| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

Delaware (State or other jurisdiction of incorporation or organization) | ||||||||

5615 High Point Drive, Irving, TX (Address of principal executive offices) | 11-3656261 (I.R.S. Employer Identification No.) 75038 (Zip Code) | |||||||

(214) 453-3000 (Registrant’s telephone number, including area code) | ||||||||

(Registrant’s telephone number, including area code)

(214) 453-3000

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock $0.01 par value | HMSY | The ( | ||||||

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large | Accelerated | Non-accelerated filer ☐ | Smaller reporting company ☐ | |||||||||||||||||

| Emerging growth company ☐ | ||||||||||||||||||||

Emerging growth company ☐

February 17, 2020.

None.

| ||||||||||||||

| Page | ||||||||||||||

| ACA | Patient Protections and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010 | |||||

| ACO | Accountable | |||||

| ADR | Additional | |||||

| ASC | Accounting Standards Codification | |||||

| ASO | Administrative | |||||

| Accounting Standards Update | ||||||

| CHIP | Children's Health Insurance Program | |||||

| CMS | Centers for Medicare & Medicaid Services | |||||

| CMS NHE | ||||||

| Coordination of Benefits | ||||||

| COSO | Committee of Sponsoring Organizations of the Treadway Commission | |||||

| Credit Agreement | The Amended and Restated Credit Agreement dated as of May 3, 2013, as amended by Amendment No. 1 to Amended and Restated Credit Agreement dated as of March 8, 2017, and as further amended by Amendment No. 2 to Amended and Restated Credit Agreement, dated as of December | |||||

| DSO | Days sales outstanding | |||||

| ERISA | Employment Retirement Income Security Act of 1974 | |||||

| Exchange Act | Securities Exchange Act of 1934, as amended | |||||

| FASB | Financial Accounting Standards Board | |||||

| FCPA | U.S. Foreign Corrupt Practices Act of 1977, as amended | |||||

| HIPAA | Health Insurance Portability and Accountability Act of 1996 | |||||

| HITECH | Health Information Technology for Economic and Clinical Health | |||||

| IRS | U.S. Internal Revenue Service | |||||

| LIBOR or LIBO Rate | Intercontinental Exchange London Interbank Offered Rate (or any successor rate determined in accordance with the Credit Agreement) | |||||

| MCO | Managed care organization | |||||

| ML | Machine learning | |||||

| NLP | Natural language processing | |||||

| PBM | Pharmacy benefit manager | |||||

| PHI | Protected health information | |||||

| PHM | Population Health Management | |||||

| PI | Payment Integrity | |||||

| PMPM | Per member per month | |||||

| PMPY | Per member per year | |||||

| RAC | Recovery Audit Contractor | |||||

| RFP | Request for proposal | |||||

| ROU | Right-of-use | |||||

| RPA | Robotic process automation | |||||

| SEC | U.S. Securities and Exchange Commission | |||||

| Securities Act | Securities Act of 1933, as amended | |||||

| Section 199 Deduction | U.S. Production Activities Deduction pursuant to IRC Section 199 | |||||

| SG&A | Selling, general and administrative | |||||

| TPL | Third-party liability | |||||

| U.S. GAAP | United States Generally Accepted Accounting Principles | |||||

| 2006 Stock Plan | HMS Holdings Corp. Fourth Amended and Restated 2006 Stock Plan, as amended by Amendment No. 1 to the HMS Holdings Corp. Fourth Amended and Restated 2006 Stock Plan dated as of February 16, 2012 | |||||

| 2011 HDI Plan | HDI Holdings, Inc. Amended 2011 Stock | |||||

| 2016 Omnibus Plan | HMS Holdings Corp. 2016 Omnibus Incentive Plan | |||||

| 2017 Tax Act | Tax Cuts and Jobs Act of 2017 | |||||

| 2019 Form 10-K | HMS Holdings Corp. Annual Report on Form 10-K for the year ended December 31, 2019 | |||||

| 2019 Omnibus Plan | HMS Holdings Corp. 2019 Omnibus Incentive Plan | |||||

| 401(k) Plan | HMS Holdings Corp. 401(k) Plan | |||||

This Annual Report on

programs, and other statements regarding our possible future actions, business plans, objectives and prospects.

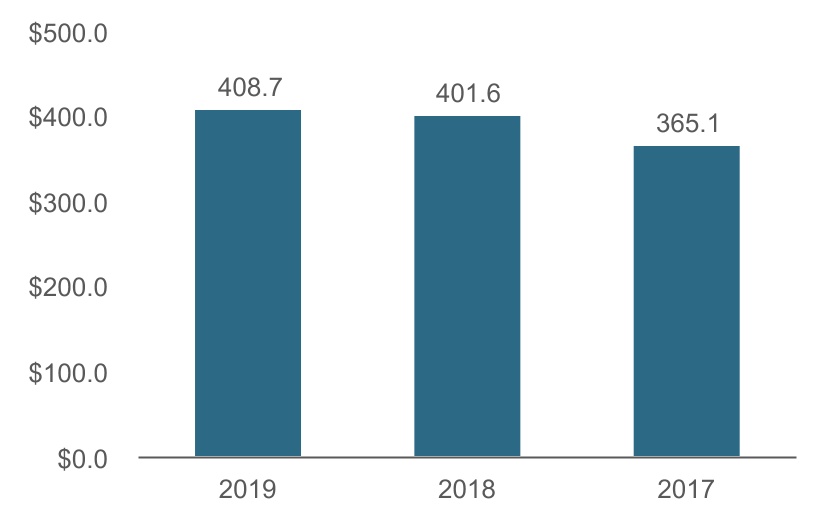

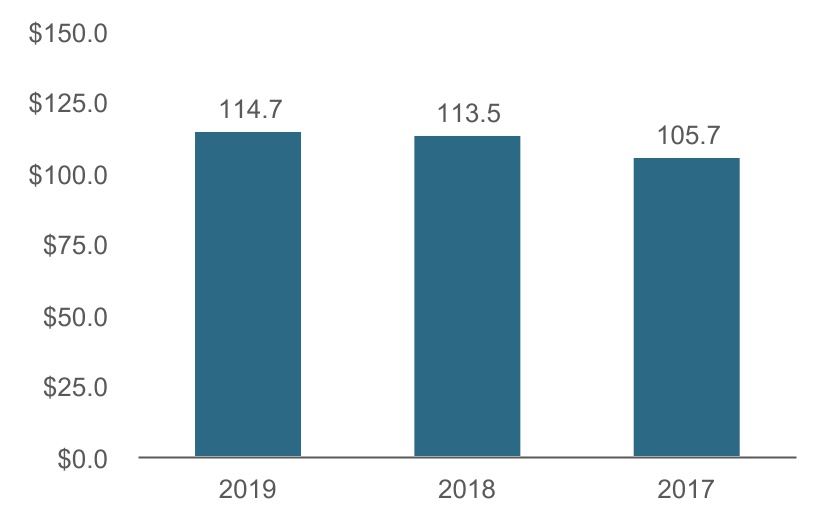

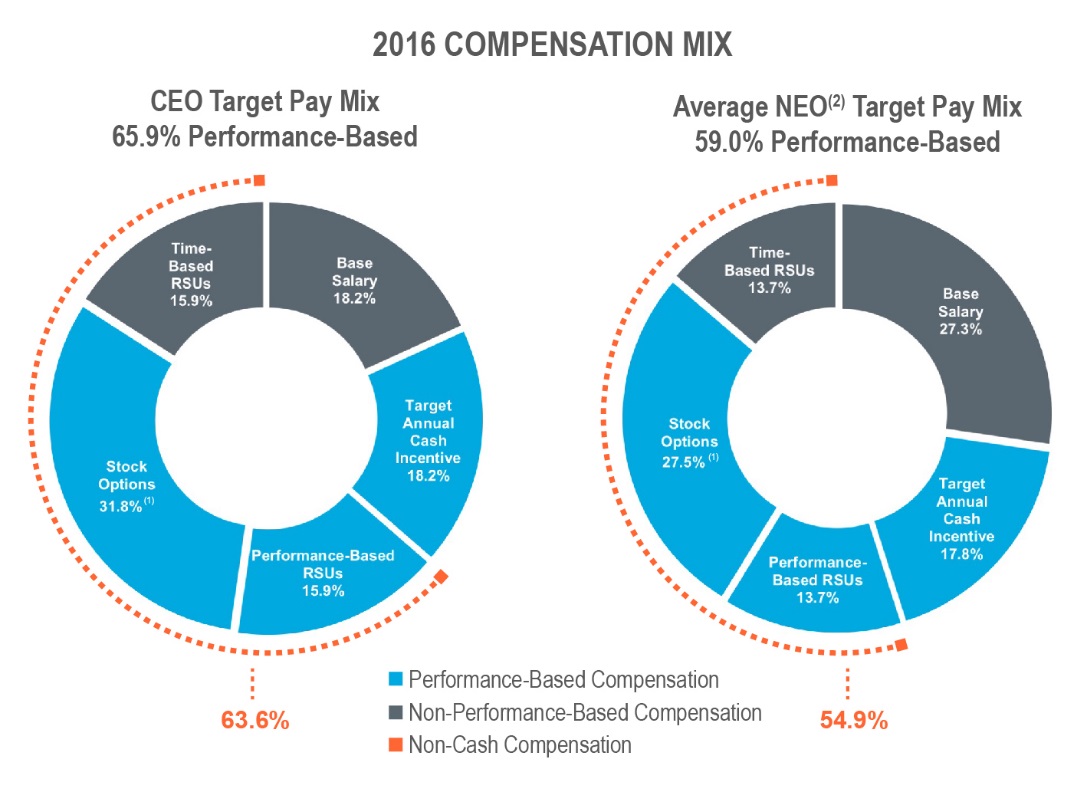

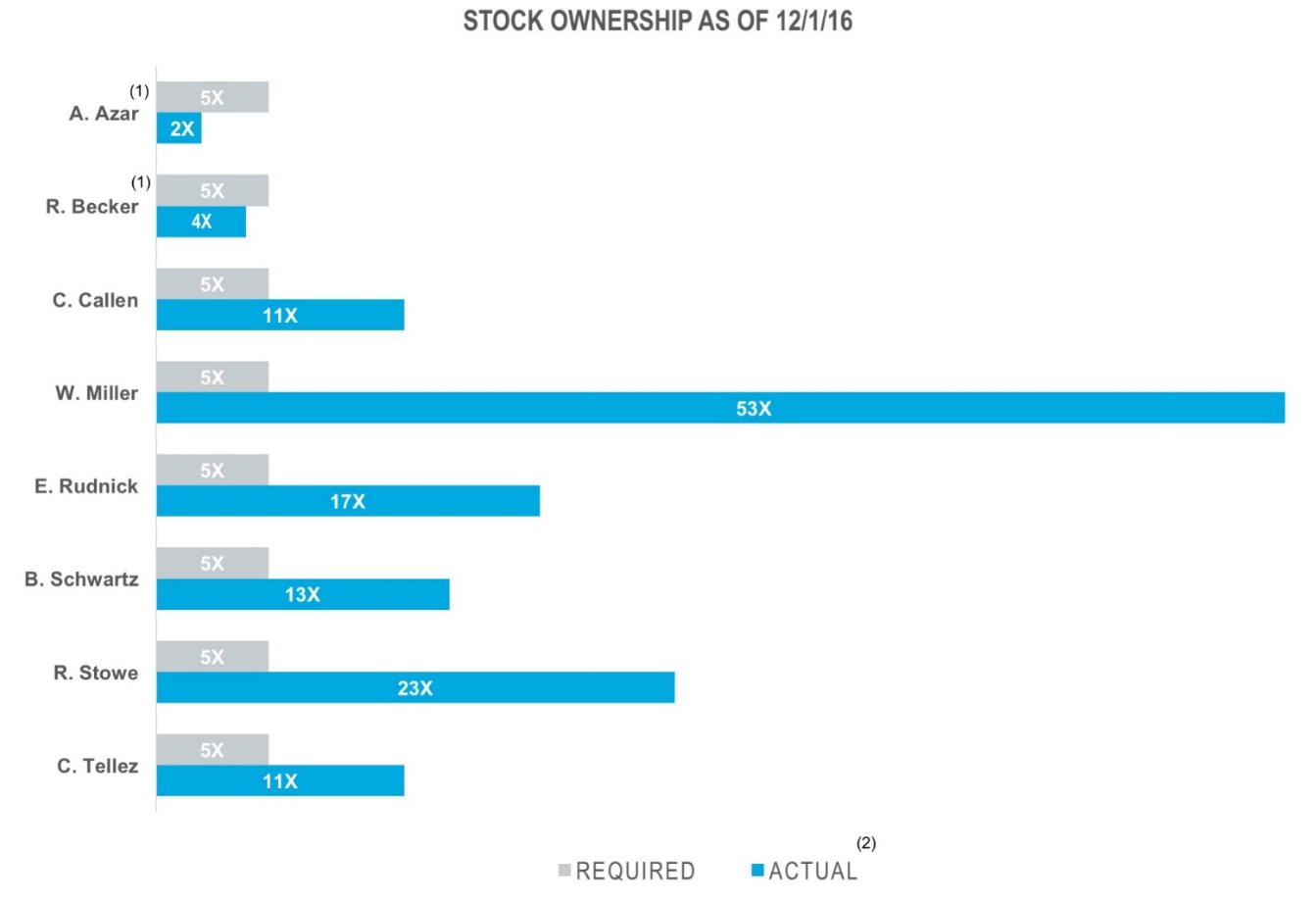

2019 Form 10-K. Additionally, our internal data and estimates are based upon information obtained from our customers, our partners, trade and business organizations, publicly available information and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Estimates are difficult to develop and inherently uncertain, and we cannot assure you that they are accurate. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those detailed above and under “Part I, Item 1A. Risk Factors” of this 2019 Form 10-K. healthcare continuum. Through our solutions, we help move the healthcare system forward by saving billions of dollars for our customers while helping consumers lead healthier lives. cost containment business. The addition of Accent enhances our capabilities across all of our coordination of benefit and payment integrity solutions and extends our reach in both new and established market segments, offering immediate market expansion and growth opportunities. As of December 31, 3,100 employees. Additional information about HMS is available on our website at www.hms.com. Directors in November 2019. If we fail to innovate and develop new or enhanced solutions and services, or if these solutions and services are not adopted by our customers, it could have a material adverse effect on our business, financial condition, results of operations and cash flows. presence. We intend to pursue future acquisitions, investments and strategic relationships that will continue to We face challenges associated with forecasting the revenue under our contracts, Any failure to maintain effective information processing systems and the integrity of the data in, and operations of, those systems could materially adversely affect our business, financial condition, results of operations and cash flows. We may rely on Adverse judgments or settlements in legal proceedings could materially harm our business, financial condition, operating results and cash flows. Our outstanding indebtedness could materially adversely affect our financial condition and our ability to operate our business, and we may not be able to generate sufficient cash flows to meet our debt service obligations or capital requirements. adversely affected. operations. HIPAA). We are also obligated by our contractual requirements with customers, which may require that we comply with additional privacy regulations imposed upon certain types of customers, such as the federal Gramm-Leach-Bliley Act and other laws. Additional legislation governing the acquisition, storage and transmission or other dissemination of health record information and other personal or sensitive information, including information outside the scope of HIPAA, continues to be proposed and come into force at the state level, such as the recently enacted California Consumer Privacy Act of 2018. There are also numerous international privacy and security laws that govern the collection, dissemination, use, access, retention, storage, protection and confidentiality of personal information. For example, the European Union General Data Protection Regulation, which became effective in May 2018, introduced new data protection requirements, which relate to, among other things, the security, confidentiality and processing of personal data in the European Union. The transferring of personal information across international borders is also becoming increasingly complex. Additionally, several countries, including Australia, have established specific legal requirements for cross-border transfers, and other countries, such as India, are considering requirements for data localization. Federal and state governments may limit or prohibit outsourcing of certain programs or functions to private entities, refuse to grant consents or waivers necessary Risks See “Leases” in Note 16 to the Consolidated Financial Statements in Part II, Item 8 for additional information. As of the close of business on business and possibly for the repurchase of shares from time to time. Our Board of Directors will evaluate various factors, including, without limitation, our future earnings, operating cash flows, financial condition, results of operations and capital requirements in determining whether to pay any cash dividends in the future. In addition, our Credit Agreement 2019. Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and the Consolidated Financial Statements and Notes thereto, in Part II, Item 8 of this 2019 Form 10-K. operations or financial results. technology firms. As of December 31, and Estimates (in millions) Administrative Expenses (in millions) 2019. (1.4%), respectively. follows other expenses. approximately $13.5 million. renewed. million year over year. 2020. the Consolidated Financial Statements in Part II, Item 8 for additional information regarding the Credit Agreement. In designing and evaluating the disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management is required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures (c)Changes in Internal Control Over Financial Reporting “ Director Our Board of Directors has adopted a Code of Conduct applicable to all of our directors, officers and employees, including all employees, officers, directors, contractors, contingent workers and business affiliates of HMS subsidiaries. The Code of Conduct is publicly available on our website under the HMS ($) 2016 Peer Group Median ($) HMS Percentile Rank (%) HMS ($) 2016 Peer Group Median ($) HMS Percentile Rank (%) 2014 Year End Salary ($) Increase (%) 2015 Year End Salary ($) Increase (1) (%) 2016 Salary (1) ($) Target Bonus ($) Actual Percentage of Target Bonus Paid (%) Performance- Based Awards Earned in 2016 Performance- Based Awards Forfeited in 2016 Grant Date Fair Value of Performance- Based Awards Value of Options Granted ($) Number of Options Granted (1)(2) (#) Value of Restricted Stock Units Granted ($) Grant Date Fair Value of Options Granted (1) ($) Grant Date Fair Value of RSUs Granted (1) ($) Salary (1) ($) ($) Non- Equity Incentive sation (5) All Other Compen- sation (6) Total Compen- sation Estimated Possible Payouts Under Non-Equity Incentive Plan Awards(1) Estimated Future Payouts Under Equity Incentive Plan Awards (2) Compensa- tion Committee Approval Date Number of Shares Acquired on Exercise (#) Value Realized on Exercise(1) ($) Number of Shares Acquired on Vesting (#) Value Realized on Vesting(2) ($) Termination without Cause(1) ($) Resignation for Good Reason(2) ($) Disability(4) ($) Death or Retirement(5) ($) “ Effective 1/1/16- 10/31/16 ($) Effective 11/1/16-12/31/16 ($) Fees Earned or Paid in Cash(1) ($) Option Awards(2)(4) ($) Deferred Stock Units Received in Lieu of 2016 Cash Compensation (#) Fair Market Value ($) Outstanding Stock Options (#) Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters Number of Outstanding Shares of Common Stock (#) Percent of Class (%) Item 13. Certain Relationships and Related Transactions and Director Independence 59. /s/ /s/ /s/ We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. 2013 We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. Assets In 2019 and 2018, the Company only issued equity awards with service conditions. In August 2016, the FASB issued ASU No. 2016-15, Statements of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments guidance on January 1, 2018. The adoption of this guidance in 2018 did not have a material effect on the Company’s consolidated financial statements. September 16, 2019. The Company allocated the purchase price, net of cash acquired, to Accounts payable, accrued expenses and other liabilities consisted of the following (in Included in Other 41. At December 31, "Credit Agreement")with certain lenders and Citibank, N.A. as administrative agent. The Credit Agreement well as customary agency fees. As part of a contractual agreement with a customer, the Company has an outstanding irrevocable letter of credit for 10. Equity Activity The Company’s certificate of incorporation, as amended, authorizes the issuance of up to 5,000,000 shares of “blank check” preferred stock with such designations, rights and preferences as may be determined by the Company’s Board of Directors. As of December 31, 12. Stock-Based Compensation (d)Restricted Stock Units Action. In HMS records accruals for outstanding legal matters when it believes it is probable that a loss will be incurred and the amount can be reasonably estimated. The Company evaluates, on a quarterly basis, developments in legal matters that could affect the amount of any accrual and developments that would make a loss contingency both probable and reasonably estimable. If a loss contingency is not both probable and estimable, HMS does not establish an accrued States with some international revenue that is not considered material. In connection with the preparation of SCHEDULE II – VALUATION AND QUALIFYING ACCOUNTS 2017I.I, Item 1. Business,” “Part I.I, Item 1A,1A. Risk Factors,” “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Part II, Item 7A. Quantitative and Qualitative Disclosures about Market Risk” of this 20162019 Form 10-K and in other documents we file with the SEC.20162019 Form 10-K speak only as of the date on which they are made. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. We caution readers not to place undue reliance upon any of these forward-looking statements. You are advised, however, to consult any further disclosures we make on related subjects in our Form 10-Q and Form 8-K8- K reports and our other filings with the SEC.20162019 Form 10-K contains market, industry and government data and forecasts that have been obtained from publicly available information, various industry publications, and other published industry sources.sources and our internal data and estimates. We have not independently verified the information from third party sources and cannot make any representation as to the accuracy or completeness of such information. None of the reports and other materials of third party sources referred to in this 20162019 Form 10-K were prepared for use in, or in connection with, this report.a leadingan industry-leading provider of cost containment and analytical solutions in the U.S. healthcare marketplace. Our mission is to make healthcare work better for everyone. We use innovativedata, technology extensive data services and powerful analytics to deliver coordination of benefits, payment integrity and population health management and engagement solutions tothat help healthcare payersorganizations reduce costs, improve performancehealth outcomes and outcomes.enhance consumer experiences. We provide coordinationa broad range of benefits servicespayment accuracy solutions to government and commercial healthcare payers, and sponsorsincluding coordination of benefits services, to ensure that the responsible partyright payer pays healthcare claims. Ourthe claim, and payment integrity services ensure healthcare claims billed are accurateto address improper payments and appropriate; and our care management technology helps risk-bearing organizations manage the care delivered to their members. Together these various services help customers recover amounts from liable third parties; prevent future improper payments; reduce fraud, waste and abuse; better manageabuse. Our population health management solutions include a portfolio of integrated risk analytics, consumer engagement and care management solutions that provide healthcare organizations with reliable intelligence insight into their population and member risks to predict, identify and avoid preventable high cost events over the care that members receive; and ensure regulatory compliance.HMSour business has grown both organicallyevolved through a combination of organic growth and through targeted acquisitions. We currently operate as one business segment with a single management team that reports to the Chief Executive Officer.businesses that helpedour service offerings and entry into new markets. In September 2019, we acquired VitreosHealth, an innovator in advanced analytics for predictive and prescriptive health insights, bolstering our predictive analytics capability within our population health management solution and establishing our geographic presence in India. We also made a strategic investment in MedAdvisor, a leading digital medication management company based in Australia, to further evolve our population health management capabilities and potentially expand our product suite, including IntegriGuard, LLC (2009), HealthDataInsights, Inc.(“HDI”) (2011), Essette, Inc. (2016), Eliza Holding Corp. (2017)international presence. In December 2019, we completed the acquisition of Accent, a payment accuracy and others.We operate as one business segment with a single management team that reports to the Chief Executive Officer.Our SolutionsOur coordination of benefits services draw principally upon proprietary information management and data mining techniques designed to ensure that the correct party pays a healthcare claim. Our payment integrity services are designed to ensure that healthcare billings and/or payments are accurate and appropriate. As a result of these services, customers received billions of dollars in cash recoveries in 2016, and saved billions more through the prevention of erroneous payments. In addition, our care management solutions help risk-bearing organizations manage the care delivered to their members with a focus on improving outcomes and patient engagement.3Our services are applicable to federal, state and commercial health plans and prevent and address errors across the payment continuum, from an individual’s enrollment in a program before any medical service is rendered, to pre-payment review of a claim by a payer, through recovery where discovery of an improper payment is made via audit. Our services address a wide spectrum of payment errors, from eligibility and coordination of benefits errors, to the identification and investigation of potential fraud, and extend to most claim types. Our services also assist customers in managing quality, risk, cost and compliance across all lines of business.

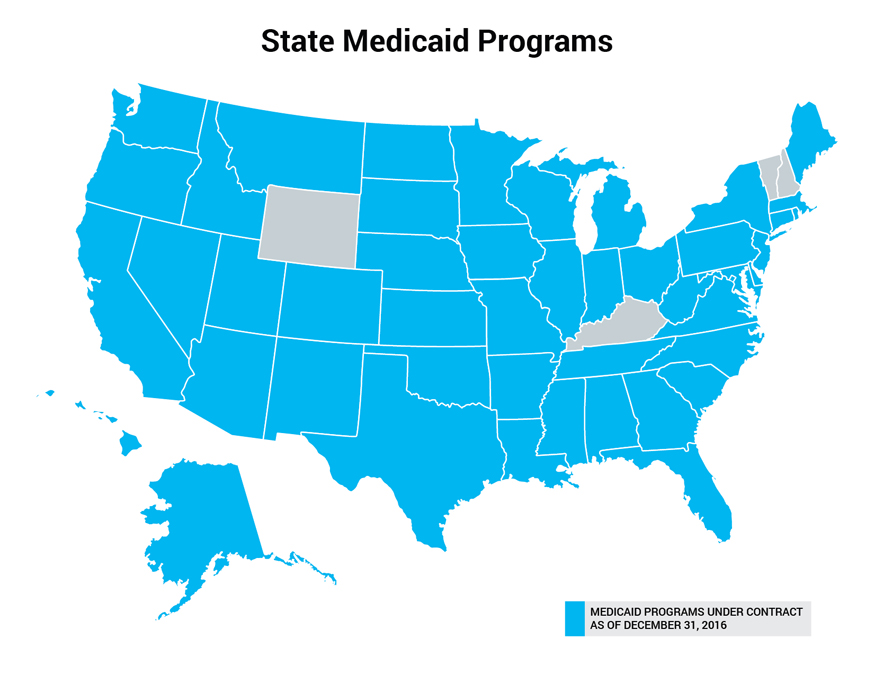

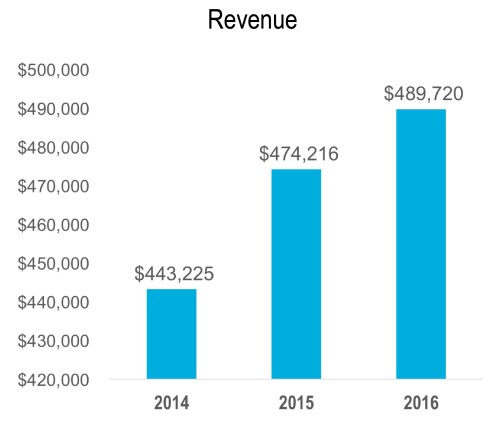

In general, our range of services includes the following:§Coordination of benefits servicesWe provide cost avoidance services, which include providing validated insurance coverage information that is used by government-sponsored payers to coordinate benefits properly for future claims. With validated insurance information, Medicaid payers can avoid unnecessary costs by ensuring that they pay only after all other benefits available have been exhausted, thereby complying with federal regulations that require Medicaid to be the payer of last resort. Nevertheless, due to a variety of factors, some Medicaid claims are paid even when there is a known responsible third party. Our government-sponsored program customers rely on us to identify those claims that were paid in error and recover these payments from the liable third party. Further, we also provide services to assist customers in identifying other third-party insurance and recovering medical expenses where a member is involved in a casualty or tort incident. Lastly, for Medicaid agencies exclusively, we provide estate recovery services to identify and recover Medicaid expenditures from the estates of deceased Medicaid members in accordance with state policies. For the years ended December 31, 2016, 2015 and 2014, our coordination of benefits services represented 72.3%, 71.2% and 70.5% of our total revenue, respectively.§Payment integrity servicesOur payment integrity services are applicable to all markets that HMS serves, including the federal and state governments, commercial health plans and other at-risk entities. Our solutions are designed to verify that medical services are utilized, billed and paid appropriately. Our services combine data analytics, clinical expertise and proprietary technology to identify improper payments on both a pre-payment and post-payment basis; identify and recover overpayments/underpayments; detect and prevent fraud, waste and abuse; and identify process improvements. For the years ended December 31, 2016, 2015 and 2014, our payment integrity services represented 24.3%, 24.5% and 24.5% of our total revenue, respectively.4§Care management and member analytics technologiesWe offer a web-based care management platform which helps risk-bearing healthcare organizations identify, engage, and manage at-risk patient populations to improve outcomes while managing costs.CustomersFor each of the years ended December 31, 2016, 2015 and 2014 no one individual Company customer accounted for more than 10% of our total revenue.The composition of our 10 largest customers changes periodically. For the years ended December 31, 2016, 2015 and 2014, our 10 largest customers represented 40.6%, 44.0% and 40.1% of our total revenue, respectively. The current terms of our agreements with these customers have expiration dates ranging between 2017 and 2020. Several of our contracts, including those with some of our largest customers, may be terminated for convenience. The early termination of a contract with one of our significant customers may have an adverse effect on our financial condition, results of operations and cash flows.We provide products and services under contracts (or sub-contracts) that contain various revenue structures, including contingent revenue and fixed-fee arrangements. Most of our contracts have terms ranging from three to five years, including renewal terms at the option of the customer. In many instances, we provide our services pursuant to agreements that are subject to periodic reprocurements. Because we provide our services pursuant to agreements that are open to competition from various businesses in the U.S. healthcare insurance benefit cost containment marketplace, we cannot provide assurance that our contracts, including those with our largest customers, will not be terminated for convenience, awarded to other parties, or renewed. Additionally, we cannot provide assurance that our contracts, if renewed, will have the same fee structures or otherwise be on satisfactory terms.Industry Trends and OpportunitiesU.S. healthcare expenditures continue to escalate and consume a large proportion of our GDP, presenting challenges for payers who wish to contain and reduce costs while also promoting quality healthcare outcomes. These aims are the same across all at-risk entities, including commercial health plans and government healthcare programs, such as Medicaid and Medicare.Within the commercial market, health plans sell policies directly to individuals (on the open market or via health insurance exchanges), contract with employers to underwrite their employees’ care, or contract with self-insured employers to oversee benefit administration to their employees. This market also includes a growing number of risk bearing provider-sponsored plans that operate and market health plan benefits. According to CMS NHE projections, private health insurance covered 195 million individuals in 2016 at a cost of $1.09 trillion.Several commercial health plans also offer government-sponsored lines of business, including partnering with Medicare, Medicaid and CHIP to oversee care delivery for beneficiaries enrolled in those programs. Government managed care grew out of pressures to contain the growth of state and federal program spending and to address general concerns about healthcare access. Commercial health plan-related partnerships with government programs include the following:§Within the Medicaid program, 38 states and the District of Columbia presently contract with managed care organizations to provide care to some or all of their Medicaid beneficiaries. In addition, many states have expanded the use of managed care organizations to new regions or to serve beneficiaries with more complex conditions. Of the 32 states and the District of Columbia that opted to expand Medicaid eligibility levels pursuant to the ACA, all except 5 use Medicaid managed care organizations. The majority of new lives that have entered the Medicaid program as a result of the ACA are enrolled in managed care plans. It is unclear at this time how, if at all, efforts in Congress to “repeal and replace” the ACA could affect any of the state expansions or future growth of Medicaid lives and expenditures.§Similarly, managed care health plans also continue to assume risk for Medicare lives, with the Kaiser Family Foundation estimating that in 2016, nearly one-third of all Medicare recipients were enrolled in a Medicare Advantage plan.5HMS also continues to serve government-sponsored agencies’ legacy fee-for-service programs at the state and federal level. These plans are generally reliant on and susceptible to the government appropriations process that determines their budget and governs the number of beneficiaries they serve.According to the CMS NHE projections, Medicare programs in 2016 covered approximately 56 million people at a cost of approximately $681 billion and Medicaid/CHIP covered approximately 77 million people, costing approximately $593 billion. Altogether, it is projected that the government programs we serve covered approximately 130 million people at a total cost of approximately $1.3 trillion in 2016. Based on the CMS NHE Projections, Medicare spending is projected to grow 5.8% in 2017 over 2016, and CMS projects Medicaid enrollment will grow by 1.7% in 2017 over 2016. Total Medicaid spending is projected to increase at a rate of 4.8% in 2017 over 2016.As commercial and government health plans continue to focus on strategies to contain costs across their different lines of business, we will continue to focus on serving them and meeting their evolving needs. Regardless of the program, coordinating benefits among a growing number of healthcare payers and ensuring that claims are paid appropriately represents an enormous challenge for our customers and an ongoing opportunity for us.Regulatory EnvironmentThe market for cost containment solutions is large and growing, driven by increasing healthcare costs and payment complexities. For 2017, Medicare and Medicaid are projected to pay approximately 45.9% of the nation’s healthcare expenditures and serve over 130 million beneficiaries. Many of these beneficiaries are enrolled in managed care plans, which have the responsibility for both patient care and claim adjudications. Since 1985, we have provided state Medicaid agencies with services to identify third parties with primary liability for Medicaid claims, and since 2005, we have provided similar services to Medicaid managed care plans.In 2006, Congress enacted the DRA and created the Medicaid Integrity Program under the Social Security Act to increase the government’s capacity to prevent, detect and address fraud, waste and abuse in the Medicaid program. Later that year, Congress passed the Tax Relief and Health Care Act of 2006, which established the Medicare RAC program. HDI was awarded one of the first contracts under the program. In October 2016, CMS made a new round of awards and we again were awarded a region.These measures, at both the federal and state level, have strengthened our ability to identify and recover erroneous payments on behalf of our customers.The ACA was signed into law in 2010. It included many provisions impacting healthcare delivery and payment programs, including employer-sponsored health coverage, expansion of the Medicaid program, health insurance exchanges with premium subsidies, and payment integrity efforts. Following the 2016 Presidential and Congressional elections, some or all of the ACA provisions may be revised or repealed, although the scope and timing of such Congressional efforts are yet to be defined. Options that have been discussed include issuing block grants or establishing per capita caps for state Medicaid populations, and looking at program design alternatives for future enrollment criteria. We will monitor ACA-related changes as they develop and assess their potential impact, as well as any opportunities they may present for our customers and for us.CompetitionThe U.S. healthcare insurance benefit cost containment marketplace is a dynamic industry with a range of businesses currently able to offer cost containment services, both directly or indirectly (through sub-contracting), to some or all of the various healthcare payers. In addition, with improvements in technology and the growth in healthcare spending, new businesses are incentivized to enter this marketplace. Many healthcare payers also have the ability to perform some or all of these cost containment services themselves and choose to exercise that option. Competition is therefore robust as customers have many alternatives available to them in their effort to contain healthcare costs.6We compete based on a variety of factors, including our ability to perform a wide range of coordination of benefits and payment integrity related functions; proven results to maximize recoveries and cost avoidance; our in-depth government healthcare program experience; clinical staff expertise; extensive insurance eligibility database; proprietary systems and processes; existing relationships with various customer and other industry shareholders; and our ability to provide customers with actionable intelligence to improve outcomes and patient engagement.Within our core coordination of benefits services, we compete primarily with large business outsourcing and technology firms, claims processors and PBMs, clearinghouses, healthcare consulting firms, smaller regional vendors and other TPL service providers. In addition, we frequently work with customers who may elect to perform some or all of their recovery and cost avoidance functions in-house. The competitive environment for payment integrity services includes some of the same companies that provide coordination of benefits services. Within the care management and risk analytics sector, we compete primarily with vendors who provide these and other population health management technology services. Companies with whom we compete across our product offerings include:§ChangeHealthcare§Experian Health§Verscend Technologies§Cotiviti§IBM/Truven§CaseNet§HP §LexisNexis§MedHok§Optum, Inc.§Performant Financial Corp.§Trizetto§Xerox§SCIO Health Analytics§ZeOmegaBusiness StrategyWe believe that the steadily increasing enrollment and rising expenditures for Medicare and Medicaid, with most new enrollees entering managed care plans; an aging U.S. population with an increasing concentration of individuals with high cost chronic conditions; and the overall complexity of the healthcare claims payment system in the U.S. all combine to create substantial growth opportunities for the suite of cost containment solutions which we offer. We also believe that these factors similarly present growth opportunities for our care management solutions. We expect to grow our business over the course of 2017 and beyond, both organically and inorganically, by leveraging existing key assets (e.g., our data, analytics and in-house expertise, and distribution channel) and pursuing a number of strategic objectives or initiatives, including:§Expanding the scope of our relationship with existing customers– by selling additional products and services.§Adding new customers– by marketing to commercial health plans, including Medicaid managed care and Medicare Advantage plans, at-risk group and individual health lines of business and ASO; government healthcare payers, including Medicaid agencies, state employee health benefit plans and CHIP; at-risk provider organizations and ACOs; and commercial employers.§Introducing new “homegrown” products and services– through internal development initiatives designed to enhance or expand our existing suite of cost containment products.§Utilizing big data – to create a more nimble operating environment and to identify new revenue opportunities within our current service delivery models.§Promoting automation and innovation to improve the efficiency and effectiveness of our services – by continuing to implement new technology and process improvements designed to increase recovery yields and increase customer satisfaction.§Building out our new health management and member engagement technology platform – by establishing a broad foundation of technology and service solutions to help customers better manage quality, cost and compliance across all lines of business. Our first step in this strategy was the acquisition of Essette Inc., a care management platform, in September 2016. More recently, we acquired Eliza Holding Corp., which provides comprehensive and personalized outreach and health engagement solutions, in April 2017.7§Continuing opportunistic growth via acquisition– by selectively seeking assets to complement our core cost-containment expertise; build care management and care coordination adjacencies to complement the Essette and Eliza acquisitions; and expand our data analytics capabilities. Our focus is on acquisitions that have long-term growth potential; target high-growth areas; are accretive to earnings; and fill a strategic need in our business portfolio as we seek to provide increasingly comprehensive solutions to our customers.Employees2016,2019, we had 2,315 employees, of which 2,287 were full-time. Of our total employees, 253 support SG&A activities.Intellectual PropertyOur ability to develop and maintain the proprietary aspects of our technology and operate without infringing the proprietary rights of others are important to our business and competitive position. We establish and protect our proprietary technology and intellectual property through a combination of patents, patent applications, trademarks, copyrights, domain names, trade secrets, including know-how, confidentiality and invention assignment agreements, security measures, non-disclosure agreements with third parties, and other contractual rights. As a result of acquiring Eliza Holding Corp. on April 17, 2017, we now own a patent portfolio comprised of approximately 55 domestic and international patents and patent applications. We do not believe that any one individual technology is essential to our business.Available Information The content on our website, or any website referred to in this Annual Report on Form 10-K, is not incorporated by reference into this Annual Report, unless expressly noted. You