UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FORM 10-K/A

(Amendment No. 1)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedAnnual Period Ended December 31, 2013.2014

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition periodTransition Period from ___ to ___

Commission file number 001-35002

CLEANTECH INNOVATIONS,6D GLOBAL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

NevadaDelaware | | 98-0516425 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

C District, Maoshan Industry Park,

Tieling Economic Development Zone,

Tieling, Liaoning Province, China

| | 112616 |

(Address of principal executive offices) | | (ZIP Code) |

(86) 0410-6129922 |

(Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Common stock, par value $.00001 per share |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes ¨ No x |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes ¨ No xNumber)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes ¨ No x

|

17 State Street, Suite 2550, New York, NY 10004(Address of principal executive offices) (Zip Code)

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | Yes ¨ No x |

Telephone: (646) 681-4900Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | Yes x No o

|

(Registrant’s telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitionsdefinition of “large accelerated filer,”filer”, “accelerated filer,”filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | o | Accelerated filer ¨ |

o | Non-accelerated filer ¨ (Do not check if smaller reporting company) | o | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes ¨Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

|

The aggregate market valueNumber of the voting common equity held by non-affiliates was $3,777,139, based on the closing price of such common equity as of June 30, 2013, the last business day of the registrant’s most recently completed second fiscal quarter.

As of April 4, 2014, there were 24,982,822 shares of the registrant’s common stock, par value $.00001 per share, issued and outstanding.outstanding at March 19, 2015: 78,175,617.

DOCUMENTS INCORPORATED BY REFERENCE

NonePortions of the registrant’s definitive proxy statement relating to its 2015 annual meeting of stockholders (the “2015 Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated herein. The 2015 Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

EXPLANATORY NOTE

This Amendment No. 1 (this “Amendment”) to 6D Global Technologies Inc.’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, filed with the Securities and Exchange Commission on March 30, 2015 (the “Original Form 10-K”), is being filed with the limited purpose of amending the Report of Independent Registered Public Accounting Firm on page F-2 of the Original Form 10-K to correct a scrivener’s error with respect to the date thereof. This Amendment does not amend or otherwise update any other information in the Original Form 10-K. Accordingly, this Amendment should be read in conjunction with the Original Form 10-K.

Part II

Item 8. – Financial Statements and Supplementary Data

Contents

| Page |

| F-2 to F-3 |

| |

| F-4 |

| |

| F-5 |

| |

| F-6 |

| |

| F-7 |

| |

| F-8 |

| |

| F-9 |

CLEANTERepCH INNOVATIONS, INC.ort of Independent Registered Public Accounting FirmBoard of Directors and Stockholders

6D Global Technologies, Inc.

New York, New York

We have audited the accompanying consolidated balance sheet of 6D Global Technologies, Inc. as of December 31, 2014 and the related consolidated statements of operations, comprehensive income (loss), stockholders’ equity (deficit), and cash flows for the year ended December 31, 2014. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of 6D Global Technologies, Inc. at December 31, 2014, and the results of its operations and its cash flows for the year ended December 31, 2014, in conformity with accounting principles generally accepted in the United States of America.

TABLE OF CONTENTS

| | Page |

PART I |

| | |

Item 1. | | 2 |

Item 1A. | | 17 |

Item 1B. | | 39 |

Item 2. | | 39 |

Item 3. | | 40 |

Item 4. | | 40 |

| | |

PART II |

| | |

Item 5. | | 41 |

Item 6. | | 42 |

Item 7. | | 42 |

Item 7A. | | 49 |

Item 8. | | 49 |

Item 9. | | 49 |

Item 9A. | | 49 |

Item 9B. | | 50 |

| | |

PART III |

| | |

Item 10. | | 51 |

Item 11. | | 55 |

Item 12. | | 57 |

Item 13. | | 57 |

Item 14. | | 59 |

| | |

PART IV |

| | |

Item 15. | | 60 |

| | |

| | F-1 |

| | |

| | 61 |

| | |

New York, New York

FORWARD-LOOKING STATEMENTS

NOTE ABOUT FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which include, but are not limited to, statements concerning our projected revenues, expenses, gross profit and income, mix of revenue, demand for our products, the benefits and potential applications for our products, the need for additional capital, our ability to obtain and successfully perform additional new contract awards and the related funding and profitability of such awards, the competitive nature of our business and markets and product qualification requirements of our customers. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. Words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “potential,” “believes,” “seeks,” “hopes,” “estimates,” “should,” “may,” “will,” “with a view to” and variations of these words or similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. Such factors include, but are not limited to the following:

· | our goals and strategies; |

· | our future business development, financial conditions and results of operations; |

· | the expected growth of the market for structural towers for wind turbine products and specialty metal products; |

· | our expectations regarding demand for our products; |

· | our expectations regarding keeping and strengthening our relationships with key customers; |

· | our ability to stay abreast of market trends and technological advances; |

· | our ability to protect our intellectual property rights effectively and not infringe on the intellectual property rights of others; |

· | our ability to attract and retain quality employees; |

· | our ability to pursue strategic acquisitions and alliances; |

· | competition in our industry in China; |

· | general economic and business conditions in the regions in which we sell our products; |

· | relevant government policies and regulations relating to our industry; and |

· | market acceptance of our products. |

Additionally, this report contains statistical data that we obtained from various publicly available government publications and industry-specific third party reports. Statistical data in these publications also include projections based on a number of assumptions. The markets for our products may not grow at the rates projected by market data, or at all. The failure of these markets to grow at the projected rates may have a material adverse effect on our business and the market price of our common stock. In addition, the changing nature of our customers’ industries results in uncertainties in any projections or estimates relating to the growth prospects or future condition of our markets. Furthermore, if any one or more of the assumptions underlying the market data is later found to be incorrect, actual results may differ from the projections based on these assumptions.

Unless otherwise indicated, information in this report concerning economic conditions and our industry is based on information from independent industry analysts and publications, as well as our estimates. Except where otherwise noted, our estimates are derived from publicly available information released by third party sources, as well as data from our internal research, and are based on such data and our knowledge of our industry, which we believe to be reasonable. None of the market data from independent industry publications cited in this report was prepared on our or our affiliates’ behalf.

Additional information on the various risks and uncertainties potentially affecting our operating results are discussed in this report and other documents we file with the Securities and Exchange Commission, or the SEC, or available upon written request to our corporate secretary at C District, Maoshan Industry Park, Tieling Economic Development Zone, Tieling, Liaoning Province, China . We undertake no obligation to revise or update publicly any forward-looking statements for any reason, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on these forward-looking statements.

PART I

General

We are a manufacturer of structural towers for megawatt-class wind turbines as well as other highly engineered metal components used in the energy industry and other industries in the PRC. We currently design, manufacture, test and sell structural towers for 1.5 -megawatt, or MW, on-land wind turbines, and have the expertise and manufacturing capacity to provide towers for 1.3, 3 MW and higher-powered on-land and off-shore turbines. We are currently the only wind tower manufacturer within Tieling, Liaoning Province, which we believe provides us with a competitive advantage in supplying towers to the wind-energy-rich northern provinces of China. We also manufacture specialty metal products that require advanced manufacturing and engineering capabilities, including bellows expansion joints and connecting bend pipes used for waste heat recycling in steel production and in ultra-high-voltage electricity transmission grids, as well as industrial pressure vessels. Our products provide solutions for China’s increasing demand for clean energy.

We sell our products exclusively in the PRC domestic market. We produce wind towers, a component of wind turbine installations, but do not compete with wind turbine manufacturers. Our specialty metal products are used by large-scale industrial companies involved mainly in the steel and coke, petrochemical, high-voltage electricity transmission and thermoelectric industries.

We believe that we benefit from the following competitive strengths:

• Strong relationships with leading utility and industrial companies;

• Geographical proximity to the multi-gigawatt pipeline of wind development projects in the northern provinces of China;

• Technically advanced, precision manufacturing expertise demonstrated, in part, by our Class III A2 grade pressure vessel manufacturing license, a key criterion in customer selection of wind tower suppliers;

• Proprietary product designs and intellectual property; and

• High-quality manufacturing, stringent testing, timely delivery and customer service.

We may experience payment delays and we do not recognize revenue until our products are delivered, tested and accepted by our customers. Our agreements with our customers generally provide for advance and partial payments of the purchase price to be due at agreed-upon milestones throughout the project duration, with the final 10% of the contractual amount to be paid up to 24 months after customer acceptance. Customer acceptance occurs after the customer receives and puts the product through quality inspection, a process that normally takes one to two weeks. Payments received prior to customer acceptance are recorded as unearned revenue. Payments may be received up to six months after their respective due dates, but we do not anticipate any significant credit risk because the majority of our customers are state-owned and publicly traded utilities and industrial companies in China.

Our headquarters are in Tieling, Liaoning Province, China, where we currently operate production facilities with 94,473 square meters of combined production space. As of December 31, 2013, we had 75 full-time employees.

Our History

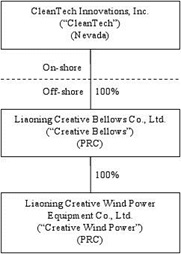

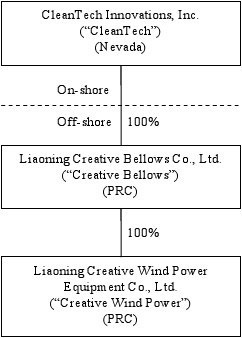

We are a U.S. holding company with no material assets other than the ownership interests of our two wholly owned subsidiaries organized under the laws of the PRC: Creative Bellows and Creative Wind Power. Creative Bellows was incorporated on September 17, 2007, and is our Wholly Foreign Owned Enterprise, or WFOE; Creative Bellows owns 100% of Creative Wind Power, which was incorporated on May 26, 2009. Creative Bellows provides the production expertise, employees and facilities to manufacture our wind towers, bellows expansion joints, pressure vessels and other fabricated metal specialty products. Creative Wind Power markets and sells the wind towers designed and manufactured by Creative Bellows.

We were incorporated in the StateReport of Nevada on May 9, 2006, under the name Everton Capital Corporation, as an exploration stage company with no revenues and no operations, engaged in the search for mineral deposits or reserves. On June 18, 2010, in anticipation of the Share Exchange Agreement and related transactions described below, we changed our name to CleanTech Innovations, Inc. through a merger with our wholly owned, non-operating subsidiary established solely to change our name pursuant to Nevada law and authorized an 8-for-1 forward split of our common stock effective July 2, 2010. Prior to the forward split, we had 5,501,000 shares of our common stock outstanding, and, after giving effect to the forward split, we had 44,008,000 shares of our common stock outstanding. We authorized the forward stock split to provide a sufficient number of shares to accommodate the trading of our common stock in the OTC marketplace after the acquisition of Creative Bellows as described below.Independent Registered Public Accounting Firm

The acquisitionBoard of Creative Bellows was accomplished pursuant toDirectors and Stockholders

6D Global Technologies, Inc.

(Formerly Initial Koncepts, Inc.)

We have audited the termsaccompanying balance sheet of 6D Global Technologies, Inc. (formerly Initial Koncepts, Inc.) (the “Company”) as of December 31, 2013, and the related statements of operations, stockholders’ equity (deficit) and cash flows for the year then ended. These financial statements are the responsibility of the Share Exchange Agreement dated July 2, 2010, as amended. PursuantCompany’s management. Our responsibility is to the Share Exchange Agreement,express an opinion on July 2, 2010, we issued 15,122,000 shares ofthese financial statements based on our common stock to the three owners of Creative Bellows and two of their designeesaudit.

We conducted our audit in exchange for their agreement to enter into and consummate a series of transactions, described below, by which we acquired 100% of Creative Bellows. Concurrentlyaccordance with the Share Exchange Agreementstandards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a condition thereof, we entered intobasis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an agreement with Jonathan Woo, our former president and director, pursuant to which he returned 40,000,000 shares of our common stock to us for cancellation in exchange for $40,000. Upon completionopinion on the effectiveness of the foregoing transactions,Company’s internal control over financial reporting. Accordingly, we had 19,130,000 shares of our common stock issuedexpress no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and outstanding.

On July 15, 2010, the PRC State Administration of Industry and Commerce, or the AIC, issued a Sino-foreign joint venture business license for Creative Bellows, indicating that a capital injection by Wonderful Limited, a British Virgin Islands company, was approved and registering its ownership of a 4.999% equity interest in Creative Bellows. On August 18, 2010, the AIC issued an approval registration of our capital injection of approximately $23.3 million in cash in exchange for approximately 87% of Creative Bellows. Finally, on October 15, 2010, we obtained PRC government approval to acquire the remaining minority interest in Creative Bellows held by its original shareholders and Wonderful Limited for approximately $6 million in cash. Pursuant to the Waiver and Release Agreements dated as of October 27, 2010, the selling minority shareholders of Creative Bellows waived their rights to receive cash for their equity interests in exchange for a mutual release of claims. As a result of these transactions, Creative Bellows became our 100% subsidiary effective as of October 15, 2010. We were required to contribute $8.45 million as additional contribution of capital to Creative Bellows by July 2012 ; however, we subsequently petitioned for a decrease of contributed capital to our existing contribution of $19.35 million which was approved.

Our organization structure as of the date of this report is set forthdisclosures in the following diagram:

Forfinancial statements. An audit also includes assessing the accounting purposes, the Share Exchange Agreementprinciples used and subsequent transactions described above were treated as a reverse acquisition and recapitalization of Creative Bellows because, prior to the transactions, we were a non-operating public shell and, subsequent to the transactions, the shareholders of Creative Bellows owned a majority of our outstanding common stock and exercise significant influence over the operating and financial policies of the consolidated entity.

Our Industry

Overview

Currently, China’s energy infrastructure is reliant predominantly on coal; however, China has limited fossil fuel reserves. As a result, China’s government has implemented social, economic, environmental, regulatory and government stimulus-related policies to drive demand for technologies that promote renewable energy production, pollution reduction and energy conservation. As described in the Chapter 11, 12 th Five-Year Plan, China has placed a priority on promoting the development of diversified and clean energyestimates made by management, as well as optimizingevaluating the layout of energy development with the goal of constructing 6 onshore and 2 coastal and offshore large wind power bases, providing additional installed capacity of over 70 million kW.

China adopted its first Renewable Energy Law in 2005, fostering the development of renewable energy such as wind power. In 2007, the National Development and Reform Commission, or the NDRC, released its “Medium and Long-Term Development Plan for Renewable Energy in China,” or the “2007 NDRC Plan,” setting a 15% target for renewable energy consumption by 2020. The growth in wind-generated electricity will also contribute towards China’s goal to cut its carbon dioxide emissions. As announced in November 2009 at Copenhagen UN climate change conference, China’s “Carbon Intensity Goal” is to cut carbon dioxide emissions per unit of GDP by 40% to 45% by 2020 compared to 2005 levels. The 12th Five-Year plan targets non-fossil fuel resources to provide 11.4% of total primary energy consumption. These government policies are intended to help stimulate sustainable wind power and clean technology development and investment.overall financial statement presentation. We believe these government policiesthat our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2013, and the results of its operations and its cash flows for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue to increase demand for our products, including structural wind towers and fabricated metal specialty components.

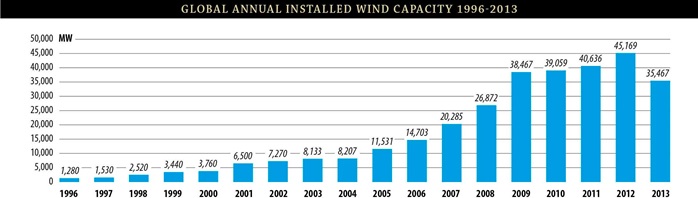

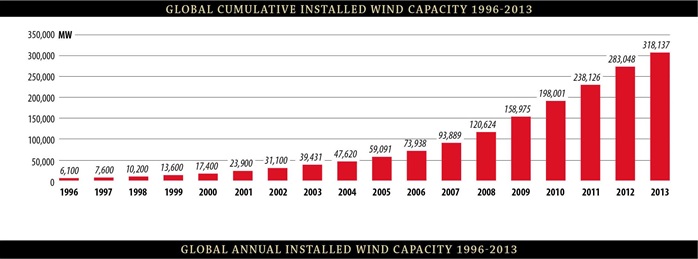

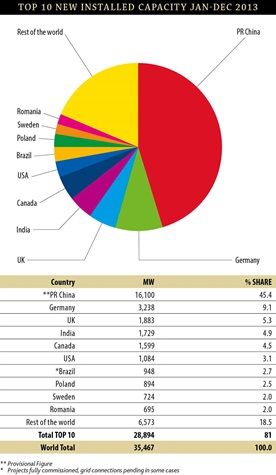

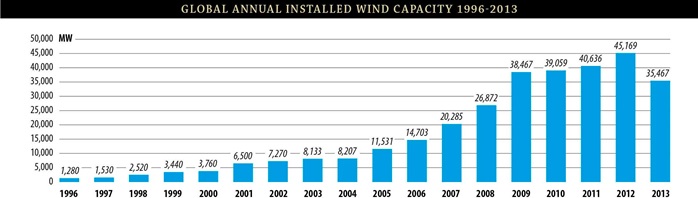

Global Wind Power Market

Wind power is the world’s fastest-growing energy sector. We believe wind power is cost-efficient and mature compared to other types of renewable energy technologies. Accordingas a going concern. As discussed in Note 9 to the Global Wind Energy Council, orfinancial statements, the GWEC, “Global Wind StatisticsCompany had an accumulated deficit at December 31, 2013,” a net loss and net cash used in 2013, global annual installed wind capacity decreasedoperating activities for the year then ended. These factors raise substantial doubt about the Company’s ability to 35,467 MW and China accounted for 45.4% of all newly installed capacity and 28.7% of all worldwide capacity. China continuedcontinue as a going concern. Management’s plans in regards to be the largest Asian market and added 16,100 MWthese matters are also described in 2013.Note 9. The following tables illustrate global annual installed capacity cumulative installed capacity and top 10 new installed capacity in 2013.

Source: Global Wind Statistics 2013, Global Wind Energy Council

Source: Global Wind Statistics 2013, Global Wind Energy Council

China Wind Power Market

The growth experienced by China’s wind industry over the past seven years has been driven mainly by national renewable energy policies as well as its active participation in the UNFCCC’s Clean Development Mechanism. The Chinese wind power market is now beginning to enter a more steady development and refinement stage, according to the GWEC Global “Wind Energy Outlook 2012.” The National Energy Administration (NEA) released the 12 th Five-Year plan for renewable energy in 2011 targeting 100 GW of wind power by 2015, consisting of 70 GWfinancial statements do not include any adjustments that might result from the large wind base program, 30 GW from smaller projects, and an additional 5 GW from offshore wind.

Since the beginning of the 12th Five-Year Plan period (2011-2015), the NEA has promoted the concept of focusing on both centralized and decentralized development, supported by corresponding administrative measures. As a resultoutcome of this guidance from the central government, inland regions began to plan wind power development projects according to local conditions, thereby opening up opportunities for mid and small-sized wind power investment enterprises. According to the GWEC 2012 China Wind Outlook, the “Three Northern Area” of China features abundant wind energy resources, where the wind power density level is Class 3 and higher, including the regions of Inner Mongolia, Gansu, Xinjiang, Hebei, Jilin, Liaoning, Heilongjiang and Ningxia. In some areas such as Huitengliang in Inner Mongolia, Urad Middle Banner in Bayannur Inner Mongolia and Saihanha in Chifeng Heibei, which are all located near to our manufacturing facilities, the wind power density level approaches Class 5.

Current guidelines published in the 2007 NDRC Plan mandate that renewable resources, including wind, generate 15% of total energy consumption by 2020. By the end of 2011, China had approximately 1,500 wind power projects in early stage development, totaling approximately 90GW. There are more than 20 provinces where the early stage development pipeline exceeds 1GW, including such provinces and regions as Yunnan, Guizhou, Hunan, Henan and Guangxi, which have more than 1.5GW each. Large wind power bases have been approved by the Central Government and are in early stage development, including the Jiuquan Phase-II GW base in Gansu (3GW), the Urad Middle Banner GW base in Bayannur, Inner Mongolia (1.8GW) and Kumui GW base in Xinjiang (2GW), for a total of 6.8GW. The following map illustrates the electricity delivery plan from the main wind power bases in China.uncertainty.

|

Source: Chinese Renewable Energy Industries Association/s/ Li and Company, PC * CleanTech’s manufacturing facilities

|

| Li and Company, PC |

Wind Tower Market Opportunity in China

The “China Wind Power Development Road Map 2050”report, jointly published by the Energy Research Institute of the National Development and Reform Commission and the International Energy Agency, proposed that by 2020,wind power installed capacity should reach 200 GW; By 2040, wind power installed capacity should reach 400GW; By 2050, wind power installed capacity should reach 1,000 GW, or should meet at least 17% of the national electricity demand, based on different scenarios. These objects translate into an annual market of approximately 15GW per year. We believe that the market for wind towers will remain robust through 2020.

Renewable Energy Policy and Regulation in China

National renewable energy policies and a supportive regulatory framework have driven the growth of renewable energy in China. The main legislation for China to develop renewable energy is the “Renewable Energy Law of the People’s Republic of China”. The law was promulgated in 2005 and executed in 2006. It was modified again in 2009. The modified law was executed in April 2010. Several initiatives mandated by China’s Renewable Energy Law such as feed-in tariffs, aggressive targets for renewable energy, priority dispatch and mandatory purchase for wind power, favorable taxation and abolishment of the 70% local content requirement have established the foundation for the rapid development of wind power. The key initiatives are outlined below:

Feed-in tariffs: In 2009, China replaced its centrally controlled bidding pricing system with a wind feed-in tariff ranging from RMB 0.51/kWh to RMB 0.61/kWh in four wind energy resource zones, representing a significant premium to coal power.

Aggressive targets for renewable energy: The 2007 NDRC Plan sets forth a renewable energy consumption target, including energy generated by wind, of at least 15% of China’s energy supply by 2020. Further, the 2007 NDRC Plan sets forth an obligation for larger power-generating companies to have 8% of non-hydro renewable energy in the total power generation mix by 2020.

Priority dispatch and mandatory purchase: Grid operators must give priority to electricity generated from renewable energy projects in their grid areas and must provide grid-connection services and related technical support. The law also requires grid operators to purchase power from qualified wind farms and institute clear and transparent pricing policies for wind-produced electricity that are intended to provide wind farm operators with a more predictable rate of return.

Abolishment of the 70% local content requirement: The 70% local content requirement first introduced in 2004 when most wind turbines in China were imported was abolished in 2009. This has increased competitiveness and helped China become the world’s largest wind market.

According to the GWEC 2012 China Wind Outlook, in order to regulate the wind power industry towards stable and rapid development, the National Energy Administration issued a series of industry management standards and technical requirements intended to strengthen electrical production from wind power which is set forth below.

The "Interim Measures for the Management of Wind Power Development and Construction," strengthen and improve wind power construction management systems and mechanisms, reinforce management of all elements of wind power projects ranging from planning to project early stage tasks, development rights, project approval, engineering construction, completion and operation, regulate and guide nationwide wind power projects to progress on an orderly basis.

The "Notice on the Planning and Arrangement of the First Group of Tentatively Approved Wind Power Projects for the ' Twelfth Five-Year Plan' Period" in July 2011, which will be implemented from 2011 to 2015, contains a total scale of 26.83 million kW for tentatively approved wind power projects nationwide, including 12.75 million kW for state-approved projects and 14.08 million kW for locally approved projects. For the four provinces and regions of Hebei, Heilongjiang, Jilin and Inner Mongolia, the Notice had specifically has accelerated the study of regional wind power electricity planning and consumption, and called for the timely completion of outgoing electrical transmission projects, and mandates coordinated development of wind power and power grids.

The "Implementation Rules of the Interim Measures for the Management of Development and Construction of Offshore Wind Power", with regard to the "Interim Measures for the Management of Development and Construction of Offshore Wind Power" was issued in 2010 and provides for specifications and requirements for offshore wind farm planning, a prefeasibility study and feasibility study stages and clearly defines the duties of individual management departments. The Rules specify that offshore wind farms must, in principle, be deployed in sea areas that are no less than 10km from the coast and where the seawater depth is no less than 10m when the tidal flat width is over 10km and that such locations must be suitable for avoiding sea-use conflicts between different industries and reducing development enterprises' investment risks.

"Notice on Decentralized Access Wind Power Development" (Guo Neng Xin Neng #[2011] 226) of In July 2011, requires the energy department of each province (region, city) to investigate and study the wind energy resources required for decentralized wind power and to propose a preliminary plan for near-term decentralized wind power development.

The "Guidance on Development and Construction of Decentralized Access Wind Power Projects" (Guo Neng Xin Neng #[2011] 374) of November 2011, provides specifications for conditions, project site selection, early staget asks and approval, access system technical requirements and operation management, engineering construction and promoted decentralized access wind power projects.The "Interim Measures for the Management of Power Prediction and Forecast at Wind Farms" (Guo Neng Xin Neng #[2011] 177), was issued in June 2011 in order to strengthen and regulate wind farm operation management. The measures propose that all wind farms must have wind power prediction and forecasting capabilities in line with the guidelines and outlined requirements for operation management, supervision, and examination of the wind farms.

The "Notice on Strengthening Wind Farm Safety Management" (Guo Neng Xin Neng #[2011] 373) was issued in November 2011 and proposed safety requirements and safety management in all elements of wind farm construction and manufacturing.

China Market for Bellows Expansion Joints and Pressure Vessels

The growing demand for energy has increased alongside China’s developing economy, created in part by fiscal stimulus policies to foster industrialization, infrastructure projects and manufacturing in China. According to the U.S. Department of Energy, the largest single environmental issue with steel production is the carburizing of coal into coke for use in iron production. As a result of concerns about pollution and energy recycling, especially in the electric utility, iron and steel industries, China is taking steps to implement more modern production processes designed to improve safety, reduce emissions and conserve energy. In addition, in 2010, China’s Ministry of Industry and Information Technology, or MIIT, announced a mandate for China’s steel industry to promote energy efficiency and emission reductions. In September 2012, the MIIT revised its 2010 regulations.3, 2014

The NDRC has encouraged the iron and steel industries to utilize a widely adopted energy saving process used in the production of iron, called Coke Dry Quenching, or CDQ, to promote energy conservation, reduce pollution and expand steel industry production. The CDQ process cools coke in an enclosed heat exchange system, which reduces harmful emissions and wastewater runoff while reclaiming energy for hot water or electricity generation, versus the conventional process using water to drench the coke. In addition, China’s MIIT mandated a consolidation of the iron and steel industries in order to reduce the number of small, inefficient iron and steel mills that do not have the resources to adapt to the new policies encouraging efficiency and pollution reduction. Bellows expansion joints are key components in the CDQ process, a prevalent technology used by the steel industries in Japan, Taiwan, Germany, Brazil and Finland. The primary markets for CDQ high temperature bellows expansion joints are new iron and steel mills in the PRC domestic market, the modernization of existing mills and regular replacement of CDQ high temperature bellows expansion joints, which we estimate have useful life expectancies of approximately two years. Connecting bend pipes, another type of expansion joint, are used in piping systems to carry gas away from coke ovens used in iron and steel mills. Connecting bend pipes are safer than rigid expansion joints and are also easier to install and replace than rigid metal pipe expansion joints, thereby reducing the cost of maintaining systems, which need replacement approximately every two years. The primary market for connecting bend pipes are iron and steel mills in the process of being modernized and upgraded for safety.

China is also in the process of upgrading its electricity grid to ultra-high-voltage transmission systems, which allow for a more efficient transportation of electricity and a reduction in energy lost during transmission over long distances. The upgrading of the grid is tied directly to the growth in renewables, especially wind power, in order to deliver electricity more efficiently from distant generation locations to population load centers. Disk spring sleeve bellows expansion joints are used in ultra-high-voltage Gas Insulated Switchgear, or GIS, to reduce safety issues caused by conventional bellows used in GIS by better accommodating the unique gas pressure movements within the switchgear. GIS are key safety devices in these ultra-high-voltage transmission systems. GIS work as a circuit breaker to isolate electrical equipment and balance electrical loads. The primary market for disk spring sleeve bellows expansion joints is provincial and municipal power companies that are upgrading their transmission systems.

A pressure vessel is a container designed to hold liquid or gas at significantly higher or lower pressures than at normal sea level. Pressure vessels are used for many industrial manufacturing purposes, including as storage tanks, compressed gas receivers and separators, in the petrochemical, electrical, steel, aerospace and metallurgical industries. Pressure vessels must be carefully designed, manufactured and operated properly in order to avoid explosions. The engineering specifications for pressure vessels are heavily regulated and vary from country to country. Pressure vessels may be made of steel or carbon composite materials. Spherical pressure vessels require forged parts constructed from high quality steel and welded together using highly sophisticated welding techniques.

Products

Each of our product lines – wind towers, bellows expansion joints and pressure vessels – are highly engineered metal components purchased by major electrical utilities and large-scale industrial companies. The manufacturing process for each of our products consists principally of the rolling and welding of raw steel materials into finished components, and makes use of the same pool of production workers and engineering talent for design, fabrication, assembly and testing. Our products are characterized and marketed by their ability to withstand temperature, pressure, structural load and other environmental factors critical to their performance in the wind power, steel and coke production, petrochemical, high voltage electricity transmission and thermoelectric industries. Our sales force sells our products directly to our customers, which are responsible for installing and integrating our component products into their finished products. We perform all manufacturing at our facilities in Tieling, Liaoning Province, China.

Wind Towers

We design and manufacture structural towers for wind turbines. A typical wind turbine installation consists of a tower; the nacelle, which houses the generator, gearbox and control systems; and the blade and rotor system. A freestanding, utility-scale wind tower is composed of rolled steel sections that we design and fabricate for sale to our customers, which, in turn, assemble and install the tower at wind farm sites.

|  |

Wind turbine installation | Subsection of wind tower in production |

We produce our wind towers in multiple subsections, which we then weld and bolt together into four main sections and the tower base for transport to the customer’s project site. After inspecting and treating the steel raw materials, we produce each tower subsection by rolling steel and then welding the rolled form together along its vertical axis to produce the final cylindrical piece. Each tower is manufactured to customer specifications and tolerances based on tower height, wind turbine size and unique installation site requirements. The height of the wind tower affects the ultimate yield of the turbine, as taller towers generally provide access to stronger winds and greater wind flow. This leads to greater power output and also helps to enable the use of higher-powered turbines. Increasing the height of the tower generally requires increasing its base diameter and wall thickness, thereby increasing the amount of raw material needed for production. We construct our towers using quality materials capable of enduring high-cycle fatigue stress, and they are designed to exceed the expected life of the wind turbine, typically 20 years.

We currently produce towers for 1.5 MW on-land wind turbines, with the expertise and manufacturing capacity to provide wind towers for 1, 3 MW and higher-powered on-land and off-shore wind turbines. The following table illustrates the general dimensions of wind towers for on-land and off-shore installations by turbine MW.

Wind Tower Sizes |

|

| | On-land Wind Turbines | | Off-shore Wind Turbines |

Turbine Capacity | | 1MW | | 1.5MW | | 3MW | | 5MW | | 3MW | | 5MW |

Tower Height | | 68m | | 72m | | 75m | | 75m | | 75m | | 75m |

Tower Wall Thickness | | 10-20mm | | 14-32mm | | 16-50mm | | 16-60mm | | 16-50mm | | 16-60mm |

Our manufacturing facilities are located in one of the top wind power production regions of China, thereby lowering transportation costs for delivery of our wind towers. We currently are the only wind tower manufacturer in Tieling, Liaoning Province. Our welding experience, Class III A2 grade pressure vessel manufacturing license and location provide us with competitive advantages when bidding on new wind tower contracts. Our wind tower customers include the wind power operating subsidiaries of two of the largest state-owned utilities – China Guodian Corporation and China Huaneng Group.

During the fiscal year ended December 31, 2013, We shipped 7 wind towers. The major customer of our wind tower products in 2013 is Huaneng Tongyu Xinhua Wind Power Co., Ltd. We plan to supply 33 more units of wind towers to Huaneng Tongyu Xinhua Wind Power Co., Ltd., and 22 more units to China Huaneng Group Panjin Co., Ltd. under existing contracts. As of December 31, 2013, we had a backlog of 2 orders for wind towers in the amount of RMB $9.54 million. As of December 31, 2013, we had altogether 33 orders for wind towers valued at RMB $51.97 million since 2011. We did not ship any wind towers in the fiscal year of 2012.

Bellows Expansion Joints

We design and manufacture specialty bellows expansion joints, which are used to absorb the expansion, contraction and movement of piping system components resulting from extreme temperature changes, vibrations, high pressure and other mechanical forces common to large industrial production systems. The “bellows” is the flexible portion that permits movement in the expansion joint and is made of specialty steel or rubber. Bellows expansion joints absorb axial, lateral and angular motions, vibrations, thermal expansions and contractions.

Large industrial production piping systems are an integral part of the manufacturing process in iron and steel production, refining, heat recycling and ultra-high-voltage transmission systems. Expansion joints must be made of high quality materials and manufactured to withstand extreme pressure, changes in temperature and vibrations. Even high quality expansion joints must be replaced on a regular basis in order to properly maintain complex manufacturing systems. Historically, our customers have imported these products from Japan due to the precision manufacturing and engineering requirements of the products.

Our bellows expansion joints accounted for approximately 13.27% of our net sales for the year ended December 31, 2013, compared to 17% of our net sales for the year ended December 31, 2012.

Our key bellows expansion joint products include:

CDQ High Temperature Bellows Expansion Joints – expansion joints are used in coke dry quenching systems, a more environmentally friendly and efficient process for the production of coke being adopted by the iron and steel industries in China. We believe that we were the first manufacturer of CDQ high temperature bellows expansion joints in China when we first introduced this product in June 2009.

|

CDQ High Temperature Bellows Expansion Joint |

Disk Spring Sleeve Bellows Expansion Joints – a key component in ultra-high-voltage electrical switching systems used by large electric utilities in China to upgrade and modernize the national electrical grid. Our products, first introduced in March 2009, reduce safety issues caused by conventional bellows used in Gas Insulated Switchgear by better accommodating the unique gas pressure movements within the switchgear.

|

Disk Spring Sleeve Bellows Expansion Joints |

Connecting Bend Pipes – unique flexible expansion joints that reduce flammable gas leaks from coal ovens used to make coke in iron and steel mills. We are one of the few manufacturers of connecting bend pipes for the steel and coke industries in China, having first introduced our product in March 2009.

|

Connecting Bend Pipes |

Pressure Vessels

We design and manufacture highly engineered pressure vessels used within heat exchangers and industrial reactors by the petrochemical, electrical, steel, aerospace and metallurgical industries. Our pressure vessels are also used as storage tanks and separators in manufacturing and electrical production processes. We manufacture pressure vessels to customer specifications from carbon or stainless steel to withstand high temperatures, high pressures and resist corrosion. Our pressure vessels are subject to stringent testing standards and are put through a battery of examinations using radiological (x-ray), ultrasonic, pneumatic and hydraulic testing to ensure quality control. We have received the necessary licensing from the State General Administration of the PRC for Quality Supervision and Inspection and Quarantine to manufacture pressure vessels of Class III A2 grade – the highest rating in China. Management estimates that our pressure vessels have an average life expectancy of 10 years. We first introduced our pressure vessels in February 2009.

Pressure vessels accounted for 52.06% of our net sales for the year ended December 31, 2013, compared to 74% of our net sales for the year ended December 31, 2012.

|

Pressure Vessel |

Sales and Marketing

As of December 31, 2013, we employed 15 sales professionals who sell and market our products directly to customers. We currently sell exclusively to large-scale utilities and industrial companies and have developed an extensive network of relationships with the utilities that are the principal developers of wind farms, large-scale steel mills and state electric grid operators within China. Our wind towers are sold primarily into wind farms being developed within 500 miles of our Tieling manufacturing facilities, leveraging our regional strength as the only wind tower manufacturer in Tieling, Liaoning Province and our transportation cost advantage.

Utilities award contracts for wind towers on a competitive basis. As a precursor to bidding, suppliers like us generally must have an existing relationship with the utility and a license to manufacture Class III A2 grade pressure vessels, which is often a specific requirement to bid on wind tower contracts. We generally become aware of upcoming projects by region as disclosed in annual NDRC wind development plans and through our customer relationships. Utilities disclose specific requests for proposals publicly via the Internet when they are prepared to accept bids. Requests for proposals are typically disclosed in the first, second and fourth calendar quarters for product delivery in the subsequent third, fourth and second calendar quarters.

A substantial deposit based upon contract amount, typically around $125,000, is required for each bid on a wind tower contract, and is returned to the bidder approximately three months after bid submission. This process is designed to ensure that only companies with sufficient manufacturing capacity and capitalization bid on projects. It is our experience that typically three to six companies bid per contract. Contract price per tower varies based on customer specifications, location requirements of the wind farm and turbine MW.

Production

We conduct all manufacturing in our facilities in the city of Tieling, Liaoning Province, China. We base our production schedule on customer orders and schedule deliveries on a just-in-time basis. We use advanced manufacturing equipment in our production process. We received ISO 9001:2008 Quality Management System certification in October 2009, which certification recognizes our adherence to formalized business processes and implementation of a quality management system that demonstrates our ability to consistently produce products meeting customer and applicable statutory and regulatory requirements. We currently operate two production facilities with 17,246 square meters of combined production space.

Product Safety and Quality Control

We have implemented multiple, comprehensive quality control procedures throughout our manufacturing and assembly process that are designed to ensure product quality and safety beginning from the receipt of raw materials to the final product inspection prior to shipment. Our manufacturing protocols establish stringent requirements and specifications that our products must meet before they are allowed to move into the next phase of the manufacturing process, ensuring that each individual piece of work in progress meets strict technical standards. Our pressure vessel manufacturing received PRC government certification. We perform non-destructive tests on our products for defect detection using our in-house radiological (x-ray) and ultrasonic testing. We use specialized pneumatic and hydraulic tests on pressure vessels and bellows expansion joints for conformance with specifications, and gas leakage tests on GIS bellows expansion joints. For some of our products, such as wind towers, production and testing is monitored throughout the production process by both customer and government on-site inspectors in addition to our own quality assurance supervisors. Our quality control procedures also include quality assurance of raw materials used in the production of our products, which includes an evaluation and selection of established and reputable suppliers.

We offer a warranty to our customers on all products for up to 24 months, depending on the terms negotiated with each customer, following the date of customer acceptance. During the warranty period, we will repair or replace defective products free of charge.

Suppliers and Raw Materials

Our major raw material purchases include stainless steel, carbon steel and component parts, including disk springs and flanges. We operate a multiple-sourcing strategy, sourcing our raw materials through various suppliers located throughout China. We do not engage in hedging transactions to protect against raw material price fluctuations; instead, we attempt to mitigate the short-term risk of price swings on raw materials by obtaining pricing commitments from suppliers in advance for inclusion in our bids for large sales contracts. This process helps to fix our raw material costs at the time of bidding, thereby locking in our margins on large sales of wind towers and other fabricated metal specialty components. We have been able to source our steel purchases directly from steel producers instead of through steel distributors, further reducing our costs. We typically place component orders after we have received firm orders for our products and have received prepayments in order to minimize our inventory.

We do not generally have long-term supply agreements with any of our raw materials suppliers. We believe we will be able to obtain an adequate supply of steel and other raw materials to meet our manufacturing requirements, and we maintain a good business relationship with all of our suppliers. Our principal suppliers are Shengbang Gongmao Industrial Trading Co., Ltd., Shengyang Haosen Trading Co., Ltd., Dongfang Kunlun Stainless Steel Co., Ltd.and Fushan Jiaye Machinery Manufacturing Co., Ltd.

Customers

Our customers include major electrical utilities and large-scale industrial companies in China specializing in heavy industry, such as the wind power, steel and coke production, petrochemical, high voltage electricity transmission and thermoelectric industries.

The majority of our business for fabricated metal specialty components is by customer purchase order made in the ordinary course of business. Installation of our component products is the responsibility of the customer. We provide a standard warranty to our customers on our products to repair or replace defective components for up to 24 months from customer acceptance depending upon the terms negotiated with each customer. Our major customer of our wind tower products in 2013 is Huaneng Tongyu Xinhua Wind Power Co., Ltd. accounting for 18% of our net sales. Our largest customer for pressure vessels in 2013, Datangh International Fuxin Coal Gas Industry Co., Ltd., accounted for approximately 36% of our net sales for the year ended December 31, 2013. And our largest customer for bellows expansion joints in 2013, ACRE Coking & Refractirt Engineering Corporation, MCC accounted for approximately 5.08% of our net sales for the year ended December 31, 2013. Xinzhong Heavy Industrial Equipment Co., Ltd accounted 18% of our net sales for the year ended December 31, 2013.

The majority of our business is affected by seasonality. We sell products that are installed outdoors. Consequently, demand for these fabricated metal specialty components can be affected by weather conditions. We typically experience stronger third and fourth calendar quarters and weaker first and second calendar quarters due to seasonal fluctuations in sales volumes. Our wind tower customers typically place requests for proposals in the fourth and first calendar quarters because of their internal operational schedules and annual budget requirements. In order to satisfy delivery schedules, we manufacture most of our wind tower products during the second and third calendar quarters for delivery in the second, third and fourth calendar quarters when weather conditions in the northern provinces of China, where our customers’ wind farms are located, are more favorable for installation by the customer.

Intellectual Property

We and our subsidiaries rely on the patent and trade secret protection laws in China, along with confidentiality procedures and contractual provisions, to protect our intellectual property and maintain our competitive position in the marketplace. We have two design patents in China for a connecting bend pipe, which expires in August 2015, and an enclosed compensator, which expires in March 2020. We have two utility patents in China related to our disk spring sleeve bellows expansion joint, which expires in March 2020, and our CDQ high temperature bellows expansion joint, which expires in May 2020. We intend to apply for more patents in China to protect our core technologies. We have been granted an exclusive license to use a production method patent for lead-free soft solder with mischmetal from the Shenyang Industry University until December 31, 2016. Under the terms of the license, we will pay Shenyang Industry University royalties based on our sales associated with our use of the patent of no more than RMB 100,000 ($15,200) each quarter.

Research and Development

We spent $179,745 on research and development in 2013, and $387,486 in 2012. We continue to evaluate opportunities to develop new products and will increase expenditures for research and development accordingly. We may increase future investments in research and development based on our growth and available capital.

Governmental and Environmental Regulation

Our Creative Bellows and Creative Wind Power subsidiaries and manufacturing facilities are located in Liaoning, Tieling Province, China, and subject to the national and local laws of the PRC. Any company that conducts business in the PRC must have a business license that covers a particular type of work. The business licenses of our PRC subsidiaries cover their present business activities. Prior to expanding our PRC subsidiaries’ business beyond that of their business license, we are required to apply and receive approval from the PRC government. Our business and company registrations for Creative Bellows and Creative Wind Power are in compliance in all material respects with the laws and regulations of the municipal and provincial authorities of Liaoning Province and China.

The manufacturing of pressure vessels requires a special license issued by the State General Administration of the PRC for Quality Supervision and Inspection and Quarantine. We received a license to manufacture pressure vessels of Class III A2 grade on January 8, 2009, which expires on January 7, 2013. We then successfully applied for a renewal of this manufacturing license. The license is effective from July 2013 to July 2017.

Our nondestructive radiological testing of products includes the use of x-rays for defect detection. In December 2008, the Department Of Environmental Protection Of Liaoning Province determined that the design and construction of our radiological (x-ray) defect detection room was in compliance with PRC Ministry of Health standards for radiological protection standards for industrial x-rays.

Environmental Regulations

We are subject to the national environmental regulations of the PRC as well as local laws regarding pollutant discharge, air, water and noise pollution, including the Environmental Protection Law of the PRC, the Environmental Impact Appraisal Law of the PRC, the Law of the PRC on the Prevention and Control of Water Pollution, the Law of the PRC on Prevention and Control of Environmental Pollution Caused by Solid Waste, the Law of the PRC on Prevention and Control of Air Pollution and the Law of the PRC on Prevention and Control of Environmental Noise Pollution. The Environmental Protection Law of the PRC sets out the legal framework for environmental protection in the PRC. The Ministry of Environmental Protection of the PRC, or the MEP, is primarily responsible for the supervision and administration of environmental protection work nationwide and formulating national waste discharge limits and standards. Local environmental protection authorities at the county level and above are responsible for environmental protection in their jurisdictions. Companies that discharge contaminants must report and register with the MEP or the relevant local environmental protection authorities. Companies discharging contaminants in excess of the discharge limits prescribed by the central or local authorities must pay discharge fees for the excess in accordance with applicable regulations and are also responsible for the treatment of the excessive discharge. Companies that directly or indirectly discharge industrial wastewater into the water or are required by law to obtain the pollutant discharge permit before discharging wastewater or sewage shall also obtain the pollutant discharge permit.

Labor Protection Regulations

The Labor Contract Law of the PRC, effective on January 1, 2008, governs the establishment of employment relationships between employers and employees, and the conclusion, performance, termination of, and the amendment to employment contracts. To establish an employment relationship, a written employment contract must be signed by the employer and employee. In the event that no written employment contract was signed at the time of establishment of an employment relationship, a written employment contract must be signed within one month after the date on which the employer first engaged the employee. We believe that we are in material compliance with such requirement.

On June 29, 2002, the Work Safety Law of the PRC was adopted by the Standing Committee of the 9th National People’s Congress and came into effect on November 1, 2002, as amended on August 27, 2009. The Work Safety Law provides general work safety requirements for entities engaging in manufacturing and business activities within the PRC. We believe we are in material compliance with all applicable laws and regulations related to work safety.

Foreign Currency Regulations

The principal regulations governing foreign currency exchange in China are the Foreign Exchange Administration Regulations promulgated by the State Council, as amended on August 5, 2008, or the Foreign Exchange Regulations. Under the Foreign Exchange Regulations, RMB is freely convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions, but not for capital account items, such as direct investments, loans, repatriation of investments and investments in securities outside of China, unless the prior approval of the SAFE is obtained and prior registration with the SAFE is made.

On October 21, 2005, the SAFE issued Circular 75, which became effective as of November 1, 2005. SAFE further promulgated Circular on issuing the operational rules concerning foreign exchange administration of company financing and round tripping investments via overseas special purpose companies by residents in china [Huifa (2011) No. 19] (“Circular 19”)] on May 17 2011. Circular 19 further clarifies issues in Circular 75 and simplifies the operational procedures for Circular 75. Circular 19 took effect on July 1, 2011. Please refer to “Risk Factors – Risks Related to Business in China – PRC regulations relating to the registration requirements for PRC resident shareholders owning shares in off-shore companies as well as registration requirements of employee stock ownership plans or share option plans may subject our PRC resident shareholders to personal liability and limit our ability to acquire companies in China or to inject capital into our operating subsidiaries in China, limit our subsidiaries’ ability to distribute profits to us or otherwise materially and adversely affect our business” for a discussion of Circular 75.

On August 29, 2008, the SAFE promulgated Circular 142 regulating the conversion by a foreign-invested company of foreign currency into RMB by restricting how the converted RMB may be used. Please refer to “Risk Factors – Risks Related to Business in China – Restrictions on currency exchange may limit our ability to receive and use our revenues effectively” for a discussion of Circular 142.

Dividend Distribution

Our ability to pay dividends may be affected by the complex currency and capital transfer regulations in China that restrict the payment of dividends to us by our subsidiaries in China. PRC regulations currently permit payment of dividends only out of accumulated profits as determined in accordance with accounting standards and regulations in China. We also are required to set aside at least 10% of our net income after taxes based on China’s accounting standards each year to statutory surplus reserves until the cumulative amount of such reserves reaches 50% of registered capital. These reserves are not distributable as cash dividends. Our subsidiaries also may allocate a portion of their after-tax profits to their staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation. If our subsidiaries incur debt, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us.

Taxation

Under the EIT Law and its implementing rules, which became effective on January 1, 2008, foreign-invested enterprises and PRC domestic companies are subject to a uniform tax rate of 25%.

Competition

Our products compete presently only in the PRC domestic market. The general manufacturing industry for fabricated metal components in China is fragmented and diverse, has low barriers to entry and is highly competitive. We compete with PRC domestic private companies, state-owned companies and international manufacturers. Many of our competitors are more established and have substantially greater manufacturing, marketing and financial resources than we do, including state backing for some companies.

Management believes that our welding quality, manufacturing experience and plant capacity for the production of large tower sections are key considerations in the awarding of contracts for wind tower components in China. Our principal competitors in the wind tower market are Engineering Company Ltd. (a subsidiary of the China Gezhouba Water & Power Group), Gansu Keyan Electricity Co., Ltd. and Qingdao Tianneng Electricity Engineering Machinery Co., Ltd. We sell wind towers directly to state-owned utilities and collaborate with wind turbine manufacturers to supply components for wind power project installations; we do not compete with wind turbine manufacturers.

Our principal competitor for high temperature bellows expansion joints for CDQ systems and connecting bend pipes in coking systems is NanJing ChenGuang. Our principal competitors in the disk spring sleeve bellows expansion joint market are Shanghai Huqiang Bellows Manufacture Co., Ltd., Shenyang Instrument Science Institution and Shenyang Aerosun-Futai Expansion Joint Co., Ltd. Our principal competitors in the pressure vessel market are Fushun Petroleum Machinery Factory, Lanzhou Petroleum Equipment Factory.

Seasonality

The majority of our business is affected by seasonality. We sell products that are installed outdoors. Consequently, demand for these fabricated metal specialty components can be affected by weather conditions. We typically experience stronger third and fourth calendar quarters and weaker first and second calendar quarters due to seasonal fluctuations in sales volumes. Our wind tower customers typically place requests for proposals in the fourth and first calendar quarters because of their internal operational schedules and annual budget requirements. In order to satisfy delivery schedules, we manufacture most of our wind tower products during the second and third calendar quarters for delivery in the second, third and fourth calendar quarters when weather conditions in the northern provinces of China, where our customers’ wind farms are located, are more favorable for installation by the customer.

Employees

As of December 31, 2013, we had 75 full time employees, and 60 part time or seasonal employees all of whom are in China. We believe that relations with our employees are satisfactory. We enter into standard labor contracts with our employees as required by the PRC government and adhere to state and provincial employment regulations. We provide our employees with all social insurance as required by state and provincial regulations, including pension, unemployment, basic medical and workplace injury insurance. We have no collective bargaining agreements with our employees.

Our business and an investment in our securities are subject to a variety of risks. The following risk factors describe the most significant events, facts or circumstances that could have a material adverse effect upon our business, financial condition, results of operations, ability to implement our business plan and the market price for our securities. Many of these events are outside of our control. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment.

Risks Related to Our Business

Our ability to develop our wind tower business is dependent upon our ability to raise funds in the U.S. capital market which we cannot provide any assurances can be accomplished given our history, the current regulatory environment and market sentiment toward U.S. public holding companies with Chinese operating subsidiaries.

During the fiscal year ended December 31, 2012, we were unable successfully bid on wind tower projects due to our inability to make the deposits required to bid on contracts. We failed to raise sufficient capital in 2011 and 2012 due to the decision by NASDAQ Listing Qualifications to delist the Company’s common stock in 2011. However, on July 11, 2013, the Securities Exchange Commission (“SEC”) reversed the 2011 delisting of the Company’s stock on the NASDAQ Stock Market, LLC. As of the filing date of this 10-K, the Company is attempting to meet the NASDAQ listing standards in order to gain meaningful access to the U.S. capital markets to fund future wind tower manufacturing. While management remains optimistic that with additional funding from the U.S. capital markets, the wind tower business may expand, we can provide no assurances that we will be able to qualify or remain listed on NASDAQ or to attract sufficient capital to develop our wind tower business.

We Are Not Currently Profitable And May Not Become Profitable .

We incurred a net loss of $16.43 million for the year ended December 31, 2013. In addition, we had loans of $2.26 million and promissory notes of $10 million and $50,000 that are past due. Through a new Line of Credit Agreement entered with the same lender on August 17, 2013, the default promissory note of $10 million became payable upon Note-holder’s request (See Note 14). As of December 31, 2013, we had an outstanding balance of $645,348 including accrued interest under this credit line and $442,827 under short term payable currently in default. The Company has been unable to raise funds from the U.S. markets to pay off these obligations. These conditions raise a substantial doubt as to whether the Company may continue as a going concern. The Company is seeking to obtain additional financing from local banks in the PRC. The Company will also seek to improve its cash flows from operations by implementing cost control measures and reducing inventory purchases.

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations, and our limited revenues may affect our future profitability.

We and our subsidiaries began operations for the production of fabricated metal specialty components in September 2007 and introduced our bellows expansion joints products and pressure vessels in the first quarter of 2009 and our wind tower products in the first quarter of 2010. Our limited history of designing and manufacturing these fabricated metal specialty components may not provide a meaningful basis on which to evaluate our business. Moreover, we have limited revenues and we cannot assure you we will be able to expand our business and gross revenue with sufficient speed to return to profitability. We will continue to encounter risks and difficulties frequently experienced by companies at an early stage of development, including our potential failure to:

· | expand our product offerings and maintain the high quality of our products; |

· | manage our expanding operations, including the integration of any future acquisitions; |

· | obtain sufficient working capital to support our expansion and to fill customers’ orders in time; |

· | maintain adequate control of our expenses; |

· | maintain our proprietary technology; |

· | implement our product development, marketing, sales, and acquisition strategies and adapt and modify them as needed; and |

· | anticipate and adapt to changing conditions in the wind power, steel, petrochemical and thermoelectric industries as well as the impact of any changes in government regulation, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

Our inability to manage successfully any or all of these risks may materially and adversely affect our business.

Our plans for growth rely on an increasing emphasis on the wind power industry; this sector faces many challenges, which may limit our potential for growth in this new market.

Our principal plan for growth is to manufacture wind towers for the PRC domestic wind power industry. The wind tower products were 24% of sales for the year ended December 31, 2013. Our success depends on receiving a majority of our future revenues and earnings from sales of wind towers for the wind power industry in China.

The wind power industry sector in China faces many challenges as it expands, including a reliance on continued PRC government environmental and energy conservation policies and incentive programs, which are one of the industry’s major growth drivers. Wind power currently accounts for a small percentage of the power generated in China, and the existing power grid and transmission system lags behind existing and planned wind power plant construction. Furthermore, the wind power industry is generally not competitive without government incentive programs and initiatives because of the relatively high generation costs for wind power compared to most other energy sources. The current government incentive programs and initiatives include a feed-in tariff paid to wind power producers by grid utility companies, a mandatory obligation for grid utility companies to purchase all the electricity generated by renewable energy projects within its grid coverage, preferential tax treatment and government spending and grants for renewable energy programs. Most of our customers are highly dependent on these government incentives, initiatives and other favorable policies to support their operations. There can be no assurance that PRC government support of the wind power industry will continue at its current level or at all, and any decrease or elimination of government incentives currently available to industry participants may result in increased operating costs incurred by our current customers or discourage our potential customers from purchasing our products.

Our ability to market to this industry segment is dependent upon both an increased acceptance of wind power as an energy source in China and the industry’s acceptance of our products. We cannot assure you that we will be able to develop this business successfully, however, and our failure to develop the business further will have a material adverse effect on our overall financial condition and the results of our operations. Additionally, any uncertainties or adverse changes in government incentives, initiatives or policies relating to the wind power industry will materially and adversely affect the investment plans of our customers and consequently our growth.

Contracts for wind power projects in China are awarded through competitive public bids and there is no assurance that we will be asked to bid on new projects or that we will win these bids.

Utilities in China award contracts for wind towers on a competitive basis. We generally become aware of upcoming projects by region as disclosed in annual NDRC wind development plans and through our customer relationships. Utilities disclose specific requests for proposals publicly via the Internet when they are prepared to accept bids. As a precursor to bidding, suppliers like us generally must have an existing relationship with the utility, which is often a specific requirement to bid on wind tower contracts. A substantial deposit based upon contract amount, typically around $125,000, is required for each bid, and is returned to the bidder approximately three months following bid submission. This process is designed to ensure that only companies with sufficient manufacturing capacity and capitalization bid on projects. It is our experience that typically three to six companies bid per contract. Competitive factors on wind tower bids include price, geographical proximity of the manufacturer to the wind power project, prior purchaser experience with the manufacturer and manufacturer reputation for quality and on-time delivery.