UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20182020

Commission File Number: 000-54191

SINO AGRO FOOD, INC.

(Exact Name of Registrant as Specified in its Charter)

| Nevada | 33-1219070 |

| (State or Other Jurisdiction | (IRS Employer Identification Number) |

Room 3801,3520, Block A, China Shine Plaza

No. 9 Lin He Xi Road

Tianhe District, Guangzhou City, P.R.C. 510610

(Address of principal executive offices, including zip code)

Registrant’s Telephone Number, including area code:(860) 20 22057860(+86)-20-22116293

Copies to:

Marc Ross, Esq.

Henry Nisser, Esq.

Sichenzia Ross Ference LLP

1185 Avenue of the Americas, 37th Floor

New York, New York 10036

Telephone: (212) 930-9700

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, $0.001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-Kannual report or any amendment to this Form 10-K.annual report. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer¨ | Accelerated Filer |

| Non-Accelerated Filer | Smaller Reporting Company |

| Emerging growth company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

The aggregate market value of the voting stock held by non-affiliates of the issuer on June 29, 2018,16th 2021, based upon the $0.361$0.086 per share closing price of such stock on that date, was $13,547,651.68.in round figure of $5,118,413.00.

There were 49,866,17460,356,776 shares of our common stock issued and outstanding as at December 31, 2018.consisting 59,516,423 free trading shares and 840,353

Documents incorporated by reference: None

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Annual Report”) contains forward-looking“forward-looking statements,” within the meaning of Section 27A of the Private Securities Litigation Reform Act of 1933,1995 and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or our future financial performance. We have attempted to identifyamended (the “Exchange Act”). The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of the Exchange Act. Forward-looking statements can be identified by the use of forward-looking terminology, including “anticipates,such as “estimates,” “projects,” “plans,” “believes,” “expects,” “can,” “continue,” “could,” “estimates,” “expects,“anticipates,” “intends,” “may,” “plans,” “potential,” “predict,” “should” or “will” or the negative of these termsthereof or other comparable terminology.variations thereon, or by discussions of strategy that involve risks and uncertainties These statements reflect management’s current beliefs and are only predictions;based on information now available to it. Accordingly, these statements are subject to certain risks, uncertainties and other factors maycontingencies that could cause ourthe Company’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Our expectations are as of the date this Annual Report is filed,2017 and we do not intend to update any of the forward-looking statements after the date this Annual Report is filed to confirm these statements to actual results, unless required by law.

This Annual Report also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other industry data. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified the statistical and other industry data generated by independent parties and contained in this Annual Report and, accordingly, we cannot guarantee their accuracy or completeness, though we do generally believe the data to be reliable. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and elsewhere in this Annual Report. These and other factors could cause resultsbeyond to differ materially from those expressed in, or implied by, such statements. Such statements, include, but are not limited to, statements contained in this Annual Report relating to the estimates madeCompany’s business, financial performance, business strategy, recently announced transactions and capital outlook. Important factors that could cause actual results to differ materially from those in the forward-looking statements include: a continued decline in general economic conditions nationally and internationally; decreased demand for our products and services; market acceptance of our products; the impact of any litigation or infringement actions brought against us; competition from other providers and products; the inability to raise capital to fund continuing operations; changes in government regulation; the ability to complete customer transactions, and other factors relating to our industry, our operations and results of operations and any businesses that may be acquired by us. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. The Company has been severely impacted by the independent parties andeffects of COVID-19 “Pandemic 2020”, which effects continue to this day as such presently the Company do not have the ability to control the exact timing of progresses in moving forward of its business plans tangibly except best effort basis. Readers of this Annual Report should not place undue reliance on any forward-looking statements. Except as required by us.

PART Ifederal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties.

ITEM 1. DESCRIPTION OF BUSINESSYou should read the following discussion and analysis of the financial condition and results of operations of the Company together with the financial statements and the related notes presented herein.

In this Annual Report, unless the context requires otherwise, references to the “Company,” “Sino Agro,” “SIAF,” “we,” “our company” and “us” refer to Sino Agro Food, Inc., a Nevada corporation together with its subsidiaries.

BUSINESSPart 1 Business

Back Ground:

Sino Agro Food, Inc.

SIAF is an agriculture technology and natural food holding company with principal operations in the People’s Republic of China. The Company acquires and maintains equity stakes in a cohesive portfolio of companies that SIAF forms according to its core mission to produce, distribute, market and sell natural, sustainable protein food and produce, primarily seafood and cattle, to the rapidly growing middle class in China. SIAF provides financial oversight and strategic direction for each company, and for the interoperation between companies, stressing vertical integration between the levels of the Company’s subsidiary food chain. The Company owns or licenses patents, proprietary methods, and other intellectual properties in its areas of expertise. SIAF provides technology consulting and services to joint venture partners to construct and operate food businesses, primarily producing wholesale fish and cattle. Further joint ventures market and distribute the wholesale products as part of an overall “farm to plate” concept and business strategy.

Revenues by division were as follows (in millions of U.S. dollars):

| Division (on Sales of Goods) | 2018 | 2017 | ||||||

| Organic Fertilizer (HSA, SJAP & QZH) | $ | 28.9 | $ | 84.4 | ||||

| (QZH derecognized as variable interest entity from December 30, 2017) | ||||||||

| Cattle (MEIJI) | 29.6 | 20.4 | ||||||

| Plantation (JHST) | 3.6 | 4.6 | ||||||

| Corporate, Marketing & Trading (SIAF) | 68.5 | 71.8 | ||||||

| Total Revenues derived on sales of goods | $ | 130.6 | $ | 181.2 | ||||

| Division (on consulting & services) | 2018 | 2017 | ||||||

| CA (Fishery related developments) | $ | 11.1 | $ | 17.0 | ||||

| Total Revenues derived on consulting & services | $ | 11.1 | $ | 17.0 | ||||

History

The Company which was formerly known as Volcanic Gold, Inc. and A Power Agro Agriculture Development, Inc., was incorporated on October 1, 1974 in the State of Nevada. The Company was formerly engaged in the mining and exploration business but ceased the mining and exploring business in 2005. On 24 August 2007, the Company entered into a merger and acquisition agreement with CA, a Belize corporation and its subsidiaries CS and CH. Effective of the same date, CA completed a reverse merger transaction with the Company.

For two years after its introduction in China, the Company operated in the dairy segment, but sold the dairy business in December of 2009 and began to implement its five-year plan to develop its vertically integrated business operations consisting of (i) cattle fattening and production of beef products and (ii) cultivation of fish and prawn and related products. The Company now operates as an engineering, technology and consulting company specializing in building and operating agriculture and aquaculture farms in China.

Our principal executive office is located at Room 3801, 38th Floor, Block A, China Shine Plaza, No. 9 Lin He Xi Road, Tianhe District, Guangzhou City, Guangdong Province, PRC, 510610.

The table below provides an overview of key events in the development of the business of the Company.

Through December 31, 2018, the Company(SIAF) has been contracted as turnkey contractor to the owners and developers of the C&S Project Companies and acted as the master engineer, pioneering the construction and building of farms, from raw land into fully operational facilities. In each development the Company completes the construction and building of infrastructure including staff quarters, offices, processing facilities, storage, and all related production facilities. The Company’s management teams are responsible for developing all business activities into effective and efficient operations. From October 1, 2016, onward, Tri-way has assumed the role as developer of aquaculture projects in Chinaestablished since 2007 with CA contracted to provide turnkey contracted services for those projects.

Over the past ten years, the Company has matured into a company dedicated to the agriculture and aquaculture industry in China. The Company currently maintains operations of its HU Plantation as well as its services in engineering consulting and specializing in the development of two major products, namely meat derived from the rearing of beef cattle and seafood derived from the growth of fish, prawns, eel and other marine species.

Background

After successfully developing many aquaculture fishery farms, cattle farms and related business operations (along with sales and marketing of produce and products) in Australia and Malaysia since 1998, SIAF’s management team introduced our business activities in China in 2006. We are an engineeringagriculture industry producing food produces and consultingproducts (as primary producer) using modern technologies introduced and transferred mainly from Australia. SIAF became a SEC fully reporting company that specializes in building and operating agriculture and aquaculture farms.

To accomplish this, we use our expertise and know how in specific agriculture and aquaculture technologies. Our “A Power Re-circulating Aquaculture System,” sometimes referred to herein as APRAS, is a patented and proven technology for indoor fish farming. We have developed modern techniques and technologies to grow, feed and house both fish and cattle. These are engineered into the designs of, and the management systems for, indoor and outdoor fishery and cattle farms. Our experience managing crops, and employing technologies, including hydroponic, to work within climate and growing conditions optimizes production of organic, green and natural agricultural produce.

In all of our developments we have acted as the master engineer, pioneering the construction and building of farms, from raw land into fully operational facilities. We complete the construction and building of infrastructure including staff quarters, offices, processing facilities, storage, and all related production facilities. Our management teams are responsible for developing all business activities into effective and efficient operations.

During the past years, SIAF has matured into a company dedicated to the agriculture and aquaculture industry in China. We currently maintain operation of our HU Plantation as well as our services in engineering consulting, specializing in the development of two major products, namely meat derived from the rearing of beef cattle and seafood derived from the growth of fish, prawns, eel and other marine species.

Revenues are generated from activities that we divide into five stand-alone business divisions or units: (1) Fishery development, (2) Cattle & Beef, (3) Organic Fertilizer, (4) HU Plantation, and (5) Marketing and Trading. This fifth and newest division, “Marketing and Trading” represents our strongest push to vertically integrate the Company’s operations, furthering the Company’s overall “farm to plate” concept.

Corporate Acquisitions

On September 5, 2007, we acquired two businesses in the People’s Republic of China (“PRC”):

(a) Tri-Way Industries Ltd., Hong Kong (“TRW”) (formerly known as Tri-way Industries Limited), a company incorporated in Hong Kong; and

(b) Macau EIJI Co. Ltd., Macau (“MEIJI”) (formerly known as Macau Eiji Company Limited), a company incorporated in Macau, and the owner of 75% equity interest in Enping City Juntang Town Hang Sing Tai Agriculture Co. Ltd. (“HST”), a PRC corporate Sino Foreign joint venture.

On November 27, 2007, MEIJI and HST established a corporate Sino Foreign joint venture, Jiangmen City Heng Sheng Tai Agriculture Development Co. Ltd, China (“JHST”) (formerly known as Jiang Men City Heng Sheng Tai Agriculture Development Co. Ltd.), a company incorporated in the PRC with MEIJI owning a 75% interest and HST owning a 25% interest. HST was dissolved insince 2010.

In September 2009, we formed a 100% owned subsidiary in Macau, A Power Agriculture Development (Macau) Ltd., China (“APWAM”) (formerly known as A Power Agro Agriculture Development (Macau) Limited). APWAM presently owns 45% of a corporate Sino Foreign joint venture, Qinghai Sanjiang A Power Agriculture Co. Ltd. (“SJAP”). On March 23, 2017, a third party, Qinghai Quanwang Investment Management Company Limited acquired a 8.3% equity interest and APWAM owned 41.25% equity interest of SJAP as of December 31, 2017. SJAP is engaged in the business of manufacturing bioorganic fertilizer, livestock feed and development of other agriculture projects in the County of Huangyuan, in the vicinity of the Xining City, Qinghai Province, PRC.

On February 28, 2011, TRW applied to form a corporate joint venture, Enping City A Power Prawn Culture Development Co. Ltd., China (“EBAPCD”) (formerly known as Enping City Bi Tao A Power Fishery Development Co., Limited), which is incorporated in the PRC. TRW initially owned a 25% equity interest in EBAPFD. On November 17, 2011, TRW formed Jiangmen City A Power Fishery Development Co. Ltd, China (“JFD”) (formerly known as Jiang Men City A Power Fishery Development Co., Limited) in which it acquired a 25% equity interest, while withdrawing its 25% equity interest in EBAPFD. As of December 31, 2011, we had invested $1,258,607 in JFD. JFD operates an indoor fish farm. On January 1, 2012, we acquired an additional 25% equity interest in JFD for total cash consideration of $1,662,365. On April 1, 2012, we acquired an additional 25% equity interest in JFD for the amount of $1,702,580. Prior to October 5th2016 we owned a 75% equity interest in JFD and control its board of directors. As of September 30, 2012, we had consolidated the assets and operations of JFD. From October 5th 2016 we brought out the remaining 25% equity interest in JFD for consideration of $4,517,426 and sold the 100% equity interest in JFD to Tri-way (inclusive all original assets of its one farm namely Fish Farm 1 that was changed to name Aqua-Farm 1 and of other additional assets transferred from work in progress etc.) for $33,538,480; and converted JFD into a Wholly Owned Foreign Entity (WOFE) such that Tri-way is holding 100% equity interest in JFD; and simultaneously (on October 5th 2016) JFD completed the acquisition: of the assets and operation from owners and investors of four other aquaculture farms (namely Aqua-farm 2, 3 and 4) for $277,055,897 collectively; and the acquisition of a Master License from CA for the rights of future development and operation of our APRAS farms in China for $30,000,000 resulting that we were owing 23.89% equity interest in Tri-way as at October 5th 2016. The Company converted the amount due from unconsolidated equity investee into equity interest during the fourth quarter of 2017, which resulted in equity interest in TRW from 23.89% to 36.60%.

On April 15, 2011, MEIJI applied to form Enping City A Power Beef Cattle Farm 2 Co. Ltd., China (“EAPBCF”) (formerly known as Enping City A Power Cattle Farm Co., Limited), all of which we would indirectly own a 25% equity interest in as of November 17, 2011. On September 13, 2012 MEIJI formed Jiangmen City Hang Mei Cattle Farm Development Co. Ltd., a company incorporated in the PRC (“JHMC”) (formerly known as Jiang Men City Hang Mei Cattle Farm Development Co., Limited) in which it owns 75% equity interest with an investment of $3,636,326, while withdrawing its 25% equity interest in ECF. As of September 30, 2012, we had consolidated the assets and operations of JHMC.

Cross-Listing on the Merkur Market

On January 13, 2016, securities representing beneficial interests in the shares of common stock on the Company, referred to as VPS Shares, began to be traded on the Oslo Børs’ Merkur Market under the symbol “SIAF-ME.” The Company’s common shares continued to trade on the OTCQB under the symbol “SIAF.”

The Merkur Market is a multilateral trading facility operated by Oslo Børs ASA. The Merkur Market is subject to the rules in the Norwegian Securities Trading Act and the Securities Trading Regulations that apply to such marketplaces. These rules apply to companies admitted to trading on the Merkur Market, as do the marketplace’s own rules, which are less comprehensive than the rules and regulations that apply to companies listed on Oslo Børs and Oslo Axess. The Merkur Market is not a regulated market, and is therefore not subject to the Norwegian Stock Exchange Act or to the Stock Exchange Regulations. Investors should take this into account when making investment decisions.

Delisting from the Merkur Market

In January of 2019 the Company applied to Oslo Børs ASA for the delisting from the Merkur Market. The principal reason for the delisting from the Merkur is the difference in the disclosure rules that the Merkur requires; the Merkur requires the disclosure of information prior to occurrence of a particular event which is inherently forward-looking in nature and thus potentially speculative; consequently, any such disclosure could thus be in conflict with US securities laws.

Uplisting to the OTC QX Premier

On January 19, 2016, the Company’s shares of common stock began to be traded on the OTCQX® Best Market in the U.S. under its existing ticker symbol “SIAF.” The Company upgraded to OTCQX Premier from the OTCQB®Venture Market.

The OTCQX® Market is the top tier of the U.S. over-the-counter markets operated by OTC Markets Company. It is reserved for established investor-focused companies meeting high financial and governance standards, and sponsored by professional third party advisors. SIAF has qualified to trade on OTCQX U.S. Premier, for which eligibility standards are higher still. For comparison, as of December 31, 2015, there were 942 companies traded on the OTCQB, 425 companies traded on the OTCQX and 98 companies traded on OTCQX U.S. Premier, of which only 17 are non-bank companies.

With OTCQX admission, OTC Market Company’s Blue Sky Monitoring Service provides the Company with a customized daily audit of its compliance status in all 50 states. Blue Sky compliance is mandatory for broker-dealers and registered investment advisors to solicit or recommend a security to investors.

U.S. investors can find current financial disclosure and Real-Time Level 2 quotes for the Company onwww.otcmarkets.com.

Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) in which we have total annual gross revenue of at least $1.0 billion or (b) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeded $700.0 million as of the prior June 30, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the “JOBS Act” and references herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

We have taken advantage of some of these reduced burdens, and thus the information we provide stockholders may be different from what you might receive from other public companies in which you hold shares.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

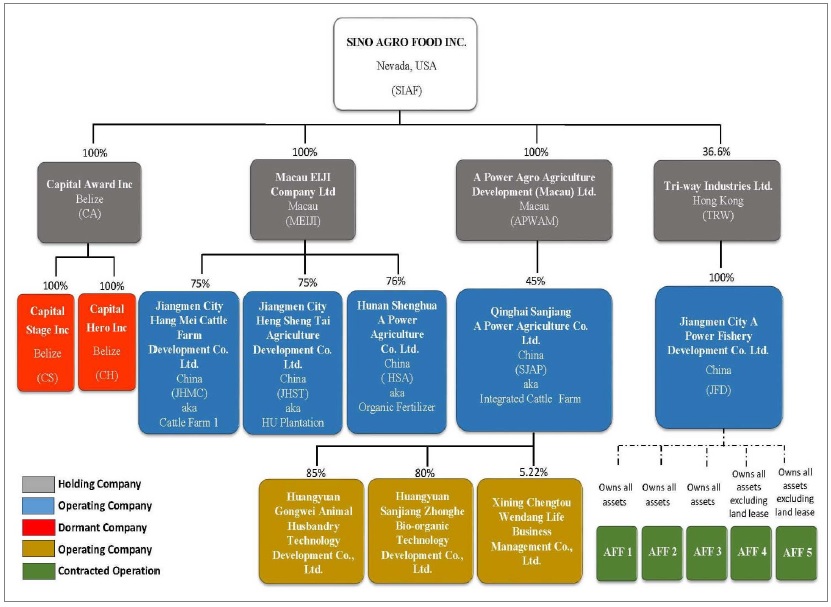

Legal structure

The Company is primarily a holding company whose operations are carried out through its subsidiaries.

The table below sets out information about the entities in which the Company, as of the date of this Annual Report, holds (directly or indirectly) more than 10 percent of the outstanding capital and votes.

The table below sets out a brief description of the companies within the Company as well as the Company’s respective holdings within such companies and their domiciles.

In addition to the legal entities included in the chart and table above, the Company is providing technology know-how with consulting service and turnkey contracting services (“C&S”) to various Chinese owned Project Companies (“C&S Project Company”) which mainly are private companies formed in China with Chinese citizens acting as legal representatives. The Company does not have any ownership in these C&S Project Companies. However, in consideration of the Company’s right to protect its technology and know-how granted to the C&S Project Companies, the Company has an option to acquire equity stakes in the future SFJVC at an agreed value equivalent to the project’s development cost.

In addition, regarding the investment agreement between QZH and QQI, (i) QQI enjoyed 6% annual interest on its capital contribution, but not any profit distribution; (ii) investment period was 3 years, and (iii) SJAP shared 100% (2016: 100%) on profit or loss after 6% interest payment to QQI and enjoyed 100% (2016: 100%) voting rights of QZH’s board and stockholders meetings.

As of December 30, 2017, the Company register authority approved the transferred of the Company’s (35.36%) equity interest in QZH to an unrelated third party, such that as from December 30, 2017 QZH was derecognized as a variable interest entity. (Further related information is provided throughout this report).

Business model

The Company works with Chinese investors to form operating companies, in which the Company retains the option to acquire equity interest. After a certain period of time and successful operating results, the Company and the Chinese investor may form a Sino Foreign Joint Venture Company (“SFJVC”). Prior to the formal naming, registration, and incorporation of an anticipated SFJVC, the Company prepays a deposit toward the consideration of its future SFJVC stake as a percentage of the assets of the fully developed farm. Upon conversion, the prepayments become equity capital.

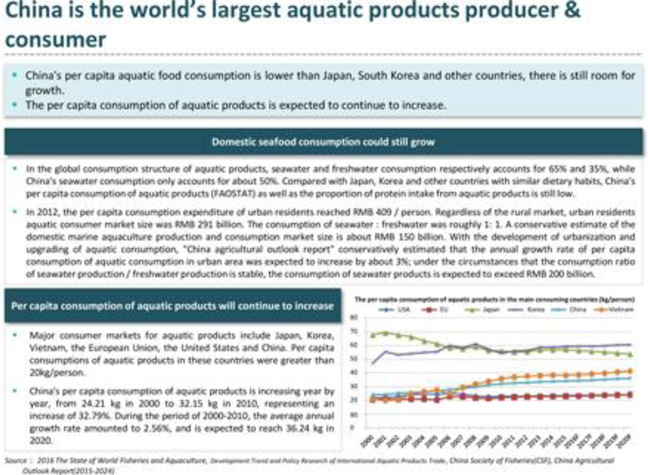

The Company oversees financing and provides interoperating strategies, encouraging vertically integrated growth. China has problems with quality assurance in primary production, distribution and poor origin traceability, as well as low food quality. This has created a market where consumers will eventually pay significant price premiums for “BAP (Best Aquaculture Practice) Certified” seafood with brands guaranteeing quality and consistency.

A vertically integrated operation in a fragmented and poorly regulated environment such as in China is the strategy that will yield the most success for the Company. Our presence in retailing and wholesale markets generates market power and provides potential for both margin maintenance and expansion.

Integration into fertilizer and feed production for rearing of beef cattle together with breeding of prawn brood stock help decrease primary production operational risks as well as helping to offset price fluctuations that sometimes occur in raw product input prices.

The Company uses expertise and know-how in specific agriculture and aquaculture technologies. The Company’s “A Power Re-circulating Aquaculture System” (the “APRAS”) is a proven recirculating aquaculture system (“RAS”) technology for indoor fish farming. The Company has developed modern techniques and technologies to grow, feed and house both fish and cattle. These are engineered into the designs of, and the management systems for, indoor and outdoor fishery and cattle farms.. In all developments the Company acts as the master engineer, pioneering the construction and building of farms, from raw land into fully operational facilities. The Company builds the infrastructure including staff quarters, offices, processing facilities, storage, and all related production facilities; then, manages developing of all business activities into effective and efficient operations. The Company’s largest customer represents a Company of thirty separate live seafood wholesalers at the Guangzhou wholesale markets.

The Company holds licenses for fertilizer formulas, enzyme patents, and for indoor fish farm techniques, including a “master license” in China for “A Power Technology” (“APT”), a modular land-based fish growing system and technology utilizing RAS.

The Company partners with Chinese investors in food projects as a turnkey project manager

The Company engages in projects as a technological and engineering expert, partnering with local and regional investors in food related projects. The Company generally has exclusive marketing, sales and distribution rights for each project company. For example, MEIJI purchases all marketable cattle from Cattle farm 2 and distributes them to wholesale markets. Up until September 30, 2016, prior to SIAF becoming an investment associate of Tri-way (i.e. post-carve-out), CA had been purchasing all seafood produced by the fishery farms and also supplied the fishery farms with fingerling, baby or adult fish or prawns and stock feed. Thus, CA is no longer involved in any sales, marketing and supplies of fishery goods being operated by Tri-way yet will continue to carry out its current contracts with other entities, as well as developing other business ties that are interested in utilizing its services.

Generally, the Company exercises an option to acquire a majority equity stake in the project company once development of the operating company has matured and successful operating results are demonstrated. Prior to acquisition, the Company prepays a deposit toward the acquisition consideration of the project company. Upon acquisition and conversion into a SFJVC, the pre-payments together with a cash consideration become equity capital, with the Company becoming a major shareholder.

Acquired project companies are operated and managed by the management team and the Chinese investor, and overseen by the Company.

Land ownership in China

In China, nearly all land is owned by the Central Government or local village collectives, which grant “usufructuary” rights (i.e., the right to use and enjoy the derived benefits for a period of time) in the form of land use rights. This is similar to “leasehold” land rights in the United States. Corporate entities and individuals may own the property (buildings) erected on Government land. Land use rights may be transferred, but they are based on agricultural contracts, and cannot be changed arbitrarily to non-agricultural purposes.

Business overview

Introduction

The Company is an agriculture technology and natural food holding company with principal operations in China participating in the ongoing transformation of China’s fragmented agrarian sector into a modern food production industry using sustainable and profitable methods. The Company focuses on seafood and beef production with integrated wholesale distribution. The Company acquires and maintains equity stakes in a cohesive portfolio of companies that the Company forms according to its core mission to produce, distribute, market and sell natural, sustainable protein food and produce, primarily seafood and cattle, to the rapidly growing middle class in China.

The Company employs a strategy of vertical integration from primary production through processing, distribution and marketing of high quality, organic food products in the food value chain. China’s fast growing middle class is creating rapidly rising demand for gourmet and high-quality protein food. The Company’s core products are live prawns, live eels, whole beef cattle and packaged beef meat.

The Company’s operations and strategy are executed through a number of subsidiaries located in China, and the Company contributes financial oversight and strategic direction to otherwise independent management teams which employ the Company’s intellectual property and proprietary methods within aquaculture, beef cattle rearing and production of organic fertilizer.

methods.

The Company has enjoyed strong growth sincebeen severely impacted by the effects of COVID-19 “Pandemic 2020”, which effects continue to this day as such presently the Company initiated its business activitiesis no longer a fully reporting company and has dropped from quoting on OTCQX to OTC Pink sheet from September 2020 onward due primarily to the Company’s auditors, which are located in Hong Kong, have been unable to do on-site inspections of the Company’s operations in China due to COVID-19 restrictions to complete the audit of 2019 and 2020. So Basically SIAF is delinquent in 2006. During theits Form 10-Ks for fiscal year end 2019 and 2020, Form 10-Qs for periods ended March 31, 2020, June 30, 2020, September 30, 2020, and March 31, 2021. It will need to amend and restate filings going back to December 31, 2019 to be able to apply to become a fully reporting company.

The aggregate market value of 2018,the voting stock held by non-affiliates of the issuer on June 16th 2021, based upon the $0.086 per share closing price of such stock on that date, was in round figure of $5,118,413.00.

There were 60,356,776 shares of our common stock issued and outstanding consisting 59,516,423 free trading shares and 840,353 restricted shares as at June 16th 2021.

In Fiscal year ended 31.12.2020 the Company’s strategy is to manage and operate its businesses under three (3) business divisions or units on a standalone basis and to generate revenues and incomes from the consolidated revenues amounted to USD $141,670,563. The four principal factors that have enabled the growth are:results of operations as follows:

Business (1): The Fishery Division is operating under Capital Award Inc. (CA), a fully owned subsidiary of the Company, provideswith major activity in providing engineering consulting and services to a number of private Chinese third party companies to construct and operate primary production facilities for fish, prawntechnology, fishery developments global (excluding China) and beef cattle,agriculture developments global.

Business (2): The Corporate and Other Division is operation under the corporation’s business operational teams consisting staff members from CA as well as wholesale marketingfrom SIAF’s Guangzhou office, with major activity in trading (importing) of agriculture food commodities and distribution centers. As partfrozen food products that are marketed and sold in China and the (exporting from China) of its consultingagricultural plants and service agreements,equipment to South Africa.

Business (3): The Leasing and Sub-contracting Division of the following operations:

(a). The fertilizer manufacturing and piggery operation of HSA (Hunan Shenghua A Power Agriculture Development Co. Ltd.)

(b). The plantation operation of JHST (Jiangmen City Heng Sheng Tai Agriculture Development Co., Ltd)

(C). The cattle (Asian Yellow Cattle) of MEIJI (Macau Eiji Company has the option to acquire these operations in order to expandLimited) and JHMC (Jiangmen City Hang Mei Cattle Farm Development Co., Ltd.)

In Fiscal year ended 31.12.2020 the Company’s proprietary production and wholesaling capacity.strategy is to derive from investment incomes generated from two (2) investees’ unconsolidated results of operations as follows:

Revenues are generated from activities that are divided into five stand-alone business divisions:(i). Cattle, Beef, Fertilizer & Livestock’ and Feed operations of SJAP

(ii). Fishery Development (China) and operations of TWL (or Twi-way) (Tri-way Industries Limited HK)

Aquaculture divisionPlease find our company’s legal structure chart listed below;

CA has entered into and completed several CSC’s (i.e., the Fish Farm 1 (or Aqua-Farm 1)) for JFD, the Prawn Farm 1 (Or Aqua-Farm 3) for EBAPCD and construction and development work still in progress for the Prawn Farm 2 (or Aqua-Farm 2) at Xin Hui District and the Prawn Farm 3 (or Aqua-Farm 4) and Prawn Farm 4 (or Aqua-Farm 5) at San Jiao Town Zhongshan for ZSAPP.

Prior to September 30, 2016, CA was the sole marketing, salesA summary of each business division and distribution agent of the APRAS fishery and prawn farms. CA had purchased all marketable fish and prawn from the farms, and then sold them to wholesale markets. CA also supplied the farms with fingerlings, baby or adult fish or prawns, and stock feed. CA generated revenue from the sale of seafood bought from farms that either had been Company subsidiaries or C&S Project Companies.

However, since then, Tri-way has acquired all assets and operation of CA’s C&S related project farms (i.e. Aqua-Farm 1 to 5) and SIAF has carved-out its controlling interest in Tri-way to 23.89% + debt converted to equity of 12.71% totaling to 36.6%, such that Tri-way, the subsidiary,operations is categorized as an “investment in associate” holding of SIAF, as a result of SIAF’s deemed disposal of equity interest in the subsidiary.

Integrated Cattle Farm division (SJAP & QZH)

Operated by SJAP, the Integrated Cattle Farm division is the business unit of the Company active in beef cattle rearing and value added processing of domestic and imported beef meat. Revenue for fiscal year ended December 31, 2018 was USD 19.23 million or 13.6 percent of the Company’s total sales of goods revenue of USD 141.67 million in the same period. Gross profit for SJAP’s integrated cattle farm division in the fiscal year ended December 31, 2018 was USD 4.3 million, or 19.86 percent of the Company’s total gross profit in sales of goods of USD 21.65 million in the same period.described below:

| 1. |

SJAP has slowed down its beef cattle rearing and fattening division since 2017 and is no longer involved with the corporative growers in the fattening of beef cattle due primarily to the depressed markets of the local cattle and beef industry caused mainly by the opening of the beef imports from a great number of developed countries that un-balanced the local cattle industry. Revenue for fiscal year ended December 31, 2018 was USD 6.64 million or 4.7 percent of the Company’s total sales of goods revenue of USD 141.67 million in the same period. Gross profit for same division in the fiscal year ended December 31,2018 was at a loss of USD(0.98) million, or (4.5)% of the Company’s total gross profit in sales of goods of USD 21.65 million in the same period.

SJAP now has in its own property twelve cattle houses, with its smaller buildings housing a minimum of 200 head and larger cattle houses accommodating up to 350 head.

The SJAP’s fertilizer division’s revenue for fiscal year ended December 31, 2018 was USD 3.02 million or 2.1 percent of the Company’s total sales of goods revenue of USD 141.65 million in the same period. Gross profit for same division in the fiscal year ended December 31, 2018 was USD 0.89 million, or 4.1% of the Company’s total gross profit in sales of goods of USD 21.65 million in the same period.

The Company prepares its agricultural wastes into bioorganic fertilizer through the environmentally friendly “Bacterial and Bio-organic Fertilizer Manufacturing Technology.” Also, the livestock feed is prepared into bioorganic livestock feed. Livestock feed consists of raw material consisting of crop wastes as well as locally grown and available wild wheat plus wild wheat sterns, wild peas with sterns and leaves, and selective pastures grown in the wild. These raw materials will be finely cut and put through several aging and fermentation processes by adopting a technology and method called “Stock Feed Manufacturing Technology,” and catalyzed by the enzyme developed by SJAP. Thereafter, the end materials will be packed and sealed in airtight and weatherproof packaging ready for storage.

Bioorganic fertilizer and the bio-organic livestock feed is sold to farmers that work on the Company’s land-use rights, which is owned by the government and leased with a subsidy or rent free, due to the many benefits for the community. Fertilizer and livestock feed are prepared based on the Company’s patented enzyme. The use of the enzyme is synergistic, as the production of fertilizer and livestock feed is permissible all 12 months of the year, which is a competitive advantage.

The Bulk Livestock feed:

The farmers use the bioorganic fertilizer on the soil and feed the grain to the cattle and sheep together with the livestock feed. Government tests show:

Through an acquired patent,1 the fat content of a 24 month-old cattle can be decreased from 18 kg to 5 kg, which improves the quality of the meat and its yield. The inventor of the patent is now an equity partner in SJAP.

SJAP’s feed division has two types of livestock feeds, namely “Bulk stock feed” mentioned above and “Concentrated stock feed” mentioned below and revenue for fiscal year ended December 31, 2018 was USD 1.52 million or 1.07 percent of the Company’s total sales of goods revenue of USD 141.65 million for the bulk stock feed and USD 8.04 million or 5.7 percent of the Company’s total sales of goods revenue of USD 141.65 million for the Concentrated stock feed in the same period. Gross profit for same division in the fiscal year ended December 31, 2018 was USD 0.82 million, or 3% of and USD 3.56 million, or 13.3% of the Company’s total gross profit in sales of goods of USD 21.65 million for the Bulk stock feed and Concentrated stock feed respectively in the same period.

The Concentrated livestock feed:

On February 28, 2013, SJAP completed its development of the Concentrated Livestock Feed (“CLF”) manufacturing factory, and started the production and sales of CLF. This CLF complements SJAP’s bulk livestock feed to provide the local cattle and sheep farming industry with a completed feed formula that can cater to the rearing of cattle and sheep at various growing cycles (e.g., specially formulated mixes with efficient nutrients for dairy cows and sheep, weaning, fattening and mature cattle and sheep). The advantage of the formulated feed combination is that the cattle and sheep growers will realize cost savings in production knowing precisely the amount of concentrated feed that will be needed by their livestock, thus avoiding wasted excess concentrated feed due to over feeding, which results in worthless excess fat in mature animals. In this respect, the Chinese central government has placed an order with SJAP to reserve up to 5,000 MT of CLF annually as part of the country’s annual reserve emergency livestock feed inventory. Thus, since March 2013 onward, SJAP has generated additional revenue generated from the sales of CLF.

SJAP sells its fertilizer and bulk and concentrated livestock feed mainly to its regional farmers in addition to using it to rear its own grown cattle, but because its geographic location is so far away from other major provinces there are high costs associated with selling its fertilizer, bulk and concentrated livestock feed and live cattle other than to local purchasers. Conversely, equivalent imports from other provinces must be purchased at a higher cost, providing SJAP with a competitive edge. Furthermore, Qinghai Province is a region rearing millions of cattle and sheep per year, providing an ample market for SJAP’s fertilizer and livestock feed.

1T1 Enzyme Technology (T1), Patent number ZL2005 10063039.9.

The Company is constantly looking and analyzing various optional business plans to enhance SJAP’s operation with improved financial performances, yet at present there is no plan has been finalized.

The average price paid to cooperatives for their fattened cattle is RMB50/Kg or RMB4/kg above average market prices, whichever is higher. A commitment by SJAP to the cooperative farmer to exercise its option to purchase cattle is made well in advance to lock-in the price before other buyers step in and also to obtain the producer’s commitment to raise its cattle based on SJAP’s quality standard for purchase. Again, if the quality of cattle raised by the cooperative does not meet SJAP standards, then there is no purchase obligation on SJAP’s part to carry out its commitment. Over the past few years until Q3 2015, when the Government relaxed its beef import policy, SJAP had generated good profit margins working under this arrangement. Since then, profit margins have steadily been depleted, such that by mid-2017 if SJAP had continued to commit buying additional heads of cattle from the cooperatives, it would have resulted in continuous operating losses for SJAP in 2017 and 2018 estimated to total $46.75 million (cumulative) based on an average market loss of RMB11.5/Kg (or $1.75/Kg), excluding other operating expenses. This alone had provided incentive for the Company to decide on what its alternatives were to sustain (and absorb) such losses, which for all intents and purposes was not an option considering current cash flow issues with the Company.

The local Government has been working with SJAP to develop a long-term plan to help ameliorate the problem faced by SJAP as well as other cattle houses throughout the region, yet the timeframe that appeared necessary to carry out a solution would also mean incurring more losses without the means to cover those losses in the meantime.

What has been decided between SJAP and its investors, including SIAF, and the local Government in the interest of its stakeholders was the following solution:

Also, consideration had to be given to the cost being incurred to meet the new regulations implemented by the Central Government on slaughterhouse operations, which license is currently held by QZH. Currently, it’s estimated that having both the funding and slaughterhouse operations underway meeting these new standards will take approximately 2 years to materialize; again, another source of income that would be completely curtailed until slaughterhouse operations were back online.

Taking into consideration and weighing its options, SJAP decided to eliminate any additional losses being incurred through QZH and has decided to discontinue QZH operations with the understanding that if favorable market conditions were to reoccur as well as the slaughterhouse license reinstituted in addition to Governmental assistance in developing a long-range plan being implemented that consideration will be given to resuming QZH operations in the future.

Thus, as of December 30, 2017 (the “deemed date of disposal”), QZH was derecognized as a variable interest entity and SIAF, based on its proportional ownership of QZH through its variable interest entity SJAP, had incurred a net loss on disposal totaling $9,365,543 as delineated in the following table:

NET LOSS FROM DISPOSAL OF A VARIABLE INTEREST ENTITY

| Cash and cash equivalents | $ | 17,060 | ||

| Inventories | 4,567,530 | |||

| Prepayments | 2,692,571 | |||

| Accounts receivables | 16,403,731 | |||

| Other receivables | 1,855,971 | |||

| Plant and equipment | 3,888,987 | |||

| Intangible assets | 2,870 | |||

| 29,428,720 | ||||

| Less: Accounts payable | (7,140,439 | ) | ||

| Other payables | (5,811,425 | ) | ||

| Short term borrowings | (1,530,456 | ) | ||

| Non-controlling interests | (5,082,410 | ) | ||

| Accumulated exchange difference | (498,347 | ) | ||

| Net assets and liabilities disposed as of December 30, 2017 | $ | 9,365,643 | ||

| Satisfied by: | ||||

| Cash consideration | $ | - |

Under the arrangement of the disposal agreement between all parties, it was agreed to that:

• SJAP is no longer liable and responsible for the liabilities of QZH.

• If any profit will be derived from the sale of existing fixed assets of QZH, 50% of any gained profit will be paid to SJAP with SIAF receiving its proportional share of the proceeds.

• There will be an annual royalty fee paid by QZH to SJAP/SIAF calculated at 25% of QZH net income over the next 3 years beginning January 1, 2018, if operations were to be reinstituted within this period.

• Also, if QZH operations were to resume under the Government’s plan to establish QZH as a regional hub for beef processing, value-added production, etc. within the next 3-years, an option to buy up to 25% equity of QZH at its fair book value (net of the loss incurred from disposal) would be made available to the Company or its nominee, on or before December 30, 2020.

Taking into consideration all issues related to the ongoing losses incurred by QZH, the Company believes that its support in favor of QZH’s disposal is the best option for its shareholders at this time foregoing incurring further and greater losses from QZH while leaving the door open to reinvest in QZH if, and when, the larger issues are resolved and the regional beef hub plan is able to be implemented.

Organic Fertilizer (HSA) division

The Organic fertilizer (HSA)’s revenue generated in fiscal year ended December 31, 2018 was USD 9.67 million, or 6.86%, of the Company’s total sales of goods revenue of USD 141.67 million in the same period. Gross profit for this division for the 12 months ended December 31, 2018 was USD 2.77 million, or 12.79% of the Company’s total gross profit on sales of goods of USD 21.65 million in the same period.

The operation in Linli District, Hunan Province, is run by HSA, a 76% owned Chinese subsidiary. HSA conducts the following business activities, both of which are in the development stage:

By January 2013, the first organic fertilizer production plant was established and started its production of organic fertilizer (“OF”). On March 5, 2013, HSA secured the rights to use an enzyme developed by a Hong Kong company some twenty years ago that has been utilized by global manufacturers of organic fertilizer. The advantage of this particular enzyme is that when it is applied to the organic fertilizer it has the ability to convert part of the organic raw materials into potash and phosphate without having to add in chemically formulated potash and phosphate, such that the Company’s end fertilizer can be qualified as pure organic fertilizer made with 100% natural organic raw materials. With this pure organic fertilizer, HSA is in a position to fully explore the potential market for fish in farm lakes and thereby to attempt to align itself with the government’s policy of encouraging lake fish farmers to use pure organic fertilizer instead of chemical fertilizers. In addition, cost savings from avoiding the use of chemical potash and phosphate will, in management’s belief, result in a better profit margin for the Company. Sales of pure organic fertilizer commenced at the end of Q1 2013. By 2014 HSA successfully developed a different mixed organic fertilizer specially designed and composed for the application in lakes to provide nutrients to enhance growth of water plants and microorganisms in the lakes that the fish are fed on. We call this type of fertilizer “the Organic Mixed Fertilizer” (“OMF”). In the same year, HSA also developed a domestic pack of fertilizer called the “Retailed Pack Fertilizer” (“RPF”) supplying to the super market chain. As such there are three types of fertilizers being produced with:

(a). The OF is being used for the growing of crops, vegetables and plants,

(b). The OMF is being used for the growing of fish in the lakes, and

(c). The Retailed Pack fertilizer (“RPF”) are being used by domestic households.

By Q2 2016, HSA completed its construction work of and started production operation with its second fertilizer production plant.

Construction work to develop HSA’s cattle station that began in March 2012 by cutting half of the hill at site next to the fertilizer production site that cost far more than the budget originally estimated (from the budgeted $8 million to almost $20 million) due mainly to extra-work required to satisfy compliance of the additional environmental impact conditions implied in the Government’s 2016 regulation and to additional work required to reconstruct the foundation of the land due to a number of land-slides occurred during the rainy season, however related main construction work were 95% completed by year end of 2017 containing a 2,000 head capacity cattle farm built and pending on the completion of the installation of associated plants and equipment, accessories and operational fittings and other necessities, it will be ready for stocking of cattle for rearing and fattening operation targeting to be within 2018. In this respect, the Company is recruiting and selecting the right management team specializing in the growing of the selected native breed cattle (namely the “Asian Yellow Cattle,” or “AYC”) in readiness to start-up the operation. The AYC are mainly found in Guangxi district and grown in free range conditions by small farms such that our initial stocking up to 2000 heads is rather significant in comparison that really needs a good management team to carry out its operation efficiently. The Company cultivated 75 acres of its land, situated below the fertilizer factory, and planted a high yielded pasture that have been developed in our Cattle Farm 1 in Enping District harvesting up to 200 MT/acre/year for the past year that has been proven as quality livestock feed suitable to the growing and fattening of AYC. The pasture will be harvested from the said 75 acres are the main bulk livestock feed fed to the AYC that will be sufficient for the growing of 2000 heads of AYC per year starting from 2018. In term, the plan is that; the cattle’s liquid waste will be used to fertilize the pasture field and the cattle’s solid waste will be used as raw materials by the fertilizer factory such that all wastes will be recycled, which we refer to as the AYC development project.

However this AYC development plan was disrupted and put on hold during mid-year of 2018 when the Government imposed an additional environmental regulation requiring the construction of a mash gas plant before the permit of the cattle farm could be issued. Although the Mash gas plant will be paid by the Government under subsidization program currently available to the project, it will take a further 12 months or more for construction, such that the Company decided to lease out the AYC development project’s property situated on land of 25 Mu to an unrelated third party whilst the Company evaluates other business opportunities and options that may allow better financial returns to the Company in the meantime.

HSA produced over 50,000 MT of organic fertilizer and organic mixed fertilizer in 2016, which was reduced to 24,448 Mt in 2018 (a decrease of 59.25%) primarily due to (i) the production of the fertilizer in HSA being affected in the second half of 2017 by the ongoing construction work of cattle station during the year and (ii) the retrofitting of the fertilizer plant to accommodate the application of cattle waste as the main source of raw material versus chicken waste as its main product source. By Q4 2017, HSA’s production lines were back to online. Organic Fertilizer generated sales of 15,105 MT in 2018 from 15,334 MT sold in 2017. Organic Mixed Fertilizer, generated sales of 14,638 MT in 2018 from 9,042 MT sold in 2017.

Cattle farms (MEIJI) division

The business division Cattle Farms, or MEIJI, refers to SIAF’s cattle rearing operations in Jiangmen, Guangdong Province. Revenue for fiscal year ended December 31, 2018 was $29.56 million, or 29.96%, of the Company’s total sales of goods revenue of USD 141.67 million in the same period. Gross profit for the Cattle Farm (MEIJI) division for the 12 months ended December 31, 2018 was $4.29 million, or 19.81% percent of the Company’s total gross profit on sales of goods of $21.65 million in the same period.

Currently there are two operations in this segment, Cattle Farm 1 and Cattle Farm 2.

Cattle Farm 1: Cattle Farm 1 was built as a demonstration farm to show that cattle can be raised in a semi-tropical climate using the Company’s semi-grazing and housing method. Using the Company’s semi-free growing management system, the cattle are allowed to graze in the field during the early morning and kept indoors and out of the sun during the hot summer days. This method has proven reliable, with the growth rate of the cattle measuring slightly higher than the cattle at SJAP (i.e., averaging around 0.28 kg per day per cattle).

Cattle Farm 2:Cattle Farm 2 is a beef cattle farm situated in Guangdong Province, Guangzhou City. Cattle Farm 2 is operated by a private company formed in China with Chinese citizens acting as its legal representative as required by Chinese law. Cattle Farm 2 is complementary to Cattle Farm 1, having an additional 76 acres of land suitable for growing the Company’s type of pasture (a cross between elephant grass and yellow grass) that has a very high yield rate of over 35 MT per 1/6 acre per year, and containing an average of over 9 percent protein that is very suitable for consumption by cattle. Between the two farms, under normal seasons, they have a capacity to produce up to 30,000 MT of pasture/year collectively that is capable to feed up to 5,000 head of cattle/year based on the consumption rate on average of 6 MT/head.

MEIJI is the marketing and distribution agent for all cattle farms that have been and will be developed by MEIJI using its “Semi-free growing” management systems and aromatic-feed programs and systems to grow beef cattle.

Similar to CA in its business model, MEIJI purchases fully-grown cattle from Cattle Farm 1 and sells them to the cattle wholesalers. MEIJI also buys young cattle from other farmers and sells the young stock to Cattle Farm 1. All cattle farms developed by MEIJI will utilize its “semi-free growing” management system and aromatic-feed programs and systems (which is a feeding program with special selected Chinese herbs to improve the health of the cattle to avoid the use of antibiotics) to raise beef cattle, such that cattle raised under this program have a distinct aromatic flavor sought by many restaurants in the Guangdong Provinces.

AYC is traditionally a high-end market in China, as it is mainly sold in higher end markets (i.e. its 2016/2017 average of wholesale price was between RMB70 to RMB78/kg (live weight) while the average of other (western origin breed beef) cattle like Angus, etc. was between RMB36 to RMB 48/kg (live weight). We are anticipating that the AYC situation is rapidly changing, though, owing to urbanization and rising incomes, the rising demand for such quality beef, such that we foresee that eventually, locally grown and produced high quality beef from local breeds like the AYC will establish its “Brand” and market niche, returning premium prices in China similar to how many locally bred Japanese Cattle found their market niches in Japan that are not be affected by the supplies of imported beef.

Initially (as demonstration farms) these farms were going smoothly rearing and fattening mainly the western origin beef cattle (“WOBC”) breeds (i.e. Angus and/or Simmental) similar to cattle fattened at SJAP until the adverse impact caused by said relaxed importation of cattle from other countries that reduced the activity of the fattened WOBC and to grow more AYC. However, although the domestic prices of the AYC were not being affected by the imports, they do have much lower growth rates due to their small stature and in turn reduces these farms’ sales revenues based on volume yet make up the difference on their return on gross profit as evidenced in 2018 for gross profit of $4.29 million derived from sales of $29.56 million when compared to 2016 for gross profit of $1.54 million derived from sales of $29.84 million of WOBC.

Presently, these farms are carrying on with the growing and fattening mainly AYC.

Plantation (JHST) division

The business division Plantation refers to SIAF’s produce production, situated at Enping City, Guangdong Province. Revenue for 12 months ended December 31, 2018 was $3.61 million or 2.56% of the Company’s total sales of goods revenue of $141.67 million in the same period. Gross profit for the plantation division for the 12 months ended December 31, 2018 was $0.52 million, or 2.4% percent of the Company’s total gross profit for sales of goods of $21.65 million in the same period.

JHST is an SFJVC that is 75% owned by SIAF consolidated as a subsidiary, and is the owner and operator of a Plantation where mainly Hylocereus Undatus, or Dragon Fruit, and cash crop vegetables, are grown.

Hylocereus Undatus is a cactus commonly referred to as dragon fruit. JHST conducts two main operations: (i) growth and sales of flowers that are consumed as vegetables in China, and (ii) drying and value added processing and sales of HU flower products (used in health-related soups and teas). JHST cultivates 187 acres of Hylocereus Undatus in the Guangdong Province.

HU cacti take three years to reach maturity, though they will flower a little even in their first year, and can produce for as long as twenty years. JHST began planting in late 2007, and by 2015 all of the plants are mature (averaging over four years). HU blooms for a very short period, sometimes only one night, and flowers must be 20 to 25 cm long when picked before they turn from green to white. HU is a delicate crop and the harvest season runs from July through October.

Small amount of fresh flowers are sold to regional wholesale and retail markets due to their short shelf life and most of the flowers are dried and packed; these flowers are sold to a few major wholesalers, who distribute them to wholesale and retail markets and export traders through the winter and spring months (from October to June) in Guangdong Province. HU is a seasonal revenue product; more than half of JHST’s revenues are recognized in the third quarter. No sales are made in the first quarter.

The Company originally expected that by 2014, dried and pickled flowers would make up 96 percent of the division’s flower income as produce is diverted away from delicate fresh flowers. In 2013, the Company also planted a special selenium-rich Chinese herb (called XueYingZi, or “Immortal Vegetable” in China and Snowsakurako in Japan) and tried many treatment methods hoping to prolong the shelf life of the fresh flowers from 2-3 days up to 12-14 days aiming to increase the sales of fresh flowers. This experimentation had not produced the desired outcome; thus the Company instead has processed up to 80 percent of HU as dried flowers from 2013, onward.

HU flowers are in greater demand than supply can meet for several reasons; (i) In Guangdong Province, HU plants can only be grown commercially along certain districts; there were over 40,000 acres of HU Plantation in 2005, but due to the growth of industrialization and modernization, acreage is now less than 4,000 acres, and (ii) farm laborers are getting harder to find. With the increase of cost of wages and salaries, the rapid rise of the land cost and the increase cost of farm developments, it is extremely difficult to start up a big acreage HU plantation. For these reasons the Company anticipates that prices of dried HU flowers will enjoy a steady rise at an average rate of 8 to 12 percent per year, which has been the trend since 2009. However, the biggest risk to yield is weather, as substantially wet rainy seasons can limit the yield of any harvest and damage their roots in term inducing diseases to the plants.

Our plantation experienced very heavy wet seasons for more than 4-5 years (2013 to 2017) requiring the Company to combat and treat diseases and related problems continuously during the period, but by 2017 had exhausted all various means to recover and to revitalize the HU plantation. With continued wet conditions experienced over the past years, damage to the soil and plant roots has increased disease problems to the HU plantation affecting its overall yield as well as quality of harvested flowers Even though new plants were being planted each year increasing the area of planting by over 900 Mu to a total of over 1700 Mu with the intent to increase productivity, proportionately, the outcome has fell well short of intended results. Furthermore, poor soil and weather conditions adversely affected the quality of the HU flowers products which caused a significant drop in selling prices (i.e., there was no sales of the fresh HU flowers decreased in 2018 while that of dried HU flowers decreased from $5.19/kg in 2017 to $4.93/kg in 2018). At the same time, the regional farmers suffered the same fate that we could not buy enough fresh flowers from them to dry to maintain the sales of dried flowers. Therefore, due to deteriorating conditions recurring in the HU sector, the Company is reviewing the following options with the hope to remedy the situation.

One of the plans of JHST was to plant other cash crops to provide an alternative source of income for the plantation. Immortal Vegetable (IV) plants have properties that some believe induce good health. The Company has processed these into small herbal tea bags - selling them as organic herbal health tea. Laboratory test results show that each kilo of fresh Immortal Vegetables contains 0.58 gram of selenium, which adds value to their sales. As of the 2015 season there were 70 Mu designated for growing immortal vegetables on the plantation, however sales of this products did not reach targeted levels such that in 2017 the Company maintained only a small plot of about 10 Mu for growing IV. We did not sell any dried IV tea in 2017, but we kept over 20,000 Kg dried IV tea in inventory planning to relaunch its sales by one of the country’s top e-commerce operators in 2018 that will involve (a) Repackaging the products by a well-known and reputable health food processor and promoter into three separate and different health products with each product reflecting its own health property instead of an all-in-one application like had been, previously, (b) To promote the product under one of China’s best brand names of health herbal products. Our herbal health tea products (“HHTP”) have been accepted by one of their franchisees during March 2018, and, as such, we are working on trials with the processor over the coming months to start launching the HHTP onto an e-commerce platform targeting Q3 2018 depending on the successful outcome of the trials to meet various marketing markers, satisfactorily. If HHTP is launched successfully, there is good potential for JHST’s plantation to generate sustainable high sales revenues and profit from 2018 onward because the IV are very durable plants with strong disease resistant characteristics having good growth rates producing 5 yields per year (average of 50 MT of fresh produce/acre/year) at a reasonable cost of production averaging at RMB1000/MT or the equivalent of RMB 50,000/acre. Practically speaking, the whole plant (that is, the flowers, leaves, sterns and roots) can be dried into the HHTP averaging 5 MT of HHTP/acre/year. We are targeting to plant about 15 acres in year 1 (starting from Q3 2018) to process into 75 MT of HHTP to generate direct farm sales (excluding marketing and other associated sales revenue and costs, etc.) up to RMB45 million/year 1 (or the equivalent of $7.2 million) at about a 70% gross profit margin. If successful, it will enhance revenue and profit by more than 200% of JHST’s annual sales revenue and gross profit generated in FY2018.

In March 2018, JHST signed two growing contracts that have stable pricing conditions: (1). With a herbal plant oil processor to grow 50 acres of plants called “Pogestemon Patchouli” (“PP”) for processing into a type of natural aromatic oil that has experienced a good market in China. 50 acres of trial will be run this year but can be expanded to 150 acres next year if proven successful. It is estimated that the 50 acres of PP will generate sales revenues over $1 million with 50% gross profit margins based on two harvests for the year 2018; and (2). To grow 200 acres of Passion Fruit for a Juice Manufacturer from 2018 to 2020 for 3 years initially estimated to produce around 2,400 MT of fruit/year contracted at RMB 8,000/MT (or $1,280/MT) to generate over $3 million in sales revenue. The combination of both fruits and PP will enhance revenue and gross profit to JHST that again will exceed its performance of FY2018, if their outcomes prove successful.

Unfortunately the typhoon during Q3 2018 has destroyed much of the winter cash crops, which reduced JHST’s performances in Q4 2018 and in turn reduced 2018’s annual revenue and incomes by 22% and 62.5% respectively compared to 2017. At the same time the typhoon also destroyed the newly planted herbal PP plants and the passion fruit trees delaying their development. Currently as at the beginning of Q2 2019, management of JHST is still evaluating JHST’s overall prospects yet it has not yet come up with any conclusive plans needed for JHST.

Marketing & Trading Division

Revenue for 12 months ended December 31, 2018 was $68.45 million or 48.5% of the Company’s total sales of goods revenue of $141.67 million in the same period. Gross profit for the plantation division for the 12 months ended December 31, 2018 was $7.18 million, or 33.16% of the Company’s total gross profit for sales of goods $21.65 million in the same period.

The Company distributes imported meat and seafood through two completed and operational facilities from which it has acted as turnkey project developer to construct and to provide supervision to these operations:

In 2013, the Company also constructed a trading complex (the “Trading Center”) for the Import and Export at another building adjacent to Wholesale Centers 1 and 2. The Trading Center has imported frozen and fresh chilled and live seafood (i.e., cuttlefish, squid, prawns, salmon, crabs and eels) from Malaysia, Thailand, Russia and Madagascar and other local coastal fishing towns. The seafood was sold to Wholesale Center 1, which distributed and sold it into various reputable food chain outlets, wholesale market stores and supermarket chains in the Guangzhou City, Shanghai City as well as in the southern coastal towns of the Guangdong Province.

Primarily, the Company distributes meat imported from Australia and seafood from other countries through these operations under their import and export permits conditioned under the China Government’s regulations.

We believe this division has excellent growth potential due mainly to the needs of import foods in China, but the sales of this division is limited mainly by “insufficient working capital” to really drive up the sales’ turn over. For instance the company’s average of gross profit of import trade is at 10.5% (derived from average of 12.5% in mark-up) for selling the imported goods to its sales agencies to distribute in China when the total working capital(WC) needs for the 1st month’s import and the subsequent 2nd months import calculated to about 4 months’ “good-sold” when considering that it will require 2 months times to complete one cycle of the monthly import allowing time provided for “ordering, shipping, custom clearance, good inspection, discharging & local transportation, storing and selling time etc. and another 2 months for subsequent month’s import totaling to 4 months. As such, if the Company wants to generate $120 million in sales in one year it will require WC of about $40 million (or 33.3%) to be locked up month after month continuously during the year whilst the Company did not have $40 million in WC in the past or currently for that purpose, such that it could only build up sales of this division gradually pending on the availability of working capital from time to time.

Over the years this division has developed many reliable suppliers and supplied sources that are supplying quality foods to our trust-worthy customers / agencies. Therefore it is within reason to assume that this division will eventually become an effective and major revenue drive of the group once when some of the financing plans will have materialized to allow more working capital being employed in the division.

Overall in 2018 this division achieved average gross profit margins of 11% for the trading of seafood and 10% on the trading of beef from selling imported goods to its sales agencies to distribute in China based on an averaged mark-up of 12.5% on cost of goods sold excluding the cost of import duties, value added taxes and local associated charges etc. that were paid by respective agencies. This kind of gross profit margin will be increased when the Company will be in the financial position to afford to buy directly from the fishermen and to sub-contract the value added processors to process the seafood directly.

Project Development Division

The project developments (or Technology engineering consulting and services) work are carried out by CA on aquaculture related projects and by SIAF on non-aquaculture projects:

Introduction

The Project Development division earns revenue by providing turnkey project management and engineering services today mainly within aquaculture. Project development revenue for 12 months ended December 31, 2017 was $16.99 million or 8.57% of the Company’s total revenue of $198.17 million (derived collectively from $181.12 million in Sales of goods and Project Development of $16.99 million) in the same period. Gross profit for project development for the 12 months ended December 31,2018 was $3.42 million or 17.42% of the Company’s total gross profit of $19.63 million (derived collectively from $16.21 million of Sales of goods and Project development of $3.42 million) in the same period. All project development activity for the year was carried out through Capital Award for its unconsolidated investee, Tri-way.

Historical events:

Historical Information and status of CA’s consulting and engineering service are shown in the table below:

| Number | Year | Name | Stage of completion | |||

| 1 | 2010 | Fish Farm 1 (JFD) | Completed and acquired by SIAF | |||

| 2 | 2011 | Fish Farm 2 | Under expansion by Tri-way | |||

| 3 | 2011 | Cattle Farm 1 (JHMC) | Completed and acquired by SIAF | |||

| 4 | 2011 | Prawn Farm 1 (EBAPCD) | Completed with hydroponic farm to go | |||

| 5 | 2011 | Prawn Farm 2 (ZSAPP) | Under expansion by Tri-way | |||

| 6 | 2012 | Cattle Farm 2 (EAPBCF) | Completed | |||

| 7 | 2012 | Wholesale Center 1 - Guangzhou (APNW)(Phase 1 & 2) | Completed | |||

| 8 | 2012 | Central kitchen, distribution network, signature restaurants | Completed | |||

| 9 | 2014 | Zhongshan New Prawn Project (ZSNP) | Commencing construction | |||

| 10 | 2014 | Wholesale Center 2 - Shanghai (APNW) (Phase 1) | Completed | |||

| 11. | 2016 | Aqua-farm 4 & 5 of the (ZSNP) | 90% completed under Tri-way’s direction |

Together with its subsidiaries, the Company essentially constitutes an engineering company providing services in engineering consultancy, supervision and management on the development of agriculture and food based projects in China. These include the construction of farms (or other facilities) as well as the development of business operations of related projects that are apply and use the Company’s principal technologies, including the following:

| · |

Capital Award generates revenues from providing engineering consulting services as turnkey contractors to owners and developers of fishery and agriculture projects that are being designed and engineered into turnkey contracts by Capital Award globally (excluding China) using its A Power Module Technology Systems (“APM”) for fishery projects’ developments and using other agricultural technologies, knowhow and patents expanded from the development of SJAP for agriculture development projects globally as follows: