UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)One)

| ☒ | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31 2020., 2023

| ☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO

Commission file number 001-3200File Number 001-32001

APTOSE BIOSCIENCES INC.Aptose Biosciences Inc.

(Exact name of registrantRegistrant as specified in its charter)Charter)

| |

Canada

| 98-1136802 |

(State or other jurisdiction of incorporation or organization) | 98-1136802

(I.R.S. Employer Identification No.) |

251 Consumers Road, Suite 1105 Toronto, Ontario, CanadaM2J 4R3

| M2J 4R3 |

(Address of principal executive offices) |

647-479-9828

(Registrant’s telephone number, including area code)Zip Code) |

Registrant’s telephone number, including area code: (647) 479-9828

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | Trading Symbol(s)

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common Shares, no par value | APTO

| APTO |

| Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrantRegistrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES Yes ☐ NONo☒

Indicate by check mark if the registrantRegistrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES Yes ☐ NO No ☒

Indicate by check mark whetherwhether the registrantRegistrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrantRegistrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES Yes☒ NO No ☐

Indicate by check mark whether the registrantRegistrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§229.405232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrantRegistrant was required to submit and post such files). YES Yes☒ NO No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer ☐ |

| ☐ |

| Accelerated filer |

| ☐ |

|

|

|

|

Non-accelerated filer ☒ |

| ☒ |

| Smaller reporting company |

| ☒ |

|

|

|

|

|

|

|

Emerging growth company ☐ |

| ☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b 212b-2 of the Exchange Act). YES Yes ☐ NO No ☒

The aggregate market value of the voting stock and nonvoting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked prices of such common equity, as of June 30, 20202023 was $478,045,833.$29,584,561.

As of March 23, 2021,26, 2024, the registrant had 88,885,238 common shares15,717,701 Common Shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our Proxy Statement for our 20212023 Annual Meeting of Stockholders (the “Proxy Statement”), are incorporated by reference in Part III.

TABLE OF CONTENTS

This Annual Report on Form 10-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is subject to the safe harbor created by those sections. For more information, see “Part I. Item 1. Business — Cautionary Note Regarding Forward-Looking Statements.”

As used in this report, the terms “Aptose,” “Aptose Biosciences,” the “Company,” “we,” “us,” “our” and similar references refer to Aptose Biosciences Inc. (formerly known as Lorus Therapeutics Inc.) and our consolidated subsidiaries, and the term “Common Shares” refers to our common shares, no par value.

Aptose hashad historically qualified as a “foreign private issuer” for purposes of reporting under the Exchange Act, and filing registration statements under the Securities Act of 1933, as amended. Effective December 31, 2018, however, Aptose ceased qualifying as a foreign private issuer and began filing reports with the SECUnited States Securities and Exchange Commission ("SEC") as a “domestic issuer”.issuer.” As a result, Aptose changed the accounting standards by which it prepares its financial statements from International Financial Reporting Standards or “IFRS”, to generally accepted accounting principles in the United States, or “US GAAP”. “U.S. GAAP.” All financial statements contained in this Annual Report are presented on the basis ofin accordance with U.S. GAAP. This report contains the following trademarks,trademark, trade namesname and service marksmark of ours: Aptose. This report also contains trademarks, trade names and service marks that are owned by other persons or entities.

PART I.

Item 1. Business

Overview

Overview

Aptose Biosciences Inc. is a science-driven, clinical-stage biotechnology company committed to precision medicines addressing unmet clinical needs in oncology, with an initial focus on hematology. The Company's small molecule cancer therapeutics pipeline includes products designed to provide single agent efficacy and to enhance the efficacy of other anti-cancer therapies and regimens without overlapping toxicities. The Company’s executive office is located in San Diego, California.

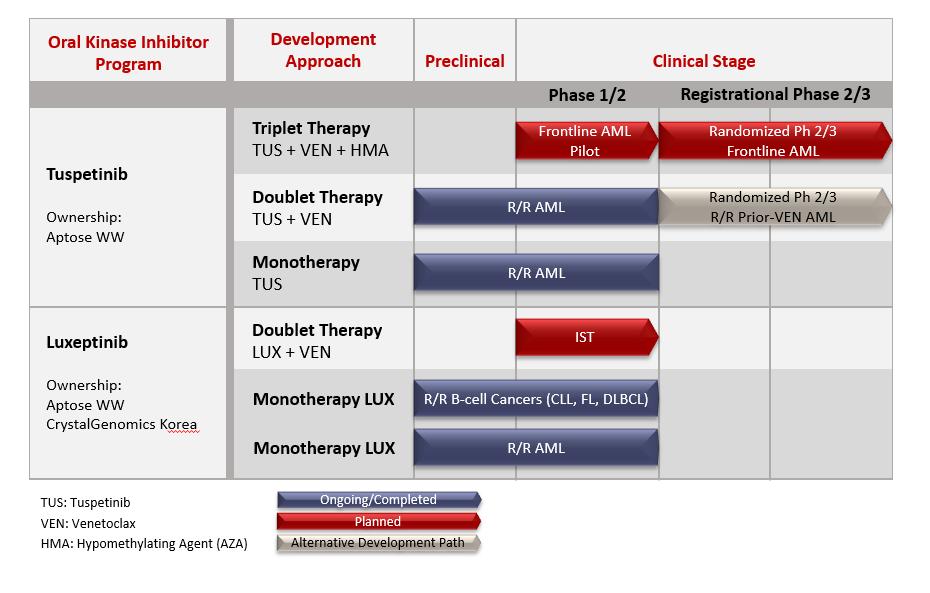

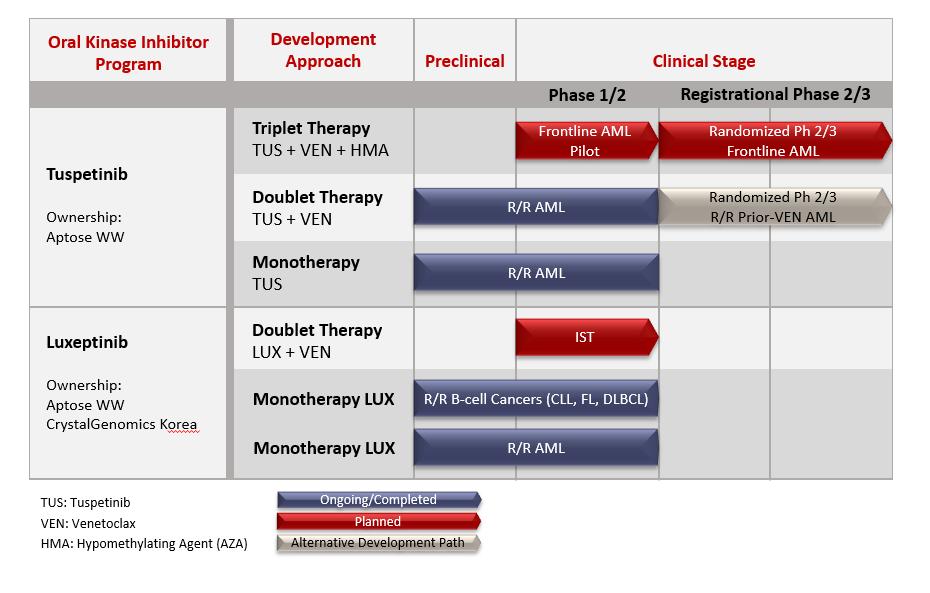

Our Programs

We are advancing highly differentiatedoral targeted agents to treat unmet medical needslife-threatening hematologic cancers that require immediate treatment. We have two clinical-stage oral kinase inhibitors under active development for the treatment of hematologic malignancies: tuspetinib (HM43239) and luxeptinib (CG-806). Tuspetinib and luxeptinib are being evaluated for safety, tolerability, pharmacokinetics and efficacy in life-threatening cancers,Phase 1/2 clinical trials, and each molecule is described below. A third molecule (APTO-253) is not undergoing active clinical development and will not be discussed further.

Tuspetinib, Aptose’s lead asset, is being developed for frontline combination therapy in newly diagnosed AML patients to unlock the most significant patient impact and greatest commercial opportunity. Tuspetinib is a once-daily oral kinase inhibitor, targeting a select group of kinases operative in myeloid malignancies, such as acute myeloid leukemia (“AML”), certain B-cell malignancies, high-risk myelodysplastic syndrome (“MDS”("AML") and the higher risk myelodysplastic syndromes ("hr-MDS"), and known to be involved in tumor proliferation, resistance to therapy, and differentiation. However, tuspetinib avoids kinases that typically cause toxicities associated with other hematologic malignancies. Aptosekinase inhibitors and is consequently a publicly listed company incorporated underwell-tolerated antileukemic agent. The clinical development path for triplet combination therapy in newly diagnosed AML patients with tuspetinib-based triplet combination therapy (tuspetinib + the lawsBCL-2 inhibitor venetoclax + hypomethylating agent; TUS+VEN+HMA) begins with a demonstration of Canada. The Company’s Common Shares are listed on the Nasdaq Capital Marketsafety and the Toronto Stock Exchange. The Company was incorporated on September 5, 1986, under the name RML Medical Laboratories (“RML”activity of tuspetinib as a single agent ("TUS") pursuant to the Business Corporations Act (Ontario) and then continued pursuant towith the Canada Business Corporations Act (“CBCA”TUS+VEN doublet combination therapy in relapsed or refractory ("R/R"). Between 1986 AML patients.

Tuspetinib monotherapy dose escalation and 2014, the Company operated under the names of RML, IMUTEC Corporation and Lorus Therapeutics Inc. On August 28, 2014, the Company changed its name from Lorus Therapeutics Inc. to Aptose Biosciences Inc. and, on October 1, 2014, we consolidated our outstanding Common Shares on the basis of one post-consolidation Common Share for each twelve pre-consolidation Common Shares.

Based on insights into the genetic and epigenetic profiles of certain cancers and patient populations, Aptose is building a pipeline of novel and targeted oncology therapies directed at dysregulated processes and signaling pathways in cancer cells, and this strategy is intended to optimize efficacy through simultaneous targeting of key drivers of disease in cancer cells, while preserving quality of life in patients by minimizing the side effects associated with conventional therapies. Our product pipeline includes cancer drug candidates that exert potent activity as stand-alone agents and that enhance thedose exploration activities of other anticancer agents without causing overlapping toxicities. Indeed, we believe our targeted products can emerge as first-in-class or best-in-class agents that deliver single agent benefit and may servehave been completed as part of an international Phase 1/2 clinical trial designed to assess the safety, tolerability, pharmacokinetics, pharmacodynamic responses, and efficacy as a single agent in patients with R/R AML. Complete responses (“CRs”) without dose limiting toxicities were achieved at four dose levels across a broad diversity of mutationally-defined AML populations and with a highly favorable safety profile. Tuspetinib to date has demonstrated a favorable safety profile and has caused no drug-related QTc prolongations, liver or kidney toxicities, muscle damage, differentiation syndrome, and no

myelosuppression with continuous dosing of patients in remission. A recommended phase 2 dose ("RP2D") of 80 mg tuspetinib once daily as an oral tablet was selected and approved by the U.S. FDA for use as a single agent in patients with R/R AML. At the RP2D, tuspetinib demonstrated notable response rates in R/R AML patients that had never been treated with venetoclax (VEN-naive AML): CR/CRh=36% among all-comers, CR/CRh=50% among patients with mutated FLT3, and CR/CRh=25% in patients with wildtype FLT3.

Following completion of the single agent dose escalation and exploration trial, tuspetinib advanced into the APTIVATE expansion trial of the Phase 1/2 program in R/R AML patient populations treated with tuspetinib combined with the BCL-2 inhibitor venetoclax (TUS+VEN doublet), with the intent to position tuspetinib for triple combination therapeutic strategystudies in frontline therapy for specific populationsnewly diagnosed AML patients. The TUS+VEN doublet combination therapy (with both 40mg and 80mg TUS) maintained a favorable safety profile: no new or unexpected safety signals were observed, and there were no reported drug-related adverse events of cancerQTc prolongation, differentiation syndrome, or deaths. Also, the TUS/VEN doublet combination (with 80mg TUS) achieved responses in heavily pretreated R/R AML patients, including those with wildtype or mutated FLT3, and those who failed prior therapy with venetoclax (Prior-VEN) or FLT3 inhibitors (Prior-FLT3i). Based on the safety and efficacy profile of tuspetinib, we believe that tuspetinib, if approved, can reach annual sales greater than $3 billion by 2035 because we believe tuspetinib could 1) become the preferred kinase inhibitor for inclusion in triplet combination for front line AML patients with FLT3 mutations and for patients with wild type FLT3, 2) become the preferred kinase inhibitor for inclusion in combination with venetoclax for second line AML patients, 3) serve as an effective agent for maintenance therapy to prevent relapse in patients who achieved a complete remission through a stem cell transplant or through drug-based therapy, 4) serve as an effective agent for the treatment of third line FLT3 mutated patients failed by prior therapy with other FLT3 inhibitors and 5) serve in front line triplet combinations, second line doublet combinations, and maintenance therapy for hr-MDS patients. These beliefs related to the potential commercial opportunity are based on management’s current assumptions and estimates, which are subject to change, and there can be no assurance that tuspetinib will ever be approved or successfully commercialized and, if approved and commercialized, that it will ever generate significant revenues. See our “Risk Factors – “We are an early-stage development company with no revenues from product sales.” and “We have a history of operating losses. We expect to incur net losses and we may never achieve or maintain profitability.” in this Annual Report on Form 10-K.

We believeLuxeptinib, Aptose's second agent, is an oral, highly potent kinase inhibitor that selectively targets defined kinases operative in myeloid and lymphoid hematologic malignancies. This small molecule has been evaluated in a Phase 1a/b study for the future of cancer treatment and management lies in the prospective selection and treatment of patients having malignancies that are genetically or epigenetically predisposed to response based onR/R B-cell leukemias and lymphomas (dose escalation from 150mg-900mg BID) and in a drug’s unique mechanism of action. We are of the view that many drugs currently approvedPhase 1a/b study for the treatment of patients with R/R AML or hr-MDS (dose escalation from 450 mg-900mg BID). These clinical studies demonstrated tumor shrinkage among B-cell cancer patients, including a complete response ("CR") in a DLBCL patient who received the original G1 formulation. Likewise, an MRD-negative CR in one R/R AML patient occurred with 450mg BID dosing of the original G1 formulation. Because absorption of the original G1 formulation hampered effectiveness of luxeptinib, a new G3 formulation was developed. Enrollment of patients in the B-cell malignancy trial and managementthe AML trial have been completed, and the initial clinical evaluation of cancerthe G3 formulation with continuous BID dosing has been completed. The G3 formulation delivered superior plasma exposure levels relative to the original G1 formulation. Regarding potential next steps with luxeptinib, a molecularly defined subgroup of hematologic malignancy patients was recently identified that may benefit from treatment with luxeptinib in combination with venetoclax. An investigator-sponsored trial is being considered while non-clinical studies are not selectiveunderway to support the use of LUX+VEN for the specific genetic alterations (targets) and pathways that cause the patient’s tumor and hence allow for disease progression and /or significant toxicities duetreatment of these patients. In parallel, efforts are underway to off-target effects. Aptose’s strategy isidentify sources of capital to develop agents that target underlying disease-promoting mutations or altered pathways withinsupport such a patient population, and we intend to apply this strategy across several therapeutic indications in oncology, including hematologic malignancies and solid tumor indications.trial.

Aptose Programs

Aptose has two clinical-stage assets, and a third program that is discovery-stage and partnered with another company.

| · | Luxeptinib (CG026806, CG-806) is a clinical stage asset with two separate clinical programs: luxeptinib, Aptose’s FMS-like tyrosine kinase 3 (“FLT3”) / Bruton’s tyrosine kinase (“BTK”) inhibitor is being evaluated currently in two separate Phase 1a/b dose escalation studies. The first trial, supported by an investigational new drug (“IND”) application submitted to the U.S. Food and Drug Administration (“FDA”) in February 2019 for luxeptinib, is being conducted in patients with certain B-cell malignancies, including chronic lymphocytic leukemia (“CLL”), small lymphocytic lymphoma (“SLL”) and certain non-Hodgkin’s lymphomas (“NHL”) that are resistant/refractory/intolerant to other therapies. The second trial, supported by an IND application submitted in June 2020 to the FDA for luxeptinib, is being conducted in patients with relapsed/refractory acute myeloid leukemia (“R/R AML”), including the emerging populations resistant to FLT3 inhibitors. |

| · | APTO-253, our second clinical-stage asset: APTO-253 is a small molecule MYC oncogene inhibitor and we are currently enrolling patients in a Phase 1a/b clinical trial for the treatment of patients with relapsed or refractory (“R/R”) blood cancers, including AML and high-risk MDS. |

| · | APL-581, our partnered program, is a dual bromodomain and extra-terminal domain motif (“BET”) protein and kinase inhibitor program which we partnered with Ohm Inc. (“OHM”) on March 7, 2018. |

Aptose is committed to the development of anticancer drugs that target aberrant oncologic signaling that underlies a particular life-threatening malignancy. This targeted approach is intended to impact the disease-causing events in cancer cells without affecting normal processes within cells. Such an approach requires that we first identify critical underlying oncogenic mechanisms in cancer cells and then develop a therapeutic asset that selectively impacts such oncogenic mechanisms.

| · | As a cluster-selective kinase inhibitor, luxeptinib targets the wild type and mutant forms of the FLT3 and BTK validated cancer targets, as well as multiple critical pathways that overlap to lead to the proliferation of cancer cells, including the B-cell receptor signaling pathway and FLT3 receptor pathways, as well as other receptor kinases and signaling cascades that drive dysregulated survival of the cancer cells. |

| · | Further, Aptose created the APTO-253 small molecule targeted drug that inhibits expression of the MYC oncogene and is under development as a novel therapy for AML and related MDS. Dysregulation of the MYC oncogene reprograms signaling of cancer cells to allow for malignant transformation and resistance to typical anticancer drugs. APTO-253 directly targets the MYC gene and inhibits production of MYC mRNA and protein, thereby leading to cancer cell death. |

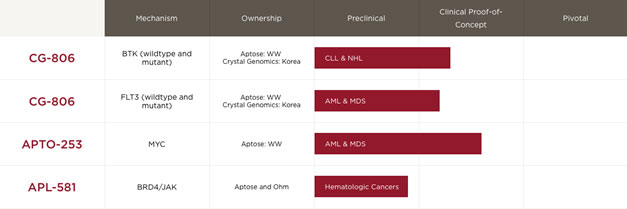

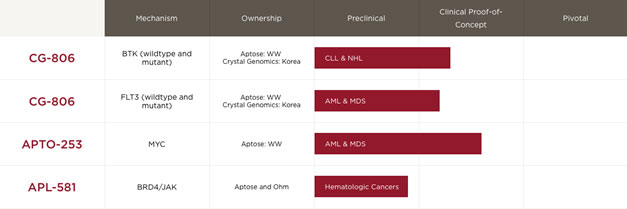

The following table sets forth various product conditionsfigure identifies the clinical stage agents in our pipeline and their respective stages of development.

Tuspetinib Program

Licensing Overview

On November 4, 2021, we entered into a licensing agreement (the "Tuspetinib Licensing Agreement") with the South Korean company Hanmi Pharmaceutical Co Ltd. (“Hanmi”) for the clinical and commercial development of tuspetinib (formerly HM43239). Under the terms of the Tuspetinib Licensing Agreement, Hanmi granted us exclusive worldwide rights to tuspetinib for all indications. Hanmi received an upfront payment of $12.5 million, including $5 million in cash and $7.5 million in Common Shares. Hanmi will also receive up to $407.5 million in future milestone payments contingent upon achieving certain clinical, regulatory and sales milestones across several potential indications, as well as tiered royalties on net sales. The term of the agreement will continue on a product-by-product and country-by-country basis until the expiration of the royalty period for such product in such country. The licenses to us will survive and become non-exclusive, perpetual, irrevocable and fully paid-up on a product-by-product and country-by-country basis, upon their natural expiration under the terms of the agreement.

Preclinical Profile

Tuspetinib is an oral, once-daily, highly potent myeloid kinome inhibitor designed to target key kinases operative in myeloid malignancies. In preclinical studies, tuspetinib demonstrated potent in vitro and in vivo activity against FLT3 ITD mutated as well as D835 and gatekeeper (F691) tyrosine kinase domain ("TKD") mutated AML that confer resistance to other agents. Additionally, tuspetinib inhibited phosphorylation of the SYK kinase, known to be highly activated in AML and associated with resistance to FLT3 targeted therapy. Tuspetinib also was designed to inhibit several kinases involved in tumor cell proliferation and/or differentiation, including mutant forms of c-KIT, JAK1, JAK2, and RSK, all with half maximal inhibitory concentration ("IC50") values < 10 nM.

Tuspetinib induced in vitro cytotoxicity in AML and Ba/F3 cell lines expressing FLT3 WT, ITD, and/or TKD point mutations. Tuspetinib showed greater inhibitory activity compared to quizartinib on Ba/F3 cells expressing

resistance-conferring ITD/TKD double mutations (ITD/F691L and ITD/D835Y). Thus, Tuspetinib may overcome clinically relevant ITD/TKD double mutations, which may result from sustained FLT3 inhibition. Moreover, target modulation was shown as tuspetinib inhibited FLT3 phosphorylation and downstream signaling molecules such as phospho-ERK and phospho-STAT5.

The in vivo anti-tumor efficacy of tuspetinib was demonstrated in murine xenograft models using MV-4-11 and MOLM-13 human AML cells having the ITD mutant form of FLT3 and using the MOLM-14 model having the ITD and F691L dual mutations of FLT3 with dosing regimens that match those currently under investigation. Tuspetinib exhibited dose-dependent tumor growth inhibition of models of FLT3 ITD mutant AML with complete tumor regression observed in some groups, and no change in body weight. Of note, tuspetinib produced greater tumor growth inhibition in the MOLM-14 FLT3-ITD/F691L model compared to gilteritinib, or entospletinib (SYK inhibitor) as single agents, and comparable activity to the gilteritinib plus entospletinib combination.

Latest Clinical Update and Program Status

On December 9, 2023, Aptose featured tuspetinib in an oral presentation at the 65th American Society of Hematology ("ASH") Annual Meeting and Exposition and announced that a growing body of clinical data for Aptose’s lead compound tuspetinib, demonstrates significant benefit as a single agent and in combination with venetoclax (VEN) in patients with R/R AML in the ongoing APTIVATE Phase 1/2 study. Data were presented in an oral presentation by lead investigator Naval G. Daver, M.D., Professor, Director Leukemia Research Alliance Program, Department of Leukemia, The University of Texas MD Anderson Cancer Center, Houston, TX.

Dr. Daver reported data from more than 100 relapsed/refractory patients from multiple international clinical sites, who had failed prior therapy and then were treated with TUS as a single agent or the TUS+VEN doublet. Both TUS and the TUS+VEN doublet delivered multiple composite complete remissions ("CRc") in this very ill AML population, while maintaining a favorable safety profile across all treated patients. The data demonstrated tuspetinib as a single agent (TUS) is active and well tolerated in one of the most challenging and heterogeneous disease settings in oncology – relapsed and refractory AML. Tuspetinib demonstrated broad activity, including activity in patients with FLT3 wild-type AML (accounting for more than 70% of the AML population), FLT3 mutated AML, NPM1 mutated AML, as well as in patients with mutations historically associated with resistance to targeted therapy. Most notably, TUS targets VEN resistance mechanisms, enabling the TUS+VEN combination therapy to uniquely treat the very ill prior-VEN AML population, including both FLT3 mutant and FLT3 wildtype disease. From a broader perspective, the growing body of antileukemic activity, and continued favorable safety profile, support advancement of tuspetinib as the TUS+VEN+HMA triplet combination therapy for the treatment of frontline newly diagnosed AML patients.

Dr. Daver also pointed out that while patients on the TUS+VEN therapy are early in their treatment cycles, most patients achieving a response remained on treatment and that responses have begun to mature as dosing continues. Highlights of Dr. Daver’s ASH oral presentation include:

| | | |

| • |

| As a single agent at therapeutic doses of 80-160 mg in 68 evaluable patients, TUS was more active in VEN-naive patients, with an overall CRc rate of 29% (8/28). This included a 42% CRc rate (5/12) in FLT3-mutated patients and a 19% CRc rate (3/16) in FLT3-unmutated, or wildtype, AML patients. Responses and blood counts improved with continuous dosing, many patients bridged to an allogeneic stem cell transplant (HSCT), durability was observed when HSCT was not performed, and 80 mg was selected as the RP2D. Overall, tuspetinib showed a favorable safety profile with only mild adverse events (AEs) and no dose-limiting toxicities (DLTs) up to 160 mg per day, and no drug discontinuations from drug-related toxicity. |

| | | |

| • |

| In the TUS+VEN doublet study, 49 patients were dosed with 80 mg of tuspetinib and 200 mg of venetoclax, with 36 evaluable (and 13 patients too early to assess). Patients were heavily exposed to Prior-VEN and Prior-FLT3 inhibitor treatment. TUS+VEN was active in both VEN-naive and prior Prior-VEN R/R AML patients. TUS demonstrated compelling composite complete remission (CRc) rates. Among all evaluable patients, TUS+VEN demonstrated a CRc rate of 25% (9/36); 43% (3/7) in VEN-naive patients, and 21% (6/29) in Prior-VEN patients. Among FLT3 wildtype patients, TUS+VEN demonstrated an overall CRc rate of 20% (5/25); 33% (2/6) in VEN-naive patients, and 16% (3/19) in |

| | | |

|

|

| Prior-VEN patients. Among FLT3 mutant patients, TUS+VEN demonstrated an overall CRc rate of 36% (4/11); a complete response in a VEN-naive patient (1/1); a 30% (3/10) in Prior-VEN patients; and 44% (4/9) in patients treated prior with a FLT3 inhibitor. |

Clinical data from tuspetinib in AML were presented at the ASH Annual Meeting in December 2022 and during a Corporate Comprehensive Clinical Update Call held December 11, 2022. Data presented demonstrated that tuspetinib delivers single agent responses without prolonged myelosuppression or life-threatening toxicities in these very ill and heavily pretreated relapsed or refractory AML patients. Responses were observed in a broad range of mutationally-defined populations, including those with mutated forms of NPM1, MLL, TP53, NRAS, KRAS, DNMT3A, RUNX1, wild-type FLT3, ITD or TKD mutated FLT3, various splicing factors, and other genes As of October 6, 2022, 60 heavily pretreated R/R AML patients were enrolled at multiple centers and treated at doses escalating from 20 mg to 200 mg, with further dose exploration at the 40 mg, 80 mg, 120 mg and 160 mg dose levels. Tuspetinib delivered multiple CRs at 40 mg, 80 mg, 120 mg and 160 mg dose levels in which no DLTs were observed. Tuspetinib demonstrated clinically meaningful benefit in all responders, by either bridging successfully to HSCT or leading to a durable response, as well as a favorable safety profile. In addition to 5 CRcs and 1 PR reported at ASH 2021, 4 new CRcs and 3 new PR had been generated during 2022. New responses during 2022 were achieved with 160 mg, 120 mg, 80 mg, and 40 mg. Among efficacy-evaluable patients treated with 80 mg, 120 mg, or 160mg, response rates ranging from 19% to 75% were achieved in specific genotypic subpopulations of R/R AML patients. Significant bone marrow leukemic blast reductions were observed broadly in FLT3+ and FLT3 wildtype patients across multiple dose levels, comparable to reported gilteritinib data, except that the patients treated with tuspetinib were more heavily pre-treated relapsed and refractory AML patients than those treated with gilteritinib. Vignettes of patient experiences highlight the potency and breadth of tuspetinib to deliver complete remissions among several mutationally-defined populations with a diversity of adverse mutations. Tuspetinib continued to show a favorable safety profile with only mild AEs and no DLTs up to 160 mg per day, and no drug discontinuations from drug-related toxicity. No drug-related SAE, drug-related deaths, differentiation syndrome, AE of QT prolongation or DLT were observed through the 160 mg level. Tuspetinib avoids many of the typical toxicities observed with other tyrosine kinase inhibitors. We identified a safe therapeutic range with a broad therapeutic window, spanning the dose levels of 40, 80, 120 and 160 milligrams. We also announced that enrollment had been initiated in the APTIVATE expansion trial for monotherapy and drug combination therapy with tuspetinib. For the APTIVATE expansion trial, we selected 120 mg as the initiating single agent expansion dose and 80 mg as the initiating dose selected for combination with venetoclax.

As of January 30, 2023, we announced the dosing of patients in the APTIVATE Phase 1/2 clinical trial of tuspetinib, and that another clinical response has been achieved by a R/R AML patient receiving 40 mg tuspetinib once daily orally in the original dose exploration trial, the second response at the recently launched low-dose 40 mg cohort. In addition, we elucidated a rationale for the superior safety profile of tuspetinib. While several kinase inhibitors require high exposures that exert near complete suppression of a single target to elicit responses, those agents often cause additional toxicity because they also cause extensive inhibition of that target in normal cells. In contrast, tuspetinib simultaneously suppresses a small suite of kinase-driven pathways critical for leukemogenesis. Consequently, tuspetinib achieves clinical responses at lower exposures with less overall suppression of each pathway, thereby avoiding many toxicities observed with competing agents.

Concurrent with the European Hematology Association (EHA) Annual Congress held June 8-11, 2023, Aptose held an interim clinical update webcast on June 10, 2023, to present highlights from the ongoing clinical development of tuspetinib. Aptose reported completion of the tuspetinib dose escalation and dose exploration Phase 1/2 trial in 77 R/R AML patients, tuspetinib demonstrated a favorable safety profile, and tuspetinib delivered monotherapy responses across four dose levels with no dose-limiting toxicity in mutationally diverse and difficult to treat R/R AML populations, including patients with highly adverse mutations that typically do not respond to monotherapy or combination therapy: TP53-mutated patients with a CR/CRh = 20% and RAS-mutated patients with a CR/CRh = 22%. Aptose also reported completion of a successful End of Phase 1 Meeting with the US FDA for tuspetinib, that a monotherapy RP2D was selected as 80mg daily, and that all development paths remain open, including the single arm accelerated path. Following completion of the dose escalation and dose exploration phases of the Phase 1/2 clinical program, Aptose focused attention on the tuspetinib APTIVATE expansion trial. The APTIVATE trial sought to identify patient populations that may serve as development paths in R/R AML patients sensitive to the TUS+VEN doublet and can serve as development paths for accelerated and full approvals. We reported that patient enrollment in

the APTIVATE expansion trial has been brisk and preliminary CR activity had already been reported in patients receiving the TUS+VEN doublet who previously failed therapy with venetoclax.

On October 29, 2023, Aptose presented two posters related to the clinical and preclinical activity of tuspetinib at the European School of Haematology 6th International Conference: Acute Myeloid Leukemia "Molecular and Translational": Advances in Biology and Treatment, held October 29-31, 2023, in Estoril, Portugal. Clinical findings included 1) data from the APTO-TUS-HV01 clinical trial (the "Food Effect Study") evaluating the pharmacokinetic (PK) properties of tuspetinib in healthy human volunteers in which tuspetinib was administered with our without food, and 2) from an international Phase 1/2 study of tuspetinib as a single agent and in combination with venetoclax in patients with R/R AML from across clinical centers in the United States, South Korea, Spain, Australia and other sites. Data from the Food Effect Study in healthy human volunteers demonstrated tuspetinib can be administered with or without food and foresee no clinically meaningful difference in exposure. This is an important finding for patient convenience, as venetoclax is dosed with food and tuspetinib can now be simultaneously administered with the venetoclax rather than require staggered dosing. Findings from the Phase 1/2 clinical trial demonstrated tuspetinib as a single agent was well-tolerated and highly active among R/R AML patients with a diversity of adverse genotypes and delivered a 42% CR/CRh cross-evaluable venetoclax-naive patients at the 80mg daily RP2D. The TUS+VEN doublet has been well tolerated in the APTIVATE international Phase 1/2 expansion trial in R/R AML patients and achieved multiple responses in patients who previously failed venetoclax ("Prior-VEN failure AML"), including Prior-VEN failure patients who also previously failed FLT3 inhibitors, all of whom represent emerging populations of high unmet medical need. Notably, tuspetinib targets venetoclax resistance mechanisms that may re-sensitize Prior-VEN failure patients to venetoclax.

Separate from the clinical studies, the preclinical study (entitled: “Tuspetinib Oral Myeloid Kinase Inhibitor Creates Synthetic Lethal Vulnerability to Venetoclax”) presented by Aptose during the ESH Conference investigated the effects of tuspetinib on key elements of the phosphokinome and apoptotic proteome in both parental and TUS-resistant AML cells. In parental cells, tuspetinib inhibits key oncogenic signaling pathways and shifts the balance of pro- and anti-apoptotic proteins in favor of apoptosis, suggesting that it may generate vulnerability to venetoclax. Indeed, acquired resistance in the AML cells to tuspetinib generated a synthetic lethal vulnerability to venetoclax of unusually high magnitude. Concurrent administration of TUS+VEN therefore may discourage the emergence of resistance to tuspetinib during treatment. In conjunction with poster presentations at the ESH Conference, on October 30, 2023, Aptose held a “Clinical Update and KOL Data Review of AML Drug Tuspetinib” that was webcast and featured Dr. Naval Daver, MD, Professor, Director Leukemia Research Alliance Program, Department of Leukemia, The University of Texas MD Anderson Cancer Center, Houston, Texas. Dr. Daver is the lead investigator on Aptose’s APTIVATE trial and is recognized for significant achievements in the development of novel AML treatments, including several combination therapies. Aptose presented data in 49 patients who received the TUS+VEN doublet, showing an overall response rate (ORR) of 48% among all patients that had achieved an evaluable stage, as well as a 44% ORR among Prior-VEN failure AML patients, including FLT3-unmutated (wildtype) patients (43% ORR) and FLT3-mutated patients (60% ORR), some of whom also had failed prior therapy with FLT3 inhibitors. The TUS+VEN doublet was well tolerated with no unexpected safety signals. The TUS/VEN doublet may serve the Prior-VEN failure R/R AML patients that represent a rapidly growing population that is highly refractory to any salvage therapy with response rates in the 4-15% range. The compelling data with the TUS+VEN doublet in R/R AML patients suggest a TUS+VEN+HMA triplet may serve the needs of frontline (1L) newly diagnosed AML patients.

On December 9, 2023, Aptose featured tuspetinib in an oral presentation at the 65th ASH Annual Meeting and Exposition and announced that a growing body of clinical data for Aptose’s lead compound tuspetinib, demonstrates significant benefit as a single agent and in combination with venetoclax in patients with R/R AML in the ongoing APTIVATE Phase 1/2 study. Data were presented in an oral presentation by lead investigator Naval G. Daver, M.D., Professor, Director Leukemia Research Alliance Program, Department of Leukemia, The University of Texas MD Anderson Cancer Center, Houston, TX.

Luxeptinib (CG-806) Program

Licensing Overview

Overview

On May 7, 2018, we exercised an option by paying $2.0 million in cash to the South Korean company CrystalGenomics Invites Co. Ltd, formerly Crystal Genomics, Inc. (“CG”), in order to purchase an exclusive license to

research, develop and commercialize luxeptinib in all countries of the world except the Republic of Korea and China, for all fields of use (collectively, the “Rights”). Subsequently, on June 14, 2018, we announced that we entered into a license agreement with CG for Aptoseus to gain a license for Rightsrights to CG-806 in China (including the People’s Republic of China, Hong Kong, and Macau) ) (the “China Rights”). Under the license agreement, Aptosewe made an upfront payment to CG of $3.0 million for the China Rights.rights. CG is eligible for development, regulatory and commercial-based milestones, as well as single-digit royalties on product sales in China. The total deal value for the China Rights, including the upfront payment, is up to $125 million. Aptose now owns worldwide (excluding Korea) Rights, including an issued patent in China,rights to luxeptinib, a first-in-class, highly potent oral small molecule being developed for AML, B-cell malignancies, and other hematologic malignancies. Future possible royalties that might be paid under these agreements are determined on a country-by-country and product-by-product basis, on net sales during the period of time beginning on the first commercial sale of such product in such country and continuing until the later of: (i) the expiration of the last-to-expire valid claim of the CG Patents in such country covering such product; and (ii) ten (10) years after the first commercial sale of such product in such country.

Preclinical Profile

Luxeptinib exhibits a picomolar half maximal inhibitory concentration (“IC50”)IC50 toward FLT3 with the Internal Tandem Duplication (“FLT3-ITD”), potency against the wild type FLT3 and a host of mutant forms of FLT3, as well as single-digit nanomolar IC50’sIC50’s against BTK and its C481S mutant (“BTK-C481S”). Consequently, luxeptinib is characterized as a mutation-agnostic FLT3/ BTK inhibitor. Further, luxeptinib suppresses a small group of other relevant oncogenic kinases/pathways (including CSF1R, PDGFRα, TRK, and the ERK, MYC, AKT/mTOR/S6K and AURK/H3S10 pathways) that are operative in AML and certain B cell malignancies, but does not inhibit the TEC, EGFRepidermal growth factor receptor (EGFR) and ErbB2/4 kinases that are responsible for safety concerns with certain other kinase inhibitors.

As a potent inhibitor of FLT3-ITD, luxeptinib may become an effective therapy in a high-risk subset of AML patients. This is because the FLT3-ITD mutation occurs in approximately 30% of patients with AML and is associated with a poor prognosis. In murine xenograft studies of human AML (FLT3-ITD), CG-806 administered orally resulted in tumor elimination (“cures”) without measurable toxicity. Importantly, luxeptinib targets other oncogenic kinases which may also be operative in FLT3-ITD AML, thereby potentially allowing the agent to become an important therapeutic option for a broader group of this difficult-to-treat AML patient population. The findings that luxeptinib targets all forms of FLT3 and several other key oncogenic pathways, and that luxeptinib was well tolerated from a safety perspective during efficacy and formal Good Laboratory Practice (“GLP”) toxicology studies, suggest that luxeptinib may also have applicability in treating patients, particularly those over the age of 65, who cannot tolerate other therapies.

Separate from the AML and FLT3 story,applications, luxeptinib may be a therapeutic option for patients with B cell malignancies. Overexpression of the BTK enzyme can drive oncogenic signaling of certain B cell malignancies, including CLL and certain NHL such as mantle cell lymphoma, (“MCL”), follicular lymphoma, (“FL”), diffuse large cell B cell lymphoma, (“DLBCL”) and others. Therapy of these patients with covalent, irreversible BTK inhibitors, such as ibrutinib, that target the active site cysteine (“Cys”) residue of BTK can be beneficial in many patients. However, therapy with covalent BTK inhibitors can select for BTK with a C481S mutation, thereby conferring resistance to covalent BTK inhibitors. Furthermore, approximately half of CLL patients have discontinued treatment with ibrutinib after 3.4 years of therapy. Discontinuation of ibrutinib is due to the development of drug resistance (in particular, patients have malignancies that developed the BTK-C481S mutation), or due to refractory disease (patient tumors did not respond to ibrutinib) or intolerance (side effects led to discontinuation of ibrutinib), according to a study performed at The Ohio State University. The C481S mutation is observed in 5-10% of the patients, while 40-45% of the patients were intolerant or refractory to ibrutinib. As a non-covalent, reversible inhibitor of BTK, luxeptinib does not rely on the Cysteine 481 residue (“C481”) for inhibition of the BTK enzyme. Indeed, recent X-ray crystallographic studies (with wild type and C481S BTK) demonstrated that luxeptinib binds productively to the BTK active site in a manner that is indifferent to the presence or absence of mutations at the 481 residue. Moreover, in vitro studies demonstrated that luxeptinib kills B cell malignancy cell lines on average approximately 1000 times more potently than ibrutinib and kills ibrutinib-resistance cancer cells, and that luxeptinib more potently killed primary malignant cells taken from the bone marrow of CLL and ALL B-cell cancer patients. Yet, luxeptinib demonstrated a high degree of safety in animal efficacy and GLP toxicology studies. Consequently, patients who are resistant, refractory or intolerant to ibrutinib or other commercially approved or development-stage BTK inhibitors with B cell malignancies may continue to be sensitive to luxeptinib therapy. This is particularly true since luxeptinib inhibits the wild type and mutant forms of BTK, as well as other kinases/pathways that drive the survival and proliferation of B cell malignancies.

Latest Clinical Update and Program Status

Role of BTK in B-cell signaling

BTK, a memberDuring 2023 and early 2024, clinical evaluation of the TEC family kinase, is an essential element of B-cell receptor (“BCR”) signaling, which is required for B-cell maturation, survival and proliferation. It is an upstream activator of multiple pro-survival / anti-apoptotic pathways, including the NF-KB, mTOR-AKT, RAS, ERK and MAPK pathways. BTK is overexpressed in malignant cells from patients with various B-cell malignancies, such as CLL, MCL, FL, and DLBCL. Disruption of BCR signaling via inhibition of BTK, has been shown to lead to clinical remissions in these patients.

Luxeptinib as a Non-covalent, Reversible Kinase Inhibitor

Binding studiesnew G3 formulation of luxeptinib have confirmed non-covalent, reversible inhibition of BTK, FLT3-ITDwas performed and Aurora Kinase A. Ibrutinib,has now been completed. The G3 formulation was tested in a commercially-approved, covalent BTK inhibitor, possesses a Michael acceptorsingle dose bioavailability study in 20 patients, including both B-cell cancer and AML patients, and across 5 dose levels (10mg to react with C481200mg). The G3 formulation then was evaluated in BTK and irreversibly inactivates the BTK enzyme. In contrast, luxeptinib does not require reactivity with the C481 residue for inhibition of the BTK enzyme, thereby allowing luxeptinib to inhibit the wild type and C481 mutant form of the BTK enzyme.

Preclinical In Vitro Evaluation of Luxeptinib

Luxeptinib is a potent inhibitor of BTK and FLT3 wild types, as well as the BTK C481S and FLT3-ITD mutants, which are strongly associated with clinical relapse or are negative prognostic factors in patients. In enzymatic assays, luxeptinib has demonstrated potency against the BTK C481S mutant with a half maximal IC50 of 2.5 nanomolar (nM). CG-806 also has potent activity against the FLT-ITD mutation, occurring in 30-35% ofR/R AML patients with an IC50 against the purified enzyme of 0.8nM (800pM). Likewise, luxeptinib exerts low nM IC50 values against the FLT3 enzyme having various mutations in the tyrosine kinase domain (TKD) and the Gatekeeper region, and luxeptinib has the ability to potently suppress the CSF1R, PDGFRα, SYK, AKT/mTOR/S6K, ERK, MAPK, MYC and AURK/H3S10 pathways. Finally, luxeptinib does not exhibit any inhibition of epidermal growth factor receptor (“EGFR”), TEC or ErbB2/4 kinases. Inhibition of one or more of these kinases has been speculated to contribute to the toxicity observed from the commercially approved BTK inhibitor.

Luxeptinib Xenograft Studies

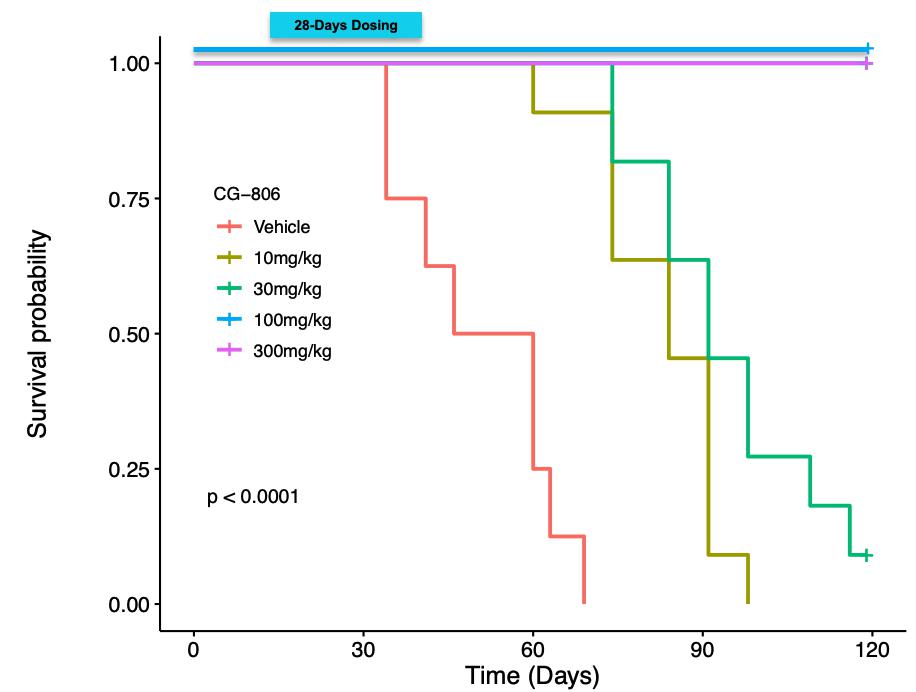

In vivo subcutaneous AML tumor models of anti-cancer efficacy revealed luxeptinib induced rapid and sustained tumor eradication (Figure 1a). Luxeptinib was administered orally once daily, for 14 days. Moreover, luxeptinib exhibited the sustained tumor elimination post therapy, while demonstrating no impact to murine body weight, no impacts to hematology cell counts or visible organ toxicities – necropsy and clinical pathology findings did not reveal any abnormal observations. A maximum tolerated dose has not yet been identified with murine xenograft studies.

Figure 1a. Efficacy of luxeptinib (CG-806) in MV4-11 xenograft model.

MV4-11 tumor bearing mice were administered an oral suspension once daily for 14 days of luxeptinib (CG-806) at 2 mg/kg (blue line), 10 mg/kg (green line) or 100 mg/kg (red line), Ibrutinib at 12 mg/kg (turquoise line), or vehicle (Control; black line) with 7-day post-treatment follow-up. Tumor volumes and body weights were measured 3 times weekly.

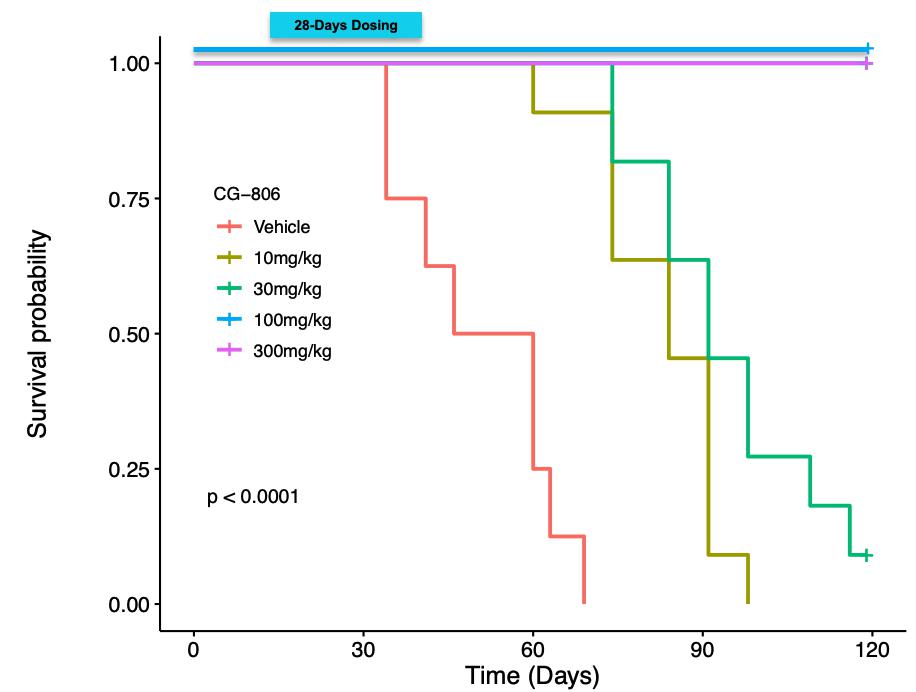

In a separate MV4-11 xenograft study (Figure 1b), the antitumor efficacy of luxeptinib and mouse survival over 120 days were evaluated when mice were treated orally for 28 consecutive days with luxeptinib atcontinuous dosing using two different dose levels of 0 (vehicle only, red), 10 (olive), 30 (green), 100 (blue), or 300 mg/kg (magenta). In this study, the clinical formulation (luxeptinib co-micronized with 2.5% sodium lauryl sulfate (SLS))(50mg BID and the dosing schedule (“BID”) was utilized. Luxeptinib produced slower tumor growth and extended survival at the 10 and 30mg/kg dose levels, while 100% cure rates were achieved at the 100 and 300 mg/kg dose levels (11/11 mice survived in the latter two groups). Moreover, no signs of toxicity were noted at any dose level.

Figure 1b. Luxeptinib (CG-806) Extends Survival200mg BID) in a Dose-Dependent Waytotal of 11 patients. Data show the G3 formulation dosed at 200mg twice daily can achieve 2-3uM steady state plasma levels, with approximately 10-fold better absorption, and interestingly even better tolerability, than the original G1 formulation. Thus, the G3 formulation achieved the desired plasma exposure benchmark and can serve as the formulation of choice for future studies with LUX. Aptose is exploring alternative development paths and collaborations to advance LUX as a single agent or in MV4-11 AML Xenograft Mouse Model Following Oral BID Dosing for 28 Consecutive Days.combination with VEN to treat defined R/R patient populations of high unmet need.

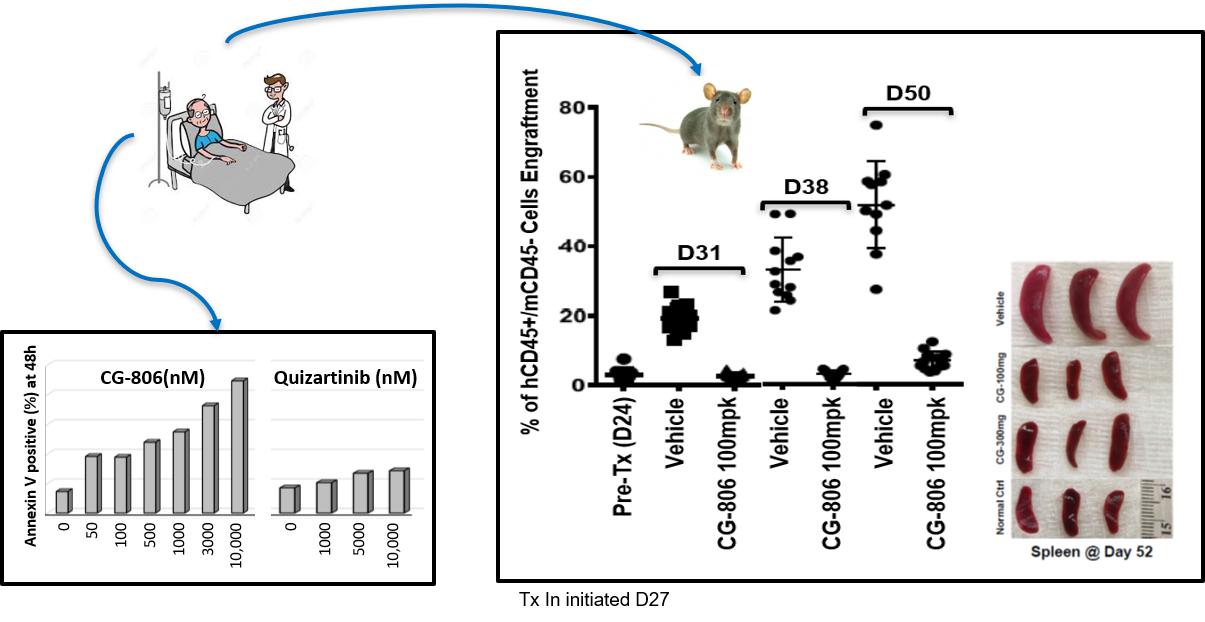

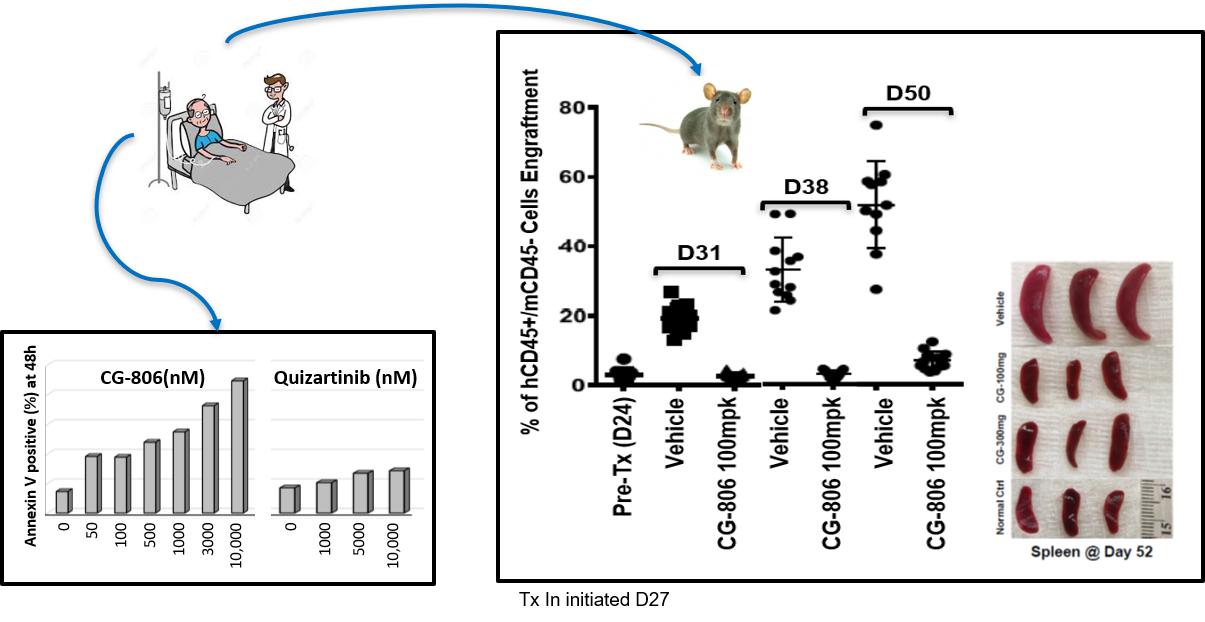

Although the above murine xenograft models demonstrate potent antitumor activity with no observed toxicity, the models utilize an AML cell line rather than cells derived from an AML patient. In a study performed at the University of Texas MD Anderson Cancer Center (“MDACC”), the efficacy of luxeptinibLuxeptinib was evaluated in a patient derived xenograft (“PDX”) model (Figure 1c). Bone marrow cells were collectedPhase 1 a/b trial in patients with relapsed or refractory B cell malignancies who have failed or are intolerant to standard therapies, and in a separate Phase 1 a/b trial in patients with relapsed or refractory AML or high-risk MDS. During 2022, a new G3 formulation was tested as a single dose in 20 patients during the ongoing Phase 1 a/b clinical program. Modeling of the PK properties of G3 predicted steady-state plasma exposure from ancontinuous dosing with 50 mg of G3 (every 12 hours, Q12h) should be comparable to that of 900 mg of the original G1 formulation Q12h, representing a significant improvement in bioavailability with G3. On November 14, 2022, we announced dosing of the first AML patient that had relapsed onto receive a clinical trial. The patient entered the trial with FLT3-ITD AML and was placed on sorafenib and azacytidine. After one cycle, the patient had a complete response but then relapsed after cycle 3. Genetic analysis demonstrated that the AML cells had acquired a second mutation in AML, and this was the D835 mutation, making the patient dual mutant FLT3-ITD/D835. Bone marrow cells from the patient (AML FLT3-ITD/D835) were implanted in mice to establish a PDX model. Expansioncontinuous dosing regimen of the human AML cellsG3 formulation (50 mg G3 Q12h), with the protocol allowing for further dose escalation of G3 in subsequent patients. Clinical data from both studies were presented during a Corporate Comprehensive Clinical Update Call held December 11, 2022. During the bone marrow and peripheral bloodCorporate Update Call, we announced a CR was achieved with a diffuse large B-cell lymphoma patient at the end of Cycle 22 with 900mg BID of the mice tookoriginal G1 formulation. Previously, an MRD-negative CR was reported with a R/R AML patient receiving 450mg BID of the original G1 formulation.

Concurrent with the EHA Annual Congress held June 8-11, 2023, Aptose held an interim clinical update webcast on June 10, 2023. During the update, Aptose reviewed clinical findings with the new G3 formulation of luxeptinib. Aptose confirmed that continuous dosing with 50mg Q12h of the G3 formulation in multiple patients achieves roughly an equivalent pharmacokinetic profile as 900mg original G1 formulation, and that dose escalation with the G3 formulation was anticipated. Since completion of the 50mg G3 Q12h dose exploration, R/R AML patients have been dosed with 200mg Q12h G3.

Safety and PK data with continuous dosing of the G3 formulation have been completed and the 200mg dose of G3 luxeptinib achieved steady state exposure plasma levels of approximately one month.2uM. The amalgam of clinical safety, PK and activity data with all formulations of luxeptinib in B-cell cancer and AML patients are being collected and evaluated, and we plan to disclose the findings at a scientific presentation. In the vehicle (15% Transcutol HP/85% PEG-400) treated mice, the leukemic burdenaddition, a molecularly defined subgroup of CLL patients (harboring mutations in the peripheral blood increased from day 31 through day 50 and beyond. However,FLT3 receptor) has been identified as a potential target population for treatment with 100 mg/kg luxeptinib (orally daily for 5 consecutive days followed by 2 days off every week), resulted in significant reduction in the leukemic burden and reductions in splenomegaly at 52 days post-implantation. These data suggest that luxeptinib may be used to treat patients whose disease has become resistant to other FLT3 inhibitors.

Figure 1c. Luxeptinib (CG-806) Efficacy in PDX Model Against AML Patient Cells with FLT3-ITD+D835Y Mutations

APTO-253 Program

Overview

APTO-253, our second clinical-stage program, is a novel small molecule therapeutic agent that inhibits expression of the MYC oncogene, leading to cell cycle arrest and programmed cell death (apoptosis) in human-derived solid tumor and hematologic cancer cells, without causing general myelosuppression of the healthy bone marrow. The MYC oncogene is overexpressed in hematologic cancers, including AML. MYC is a transcription factor that regulates cell growth, proliferation, differentiation and apoptosis, and overexpression amplifies new sets of genes to promote oncogenesis. APTO-253 dramatically down-regulates expression of the MYC oncogene in AML cells and depletes those cells of the MYC oncoprotein, leading to apoptotic cell death in AML cells. Thus APTO-253 may serve as a safe and effective MYC inhibitor for AML that combines wellcombination with other agents, and does not impact the normal bone marrow.

During 2015, we were evaluating APTO-253 in a Phase 1a/b clinical trial in patients with R/R hematologic malignancies, particularly AML and MDS, before being placed on clinical hold by the FDA in November 2015. The Phase 1a/b trial was placed on clinical hold in order to solve a chemistry-based formulation issue, and the chemistry of the active pharmaceutical ingredient (“API”) and the formulation underwent minor modifications to deliver a stable and soluble drug product for return to the clinical setting. In December 2016, we announced that we had successfully manufactured multiple non-GMP batches of a new drug product formulation for APTO-253, including a batch that had been stable and soluble for over six months. However, the 40L batch that was the intended clinical supply encountered an unanticipated mishap during the filling process that compromised the stability of that batch of drug product. On January 23, 2017, we announced that the root cause and corrective action studies would take longer than originally expected and that we would temporarily delay clinical activities with APTO-253 in order to elucidate the cause of manufacturing mishap, with the intention of restoring the molecule to a state supporting clinical development and partnering. Formal root cause analyses studies were completed to identify the reasonfeasibility analysis for the drug product stability failure, and a correction action was implemented. We then manufactured a new GMP clinical supplypotential development of drug product and performed the studies required to demonstrate the fitness of the drug product for clinical usage, and presented the findings to the FDA in the second quarter of 2018. On June 28, 2018, the FDA notified us that it had lifted the clinical hold on APTO-253. This was followed by resubmission of the revised clinical protocol to Institutional Review Boards (“IRB”) at multiple clinical sites.

On November 28, 2018, we announced that we dosed the first patient in the re-initiation of the Phase 1a/b Clinical Study of APTO-253. Since then, we have completed the first four dose cohorts (20mg/m2, 40mg/m2, 66mg/m2 and 100mg/m2) and are currently dosing patients in the fifth dose cohort at 150mg/m2 dose level. In the patients we have dosed at the first four dose levels, we observed meaningful reductions in MYC expression in the patient PBMC samples and noted that the drug product is well tolerated to date.

APTO-253 Studies on Solid Tumors

In January 2011, Aptose announced the first patient enrollment in a Phase 1 dose-escalation study for APTO-253 in patients with advanced or metastatic solid tumors who are unresponsive to conventional therapy or for whom no effective therapy is available. The study was initially being conducted at Memorial Sloan-Kettering Cancer Center in New York. Objectives of the study included determination or characterization of the safety profile, maximum tolerated dose, and antitumor activity of APTO-253, as well as pharmacokinetics and a recommended Phase 2 dose for subsequent clinical trials.

In June 2012, MDACC in Houston was added as a second site under the direction of Dr. Jennifer Wheler as the principal investigator. In addition, Aptose announced that the study had successfully completed the accelerated drug dose escalation stage (Stage 1), with further escalation under way in the non-accelerated dose escalation stage (Stage 2)luxeptinib for the purpose of determining the maximal tolerated dose level and recommended Phase 2 dose. The addition of a second site expanded patient availability for enrollment.target population is underway.

In January 2013, Aptose announced that Phase 1 clinical study of APTO-253 had successfully escalated to the target dose level based on predicted and observed clinical effects without limitation by toxicity. The success of this study allowed Aptose to initiate a biomarker clinical investigation to further explore the effects of the drug at relevant doses determined in the clinical trial.

In April 2013, Aptose announced that studies demonstrated the antitumor activity of APTO-253 in animal models of human non-small cell lung cancer (“NSCLC”) with a dose-response effect in NSCLC.

In July 2013, Aptose announced the results of the Phase 1 clinical trial of APTO-253. In this first-in-man dose-escalation clinical study, APTO-253 demonstrated a favorable safety profile, as well as encouraging signs of antitumor activity in patients with solid tumors. The design of this trial consisted of APTO-253 as a single agent in patients with advanced solid tumors resistant to multiple standard therapies. The study enrolled 27 patients, all of which had failed a median of four prior chemotherapies. Although this was primarily a dose-escalation safety study, efficacy and pharmacokinetics were also explored.

The clinical trial enrolled patients at seven dose levels ranging from 20 to 229 mg/m2. Of the 27 patients enrolled, 17 were evaluable for efficacy. Of these 17 patients, seven (41%) achieved stable disease by Response Evaluation Criteria In Solid Tumors (“RECIST”). This included patients with colorectal, lung, appendiceal, liver and uterine cancers. Dose related activity was demonstrated at the higher dose levels (176 and 229 mg/m2). At these two highest dose levels, four of five evaluable patients (80%) achieved sustained stable disease by RECIST ranging from 5.6 months to 8 months, representative of disease control. Of these, a patient with NSCLC at the highest dose level additionally demonstrated non-index tumor shrinkage.

The safety assessment indicated that APTO-253 was well tolerated at all dose levels tested in this trial. The dose escalation was not limited by toxicity. The most common adverse event was Grade 1 or 2 fatigue seen in three patients. There was one Grade 3 toxicity, asymptomatic low blood phosphate level that was reversible by supplementation with phosphates. The pharmacokinetic profile was consistent with the predictive profile seen preclinically, and the elimination profile and half-life in patients were suggestive of a very rapid distribution phase and prolonged retention. No further studies were performed after late 2013.

APL-581 Program

In November 2015, Aptose announced an exclusive drug discovery partnership with Laxai Avanti Life Sciences (“LALS”) for their expertise in next generation epigenetic-based therapies. Under the agreement, LALS was to be responsible for developing multiple clinical candidates, including optimizing candidates that exert dual BRD4 / kinase inhibitory activity. Based on available resources, Aptose halted further investment in the collaboration with LALS in late 2016. However, the program delivered novel intellectual property and hit molecules (such as APL-581). Consequently, Aptose chose to out-license the program.

On March 7, 2018, Aptose entered into an exclusive global license agreement with OHM, an affiliate of LALS that was formed in 2016 to advance the clinical development of compelling molecules derived from the LALS initiative, for the development, manufacture and commercialization of APL-581, as well as related molecules, from Aptose’s dual BET protein and kinase inhibitor program. Under the agreement, Aptose retained reacquisition rights to certain molecules, while OHM/LALS has the rights to develop and sublicense all other molecules. Aptose received a nominal upfront cash payment and is eligible to receive up to $125 million of additional payments based on the achievement of certain developmental, regulatory and sales milestones, as well as significant royalties on future sales generated from the program, if any. We have not received any milestone or royalty payments pursuant to this agreement. Future possible royalties that might be paid by OHM to Aptose under these agreements are determined on a country-by-country and product-by-product basis, on net sales during the period of time beginning on the first commercial sale of such product in such country and continuing until the later of: (i) the expiration of the last-to-expire valid claim of the patents in such country covering such product; and (ii) ten (10) years after the first commercial sale of such product in such country.

Competitive Conditions

The biotechnology and pharmaceutical industries are characterized by rapidly evolving technology and intense competition. There are numerous companies in these industries that are focusing their efforts on activities similar to ours. Some of these are companies with established positions in the pharmaceutical industry and may have substantially more financial and technical resources, more extensive research and development capabilities, and greater marketing, distribution, production, and human resources than Aptose.us. In addition, we face competition from other companies for opportunities to enter into partnerships with biotechnology and pharmaceutical companies and academic institutions.

Competition with our potential products may include chemotherapeutic agents, monoclonal antibodies, antisense therapies, small molecules, immunotherapies, vaccines, and other biologics with novel mechanisms of action. These drugs may kill cancer cells indiscriminately, or through a targeted approach, and some have the potential to be used in non-cancer indications. We also expect that we will experience competition from established and

emerging pharmaceutical and biotechnology companies that have other forms of treatment for the cancers that we target, including drugs currently in development for the treatment of cancer that employ a number of novel approaches for attacking these cancer targets. Cancer is a complex disease with more than 100 indications requiring drugs for treatment. The drugs in competition with our potential drugs have specific targets for attacking the disease, targets which are not necessarily the same as ours. These competitive drugs, however, could potentially also be used together in combination therapies with our drugs to manage the disease. Other factors that could render our potential products less competitive may include the stage of development, where competitors’ products may achieve earlier commercialization, as well as superior patent protection, better safety profiles, or a preferred cost-benefit profile.

Luxeptinib Treatment for B Cell Malignancies

We are aware of a number of companies that have developed and are pursuing different approaches to BTK inhibition, both for the wild type and to the C481S-mutant forms. Companies that have developed approved or are currently developing inhibitors that directly target the wild type include AbbVie (IMBRUVICA) and AstraZeneca (CALQUENCE) and Beigene Co., Ltd. (Zanubrutinib).

Others that are developing inhibitors that target the C481S-mutant BTK include Merck (MK-1026), Roche, and Eli Lilly (LY3527727) among others.

Luxeptinib and APTO-253 for AML

We also face intense competition in AML as there is a wide range of therapies that have been approved and are under development for the treatment of AML. Companies that have developed approved or are currently developing non-targeted therapies include Jazz (VYXEOS), Pfizer (MYLOTARG) and AbbVie (VENCLEXTA), among others. Others that have developed or are developing highly targeted therapies such as FLT3 inhibitors include Novartis (RYDAPT), Astellas (XOSPATA), Daiichi Sankyo (quizartinib), Arog (crenolanib), and IDH1/2 inhibitors include Agios/Servier (TIBSOVO) and Celgene/BMS (IDHIFA) among others.

Manufacturers, Suppliers and Other Third Party Contractors

Contract manufacturing organizations (“CMOs”) manufacture our product candidates for all preclinical studies and clinical trials. We rely on CMOs for manufacturing, filling, packaging, storing and shipping of drug product in compliance with Current Good Manufacturing Practice (“cGMP”) regulations applicable to our products. The FDA ensures the quality of drug products by carefully monitoring drug manufacturers’ compliance with cGMP regulations. The cGMP regulations for drugs contain minimum requirements for the methods, facilities and controls used in manufacturing, processing and packing of a drug product. These CMOs are reputable companies active in the biotechnology industry. Pricing is predictable as there are many alternatives of such supplies that are readily available.

We rely and will continue to rely on third party contract research organizations (“CROs”) to conduct a significant portion of our preclinical and clinical development activities. Preclinical activities include in vivo studies providing access to specific disease models, pharmacology and toxicology studies, and assay development. Clinical development activities include trial design, regulatory submissions, clinical patient recruitment, clinical trial monitoring, clinical data management and analysis, safety monitoring and project management, contract manufacturing and quality assurance.

Intellectual Property

We believe that our issued patents and pending applications are important in establishing and maintaining a competitive position with respect to our products and technology.

CG-806Tuspetinib (HM43239)

A Patent Cooperation Treaty (“PCT”In November 2021, we licensed the exclusive rights to research, develop and commercialize tuspetinib (the "Tuspetinib Licensing Agreement") application providing. Under the terms of the Tuspetinib Licensing Agreement, Hanmi granted Aptose exclusive worldwide rights to tuspetinib for all indications.Aptose is now the exclusive licensee of composition of matter and use patents covering tuspetinib, and tuspetinib analogs. Aptose believes that it now owns rights to a strong and defensive intellectual property position.

As of December 31, 2023, Aptose owned rights in 46 issued patents, including 4 issued U.S. patents, and 23 patents validated in countries in Europe, that are in force and cover the tuspetinib compound, or analog compounds. These patents are expected to provide protection until 2038 through 2039. Patent applications are also pending in the United States and in contracting states to the Patent Cooperation Treaty for CG-806 was filed in late 2013,coverage of tuspetinib and analog compounds, with a potentialexpected expiry in 2033 before extension opportunities, across all major geographiesdates between 2038 and 2042.

Luxeptinib (CG-806)

In May 2018 and June 2018, we paid $2.0 million in cash and licensed the Rights to CG-806, for all fields of use, in all territories outside of the Republic of Korea and China, by exercising an option we obtained through a June 2016 option-license agreement with CG that had granted us an exclusive option to research, develop and commercialize CG-806.

In June 2018, we entered into a separate license agreement with CG for Aptose to gain a license for the China Rights. This license agreement was formally executed by Aptose through an upfront payment to CG of $3.0 million for the China Rights. CG is eligible for payments upon the achievement of developmental, regulatory and commercial-based milestones, as well as single-digit royalties on product sales in China. Aptose now owns worldwide Rights to CG-806, including an issued patent in China but excluding any Rights in Korea.

US Patent No. 9,758,508

On September 12, 2017, we announcedAs of December 31, 2023, Aptose owned rights to 49 issued patents, including 3 issued U.S. patents, and 30 patents validated in countries in Europe, that United States Patentare in force and Trademark Office (“USPTO”) issued patent number 9,758,508, entitled “2,3-dihydro-isoindole-1-on derivative as BTK kinase suppressant, and pharmaceutical composition including same”, which claimscover numerous compounds, including the CG-806 compound, pharmaceutical compositions comprising the CG-806 compound, and methods of treating various diseases. The patent is expected to provide protection until December of 2033.

US Patent No. 10,604,508

The issued patent, issued on March 21, 2020, claims a genus that covers the CG-806 compound, pharmaceutical compositions comprising a compound from the genus, and methods ofuse for treating various diseases caused by abnormal or uncontrolled activation of protein kinases, including lymphoma and leukemia. This US patent is expected to provide protection until December 2033.

European Patent No. EP2940014B1

The granted patent claims the CG-806 compound, pharmaceutical compositions comprising the CG-806 compound, and uses for treating diseases caused by abnormal or uncontrolled activation of protein kinases, such as cancer. This European patent will be nationalized in, and cover, approximately twenty European countries including the United Kingdom, France, Germany, Italy, Netherlands and Spain. The patent is expected to provide protection until December of 2033.

Australian Patent Nos. 2013371146 and 2018214134

The granted patents claim numerousadministering various compounds, including the CG-806 compound, pharmaceutical compositions comprising the CG-806 compound, and methods of treating various diseases, including treating cancers such as lymphoma and leukemia. The patent is expected to provide protection until December of 2033.

Chinese Patent No. CN 104995184 B

The granted patent claims numerous compounds, including the CG-806 compound, pharmaceutical compositions comprising the CG-806 compound, and the use of such a compound for the manufacture of a pharmaceutical composition for treating a disease caused by an abnormal or uncontrolled protein kinase. The patent is expected to provide protection until December of 2033.

Japanese Patent Nos. 6325573 and 6596537

The granted patents claim numerous compounds, including the CG-806 compound, pharmaceutical compositions comprising the CG-806 compound, and the use of such a compound for the manufacture of a pharmaceutical composition for treating a disease caused by an abnormal or uncontrolled protein kinase, and pharmaceutical compositions for treating various diseases, including treating cancers such as lymphoma and leukemia. Thecompound. These patents are expected to provide protection until December of 2033.

Canadian2033-2038. Patent No. 2896711

The granted patent claims numerous compounds, including the CG-806 compound, pharmaceutical compositions comprising the CG-806 compound, and the use of such a compound for the manufacture of a pharmaceutical composition for treating a disease caused by an abnormal or uncontrolled protein kinase. The patent is expected to provide protection until December of 2033.

Russian Patent No. 2671847

The granted patent claims various compounds, including the CG-806 compound, pharmaceutical compositions comprising the CG-806 compound, and methods for treating diseases caused by abnormal or uncontrolled activation of protein kinases, and uses for the treatment, relief or prevention of cancer. The patent is expected to provide protection until December 2033.

APTO-253

As of March 23, 2021, weapplications are the owner of record of five issued U.S. patents, which together provide coverage for the APTO-253 compound, its pharmaceutical composition and methods of treating various cancers with APTO-253, including solid tumors and leukemia. The APTO-253 composition of matter has patent protection until February, 2028also pending in the United States and May, 2026 in other countries. We also hold 23 international (non-U.S.) granted patents which together providecontracting states to the Patent Cooperation Treaty for coverage for APTO-253, three of which are granted European patents, validated in at least eight countries in Europe. Our patents also include several compounds that are similar to APTO-253, which provide protection from competitors seeking to develop anticancer products that are related in chemical structure to APTO-253.CG-806, with expected expiry dates between 2038‑2039.

Environmental Protection

The Company’s research and development activities involve the controlled use of hazardous and radioactive materials and, accordingly, the Company is subject to federal, provincial and local laws and regulations in the United States and Canada governing the use, manufacture, storage, handling and disposal of such materials and certain waste products. To the knowledge of the Company, compliance with such environmental laws and regulations does not and will not have any significant impact on its capital spending, profits or competitive position within the normal course of its operating activities. There can be no assurance, however, that the Company will not be required to incur significant costs to comply with environmental laws and regulations in the future or that its operations, business or assets will not be materially adversely affected by current or future environmental laws or regulations.

Employees

Employees

As atof December 31, 2020,2023, we employed 3935 full-time persons and twoone part-time personsperson in research and drug development and administration activities. SixEleven of our employees hold Ph.D.s, two hold M.D.s, and numerous others hold degrees and designations such as MD, MSc, BSc, CPA (CA)M.Sc., CPA (California)B.Sc., C.P.A., C.M.A., M.Acc. and MBA.M.B.A. To encourage a focus on achieving long-term performance, employees and members of the board of directors of the Company (the “Board”) have the ability to acquire an ownership interest in the Company through Aptose’s share option and alternate compensation plans. Of note, in January of 2020, Aptose hired a Chief Medical Officer holding an MD and a Ph.D.

The business of the Company requires personnel with specialized skills and knowledge in oncology. Researchers must be able to design and implement studies to assess the efficacy of anticancer drugs. Specialized knowledge and skills relating to chemistry and formulation process development are also needed. Such knowledge and skills are needed to develop product specific analytical methods and formulation processes. The Company’s business also requires clinical and regulatory expertise and knowledge. The Company has trained scientists and personnel with broad experience in these fields.

None of our employees are unionized, and we consider our relations with our employees to be good.

Government Regulation

Overview

Overview

Our overall regulatory strategy is to work with the appropriate government departments which regulate the use and sale of therapeutic drug products. This includes the FDA in the United States, Health Canada in Canada, the European Medicines Agency (“EMA”) in Europe, and other local regulatory agencies with oversight of preclinical studies, clinical trials and marketing of therapeutic products. Where possible, we intend to take advantage of opportunities for accelerated development of drugs designed to treat rare and serious or life-threatening diseases. We also intend to pursue priority evaluation of any application for marketing approval filed in Canada, the United States or the European Union and to file additional drug applications in other markets where commercial opportunities exist. We may not be able to pursue these opportunities successfully.

Regulation(s) by government authorities in the United States, Canada, and the European Union are significant factors in guiding our current research and drug development activities. To clinically test, manufacture and market drug products for therapeutic use, we must be in compliance with guidance and regulations established by the regulatory agencies in the countries in which we currently operate or intend to operate.

The laws of most of these countries require the licensing of manufacturing facilities, carefully controlled research and the extensive testing of products. Biotechnology companies must establish the safety and efficacy of their new products in clinical trials; they must establish and comply with cGMPscurrent good manufacturing practices ("cGMPs") for the manufacturing of the product and control over marketing activities before being allowed to market a product. The safety and efficacy of a new drug must be shown through human clinical trials of the drug carried out in accordance with the guidance and regulations established by local and federal regulatory agencies.