FORM 10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20172021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 0-20713

CASI PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| | |

Delaware | | 58-1959440 |

(State of Incorporation) | | (I.R.S. Employer Identification No.) |

9620 Medical Center Drive, Suite 300, Rockville, MD | 20850 | |

(Address of principal executive offices) | (Zip Code) |

(240) 864-2600

Registrant’s telephone number, including area code: (240) 864-2600code

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $0.01 par value | Trading Symbol | NASDAQ | ||

(Title of each class) | | CASI | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨◻ No x⌧

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Act. Yes ¨◻ No x⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx⌧ No ¨◻

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yesx⌧ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this form 10-K or any amendment to this Form 10-K¨

◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”filer” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

(Check one):

Large accelerated filer | Accelerated filer | Non-accelerated filer | Smaller reporting company | |||

| ☒ Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨◻

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨☐ No x

⌧

As of June 30, 2017,2021, the aggregate market value of the shares of common stock held by non-affiliates was approximately $35,022,789.

$179,150,437.

As of March 28, 2018, 79,641,87618, 2022, 136,589,826 shares of the Company’s common stock were outstanding.

Documents Incorporated By Reference

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days of the end of the fiscal year ended December 31, 2017.2021. The proxy statement is incorporated herein by reference into the following parts of the Form 10-K:

Part III, Item 10, Directors, Executive Officers and Corporate Governance;

Part III, Item 11, Executive Compensation;

Part III, Item 12, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters;

Part III, Item 13, Certain Relationships and Related Transactions, and Director Independence; and

Part III, Item 14, Principal Accounting Fees and Services.

CASI PHARMACEUTICALS, INC.

FORM 10-K - FISCAL YEAR ENDED DECEMBER 31, 20172021

TABLE OF CONTENTS

Form 10-K |

| Form 10-K |

| Description |

| Page No. |

4 | ||||||

|

| |||||

| 20 | |||||

|

| |||||

| 43 | |||||

|

| |||||

| 43 | |||||

|

| |||||

| 44 | |||||

|

| |||||

| 44 | |||||

|

| |||||

45 | ||||||

|

| |||||

| 45 | |||||

|

| |||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 45 | ||||

|

| |||||

| 52 | |||||

|

| |||||

| 52 | |||||

|

| |||||

| Changes in and Disagreements with Accountants On Accounting and Financial Disclosure | 53 | ||||

|

| |||||

| 53 | |||||

|

| |||||

| 53 | |||||

|

| |||||

54 | ||||||

|

| |||||

| 54 | |||||

|

| |||||

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 54 | ||||

|

| |||||

| Certain Relationships and Related Transactions, and Director Independence | 54 | ||||

|

| |||||

| 54 | |||||

|

| |||||

55 | ||||||

|

| |||||

| 59 | |||||

|

| |||||

| F-1 |

2

TRADEMARKS AND SERVICE MARKS

We own or have rights to trademarks and trademark applications for use in connection with the operation of our business, including, but not limited to, CASI and CASI PHARMACEUTICALS. All other trademarks appearing in this Annual Report on Form 10-K that are not identified as marks owned by CASI are the property of their respective owners.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains certain forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements also may be included in other statements that we make. All statements that are not descriptions of historical facts are forward-looking statements. These statements can generally be identified by the use of forward-looking terminology such as “believes,” “expects,” “intends,” “may,” “will,” “should,” or “anticipates” or similar terminology. These forward-looking statements include, among others, statements regarding the timing of our commercial launch of products, clinical trials, our cash position and future expenses, and our future revenues.

Actual results could differ materially from those currently anticipated due to a number of factors, including: the risk that we may be unable to continue as a going concern as a result of our inability to raise sufficient capital for our operational needs; the possibility that we may be delisted from trading on The Nasdaq Capital Market if we fail to satisfy applicable continued listing standards, including compliance with the Nasdaq Capital Market;bid price rule; the volatility in the market price of our common stock; risks relating to intereststhe outbreak of our largest stockholders that differ from our other stockholders;the COVID-19 pandemic and its effects on global markets and supply chains; the risk of substantial dilution of existing stockholders in future stock issuances; the difficulty of executing our business strategy on a global basis including China; our inability to enter into strategic partnerships for the development, commercialization, manufacturing and distribution of our proposed product candidates or future candidates; legal or regulatory developments in China;China that adversely affect our ability to operate in China, our lack of experience in manufacturing products and uncertainty about our resources and capabilities to do so on a clinical or commercial scale; risks relating to the risk that we will not be able to effectively select, registercommercialization, if any, of our products and commercializeproposed products from our recently acquired portfolio of Abbreviated New Drug Applications (ANDAs)(such as marketing, safety, regulatory, patent, product liability, supply, competition and other risks); our inability to predict when or if our product candidates will be approved for marketing by the ChinaU.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), National Medical Products Administration (NMPA), or other regulatory authorities; our inability to enter into strategic partnerships for the development, commercialization, manufacturing and distribution of our proposed product candidates or future candidates; the risks relating to the need for additional capital and the uncertainty of securing additional funding on favorable terms; the risks associated with our product candidates;candidates, and the risks associated with anyour other early-stage products under development; the risk that resultsresult in preclinical and early clinical models are not necessarily indicative of later clinical results; uncertainties relating to preclinical and clinical trials, including delays to the commencement of such trials; our ability to protect our intellectual property rights; our ability to design and implement a development plan for our ANDAs held by CASI Wuxi; the lack of success in the clinical development of any of our products; and our dependence on third parties; the risks related to our dependence on Juventas to conduct the clinical development of CNCT19 and to partner with us to co-market CNCT19; risks related to our dependence on Juventas to ensure the patent protection and prosecution for CNCT19; risks relating to the commercialization, if any, of our proposed products (such as marketing, safety, regulatory, patent, product liability, supply, competition and other risks).; risks relating to interests of our largest stockholders and our Chairman and CEO that differ from our other stockholders; and risks related to the development of a new manufacturing facility by CASI Wuxi. Such factors, among others, could have a material adverse effect upon our business, results of operations and financial condition.

We caution investors that actual results or business conditions may differ materially from those projected or suggested in forward-looking statements as a result of various factors including, but not limited to, those described above and in Section IA, “Risk Factors” of this Annual Report on Form 10-K for the fiscal year ended December 31, 20172021 (this “Annual Report”) and our other filings with the Securities and Exchange Commission (“SEC”). We cannot assure you that we have identified all the factors that create uncertainties. Moreover, new risks emerge from time to time and it is not possible for our management to predict all risks, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. Readers should not place undue reliance on forward-looking statements.statements, which only relate to events or information as of the date made. We undertake no obligation to publicly release the result of any revision of these forward-looking statements to reflect events or circumstances after the date they are made or to reflect the occurrence of unanticipated events. Additional information about the factors and risks that could affect our business, financial condition and results of operations, are contained in our filings with the U.S. Securities and Exchange Commission (“SEC”), which are available at www.sec.gov.

3

PART I

ITEM 1. BUSINESS. |

OVERVIEW

CASI Pharmaceuticals, Inc. (“CASI”, or the “Company”, or “we” or “our”) (Nasdaq: CASI) is a U.S. based biopharmaceutical company dedicated to bringing high quality, cost-effectivefocused on developing and commercializing innovative therapeutics and pharmaceutical products in China, the United States, and innovativethroughout the world. We were incorporated in 1991, and in 2012, with new leadership, we shifted our business strategy to China and has since built an infrastructure in China that includes sales and marketing, medical affairs, regulatory and clinical development and in the foreseeable future, manufacturing. We are focused on acquiring, developing and commercializing products that augment our hematology oncology therapeutics to patients.therapeutic focus as well as other areas of unmet medical need. We intend to executeare executing our plan to become a leading pharmaceutical company with a substantial market share in China. We are headquartered in Rockville, Maryland with established China operations that are growing as we continue to further in-license or acquire products for our pipeline.

Our product pipeline features (1) EVOMELA®, MARQIBO®, and ZEVALIN®, all U.S. Food and Drug Administration (“FDA”) approved drugs in-licensed from Spectrum Pharmaceuticals, Inc. for China regional rights, and currently in various stagesbiopharmaceutical leader by launching medicines in the greater China market, leveraging our China-based regulatory, process for market approval in China, (2) an acquired portfolioclinical and commercial competencies and our global drug development expertise. The majority of 25 FDA-approved abbreviated new drug applications (“ANDAs”) one ANDA that FDA tentatively approved, and three ANDAs thatour operations are pending FDA approval, from which we will prioritize a select subset for product registration and commercialization in China, (3) our proprietary drug candidate, ENMD-2076, currently in Phase 2 clinical development, and (4) CASI-001 and CASI-002, proprietary early-stage candidates in immuno-oncology in preclinical development. We believe our pipeline reflects a risk-balanced approach between products in various stages of development, and between products that we develop ourselves and those that we develop with our partners for the China regional market. We intend to continue building a significant product pipeline of high quality, cost-effective pharmaceuticals, as well as innovative drug candidates that we will commercialize alonenow located in China and are conducted primarily through two of our subsidiaries: (i) CASI Pharmaceuticals (China) Co., Ltd. (“CASI China”), which is wholly owned and is located in Beijing, China, and (ii) CASI Pharmaceuticals (Wuxi) Co., Ltd. (“CASI Wuxi”), which is located in Wuxi, China. Our Beijing office is primarily responsible for our day-to-day operations, and our commercial team of over 100 hematology/oncology sales and marketing specialists is based in China. CASI Wuxi is part of the long-term strategy to support our future clinical and commercial manufacturing needs, to manage our supply chain for certain products, and to develop a GMP manufacturing facility in China.

We launched our first commercial product, EVOMELA® (Melphalan for Injection) in China in August 2019. In China, EVOMELA® is approved for use as a conditioning treatment prior to stem cell transplantation and as a palliative treatment for patients with partnersmultiple myeloma. The other core hematology/oncology assets in our pipeline include:

| ● | CNCT19 is an autologous CD19 CAR-T investigative product (“CNCT19”) being developed by our partner Juventas Cell Therapy Ltd. (“Juventas”) for which we have exclusive World-Wide co-commercial and profit-sharing rights. CNCT19 is being developed as a potential treatment for patients with hematological malignancies which express CD19 including, B-cell acute lymphoblastic leukemia (“B-ALL”) and B-cell non-Hodgkin lymphoma (“B-NHL”). The CNCT19 Phase 1 studies in patients with B-ALL and B-NHL in China have been completed by Juventas, the Phase 2 B-ALL and B-NHL registration studies are both currently enrolling in China since the fourth quarter of 2020. |

| ● | BI-1206 is an antibody which has a novel mode-of-action, blocking the inhibitory antibody checkpoint receptor FcγRIIB to unlock anti-cancer immunity and enhance the efficacy of antibody-based immunotherapy in both hematological malignancies and solid tumors for which we have licensed exclusive greater China rights from BioInvent International AB (“BioInvent”). BI-1206 is being investigated by BioInvent in a Phase 1/2 trial, in combination with anti-PD1 therapy Keytruda® (pembrolizumab), in patients with solid tumors, and in a Phase 1/2a trial in combination with MabThera® (rituximab) in patients with relapsed/refractory non-Hodgkin lymphoma (NHL). BI-1206 has the potential to restore the activity of rituximab in patients with relapsed/refractory non-Hodgkin lymphoma. Clinical Trial Application (CTA) was approved by China National Medical Products Administration (NMPA) in December 2021. We are planning Phase 1 trials of BI-1206 as a single agent to evaluate the PK/safety profile and in combination with rituximab in patients with NHL (mantle cell lymphoma, marginal zone lymphoma, and follicular lymphoma) to assess safety and tolerability, select the Recommended Phase 2 Dose and assess early signs of clinical efficacy as part of our development program for BI-1206 in China. The studies are expected to start in the first half of 2022. |

| ● | CB-5339 is a novel VCP/p97 inhibitor focused on valosin-containing protein (VCP)/p97 as a novel target in protein homeostasis, DNA damage response and other cellular stress pathways for therapeutic use in the treatment of patients with various malignancies. We entered into an exclusive license on March 21, 2021 with Cleave Therapeutics, Inc. (“Cleave”) for the development and commercialization of CB-5339 in Mainland China, Hong Kong, Macau and Taiwan. CB-5339, an oral second-generation, small molecule VCP/p97 inhibitor, is being evaluated in a Phase 1 clinical trial in patients with acute myeloid leukemia (AML) and myelodysplastic syndrome (MDS). CB-5339 CTA application for the multiple myeloma indication is in preparation after receiving an acceptance letter for the CB-5339 IND package from the China Center of Drug Evaluation (“CDE”) |

| ● | CID-103 is a full human IgG1 anti-CD38 monoclonal antibody recognizing a unique epitope that has demonstrated encouraging preclinical efficacy and safety profile compared to other anti-CD38 monoclonal antibodies for which we have exclusive global rights. CID-103 is being developed for the treatment of patients with multiple myeloma. The Phase 1 |

4

| dose escalation and expansion study of CID-103, in patients with previously treated, relapsed or refractory multiple myeloma is ongoing in France and the UK. |

We also have greater China rights to Octreotide (Long Acting Injectable), a standard of care for the resttreatment of acromegaly and for the world. For in-licensedcontrol of symptoms associated with certain neuroendocrine tumors; and Thiotepa, a cytotoxic agent which has a long history of established use in the hematology/oncology setting, we have an exclusive China license and distribution rights to a novel formulation of thiotepa, which has multiple indications including use as a conditioning treatment for certain allogeneic haemopoietic stem cell transplants. However, due to the evolving standard of care environment, the rare and niche indication for these products, potential US regulatory action and our commitment to prioritize resources, we are currently evaluating our potential opportunities for these products. In addition, our assets include six FDA-approved ANDAs which we are evaluating due to generic drug pricing reforms by the Company usesChinese government and its impact on the pricing and competitiveness of these products.

CASI has built a fully integrated, world class biopharmaceutical company dedicated to the successful development and commercialization of innovative and other therapeutic products. Our business development strategy is currently focused on acquiring additional targeted drugs and immuno-oncology therapeutics through licensing that will expand our hematology/oncology franchise. We use a market-oriented approach to identify pharmaceuticalpharmaceutical/biotechnology candidates that it believeswe believe to have the potential for gaining widespread market acceptance, either globally or in China, and for which development can be accelerated under the Company’sour global drug development strategy.

Our focus is to bring high quality, cost-effective pharmaceutical products and innovative oncology therapeutics to patients. The implementation of In many cases our plans will include leveraging our resources in both the United States and China. In order to capitalize on the drug development and capital resources available in China, the Company is doing business in China through its wholly-owned China-based subsidiary that will execute the China portion of the Company’s drug development strategy including conducting clinical trials in China, pursuing local funding opportunities and strategic collaborations, and implementing the Company’s transition to a commercial enterprise.

IN-LICENSED PRODUCTS FOR THE CHINA REGIONAL MARKET

In September 2014, we acquired from Spectrum Pharmaceuticals, Inc. and certain of its affiliates (together referred to as “Spectrum”) exclusive rights in greater China (including Taiwan, Hong Kong and Macau) to three in-licensed oncology products, including EVOMELA® (melphalan hydrochloride for injection) approvedincludes direct equity investments in the U.S. primarily for use as a high-dose conditioning treatment prior to hematopoietic progenitor (stem) cell transplantation in patients with multiple myeloma, MARQIBO® (vinCRIStine sulfate LIPOSOME injection) approved in the U.S. for advanced adult Ph- acute lymphoblastic leukemia (ALL), and ZEVALIN® (ibritumomab tiuxetan) approved in the U.S. for advanced non-Hodgkin’s lymphoma. A description of the products and their current status is below.

EVOMELA®

EVOMELA® is a new intravenous formulation of melphalan being investigated by Spectrum in the multiple myeloma transplant setting. The formulation avoids the use of propylene glycol, which is used as a co-solvent in the current formulation of melphalan and has been reported to cause renal and cardiac side-effects that limit the ability to deliver higher quantities of intended therapeutic compounds. The use of Captisol technology to reformulate melphalan is anticipated to allow for longer administration durations and slower infusion rates, potentially enabling clinicians to avoid reductions and safely achieve a higher dose intensity of pre-transplant chemotherapy. In March 2016, Spectrum received notification from the FDA of the grant of approval of its NDA for EVOMELA® (melphalan) for injection primarily for use as a high-dose conditioning treatment prior to hematopoietic progenitor (stem) cell transplantation in patients with multiple myeloma. We have initiated the regulatory and development process towards marketing approval for EVOMELA® in China. In December 2016, the China Food and Drug Administration (“CFDA”) accepted for review our import drug registration application for EVOMELA® and in 2017 has granted priority review of the import drug registration clinical trial application (CTA), which has completed the quality testing phase of the regulatory process and is currently in technical review by Center for Drug Evaluation (CDE) of the CFDA as part of the regulatory process.

MARQIBO®

MARQIBO® is a novel, sphingomyelin/cholesterol liposome-encapsulated, formulation of vincristine sulfate, a microtubule inhibitor. MARQIBO® is approved by the FDA for the treatment of adult patients with Philadelphia chromosome-negative (Ph-) acute lymphoblastic leukemia (ALL) in second or greater relapse or whose disease has progressed following two or more anti-leukemia therapies. We have initiated the regulatory and development process towards marketing approval for MARQIBO in China. In January 2016, the CFDA accepted for review our import drug registration application for MARQIBO® which currently is in the quality testing phase of the regulatory review.

ZEVALIN®

ZEVALIN® injection for intravenous use is a CD20-directed radiotherapeutic antibody. It is indicated for the treatment of patients with relapsed or refractory, low-grade or follicular B-cell non-Hodgkin’s lymphoma (NHL). ZEVALIN®is also indicated for the treatment of patients with previously untreated follicular non-Hodgkin’s Lymphoma who achieve a partial or complete response to first-line chemotherapy. ZEVALIN®therapeutic regimen consists of two components: rituximab, and Yttrium-90 (Y-90) radiolabeled ZEVALIN® for therapy. ZEVALIN®builds on the combined effect of a targeted biologic monoclonal antibody augmented with the therapeutic effects of a beta-emitting radioisotope. Since ZEVALIN®is already approved in the U.S. and marketed by Spectrum, we expect that gaining approval from local regulatory authorities for commercialization in greater China will require a shorter timeframe compared to clinical-stage drugs. In 2017, the CFDA accepted for review our import drug registration for ZEVALIN®including both the antibody kit and the radioactive Yttrium-90 component.

U.S. FDA ANDAs

On January 26, 2018 the Company acquired a portfolio of 25 U.S. FDA-approved abbreviated new drug applications (ANDAs), one ANDA that FDA tentatively approved, and three ANDAs that are pending FDA approval. CASI intends to select and commercialize certain products from the portfolio that offer unique market and cost-effective manufacturing opportunities in China and/or in the U.S.

The portfolio consists of:

ENMD-2076

ENMD-2076, internally developed, is an orally-active, Aurora A/angiogenic kinase inhibitor with a unique kinase selectivity profile and multiple mechanisms of action. We are currently conducting multiple Phase 2 studies of ENMD-2076, the status of which is outlined below:

| |||||

|

| ||||

|

|

| |||

ENMD-2076 has received orphan drug designation from the FDA for the treatment of ovarian cancer, multiple myeloma, acute myeloid leukemia and hepatocellular carcinoma (HCC). In October 2015, the Company also received orphan drug designation from the European Medicines Agency (EMA) for the treatment of HCC including FLC. In the United States, the Orphan Drug Act is intended to encourage companies to develop therapies for the treatment of diseases that affect fewer than 200,000 people in this country. Orphan drug designation provides us with seven years of market exclusivity that begins once ENMD-2076 receives FDA marketing approval for a specific indication. It also provides certain financial incentives that can help support the development of ENMD-2076, such as a tax credit.

PRECLINICAL DEVELOPMENT

Our primary focus is on clinical-stage and late-stage drug candidates so that we can immediately employ our U.S. and China drug development model to accelerate clinical and regulatory progress. In addition to our clinical-and late-stage approach, we have two potential drug candidates in preclinical development that we will continue to evaluate in 2018.

MANAGEMENT

The current senior management team includes: Dr. Wei-Wu He, Executive Chairman, Dr. Ken K. Ren, Chief Executive Officer; Cynthia W. Hu, Chief Operating Officer, General Counsel & Secretary; Dr. Alexander A. Zukiwski, Chief Medical Officer, Sara B. Capitelli, Vice President, Finance & Principal Accounting Officer; and Dr. James E. Goldschmidt, Senior Vice President, Business Development. The Company, as part of its normal operations, also has consulting relationships with a core team of experts in clinical trial design, FDA and CFDA strategy, scientific research, manufacturing and formulation, among others.

Our management team promotes and instills a corporate culture of prudent resource management, fiscal responsibility and accountability, while maintaining an environment of innovation and entrepreneurialism in order to quickly respond to opportunities and to react to any changes in market conditions and in the regulatory landscape.

BUsiness Development AND COMMERCIALIZATION Strategy

licensor company. We intend to continuefor our pathpipeline to become fully integrated with drug development and commercial operations. Our current external business development effort is concentrated on acquiring additional drug candidates through in-license and acquisitions to expand our pipeline. Our pipeline will reflect a diversified and risk-balanced set of assets that include (1) late-stage clinical drug candidates in-licensed for China or global regional rights, such(2) proprietary or licensed innovative drug candidates, and (3) select high quality pharmaceuticals that fit our therapeutic focus. We have focused on US/EU approved product candidates, and product candidates with proven targets or product candidates that have reduced clinical risk with a greater emphasis on innovative therapeutics. Although oncology with a focus on hematological malignancies is our principal clinical and commercial target, we are opportunistic about other therapeutic areas that can address unmet medical needs. We will continue to pursue building a robust pipeline of drug candidates for development and commercialization in China as our primary market, and if rights are available for the rest of the world.

We believe our China operations offer a significant market and growth potential due to the extraordinary increase in demand for high quality medicines coupled with regulatory reforms in China that facilitate the entry of new pharmaceutical products into the country. We will continue to in-license clinical-stage and late-stage drug candidates, and leverage our cross-border operations and expertise, and hope to be the partner of choice to provide access to the China market. We expect the implementation of our plans will include leveraging our resources and expertise in both the U.S. and China so that we can maximize regulatory, development and clinical strategies in both countries.

Our commercial product, EVOMELA®, MARQIBOwas originally licensed from Spectrum Pharmaceuticals, Inc. (“Spectrum”) and we had a supply agreement with Spectrum to support our application for import drug registration and for commercialization purposes. Spectrum completed the sale of its portfolio of FDA-approved hematology/oncology products including EVOMELA® and ZEVALINto Acrotech Biopharma L.L.C. (“Acrotech”) on March 1, 2019. The original supply agreement with Spectrum was assumed by Acrotech; Spectrum agreed to continue with a short-term supply agreement for EVOMELA® for the initial commercial product supply in connection with the launch, with the long-term supply assumed by Acrotech.

As part of the long-term strategy to support its future clinical and commercial manufacturing needs and to manage its supply chain for certain products, on December 26, 2018, the Company, together with Wuxi Jintou Huicun Investment Enterprise, a limited partnership organized under Chinese law (“Wuxi LP”) established CASI Pharmaceuticals (WUXI) Co., (2)Ltd. (“CASI Wuxi”) to build and operate a GMP manufacturing facility in the Wuxi Huishan Economic Development Zone in Jiangsu Province, China.

5

CORE PRODUCT AND CANDIDATES IN HEMATOLOGY/ONCOLOGY

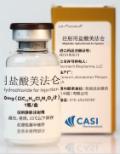

EVOMELA® (Melphalan for Injection) - Launched In China

| |

| EVOMELA® (Melphalan for Injection) is an intravenous formulation of melphalan commercialized by Acrotech (formally by Spectrum) in the multiple myeloma treatment setting in the United States, of which we have exclusive greater China rights. The EVOMELA® formulation avoids the use of propylene glycol, which is used as a co-solvent in other formulations of injectable melphalan. The use of Captisol in the EVOMELA® formulation improves the melphalan stability when reconstituted, allowing for longer preparation and infusion times. In August 2019, CASI launched EVOMELA® in China as its first commercial product. The NMPA required post-marketing study has completed and the clinical study report is being finalized for regulatory submission. |

CNCT19 (CD19 CAR-T).

In June 2019, the Company acquired worldwide license and commercialization rights to CNCT19 from Juventas, a China-based domestic company engaged in cell therapy. Juventas continues to be responsible for the clinical development and regulatory submission and maintenance of CNCT19 regulatory applications and CASI is responsible for the launch and commercial activities of CNCT19 under the direction of a joint steering committee. Subsequently, the worldwide license and commercialization rights to CNCT19 acquired in June 2019 were amended.

CNCT19 is an autologous CD19 CAR-T investigative product (CNCT19) being developed by our partner Juventas for which we have co-commercial and profit-sharing rights. CNCT19 targets CD19, a B-cell surface protein widely expressed during all phases of B-cell development and a validated target for B-cell driven hematological malignancies. CD19 targeted CAR constructs from several different institutions have demonstrated consistently high qualityantitumor efficacy in children and adults with relapsed B-cell acute lymphoblastic leukemia (B-ALL), chronic lymphocytic leukemia (CLL), and B-cell non-Hodgkin lymphoma (B-NHL).

CNCT19 is being developed as a potential treatment for patients with hematological malignancies which express CD19 including, B-cell acute lymphoblastic leukemia (“B-ALL”) and B-cell non-Hodgkin lymphoma (“B-NHL”). The CNCT19 Phase 1 studies in patients with B-ALL and B-NHL in China have been completed by Juventas, with the Phase 2 B-NHL and B-ALL registration studies both currently enrolling in China since the fourth quarter of 2020.

BI-1206 (anti-FcyRIIB antibody)

BI-1206 is an antibody which has a novel mode-of-action, blocking the inhibitory antibody checkpoint receptor FcγRIIB to unlock anti-cancer immunity and enhance the efficacy of antibody-based immunotherapy in both hematological malignancies and solid tumors for which we have licensed exclusive greater China rights. BI-1206 was added to our portfolio in October 2020 pursuant to a license agreement with our partner, BioInvent International AB (“BioInvent”). BI-1206 is being investigated by BioInvent in a Phase 1/2 trial, in combination with anti-PD1 therapy Keytruda® (pembrolizumab), in patients with solid tumors, and in a Phase 1/2a trial in combination with MabThera® (rituximab) in patients with relapsed/refractory non-Hodgkin lymphoma (NHL). BI-1206 has the potential to restore the activity of rituximab in patients with relapsed/refractory non-Hodgkin lymphoma.

Clinical Trial Application (CTA) was approved by China National Medical Products Administration (NMPA) in December 2021. The Company is planning Phase 1 trials of BI-1206 as a single agent to evaluate the PK/safety profile and in combination with rituximab in patients with NHL (mantle cell lymphoma, marginal zone lymphoma, and follicular lymphoma) to assess safety and tolerability, select the Recommended Phase 2 Dose and assess early signs of clinical efficacy as part of its development program for BI-1206 in China. The studies are expected to start in the first half of 2022.

CB-5339 (VCP/p97inhibitor)

CB-5339 is a novel VCP/p97 inhibitor focused on valosin-containing protein (VCP)/p97 as a novel target in protein homeostasis, DNA damage response and other cellular stress pathways for therapeutic use in the treatment of patients with cancer. The Company entered into an exclusive license on March 21, 2021 with Cleave Therapeutics, Inc. (Cleave”) for the development and commercialization of CB-5339 in Mainland China, Hong Kong, Macau and Taiwan. CB-5339, an oral second-generation, small molecule VCP/p97 inhibitor, is being evaluated in a Phase 1 clinical trial in patients with acute myeloid leukemia (AML) and myelodysplastic syndrome (MDS). CB-5339 CTA application for the multiple myeloma indication is in preparation after receiving an acceptance letter for the CB-5339 IND package from the China CDE.

6

CID 103 (anti-CD38 monoclonal antibody)

CID-103 is a full human IgG1 anti-CD38 monoclonal antibody recognizing a unique epitope that has demonstrated encouraging preclinical efficacy and safety profile compared to other anti-CD38 monoclonal antibodies for which the Company has exclusive global rights. CID-103 is being developed for the treatment of patients with multiple myeloma. The Phase 1 dose escalation and expansion study of CID-103, in patients with previously treated, relapsed or refractory multiple myeloma is ongoing in the UK and France.

OTHER MISCELLANEOUS ASSETS

The Company also has greater China rights to Octreotide LAI, a standard of care for the treatment of acromegaly and for the control of symptoms associated with certain neuroendocrine tumors, and Thiotepa, a cytotoxic agent which has a long history of established use in the hematology/oncology setting, the Company has an exclusive China license and distribution rights to a novel formulation of thiotepa, which has multiple indications including use as a conditioning treatment for certain allogeneic haemopoietic stem cell transplants. However, due to the evolving standard of care environment, the rare and niche indication for these products, potential US regulatory action and the Company’s commitment to prioritize resources, the Company is currently evaluating its options for these products. In addition, the Company’s assets include six FDA-approved ANDAs which the Company is evaluating due to generic pharmaceuticals, such asdrug pricing reforms by the portfolioChinese government and its impact on the pricing and competitiveness of 29 ANDAs recently acquired, (3) proprietarythese products.

BUSINESS DEVELOPMENT

CASI has built a fully integrated, world class biopharmaceutical company dedicated to the successful development and commercialization of innovative drug candidates, such asand other therapeutic products.

Our business development strategy is currently focused on acquiring additional targeted drugs and immuno-oncology therapeutics through licensing that will expand our ENMD-2076, and (4) new drug candidates under internal preclinical development.hematology/oncology franchise. We use a market-oriented approach to identify pharmaceuticalpharmaceutical/biotechnology candidates that we believe to have the potential for gaining widespread market acceptance, either globally or in China, and for which development can be accelerated under the Company’sour global drug development strategy. In many cases our business development strategy includes direct equity investments in the licensor company. We intend for our pipeline to reflect a diversified and risk-balanced set of assets that include (1) late-stage clinical drug candidates in-licensed for China or global regional rights, (2) proprietary or licensed innovative drug candidates, and (3) select high quality pharmaceuticals that fit our therapeutic focus. We have focused on US/EU approved product candidates, and product candidates with proven targets or product candidates that have reduced clinical risk with a greater emphasis on innovative therapeutics. Although oncology with a focus on hematological malignancies is our principal clinical and commercial focus,target, we will beare opportunistic about other pharmaceuticalstherapeutic areas that can address unmet medical needs.

The Company’s wholly-owned China-based subsidiary is executing the China portion We will continue to pursue building a robust pipeline of our drug development strategy, including conducting clinical trials in China, pursuing local funding opportunities and strategic collaborations, and implementing our plancandidates for accelerated development and commercialization in China as our primary market, and, if rights are available, for the rest of the world.

CASI PHARMACEUTICALS (CHINA) CO., LTD. (“CASI China”)

In August 2012, we established a wholly-owned China-based subsidiary CASI Pharmaceuticals (China) Co., Ltd.. (“CASI China”). CASI China market.is headquartered in Beijing, and in 2020, we established an office in Shanghai. CASI China’s staff currently consists of 168 full-time employees which includes our commercial team of over 100 hematology and oncology sales and marketing specialists based in China. Among its activities, our China operations oversee the Company’s sales and marketing of EVOMELA® and the anticipated commercial activities of our pipeline products, technology transfer, local preclinical and clinical operation activities, as well as its NMPA regulatory activities. In addition, our Beijing operations include business development activities and executive management activities. Global management decisions are primarily being made out of CASI China where our executive team spends a significant amount of time. We expect our operations in China to continue to grow.

CASI PHARMACEUTICALS (WUXI) CO., LTD. (“CASI Wuxi”)

On December 26, 2018, the Company, together with Wuxi LP established CASI Wuxi to build and operate a GMP manufacturing facility in the Wuxi Huishan Economic Development Zone in Jiangsu Province, China. The Company controls CASI Wuxi through 80% voting and ownership rights. Accordingly, the financial statements of CASI Wuxi have been consolidated in the Company’s consolidated financial statements since its inception.

In November 2019, CASI Wuxi entered into a fifty-year lease agreement for the right to use state-owned land in China for the construction of a GMP manufacturing facility. Pursuant to the agreement, CASI Wuxi has committed to invest land use right and

7

property, plant and equipment of RMB1 billion (equivalent to $143 million) by August 2022. In April 2020, CASI Wuxi received RMB 15.9 million (equivalent to $2.2 million) from the Jiangsu Province Wuxi Huishan Economic Development Zone as government grant for this development project which was recorded as deferred income in April 2020. In November 2021, CASI Wuxi received an additional RMB 3.0 million (equivalent to $0.5 million) from the Jiangsu Province Wuxi Huishan Economic Development Zone as a government grant for this development project which was recorded as deferred income in November 2021.

In 2020, for the design and construction work of the land, CASI Wuxi entered into several contracts for RMB 76.1 million ($12.0 million) to complete the phase 1 project of CASI Wuxi's research and development production base, the project was the estimated to be completed in October 2023. In February 2022, CASI Wuxi has reached an alignment with the Wuxi local government that it will collaborate with Wuxi LP to co-develop the land continuously in the future, and the development plan will be extended, details regarding the plan are under negotiation.

Also in 2020, CASI Wuxi entered in to a lease agreement with local government for a manufactory building next to the leased land. Since then, the Company entered into a series of contracts for the remodeling and installation work of the building and warehouse, as well as purchase of equipments. The total contract amount entered into for this building is approximately RMB 92.9 million ($14.6 million).

RELATIONSHIPS RELATING TO CLINICAL PROGRAMS

EVOMELA® (Melphalan Hydrochloride For Injection)

Contract Manufacturing. Clinical trial materials forThe Company has product rights and perpetual exclusive licenses from Acrotech Biopharma L.L.C. (“Acrotech”) to develop and commercialize its commercial product EVOMELA®, MARQIBO®, (Melphalan Hydrochloride For Injection) in the greater China region (which includes Mainland China, Taiwan, Hong Kong and ZEVALIN® are suppliedMacau). The exclusive licenses held by our partnerthe Company were originally licensed from Spectrum Pharmaceuticals, and Spectrum completed the sale of its contract manufacturers. We anticipate thatportfolio of FDA-approved hematology/oncology products including EVOMELA® to Acrotech on March 1, 2019. On December 3, 2018, the manufacturingCompany received NMPA’s approval for our newly acquired ANDA portfolio will be through new contract manufacturers locatedimportation, marketing and sales in China and outside ofin August 2019 the U.S. after technology transfer.Company launched EVOMELA® in China. The manufacturing effortsNMPA required post-marketing study has completed and the clinical study report is being finalized for the production of our clinical trial materials for ENMD-2076 are performed by contract manufacturing organizations. Established regulatory submission.

The Company has establishedrelationships, coupled with supply agreements, have securedto secure the necessary resources to supply the EVOMELA® commercial drug product as well as any clinical trials materials required for our clinical development program. We believeAs an import drug product into China, we expect that the future supply of EVOMELA® will continue to be met by our partner Acrotech and its contract manufacturers.

In March 2019, the Company entered into a three-year exclusive distribution agreement with China Resources Pharmaceutical Commercial Group International Trading Co., Ltd. (“CRPCGIT”) to appoint CRPCGIT on an exclusive basis as its distributor to distribute EVOMELA® in the territory of the People’s Republic of China (excluding Hong Kong, Taiwan and Macau), subject to certain terms and conditions. The Company’s internal marketing and sales team are responsible for commercial activities, including, for example, direct interaction with Key Opinion Leaders (KOL), physicians, hospital centers and the generation of sales. The agreement was renewed in March 2022 for another two years.

CNCT19 (CAR-T CD19)

In June 2019, the Company entered into a license agreement for exclusive worldwide license to commercialize an autologous anti-CD19 T-cell therapy product (CNCT19) from Juventas (the “Juventas license agreement”). Juventas is a privated China-based company engaged in cell therapy. Upon completion of the financing, our investment in Juventas represented a 16.327% equity interest on a fully diluted basis.

In September 2020, Juventas and its shareholders (including CASI Biopharmaceuticals (WUXI) Co., Ltd. ("CASI Biopharmaceuticals”), a majority indirectly-owned subsidiary of us) agreed to certain terms and conditions required by a new third-party investor to facilitate the Series B financing of Juventas, pursuant to which the Company agreed to amend and supplement the original licensing agreement (the "Supplementary Agreement") by agreeing to pay Juventas certain percentage of net profits generated from commercial sales of CNCT19 in addition to the royalty fee payment calculated as a percentage of net sales. The Supplementary Agreement also specifies a minimum annual target net profit to be distributed to Juventas and certain other terms and obligations. In return, the Company obtained additional equity interests in Juventas.

8

Under the Supplementary Agreement, Juventas and the Company will jointly market CNCT19, including, but not limited to, establishing medical teams, developing medical strategies, conducting post-marketing clinical studies, establishing Standardized Cell Therapy Centers, establishing and training providers with respect to cell therapy, testing for cell therapy, and monitoring quality controls (cell collection and transfusion, etc.), and patient management (adverse reactions treatment, patients’ follow-up visits, and establishment of a database). The Company also will reimburse Juventas for a portion of Juventas’ marketing expenses as reviewed and approved by a joint commercial committee to be constituted. The Company will continue to be responsible for recruiting and establishing a sales team to commercialize CNCT19.

On October 26, 2021, Juventas completed its Series C financing. Upon the completion of Juventas Series C financing, the Company’s equity ownership in Juventas decreased to 12.01% on a fully diluted basis, with the total fair value of the equity interest amounted to RMB 206 million ($32.3 million).

BI-1206 (anti-FcyRIIB antibody)

In October 2020, the Company entered into an exclusive licensing agreement with BioInvent International AB (“BioInvent”) for the development and commercialization of novel anti-FcγRIIB antibody, BI-1206, in mainland China, Taiwan, Hong Kong and Macau. BioInvent is a biotechnology company focused on the discovery and development of first-in-class immune-modulatory antibodies for cancer immunotherapy. BI-1206 is being investigated in a Phase 1/2 trial, in combination with anti-PD1 therapy Keytruda® (pembrolizumab), in patients with solid tumors, and in a Phase 1/2a trial in combination with MabThera® (rituximab) in patients with relapsed/refractory non-Hodgkin lymphoma (NHL). Clinical Trial Application (CTA) was approved by NMPA in December 2021. The Company is planning Phase 1 trials of BI-1206 as a single agent to evaluate the PK/safety profile and in combination with rituximab in patients with NHL (mantle cell lymphoma, marginal zone lymphoma, and follicular lymphoma) to assess safety and tolerability, select the Recommended Phase 2 Dose and assess potential evidence of clinical efficacy as part of its development program for BI-1206 in China. The studies are expected to start in the first half of 2022.

Under the terms of the agreement, BioInvent and CASI will develop BI-1206 in both hematological malignancies and solid tumors, with CASI responsible for commercialization in China and associated markets. CASI made a $5.9 million upfront payment in November 2020 to BioInvent and will pay up to $83 million in development and commercial milestone payments plus tiered royalties in the high-single to mid-double-digit range on net sales of BI-1206.

In conjunction with its license agreement entered into with BioInvent, CASI made a SEK 53.8 million investment (equivalent to $6.3 million) in 1.2 million new shares of BioInvent, and 14,700,000 new warrants, each warrant with a right to subscribe for 0.04 new shares in BioInvent within a period of five years and at a subscription price of SEK 78.50 per share.

As an import drug product into China, we expect that future supply of BI-1206 will be met by our partner BioInvent and its contract manufacturers. For local development in China, we expect that our current strategy of outsourcing manufacturing is cost-effectiveclinical materials and allowscommercial inventory will be supplied by one or more contract manufacturers.

CB-5339 (VCP/p97inhibitor)

In March 2021, the Company entered into an exclusive license with Cleave Therapeutics, Inc. (“Cleave”) for the flexibilitydevelopment and commercialization of CB-5339, an oral novel VCP/p97 inhibitor, in both hematological malignancies and solid tumors, in Mainland China, Hong Kong, Macau and Taiwan. Cleave is a clinical-stage biopharmaceutical company focused on valosin-containing protein (VCP)/p97 as a novel target in protein homeostasis, DNA damage response and other cellular stress pathways for therapeutic use in the treatment of patients with cancer.

CB-5339 is being evaluated by Cleave in a Phase 1 clinical trial in patients with acute myeloid leukemia (AML) and myelodysplastic syndrome (MDS). Under the terms of the agreement, CASI is responsible for development and commercialization in China and associated markets. Cleave received a $5.5 million upfront payment and is eligible to receive up to $74 million in development and commercial milestone payments plus tiered royalties in the high-single to mid-double-digit range on net sales of CB-5339. In conjunction with the license agreement, CASI made a $5.5 million investment in Cleave through a convertible note.

As an import drug product into China, we require.expect that future supply of CB-5339 will be met by our partner Cleave and its contract manufacturers. For local development in China, we expect that our clinical materials and commercial inventory will be supplied by one or more contract manufacturers.

9

CID-103 (anti-CD38 Monoclonal Antibody)

Sponsored Research Agreements. To support development efforts, we may enterIn April 2019, the Company entered into sponsored research agreementsa license agreement with outside scientists to conduct specific projects. Under these agreements, we have secured thea newly established, privately held UK Company Black Belt Therapeutics Limited (“Black Belt”) for exclusive worldwide rights to intellectual propertyCID-103, an investigational anti-CD38 monoclonal antibody (Mab) (formerly known as TSK011010). In conjunction with the license agreement, CASI invested 2 million euros in Black Belt.

The Company expects that its clinical materials and commercial inventory will be supplied by one or more contract manufacturers with whom the Company has contracted with. Under the terms of the agreement, CASI obtained global rights to developCID-103 for an upfront payment of 5 million euros ($5.7 million) as well as certain milestone and royalty payments. In June 2021, the Company achieved the First-Patient-In (FPI) in the Phase 1 dose escalation and expansion study of CID-103, and made $750,000 milestone payment in June 2021 and €250,000 ($305,000) payment in August 2021 under the terms of the agreement.

Thiotepa

In August 2019, the Company entered into an Exclusive License and Distribution Agreement with Riemser Pharma GmbH (“Riemser”), pursuant to which we obtained exclusive license any discoveries resultingdistribution rights for Thiotepa in China. Under the agreement, Riemser will be responsible for manufacturing and supplying CASI with clinical trials materials and commercial drug product, and costs of clinical trials (if any) for the registration, product launch and commercialization of Thiotepa in China. In January 2020, Riemser was acquired by Esteve Healthcare, S.L. (“ESTEVE”), an international pharmaceutical company headquartered in Barcelona.

Octreotide LAI

In October 2019, the Company entered into an exclusive distribution agreement with Pharmathen Global BV ("Pharmathen") for the development and distribution of Octreotide LAI microsphere in China. Octreotide LAI formulations, which are approved in various European countries, are considered a standard of care for the treatment of acromegaly and the control of symptoms associated with certain neuroendocrine tumors. Octreotide LAI’s ANDA review is pending due to CDE’s sterilization requirement is different from these collaborations. European standard. CASI is now working with licensor Pharmathen to improve the sterilization process in order to meeting CDE’s requirement.

The funds, if any, we provideterms of the agreement include an upfront payment of 1 million euros which was paid by the Company in accordance with these agreements partially support2019, and up to 2 million euros of additional milestone payments, of which 1.5 million euros ($1.7 million) was expensed in the scientists’ laboratory,year ended December 31, 2020 as acquired in-process research personnel and research supplies.development following Pharmathen’s achievement of certain milestones. CASI is responsible for the development, import drug registration, product approval and commercialization in China. CASI has a 10-year non-royalty exclusive distribution period after the product launch at agreed supply costs for the first three years.

INTELLECTUAL PROPERTY

We generally seek patent protection for our technology and product candidates in the United States, Canada, China and other key markets. The patent position of biopharmaceutical companies generally is highly uncertain and involves complex legal and factual questions. Our success will depend, in part, on whether we can: (i) obtain patents to protect our own products; (ii) obtain licenses to use the technologies of third parties, which may be protected by patents; (iii) protect our trade secrets and know-how; and (iv) operate without infringing the intellectual property and proprietary rights of others.

With regardregards to our in-licensedcommercial drug candidates (EVOMELAEVOMELA®, MARQIBO®, and ZEVALIN®), licensed for greater China rights from our partner, we have acquired exclusive licenses to intellectual property to enable us to develop and continue to commercialize EVOMELA® in China.

With regards to CNCT19, we have acquired an exclusive license to intellectual property from our partner Juventas to enable us to co-commercialize CNCT19 in China and well as the drug candidatesrest of the world. Juventas is responsible for prosecuting and maintaining the licensed intellectual property.

With regards to BI-1206, we have acquired an exclusive license to intellectual property and the know-how from our partner BioInvent to enable us to develop and commercialize BI-1206 in our greater China commercial markets. BioInvent is responsible for prosecuting and maintaining the licensed BioInvent intellectual property.

10

With regards to CB-5339, we have acquired an exclusive license to intellectual property and the know-how from our partner Cleave to enable us to develop and commercialize CB-5339 in our greater China commercial markets. Cleave is responsible for prosecuting and maintaining the licensed Cleave intellectual property.

With respectregards to ENMD-2076,our in-licensed anti-CD38 antibody candidate CID-103, we directly own 22 grantedhave acquired an exclusive worldwide license to patents or allowedaround CID-103 and other anti-CD38 antibodies, covering multiple pending applications worldwide, directed to the antibodies themselves and treatment methods using the antibodies. We have since filed additional applications, with current pending applications including U.S., Australia, Canada, China, Europe, India, Japan, Korea, New Zealand, Singapore and Hong Kong. We intend to further expand our patent applications (including 2 granted United States patents, 1 granted Chinese patent,portfolio and 18 granted patents and 1in the submission stage of additional pending patent application in Brazil).applications. The patent term for U.S. Patent No. 7,563,787any patents granted from the earliest of these pending applications will expire March 5, 2027, assuming all maintenance fees are paid. If and when the FDA approves ENMD-2076, this patent term may be extended. The patent terms of our granted patents (including any patents issuing from our pending patent applications) in other countries will expire September 29, 2026,June 2038, assuming all annuities are paid and not considering any term extensions for regulatory approval that might be available. We also directly own two pending U.S. provisional applications directed

With regards to treatment methods using ENMD-2076.our drug candidates Thiotepa and Octreotide LAI, we have acquired exclusive licenses to intellectual property and/or the know-how to enable us to develop and commercialize the drug candidates in the China market.

The Company holds certain intellectual property in connection with a proprietary aurora kinase inhibitor that we no longer devote resources to. Our intellectual property for this asset remains available for business development partnering.

We havecurrently own a number of registered trademarks and pending trademark applications for CASI, including our corporate logo and product name in the United States, China and other jurisdictions, and we are seeking further trademark protection for CASI, PHARMACEUTICALS.

including our corporate logo, product name, and other marks in jurisdictions where available and appropriate.

We review and assess our portfolio on a regular basis to secure protection and to align our patentintellectual property strategy with our overall business strategy.

GOVERNMENT REGULATION

U.S. Food and Drug Administration (FDA)

Our research, development, testing, manufacture, labeling, sale, marketing, advertising, and potential saledistribution of therapeutics in the United States, China and other countries are subject to extensive regulations by federal, state, local and foreign governmental authorities.

In the United States, the FDA regulates product candidates being developed asthe development and commercialization of drugs orand biologics. New drugsDrugs are subject to regulation under the Federal Food, Drug, and Cosmetic Act (FFDCA), and biological products, in addition to being subject to certain provisions of the FFDCA, are regulated under the Public Health Service Act (PHSA). We believe that the FDA will regulate the products currently being developed by us or our collaborators as new drugs.drugs or biologics. Both the FFDCA and PHSA and corresponding regulations govern, among other things, the testing, manufacturing, safety, efficacy, labeling, storage, recordkeeping, advertising and other promotion of biologics or newand drugs, as the case may be. FDA clearances must be obtained before clinical testing, and approvals must be obtained before marketing of biologics or drugs.

From time to time, legislation is drafted, introduced and passed in Congress that could significantly change the statutory provisions governing the approval, manufacturing and marketing of products regulated by the FDA. In addition to new legislation, FDA regulations and policies are often revised or reinterpreted by the agency in ways that may significantly affect our business and our product candidates or any future product candidates we may develop. It is impossible to predict whether further legislative or FDA regulation or policy changes will be enacted or implemented and what the impact of such changes, if any, may be.

Preparing drug and biologic candidates for regulatory approval has historically beenis a costly and time-consuming process. Generally, in order to gain FDA permission to test a new agent, a developer first must conduct preclinical studies in the laboratory and in animal model systems in accordance with applicable FDA requirements, including Good Laboratory Practice regulations, to gain preliminary information on an agent’s effectiveness and to identify any safety problems. The results of these studies, together with manufacturing information and analytical data as well as protocols and detailed descriptions for proposed clinical investigations, are submitted to FDA as a part of an Investigational New Drug Application (IND) for a drug or biologic, which the FDA must reviewbecome effective before human clinical trials of an investigational drug can begin. In addition toAn IND application will automatically become effective 30 days after receipt by the known safety and effectiveness data onFDA, unless before that time the drugFDA raises concerns or biologic,questions about issues, such as the IND must include a detailed descriptionconduct of the clinical investigations proposed. Basedtrials as outlined in the IND application, and places the clinical trial(s) on a clinical hold. In such a case, the currentIND application sponsor and the FDA organizational structure, ENMD-2076 is regulated as a new chemical entity by the FDA’s Center for Drug Evaluation and Research. Generally, as new chemical entities like our small molecules are discovered, formal IND-directed toxicology studies are required prior to initiating human testing. Clinical testing may begin 30 days aftermust resolve any outstanding FDA concerns or questions before clinical trials can proceed. We cannot be certain that submission of an IND toapplication will result in the FDA unless FDA objectsallowing clinical trials to the initiationbegin.

11

In order to commercialize any drug or biological products, weWe or our collaborators must sponsorthen conduct adequate and file anwell-controlled clinical trials, in accordance with applicable IND regulations, Good Clinical Practices (“GCPs”), and conduct clinical studiesother clinical-trial related regulations, to demonstrateestablish the safety and effectiveness necessary to obtain FDA approvalefficacy of such products. For studies conducted under INDs sponsored by us or our collaborators, wethe candidate for each proposed indication We or our collaborators will be required to select qualified investigators (usually physicians within medical institutions) to supervise the administration of the products, test or otherwise assess patient results, and collect and maintain patient data; monitor the investigations to ensure that they are conducted in accordance with applicable requirements, including the requirements set forth in the general investigational plan and protocols contained in the IND; and comply with applicable reporting and recordkeeping requirements.

The study protocol and informed consent information for study subjects in clinical trials must also be approved by an institutional review board (“IRB”) for each institution where the trials will be conducted before the trial can begin, and each IRB must monitor the study until completion. Study subjects must provide informed consent and sign an informed consent form before participating in a clinical trial.

Clinical trials of drugs or biologics are normally done in three phases, although the phases may overlap.overlap or be combined. Phase 1 trials for drug candidates to be used to treat cancer patients are concerned primarily withusually involve the safety and preliminary effectivenessinitial introduction of the drug, involve a small group ranging from 15 - 40 subjects,investigational candidate into humans to evaluate its short-term safety, dosage tolerance, metabolism, pharmacokinetics and may take from six monthspharmacologic actions, and, if possible, to over one year to complete.gain an early indication of its effectiveness. Phase 2 trials normally involve 30 - 200 patientstrials in a limited patient population to evaluate dosage tolerance and are designed primarily to demonstrate effectiveness in treating or diagnosing the disease or condition for which the drug is intended, although short-term sideappropriate dosage, identify possible adverse effects and safety risks, in study subjects whose health is impaired may also be examined.and evaluate preliminarily the efficacy of the candidate for specific target indications. Phase 3 trials are expanded clinical trials with larger numbers of patients which are intended to evaluate the overall benefit-risk relationship of the drug and to gather additional information for proper dosage and labeling of the drug. Phase 3 clinical trials generallymay take two to fiveseveral years to complete, butcomplete. Annual progress reports detailing the results of the clinical studies must be submitted to the FDA and IND safety reports must be submitted to the FDA and investigators within 15 calendar days for serious and unexpected adverse events, any findings from other studies, tests in laboratory animals or in vitro testing that suggest a significant risk for human subjects, or any clinically important increase in the rate of a serious suspected adverse reaction over that listed in the protocol or investigator brochure. We or our collaborators, the FDA, or an IRB (with respect to a particular study site) may take longer. suspend or terminate clinical trials at any time on various grounds, including a finding that the subjects or patients are being exposed to an unacceptable health risk.

Post-approval trials, sometimes referred to as Phase 4 clinical trials, may be conducted after receiving initial marketing approval. These trials are used to gain additional experience from the treatment of patients in the intended therapeutic indication and are commonly intended to generate additional safety data regarding use of the product in a clinical setting. In certain instances, the FDA may mandate the performance of Phase 4 clinical trials as a condition of approval of the product or, in certain circumstances, post-approval.

The FDA receives reportshas various programs, including fast track designation, breakthrough therapy designation, priority review, accelerated approval, and, for regenerative medicine therapies, regenerative medicine advanced therapy designation, which are intended to expedite or simplify the process for the development, and FDA’s review, of drugs and biologics (e.g., granting approval on the progressbasis of each phasesurrogate endpoints subject to post-approval trials). Generally, drugs or biologics that may be eligible for one or more of clinical testing,these programs are those intended to treat serious or life-threatening diseases or conditions, those with the potential to address unmet medical needs for those disease or conditions, and/or those that provide a meaningful benefit over existing treatments. Moreover, if a sponsor submits a marketing application for a product intended to treat certain rare pediatric or tropical diseases or for use as well as reportsa medical countermeasure for a material threat, and that meets other eligibility criteria, upon approval such sponsor may be granted a priority review voucher that can be used for a subsequent application. Even if a product qualifies for one or more of unexpected adverse experiences occurring duringthese programs, the trial. The FDA may require the modification, suspension, or termination of clinical trials, if it concludes that an unwarranted risk is presented to patients, or, in Phase 2 and 3, if it concludeslater decide that the study protocols are deficient in design to meet their stated objectives.

product no longer meets the conditions for qualification or decide that the time period for FDA review or approval will not be shortened. Furthermore, these programs do not change the standards for approval and may not ultimately expedite the development or approval process.

If clinical trials of a new drugproduct candidate are completed successfully, the sponsor of the product may seek FDA marketing approval. If the product is classified as a new drug, an applicant must file a New Drug Application (NDA) with. For biological products, an applicant must file a Biologics License Application (BLA). In each case, FDA must approve the FDAapplication before the product can be marketed commercially. NDAs and receive approval before marketing the drug commercially. The NDABLAs must include, among other things, detailed information about the productproduct’s chemistry, manufacture, controls, and its manufacturerproposed labeling and the results of product development, preclinical studies and clinical trials. Generic drugs, which are therapeutic equivalents of existing brand name drugs, requireTo support marketing approval, the filing of an ANDA. An ANDA does not, fordata submitted must be sufficient in quality and quantity to establish the most part, require clinical studies since safety and efficacy have already been demonstrated byof a drug, and safety, purity, and potency of a biologic, to the product originator. However, the ANDA must provide data to support the bioequivalencesatisfaction of the generic drug product. User feesFDA. A user fee must be paid with the submission of applications for non-orphan productsan NDA or BLA (unless a fee waiver applies) in order to support the cost of agency review. While such feesreview, which is currently almost $3 million. FDA usually will inspect the facility or the facilities at which the drug is manufactured and will not approve the product unless the manufacturing and production and testing facilities are not significantin compliance with current Good Manufacturing Practice (cGMP) regulations. In addition, FDA may also inspect clinical trial sites that generated data for ANDAs, anthe NDA foror BLA as well as us or our collaborators as a non-orphan product requires a user feeclinical trial sponsor.

12

The testing and approval processes require substantial time and effort, and there can be no assurance that FDA will accept the application for filing or that any approval will be obtained on a timely basis, if at all. TheUnder the goals and policies agreed to by the FDA under the Prescription Drug User Fee Act, the FDA has ten months from the 60 day filing date in which to complete its initial review of a standard application and respond to the applicant. However, the time required by the FDA to review and approve NDAs and ANDAsBLAs is variable and, to a large extent, beyond our control. Notwithstanding the submission of relevant data, the FDA may ultimately decide that an NDA or BLA does not satisfy its regulatory criteria and deny the approval. Further,In such instance, FDA will issue a Complete Response Letter, describing all the deficiencies that the FDA has identified in an application that must be satisfactorily addressed before it can be approved. A Complete Response Letter may require additional clinical data and/or an additional pivotal Phase 3 clinical trial(s), and/or other significant, expensive and time-consuming requirements related to clinical trials, preclinical studies before makingor manufacturing. Further, even if such additional information is submitted, the FDA may ultimately decide that the application does not satisfy the criteria for approval. The FDA may also refer the application to an appropriate advisory committee, typically a decision on approval.panel of clinicians, for review, evaluation and a recommendation as to whether the application should be approved. The FDA is not bound by the recommendations of the advisory committee, but the Agency historically has tended to follow such recommendations. In addition, the FDA may condition marketing approval on the conduct of specific post-marketing studies to further evaluate safety and effectiveness. Even if FDA regulatory clearances areeffectiveness or a Risk Evaluation and Mitigation Strategy (REMS) that may include both special labeling and controls, known as Elements to Assure Safe Use, on the distribution, prescribing, dispensing and use of a drug product. After approval is obtained, a marketed product is subject to continuing regulatory requirements and review relating to current Good Manufacturing Practices, or cGMP, adverse event reporting, promotion and advertising, and other matters. The FDA strictly regulates labeling, advertising, promotion and other types of information on products that are placed on the market. Products may be promoted only for the approved indications and in accordanceconsistent with the provisions of the approved label. Discovery of previously unknown problems or failure to comply with the applicable regulatory requirements may result in restrictions on the marketing of a product, mandated labeling changes, or withdrawal of the product from the market, as well as possible civil or criminal sanctions.

Drugs and biological products may be eligible to receive certain regulatory exclusivities upon approval. For example, a drug that constitutes a new chemical entity (i.e., an active moiety that has not been previously approved in another NDA) is entitled to five years of exclusivity during which FDA may not accept an ANDA or 505(b)(2) NDA for filing referencing such chemical entity, unless a “Paragraph IV certification” is made in which case FDA may accept such applications four years after initial approval of the new chemical entity. In addition, three years of exclusivity can be awarded for applications (including supplements) containing the results of new clinical investigations (other than bioavailability studies) conducted by the applicant and essential to the FDA’s approval of new versions or conditions of use of previously approved drug products, such as new indications, delivery mechanisms, dosage forms, strengths, or other conditions of use. A reference biological product is granted twelve years of data exclusivity from the time of first licensure of the product, and the FDA will not accept an application for a biosimilar or interchangeable product based on the reference biological product until four years after the date of first licensure of the reference product. Moreover, a drug or biologic may receive orphan drug designation if intended to treat a rare disease or condition, which is generally a disease or condition that affects fewer than 200,000 individuals in the United States, or more than 200,000 individuals in the United States and for which there is no reasonable expectation that the cost of developing and making the product available in the United States for this type of disease or condition will be recovered from sales of the product in the United States. If a product that has orphan designation subsequently receives the first FDA approval for the disease or condition for which it has such designation, the product is entitled to orphan drug exclusivity, which restricts FDA from approving any other applications to market the same drug for the same indication for seven years from the date of such approval, except in limited circumstances, such as a showing of clinical superiority to the product with orphan exclusivity by means of greater effectiveness, greater safety, by providing a major contribution to patient care, or in instances of an inability to assure drug supply.