UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C.D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 20182019

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________________ to ________________. |

Commission File Number: 001-37939

MARKER THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 45-4497941 | |

(State or other jurisdiction of incorporation) | (IRS Employer Identification No.) |

3200 Southwest Freeway, Suite 2240 Houston, Texas | ||

(Address of principal executive offices) | 77027 (Zip |

(713) 400-6400

(Registrant’s telephone number, including area code)Telephone Number)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, Par Value $0.001

(Title of class)

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | MRKR | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act. Yes¨ Nox

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 ofRegulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ||||

| ¨ | Accelerated filer | x | ||

| Non-accelerated filer | ¨ | Smaller reporting company | x | |

| Emerging growth company | ¨ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Nox

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $81,400,000 computed by reference to the price per share ($9.43) at which the registrant’s common equity was last sold, as of June 30, 201828, 2019 (the last day of the registrant’s most recently completed second fiscal quarter). based on the closing sale price of $7.92 as reported on the Nasdaq Capital Market as of that date was approximately $198,900,000.

The registrant had 45,467,68446,532,522 shares of common stock outstanding as of February 28, 2019.March 9, 2020.

Documents Incorporated By Reference

Portions of the registrant’s proxy statement relating to registrant’s 20192020 Annual Meeting of Stockholders (the “Proxy Statement”) to be filed with the Securities and Exchange Commission pursuant to Regulation 14A, not later than 120 days after the close of the registrant’s fiscal year, are incorporated by reference in Part III of this Annual Report on Form 10-K. Except with respect to information specifically incorporated by reference in this Annual Report on Form 10-K, the Proxy Statement is not deemed to be filed as part of this Annual Report on Form 10-K.

TABLE OF CONTENTS

i

This annual report contains forward-looking statementswithin the meaning of the Private Securities Litigation Reform Act of 1995that involve substantial risks and uncertainties.The forward-looking statements are contained principally in Part I, Item 1: "Business," Part I, Item 1A: "Risk Factors," and Part 2, Item 7: "Management's Discussion and Analysis of Financial Condition and Results of Operations," but are also contained elsewhere in this annual report.Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue”, the negative of such terms or other comparable terminology. In evaluating theseThese statements you should consider variousspeak only as of the date of this Annual Report and involve known and unknown risks, uncertainties and other important factors including the assumptions, risks and uncertainties outlined in this annual report. Any of these itemsthat may cause our actual results, performance or achievements to differbe materially different from any future results, performance or achievements expressed or implied by the forward-looking statement made in this annual report. statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Forward-looking statements in this annual report include statements as to:

| · | the |

| · | the timing of any submission of filings for regulatory approval of product candidates and | |

| · | our ability to | |

| · | our expectations regarding | |

| · | our | |

| · | our | |

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding future events, our actual results will likely vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Some of the risks and assumptions include:

| · | our expectations regarding the scope of any approved indications for product candidates; | |

| · | the potential benefits of and our ability to maintain our relationships and collaborations with the Baylor College of Medicine and other potential collaboration or strategic relationships; | |

| · | our ability to | |

| · | our | |

| · | our ability to |

| · | our ability to | |

| · | ||

| · | our competitive position and the development of and projections relating to our competitors or our industry; and | |

| · | the impact of |

Given

ii

You should refer to "Item 1A. Risk Factors" in this annual report for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these risks andfactors, we cannot assure you that the forward-looking statements in this annual report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not place undue reliance onregard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. The forward-looking statements in this annual report represent our views as of the date of this annual report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements. Except as required by federal securities laws,statements at some point in the future, we undertake no obligation to publicly update any forward-looking statements, for any reason, even ifwhether as a result of new information, becomes availablefuture events or other events occurotherwise, except as required by law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this annual report.

You should read this annual report and the documents that we reference in this annual report and have filed as exhibits to this annual report completely and with the future.understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

In this report all references to (i) “Marker” “we,” “us,” “our” or the “Company” mean Marker Therapeutics, Inc. and its wholly-owned subsidiaries, Marker Cell Therapy, Inc. and GeneMax Pharmaceuticals, Inc., which wholly owns GeneMax Pharmaceuticals Canada Inc., unless the context otherwise requires; (ii) “SEC” refers to the Securities and Exchange Commission; (iii) “Securities Act” refers to the United StatesSecurities Act of 1933, as amended; (iv) “Exchange Act” refers to the United StatesSecurities Exchange Act of 1934, as amended; and (v) all dollar amounts refer to United States dollars unless otherwise indicated.

iii

Overview

We are a clinical-stage immuno-oncology company specializing in the development and commercialization of novel T cell-based immunotherapies and innovative peptide-based vaccines for the treatment of hematological malignancies and solid tumor indications. Our MultiTAAWe developed our lead product candidates from our MultiTAA-specific T cell technology, which is based on the selective expansion of non-engineered, tumor-specific T cells that recognize tumor associated antigens, (“TAA” i.e.or TAAs, which are tumor targets)targets, and then kill tumor cells expressing those targets. Once infused into patients, this population ofThese T cells recognizesare designed to recognize multiple tumor targets to produce broad spectrum anti-tumor activity. We are advancing two pipelines of product candidates as part of our MultiTAA-specific T cell program: the autologous T cells for the treatment of lymphoma, multiple myeloma, or MM, and selected solid tumors and the allogeneic T cells for the treatment of acute myeloid leukemia, or AML, and acute lymphoblastic leukemia, or ALL. Because we do not genetically engineer the MultiTAA-specific T cell therapies, we believe that our T cells, when comparedproduct candidates are easier and less expensive to manufacture, with reduced toxicities, than current engineered chimeric antigen receptor, (“CAR”)or CAR-T, and T cell receptor (“TCR”)-based approaches, our products are significantly less expensive to manufacturereceptor-based therapies and appear to be markedly less toxic, and yet are associatedmay provide patients with meaningful clinical benefit. We are also developing innovative peptide-based immunotherapeutic vaccines for the treatment of metastatic solid tumors.

We are pursuing post-transplant AML as the lead indication for our first company-sponsored MultiTAA-specific T cell program. The MultiTAA-specific T cell therapy has been well tolerated in an ongoing Phase 1/2 clinical trial conducted by our strategic partner Baylor College of Medicine, or BCM. As reported in March 2019, eleven of the thirteen patients in the adjuvant disease setting dosed with the MultiTAA-specific T cell therapy after receiving an allogeneic stem cell transplant survived, ranging from 6 weeks to 2.5 years post-infusion, with nine of these remaining patients in continuing complete remission, or CCR. Survival of the six patients with active disease ranged from 4 to 21 months, as compared to a result,historical survival rate of approximately 4.5 months for patients who receive the standard of care post-transplant.

We submitted an investigational new drug, or IND, application to the United States Food and Drug Administration, or the FDA to initiate a Phase 2 clinical trial of MultiTAA-specific T cell therapy, which we believerefer to as MT-401, in post-allogeneic hematopoietic stem cell transplant patients with AML in both the adjuvant and active disease setting, which may become pivotal pending the results of the interim analysis. The dose administered in this multicenter trial is the current maximum tolerated dose from the ongoing Phase 1/2 trial. In the adjuvant setting, patients will be randomized to either MultiTAA-specific T cell therapy at approximately 90 days post-transplant versus standard of care observation, while the active disease patients will receive MT-401 following relapse post-transplant as part of a single-arm group. In February 2020, we announced that the FDA has permitted us to initiate our portfolioPhase 2 clinical trial beginning with a safety lead-in portion of the trial.

We recently reported interim data for an ongoing Phase 1/2 clinical trial of the MultiTAA-specific T cell therapy for the treatment of pancreatic adenocarcinoma being conducted by BCM. In this trial, we have observed a clinical benefit correlated with the post-infusion detection of tumor-reactive T cells in patient peripheral blood and within tumor biopsy samples in patients in the tumor-resection arm of the trial. These T cells exhibited activity against both targeted antigens and non-targeted TAAs, indicating induction of antigen spreading. To date, we have not observed any cytokine release syndrome or neurotoxicity in this trial.

We are also evaluating the MultiTAA-specific T cell therapies hasin a compelling therapeutic product profile, as compared to current gene-modified CARPhase 2 clinical trial for the treatment of breast cancer and TCR-based therapies. In addition, our Folate Receptor Alpha program (TPIV200) for breast and ovarian cancers and our HER2/neu program (TPIV100/110) are in Phase II1 clinical trials. In parallel, wetrials for the treatment of ALL, lymphoma, MM and sarcoma, all of which are developing a proprietary nucleic acid-based antigen expression technology named PolyStart™ to improvebeing conducted by BCM. As of December 2019, the abilityMultiTAA-specific T cell therapies have been generally well tolerated by all of the immune system to recognizepatients enrolled in clinical trials in hematological and destroy diseased cells.

Immuno-oncology,solid tumor indications with no incidents of cytokine release syndrome or neurotoxicity, which utilizes a patient’s own immune system to combatare frequently associated with CD19 CAR-T therapies. Based on our observations in clinical trials in AML, pancreatic cancer, is one oflymphoma, ALL and MM, we believe that the most actively pursued areas of research by biotechnology and pharmaceutical companies today. Interest and excitement about immunotherapy are driven by compelling efficacy data in cancers with historically bleak outcomes, andMultiTAA-specific T cell therapies have the potential to achievemediate a cure or functional cure for somemeaningful anti-tumor effect, as well as significant in vivo expansion of T cells. We may initiate additional Phase 2 clinical trials investigating other indications in 2020 in addition to our planned Phase 2 trial in post-transplant AML patients. Harnessing the power of the immune system is an important component of fighting cancerous cells in the body. Our MultiTAA T cell therapy platform identifies and selects effectively all T cells that are specific for any peptide from the antigens that we target (e.g., WT1, MAGE-A4, PRAME, Survivin, NY-ESO-1, and SSX2). Our in-vitro manufacturing process promotes proliferation of very rare cancer-killing T cells and augments their anti-tumor properties to provide benefit to patients following their infusion. By using the multi-antigen targeted approach, our proprietary technology can kill heterogeneous tumor cell populations more effectively than single-antigen targeted approaches, thereby reducing the likelihood of tumor escape and potentially increasing the durability of a patient’s response to therapy.

We believe that our therapy presents atherapies present promising innovationinnovations in immuno-oncology. OurWe developed the MultiTAA-specific T cell therapy has been developed through ourin collaboration with the Cell and Gene Therapy Center at Baylor College of Medicine (“BCM”)BCM, which was founded by Dr. Malcolm K. Brenner, M.D., Ph.D., a recognized pioneer in immuno-oncology. BCM remains an important strategic partner and conducts early-stage clinical trials of the MultiTAA-specific T cell therapies pursuant to a sponsored research agreement. Our cell therapy founders include Drs. Malcolm Brenner, M.D., Ph.D., Ann Leen, Ph.D., Juan Vera, M.D., Helen Heslop, M.D., DSc (Hon) and Cliona Rooney, Ph.D., who all have significant experience in this field. Dr.Drs. Brenner, Heslop, Rooney, James P. Allison Dr. Malcom K. Brenner, Dr. Helen E. Heslop, Dr. Cliona M. Rooney and Dr. Padmanee Sharma serve on our Scientific Advisory Board.

Pipeline

Our clinical-stage pipeline, including clinical trials being conducted by BCM and other partners, is set forth below.

Recent Developments

AML Clinical Program Update

In February 2020, we announced that the FDA lifted the clinical hold on the Phase 2 clinical trial investigating the safety and efficacy of MT-401 for the treatment of patients with AML post-transplant permitting us to initiate the trial with the safety lead-in portion that is expected to enroll approximately six patients. Three patients will be dosed with MT-401 manufactured using the legacy reagent used in the Phase 1 trial, and three patients will be dosed with MT-401 manufactured using a reagent from an alternative supplier. We anticipate using this supplier for clinical and commercial supply of MT-401. The FDA placed a partial clinical hold on the trial for the use of the MT-401 product manufactured using one of the reagents supplied by the alternative supplier until the final data and certificate of analysis for the reagent are reviewed and accepted by the FDA. We currently estimate that the alternative supplier will deliver the final reagent, along with the final data and certificate of analysis required by the FDA, by the end of the second quarter of 2020. During the second half of 2020, we anticipate completing enrollment of the first three patients and submission of both the final technical specifications and comparability data of the new reagents to the FDA, the latter of which would satisfy the requirements for lifting the partial hold on the clinical trial. Given this expected timing, we do not currently expect the partial clinical hold to significantly impact site and patient enrollment of the Phase 2 trial.

The safety lead-in will be followed by the 160-patient randomized portion of the trial at approximately 20 transplant centers. Group 1 will comprise 120 adjuvant (disease-free) patients, with the primary endpoint of relapse-free survival of patients receiving MT-401 versus a control group. Group 2 will comprise 40 active disease patients in a single arm, with primary endpoints of complete remission and duration of complete remission.

Our Strategy

Our goal is to be the leader in the development and commercialization of transformative immunotherapies for the treatment of hematological malignancies and solid tumors. We will beare developing a portfolio of highly-differentiatedhighly differentiated T cell therapies utilizing our MultiTAAthe MultiTAA-specific T cell platform that haswe believe have the potential to significantly disrupt the current cell therapy landscape, while substantially improving survival and quality of life for patients with cancers.

KeyThe key elements of our strategy include:

·

| · | Expedite clinical development, regulatory approval, and commercialization of our lead product candidates. |

Based on the results inof the Phase I1 clinical trials of the MultiTAA-specific T cell therapies conducted at BCM, we plan to advance our lead product candidates into Phase II2 clinical trials and facilitate the initiation of company-sponsored clinical trialstrials. We are pursuing post-transplant AML as the lead indication for the MultiTAA-specific T cell program. During the second half of 2020, we expect to complete the safety lead-in portion of our Phase 2 trial in post-transplant acute myeloid leukemia (AML)AML and satisfy the FDA’s other requirements for lifting the partial hold on the clinical trial.

We plan to initiate in the future additional clinical trials in other tumor types based on emerging data. We expect to finalize our first clinical trial protocol by end of second quarter of 2019.

We plan to initiate a Phase II clinical trial in post-transplant AML in the second half of 2019 and in other tumor types based on emerging data in the future. We anticipate that product manufacturing in support of those clinical trials will be conducted at BCM’s Good Manufacturing Practices, (“GMP”)or GMP, cell manufacturing facility.

In 2019,2020, we expect to begin the technology transfer process and begin the planning and implementation of an additional GMP manufacturing capacity capable of supporting our manufacturing needs with respect to potentially pivotal trials. If the results of our Phase II studies2 clinical trials are positive, we willintend to explore potential avenues to achieve regulatory approval for the use of our products in these indications, including any potential avenues for obtaining accelerated approval. The U.S. Food and Drug Administration (“FDA”) may grant accelerated approval for product candidates used to treat serious conditions that fill an unmet medical need based on a surrogate or intermediate endpoint. We believe that an accelerated approval strategy may be warranted given the limited options available for patients with post-transplant AML. However, if the FDA grants accelerated approval, confirmatory trials will be required by the FDA.

·Continue collaboration with our partners and increase our internal research and development activities to improve and develop adoptive cell therapy technologies.

| · | Continue to collaborate with our partners and increase our internal research and development activities to improve and develop adoptive cell therapy technologies. |

We finalizedare party to a strategic alliance with BCM, inpursuant to which we will sponsor selected research at the institutionBCM in support of our technology. In conjunction with this strategic alliance, BCM will conduct selected Phase I/II1 and Phase 2 clinical trials usingof our technology.product candidates. If data from these early clinical trials appearare positive, we will consider the therapeutic and commercial potential for such therapies to be advanced as new productsproduct candidates for us.

In addition, we plan to use BCM facilities and our company laboratories to enable the process development and manufacturing required to support the Phase II2 clinical trials of our product candidates. Outside of our relationship with BCM, we willWe plan to invest in our own research and development and chemistry, manufacturing and controls, (“CMC”)or CMC, capabilities to enhance our ability to conduct process development to optimize our manufacturing process, product quality and commercial scalability.

We believe that the G-Rex® (G-Rex® is a registered trademark of Wilson Wolf Manufacturing Corporation (“Wilson Wolf:”)) based manufacturing process we have in place is highly robust and scalable, and we will continue to invest resources in further refining the manufacturing process to create a product with highly attractive commercial attributes. We plan to engage Wilson Wolf (a company controlled by John Wilson, a director of the Company) to further customize the G-Rex® to optimally match our manufacturing requirements and to develop a scalability plan to drive efficiencies for a commercial product.

| · | Invest in our platform to maximize the beneficial outcomes for cancer patients. |

·Invest in our platform to maximize the beneficial outcomes for cancer patients.

We plan to explore new product opportunities by expandingincreasing and/or customizing the antigens we target to expand the indications in which ourthe MultiTAA-specific T cell products maywill be used,efficacious, including solid tumors or other hematologic malignancies. Additionally, our research and development efforts may include the exploration of dosingdifferent doses and/or frequency of product administrationdosing and the relationship of these factors with potential therapeutic benefit.

·

| · | Leverage our relationships with our founding institutions, scientific founders and other scientific advisors. |

Our world-renowned scientific founders and scientific advisors have made seminal contributions to major discoveries in the field of immuno-oncology, and have significant experience in oncology, immunology and cell therapy. We intend to significantly leverage the knowledge, experience and advice of our scientific founders and advisors, as well as the institutional expertise of BCM, the Mayo Foundation and our other major institutional partners, to advance our therapies through the clinic and into commercialization.

We are in the process of evaluating the peptide vaccine therapeutic products and programs to determine the future strategy and the proper allocation of our resources to best maximize stockholder value. In conjunction with this evaluation process we may de-emphasize or terminate certain of ourvaccine therapeutic products or programs. Such strategic review and evaluations are to be a priority and an important part of our ongoing operations.

MultiTAA T Cell Products

Multi Tumor-Associated Antigen (“MultiTAA”) Approach

Cancers are heterogeneous in their expression of antigens. Tumors generally consist of individual cancer cells expressing different antigens, and each of those antigens can be present at a different level that can change over time. Therapies targeting only a single antigen are vulnerable to evolutionary escape mechanisms.

Even if the single-antigen specific therapy can eliminate all the tumor cells expressing the targeted antigen, the residual tumor cells that do not express that antigen may survive and expand. In addition, tumor cells may also downregulate or mutate the targeted antigen, thus becoming invisible to the T cell therapy. Both phenomena create a transformed tumor that is impervious to that therapy. This process is referred to as antigen-negative tumor immune escape. Our solution to the problem of tumor heterogeneity was to develop T cell products that simultaneously attack multiple tumor-expressed antigens and thereby enable more complete initial tumor targeting, thus minimizing the subsequent opportunity for the cancer to engage escape mechanisms. Data suggest this strategy may be responsible for recruitment and activation of unique cancer-killing cells from the patient’s own immune repertoire to participate in cancer eradication, further minimizing the possibility for tumor cell escape.

Our proprietary MultiTAA T cell platform may have meaningful advantages over CAR and TCR-engineered cell therapy approaches. Compared to current gene-modified T cell therapies, our programs are characterized by the following:

·Demonstrated clinical benefit, without the need for lymphodepletion before infusion: In BCM’s Phase I lymphoma study, we saw complete responses (“CRs”) in six of its evaluable patients, including three CRs in patients with diffuse large B-cell lymphoma (“DLBCL”). We believe it is significant that no patient with a CR has subsequently relapsed with disease, whereas typically 30% or more of patients with CR in reported CAR-T studies relapse within one year. In patient results to date, observed therapeutic responses appear to be highly durable, with some patients being relapse-free beyond five years.

·Non-gene-modified: Unlike CAR-T and TCR approaches, our therapy requires no genetic modification of T cells, a costly and complex process that significantly complicates the manufacturing of a patient product. We believe our therapy can be manufactured at a fraction of the cost of a gene-modified T cell product.

·Low incidence rate of adverse events: In 78 patients treated to date, BCM has seen only one grade III adverse reaction possibly related to its therapy. This appears favorable compared to published CD19 CAR-T studies, wherein up to 95% of patients had associated grade III or higher adverse events during treatment. There have been no cases of cytokine-release syndrome (“CRS”), or related serious adverse events (“SAEs”) in patients treated with our therapy to date.

·Capable of addressing a broad repertoire of cancer cells: While CAR-T and TCR therapies generally target a single epitope, our manufacturing process selects T cells that are specific for multiple peptides derived from several targeted antigens. Deep gene sequencing of the clinical products shows that a typical patient dose usually consists of approximately 4,000 unique T cell clonotypes targeting up to five different tumor-associated antigens. The five antigen targets can be recognized by a very wide range of T cells, facilitating robust killing of targeted cancer cells.

·Appears to drive endogenous immune responses: We see evidence of “epitope spreading” in the treated patients, meaning that the therapy is potentially inducing an enhanced response by the patient’s own T cells (specific for an expanded set of tumor-associated antigens beyond those targeted by the infused product). BCM’s correlative analyses show expansion of endogenous T cells, other than those present in our product, in the months following the infusion of our product. This phenomenon, also known as “antigen spreading,” is potentially important in generating a durable response for a patient, because it enables the killing of tumors that do not express any of the antigens initially targeted by our product.

Peptide Vaccine Products and Technologies in Development

In contrast to standard therapies for cancer treatment including surgery, radiation therapy and chemotherapy that target both cancer cells and normal cells, we are also developing vaccines that precisely target breast and ovarian cancers. We are currently developing three core technology platforms:

1) an exclusively licensed peptide-based vaccine (composition and methods of use) for the treatment of breast cancers that overexpress Human Epidermal Growth Factor Receptor 2 (HER2/neu) (TPIV100/110),

(2) an exclusively licensed peptide-based vaccine (composition and methods of use) for treating breast and ovarian cancers that overexpress Folate Receptor Alpha (TPIV200), and

(3) a wholly-owned nucleic acid-based vaccine (composition and methods of use) technology (PolyStart™) for treatment of various cancers or infectious disease.

Our peptide vaccines are derived from naturally processed T cell antigens and are potentially effective standalone therapies but may also enhance the efficacy of other immunotherapy approaches such as CAR-T cell therapies and PD-1 inhibitors, for example, as well as our own MultiTAA T cell therapies.

The status of our development of other products and technologies is set forth in the table below:

Background and History of Cancer Immunotherapies

Despite advances in options for treatment, cancer continues to be one of the main causes of death in developed countries. Historically, cancer therapy has been constrained to surgery, radiation, and chemotherapy. More recently, advances in the understanding of the immune system’s role in cancer surveillance have led to immunotherapy becoming an important treatment approach. Cancer immunotherapy began with treatments that nonspecifically activated the immune system and had limited efficacy and/or significant toxicity. In contrast, newer immunotherapy treatments can activate specific, potent immune cells, leading to improved safety and efficacy. Within the immunotherapy category, treatments have included vaccines, cytokine therapies, antibody therapies, and adoptive cell therapies.

In 1996, Dr. Dana Leach, Dr. Matthew Krummel and Dr. James Allison reported that monoclonal antibodies, (“mAbs”)or mAbs, blocking CTLA-4 could treat tumors in animal models. Subsequently, mAbs that targeted CTLA-4 and PD-1 became known as “immuneimmune checkpoint inhibitors” (“ICIs”).inhibitors, or ICIs. Immune checkpoints are a means by which cancer cells inhibit or turn down the body’s immune response to cancer. By interfering with these cloaking mechanisms, ICIs have shown an ability to activate T cells, shrink tumors, and improve patient survival. Recent clinical data from checkpoint inhibitors such as ipilimumab, nivolumab and pembrolizumab have confirmed both the validity of this approach and the importance of T cells as promising tools for the treatment of cancer.

Despite these many advances, there persists a significant unmet need in cancer therapeutics. We believe that the use of human cells as a therapeutic modality to re-engage the immune system will be the next significant advancement in the treatment of cancer. These cellular therapies may avoid the long-term side effects associated with current treatments and have the potential to be effective regardless of the type of previous treatments patients have experienced.

T Cell Therapy Overview

The field of adoptive cell transfer (“ACT”) is currently comprised primarily of CAR and TCR engineered T cells and has emerged from principles of basic immunology to become a paradigm-shifting clinical immunotherapy. T cell therapy has evolved as one of the most promising branches of immunotherapy. T cell immunotherapy involves the infusion of immuneT cells into a patient. Immune cells used for immunotherapy treatments can either be collected from the patient (autologous) or harvested from a donor (allogeneic). The cells are retrieved and either genetically modified to express tumor-specific CARs or TCRs or mixed with specific antigens. The cells are then cultured to proliferate, and the proliferated cells are infused into the patient. Upon infusion, the cells can target and eliminate cancerous cells. Unlike chemotherapy, which is unable to distinguish between healthy and malignant cells, T cells produced for immunotherapy can selectively attack cancer cells that express the target antigen(s). This leads to a more effective treatment platform with fewer side effects. Some of these infused T cells may remain in the body for long periods, of time, providing immunological memory, thus leading to longer and more durable responses.

TCRs and CARs have distinct signaling properties and antigen sensitivities. TCRs recognize peptide fragments from proteins expressed either inside the cell or on the cell surface, which are presented to T cells via a major histocompatibility complex (“MHC”).molecules. CARs are programmed to recognize a specific cell surface protein. Because CARs are specific for a single antigen, or more precisely a single epitope within the single antigen, they are very narrowly focused and come withhave limitations. When a CAR-T cell product is applied to a specific antigen of a heterogeneous disease, CAR-T cells may leave behind tumor cells that do not express the target antigen, which can lead to tumor relapse due to immune escape.

Our approach is to avoid genetic engineering by relying upon the native T cell receptor, which has evolved over millions of years to provide T cells with an exquisite capacity to recognize and kill cancer cells. Use of the native T cell receptor is the bedrock of our versatile immunotherapy, which is intended to provide a cost-effective and non-toxic strategy to target multiple tumor antigens and lead to durable responses. The process entails expanding tumor-specific T cells from patients (autologous), or a patient’s hematopoietic stem cell donor (allogeneic). This is achieved byin vitro manipulation consisting of co-culturing a patient’s or donor’s antigen presenting cells with patient (or donor) peripheral blood mononuclear cells, (“PBMCs”),or PBMCs, respectively. As a source of antigen, we use overlapping peptide libraries spanning each of several immunogenic target antigens that are typically associated with certain types of cancer. These peptides are 15 amino acids in length, overlapping by 11 amino acids and span the entire length of each of the target antigens. This typical footprint of peptides allows us to induce both CD4+ (helper) and CD8+ (cytotoxic) T cells. Following manufacture, these cells are frozen and stored for later infusion. Once infused, the natural characteristics of T cells take over and the T cells multiply in quantity, forming an army of T cells that kill the targeted cancer cells.

Process DevelopmentWe have observed evidence of “epitope spreading” in our clinical trials, suggesting that the MultiTAA-specific T cell therapy is inducing an enhanced response by the patient’s own T cells (specific for an expanded set of tumor-associated antigens beyond those targeted by the infused product). Correlative analyses show expansion of endogenous T cells, other than those present in the infused product, in the months following infusion. This phenomenon, also known as “antigen spreading,” is potentially important in generating a deep and Manufacturingdurable response for a patient because it enables the killing of tumors that do not express any of the antigens initially targeted by our therapy and could be due to the lack of lymphodepletion that allows recruitment of the endogenous immune system for anti-tumor activity.

WeThe MultiTAA-Specific T Cell Therapies

In collaboration with BCM, we are advancing two MultiTAAMultiTAA-specific T cell productstherapies through clinical development:(a) Mixed Antigen Peptide Pool (“MAPP”) T cells currently used for patients with lymphoma, multiple myeloma (“MM”) and selected solid tumors, is an autologous product that targets the NY-ESO-1, PRAME, MAGE-A4, Survivin and SSX2 antigens; and (b) Leukemia Antigen Peptide Pool (“LAPP”) T cells, currently used for patients with AML, is an allogeneic product targeting the WT1, NY-ESO-1, PRAME, and Survivin antigens using the blood of the stem cell donor as a source of the cells used for therapy.

| · | Autologous MultiTAA-specific T cell therapies target the NY-ESO-1, PRAME, MAGE-A4, Survivin and SSX2 antigens. We recently reported updated clinical data from BCM’s Phase 1/2 clinical trial of the autologous MultiTAA therapy for the treatment of patients with pancreatic cancer, and we are currently evaluating these therapies for the treatment of patients with lymphoma, MM and other selected solid tumors in Phase 1 trials. |

| · | Allogeneic MultiTAA-specific T cell therapiestarget the WT1, NY-ESO-1, PRAME, and Survivin antigens. The stem cell transplant donor is used as the source of the cells manufactured for our allogeneic therapies. We are pursuing post-transplant AML as the lead indication for the MultiTAA-specific T cell program using our allogeneic therapies. |

While the blood source and the antigens for stimulation differ between the LAPPautologous and the MAPP products,allogeneic therapies, the manufacturing process for each product is otherwise identical.

Cancers are heterogeneous in their expression of antigens. Tumors generally consist of individual cancer cells expressing different antigens, and each of those antigens can be present at a different level that can change over time. Therapies targeting only a single antigen are vulnerable to evolutionary escape mechanisms.

While single-antigen specific therapy can eliminate all the tumor cells expressing the targeted antigen, the residual tumor cells that do not express that antigen may survive and expand. In addition, tumor cells may also downregulate or mutate the targeted antigen, thus becoming invisible to the T cell therapy. Both phenomena create a transformed tumor that is impervious to that therapy. This process is referred to as antigen-negative tumor escape.

Our solution to the problem of tumor heterogeneity is the development of T cell products that simultaneously attack multiple tumor-expressed antigens and thereby enable more complete initial tumor targeting, thus minimizing the subsequent opportunity for the cancer to engage escape mechanisms. Of note, data suggest that this strategy may be responsible for recruitment and activation of unique cancer-killing cells from the patient’s own immune repertoire to participate in cancer eradication, further minimizing the possibility for tumor cell escape.

We believe our proprietary MultiTAA-specific T cell platform may have meaningful advantages over current CAR and TCR-engineered cell therapy approaches. Compared to current gene-modified T cell therapies, the MultiTAA-specific T cell product candidates are characterized by the following:

| · | Clinical benefits observed in early-stage clinical trials in multiple cancer indications. |

Based on our observations in clinical trials in AML, pancreatic cancer, lymphoma, ALL and MM, we believe that the MultiTAA-specific T cell therapies have the potential to mediate a meaningful anti-tumor effect, as well as significant in vivo expansion of T cells. For example, in BCM’s Phase 1 clinical trial in lymphoma, there were complete responses, or CRs, in six of the fifteen evaluable patients with active disease. Significantly, no patient with a CR has subsequently relapsed with disease, whereas typically 30% or more of patients with CR in reported CAR-T studies relapse within one year. In patient results to date in this trial, observed therapeutic responses appear to be highly durable, with some patients being relapse-free beyond five years.

| · | Non-gene modified. |

Unlike CAR and TCR-based approaches, our MultiTAA-specific T cell therapy does not require genetic modification of T cells, a costly and complex process that significantly complicates the manufacturing of a patient product. We believe our MultiTAA-specific T cell therapy can be manufactured at a fraction of the cost of a gene-modified T cell product, with substantially reduced complexity of manufacturing.

| · | No need for lymphodepletion before infusion. |

Unlike CAR-T therapies, which require lymphodepletion of a patient’s existing T cells so that they will not compete with the infused therapy, the MultiTAA-specific T cell therapies work with the natural capabilities of T cells to target cancer and do not require lymphodepletion prior to infusion.

| · | Low incidence rate of adverse events. |

As of December 2019, the MultiTAA-specific T cell therapy has been generally well tolerated by all of the patients enrolled in clinical trials in hematological and solid tumor indications with no incidences of cytokine release syndrome or neurotoxicity. In these trials, there has been only one Grade 3 adverse reaction considered possibly related to the therapy. This appears to compare favorably with published CD19 CAR-T studies that have been associated with substantial tolerability concerns, including one Phase 1 trial in which 95% of patients had Grade 3 or higher adverse events during treatment.

| · | Appears to drive endogenous immune responses. |

In our clinical trials, we have observed evidence of “epitope spreading” in the treated patients, meaning that the MultiTAA-specific T cell therapy is potentially inducing an enhanced response by the patient’s own T cells (specific for an expanded set of tumor-associated antigens beyond those targeted by the infused product). Correlative analyses show expansion of endogenous T cells, other than those present in the infused product, in the months following infusion. This phenomenon, also known as “antigen spreading,” is potentially important in generating a deep and durable response for a patient, because it enables the killing of tumors that do not express any of the antigens initially targeted by our therapy and could be due to the lack of lymphodepletion that allows recruitment of the endogenous immune system for anti-tumor activity.

| · | Capable of addressing a broad repertoire of cancer cells. |

While CAR-T and TCR therapies generally target a single epitope, our manufacturing process selects for T cells that are specific for multiple peptides derived from several targeted antigens. Deep gene sequencing of our products shows that a typical patient dose usually consists of approximately 4,000 unique T cell clonotypes, some of which target up to five different tumor-associated antigens. The five antigen targets can be recognized by a very wide range of T cells, which we believe facilitates robust killing of targeted cancer cells.

MT-401 for the Treatment of Post-Transplant AML

We have submitted an IND to the FDA to initiate a Phase 2 clinical trial in post-allogeneic hematopoietic stem cell transplant patients with AML in both the adjuvant and active disease setting, which may become pivotal pending the results of the interim analysis. The dose administered in this multicenter trial is the current maximum tolerated dose from the Phase 1/2 trial. In the adjuvant setting, patients will be randomized to either MT-401 at approximately 90 days post-transplant versus standard of care observation, while the active disease patients will receive MT-401 following relapse post-transplant as part of a single-arm group.

In February 2020, we announced that the FDA lifted the clinical hold on the Phase 2 trial and has permitted us to initiate the trial, beginning with a safety lead-in portion that is expected to enroll approximately six patients. Three patients will be dosed with MT-401 manufactured using the legacy reagent used in the Phase 1 trial, and three patients will be dosed with MT-401 manufactured using a reagent from an alternative supplier. We anticipate using this supplier for clinical and commercial supply of MT-401. The FDA placed a partial clinical hold on the trial for the use of the MT-401 product manufactured using one of the reagents supplied by the alternative supplier until the final data and certificate of analysis for the reagent are reviewed and accepted by the FDA. We currently estimate that the alternative supplier will deliver the final reagent, along with the final data and certificate of analysis required by the FDA, by the end of the second quarter of 2020. We anticipate to complete enrollment of the first three patients and submission of the final technical specifications and comparability data of the new reagents to the FDA during the second half of 2020, thereby satisfying the requirements for lifting the partial hold on the clinical trial. Given this expected timing, we do not currently expect the partial clinical hold to significantly impact site and patient enrollment of the Phase 2 trial.

The safety lead-in will be followed by the 160-patient randomized portion of the trial at approximately 20 transplant centers. Group 1 will comprise 120 adjuvant (disease-free) patients, with the primary endpoint of relapse-free survival of patients receiving MT-401 versus a control group. Group 2 will comprise 40 active disease patients in a single arm, with primary endpoints of complete remission and duration of complete remission.

Clinical Development of Our MultiTAA-Specific T Cell Therapies by BCM

The following clinical trials are being conducted by BCM pursuant to our strategic alliance. If data from these early clinical trials are positive, we will consider the therapeutic and commercial potential for such therapies to be advanced as new product candidates for us. In each trial, correlative studies showed significant expansion of MultiTAA-specific T cells, as well as significant evidence of epitope spreading with expansion of endogenous T cells specific for tumor-associated antigens that were not targeted by the MultiTAA-specific T cell therapy.

Acute Myeloid Leukemia

We are pursuing post-transplant AML as the lead indication for the MultiTAA-specific T cell program. Currently, available treatments for post-transplant AML patients are limited and include donor lymphocyte infusion, which has an approximately 15% overall response rate but a 30% to 50% risk of severe and debilitating graft-versus-host disease. The five-year mortality rate for patients who receive an allogeneic hematopoietic stem cell transplant exceeds 50%, and patients who relapse after a transplant have a survival expectation of approximately 4.5 months.

BCM recently completed a Phase 1 clinical trial of the MultiTAA-specific T cell therapy for the treatment of patients with post-transplant AML. In this trial, we treated patients in remission and with active disease post-transplant. As illustrated below, eleven of the thirteen patients in the adjuvant disease setting dosed with the MultiTAA-specific T cell therapy after receiving an allogeneic stem cell transplant survived, ranging from 6 weeks to 2.5 years post-infusion, with nine of these patients in CCR, as reported in March 2019. Two patients saw local relapse in the central nervous system, but in both cases these patients were successfully treated with local therapy alone. One patient saw extramedullary relapse and was subsequently treated in the active disease arm of the trial, generating a CR that was durable for 13 months. One patient relapsed 8 months after receiving MultiTAA-specific T cells but following a second allogeneic stem cell transplant this patient remains alive in relapse 1.5 years following his initial T cell infusion.

As illustrated below, and reported in March 2019, survival of the six evaluable patients with active disease ranged from 4 to 21 months, as compared to a historical survival rate of 4 months for patients who receive the standard of care post-transplant. Of these patients, one patient demonstrated a complete response that was durable for 13 months, one patient demonstrated a partial response that enabled that patient to receive a second allogeneic stem cell transplant and two patients, who did not meet partial response criteria, experienced disease stabilization enabling a two-month delay to next-line therapy.

In this trial, the MultiTAA-specific T cell therapy was well tolerated, with no drug-related serious adverse events and no instances of graft-versus-host disease. One patient in the adjuvant disease group had a possibly drug-related Grade 3 elevation of liver enzymes, which was treated with prednisone. After discontinuing treatment and receiving decitabine, the patient relapsed and later re-enrolled in the trial in the active disease group and entered CR for 13 months and survived for 2.5 years.

Pancreatic Cancer

In July 2019, we reported interim data from an ongoing Phase 1/2 clinical trial of the MultiTAA-specific T cell therapy for the treatment of pancreatic adenocarcinoma being conducted by BCM. In this trial, BCM plans to enroll approximately 45 patients with advanced or borderline resectable pancreatic adenocarcinoma in three arms: Arm A, which includes patients with unresectable/metastatic disease who are responding to standard first-line chemotherapy; Arm B, which includes patients with progressive disease or therapy intolerance; and Arm C, which includes patients with surgically resectable disease. As of July 5, 2019, a total of 19 patients were administered the MultiTAA-specific T cell therapy: 10 patients in Arm A, 6 patients in Arm B and 3 patients in Arm C.

Overall, we have observed a clinical benefit correlated with the detection of tumor-reactive T cells in patient peripheral blood (Arms A, B and C) and within tumor biopsy samples (Arm C) post-infusion. T cells exhibited activity against both targeted antigens as well as non-targeted TAAs, including MAGE-A2B and AFP, indicating induction of antigen/epitope spreading. No cytokine release syndrome or neurotoxicity had been observed as of July 5, 2019.

Arm A

Arm A is designed to evaluate the safety and potential efficacy of using MultiTAA-specific T cell therapy as part of first-line treatment for patients with pancreatic cancer. These patients in the chemo-responsive arm have completed or will complete at least three months of standard-of-care chemotherapy (gemcitabine/nab-paclitaxel or FOLFIRINOX), which is the period during which a response to chemotherapy would typically occur, before receiving up to six administrations of MultiTAA-specific T cell therapy in conjunction with chemotherapy. Of the nine evaluable patients in Arm A as of July 5, 2019 (one patient was too early to be evaluated):

| · | Three patients experienced objective responses after administration of MultiTAA-specific T cell therapy: |

| o | One patient experienced a complete response; and |

| o | Two patients experienced partial responses. |

| · | Four patients experienced disease stabilization. Two patients within stable disease boundaries (+20%/-30%) saw reversal of tumor growth in which tumors previously growing after chemotherapy alone showed shrinkage after administration of MultiTAA-specific T cell therapy. |

| · | One patient experienced a mixed response, in which some lesions increased in size and others decreased in size for a net zero change in the size of tumor lesions. |

| · | One patient experienced disease progression. |

In addition, overall tumor shrinkage volume was observed in six out of the eight patients with a measurable tumor after administration of MultiTAA-specific T cell therapy. One evaluable patient did not have tumor measurements for analysis.

In patients responding to therapy, significant expansion of the infused MultiTAA-specific T cell therapy was observed, along with broad-based epitope spreading, with significant expansion of endogenous T cells specific for other tumor specific antigens.

Arm B

Arm B is designed to evaluate the use of MultiTAA-specific T cell therapy as a second-line therapy for patients who have failed first-line chemotherapy. The patients in this chemo-refractory arm are either ineligible for chemotherapy or have progressed on chemotherapy and have received or are receiving up to six doses of MultiTAA-specific T cell therapy as a monotherapy. Of the six evaluable patients in Arm B as of July 5, 2019:

| · | Three patients experienced stable disease or clinical disease stabilization: |

| o | Two patients who previously had progressive disease experienced clinical disease stabilization for up to two months. |

| o | One patient has maintained stable disease for seven months (ongoing). |

| · | Three patients experienced clinical decline. |

Among the patients who saw clinical disease stabilization, significant expansion of the infused MultiTAA-specific T cell therapy was observed, along with broad-based epitope spreading, with significant expansion of endogenous T cells specific for other tumor-specific antigens.

Arm C

Arm C is designed to assess T cell infiltration and expansion. These patients with borderline surgically resectable disease received or will receive a dose of MultiTAA-specific T cell therapy following chemotherapy, radiotherapy or combination and prior to surgical resection and up to five additional doses of T cells after surgery. In the patients evaluable in Arm C as of July 5, 2019, MultiTAA-specific T cells were measurable in meaningful numbers as detected by correlative analysis of resected tumor, and significant expansion of the infused MultiTAA-specific T cells was observed, along with broad-based epitope spreading, with significant expansion of endogenous T cells specific for other tumor specific antigens.

Lymphoma

BCM is currently evaluating the MultiTAA-specific T cell therapy in a Phase 1 clinical trial for the treatment of patients with lymphoma.

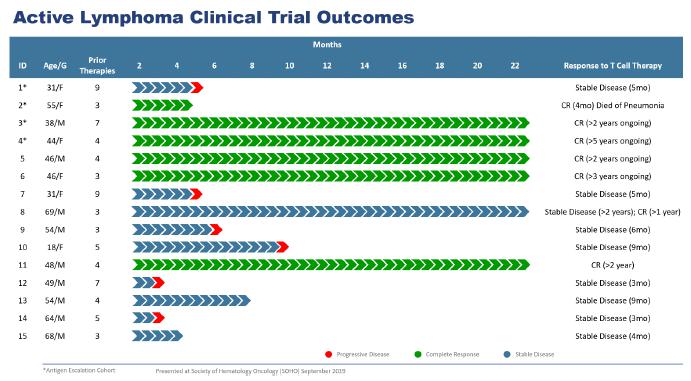

As of January 2019, we had treated 15 patients with active disease, which we refer to as the active lymphoma group, all of whom had completed a follow-up period beyond three months post-infusion. These patients were heavily pre-treated and, on average, had failed between four and seven prior therapies, with two patients having failed nine prior therapies. As illustrated below, in the active lymphoma group, six patients entered CR and nine patients had experienced stable disease, with three of those patients experiencing durable stable disease and six of those patients experiencing transient stable disease ranging from three months to ten months. None of the patients in CR had relapsed, and the range for the duration of CR in these patients were between one and over five years after being infused with the MultiTAA-specific T cell therapy. Responses in all six patients who entered CR were associated with an expansion of infused T cells, as well as induction of antigen spreading. Of the nine patients with stable disease, three had not relapsed, with two of those patients in stable disease for nine months and over 24 months, respectively, which we believe shows potential durable disease stabilization.

We also had treated 18 patients, including one patient who was treated a second time after a relapse, in remission, which we refer to as the adjuvant lymphoma group. Like the active lymphoma group, these patients were heavily pre-treated. As illustrated below, in the adjuvant lymphoma group as reported in January 2019, all 18 patients had entered CR, with 14 patients in CCR. The duration of response ranged from nine months to over 48 months.

In both treatment groups, the MultiTAA-specific T cell therapy was well tolerated, with no drug-related serious adverse events, suggesting that the MultiTAA-specific T cell therapy might serve as a standard-of-care maintenance therapy for lymphoma patients in remission.

Further, data from this trial show “epitope spreading,” or expansion of patients’ endogenous T cells (specific for an expanded set of tumor-associated antigens beyond those targeted by the infused therapy) in the months following infusion. Significantly, we have observed this effect even though some patients in this trial received doses that had not yet been antigen-escalated to the full antigen dose.

Acute Lymphoblastic Leukemia

BCM is currently evaluating the MultiTAA-specific T cell therapy in a Phase 1 clinical trial for the treatment of patients with ALL. Leukemic relapse is one of the primary causes of treatment failure in hematopoietic stem cell transplant recipients. Like post-transplant AML patients, post-transplant ALL patients have limited treatment options, with donor lymphocyte infusions similarly associated with the risk of life-threatening graft-versus-host disease. While CAR-T therapies have shown potent anti-leukemia activity in post-transplant ALL patients, CD19-CAR-T cell therapies target a single antigen, carrying the inherent risk of immune escape, and are most effective in malignancies of B-cell lineage. In contrast, the MultiTAA-specific T cell therapy targets multiple antigens expressed in both B- and T-cell ALL.

In this trial, as reported in February 2019 we had treated 18 patients. Of the seven evaluable patients:

| · | All evaluable patients were up to 28 months in CCR; |

| · | One patient experienced relapse displayed mixed donor/recipient chimerism after transplant, but remained in CCR for 6 months; and |

| · | Patients who remained in CCR had been durable for between four to 28 months, with a median of 16 months. |

Multiple Myeloma

BCM is currently evaluating the MultiTAA-specific T cell therapy in a Phase 1b/2a clinical trial for the treatment of patients with MM. In this trial, we are treating both active and adjuvant post-autologous stem cell transplant MM patients both within 90 days and more than 90 days post-transplant. We have not seen a meaningful difference in response rates or durability between the two arms and intend to standardize future trials based upon a protocol wherein patients will receive MultiTAA-specific T cell therapy immediately post-transplant.

As reported in January 2019, of the 12 patients that had been treated in the active MM group:

| · | One patient had a CR; |

| · | Three patients achieved partial responses; and |

| · | All eight remaining patients experienced stabilization of disease following initial MultiTAA-specific T cell infusion. |

As reported in January 2019, of the eight patients that had been treated in the adjuvant MM group, all eight patients had experienced a partial response or CR, with a median follow-up of 21 months. Only one patient had relapsed as of such date.

Process Development and Manufacturing of The MultiTAA-Specific T Cell Therapies

In the manufacturing process, blood is drawn from either the individual patient (in the case of the autologous MAPP T cells) or from the allogeneic stem cell transplant donor (in the case of the allogeneic LAPP T cells). Although the T cells that are selected and expanded by our process exist in a patient’s circulating blood, these T cells are often present at very low frequencies. Researchers at BCM believe that these T cells are adversely affected by the suppressive tumor microenvironment. It is a well-accepted concept that cancers not only evade immune detection but often actively suppress the function of the human immune system. Our manufacturing and culturing process is intended to (i)(1) identify the T cells specific for the antigens that we intend to target, (ii)(2) restore these T cells to functionality with respect to their anti-tumor capability and (iii)(3) expand the population of those T cells specific for our targets to achieve the required patient dose.

After blood is drawn, PBMCs are isolated and cryopreserved. Sufficient numbers of cryopreserved PBMCs are taken to be used to manufacture a patient-specific product. These cells are placed inside a G-Rex®G-Rex manufacturing device or standard plasticware and combined with an experimentally optimized mix of GMP-grade cytokines that is used to restore and enhance the functional capability of the cultured T cells.

In addition, libraries of overlapping peptides, (“pepmix”)which we refer to as peptide pools, spanning the target antigens are combined with antigen presenting cells and added to the cell culture. Each peptide within the pepmixa peptide pool represents a small segment of a target antigen, which a T cell might recognize. Each library represents the entire protein sequence of a target antigen, with each peptide in the pepmix overlapping significantly with the peptides adjacent to it within the antigen’s protein sequence. This overlapping structure allows us to isolate, activate and expand any T cell that is specific for any segment of the antigens that we target in the unique genetic background of every patient.

The G-Rex®G-Rex is a cell culture device manufactured by Wilson Wolf used by many cell therapy developers, both in commercial and academic settings. The device allows a user to introduce cells, media and other reagents into a cell culture chamber, which has a gas-permeable membrane at its bottom. The cells settle on this gas-permeable membrane through which oxygen and carbon dioxide are exchanged (i.e. the cells can breathe at the base of the device), while nutrients required for cell expansion are obtained from the medium above the cells. This system allows for the highly robust growth of cells in culture, by providing them with superior access to oxygen and nutrients. Cells manufactured in the device grow efficiently without need for agitation by a technician, scientist or automated system.

Inside the G-Rex®G-Rex or the regular plasticware, PBMCs are co-cultured with antigen-presenting cells that have been exposed to the stimulating pepmixes.peptide pools. This results in the selective expansion of T cells that specifically recognize the target antigens. At the end of the manufacturing process, the resulting product is a mix of helper (CD4+) and cytotoxic (CD8+) T cells that recognize the antigens we are targeting.

Once cell manufacturing is complete, the product is tested for identity, sterility, phenotype and safetyfunctionality before it is released for infusion into a patient. Sampling of product indicates that, on average, approximately 4,000 different T cell clonotypes are present in a typical 5-antigen-specific patient product.

Upon release of the final patient product, the cells are frozen and transported to the site where the cells will be administered. The standard dose for patients with lymphoma, AML or myeloma ranges from 5 –to 20 million cells per meter squared (compared(corresponding to typical doses of 10 –to 40 million cells per adult patient). These cell doses represent a significantly smaller dose of cells, when compared to CAR-T or TCR therapies. As a result, our therapy requires only a very small infusion volume that can be administered to patients within minutes at an outpatient center. Due to the low incidence of adverse events with our therapies, patients do not need to be hospitalized and monitored overnight. Instead, the patients are evaluated for any immediate infusion-related reactions and can then usually be discharged within two hours.

Clinical-stage MultiTAA T Cell Therapy

In addition to our MultiTAA-specific T cell therapies, we are developing peptide-based immunotherapeutic vaccines that are designed to precisely target breast and ovarian cancer cells, in contrast to standard therapies for the treatment of cancer that target both cancer cells and normal cells. Our peptide vaccines are derived from naturally processed T cell-targeted antigens. We believe that our peptide vaccines are potentially effective standalone therapies but may also enhance the efficacy of other immunotherapy approaches, including our own MultiTAA-specific T cell therapies. Our multipeptide approach is fundamentally different from traditional vaccine therapies that have generally targeted a major histocompatibility complex, or MHC, class I-restricted epitope and have historically performed poorly as stand-alone treatments. We are currently evaluating TPIV200 for the treatment of breast and ovarian cancers that overexpress FRa in multiple Phase 2 clinical trials and TPIV100/110 for the treatment of breast cancers that overexpress HER2/neu in Phase 1b and Phase 2 clinical trials.

We are in the process of evaluating the peptide vaccine therapeutic products and programs to determine the future strategy and the proper allocation of our resources to best maximize stockholder value. In conjunction with this evaluation process we may de-emphasize or terminate certain vaccine therapeutic products or programs. Such strategic review and evaluations are a priority and an important part of our ongoing operations.

TPIV200 for the Treatment of FRa-Overexpressed Breast and Ovarian Cancers

FRa is overexpressed in over 80% of breast cancers and over 90% of ovarian cancers. The only treatment options for these cancers are surgery, radiation therapy and chemotherapy, creating a very important and urgent clinical need for a new therapeutic strategy. Time to recurrence is relatively short for ovarian cancer and survival prognosis is extremely poor after recurrence. In the United States alone, every year there are 22,350 new ovarian cancer diagnoses and 268,600 new breast cancer diagnoses, of which 10% are diagnoses of triple-negative breast cancer.

TPIV200 is composed of a mixture of five FRa-derived immunogenic peptides adjuvanted with low-dose granulocyte-macrophage colony-stimulating factor, or GM-CSF, and is designed to activate both the CD4+ and CD8+ T cell compartments in order to activate a patient’s T cells against the targets. Recent developments in immunology suggest that both CD4+ and CD8+ activation support a robust immune response.

Clinical Development

Phase 1 Clinical Trial in Advanced Breast and Ovarian Cancer

In this Phase 1 clinical trial, completed by Mayo Clinic in 2015, 21 patients with advanced breast or ovarian cancer who had undergone standard surgery and adjuvant treatment were treated with one cycle of cyclophosphamide, followed by intradermal vaccination of TPIV200 on day one of a 28-day cycle for a maximum of six vaccination cycles. In the trial, 20 of 21 patients generated T cell responses. These responses developed slowly over the course of the vaccination cycles, with a median time to maximal immunity of five months. Over 90% of patients developed robust and durable antigen-specific immune responses against FRa without regard for HLA type, which aligns with the intended mechanism of action of the vaccine, and 89% of the patients responded to multiple epitopes included in the TPIV200 vaccine, with most patients demonstrating T cell immunity to three or more epitopes. Further, all 16 patients in the observation stage generated T cell responses that lasted over six months.

TPIV200 was well-tolerated, with only one Grade 3 drug-related adverse event. In a two-year patient follow-up analysis, the 10 enrolled ovarian cancer patients had longer median progression-free survival time of 528 days than the 313 days historically reported for the standard-of-care chemotherapy treatment. All patients were alive at the final follow-up. None of the 7 breast cancer patients had experienced a recurrence.

Phase 2 Clinical Trials in Triple-Negative Breast Cancer

Triple-negative breast cancer is one of the most difficult cancers to treat and represents a clear unmet medical need. With the support of a $13.3 million grant from the Department of Defense, the Mayo Foundation is conducting a 280-patient Phase 2 clinical trial of TPIV200 in patients with triple-negative breast cancer, which began enrolling patients in late 2017 and is still recruiting patients.

On June 21, 2016, we announced the initiation of a randomized four-arm Phase 2 trial of TPIV200 for the treatment of patients with Stage 1 to Stage 3 triple-negative breast cancer who have completed initial surgery and chemo/radiation therapy. This open-label, 80-patient clinical trial is designed to evaluate dosing regimens, pre-treatment, efficacy and immune responses. In the trial, we are evaluating a high dose and a low dose of TPIV200, each of which will be tested both with and without cyclophosphamide prior to vaccination. To date, there have been no drug-related serious adverse events reported. Based on a preliminary analysis of 34 patients enrolled in the triple negative breast cancer trial as of September 30, 2019, 31 patients showed meaningful immune response to vaccine treatment. These data are subject to final review by independent biostatistical analysis. As of September 30, 2019, 16 of the 80 patients treated have shown disease progression following treatment with TPIV200.

Phase 2 Clinical Trial in Platinum-Sensitive Ovarian Cancer

A Phase 2 trial, which we sponsored, of TPIV200 in platinum-sensitive ovarian cancer patients (FRV-004) was initiated in January 2017. The trial is a multi-center double-blind efficacy study designed to evaluate TPIV200 compared to GM-CSF alone in a randomized, placebo-controlled fashion during the first maintenance period after primary surgery and chemotherapy. Multiple clinical sites enrolled approximately 120 patients. Safety and interim efficacy has been reviewed by independent data and safety monitoring board, or DSMB.

(1) Baylor CollegeIn November 2019 we announced the discontinuation of Medicinethis trial of TPIV200 based on an unblinded review of interim results from the trial conducted by the DSMB. Although the DSMB did not express any safety concerns with respect to TPIV200, we elected to suspend the trial because it did not meet the threshold for probability of clinical benefit based upon our pre-specified criteria.

Phase 2 Clinical Trial in Combination With Durvalumab for Patients with Ovarian Cancer

On April 21, 2016, we announced our participation in an ovarian cancer trial sponsored by Memorial Sloan Kettering Cancer Center, or MSKCC, in collaboration with AstraZeneca Pharmaceuticals in ovarian cancer patients who are not responsive to platinum, a commonly used chemotherapy for ovarian cancer. This open-label Phase 2 trial of TPIV200 in 40 patients is designed to evaluate the effects of combination therapy with AstraZeneca’s checkpoint inhibitor durvalumab (anti-PD-L1). Interim results from the first 27 patients were presented at the AACR-Rivkin Symposium in September 2018; safety of the combination was shown in these heavily pretreated patients and a subset of patients exhibited durable disease stabilization. Objective response rate and progression-free survival with combination treatment was not superior from the expected efficacy of durvalumab as a monotherapy. However, post-immunotherapy follow-up was suggestive of improved clinical benefit from standard therapies, as the majority of patients’ post-progression went on to receive subsequent standard therapy with durable clinical benefit, creating a rationale for exploration of these agents in combination with chemotherapy. Although we have no business relationship with AstraZeneca, we paid for half of the costs of this trial, in addition to providing TPIV200.

TPIV 100/110 for the Treatment of HER2/neu-Overexpressed Breast Cancers

HER2/neu amplification/overexpression results in an effective therapeutic target in breast and gastric cancer. Over-expressed HER2 is detected predominantly in malignancies of epithelial origin, such as breast, gastric, esophageal, colorectal, salivary gland, pancreatic, epithelial ovarian, endometrial, and bladder carcinomas, as well as gallbladder and extrahepatic cholangiocarcinomas. HER2 is over-expressed in approximately 25% of breast cancers and its expression is associated with unfavorable pathologic features and aggressive disease if not treated with targeted therapies, relative to other forms of breast cancer. While the outcome of patients with HER2 positive breast cancer has significantly improved in the past few decades with an advent of anti-HER2 therapies, a substantial number of resected patients with all types of breast cancer subsequently develop metastatic disease. The continued prevalence of these cancers represents a high unmet medical need, justifying the targeted development of immunotherapeutic strategies.

We have added a MHC class I-restricted peptide, which we licensed from the Mayo Foundation on April 16, 2012, to the four MHC class II-restricted peptides present in TPIV100, resulting in TPIV 110 after the five peptides are mixed with GM-CSF. We have amended the existing IND to incorporate the fifth peptide and will use TPIV110 in future trials with the goal of producing an even more robust vaccine activating both CD4+ (helper) and CD8+ (killer) T cells.

On June 7, 2016, we announced that we had exercised our option agreement with Mayo Foundation and signed a worldwide license agreement to TPIV100. The license gives us the right to develop and commercialize the technology in any cancer indication in which the HER2/neu antigen is overexpressed. As part of this agreement, the IND for the HER2/neu Phase 1 trial was transferred from Mayo Foundation to us for Phase 2 clinical trials of TPIV100. See “—Mayo Foundation for Medical Education and Research Relationships—Mayo HER2/neu License.”

Clinical Development

Phase 1 Clinical Trials in HER2/neu+ Breast Cancer

In the Phase 1 trial of 20 patients conducted at the Mayo Clinic, TPIV100 was well tolerated. Nineteen of the twenty evaluable patients showed robust T-cell immune responses to the antigens in the vaccine. An additional secondary endpoint incorporated into this trial was a two-year follow-on recording the time to disease recurrence in the participating breast cancer patients.

On March 14, 2017, we announced that our partners at the Mayo Clinic received a $3.8 million grant from the Department of Defense to conduct a Phase 1b trial of TPIV100 in ductal carcinoma in situ, or DCIS, an early form of breast cancer. We are working closely with the Mayo Foundation on this clinical trial by providing clinical and manufacturing expertise, as well as providing GMP vaccine formulations under contract. The trial is expected to enroll 40 – 45 women with DCIS and commenced such enrollment during the first quarter of 2019. If the trial is successful and subject to receiving marketing approval from the FDA, we believe that TPIV100 may eventually augment or even replace standard surgery and chemotherapy, and potentially could become part of a routine immunization schedule for preventing breast cancer in healthy women.

Phase 2 Clinical Trials in HER2/neu+ Breast Cancer

On October 10, 2018, we announced that the Mayo Clinic had been awarded a grant of $11 million from the Department of Defense intended to cover the costs of a large randomized, double-blind Phase 2 trial of TPIV100. We are working closely with the Mayo Foundation on this clinical trial by providing clinical and manufacturing expertise, as well as providing GMP vaccine formulations under contract. In this trial, 190 patients will be randomized, in a 2:1 fashion, to receive TPIV100 plus maintenance ado-trastuzumab emtansine, or T-DM1, or maintenance T-DM1with placebo plus GM-CSF. \The trial will evaluate whether the administration of vaccine during T-DM1 maintenance therapy in patients with residual disease post-neoadjuvant chemotherapy effectively blocks disease recurrence and the development of metastatic breast cancer. By prevention of recurrence and metastasis, the expectation is that mortality associated with breast cancer will be decreased.

Manufacturing