SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(XFORM 10-K

)ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

Commission File No. 0-14616

J & J SNACK FOODS CORP.

New Jersey | 22-1935537 | |||||

(State or other jurisdiction of | (I.R.S. Employer Identification No.) | |||||

6000 Central Highway | 08109 | |||||

Pennsauken, New Jersey | (Zip Code) | |||||

(Address of principal executive offices) | ||||||

Registrant's telephone number, including area code: (856) 665-9533

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |||||

Common Stock, no par value | The NASDAQ Global Select Exchange | |||||

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] X No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] X No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | Accelerated filer | |||||

Non-accelerated filer | ||||||

| ( ) (Do not check if a smaller reporting company) | Smaller reporting company ( ) | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ]Yes___ No [X]

As of November 26, 2010,15, 2013, the latest practicable date, 18,511,53718,678,012 shares of the Registrant’s common stock were issued and outstanding. The aggregate market value of shares held by non-affiliates of the Registrant on such date was $634,133,219$1,142,800,154 based on the last sale price on March 26, 201029, 2013 of $44.32$76.89 per share. March 26, 201029, 2013 was the last business day of the registrant’s most recently completed second fiscal quarter.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its Annual Meeting of Shareholders scheduled for February 9, 201118, 2014 are incorporated by reference into Part III of this report.

J & J SNACK FOODS CORP.2010

2013 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

Page | ||||||||||||||

PART I | ||||||||||||||

Item | Business | 1 | ||||||||||||

Item | Risk Factors | 6 | ||||||||||||

Item | Unresolved Staff Comments | 8 | ||||||||||||

Item | Properties | 8 | ||||||||||||

Item | Legal Proceedings | 9 | ||||||||||||

Item 4 | Mine Safety Disclosures | 9 | ||||||||||||

PART II | ||||||||||||||

Item 5 | Market For Registrant’s Common Equity, RelatedStockholder Matters And Issuer Purchases | 10 | ||||||||||||

Item 6 | Selected Financial Data | 11 | ||||||||||||

Item 7 | Management’s Discussion And Analysis OfFinancial Condition And Results Of Operations | 12 | ||||||||||||

Item 7A | Quantitative And Qualitative DisclosuresAbout Market Risk | 22 | ||||||||||||

Item 8 | Financial Statements And Supplementary Data | 22 | ||||||||||||

Item 9 | Changes In And Disagreements With AccountantsOn Accounting And Financial Disclosure | 22 | ||||||||||||

Item 9A | Controls and Procedures | 22 | ||||||||||||

Item 9B | Other Information | 23 | ||||||||||||

PART III | ||||||||||||||

Item 10 | Directors, Executive Officers and CorporateGovernance | 24 | ||||||||||||

Item 11 | Executive Compensation | 24 | ||||||||||||

Item 12 | Security Ownership Of Certain BeneficialOwners And Management And Related | 25 | ||||||||||||

Item 13 | Certain Relationships And Related Transactions,and Director Independence | 25 | ||||||||||||

Item 14 | Principal Accountant Fees and Service | 25 | ||||||||||||

PART IV | ||||||||||||||

| Item | ||||||||||||||

| Exhibits, Financial Statement Schedules | 26 | |||||||||||||

In addition to historical information, this document and analysis contains forward-looking statements. The forward-looking statements contained herein are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected in the forward-looking statements. Important factors that might cause such a difference include, but are not limited to, those discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events or circumstances that arise after the date hereof.

Item 1.1. Business

General

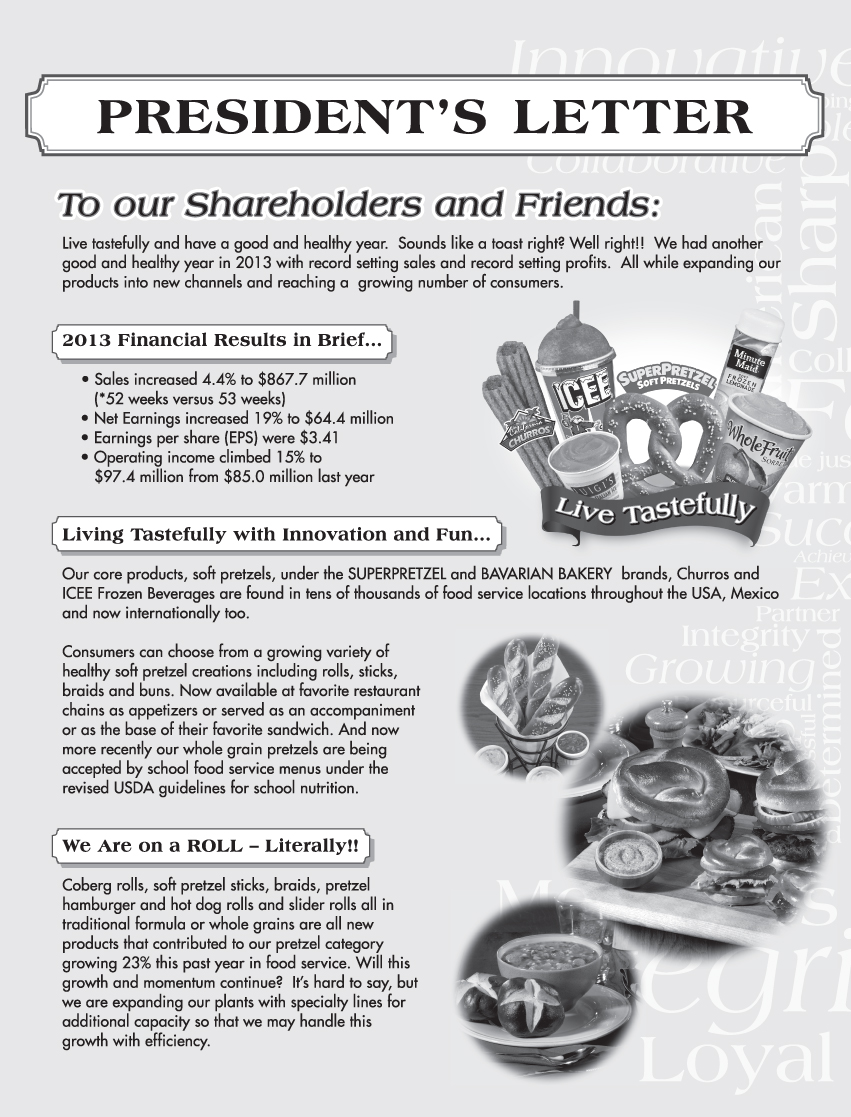

J & J Snack Foods Corp. (the “Company” or “J & J”) manufactures nutritional snack foods and distributes frozen beverages which it markets nationally to the food service and retail supermarket industries. The Company’s principal snack food products are soft pretzels marketed primarily under the brand name SUPERPRETZEL, and frozen juice treats and desserts marketed primarily under the LUIGI’S, FRUIT-A-FREEZE, WHOLE FRUIT, ICEE BARQ’S* and MINUTE MAID*MAID* brand names.names, churros marketed primarily under the TIO PEPE’S and CALIFORNIA CHURROS brand names and bakery products sold primarily under the READI-BAKE, COUNTRY HOME, MARY B’S AND DADDY RAY’S brand names as well as for private label and contract packing. J & J believes it is the largest manufacturer of soft pretzels in the United States, Mexico and Canada. Other snack food products include churros (an Hispanic pastry), funnel cake and bakerydough enrobed handheld products. The Company’s principal frozen beverage products are the ICEE brand frozen carbonated beverage and the SLUSH PUPPIE brand frozen uncarbonated beverage.

The Company’s Food Service and Frozen Beverages sales are made primarily to food service customers including snack bar and food stand locations in leading chain, department, discount, warehouse club and convenience stores; malls and shopping centers; fast food outlets; stadiums and sports arenas; leisure and theme parks; movie theatres; independent retailers; and schools, colleges and other institutions. The Company’s retail supermarket customers are primarily supermarket chains. The Company’s restaurant group sells direct to the public through its specialty snack food retail outlets, BAVARIAN PRETZEL BAKERY. At September 25, 2010, two outlets remained open.

The Company was incorporated in 1971 under the laws of the State of New Jersey.

The Company has made acquisitions in 2010 and in prior years as described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto.

The Company operates in fourthree business segments: Food Service, Retail Supermarkets The Restaurant Group and Frozen Beverages. These segments are described below.

The Chief Operating Decision Maker for Food Service and Retail Supermarkets and The Restaurant Group and the Chief Operating Decision Maker for Frozen Beverages monthly review detailed operating income statements and sales reports in order to assess performance and allocate resources to each individual segment. Sales is considered to be the one and only key variable monitored by the Chief Operating Decision Makers and management when determining each segment’s and the company’s financial condition and operating performance. In addition, the Chief Operating Decision Makers review and evaluate depreciation, capital spending and assets of each segment on a quarterly basis to monitor cash flow and asset needs of each segment (see Item 7 —– Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8 —– Financial Statements and Supplementary Data for financial information about segments).

Food Service

The primary products sold by the food service segment are soft pretzels, frozen juice treats and desserts, churros, dough enrobed handheld products and baked goods. Our customers in the food service segment include snack bars and food stands in chain, department and discount stores; malls and shopping centers; casual dining restaurants; fast food outlets; stadiums and sports arenas; leisure and theme parks; convenience stores; movie theatres; warehouse club stores; schools, colleges and other institutions. Within the food service industry, our products are purchased by the consumer primarily for consumption at the point-of-sale.

*Minute Maid is a registered trademark of the Coca-Cola Company

The primary products sold to the retail supermarket channel are soft pretzel products —– including SUPERPRETZEL, frozen juice treats and desserts including LUIGI’S Real Italian Ice, MINUTE MAID Juice Bars and Soft Frozen Lemonade, WHOLE FRUIT frozen fruit bars and sorbet, ICEE Squeeze-Up Tubes TIO PEPE’S Churros and CALIFORNIA CHURROS.dough enrobed handheld products including PATIO burritos. Within the retail supermarket channel, our frozen and prepackaged products are purchased by the consumer for consumption at home.

We sell frozen beverages to the food service industry primarily under the names ICEE, SLUSH PUPPIE and PARROT ICE and ARCTIC BLAST in the United States, Mexico and Canada. We also provide repair and maintenance service to customers for customers’ owned equipment.

Products

Soft Pretzels

The Company’s soft pretzels are sold under many brand names; some of which are: SUPERPRETZEL, PRETZEL FILLERS, PRETZELFILS, GOURMET TWISTS, MR. TWISTER, SOFT PRETZEL BITES, SOFTSTIX, SOFT PRETZEL BUNS, HOT KNOTS, DUTCH TWIST, TEXAS TWIST, SANDWICH TWIST, CINNAPRETZEL*KIM & SCOTT’S GOURMET PRETZELS and SERIOUSLY TWISTED!; and, to a lesser extent, under private labels.

Soft pretzels are sold in the Food Service and Retail Supermarket and The Restaurant Group segments. Soft pretzel sales amounted to 19%21% of the Company’s revenue in fiscal year 2010, 20%2013, 18% in 2009,2012 and 20%18% in 2008.

Certain of the Company’s soft pretzels qualify under USDA regulations as the nutritional equivalent of bread for purposes of the USDA school lunch program, thereby enabling a participating school to obtain partial reimbursement of the cost of the Company’s soft pretzels from the USDA.

The Company’s soft pretzels are manufactured according to a proprietary formula. Soft pretzels, ranging in size from one to ten ounces in weight, are shaped and formed by the Company’s twister machines. These soft pretzel tying machines are automated, high-speed machines for twisting dough into the traditional pretzel shape. Additionally, we make soft pretzels which are extruded or shaped by hand. Soft pretzels, after processing, are primarily quick-frozen in either raw or baked form and packaged for delivery.

The Company’s principal marketing program in the Food Service segment includes supplying ovens, mobile merchandisers, display cases, warmers and similar merchandising equipment to the retailer to prepare and promote the sale of soft pretzels. Some of this equipment is proprietary, including combination warmer and displaycases that reconstitute frozen soft pretzels while displaying them, thus eliminating the need for an oven. The Company retains ownership of the equipment placed in customer locations, and as a result, customers are not required to make an investment in equipment.

Frozen Juice Treats and Desserts

The Company’s frozen juice treats and desserts are marketed primarily under the LUIGI’S, FRUIT-A-FREEZE, WHOLE FRUIT, ICEE BARQ’S and MINUTE MAID brand names. Frozen juice treats and desserts are sold in the Food Service and Retail Supermarkets segments. Frozen juice treats and dessert sales were 11% of the Company’s revenue in 2013, 13% of the Company’s revenue in 2012 and 14% of the Company’s revenue in 2010, 13% in fiscal year 2009 and 13% in 2008.

The Company’s school food service MINUTE MAID and WHOLE FRUIT frozen juice fruit bars and cups are manufactured from an apple or pearand pineapple juice baseconcentrate to which water, sweeteners, coloring (in some cases) and flavorings

Churros

The Company’s churros are sold primarily under the LA CHURROS, TIO PEPE’S and CALIFORNIA CHURROS brand names. Churros are sold to the Food Service and Retail Supermarkets segments. Churro sales were 5%7% of the Company’s sales in fiscal year 2010, 5%2013, 6% of the Company’s sales in 2009the fiscal year 2012 and 4%6% in 2008.fiscal year 2011. Churros are Hispanic pastries in stick form which the Company produces in several sizes according to a proprietary formula. The churros are deep fried, frozen and packaged. At food service point-of-sale they are reheated and topped with a cinnamon sugar mixture. The Company also sells fruit and crème-filled churros. The Company supplies churro merchandising equipment similar to that used for its soft pretzels.

Handheld Products

The Company's dough enrobed handheld products are marketed under the PATIO, HAND FULLS, HOLLY RIDGE BAKERY, VILLA TALIANO, TOP PICKS brand names and under private labels. Handheld products are sold to the Food Service and Retail Supermarket segments. Handheld product sales amounted to 6% of the Company’s sales in 2013, 6% in 2012 and 2% in 2011.

Bakery Products

The Company’s bakery products are marketed under the MRS. GOODCOOKIE, CAMDEN CREEK BAKERY, READI-BAKE, COUNTRY HOME, MARY B’S, DADDY RAY’S and PRETZEL COOKIEJANA’S brand names, and under private labels. Bakery products include primarily biscuits, fig and fruit bars, cookies, breads, rolls, crumb, muffins and donuts. Bakery products are sold to the Food Service segment. Bakery products sales amounted to 34%32% of the Company’s sales in fiscal year 2010, 35%2013, 32% in 2009fiscal year 2012 and 35%32% in 2008.

Frozen Beverages

The Company markets frozen beverages primarily under theunderthe names ICEE, SLUSH PUPPIE and PARROT ICE and ARCTIC BLAST in the United States, Mexico and Canada. Additional frozen beverages are JAVA FREEZE and CALIFORNIA NATURAL. Frozen beverages are sold in The Restaurant Group andthe Frozen Beverages segments.

Frozen beverage sales amounted to 18%15% of revenue in fiscal 2010, 17%year 2013, 16% in 20092012 and 18% in 2008.

Under the Company’s principal marketing program for frozen carbonated beverages, it installs frozen beverage dispensers for its ICEE and ARCTIC BLAST brandsbrand at customer locations and thereafter services the machines, arranges to supply customers with ingredients required for production of the frozen beverages, and supports customer retail sales efforts with in-store promotions and point-of-sale materials. In most cases, the Company retains ownership of its dispensers, and as a result, customers are not required to make an investment in equipment or arrange for the ingredients and supplies necessary to produce and market the frozen beverages. The Company also provides repair and maintenance service to customers for customers’ owned equipment and sells equipment in its Frozen Beverages segment, revenue from which amounted to 8% of sales in 2010, 8%2013 and 7% of sales in 20092012 and 9% of the Company’s sales in2011 fiscal year 2008.years. The Company sells frozen uncarbonated beverages under the SLUSH PUPPIE and PARROT ICE brands through a distributor network and through its own distribution network.

Each new frozen carbonated customer location requires a frozen beverage dispenser supplied by the Company or by the customer. Company-supplied frozen carbonated dispensers are purchased from outside vendors, built new or rebuilt by the Company.

The Company provides managed service and/or products to approximately 75,00093,000 Company-owned and customer-owned dispensers.

The Company has the rights to market and distribute frozen beverages under the name ICEE to the entire continental United States (except for portions of nine states)ninestates) as well as internationally.

Other products sold by the Company include soft drinks, funnel cakes sold under the FUNNEL CAKE FACTORY brand name and smaller amounts of various other food products. These products are sold in the Food Service The Restaurant Group and Frozen Beverages segments.

Customers

The Company sells its products to two principal channels: food service and retail supermarkets. The primary products sold to the food service channel are soft pretzels, frozen beverages, frozen juice treats and desserts, churros, dough enrobed handheld products and baked goods. The primary products sold to the retail supermarket channel are soft pretzels, and frozen juice treats and desserts. Additionally, the Company sells soft pretzels, frozen beveragesdesserts and various other food products direct to the public through its Restaurant Group, which operates BAVARIAN PRETZEL BAKERY. At September 25, 2010, we had two retail stores.

We have several large customers that account for a significant portion of our sales. Our top ten customers accounted for 42%43%, 43%41% and 42%43% of our sales during fiscal years 2010, 20092013, 2012 and 2008,2011, respectively, with our largest customer accounting for 8% of our sales in 2010, 9%2013, 8% of our sales in 20092012 and 9%8% in 2008.2011. Three of the ten customers are food distributors who sell our product to many end users. The loss of one or more of our large customers could adversely affect our results of operations. These customers typically do not enter into long-term contracts and make purchase decisions based on a combination of price, product quality, consumer demand and customer service performance. If our sales to one or more of these customers are reduced, this reduction may adversely affect our business. If receivables from one or more of these customers become uncollectible, our operating income would be adversely impacted.

The Food Service and the Frozen Beverages segments sell primarily to food service channels. The Retail Supermarkets segment sells to the retail supermarket channel.

The Company’s customers in the food service segment include snack bars and food stands in chain, department and mass merchandising stores, malls and shopping centers, fast food outlets, casual dining restaurants, stadiums and sports arenas, leisure and theme parks, convenience stores, movie theatres, warehouse club stores, schools, colleges and other institutions, and independent retailers. Machines and machine parts are sold to other food and beverage companies. Within the food service industry, the Company’s products are purchased by the consumer primarily for consumption at the point-of-sale.

The Company sells its products to an estimated 85-90% of supermarkets in the United States. Products sold to retail supermarket customers are primarily soft pretzel products, including SUPERPRETZEL, frozen juice treats and desserts including LUIGI’S Real Italian Ice, MINUTE MAID Juice Bars and Soft Frozen Lemonade, WHOLE FRUIT frozen fruit bars, WHOLE FRUIT Sorbet, MARY B’S biscuits and dumplings, DADDY RAY’S fig and fruit bars, ICEE Squeeze-Up Tubes, PATIO burritos and TIO PEPE’S Churros. Within the retail supermarket industry, the Company’s frozen and prepackaged products are purchased by the consumer for consumption at home.

Marketing and Distribution

The Company has developed a national marketing program for its products. For Food Service and Frozen Beverages segments’ customers, this marketing program includes providing ovens, mobile merchandisers, display cases, warmers, frozen beverage dispensers and other merchandising equipment for the individual customer’s requirements and point-of-sale materials as well as participating in trade shows and in-store demonstrations. The Company’s ongoing advertising and promotional campaigns for its Retail Supermarket segment’s products include trade shows, newspaper advertisements with coupons, in-store demonstrations and consumer advertising campaigns.

The Company develops and introduces new products on a routine basis. The Company evaluates the success of new product introductions on the basis of sales levels, which are reviewed no less frequently than monthly by the Company’s Chief Operating Decision Makers.

The Company’s products are sold through a network of about 200100 food brokers, and over 1,000 independent sales distributors and the Company’s own direct sales force. For its snack food products, the Company maintains

Seasonality

The Company’s sales are seasonal because frozen beverage sales and frozen juice treats and desserts sales are generally higher during the warmer months.

Trademarks and Patents

The Company has numerous trademarks, the most important of which are SUPERPRETZEL, DUTCH TWIST, TEXAS TWIST, MR. TWISTER, SOFT PRETZEL BITES, SOFTSTIX, PRETZEL FILLERS and PRETZELFILS for its pretzel products; FROSTAR,SHAPE-UPS, MAMA TISH’S, FRUIT-A-FREEZE, WHOLE FRUIT and LUIGI’S for its frozen juice treats and desserts; TIO PEPE’S and CALIFORNIA CHURROS for its churros; ARCTIC BLAST, SLUSH PUPPIE and PARROT ICE for its frozen beverages; FUNNEL CAKE FACTORY for its funnel cake products, PATIO for its handheld burritos and MRS. GOODCOOKIE, READI-BAKE, COUNTRY HOME, CAMDEN CREEK, MARY B’S, JANA’S and DADDY RAY’S for its bakery products.

The Company markets frozen beverages under the trademark ICEE in all of the continental United States, except for portions of nine states, and in Mexico and Canada.andCanada. Additionally, the Company has the international rights to the trademark ICEE.

The trademarks, when renewed and continuously used, have an indefinite term and are considered important to the Company as a means of identifying its products. The Company considers its trademarks important to the success of its business.

The Company has numerous patents related to the manufacturing and marketing of its product.

Supplies

The Company’s manufactured products are produced from raw materials which are readily available from numerous sources. With the exception of the Company’s soft pretzel twisting equipment and funnel cake production equipment, which are made for J & J by independent third parties, and certain specialized packaging equipment, the Company’s manufacturing equipment is readily available from various sources. Syrup for frozen beverages is purchased primarily from The Coca-Cola Company, Dr Pepper/Seven Up, Inc., the Pepsi Cola Company, and Jogue, Inc. Cups, straws and lids are readily available from various suppliers. Parts for frozen beverage dispensing machines are purchased from several sources. Frozen beverage dispensers are purchased primarily from IMI Cornelius, Inc. and FBD Partnership.

Competition

Snack food and bakery products markets are highly competitive. The Company’s principal products compete against similar and different food products manufactured and sold by numerous other companies, some of which are substantially larger and have greater resources than the Company. As the soft pretzel, frozen juice treat and dessert, bakery products and related markets grow, additional competitors and new competing products may enter the markets. Competitive factors in these markets include product quality, customer service, taste, price, identity and brand name awareness, method of distribution and sales promotions.

The Company believes it is the only national distributor of soft pretzels. However, there are numerous regional and local manufacturers of food service and retail supermarket soft pretzels as well as several chains of retail pretzel stores.

In Frozen Beverages the Company competes directly with other frozen beverage companies. These include several companies which have the right to use the ICEE name in portions of nine states. There are many other

The Company competes with large soft drink manufacturers for counter and floor space for its frozen beverage dispensing machines at retail locations and with products which are more widely known than the ICEE, SLUSH PUPPIE, PARROT ICE and ARCTIC BLAST frozen beverages.

The Company competes with a number of other companies in the frozen juice treat and dessert and bakery products markets.

Risks Associated with Foreign Operations

Foreign operations generally involve greater risk than doing business in the United States. Foreign economies differ favorably or unfavorably from the United States’ economy in such respects as the level of inflation and debt, which may result in fluctuations in the value of the country’s currency and real property. Sales of our foreign operations were $14,301,000, $11,658,000$23,161,000, $19,491,000 and $11,078,000$18,025,000 in fiscal years 2010, 20092013, 2012 and 2008,2011, respectively. At September 25, 2010,28, 2013, the total assets of our foreign operations were approximately $10.4$24 million or 2%3.7% of total assets.

Employees

The Company has approximately 2,700about 3,400 full and part time employees as of September 25, 2010. Certain28, 2013. About 900 production and distribution employees atthroughout the Pennsauken and Bridgeport, New Jersey plantsCompany are covered by a collective bargaining agreement which expires in September 2013.

The Company considers its employee relations to be good.

Available Information

The Company’s internet address iswww.jjsnack.com. On the investor relations section of its website, the Company provides free access to its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). The information on the website listed above is not and should not be considered part of this annual report on Form 10-K and is not incorporated by reference in this document.

Item 1A.Risk Factors

You should carefully consider the risks described below, together with all of the other information included in this report, in considering our business and prospects. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us or that we currently deem insignificant may also impair our business operations. Following is a discussion of known potentially significant risks which could result in harm to our business, financial condition or results of operations.

Risks of Shortages or Increased Cost of Raw Materials

We are exposed to the market risks arising from adverse changes in commodity prices, affecting the cost of our raw materials and energy. The raw materials and energy which we use for the production and distribution of our products are largely commodities that are subject to price volatility and fluctuations in availability caused by changes in global supply and demand, weather conditions, agricultural uncertainty or governmental controls. We purchase these materials and energy mainly in the open market. If commodity price changes result in increases in raw materials and energy costs, we may not be able to increase our prices to offset these increased costs without suffering reduced volume, revenue and operating income.

Food processors are subject to the risks of adverse changes in general economic conditions; evolving consumer preferences and nutritional and health-related concerns; changes in food distribution channels; federal, state and localandlocal food processing controls or other mandates; consumer product liability claims; and risks of product tampering. The increased buying power of large supermarket chains, other retail outlets and wholesale food vendors could result in greater resistance to price increases and could alter the pattern of customer inventory levels and access to shelf space.

Environmental Risks

The disposal of solid and liquid waste material resulting from the preparation and processing of foods areis subject to various federal, state and local laws and regulations relating to the protection of the environment. Such laws and regulations have an important effect on the food processing industry as a whole, requiring substantially all firms in the industry to incur material expenditures for modification of existing processing facilities and for construction of upgraded or new waste treatment facilities.

We cannot predict what environmental legislation or regulations will be enacted in the future, how existing or future laws or regulations will be administered or interpreted or what environmental conditions may be found to exist. Enactment of more stringent laws or regulations or more strict interpretation of existing laws and regulations may require additional expenditures by us, some of which could be material.

Risks Resulting from Several Large Customers

We have several large customers that account for a significant portion of our sales. Our top ten customers accounted for 42%43%, 43%41% and 42%43% of our sales during fiscal years 2010, 20092013, 2012 and 2008,2011, respectively, with our largest customer accounting for 8% of our sales in 2010, 9%2013, 8% of our sales in 20092012 and 9%8% in 2008.2011. Three of the ten customers are food distributors who sell our product to many end users. The loss of one or more of our large customers could adversely affect our results of operations. These customers typically do not enter into long-term contracts and make purchase decisions based on a combination of price, product quality, consumer demand and customer service performance. If our sales to one or more of these customers are reduced, this reduction may adversely affect our business. If receivables from one or more of these customers become uncollectible, our operating income would be adversely impacted.

Competition

Our businesses operate in highly competitive markets. We compete against national and regional manufacturers and distributors on the basis of price, quality, product variety and effective distribution. Many of our major competitors in the market are larger and have greater financial and marketing resources than we do. Increased competition and anticipated actions by our competitors could lead to downward pressure on prices and/or a decline in our market share, either of which could adversely affect our results. See “Competition” in Item 1 for more information about our competitors.

Risks Relating to Manufacturing

Our ability to purchase, manufacture and distribute products is critical to our success. Damage or disruption to our manufacturing or distribution capabilities due to weather, natural disaster, fire or explosion, terrorism, pandemic, political upheaval, strikes or other reasons could impair our ability to manufacture or distribute our products.

Our Certificate of Incorporation may inhibit a change in control that you may favor

Our Certificate of Incorporation contains provisions that may delay, deter or inhibit a future acquisition of JofJ & J Snack Foods Corp. not approved by our Board of Directors. This could occur even if our shareholders are offered an attractive value for their shares or if a substantial number or even a majority of our shareholders believe the takeover is in their best interest. These provisions are intended to encourage any person interested in acquiring us

-- | a classified Board of Directors; |

the requirement that our shareholders may only |

limitations on share holdings and voting of |

special Director voting rights; and |

the ability of the Board of Directors to consider |

Risks Relating to the Control by Gerald B. Shreiber

Gerald B. Shreiber is the founder of the Company and the current beneficial owner of 22%20% of its outstanding stock. Our Certificate of Incorporation provides that he has three votes on the Board of Directors (subject to certain adjustments). Therefore, he and one other director have voting control of the Board. The performance of this Company is greatly impacted by his leadership and decisions. His voting control reduces the restrictions on his actions. His retirement, disability or death may have a significant impact on our future operations.

Risk Related to Product Changes

There are risks in the marketplace related to trade and consumer acceptance of product improvements, packing initiatives and new product introductions.

Risks Related to Change in the Business

Our ability to successfully manage changes to our business processes, including selling, distribution, product capacity, information management systems and the integration of acquisitions, will directly affect our results of operations.

Risks Associated with Foreign Operations

Foreign operations generally involve greater risk than doing business in the United States. Foreign economies differ favorably or unfavorably from the United States’ economy in such respects as the level of inflation and debt, which may result in fluctuations in the value of the country’s currency and real property. Further, there may be less government regulation in various countries, and difficulty in enforcing legal rights outside the United States. Additionally, in some foreign countries, there is the possibility of expropriation or confiscatory taxation limitations on the removal of property or other assets, political or social instability or diplomatic developments which could affect the operations and assets of U.S. companies doing business in that country. Sales of our foreign operations were $14,301,000, $11,658,000,$23,161,000, $19,491,000 and $11,078,000$18,025,000 in fiscal years 2010, 20092013, 2012 and 2008,2011, respectively. At September 25, 2010,28, 2013, the total assets of our foreign operations were approximately $10.4$24 million or 2%3.7% of total assets.

Seasonality and Quarterly Fluctuations

Our sales are affected by the seasonal demand for our products. Demand is greater during the summer months primarily as a result of the warm weather demand for our ICEE and frozen juice treats and desserts products. Because of seasonal fluctuations, there can be no assurance that the results of any particular quarter will be indicative of results for the full year or for future years.

Item 1B.Unresolved Staff Comments

We have no unresolved SEC staff comments to report.

Item 2.2. Properties

The Company’s primary east coast manufacturing facility is located in Pennsauken, New Jersey in a 70,000 square foot building on a two-acre lot. Soft pretzels are manufactured at this Company-owned facility which also serves as the Company’s corporate headquarters. This facility operates at approximately 65%50% of capacity. The

The Company owns a 150,000 square foot building on eight acres in Bellmawr, New Jersey. The facility is used by the Company to manufacture some of its products including funnel cake, pretzels churros and cookies.churros. The facility operates at about 85%65% of capacity.

The Company’s primary west coast manufacturing facility is located in Vernon (Los Angeles), California. It consists of a 137,000 square foot facility in which soft pretzels, churros and various lines of baked goods are produced and warehoused. Included in the 137,000 square foot facility is a 30,000 square foot freezer used for warehousing and distribution purposes which was constructed in 1996.purposes. The facility is leased through November 2030. The Company leases an additional 80,000 square feet of office and warehouse space, adjacent to its manufacturing facility, through November 2030. The manufacturing facility operates at approximately 45% of capacity.

The Company leases through June 2015 a 45,000 square foot churros manufacturing facility located in Colton, California which operates at approximately 70%60% of capacity.

The Company owns a 46,000 square foot frozen juice treat and dessert manufacturing facility and a 42,000 square foot dry storage warehouse located on six acres in Scranton, Pennsylvania. The manufacturing facility which was expanded from 26,000 square feet in 1998, operates at approximately 65% of capacity.

The Company leases a 29,600 square foot soft pretzel manufacturing facility located in Hatfield, Pennsylvania. ThePennsylvania.The lease runs through June 2017. The facility operates at approximately 65%60% of capacity.

The Company leases a 19,20048,000 square foot soft pretzel manufacturing facility located in Carrollton, Texas. The lease runs through April 2016.2019. The facility operates at approximately 60% offull capacity. The Company leases an additional property containing a 6,500 square foot storage freezer across the street from the manufacturing facility, which lease expires May 2016.

The Company leases an 18,000 square foot soft pretzel manufacturing facility located in Chambersburg, Pennsylvania. The lease runs through September 2010 with options to extend the term.2016. The facility operates at approximately 45%30% of capacity.

The Company’s fresh bakery products manufacturing facility and offices are located in Bridgeport, New Jersey inJerseyin three buildings totaling 133,000 square feet. The buildings are leased through December 2015. The manufacturing facility operates at approximately 45%55% of capacity.

The Company owns a 65,000165,000 square foot fig and fruit bar manufacturing facility located on 9-1/2 acres in Moscow Mills (St. Louis), Missouri. The facility operates at about 80%55% of capacity.

The Company leases a building in Pensacola, Florida for the manufacturing, packing and warehousing of dumplings. The building is approximately 14,000 square feet and the lease runs through December 2013.2017. The manufacturing facility operates at approximately 75% of capacity.

The Company’s Bavarian Pretzel Bakery headquarters and warehouse and distribution facilities are owned and located inCompany owns an 11,00084,000 square foot buildinghandheld products manufacturing facility in Lancaster, Pennsylvania.

The Company leases a 70,000 square foot handheld products manufacturing facility in Weston, Oregon, which operates at about 45% of capacity. The facility is leased through May 13, 2021.

The Company also leases approximately 136141 warehouse and distribution facilities in 44 states, Mexico and Canada.

The Company has no material pending legal proceedings, other than ordinary routine litigation incidental to the business, to which the Company or any of its subsidiaries is a party or of which any of their property is subject.

Item 4.Submission Mine Safety Disclosures

Not Applicable

PART II

Item 5.Market For Registrant’s Common Equity, Related Stockholder Matters And Issuer Purchases Of Matters To A Vote Of Security HoldersEquity

| High | Low | Dividend Declared | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Fiscal 2009 | ||||||||||||||

| First quarter | $ | 34.50 | $ | 24.07 | $ | .0975 | ||||||||

| Second quarter | 36.57 | 30.12 | .0975 | |||||||||||

| Third quarter | 40.14 | 32.10 | .0975 | |||||||||||

| Fourth quarter | 44.75 | 35.17 | .0975 | |||||||||||

Fiscal 2010 | ||||||||||||||

| First quarter | $ | 44.00 | $ | 35.19 | $ | .1075 | ||||||||

| Second quarter | 44.90 | 36.80 | .1075 | |||||||||||

| Third quarter | 48.51 | 42.56 | .1075 | |||||||||||

| Fourth quarter | 45.22 | 37.00 | .1075 | |||||||||||

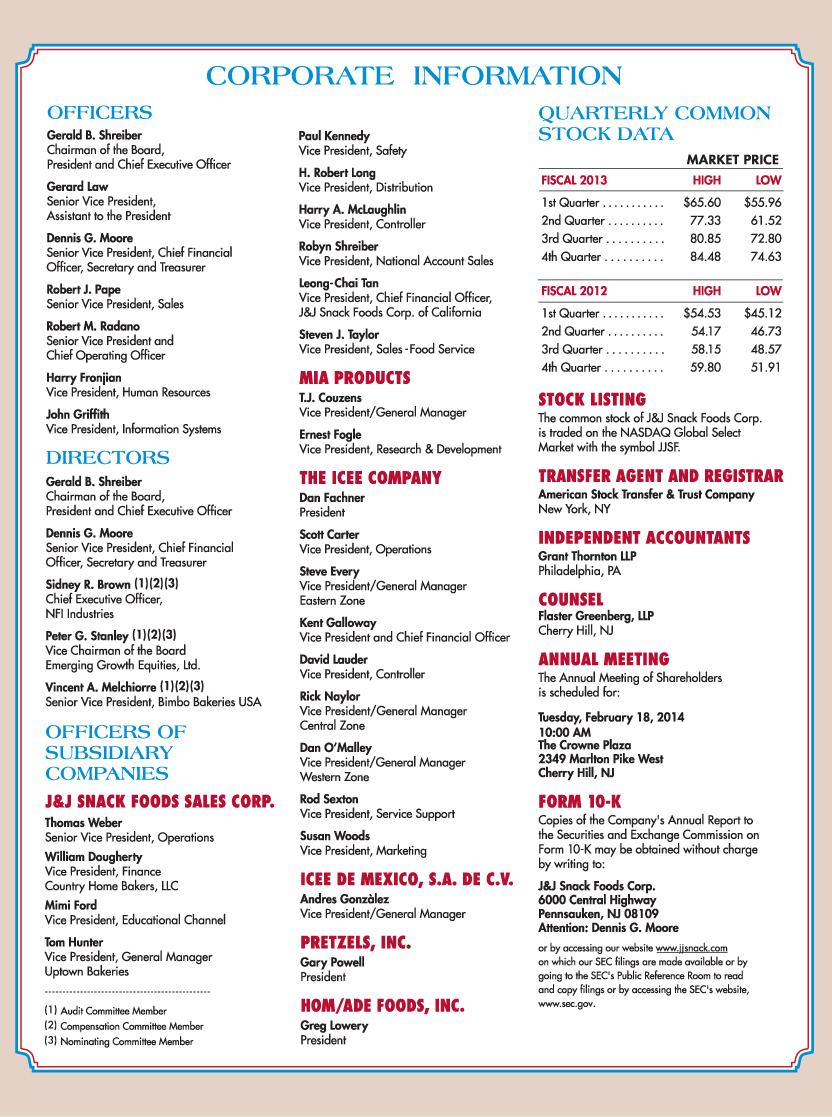

| Common Stock Market Price | ||||||||||||

High | Low | Dividend Declared | ||||||||||

Fiscal 2012 | ||||||||||||

First quarter | $ | 54.53 | $ | 45.12 | $ | 0.1300 | ||||||

Second quarter | 54.17 | 46.73 | 0.1300 | |||||||||

Third quarter | 58.15 | 48.57 | 0.1300 | |||||||||

Fourth quarter | 59.80 | 51.91 | 0.1300 | |||||||||

Fiscal 2013 | ||||||||||||

First quarter | $ | 65.60 | $ | 55.96 | $ | 0.1600 | ||||||

Second quarter | 77.33 | 61.52 | 0.1600 | |||||||||

Third quarter | 80.85 | 72.80 | 0.1600 | |||||||||

Fourth quarter | 84.48 | 74.63 | 0.1600 | |||||||||

As of November 26, 2010, there were about 7,700October 23, 2013, we had 7,550 beneficial shareholders.

In our fiscal year ended September 25, 2010,28, 2013, we purchased and retired 203,507204,397 shares of our common stock at a cost of $7,768,000 under a million share buyback authorization approved by the Company’s Board of Directors in February 2008. 49,804$14,500,215. In our first quarter, we purchased and retired 48,255 shares were purchased in the fourth quarter of 2010 at a cost of $1,874,000. There remains 210,772$2,762,622. In our third quarter, we purchased and retired 58,840 shares that can beat a cost of $4,435,078. In our fourth quarter, we purchased under the existing authorization.

In our fiscal year ended September 26, 2009,29, 2012, we purchased and retired 450,597142,038 shares of our common stock at a cost of $12,510,000. Of the shares purchased and retired in 2009, 400,000 shares were purchased at the purchase price of $27.90 per share from Gerald B. Shreiber, Chairman of the Board, Chief Executive Officer and Director of the Company.

In our 2008 fiscal year ended September 27, 2008,24, 2011, we purchaseddid not purchase and retired 135,124retire any shares of our common stock at a coststock.

On November 8, 2012 the Company’s Board of $3,539,000.

For information on the Company’s Equity Compensation Plans, please see Item 12 herein.

Item 6.Selected Financial Data

The selected financial data for the last five years was derived from our audited consolidated financial statements. The following selected financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto, especially as the information pertains to fiscal 2008, 20092011, 2012 and 2010.

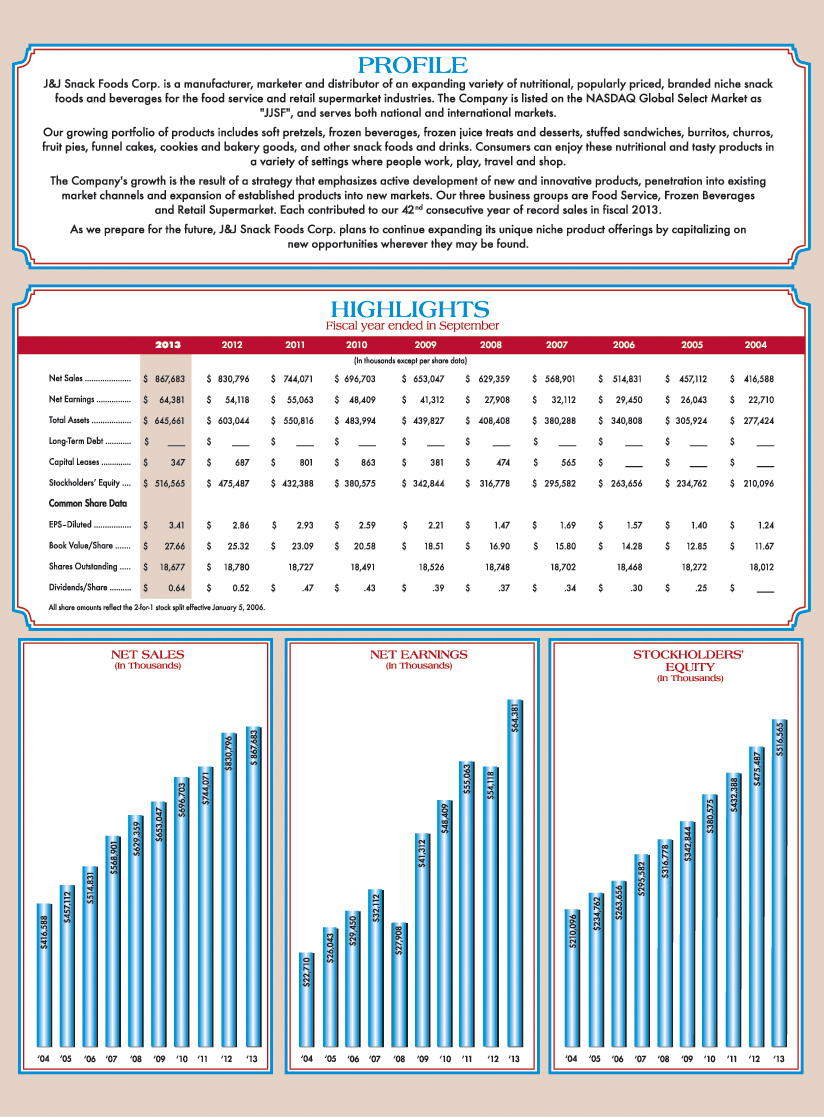

(In thousands except per share data) 2013 2012 2011 2010 2009 Net Sales Net Earnings Total Assets Long-Term Debt Capital Lease Obligations Stockholders' Equity Common Share Data Earnings Per Diluted Share Earnings Per Basic Share Book Value Per Share Common Shares Outstanding At Year End Cash Dividends Declared Per Common Share Fiscal year ended in September $ 867,683 $ 830,796 $ 744,071 $ 696,703 $ 653,047 $ 64,381 $ 54,118 $ 55,063 $ 48,409 $ 41,312 $ 645,661 $ 603,044 $ 550,816 $ 483,994 $ 439,827 $ - $ - $ - $ - $ - $ 347 $ 687 $ 801 $ 863 $ 381 $ 516,565 $ 475,487 $ 432,388 $ 380,575 $ 342,844 $ 3.41 $ 2.86 $ 2.93 $ 2.59 $ 2.21 $ 3.43 $ 2.87 $ 2.95 $ 2.61 $ 2.23 $ 27.66 $ 25.32 $ 23.09 $ 20.58 $ 18.51 18,677 18,780 18,727 18,491 18,526 $ 0.64 $ 0.52 $ 0.47 $ 0.43 $ 0.39

| Fiscal year ended in September (In thousands except per share data) | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||||||

| Net Sales | $ | 696,703 | $ | 653,047 | $ | 629,359 | $ | 568,901 | $ | 514,831 | |||||||||||||

| Net Earnings | $ | 48,409 | $ | 41,312 | $ | 27,908 | $ | 32,112 | $ | 29,450 | |||||||||||||

| Total Assets | $ | 483,994 | $ | 439,827 | $ | 408,408 | $ | 380,288 | $ | 340,808 | |||||||||||||

| Long-Term Debt | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||

| Capital Lease Obligations | $ | 863 | $ | 381 | $ | 474 | $ | 565 | $ | — | |||||||||||||

| Stockholders’ Equity | $ | 380,575 | $ | 342,844 | $ | 316,778 | $ | 295,582 | $ | 263,656 | |||||||||||||

| Common Share Data | |||||||||||||||||||||||

| Earnings Per Diluted Share | $ | 2.59 | $ | 2.21 | $ | 1.47 | $ | 1.69 | $ | 1.57 | |||||||||||||

| Earnings Per Basic Share | $ | 2.61 | $ | 2.23 | $ | 1.49 | $ | 1.72 | $ | 1.60 | |||||||||||||

| Book Value Per Share | $ | 20.58 | $ | 18.51 | $ | 16.90 | $ | 15.80 | $ | 14.28 | |||||||||||||

| Common Shares Outstanding At Year End | 18,491 | 18,526 | 18,748 | 18,702 | 18,468 | ||||||||||||||||||

| Cash Dividends Declared Per Common Share | $ | .43 | $ | .39 | $ | .37 | $ | .34 | $ | .30 | |||||||||||||

In addition to historical information, this document and analysis contains forward-looking statements. The forward-looking statements contained herein are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected in the forward-looking statements. Important factors that might cause such a difference include, but are not limited to, those discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events or circumstances that arise after the date hereof.

Critical Accounting Policies, Judgments and Estimates

We prepare our financial statements in conformity with accounting principles generally accepted in the United States of America. The preparation of such financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of those financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The Company discloses its significant accounting policies in the accompanying notes to its audited consolidated financial statements.

Judgments and estimates of uncertainties are required in applying the Company’s accounting policies in certain areas. Following are some of the areas requiring significant judgments and estimates: revenue recognition, accounts receivable, cash flow and valuation assumptions in performing asset impairment tests of long-lived and intangible assets, estimates of the value and useful lives of intangible assets and insurance reserves.

There are numerous critical assumptions that may influence accounting estimates in these and other areas. We base our critical assumptions on historical experience, third-party data and various other estimates we believe to be reasonable. A description of the aforementioned policies follows:

Revenue Recognition —- We recognize revenue from our products when the products are shipped to our customers. Repair and maintenance equipment service revenue is recorded when it is performed provided the customer terms are that the customer is to be charged on a time and material basis or on a straight-line basis over the term of the contract when the customer has signed a service contract. Revenue is recognized only where persuasive evidence of an arrangement exists, our price is fixed or estimable and collectability is reasonably assured. We record offsets to revenue for allowances, end-user pricing adjustments, trade spending, coupon redemption costs and returned product. Customers generally do not have the right to return product unless it is damaged or defective. Off-invoice allowances are deducted directly from the amount invoiced to our customer when our products are shipped to the customer. Offsets to revenue for allowances, end-user pricing adjustments and trade spending are recorded primarily as a reduction of accounts receivable based on our estimates of liability which are based on customer programs and historical experience. These offsets to revenue are based primarily on the quantity of product purchased over specific time periods. For our Retail Supermarket and Frozen Beverages segments, we accrue for the liability based on products sold multiplied by per product offsets. Offsets to revenue for our Food Service segment are calculated in a similar manner for offsets owed to our direct customers; however, because shipments to end-users are unknown to us until reported by our direct customers or by the end-users, there is a greater degree of uncertainty as to the accuracy of the amounts accrued for end-user offsets. Additional uncertainty may occur as customers take deductions when they make payments to us. This creates complexities because our customers do not always provide reasons for the deductions taken. Additionally, customers may take deductions to which they are not entitled and the length of time customers take deductions to which they are entitled can vary from two weeks to well over a year. Because of the aforementioned uncertainties, the process to determine these estimates requires judgment. We feel that due to constant monitoring of the process, including but not limited to comparing actual results to estimates made on a monthly basis, these estimates are reasonable in all material respects. Our recorded liability for allowances, end-user pricing adjustments and trade spending was approximately $13 million and $14$10 million at September 25, 201028, 2013 and $12 million at September 26, 2009,29, 2012, respectively.

Accounts Receivable —- We record accounts receivable at the time revenue is recognized. Bad debt expense is recorded in marketing and administrative expenses. The amount of the allowance for doubtful accounts is based

Accounts receivable due from any of our customers is subject to risk. Our total bad debt expense was $493,000, $492,000$276,000 and $502,000$423,000 for the fiscal years 2010, 20092012 and 2008,2011, respectively. We had a credit to expense of $70,000 in fiscal year 2013. At September 25, 201028, 2013 and September 26, 2009,29, 2012, our accounts receivables were $68,183,000$87,545,000 and $59,734,000,$76,414,000 net of an allowance for doubtful accounts of $591,000$854,000 and $623,000.$987,000.

Asset Impairment —– We have three reporting units with goodwill totaling $70,070,000$76,899,000 as of September 25, 2010.28, 2013. Goodwill is evaluated annually by the Company for impairment. We utilize historicalperform impairment tests for our reporting unitunits, which is also the operating segment level, with recorded goodwill utilizing primarily the discounted cash flows (defined as reporting unit operating income plus depreciation and amortization) as a proxy for expected future reporting unit cash flowsflow method. This methodology used to evaluateestimate the fair value of thesethe total Company and its reporting units. If theunits requires inputs and assumptions (i.e. revenue growth, operating profit margins, capital spending requirements and discount rates) that reflect current market conditions. The estimated fair value estimated substantially exceedsof each reporting unit is compared to the carrying value of the reporting unit. If the carrying value of the reporting unit includingexceeds its fair value, the goodwill of the reporting unit is potentially impaired, and the Company then determines the implied fair value of goodwill, which is compared to the carrying value of goodwill to determine if any, associatedimpairment exists. Our tests at September 28, 2013 show that the fair value of each of our reporting units with that unit, we do not recognize any impairment loss. We generally do not engage a third partygoodwill exceeded its carrying value. Therefore no further analysis was required. The inputs and assumptions used involve considerable management judgment and are based upon assumptions about expected future operating performance. Assumptions used in these forecasts are consistent with internal planning. The actual performance of the reporting units could differ from management’s estimates due to assistchanges in this analysis as we believe that our in-house expertise is adequate to perform the analysis.business conditions, operating performance, economic conditions, competition and consumer preferences.

Licenses and rights, customer relationships and non compete agreements are being amortized by the straight-line method over periods ranging from 3 to 20 years and amortization expense is reflected throughout operating expenses. Long-lived assets, including fixed assets and amortizing intangibles, are reviewed for impairment as events or changes in circumstances occur indicating that the carrying amount of theofthe asset may not be recoverable. Indefinite lived intangibles are reviewed annually for impairment. Cash flow and sales analyses are used to assess impairment. The estimates of future cash flows and sales involve considerable management judgment and are based upon assumptions about expected future operating performance. Assumptions used in these forecasts are consistent with internal planning. The actual cash flows and sales could differ from management’s estimates due to changes in business conditions, operating performance, economic conditions, competition and consumer preferences.

Useful Lives of Intangible Assets —- Most of our trade names which have carrying value have been assigned an indefinite life and are not amortized because we plan to receive the benefit from them indefinitely. If we decide to curtail or eliminate the use of any of the trade names or if sales that are generated from any particular trade name do not support the carrying value of the trade name, then we would record an impairment or assign an estimated useful life and amortize over the remaining useful life. Rights such as prepaid licenses and non compete agreements are amortized over contractual periods. The useful lives of customer relationships are based on the discounted cash flows expected to be received from sales to the customers adjusted for an attrition rate. The loss of a major customer or declining sales in general could create an impairment charge.

Insurance Reserves —- We have a self-insured medical plan which covers approximately 1,2001,400 of our employees. We record a liability for incurred but not yet reported or paid claims based on our historical experience of claims payments and a calculated lag time period. We maintain a spreadsheet that includes claims payments made each month according to the date the claim was incurred. This enables us to have an historical record of claims incurred but not yet paid at any point in the past. We then compare our accrued liability to the more recent claims incurred but not yet paid amounts and adjust our recorded liability up or down accordingly. Our recorded liability at September 25, 201028, 2013 and September 26, 200929, 2012 was $1,106,000$1,516,000 and $1,157,000,$1,332,000, respectively. Considering that we have stop loss coverage of $175,000$200,000 for each individual plan subscriber, the general consistency of claims payments and the short time lag, we believe that there is not a material exposure for this liability. Because of the foregoing, we do not engage a third party actuary to assist in this analysis.

We self-insure, up to loss limits, worker’s compensation and automobile liability claims. Accruals for claims under our self-insurance program are recorded on a claims-incurred basis. Under this program, the estimated liability for claims incurred but unpaid in fiscal years 20102013 and 20092012 was $2,200,000$3,200,000 and $2,300,000,$1,800,000, respectively. Our total recorded liability for all years’ claims incurred but not yet paid was $7,300,000$8,500,000 and $7,100,000$6,200,000 at September 25, 201028, 2013 and September 26, 2009,29, 2012, respectively. We estimate the liability based on total incurred claims and paid claims adjusting for loss development factors which account for the development of open claims over time. We estimate the amounts we expect to pay for some insurance years by multiplying incurred losses by a loss

Refer to Note A to the accompanying consolidated financial statements for additional information on our accounting policies.

RESULTS OF OPERATIONS

Fiscal 20102013 (52 weeks) Compared to Fiscal 2009 (522012 (53 weeks)

Net sales increased $43,656,000,$36,887,000, or 7%4%, to $696,703,000$867,683,000 in fiscal 20102013 from $653,047,000$830,796,000 in fiscal 2009.

Excluding sales from the acquisition of Parrot Ice in February 2010 and California ChurrosKim & Scott’s Gourmet Pretzels in June 2010,2012 in the twelve months post acquisition and the extra week in 2012, sales increased approximately 6% for the year.

The Chief Operating Decision Maker for Food Service and Retail Supermarkets and The Restaurant Group and the Chief Operating Decision Maker for Frozen Beverages monthly review detailed operating income statements and sales reports in order to assess performance and allocate resources to each individual segment. Sales is considered to be the one and only key variable monitored by the Chief Operating Decision Makers and management when determining each segment’s and the company’s financial condition and operating performance. In addition, the Chief Operating Decision Makers review and evaluate depreciation, capital spending and assets of each segment on a quarterly basis to monitor cash flow and asset needs of each segment.

Sales to food service customers increased $19,206,000,$39,497,000 or 5%8%, to $436,959,000$560,759,000 in fiscal 2010.2013. Excluding sales from the extra week in 2012, sales increased approximately 10% from 2012 to 2013. Excluding Kim & Scott’s sales in the twelve months post acquisition of California Churros, food serviceand the extra week in 2012, sales would have increased 4%approximately 9% for the year. Sales of funnel cake fries to one customer accounted for over 66% of the food service sales increase. Soft pretzel sales to the food service market increased 1%23% to $100,694,000$145,026,000 for the year aided by increased sales to restaurant chains, warehouse club stores and throughout our customer base. Increased sales to two customers accounted for approximately 1/3 of the pretzel sales increase. Excluding Kim & Scott’s sales, food service soft pretzel sales increased 20% for the year. Frozen juice bar and ices sales decreased $2,999,000,$4,982,000 or 6%9%, to $47,273,000$48,831,000 for the year primarily as the result of lower sales to one contract packing customerwarehouse club stores due we believe to weather and to school food service accounts.accounts due to changes in USDA school food programs. We believe the impact of the changes in the USDA school food programs on our frozen juice and ices sales has bottomed out. Churro sales to food service customers increased 8%22% to $31,732,000$56,099,000 in 2010. Without2013 with sales from California Churros, churroto one restaurant chain accounting for all of the sales for the year would have been down about 1/2 of one percent.increase. Sales of bakery products excluding biscuit and dumpling sales and fruit and fig bar sales, increased $5,606,000,$8,591,000, or 3%, for the year due primarily to increasedas sales increases and decreases were spread throughout our customer base. Handheld sales to private label customers. Biscuit and dumpling sales increased 1%food service customers were down 5% to $33,326,000. Sales$26,488,000 in 2013 as two customers accounted for all of fig and fruit bars decreased 4% to $31,715,000 due primarily to lower sales to one customer who discontinued a particular product. Funnel cake and related funnel cake product sales increased by $14,083,000 to $22,804,000 primarily due to sales to one customer.the decrease in sales. Sales of new products in the first twelve months since their

Sales of products to retail supermarkets increased $10,961,000decreased $7,529,000 or 17%7% to $76,119,000$102,339,000 in fiscal year 2010.2013. Excluding sales from the extra week in 2012, sales decreased approximately 5% from 2012 to 2013. Excluding Kim & Scott’s sales in the twelve months post acquisition and the extra week in 2012, sales decreased approximately 5% for the year. Soft pretzel sales to retail supermarkets were $30,463,000$34,597,000 compared to $30,506,000$33,842,000 in 20092012 on a unit volume decreaseincrease of less than 1%2%. This makes the third consecutive year of flat or modestly up or down unit sales. Sales of frozen juices and ices increased $10,469,000decreased $5,596,000 or 28%10% to $48,288,000$48,077,000 on a unit volume increasedecrease of 24%about 9%. Reduced trade spendingFrozen juices and ices sales were impacted by cold weather throughout the second half of $1.5 million for the introduction of new frozen novelty items and a shift in product mix increased sales dollars in relation to the overall unit volume increases.year. Coupon redemption costs, a reduction of sales, decreased 9%increased 14% or about $354,000$459,000 for the year. Handheld sales to retail supermarket customers decreased 8% to $22,528,000 in 2013 as two customers accounted for all of the decrease in sales. Sales of products in the first twelve months since their introduction were approximately $4.2$1.4 million in fiscal year 2010. Net2013. Price increases accounted for approximately $2.9 million of sales for the year and net volume increases,decreases, including new product sales as defined above and Kim & Scott’s sales and net of decreasedincreased coupon costs, and reduced trade spendingsales by approximately $10.4 million for new product introductions, accounted for virtually all of the sales increases in 2010.year. Operating income in our Retail Supermarkets segment increaseddecreased from $7,442,000$13,316,000 in 20092012 to $11,281,000$8,594,000 in 2010 primarily as a result2013 with 84% of volume increasesthe decrease, or $3,982,000, coming in the fourth quarter. The fourth quarter was impacted by sharply lower sales of frozen juices and reducedices, which were down 26%, and by increased trade spending forneeded to generate those sales. We believe that the introductionimpact of newcold weather on frozen novelty items.

Other than as commented upon above by segment, there are no material specific reasons for the reported sales increases or decreases. Sales levels can be impacted by the appeal of our products to our customers and consumers and their changing tastes, competitive and pricing pressures, sales execution, marketing programs, seasonal weather, customer stability and general economic conditions.

Gross profit as a percentage of sales increased to 32.69%30.35% in 20102013 from 31.98%30.11% in 2009. Lower2012 primarily due to higher volume in our food service segment, and the margin also benefitted by lower ingredient and packaging costs of about $2.3 million. Gross profit was impacted by about $2.1 million of increased liability insurance expense compared to last year and a product write down of approximately $2.2 million, the benefit of higher volumes leveraging our fixed manufacturing costs and reduced trade spending for$500,000 related to a new product introductions in our Retail Supermarket segment were primarily responsible for the increased gross profit percentage.that was not successful. Ingredient and packaging costs can be extremely volatile and may be significantly different from what we are presently expecting and therefore we cannot project the impact of ingredient and packaging costs on our business going forward; however, there has been a very significant increase in the market cost of flour and other commodities over the past six months which we

Operating income increased $10,224,000$12,437,000 or 15% to $77,162,000$97,404,000 in fiscal year 20102013 as a result of the aforementioned items.

Investment income decreasedincreased by $272,000$2,100,000 to $1,114,000$3,492,000 due to the general declineincreased investments in marketable securities. We invested $80 million in the levelfirst quarter and $30 million in the third quarter in mutual funds that seek current income with an emphasis on maintaining low volatility and overall moderate duration. We estimate the annual yield from these funds to approximate 3.5 – 3.75%. US Government Agency debt of interest rates.$23.0 million held at September 29, 2012 which was yielding 2.0% was called in the year ended September 28, 2013.

The effective income tax rate decreased 1.42 percentage points to 38%36% from 39%37% last year. About 2/3 ofyear because actual liability for last year’s taxes was less than estimated and the estimate for this decrease was from the reduction of $750,000 of unrecognized tax benefits.

Net earnings increased $7,097,000,$10,263,000 or 17%19%, in fiscal 20102013 to $48,409,000,$64,381,000, or $2.59$3.41 per diluted share as a result of the aforementioned items.

There are many factors which can impact our net earnings from year to year and in the long run, among which are the supply and cost of raw materials and labor, insurance costs, factors impacting sales as noted above, the continuing consolidation of our customers, our ability to manage our manufacturing, marketing and distribution activities, our ability to make and integrate acquisitions and changes in tax laws and interest rates.

Net sales increased $23,688,000,$86,725,000, or 4%12%, to $653,047,000$830,796,000 in fiscal 20092012 from $629,359,000$744,071,000 in fiscal 2008.

Excluding sales from the acquisitions of the frozen handheld business of ConAgra Foods in May 2011 and Kim & Scott’s Gourmet Pretzels in June 2012 in the twelve months post acquisitions and the extra week in 2012, sales increased approximately 5% for the year.

We have fourthree reportable segments, as disclosed in the accompanying notes to the consolidated financial statements: Food Service, Retail Supermarkets The Restaurant Group and Frozen Beverages.

The Chief Operating Decision Maker for Food Service and Retail Supermarkets and The Restaurant Group and the Chief Operating Decision Maker for Frozen Beverages monthly review detailed operating income statements and sales reports in order to assess performance and allocate resources to each individual segment. Sales is considered to be the one and only key variable monitored by the Chief Operating Decision Makers and management when determining each segment’s and the company’s financial condition and operating performance. In addition, the Chief Operating Decision Makers review and evaluate depreciation, capital spending and assets of each segment on a quarterly basis to monitor cash flow and asset needs of each segment.

Sales to food service customers increased $17,559,000,$57,700,000 or 4%12%, to $417,753,000$521,262,000 in fiscal 2009.2012. Excluding sales from the extra week in 2012, sales increased approximately 10% from 2011 to 2012. Excluding handhelds and Kim & Scott’s sales in the twelve months post acquisitions and the extra week in 2012, sales increased approximately 6% for the year. Soft pretzel sales to the food service market decreased $313,000, or about 1/3 of one percent,increased 14% to $99,471,000 for the year. Unit sales of soft pretzels were down 3%$118,014,000 for the year which is a continuation of a multi-year trend of flat or modestly up or down sales. Sales of bakery products excluding biscuitaided by increased sales to restaurant chains, warehouse club stores and dumpling sales and fruit and fig bar sales, increased $6,607,000, or 4%, for the year. Biscuit and dumpling sales were up 8% to $32,845,000 due to increased distribution and new product offerings. Sales of fig and fruit bars increased 11% to $29,497,000 due to strong volume growth spread acrossthroughout our customer base. Churro sales were up 16% for the year with $29,404,000 of sales in 2009 with over 80% of the sales increase coming fromIncreased sales to one customer who previously had not been a purchaseraccounted for approximately 25% of churros.the pretzel sales increase. Excluding Kim & Scott’s sales, food service soft pretzel sales increased 12% for the year. Frozen juice bar and ices sales decreased $934,000increased $4,073,000 or 2%8%, to $50,272,000$53,813,000 for the year. Ouryear primarily as the result of higher sales of frozen juice barto warehouse club stores and ices to school food service have been impacted and we expect them to continue to be impacted by nutritional concerns. Sales ofthroughout our funnel cake products were up $2,872,000, or 49%, withcustomer base. Increased sales to one customer who previously had not been a purchaseraccounted for about 85% of funnel cake productsthe frozen juices and ices sales increase. Churro sales to food service customers increased 11% to $45,974,000 in 2012 with sales increasing generally throughout our customer base, with sales to international customers accounting for about one-half1/3 of the increase

Sales of products to retail supermarkets increased $8,046,000$18,769,000 or 14%21% to $65,158,000$109,868,000 in fiscal 2009. Total softyear 2012. Excluding sales from the extra week in 2012, sales increased approximately 18% from 2011 to 2012. Excluding handheld sales and Kim & Scott’s sales in the twelve months post acquisitions and the extra week in 2012, sales increased approximately 2% for the year. Soft pretzel sales to retail supermarkets were $30,506,000, an increase of 11% from fiscal 2008,$33,842,000 compared to $32,044,000 in 2011 on a unit volume decreaseincrease of 2%. Sales of frozen juice barsjuices and ices increased 19%$1,733,000 or 3% to $37,819,000 in 2009$53,673,000 on a case volume increase of 25%. Increased trade spending of $1.3 million for the introduction of new frozen novelty items and a shift in product mix reduced sales dollars in relation to the unit volume increases.flat volume. Coupon redemption costs, a reduction of sales, increased 38%decreased 16% or about $1,029,000$635,000 for the year as we increased couponingyear. Handheld sales to retail supermarket customers were $24,358,000 in light of a trend toward increased use of coupons by shoppers.2012. Sales of products in the first twelve months since their introduction were approximately $6,300,000$7.0 million in fiscal year 2009.2012. Price increases accounted for estimatedapproximately $3.7 million of sales of $2,400,000 in fiscalfor the year 2009 and net volume increases, including new product sales as defined above and handheld sales and Kim & Scott’s sales and net of increaseddecreased coupon costs, accounted for approximately $5,600,000$15.0 million of sales in fiscal 2009.for the year. Operating Incomeincome in our Retail Supermarkets segment increased from $4,665,000$11,830,000 in 20082011 to $7,442,000$13,316,000 in 2009 primarily as a result of price and volume increases.

Frozen beverage and related product sales decreased $1,539,000 or 1%increased 5% to $168,879,000$199,666,000 in fiscal 2009.2012. Excluding sales from the extra week in 2012, sales increased approximately 4% from 2011 to 2012. Beverage sales alone were down 1%increased 2% to $135,436,000 for the year. Gallonyear with increases and decreases throughout our customer base. Domestic gallon sales were down 2% for the yearflat in our base ICEE business which is a continuation of a multi-year trend.business. Service revenue increased $3,210,000, or 8%,15% to $42,013,000$49,115,000 for the year as we continue to grow this part ofwith increases and decreases spread across our business to new and existing customers.customer base. Sales of beverage machines, which tend to fluctuate from year to year while following no specific trend, decreased $3,065,000increased from $11,362,000 in 2011 to $11,729,000 for the year.$13,136,000 in 2012. The estimated number of companyCompany owned frozen beverage dispensers was 35,70042,500 and 33,40040,800 at September 26, 200929, 2012 and September 27, 2008,24, 2011, respectively. Operating Incomeincome in our Frozen BeveragesBeverage segment increased from $14,027,000$18,582,000 in 20082011 to $14,536,000$21,881,000 in 2009.

Other than as commented upon above by segment, there are no material specific reasons for the reported sales increases or decreases. Sales levels can be impacted by the appeal of our products to our customers and consumers and their changing tastes, competitive and pricing pressures, sales execution, marketing programs, seasonal weather, customer stability and general economic conditions.

Gross profit as a percentpercentage of sales increased 2.28 percentage pointsdecreased to 30.11% in 20092012 from 200830.88% in 2011. Higher ingredient and packaging costs compared to 32%.

Operating income for the year was impacted by approximately $800,000 of costs of a management and sales meeting held in October 2011, which has historically been held every five years.

Operating income increased $23,602,000,$8,384,000 or 54%,11% to $66,938,000$84,967,000 in fiscal 2009year 2012 as a result of the aforementioned items.

Gain on the bargain purchase of a business of $6,580,000 in 2011 resulted from the fair value of the identifiable assets acquired in the handhelds acquisition exceeding the purchase price.

Investment income decreasedincreased by $1,279,000$351,000 to $1,386,000$1,392,000 due to the general declineincreased investments in the level of interest rates.marketable securities.

The effective income tax rate increased 2.78 percentage points to 37% from 35% last year. Adjusting out the effect of the gain on bargain purchase of a business, the effective tax rate in 2011 was 39% in both fiscal years.

Net earnings increased $13,404,000,decreased $945,000 or 48%2%, in fiscal 20092012 to $41,312,000,$54,118,000, or $2.21$2.86 per diluted share as a result of the aforementioned items.

There are many factors which can impact our net earnings from year to year and in the long run, among which are the supply and cost of raw materials and labor, insurance costs, factors impacting sales as noted above, the continuing consolidation of our customers, our ability to manage our manufacturing, marketing and distribution activities, our ability to make and integrate acquisitions and changes in tax laws and interest rates.

ACQUISITIONS

In May 2011, we acquired the frozen handheld business of ConAgra Foods. This business had sales of approximately $50 million over the prior twelve months to food service and retail supermarket customers and sales of $18.3 million in our 2011 fiscal year from the acquisition date.

In June 2012, we acquired the assets of Kim & Scott’s Gourmet Pretzels, Inc., a manufacturer and seller of a premium brand soft pretzel. This business had sales of approximately $8 million over the prior twelve months to food service and retail supermarket customers, and had sales of approximately $1.8 million in our 2012 fiscal year from the acquisition date.

These acquisitions were accounted for under the purchase method of accounting, and their operations are included in the accompanying consolidated financial statements from their respective acquisition dates.

LIQUIDITY AND CAPITAL RESOURCES

Although there are many factors that could impact our operating cash flow, most notably net earnings, we believe that our future operating cash flow, along with our borrowing capacity, our current cash and cash equivalent balances and our investment securities is sufficient to fund future growth and expansion. See Note C to these financial statements for a discussion of our investment securities.

Fluctuations in the value of the Mexican and Canadian currencies and the resulting translation of the net assets of our Mexican and Canadian subsidiaries caused a decreasean increase of $577,000$571,000 in accumulated other comprehensive loss in 20102013, a decrease of $782,000 in accumulated other comprehensive loss in 2012 and an increase of $1,428,000$1,060,000 in 2009 and a decrease of $3,000 in 2008.2011. In 2010,2013, sales of the two subsidiaries were $14,301,000$23,161,000 as compared to $11,658,000$19,491,000 in 20092012 and $11,078,000$18,025,000 in 2008.

In our fiscal year ended September 25, 2010,28, 2013, we purchased and retired 203,507204,397 shares of our common stock at a cost of $7,768,000 under a million share buyback authorization approved by the Company’s Board of Directors in February 2008. 49,804$14,500,215. In our first quarter, we purchased and retired 48,255 shares were purchased in the fourth quarter of 2010 at a cost of $1,874,000. There remains 210,772$2,762,622. In our third quarter, we purchased and retired 58,840 shares that can beat a cost of $4,435,078. In our fourth quarter, we purchased under the existing authorization.

In our fiscal year ended September 26, 2009,29, 2012, we purchased and retired 450,597142,038 shares of our common stock at a cost of $12,510,000. Of the shares purchased and retired in 2009, 400,000 shares were purchased at the purchase price of $27.90 per share from Gerald B. Shreiber, Chairman of the Board, Chief Executive Officer and Director of the Company.

In our 2008 fiscal year ended September 27, 2008,24, 2011, we purchaseddid not purchase and retired 135,124retire any shares of our common stock at a cost of $3,539,000.

In December 2006,November 2011, we entered into an amendment and modification to an amended and restated loan agreement with our existing banks which provides for up to a $50,000,000 revolving credit facility repayable in December 2011.November 2016. The agreement contains restrictive covenants and requires commitment fees in accordance with standard banking practice. There were no outstanding balances under the facility at September 25, 2010 and28, 2013 or at September 26, 2009.29, 2012. The significant financial covenants are:

. | Tangible net worth must initially be more than $294million. | |

| . | Total funded indebtedness divided by earnings beforeinterest expense, income taxes, depreciation andamortization shall not be greater than 2.25 to 1. |

We were in compliance with the financial covenants described above at September 25, 2010.