2

2011 ANNUAL REPORT ON FORM 10-KFor the Fiscal Year Ended March 31, 2009INDEX

QSI Dental Division, NextGen Division, Inpatient Solutions Division and Practice Solutions Division.

Divisions.

The NextGen Division, with headquarters in Horsham, Pennsylvania, and significant locations in Atlanta, Georgia, St. Louis, Missouri and Hunt Valley, Maryland, focuses principally on developing and marketing products and services for medical practices.

Both divisionsDivisions develop and market practice management software that is designed to automate and streamline a number of the administrative functions required for operating a medical or dental practice. Examples of practice management software functions include scheduling and billing capabilities. Itcapabilities, and it is important to note that in both the medical and dental environments, practice management software systems have already been implemented by the vast majority of practices. Therefore, we actively compete for the replacement market.

In addition, both divisionsthe QSI Dental and NextGen Divisions develop and market software that automates theautomate patient record. Adoption rates for this software, commonly referred to as clinical software, are relatively low.records in both a practice and hospital setting. Therefore, we are typically competing to replace paper-based patient record alternatives as opposed to replacing previously purchased systems.

3

Electronic Data Interchange (“EDI”)/connectivity products

| Segment Revenue Breakdown | Segment Revenue Growth | |||||||||||||||||||||||

| Fiscal Year Ended March 31, | Fiscal Year Ended March 31, | |||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2011 | 2010 | 2009 | |||||||||||||||||||

| QSI Dental Division | 5.7 | % | 5.9 | % | 6.5 | % | 16.6 | % | 8.1 | % | (1.2 | )% | ||||||||||||

| NextGen Division | 75.3 | % | 78.3 | % | 83.0 | % | 16.5 | % | 12.1 | % | 19.6 | % | ||||||||||||

| Inpatient Solutions Division (1) | 5.1 | % | 1.0 | % | 0.0 | % | 519.1 | % | N/A | N/A | ||||||||||||||

| Practice Solutions Division (2) | 13.9 | % | 14.8 | % | 10.5 | % | 13.7 | % | 67.5 | % | N/A | |||||||||||||

| Consolidated | 100.0 | % | 100.0 | % | 100.0 | % | 21.1 | % | 18.9 | % | 31.6 | % | ||||||||||||

| (1) | Inpatient Solutions Division consists of two acquisitions, Opus and NextGen IS, acquired in February 2010 and August 2009, respectively. | |

| (2) | Practice Solutions Division consists of two acquisitions, HSI and PMP, acquired in May 2008 and October 2008, respectively. |

The NextGen Division also offers RCM services under the Practice Solutions name. Services provided through the Practice Solutions/RCM unit consist primarily of billing and collections services for medical practices. The Practice Solutions unit utilizes NextGen Enterprise Practice Management software to a significant extent.

product.

OurThe NextGen Division, developswith headquarters in Horsham, Pennsylvania and sells proprietary electronic medical records softwaresignificant locations in Atlanta, Georgia and practice management systems underAustin, Texas, provides integrated clinical, financial and connectivity solutions for ambulatory and dental provider organizations.

| • | NextGen Electronic Health Records (“NextGenehr”) to ensure complete, accurate documentation to manage patient care electronically and to improve clinical processes and patient outcomes with electronic charting at the point of care; | ||

| • | NextGen Practice Management (“NextGenpm”) to automate business processes, from front-end scheduling to back-end collections and financial and administrative processes for increased performance and efficiencies; | ||

| • | NextGen Dashboard, which allows providers to view patient data in a visually rich graphical format. Using bar charts, pie charts, gauges and more, the system displays information at the practice or single provider level; | ||

| • | NextGen Mobile improves patient care through anytime, anywhere access of patient data. In addition, Mobile has the capability to increase revenue by easily capturing charges at the point of care resulting in potential reduction of medical liability through better documentation of out-of-office actions; and | ||

| • | NextGen NextPen is a revolutionary digital pen that quickly captures data into NextGen Ambulatory EHR. NextPen captures structured data and graphic drawings as part of the patient record without scanning or transcription. This technology requires no learning curve for adoption. |

4

| • | NextGen Health Information Exchange (“HIE”), formerly Community Health Solution, to exchange patient data securely with community healthcare organizations; | ||

| • | NextGen Patient Portal (“NextMD.com”) to communicate with patients online and import information directly into NextGenehr; and | ||

| • | NextGen Health Quality Measures (“HQM”) to allow seamless quality measurement and reporting for practice and physician performance initiatives. |

We continue to pursue product enhancement initiatives within each division. The majority of such expenditures are currently targeted to

Inclusive of divisional maintenance, EDI and RCM revenue, the NextGen Division accounted for approximately 93.5% of our revenue for fiscal year 2009 compared to 91.4% in fiscal year 2008. Inclusive of divisional maintenance and EDI revenue, the QSI Division accounted for approximately 6.5% and 8.6% of revenue in fiscal year 2009 and 2008, respectively. The NextGen Division’s revenue grew 34.7% and 21.3% in fiscal year 2009 and 2008, respectively, while the QSI Division’s revenue decreased by 1.2% and decreased by 3.3% in fiscal year 2009 and 2008, respectively, over the prior year.

include:

| • | EDI services that are intended to automate the entire patient statement process, reducing labor and printing costs associated with producing statements in house. In addition,

| ||

| • | Hosting services that allow practices seeking the benefits of IT automation but not the maintenance of in-house hardware and networking; | ||

| • | NextGuard — Data Protection services that provide an off-site, data archiving, restoration and disaster recovery preparedness solution for practices to protect clinical and financial data; | ||

| • | Consulting services, such as strategic governance models and operational transformation, technical consulting such as data conversions or interface development, that also allow practices to build custom add-on features; Physician Consulting Resources, services that allow practices to consult with the NextGen Division’s physician team; and eHealth consulting services that assist in connecting communities of practice for data sharing. |

RCM services.services, primarily billing and collection services for medical practices. This divisionDivision combines a web-delivered Software as a Service, orWeb-delivered SaaS model and the NextGenepmpm software platform to execute its service offerings. Clients may also deployExecution of the plan to transition our client base onto the NextGenehr as part of their platform is under execution. The Practice Solutions implementation.

Division provides technology solutions and consulting services to cover the full spectrum of providers’ revenue cycle needs from patient access through claims denials.

5

health systems consist of:

| • | NextGen Clinicals, which resides on an advanced truly active web 2.0 platform — and is designed to initiate widespread work efficiency and communication, reduce errors and time-to-chart, and improve care; and | ||

| • | NextGen Financials, which is a financial and administrative system that helps hospitals significantly improve the smart operations and financial and regulatory management of their facilities. |

well positioned to aid physicians and hospitals with their EHR decisions as they prepare to make incentive-based purchases.

Our Strategy

• |

| Continue development and enhancement of select software solutions in target markets; | |

|

| Continue investments in our infrastructure including, but not limited to, | |

|

| Continue investment in product development, which includes developing a new integrated inpatient and outpatient, web-based software platform; | |

| • | Continue efforts to make infrastructure investments within an overall context of maintaining reasonable expense discipline; |

6

• | Addition of new | ||

|

| Expand our relationship with existing | |

| • | Continue our gold standard commitment of service in support of our client satisfaction programs. |

and Services

We offer both standard licenses and SaaS arrangements in our software offerings; although to date, SaaS arrangements have represented less than 5% of our arrangements.

| • | Data captured using user-customizable input “templates”; | ||

| • | Scanned or electronically acquired images, including X-rays and photographs; | ||

| • | Data electronically acquired through interfaces with clinical instruments or external systems; | ||

| • | Other records, documents or notes, including electronically captured handwriting and annotations; and | ||

| • | Digital voice recordings. |

7

NextGenepm is

We also offer a practice management solution for dental practices and an electronic health records and practice management system for medical practices through the Internet (software as a service). These products are marketed under the QSINet and NextGenweb trade names, respectively.

Clinical Systems. Ouroffering, our dental charting software system, the Clinical Product Suite (CPS),CPS is a comprehensive solution designed specifically for the dental group practice environment. CPS integrates the dental practice management product with a computer-based clinical information system that incorporates a wide range of clinical tools, including:

|

|

|

|

|

|

|

|

|

|

|

|

The result is a comprehensive clinical information management system that helps practices save time, reduce costs, improve case presentation and enhance the delivery of dental services and quality of care. Clinical information is managed and maintained electronically thus forming an electronic patient record that allows for the implementation of the “chartless” office.

NextGen provides

| • | Electronic claims submission service that submits Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) compliant insurance claims electronically to insurance payors; | ||

| • | Electronic remittance and payment posting service that uses NextGen Document Management system to link an image of each explanation of benefit (“EOB”) to the corresponding encounter at the time of payment posting to minimizes the need for storage of paper EOBs; and | ||

| • | Accounts receivable follow-up methodology that allows practices to establish parameters, adjustment rules and standards for account elevation. |

NextGenehr was developed with client-server architecture and a GUI and utilizes Microsoft Windows 2000, Windows NT or Windows XP on each workstation and either Windows 2000, Windows NT, Windows XP or UNIX on the database server. NextGenehr maintains data using industry standard relational database engines such as Microsoft SQL Server or Oracle. The system is scalable from one to thousands of workstations.

NextGenehr stores and maintains clinical data including:

| • | Electronic claims submission through our relationships with a number of payors and national claims clearinghouses; | ||

|

| ||

| • | Electronic patient statement processing, appointment reminder cards and calls, recall cards, patient letters and other correspondence; | ||

|

| ||

| • | Electronic insurance eligibility verification; and | ||

|

| ||

• |

| ||

|

|

NextGenehr also offers a workflow module, prescription management, automatic document and letter generation, patient education, referral tracking, interfaces to billing and lab systems, physician alerts and reminders, and powerful reporting and data analysis tools. NextGen Express is a version of NextGenehr designed for small practices.

NextGen also markets RCM services through our Practice Solutions unit. This service provides billing services to solo and group practices.

Connectivity Services. We make available EDI capabilities and connectivity services to our customers. The EDI/connectivity capabilities encompass direct interfaces between our products and external third party systems, as well as transaction-based services. Services include:

|

|

|

|

|

|

|

|

Revenue Cycle Management Services. Our NextGen Practice Solutions unit offers RCM services to physicians. On May 20, 2008, we acquired HSI, a full-service healthcare RCM company servicing the RCM needs of physician groups and a variety of other healthcare clients. HSI has historically and primarily focused on assisting its clients in increasing the accuracy and speed of client billing and collections activities. On October 28, 2008, we acquired PMP, a full-service healthcare RCM company. Founded in 2001, PMP provides physician billing and technology management services to healthcare providers, primarily in the Mid-Atlantic region.

Internet Applications. Our NextGen Division maintains an Internet-based patient health portal, NextMD.com.NextGen Patient Portal. NextMD.com is athe URL for our vertical portal for the healthcare industry, linking patients with their physicians, while providing a centralized source of health-oriented information for both consumers and medical professionals. Patients whose physicians are linked to the portal are able to request appointments, send appointment changes or cancellations, receive test results on-line, request prescription refills, view and/or pay their statements, and communicate with their physicians, all in a secure, on-line environment. Our NextGen suite of information systems are or can be linked to NextMD.com, integrating a number of these features with physicians’ existing systems.

8

2009.

MSOs, PHOs and similar networks to which we have sold systems provide use of our software to those group and single physician practices associated with the organization or hospital on either a service basis or by directing us to contract with those practices for the sale of stand-alone systems.

Customer2009.

9

Competition

Competition

10

EHR technology beginning in 2011. While the Company expects the ARRA to create significant opportunities for sales of NextGenehr over the next several years, the lack of a final definition of “meaningful use” as well as other details we believe has negatively impacted sales cycles in the March, 2009 quarter. While the Federal government has set a deadline of December 31, 2009 to publish final rules, there can be no assurance that the slowdown in sales cycles resulting from such uncertainty will not continue into the fiscal year, 2010 or beyond.

The effects of the recent global economic crisis may impact our business, operating results or financial condition. The recent global economic crisis has caused a general tightening in the credit markets, lower levels of liquidity, increases in the rates of default and bankruptcy and extreme volatility in credit, equity and fixed income markets. These macroeconomic developments could negatively affect our business, operating results or financial condition in a number of ways. For example, current or potential customersclients may be unable to fund software purchases, which could cause them to delay, decrease or cancel purchases of our products and services or to not pay us or to delay paying us for previously purchased products and services. Our clients may cease business operations or conduct business on a greatly reduced basis. Finally, our investment portfolio which includes auction rate securities, is generally subject to general credit, liquidity, counterparty, market and interest rate risks that may be exacerbated by the recent global financial crisis. If the banking system or the fixed income, credit or equity markets continue to deteriorate or remain volatile, our investment portfolio may be impacted and the values and liquidity of our investments could be adversely affected as well.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our software products are generally shipped as orders are received and accordingly, we have historically operated with a minimal backlog of license fees. As a result, revenue in any quarter is dependent on orders booked and shipped in that quarter and is not predictable with any degree of certainty. Furthermore, our systems can be relatively large and expensive, and individual systems sales can represent a significant portion of our revenue and profits for a quarter such that the loss or deferral of even one such sale can adversely affect our quarterly revenue and profitability.

Clients often defer systems purchases until our quarter end, so quarterly results generally cannot be predicted and frequently are not known until after the quarter has concluded.

Our sales are dependent upon clients’ initial decisions to replace or substantially modify their existing information systems, and subsequently, their decision concerning which products and services to purchase. These are major decisions for healthcare providers and, accordingly, the sales cycle for our systems can vary significantly and typically ranges from six to twenty four months from initial contact to contract execution/shipment.

Because a significant percentage of our expenses are relatively fixed, a variation in the timing of systems sales, implementations, and installations can cause significant variations in operating results from quarter to quarter. As a result, we believe that interim period-to-period comparisons of ourbusiness, results of operations are not necessarily meaningful and should notfinancial condition may be relied upon as indicationsadversely affected.The software market generally is characterized by rapid technological change, changing client needs, frequent new product introductions and evolving industry standards. The introduction of future performance. Further,products incorporating new technologies and the emergence of new industry standards could render our historical operating results are not necessarily indicative of future performance for any particular period.

We currently recognize revenue pursuant to Statement of Position (“SOP”) 97-2, as modified by SOP 98-9existing products obsolete and Staff Accounting Bulletin (SAB) 104. SAB 104 summarizes the Commission staff’s views in applying generally accepted accounting principles to revenue recognition in financial statements.

unmarketable. There can be no assurance that applicationwe will be successful in developing and subsequent interpretationsmarketing new products that respond to technological changes or evolving industry standards. New product development depends upon significant research and development expenditures which depend ultimately upon sales growth. Any material shortfall in revenue or research funding could impair our ability to respond to technological advances or opportunities in the marketplace and to remain competitive. If we are unable, for technological or other reasons, to develop and introduce new products in a timely manner in response to changing market conditions or client requirements, our business, results of operations and financial condition may be adversely affected.

11

| • | potentially dilutive issuances of our securities, the incurrence of debt and contingent liabilities and amortization expenses related to intangible assets with indefinite useful lives, which could adversely affect our results of operations and financial condition; | ||

| • | use of cash as acquisition currency may adversely affect interest or investment income, thereby potentially adversely affecting our earnings and /or earnings per share; | ||

| • | difficulty in fully or effectively integrating any acquired technologies or software products into our current products and technologies, where we may not receive the intended benefits of an acquisition; | ||

| • | difficulty in predicting and responding to issues related to product transition such as development, distribution and client support; | ||

| • | the possible adverse effect of such acquisitions on existing relationships with third party partners and suppliers of technologies and services; | ||

| • | the possibility that staff or clients of the acquired company might not accept new ownership and may transition to different technologies or attempt to renegotiate contract terms or relationships, including maintenance or support agreements; | ||

| • | the possibility that the due diligence process in any such acquisition may not completely identify material issues associated with product quality, product architecture, product development, intellectual property issues, key personnel issues or legal and financial contingencies, including any deficiencies in internal controls and procedures and the costs associated with remedying such deficiencies; | ||

| • | difficulty in entering geographic and business markets in which we have no or limited prior experience; | ||

| • | difficulty in integrating acquired operations due to geographical distance and language and cultural differences; and | ||

| • | the possibility that acquired assets become impaired, requiring us to take a charge to earnings which could be significant. |

12

Duemalfunctioning could also disrupt our ability to alltimely and accurately process and report results of our operations, financial position and cash flows, which could impact our ability to timely complete important business processes such as the evaluation of its internal controls and attestation activities pursuant to Section 404 of the foregoing factors, itSarbanes-Oxley Act of 2002.

The failure of auction rate securitiesaffected by general economic conditions and economic and fiscal policy in India, including changes in exchange rates and controls, interest rates and taxation policies, as well as social stability and political, economic or diplomatic developments affecting India in the future. In particular, India has experienced significant economic growth over the last several years, but faces major challenges in sustaining that growth in the years ahead. These challenges include the need for substantial infrastructure development and improving access to sell at their reset dates could impact the liquidity of the investment and could negatively impact the carrying value of the investment. Our investments include auction rate securities (“ARS”). ARS are securities that are structured with short-term interest rate reset dates of generally less than ninety days but with longer contractual maturities that range, for our holdings, from nine to 28 years. At the end of each reset period, investors can typically sell at auction or continue to hold the securities at par. These securities are subject to fluctuations in interest rate depending on the supply and demand at each auction. Through March 31, 2009, auctions held for the Company’s ARS with a total aggregate value of approximately $8.1 million failed. As of March 31, 2009, we were holding a total of approximately $7.4 million, net of unrealized loss, in ARS. While these debt securities are all highly-rated investments, generally with AAA/Aaa ratings, continued failure to sell at their reset dates could impact the liquidity of the investment which in turn could negatively impact our liquidity position.

Our common stock price has been volatile, which could result in substantial losses for investors purchasing shares of our common stock and in litigation against us. Volatility may be caused by a number of factors including but not limited to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Furthermore, the stock market in general, and the market for software, healthcare and high technology companies in particular, has experienced extreme volatility that often has been unrelatededucation. Our ability to the operating performance of particular companies. These broad marketrecruit, train and industry fluctuations mayretain qualified employees, develop and operate our captive facility could be adversely affect the trading price of our common stock, regardless of actual operating performance.

Moreover, in the past, securities class action litigation has often been brought against a company following periods of volatility in the market price of its securities. We may in the future be the target of similar litigation. Securities litigation could result in substantial costsaffected if India does not successfully meet these challenges.

Two of our directors are significant shareholders, which makes it possible for them to have significant influence over the outcome of all matters submitted to our shareholders for approval and which influence may be alleged to conflict with our interests and the interests of our other shareholders.Service Two of our directors and principal shareholders beneficially owned an aggregate of approximately 34.2% of the outstanding shares of our common stock at March 31, 2009. California law and our Bylaws permit our shareholders to cumulate their votes, the effect of which is to provide shareholders with sufficiently large concentrations of our shares the opportunity to assure themselves one or more seats on our Board. The amounts required to assure a Board position can vary based upon the number of shares outstanding, the number of shares voting, the number of directors to be elected, the number of “broker non-votes,” and the number of shares held by the shareholder exercising cumulative voting rights. In the event that cumulative voting is invoked, it is likely that the two of our directors holding an aggregate of approximately 34.2% of the outstanding shares of our common stock at March 31, 2009 will each have sufficient votes to assure themselves of one or more seats on our Board. With or without cumulative voting, these shareholders will have significant influence over the outcome of all matters submitted to our shareholders for approval, including the election of our directors and other corporate actions. In fiscal year 2009, one of the principal shareholders, Ahmed Hussein, proposed a different slate of directors than what the Company proposed to shareholders. The Company spent approximately $1.5 million to defend the Company’s slate. In addition, such influence by one or both of these shareholders could have the effect of discouraging others from attempting to purchase us, implement a change over our Board and management, and/or reducing the market price offered for our common stock in such an event.

If the emerging technologies and platforms of Microsoft and others upon which we build our products do not gain or continue to maintain broad market acceptance, or if we fail to develop and introduce in a timely manner new products and services compatible with such emerging technologies, we may not be able to compete effectively and our ability to generate revenue will suffer.Our software products are built and depend upon several underlying and evolving relational database management system platforms such as those developed by Microsoft. To date, the standards and technologies upon which we have chosen to develop our products have proven to have gained industry acceptance. However, the market for our software products is subject to ongoing rapid technological developments, quickly evolving industry standards and rapid changes in customerclient requirements, and there may be existing or future technologies and platforms that achieve industry standard status, which are not compatible with our products.

13

Many of our competitors have greater resources than we do. In order to compete successfully, we must keep pace with our competitors in anticipating and responding to the rapid changes involving the industry in which we operate, or our business, results of operations and financial condition may be adversely affected. The software market generally is characterized by rapid technological change, changing customer needs, frequent new product introductions, and evolving industry standards. The introduction of products incorporating new technologies and the emergence of new industry standards could render our existing products obsolete and unmarketable. There can be no assurance that we will be successful in developing and marketing new products that respond to technological changes or evolving industry standards. New product development depends upon significant research and development expenditures which depend ultimately upon sales growth. Any material shortfall in revenue or research funding could impair our ability to respond to technological advances or opportunities in the marketplace and to remain competitive. If we are unable, for technological or other reasons, to develop and introduce new products in a timely manner in response to changing market conditions or customer requirements, our business, results of operations and financial condition may be adversely affected.

In response to increasing market demand, we are currently developing new generations of certain of our software products. There can be no assurance that we will successfully develop these new software products or that these products will operate successfully, or that any such development, even if successful, will be completed concurrently with or prior to introduction of competing products. Any such failure or delay could adversely affect our competitive position or could make our current products obsolete.

We face risk and/or the possibility of claims from activities related to strategic partners, which could be expensive and time-consuming, divert personnel and other resources from our business and result in adverse publicity that could harm our business. We rely on third parties to provide services that affect our business. For example, we use national clearinghouses in the processing of some insurance claims and we outsource some of our hardware maintenance services and the printing and delivery of patient statements for our customers. These third parties could raise their prices and/or be acquired by competitors of ours, which could potentially create short and long-term disruptions to our business negatively impacting our revenue, profit and/or stock price. We also have relationships with certain third parties where these third parties serve as sales channels through which we generate a portion of our revenue. Due to these third-party relationships, we could be subject to claims as a result of the activities, products, or services of these third-party service

providers even though we were not directly involved in the circumstances leading to those claims. Even if these claims do not result in liability to us, defending and investigating these claims could be expensive and time-consuming, divert personnel and other resources from our business and result in adverse publicity that could harm our business.

We face the possibility of claims based upon our Web site content, which may cause us expense and management distraction. We could be subject to third party claims based on the nature and content of information supplied on our Web site by us or third parties, including content providers or users. We could also be subject to liability for content that may be accessible through our Web site or third party Web sites linked from our Web site or through content and information that may be posted by users in chat rooms, bulletin boards or on Web sites created by professionals using our applications. Even if these claims do not result in liability to us, investigating and defending against these claims could be expensive and time consuming and could divert management’s attention away from our operations.

14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A failure to successfully integrate acquired businesses or technology for any of these reasons could have an adverse effect on our financial condition andbusiness, results of operations.operations and financial condition.Certain of our products provide applications that relate to patient clinical information. Any failure by our products to provide accurate and timely information concerning patients, their medication, treatment and health status, generally, could result in claims against us which could materially and adversely impact our financial performance, industry reputation and ability to market new system sales. In addition, a court or government agency may take the position that our delivery of health information directly, including through licensed practitioners, or delivery of information by a third party site that a consumer accesses through our Web sites, exposes us to assertions of malpractice, other personal injury liability, or other liability for wrongful delivery/handling of healthcare services or erroneous health information. We maintain insurance to protect against claims associated with the use of our products as well as liability limitation language in our end-user license agreements, but there can be no assurance that our insurance coverage or contractual language would adequately cover any claim asserted against us. A successful claim brought against us in excess of or outside of our insurance coverage could have an adverse effect on our business, results of operations and financial condition. Even unsuccessful claims could result in our expenditure of funds for litigation and management time and resources.

| • | state and federal privacy and confidentiality laws; | ||

| • | our contracts with clients and partners; | ||

| • | state laws regulating healthcare professionals; | ||

| • | Medicaid laws; | ||

| • | the HIPAA and related rules proposed by the Health Care Financing Administration; and | ||

| • | Health Care Financing Administration standards for Internet transmission of health data. |

15

Because we believe that proprietary rights are material to our success, misappropriation of these rights could adversely affect our financial condition.We are heavily dependent on the maintenance and protection of our intellectual property and we rely largely on license agreements, confidentiality procedures and employee nondisclosure agreements to protect our intellectual property. Our software is not patented and existing copyright laws offer only limited practical protection.

16

We face the possibility of damages resulting from internal and external security breaches, and viruses. In the course of our business operations, we compile and transmit confidential information, including patient health information, in our processing centers and other facilities. A breach of security in any of these facilities could damage our reputation and result in damages being assessed against us. In addition, the other systems with which we may interface, such as the Internet and related systems may be vulnerable to security breaches, viruses, programming errors, or similar disruptive problems. The effect of these security breaches and related issues could disrupt our ability to perform certain key business functions and could potentially reduce demand for our services. Accordingly, we have expended significant resources toward establishing and enhancing the security of our related infrastructures, although no assurance can be given that they will be entirely free from potential breach. Maintaining and enhancing our infrastructure security may require us to expend significant capital in the future.

The success of our strategy to offer our EDI services and Internet solutions depends on the confidence of our customers in our ability to securely transmit confidential information. Our EDI services and Internet solutions rely on encryption, authentication and other security technology licensed from third parties to achieve secure transmission of confidential information. We may not be able to stop unauthorized attempts to gain access to or disrupt the transmission of communications by our customers. Anyone who is able to circumvent our security measures could misappropriate confidential user information or interrupt our, or our customers’, operations. In addition, our EDI and Internet solutions may be vulnerable to viruses, physical or electronic break-ins, and similar disruptions.

Any failure to provide secure infrastructure and/or electronic communication services could result in a lack of trust by our customers causing them to seek out other vendors, and/or, damage our reputation in the market, making it difficult to obtain new customers.

We are subject to the development and maintenance of the Internet infrastructure, which is not within our control, and which may diminish Internet usage and availability as well as access to our Web site. We deliver Internet-based services and, accordingly, we are dependent on the maintenance of the Internet by third parties. The Internet infrastructure may be unable to support the demands placed on it and our performance may decrease if the Internet continues to experience its historic trend of expanding usage. As a result of damage to portions of its infrastructure, the Internet has experienced a variety of performance problems which may continue into the foreseeable future. Such Internet related problems may diminish Internet usage and availability of the Internet to us for transmittal of our Internet-based services. In addition, difficulties, outages, and delays by Internet service providers, online service providers and other Web site operators may obstruct or diminish access to our Web site by our customers resulting in a loss of potential or existing users of our services.

Our failure to manage growth could harm our business, results of operations and financial condition. We have in the past experienced periods of growth which have placed, and may continue to place, a significant strain on our non-cash resources. We also anticipate expanding our overall software development, marketing, sales, client management and training capacity. In the event we are unable to identify, hire, train and retain qualified individuals in such capacities within a reasonable timeframe, such failure could have an adverse effect on us. In addition, our ability to manage future increases, if any, in the scope of our operations or personnel will depend on significant expansion of our research and development, marketing and sales, management, and administrative and financial capabilities. The failure of our management to effectively manage expansion in our business could have an adverse effect on our business, results of operations and financial condition.

Our operations are dependent upon our key personnel. If such personnel were to leave unexpectedly, we may not be able to execute our business plan. Our future performance depends in significant part upon the continued service of our key technical and senior management personnel, many of whom have been with us for a significant period of time. These personnel have acquired specialized knowledge and skills with respect to our business. We maintain key man life insurance on only one of our employees. Because we have a relatively small number of employees when compared to other leading companies in our industry, our dependence on maintaining our relationships with key employees is particularly significant. We are also dependent on our ability to attract high quality personnel, particularly in the areas of sales and applications development.

The industry in which we operate is characterized by a high level of employee mobility and aggressive recruiting of skilled personnel. There can be no assurance that our current employees will continue to work for us. Loss of services of key employees could have an adverse effect on our business, results of operations and financial condition. Furthermore, we may need to grant additional equity incentives to key employees and provide other forms of incentive compensation to attract and retain such key personnel. Equity incentives may be dilutive to our per share financial performance. Failure to provide such types of incentive compensation could jeopardize our recruitment and retention capabilities.

Our products may be subject to product liability legal claims, which could have an adverse effect on our business, results of operations and financial condition. Certain of our products provide applications that relate to patient clinical information. Any failure by our products to provide accurate and timely information concerning patients, their medication, treatment, and health status, generally, could result in claims against us which could materially and adversely impact our financial performance, industry reputation and ability to market new system sales. In addition, a court or government agency may take the position that our delivery of health information directly, including through licensed practitioners, or delivery of information by a third party site that a consumer accesses through our Web sites, exposes us to assertions of malpractice, other personal injury liability, or other liability for wrongful delivery/handling of healthcare services or erroneous health information. We maintain

insurance to protect against claims associated with the use of our products as well as liability limitation language in our end-user license agreements, but there can be no assurance that our insurance coverage or contractual language would adequately cover any claim asserted against us. A successful claim brought against us in excess of or outside of our insurance coverage could have an adverse effect on our business, results of operations and financial condition. Even unsuccessful claims could result in our expenditure of funds for litigation and management time and resources.

Certain healthcare professionals who use our Internet-based products will directly enter health information about their patients including information that constitutes a record under applicable law that we may store on our computer systems. Numerous federal and state laws and regulations, the common law, and contractual obligations, govern collection, dissemination, use and confidentiality of patient-identifiable health information, including:

|

|

|

|

|

|

|

|

|

|

|

|

HIPAA establishes elements including, but not limited to, federal privacy and security standards for the use and protection of Protected Health Information. Any failure by us or by our personnel or partners to comply with applicable requirements may result in a material liability to us.

Although we have systems and policies in place for safeguarding Protected Health Information from unauthorized disclosure, these systems and policies may not preclude claims against us for alleged violations of applicable requirements. Also, third party sites and/or links that consumers may access through our web sites may not maintain adequate systems to safeguard this information, or may circumvent systems and policies we have put in place. In addition, future laws or changes in current laws may necessitate costly adaptations to our policies, procedures, or systems.

There can be no assurance that we will not be subject to product liability claims, that such claims will not result in liability in excess of our insurance coverage, that our insurance will cover such claims or that appropriate insurance will continue to be available to us in the future at commercially reasonable rates. Such product liability claims could adversely affect our business, results of operations and financial condition.

We are subject to the effect of payor and provider conduct which we cannot control and accordingly, there is no assurance that revenues for our services will continue at historic levels. We offer certain electronic claims submission products and services as part of our product line. While we have implemented certain product features designed to maximize the accuracy and completeness of claims submissions, these features may not be sufficient to prevent inaccurate claims data from being submitted to payors. Should inaccurate claims data be submitted to payors, we may be subject to liability claims.

Electronic data transmission services are offered by certain payors to healthcare providers that establish a direct link between the provider and payor. This process reduces revenue to third party EDI service providers such as us. As a result of this, or other market factors, we are unable to ensure that we will continue to generate revenue at or in excess of prior levels for such services.

A significant increase in the utilization of direct links between healthcare providers and payors could adversely affect our transaction volume and financial results. In addition, we cannot provide assurance that we will be able to maintain our existing links to payors or develop new connections on terms that are economically satisfactory to us, if at all.

via the Internet. On an increasingly frequent basis, federal and state legislators are proposing laws and regulations that apply to Internet commerce and communications. Areas being affected by these regulations include user privacy, pricing, content, taxation, copyright protection, distribution, and quality of products and services. To the extent that our products and services are subject to these laws and regulations, the sale of our products and services could be harmed. 17InRecently enacted public laws reforming the past,U.S. healthcare system may have an impact on our business. The Patient Protection and Affordable Care Act (H.R. 3590; Public Law 111-148) (“PPACA”) and The Health Care and Education Reconciliation Act of 2010 (H.R. 4872) (the “Reconciliation Act”), which amends the PPACA (collectively the “Health Reform Laws”), were signed into law in March 2010. The Health Reform Laws contain various provisions which may impact us and our customers. Some of these provisions may have a positive impact, by expanding the use of electronic health records in certain federal programs, for example, while others, such as reductions in reimbursement for certain types of providers, may have a negative impact due to fewer available resources. Increases in fraud and abuse penalties may also adversely affect participants in the health care sector, including us.system including proposals which may change governmental involvement in healthcare and reimbursement rates, and otherwise alter the operating environment for us and our clients.system. Healthcare providers may react to these proposals, and the uncertainty surrounding such proposals, by curtailing or deferring investments, including those for our systems and related services. Cost-containment measures instituted by healthcare providers as a result of regulatory reform or otherwise could result in a reduction in the allocation of capital funds. Such a reduction could have an adverse effect on our ability to sell our systems and related services. On the other hand, changes in the regulatory environment have increased and may continue to increase the needs of healthcare organizations for cost-effective data management and thereby enhance the overall market for healthcare management information systems. We cannot predict what effect, if any, such proposals or healthcare reforms might have on our business, financial condition and results of operations.In addition, developmentsIn addition, our

price.

| • | the size and timing of orders from clients; | ||

| • | the specific mix of software, hardware and services in client orders; | ||

| • | the length of sales cycles and installation processes; | ||

| • | the ability of our clients to obtain financing for the purchase of our products; | ||

| • | changes in pricing policies or price reductions by us or our competitors; | ||

| • | the timing of new product announcements and product introductions by us or our competitors; | ||

| • | changes in revenue recognition or other accounting guidelines employed by us and/or established by the Financial Accounting Standards Board or other rule-making bodies; | ||

| • | accounting policies concerning the timing of the recognition of revenue; | ||

| • | the availability and cost of system components; | ||

| • | the financial stability of clients; | ||

| • | market acceptance of new products, applications and product enhancements; | ||

| • | our ability to develop, introduce and market new products, applications and product enhancements; | ||

| • | our success in expanding our sales and marketing programs; | ||

| • | deferrals of client orders in anticipation of new products, applications, product enhancements, or public/private sector initiatives; | ||

| • | execution of or changes to our strategy; | ||

| • | personnel changes; and | ||

| • | general market/economic factors. |

18

Our future policy concerning stock splits is uncertain. While we effectedcycle for our systems can vary significantly and typically ranges from six to twenty four months from initial contact to contract execution/shipment.

| • | actual or anticipated quarterly variations in operating results; | ||

| • | rumors about our performance, software solutions, or merger and acquisition activity; | ||

| • | changes in expectations of future financial performance or changes in estimates of securities analysts; | ||

| • | governmental regulatory action; | ||

| • | health care reform measures; | ||

| • | client relationship developments; | ||

| • | purchases or sales of company stock; | ||

| • | activities by one or more of our major shareholders concerning our policies and operations; | ||

| • | changes occurring in the markets in general; | ||

| • | macroeconomic conditions, both nationally and internationally; and | ||

| • | other factors, many of which are beyond our control. |

19

|

We lease approximately 78,000 square feet of space for the principal office of our NextGen Division in Horsham, Pennsylvania. This lease expires in March 2011. In January 2007, we executed a new lease for approximately 35,000 square feet of space for the NextGen Division in Atlanta, Georgia. This lease expires in October 2011. In May 2006, we executed a lease for approximately 3,000 square feet of space in Dallas, Texas for NextGen staff and a new NextGen training facility. In addition, we lease approximately 6,000 square feet of space in Santa Ana, California, to house our assembly and warehouse operations of the QSI Division. We also have an aggregate of approximately 3,000 square feet of space in Minnesota, Utah, Wisconsin, and Washington to house additional sales, training, development and service operations. These leases, excluding options, have expiration dates ranging from month-to-month to October 2011.California. Should we continue to grow, we may be required to lease additional space. We believe that suitable additional or substitute space is available, if needed, at market rates.

As a result of our acquisition of PMP on October 28, 2008, we lease approximately 40,500 square feet for our PMP operations in Hunt Valley, Maryland under various leases which will expire in July 2010.

| Square Feet | |||

| QSI Dental Division | ||||

| Irvine, California — Corporate Headquarters | 34,800 | |||

| NextGen Division | ||||

| Horsham, Pennsylvania | 98,000 | |||

| Atlanta, Georgia | 35,000 | |||

| Inpatient Solutions Division | ||||

| Austin, Texas | 39,000 | |||

| Irvine, California | 4,200 | |||

| Practice Solutions Division | ||||

| St. Louis, Missouri | 67,000 | |||

| Hunt Valley, Maryland | 33,000 | |||

| Other U.S. locations | 10,000 | |||

| Total leased properties | 321,000 | |||

|

No matter was submitted

20

|

|

Market Price and Holders

|

|

|

|

|

|

|

|

|

Quarter Ended |

| High |

| Low |

| |||

|

|

|

| |||||

|

|

|

|

|

|

|

| |

June 30, 2007 |

| $ | 42.44 |

| $ | 36.96 |

| |

September 30, 2007 |

| $ | 45.35 |

| $ | 32.37 |

| |

December 31, 2007 |

| $ | 38.99 |

| $ | 26.08 |

| |

March 31, 2008 |

| $ | 36.30 |

| $ | 26.90 |

| |

June 30, 2008 |

| $ | 35.97 |

| $ | 29.00 |

| |

September 30, 2008 |

| $ | 47.94 |

| $ | 27.34 |

| |

December 31, 2008 |

| $ | 44.98 |

| $ | 25.70 |

| |

March 31, 2009 |

| $ | 48.46 |

| $ | 34.26 |

| |

Market:

| High | Low | |||||||

| Three Months Ended | ||||||||

| June 30, 2009 | $ | 62.00 | $ | 43.44 | ||||

| September 30, 2009 | $ | 64.16 | $ | 50.87 | ||||

| December 31, 2009 | $ | 65.98 | $ | 57.63 | ||||

| March 31, 2010 | $ | 68.59 | $ | 51.30 | ||||

| June 30, 2010 | $ | 68.89 | $ | 53.86 | ||||

| September 30, 2010 | $ | 67.27 | $ | 52.90 | ||||

| December 31, 2010 | $ | 71.81 | $ | 58.35 | ||||

| March 31, 2011 | $ | 83.68 | $ | 69.33 | ||||

On May 27, 2009, our Board approved a quarterly cash dividend of $0.30 per share on our outstanding shares of common stock, payable to shareholders of record as of June 12, 2009 with an expected distribution date on or about July 6, 2009.

On January 28, 2009, our Board approved a quarterly cash dividend of $0.30 per share on our outstanding shares of common stock, payable to shareholders of record as of March 11, 2009 with a distribution date on or about April 3, 2009.

On October 30, 2008, our Board approved a quarterly cash dividend of $0.30 per share on our outstanding shares of common stock, payable to shareholders of record as of December 15, 2008 with a distribution date on or about January 5, 2009.

On August 4, 2008, our Board approved a quarterly cash dividend of $0.30 per share on our outstanding shares of common stock, payable to shareholders of record as of September 15, 2008 with a distribution date on or about October 1, 2008.

On May 29, 2008, our Board approved a quarterly cash dividend of $0.25 per share on our outstanding shares of common stock, payable to shareholders of record as of June 15, 2008 with a distribution date on or about July 2, 2008.

On January 30, 2008, our Board approved a quarterly cash dividend of $0.25 per share on our outstanding shares of common stock, payable to shareholders of record as of March 14, 2008 and was distributed to shareholders on or about April 7, 2008.

On October 25, 2007, our Board approved a quarterly cash dividend of $0.25 per share on our outstanding shares of common stock, payable to shareholders of record as of December 14, 2007 and was distributed to shareholders on or about January 7, 2008.

On July 31, 2007, our Board approved a quarterly cash dividend of $0.25 per share on our outstanding shares of common stock, payable to shareholders of record as of September 14, 2007 and was distributed to shareholders on or about October 5, 2007.

On May 31, 2007, our Board declared a quarterly cash dividend of $0.25 per share on our outstanding shares of common stock, payable to shareholders of record as of June 15, 2007 and was distributed to shareholders on July 5, 2007.

In February 2007, we paid a $1.00 per share cash dividend on shares of our common stock. The record date for the dividend was February 13, 2007.

In January 2007, our Board of Directors adopted a policy whereby we intend to pay a regular quarterly dividend of $0.25 per share on our outstanding common stock commencing with conclusion of our first fiscal quarter of 2008 (June 30, 2007) and continuing each fiscal quarter thereafter,Common Stock, subject to further Board review and approval and establishment of record and distribution dates by our Board of Directors prior to the declaration of each such quarterly dividend. In August 2008, ourOur Board of Directors increased the quarterly dividend to $0.30 per share.share in August 2008 and to $0.35 per share in January 2011. We anticipate that future quarterly dividends, if and when declared by our Board of Directors pursuant to this policy, would likely be distributable on or about the fifth day of each of the months of October, January, April and July.

| Per Share | ||||||||

| Declaration Date | Record Date | Payment Date | Dividend | |||||

| May 26, 2010 | June 17, 2010 | July 6, 2010 | $ | 0.30 | ||||

| July 28, 2010 | September 17, 2010 | October 5, 2010 | 0.30 | |||||

| October 25, 2010 | December 17, 2010 | January 5, 2011 | 0.30 | |||||

| January 26, 2011 | March 17, 2011 | April 5, 2011 | 0.35 | |||||

| Fiscal year 2011 | $ | 1.25 | ||||||

| May 27, 2009 | June 12, 2009 | July 6, 2009 | $ | 0.30 | ||||

| July 23, 2009 | September 25, 2009 | October 5, 2009 | 0.30 | |||||

| October 28, 2009 | December 23, 2009 | January 5, 2010 | 0.30 | |||||

| January 27, 2010 | March 23, 2010 | April 5, 2010 | 0.30 | |||||

| Fiscal year 2010 | $ | 1.20 | ||||||

| May 29, 2008 | June 15, 2008 | July 2, 2008 | $ | 0.25 | ||||

| August 4, 2008 | September 15, 2008 | October 1, 2008 | 0.30 | |||||

| October 30, 2008 | December 15, 2008 | January 5, 2009 | 0.30 | |||||

| January 28, 2009 | March 11, 2009 | April 3, 2009 | 0.30 | |||||

| Fiscal year 2009 | $ | 1.15 | ||||||

21

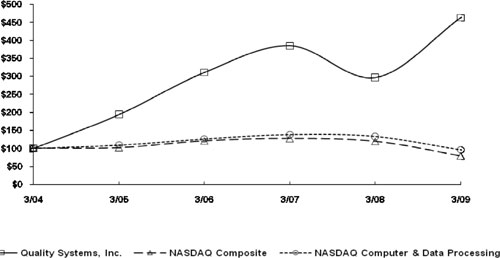

Among Quality Systems, Inc., The NASDAQ Composite Index

And The NASDAQ Computer & Data Processing Index

| * |

| $100 invested on 3/31/ |

Fiscal year ending March 31. |

22

|

(In thousands, except per share data)

| Fiscal Year Ended March 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Statements of Income Data: | ||||||||||||||||||||

| Revenue | $ | 353,363 | $ | 291,811 | $ | 245,515 | $ | 186,500 | $ | 157,165 | ||||||||||

| Cost of revenue | 127,482 | 110,807 | 88,890 | 62,501 | 50,784 | |||||||||||||||

| Gross profit | 225,881 | 181,004 | 156,625 | 123,999 | 106,381 | |||||||||||||||

| Selling, general and administrative | 108,310 | 86,951 | 69,410 | 53,260 | 45,337 | |||||||||||||||

| Research and development costs | 21,797 | 16,546 | 13,777 | 11,350 | 10,166 | |||||||||||||||

| Amortization of acquired intangible assets | 1,682 | 1,783 | 1,035 | — | — | |||||||||||||||

| Income from operations | 94,092 | 75,724 | 72,403 | 59,389 | 50,878 | |||||||||||||||

| Interest income | 263 | 226 | 1,203 | 2,661 | 3,306 | |||||||||||||||

| Other income (expense), net | 61 | 268 | (279 | ) | 953 | — | ||||||||||||||

| Income before provision for income taxes | 94,416 | 76,218 | 73,327 | 63,003 | 54,184 | |||||||||||||||

| Provision for income taxes | 32,810 | 27,839 | 27,208 | 22,925 | 20,952 | |||||||||||||||

| Net income | $ | 61,606 | $ | 48,379 | $ | 46,119 | $ | 40,078 | $ | 33,232 | ||||||||||

| Basic net income per share | $ | 2.13 | $ | 1.69 | $ | 1.65 | $ | 1.47 | $ | 1.24 | ||||||||||

| Diluted net income per share | $ | 2.12 | $ | 1.68 | $ | 1.62 | $ | 1.44 | $ | 1.21 | ||||||||||

| Basic weighted average shares outstanding | 28,947 | 28,635 | 28,031 | 27,298 | 26,882 | |||||||||||||||

| Diluted weighted average shares outstanding | 29,118 | 28,796 | 28,396 | 27,770 | 27,550 | |||||||||||||||

| Dividends declared per common share | $ | 1.25 | $ | 1.20 | $ | 1.15 | $ | 1.00 | $ | 1.00 | ||||||||||

| March 31, | March 31, | March 31, | March 31, | March 31, | ||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||

| Cash and cash equivalents | $ | 116,617 | $ | 84,611 | $ | 70,180 | $ | 59,046 | $ | 60,028 | ||||||||||

| Working capital | $ | 145,758 | $ | 118,935 | $ | 98,980 | $ | 79,932 | $ | 76,616 | ||||||||||

| Total assets | $ | 378,686 | $ | 310,180 | $ | 242,101 | $ | 187,908 | $ | 150,681 | ||||||||||

| Total liabilities | $ | 154,016 | $ | 121,891 | $ | 86,534 | $ | 74,203 | $ | 59,435 | ||||||||||

| Total shareholders’ equity | $ | 224,670 | $ | 188,289 | $ | 155,567 | $ | 113,705 | $ | 91,246 | ||||||||||

23

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year ended March 31, |

| |||||||||||||

|

| 2009 |

| 2008 |

| 2007 |

| 2006 |

| 2005 |

| |||||

|

| |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Statements of Income Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

| $ | 245,515 |

| $ | 186,500 |

| $ | 157,165 |

| $ | 119,287 |

| $ | 88,961 |

|

Cost of revenue |

|

| 88,890 |

|

| 62,501 |

|

| 50,784 |

|

| 39,828 |

|

| 32,669 |

|

|

|

| ||||||||||||||

Gross profit |

|

| 156,625 |

|

| 123,999 |

|

| 106,381 |

|

| 79,459 |

|

| 56,292 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

| 70,445 |

|

| 53,260 |

|

| 45,337 |

|

| 35,554 |

|

| 24,776 |

|

Research and development costs |

|

| 13,777 |

|

| 11,350 |

|

| 10,166 |

|

| 8,087 |

|

| 6,903 |

|

|

|

| ||||||||||||||

Income from operations |

|

| 72,403 |

|

| 59,389 |

|

| 50,878 |

|

| 35,818 |

|

| 24,613 |

|

Interest income |

|

| 1,203 |

|

| 2,661 |

|

| 3,306 |

|

| 2,108 |

|

| 876 |

|

Other income (expense) |

|

| (279 | ) |

| 953 |

|

| — |

|

| — |

|

| — |

|

|

|

| ||||||||||||||

Income before provision for income taxes |

|

| 73,327 |

|

| 63,003 |

|

| 54,184 |

|

| 37,926 |

|

| 25,489 |

|

Provision for income taxes |

|

| 27,208 |

|

| 22,925 |

|

| 20,952 |

|

| 14,604 |

|

| 9,380 |

|

|

|

| ||||||||||||||

Net income |

| $ | 46,119 |

| $ | 40,078 |

| $ | 33,232 |

| $ | 23,322 |

| $ | 16,109 |

|

|

|

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per share |

| $ | 1.65 |

| $ | 1.47 |

| $ | 1.24 |

| $ | 0.88 |

| $ | 0.63 |

|

Diluted net income per share |

| $ | 1.62 |

| $ | 1.44 |

| $ | 1.21 |

| $ | 0.85 |

| $ | 0.61 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average shares outstanding |

|

| 28,031 |

|

| 27,298 |

|

| 26,882 |

|

| 26,413 |

|

| 25,744 |

|

Diluted weighted average shares outstanding |

|

| 28,396 |

|

| 27,770 |

|

| 27,550 |

|

| 27,356 |

|

| 26,406 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data (at end of year): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

| $ | 70,180 |

| $ | 59,046 |

| $ | 60,028 |

| $ | 57,255 |

| $ | 51,157 |

|

Working capital |

| $ | 98,980 |

| $ | 79,932 |

| $ | 76,616 |

| $ | 61,724 |

| $ | 55,111 |

|

Total assets |

| $ | 242,101 |

| $ | 187,908 |

| $ | 150,681 |

| $ | 122,247 |

| $ | 99,442 |

|

Total liabilities |

| $ | 86,534 |

| $ | 74,203 |

| $ | 59,435 |

| $ | 49,838 |

| $ | 36,711 |

|

Total shareholders’ equity |

| $ | 155,567 |

| $ | 113,705 |

| $ | 91,246 |

| $ | 72,409 |

| $ | 62,731 |

|

|

| • | |||

| Management Overview.This section provides a general description of our Company and operating segments, a discussion as to how we derive our revenue, background information on certain trends and developments affecting our Company, a summary of our acquisition transactions and a discussion on management’s strategy for driving revenue growth. | ||

• | Critical Accounting Policies and Estimates.This section discusses those accounting policies that are considered important to the evaluation and reporting of our financial condition and results of operations, and whose application requires us to exercise subjective or complex judgments in making estimates and assumptions. In addition, all of our significant accounting policies, including our critical accounting policies, are summarized in Note 2, “Summary of Significant Accounting Policies,” of our notes to | ||

• | Company Overview.This section provides a more detailed description of our Company, operating segments, products and services offered. | ||

| • | Overview of Results of Operations and Results of Operations by Operating Divisions.These sections provide our analysis and outlook for the significant line items on our consolidated statements of | ||

• | Liquidity and Capital Resources.This section provides an analysis of our liquidity and cash flows and discussions of our contractual obligations and commitments as of March 31, | ||

• |

24

Our Company

The turbulence in the worldwide economy has impacted almost all industries. While healthcare is not immune to economic cycles, we believe it is more resilient than most segments of the economy. The impact of the current economic conditions on our existing and prospective clients has been mixed. We continue to see organizations that are doing fairly well operationally, however, some organizations with a large dependency on Medicaid populations are being impacted by the challenging financial condition of the many state governments in whose

jurisdictions they conduct business. A positive factor for U.S. healthcare is the fact that the Obama administration is pursuing broad healthcare reform aimed at improving issues surrounding healthcare. The ARRA, which became law on February 17, 2009, includes more than $20 billion to help healthcare organizations modernize operations through the acquisition of health careclinical information technology. While we are unsure of the immediate impact from the ARRA, the long-term potential could be significant.

operations.

services and continuing our gold-standard commitment of service in support of our client satisfaction programs.

25

Revenue Recognition. We currently recognize system sales revenue pursuant to SOP 97-2, as amended by SOP 98-9. We generate revenue from the sale of licensing rights to use our software products sold directly to end-users and value-added resellers, or VARs. We also generate revenue from sales of hardware and third party software, implementation, training, software customization, EDI, post-contract support (maintenance) and other services, including RCM services, performed for customers who license our products.

A typical system contract contains multiple elements of the above items. SOP 97-2, as amended, requires revenue earned on software arrangements involving multiple elements to be allocated to each element based on the relative fair values of those elements. The fair value of an element must be based on vendor specific objective evidence (“VSOE”). We limit our assessment of VSOE for each element to either the price charged when the same element is sold separately or the price established by management having the relevant authority to do so, for an element not yet sold separately. VSOE calculations are updated and reviewed at the end of each quarter or annually depending on the nature of the product or service. We have

established VSOE for the related undelivered elements based on the bell-shaped curve method. Maintenance VSOE for our largest customers is based on stated renewal rates only if the rate is determined to be substantive and falls within our customary pricing practices.

When evidence of fair value exists for the undelivered elements only, the residual method, provided for under SOP 98-9, is used. Under the residual method, we defer revenue related to the undelivered elements in a system sale based on VSOE of fair value of each of the undelivered elements, and allocate the remainder of the contract price net of all discounts to revenue recognized from the delivered elements. Undelivered elements of a system sale may include implementation and training services, hardware and third party software, maintenance, future purchase discounts, or other services. If VSOE of fair value of any undelivered element does not exist, all revenue is deferred until VSOE of fair value of the undelivered element is established or the element has been delivered.

We bill for the entire system sales contract amount upon contract execution, except for maintenance which is billed separately. Amounts billed in excess of the amounts contractually due are recorded in accounts receivable as advance billings. Amounts are contractually due when services are performed or in accordance with contractually specified payment dates. Provided the fees are fixed and determinable and collection is considered probable, revenue from licensing rights and sales of hardware and third party software is generally recognized upon shipment and transfer of title. In certain transactions whose collections risk is high, the cash basis method is used to recognize revenue. If the fee is not fixed or determinable, then the revenue recognized in each period (subject to application of other revenue recognition criteria) will be the lesser of the aggregate of amounts due and payable or the amount of the arrangement fee that would have been recognized if the fees were being recognized using the residual method. Fees which are considered fixed or determinable at the inception of our arrangements must include the following characteristics:

Revenue Recognition | Judgments and Uncertainties | |

| ||

| We generate revenue from the sale of licensing rights to use our software products sold directly to end-users and value-added resellers, or VARs. We also generate revenue from sales of hardware and third party software, implementation, training, software customization, EDI, post-contract support (maintenance) and other services, including RCM services, performed for clients who license our products. Revenue from implementation and training services is recognized as the corresponding services are performed. Maintenance revenue is recognized ratably over the contractual maintenance period. RCM revenue is derived from services fees, which include amounts charged for ongoing billing and other related services and are generally billed to the client as a percentage of total collections. We do not recognize revenue for services fees until these collections are made as the services fees are not fixed or determinable until such time. | A typical system contract contains multiple elements of the above items. FASB ASC Topic 985-605-25,Software, Revenue Recognition, Multiple Elements,or ASC 985-605-25, requires revenue earned on software arrangements involving multiple elements to be allocated to each element based on the relative fair values of those elements. The fair value of an element must be based on vendor specific objective evidence (“VSOE”). We limit our assessment of VSOE for each element to either the price charged when the same element is sold separately or the price established by management having the relevant authority to do so, for an element not yet sold separately. VSOE calculations are updated and reviewed at the end of each quarter or annually depending on the nature of the product or service. We have established VSOE for the related undelivered elements based on the bell-shaped curve method. Maintenance VSOE for our largest clients is based on stated renewal rates only if the rate is determined to be substantive and falls within our customary pricing practices. When evidence of fair value exists for the undelivered elements only, the residual method, provided for under ASC 985-605, is used. Under the residual method, we defer revenue related to the undelivered elements in a system sale based on VSOE of fair value of each of the undelivered elements and allocate the remainder of the contract price net of all discounts to revenue recognized from the delivered elements. Undelivered elements of a system sale may include implementation and training services, hardware and third party software, maintenance, future purchase discounts, or other services. If VSOE of fair value of any undelivered element does not exist, all revenue is deferred until VSOE of fair value of the undelivered element is established or the element has been delivered. We bill for the entire system sales contract amount upon contract execution, except for maintenance which is billed separately. Amounts billed in excess of the amounts contractually due are recorded in accounts receivable as advance billings. Amounts are contractually due when services are performed or in accordance with contractually specified payment dates. Provided the fees are fixed or determinable and collection is considered probable, revenue from licensing rights and sales of hardware and third party software is generally recognized upon shipment and transfer of title. In certain transactions whose collections risk is high, the cash basis method is used to recognize revenue. If the fee is not fixed or determinable, then the revenue recognized in each period (subject to application of other revenue recognition criteria) will be the lesser of the aggregate of amounts due and payable or the amount of the arrangement fee that would have been recognized if the fees were being recognized using the residual method. Fees which are considered fixed or determinable at the inception of our arrangements must include the following characteristics: | |

§The fee must be negotiated at the outset of an arrangement and generally be based on the specific volume of products to be delivered without being subject to change based on variable pricing mechanisms such as the number of units copied or distributed or the expected number of users; and | ||

| §Payment terms must not be considered extended. If a significant portion of the fee is due more than 12 months after delivery or after the expiration of the license, the fee is presumed not fixed |

Revenue from implementation and training services is recognized as the corresponding services are performed. Maintenance revenue is recognized ratably over the contractual maintenance period.

Contract accounting is applied where services include significant software modification, development or customization. In such instances, the arrangement fee is accounted for in accordance with SOP 81-1 “Accounting for Performance of Construction-Type and Certain Production-Type Contracts.”

Pursuant to SOP 81-1, we use the percentage of completion method provided all of the following conditions exist:

|

| |

| Effect if Actual Results Differ from Assumptions | ||

| Although we believe that |

26

Allowance for Doubtful Accounts | Judgments and Uncertainties | |

| We maintain allowances for doubtful accounts for estimated losses resulting from the | Specific reserves are based on management’s estimate of the probability of collection for certain troubled accounts. General reserves are established based on our historical experience of bad debt expense and the aging of our accounts receivable balances net of deferred revenue and specifically reserved accounts. If the financial condition of our clients were to deteriorate resulting in an impairment of their ability to make payments, additional allowances would be required. Effect if Actual Results Differ from Assumptions Although we believe that our approach to estimates and judgments as described herein is reasonable, actual results could differ and we may be exposed to increases or | |

Software Development Costs | Judgments and Uncertainties | |

Development costs incurred in the research and development of new software products and enhancements to existing software products for external use are expensed as incurred until technological feasibility has been established. After technological feasibility is established, any additional external software development costs are capitalized in accordance with FASB ASC Topic 985-20,Software, Costs of Computer Software to be | We perform an annual review of the estimated economic life and Effect if Actual Results Differ from Assumptions Although we believe that our approach to estimates and judgments as described herein is reasonable, actual results could differ and we may be exposed to increases or decreases in revenue that could be material. | |

Goodwill | Judgments and Uncertainties | |