Our stock is controlled by a single majority shareholder for the foreseeable future andwho as a result, will be able to control our overall direction. This majority shareholder could conceivably control the outcome of matters requiring stockholder approval and could be able to elect all of our directors. Such control, which may have the effect of delaying, deferring or preventing a change of control, is likely to continue for the foreseeable future and significantly diminishes control and influence which existing and future stockholders may have in theour Company.

Our preferred stock has certain preferences over our common stock with regard to liquidation, dividends and election of directors.

Our issued and outstanding preferred stock holds a preference in liquidation over our common stock. Certain classes of our outstanding preferred stock isare subject to conversion into common stock upon the occurrence of certain enumerated events and contain provisions that may limit our ability to raise additional capital if needed. In addition, any such conversion will dilute our existing and future common stockholders.

Our ability to issue additional preferred stock or other convertible securities may adversely affect the rights of our common stockholders and may make takeovers more difficult, possibly preventing you from obtaining optimal share price.

Our Articles of Incorporation authorize the issuance of shares of "blank check" preferred stock, which would have the designations, rights and preferences as may be determined from time to time by the board of directors. Accordingly, the board of directors is empowered, without shareholder approval (but subject to applicable government regulatory restrictions), to issue additional preferred stock with dividend, liquidation, conversion, voting or other rights that could adversely affect the voting power or other rights of the holders of the common stock. In the event of an issuance, the preferred stock could be used, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company. We have also historically used securities that are convertible into common stock as a currency to finance a cquisitionsacquisitions and may continue to do so in the future.

Our principal executive offices are located at 14860 Montfort Drive, Suite 210, Dallas, Texas 75254. We moved to these offices during the fall of 2006. NewMarket Technology, Inc., our majority stockholder, leases the space.

CLPTEC’s offices are located at No. 123 Qinjiang Road, Shanghai, 200233, People’s Republic of China. The offices are leased from Gaozhi, a strategic partner, on a month-to-month basis. The annual rent expense for the year ended December 31, 20092010 was approximately $6,336.$7,000.

None.

| MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock is presently traded on the over-the-counter market onmaintained by the OTC Bulletin Board (the "OTCBB")Markets Group, Inc. under the symbol “CCTR.” The following table sets forthsummarizes the range of high and low bid quotationsprices for our common stock of each full quarterly period duringof the fiscal yearcalendar quarters of 2010 and 2009:

| | | 2010 | | | 2009 | |

| | | High | | | Low | | | High | | | Low | |

| First Quarter | | | 0.023 | | | | 0.011 | | | | 0.375 | | | | 0.115 | |

| Second Quarter | | | 0.03 | | | | 0.0071 | | | | 0.225 | | | | 0.029 | |

| Third Quarter | | | 0.0085 | | | | 0.0054 | | | | 0.075 | | | | 0.020 | |

| Fourth Quarter | | | 0.0069 | | | | 0.0015 | | | | 0.060 | | | | 0.020 | |

Our common stock is subject to rules adopted by the SEC regulating broker dealer practices in connection with transactions in "penny stocks." Those disclosure rules applicable to "penny stocks" require a broker dealer, prior to a transaction in a "penny stock" not otherwise exempt from the rules, to deliver a standardized disclosure document prepared by the SEC. That disclosure document advises an investor that investment in "penny stocks" can be very risky and that the investor's salesperson or equivalent periodbroker is not an impartial advisor, but rather paid to sell the shares. The disclosure contains further warnings for the fiscal periods indicated below.

| 2009 Fiscal Year | | | | | | |

| | | | | | | |

| First Quarter | | | 0.375 | | | | 0.115 | |

| Second Quarter | | | 0.225 | | | | 0.029 | |

| Third Quarter | | | 0.075 | | | | 0.02 | |

| Fourth Quarter | | | 0.06 | | | | 0.02 | |

| 2008 Fiscal Year | | | | | | |

| | | | | | | |

| First Quarter | | | 3.75 | | | | 1.50 | |

| Second Quarter | | | 2.825 | | | | 0.75 | |

| Third Quarter | | | 0.975 | | | | 0.35 | |

| Fourth Quarter | | | 0.425 | | | | 0.10 | |

Number of Shareholders

At December 31, 2009,2010, there were 620 stockholders of record of our common stock. Based upon information provided to usThis number does not include an indeterminate number of shareholders whose shares are held by persons holding securities for the benefit of others, it is estimated that we havebrokers in excess of 3,500 beneficial owners of our common stock as of that date.“street name.”

PurchaseIssuer Purchases of Equity Securities

We have made no repurchases of our equity securities in the fiscal year ended December 31, 2009.2010.

Dividend Policy

We have not declared any cash dividends on our common stock during our fiscal years ended on December 31, 2010 or paid any dividends to our stockholders. Any future2009. Our Board of Directors has made no determination to date to declare cash dividends during the foreseeable future, but is not likely to do so. There are no restrictions on our ability to pay dividends, if any, will be at the discretion of our board of directors.dividends.

Not applicable.

The following selected financial data is derived from the consolidated financial statements of the Company. The data should be read in conjunction with the consolidated financial statements, related notes, and other financial information included herein. The information presented below is in thousands, except per share amounts.

| | | Year ended December 31, | |

| | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | |

| SELECTED STATEMENT OF OPERATIONS DATA | | | | | | | | | |

| Revenues | | $ | 45,628 | | | $ | 41,878 | | | $ | 40,007 | |

| Income from operations | | | 2,890 | | | | 1,258 | | | | 671 | |

| Net income | | | 2,183 | | | | 638 | | | | 438 | |

| Net income per weighted avg. common share-basic | | $ | 0.03 | | | $ | 0.02 | | | $ | 0.02 | |

| | | | | | | | | | | | | |

| SELECTED BALANCE SHEET DATA | | | | | | | | | | | | |

| Cash | | $ | 3,977 | | | $ | 2,600 | | | $ | 1,489 | |

| Working capital | | | 13,666 | | | | 6,124 | | | | 3,461 | |

| Total assets | | | 17,804 | | | | 10,346 | | | | 7,209 | |

| Total liabilities | | | 3,974 | | | | 4,277 | | | | 3,650 | |

| | | | | | | | | | | | | |

| Stockholders' equity | | | 10,680 | | | | 4,456 | | | | 2,560 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Forward-Looking Statements:

Statements

Some statements contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include the words “may,” “estimate,” “intend,” “continue,” “believe,” “expect,” or “anticipate” and other similar words. These forward-looking statements generally relate to plans and objectives for future operations and are based upon management’s reasonable estimates of future results or trends. Although we believe that the plans and objectives reflected in or suggested by such forward-looking statements are reasonable, such plans or objectives may not be a chieved.achieved. Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties, including: (a) lack of demand for our products and services; (b) competitive products and pricing; (c) limited amount of resources devoted to advertising; (d) lack of demand for our products and services being purchased via the Internet; and (e) other factors that may negatively affect our operating results. Statements made herein are as of the date of the filing of this Form 10-K with the Securities and Exchange CommissionSEC and should not be relied upon as of any subsequent date. We expressly disclaim any obligation to update any information or forward-looking statements contained in this Form 10-K, except as may otherwise be required by applicable law.

Overview

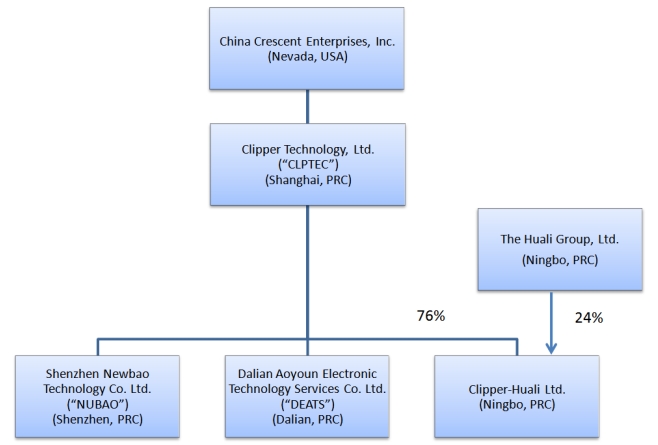

We sell information technology products and services and provide systems integration services in mainland China through our wholly-owned foreign entity, Clipper Technology, Ltd. The majority of our sales are concentrated in and around the cities of Shanghai, Ningbo, and Hangzhou, in China. In the fourth quarter of 2009, we acquired new subsidiary companies in Dalian, and Shenzhen in China.

In June 2008, we changed the Company name from NewMarket China, Inc. to China Crescent Enterprises, Inc. In July 2008, Paul K. Danner was appointed President and Chief Executive Officer of the Company. In February 2010, Dr. James Jiang was appointed President and Chief Executive Officer of the Company.

In April 2009, we issued 750 shares of Series B Convertible Preferred Stock, $.001 par value, to The Huali Group in connection with the acquisition by CLPTEC of an additional 25% interest in Clipper-Huali, bringing our total ownership in Clipper-Huali to 76%. In the fourth quarter of 2009, all 750 shares of Series B Convertible Preferred Stock were converted into a total of 81,027,024 shares of the common stock of the Company.

In December 2009, we acquired 100% of Shenzhen NewbaoNubao Technology Co., Ltd. (“Newbao”Nubao”), an Original Design Manufacturer of wireless products, from China Radio Technology Co., Ltd. in exchange for a $300,000 note. Additionally, in December 2009 we acquired 100% of Dalian Aoyuan Electronic Technology Services Co., Ltd. (“DAETS”), a systems integration company, from Aoyuan Electronic Company, Ltd., in exchange for a $200,000 note.

2009 ComparedIn February 2010, Paul K. Danner resigned as President and Chief Executive Officer of the Company and Dr. James Jiang was appointed President and Chief Executive Officer of the Company.

In March 2010, we executed a non-binding letter of intent (the “Fonix LOI”) under which CLPTEC, our wholly-owned subsidiary based in Shanghai, China, would acquire 100% of Shanghai Gaozhi Software Systems, Ltd. (“Gaozhi”), a telecommunications software developer, from Fonix Corporation (“Fonix”) in exchange for the issuance of a newly authorized series of preferred stock, the terms and conditions of which were subject to 2008negotiation. The transaction was subject to the parties successfully entering into a definitive agreement which we originally projected would occur in the third quarter of 2010. Simultaneous with the execution of the Fonix LOI, we planned to enter into a one-year management agreement with Fonix under which CLPTEC would assist in the management of Gaozhi until the execution of a definitive agreement between the parties for the acquisition of Gaozhi by CLPTEC. In August 2010 it became apparent the parties would be unable to negotiate a mutually satisfactory definitive agreement regarding the intended transaction, therefore all aforementioned relationships between CLPTEC and Fonix were subsequently terminated.

Through our Nubao subsidiary, in February 2010 we entered into a non-binding letter of intent (“LOI”) with an undisclosed Japanese technology company to develop and potentially provide 10,000 custom Wi-Fi devices. In conjunction with the LOI, the Japanese firm placed a $1.6 million purchase order with Nubao for 100 sets of the device as part of a pilot program. Although the pilot program has been completed, the long-term status of project remains uncertain. In light of the earthquake, tsunami and associated events that have taken place in Japan in March 2011, the likelihood and timing of a follow on order is less certain.

Results of Operations

Fiscal Years Ended December 31, 2010 and 2009

Revenue increased 9%71% from $41,877,584 for the year ended December 31, 2008 to $45,628,397 for the year ended December 31, 2009.2009 to $78,187,546 for the year ended December 31, 2010. This was dueincrease is primarily attributable to revenue from our Nubao and DAETS subsidiaries which were acquired in the fourth quarter sales in the Dalian and Shenzhen regions. Year over yearof 2009. Year-over-year systems integration sales from our Clipper-Huali subsidiary in the Ningbo and Shanghai regions werewas essentially even. CostHistorically, we have reported a disproportionate percentage increase in revenue in the fourth quarter of sales increased 5% from $39,538,508our fiscal year compared to earlier quarters. This was the case again for the year ended December 31, 20082010. However, the comparative increase in gross profit was approximately 17% less than the growth in revenue. This was attributable to $41,578,414(i) a lower gross margin associated with the fulfillment of a specific contract for our Nubao subsidiary, and; (ii) a government mandate in the fourth quarter of 2010 to accelerate the completion and billing on all government-related contracts which resulted in a higher percentage of lower margin, government-related revenue associated with our Clipper-Huali and DAETS subsidiaries. Cost of sales increased 72% from $41,578,424 for the year ended December 31, 2009.2009 to $71,635,967 for the year ended December 31, 2010. This increase was primarily due to the corresponding increase in sales volume.sales. Cost of sales as a percentage of sales was approximately 91%92% and 94%91% for the years ended December 31, 2010 and 2009, and 2008, respectively. We plan to continue to pursue strategies to reduce the overall cost of sales as a percentage of sales as the Company grows, such as enteri ng into higher margin outsourcing agreements.

General and administrative expenses for the year ended December 31, 20092010 were $1,138,739$2,019,376 compared to $1,064,491$1,138,739 for the year ended December 31, 2008,2009, an increase of 7%77%. The increase is primarily attributable to start-up costs associated with our new Dalian and Shenzhen subsidiaries in the fourth quarter of 2009.subsidiaries.

For the year ended December 31, 2009,2010, we recognized net income of $2,182,620$4,201,431 after accounting for the non-controlling interest in a consolidated subsidiary, compared to net income of $638,319$2,182,620 for the year ended December 31, 2008,2009, a 242%92% increase. The increase in net income is attributable to (i) an increase in overall sales;sales as our gross margin remained approximately the same; and (ii) an increase in gross margin.other income compared to the previous year. Comprehensive income for the year ended December 31, 20092010 was $2,101,432$4,434,924 compared to comprehensive income of $1,131,931$2,101,432 for the year ended December 31, 2007,2009, a 86%111% increase. Comprehensive income includes foreign currency translation adjustments and gains or losses on investment securities held.

2008 Compared to 2007

Revenue increased 5% from $40,007,006 for the year ended December 31, 2007 to $41,877,584 for the year ended December 31, 2008. This was due to increased sales of computer hardware in the Hangzhou region. Year over year sales in the Ningbo and Shanghai regions were essentially even. Cost of sales increased 3% from $38,211,067 for the year ended December 31, 2007 to $39,538,508 for the year ended December 31, 2008. This increase was primarily due to the corresponding increase in sales volume. Cost of sales as a percentage of sales was approximately 94% and 96% for the years ended December 31, 2008 and 2007, respectively. We plan to continue to pursue strategies to reduce the overall cost of sales as a percentage of sales as the Company grows. Management intends to leverage the increased purchasing volume to improve purchasing contracts and reduce overall cost of sales.

General and administrative expenses for the year ended December 31, 2008 were $1,064,491 compared to $1,085,982 for the year ended December 31, 2007, a decrease of 2%. The decrease is primarily attributable to decreased administrative headcount in the Shanghai region.

For the year ended December 31, 2008, we recognized net income of $638,319 after accounting for the non-controlling in a consolidated subsidiary, compared to net income of $437,824 for the year ended December 31, 2007, a 46% increase. The increase in net income is attributable to (i) an increase in overall sales; (ii) a decrease in general and administrative expenses for the year; and (iii) a decrease in cost of sales as a percentage of sales. Comprehensive income for the year ended December 31, 2008 was $1,131,931 compared to comprehensive income of $909,771 for the year ended December 31, 2007, a 24% increase. Comprehensive income includes foreign currency translation adjustments and gains or losses on investment securities held.

Liquidity and Capital Resources

Cash Flow Activities

Our cash balance at December 31, 2009 increased $1,376,884,2010 decreased $1,827,649, from $2,600,498$3,977,382 as of December 31, 2008,2009, to $3,977,382.$2,149,733. The increasedecrease was the result of cash provided byused in investing activities of $233,036,$3,300,000 and cash used in operating activities of $2,797,926 offset by cash provided by financing activities of $1,000,000$2,577,525 and the effect of exchange rates on cash of $1,570,970, offset by cash used in operating activities of $1,427,122.$1,692,752. Operating activities for the year ended December 31, 2009,2010, exclusive of changes in operating assets and liabilities provided $2,741,254,$4,225,035, as well as a decrease in inventory of $778,030 and an increase in accrued expensesaccounts payable of $119,330,$17,609, offset by an increase in inventory of $792,898, an increase in accounts receivable of $2,054,206$6,490,133, an increase in deposits and other assets of $1,162,536 and a decrease in accounts payableaccrued expenses of $375,770.$165,931.

Financing Activities

In recent years, we have funded our working capital requirements principally through borrowings under bank lines of credit, term loans, and issuances of common stock in exchange for debt. To the extent our operations are not sufficient to fund our capital requirements, we may enter into additional revolving loan agreements with a financial institution, or attempt to raise additional capital through the sale of additional common or preferred stock or through the issuance of additional debt. To the extent that we raise additional capital or settle existing liabilities through the sale or issuance of equity or convertible debt securities, the ownership interest of our existing stockholders will be diluted, and the terms may include liquidation or other preferences that adversely affect the rights of our stockholders.& #160; Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring debt, making capital expenditures or declaring dividends. The current financing environment in the United States is exceptionally challenging and we can provide no assurances that we could raise capital either for operations or to finance an acquisition.

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires our management to make assumptions, estimates and judgments that affect the amounts reported in the financial statements, including the notes thereto, and related disclosures of commitments and contingencies, if any. We consider our critical accounting policies to be those that require the more significant judgments and estimates in the preparation of financial statements, including the following:

Principles of Consolidation

The consolidated financial statements include the accounts of the Company, our wholly-owned subsidiaries CLPTEC, NewbaoNubao and DAETS and our majority-owned subsidiary Clipper Huali. All material intercompany accounts, transactions and profits have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Fair Value of Financial Instruments

The Company’sWe follow paragraph 825-10-50-10 of the FASB Accounting Standards Codification (“ASC”) for disclosures about fair value of our financial instruments and paragraph 820-10-35-37 of the FASB Accounting Standards Codification to measure the fair value of our financial instruments. Our financial instruments consist of cash and cash equivalents, trade receivables, prepaid expenses, payables and accrued expenses, Fair value estimates are made at a specific point in time, based on relevant market information aboutexpenses. The carrying amounts of the Company’s financial instrument. These estimates are subjective in natureassets and involve uncertainties and mattersliabilities approximate their fair values because of significant judgment and therefore cannot be determined with precision. We consider the carrying valuesshort maturity of our financial instruments in the consolidated financial statements to approximate fair value, due to their short-term nature.these instruments.

Accounts Receivable

Receivables were carried at their estimated collectible amounts. Accounts were periodically evaluated for collectability based on past credit history with customers and their current financial condition and were written off when deemed to be uncollectible. An allowance for doubtful accounts was recorded when management determined the collection was unlikely.

Property and Equipment

Property and equipment are recorded at cost, less accumulated depreciation. Depreciation is provided for using straight-line methods over the estimated useful lives of the respective assets, usually three to seven years.

Stock-Based Compensation

We recognize the cost of stock-based compensation plans and awards in operations on a straight-line basis over the vesting period (if any) of the awards. We measure and recognize compensation expense for all stock-based payment awards made to employees and directors. The compensation expense for our stock-based payments is based on an estimated fair value at the time of the grant. We estimate the fair value of stock based payment awards on the date of the grant using an option pricing model. These option pricing models involve a number of assumptions, including the expected lives of stock options, the volatility of the market price of our common stock and interest rates. We are using the Black-Scholes option pricing model. Stock based compensation expense recognized durin gduring the period is based on the value of the portion of stock-based payment awards that are ultimately expected to vest. Changes in our assumptions can materially affect the estimate of the fair value of stock-based payments and the related amount recognized in our consolidated financial statements.

Valuation of Long-Lived Assets

We periodically evaluate long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. If the estimated future cash flows (undiscounted and without interest charges) from the use of an asset were less than the carrying value, a write-down would be recorded to reduce the related asset to its estimated fair value. We do not believe that there has been any impairment to long-lived assets as of December 31, 2009.2010.

Statement of Cash Flows

In accordance with Accounting Standards Codification (“ASC”)ASC 230-10, Statement of Cash Flows, cash flows from our operations are based upon the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

Translation Adjustment

The Chinese Renminbi ("RMB"), the national currency of the China, is the primary currency of the economic environment in which our operations are conducted. We use the United States dollar ("U.S. dollars") for financial reporting purposes.

In accordance with ASC 830-10, Foreign Currency Matters, our results of operations and cash flows are translated at the average exchange rates during the period, assets and liabilities are translated at the exchange rates at the balance sheet dates, and equity is translated at the historical exchange rates. As a result, amounts related to assets and liabilities reported on the consolidated statements of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance sheets.

Comprehensive Income

Comprehensive income includes accumulated foreign currency translation gains and losses and any accumulated gains or losses attributable to securities held for investment purposes. We have reported the components of comprehensive income on our statements of stockholders’ equity.

Effects of Inflation

Inflation and changing prices have not had a material effect on our business and we do not expect that inflation or changing prices will materially affect our business in the foreseeable future. However, our management will closely monitor the price change and continually maintain effective cost control in operations

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements as defined in Regulation S-K Item 303(a)(4).

Recent Accounting Pronouncements

(See “Recently Issued Accounting Pronouncements” in Note 2 of Notes to the Consolidated Financial Statements.)

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

Exchange Rate Risk

While our reporting currency is the U.S. dollar, the majority of our consolidated revenues and consolidated costs and expenses are denominated in foreign currency, specifically the Chinese RMB. The majority of our assets are denominated in RMB. As a result, we are exposed to foreign exchange risk as our revenues and results of operations may be affected by fluctuations in the exchange rate between U.S. dollars and the Chinese currencies. If the Chinese currency depreciates against the U.S. dollar, the value of a portion of our revenues, earnings and assets as expressed in our U.S. dollar financial statements will decline. We have not entered into any hedging transactions in an effort to reduce our exposure to foreign exchange risk.

| FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

18

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The full text of our audited consolidated financial statements as of December 31, 20092010 and 20082009 begins on page F-1 of this annual report.

| CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISLCOSURE |

On August 3, 2009, the Board of Directors of the Company was notified that Pollard-Kelley Auditing Services, Inc. (“PKASI”) had resigned as its independent registered public accounting firm. Subsequently, in August 2009, the Board of Directors approved the engagement of Hamilton, PC as the Company’s independent registered public accounting firm.

During the fiscal years ended December 31, 2008 and 2007 and through August 3, 2009 (i) there were no disagreements between the Company and PKASI on any matter of accounting principles or practices, financial statement disclosure or auditing scope and procedure which, if not resolved to the satisfaction of PKASI would have caused PKASI to make reference to the matter in reports on the Company’s financial statements, and (ii) PKASI’s reports on the Company’s financial statements did not contain an adverse opinion or disclaimer of opinion, or was modified as to uncertainty, audit scope or accounting principles.None.

Management’s Report on Internal Control Over Financial Reporting

(a) Evaluation of Disclosure Controls and Procedures

Management of the Company with the participation of the Chief Executive Officer and Chief Financial Officer, conducted an evaluation of the effectiveness of the Company’s disclosure controls and procedures (as such term is defined in Rule 13a-15(e) and Rule 15d-15(e) under the Securities Exchange Act of 1934) pursuant to Rile 13a-15 under the Exchange Act. The Company’s disclosure controls and procedures are designed to ensure that information required to be disclosed by the Company in the reports it files or submits under the Exchange Act is recorded, processed, summarized and reported on a timely basis and that such information is communicated to management, including the Chief Executive Officer, Chief Financial Officer and the Company’s Board of Directors, to allow timely decisions regarding required disc losure.disclosure.

Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures were effective as of December 31, 2009.2010.

(b) Management’s Report on Internal Control over Financial Reporting

Management of the CompanyOur management is responsible for establishing and maintaining adequate internal control over financial reposting and the assessment of the effectiveness of internal control over financial reporting. As defined by the SEC, internal control over financial reporting as defined in Rule 13a-15(f)is a process designed by, or under the Exchange Act.supervision of our principal executive officer and principal financial officer and implemented by our Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of our financial statements in accordance with U.S. generally accepted accounting principles.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

It should be noted that the Company’s management, including the Chief Executive Officer and Chief Financial Officer, do not expect that the Company’s internal controls will necessarily prevent all errors or fraud. A control system, no matter how well conceived or operated, can only provide reasonable, not absolute, assurance that the objectives of the control system are met, Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs.

As of December 31, 2010, we conducted an evaluation of the effectiveness of our internal controls over financial reporting based on criteria established in “Internal Control-Integrated Framework” issued by the Committee of Sponsoring Organizations of the Treadway Commission, or the COSO Framework. Management’s assessment included an evaluation of the design of our internal control over financial reporting and testing of the operational effectiveness of those controls.

A material weakness is defined within the Public Company Accounting Oversight Board’s Auditing Standard No. 5 as a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis.

We conducted an evaluation of the effectiveness of our internal controls over financial reporting based on the framework in “Internal Control-Integrated Framework” issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based onupon this evaluation, ourassessment, management concluded that our internal control over financial reporting was effective as of December 31, 2009.2010.

This annual report does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. The Company’s internal controls over financial reporting was not subject to attestation by the Company’s independent registered public accounting firm pursuant to temporary rules ifof the Securities and Exchange CommissionSEC that permit the Company to provide only management’s report in this annual report.

(c) Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during the last fiscal quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART IIINone.

| DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The following table sets forth information with respect to the sole executive officers and directors of the Company as of March 31, 2010:2011:

| Name and Age | Position | Date of Appointment |

| | |

James Jiang, Ph.D. (56)PhD (57) | President & Chief Executive Officer | February 1, 2010 |

Paul K. Danner (52)(53) | President & Chief Executive Officer, Director | July 1, 2008 to February 1, 2010 |

Philip J. Rauch (49)(50) | Chief Financial Officer, Director | October 18, 2006 |

Philip Verges (44)(45) | Chairman | October 18, 2006 |

Committees of the Board of Directors

We presently do not have an audit committee, compensation committee, nominating committee, an executive committee of itsour board of directors, stock plan committee or any other committees.

Biographical Information on Officers and Directors

James Jiang, PhD. Dr. James Jiang was appointed Chief Executive Officer of the Company on February 1, 2010. Dr, Jiang was previously the Managing Director of Clipper Technology, Ltd., a wholly-owned subsidiary of the Company. Dr. Jiang has over 18 years of senior executive management experience in the information technology and wireless industries. His management resume includes posts with various multinational firms including British Telecom Laboratory, Telular Corp, Singapore Technologies and GaozhiSoft, Inc. Dr. Jiang has extensive knowledge of GSM/GPRS systems and architecture, 3G wireless communications and Internet technologies. In 1996, he developed and launched AirTrak, China's first e-com mercee-commerce service to deliver commerce information from the Internet via a wireless network, and was the Chief Architect of a dynamic web content cache engine and mobile application platform. Dr. Jiang holds two patents in Viterbi Decoding and Dynamic Contents Extraction, and is a World Bank Scholar.