Washington, D.C. 20549

FORM 10-K

| ☒ | |||||||||

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||

For the fiscal year ended December 31, 20212023 or

| ☐ | |||||||||

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||

For the transition period from to

Commission file number: 001-31465

NATURAL RESOURCE PARTNERS LP | ||||||||||||||||||||||

(Exact name of registrant as specified in its charter) | ||||||||||||||||||||||

Delaware | 35-2164875 | |||||||

(State or other jurisdiction of | (I.R.S. Employer | |||||||

1415 Louisiana Street, Suite 3400

Houston, Texas 77002

(Address of principal executive offices)

(Zip Code)

(713) 751-7507

(Registrant’sRegistrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Units representing limited partner interests | NRP | New York Stock Exchange | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act:

NoneIndicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

☐ No ☒Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

☐ No ☒Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

☒ No ☐Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

☒ No ☐Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of "accelerated filer", "large accelerated filer", "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ☐ | Accelerated Filer | ☒ | ||||||||||

Non-accelerated Filer | ☐ | Smaller Reporting Company | |||||||||||

Emerging Growth Company | ☐ | ||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report

☒If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes

☐ No ☒The aggregate market value of the common units held by non-affiliates of the registrant on June 30, 2021, w

Documents incorporated by reference:

None.REGARDING FORWARD-LOOKING STATEMENTS

Statements included in this 10-K may constitute forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements which are also forward-looking statements. Such forward-looking statements include, among other things, statements regarding: the effects of the global COVID-19 pandemic;future distributions on our common and preferred units; our business strategy; our liquidity and access to capital and financing sources; our financial strategy; prices of and demand for coal, trona and soda ash, and other natural resources; estimated revenues, expenses and results of operations; projected production levels by our lessees; Sisecam Wyoming LLC’s ("Sisecam Wyoming's"), formerly known as Ciner Wyoming, trona mining and soda ash refinery operations; distributions from our soda ash joint venture; the impact of governmental policies, laws and regulations, as well as regulatory and legal proceedings involving us, and of scheduled or potential regulatory or legal changes; and global and U.S. economic conditions.

These forward-looking statements speak only as of the date hereof and are made based upon our current plans, expectations, estimates, assumptions and beliefs concerning future events impacting us and involve a number of risks and uncertainties. We caution that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements. You should not put undue reliance on any forward-looking statements. See "

Item 1A. Risk Factors" in this Annual Report on Form 10-K for important factors that could cause our actual results of operations or our actual financial condition to differ.We are subject to a variety of risks and uncertainties, including risks related to our business, risks related to our indebtedness, risks related to our common stockunits and certain general risks, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. Risks that we deem material are described under “

Risks Related to Our Business

• | Cash distributions are not guaranteed and may fluctuate with our performance and the establishment of financial reserves. In addition, our debt agreements and our partnership agreement place restrictions on our ability to pay, and in some cases raise, the quarterly distribution under certain circumstances. |

• | Our leverage and debt service obligations may adversely affect our financial condition, results of operations and business prospects. |

| • | Global pandemics, including the COVID-19 pandemic, have in the past and may continue to adversely affect our business. |

• | Prices for both metallurgical and thermal coal are volatile and depend on a number of factors beyond our control. Declines in prices could have a material adverse effect on our business and results of operations. |

• | Prices for soda ash are volatile. Any substantial or extended decline in soda ash prices could have an adverse effect on Sisecam Wyoming’s ability to continue to make distributions to us. |

• | We derive a large percentage of our revenues and other income from a small number of coal lessees. |

• | Bankruptcies in the coal industry, and/or the idling or closure of mines on our properties could have a material adverse effect on our business and results of operations. |

• | Mining operations are subject to operating risks that could result in lower revenues to us. |

• | The adoption of climate change legislation and regulations restricting emissions of greenhouse gases and other hazardous air pollutants have resulted in changes in fuel consumption patterns by electric power generators and a corresponding decrease in coal production by our lessees and reduced coal-related revenues. |

• | Concerns about the environmental impacts of coal combustion, including perceived impacts on global climate issues, are also resulting in unfavorable lending and investment policies by institutions and insurance companies which could significantly affect our ability to raise capital or maintain current insurance levels. |

| • | Increased attention to climate change, environmental, social and governance ("ESG") matters and conservation measures may adversely impact our business. |

• | In addition to climate change and other Clean Air Act legislation, our businesses are subject to numerous other federal, state and local laws and regulations that may limit production from our properties and our profitability. |

• | If our lessees do not manage their operations well, their production volumes and our royalty revenues could decrease. |

• | We have limited approval rights with respect to the management of our Sisecam Wyoming soda ash joint venture, including with respect to cash distributions and capital expenditures. In addition, we are exposed to operating risks that we do not experience in the royalty business through our soda ash joint venture and through our ownership of certain coal transportation assets. |

| • | Sisecam Wyoming's deca stockpiles will substantially deplete by 2024, and its production rates will decline if Sisecam Wyoming does not make further investments or otherwise execute on one or more initiatives to prevent such decline. |

• | Fluctuations in transportation costs and the availability or reliability of transportation could reduce the production of coal, soda ash and other minerals from our properties. |

• | Our lessees could satisfy obligations to their customers with minerals from properties other than ours, depriving us of the ability to receive amounts in excess of minimum royalty payments. |

• | A lessee may incorrectly report royalty revenues, which might not be identified by our lessee audit process or our mine inspection process or, if identified, might be identified in a subsequent period. |

Risks Related to Our Structure

• | Unitholders may not be able to remove our general partner even if they wish to do so. |

• | The preferred units are senior in right of distributions and liquidation and upon conversion, would result in the issuance of additional common units in the future, which could result in substantial dilution of our common unitholders’ ownership interests. |

• | We may issue additional common units or preferred units without common unitholder approval, which would dilute a unitholder’s existing ownership interests. |

• | Our general partner has a limited call right that may require unitholders to sell their units at an undesirable time or price. |

• | Cost reimbursements due to our general partner may be substantial and will reduce our cash available for distribution to unitholders. |

• | Conflicts of interest could arise among our general partner and us or the unitholders. |

• | The control of our general partner may be transferred to a third party without unitholder consent. A change of control may result in defaults under certain of our debt instruments and the triggering of payment obligations under compensation arrangements. |

• | Unitholders may not have limited liability if a court finds that unitholder actions constitute control of our business. |

Tax Risks to Common Unitholders

• | Our tax treatment depends on our status as a partnership for U.S. federal income tax purposes as well as our not being subject to a material amount of entity-level taxation by individual states. If the Internal Revenue Service ("IRS") were to treat us as a corporation for U.S. federal income tax purposes or we were to become subject to material additional amounts of entity-level taxation for state tax purposes, then our cash available for distribution to unitholders would be substantially reduced. |

• | The tax treatment of publicly traded partnerships or an investment in our units could be subject to potential legislative, judicial or administrative changes or differing interpretations, possibly applied on a retroactive basis. |

• | Certain U.S. federal income tax preferences currently available with respect to coal exploration and development may be eliminated as a result of future legislation. |

• | Our unitholders are required to pay taxes on their share of our taxable income even if they do not receive any cash distributions from us. Our unitholders' share of our portfolio income may be taxable to them even though they receive other losses from our activities. |

• | We may engage in transactions to reduce our indebtedness and manage our liquidity that generate taxable income (including income and gain from the sale of properties and cancellation of indebtedness income) allocable to our unitholders, and income tax liabilities arising therefrom may exceed any distributions made with respect to their units. |

• | If the IRS contests the U.S. federal income tax positions we take, the market for our units may be adversely impacted and the cost of any IRS contest will reduce our cash available for distribution to our unitholders. |

• | If the IRS makes audit adjustments to our income tax returns, it (and some states) may assess and collect any taxes (including any applicable penalties and interest) resulting from such audit adjustments directly from us, in which case our cash available for distribution to our unitholders might be substantially reduced. |

• | Tax gain or loss on the disposition of our common units could be more or less than expected. |

• | Our unitholders may be subject to limitation on their ability to deduct interest expense incurred by us. |

• | Tax-exempt entities face unique tax issues from owning our units that may result in adverse tax consequences to them. |

• | Non-U.S. unitholders will be subject to U.S. federal income taxes and withholding with respect to their income and gain from owning our units. |

• | We will treat each purchaser of our common units as having the same tax benefits without regard to the actual common units purchased. The IRS may challenge this treatment, which could adversely affect the value of the common units. |

• | We have adopted certain valuation methodologies in determining a unitholder’s allocations of income, gain, loss and deduction. The IRS may challenge these methodologies or the resulting allocations, and such a challenge could adversely affect the value of our common units. |

• | We generally prorate our items of income, gain, loss and deduction between transferors and transferees of our common units each month based upon the ownership of our common units on the first day of each month, instead of on the basis of the date a particular unit is transferred. The IRS may challenge this treatment, which could change the allocation of items of income, gain, loss and deduction among our unitholders. |

• | A unitholder whose units are the subject of a securities loan (e.g., a loan to a "short seller" to cover a short sale of units) may be considered as having disposed of those units. If so, such unitholder would no longer be treated for tax purposes as a partner with respect to those units during the period of the loan and may recognize gain or loss from the disposition. |

• | As a result of investing in our units, our unitholders are likely subject to state and local taxes and return filing requirements in jurisdictions where we operate or own or acquire property. |

General Risks

• | Our business is subject to cybersecurity risks. |

Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may have an adverse effect on our business, financial condition, results of operations, and cash flows.

As used in this Part I,Annual Report on Form 10-K, unless the context otherwise requires: "we," "our," "us" and the "Partnership" refer to Natural Resource Partners L.P. and, where the context requires, our subsidiaries. References to "NRP" and "Natural Resource Partners" refer to Natural Resource Partners L.P. only, and not to NRP (Operating) LLC or any of Natural Resource Partners L.P.’s subsidiaries. References to "Opco" refer to NRP (Operating) LLC, a wholly owned subsidiary of NRP, and its subsidiaries. NRP Finance Corporation ("NRP Finance") is a wholly owned subsidiary of NRP and was a co-issuer with NRP on the 9.125% senior notes due 2025 (the "2025 Senior Notes").

We are a publicly traded Delaware limited partnership formed in 2002. We own, manage and lease a diversified portfolio of mineral properties in the United States, including interests in coal and other natural resources and own a no

Our business is organized into two operating segments:

Mineral Rights (formerly named Coal Royalty and Other segment)

Soda Ash

—consists of our 49% non-controlling equity interest in Sisecam Wyoming, a trona ore mining and soda ash production business located in the Green River Basin of Wyoming. Sisecam Wyoming mines trona and processes it into soda ash that is sold both domestically and internationally into the glass and chemicals industries.Our operations are conducted through Opco and our operating assets are owned by our subsidiaries. NRP (GP) LP, our general partner (the "general partner" or "NRP GP"), has sole responsibility for conducting our business and for managing our operations. Because our general partner is a limited partnership, its general partner, GP Natural Resource Partners LLC (the "managing general partner"), conducts its business and operations and the Boardboard of Directorsdirectors and officers of GP Natural Resource Partners LLC make decisions on our behalf. Robertson Coal Management LLC ("RCM"), a limited liability company whollyindirectly owned by Corbin J. Robertson, Jr., owns all of the membership interest in GP Natural Resource Partners LLC. SubjectPursuant to the Board Representation and Observation Rights Agreement entered into in 2017 with certain entities controlled by funds affiliated with Blackstone Inc. (collectively referred to as "Blackstone") and affiliates of GoldenTree Asset Management LP (collectively referred to as "GoldenTree"), Mr. Robertson, Jr. isBlackstone was entitled to appoint one person to the board of directors of GP Natural Resource Partners LLC (the "Board of Directors"). However, in 2023, we repurchased all of Blackstone's preferred units, which were subsequently retired and no longer remain outstanding, and all rights of Blackstone related thereto ceased as a result. In connection with the repurchase, Blackstone's board designee resigned from the Board of Directors and all members of the Board of Directors of GP Natural Resource Partners LLC and has delegated the right to appoint one director to Blackstone.

The senior executives and other officers who manage NRP are employees of Western Pocahontas Properties Limited Partnership or Quintana Minerals Corporation, which are companies controlled by Mr. Robertson, Jr. These officers allocate varying percentages of their time to managing our operations. Neither our general partner, GP Natural Resource Partners LLC, nor any of their affiliates receive any management fee or other compensation in connection with the management of our business, but they are entitled to be reimbursed for all direct and indirect expenses incurred on our behalf.

We have regional offices through which we conduct our operations, the largest of which is located at 5260 Irwin Road, Huntington, West Virginia 25705 and the telephone number is (304) 522-5757. Our principal executive office is located at 12011415 Louisiana Street, Suite 3400,3325, Houston, Texas 77002 and our telephone number is (713) 751-7507.

Segment and Geographic Information

The amount of 20212023 revenues and other income from our two operating segments is shown below. For additional business segment information, please see "

| (In thousands) | Amount | % of Total | ||||||||||||||||||||||||

| Mineral Rights | $ | 194,493 | 90% | |||||||||||||||||||||||

| Soda Ash | 21,871 | 10% | ||||||||||||||||||||||||

| Total | $ | 216,364 | 100% | |||||||||||||||||||||||

(In thousands) | Amount | % of Total | ||||||

Mineral Rights | $ | 296,612 | 80 | % | ||||

Soda Ash | 73,397 | 20 | % | |||||

Total | $ | 370,009 | 100 | % | ||||

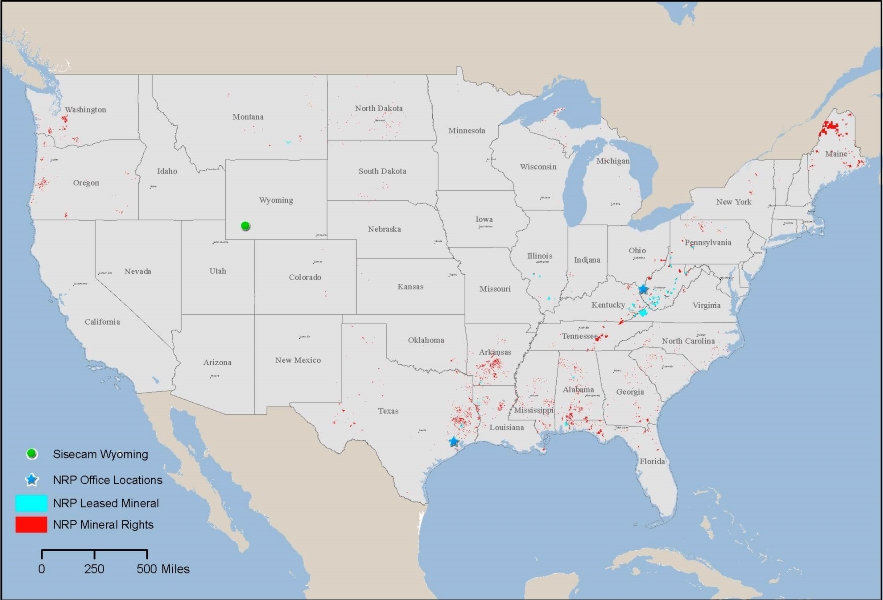

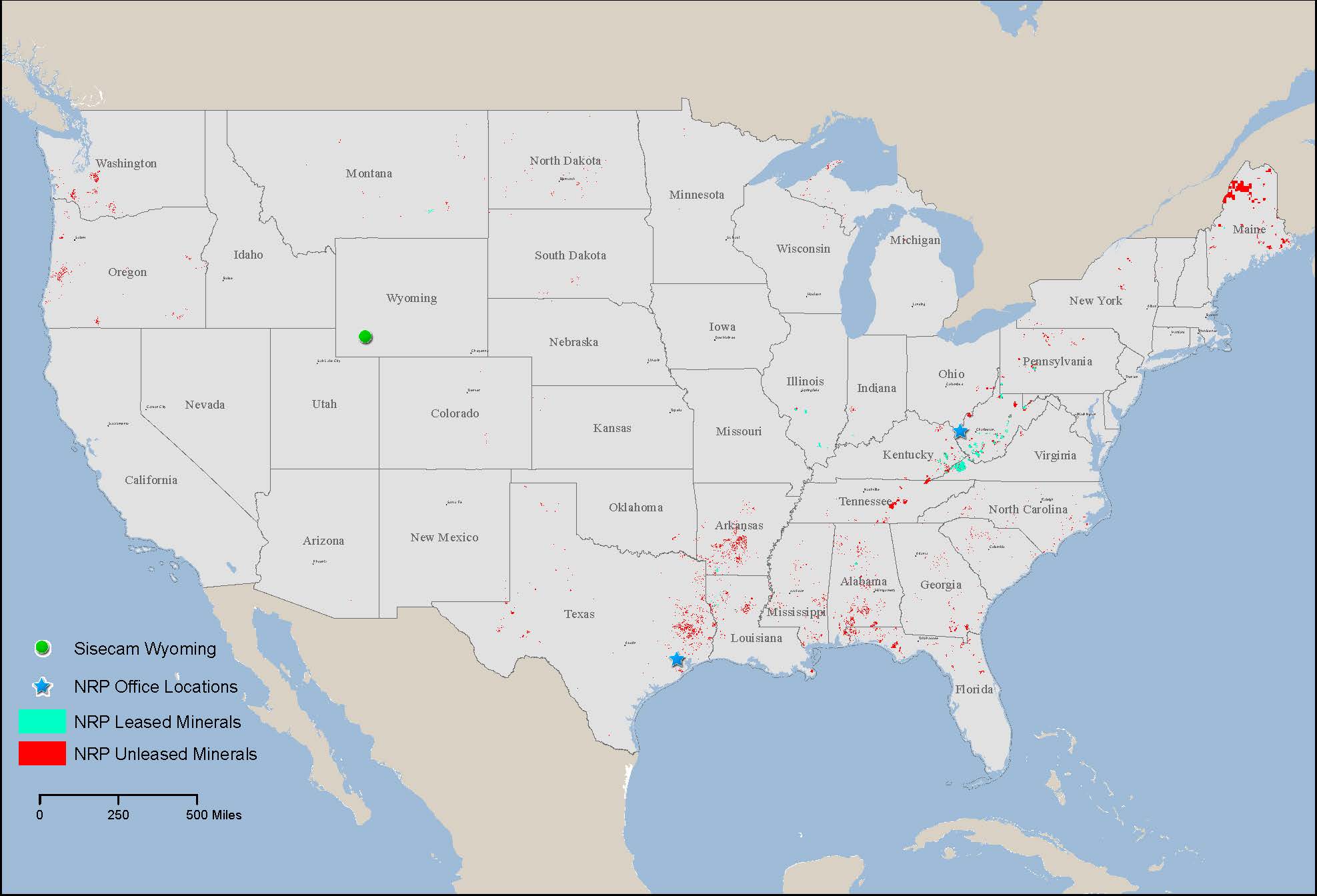

The following map shows the approximate geographic distribution of our ownership footprint:

Mineral Rights Segment

Mineral Rights

We do not mine, drill or produce minerals. Instead, we lease our acreage to companies engaged in the extraction of minerals in exchange for the payment of royalties and various other fees. The royalties we receive are generally a percentage of the gross revenue received by our lessees. The royalties we receive are typically supported by a floor price and minimum payment obligation that protect us during significant price or demand declines.

The majority of our Mineral Rights segment revenues come from royalties related to the sale of coal from our properties. Our coal is primarily located in the Appalachia Basin, the Illinois Basin and the Northern Powder River Basin in the United States. We lease our coal to experienced mine operators under long-term leases. Approximately two-thirds of our royalty-based leases have initial terms of five to 40 years, with substantially all lessees having the option to extend the lease for additional terms. Leases include the right to renegotiate royalties and minimum payments for the additional terms. We also own and manage coal-related transportation and processing assets in the Illinois Basin that generate additional revenues generally based on throughput or rents. We also own oil and gas, industrial minerals and aggregates that generate a portion of the Mineral Rights segment revenues.

Under our standard royalty lease, we grant the operators the right to mine and sell our coalminerals in exchange for royalty payments based on the greater of a percentage of the sale price or fixed royalty per ton of minerals mined and sold. Lessees calculate royalty payments due to us and are required to report tons of minerals mined and sold as well as the sales prices of the extracted minerals. Therefore, to a great extent, amounts reported as royalty revenues are based upon the reports of our lessees. We periodically audit this information by examining certain records and internal reports of our lessees and we perform periodic mine inspections to verify that the information that our lessees have submitted to us is accurate. Our audit and inspection processes are designed to identify material variances from lease terms as well as differences between the information reported to us and the actual results from each property.

In addition to their royalty obligations, our lessees are often subject to minimum payments, which reflect amounts we are entitled to receive even if no mining activity occurs during the period. Minimum payments are usually credited against future royalties that are earned as minerals are produced. In certain leases, the lessee is time limited on the period available for recouping minimum payments and such time is unlimited on other leases.

Because we do not operate, any coal mines, our coal royalty business does not bear ordinary operating costs and has limited direct exposure to environmental, permitting and labor risks. Our lessees, as operators, are subject to environmental laws, permitting requirements and other regulations adopted by various governmental authorities. In addition, the lessees generally bear all labor-related risks, including retiree health care costs, black lung benefits and workers’ compensation costs associated with operating the mines on our coal and aggregates properties. We pay property taxes on our properties, which are largely reimbursed by our lessees pursuant to the terms of the various lease agreements.

The SEC has adopted new rules to modernizeamended the property disclosure requirements for registrants with significant mining activities, effective for the fiscal year 2021, with new rules which we have to comply with in this Annual Report on Form 10-K. The new rules contain exceptions that allow royalty companies, such as NRP, to omit information that they lack access to and cannot obtain without incurring an unreasonable burden or expense. As a royalty company, we do not have access to the information required to prepare the technical reports used to determine reserves under the new rules, and we are not able to obtain such information without unreasonable burden or expense. The new rules require that reserve estimates be based on and disclosures include technical reports prepared using extensive mine-specific geological and engineering data, as well as market and cost assumptions that we as a mineral owner do not have, include,including, but are not limited to a) site infrastructure costs; b) processing plant costs; c) detailed analysis of environmental compliance and permitting requirements; d) detailed baseline studies with impact assessment; and e) detailed tailings disposal, reclamation and mitigation plans. Our leases do not require the operators of our material properties to prepare technical report summaries or permit us the access and information sufficient to prepare our own technical report summaries under the new rules. As a result, we are relying on the royalty company exceptions and have ceased to report coal and other hard mineral reserves in this Annual Report on Form 10-K.

In addition to summary information about our overall portfolio of mineral rights, this section provides detailed information about four properties in our Mineral Rights segment. These properties were determined to be material to our business based on historical revenue compared to our Mineral Rights segment considered as a whole. These four properties are: 1) Alpha-CAPP (VA), 2) Oak Grove, 3) Williamson, and 4) Hillsboro. We have also included a description of other significant properties, which have had lower revenues historically than our material properties but are important to our business.

Coal

Metallurgical Coal

Metallurgical (“Met”) coal is used to fuel blast furnaces that forge steel and is the primary driver of our long-term cash flows. Met coal is a high-quality, cleaner coal that generates exceptionally high temperatures when burned and is an essential element in the steel manufacturing process. Metallurgical coal is a finite and declining resource, particularly in industrialized nations. We believe the indispensable role met coal plays in manufacturing steel combined with the increasing scarcity of the resource will provide support for this portion of our business for decades to come. Our metallurgical coal is located in the Northern, Central and Southern Appalachian regions of the United States.

Thermal Coal

Thermal coal, sometimes referred to as steam coal, is used in the production of electricity. The amount of thermal coal produced in the United States has been steadily falling over the last decade as energy providers shift from coal-fired plants to natural gas-fired facilities, and to a lesser extent, alternative energy sources such as geothermal, wind and solar. We believe the long-term secular decline experienced by thermal coal over the last decade will continue. That fact, combined with the long-term strength of our metallurgical business and the carbon neutral initiatives we discuss below, will result in thermal coal becoming a diminishing contributor to NRP in years to come. The vast majority of our thermal sales are located in Illinois and its operations are some of the most cost-efficient mines east of the Mississippi River. The remainder of our thermal coal is located in Montana, the Gulf Coast and Appalachia.

The following tables present the type of coal sales volumes by major coal region for the years ended December 31, 2021, 20202023, 2022 and 2019:

| For the Year Ended December 31, 2021 | ||||||||||||||||||||

| Type of Coal | ||||||||||||||||||||

| (Tons in thousands) | Thermal | Metallurgical | Total | |||||||||||||||||

| Appalachia Basin | ||||||||||||||||||||

| Northern | 718 | 617 | 1,335 | |||||||||||||||||

| Central | 1,140 | 11,139 | 12,279 | |||||||||||||||||

| Southern | 119 | 1,452 | 1,571 | |||||||||||||||||

| Total Appalachia Basin | 1,977 | 13,208 | 15,185 | |||||||||||||||||

| Illinois Basin | 9,388 | — | 9,388 | |||||||||||||||||

| Northern Powder River Basin | 3,151 | — | 3,151 | |||||||||||||||||

| Gulf Coast | 55 | — | 55 | |||||||||||||||||

| Total | 14,571 | 13,208 | 27,779 | |||||||||||||||||

| For the Year Ended December 31, 2020 | ||||||||||||||||||||

| Type of Coal | ||||||||||||||||||||

| (Tons in thousands) | Thermal | Metallurgical | Total | |||||||||||||||||

| Appalachia Basin | ||||||||||||||||||||

| Northern | 267 | 380 | 647 | |||||||||||||||||

| Central | 1,157 | 8,954 | 10,111 | |||||||||||||||||

| Southern | 143 | 746 | 889 | |||||||||||||||||

| Total Appalachia Basin | 1,567 | 10,080 | 11,647 | |||||||||||||||||

| Illinois Basin | 3,381 | — | 3,381 | |||||||||||||||||

| Northern Powder River Basin | 1,738 | — | 1,738 | |||||||||||||||||

| Total | 6,686 | 10,080 | 16,766 | |||||||||||||||||

| For the Year Ended December 31, 2019 | ||||||||||||||||||||

| Type of Coal | ||||||||||||||||||||

| (Tons in thousands) | Thermal | Metallurgical | Total | |||||||||||||||||

| Appalachia Basin | ||||||||||||||||||||

| Northern | 2,781 | 679 | 3,460 | |||||||||||||||||

| Central | 3,117 | 10,260 | 13,377 | |||||||||||||||||

| Southern | 470 | 1,200 | 1,670 | |||||||||||||||||

| Total Appalachia Basin | 6,368 | 12,139 | 18,507 | |||||||||||||||||

| Illinois Basin | 2,201 | — | 2,201 | |||||||||||||||||

| Northern Powder River Basin | 3,036 | — | 3,036 | |||||||||||||||||

| Total | 11,605 | 12,139 | 23,744 | |||||||||||||||||

For the Year Ended December 31, 2023 | ||||||||||||

Type of Coal | ||||||||||||

(Tons in thousands) | Thermal | Metallurgical | Total | |||||||||

Appalachia Basin | ||||||||||||

Northern | 794 | 351 | 1,145 | |||||||||

Central | 1,418 | 12,509 | 13,927 | |||||||||

Southern | — | 2,670 | 2,670 | |||||||||

Total Appalachia Basin | 2,212 | 15,530 | 17,742 | |||||||||

Illinois Basin | 8,119 | — | 8,119 | |||||||||

Northern Powder River Basin | 4,589 | — | 4,589 | |||||||||

Gulf Coast | 1,477 | — | 1,477 | |||||||||

Total | 16,397 | 15,530 | 31,927 | |||||||||

For the Year Ended December 31, 2022 | ||||||||||||

Type of Coal | ||||||||||||

(Tons in thousands) | Thermal | Metallurgical | Total | |||||||||

Appalachia Basin | ||||||||||||

Northern | 1,166 | 530 | 1,696 | |||||||||

Central | 1,186 | 12,460 | 13,646 | |||||||||

Southern | 93 | 1,691 | �� | 1,784 | ||||||||

Total Appalachia Basin | 2,445 | 14,681 | 17,126 | |||||||||

Illinois Basin | 11,135 | — | 11,135 | |||||||||

Northern Powder River Basin | 4,288 | — | 4,288 | |||||||||

Gulf Coast | 385 | — | 385 | |||||||||

Total | 18,253 | 14,681 | 32,934 | |||||||||

For the Year Ended December 31, 2021 | ||||||||||||

Type of Coal | ||||||||||||

(Tons in thousands) | Thermal | Metallurgical | Total | |||||||||

Appalachia Basin | ||||||||||||

Northern | 718 | 617 | 1,335 | |||||||||

Central | 1,140 | 11,139 | 12,279 | |||||||||

Southern | 119 | 1,452 | 1,571 | |||||||||

Total Appalachia Basin | 1,977 | 13,208 | 15,185 | |||||||||

Illinois Basin | 9,388 | — | 9,388 | |||||||||

Northern Powder River Basin | 3,151 | — | 3,151 | |||||||||

Gulf Coast | 55 | 55 | ||||||||||

Total | 14,571 | 13,208 | 27,779 | |||||||||

Major Coal Producing Properties

The following table provides a summary of our significant coal royalty properties by sales volumes for 20212023 and is followed by additional information for each property:

Region | Property/Lease Name | Operator(s) | Coal Type | |||||||||||||||||||||||

Appalachia Basin | ||||||||||||||||||||||||||

Central | ||||||||||||||||||||||||||

Alpha-CAPP (VA) | Alpha Metallurgical Resources Inc. | Met | ||||||||||||||||||||||||

Central | Kepler | Alpha Metallurgical Resources Inc. | Met | |||||||||||||||||||||||

Central | Elk Creek | Ramaco Royalty Company, LLC | Met | |||||||||||||||||||||||

Central | Coal Mountain | ECP | Met | |||||||||||||||||||||||

Southern | ||||||||||||||||||||||||||

Oak Grove | Hatfield Metallurgical Coal Holdings, LLC | Met | ||||||||||||||||||||||||

Illinois Basin | Williamson | Foresight Energy Resources LLC | Thermal | |||||||||||||||||||||||

Illinois Basin | Hillsboro | Foresight Energy Resources LLC | Thermal | |||||||||||||||||||||||

Northern Powder River Basin | Western Energy | Rosebud Mining, LLC | Thermal | |||||||||||||||||||||||

Alpha-CAPP (VA).

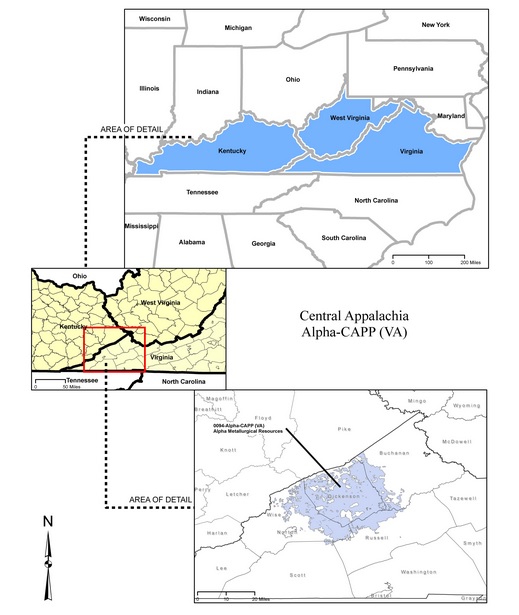

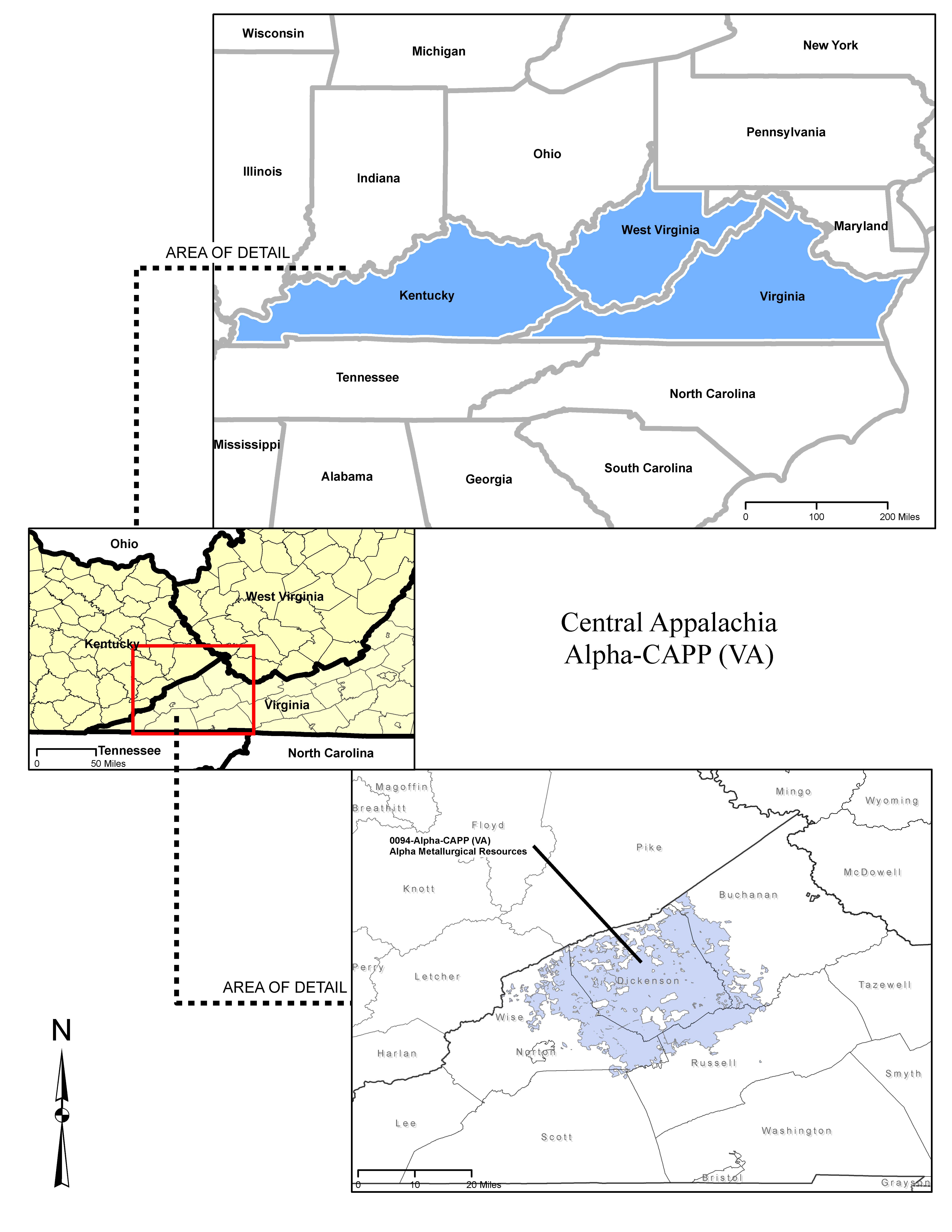

The Alpha-CAPP (VA) property is located in Wise, Dickenson, Russell and Buchanan Counties, Virginia.Below is a map of our Alpha-CAPP (VA) property:

Elk Creek.

The Elk Creek property is located in Logan and Wyoming Counties, West Virginia.Coal Mountain.

The Coal Mountain property is located in Wyoming County, West Virginia.Kepler

. The Kepler property is located in Wyoming County, West Virginia.Oak Grove

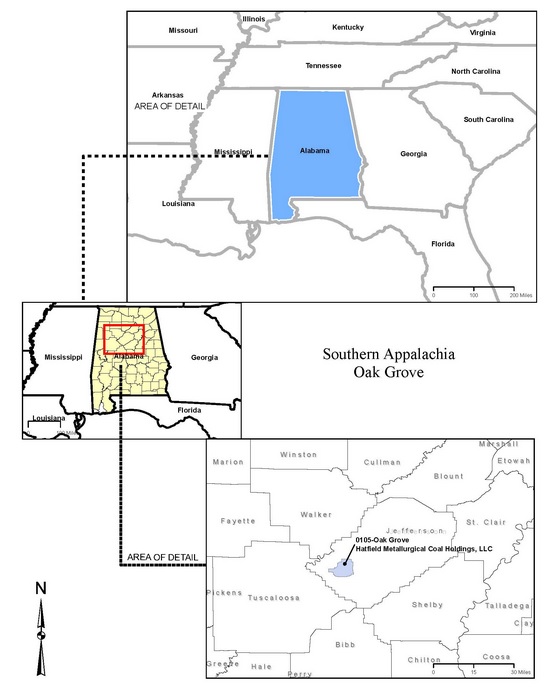

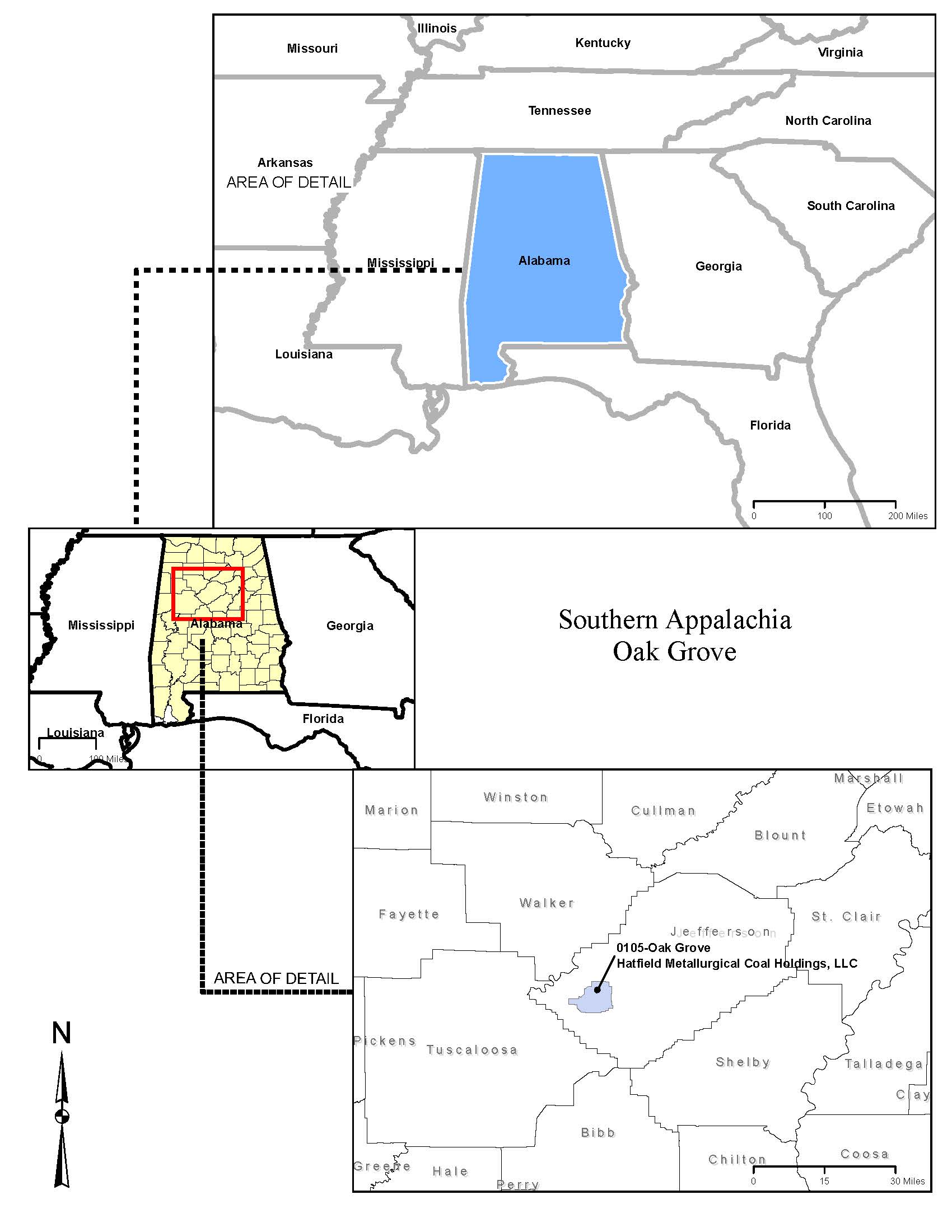

. The Oak Grove property is located in Jefferson County, Alabama.Below is a map of our Oak Grove property:

Williamson.

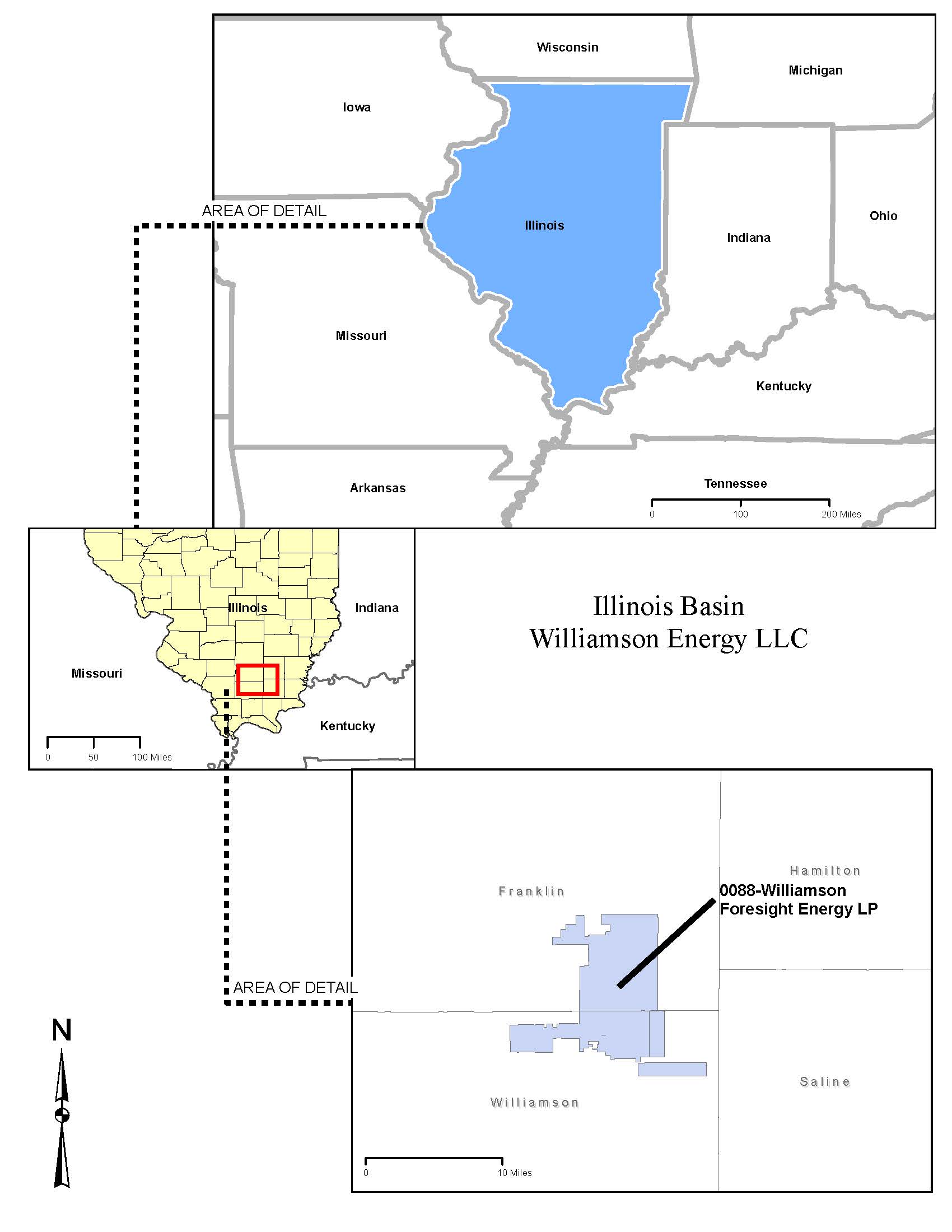

The Williamson property is located in Franklin and Williamson Counties, Illinois. This property is under leases to Williamson Energy, a subsidiary of Foresight Energy Resources LLC ("Foresight"). The current leases expire in 2026 and 2033 andBelow is a map of our Williamson property:

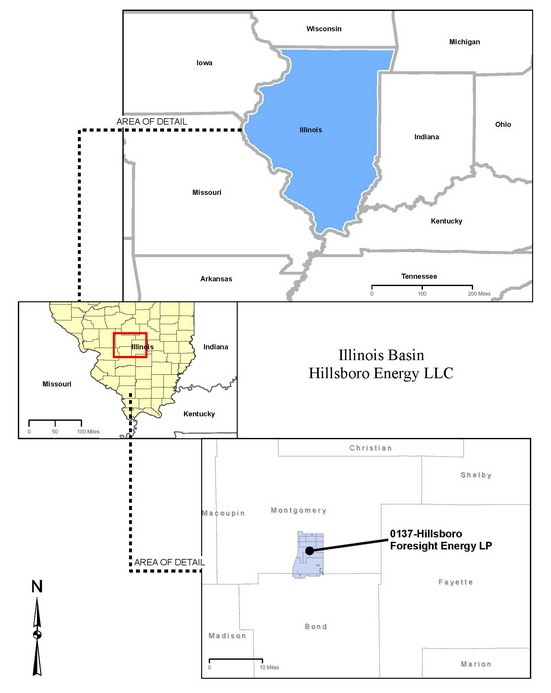

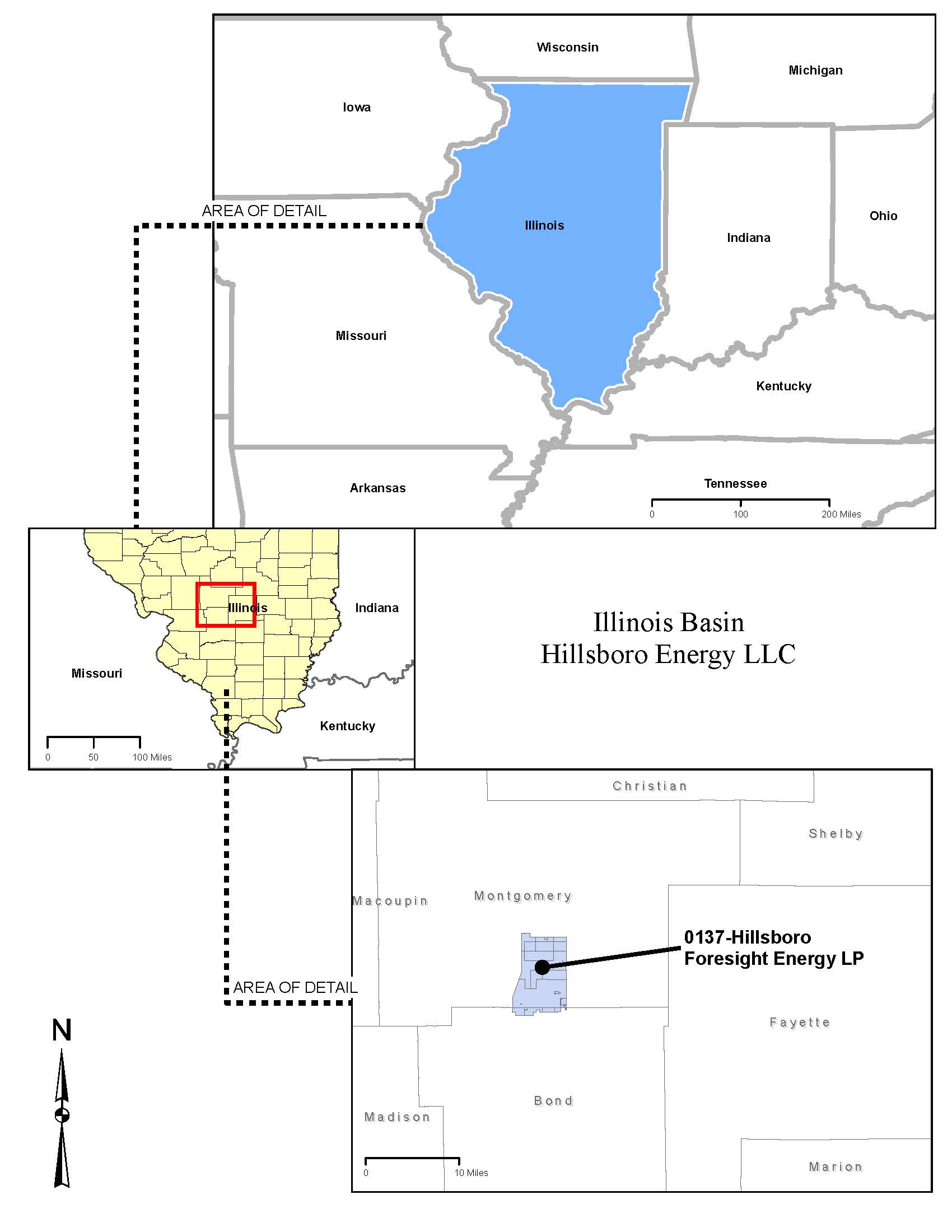

Hillsboro.The Hillsboro property is located in Montgomery and Bond Counties, Illinois. This property is under lease to Hillsboro Energy, a subsidiary of Foresight. The current lease expires in 2033 and Hillsboro Energy will have the option toautomatically renew the lease upon the expiration of its current term.unless otherwise notified. We receive payments based on the greater of a percentage of the sale price or fixed royalty per ton of coal mined and sold. In addition to the royalty obligations, this lease is subject to non-recoupable minimum payments, which reflect amounts we are entitled to receive even if no mining activity occurs during the period. In 2021, approximately 3.7 million tons of thermalThermal coal were sold from this property. Productionproduction comes from a longwall mine. Coal is shipped by rail via either the Union Pacific, Norfolk Southern or Canadian National railroads, or by barges to domestic utilities customers. The book value of this property was $224.6$209.3 million at December 31, 2021.

Below is a map of our Hillsboro property:

In addition to these properties, we own loadout and other transportation assets at the Williamson mine and at the Macoupin and Sugar Camp mines, which are also operated by Foresight. See "—Coal Transportation and Processing Assets" below for additional information on these assets.

Production at the Foresight Macoupin mine was temporarily ceased in March 2020. Pursuant to the Master Agreement, Foresight is no longer obligated to make royalty, transportation fee, or quarterly minimum payments to us under the Macoupin coal mining lease and transportation agreements. Foresight will instead pay an annual Macoupin fee of $2.0 million to NRP each year through 2023. The amounts paid for 2021 are included in the fixed amounts discussed in the paragraph above.2026. Foresight also forfeited its right to recoup all previously paid but unrecouped minimum payments with respect to the Macoupin mine. At all times that the Macoupin mine remains in temporary cessation of production, Foresight will take reasonable actions to preserve, protect, and store the equipment, infrastructure, and property located at the mine.

Beginning January 1, 2024,2027, we may at any time elect to cause Foresight to transfer the Macoupin mine and all associated equipment and permits to us for no consideration. If we make this election, we will assume all liabilities associated with the Macoupin mine. Also beginning January 1, 2024,2027, Foresight may at any time elect to offer to sell the Macoupin assets to us for $1.00. If we accept Foresight’s offer, we will assume all liabilities associated with the Macoupin mine. If we do not accept Foresight’s offer, Foresight may proceed to permanently seal the Macoupin mine and conduct all reclamation activities. To the extent the elections described above are not made, Foresight will continue to pay the annual $2.0 million fee to NRP each year that the mine remains in temporary cessation of production. In addition, Foresight may determine at any time to recommence operations at the Macoupin mine, at which time we and Foresight will negotiate in good faith to enter into new coal mining lease and transportation agreements.agreements applicable to the Macoupin mine.

Western Energy.

The Western Energy property is located in Rosebud and Treasure Counties, Montana.Coal Transportation and Processing Assets

We own transportation and processing infrastructure related to certain of our coal properties, including loadout and other transportation assets at Foresight's Williamson and Macoupin minesmine in the Illinois Basin, for which we collect throughput fees or rents. We lease our Macoupin and Williamson transportation and processing infrastructure to subsidiariesa subsidiary of Foresight and are responsible for operating and maintaining the transportation and processing assets at the Williamson mine that we subcontract to a subsidiary of Foresight. In addition, we own rail loadout and associated infrastructure at the Sugar Camp mine, an Illinois Basin mine also operated by a subsidiary of Foresight. While we own coal at the Williamson and Macoupin mines,mine, we do not own coal at the Sugar Camp mine. The infrastructure at the Sugar Camp mine is leased to a subsidiary of Foresight and we collect minimums and throughput fees. We recorded $9.1$14.9 million in revenue related to our coal transportation and processing assets during the year ended December 31, 2021. Production2023.

We also own transportation and processing infrastructure, including loadout and other transportation assets at Foresight's Macoupin mine. As previously mentioned, the Macoupin mine was temporarily ceased in March 2020 and in June 2020, we and Foresight entered into a Master Agreement in connection with Foresight’s emergence from bankruptcy as discussed above.

Oil and Gas / Industrial Minerals / Construction Aggregates / Timber

Our oil and gas properties are predominately located in Louisiana.Louisiana and during 2023, we received $7.4 million in oil and gas royalty revenues. Our various industrial mineral and construction aggregates properties are located across the United States and include minerals such as limestone, frac sand, lithium, copper, lead and zinc. We lease a portion of these minerals to third parties in exchange for royalty payments. The structure of these leases is similar to our coal leases, and these leases typically require minimum rental payments in addition to royalties. During 2021,2023, we received $1.9$2.9 million inin aggregates royalty revenues, including overriding royalty revenues. We also own forest assets, primarily in West Virginia, which generate revenues from the forestland through carbon offset credits and timber sales.

Carbon Neutral Initiatives

We continue to explore and identify alternative carbon neutral revenue sources across our large portfolio of land,surface, mineral, and timber assets. The types of opportunities includeassets, including the permanent sequestration of carbon dioxide ("CO2") underground and in standing forests, and the generation of electricity using geothermal, solar and wind energy.energy, as well as lithium production. As with our existing mineral activities, we do not plan to develop or operate carbon sequestration or carbon neutral energy projects ourselves but we plan to lease our acreage to companies that will conduct those operations in exchange for payment of royalties and other fees to us.

We executed our first carbon neutral project in the fourth quarter of 2021 through the sale of 1.1 million carbon offset credits for $13.8 million. The offset credits were issued to us by the California Air Resources Board under its cap-and-trade program and represent 1.1 million tonnesmetric tons of carbon sequestered in approximately 39,000 acres of our forestland in West Virginia. This is an encouraging first step in ourWe have the ability to create value through alternative revenue sources.

Carbon Sequestration.

We own approximately 3.5 million acres of specifically reserved subsurface rights in the southern United States with the potential for permanent sequestration of greenhouse gases. The carbon capture utilization and storage industry (“CCUS”) is in its infancy and the future is highly uncertain, but a few facts are clear. A sequestration project requires acreage possessing unique geologic characteristics, close proximity to sources of industrial-scale greenhouse gas emissions or direct air capture capability, and the appropriate form of legal title that grants the acreage owner the right to sequester emissions in the subsurface. While carbon sequestration rights and ownership continue to evolve, we believe we own one of the largest inventory of acreage with potential for carbon sequestration activities in the United States.In Februarythe first quarter of 2022 we announced the execution of a CO

Renewable Energy.

In addition,We own a 49% non-controlling equity interest in Sisecam Wyoming. Prior to 2023, Sisecam Resources LP (formerly know as Cinerowned 51% interest in Sisecam Wyoming. Sisecam Resources LP)LP was a publicly traded master limited partnership that depended on distributions from Sisecam Wyoming in order to make distributions to its public unitholders. In 2023, Sisecam Resources LP was dissolved and Sisecam Chemicals Wyoming LLC ("SCW LLC") became the direct owner of 51% of Sisecam Wyoming. SCW LLC, our operating partner, ("Sisecam Resources"), controls and operates Sisecam Wyoming. SCW LLC is 100% owned by Sisecam Chemicals Resources LLC ("Sisecam Chemicals,") which is 60% owned by Sisecam USA Inc. ("Sisecam USA") and 40% owned by Ciner Enterprises Inc. ("Ciner Enterprises"). Sisecam USA is a direct wholly-owned subsidiary of Türkiye Şişe ve Cam Fabrikalari A.Ş, a Turkish Corporation ("Şişecam Parent"), which is an approximately 51%-owned subsidiary of Turkiye Is Bankasi Turkiye Is Bankasi ("Isbank"). Şişecam Parent is a global company operating in soda ash, chromium chemicals, flat glass, auto glass, glassware glass packaging and glass fiber sectors. Şişecam Parent was founded over 88 years ago, is based in Turkey and is one of the largest industrial publicly-listed companies on the Istanbul exchange. With production facilities in several continents and in several countries, Sisecam is one of the largest glass and chemicals producers in the world. Ciner Enterprises is a direct wholly-owned subsidiary of WE Soda Ltd., a U.K. Corporation (“WE Soda”). WE Soda is a direct wholly-owned subsidiary of KEW Soda Ltd., a U.K. corporation (“KEW Soda”), which is a direct wholly owned subsidiary of Akkan Enerji ve Madencilik Anonim Şirketi (“Akkan”). Akkan is directly and wholly owned by Turgay Ciner, the Chairman of the Ciner Group (“Ciner Group”), a Turkish conglomerate of companies engaged in energy and mining (including soda ash mining), media and shipping markets. Sisecam Wyoming mines trona and processes it into soda ash that is sold both domestically and internationally into the glass and chemicals industries. Sisecam Resources is a publicly traded master limited partnership that depends on distributions from Sisecam Wyoming in order to make distributions to its public unitholders. As a minority interest owner in Sisecam Wyoming, we do not operate and are not involved in the day-to-day operation of the trona ore mine or soda ash production plant. We appoint three of the seven members of the Board of Managers of Sisecam Wyoming and have certain limited negative controls relating to the company. We have limited approval rights with respect to Sisecam Wyoming, and our partner controls most business decisions, including decisions with respect to distributions and capital expenditures. During 2020, Sisecam Wyoming suspended cash distributions to its members due to adverse developments in the soda ash market resulting from the COVID-19 pandemic. In 2021, as soda ash markets improved, Sisecam Wyoming resumed distributions with respect to the third quarter; however, distributions may again be suspended in the future.

Sisecam Wyoming is one of the largest and lowest cost producers of soda ash in the world, serving a global market from its facility located in the Green River Basin of Wyoming. The Green River Basin geological formation holds the largest, and one of the highest purity, known deposits of trona ore in the world. Trona, a naturally occurring soft mineral, is also known as sodium sesquicarbonate and consists primarily of sodium carbonate, or soda ash, sodium bicarbonate and water. Sisecam Wyoming processes trona ore into soda ash, which is an essential raw material in flat glass, container glass, detergents, chemicals, paper and other consumer and industrial products. The vast majority of the world’s accessible trona is located in the Green River Basin. According to historical production statistics, approximately 30% of global soda ash is produced by processing trona, with the remainder being produced synthetically through chemical processes. The costs associated with procuring the materials needed for synthetic production are greater than the costs associated with mining trona for trona-based production. In addition, trona-based production consumes less energy and produces fewer undesirable by-products than synthetic production.

Sisecam Wyoming’s Green River Basin surface operations are situated on approximately 2,360 acres in Wyoming (of which, 880 acres are owned by Sisecam Wyoming), and its mining operations consist of approximately 23,500 acres of leased and licensed subsurface mining area.areas in Wyoming. The facility is accessible by both road and rail. Sisecam Wyoming uses seven large continuous mining machines and 14 underground shuttle cars in its mining operations. Its processing assets consist primarily of material sizing units, conveyors, calciners, dissolver circuits, thickener tanks, drum filters, evaporators and rotary dryers.

In trona ore processing, insoluble materials and other impurities are removed by thickening and filtering liquor, a solution consisting of sodium carbonate dissolved in water. Sisecam Wyoming then adds activated carbon to filters to remove organic impurities, which can cause color contamination in the final product. The resulting clear liquid is then crystallized in evaporators, producing sodium carbonate monohydrate. The crystals are then drawn off and passed through a centrifuge to remove excess water. The resulting material is dried in a product dryer to form anhydrous sodium carbonate, or soda ash. The resulting processed soda ash is then stored in on-site storage silos to await shipment by bulk rail or truck to distributors and end customers. Sisecam Wyoming’s storage silos can hold over 58,000 short tons of processed soda ash at any given time. The facility is in good working condition and has been in service for more than 5060 years.

Deca Rehydration.

Shipping and Logistics.

For the year ended December 31, 2023, Sisecam Wyoming assisted the majority of its domestic customers in arranging their freight services.All of the soda ash produced is shipped by rail or truck from the Green River Basin facility. For the year ended December 31,Customers. Sisecam Wyoming's largest customer was ANSAC for the year ended December 31, 2021 and the sales to ANSAC accounted forWyoming generated approximately 21%half of its net sales. The significant volumegross revenue from export sales, which consist of sales to ANSAC for the year ended December 31, 2021 was primarily related to the terms of the ANSAC exit settlement agreement. No other individual customer accounted for more than 10% of Sisecam Wyoming's net sales.

Sisecam Wyoming’s customers including end users to whom ANSAC makes sales overseas, consist primarily of glass manufacturing companies, which account for 50% or more of the consumption of soda ash around the world;world, and chemical and detergent manufacturing companies.

Sisecam Chemical Resources’ exit from ANSAC, ANSAC managed most of Sisecam Wyoming'sChemicals has now completed three full years directly managing its international sales, marketing and logistics and as a result, was its largest customer foractivities since exiting ANSAC at the years ended December 31, 2020 and 2019, accounting for 45% and 60%, respectively,end of its net sales. ANSAC takes soda ash orders directly from its overseas customers and then purchases soda ash for resale from its member companies pro rata based on each member’s allocated volumes. ANSAC is the exclusive distributor for its members to the markets it serves. The ANSAC exit allowed2020. Sisecam Chemical ResourcesChemicals took direct control of these activities to improve access to customers and gain control over placement of its sales in the international marketplace in 2021.marketplace. This enhanced view of the global market allows Sisecam Chemical ResourcesChemicals to better understand supply/demand fundamentals thus allowing better decision making for its business. Sisecam Chemical ResourcesChemicals continues to optimize its distribution network leveraging strengths of existing distribution partners while expanding as theits business requires in certain target areas.

Leases and License.

Sisecam Wyoming is party to several mining leases and one license for its subsurface mining rights. Some of the leases are renewable at Sisecam Wyoming’s option upon expiration. Sisecam Wyoming pays royalties to the State of Wyoming, the U.S. Bureau of Land Management and Sweetwater Royalties LLC, a subsidiary of Sweetwater Trona OpCo LLC and the successor in interest to the license with the Rock Springs Royalty Company LLC, an affiliate of Occidental Petroleum Corporation (formerly an affiliate of Anadarko Petroleum Corporation)As a minority interest owner in Sisecam Wyoming, we do not operate and are not involved in the day-to-day operation of the trona ore mine or soda ash production plant. Our partner, Sisecam Resources,SCW, manages the mining and plant operations. We appoint three of the seven members of the Board of Managers of Sisecam Wyoming and have certain limited negative controls relating to the company.

Significant Customers

We have a significant concentration of revenues from Alpha, with total revenues of $86.1

Competition

We face competition from land companies, coal producers, international steel companies and private equity firms in purchasing coal and royalty producing properties. Numerous producers in the coal industry make coal marketing intensely competitive. Our lessees compete among themselves and with coal producers in various regions of the United States for domestic sales. Lessees compete with both large and small producers nationwide on the basis of coal price at the mine, coal quality, transportation cost from the mine to the customer and the reliability of supply. Continued demand for our coal and the prices that our lessees obtain are also affected by demand for electricity and steel, as well as government regulations, technological developments and the availability and the cost of generating power from alternative fuel sources, including nuclear, natural gas, wind, solar and hydroelectric power.

Sisecam Wyoming's trona mining and soda ash refinery business faces competition from a number of soda ash producers in the United States, Europe and Asia, some of which have greater market share and greater financial, production and other resources than Sisecam Wyoming does. Some of Sisecam Wyoming’s competitors are diversified global corporations that have many lines of business and some have greater capital resources and may be in a better position to withstand a long-term deterioration in the soda ash market. Other competitors, even if smaller in size, may have greater experience and stronger relationships in their local markets. Competitive pressures could make it more difficult for Sisecam Wyoming to retain its existing customers and attract new customers, and could also intensify the negative impact of factors that decrease demand for soda ash in the markets it serves, such as adverse economic conditions, weather, higher fuel costs and taxes or other

Title to Property

We owned substantially all of our coal and aggregates mineral rights in fee as of December 31, 2021.2023. We lease the remainder from unaffiliated third parties. Sisecam Wyoming leases or licenses its trona. We believe that we have satisfactory title to all of our mineral properties, but we have not had a qualified title company confirm this belief. Although title to these properties is subject to encumbrances in certain cases, such as customary easements, rights-of-way, interests generally retained in connection with the acquisition of real property, licenses, prior reservations, leases, liens, restrictions and other encumbrances, we believe that none of these burdens will materially detract from the value of our properties or from our interest in them or will materially interfere with their use in the operation of our business.

For most of our properties, the surface, oil and gas and mineral or coal estates are not owned by the same entities. Some of those entities are our affiliates. State law and regulations in most of the states where we do business require the oil and gas owner to coordinate the location of wells so as to minimize the impact on the intervening coal seams. We do not anticipate that the existence of the severed estates will materially impede development of the minerals on our properties.

General

Operations on our properties must be conducted in compliance with all applicable federal, state and local laws and regulations. These laws and regulations include matters involving the discharge of materials into the environment, employee health and safety, mine permits and other licensing requirements, reclamation and restoration of mining properties after mining is completed, management of materials generated by mining operations, surface subsidence from underground mining, water pollution, legislatively mandated benefits for current and retired coal miners, air quality standards, protection of wetlands, plant and wildlife protection, limitations on land use, storage of petroleum products and substances which are regarded as hazardous under applicable laws and management of electrical equipment containing polychlorinated biphenyls ("PCBs"). Because of extensive, comprehensive and often ambiguous regulatory requirements, violations during natural resource extraction operations are not unusual and, notwithstanding compliance efforts, we do not believe violations can be eliminated entirely.

While it is not possible to quantify the costs of compliance with all applicable federal, state and local laws and regulations, those costs have been and are expected to continue to be significant. Our lessees in our coal and aggregates royalty businesses are required to post performance bonds pursuant to federal and state mining laws and regulations for the estimated costs of reclamation and mine closures, including the cost of treating mine water discharge when necessary. In many states our lessees also pay taxes into reclamation funds that states use to achieve reclamation where site specific performance bonds are inadequate to do so. Determinations by federal or state agencies that site specific bonds or state reclamation funds are inadequate could result in increased bonding costs for our lessees or even a cessation of operations if adequate levels of bonding cannot be maintained. We do not accrue for reclamation costs because our lessees are both contractually liable and liable under the permits they hold for all costs relating to their mining operations, including the costs of reclamation and mine closures. Although the lessees typically accrue adequate amounts for these costs, their future operating results would be adversely affected if they later determined these accruals to be insufficient. In recent years, compliance with these laws and regulations has substantially increased the cost of coal mining for all domestic coal producers.

In addition, the electric utility industry, which is the most significant end-user of thermal coal, is subject to extensive regulation regarding the environmental impact of its power generation activities, which has affected and is expected to continue to affect demand for coal mined from our properties. Current and future proposed legislation and regulations could be adopted that will have a significant additional impact on the mining operations of our lessees or their customers’ ability to use coal and may require our lessees or their customers to change operations significantly or incur additional substantial costs that would negatively impact the coal industry.

Many of the statutes discussed below also apply to Sisecam Wyoming’s trona mining and soda ash production operations, and therefore we do not present a separate discussion of statutes related to those activities, except where appropriate.

Air Emissions

The Clean Air Act and corresponding state and local laws and regulations affect all aspects of our business. The Clean Air Act directly impacts our lessees’ coal mining and processing operations by imposing permitting requirements and, in some cases, requirements to install certain emissions control equipment, on sources that emit various hazardous and non-hazardous air pollutants. The Clean Air Act also indirectly affects coal mining operations by extensively regulating the air emissions of coal-fired electric power generating plants. There have been a series of federal rulemakings that are focused on emissions from coal-fired electric generating facilities, including the Cross-State Air Pollution Rule ("CSAPR"), regulating emissions of nitrogen oxide ("NOx") and sulfur dioxide, and the Mercury and Air Toxics Rule ("MATS"), regulating emissions of hazardous air pollutants. In March 2021, the U.S. Environmental Protection Agency ("EPA") revised the CSAPR to require additional emissions reductions of nitrogen oxideNOx from power plants in twelve states. Further, in April 2022, EPA published a proposed rule to build on the CSAPR by imposing Federal Implementation Plans on over 20 states to implement the National Ambient Air Quality Standards ("NAAQS") for ozone. However, on August 21, 2023, the EPA announced a new review of the ozone NAAQS in combination with its reconsideration of EPA's December 2020 decision to retain the 2015 NAAQS. The EPA is expected to release its Integrated Review Plan in the fall of 2024. Installation of additional emissions control technologies and other measures required under EPA regulations make it more costly to operate coal-fired power plants and could make coal a less attractive or even effectively prohibited fuel source in the planning, building and operation of power plants in the future. These rules and regulations have resulted in a reduction in coal’s share of power generating capacity, which has negatively impacted our lessees’ ability to sell coal and our coal-related revenues. Further reductions in coal’s share of power generating capacity as a result of compliance with existing or proposed rules and regulations would have a material adverse effect on our coal-related revenues.

The EPA’s regulation of methane under the Clean Air Act may also affect oil and gas production on properties in which we hold oil and gas interests. In December 2023, the EPA issued its methane rules, known as OOOOb and OOOOc, that establish new source and first-time existing source standards of performance for GHG and VOC emissions for crude oil and natural gas well sites, natural gas gathering and boosting compressor stations, natural gas processing plants, and transmission and storage facilities. We are unable to predict at this time the impact of these requirements on any such oil and gas production on our properties.

In December 2009, EPA determined that emissions of carbon dioxide, methane, and other GHGs present an endangerment to public health and welfare because emissions of such gases are, according to EPA, contributing to warming of the Earth’s atmosphere and other climatic changes. Based on its findings, EPA began adopting and implementing regulations to restrict emissions of GHGs under various provisions of the Clean Air Act.

In August 2015, EPA published its final Clean Power Plan ("CPP") Rule, a multi-factor plan designed to cut carbon pollution from existing power plants, including coal-fired power plants. The rule required improving the heat rate of existing coal-fired power plants and substituting lower carbon-emission sources like natural gas and renewables in place of coal. As promulgated, the rule would force many existing coal-fired power plants to incur substantial costs in order to comply or alternatively result in the closure of some of these plants, likely resulting in a material adverse effect on the demand for coal by electric power generators. The rule was being challenged by several states, industry participants and other parties in the United States Court of Appeals for the District of Columbia Circuit. In February 2016, the Supreme Court of the United States stayed the CPP Rule pending a decision by the District of Columbia Circuit as well as any subsequent review by the Supreme Court. In April 2017, the United States Court of Appeals for the District of Columbia Circuit granted EPA’s motion to hold the litigation in abeyance. In December 2017, EPA issued a proposed rule repealing the CPP Rule and issued an Advance Notice of Proposed Rulemaking soliciting information regarding a potential replacement rule to the CPP Rule. In August 2018, EPA formally proposed the Affordable Clean Energy ("ACE") Rule, which would replace the CPP Rule. The ACE Rule contemplates a narrower approach than the CPP Rule, focusing on efficiency improvements at existing power plants and eliminating the CPP Rule’s broader goals that envisioned switches to non-fossil fuel energy sources and the implementation of efficiency measures on demand-side entities, which the EPA now considers beyond the reach of its authority under the Clean Air Act. The ACE Rule would also omit specific numerical emissions targets that had been established under the CPP Rule. The ACE Rule went into effect on September 6, 2019. As a result, the United States Court of Appeals for the District of Columbia Circuit dismissed the pending challenges to the CPP Rule as moot. The ACE Rule was challenged by public health groups, environmental groups, states, municipalities, industry groups, and power providers. The legal challenges were consolidated as

American Lung Assoc. v. EPA before the D.C. Circuit Court of Appeals. Dozens of parties and over 170 amici filed briefs on the merits, and oral argument was held before a three-judge panel in October 2020. In January 2021, the D.C. Circuit issued a written opinion holding that the ACE Rule was based on EPA’s “erroneous legal premise” that when it determines the “best system of emission reduction” for existing sources, the Clean Air Act mandates that EPA may only consider emission reduction measures that can be applied at and/or to a stationary source (often referred to as “inside-the-fence” measures). The Court vacatedIn October 2015, EPA published its final rule on performance standards for greenhouse gas emissions from new, modified, and reconstructed electric generating units. The final rule requires new steam generating units to use highly efficient supercritical pulverized coal boilers that use partial post-combustion carbon capture and storage technology. The final emission standard is less stringent than EPA had originally proposed due to updated cost assumptions, but could still have a material adverse effect on new coal-fired power plants. The final rule has been challenged by several states, industry participants and

Certain authorizations required for certain mining and oil and gas operations may be difficult to obtain or use due to challenges from environmental advocacy groups to the environmental analyses conducted by federal agencies before granting permits. In particular, those approvals necessary for certain coal activities that are subject to the requirements of the National Environmental Policy Act (“NEPA”) are subject to real uncertainty. In April 2022, the Council on Environmental Quality (“CEQ”) issued a final rule, which is considered “Phase I” of the Biden Administration’s two-phased approach to modifying the NEPA, revoking some of the modifications made to the NEPA regulations under the previous administration and reincorporating the consideration of direct, indirect, and cumulative effects of major federal actions, including GHG emissions. In July 2023, the CEQ announced a “Phase 2” Notice of Proposed Rulemaking, the “Bipartisan Permitting Reform Implementation Rule,” which revises the implementing regulations of the procedural provisions of NEPA and implements the amendments to NEPA included in the June 3, 2023, Fiscal Responsibility Act of 2023. The final rule is expected in 2024. If any mining, or oil and gas operations are subject to permitting requirements that trigger NEPA, there is likely to be some uncertainty about the viability of any approvals that our lessees may obtain.

In November 2014, President Obama also announced an emission reduction agreement with China’s President Xi Jinping in November 2014.Jinping. The United States pledged that by 2025 it would cut climate pollution by 26% to 28% from 2005 levels. China pledged it would reach its peak carbon dioxide emissions around 2030 or earlier, and increase its non-fossil fuel share of energy to around 20% by 2030. In December 2015, the United States was one of 196 countries that participated in the Paris Climate Conference, at which the participants agreed to limit their emissions in order to limit global warming to 2°C above pre-industrial levels, with an aspirational goal of 1.5°C. While there is no way to estimate the impact of these climate pledges and agreements, including, most recently, the 28th session of the United Nations Conference of the Parties ("COP28") in December 2023, they could ultimately have an adverse effect on the demand for coal, both nationally and internationally, if implemented. In 2019, President Trump withdrew from the Paris Climate Agreement. On February 19, 2021, the United States officially rejoined the Paris Climate Agreement per President Biden’s order signed January 20. Additionally, at COP28, the parties signed onto an agreement to transition “away from fossil fuels in energy systems in a just, orderly and equitable manner” and increase renewable energy capacity so as to achieve net zero by 2050, although no timeline for reaching net zero by that date was set.

The Federal Comprehensive Environmental Response, Compensation and Liability Act ("CERCLA" or the Superfund law) and analogous state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons that are considered to haveresponsible for having contributed to the release of a “hazardous substance” into the environment. We could become liable under federal and state Superfund and waste management statutes if our lessees are unable to pay environmental cleanup costs relating to hazardous substances. In addition, we may have liability for environmental clean-up costs in connection with Sisecam Wyoming's soda ash businesses.

Water Discharges

Operations conducted on our properties can result in discharges of pollutants into waters. The Clean Water Act and analogous state laws and regulations create two permitting programs for mining operations. The National Pollutant Discharge Elimination System (NPDES)("NPDES") program under Section 402 of the statute is administered by the states or EPA and regulates the concentrations of pollutants in discharges of waste and storm water from a mine site. The Section 404 program is administered by the Army Corps of Engineers and regulates the placement of overburden and fill material into channels, streams and wetlands that comprise “waters of the United States.” The scope of waters that may fall within the jurisdictional reach of the Clean Water Act is expansive and may include land features not commonly understood to be a stream or wetlands. The Clean Water Act and its regulations prohibit the unpermitted discharge of pollutants into such waters, including those from a spill or leak. Similarly, Section 404 also prohibits discharges of fill material and certain other activities in waters unless authorized by the issued permit. In June 2015, EPA issued a new rule defining the scope of “Waters of the United States” (WOTUS) that are subject to regulation. The 2015 WOTUS rule was challenged by a number of states and private parties in federal district and circuit courts. In December 2017, EPA and the Corps proposed a rule to repeal the 2015 WOTUS rule and implement the pre-2015 definition. The repeal of the 2015 WOTUS rule took effect in December 2019. In December 2018, EPA and the Corps issued a proposed rule again revising the definition of “Waters of the United States.” The new rule (the Navigable Waters Protection Rule) took effect in June 2020. In most of the pending legal challenges to the 2015 WOTUS rule, the petitioners filed amended complaints to include allegations challenging the 2020 rule. In addition, various industry groups, environmental groups,January 2023, the EPA and states filed new legal challengesthe Army Corps of Engineers published a final revised definition of WOTUS founded upon a pre-2015 definition and including updates to incorporate existing Supreme Court decisions. Judicial developments further add to this uncertainty. In October 2022, the Supreme Court heard oral arguments in Sackett v. EPA regarding the scope and authority of the Clean Water Act and the definition of WOTUS and in May 2023, issued a ruling invalidating certain parts of the January 2023 rule. A revised WOTUS rule was issued in September 2023. Due to the 2020 rule.injunction in certain states, however, the implementation of the September 2023 rule currently varies by state.

States issue a certificate pursuant to Clean Water Act Section 401 that is required for the Corps of Engineers to issue a Section 404 permit. In AugustOctober 2021, the U.S. District Court for the Northern District of ArizonaCalifornia vacated a 2020 rule revising the Section 401 certification process. The Supreme Court stayed this vacatur and, remandedin September 2023, the 2020 rule. In lightEPA finalized its Clean Water Act Section 401 Water Quality Certification Improvement Rule, effective as of this order, agencies have reverted to interpreting WOTUS in line withNovember 27, 2023. While the pre-2015 regulatory regime. In late November 2021, EPA proposed a rule to revise the definition yet again,full extent and impact of these actions is unclear at this time, any disruption in the ability to restore the pre-2015 definition, with updates to reflect recent Supreme Court decisions.

In addition to government action, private citizens’ groups have continued to be active in bringing lawsuits against operators and landowners. Since 2012, several citizen group lawsuits have been filed against mine operators for allegedly violating conditions in their National Pollutant Discharge Elimination System (“NPDES”) permits requiring compliance with West Virginia’s water quality standards. Some of the lawsuits alleged violations of water quality standards for selenium, whereas others alleged that discharges of conductivity and sulfate were causing violations of West Virginia’s narrative water quality standards, which generally prohibit adverse effects to aquatic life. The citizen suit groups have sought penalties as well as injunctive relief that would limit future discharges of selenium, conductivity or sulfate. The federal district court for the Southern District of West Virginia has ruled in favor of the citizen suit groups in multiple suits alleging violations of the water quality standard for selenium and in two suits alleging violations of water quality standards due to discharges of conductivity (one of which was upheld on appeal by the United States Court of Appeals for the Fourth Circuit in January 2017). Additional rulings requiring operators to reduce their discharges of selenium, conductivity or sulfate could result in large treatment expenses for our lessees. In 2015, the West Virginia Legislature enacted certain changes to West Virginia’s NPDES program to expressly prohibit the direct enforcement of water quality standards against permit holders. EPA approved those changes as a program revision effective in March 2019. This approval may prevent future citizen suits alleging violations of water quality standards.

Since 2013, several citizen group lawsuits have been filed against landowners alleging ongoing discharges of pollutants, including selenium and conductivity, from valley fills located at reclaimed mountaintop removal mining sites in West Virginia. In each case, the mine on the subject property has been closed, the property has been reclaimed, and the state reclamation bond has been released. Any determination that a landowner or lessee has liability for discharges from a previously reclaimed mine site could result in substantial compliance costs or fines and would result in uncertainty as to continuing liability for completed and reclaimed coal mine operations.

Endangered Species Act

The federal Endangered Species Act (“ESA”) and counterpart state legislation protect species threatened with possible extinction. The U.S. Fish and Wildlife Service (“USFWS”) works closely with state regulatory agencies to ensure that species subject to the ESA are protected from potential impacts from mining-related and oil and gas exploration and production activities. In October 2021, the Biden Administration proposed the rollback of new rules promulgated under the Trump Administration and published an advanced notice of proposed rulemaking to codify a general prohibition on incidental take while establishing a process to regulate or permit exceptions to such a prohibition. In February 2023, the USFWS published a proposed rule that revised the requirements for an incidental take permit application. A final rule is scheduled for release in 2024. Additionally, in June 2022, the USFWS and the National Marine Fisheries Service published a final rule rescinding the 2020 regulatory definition of “habitat.” If the USFWS were to designate species indigenous to the areas in which we operate as threatened or endangered or to redesignate a species from threatened to endangered, we or the operators of the properties in which we hold oil and gas or mineral interests could be subject to additional regulatory and permitting requirements, which in turn could increase operating costs or adversely affect our revenues.

Mine Health and Safety Laws

The operations of our coal lessees and Sisecam Wyoming are subject to stringent health and safety standards that have been imposed by federal legislation since the adoption of the Mine Health and Safety Act of 1969. The Mine Health and Safety Act of 1969 resulted in increased operating costs and reduced productivity. The Mine Safety and Health Act of 1977, which significantly expanded the enforcement of health and safety standards of the Mine Health and Safety Act of 1969, imposes comprehensive health and safety standards on all mining operations. In addition, the Black Lung Acts require payments of benefits by all businesses conducting current mining operations to coal miners with black lung or pneumoconiosis and to some beneficiaries of miners who have died from this disease.

Mining accidents in recent years have received national attention and instigated responses at the state and national level that have resulted in increased scrutiny of current safety practices and procedures at all mining operations, particularly underground mining operations. Since 2006, heightened scrutiny has been applied to the safe operations of both underground and surface mines. This increased level of review has resulted in an increase in the civil penalties that mine operators have been assessed for non-compliance. Operating companies and their supervisory employees have also been subject to criminal convictions. The Mine Safety and Health Administration ("MSHA") has also advised mine operators that it will be more aggressive in placing mines in the Pattern of Violations program, if a mine’s rate of injuries or significant and substantial citations exceed a certain threshold. A mine that is placed in a Pattern of Violations program will receive additional scrutiny from MSHA.

Surface Mining Control and Reclamation Act of 1977

The Surface Mining Control and Reclamation Act of 1977 ("SMCRA") and similar statutes enacted and enforced by the states impose on mine operators the responsibility of reclaiming the land and compensating the landowner for types of damages occurring as a result of mining operations. To ensure compliance with any reclamation obligations, mine operators are required to post performance bonds. Our coal lessees are contractually obligated under the terms of our leases to comply with all federal, state and local laws, including SMCRA. Upon completion of the mining, reclamation generally is completed by seeding with grasses or planting trees for use as pasture or timberland, as specified in the reclamation plan approved by the state regulatory authority. In addition, higher and better uses of the reclaimed property are encouraged.

Mining Permits and Approvals