UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

x☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20162019

OR

|

| |

¨☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

| |

| For the transition period from __________ to __________ |

Commission File Number: Number 001-32335

Halozyme Therapeutics, Inc.___________________________

HALOZYME THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

___________________________

|

| | |

| Delaware | | 88-0488686 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 11388 Sorrento Valley Road San Diego, California

| | 92121 |

| San Diego | | (Zip Code) |

| CA | | |

| (Address of principal executive offices) | | |

(858) (858) 794-8889

(Registrant’s Telephone Number, Including Area Code)telephone number, including area code)

Securities registered under Section 12(b) of the Act:

|

| | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 Par Value | HALO | The NASDAQ Stock Market, LLC |

Securities registered under Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x☒ Yes ¨☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. ¨☐ Yes x☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x☒ Yes ¨☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x☒ Yes ¨☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and, “smaller reporting company”company”and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | | |

| Large accelerated filer | x | Accelerated filero | | Non-accelerated filero | Smaller reporting company | Emerging growth company |

| ☒ | ☐ | | Smaller reporting company o

☐ | ☐ | ☐ |

(DoIf an emerging growth company, indicate by check mark if the registrant has elected not check if a smaller reporting company) | | | to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨☐ Yes x☒ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 20162019 was approximately $1.1$2.5 billion based on the closing price on the NASDAQ Global Select Market reported for such date. Shares of common stock held by each officer and director and by each person who is known to own 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

AsThe number of February 22, 2017, there were 129,764,415outstanding shares of the registrant’s common stock, issued, $0.001 par value $0.001 per share, and outstanding.

was 138,226,070 as of February 14, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be filed subsequent to the date hereof with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant’s 20172020 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report.

Table of ContentsHALOZYME THERAPEUTICS, INC.

INDEX

|

| | | |

| | | |

| | Page |

|

| Item 1. | | | |

| Item 1A. | | | |

| Item 1B. | | | |

| Item 2. | | | |

| Item 3. | | | |

| Item 4. | | | |

| | | | |

|

| Item 5. | | | |

| Item 6. | | | |

| Item 7. | | | |

| Item 7A. | | | |

| Item 8. | | | |

| Item 9. | | | |

| Item 9A. | | | |

| Item 9B. | | | |

| | | | |

|

| Item 10. | | | |

| Item 11. | | | |

| Item 12. | | | |

| Item 13. | | | |

| Item 14. | | | |

| | | | |

|

| Item 15. | | | |

| Item 16. | | |

|

| | |

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the “safe harbor” provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. All statements, other than statements of historical fact, included herein, including without limitation those regarding our future product development and regulatory events and goals, product collaborations, our business intentions and financial estimates and anticipated results, are, or may be deemed to be, forward-looking statements. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “think,” “may,” “could,” “will,” “would,” “should,” “continue,” “potential,” “likely,” “opportunity”“opportunity,” “project” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Annual Report. Additionally, statements concerning future matters such as the development or regulatory approval of new partner products, enhancements of existing products or technologies, timing and success of launch of new products by our collaborators, third party performance under key collaboration agreements, revenue, expense and expensecash burn levels, anticipated profitability and expected trends, expected repayment of the Royalty backed Loan and trends and other statements regarding matters that are not historical are forward-looking statements.

Although forward-looking statements in this Annual Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include without limitation those discussed under the heading “Risk Factors” in Part I, Item 1A below, as well as those discussed elsewhere in this Annual Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report. Readers are urged to carefully review and consider the various disclosures made in this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

References to “Halozyme,” “the Company,” “we,” “us,” and “our” refer to Halozyme Therapeutics, Inc. and its wholly owned subsidiary, Halozyme, Inc., and Halozyme, Inc.’s wholly owned subsidiaries, Halozyme Holdings Ltd., Halozyme Royalty LLC, Halozyme Switzerland GmbH and Halozyme Switzerland Holdings GmbH. References to “Notes” refer to the Notes to Consolidated Financial Statements included herein (refer to Part II, Item 8).

PART I

Overview

Halozyme Therapeutics Inc. is a biotechnologybiopharma technology platform company focused on developing and commercializing novel oncology therapies. We are seeking to translate our unique knowledge of the tumor microenvironment to create therapies that have the potential to improve cancer patient survival. Our research primarily focuses on human enzymes that alter the extracellular matrix and tumor microenvironment. The extracellular matrix is a complex matrix of proteins and carbohydrates surrounding the cell that provides structural support in tissuesinnovative and orchestrates many important biological activities, including cell migration, signalingdisruptive solutions with the goal of improving patient experience and survival. Over many years, we have developed unique technology and scientific expertise enabling us to pursue this target-rich environment for the development of therapies.

outcomes. Our proprietary enzymes areenzyme rHUPH20 is used to facilitate the delivery of injected drugs and fluids, potentially enhancing the efficacy and the convenience of other drugs or can be used to alter tissue structures for potential clinical benefit.fluids. We exploit our technology and expertise using a two pillar strategy that we believe enables us to manage risk and cost by: (1) developing our own proprietary products in therapeutic areas with significant unmet medical needs, with a focus on oncology, and (2) licensinglicense our technology to biopharmaceutical companies to collaboratively develop products that combine our ENHANZE® drug delivery technology with the collaborators’ proprietary compounds.

The majority of ourOur approved product and our collaborators’ approved products and product candidates are based on rHuPH20, our patented recombinant human hyaluronidase enzyme. rHuPH20 is the active ingredient in our first commercially approved product, Hylenex® recombinant (hyaluronidase human injection) (Hylenex), and it works by temporarily breaking down hyaluronan (or HA), a naturally occurring complex carbohydrate that is a major component of the extracellular matrix in tissues throughout the body such as skin and cartilage. We believe this temporary degradation creates an opportunistic windowThis temporarily increases dispersion and absorption allowing for the improved subcutaneous delivery of injectable biologics, such as monoclonal antibodies and other large therapeutic molecules, as well as small molecules and fluids. We refer to the application of rHuPH20 to facilitate the delivery of other drugs or fluids as our ENHANZE™® Technology. Drug Delivery Technology (ENHANZE). We license the ENHANZE Technologytechnology to form collaborations with biopharmaceutical companies that develop or market drugs requiring or benefiting from injection via the subcutaneous route of administration. In the development of proprietary intravenous (IV) drugs combined with our ENHANZE technology, data have been generated supporting the potential for ENHANZE to reduce treatment burden, as a result of shorter duration of subcutaneous (SC) administration. ENHANZE may enable fixed-dose SC dosing compared to weight-based dosing required for IV administration, and potentially allow for lower rates of infusion related reactions. Lastly, certain proprietary drugs co-formulated with ENHANZE have been granted additional exclusivity, extending the patent life of the product beyond the one of the proprietary IV drug.

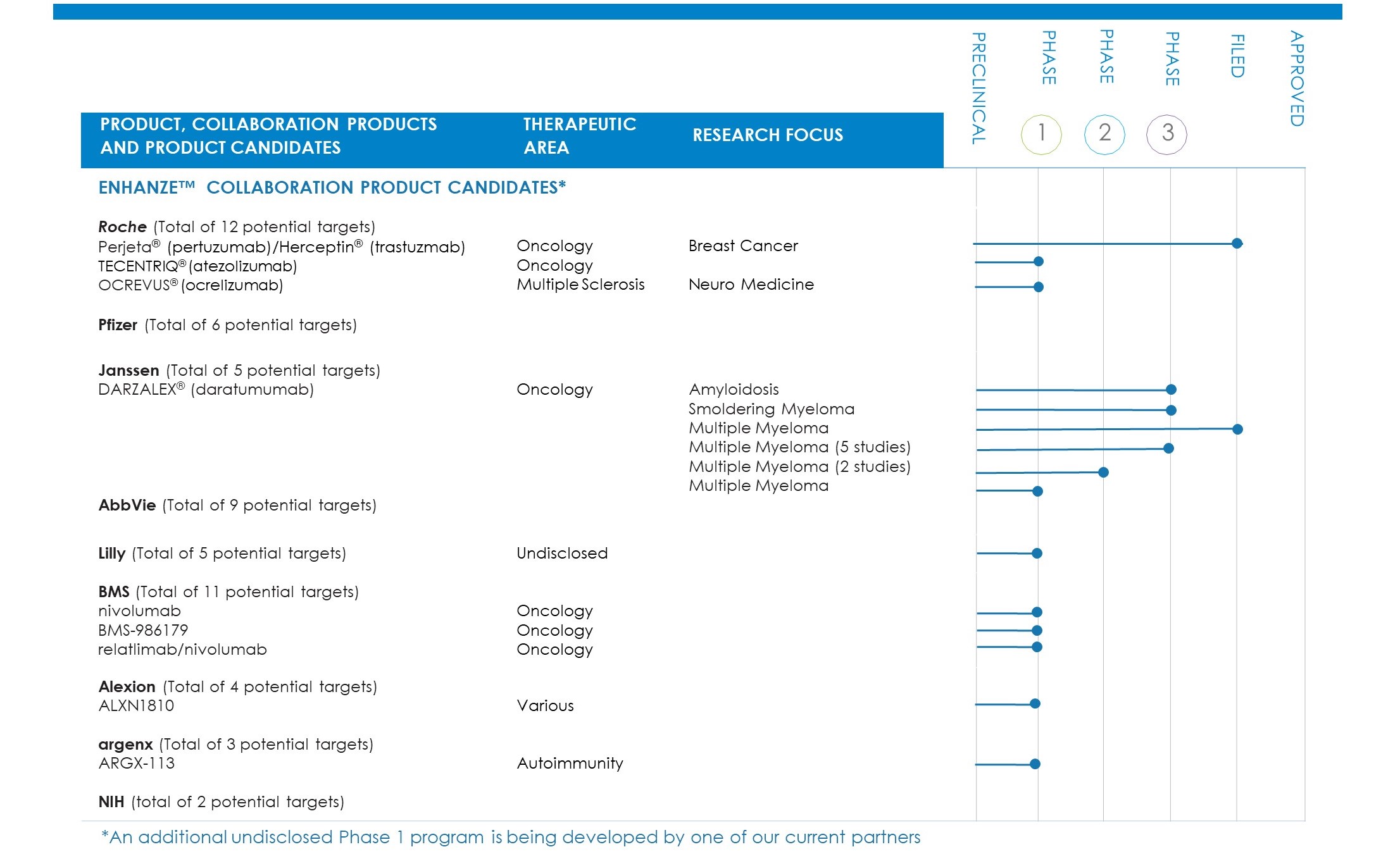

We currently have ENHANZE collaborations with F. Hoffmann-La Roche, Ltd. and Hoffmann-La Roche, Inc. (Roche), Baxalta US Inc. and Baxalta GmbH (Baxalta Incorporated was acquired by(now members of the Takeda group of companies, following the acquisition of Shire plc by Takeda Pharmaceutical Company Limited in June 2016)January 2019) (Baxalta), Pfizer Inc. (Pfizer), Janssen Biotech, Inc. (Janssen), AbbVie, Inc. (AbbVie), and Eli Lilly and Company (Lilly), Bristol-Myers Squibb Company (BMS), Alexion Pharma Holding (Alexion) and ARGENX BVBA (argenx). We receive royalties from two of these collaborations, including royalties from sales of one product approved in both the United States and outside the United States from the Baxalta collaboration and from sales of two products approved for marketing outside the United States from the Roche collaboration. Future potential revenues from the sales and/or royalties of our approved products, product candidates, and ENHANZE collaborations will depend on the ability of Halozyme and our collaborators to develop, manufacture, secure and maintain regulatory approvals for approved products and product candidates and commercialize product candidates.

Our proprietary development pipeline consists primarily of pre-clinical andOn November 4, 2019, we announced that our HALO-301 Phase 3 clinical stage product candidates in oncology. Our lead oncology program is PEGPH20 (PEGylatedstudy evaluating PEGylated recombinant human hyaluronidase), a molecular entity we are developinghyaluronidase (PEGPH20) in combination with currently approved cancer therapiesABRAXANE® (nab-paclitaxel) and gemcitabine as a candidatefirst-line therapy for the systemic treatment of tumors that accumulate HA. We have demonstrated that when HA accumulatespatients with metastatic pancreatic cancer failed to reach the primary endpoint of overall survival. The study failed to demonstrate an improvement in a tumor, it can cause higher pressure in the tumor, reducing blood flow into the tumoroverall survival compared to gemcitabine and with that, reduced access of cancer therapiesnab-paclitaxel alone (11.2 months median overall survival compared to 11.5 months, HR=1.00, p=0.9692). Due to the tumor.results of the study, we halted development activities for PEGPH20, has been demonstrated in animal modelsclosed our oncology operations and implemented an organizational restructuring to work by temporarily degrading HA surrounding cancer cells resulting in reduced pressure and increased blood flow tofocus our operations on ENHANZE.

We closed all ongoing oncology clinical studies including the tumor thereby enabling increased amounts of anticancer treatments administered concomitantly gaining access to the tumor. Through our efforts and efforts of our partners and collaborators, we are currently in Phase 2 and Phase 3 clinical testing for PEGPH20 with ABRAXANE® (nab-paclitaxel) and gemcitabine in stage IV pancreatic ductal adenocarcinoma (PDA) (Studies 109-202(“PDA”) (HALO-301) and 109-301), in Phase 1b clinical testing for PEGPH20 with KEYTRUDA® (pembrolizumab) in non-small cell lung cancer and gastric cancer (Study 107-101) and inthe Phase 1b/2 clinical testing for PEGPH20 with HALAVEN® (eribulin)Tecentriq in patients with cholangiocarcinoma and gall bladder cancer (HALO 110-101/MATRIX). The Roche -Genentech sponsored MORPHEUS PDA and gastric cancer studies closed the arms containing PEGPH20 to enrollment. All patients who were treated within PEGPH20 arms are off PEGPH20 treatment and are in follow up, to two lines of prior therapy for HER2-negative metastatic breast cancer.per study protocol.

Our principal offices and research facilities are located at 11388 Sorrento Valley Road, San Diego, California 92121. Our telephone number is (858) 794-8889 and our e-mail address is info@halozyme.com. Our website address is www.halozyme.com. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this Annual Report on Form 10-K. Our periodic and current reports that we filed with the SEC are available on our website at www.halozyme.com, free of charge, as soon as reasonably practicable after we have electronically filed such material with, or furnished them to, the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports. Further copies of these reports are located at the SEC’s Public Reference Room at 100 F Street, N.W., Washington, D.C. 20549, and online at http://www.sec.gov.

Technology

rHuPH20 can be applied as a drug delivery platform to increase dispersion and absorption of other injected drugs and fluids that are injected under the skin or in the muscle thereby potentially enhancing efficacy or convenience.reducing treatment burden. For example, rHuPH20 has been used to convert drugs that must be delivered intravenously into subcutaneous injections or to reduce the number of subcutaneous injections needed for effective therapy. When ENHANZE Technologytechnology is applied subcutaneously, the rHuPH20 acts locally and hastransiently, with a tissue half-life of less than 15 minutes. HA at the local site reconstitutes its normal density within a few days and, therefore, we anticipate that anythe effect of rHuPH20 on the architecture of the subcutaneous space is temporary.

Additionally, we are expanding our scientific work to develop other enzymes and agents that target the extracellular matrix’s unique aspects, giving rise to potentially new molecular entities with a particular focus on oncology. We are developing a PEGylated version of the rHuPH20 enzyme (PEGPH20), that lasts for an extended period in the bloodstream (half-life of one to two days), and may therefore better target solid tumors that accumulate HA by degrading the surrounding HA and reducing the interstitial fluid pressure within malignant tumors to allow better penetration by co-administered agents.

Strategy

During 2016, we continued our strategy of focusing on developing our oncology pipeline and expanding our collaborations for ENHANZE Technology. This business model allows for revenue garnered from collaboration products to help fund our investment in PEGPH20 clinical development, with the goal of a future product approval that will support sustained growth.

Key aspects of our corporate strategy include the following:

Focus on our oncology pipeline. We are currently developing PEGPH20, our investigational new drug candidate, in multiple different tumors that accumulate high levels of HA. PEGPH20 is in Phase 2 and Phase 3 development in stage IV PDA, in Phase 1b development in non-small cell lung cancer and gastric cancer and in Phase 1b/2 development in patients treated with up to two lines of prior therapy for HER2-negative metastatic breast cancer. Over time, it is our goal to study additional types of cancer and to advance this program toward regulatory approval and commercial launch. In addition, we have two novel oncology preclinical assets.

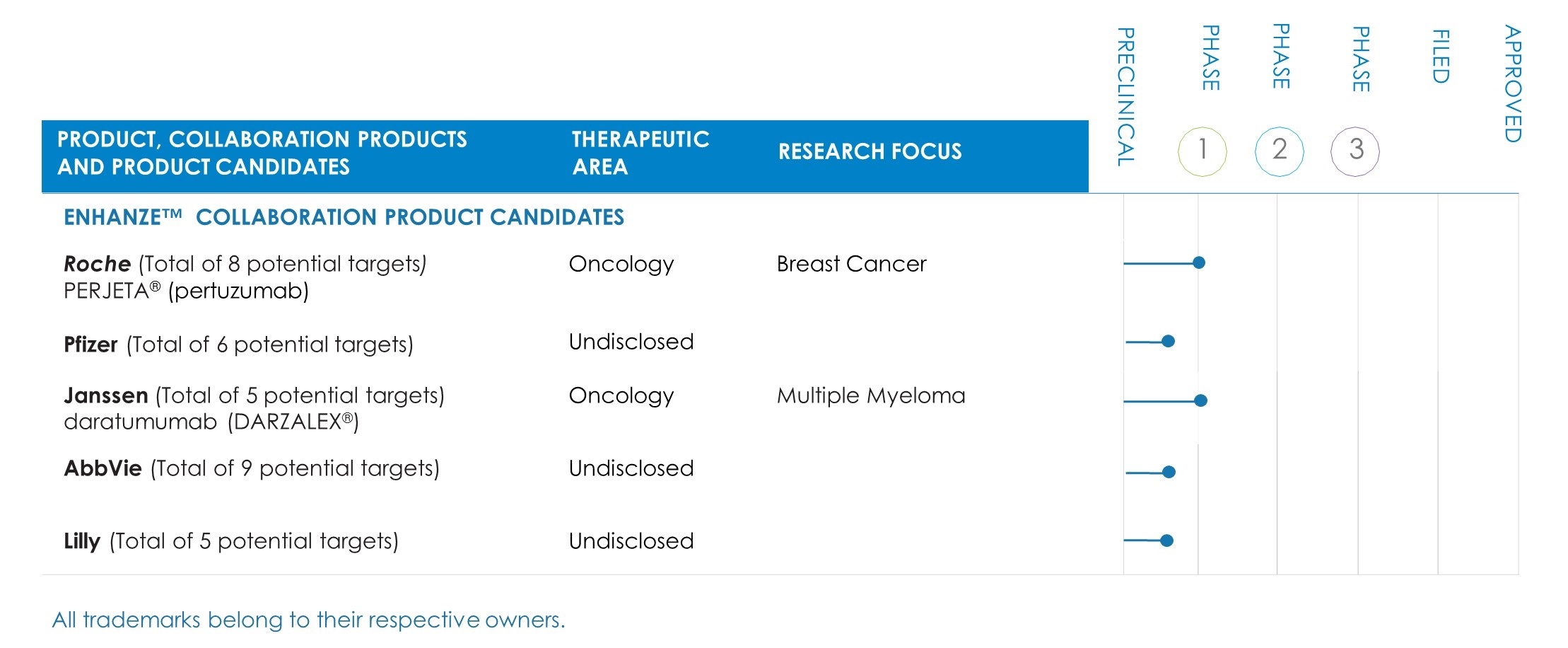

Focus on our ENHANZE platform. We currently have sixnine collaborations with three current product approvals and additional product candidates in development.development using our ENHANZE technology. We intend to work with our existing collaborators to expand our collaborations to add new targets and develop targets and product candidates under the terms of the operative collaboration agreements. In addition, weWe will also continue our efforts to enter into new collaborations to further exploit and derive additional value from our proprietary technology.

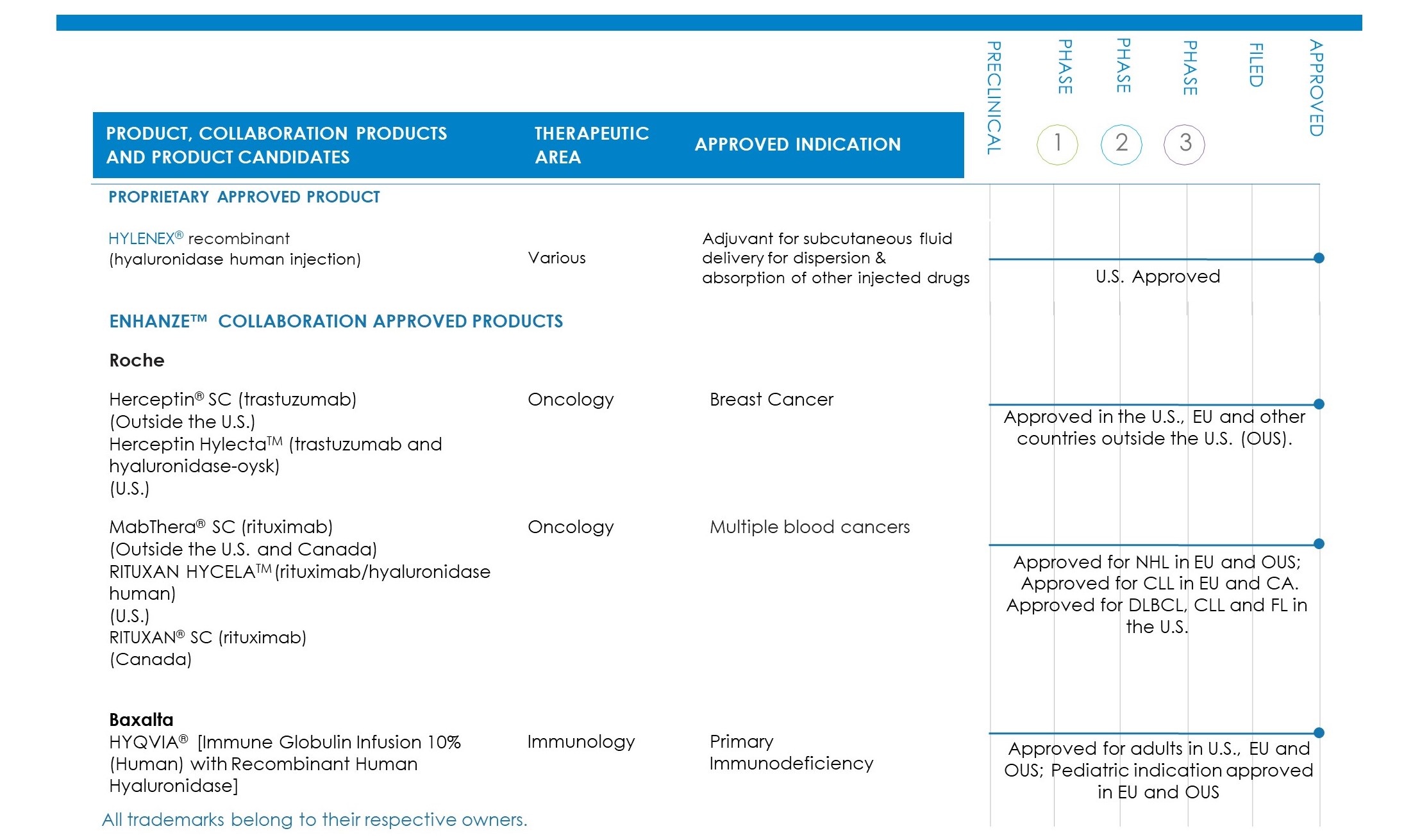

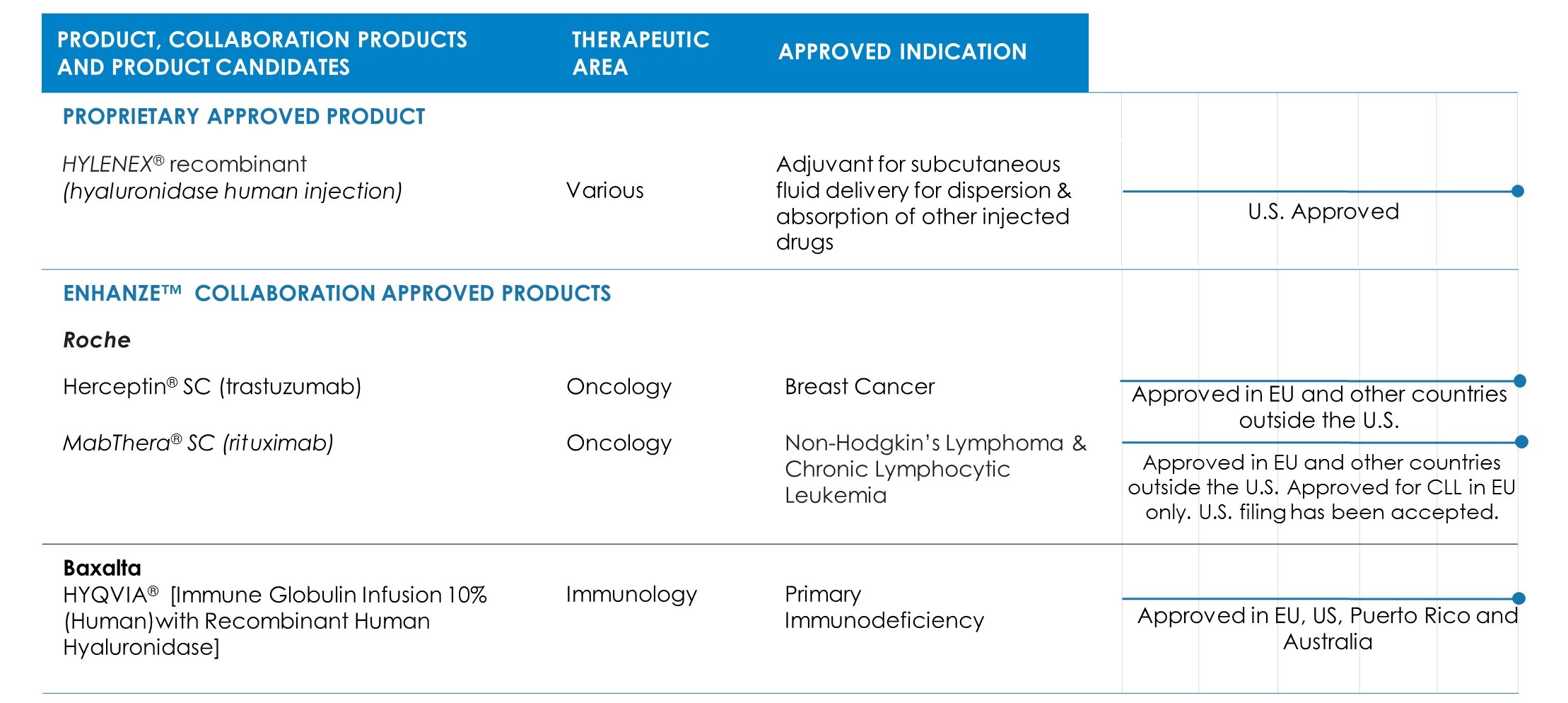

Product and Product Candidates

We currently have one marketed proprietary product and three marketed partnered products, one proprietary product candidate targeting several indications in various stages of development, and two preclinical product candidates.products. The following table summarizes our proprietary product, and product candidate as well asmarketed partnered products and product candidates under development with our collaborators:

Proprietary PipelineProduct

Hylenex Recombinant (hyaluronidase human injection)

Hylenex recombinant is a formulation of rHuPH20 that has received U.S. Food and Drug Administration (FDA) approval to facilitatefacilitates subcutaneous fluid administration for achieving hydration, to increase the dispersion and absorption of other injected drugs and, in subcutaneous urography, to improve resorption of radiopaque agents. Hylenex recombinant is currently the number one prescribed branded hyaluronidase.

PEGPH20

We are developing PEGPH20 in combination with currently approved cancer therapies as a candidate for the systemic treatment of tumors that accumulate HA. ‘PEG’ refers to the attachment of polyethylene glycol to rHuPH20, thereby creating PEGPH20. One of the novel properties of PEGPH20 is that it lasts for an extended duration in the bloodstream and, therefore, can be administered systemically to maintain its therapeutic effect to treat disease.

Cancer malignancies, including pancreatic, lung, breast, gastric, colon and prostate cancers can accumulate high levels of HA and therefore we believe that PEGPH20 has the potential to help patients with these types of cancer when used with certain currently approved cancer therapies. Among solid tumors, PDA has been reported to be associated with the highest frequency of HA accumulation. There are approximately 65,000 annual diagnoses of PDA in the United States and the European Union, and we estimate that 35-40% have high levels of HA.

The pathologic accumulation of HA, along with other matrix components, creates a unique microenvironment for the growth of tumor cells compared to normal cells. We believe that depleting the HA component of the tumor microenvironment with PEGPH20 remodels the tumor microenvironment, resulting in tumor growth inhibition in animal models. Removal of HA from the tumor microenvironment results in expansion of previously constricted blood vessels allowing increased blood flow, potentially increasing the access of activated immune cells and factors in the blood into the tumor microenvironment. If PEGPH20 is administered in conjunction with other anti-cancer therapies, the increase in blood flow may allow anti-cancer therapies to have greater access to the tumor, which may enhance the treatment effect of therapeutic modalities like chemotherapies, monoclonal antibodies and other agents.

We are developing PEGPH20 as a targeted therapy, for patients who have tumors with high levels of HA. We have a collaboration with Ventana Medical Systems Inc. (Ventana), a member of the Roche Group, to develop, and for Ventana to ultimately commercialize, a companion diagnostic assay for use with PEGPH20. The companion diagnostic assay is being used to identify high levels of HA in tumor biopsies, and may be the first diagnostic to target tumor-associated HA and possibly the first companion diagnostic assay in pancreatic cancer.

Pancreatic cancer indications:

Study Halo 109-201:

In January 2015, we presented the final results from Study 109-201, a multi-center, international open label dose escalation Phase 1b clinical study of PEGPH20 in combination with gemcitabine for the treatment of patients with stage IV PDA at the 2015 Gastrointestinal Cancers Symposium (also known as ASCO-GI meeting). This study enrolled 28 patients with previously untreated stage IV PDA. Patients were treated with one of three doses of PEGPH20 (1.0, 1.6 and 3.0 µg/kg twice weekly for four weeks, then weekly thereafter) in combination with gemcitabine 1000 mg/m2 administered intravenously. In this study, the confirmed overall response rate (complete response + partial response confirmed on a second scan as assessed by an independent radiology review) was 29 percent (7 of 24 patients) for those treated at therapeutic dose levels of PEGPH20 (1.6 and 3.0 µg/kg). Median progression-free survival (PFS) was 154 days (95% CI, 50-166) in the efficacy-evaluable population (n = 24). Among efficacy-evaluable patients with baseline tumor HA staining (n = 17), the median PFS in patients with high baseline tumor HA staining (6/17 patients) was substantially longer, 219 days, than in the patients with low baseline tumor HA staining (11/17 patients), 108 days. Median overall survival (OS) was 200 days (95% CI, 123-370) in the efficacy-evaluable population (n = 24). Among efficacy-evaluable patients with baseline tumor HA staining (n = 17), the median OS in patients with high baseline tumor HA staining (6/17 patients) was substantially longer, 395 days, than in the patients with low baseline tumor HA staining (11/17 patients), 174 days. The most common treatment-emergent adverse events (occurring in ≥ 15% of patients) were peripheral edema, muscle spasms, thrombocytopenia, fatigue, myalgia, anemia, and nausea. Thromboembolic (TE) events were reported in 8 patients (28.6%) and musculoskeletal events were reported in 21 patients (75%) which were generally grade 1/2 in severity.

Study Halo 109-202:

In the second quarter of 2013, we initiated Study 109-202, a Phase 2 multicenter randomized clinical trial evaluating PEGPH20 as a first-line therapy for patients with stage IV PDA. The study was designed to enroll patients who would receive gemcitabine and nab-paclitaxel (ABRAXANE®) either with or without PEGPH20. The primary endpoint is to measure the improvement in PFS in patients receiving PEGPH20 plus gemcitabine and ABRAXANE (PAG arm) compared to those who are receiving gemcitabine and ABRAXANE alone (AG arm). In April 2014, after 146 patients had been enrolled, the trial was put on clinical hold by Halozyme and the FDA to assess a question raised by the Data Monitoring Committee regarding a possible difference in the TE events rate between the group of patients treated in the PAG arm versus the group of patients treated in the AG arm. This portion of the study and patients in this portion are now referred to as Stage 1. At the time of the clinical hold all patients remaining in the study continued on gemcitabine and ABRAXANE. In July 2014, Study 109-202 was reinitiated (Stage 2) under a revised protocol, which excludes patients that are expected to be at a greater risk for TE events. The revised protocol provides for thromboembolism prophylaxis of all patients in both arms of the study with low molecular weight heparin, and adds evaluation of the TE events rate in Stage 2 PEGPH20-treated patients as a co-primary end point. Stage 2 of Study 109-202 enrolled an additional 133 patients, to add to the 146 patients already in the clinical trial, with a 2:1 randomization for the PAG arm compared to the AG arm.

In March 2016, our partner Ventana received approval for an investigational device exemption (IDE) application from the FDA for our companion diagnostic test to enable patient selection in our Phase 3 Study 301 of PEGPH20 in HA-High patients. Based on the cutpoint for the Ventana diagnostic, we expect approximately 35 to 40 percent of stage IV PDA patients to have HA-High tumors, similar to the previously reported interim results from Stage 1 of Study 202 using the Halozyme prototype assay.

In January 2017, we announced topline results from the combined analysis of Stage 1 and Stage 2, and Stage 2 alone, based on a December 2016 data cutoff. The combined analysis included 135 treated patients in Stage 1, of whom a total of 45 patients (25 in the PAG arm and 21 in the AG arm) were determined to have high HA, and 125 treated patients in Stage 2, of whom a total of 35 patients (24 in the PAG arm and 11 in the AG arm) were determined to have high HA. This analysis of secondary and exploratory endpoints was conducted using the Ventana companion diagnostic to prospectively identify high levels of HA. The key results showed in the combined Stage 1 and Stage 2 dataset:

The primary endpoint of PFS in the efficacy evaluable population (total of 231 patients) was met with statistical significance with a median PFS of 6.0 months in the PAG arm compared to 5.3 months in the AG arm, hazard ratio (HR) with a 95% confidence interval (CI): 0.73 (0.53, 1.00); p=0.048;

The secondary endpoint of PFS in the HA-High intent to treat population (total of 84 HA-High patients) was met with

statistical significance with a median PFS of 9.2 months in the PAG arm compared to 5.2 months in the AG arm, HR 0.51 (95% CI: 0.26, 1.00); p=0.048;

The exploratory analysis of median OS was 11.5 months vs. 8.5 months in the PAG vs. AG arms, respectively. Factors potentially having an impact on these results include less aggressive disease among patients in the AG arm within the Stage 1 patient population, and 9 of the 24 patients in the PAG arm (approximately 40 percent) discontinued PEGPH20 treatment at the time of the clinical hold, resulting in many patients receiving AG alone in both arms.

In the Stage 2 cohort population, in a total of 35 HA-High patients, the key results showed:

Median PFS was 8.6 months in the PAG arm compared to 4.5 months in the AG arm, hazard ratio of 0.63 (95% CI: 0.21, 1.93);

Median overall survival (OS) was 11.7 months in the PAG arm compared to 7.8 months in the AG arm, hazard ratio of 0.52 (95% CI: 0.22, 1.23);

The primary safety endpoint of decreasing the rate of TE events in Stage 2 was also met with the rate of TE events reducing from 43 percent to 10 percent in the PAG arm and from 25 percent to 6 percent in the AG arm, following a protocol amendment that excluded patients at high risk of TE events and with the introduction of prophylaxis with low molecular weight heparin (enoxaparin) in Stage 2 of the study with the current 1mg/kg/day dose of enoxaparin prophylaxis given in both treatment arms of the study.

Study 202 is an ongoing study with an open database and therefore we continue to collect and receive data on both Stage 1 and Stage 2 patients. When the database is considered complete and locked, an updated analysis and Final Study Report will be generated.

Study Halo 109-301:

In March 2015, we met with the FDA to discuss both the interim efficacy and safety data from Study 109-202, which included the potential risk profile including TE event rate. Based on the feedback from that meeting, we proceeded with a Phase 3 clinical study (Study 109-301) of PEGPH20 in patients with stage IV PDA, using a design allowing for potential marketing application based on either PFS or OS.The study will enroll patients whose tumors accumulate high levels of HA measured using the Ventana companion diagnostic test. The FDA provided feedback on the current companion diagnostic approach and confirmed that an approved IDE is required for the Phase 3 study.

The use of PFS as the basis for marketing approval will be subject to the overall benefit and risk associated with PEGPH20 combined with gemcitabine and ABRAXANE therapy, including the:

Magnitude of the PFS treatment effect observed;

Toxicity profile; and

Interim OS data.

In June 2015, we received scientific advice/protocol assistance from the European Medicines Agency (EMA) regarding our Phase 3 study. The EMA agreed to the patient population, and the use of both PFS and OS as co-primary endpoints stating that OS is the preferred endpoint and that ultimate approval would require an overall positive benefit:risk balance.

In March 2016, we dosed the first patient in Study 109-301, a Phase 3 multicenter randomized clinical trial evaluating PEGPH20 as a first-line therapy for patients with stage IV PDA. The study will evaluate the effects on PFS and OS of PEGPH20 with gemcitabine and ABRAXANE compared with gemcitabine and ABRAXANE alone in stage IV PDA patients at approximately 200 sites in 20 countries located in North America, Europe, South America and Asia Pacific. By January 2017, we had initiated 85% of the global study sites participating in the HALO 301 study.

SWOG Study S1313:

In October 2013, SWOG, a cancer research cooperative group of more than 4,000 researchers in over 500 institutions around the world, initiated a 144 patient Phase 1b/2 randomized clinical trial in some of their study centers, examining PEGPH20 in combination with modified FOLFIRINOX chemotherapy (mFOLFIRINOX) compared to mFOLFIRINOX treatment alone in patients with stage IV PDA (funded by the National Cancer Institute). This study was also placed on clinical hold temporarily at

the time of the hold on Study 109-202. In September 2014, the FDA removed the clinical hold on patient enrollment and dosing of PEGPH20 in this SWOG cooperative study. The study has resumed under a revised protocol, and patient enrollment is continuing. The Phase 2 portion of the study, where up to 172 patients are planned to be enrolled, began in June 2015. As with Study 109-202, the occurrence of TE events will be closely monitored in enrolled patients, and the continuation of this study may be halted again in accordance with event rate rules established in the protocol, or for other safety reasons.

Clinical collaboration:

In October 2016, we announced that PEGPH20 will be included in a pancreatic cancer clinical trial initiative called Precision Promise, an initiative that aims to change the current treatment approach to pancreatic cancer by offering options to patients based on the molecular profile of their tumor. This is being accomplished through the Pancreatic Cancer Action Network leading a collaboration that brings together clinicians, researchers, and drug developers. Pancreatic Cancer Action Network has announced plans to begin enrolling patients at 12 initial consortium sites in Spring 2017.

Other indications outside of pancreatic cancer:

Study HALO 107-201, PRIMAL Study:

In December 2014, we initiated a Phase 1b/2 trial, to evaluate PEGPH20 in second line in combination with docetaxel (Taxotere®) in non-small cell lung cancer patients. In August 2016, after assessing recruitment and the enrollment of increasingly later line patients, we discontinued the PRIMAL study.

Study HALO 107-101:

In November 2015, we initiated a Phase 1b study exploring the combination of PEGPH20 and KEYTRUDA®, an immuno-oncology agent in relapsed non-small cell lung cancer (NSCLC) and gastric cancer. In December 2016, we identified a dose of PEGPH20, namely 2.2 ug/kg, to move into the dose expansion phase of the study with KEYTRUDA in combination with PEGPH20. We are now enrolling both NSCLC and gastric cancer patients prospectively based on a patient being determined to be HA-High using the Ventana companion diagnostic test.

Clinical collaborations:

In July 2015, we entered into a clinical collaboration agreement with Eisai Co., Ltd.. (Eisai) to evaluate Eisai's HALAVEN® (eribulin) with PEGPH20 in HER2-negative metastatic breast cancer. In July 2016, the first patient was dosed in a Phase 1b/2 study for patients treated with up to two lines of prior therapy for HER2-negative HA-High metastatic breast cancer. Halozyme and Eisai are jointly sharing the costs to conduct this global study which remains in dose escalation.

In November 2016, we entered into an agreement with Genentech, a member of the Roche Group, to collaborate on clinical studies evaluating up to eight different tumor types, beginning in 2017. The first study will be a Phase 1b/2 open-label, multi-arm randomized global study, led by Genentech to evaluate their cancer immunotherapy Tecentriq® (atezolizumab), an anti-PD-L1 monoclonal antibody, in combination with PEGPH20 in up to six tumor types. Halozyme will supply PEGPH20 for the Genentech study, which will have an initial focus on gastrointestinal malignancies, including pancreatic and gastric cancers. The second study will be a Phase 1b open-label randomized study led by Halozyme to assess Tecentriq in combination with PEGPH20 and chemotherapy in advanced or metastatic biliary and gallbladder cancers. Genentech will supply Tecentriq for the Halozyme study.

Regulatory

The FDA has granted Fast Track designation for our program investigating PEGPH20 in combination with gemcitabine and nab-paclitaxel for the treatment of patients with stage IV PDA to demonstrate an improvement in OS. The Fast Track designation process was developed by the FDA to facilitate the development and expedite the review of drugs to treat serious or life-threatening diseases and address unmet medical needs.

The FDA has granted Orphan Drug designation for PEGPH20 for the treatment of pancreatic cancer. The FDA Office of Orphan Products Development’s mission is to advance the evaluation and development of products (drugs, biologics, devices, or medical foods) that demonstrate promise for the diagnosis and/or treatment of rare diseases or conditions. Similarly, the European Committee for Orphan Medicinal Products of the EMA designated PEGPH20 an orphan medicinal product for the treatment of pancreatic cancer.

In March 2015, we met with the FDA to discuss both the interim efficacy and safety data from Study 109-202 and to discuss the Phase 3 Study 109-301 as a potential registration study in stage IV PDA patients whose tumors are determined to have high levels of HA accumulation. In June 2015, we received scientific advice/protocol assistance from the EMA regarding our Phase 3 study. In March 2016, our partner, Ventana, received approval for an IDE application from the FDA for our companion diagnostic test to enable patient selection in our Phase 3 Study 301 of PEGPH20 in HA-High patients.

Other Pipeline Assets

PEG-ADA2: PEGylated adenosine deaminase 2, or PEG-ADA2, is an immune checkpoint inhibitor that targets adenosine, which may accumulate to high levels in the tumor microenvironment and has been linked to immunosuppression. We are currently in preclinical development with PEG-ADA2, with the next milestone expected to be final drug candidate selection to determine its suitability for continued evaluation as a targeted therapy for clinical development.

HTI-1511: HTI-1511 is a novel antibody-drug conjugate (ADC) targeting epidermal growth factor receptor (EGFR) to treat solid tumors, including those with drug-resistant mutations. We are in preclinical development with a drug candidate selected. Good laboratory practices (GLP) toxicity studies and chemistry, manufacturing and controls (CMC) development activities are planned as next steps in support of a potential investigational new drug (IND) filing.

ENHANZE Collaborations

Roche Collaboration

In December 2006, we and Roche entered into a collaboration and license agreement under which Roche obtained a worldwide license to develop and commercialize product combinations of rHuPH20 and up to thirteen Roche target compounds (the Roche Collaboration). Roche initially had the exclusive right to apply rHuPH20 to three pre-defined Roche biologic targets with the option to develop and commercialize rHuPH20 with ten additional targets. Roche had the right to exerciseUnder this option to identify additional targets for ten years. As of the ten year anniversary of theagreement, Roche Collaboration in December 2016, Roche had elected a total of eight targets, two of which are exclusive.

In September 2013, Roche launched a subcutaneous (SC) formulation of Herceptin (trastuzumab) (Herceptin SC) in Europe for the treatment of patients with HER2-positive breast cancer.cancer followed by launches in additional countries. This formulation utilizes our patented ENHANZE Technologytechnology and is administered in two to five minutes, compared to 30 to 90 minutes with the standard intravenous form. In September 2018, we announced that Roche received European marketing approval from Health Canada for Herceptin SC in August 2013. The European Commission’s approval was based on data from Roche’s Phase 3 HannaH study which showed thatfor the subcutaneous formulationtreatment of Herceptin was associated with comparable efficacy (pathological complete response, pCR) to Herceptin administered intravenously in womenpatients with HER2-positive early breast cancer and resulted in non-inferior trastuzumab plasma levels. Overall, the safety profile in both arms of the HannaH study was consistent with that expected from standard treatment with Herceptin and chemotherapy in this setting. No new safety signals were identified. Breast cancer is the most common cancer among women worldwide. In HER2-positive breast cancer, increased quantities of the human epidermal growth factor receptor 2 (HER2) are present on the surface of the tumor cells. This is known as “HER2 positivity” and affects approximately 15% to 20% of women with breast cancer. HER2-positive cancer is reported to be a particularly aggressive form of breast cancer. In February 2019, we announced that Roche received approval from the FDA for Herceptin SC under the brand name Herceptin Hylecta™ (trastuzumab and hyaluronidase-oysk). In April 2019, Roche made Herceptin Hylecta available in the U.S.

Directed at the same target, Roche initiated a Phase 1 study of rHuPH20 with PERJETA®Perjeta® (pertuzumab) and Herceptin (trastuzumab) using ENHANZE technology in patients with early breast cancer in March 2016. In June 2018, Roche initiated a global Phase 3 study of a fixed-dose combination of Perjeta and Herceptin using ENHANZE technology in patients with HER2-positive early breast cancer. In August 2019, the global phase 3 study met its primary endpoint. The study results demonstrated non-inferior levels of Perjeta in the blood (pharmacokinetics) compared to standard intravenous (IV) infusion of Perjeta plus Herceptin and chemotherapy in patients with HER2-positive early breast cancer. The study also demonstrated that the safety profile of the fixed dose subcutaneous combination of Perjeta and Herceptin was consistent with the safety profile of Perjeta and Herceptin administered intravenously. In December 2019, the full data from the study was presented at the San Antonio Breast Cancer Symposium. Based on the results of this study, BLA and MAA submissions are expected to be completed in the first quarter of 2020.

In June 2014, Roche launched MabThera SC in Europe for the treatment of patients with common forms of non-Hodgkin lymphoma (NHL). followed by launches in additional countries. This formulation utilizes our patented ENHANZE Technologytechnology and is administered in approximately five minutes compared to the approximately 2.51.5 to 4 hour infusion time for intravenous MabThera. The European Commission approved MabThera SC in March 2014. The European Commission’s approval was based primarily on data from Roche’s Phase 3 pivotal clinical studies, which was published in The Lancet Oncology. NHL is a type of cancer that affects lymphocytes (white blood cells). Lymphomas are a cancer of the lymphatic system (composed of lymph vessels, lymph nodes and organs) which helps to keep the bodily fluid levels balanced and to defend the body against invasion by disease. Lymphoma develops when white blood cells (usually B-lymphocytes) in the lymph fluid become cancerous and begin to multiply and collect in the lymph nodes or lymphatic tissues such as the spleen. Some of these cells are released into the bloodstream and spread to other parts of the body, interfering with the body’s production of healthy blood cells.infusion. In May 2016, Roche announced that the EMA approved Mabthera SC to treat patients with chronic lymphocytic leukemia (CLL).

In November 2016,June 2017, the FDA acceptedapproved Genentech’s (a member of the Roche Group) Biologic License Application (BLA) forRITUXAN HYCELA™, a subcutaneous formulationcombination of rituximab for CLL and NHL. This is a co-formulation with rHuPH20 which is approved(approved and marketed under the MabThera SC brand in countries outside the U.S. and Canada), for CLL and two types of NHL, follicular lymphoma and diffuse large B-cell lymphoma. In March 2018, Health Canada approved a combination of rituximab and rHuPH20 (approved and marketed under the brand name RITUXAN® SC) for patients with CLL.

In September 2017, we and Roche entered into an agreement providing Roche the right to develop and commercialize one additional exclusive target using ENHANZE technology. The upfront license payment may be followed by event-based payments subject to Roche’s achievement of specified development, regulatory and sales-based milestones. In addition, Roche will pay royalties to us if products under the collaboration are commercialized.

In October 2018, we entered into an agreement with Roche for the right to develop and commercialize one additional exclusive target and an option to select two additional targets within four years using our ENHANZE technology. The upfront license payment may be followed by event-based payments subject to Roche’s achievement of specified development, regulatory and sales-based milestones. In addition, Roche will pay royalties to us if products under the collaboration are commercialized.

In December 2018, Roche initiated a Phase 1b/2 study in patients with non-small cell lung cancer for Tecentriq (atezolizumab) using ENHANZE technology. In August 2019, Roche initiated a Phase 1 study evaluating OCREVUS (ocrelizumab) with ENHANZE Technology in subjects with multiple sclerosis. In October 2019, Roche nominated a new undisclosed target to be studied using ENHANZE technology, triggering a $10 million milestone payment.

Baxalta Collaboration

In September 2007, we and Baxalta entered into a collaboration and license agreement under which Baxalta obtained a worldwide, exclusive license to develop and commercialize product combinations of rHuPH20 with GAMMAGARD LIQUID (HYQVIA) (the Baxalta Collaboration). GAMMAGARD LIQUID is a current Baxalta product thatHYQVIA is indicated for the treatment of primary immunodeficiency disorders associated with defects in the immune system.

In May 2013, the European Commission granted Baxalta marketing authorization in all EU Member States for the use of HYQVIA (solution for subcutaneous use) as replacement therapy for adult patients with primary and secondary immunodeficiencies. Baxalta launched HYQVIA in the first EU country in July 2013 and has continued to launch in additional countries.

In OctoberSeptember 2014, Baxalta announcedHYQVIA was approved by the launch and first shipments of Baxalta’s HYQVIA productFDA for treatment of adult patients with primary immunodeficiency in the U.S. HYQVIA was approved by the FDA in September 2014 and is the first subcutaneous immune globulin (IG) treatment approved for adult primary immunodeficiency patients with a dosing regimen requiring only one infusion up to once per month (every three to four weeks) and one injection site per infusion in most patients, to deliver a full therapeutic dose of IG. The majority of primary immunodeficiency patients today receive intravenous infusions in a doctor’s office or infusion center, and current subcutaneous IG treatments require weekly or bi-weekly treatment with multiple infusion sites per treatment. The FDA’s approval of HYQVIA was a significant milestone for us as it represented the first U.S. approved BLA which utilizes our rHuPH20 platform.

In May 2016, Baxalta announced that HYQVIA received a marketing authorization from the European Commission for a pediatric indication, which is beingwas launched in eight European countriesEurope to treat primary and certain secondary immunodeficiencies.

Pfizer Collaboration

In December 2012, we and Pfizer entered into a collaboration and license agreement, under which Pfizer has the worldwide license to develop and commercialize products combining our rHuPH20 enzyme with Pfizer proprietary biologics directed to up to six targets in primary care and specialty care indications. Targets may be selected on an exclusive or non-exclusive basis. Pfizer has elected five targets on an exclusive basis. One of the targets is proprotein convertase subtilisin/kexin type 9 (PCSK9). Pfizer initiated dosing of a subcutaneous formulation of rHuPH20 and bococizumab, an investigational PCSK9 inhibitor, in a Phase 1 trial in February 2016. In November 2016, Pfizer announced they discontinued their development program for bococizumab, including the development of the subcutaneous formulation of rHuPH20 with bococizumab. In December 2016, Pfizerhas returned PCSK9 as an elected target. In April 2016, Pfizer completed a Phase 1 study of rHuPH20 with rivipansel, directed to another target to treat vaso-occlusive crisis in individuals with sickle cell disease, demonstrating feasibility of large volume subcutaneous administration with rHuPH20. In November 2016, Pfizer made a portfolio decision to discontinue development of rHuPH20 with rivipansel. Pfizer is currently in development of one program on the ENHANZE platform with an undisclosed target.two targets.

Janssen Collaboration

In December 2014, we and Janssen entered into a collaboration and license agreement, under which Janssen has the worldwide license to develop and commercialize products combining our rHuPH20 enzyme with Janssen proprietary biologics directed to up to five targets. Targets may be selected on an exclusive basis. Janssen has elected CD38 as the first target on an exclusive basis. In November 2015,October 2017, Janssen initiated dosing in aits first Phase 1b clinical trial evaluating3 study of subcutaneous delivery of daratumumab,DARZALEX® (daratumumab), directed at CD38, using ENHANZE Technology,technology, in multiple myeloma patients. In December 2016, Janssen announced results of the trial, which supported continued development of daratumumab with rHuPH20. Janssen has said it plans to initiate ainitiated seven Phase 3 studies, two Phase 2 study and one Phase 1 study of daratumumab combinedusing ENHANZE technology in patients with amyloidosis, smoldering myeloma and multiple myeloma.

In February 2019, Janssen’s development partner, Genmab, announced positive Phase 3 trial results from the COLUMBA study evaluating subcutaneous DARZALEX in comparison to DARZALEX IV in patients with relapsed or refractory multiple myeloma. DARZALEX SC (utilizing ENHANZE technology.technology) was found to be non-inferior to Darzalex IV with regard the co-primary endpoints of Overall Response Rate and Maximum Trough concentration. In July 2019, Janssen submitted a BLA to the FDA and an extension application to the EMA for the subcutaneous delivery of DARZALEX for patients with multiple myeloma.

In December 2019, Janssen elected targets EGFR and cMET on an exclusive basis as part of the bispecific antibody (JNJ-61186372), which is being studied in solid tumors.

AbbVie Collaboration

In June 2015, we and AbbVie entered into a collaboration and license agreement, under which AbbVie has the worldwide license to develop and commercialize products combining our rHuPH20 enzyme with AbbVie proprietary biologics directed to up to nine targets. Targets may be selected on an exclusive basis. AbbVie elected TNF alpha as the firstone target on an exclusive basis. In January 2016, AbbVie initiated dosing in a Phase 1 clinical trial evaluating if rHuPH20 with adalimumab (HUMIRA®) would allowbasis, TNF alpha, for a reduced number of induction injectionswhich it has discontinued development and deliver additional performance benefits. In November 2016, AbbVie discontinued this program following completion ofreturned the Phase 1 study in which the target results were not achieved.target.

Lilly Collaboration

In December 2015, we and Lilly entered into a collaboration and license agreement, under which Lilly has the worldwide license to develop and commercialize products combining our rHuPH20 enzyme with Lilly proprietary biologics directed to up to five targets. Targets may be selected on an exclusive basis. Lilly has elected two targets on an exclusive basis and one target on a semi-exclusive basis. In August 2017, Lilly initiated a Phase 1 study of an investigational therapy in combination with rHuPH20.

BMS Collaboration

In September 2017, we and BMS entered into a collaboration and license agreement, which became effective in November 2017, under which BMS has the worldwide license to develop and commercialize products combining our rHuPH20 enzyme with BMS immuno-oncology targets directed at up to eleven targets. Targets may be selected on an exclusive basis, with the exception of one co-exclusive target. BMS has designated multiple immuno-oncology targets including programmed death 1 (PD-1) and has an option to select additional targets within five years from the effective date. In October 2018, BMS dosed the first patient in a Phase 1/2a study evaluating the safety, pharmacokinetics and pharmacodynamics of BMS-986179, an investigational anti-CD-73 antibody alone and in combination with nivolumab, using ENHANZE technology. BMS is also conducting a Phase 1/2 study of nivolumab using ENHANZE technology in patients with solid tumors. In October 2019, BMS initiated a Phase 1 study for Relatlimab in combination with nivolumab and ENHANZE technology.

Alexion Collaboration

In December 2017, we and Alexion entered into a collaboration and license agreement, under which Alexion has the worldwide license to develop and commercialize products combining our rHuPH20 enzyme with Alexion’s portfolio of products directed at up to four targets. Targets may be selected on an exclusive basis. Alexion elected two targets on an exclusive basis, including a

C5 complement inhibitor and has an option to select two additional targets within five years from the effective date. In August 2018, Alexion announced that it initiated a Phase 1 trial to study a next-generation subcutaneous formulation of ALXN1210 using ENHANZE technology. Alexion believes this next-generation subcutaneous formulation, called ALXN1810, has the potential to extend the dosing interval from once a week to greater than two weeks between doses. In January 2020, Alexion announced plans to conduct a phase 2 basket trial in renal indications for ALXN1810.

argenx Collaboration

In February 2019, we entered into an agreement with argenx for the right to develop and commercialize one exclusive target, the human neonatal Fc receptor FcRn, which includes argenx's lead asset efgartigimod (ARGX-113), and an option to select two additional targets using ENHANZE technology. In May 2019, argenx nominated a second target to be studied using ENHANZE technology, a human complement factor C2 associated with the product candidate ARGX-117, which is being developed to treat severe autoimmune diseases.

In July 2019, argenx dosed the first subject in a phase 1 clinical trial evaluating the safety, pharmacokinetics and pharmacodynamics of efgartigimod (ARGX-113), using ENHANZE technology. In December 2019, argenx reported that based on data from the phase 1 study and internal company analysis, a one minute injection administered every 2 weeks may be possible.

NIH CRADA

In June 2019, we announced a Cooperative Research and Development Agreement (CRADA) with the National Institute of Allergy and Infectious Diseases’ Vaccine Research Center (VRC), part of National Institute of Health (NIH), enabling the VRC’s use of ENHANZE technology to develop subcutaneous formulations of broadly neutralizing antibodies (bnAbs) against HIV for HIV treatment.

For a further discussion of the material terms of our collaboration agreements, refer to Note 4, 2, Summary of Significant Accounting Policies - Revenues under Collaborative Agreements, to our consolidated financial statements.Agreements.

Customers

The following table indicates the percentage of total revenues in excess of 10% with any single customer:

|

| | | | | | | | |

| | Year Ended December 31, |

| | 2016 | | 2015 | | 2014 |

| Roche | 63 | % | | 42 | % | | 57 | % |

| Baxalta | 12 | % | | 7 | % | | 3 | % |

| Lilly | 6 | % | | 19 | % | | — |

|

| AbbVie | 4 | % | | 17 | % | | — |

|

| Janssen | 2 | % | | 1 | % | | 20 | % |

|

| | | | | | | | |

| | Year Ended December 31, |

| | 2019 | | 2018 | | 2017 |

| Roche | 40 | % | | 72 | % | | 38 | % |

| argenx | 23 | % | | — | % | | — | % |

| Janssen | 18 | % | | 2 | % | | 6 | % |

| BMS | 1 | % | | 4 | % | | 32 | % |

| Alexion | 1 | % | | 3 | % | | 13 | % |

For additional information regarding our revenues from external customers, refer to Note 2, Summary of Significant Accounting Policies — Concentrations of Credit Risk, Sources of Supply and Significant Customers, to our consolidated financial statements.

Patents and Proprietary Rights

Patents and other proprietary rights are essential to our business. Our success will depend in part on our ability to obtain patent protection for our inventions, to preserve our trade secrets and to operate without infringing the proprietary rights of third parties. Our strategy is to actively pursue patent protection in the U.S. and certain foreign jurisdictions for technology that we believe to be proprietary to us and that offers us a potential competitive advantage. Our patent portfolio includes 2543 issued patents in the U.S., more than 285520 issued patents in Europe and other countries in the world and more than 30070 pending patent applications. In general, patents have a term of 20 years from the application filing date or earlier claimed priority date. Our issued patents will expire between 20222023 and 2032.2035. We have multiple patents and patent applications throughout the world pertaining to our recombinant human hyaluronidase and methods of use and manufacture, including an issued U.S. patent which expires in 2027 and an issued European patent which expires in 2024, which we believe cover the products and product candidates under our existing

collaborations and Hylenex recombinant PEGPH20 and our endocrinology product candidates.. In addition, we have, under prosecution throughout the world, multiple patent applications that relate specifically to individual product candidates under development, the expiration of which can only be definitely determined upon maturation into our issued patents. We believe our patent filings represent a barrier to entry for potential competitors looking to utilize these hyaluronidases.

In addition to patents, we rely on unpatented trade secrets, proprietary know-how and continuing technological innovation. We seek protection of these trade secrets, proprietary know-how and innovation, in part, through confidentiality and proprietary information agreements. Our policy is to require our employees, directors, consultants, advisors, collaborators, outside scientific collaborators and sponsored researchers, other advisors and other individuals and entities to execute confidentiality agreements upon the start of employment, consulting or other contractual relationships with us. These agreements provide that all confidential information developed or made known to the individual or entity during the course of the relationship is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of employees and some other parties, the agreements provide that all inventions conceived by the individual will be our exclusive property. Despite the use of these agreements and our efforts to protect our intellectual property, there will always be a risk of unauthorized use or disclosure of information. Furthermore, our trade secrets may otherwise become known to, or be independently developed by, our competitors.

We also file trademark applications to protect the names of our products and product candidates. These applications may not mature to registration and may be challenged by third parties. We are pursuing trademark protection in a number of different countries around the world. There can be no assurances that our registered or unregistered trademarks or trade names will not infringe on rights of third parties or will be acceptable to regulatory agencies.

Research and Development Activities

Our research and development expenses consist primarily of costs associated with the product development, quality and regulatory work required to maintain the ENHANZE platform, development and manufacturing of our product candidates performed on behalf of our partners, compensation and other expenses for research and development personnel, supplies and materials, costs for consultants and related contract research, clinical trials, facility costs and amortization and depreciation. We charge all research and development expenses to operations as they are incurred. OurPrior to our November 2019 restructuring, our research and development activities arewere primarily focused on the development of our various product candidates.

Due to the uncertainty in obtaining the FDA and other regulatory approvals, our reliance on third parties and competitive pressures, we are unable to estimate with any certainty the additional costs we will incur in the continued development of our proprietary product candidates for commercialization. However, we expect our research and development expenses for PEGPH20 to increase as our program advances into additional tumors and later stages of clinical development.PEGPH20.

Manufacturing

We do not have our own manufacturing facility for our product and our partners’ products and product candidates, or the capability to package our products. We have engaged third parties to manufacture bulk rHuPH20 PEGPH20 and Hylenex recombinant.Hylenex.

We have existing supply agreements with contract manufacturing organizations Avid Bioservices, Inc. (Avid) and Catalent Indiana LLC (formerly Cook Pharmica LLC (Cook)LLC) (Catalent) to produce supplies of bulk rHuPH20. These manufacturers each produce bulk rHuPH20 under current Good Manufacturing Practices (cGMP) for clinical and commercial uses. CookCatalent currently produces bulk rHuPH20 for use in Hylenex recombinant, product candidates and collaboration product candidates. Avid currently produces bulk rHuPH20 for use in collaboration products. We rely on their ability to successfully manufacture these batches according to product specifications. In addition, we are working to scale-up, validate and qualify a new facility operated by Avid as a manufacturer of bulk rHuPH20 for use in the products and product candidates under the Roche Collaboration. It is important for our business for CookCatalent and Avid to (i) retain their status as cGMP-approved manufacturing facilities; (ii) successfully scale up bulk rHuPH20 production; and/or (iii) manufacture the bulk rHuPH20 required by us and our collaborators for use in our proprietary and collaboration products and product candidates. In addition to supply obligations, Avid and CookCatalent will also provide support for data and information used in the chemistry, manufacturing and controls sections for FDA and other regulatory filings.

We have a commercial manufacturing and supply agreement with Patheon Manufacturing Services, LLC (Patheon) under which Patheon will provide the final fill and finishing steps in the production process of Hylenex recombinant. Under our commercial services agreement with Patheon, Patheon has agreed to fill and finish Hylenexrecombinant product for us until December 31, 2019,2021, subject to further extensions in accordance with the terms of the agreement. In addition, we are scaling up our manufacturing of PEGPH20 with third party suppliers to support additional clinical trials, including the Phase 3 trial, and ultimately, if approved, potential commercial supply.

Sales, Marketing and Distribution

Hylenex Recombinant

Our commercial activities currently focus on Hylenex recombinant. We have a team of sales specialists that provide hospital and surgery center customers with the information about Hylenex recombinant and information needed to obtain formulary approval for, and support utilization of,Hylenex recombinant. Our commercial activities also include marketing and related services and commercial support services such as commercial operations, managed markets and commercial analytics. We also employ third-party vendors, such as advertising agencies, market research firms and suppliers of marketing and other sales support related services to assist with our commercial activities.

We sell Hylenex recombinant in the U.S. to wholesale pharmaceutical distributors, who sell the product to hospitals and other end-user customers. We have engagedengage Integrated Commercialization Solutions (ICS), a division of AmerisourceBergen Specialty Group, a subsidiary of AmerisourceBergen, to act as our exclusive distributor for commercial shipment and distribution of Hylenex recombinant to our customers in the United States. In addition to distribution services, ICS provides us with other key services related to logistics, warehousing, returns and inventory management, contract administration and chargebacks processing and accounts receivable management. In addition, we utilize third parties to perform various other services for us relating to regulatory monitoring, including call center management, adverse event reporting, safety database management and other product maintenance services.

Competition

The pharmaceutical industry is characterized by rapidly advancing technologies, intense competition and a strong emphasis on proprietary therapeutics. We face competition from a number of sources, some of which may target the same indications as our product or product candidates, including large pharmaceutical companies, smaller pharmaceutical companies, biotechnology companies, academic institutions, government agencies and private and public research institutions, many of which have greater financial resources, drug development experience, sales and marketing capabilities, including larger, well established sales forces, manufacturing capabilities, experience in obtaining regulatory approvals for product candidates and other resources than us. We face competition not only in the commercialization of Hylenex recombinant, but also for the in-licensing or acquisition of additional product candidates, and the out-licensing of our ENHANZE Technology.technology. Our ENHANZE technology may face increasing competition from alternate approaches and/or emerging technologies to deliver medicines SC. In addition, our collaborators face competition in the commercialization of the product candidates for which the collaborators seek marketing approval from the FDA or other regulatory authorities.

Hylenex Recombinant

Hylenex recombinant is currently the only FDA approved recombinant human hyaluronidase on the market. The competitors for Hylenex recombinant include, but are not limited to, Valeant Pharmaceuticals International, Inc.’s product, Vitrase®, an ovine (ram) hyaluronidase, and Amphastar Pharmaceuticals, Inc.’s product, Amphadase®, a bovine (bull) hyaluronidase. In addition, some commercial pharmacies compound hyaluronidase preparations for institutions and physicians even though compounded preparations are not FDA approved products.

Government Regulations

The FDA and comparable regulatory agencies in foreign countries regulate the manufacture and sale of the pharmaceutical products that we or our partners have developed or that our partners currently are developing. The FDA has established guidelines and safety standards that are applicable to the laboratory and preclinical evaluation and clinical investigation of therapeutic products and stringent regulations that govern the manufacture and sale of these products. The process of obtaining regulatory approval for a new therapeutic product usually requires a significant amount of time and substantial resources. The steps typically required before a product can be introduced for human use include:

animal pharmacology studies to obtain preliminary information on the safety and efficacy of a drug; or

laboratory and preclinical evaluation in vitro and in vivo including extensive toxicology studies.

The results of these laboratory and preclinical studies may be submitted to the FDA as part of an IND application. The sponsor of an IND application may commence human testing of the compound 30 days after submission of the IND, unless notified to the contrary by the FDA.

The clinical testing program for a new drug typically involves three phases:

Phase 1 investigations are generally conducted in healthy subjects (in certain instances, Phase 1 studies that determine the maximum tolerated dose and initial safety of the product candidate are performed in patients with the disease);

Phase 2 studies are conducted in limited numbers of subjects with the disease or condition to be treated and are aimed at determining the most effective dose and schedule of administration, evaluating both safety and whether the product demonstrates therapeutic effectiveness against the disease; and

Phase 3 studies involve large, well-controlled investigations in diseased subjects and are aimed at verifying the safety and effectiveness of the drug.

Data from all clinical studies, as well as all laboratory and preclinical studies and evidence of product quality, are typically submitted to the FDA in a new drug application (NDA). The results of the preclinical and clinical testing of a biologic product candidate are submitted to the FDA in the form of a BLA, for evaluation to determine whether the product candidate may be approved for commercial sale. In responding to a BLA or NDA, the FDA may grant marketing approval or request additional information. If additional information is requested we may provide such information or withdraw our application. Although the FDA’s requirements for clinical trials are well established and we believe that we have planned and conducted our clinical trials in accordance with applicable regulations and guidelines, these requirements may be subject to change. Accordingly, we could be required to conduct additional trials beyond what we had planned due to the FDA’s safety and/or efficacy concerns or due to differing interpretations of the meaning of our clinical data or a change in the therapeutic landscape. (See Part I, Item 1A, Risk Factors.)

The FDA’s Center for Drug Evaluation and Research must approve an NDA and the FDA’s Center for Biologics Evaluation and Research must approve a BLA for a drug before it may be marketed in the United States. If we begin to market our proposed products for commercial sale in the U.S., any manufacturing operations that may be established in or outside the U.S. will also be subject to rigorous regulation, including compliance with cGMP. We also may be subject to regulation under the Occupational Safety and Health Act, the Environmental Protection Act, the Toxic Substance Control Act, the Export Control Act and other present and future laws of general application. In addition, the handling, care and use of laboratory animals are subject to the Guidelines for the Humane Use and Care of Laboratory Animals published by the National Institutes of Health.

Regulatory obligations continue post-approval and include the reporting of adverse events when a drug is utilized in the broader patient population. Promotion and marketing of drugs is also strictly regulated, with penalties imposed for violations of FDA regulations, the Lanham Act and other federal and state laws, including the federal anti-kickback statute.

We currently intend to continue to seek, directly or through our collaborators, approval to market our products and product candidates in foreign countries, which may have regulatory processes that differ materially from those of the FDA. We anticipate that we willOur partners may rely upon independent consultants to seek and gain approvals to market our proposed products in foreign countries or may rely on other pharmaceutical or biotechnology companies to license our proposed products. We cannot guarantee that approvals to market any of our proposedpartners’ products can be obtained in any country. Approval to market a product in any one foreign country does not necessarily indicate that approval can be obtained in other countries.

From time to time, legislation is drafted and introduced in Congress that could significantly change the statutory provisions governing the approval, manufacturing and marketing of drug products. In addition, FDA regulations and guidance are often revised or reinterpreted by the agency or reviewing courts in ways that may significantly affect our business and development of our partners’ product candidates and any products that we may commercialize. It is impossible to predict whether additional legislative changes will be enacted, or FDA regulations, guidance or interpretations changed, or what the impact of any such changes may be.

Segment Information

We operate about our business as one segment, which includes all activities related to the research, development and commercialization of human enzymes and other drug candidates. This segment also includes revenues and expenses related to (i) research and development activities conducted under our collaboration agreements with third parties and (ii) product sales of Hylenex recombinant. The chief operating decision-maker reviews the operating results on an aggregate basis and manages the operations as a single operating segment. Our long-lived assets located in foreign countries had minimal book value as of December 31, 2016 and 2015.

Executive Officers of the Registrant

Information concerning our executive officers, including their names, ages and certain biographical information can be found in Part III, Item 10, Directors, Executive Officers and Corporate Governance. This information is incorporated by reference into Part I of this report.

Employees

As of February 22, 2017,14, 2020, we had 259132 full-time employees. None of our employees are unionized and we believe our employee relations to be good.

Item 1A.Risk Factors

Risks Related To Our Business

We recently initiated a significant corporate restructuring including a substantial reduction in our workforce to reduce our operating costs. As a result of this initiative, we may experience a disruption to our business operations. In addition, we may not realize all of the expected cost savings from our corporate restructuring which could have an adverse effect on our business or results of operations.

In November 2019, we announced that our HALO-301 Phase 3 clinical study evaluating investigational new drug PEGPH20 as a first-line therapy for treatment of patients with metastatic pancreatic cancer failed to reach the primary endpoint of overall survival. As a result, we have closed all ongoing oncology clinical studies including all development activities for PEGPH20. In connection with this decision, we have initiated a significant restructuring, including a staff reduction of approximately 55 percent of our total workforce. This restructuring and staff reduction is aimed at reducing operating costs and focusing our resources on our ENHANZE technology and Hylenex. Our restructuring initiative and staff reduction may cause disruption to our business operations. For example, the reduction in force has resulted in the loss of a number of long-term employees including some members of the senior management team, the loss of institutional knowledge and expertise and the reallocation and combination of certain roles and responsibilities across the organization, all of which could adversely affect our operations. In addition, we may not be able to effectively realize all the cost savings anticipated by the restructuring initiative and reduction-in-force and we may incur unanticipated charges or make cash payments as a result of our restructuring initiative that were not previously contemplated which could result in an adverse effect on our business or results of operations.

Our inability to attract, hire and retain key management and scientific personnel could negatively affect our business.

Our success depends on the performance of key management and scientific employees with relevant experience. We depend substantially on our ability to hire, train, motivate and retain high quality personnel, especially our scientists and management team which may be adversely affected by our recent restructuring and reduction in force. Particularly in view of the small number of employees on our staff to manage our alliance programs and key functions, if we are unable to retain existing personnel or identify or hire additional personnel, we may not be able to adequately support current and future alliances with strategic collaborators. Our use of domestic and international third-party contractors, consultants and staffing agencies also subjects us to potential co-employment liability claims.

Furthermore, if we were to lose key management personnel, we would likely lose some portion of our institutional knowledge and technical know-how, potentially causing a substantial disruption or delay in one or more of our partnered development programs until adequate replacement personnel could be hired and trained. In addition, we do not have key person life insurance policies on the lives of any of our employees which would help cover the cost of associated with the loss of key employees.

We have generated only limited revenues from product sales to date;date and we have a history of net losses and negative cash flows and we may never achieve or maintain profitability..

Relative to expenses incurred in our operations, we have generated only limited revenues from product sales, royalties, licensing fees, milestone payments, bulk rHuPH20 supply payments and research reimbursements to date, and we may never generate sufficient revenues from future product sales, licensing fees and milestone payments to offset expenses. Even if we ultimately do achieve significant revenues from product sales, royalties, licensing fees, research reimbursements, bulk rHuPH20 supply payments and/or milestone payments, we expect to incur significant operating losses over the next few years. We have never been profitable, and we may never become profitable.date. Through December 31, 2016,2019, we have incurred aggregate net losses of approximately $585.3$603.7 million. Although we expect to achieve sustainable profitability beginning the second quarter of 2020, unexpected declines in revenues and increases in expenses could inhibit our ability to achieve and sustain profitability.