UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| (Mark One) | |

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2019 | |

Or | |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _______ to _______ | |

Commission file number001-15771

ABEONA THERAPEUTICS INC.

(Exact name of registrant as specified in its charter)

Delaware | 83-0221517 | ||||

| (State or other jurisdiction of | (I.R.S. Employer I.D. No.) | ||||

| incorporation or organization) | |||||

1330 Avenue of the Americas, 33rd Floor, New York, NY 10019

(Address of principal executive offices, zip code)

(646) 813-4701

(Registrant’s telephone number, including area code: (646) 813-4712

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.01 par value | ABEO | Nasdaq Capital Markets |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐[ ] No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐[ ] No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒[X] No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒[X] No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Act:

Large accelerated filer | Accelerated filer | ||||

Non-accelerated filer | Smaller reporting company | ||||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐[ ] No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity, as of June 30, 2018,2019, was approximately $445,125,000.

The number of shares outstanding of the registrant’s common stock as of March 13, 20199, 2020 was 47,949,69483,622,135 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement relating to our 20192020 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

FORWARD-LOOKING STATEMENTS

This Form 10-K (including information incorporated by reference) contains statements that express ourmanagement’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “could,” “would,” “seeks,” “estimates,” and variations of such words and similar expressions, and the negatives thereof, are intended to identify such forward-looking statements. We caution readers not to place undue reliance on any such “forward-looking statements,” which speak only as of the date made, and advise readers that these forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties, estimates, and assumptions by usmanagement that are difficult to predict. Various factors, some of which are beyond ourthe Company’s control, could cause actual results to differ materially from those expressed in, or implied by, such forward-looking statements. All such forward-looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by these cautionary statements and any other cautionary statements that may accompany the forward-looking statements. In addition, we disclaim any obligation to update any forward-looking statements to reflect events or circumstances after the date of this report, except as may otherwise be required by the federal securities laws.

Forward-looking statements necessarily involve risks and uncertainties. Weuncertainties, and our actual results could differ materially from those anticipated in forward-looking statements due to a number of factors. These statements include statements about: the achievement of or expected timing, progress and results of clinical development, clinical trials and potential regulatory approvals; our Phase III clinical trial for patients with recessive dystrophic epidermolysis bullosa (“RDEB”) and our beliefs relating thereto; our belief that our Chemistry, Manufacturing and Controls (“CMC”) work will be able to consistently supply EB-101 material for the Phase III clinical trial; our ability to identify and enroll patients in the Phase III clinical trial; our cash burn rate; our pipeline of product candidates; our belief that we have identifiedsufficient resources to fund operations through the following importantsecond quarter of 2021; the dilutive effect that raising additional funds by selling additional equity securities would have on the relative equity ownership of our existing investors; our belief that EB-101 could potentially benefit patients with RDEB; our belief that adeno-associated virus (“AAV”) treatment could potentially benefit patients with Sanfilippo syndrome type A (“MPS IIIA”) and Sanfilippo syndrome type B (“MPS IIIB”); our ability to develop our novel AAV-based gene therapy platform technology; our belief in the adequacy of the data from clinical trials, including trials in EB-101 and our Phase I/II clinical trial in ABO-102 (AAV-SGSH) for MPS IIIA, together with the data generated in the program to date, to support regulatory approvals; our dependence upon our third-party and related-party customers and vendors and their compliance with regulatory bodies; our intellectual property position and our ability to obtain, maintain and enforce intellectual property protection and exclusivity for our proprietary assets; our estimates regarding the size of the potential markets for our product candidates, the strength of our commercialization strategies and our ability to serve and supply those markets; and future economic conditions or performance.

Important factors that could affect performance and cause actual results to differ materially from those discussed in our forward-looking statements. Such factors may be in addition to the risksmanagement’s expectations are described in Part I, Item 1A, Risk Factors; Part II, Item 7. Management’sthe sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations; and other parts ofOperations” in this Form 10-K. These factors include: our estimates regarding expenses, future revenues, capital requirements, and needs for additional financing; our ability to raise capital; our ability to fund our operating expenses and capital expenditure requirements for at least the next 12 months with our existing cash and cash equivalents; our expectation that we will continue to incur losses; our belief that we will expend substantial funds to conduct research and development programs; our belief in our future ability to achieve profitability at allobtain additional equity funding from current or on a sustained basis; our expected cash burn rate;new stockholders, out-licensing technology and/or other assets, deferring and/or eliminating planned expenditures, restructuring operations and/or reducing headcount, and sales of assets; the dilutive effect that raising additional funds by selling additional equity securities would have on the relative equity ownership of our existing investors; our belief that we have a rich pipeline of products and product candidates; our belief in our ability to continue to develop our novel AAV-vectorAAV-based gene therapy platform technologytechnology; the outcome of any interactions with the U.S. Food and Drug Administration (“FDA”) or other regulatory agencies relating to target cells related to neurologic disorders, cystic fibrosis and eye disorders in human subjects;any of our belief that EB-101 could potentially benefit patients with recessive dystrophic epidermolysis bullosa (“RDEB”);products or product candidates; our ability to initiateexecute a Phase III clinical trial for patients with RDEB andRDEB; our ability to complete enrollment of patients into the trial; our belief that AAV treatment could potentially benefit patients with MPS IIIAclinical trials to secure sufficient data to assess efficacy and B;safety; our ability to add clinical sites and identify additional patients for our Phase I/II clinical trial for patients with MPS IIIA and B;MPS IIIB; our ability to continue to secure and maintain regulatory designations for our product candidates; our ability to develop manufacturing capability compliant with current good manufacturing practices for our product candidates; our ability to manufacture gene and cell therapy products and produce an adequate product supply to support clinical trials and potentially future commercialization; our ability to secure timely regulatory review related to our clinical program; our belief in the adequacy of the data from clinical trials in EB-101 and expansion cohort of our Phase I/II clinical trial in ABO-102 (AAV-SGSH) for MPS IIIA, together with the data generated in the program to date, to support regulatory approvals; our intellectual property position and our ability to obtain, maintain and enforce intellectual property protection and exclusivity for our proprietary assets; the rate and degree of market acceptance of our product candidates for any indication once approved; our estimates regarding the size of the potential markets for our product candidates, the strength of our commercialization strategies and our ability to serve and supply those markets; our ability to meet our obligations contained in license agreements to which we are party; and the terms of future licensing arrangements or collaborations.

| 2 |

Business

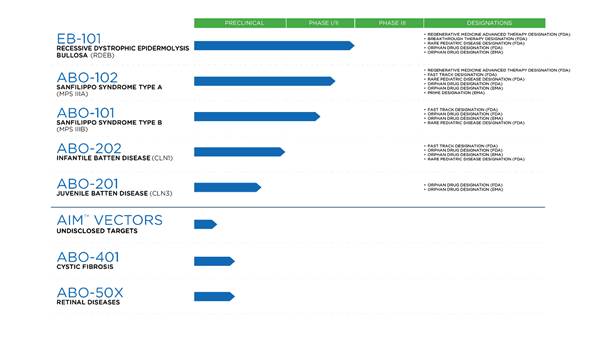

Abeona Therapeutics Inc., a Delaware corporation (together with our subsidiaries, “we,” “our,” “Abeona” or the “Company”), a Delaware corporation, is a clinical-stage biopharmaceutical company developing cellgene and genecell therapies for life-threatening rare genetic diseases. Our lead clinical programs includeconsist of: (i) EB-101, an autologous, gene-corrected cell therapy for recessive dystrophic epidermolysis bullosa (“RDEB”), (ii) ABO-102, an adeno-associated virus (“AAV”)-based gene therapy for Sanfilippo syndrome type A (“MPS IIIA”), and (iii) ABO-101, an AAV-based gene therapy for Sanfilippo syndrome type B (“MPS IIIB”). We also are developing ABO-202 and ABO-201, which arehave additional AAV-based gene therapies forin various developmental stages designed to treat the CLN1 and CLN3 forms of Batten Disease, respectively, ABO-401 for the treatment of cystic fibrosis and ABO-5OX for the treatment of retinal diseases. In addition, we are developing next generationnext-generation AAV-based gene therapy thoughtherapies through our novel AIM™ capsid platform and internal AAV vector platformresearch programs. OurWe believe our product candidates are eligible for orphan drug designation, breakthrough therapy designation, or other expedited review processes in the U.S., Europe or Japan. WeOur pipeline includes five product candidates for which we hold several U.S. and EU regulatory designations for productdesignations:

Our robust pipeline features early-stage and late-stage candidates as follows:

![[MISSING IMAGE: tv515695_img1.jpg]](https://capedge.com/proxy/10-K/0001144204-19-014623/tv515695_img1.jpg)

Our Mission and Strategy

Abeona is at the forefront of cellgene and genecell therapy research and development. We are a fully-integrated company featuring therapies in clinical development, in-house manufacturing facilities, a robust pipeline, and scientific, clinical, and commercial leadership. We see our mission as working together to create, develop, manufacture and deliver cellgene and genecell therapies for people impacted by serious diseases. We partner with leading academic researchers, patient advocacy organizations and caregivers to bringdevelop therapies that address the underlying cause of a broad spectrum of rare genetic diseases wherefor which no effective treatment options exist today.

Since our last fiscal year, we have made significant progress toward fulfilling our goal of harnessing the promise of genetic medicine to transform the lives of people impacted by serious diseases and redefineredefining the standard of care through gene and cell therapies. Our strategy to achieve this goal consists of:

Advancing our Clinical CellGene and GeneCell Therapy Programs and Research and Development with a Focus on Rare and Orphan Diseases.

We have three programs in clinical development—EB-101, ABO-101 and ABO-102—and a pipeline of additional earlier stage programs. Our programs are focused on rare serious diseases. Through our cellgene and genecell therapy expertise in research and development, we believe we are positioned to rapidly

Applying Novel Next GenerationNext-Generation AIM™ VectorCapsid Technology to Develop New In-Vivo Gene Therapies.

We are researching and developing the next generation of adeno-associated virus (“AAV”)next-generation AAV-based gene therapy using our novel capsids developed from the AIM™ VectorCapsid Technology Platform.Platform and additional Company-invented AAV capsids. We aim to continue to develop chimeric AAV capsids capable of improved tissue targeting for various indications and potentially evading immunity to wildtype AAV vectors.

Establishing Leadership Position in Commercial-Scale Gene and Cell-TherapyCell Therapy Manufacturing.

We established current Good Manufacturing Practice (“cGMP”), clinical-scale manufacturing capabilities for gene-corrected cell therapy and AAV-based gene therapies in our state-of-the-art Cleveland, OH facility. We believe that our platform provides us with distinct advantages, including flexibility, scale, reliability, and the potential for reduced development risk, cost, and faster times to market. We have focused on establishing internal Chemistry, Manufacturing and Controls (“CMC”) capabilities that drive value for theour organization through process development, assay development and manufacturing. We have also deployed robust quality systems governing all aspects of product lifecycle from preclinical through commercial stage.

Establishing Additional Gene and Cell Therapy Franchises and Adjacencies through In-Licensing and Strategic Partnerships.

We seek to be the partner of choice in rare disease and hashave closely collaborated with leading academic institutions, key opinion leaders, patient foundations and industry partners to generate novel intellectual property, accelerate research and development, and understand the needs of patients and their families.

Maintaining and Growing IP Portfolio.

We strive to have a leading intellectual property portfolio. To that end, we seek patent rights for various aspects of our programs, including vector engineering and construct design, our production process, and all features of our clinical products including composition of matter and method of administration and delivery. We expect to continue to expand our intellectual property portfolio by aggressively seeking patent rights for promising aspects of our product engine and product candidates.

| 4 |

Our Pipeline

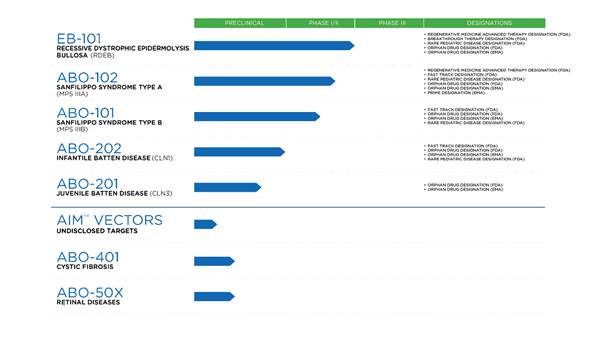

![[MISSING IMAGE: tv515695_chrt-pipline.jpg]](https://capedge.com/proxy/10-K/0001144204-19-014623/tv515695_chrt-pipline.jpg)

Our robust and diverse pipeline features early-stage and late-stage candidates with the potential to transform the treatment of devastating genetic diseases, and we are conducting clinical trials in the U.S. and abroad.

Our lead clinical programs includeconsist of: (i) EB-101, an autologous, gene-corrected cell therapy for RDEB, (ii) ABO-102, (AAV-SGSH), an AAV-based gene therapy for MPS IIIA and (iii) ABO-101, (“AAV NAGLU”), an AAV-based gene therapy forMPSfor MPS IIIB. We are also developing ABO-201 (“AAV-CLN3”)have additional AAV-based gene therapy for treatmenttherapies in various developmental stages designed to treat the CLN1 and CLN3 forms of juvenile Batten disease (“CLN3”), ABO-202 (“AAV-CLN1”) for treatment of infantile Batten disease (“CLN1”), ABO-401 for treatment ofDisease, cystic fibrosis and ABO-50X for treatment of retinal diseases. In addition, we are developing next generationnext-generation AAV-based gene therapy products utilizing atherapies through our novel AIM™ capsid platform and internal AAV vector platform, AIM™, for additional disease areas.

Developing Next Generation Gene and Cell and Gene Therapy

EB-101 for the Treatment of Recessive Dystrophic Epidermolysis Bullosa (RDEB)

Disease Overview

RDEB belongs to a group of genetic skin disorders known more broadly as epidermolysis bullosa (“EB”). Patients with RDEB have a defect in the COL7A1 gene resulting in the inability to produce Type VII collagen, which plays an important role in anchoring the dermal and epidermal layers of the skin. RDEB patients have extremely fragile skin resulting in severe and chronic blistering and mutilating scarring throughout the body, fusion of the handsfingers and feet,toes (called pseudo-syndactyly), joint contractures, strictures of the esophagus, a high risk of developing aggressive squamous cell carcinomas and infections, and a high risk of premature death.

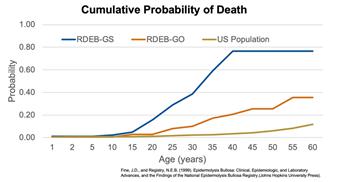

The two most common subtypes of RDEB are (1) Recessive Dystrophic Epidermolysis Bullosa —- Severe (“RDEB-GS”); and (2) Recessive Dystrophic Epidermolysis Bullosa —- Generalized Other (“RDEB-GO”). The two subtypes differ in the specific genetic mutation type which correlates with defects in Collagen VII formation and results in different phenotypes. Individuals with RDEB-GS produce little or no Collagen VII. They have generalized blistering from birth that results in extensive scarring, sparse hair, and blistering of the mucous membranes. Patients with RDEB-GO produce some functional, albeit abnormal, Collagen VII and therefore have more variable and generally less severe disease manifestation. Nevertheless, as described in natural history studies and in the NEBR registry (Fine, J., 2016), some patients with RDEB-GS and RDEB-GO have persistent blistering, severe systemic complications and are at a higher risk of premature death. As observed in the RDEB Registry, patients with RDER-GSRDEB-GS and RDEB-GO have a twenty times and five times, respectively, greater probability of death at the age of 30 years than the general population.

![[MISSING IMAGE: tv515695_chrt-line1.jpg]](https://capedge.com/proxy/10-K/0001144204-19-014623/tv515695_chrt-line1.jpg)

The incidence and prevalence of RDEB are not well defined. To date, the estimated incidence of 0.2-6.65 per million births and prevalence of 3.5-20.4 per million people have been primarily characterized by limited analyses of clinical databases or registries. Using genetic modeling of pathogenic variants of the COL7A1 gene, we estimate the incidence of RDEB to be 95 per million births in the US,U.S., of which 3% are RDEB-GS. Considering the relative mortality rates of RDEB-GS, RDEB-GO, and general population, we estimate a prevalence of RDEB from 700 to 4,000 patients in the USU.S. (most likely estimate of 2,500 patients), many of whom could benefit from a treatment such as EB-101. This estimate is similar to the number of RDEB patients registered with DEBRA, an advocacy group in the USU.S. devoted to the patient community with EB.

From a natural history study conducted by Stanford University in 2017 (Solis, D., et al., 2017), RDEB-GS and RDEB-GO patients have on average eight chronic and recurrent wounds of varying sizes per patient, with the majority of wounds being >20cm2. Chronic wounds, which have an average area of >100 cm2, are defined as those that stay open for more than 12 weeks. Recurrent wounds partially heal but easily re-blister, with most wounds re-blistering within three weeks of healing.healing; recurrent wounds tend to be smaller, with an average size of ~26 cm2. The larger wounds carry the highest burden, including pain, pruritis, and risk of infection.

Current Management of RDEB

At present, there are no approved treatments available for RDEB in the U.SU.S. or Europe. The management of RDEB currently consists of supportive wound care to limit contamination/infection and reduce mechanical forces that produce new blisters. Wound care usually includes treatment of new blisters by lancing and draining. Wounds are then dressed with a non-adherent material, covered with padding for stability and protection, and secured with an elastic wrap for integrity.

Individuals with RDEB have increased caloric and protein needs due to the increased energy utilized in wound healing, while oral intake is limited by oral and esophageal involvement. Infants and children with RDEB may require nutritional support, including a gastrostomy feeding tube. Anemia is typically treated with iron supplements and transfusions as needed.

We estimate that the annual cost of symptom supportive carewound dressings alone for aan RDEB patient is in the range of approximately $20,000$4,000 to $400,000$245,000 per year.

Program Status

EB-101 is an autologous, gene-corrected cell therapy in which the normalfunctioning COL7A1 gene is inserted into a patient’s own skin cells (keratinocytes) and transplanted back to the patient to restore normal Type VII collagen expression and skin function. From preliminary clinicalBased on data from the completed Phase I/II study and expert input, we expect EB-101 to be a potential treatment choice for most wounds, and currently the only product candidate being evaluated as a treatmentthat has shown durable wound healing for larger wounds. EB-101 has been granted both RMAT and Breakthrough designations, FDA and EU Orphan Drug designations and FDA Rare Pediatric Disease designation.

Results from a completed Phase I/II study (Phase I/II gene transfer for recessive dystrophic epidermolysis bullosa (NCT01263379)) that enrolled 7 patients with chronic RDEB wounds at Stanford University showed that EB-101 was well-tolerated and resulted in significant and durable wound healing (Siprashvili, Z., et al., 2016). The Phase I/II study showed significant and durable healing of large chronic wounds, with up to five years of follow-up.follow-up (Eichstadt, S., et al. JCI Insight 2019). There have been no reported serious adverse events observed to date. Continuous Type VII collagen expression was observed for more than two years post treatment. There has been no detection of replication competent retrovirus (RCR) up to four years.

We have initiated a pivotal Phase III clinical trial evaluating the potential of EB-101 for the treatment of RDEB in the middlefirst quarter of 2019.2020. The VITAL™VIITAL™ Study will be a multicenter, randomized, Phase III clinical trial assessing 10-15 patients treated with EB-101. The intended primary endpoint of the study will

ABO-102 and ABO-101 for the treatment of Mucopolysaccharidosis (MPS) III (Sanfilippo syndrome)

Disease Overview

MPS III (Sanfilippo syndrome) is a group of four inherited lysosomal storage diseases, described as type A, B, C or D, which causeresult from enzyme deficiencies that result in thelead to abnormal accumulation of glycosaminoglycans (sugars) in body tissues. The incidence of MPS III (all four types combined) is estimated to be 1 in 70,000 births.

Lysosomes are long chains of sugar molecules used in the building of connective tissues in the body. Lysosomes areintra-cellular structures responsible for a continuous process of replacing used materials and breaking them down for disposal. Children with MPS IIIAIII are missing a lysosomal enzyme that is essential in breaking down used mucopolysaccharides, specifically heparan sulfate (“HS”). The partially broken down heparan sulfate remains stored in cells in the body causing progressive lysosomal and cell damage and eventually cell death. Babies may show little sign of the disease at first, but as neurodevelopment is impaired and more cells become damaged, symptoms start to appear within the first few years of life.

In MPS III, the predominant glycosaminoglycan accumulation occurs in the brain and spinal cord, resulting insymptoms are characterized by speech/language delay, cognitive decline, behavioral abnormalities, motor dysfunction, and eventualseizures, eventually leading to premature death. Most patients with the rapidly progressing form of MPS III neverdo not reach a cognitive function above that of an unaffected 3-year-oldthree-year-old child. Accumulation of heparan sulfate and cell dysfunction also occurs inaffects other organs, leading to liver enlargement and soft tissue coarsening. To date, there is no cure for MPS III and treatmentscare is only supportive and palliative.

| 7 |

Program Status

We are largely supportive.

ABO-102 for MPS IIIA

Preclinicalin vivoefficacy studies in animals with MPS IIIA showed that a single dose of ABO-102 significantly restored normal cell and organ function, corrected neurological deficits, increased neuromuscularmotor control, and increased the lifespan by more than 100% one year after treatment compared with untreated control animals. These results are consistent with studies from several laboratories suggesting AAV treatment could potentially benefit patients with MPS III. In addition, safety studies conducted in animal models of MPS IIIA have demonstrated that delivery of ABO-102 is well toleratedwell-tolerated with minimal side effects. ABO-102 was grantedreceived Fast Track and RMAT designations by the FDA, FDA andPRIME designation in the EU, Orphan Drug designations in the U.S. and EU, and FDA Rare Pediatric Disease designation.

On December 6, 2018,October 25, 2019, we reported updated clinical data from the ongoing Phase I/II gene transfer clinical trial of scAAV9.U1a.hSGSH for Mucopolysaccharidosis IIIA (NCT02716246)(study ABT-001; NCT02716246), our investigational gene therapy for the treatment of MPS IIIA. In the trial, subjects received a single intravenous injection of ABO-102 to facilitate systemic delivery, including to the CNS, of a corrective copy of the gene associated with onset and progression of MPS IIIA. Subjects were evaluated at multiple time points post-injectionpost-treatment for safety assessments and signals of biopotency and clinical activity.efficacy. The results from the dose cohort 3 (currently enrolling) showed a robust and durable reductionevidence of heparan sulfate levelspreservation of neurocognitive development in the three young patients treated before 30 months of age, as well as dose-related and sustained reduction in cerebrospinal fluid (“CSF”), levels of heparan sulfate, denoting transgene expression in the CNS, and a durable reduction of liver volume. Effects were notable within 30 days post ABO-102 administration and remained stable with up to 2+ years of follow-up. No treatment related serious adverse events (“SAEs”) have been reported to date.

Summary of MPS IIIA ABO-102 Phase I/II Study Data:

| ● | 14 patients treated as of November 2019 | |

| ● | Clear dose-response and sustained reduction of heparan sulfate levels in CSF | |

| ● | Sustained reduction in liver volume | |

| ● | Encouraging neurocognitive signals seen in younger, higher functioning patients enrolled in cohort 3 | |

| ● | As of November 2019, follow-up in cohort 1 (40-43 months); cohort 2 (32-35 months); and cohort 3 (13-29 months): |

| ● | ABO-102 has been well tolerated to date | |

| ● | No serious drug related adverse events | |

| ● | ELISpot negative for the SGSH enzyme |

We have initiated a second Phase I/II clinical trial with ABO-102 (study ABT-003) to treat patients who do not qualify for participation on study ABT-001 because of their more advanced cognitive impairment caused by MPS IIIA. The first patient in study ABT-003 was enrolled in cohort 3

ABO-101 for MPSIIIB

In the ABO-101 program for MPS IIIB, subjects in our ongoing clinical study (Phase I/II gene transfer clinical trial of rAAV9.CMV.hNAGLU for Mucopolysaccharidosis (MPS) IIIB (NCT03315182)(study ABT-002; NCT03315182)) receive a single, intravenous infusion of ABO-101, which uses an AAVAAV9 vector to introduce the functional NAGLU gene to treat patients with MPS IIIB disease. Subjects will be evaluated at multiple time points post-injection for safety assessments and efficacy parameters. The clinical program is supported by a Natural History Study which included potential efficacy assessments consisting of neurocognitive evaluations, biochemical assays and MRI dataMRIs generated over one year of follow-up assessments.

Preclinicalin vivoefficacy studies in mice with MPS IIIB showed that a single dose of ABO-101 significantly restored normal cell and organ function, corrected neurological deficits, increased neuromuscular control, and normalized lifespan compared with untreated control animals. In addition, safety studies conducted in MPS IIIB and wildtype mice and in non-human primates have demonstrated that systemic delivery of ABO-101 is well tolerated with minimal side effects.

As of November 2019, the Phase I/II clinical trial for ABO-101 (“AAV-NAGLU”) was enrolled in 2017 at Nationwide Children’s Hospital (“NCH”) in Columbus, Ohio. Preliminary results observed in the initial U.S. trial enrollment to date demonstrate a clinically relevant biomarker response and a favorable safety profile. A second patient was enrolled in this study in January 2019, also at NCH.

Summary of MPS IIIB ABO-101 Phase I/II Study Data:

| ● | 7 patients treated as of November 2019 | |

| ● | Clear signals of biologic effect with reduction of disease-specific biomarkers in the CSF, plasma and urine and reduction in liver volumes | |

| ● | As of November 2019, follow-up in cohort 1 (11-24 months) and cohort 2 (0-7 months): |

| ● | ABO-101 has been well tolerated to date | |

| ● | No serious drug related adverse events | |

| ● | ELISpot negative for the NAGLU enzyme |

ABO-202 for the treatment of CLN1 disease, also known as infantile Batten disease (or Neuronal Ceroid Lipofuscinosis) (“NCL”)

Disease Overview

CLN1 disease (also known as infantile neuronal ceroid lipofuscinosis or Batten disease type 1) is a severe neurodegenerative lysosomal storage disease, currently with no approved treatment. It is caused by mutations in the CLN1 gene, encoding the soluble lysosomal enzyme palmitoyl-protein thioesterase-1 (“PPT1”).

In the classic form, rapidly progressive clinical features appear between the ages of 6 and 24 months, including speech and motor deterioration, refractory epilepsy, ataxia, myoclonus, and visual loss. By five years of age, CLN1 disease patients with the classic infantile form are typically poorly responsive and are no longer communicative. Death follows a few years after disease onset. Patients with low level of residual PPT1 activity develop a later onset form of CLN1 disease characterized by similar symptoms, but with slower progression. Patients with later onset of CLN1 generally succumb to the disease in the second decade.

There is no approved treatment for patients with CLN1 and the current care option is supportive and palliative. Gene therapy is proposed as a potential treatment for CLN1.

ABO-202 is designed to replace the faulty gene in affected cells and restore functionality of the protein. This therapy’s viral construct, utilizing the AAV9 serotype, is able to cross the blood brain barrier (“BBB”)BBB to deliver the CLN1 gene to the CNS. The AAV9 trans-BBB neurotropism is advantageous because of involvement of the CNS in disease progression. This potential therapy is designed to allow the transformed cells to properly express the functional protein, and target PPT1 protein to the correct site of action, which in this case is the lysosomal matrix. The corrected enzyme can be secreted by transduced CNS cells and be taken up by neighboring cells via mannose 6-phosphate-mediated endocytosis and trafficked to the lysosome, cross-correcting substrate storing cells. This enables a potential therapeutic effect that goes beyond the initial transduction efficiency of the drug product. This in vivo gene therapy offers the possibility of a one-time treatment by inserting a healthy copy of the CLN1 gene and allowing the body to start making the missing enzyme, therefore slowing or halting CLN1 disease progression.

| 9 |

Program Status

An investigational new drug (“IND”) application is expected to be filedwas approved in this first quarter of 2019, with the clinical study initiation expected later inMay 2019.

The preclinical data for ABO-202 were presented at our Research & Development Day on December 6, 2018 and a slightly updated versionversions of the presentation waswere delivered at the WORLD Congress of Lysosomal Storage Diseases in Orlando, FL on February 6, 2019 and at the meeting of the American Society of Gene and Cell Therapy in Washington DC on April 29, 2019. Key findings included:

| ● | CLN1 mice recapitulate the major features of the human disease manifestations; | |

| ● | The study data showed that a single intrathecal (“IT”) injection of self-complementary adeno-associated virus 9 (scAAV9) encoding the human CLN1 gene administered to CLN1 mice at 1 week and 1 month (pre-symptomatic) and 12 weeks significantly increased their survival, improved behavior and reduced motor deficits; higher IT doses further improved longevity and function, suggesting that methods increasing CNS exposure may be beneficial and provided some survival and behavioral benefit to symptomatic CLN1 mice; | |

| ● | A combination delivery approach administering ABO-202 by both intravenous and intrathecal routes to symptomatic animals (at 20 weeks) increased survival efficacy by >50% over intrathecal alone and significantly slowed disease progression, and thus indicate a potential for treatment of patients with more advanced disease manifestations; and | |

| ● | Consistent with other AAV studies for lysosomal storage disease, early intervention (i.e., treatment at a younger age) yielded better results compared with animals treated later, which required higher doses for the same benefit. |

ABO-201 for the treatment of CLN3 disease, also known as juvenile Batten disease (or Juvenile Neuronal Ceroid Lipofuscinoses) (“CLN3 Disease”)

Disease Overview and Program Status

CLN3 disease is a rare, fatal, autosomal recessive (inherited) disorder of the nervous system that typically begins between 4 and 8 years of age. Often the first noticeable sign of CLN3 disease is vision

CLN3 disease is the most common form of a group of disorders known as neuronal ceroid lipofuscinosis (“NCLs”). Collectively, all forms of NCL affect an estimated 2 to 4 in 100,000 live births in the United States. NCLs are more common in Finland, where approximately 1 in 12,500 individuals are affected, as well as Sweden, other parts of northern Europe, and Newfoundland, Canada.

CLN3 disease is the most common form of Batten disease. Mutations associated with CLN3 disrupt the function of cellular structures called lysosomes. Lysosomes are compartments in the cell that normally digest and recycle different types of molecules. Lysosome malfunction leads to a buildup of fatty substances called lipopigments and proteins within these cell structures. These accumulations occur in cells throughout the body, but neurons in the brain seem to be particularly vulnerable to damage. The progressive functional impairment and eventual death of cells, especially in the brain, leads to vision loss, seizures, and intellectual decline in children with CLN3 disease.

ABO-201 (scAAV9.CLN3) is being developed as an AAV9-based gene therapy that has shown preclinical efficacy following delivery of a normalfunctioning copy of the CLN3 gene to a mouse model of CLN3 disease. Preclinical studies have previously demonstrated reduced lysosomal storage and decreased astrocyte/microglia activation in the CNS as well as improved motor function.

ABO-401 for the Treatment of Cystic Fibrosis

Disease Overview

Cystic Fibrosis (“CF”) is a progressive, genetic disorder caused by a mutation in the cystic fibrosis transmembrane conductance regulator (“CFTR”) gene. Malfunction of this gene affects cells that produce mucus, sweat and digestive juices. In unaffected individuals, these secreted fluids are normally thin and slippery, but in cystic fibrosis, a defective gene causes the secretions to become sticky and thick. Instead of acting as a lubricant, the secretions plug up tubes, ducts and passageways, especially in the lungs and pancreas, and cause repeated lung infections and difficulty breathing, and impaired pancreas function and digestive abnormalities.

Cystic fibrosis affects at least 30,000 people in the United States; between 900 and 1,000 new cases are diagnosed every year.

Program Status

The preclinical ABO-401 program employs AAV204 AIMTM capsid. ABO-401 has demonstrated vector deliveryshown ability to deliver the CFTR transgene to the lungs of unaffected mice. Study results also demonstrate CFTR transgene expression that has corrected the underlying chloride current deficit in CF animals. Pre-clinical data suggest ABO-401, based on the AAV204 vector, efficiently

ABO-50X for the treatment of genetic eye disorders

Program Overview

This research program comprises several vectors being tested for different monogenic retinal disorders. Eighty percent of genetic eye disorders occur in the photoreceptors and a correction of mutations in the retina has been accomplished by several groups using AAV gene therapy delivered through subretinal injection. IntravitrealWe are exploring various routes of administration to deliver AAV to the retina, including intravitreal delivery. We believe intravitreal delivery of small volume gene therapies constitutesis an attractive alternative to deliver gene therapy to the retina in an out-patient setting.

Program Status

We reported non-human primate data suggesting that next-generation AIM™ AAV vectors can be used to efficiently target the retinal epithelium after intravitreal injection, creating the potential for new pipeline candidates that can address multiple eye disorders.

Also presented were data showing that certain AIM™ capsids demonstrated high tropisms for central nervous system tissue can evade neutralizing antibodies against naturally occurring AAV serotype, and potentially enable redosing in patients that have previously received an AAV injection.

| 11 |

® (mucoadhesive oral wound rinse) for mucositis, stomatitis, aphthous ulcers, and traumatic ulcers

Next-Generation Gene Therapy Treatments anchored in AIM™ Vector Platform

In 2016, we licensed a library of oral mucositis, a frequent side-effect of cancer therapy for which there is no other established treatment. MuGard, a proprietary nanopolymer formulation, received marketing clearancefirst-generation novel AAV capsids from the FDA inUniversity of North Carolina at Chapel Hill. In partnership with academic institutions, our own scientific research teams have identified vectors within the U.S. as well asAIM™ capsid library showing strong potential to successfully target and reach the applicable regulatory authorities in Europe, China, Australia, New Zealand and Korea. We launched MuGard in the U.S. in 2010 and licensed MuGard for commercialization in the U.S. to AMAG Pharmaceuticals, Inc. (AMAG) in 2013. We licensed MuGard to RHEI Pharmaceuticals, N.V. for Chinacentral nervous system, lung, skin, muscle, liver and other Southeast Asian countriestissues. Based on continuing research being conducted by Abeona and our research partners, we observed improvements in 2010; Hanmi Pharmaceutical Co. Ltd.gene delivery to specific tissues compared to currently available AAV technology. We believe AIM™ vectors also have the potential for South Korea in 2014; and Norgine B.V. for the European Union, Switzerland, Norway, Iceland, Lichtenstein, Australia and New Zealand in 2014.

Establishing Leadership Position in Commercial-Scale Gene and Cell-Therapy Manufacturing

We have established a cGMP manufacturing facility, the Elisa Linton Center located in Cleveland, Ohio, which enables us to increase quality control, enhance supply chain control, establish tighter quality control testing, increase supply capacity, reduce production costs and gain manufacturing efficiency for clinical trials related to our product candidates and ensure commercial demand is met in the event our therapies receive marketing approval. Our facility is led by a team of highly-skilled production, process/assay development and QA/QC scientists with expertise in cellgene and genecell therapy, particularly in cell culture, formulation, upstream, downstream and purification manufacturing. We have completed the first two phases of our 26,000+ square foot manufacturing build-out plans in Cleveland, Ohio. The first phase, completed in 2018, was a 6,000 square feet stage of our planned 26,000 square feet manufacturing build-out of afoot state-of-the-art process cGMP production facility for the manufacturing of gene and cell and gene therapies at our Cleveland, Ohio location.therapies. The facility is designed to initially manufacture clinical drug productproducts with later intent of manufacturing commercial grade cGMP drug product. The second stagephase, completed in 2019, was the completion of the build-out is underway and includes an additional 8,000 square feet of state-of-the-art lablaboratory space to support our expanding quality control and process/process development, and assay development teams.

We have advanced our in-house manufacturing capabilities for our LZRSE COL7A1 retroviral autologous cell replacement therapy (EB-101) for the treatment of RDEB. The product is manufactured as a multilayer cellular sheet containing corrected keratinocytes that is fastened to a petrolatum gauze backing with surgical hemoclips. It is applied over wound areas, where they are expected to produce keratinocytes with normalfunctioning Type VII collagen, providing wound coverage and allowing for wound healing.

We are developing manufacturing capabilities that use a chemical method we refer to ascalled transfection for our AAV-based vector product candidates. We insert (“transfect”) many copies of DNA plasmids encoding the specific therapeutic gene sequence, or transgene, into human embryonic kidney (“HEK”) 293 cells (HEK) 293 using adherent and suspension vector production technologies. During an incubation period following transfection, each cell produces AAV vectors through biosynthesis using the cells’ natural machinery available within the cell.machinery. At the end of the incubation period, the newly generatednewly-generated vectors are collected from the cells that have been broken apart or, alternatively, from the cell culture medium. We continue to maintain focus on cGMP compliance and ensuring adequate supply to support our future clinical activity.

We have established and maintained strong and collaborative contract manufacturing and testing relationships with third-party companies specializing in the manufacturing and/or testing of gene and cell therapy material to complement our process and assay development needs.

We have made significant investments in developing optimized manufacturing processes and believe that our processes and methods developed to date provide a comprehensive manufacturing process developed to date for EB-101 and AAV-based vector therapies, including:

| ● | sufficient scale to support commercial manufacturing requirements for EB-101; | |

| ● | processes related to biopsy, cell collection, storage and transportation as part of manufacturing for EB-101; | |

| ● | processes related to product release testing for EB-101; | |

| ● | establishing transportation and packaging processes and materials for finished EB-101 product; |

| ● | proprietary AAV vector manufacturing processes and techniques that produce a highly purified product candidate; | |

| ● | AAV suspension technology that is readily scalable; | |

| ● | multiple assays to accurately characterize our process and the AAV vectors we produce; | |

| ● | a series of purification processes, which may be adapted and customized for multiple different AAV capsids, with a goal of higher concentrations of active vectors, and that are essentially free of empty capsids. |

We believe these improvements, and our continued investment in our manufacturing platform, will enable us to develop best-in-class, next-generation gene and cell therapy products. WeAs we look to commercialize EB-101, we are working towards receiving FDA cGMP validationfiling a Biologics License Application (“BLA”) to support commercial manufacturing of EB-101 from our facility in Cleveland, to produce commercial supply of EB-101.

Maintain a Strong Intellectual Property Portfolio

We strive to protect theour commercially important proprietary technology, inventions, and know-how, to enhance improvements that are commercially important to the development of our business, including by seeking, maintaining, and defending patent rights, whetherboth for inventions developed internally orand for inventions licensed from third parties. We also rely on trade secrets and know-how relating to our proprietary technology platform,platforms, continuing technological innovation, and in-licensing opportunities to develop, strengthen and maintain our position in the field of gene therapy thatand cell therapy. We may be important for the development of our business. We additionally mayalso rely on regulatory protection afforded through data exclusivity, market exclusivity, and patent term extensions where available.

Our success may depend in part on our ability to:to obtain and maintain patent and other protections for commercially important technology, inventions and know-how related to our business; defend and enforce our patents; preserve the confidentiality of our trade secrets; and operate without infringing the valid enforceable patents and intellectual property rights of third parties. Our ability to stop third parties from making, having made, using, selling, offering to sell or importing our products may depend on the extent to which we have rights under valid and enforceable licenses, patents or trade secrets that cover these activities. In some cases, these rights may need to be enforced by third-party licensors. With respect to both licensed and company-owned intellectual property, we cannot be sure that patents will be granted with respect to

We are actively seeking U.S. and international patent protection for a variety of technologies, including the following: research tools and methods, methods for transferring genetic material into cells, AAV-based biological products, methods of designing novel AAV constructs, methods for treating diseases of interest and methods for manufacturing, packaging, and transporting our products.product candidates. We also intend to seek patent protection or rely upon trade secret rights to protect other technologies that may be used to discover and validate targets and that may be used to identify and develop novel biological products. We seek protection, in part, through confidentiality and proprietary information agreements. We are a party to various license agreements that give us rights to use specific technologies in our research and development, and future commercialization.

Licensed TechnologyTechnologies and Intellectual Property

| 1. | Mucopolysaccharidosis (“MPS”) IIIA and IIIB |

We have secured an exclusive license through Nationwide Children’s Hospital to a family of patent applications for AAVAAV-based treatments for patients with MPS III AIIIA and B.IIIB. The family includes three pending applications in the United States. Patent(s)United States patent(s) that may grant from this family is/arewould be expected to expire in approximately in 2031 and 2032.

| 13 |

| 2. | CLN3 Disease (Juvenile Batten Disease) |

We have licensed the exclusive rights to an international patent family from the University of Nebraska Medical Center and the Ohio State Innovation Foundation. The family isFoundation, directed to AAV gene therapy for the treatment of CLN3 disease.disease (also known as juvenile Batten disease). The licensed patent family includes pending national stage applications in the United States, Canada, Europe, China, Japan, New Zealand, and Australia. Patent(s)United States patent(s) that may grant from this family is/arewould be expected to expire in approximately in 2035.

| 3. | Recessive Dystrophic Epidermolysis Bullosa |

To support our EB franchise, we have licensed a patent family from Stanford University. The patent family coversUniversity covering technology for the treatment of RDEB. PatentNational stage patent applications are pending in the United States, Canada, Europe, Israel, Japan, South Korea, China, New Zealand, Australia, Russia, Mexico, South Africa, and Brazil. Patent(s)United States patent(s) that may grant from this portfolio is/arewould be expected to expire in approximately in 2037.

| 4. | AIM™ Capsids |

We have an exclusive license to an international patent family of novel AAV vectors for use across diseases from the University of North CarolinaUNC at Chapel Hill. This portfolio hasHill covering novel adeno-associated virus (“AAV”) capsids (“AIM™ capsids”) that may potentially be used to deliver a wide variety of therapeutic transgenes to human cells to treat genetic diseases. National stage applications directed to the AIM™ capsids have been filed nationally in multiple jurisdictions including the United States, Australia, Brazil, China, Hong Kong, Europe, Canada, Israel, India, Japan, South Korea, Mexico, New Zealand, Russia, and South Africa. Patent(s) that may grant fromThe first patent in this patent family, is/are generallyU.S. Patent No. 10,532,110 (the “‘110 Patent”), issued to UNC on January 14, 2020. The ‘110 Patent is entitled to 352 days of patent term adjustment, making its projected expiration date November 6, 2036. The second patent in this patent family, U.S. Patent No. 10,561,743 (the “‘743 Patent”), issued to UNC on February 18, 2020. The ‘743 Patent is expected to expire approximately inon November 20, 2035.

| 5. | CLN1 Disease (Infantile Batten Disease) |

We have also licensed from the University of North CarolinaUNC at Chapel Hill we have rights to a patent portfolio directed to optimized CLN1 genes and expression cassettes, to support our CLN1 disease (also known as infantile Batten disease) gene therapy program. This agreement provides an exclusive field of use license for the treatment of CLN1 disease. Patent applications are pending in the United States, Canada, Europe, Israel, India, China, Japan, South Korea, Australia, New Zealand, Mexico, Brazil, Russia, and South Africa. Patent(s)United States patent(s) that may grant from this portfolio arewould be expected to expire approximately in 2037.

| 6. | Rett Syndrome |

To support our gene therapy research program for the treatment of Rett Syndrome, we have licensed rights to patent applications from both UNC at Chapel Hill and the University of Edinburgh. The patent applications licensed from UNC at Chapel Hill are directed to viral genomes designed to regulate expression of the MeCP2 gene, which is mutated in patients with Rett Syndrome. The patent applications licensed from the University of Edinburgh are directed to expression cassettes for MeCP2 polypeptides and to synthetic MeCP2 polypeptides. National stage applications for the patent application directed to MeCP2 expression cassettes are now pending in the United States, Canada, Brazil, China, Japan, Australia, Europe, India, South Korea, and Russia, and national stage applications for the international application directed to synthetic polypeptides are currently pending in the United States, Canada, Brazil, China, and Japan.

| 14 |

| 7. | AAV9 Vectors |

On November 5, 2018, we announced a license agreement with REGENXBIO Inc. Under the terms of the agreement, REGENXBIO has granted Abeona an exclusive worldwide license (subject to certain non-exclusive rights previously granted for MPS IIIA), with rights to sublicense, to REGENXBIO’s NAV AAV9 vector for the development and commercialization of gene therapies for the treatment of MPS IIIA, MPS IIIB, CLN1 Disease and CLN3 Disease. In return for these rights, REGENXBIO will receivereceived a guaranteed $20 million upfront payment, $10 million of which was paid uponon signing of the agreement on November 4, 2018 and $10 million of which willwas originally required under the agreement to be paid within 12 months of the effective date.by November 4, 2019. In addition, REGENXBIO will receive a total of $100 million in annual fees, payable upon the second through sixth anniversaries of the agreement, $20 million of which is guaranteed.guaranteed and payable on November 4, 2020. REGENXBIO is also eligible to receive potential commercial milestone payments of up to $60 million. REGENXBIO will also receivemillion as well as royalties payable in the low double-digit royaltiesdouble digits to low teens on net sales of products incorporating the licensed intellectual property.

We continue towill explore in due course strategies to support patent grantterm extensions for all of our licensed portfolios.

U.S. Biologic Products Development Process

In the United States, the FDA regulates biologic products including gene therapy products under the Federal Food, Drug, and Cosmetic Act (“FDCA”), the Public Health Service Act (“PHSA”), and

Within the FDA, the Center for Biologics Evaluation and Research (“CBER”) regulates gene therapy products. Within CBER, the review of gene therapy and related products is consolidated in the Office of Cellular, TissueTissues and GeneAdvanced Therapies (“OCTGT”OTAT”) and the FDA has established the Cellular, Tissue and Gene Therapies Advisory Committee (“CTGTAC”), a panel of medical and scientific experts and consumer representatives, to advise CBER on its reviews. CBER works closely with NIH and the RAC, which makes recommendations to NIH on gene therapy issues and engages in a public discussion of scientific, safety, ethical and societal issues related to proposed and ongoing gene therapy protocols. The FDA has issued a growing body of guidance documents on chemistry, manufacturing and control (“CMC”), clinical investigations and other areas of gene therapy development, all of which are intended to facilitate the industry’s development of gene therapy products.

The process required by the FDA before a biologic product candidate may be marketed in the United States generally involves the following:

| ● | completion of preclinical laboratory tests and in vivo studies in accordance with the FDA’s current Good Laboratory Practice (“GLP”) regulations and applicable requirements for the humane use of laboratory animals or other applicable regulations; | |

| ● | submission to the FDA of an application for an Investigational New Drug Application (“IND”), which allows human clinical trials to begin unless the FDA objects within 30 days; | |

| ● | approval by an independent institutional review board (“IRB”), reviewing each clinical site before each clinical trial may be initiated; | |

| ● | performance of adequate and well-controlled human clinical trials according to the FDA’s Good Clinical Practice (“GCP”) regulations, and any additional requirements for the protection of human research subjects and their health information, to establish the safety and efficacy of the proposed biologic product candidate for its intended use; |

| ● | preparation and submission to the FDA of a BLA for marketing approval that includes substantial evidence of safety, purity and potency from results of nonclinical testing and clinical trials; | |

| ● | satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities where the biologic product candidate is produced to assess compliance with cGMP and to assure that the facilities, methods and controls are adequate to preserve the biologic product candidate’s identity, safety, strength, quality, potency and purity; | |

| ● | potential FDA audit of the nonclinical and clinical trial sites that generated the data in support of the BLA; and | |

| ● | payment of user fees and the FDA review and approval, or licensure, of the BLA. BLA or new drug application (“NDA”), application fees for products designated as orphan drugs by the FDA are waived. |

Before testing any biologic product candidate on humans, including a gene therapy product candidate, the product candidate must undergo preclinical testing. Preclinical tests, also referred to as nonclinical studies, include laboratory evaluations of product chemistry, toxicity and formulation, as well as in vivo studies to assess the potential safety and activity of the product candidate. The conduct of the preclinical tests must comply with federal regulations and requirements including GLPs.

If a gene therapy trial is conducted at, or sponsored by, institutions receiving NIH funding for recombinant DNA research, prior to the submission of an IND to the FDA, a protocol and related documents must be submitted to, and the study registered with, the NIH Office of Biotechnology Activities (“OBA”), pursuant to the NIH Guidelines for Research Involving Recombinant DNA Molecules (“NIH Guidelines”). Compliance with the NIH Guidelines is mandatory for investigators at institutions receiving NIH funds for research involving recombinant DNA. However, many companies and other institutions, not otherwise subject to the NIH Guidelines, voluntarily follow them. NIH is responsible for convening the RAC that discusses protocols that raise novel or particularly important scientific, safety or ethical considerations at one of its quarterly public meetings. The OBA will notify the FDA of the RAC’s decision regarding the necessity for full public review of a gene therapy protocol. RAC proceedings and reports are posted to the OBA website and may be accessed by the public.

The clinical trial sponsor must submit the results of the preclinical tests, together with manufacturing information, analytical data, any available clinical data or literature and a proposed clinical protocol, to the FDA as part of the IND. Some preclinical testing may continue even after the IND is submitted. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA places the clinical trial on a clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. With gene therapy protocols, if the FDA allows the IND to proceed, but the RAC decides that full public review of the protocol is warranted, the FDA will request at the completion of its IND review that sponsors delay initiation of the protocol until after completion of the RAC review process. The FDA also may impose clinical holds on a biologic product candidate at any time before or during clinical trials due to safety concerns or non-compliance. If the FDA imposes a clinical hold, trials may not commence or recommence without FDA authorization and then only under terms authorized by the FDA.

Human clinical trials under an IND

Clinical trials involve the administration of the biologic product candidate to healthy volunteers or patients under the supervision of qualified investigators, which generally are physicians not employed by, or under the control of, the trial sponsor. Clinical trials are conducted under protocols detailing, among other things, the objectives of the clinical trial, dosing procedures, subject selection and exclusion criteria and the parameters to be used to monitor subject safety, including stopping rules that assure a clinical trial will be stopped if certain adverse events should occur. Each protocol and any amendments to the protocol must be submitted to the FDA as part of the IND. Clinical trials must be conducted and monitored in accordance with the FDA’s regulations comprising the GCP requirements, including the requirement that all research subjects provide informed consent.

Further, each clinical trial must be reviewed and approved by an IRB at or servicing each institution at which the clinical trial will be conducted. An IRB is charged with protecting the welfare and rights of trial participants and considers items such as whether the risks to individuals participating in the clinical trials are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the form and content of the informed consent that must be signed by each clinical trial subject, or his or her legal representative, and must monitor the clinical trial until completed. Clinical trials involving recombinant DNA also must be reviewed by an institutional biosafety committee (“IBC”), a local institutional committee that reviews and oversees basic and clinical research that utilizes recombinant DNA at that institution. The IBC assesses the safety of the research and identifies any potential risk to public health or the environment.

Human clinical trials typically are conducted in three sequential phases that may overlap or be combined:

| ● | Phase I: The biologic product candidate initially is introduced into healthy human subjects and tested for safety, dosage tolerance, absorption, metabolism, distribution, excretion and, if possible, to gain an early understanding of its effectiveness. In the case of some product candidates for severe or life-threatening diseases, especially when the product candidate may be too inherently toxic to ethically administer to healthy volunteers, the initial human testing is often conducted in patients. | |

| ● | Phase II: The biologic product candidate is evaluated in a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product candidate for specific targeted diseases and to determine dosage tolerance, optimal dosage and dosing schedule. | |

| ● | Phase III: The biologic product candidate is administered to an expanded patient population at geographically dispersed clinical trial sites in adequate and well-controlled clinical trials to generate sufficient data to statistically confirm the efficacy and safety of the product for approval. These clinical trials are intended to establish the overall risk/benefit ratio of the product candidate and provide an adequate basis for product labeling. |

Post-approval clinical trials, sometimes referred to as Phase IV clinical trials, may be conducted after initial approval. These clinical trials are used to gain additional experience from the treatment of patients in the intended therapeutic indication, particularly for long-term safety follow-up.

During all phases of clinical development, regulatory agencies require extensive monitoring and auditing of all clinical activities, clinical data and clinical trial investigators. Annual progress reports detailing the results of the clinical trials must be submitted to the FDA.

Written IND safety reports must be promptly submitted to the FDA, NIH and the investigators for serious and unexpected adverse events; any findings from other trials, in vivo laboratory tests or in vitro testing that suggest a significant risk for human subjects; or any clinically important increase in the rate of a serious suspected adverse reaction over that listed in the protocol or investigator brochure. The sponsor must submit an IND safety report within 15 calendar days after the sponsor determines that the information qualifies for reporting. The sponsor also must notify the FDA of any unexpected fatal or life-threatening suspected adverse reaction within seven calendar days after the sponsor’s initial receipt of the information.

The FDA, or the sponsor or its data safety monitoring board may suspend a clinical trial at any time on various grounds, including a finding that the research subjects or patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the biologic product candidate has been associated with unexpected serious harm to patients.

| 17 |

Additional regulation for gene therapy clinical trials

In addition to the regulations discussed above, there are a number of additional standards that apply to clinical trials involving the use of gene therapy. The FDA has issued various guidance documents regarding gene therapies, which outline additional factors that the FDA will consider at each of the above stages of development and relate to, among other things: the proper preclinical assessment of gene therapies; the CMC information that should be included in an IND application; the proper design of tests to measure product efficacy in support of an IND or BLA application; and measures to observe delayed adverse effects in subjects who have been exposed to investigational gene therapies when the risk of such effects is high. Further, the FDA usually recommends that sponsors observe subjects for potential gene therapy-related delayed adverse events for a 15-year period, including a minimum of five years of annual examinations followed by 10 years of annual queries, either in person or by questionnaire.

NIH and the FDA have a publicly accessible database, the Genetic Modification Clinical Research Information System, which includes information on gene therapy trials and serves as an electronic tool to facilitate the reporting and analysis of adverse events on these trials.

Compliance with cGMP requirements

Manufacturers of biologics must comply with applicable cGMP regulations. Manufacturers and others involved in the manufacture and distribution of such products also must register their establishments with the FDA and certain state agencies. Both domestic and foreign manufacturing establishments must register and provide additional information to the FDA upon their initial participation in the manufacturing process. Establishments may be subject to periodic, unannounced inspections by government authorities to ensure compliance with cGMP requirements and other laws. Discovery of problems may result in a

Concurrent with clinical trials, companies usually complete additional preclinical studies and must also develop additional information about the physical characteristics of the biologic product candidate as well as finalize a process for manufacturing the product candidate in commercial quantities in accordance with cGMP requirements. To help reduce the risk of the introduction of adventitious agents or of causing other adverse events with the use of biologic products, the PHSA emphasizes the importance of manufacturing control for products whose attributes cannot be precisely defined. The manufacturing process must be capable of consistently producing quality batches of the product candidate and, among other requirements, the sponsor must develop methods for testing the identity, strength, quality, potency and purity of the final biologic product. Additionally, appropriate packaging must be selected and tested, and stability studies must be conducted to demonstrate that the biologic product candidate does not undergo unacceptable deterioration over its shelf life.

U.S. review and approval processes

The results of the preclinical tests and clinical trials, together with detailed information relating to the product’s CMC and proposed labeling, among other things, are submitted to the FDA as part of a BLA requesting approval to market the product for one or more indications.

For gene therapies, selecting patients with applicable genetic defects is a necessary condition to effective treatment. For the therapies we are currently developing, we believe that diagnoses based on symptoms, in conjunction with existing genetic tests developed and administered by laboratories certified under the Clinical Laboratory Improvement Amendments (“CLIA”), are sufficient to select appropriate patients and will be permitted by the FDA. For future therapies, however, it may be necessary to use FDA-cleared or FDA-approved diagnostic tests to select patients or to assure the safe and effective use of therapies in appropriate patients. The FDA refers to such tests as in vitro companion diagnostic devices. On July 31, 2014, the FDA announced the publication of a final guidance document describing the agency’s current thinking about the development and regulation of in vitro companion diagnostic devices. The final guidance articulates a policy position that, when safe and effective use of a therapeutic product depends on a diagnostic device, the FDA generally will require approval or clearance of the diagnostic device at the same time that the FDA approves the therapeutic product. The final guidance allows for two exceptions to the general rule of concurrent drug/device approval, namely, when the therapeutic product is intended to treat serious and life-threatening conditions for which no alternative exists, and when a serious safety issue arises for an already approved therapeutic agent, and no FDA-cleared or FDA-approved companion diagnostic test is yet available. At this point, it is unclear how the FDA will apply this policy to our future gene therapy candidates, or even to our current products. Should the FDA deem genetic tests used for selecting appropriate patients for our therapies to be in vitro companion diagnostics requiring FDA clearance or approval, we may face significant delays or obstacles in obtaining approval for a BLA.

In addition, under the Pediatric Research Equity Act (“PREA”), a BLA or supplement to a BLA must contain data to assess the safety and effectiveness of the biologic product candidate for the claimed indications in all relevant pediatric subpopulations and to support dosing and administration for each pediatric subpopulation for which the product candidate is safe and effective. The FDA may grant deferrals for submission of data or full or partial waivers. Unless otherwise required by regulation, PREA does not apply to any biologic product candidate for an indication for which orphan designation has been granted.

Under the Prescription Drug User Fee Act (“PDUFA”), as amended, each BLA must be accompanied by a user fee. The FDA adjusts the PDUFA user fees on an annual basis. According to the FDA’s fee schedule, effective for fiscal year 2019,2020, the user fee for an application requiring clinical data, such as a BLA, is $2,588,478.$2,942,965. PDUFA also imposes an annual program fee of $309,915.$325,424. Fee waivers or reductions are available in certain circumstances, including a waiver of the application fee for the first application filed by a small business. Additionally, no user fees are assessed on BLAs for product candidates designated as orphan drugs, unless the product candidate also includes a non-orphan indication.

The FDA reviews a BLA within 60 days of submission to determine if it is substantially complete before the agency accepts it for filing. The FDA may refuse to file any BLA that it deems incomplete or not properly reviewable at the time of submission and may request additional information. In that event, the BLA must be resubmitted with the additional information. The resubmitted application also is subject to review before the FDA accepts it for filing. Once the submission is accepted for filing, the FDA begins an in-depth, substantive review of the BLA.

The FDA reviews the BLA to determine, among other things, whether the proposed product candidate is safe and potent, or effective, for its intended use, has an acceptable purity profile and whether the product candidate is being manufactured in accordance with cGMP to assure and preserve the product candidate’s identity, safety, strength, quality, potency and purity. The FDA may refer applications for novel biologic products or biologic products that present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions. During the product approval process, the FDA also will determine whether a risk evaluation and mitigation strategy (“REMS”) is necessary to assure the safe use of the product candidate. A REMS could include medication guides, physician communication plans and elements to assure safe use, such as restricted distribution methods, patient registries and other risk minimization tools. If the FDA concludes a REMS is needed, the sponsor of the BLA must submit a proposed REMS; the FDA will not approve the BLA without a REMS, if required.

Before approving a BLA, the FDA will inspect the facilities at which the product candidate is manufactured. The FDA will not approve the product candidate unless it determines that the manufacturing processes and facilities comply with cGMP requirements and are adequate to assure consistent production of the product candidate within required specifications. Additionally, before approving a BLA, the FDA typically will inspect one or more clinical sites to assure that the clinical trials were conducted in compliance with IND trial requirements and GCP requirements.

On the basis of the BLA and accompanying information, including the results of the inspection of the manufacturing facilities, the FDA may issue an approval letter or a complete response letter. An approval letter authorizes commercial marketing of the biologic product with specific prescribing information for specific indications. A complete response letter generally outlines the deficiencies in the submission and may require substantial additional testing or information for the FDA to reconsider the application. If those deficiencies have been addressed to the FDA’s satisfaction in a resubmission of the BLA, the FDA will issue an approval letter.

If a product candidate receives regulatory approval, the approval may be significantly limited to specific diseases and dosages or the indications for use may otherwise be limited. Further, the FDA may require that certain contraindications, warnings or precautions be included in the product labeling. The FDA may impose restrictions and conditions on product distribution, prescribing or dispensing in the form of a REMS, or otherwise limit the scope of any approval. In addition, the FDA may require post-marketing clinical trials, sometimes referred to as Phase IV clinical trials, designed to further assess a biologic product’s safety and effectiveness, and testing and surveillance programs to monitor the safety of approved products that have been commercialized.

The FDA has agreed to specified performance goals in the review of BLAs under the PDUFA. One such goal is to review 90% of standard BLAs in 10 months after the FDA accepts the BLA for filing, and 90% of priority BLAs in six months, whereupon a review decision is to be made. The FDA does not always meet its PDUFA goal dates for standard and priority BLAs and its review goals are subject to change from time to time. The review process and the PDUFA goal date may be extended by three months if the FDA requests or the BLA sponsor otherwise provides additional information or clarification regarding information already provided in the submission within the last three months before the PDUFA goal date.

Orphan drug designation

Under the Orphan Drug Act, the FDA may designate a biologic product as an “orphan drug” if it is intended to treat a rare disease or condition (generally meaning that it affects fewer than 200,000 individuals in the United States, or more in cases in which there is no reasonable expectation that the cost of developing