. Accordingly, if any of our officers or directors becomes aware of a business combination opportunity which is suitable for an entity to which he or she has then-current fiduciary or contractual obligations, he or she will honor these obligations to present such business combination opportunity to such entity, and only present it to us if such entity rejects the opportunity. Without limiting the generality of the foregoing, members of our management team who are affiliated with MatlinPatterson have fiduciary and contractual obligations with respect to MatlinPatterson’s private equity partnerships and the portfolio companies on whose boards they serve, including presenting business combination opportunities to them. While MatlinPatterson’s existing private equity partnerships are beyond their investment periods, members of our management team who are affiliated with MatlinPatterson would have business opportunity conflicts with respect to new private equity funds or other investment vehicles that MatlinPatterson or its affiliates may sponsor in the future. We do not believe however, that the fiduciary dutiescurrent costs of managing our wastes, as presently classified, to be significant, any legislative or contractual obligationsregulatory reclassification of oil and natural gas exploration and production wastes could increase our officers or directors will materially affect our abilitycosts to complete our initial business combination. Our amendedmanage and restated certificatedispose of incorporation provides that we renounce our interest in any corporate opportunity offered to any director or officer unless such opportunity is expressly offered to such person solely in his or her capacity as a director or officer of our company and such opportunity is one we are legally and contractually permitted to undertake and would otherwise be reasonable for us to pursue.wastes.

Our directorsRemediation of Hazardous Substances. The Comprehensive Environmental Response, Compensation and officers have agreed notLiability Act (“CERCLA” or “Superfund”) and analogous state laws generally impose liability without regard to participate in the formation of,fault or become an officer or director of, any other special purpose acquisition company with a class of securities registered under the Exchange Act until we have entered into a definitive agreement regarding our initial business combination or we have failed to complete our initial business combination within 24 months after the closing of our initial public offering.

Initial Business Combination

The NASDAQ rules require that our initial business combination must be with one or more target businesses that together have a fair market value equal to at least 80%legality of the balance inoriginal conduct, on classes of persons who are considered to be responsible for the trust account (less any deferred underwriting commissions and taxes payable on interest earned)release of a hazardous substance into the environment or, under some state CERCLA-analogous laws, the release of solid waste. These persons include the current owner or operator of a contaminated facility, a former owner or operator of the facility at the time of our signing a definitive agreement in connection with our initial business combination. If our boardcontamination, those persons that disposed or arranged for the disposal of directorsthe substance at the facility, and transporters who selected the disposal site.