| ● | ITEM 6. SELECTED FINANCIAL DATA

The following financial information for the five years ended December 31, 2020 has been derived from the Company’s audited consolidated financial statements. This information should be readan increase in conjunction with those statements, notes and other information included elsewhere herein.

WESTAMERICA BANCORPORATION | | FINANCIAL SUMMARY | | | | | | | | | | | | | | | | | | | | | | | | | | | For the Years Ended December 31, | | | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | | | (In thousands, except per share data and ratios) | | Interest and loan fee income | | $ | 165,856 | | | $ | 158,682 | | | $ | 151,723 | | | $ | 138,312 | | | $ | 135,919 | | Interest expense | | | 1,824 | | | | 1,888 | | | | 1,959 | | | | 1,900 | | | | 2,116 | | Net interest and loan fee income | | | 164,032 | | | | 156,794 | | | | 149,764 | | | | 136,412 | | | | 133,803 | | Provision (reversal) for credit losses | | | 4,300 | | | | - | | | | - | | | | (1,900 | ) | | | (3,200 | ) | Noninterest income: | | | | | | | | | | | | | | | | | | | | | Gains on sales of property | | | 3,536 | | | | - | | | | 216 | | | | 332 | | | | - | | Securities gains (losses) | | | 71 | | | | 217 | | | | (52 | ) | | | 7,955 | | | | - | | Other noninterest income | | | 42,030 | | | | 47,191 | | | | 47,985 | | | | 48,341 | | | | 46,574 | | Total noninterest income | | | 45,637 | | | | 47,408 | | | | 48,149 | | | | 56,628 | | | | 46,574 | | Noninterest expense: | | | | | | | | | | | | | | | | | | | | | Loss contingency | | | - | | | | 553 | | | | 3,500 | | | | 5,542 | | | | 3 | | Other noninterest expense | | | 98,566 | | | | 98,433 | | | | 103,416 | | | | 102,226 | | | | 103,617 | | Total noninterest expense | | | 98,566 | | | | 98,986 | | | | 106,916 | | | | 107,768 | | | | 103,620 | | Income before income taxes | | | 106,803 | | | | 105,216 | | | | 90,997 | | | | 87,172 | | | | 79,957 | | Income tax provision | | | 26,390 | | | | 24,827 | | | | 19,433 | | | | 37,147 | | | | 21,104 | | Net income | | $ | 80,413 | | | $ | 80,389 | | | $ | 71,564 | | | $ | 50,025 | | | $ | 58,853 | | | | | | | | | | | | | | | | | | | | | | | | Average common shares outstanding | | | 26,942 | | | | 26,956 | | | | 26,649 | | | | 26,291 | | | | 25,612 | | Average diluted common shares outstanding | | | 26,960 | | | | 27,006 | | | | 26,756 | | | | 26,419 | | | | 25,678 | | Common shares outstanding at December 31, | | | 26,807 | | | | 27,062 | | | | 26,730 | | | | 26,425 | | | | 25,907 | | | | | | | | | | | | | | | | | | | | | | | | Per common share: | | | | | | | | | | | | | | | | | | | | | Basic earnings | | $ | 2.98 | | | $ | 2.98 | | | $ | 2.69 | | | $ | 1.90 | | | $ | 2.30 | | Diluted earnings | | | 2.98 | | | | 2.98 | | | | 2.67 | | | | 1.89 | | | | 2.29 | | Book value at December 31, | | | 31.51 | | | | 27.03 | | | | 23.03 | | | | 22.34 | | | | 21.67 | | | | | | | | | | | | | | | | | | | | | | | | Financial ratios: | | | | | | | | | | | | | | | | | | | | | Return on assets | | | 1.30 | % | | | 1.44 | % | | | 1.27 | % | | | 0.92 | % | | | 1.12 | % | Return on common equity | | | 11.30 | % | | | 11.90 | % | | | 11.35 | % | | | 8.39 | % | | | 10.85 | % | Net interest margin (FTE)(1) | | | 2.91 | % | | | 3.11 | % | | | 2.98 | % | | | 2.95 | % | | | 3.03 | % | Net loan losses to average loans | | | 0.16 | % | | | 0.16 | % | | | 0.14 | % | | | 0.08 | % | | | 0.04 | % | Efficiency ratio(2) | | | 46.2 | % | | | 47.4 | % | | | 52.52 | % | | | 52.51 | % | | | 53.55 | % | Equity to assets | | | 12.52 | % | | | 13.02 | % | | | 11.05 | % | | | 10.71 | % | | | 10.46 | % | | | | | | | | | | | | | | | | | | | | | | | Period end balances: | | | | | | | | | | | | | | | | | | | | | Assets | | $ | 6,747,931 | | | $ | 5,619,555 | | | $ | 5,568,526 | | | $ | 5,513,046 | | | $ | 5,366,083 | | Loans | | | 1,256,243 | | | | 1,126,664 | | | | 1,207,202 | | | | 1,287,982 | | | | 1,352,711 | | Allowance for credit losses | | | 23,854 | | | | 19,484 | | | | 21,351 | | | | 23,009 | | | | 25,954 | | Investment securities | | | 4,578,783 | | | | 3,816,918 | | | | 3,641,026 | | | | 3,352,371 | | | | 3,237,070 | | Deposits | | | 5,687,979 | | | | 4,812,621 | | | | 4,866,839 | | | | 4,827,613 | | | | 4,704,741 | | Identifiable intangible assets and goodwill | | | 122,777 | | | | 123,064 | | | | 123,602 | | | | 125,523 | | | | 128,600 | | Short-term borrowed funds | | | 102,545 | | | | 30,928 | | | | 51,247 | | | | 58,471 | | | | 59,078 | | Shareholders' equity | | | 844,809 | | | | 731,417 | | | | 615,591 | | | | 590,239 | | | | 561,367 | | | | | | | | | | | | | | | | | | | | | | | | Capital ratios at period end: | | | | | | | | | | | | | | | | | | | | | Total risk based capital | | | 16.68 | % | | | 16.83 | % | | | 17.03 | % | | | 16.17 | % | | | 15.95 | % | Tangible equity to tangible assets | | | 10.90 | % | | | 11.07 | % | | | 9.04 | % | | | 8.63 | % | | | 8.26 | % | | | | | | | | | | | | | | | | | | | | | | | Dividends paid per common share | | $ | 1.64 | | | $ | 1.63 | | | $ | 1.60 | | | $ | 1.57 | | | $ | 1.56 | | Common dividend payout ratio | | | 55 | % | | | 55 | % | | | 60 | % | | | 83 | % | | | 68 | % |

(1)

| Yields on securities and certain loans have been adjusted upward to a "fully taxable equivalent" ("FTE") basis in order to reflect the effect of income which is exempt from federal income taxation at the current statutory tax rate.operating costs

|

(2)

| The efficiency ratio is defined as noninterest expense divided by total revenue (net interest income on an FTE basis and noninterest income).

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTSOF OPERATIONS

The following discussion addresses information pertaining to the financial condition and results of operations of Westamerica Bancorporation and subsidiaries (the “Company”) that may not be otherwise apparent from a review of the consolidated financial statements and related footnotes. It should be read in conjunction with those statements and notes found on pages 50 through 92,

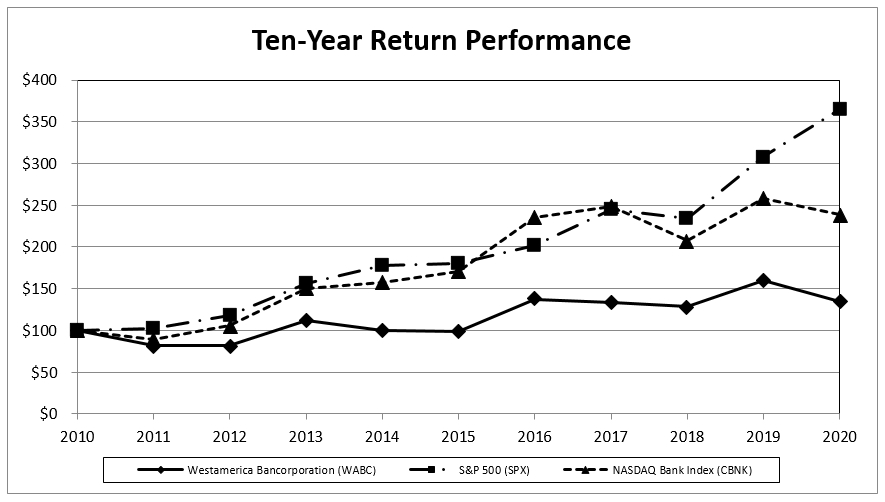

The 2008 - 2009 financial crisis led to the failure or merger of a number of financial institutions. Financial institution failures can result in further losses as a consequence of defaults on securities issued by them and defaults under contracts entered into with such entities as counterparties. The failure of institutions with FDIC insured deposits can cause the DIF reserve ratio to decline, resulting in increased deposit insurance assessments on surviving FDIC insured institutions. Weak economic conditions can significantly weaken the strength and liquidity of financial institutions. The Company’s financial performance generally, and in particular the ability of borrowers to pay interest on and repay principal of outstanding loans and the value of collateral securing those loans, is highly dependent upon the business environment in the markets where the Company operates, in the State of California and in the United States as a whole. A favorable business environment is generally characterized by, among other factors, economic growth, healthy labor markets, efficient capital markets, low inflation, high business and investor confidence, and strong business earnings. Unfavorable or uncertain economic and market conditions can be caused by: declines in economic growth, high rates of unemployment, deflation, pandemics, declines in business activity or consumer, investor or business confidence; limitations on the availability of or increases in the cost of credit and capital; increases in inflation; natural disasters; or a combination of these or other factors. Such business conditions could adversely affect the credit quality of the Company’s loans, the demand for loans, loan volumes and related revenue, securities valuations, amounts of deposits, availability of funding, results of operations and financial condition. Regulatory Risks Restrictions on dividends and other distributions could limit amounts payable to the Company. As a holding company, a substantial portion of the Company’s cash flow typically comes from dividends paid by the Bank. Various statutory provisions restrict the amount of dividends the Company’s subsidiaries can pay to the Company without regulatory approval. A reduction in subsidiary dividends paid to the Company could limit the capacity of the Company to pay dividends. In addition, if any of the Company’s subsidiaries were to liquidate, that subsidiary’s creditors will be entitled to receive distributions from the assets of that subsidiary to satisfy their claims against it before the Company, as a holder of an equity interest in the subsidiary, will be entitled to receive any of the assets of the subsidiary. The Company’s payment of dividends on common stock could be eliminated or reduced. Holders of the Company’s common stock are entitled to receive dividends only when, as, and if declared by the Company’s Board of Directors. The Company’s ability to pay dividends is limited by banking and corporate laws, and depends, among other things, on the Company’s regulatory capital levels and earnings prospects, as well as the Bank’s ability to pay cash dividends to the Company. Although the Company has historically paid cash dividends on the Company’s common stock, the Company is not required to do so and the Company’s Board of Directors could reduce or eliminate the Company’s common stock dividend in the future. Adverse effects of changes in banking or other laws and regulations or governmental fiscal or monetary policies could adversely affect the Company. The Company is subject to significant federal and state regulation and supervision, which is primarily for the benefit and protection of the Company’s customers and not for the benefit of investors. In the past, the Company’s business has been materially affected by these regulations. Laws, regulations or policies, including accounting standards and interpretations currently affecting the Company and the Company’s subsidiaries, may change at any time. Regulatory authorities may also change their interpretation of these statutes and regulations. Therefore, the Company’s business may be adversely affected by any future changes in laws, regulations, policies or interpretations or regulatory approaches to compliance and enforcement including future acts of terrorism, major U.S. corporate bankruptcies and reports of accounting irregularities at U.S. public companies. Additionally, the Company’s business is affected significantly by the fiscal and monetary policies ofthe federal government and its agencies. The Company is particularly affected by the policies of the FRB, which regulates the supply of money and credit in the United States of America. Among the instruments of monetary policy available to the FRB are (a) conducting open market operations in U.S. government securities, (b) changing the discount rates of borrowings by depository institutions, (c) changing interest rates paid on balances financial institutions deposit with the FRB, and (d) imposing or changing reserve requirements against certain borrowings by banks and their affiliates. These methods are used in varying degrees and combinations to directly affect the availability of bank loans and deposits, as well as the interest rates charged on loans and paid on deposits. The policies of the FRB may have a material effect on the Company’s business, results of operations and financial condition. Under long- standing policy of the FRB, a BHC is expected to act as a source of financial strength for its subsidiary banks. As a result of that policy, the Company may be required to commit financial and other resources to its subsidiary bank in circumstances where the Company might not otherwise do so. Federal and state governments could pass legislation detrimental to the Company’s performance. As an example, the Company could experience higher credit losses because of federal or state legislation or regulatory action that reduces the amount the Bank's borrowers are otherwise contractually required to pay under existing loan contracts. Also, the Company could experience higher credit losses because of federal or state legislation or regulatory action that limits or delays the Bank's ability to foreclose on property or other collateral or makes foreclosure less economically feasible. Federal, state and local governments could pass tax legislation causing the Company to pay higher levels of taxes. The FDIC insures deposits at insured financial institutions up to certain limits. The FDIC charges insured financial institutions premiums to maintain the Deposit Insurance Fund. The FDIC may increase premium assessments to maintain adequate funding of the Deposit Insurance Fund. The behavior of depositors in regard to the level of FDIC insurance could cause the Bank’s existing customers to reduce the amount of deposits held at the Bank, and could cause new customers to open deposit accounts at the Bank. The level and composition of the Bank's deposit portfolio directly impacts the Bank's funding cost and net interest margin. Systems, Accounting and Internal Control Risks The accuracy of the Company’s judgments and estimates about financial and accounting matters will impact operating results and financial condition. The Company makes certain estimates and judgments in preparing its financial statements. For example, the Company maintains a reserve for potential loan defaults and non-performance. There is no precise method of predicting loans losses and determining the adequacy of the reserve requires the Company’s management to make a number of estimates and judgments. If the estimates or judgments prove to be incorrect, the Company could be required to increase its provisions for credit losses, which could reduce its income or could cause it to incur operating losses in the future. The Company also uses models to estimate the effects of changing interest rates, which are based on estimates and assumptions that may prove to be inaccurate, particularly in times of market stress or unforeseen circumstances. Therefore, the quality and accuracy of management’s estimates and judgments will have an impact on the Company’s operating results and financial condition. For additional information, please see the discussion under “Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Policies” in this Report, which is incorporated by reference in this paragraph. The Company’s information systems or those of its vendors may experience an interruption or breach in security. The Company relies heavily on communications and information systems, including those of third party vendors and other service providers, to conduct its business. Any failure, interruption or breach in security of these systems could result in failures or disruptions in the Company’s data processing, accounting, customer relationship management and other systems. Communication and information systems failures can result from a variety of risks including, but not limited to, events that are wholly or partially out of the Company’s control, such as telecommunication line integrity, weather, terrorist acts, natural disasters, accidental disasters, unauthorized breaches of security systems, energy delivery systems, cybersecurity incidents, and other events. Although the Company devotes significant resources to maintain and regularly upgrade its systems and processes that are designed to protect the security of the Company’s computer systems, software, networks and other technology assets and the confidentiality, integrity and availability of information belonging to the Company and its customers, there is no assurance that any such failures, interruptions or security breaches will not occur or, if they do occur, that they will be adequately corrected by the Company or its vendors. The occurrence of any such failures, interruptions or security breaches could result in the loss or theft of customer or employee data, damage the Company’s reputation, impair or disrupt the Company’s business operations, result in a loss of customer business, subject the Company to additional regulatory scrutiny, or expose the Company to litigation and possible financial liability, any of which could have a material adverse effect on the Company’s financial condition and results of operations. For example, during the second quarter 2023, the Company was notified that there may have been a compromise of a specific set of files processed by a third party vendor that could have affected a limited number of customers. This incident did not occur on a Company system and the Company does not use the software that may have been compromised. The Company has implemented data security safeguards with its third party vendors designed to quickly identify and contain improper access to sensitive information. The Company notified the affected customers as required by law. As of December 31, 2023, to the Company’s knowledge, there is no indication that any information has been subject to misuse as a result of the incident. The Company’s controls and procedures may fail or be circumvented. Management regularly reviews and updates the Company’s internal control over financial reporting, disclosure controls and procedures, and corporate governance policies and procedures. The Company maintains controls and procedures to mitigate against risks such as processing system failures and errors, and customer or employee fraud, and maintains insurance coverage for certain of these risks. Any system of controls and procedures, however well designed and operated, is based in part on certain assumptions and can provide only reasonable, not absolute, assurances that the objectives of the system are met. Events could occur which are not prevented or detected by the Company’s internal controls or are not insured against or are in excess of the Company’s insurance limits or insurance underwriters’ financial capacity. Any failure or circumvention of the Company’s controls and procedures or failure to comply with regulations related to controls and procedures could have a material adverse effect on the Company’s business, results of operations and financial condition. [The remainder of this page intentionally left blank] Operational Risks Climate change and the transition to renewable energy and a net zero emissions economy pose operational, commercial and regulatory risks. Climate change may increase the frequency or severity of extreme weather events, and if the Company is not adequately resilient to deal with acute climate events, its operations may be impacted. Extreme weather events could also impact the activities of its customers or third-party vendors. The physical commodities and assets underlying some of its markets or investments may also be impacted by climate change. Our risk management practices incorporate the challenges brought about by climate change. The operations conducted in our centralized facilities and branch locations can be disrupted by acute physical risks such as flooding and windstorms, and by chronic physical risks such as rising sea levels, sustained higher temperatures, drought, and increased wildfires. Over the intermediate and longer-term, the Company can be subject to transition risks such as market demand, and policy and law changes. None of the Company’s physical locations are located near sea level, and only a limited number of branches are located in flood zones. Our principal electricity supplier reports a Power Content Label of 100% greenhouse gas free using the California Energy Commission’s methodology. Our principal information technology vendor’s goal is to achieve 100 percent carbon neutrality for Scope 1 and 2 greenhouse gas emissions by 2025. The Company and its critical vendors maintain property and casualty insurance, and maintain and regularly test disaster recovery plans, which include redundant operational locations and power sources. The Company’s operations do not use a significant amount of water in producing our products and services. The Company monitors the climate risks of our loan customers. Borrowers with real estate loan collateral located in flood zones must carry flood insurance under the loans’ terms. The Company has $18 million in loans to agricultural borrowers; Management continuously monitors these customers’ access to adequate water sources as well as their ability to sustain low crop yields without encountering financial hardship. The Company makes automobile loans; changes in consumer demand, or governmental laws or policies, regarding gasoline, electric and hybrid vehicles is not considered a risk to the Company’s automobile lending practices. The Company considers climate risk in its underwriting of corporate bonds, and avoids purchasing bonds of issuers, which, in Management’s judgement, have elevated climate risk. In addition, the transition to renewable energy and a net zero emissions economy involves changes to consumer and institutional preferences for energy consumption, and other products and services, and the possible failure of its services to facilitate the needs of customers during the transition to renewable energy and changes in customer preferences could adversely impact its business and revenues. Changing preferences could also have an adverse impact on the operations or financial condition of its customers, which could result in reduced revenues from those customers. The Company is also subject to risks relating to new or heightened climate change-related regulations or legislation, which could impact its customers. The risks associated with climate change and the transition to renewable energy and a net zero emissions economy continue to evolve rapidly, and climate change-related risks may change or increase over time. The effects of pandemics and their impact are highly unpredictable and could be significant, and could harm the Company’s business, financial condition, and operating results. The Company’s business, operations and financial performance may be affected by the macroeconomic impacts resulting from pandemics, and the Company’s financial results in future periods could differ significantly from the Company’s historical results. The extent to which the Company’s business will be affected will depend on a variety of factors, many of which are outside of the Company’s control, including the persistence of the pandemic, the actions of governmental authorities, changes in customer preferences, impacts on economic activity, and the possibility of recession or financial market instability. If the Company loses the services of any of our key management personnel, its business could suffer. Our future success significantly depends on the continued service and performance of our key management personnel. Our senior management team has significant industry experience and would be difficult to replace. In particular, David L. Payne, our Chairman, President and Chief Executive Officer, has led the Company for over 30 years. Competition for these employees is intense and we may not be able to attract and retain key personnel. If we are unable to attract or retain appropriately qualified personnel, we may not be successful in originating loans and servicing our customers, which could have a materially adverse effect on our business, financial condition and results of operations. The Company competes with many banks and other traditional, non-traditional, brick and mortar and online financial service providers. Competition among providers of financial services in markets, particularly within California, is intense. The Company competes with other financial and bank holding companies, state and national commercial banks, savings and loan associations, consumer finance companies, credit unions, securities brokerages, insurance companies, mortgage banking companies, money market mutual funds, asset-based non-bank lenders, government sponsored or subsidized lenders and other financial services providers. Many of these competitors have substantially greater financial resources, lending limits and technological resources than the Company and are able to offer a broader range of products and services. Many competitors offer lower interest rates and more liberal loan terms that appeal to borrowers but adversely affect net interest margin and assurance of repayment. The Company is increasingly faced with competition in many of its products and services by non-bank providers who may have competitive advantages of size, access to potential customers and fewer regulatory requirements, such as “fintech” lenders. Failure to compete effectively for deposit, loan and other banking customers in any of the lines of business could cause the Company to lose market share, slow or reverse growth rate or suffer adverse effects on financial condition, results of operations or profitability. The Company must continue to attract, retain and develop key personnel. The Company’s success depends to a significant extent upon its ability to attract, develop and retain experienced personnel in each of its lines of business and markets including managers in operational areas, compliance and other support areas to build and maintain the infrastructure and controls required to support continuing growth. Competition for the best people in the industry can be intense, and there is no assurance that the Company will continue to attract or retain talent or develop personnel. Factors that affect its ability to attract, develop and retain key employees include compensation and benefits programs, profitability, ability to establish appropriate succession plans for key talent, reputation for rewarding and promoting qualified employees and market competition for employees with certain skills, including information systems development and security. The cost of employee compensation is a significant portion of operating expenses and can materially impact results of operations or profitability, especially during periods of wage inflation. The unanticipated loss of the services of key personnel could have an adverse effect on the business. The Company is subject to environmental liability risk associated with lending activities. A significant portion of our loan portfolio is secured by real property. During the ordinary course of business, we foreclose on and take title to properties securing certain loans. In doing so, there is a risk that hazardous or toxic substances could be found on these properties. If hazardous or toxic substances are found, we may be liable for remediation costs, as well as for personal injury and property damage. Environmental laws may require us to incur substantial expenses and may materially reduce the affected property’s value or limit our ability to use or ability to sell the affected property. Environmental reviews of real property before initiating foreclosure actions may not be sufficient to detect all potential environmental hazards. The remediation costs and any other financial liabilities associated with an environmental hazard could have a material adverse effect on our business, financial condition and results of operations. ITEM 1B. UNRESOLVED STAFF COMMENTS None ITEM 1C. CYBERSECURITY The Company has developed and implemented an Information Security Program based on the Cybersecurity Framework (CSF) best practices and recommendations from the National Institute of Standards and Technology (NIST), applicable regulatory guidance, and other industry standards. Components of the program include a risk assessment program to identify, assess, and mitigate cybersecurity risk; a vendor management program to address third-party cybersecurity risk; and an incident response program documenting cybersecurity incident response and notification procedures. The Company's Information Security Officer (ISO) oversees the programs and reports on their statuses to management committees including the Information Security Review Committee (ISRC) and the Information Systems Steering Committee (ISSC). The ISO has several years of professional experience in cybersecurity and vendor management, and holds multiple relevant professional certifications. The ISO provides an update to the Board of Directors on a quarterly basis. The Information Security Program is approved by the Board annually. The ISO maintains risk assessments for key IT systems. A third party cybersecurity risk assessment tool, as well as the FFIEC's Cybersecurity Assessment Tool (CAT) are also used annually to assess cybersecurity risk. Third parties are assessed and categorized according to service type, compliance risk, financial risk, operational risk, and security risk. The level of due diligence and ongoing monitoring that is performed is based on inherent risk as well as specifics such as if the vendor hosts data in the cloud or has access to consumer information. The Company uses a training system to educate new and existing employees on cybersecurity risks. In addition to this training program, simulated phishing attempts are sent to employees on a regular basis to evaluate their understanding of these risks. The Company uses data loss prevention and web filtering software to ensure malicious data does not enter the Company's network, and sensitive information does not leave the network unless properly secured. Penetration tests and vulnerability scanning are performed on a regular basis. All Company networks are secured behind firewalls. Additionally, Security Information and Event Management (SIEM) technology, an Intrusion Detection System (IDS), and an Intrusion Prevention System (IPS) are used. Access to data on the Company's networks is granted only if needed for job functions. Data Security Analysts review changes to access to ensure they are authorized and appropriate. An Incident Response Committee that includes representatives from key areas of the Company meets in the event of cybersecurity incidents. The Committee ensures the proper notifications are made in order to comply with all relevant laws, rules and regulations. During the year ended December 31, 2023, there were no cybersecurity incidents that materially affected or are reasonably likely to materially affect the Company. For discussion of the risks from cybersecurity threats, including potential impact to the Company’s business strategy, results of operations, and financial condition, refer to “Item 1A – Risk Factors – The Company’s information systems may experience an interruption or breach in security” in this Report, which is incorporated by reference in this paragraph. ITEM 2. PROPERTIES Branch Offices and Facilities The Bank is engaged in the banking business through 77 branch offices in 20 counties in Northern and Central California. The Bank believes all of its offices are constructed and equipped to meet prescribed security requirements. The Company owns 28 banking office locations and one centralized administrative service center facility and leases 55 facilities. Most of the leases contain renewal options and provisions for rental increases, principally for changes in the cost of living index, and for changes in other operating costs such as property taxes and maintenance. ITEM 3. LEGAL PROCEEDINGS Due to the nature of its business, the Company is subject to various threatened or filed legal cases. Neither the Company nor any of its subsidiaries is a party to any material pending legal proceeding, nor is their property the subject of any material pending legal proceeding, other than ordinary routine legal proceedings arising in the ordinary course of the Company’s business. Based on the advice of legal counsel, the Company does not expect such cases will have a material, adverse effect on its business, financial position or results of operations. Legal liabilities are accrued when obligations become probable and the amount can be reasonably estimated. ITEM 4. MINE SAFETY DISCLOSURES Not applicable PART II ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS ANDISSUER PURCHASES OF EQUITY SECURITIES The Company’s common stock is traded on the NASDAQ Stock Market (“NASDAQ”) under the symbol “WABC”. As of January 31, 2024, there were approximately 4,700 shareholders of record of the Company’s common stock. The Company has paid cash dividends on its common stock in every quarter since its formation in 1972. See Item 8, Financial Statements and Supplementary Data, Note 19 to the consolidated financial statements for recent quarterly dividend information. It is currently the intention of the Board of Directors of the Company to continue payment of cash dividends on a quarterly basis. There is no assurance, however, that any dividends will be paid since they are dependent upon earnings, cash balances, financial condition and capital requirements of the Company and its subsidiaries as well as policies of the FRB pursuant to the BHCA. See Item 1, “Business - Supervision and Regulation.” The notes to the consolidated financial statements included in this Report contain additional information regarding the Company’s capital levels, capital structure, regulations affecting subsidiary bank dividends paid to the Company, the Company’s earnings, financial condition and cash flows, and cash dividends declared and paid on common stock. Stock performance The following chart compares the cumulative return on the Company’s stock during the ten years ended December 31, 2023 with the cumulative return on the S&P 500 composite stock index and NASDAQ’S Bank Index. The comparison assumes $100 invested in each on December 31, 2013 and reinvestment of all dividends. | | | December 31, | | | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | Westamerica Bancorporation (WABC) | | $ | 100.00 | | | $ | 89.54 | | | $ | 88.30 | | | $ | 122.54 | | | $ | 119.28 | | | $ | 114.52 | | S&P 500 (SPX) | | | 100.00 | | | | 113.57 | | | | 115.09 | | | | 128.83 | | | | 156.90 | | | | 149.95 | | NASDAQ Bank Index (CBNK) | | | 100.00 | | | | 104.86 | | | | 114.02 | | | | 157.13 | | | | 165.51 | | | | 138.51 | |

| | | December 31, | | | | | 2019 | | | 2020 | | | 2021 | | | 2022 | | | 2023 | | Westamerica Bancorporation (WABC) | | $ | 143.05 | | | $ | 120.04 | | | $ | 128.93 | | | $ | 135.57 | | | $ | 134.51 | | S&P 500 (SPX) | | | 197.00 | | | | 233.39 | | | | 300.27 | | | | 245.75 | | | | 310.24 | | NASDAQ Bank Index (CBNK) | | | 172.04 | | | | 159.11 | | | | 227.27 | | | | 190.13 | | | | 183.55 | |

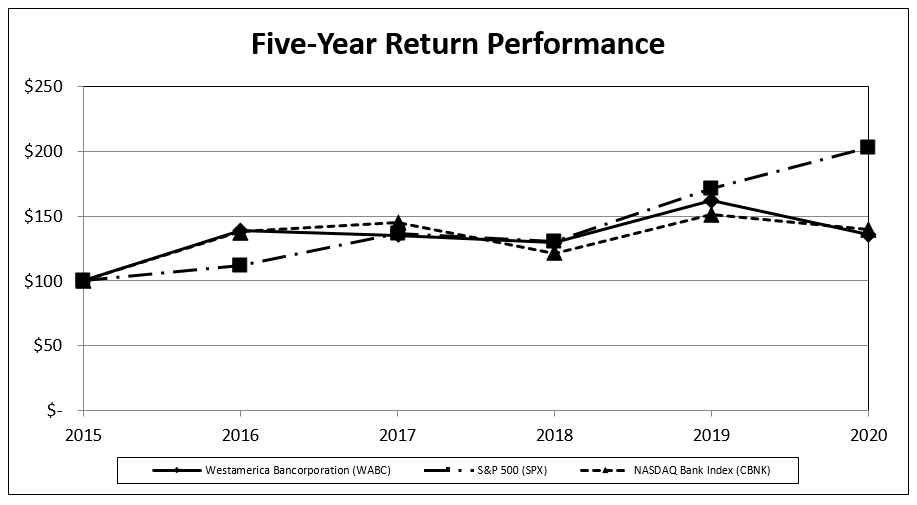

[The remainder of this page intentionally left blank] The following chart compares the cumulative return on the Company’s stock during the five years ended December 31, 2023 with the cumulative return on the S&P 500 composite stock index and NASDAQ’S Bank Index. The comparison assumes $100 invested in each on December 31, 2018 and reinvestment of all dividends. | | | December 31, | | | | | 2018 | | | 2019 | | | 2020 | | | 2021 | | | 2022 | | | 2023 | | Westamerica Bancorporation (WABC) | | $ | 100.00 | | | $ | 124.91 | | | $ | 104.82 | | | $ | 112.58 | | | $ | 118.38 | | | $ | 117.45 | | S&P 500 (SPX) | | | 100.00 | | | | 131.38 | | | | 155.65 | | | | 200.25 | | | | 163.89 | | | | 206.90 | | NASDAQ Bank Index (CBNK) | | | 100.00 | | | | 124.21 | | | | 114.87 | | | | 164.08 | | | | 137.27 | | | | 132.52 | |

ISSUER PURCHASES OF EQUITY SECURITIES The Company repurchases shares of its common stock in the open market to optimize the Company’s use of equity capital and enhance shareholder value and with the intention of lessening the dilutive impact of issuing new shares under stock option plans, and other ongoing requirements. The repurchase plan approved July 28, 2022 expired September 1, 2023. There is no replacement plan in place currently. No shares were repurchased during the period from October 1, 2023 through December 31, 2023. ITEM 6. [RESERVED] [The remainder of this page intentionally left blank] ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTSOF OPERATIONS The following financial information for the three years ended December 31, 2023 has been derived from the Company’s audited consolidated financial statements. This information should be read in conjunction with those statements, notes and other information included elsewhere herein. WESTAMERICA BANCORPORATION FINANCIAL SUMMARY | | | For the Years Ended December 31, | | | | | 2023 | | | 2022 | | | 2021 | | | | | (In thousands, except per share data and ratios) | | Interest and loan fee income | | $ | 284,013 | | | $ | 221,756 | | | $ | 173,443 | | Interest expense | | | 3,890 | | | | 1,925 | | | | 1,955 | | Net interest and loan fee income | | | 280,123 | | | | 219,831 | | | | 171,488 | | Reversal of provision for credit losses | | | (1,150 | ) | | | - | | | | - | | Noninterest income: | | | | | | | | | | | | | Life insurance gains | | | 279 | | | | 930 | | | | - | | Securities (losses) gains | | | (125 | ) | | | - | | | | 34 | | Other noninterest income | | | 43,368 | | | | 44,191 | | | | 43,311 | | Total noninterest income | | | 43,522 | | | | 45,121 | | | | 43,345 | | Noninterest expense | | | 103,216 | | | | 99,361 | | | | 97,806 | | Income before income taxes | | | 221,579 | | | | 165,591 | | | | 117,027 | | Income tax provision | | | 59,811 | | | | 43,557 | | | | 30,518 | | Net income | | $ | 161,768 | | | $ | 122,034 | | | $ | 86,509 | | | | | | | | | | | | | | | | Average common shares outstanding | | | 26,703 | | | | 26,895 | | | | 26,855 | | Average diluted common shares outstanding | | | 26,706 | | | | 26,907 | | | | 26,870 | | Common shares outstanding at December 31, | | | 26,671 | | | | 26,913 | | | | 26,866 | | | | | | | | | | | | | | | | Per common share: | | | | | | | | | | | | | Basic earnings | | $ | 6.06 | | | $ | 4.54 | | | $ | 3.22 | | Diluted earnings | | | 6.06 | | | | 4.54 | | | | 3.22 | | Book value at December 31, | | | 28.98 | | | | 22.37 | | | | 30.79 | | | | | | | | | | | | | | | | Financial ratios: | | | | | | | | | | | | | Return on assets | | | 2.35 | % | | | 1.65 | % | | | 1.23 | % | Return on common equity | | | 18.08 | % | | | 15.21 | % | | | 11.52 | % | Net interest margin (FTE)(1) | | | 4.37 | % | | | 3.17 | % | | | 2.62 | % | Net loan losses to average loans | | | 0.25 | % | | | 0.32 | % | | | 0.03 | % | Efficiency ratio(2) | | | 31.7 | % | | | 37.2 | % | | | 45.0 | % | Equity to assets | | | 12.14 | % | | | 8.66 | % | | | 11.09 | % | | | | | | | | | | | | | | | Period end balances: | | | | | | | | | | | | | Assets | | $ | 6,364,592 | | | $ | 6,950,317 | | | $ | 7,461,026 | | Loans | | | 866,602 | | | | 958,488 | | | | 1,068,126 | | Allowance for credit losses | | | 16,867 | | | | 20,284 | | | | 23,514 | | Investment securities | | | 4,878,198 | | | | 5,247,657 | | | | 4,945,258 | | Deposits | | | 5,474,267 | | | | 6,225,290 | | | | 6,413,956 | | Identifiable intangible assets and goodwill | | | 122,020 | | | | 122,256 | | | | 122,508 | | Short-term borrowed funds | | | 58,162 | | | | 57,792 | | | | 146,246 | | Shareholders' equity | | | 772,894 | | | | 602,110 | | | | 827,102 | | | | | | | | | | | | | | | | Capital ratios at period end: | | | | | | | | | | | | | Total risk based capital | | | 19.15 | % | | | 15.64 | % | | | 15.47 | % | Tangible equity to tangible assets | | | 10.43 | % | | | 7.03 | % | | | 9.60 | % | | | | | | | | | | | | | | | Dividends paid per common share | | $ | 1.72 | | | $ | 1.68 | | | $ | 1.65 | | Common dividend payout ratio | | | 28 | % | | | 37 | % | | | 51 | % |

(1) Yields on securities and certain loans have been adjusted upward to a "fully taxable equivalent" ("FTE") basis in order to reflect the effect of income which is exempt from federal income taxation at the current statutory tax rate. (2) The efficiency ratio is defined as noninterest expense divided by total revenue (net interest income on an FTE basis and noninterest income). The following discussion addresses information pertaining to the financial condition and results of operations of Westamerica Bancorporation and subsidiaries (the “Company”) that may not be otherwise apparent from a review of the consolidated financial statements and related footnotes. It should be read in conjunction with those statements and notes found on pages 52 through 89, as well as with the other information presented throughout this Report. Critical Accounting Policies The Company’s consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America and follow general practices within the banking industry. Application of these principles requires the Company to make certain estimates, assumptions, and judgments that affect the amounts reported in the financial statements and accompanying notes. These estimates, assumptions, and judgments are based on information available as of the date of the financial statements; accordingly, as this information changes, the financial statements could reflect different estimates, assumptions, and judgments. Certain accounting policies inherently have a greater reliance on the use of estimates, assumptions and judgments and as such have a greater possibility of producing results that could be materially different than originally reported. Estimates, assumptions and judgments are necessary when assets and liabilities are required to be recorded at fair value, when a decline in the value of an asset not carried on the financial statements at fair value warrants an impairment writedown or valuation reserve to be established, or when an asset or liability needs to be recorded contingent upon a future event. Carrying assets and liabilities at fair value inherently results in more financial statement volatility. The fair values and the information used to record valuation adjustments for certain assets and liabilities are based either on quoted market prices or are provided by other third-party sources, when available. The most significant accounting policies followed by the Company are presented in Note 1 to the consolidated financial statements. These policies, along with the disclosures presented in the other financial statement notes and in this discussion, provide information on how significant assets and liabilities are valued in the financial statements and how those values are determined. Based on the valuation techniques used and the sensitivity of financial statement amounts to the methods, assumptions, and estimates underlying those amounts, Management has identified the allowance for credit losses on loans accounting to be a critical accounting estimate. The accounting for the accounting area requiringallowance for credit losses on loans requires the most subjective or complex judgments, and as such could be most subject to revision as new information becomes available. AThe methodology, significant inputs and assumptions for the allowance for credit losses on loans are discussed in the section “Allowance for Credit Losses on Loans” below. Additional discussion of the factors affecting accounting for the allowance for credit losses and purchasedon loans is included in the “Loan Portfolio Credit Risk” discussion below. The Company’s allowance for credit losses on loans is established to provide for expected losses based on the available estimates at that point in time. Changes in economic conditions could significantly impact the estimated losses and could materially affect the Company’s operating results. Financial Overview Westamerica Bancorporation and subsidiaries’ (collectively, the “Company”)The Company reported net income of $80.4$161.8 million or $2.98$6.06 diluted earnings per common share (“EPS”) in 2020. The COVID-19 coronavirus pandemic began2023 compared with net income of $122.0 million or $4.54 EPS in the United States2022 and Californianet income of $86.5 million or $3.22 EPS in the first quarter 2020 and continued to cause escalating infections in the United States through the fourth quarter 2020. In response to the pandemic, the Company’s primary and wholly-owned subsidiary bank, Westamerica Bank (the “Bank”), funded $249 million Paycheck Protection Program (“PPP”) loans for the Bank’s customers during the second quarter 2020. PPP loans meaningfully increased interest-earning assets and related interest and fee income. The Bank continues to work with loan customers requesting deferral of loan payments due to economic weakness caused by the pandemic. At December 31, 2020, consumer loans granted loan deferrals totaled $2.5 million, commercial real estate loans with deferred payments totaled $7.8 million, primarily for hospitality and retail properties, and commercial loans with deferred payments totaled $33 thousand. The2021. 2023 results for 2020 included a $1.2 million reversal of provision for credit losses, of $4.3 million, which reduced EPS $0.11, representing Management’s estimate of additional reserves needed over the remaining life of its loans due to increased credit-risk from deteriorating economic conditions caused by the COVID-19 pandemic. Results for 2020 include a $3.5 million gain on salesnet of a closed branch building which increased EPS $0.13. These results compare to net income of $80.4 million or $2.98 diluted earnings per common share$400 thousand provision for 2019. Results for 2019 includecredit losses, a tax-exempt life insurance gain of $433$279 thousand and $553 thousand in loss contingencies. The loss contingencies include a $301 thousand increase in estimated customer refunds of revenue recognized prior to 2018 and a $252 thousand settlement to dismiss a lawsuit. During the year ended December 31, 2020, the Company paid $4,410 thousand of obligations accrued in prior years to customers eligible for refunds. The remaining obligations at December 31, 2020 was $1,433 thousand, included in other liabilities. The tax-exempt life insurance gain and loss contingencies did not have a significant impact$492 thousand increase to reconcile the 2022 income tax provision to the filed 2022 tax returns. 2022 results included a $1.2 million reconciling payment from a payments network and a $930 thousand life insurance gain equivalent to combined EPS of $0.07. 2021 results included “make-whole” interest income on the EPS for 2019.corporate bonds redeemed prior to maturity of $2.8 million.

Regions and states of the United States of America, including California implemented varying degrees of “stay at home” directives in an effort to prevent the spread of the virus in the first quarter of 2020. These directives have significantly reduced economic activity in the United States and the State of California. In the second and third quarters 2020 the “stay at home” directives were gradually lifted in varying stages in counties of the State of California. Counties with high infection rates delayed reopening and restrictions on certain economic activity remained. When infections increased in the fourth quarter restrictions were re-imposed to some degree. California-based claims for unemployment rose and remained elevated during 2020. The California “stay at home” directive excludes essential businesses including banks. The Bank remains open and fully operational.

In response to the pandemic, the Federal Reserve has engaged significant levels of monetary policy to provide liquidity and credit facilities to the financial markets. On March 15, 2020, the Federal Open Market Committee of the Federal Reserve Board (“FOMC”) reducedhas tightened monetary policy through increases to the overnight federal funds interest rate starting in March 2022. On January 31, 2024, the FOMC decided to maintain the target range for the federal funds rate at the range of 5.25% to 05.50%. The January 31, 2024 Federal Reserve press release stated, “Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have moderated since early last year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. The Committee seeks to 0.25 percent; relatedly,achieve maximum employment and inflation at the FOMC reducedrate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain, and Committee remains highly attentive to inflation risks. In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5.25% to 5.50%. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent… The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.” The interest rate paid on depositreserve balances to 0.10 percent effective March 16, 2020.at the Federal Reserve Bank remained at 5.40%. The Bank maintains depositreserve balances at the Federal Reserve Bank; the amount that earns interest is identified in the Company’s financial statements as “interest-bearing cash”.

Management continues to evaluate the impacts of inflation, the Federal Reserve’s monetary policy and climate changes on the Company’s business and its customers. Recently, the banking industry experienced significant volatility with several regional bank failures in the first half of 2023. Industrywide concerns remained related to liquidity, deposit outflows and unrealized losses on debt securities. These events could adversely affect the Company’s funding of its operations. The extent of the spread of the coronavirus and its ultimate containment are uncertain at this time. The effectiveness of the Federal Reserve Bank’s monetary policies and the federal government’s fiscal policies in stimulating the United States economy is uncertain at this time. Management expects the Company’s net interest margin and non-interest income to decline and credit-related losses to increase for an uncertain period given the decline in economic activity occurring due to the coronavirus. The amount of impact on the Company’s results of operations, cash flow liquidity, and financial results is uncertain. Please referperformance, as well as the Company’s ability to Part II, Item 1A “Risk factors” in this reportexecute near- and long-term business strategies and initiatives, will depend on Form 10-K.numerous evolving factors and future developments, which are uncertain and cannot be reasonably predicted. The Company presents its net interest margin and net interest income on a fully taxable equivalent (“FTE”) basis using the current statutory federal tax rate. Management believes the FTE basis is valuable to the reader because the Company’s loan and investment securities portfolios contain a relatively large portion of municipal loans and securities that are federally tax exempt. The Company’s tax exempt loans and securities composition may not be similar to that of other banks, therefore in order to reflect the impact of the federally tax exempt loans and securities on the net interest margin and net interest income for comparability with other banks, the Company presents its net interest margin and net interest income on an FTE basis. The Company’s significant accounting policies (see Note 1 “Summary of Significant Accounting Policies” to the Consolidated Financial Statements below) are fundamental to understanding the Company’s results of operations and financial condition. The Company adopted the following new accounting guidance: FASB ASU 2016-13,2022-02, Financial Instruments – - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments,Troubled Debt Restructurings and Vintage Disclosures was, issued on June 16, 2016.March 2022, eliminates the recognition and measurement guidance for troubled debt restructurings and requires enhanced disclosures about loan modifications for borrowers experiencing financial difficulty. This ASU also requires enhanced disclosure for loans that have been charged off. The ASU significantly changed estimates for credit losses related to financial assets measured at amortized cost and certain other contracts. For estimating credit losses, the FASB replaced the incurred loss model with the current expected credit loss (CECL) model, which accelerated recognition of credit losses. Additionally, credit losses relating to debt securities available-for-sale are recorded through an allowance for credit losses under the new standard. The Company is also required to provide additional disclosures related to the financial assets within the scope of the new standard. The Company adopted the ASU provisions on January 1, 2020. Management evaluated available data, defined portfolio segments of loans with similar attributes, and selected loss estimate models for each identified loan portfolio segment. Management measured historical loss rates for each portfolio segment. Management also segmented debt securities held to maturity, selected methods to estimate losses for each segment, and measured a loss estimate. Agency mortgage-backed securities were assigned no credit loss allowance due to the perceived backing of government sponsored entities. Municipal securities were evaluated for risk of default based on credit rating and remaining term to maturity using Moody’s risk of default factors; Moody’s loss upon default factors were applied to the assumed defaulted principal amounts to estimate the amount for credit loss allowance. The adjustment to the allowance for credit losses was recorded through an offsetting after-tax adjustment to shareholders’ equity. The implementing entry increased allowance for credit losses on loans by $2,017 thousand, reduced allowance for unfunded credit commitments by $2,107 thousand and increased retained earnings by $52 thousand.

FASB ASU 2018-13, Fair Value Measurements (Topic 820): Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement, was issued August 2018. The ASU is part of the disclosure framework project, where the primary focus is to improve the effectiveness of disclosures in the financial statements. The ASU removes, modifies and adds disclosure requirements related to Fair Value Measurements.

The provisions of the ASU werebecame effective January 1, 2020 with the option to early adopt any removed or modified disclosures upon issuance of the ASU.2023 under a prospective approach. The Company early adopted the provisions to remove the recognition and measurement guidance for troubled debt restructurings and/or modify relevant disclosures in the “Fair Value Measurements”“Loans” note to the unaudited consolidated financial statements. The requirement to include additional disclosures was adopted by the Company January 1, 2020.2023. The additional disclosures did not affect the financial results upon adoption.

FASB Accounting Standards Update (“ASU”) 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes, was issued December 2019. The ASU is intended to simplify various aspects related to accounting for income taxes, eliminates certain exceptions to the general principles in ASC Topic 740 related to intra-period tax allocation, simplifies when companies recognize deferred taxes in an interim period, and clarifies certain aspects of the current guidance to promote consistent application. This guidance was effective for public entities for fiscal years beginning after December 15, 2020, and for interim period within those fiscal years, with early adoption permitted. The Company adopted the ASU provisions on January 1, 2021 and the adoption of the ASU provisions did not have a significant impact on the Company’s consolidated financial statements. [The remainder of this page intentionally left blank] Net Income Following is a summary of the components of net income for the periods indicated: | | | For the Years Ended December 31, | | | For the Years Ended December 31, | | | | | 2020 | | | 2019 | | | 2018 | | | 2023 | | | 2022 | | | 2021 | | | | | ($ in thousands, except per share data) | | | ($ in thousands, except per share data) | | Net interest and loan fee income | | $ | 164,032 | | | $ | 156,794 | | | $ | 149,764 | | | $ | 280,123 | | | $ | 219,831 | | | $ | 171,488 | | FTE adjustment | | | 3,650 | | | | 4,612 | | | | 5,646 | | | | 1,550 | | | | 1,944 | | | | 2,663 | | Net interest and loan fee income (FTE) | | 167,682 | | | 161,406 | | | 155,410 | | | 281,673 | | | 221,775 | | | 174,151 | | Provision for credit losses | | (4,300 | ) | | - | | | - | | | Reversal of provision for credit losses | | | 1,150 | | | - | | | - | | Noninterest income | | 45,637 | | | 47,408 | | | 48,149 | | | 43,522 | | | 45,121 | | | 43,345 | | Noninterest expense | | | (98,566 | ) | | | (98,986 | ) | | | (106,916 | ) | | | (103,216 | ) | | | (99,361 | ) | | | (97,806 | ) | Income before income taxes (FTE) | | 110,453 | | | 109,828 | | | 96,643 | | | 223,129 | | | 167,535 | | | 119,690 | | Income taxes (FTE) | | | (30,040 | ) | | | (29,439 | ) | | | (25,079 | ) | | | (61,361 | ) | | | (45,501 | ) | | | (33,181 | ) | Net income | | $ | 80,413 | | | $ | 80,389 | | | $ | 71,564 | | | $ | 161,768 | | | $ | 122,034 | | | $ | 86,509 | | | | | | Net income per average fully-diluted common share | | $ | 2.98 | | | $ | 2.98 | | | $ | 2.67 | | | $ | 6.06 | | | $ | 4.54 | | | $ | 3.22 | | Net income as a percentage of average shareholders' equity | | 11.30 | % | | 11.90 | % | | 11.35 | % | | 18.08 | % | | 15.21 | % | | 11.52 | % | Net income as a percentage of average total assets | | 1.30 | % | | 1.44 | % | | 1.27 | % | | 2.35 | % | | 1.65 | % | | 1.23 | % |

Net income remained at the same level in 2020 and 2019.for 2023 increased $39.7 million compared with 2022. Net interest and loan fee income (FTE) income increased $6.3$59.9 million in 2023 compared with 2022 due to higher yield on interest-earning assets and higher average balances of investments and average balances of $151 million of PPP loans,investment debt securities, partially offset by lower yield on interest-bearing earning assets and lower average balances of other loans. Resultsloans and interest-bearing cash and higher rate on interest-bearing liabilities. The Company recorded a $1.2 million reversal of provision for 2020 includecredit losses in 2023, reflecting a $2.2 million recovery on a previously charged off loan in the first quarter 2023 and a $400 thousand credit loss provision, based on the results of the Company’s current expected credit loss (“CECL”) model and Management’s estimate of credit losses of $4.3 million, representing Management estimate of additional reserves needed over the remaining life of its loans dueand debt securities held to credit-risk from economic weakness caused bymaturity. The Company provided no provision for credit losses in 2022, based on Management’s estimate of credit losses over the COVID-19 pandemic.remaining life of its loans and debt securities held to maturity. Noninterest income in 2023 decreased $1.8$1.6 million compared with 20192022 primarily because 2022 included a $1.2 million reconciling payment from a payments network and higher gains on life insurance. Noninterest expense in 2023 increased $3.9 million compared with 2022 primarily due to lower income from activity based fees due to reduced economic activity related to the COVID-19 pandemic. Additionally, the results for 2019 included a life insurance gain of $433 thousand. The decreaseincreases in noninterest income from 2019 to 2020 was partially offset by $3.5 million in gains on sales of a closed branch building in 2020. In 2020 noninterest expense decreased $420 thousand compared with lower salaries and benefits, occupancy and equipment expenses, and lower amortization of intangible assets, and because the resultsincreased FDIC insurance assessments for 2019 included $553 thousand of loss contingency. The decrease wasall insured depository institutions. Lower professional fees partially offset by higher FDIC assessments (includedthe increases in “other noninterest expense”)expense in 2020 because FDIC assessments in 2019 were reduced by application of the Bank’s FDIC assessment credit described in Part 1, Item 1, “Premiums for Deposit Insurance”.2023 compared with 2022. The effective tax ratesrate (FTE) was 27.5% in 2023 and 27.2% in 2022. 2023 tax provision included a $492 thousand increase to reconcile the 2022 income tax provision to the filed 2022 tax returns.

Net income for 20202022 increased $35.5 million compared with 26.8% for 2019. Comparing 2019 with 2018, net income increased $8.8 million.2021. Net interest and loan fee income (FTE) income increased $6.0$47.6 million in 2022 compared with 2021 due to a higher net yield on earning assets and higher average balances of investments,investment debt securities and higher yield on interest-earning assets, partially offset by lower average balances of interest-bearing cash and loans. The provision for loancredit losses remainedwas zero for 2022 and 2021, reflecting Management's evaluationestimate of credit losses inherentover the remaining life of its loans and investment debt securities. Noninterest income in the loan portfolio. In 2019, noninterest income decreased $741 thousand2022 increased $1.8 million compared with 20182021 primarily due to lowera $1.2 million reconciling payment from a payments network, a $930 thousand life insurance gain and higher fee income from service charges on deposit accounts, other service charges and debit card fees,accounts. The increases in 2022 compared 2021 was partially offset in part by an increasedecreases in merchant processing servicesservice income and securities gainsother noninterest income. Noninterest expense in 2019. In 2019 noninterest expense decreased $7.92022 increased $1.6 million compared with 20182021. Limited partnership operating losses increased $3.1 million due to higher estimated operating losses on limited partnership investments in low-income housing and occupancy and equipment expense increased primarily due to decreasessoftware upgrades. The increase in loss contingencies,2022 compared with 2021 was partially offset by a decrease in salaries and related benefits FDIC insurance assessments,resulting from attrition and intangible amortization.lower professional fees. The effective tax ratesrate (FTE) was 26.8% for 201927.2% in 2022 compared with 26.0% for 2018.27.7% in 2021.

[The remainder of this page intentionally left blank] Net Interest and Loan Fee Income (FTE) The Company's primary source of revenue is net interest income, or the difference between interest income earned on loans and investment securities and interest expense paid on interest-bearing deposits and other borrowings. Components of Net Interest and Loan Fee Income (FTE) | | | For the Years Ended December 31, | | | For the Years Ended December 31, | | | | | 2020 | | | 2019 | | | 2018 | | | 2023 | | | 2022 | | | 2021 | | | | | ($ in thousands) | | | ($ in thousands) | | Interest and loan fee income | | $ | 165,856 | | | $ | 158,682 | | | $ | 151,723 | | | $ | 284,013 | | | $ | 221,756 | | | $ | 173,443 | | FTE adjustment | | | 3,650 | | | | 4,612 | | | | 5,646 | | | | 1,550 | | | | 1,944 | | | | 2,663 | | Net interest and loan fee income (FTE) | | 169,506 | | | 163,294 | | | 157,369 | | | Interest and loan fee income (FTE) | | | 285,563 | | | 223,700 | | | 176,106 | | Interest expense | | | (1,824 | ) | | | (1,888 | ) | | | (1,959 | ) | | | (3,890 | ) | | | (1,925 | ) | | | (1,955 | ) | Net interest and loan fee income (FTE) | | $ | 167,682 | | | $ | 161,406 | | | $ | 155,410 | | | $ | 281,673 | | | $ | 221,775 | | | $ | 174,151 | | | | | | Net interest margin (FTE) | | 2.91 | % | | 3.11 | % | | 2.98 | % | | 4.37 | % | | 3.17 | % | | 2.62 | % |

Net interest and loan fee income (FTE) increased $6.3$59.9 million in 20202023 compared with 20192022 due to higher average balances of investments (up $445 million) and average balances of $151 million of PPP loans, partially offset by lower yield on interest-bearing earning assets (down 0.20%) and lower average balances of other loans (down $74 million). Comparing 2019 with 2018, net interest and loan fee income (FTE) increased $6.0 million due to a higher net yield on earninginterest-earning assets (up 0.12%1.23%) and higher average balances of investmentsinvestment debt securities (up $127$31 million), partially offset by lower average balances of loans (down $86 million) and interest-bearing cash (down $101$486 million) and higher rate on interest-bearing liabilities (up 0.07%).

Net interest and loan fee income (FTE) increased $47.6 million in 2022 compared with 2021 due to higher average balances of investment securities (up $723 million) and higher yield on interest-earning assets (up 0.55%), partially offset by lower average balances of loans (down $47$197 million). The net interest margin (FTE) was 2.91%4.37% in 2020, 3.11%2023, 3.17% in 20192022 and 2.98%2.62% in 2018.2021. The yield on earning assets (FTE) was 2.94%4.43% in 2020, 3.14%2023, 3.20% in 20192022 and 3.02%2.65% in 2018. Market interest rates declined in 2020 compared with 2019. Additionally, investments, which generally carry lower yield than loans, made up a higher percentage of total earning assets in 2020 than in prior periods. (72.0% in 2020 compared with 71.4% in 2019 and 68.6% in 2018).2021. The Company’s funding costs were 0.06% in 2023, compared with 0.03% in 20202022 and 2019 compared with 0.04%2021. Noninterest bearing deposits represented 47% of average deposits in 2018.2023 and 2022, while higher-cost time deposits represented 2% for both periods. Average balances of time deposits in 20202023 declined $18$24 million from 2019. Average balances of lower-cost checking and savings deposits grew 11% from 2019 to 2020.2022. Average balances of checking and saving deposits accounted for 96.9%98.0% of average total deposits in 20202023 compared with 96.2%97.8% in 20192022. The customer deposits and 95.6% in 2018.shareholders’ equity fully funded the Company’s interest earning assets for 2023 and 2022; there was no borrowing from the Federal Reserve Bank or correspondent banks. Net Interest Margin (FTE) The following summarizes the components of the Company's net interest margin (FTE) for the periods indicated. | | | For the Years Ended December 31, | | | For the Years Ended December 31, | | | | | 2020 | | | 2019 | | | 2018 | | | 2023 | | | 2022 | | | 2021 | | | | | | Yield on earning assets (FTE) | | 2.94 | % | | 3.14 | % | | 3.02 | % | | 4.43 | % | | 3.20 | % | | 2.65 | % | Rate paid on interest-bearing liabilities | | | 0.06 | % | | | 0.07 | % | | | 0.07 | % | | | 0.12 | % | | | 0.05 | % | | | 0.06 | % | Net interest spread (FTE) | | 2.88 | % | | 3.07 | % | | 2.95 | % | | 4.31 | % | | 3.15 | % | | 2.59 | % | Impact of noninterest-bearing demand deposits | | | 0.03 | % | | | 0.04 | % | | | 0.03 | % | | Benefit of noninterest-bearing demand deposits | | | | 0.06 | % | | | 0.02 | % | | | 0.03 | % | Net interest margin (FTE) | | | 2.91 | % | | | 3.11 | % | | | 2.98 | % | | | 4.37 | % | | | 3.17 | % | | | 2.62 | % |

[The remainderincrease in the Company’s yield on earning assets has been generated primarily by collateralized loan obligations (CLOs), held in debt securities available for sale portfolio, and interest-bearing cash. The CLOs have interest coupons that change once every three months by the amount of this page intentionally left blank]change in the three-month SOFR base rates. The average balances and yields of CLOs for 2023 and 2022 was $1,543 million yielding 6.99% and $1,567 million yielding 3.62%, respectively. The interest-bearing cash yield changes by the amount of change in the overnight federal funds rate on the effective date declared by the FOMC. The average balance and yields of interest-bearing cash for 2023 and 2022 was $205 million yielding 5.21% and $691 million yielding 1.13%, respectively. The Company has other earning assets with variable yields such as commercial loans and lines of credit, consumer lines of credit and adjustable rate residential real estate loans, which are included in “other taxable loans” in the following “Summary of Average Balances, Yields/Rates and Interest Differential.”

Summary of Average Balances, Yields/Rates and Interest Differential The following tables present information regarding the consolidated average assets, liabilities and shareholders’ equity, the amounts of interest income earned from average interest earning assets and the resulting yields, and the amounts of interest expense incurred on average interest-bearing liabilities and the resulting rates. Average loan balances include nonperforming loans. Interest income includes reversal of previously accrued interest on loans placed on non-accrual status during the period and proceeds from loans on nonaccrual status only to the extent cash payments have been received and applied as interest income and accretion of purchased loan discounts. Yields on tax-exempt securities and loans have been adjusted upward to reflect the effect of income exempt from federal income taxation at the federal statutory tax rate of 21 percent. Distribution of Assets, Liabilities & Shareholders’ Equity and Yields, Rates & Interest Margin | | | For the Year Ended December 31, 2020 | | | For the Year Ended December 31, 2023 | | | | | | | Interest | | | | | | | Interest | | | | | | | Average | | Income/ | | Yields/ | | | Average | | Income/ | | Yields/ | | | | | Balance | | | Expense | | | Rates | | | Balance | | | Expense | | | Rates | | | | | ($ in thousands) | | | ($ in thousands) | | Assets | | | | | | | | | Investment securities: | | | | | | | | | Taxable | | $ | 3,689,769 | | | $ | 93,163 | | | 2.52 | % | | $ | 5,176,278 | | | $ | 221,742 | | | 4.28 | % | Tax-exempt (1) | | | 460,191 | | | | 15,395 | | | 3.35 | % | | | 158,433 | | | | 5,668 | | | 3.58 | % | Total investments (1) | | 4,149,960 | | | 108,558 | | | 2.62 | % | | 5,334,711 | | | 227,410 | | | 4.26 | % | Loans: | | | | | | | | | Taxable: | | | | | | | | | PPP loans | | 151,320 | | | 6,516 | | | 4.31 | % | | Other | | | 1,039,724 | | | | 51,336 | | | 4.94 | % | | Total taxable | | 1,191,044 | | | 57,852 | | | 4.86 | % | | Taxable | | | 868,255 | | | 45,739 | | | 5.27 | % | Tax-exempt (1) | | | 48,100 | | | | 1,931 | | | 4.01 | % | | | 44,061 | | | | 1,743 | | | 3.96 | % | Total loans (1) | | 1,239,144 | | | 59,783 | | | 4.82 | % | | 912,316 | | | 47,482 | | | 5.20 | % | Total interest-bearing cash | | | 371,444 | | | | 1,165 | | | 0.31 | % | | | 204,794 | | | | 10,671 | | | 5.21 | % | Total Interest-earning assets (1) | | 5,760,548 | | | 169,506 | | | 2.94 | % | | 6,451,821 | | | 285,563 | | | 4.43 | % | Other assets | | | 413,922 | | | | | | | | | 419,545 | | | | | | | Total assets | | $ | 6,174,470 | | | | | | | | $ | 6,871,366 | | | | | | | | | | | Liabilities and shareholders' equity | | | | | | | | | Noninterest-bearing demand | | $ | 2,538,819 | | | $ | - | | | - | % | | $ | 2,748,544 | | | $ | - | | | - | % | Savings and interest-bearing transaction | | 2,603,476 | | | 1,258 | | | 0.05 | % | | 2,922,909 | | | 3,450 | | | 0.12 | % | Time less than $100,000 | | 91,519 | | | 193 | | | 0.21 | % | | 67,832 | | | 204 | | | 0.30 | % | Time $100,000 or more | | | 72,363 | | | | 319 | | | 0.44 | % | | | 48,076 | | | | 116 | | | 0.24 | % | Total interest-bearing deposits | | 2,767,358 | | | 1,770 | | | 0.06 | % | | 3,038,817 | | | 3,770 | | | 0.12 | % | Short-term borrowed funds | | 80,456 | | | 53 | | | 0.07 | % | | | 89,298 | | | | 120 | | | 0.13 | % | Other borrowed funds | | | 174 | | | | 1 | | | 0.35 | % | | Total interest-bearing liabilities | | 2,847,988 | | | 1,824 | | | 0.06 | % | | 3,128,115 | | | 3,890 | | | 0.12 | % | Other liabilities | | 76,109 | | | | | | | | | 100,097 | | | | | | | Shareholders' equity | | | 711,554 | | | | | | | | 894,610 | | | | | | | Total liabilities and shareholders' equity | | $ | 6,174,470 | | | | | | | | $ | 6,871,366 | | | | | | | Net interest spread (1) (2) | | | | | | | 2.88 | % | | | | | | | 4.31 | % | Net interest and fee income and interest margin (1) (3) | | | | | $ | 167,682 | | | 2.91 | % | | | | | $ | 281,673 | | | 4.37 | % |

(1) | Amounts calculated on an FTE basis using the current statutory federal tax rate.

|

(2)

| Net interest spread represents the average yield earned on interest-earning assets less the average rate incurred on interest-bearing liabilities.

|

(3) | (1) Amounts calculated on an FTE basis using the current statutory federal tax rate. (2) Net interest spread represents the average yield earned on interest-earning assets less the average rate incurred on interest-bearing liabilities. (3)Net interest margin is computed by calculating the difference between interest income and expense, divided by the average balance of interest-earning assets. The net interest margin is greater than the net interest spread due to the benefit of noninterest-bearing demand deposits. |

Distribution of Assets, Liabilities & Shareholders’ Equity and Yields, Rates & Interest Margin | | | For the Year Ended December 31, 2022 | | | | | | | | | Interest | | | | | | | | | Average | | | Income/ | | | Yields/ | | | | | Balance | | | Expense | | | Rates | | | | | ($ in thousands) | | Assets | | | | | | | | | | | | | Investment securities: | | | | | | | | | | | | | Taxable | | $ | 5,093,921 | | | $ | 158,465 | | | | 3.11 | % | Tax-exempt (1) | | | 209,725 | | | | 7,390 | | | | 3.52 | % | Total investments (1) | | | 5,303,646 | | | | 165,855 | | | | 3.13 | % | Loans: | | | | | | | | | | | | | Taxable | | | 951,516 | | | | 48,274 | | | | 5.07 | % | Tax-exempt (1) | | | 46,448 | | | | 1,781 | | | | 3.83 | % | Total loans (1) | | | 997,964 | | | | 50,055 | | | | 5.02 | % | Total interest-bearing cash | | | 691,086 | | | | 7,790 | | | | 1.13 | % | Total Interest-earning assets (1) | | | 6,992,696 | | | | 223,700 | | | | 3.20 | % | Other assets | | | 420,312 | | | | | | | | | | Total assets | | $ | 7,413,008 | | | | | | | | | | | | | | | | | | | | | | | | Liabilities and shareholders' equity | | | | | | | | | | | | | Noninterest-bearing demand | | $ | 3,018,350 | | | $ | - | | | | - | % | Savings and interest-bearing transaction | | | 3,257,858 | | | | 1,510 | | | | 0.05 | % | Time less than $100,000 | | | 77,007 | | | | 180 | | | | 0.23 | % | Time $100,000 or more | | | 62,411 | | | | 156 | | | | 0.25 | % | Total interest-bearing deposits | | | 3,397,276 | | | | 1,846 | | | | 0.05 | % | Short-term borrowed funds | | | 109,283 | | | | 79 | | | | 0.07 | % | Total interest-bearing liabilities | | | 3,506,559 | | | | 1,925 | | | | 0.05 | % | Other liabilities | | | 85,610 | | | | | | | | | | Shareholders' equity | | | 802,489 | | | | | | | | | | Total liabilities and shareholders' equity | | $ | 7,413,008 | | | | | | | | | | Net interest spread (1) (2) | | | | | | | | | | | 3.15 | % | Net interest and fee income and interest margin (1) (3) | | | | | | $ | 221,775 | | | | 3.17 | % |

| | | For the Year Ended December 31, 2019 | | | | | | | | | Interest | | | | | | | | | Average | | | Income/ | | | Yields/ | | | | | Balance | | | Expense | | | Rates | | | | | ($ in thousands) | | Assets | | | | | | | | | | | | | Investment securities: | | | | | | | | | | | | | Taxable | | $ | 3,089,099 | | | $ | 77,800 | | | | 2.52 | % | Tax-exempt (1) | | | 615,665 | | | | 19,923 | | | | 3.24 | % | Total investments (1) | | | 3,704,764 | | | | 97,723 | | | | 2.64 | % | Loans: | | | | | | | | | | | | | Taxable | | | 1,112,250 | | | | 56,550 | | | | 5.08 | % | Tax-exempt (1) | | | 49,529 | | | | 2,028 | | | | 4.10 | % | Total loans (1) | | | 1,161,779 | | | | 58,578 | | | | 5.04 | % | Total interest bearing cash | | | 324,733 | | | | 6,993 | | | | 2.15 | % | Total interest-earning assets(1) | | | 5,191,276 | | | | 163,294 | | | | 3.14 | % | Other assets | | | 405,833 | | | | | | | | | | Total assets | | $ | 5,597,109 | | | | | | | | | | | | | | | | | | | | | | | | Liabilities and shareholders' equity | | | | | | | | | | | | | Noninterest-bearing demand | | $ | 2,222,876 | | | $ | - | | | | - | % | Savings and interest-bearing transaction | | | 2,396,604 | | | | 1,274 | | | | 0.05 | % | Time less than $100,000 | | | 103,399 | | | | 254 | | | | 0.25 | % | Time $100,000 or more | | | 78,925 | | | | 326 | | | | 0.41 | % | Total interest-bearing deposits | | | 2,578,928 | | | | 1,854 | | | | 0.07 | % | Short-term borrowed funds | | | 51,442 | | | | 34 | | | | 0.07 | % | Total interest-bearing liabilities | | | 2,630,370 | | | | 1,888 | | | | 0.07 | % | Other liabilities | | | 68,351 | | | | | | | | | | Shareholders' equity | | | 675,512 | | | | | | | | | | Total liabilities and shareholders' equity | | $ | 5,597,109 | | | | | | | | | | Net interest spread (1) (2) | | | | | | | | | | | 3.07 | % | Net interest and fee income and interest margin (1) (3) | | | | | | $ | 161,406 | | | | 3.11 | % |

(1) Amounts calculated on an FTE basis using the current statutory federal tax rate. (1)

| Amounts calculated on a fully taxable equivalent basis using the current statutory federal tax rate.

|

(2)

| Net interest spread represents the average yield earned on interest-earning assets less the average rate incurred on interest-bearing liabilities.

|

(3)

| (2) Net interest spread represents the average yield earned on interest-earning assets less the average rate incurred on interest-bearing liabilities. (3)Net interest margin is computed by calculating the difference between interest income and expense, divided by the average balance of interest-earning assets. The net interest margin is greater than the net interest spread due to the benefit of noninterest-bearing demand deposits. |