UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2018

☒ | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2021 | |

☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from ________ to ___________ |

Commission File Number 001-33718

U.S. STEM CELL, INC.

(Exact name of registrant as specified in its charter)

Florida |

| 001-33718 | 65-0945967 | |

(State or other jurisdiction of incorporation or organization) |

|

| ||

file number) |

| (I.R.S. Employer Identification No.) |

1560 Sawgrass Corporate Pkwy

4th Floor, Sunrise, FL 33323

(Address of Principal Executive Offices)

(954) 835-1500

(Issuer’s telephone number)

Securities registered pursuant to Section 12(b) of the Exchange Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value per shareNone

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b–2 of the Exchange Act.

(Check one):

Large accelerated filer | ☐ |

| Accelerated filer | ☐ |

Non-accelerated filer | ☐ |

| Smaller reporting company | ☒ |

Emerging growth company | ☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2018, the last day of registrant’s second fiscal quarter, theThe aggregate market value of the registrant’s common stock, $0.001 par value,voting equity held by non-affiliates computed by reference toof the registrant, as of June 30, 2021, the last day of the registrant’s most recently completed second fiscal quarter, was $2,376,858 (based on the closing sale price of the common stock reported on the OTC Markets, Inc., OTCQB as of on June 30, 2018, was approximately $9,732,678.2021). For purposes of the above statement only, all directors, executive officers and 10% shareholders are assumed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant’s Common Stock, $0.001 par value, as of March 13, 201931, 2022 was 386,675,905.571,626,258.

Transitional Small Business Disclosure Format Yes ☐ No ☒

Documents Incorporated By Reference None

U.S. STEM CELL, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

Fiscal Year Ended December 31, 20182021

|

| Page |

|

|

|

PART I | ||

Item 1. | 2 | |

Item 1A. |

| |

Item 1B. |

| |

Item 2. |

| |

Item 3. |

| |

Item 4. |

| |

|

|

|

PART II | ||

|

|

|

Item 5. |

| |

Item 6. |

| |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

Item 7A. |

| |

Item 8. |

| |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

Item 9A. |

| |

Item 9B. |

| |

|

|

|

PART III | ||

|

|

|

Item 10. |

| |

Item 11. |

| |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence |

|

Item 14. |

| |

|

|

|

PART IV | ||

|

|

|

Item 15. |

| |

|

|

|

CERTIFICATION PURSUANT TO SECTION 302 (a) OF THE SARBANES-OXLEY ACT OF 2002 |

| |

|

|

|

| ||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as well as historical information. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or industry results, to be materially different from anticipated results, performance or achievements expressed or implied by such forward-looking statements. When used in this Annual Report on Form 10-K, statements that are not statements of current or historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “plan,” “intend,” “may,” “will,���” “expect,” “believe,” “could,” “anticipate,” “estimate,” or “continue” or similar expressions or other variations or comparable terminology are intended to identify such forward-looking statements, although some forward-looking statements are expressed differently. We remind readers that forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors and involve known and unknown risks that could cause the actual results, performance, levels of activity or our achievements or industry results, to be materially different from any future results, performance levels of activity or our achievements or industry results expressed or implied by such forward-looking statements. Such forward looking statements appear in Item 1- “Business” and Item 7-“Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as elsewhere in this Annual Report. Factors that could cause our actual results to differ materially from anticipated results expressed or implied by forward-looking statements include, among others:

• our ability to manage our business despite operating losses and cash outflows;

• our ability to obtain sufficient capital or strategic business arrangements to fund our operations and expansion plans, including meeting our financial obligations under various licensing and other strategic arrangements and the funding of our clinical trials for product candidates in our development programs;

• our ability to build and maintain the management and human resources infrastructure necessary to support the growth of our business;

• our ability to operate our subsidiary businesses successfully and grow such subsidiary businesses as anticipated;

• the success and profitability of related clinics and our ability to directly, or in conjunction with third parties, open and manage new clinics

• whether a large global market is established for our cellular-based products and services and our ability to capture a meaningful share of this market;

• the effect of any U.S. Food and Drug Administration rulings, rules and regulations;

• scientific and medical developments beyond our control;

• our ability to obtain and maintain, as applicable, appropriate governmental licenses, accreditations or certifications or comply with healthcare laws and regulations or any other adverse effect, actions, or limitations caused by government regulation of our business;

• whether any of our current or future patent applications result in issued patents, the scope of those patents and our ability to obtain and maintain other rights to technology required or desirable for the conduct of our business; and

• our ability to completebring our planned clinical trials (or initiate other trials) in accordancefilings with our estimated timelines due to delays associated with obtaining sufficient capital to complete such trials, enrolling patients due to the noveltySecurities and Exchange Commission current and maintain current filings;

• the economic effects of the treatment,pandemic, the sizepromptness of distribution of vaccines, domestically and internationally to limit the patient populationimpact of COVID-19, the effect of new variants of COVID-19, and the needshort and long term economic impact of patients to meetCOVID-19 on the inclusion criteria of the trial or otherwise.marketplace

The factors discussed herein, including those selected risks described in Item 1A. “Risk Factors” and elsewhere in this Annual Report on Form 10-K and in the Company’s other periodic filings with the Securities and Exchange Commission (the “SEC”) which are available for review at www.sec.gov under “Search for Company Filings” could cause actual results and developments to be materially different from those expressed or implied by such statements. All forward-looking statements attributable to us are expressly qualified in their entirety by these and other factors. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

Consequently, all the forward-looking statements made in this Form 10-K are qualified by these cautionary statements and there can be no assurance that the actual results anticipated by management will be realized or, even if substantially realized, that they will have the expected consequences to or effects on our business operations. Except as required by law, the Company undertakeswe undertake no obligation to update anyor revise these forward-looking statements, whether as a resultto reflect events or circumstances after the date initially filed or published, to reflect the occurrence of new information, futureunanticipated events or otherwise.

Unless otherwise indicated or the context otherwise requires, all references in this Form 10-K to “we,” “us,” “our,” “our company,” “U.S. Stem Cell” or the “Company” refer to U.S. Stem Cell, Inc. and its subsidiaries.

PART I

OVERVIEW

We are a biotechnology company focused on the discovery, development and, subject to regulatory approval, commercialization of autologous cell therapies for the treatment of disease and injury. We are also a regenerative medicine company specializing in physician/veterinary training and certification and stem cell products, stem cell banking, and the creation and management of stem cell clinics.products. Our lead cardiac product candidate is MyoCell™, an innovative clinical therapy designed to populate regions of scar tissue within a patient’s heart with autologous muscle cells, or cells from a patient’s body, for the purpose of improving cardiac function in chronic heart failure patients. Our lead product for in clinic use iswas Adipocell, a proprietary kit for the isolation of adipose derived stem cells.cells which, as of the date of this filing, is currently on hold.

Biotechnology Product Candidates

We are an enterprise in the regenerative medicine/cellular therapy industry. Our prior focus was on the discovery, development, and commercialization of cell based therapeutics. Our business includesincluded the development of proprietary cell therapy products, distribution of regenerative medicine products, as well as revenue generating physician and patient based regenerative medicine / medicine/cell therapy training services, cell collection and cell storage services, the sale of cell collection and treatment kits for humans and animals, and the operation of a cell therapy clinic. Management maintains that revenues and their associated cash in-flows generated from our businesses will, over time, provide funds to support our clinical development activities as they do today for our general business operations. We believe the combination of our own therapeutics pipeline combined with our revenue generating capabilities provides the Company with a unique opportunity for growth and a pathway to profitability.services.

US Stem Cell Training, Inc. (“SCT”), an operating division of U.S. Stem Cell, Inc.,our company, is a content developer of regenerative medicine / medicine/cell therapy informational and training materials for physicians and patients. SCT also provides in-person and online training courses which are delivered through in-person presentations at SCT’s state of the art facilities and globally at university, hospital and physician’s office locations as well as through online webinars. Additionally, SCT provides hands-on clinical application training for physicians and health care professionals interested in providing regenerative medicine / cell therapy procedures.

Vetbiologics,Vet biologics, (“VBI”), an operating division of our company, is a veterinary regenerative medicine company committed to providing veterinarians with the ability to deliver the highest quality regenerative medicine therapies to dogs, cats and horses. VBI provides veterinarians with extensive regenerative medicine capabilities including the ability to isolate regenerative stem cells from a patient’s own adipose (fat) tissue directly on-site within their own clinic or stall-side.

In early 2021, following the adjustments to our business plan, we divested ourselves of our Member Interests in US Stem Cell Clinic, LLC, ,(“SCC”) and Regenerative Wellness Clinic, LLC, partially owned (33.3% as of December 31, 2018) ) investments byretained our company, is a physician run regenerative medicine/cell therapy clinic providing cellular treatments for patients afflicted with neurological, autoimmune, orthopedic and degenerative diseases. On January 29, 2019, through a reorganization of49% Member Interests of U.S.in US Stem Cell Clinic of the Villages, LLC, and Regenerative Wellness Clinic, LLC respectively, we increased our holdings to a 49.9 percent Member Interest ownership of U.S. Stem Cell Clinic, LLC and Regenerative Wellness Clinic, LLC respectively. The clinics are operating in compliance with the FDA 1271s which allow for same day medical procedures to be considered the practice of medicine. We isolate stem cells from bone marrow and adipose tissue and also utilize platelet rich plasma.is currently dormant.

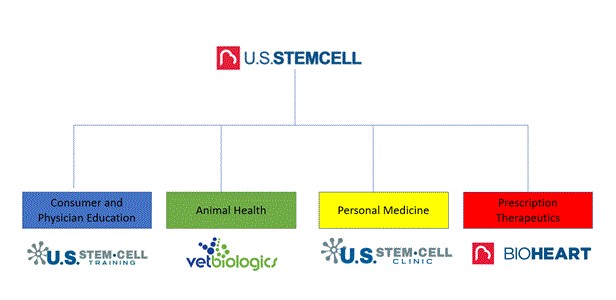

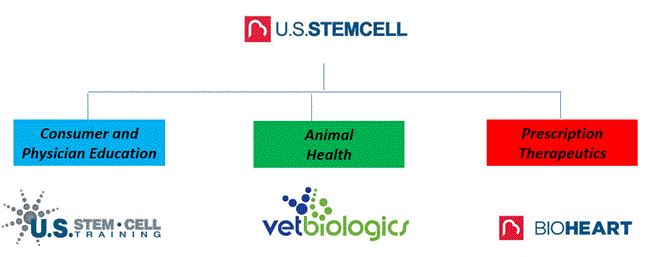

U.S. Stem Cell’s comprehensive map of products and services:

U.S. Stem Cell, Inc. was incorporated in the State of Florida in August 1999 as Bioheart, Inc. In 2015, we changed our name to U.S. Stem Cell, Inc. Our principal executive offices are located at 13794 NW1560 Sawgrass Corporate Parkway, 4th Street, Suite 212,FL Sunrise Florida 33325FL 33323 and our telephone number is (954) 835-1500. Information about us is available on our corporate websites at www. us-stemcell.com, www.usstemcelltraining.com, www.vetbiologics.com, www.regenerativewellnessclinic.com and www.usstemcellclinic.com.us-stemcell.com. We include our website addresses in the Annual Report on Form 10-K only as an interactive textual reference and do not intend it to be an active link to our website. The information on our websiteswebsite is expressly not incorporated by reference in the Annual Report on Form 10-K.

The Annual Report includes the following trademarks, service marks and trade names owned by the Company: U.S. Stem Cell, Inc. ™, US Stem Cell Training, Vetbiologics, US Stem Cell Clinic, LLC. ™,, MyoCell ™ and Adipocell ™. These trademarks, service marks and trade names are the property of U.S. Stem Cell, Inc. and its affiliates.

REGENERATIVE MEDICINE / CELL THERAPY INDUSTRY

Regenerative medicine is defined as the process of replacing or regenerating human cells, tissues or organs to restore normal function. Among the categories of therapeutic technology platforms within this field are cell therapy; tissue engineering; tools, devices and diagnostics; and aesthetic medicine. U.S. Stem Cell’s business model is focused on two of these areas. First, cell therapy, in which we introduce cells (adult, donor or patient, stem cell or differentiated) into the body to prevent and treat disease; and second, we are a provider of services and products to physicians and veterinaries who provide or seek to provide cellular therapies and direct patient care for individuals and animals who may benefit from cellular therapy.

All living complex organisms start as a single cell that replicates, differentiates (matures) and perpetuates in an adult organism through its lifetime. Cellular therapy is the process that uses cells to prevent, treat or cure disease, or regenerate damaged or aged tissue. To date, the most common type of cell therapy has been the replacement of mature, functioning cells such as through blood and platelet transfusions. Since the 1970s, first bone marrow and then blood and umbilical cord-derived stem cells have been used to restore bone marrow, as well as blood and immune system cells damaged by the chemotherapy and radiation that are used to treat many cancers. These types of cell therapies are standard practice world-wide and are typically reimbursed by insurance.

Within the field of cell therapy, research and development using stem cells to treat a host of diseases and conditions has greatly expanded. Stem cells (in either embryonic or adult forms) are primitive and undifferentiated cells that have the unique ability to transform into or otherwise affect many different cells, such as white blood cells, nerve cells or heart muscle cells. U.S. Stem Cell’s cell therapy development efforts are focused on the use of adult stem cells; those cells which are found in the muscle, fat tissue and peripheral blood.

There are two general classes of cell therapies: Patient Specific Cell Therapies (“PSCTs”) and Off-the-Shelf Cell Therapies (“OSCTs”). In PSCTs, cells collected from a person (“donor”) are transplanted, with or without modification, to a patient (“recipient”). In cases where the donor and the recipient are the same individual, these procedures are referred to as “autologous”. In cases in which the donor and the recipient are not the same individual, these procedures are referred to as “allogeneic.” Autologous cells offer a low likelihood of rejection by the patient and we believe the long-term benefits of these PSCTs can best be achieved with an autologous product. In the case of OSCT, donor cells are expanded many fold in tissue culture, and large banks of cells are frozen in individual aliquots that may result in treatments, in our observation, for as many as 10,000 people from a single donor tissue. By definition, OSCTs are always allogeneic in nature.

Various adult stem cell therapies are in clinical development for an array of human diseases, including autoimmune, oncologic, neurologic and orthopedic, among other indications. While no assurances can be given regarding future medical developments, we believe that the field of cell therapy holds the promise to better the human experience and minimize or ameliorate the pain and suffering from many common diseases and/or from the process of aging.

According to Robin R. Young’s Stem Cell Summit Executive Summary-Analysis and Market Forecasts 2014-2024, the United States stem cell therapy market is estimated to grow from an estimated $237 million in 2013 to more than $5.7 billion in 2020.

With approved cell therapy products currently being sold in the United States and abroad, and an increasing number of Phase 2 and Phase 3 trials with cell therapies underway, we believe the “promise” of cell therapy is becoming clearer. We contend that cell therapies, if approved, should cut health care costs as they aim to facilitate functional restoration of damaged tissues and not just abate or moderate symptoms. Safe and efficacious cell therapies for chronic diseases could potentially capture an increasing portion of future healthcare spending in the United States, driven both by favorable demographics and meaningful pharma-coeconomic benefit.

CELLULAR THERAPY PRODUCT DEVELOPMENT PIPELINE

Specific to cellular therapy, we are focused on the discovery, development and commercialization of autologous cellular therapies for the treatment of chronic and acute heart damage as well as vascular and autoimmune diseases.

In our pipeline, subject to development based on future financing, and regulatory approval we have multiple product candidates for the treatment of heart damage, including MyoCell™ and Myocell SDF-1. MyoCell and MyoCell SDF-1 are autologous muscle-derived cellular therapies designed to populate regions of scar tissue within a patient’s heart with new living cells for the purpose of improving cardiac function in chronic heart failure patients.

MyoCell SDF-1 is intended to be an improvement to MyoCell™. MyoCell SDF-1 is similar to MyoCell but the myoblast cells to be injected for use in MyoCell SDF-1 are modified prior to injection by an adenovirus vector or non-viral vector so that they will release extra quantities of the SDF-1 protein, which expresses angiogenic factors.

AdipocellAt present, our development pipeline is a proprietary kit which also for isolation of patient-derived cell therapy that is currently being utilized in clinic treatments at the point of care. US Stem Cell clinicon hold and other trained physicians utilize this therapyno assurances can be provided as a medical procedure for a variety of indications.to when they will restart.

STATUS OF CELLULAR THERAPY PRODUCT DEVELOPMENT CLINICAL TRIALS.

MyoCell/MyoCell SDF-1

MyoCell™ is a regenerative, cellular therapy intended to improve cardiac function for those with congestive heart failure and is designed to be utilized months or even years after a patient has suffered severe heart damage due to a heart attack or other cause. We believe that MyoCell has the potential to become a leading treatment for severe, chronic damage to the heart due to its perceived ability to satisfy, at least in part, what we believe to be an unmet demand for more effective and/or more affordable therapies for chronic heart damage. MyoCell™ uses myoblasts, cells that are precursors to muscle cells, from the patient’s own body. The myoblasts are removed from a patient’s thigh muscle, isolated, grown through our proprietary cell culturing process, and injected directly in the scar tissue of a patient’s heart. A qualified physician performs this minimally invasive procedure using an endoventricular catheter. We entered into an agreement with Biosense Webster (a Johnson & Johnson company) to use its NOGA® Cardiac Navigation System along with its MyoStar™ injection catheter for the delivery of MyoCell™ in the MARVEL Trial.Trial (as defined below).

When injected into scar tissue within the heart wall, myoblasts have been shown to be capable of engrafting in the damaged tissue and differentiating into mature skeletal muscle cells. In a number of clinical and animal studies, the engrafted skeletal muscle cells have been shown to express various proteins that are important components of contractile function. By using myoblasts obtained from a patient’s own body, we believe MyoCell™ is able to avoid certain challenges currently faced by other types of cell-based clinical therapies including tissue rejection and instances of the cells differentiating into cells other than muscle. Although a number of therapies have proven to improve the cardiac function of a damaged heart, no currently available competing treatment, to our knowledge, has demonstrated an ability to generate new muscle tissue within the scarred regions of a heart as MyoCell™ has demonstrated.

Our completed clinical trials of MyoCell™ to date have beenwere primarily targeted to patients with severe, chronic damage to the heart, who are in Class II or Class III heart failure according to the New York Heart Association, or NYHA, heart failure classification system. The NYHA system classifies patients in one of four categories based on how limited they are during physical activity. NYHA Class II heart failure patients have a mild limitation of activity and are generally comfortable at rest or with mild exertion while NYHA Class III heart failure patients suffer from a marked limitation of activity and are generally comfortable only at rest.

We believe the market for treating patients in NYHA Class II or NYHA Class III heart failure is significant. According to the American Heart Association (“AHA”) Statistics and the European Society of Cardiology Task Force for the Treatment of Chronic Heart Failure, in the United States and Europe there are approximately 5.2 million and 9.6 million, respectively, patients with heart failure. The AHA Statistics further indicate that, after heart failure is diagnosed, the one-year mortality rate is high, with one in five dying and that 80% of men and 70% of women under age 65 who have heart failure will die within eight years.

We believe that approximately 60% of heart failure patients are in either NYHA Class II or NYHA Class III heart failure based upon a 1999 study entitled “Congestive Heart Failure Due to Diastolic or Systolic Dysfunction – Frequency and Patient Characteristics in an Ambulatory Setting” by Diller, PM, et. al.

MyoCell™ SDF-1 is intended to be an improvement to MyoCell™. MyoCell™ SDF-1 is similar to MyoCell™ except that the myoblast cells to be injected for use in MyoCell™ SDF-1 will be modified prior to injection by an adenovirus vector or non-viral vector so that they will release extra quantities of the SDF-1 protein, which expresses angiogenic factors. Adipocell is a patient-derived cell therapy proposed for the treatment of acute myocardial infarction, chronic heart ischemia, and lower limb ischemia. We hope to demonstrate that these product candidates are safe and effective complements to existing therapies for chronic and acute heart damage.

We have completed various clinical trials for MyoCell™ including the SEISMIC Trial, a 40-patient, randomized, multicenter, controlled, Phase II-a study conducted in Europe and the MYOHEART Trial, a 20-patient, multicenter, Phase I dose-escalation trial conducted in the United States. We were approved by the U.S. Food and Drug Administration, or the “FDA”, to proceed with a 330-patient, multicenter Phase II/III trial of MyoCell™ in North America and Europe, or the “MARVEL Trial”. We completed the MyoCell™ implantation procedure on the first patient in the MARVEL Trial on October 24, 2007. Thus far, 20 patients, including 6 control patients, have been treated. Initial results for the 20 patients were released at the Heart Failure Society of American meeting in September, 2009, showing a significant (35%) improvement in the 6 minute walk for those patients who were treated, and no improvement for those who received a placebo. On the basis of these results, we have applied for and received approval from the FDA to reduce the number of additional patients in the trial to 134, for a total of 154 patients. We are planning, on the basis of these results, to request the FDA to consider the MARVEL Trial a pivotal trial (pivotal from Phase II to Phase III) and to reduce the number of patients in the trial to 150. No assurances can be provided that this request will be approved. We have also initiated the MIRROR trial, which is a Phase III, double-blind placebo controlled study for centers outside the United States. The SEISMIC, MYOHEART, MARVEL and MIRROR Trials have been designed to test the safety and efficacy of MyoCell™ in treating patients with severe, chronic damage to the heart. We received approval from the FDA in July of 2009 to conduct a Phase I safety study on 15 patients of a combined therapy (MyoCell™ with SDF-1) called the REGEN trial, during the first quarter of 2010.

Advancement of the MyoCell™ and MyoCell™ SDF-1 clinical development programs is contingent, among many factors, upon the Company obtaining access to sufficient funding to execute the necessary clinical trials to achieve proof of efficacy and regulatory authorization to market such products. The Company,No assurances can be provided that such development programs will be realized. At present, these development programs are on hold and no assurances can be provided as to continuewhen they will restart.

Adipocell

Adipocell, a proprietary kit for the efforts stemming from the progress observed from the last activity in 2010, is also presently seeking a joint development partner for its MyoCell™ SDF-1 product candidate.

Adipocell

U.S. Stem Cell has successfully completed various trials using adipose stem cells. We have completed the Phase 1 Angel Trial for Adipocell (kits to obtain adipose derived stem cells) in congestive heart failure patients. Five patients were enrolled and treated in the second quarterisolation of 2013. At the twelve (12) month time point, patients demonstrated a statistically significant average improvement in ejection fraction (“EF”) by echocardiogram.

At the three (3) month time point, 100% of the patients demonstrated either improvement or stayed the same. After three (3) months, patients showed an average absolute improvement of 3 percentage points in EF. The patients continued to improve from 3 months to 6 months with a statistically significant average absolute improvement of 10 percentage points (p=0.01) and at the 12 month follow up patients showed this same level of improvement (p=0.01).

These trials were expanded to include a total of 28 patients. The patients underwent a local tumescent liposuction procedure to remove approximately 60 ml of fat tissue. The fat was separated to isolate the SVF and the cells were delivered into the akinetic myocardial scar region using a transendocardial delivery system (MyoCath®) in patients who had experienced a previous myocardial infarct. The subjects were then monitored for adverse events, ejection fraction via echocardiogram and 6-minute walk test (6MWT) over a period of 6 months.

The average EF was 29% at baseline and significantly increased to 35% at both 3 and 6 months. Patients walked an average of 349 meters at baseline and demonstrated a statistically significant improvement at 3 and 6 months’ post treatment of more than 80 meters. Overall, patients were pleased with the treatment results. More importantly, the procedure demonstrated a strong safety profile with no severe adverse events or complications linked to the therapy.

The adipose cells have also been utilized in a phase I trial in Europe for critical limb ischemia (n=20). Patients enrolled in the trial were already on the list for amputation. The cells were directly injected into the affected limbs in an effort to prevent the amputation. Seventy-five percent of the patients were able to avoid amputation and progressed to wound healing. No adverse events or complications were reported or linked to the cell therapy.

We have also initiated several Institutional Review Board studies in 2013 using adipose derived stem cells for various indications including dry macular degeneration, degenerative disc disease (DDD), erectile dysfunction (ED) and chronic obstructive pulmonary disease (COPD). Atwhich, as of the date of this time, we are not enrolling patients in any IRB studies. We have discontinued any studies or patient treatments with macular degeneration. We are continuing to see patients in the clinic for various indications including ED and COPD. filing, is currently on hold.

In the DDD trial, a total of 15 patients underwent a local tumescent liposuction procedure to remove approximately 60 ml of fat tissue. The fat was separated to isolate the SVF and the cells were delivered into the disc nucleus of patients with degenerative disc disease. The subjects were then monitored for adverse events, range of motion, visual analog scale (VAS), present pain intensity (PPI), Oswestry Disability Index (ODI), Beck Depression Inventory (BDI), Dallas Pain Questionnaire and Short Form (SF)-12 scores over a period of 6 months. Safety events were followed for 12 months.

No severe adverse events (SAEs) were reported during a 12 month follow up period with no incidences of infection. Patients demonstrated statistically significant improvements in several parameters including flexion, pain ratings, VAS, PPI, and short form questionnaires. In addition, both ODI and BDI data was trending positive and a majority of patients reported improvements in their Dallas Pain Questionnaire scores. Overall, we observed that patients were pleased with the treatment results. More importantly, the procedure demonstrated a strong safety profile with no severe adverse events or complications linked to the therapy.

We have published a variety of studies using adipose cells and these studies are available on PubMed. Studies include COPD, ischemia, salivary gland damage, safety analysis, and osteoarthritis. These studies are expressly not incorporated by reference to this report.

Business Strategy

U.S. Stem Cell’s mission is to advance to market novel regenerative medicine and cellular therapy products that substantially benefit humankind. Our business strategy is, to the extent possible, finance our clinical development pipeline through revenue (cash in-flows) generated through the marketing and sales of unique educational and training services, animal health products and personalized cellular therapeutic treatments.distribution of products in the industry.

A fundamental shift in venture capital investment strategies where, management believes, financial sponsorship is now directed toward commercial or near commercial enterprises has required U.S. Stem Cell to adapt its mission combining immediate revenue generating opportunities with longer-term development programs. Accordingly, U.S. Stem Cell has developed a multifaceted portfolio of revenue generating products and services in its US Stem Cell Training Vetbiologics, and US Stem Cell Clinic,Vetbiologics, operating divisions that will, if successful, financially support its clinical development programs. Our goal is to maximize shareholder value through the generation of short-term profits that increase cash in-flows and decrease the need venture financings – a modern biotechnology company development strategy.

Today, we contend that On May 9, 2018, the U.S. Department of Justice filed an injunctive action, specifically United States of America v. U.S. Stem Clinic, LLC, U.S. Stem Cell, is a combinationInc., Kristin C. Comella, and Theodore Gradel. The Complaint was filed at the request of opportunistic business enterprises. We estimatethe U.S. Food and Drug Administration (FDA) and alleges that the respective defendants manufacture “stromal vascular fraction” (SVF) products and services we offer through US Stem Cell Training, Vetbiologics, and US Stem Cell Clinics hasfrom patient adipose (fat) tissue, which the potential, although we cannot provide assurancescompanies then market as stem cell-based treatments without first obtaining what the government alleges are necessary FDA approvals. The Company retained counsel to if and when it will be accomplished, to drive up to $100 million dollarsdefend in cumulative peak annual revenues. What we are establishing is a foundation of value inthis action. On June 25, 2019, the products and services we are selling and plan to sell from US Stem Cell Training, Vetbiologics, and US Stem Cell clinics. Our strategy is to expand the revenues generated from each of these operating divisions and to reinvest the profits we generate into our U.S. Stem Cell clinical development pipeline.

On January 29th, 2015 we announced an update and diversification of our clinical development pipeline. Our cardiovascular and vascular product candidates have been streamlined, putting our best opportunities at the forefront of our efforts. The MYOCELL™ and MYOCELL™ SDF-1 candidates will, in our opinion, advance forward in the treatment of chronic heart failure (CHF). We are in active prospective partnering discussionfederal court for the MYOCELL™ SDF-1 program. Partnering, we contend, will enhance our capabilities, reduce our development cost through cost sharing and potentially accelerate our time to approval and commercialization. We will continue to apply our ADIPOCELL technology toSouthern District of Florida ruled in favor of the treatment of patients in clinic atgovernment, enjoining the point of care. We believe that updating and diversifying our clinical development programs increases the probability of our success, brings operational and fiscal clarity to our Company and will ultimately enhance shareholder value.the other defendants from certain product sales and processes. The Company filed an appeal on August 23, 2019 and attended oral argument on January 13th, 2021. On June 2nd, 2021, the Eleventh Circuit Court ruled to affirm lower courts’ judgement. The Company did not challenge the district court’s judgment upon any other ground. The Company is not able to predict the duration, scope, results, or consequences of the U.S. Department of Justice actions and final rulings and management is assessing its options on a going forward basis.

We will continue to evaluate and act upon opportunities to increase our top line revenue position and that correspondingly increase cash in-flows. These opportunities include but are not limited to the development and marketing of new products and services, mergers and acquisitions, joint ventures, licensing deals and more.

Further, if the opportunity presents itself whereby the Company can raise additional capital at a reasonable fair market value, the Company will do so. Accordingly, we plan to continue in our efforts to restructure, equitize or eliminate legacy balance sheet issues that are obstacles to market capitalization appreciation and capital fund raising.

US STEM CELL TRAINING

US Stem Cell Training offers a variety of courses for physicians and other health care professionals. These courses include didactic lecture series and hands-on clinical techniques in the field of regenerative medicine. We are currently hosting these courses throughout the United States and in multiple countries. These courses are also available in an online format. Pricing currently ranges from $500-$7,500 depending on the location and modules.

U.S. STEM CELL, INC.

U.S. Stem Cell markets several products to physicians for in clinic regenerative medicine use. These products include equipment (centrifuges, heating block, laminar hood, autoclave) for laboratory use. We are also providing a variety of materials necessary to obtain bone marrow including, trocars, syringes and other supplies.

VETBIOLOGICS

Vetbiologics is focused on providing regenerative medicine therapies to veterinarians for use in both small and large animals. We provide a complete regenerative medicine package which includes training, equipment and supplies necessary for in clinic cell therapy. We sell kits for isolating stem cells from bone marrow and fat. We also provide kits for isolating platelet rich plasma. The kits include all of the disposables and reagents necessary. Vetbiologics is also working on several off the shelf type products including an allogeneic stem cell source.

GENERAL AMERICAN CAPITAL PARTNERS

On March 3, 2017, we entered into an asset sale and lease agreement (sale/leaseback transaction; “Asset Sale and Lease Agreement”), with GACP (General American Capital Partners) Stem Cell Bank LLC, a Florida limited liability company (“GACP) whereby we sold certain lab, medical and other equipment relating to the cell banking business for $400,000 and leased back the sold equipment over a three year term. The lease includes a base monthly rental payment of $20,000, due the first day of each calendar month. In addition, we are required to pay 2.3%, 22.5% and 31.6% of revenues collected on deposits arising from cell banking business for years 1, 2 and 3, respectively. At the expiration of the lease, we returned all leased equipment and along with any maintenance records, logs, etc. in our possession to the lessor with no right of repurchase. Further, as a consequence of the Court Order , the Company resolved to divest itself of certain equipment and other assets (the “Equipment Assets”) used in connection with the Company’s human tissue banking business, but consistent however with the requirements of the Court Order, and to adjust the business plan and operations to accommodate this potential divesture. The divestiture became effective October 10th, 2019.

Royalty Agreement/Middle East

On November 9, 2016, the Company entered into an Intellectual Property License Agreement whereby the Company granted High Rise Group Company the exclusive right to the Company’s intellectual property (as defined) for the licensed use and development in Kuwait and other GCC/Middle East countries for 25 years in exchange for a payment of $75,000 and a 5% royalty generated under the agreement. The royalty payment is recorded as deferred revenue and amortized over the term of the agreement. The carrying balance as of December 31, 2021 and 2020 was $59,500 and $62,500 respectively.

The intent is for U.S. Stem Cell Middle East to offer regenerative treatment options to patients, based on U.S. Stem Cell, Inc. products and technologies like MyoCell™. To date, the first clinic in Kuwait City has been completed but has not begun operations as High Rising Group has not yet been able to secure regulatory approvals to operate. No assurances can be provided as to the ability to secure regulatory approvals to operate or the capacity for any significant revenues arising from such operation once commenced.

U.S. STEM CELL, INC.

U.S. Stem Cell markets several products to physicians for in clinic regenerative medicine use. These products include equipment (centrifuges, heating block, laminar hood, autoclave) necessary to separate and obtain cellular medicine therapies. We are also providing a variety of materials necessary to obtain fat and/or bone marrow including cannulas, trocars, syringes and other supplies. U.S. Stem Cell also supplies laboratory kits for processing adipose and bone marrow tissue to obtain a mixture of cells for use in clinic. These kits include disposables and reagents. U.S. Stem Cell also provides banking services to patients interested in storing their fat or bone marrow and the cells from this tissue. U.S. Stem Cell is a registered FDA tissue bank in good standing.

VETBIOLOGICS

Vetbiologics is focused on providing regenerative medicine therapies to veterinarians for use in both small and large animals. We provide a complete regenerative medicine package which includes training, equipment and supplies necessary for in clinic cell therapy. We sell kits for isolating stem cells from bone marrow and fat. We also provide kits for isolating platelet rich plasma. The kits include all of the disposables and reagents necessary. Vetbiologics is also working on several off the shelf type products including an allogeneic stem cell source.

US STEM CELL CLINIC, LLC, REGENERATIVE WELLNESS CLINIC, LLC and US STEM CELL OF THE VILLAGES, LLC

US Stem Cell Clinic LLC, Regenerative Wellness Clinic LLC and US Stem Cell of the Villages LLC, partly owned investments, are offering in-clinic regenerative medicine treatments to patients suffering from degenerative diseases. Adipose stem cells can be obtained from the patient easily, abundantly, and with minimal patient discomfort. Clinical applications for patients can be performed in an office setting using autologous adipose-derived stem cells. Current applications include orthopedic conditions (tendon/ligament injuries, osteoarthritis, etc.), degenerative conditions (COPD, diabetes), neurological (MS, Parkinson’s, spinal cord injuries, autism, etc.) and auto-immune (RA, Crohn’s, colitis, lupus). Pricing depends on application and ranges from $5,000 to $12,000. We will provide operating assistance as well as management services to US Stem Cell of the Villages LLC, the latter to be compensated at fee of five percent (5%) of the LLC gross revenues.

GENERAL AMERICAN CAPITAL PARTNERS

On March 3, 2017, we entered into an asset sale and lease agreement (sale/leaseback transaction; “Asset Sale and Lease Agreement”), with GACP (General American Capital Partners) Stem Cell Bank LLC, a Florida limited liability company (“GACP) whereby we sold certain lab, medical and other equipment relating to the cell banking business for $400,000 and leased back the sold equipment over a three year term. The lease includes a base monthly rental payment of $20,000, due the first day of each calendar month. In addition, we are required to pay 2.3%, 22.5% and 31.6% of revenues collected on deposits arising from cell banking business for years 1, 2 and 3, respectively. At the expiration of the lease, we are required to return all leased equipment and along with any maintenance records, logs, etc. in our possession to the lessor with no right of repurchase.

American Stem Cell Centers of Excellence are clinics derived from the investment group behind the Asset Purchase and Leaseback Agreement. American Stem Cell Centers of Excellence provide comprehensive stem cell treatments using innovative technologies and the latest research with the intent that after treatment, the body’s own healing potential naturally repairs and regenerates damaged tissue. With a new clinic in Miami, Florida and, as we intend, additional clinics opening soon around the country, management contends that American Stem Cell Centers of Excellence provides comprehensive stem cell treatments using the U.S. Stem Cell Inc. innovative technologies and the latest regenerative medicine research. U.S. Stem Cell’s team of scientists have pioneered these in-clinic regenerative medicine protocols and, in our estimation, have helped thousands of patients through their partly-owned subsidiary U.S. Stem Cell Clinic. American Stem Cell Centers of Excellence would like to replicate this success and have partnered and, with the Board of Directors’ approval and continued oversight that this will not diminish their responsibilities to our company, have retained the professional services of Mike Tomas as CEO to with scientific and successful operational deployment of their clinics. The board of directors contends that the successful deployment of American Stem Cell Centers of Excellence will lead to the financial value and revenue growth of US Stem Cell, Inc. through sales of our products and services at American Stem Cell Center of Excellence clinics.

Royalty Agreement/Middle East

On November 9, 2016, the Company entered into an Intellectual Property License Agreement whereby the Company granted High Rise Group Company the exclusive right to the Company’s intellectual property (as defined) for the licensed use and development in Kuwait and other GCC/Middle East countries for 25 years in exchange for a payment of $75,000 and a 5% royalty generated under the agreement. The royalty payment is recorded as deferred revenue and amortized over the term of the agreement. The carry balance as of December 31, 2018 and 2017 was $68,500 and $71,500, respectively.

The intent is for U.S. Stem Cell Middle East to offer regenerative treatment options to patients, based on U.S. Stem Cell, Inc. products and technologies like MyoCell™. To date, the first clinic in Kuwait City has been completed but has not begun operations as High Rising Group has not yet been able to secure regulatory approvals to operate.

Patents and Proprietary Rights

We own or hold licenses or sublicenses to an intellectual property portfolio consisting of numerous patents and patent applications in the United States, and in foreign countries, for use in the field of heart muscle regeneration. References in this report to “our” patents and patent applications and other similar references include the patents and patent applications that are owned by us, and references to patents and patent applications that are “licensed” to us and other similar references refer to patents, patent applications and other intellectual property that are licensed or sublicensed to us.

Patent life determination depends on the date of filing of the application or the date of patent issuance and other factors as promulgated under the patent laws. Under the U.S. Drug Price Competition and Patent Term Restoration Act of 1984, as amended, a patent which claims a product, use or method of manufacture covering drugs and certain other products, including biologic products, may be extended for up to five years to compensate the patent holder for a portion of the time required for research and FDA review of the product. Only one patent applicable to an approved drug or biologic product is eligible for a patent term extension. This law also establishes a period of time following approval of a drug or biologic product during which the FDA may not accept or approve applications for certain similar or identical drugs or biologic products from other sponsors unless those sponsors provide their own safety and efficacy data.

MyoCell™ is no longer protected by patents, which means that competitors will be free to sell products that incorporate the same or similar technologies that are used in MyoCell™ without infringing our patent rights. As a result, MyoCell, if approved for use, may be vulnerable to competition. In addition, many of the patent and patent applications that have been licensed to us that pertain to our other product candidates do not cover certain countries within Europe.

Our commercial success will depend to a significant degree on our ability to:

● | defend and enforce our patents and/or compel the owners of the patents licensed to us to defend and enforce such patents, to the extent such patents may be applicable to our products and material to their commercialization; |

● | obtain additional patent and other proprietary protection for MyoCell™ and our other product candidates; |

● | obtain and/or maintain appropriate licenses to patents, patent applications or other proprietary rights held by others with respect to our technology, both in the United States and other countries; and |

● | preserve company trade secrets and other intellectual property rights relating to our product candidates; and operate without infringing the patents and proprietary rights of third parties. |

In addition to patented intellectual property, we also rely on our own trade secrets and proprietary know-how to protect our technology and maintain our competitive position, since patent protection may not be available or applicable to our technology. Our policy is to require each of our employees, consultants and advisors to execute a confidentiality and inventions assignment agreement before beginning their employment, consulting or advisory relationship with us. The agreements generally provide that the individual must keep confidential and not disclose to other parties any confidential information developed or learned by the individual during the course of the individual’s relationship with us except in limited circumstances. These agreements generally also provide that we shall own all inventions conceived by the individual in the course of rendering services to us. Moreover, some of our academic institution licensors, collaborators and scientific advisors have rights to publish data and information to which we have rights, which may impair our ability to protect our proprietary information or obtain patent protection in the future.

We work with others in our research and development activities and one of our strategies is to enter into collaborative agreements with third parties to develop our proposed products. Disputes may arise about inventorship and corresponding rights in know-how and inventions resulting from the joint creation or use of intellectual property by us and our licensors, collaborators, consultants and others. In addition, other parties may circumvent any proprietary protection we do have. As a result, we may not be able to maintain our proprietary position.

We are not currently a party to any litigation or other adverse proceeding challenging our patents, patent licenses or intellectual property rights. However, if we become involved in litigation or any other adverse intellectual property proceeding, for example, as a result of an alleged infringement, or a third party alleging an earlier date of invention, we may have to spend significant amounts of money and time and, in the event of an adverse ruling, we could be subject to liability for damages, including treble damages, invalidation of our intellectual property and injunctive relief that could prevent us from using technologies or developing products, any of which could have a significant adverse effect on our business, financial condition and results of operation.

In addition, any claims relating to the infringement of third party proprietary rights, or earlier date of invention, even if not meritorious, could result in costly litigation, lengthy governmental proceedings, divert management’s attention and resources and require us to enter royalty or license agreements which are not advantageous, if available at all.

See Item 1A. “Risk Factors — Risks Related to Our Intellectual Property” for a discussion of additional risks we face with respect to our intellectual property rights.

Primary MyoCath PatentRecent Developments

COVID-19

In December 2019, a novel strain of coronavirus, COVID-19, was reported in Wuhan, China. The Primary MyoCath Patent includes device claimsWorld Health Organization determined that we believe covers,the outbreak constituted a “Public Health Emergency of International Concern” and declared a pandemic. The COVID-19 pandemic is disrupting businesses and affecting production, supply, and sales across a range of industries, as well as causing volatility in the financial markets. The extent of the impact of the COVID-19 pandemic on our customer demand, sales and financial performance will depend on certain developments, including, among other things, the structure of MyoCath. The Primary MyoCath Patent expired in the United States in September 2017.

In January 2000, we entered into a license agreement with Comedicus Incorporated pursuant to which Comedicus granted us a royalty-free, fully paid-up, non-exclusive and irrevocable license to the Primary MyoCath Patent in exchange for a payment of $50,000. This agreement was amended in August 2000 to provide us an exclusive license to the Primary MyoCath Patent in exchange for a payment of $100,000 and our loan of $250,000 to Comedicus. Pursuant to this amendment we also received the right, but not the obligation, with Comedicus’ consent, which consent is not to be unreasonably withheld, to defend the Primary MyoCath Patent against third party infringers.

In June 2003, we entered into agreements with Advanced Cardiovascular Systems, Inc., or ACS, originally a subsidiary of Guidant Corporation and now d/b/a Abbott Vascular, a division of Abbott Laboratories, pursuant to which we assigned our rights under the license agreement with Comedicus, as amended, and committed to deliver 160 units of MyoCath and sold certain of our other catheter related intellectual property, or, collectively, with the Primary MyoCath Patent (the Catheter IP), for aggregate consideration of $900,000. In connection with these agreements, ACS granted to us a co-exclusive, irrevocable, fully paid-up license to the Catheter IP for the life of the patents related to the Catheter IP.

ACS has the exclusive right, at its own expense, to file, prosecute, issue, maintain, license, and defend the Catheter IP, and the primary right to enforce the Catheter IP against third party infringers. If ACS fails to enforce the Catheter IP against a third party infringer within a specified period of time, we have the right to do so at our expense. The party enforcing the Catheter IP is entitled to retain any recoveries resulting from such enforcement. The asset purchase agreement only pertains to the Catheter IP developed or acquired by us prior to June 24, 2003.

Our subsequent catheter related developments and/or acquisitions, such as MyoCath II, were not sold or licensed to ACS.

MyoCell™ SDF-1 Patents

To develop our MyoCell™ SDF-1 product candidate, we rely primarily on patents. We had an agreement to license patents from Juventas. These patents relate to methods of repairing damaged heart tissue by transplanting myoblasts that express SDF-1 and other therapeutic proteins capable of recruiting other stem cells within a patient’s own body to the cell transplant area. We believe we will also need to, among other things, license some additional intellectual property to commercialize MyoCell™ SDF-1 in the form we believe may prove to be the most safe and/or effective.

MyoCath II Patents

In April 2006, we entered into an agreement with Tricardia, LLC pursuant to which Tricardia granted us a sublicenseable license to certain patents and patent applications in the United States, Australia, Canada, Europe and Japan covering the modified injection needle we intend to use as part of MyoCath II, or the MyoCath II Patents, in exchange for a one-time payment of $100,000. Our license covers and is exclusive with respect to products developed under the MyoCath II Patents for the delivery of therapeutic compositions to the heart. Unless earlier terminated by mutual consent of the parties, our agreement with Tricardia will terminate upon the expiration date of the last MyoCath II Patent. Tricardia has the obligation to take all actions necessary to file, prosecute and maintain the MyoCath II Patents. We are required to reimburse Tricardia, on a pro-rata basis with other licensees of Tricardia of the MyoCath II Patents, for all reasonable out-of-pocket costs and expenses incurred by Tricardia in prosecuting and maintaining the MyoCath II Patents. To the extent Tricardia determines not to initiate suit against any infringer, we have the right, but not the obligation, to commence litigation for such alleged infringement with respect to any jurisdiction or, in the alternative, the agreement will be automatically amended to exclude such jurisdiction.

GOVERNMENT REGULATION

The health care industry is one of the most highly regulated industries in the United States and abroad. Various governmental regulatory authorities, as well as private accreditation organizations, oversee and monitor the activities of individuals and businesses engaged in the development, manufacture and delivery of health care products and services. The following is a general description of certain current laws and regulations that are relevant to our business.

HCT/P Regulations

Manufacturing facilities that produce cellular therapies are subject to extensive regulation by the FDA. In particular, FDA regulations set forth requirements pertaining to establishments that manufacture human cells, tissues, and cellular and tissue-based products (“HCT/Ps”). Title 21, Code of Federal Regulations, Part 1271 provides for a unified registration and listing system, donor-eligibility, current Good Tissue Practices (“cGTP”), and other requirements that are intended to prevent the introduction, transmission,duration and spread of communicable diseases by HCT/Ps. More specifically, key elementsthe outbreak of Part 1271 include:

• Registration and listing requirements for establishments that manufacture HCT/Ps;

• Requirements for determining donor eligibility, including donor screening and testing;

• cGTP requirements, which include requirements pertaining to the manufacturer’s quality program, personnel, procedures, manufacturing facilities, environmental controls, equipment, supplies and reagents, recovery, processing and process controls, labeling, storage, record-keeping, tracking, complaint files, receipt, pre-distribution shipment, distribution, and donor eligibility determinations, donor screening, and donor testing;

• Adverse reaction reporting;

• Labeling of HCT/Ps; and

• FDA inspection, retention, recall, destruction, and cessation of manufacturing operations.

U.S. Stem Cell and its affiliated entities currently collects, processes, stores and manufactures HCT/Ps, including the manufacture of cellular therapy products. Therefore, U.S. Stem Cell must comply with cGTP and with the current Good Manufacturing Practices (“cGMP”) requirements that apply to biological products. Cell and tissue based products may also be subject to the same approval standards, including demonstration of safety and efficacy, as other biologic and drug products if they meet certain criteria such as if the cells or tissues are more than minimally manipulated or if they are intended for a non-homologous use.

Management believes that requirements pertaining to premarket approval do not currently apply to U.S. Stem Cell because those entities are not currently investigating, marketing or selling cellular therapy products. If U.S. Stem Cell changes its business operations in the future, the FDA requirements that apply to U.S. Stem Cell may also change.

Pharmaceutical and Biologic Products

Government authorities in the United States, at the federal, state and local level, and in other countries, extensively regulate, among other things, the research, development, testing, manufacture, including any manufacturing changes, packaging, storage, recordkeeping, labeling, advertising promotion, distribution, marketing, import and export of biological products such as MyoCell™. The process of obtaining required regulatory approvalsvirus and the subsequent compliance with appropriate statutes and regulations require the expenditure of substantial time and money, and there is no guarantee that we will successfully complete the steps needed to obtain regulatory approval of MyoCell™ or any future product candidates. In addition, these regulations may change and our product candidates may be subject to new legislation or regulations.

In the United States, pharmaceutical and biologic products, including cellular therapies, are subject to extensive pre- and post-market regulation by the U.S. FDA. The Federal Food, Drug, and Cosmetic Act (“FD&C Act”), and other federal and state statutes and regulations, govern, among other things, the research, development, testing, manufacture, storage, recordkeeping, approval, labeling, promotion and marketing, distribution, post-approval monitoring and reporting, sampling, and import and export of pharmaceutical products. Biological products are approved for marketing under provisions of the Public Health Service Act, or PHS Act. However, because most biological products also meet the definition of “drugs” under the FD&C Act, they are also subject to regulation under FD&C Act provisions. The PHS Act requires the submission of a biologics license application (“BLA”), rather than a New Drug Application (“NDA”), for market authorization. However, the application process and requirements for approval of BLAs are similar to those for NDAs, and biologics are associated with similar approval risks and costs as drugs.

Failure to comply with applicable U.S. requirements may subject a company to a variety of administrative or judicial sanctions, such as FDA refusal to approve pending NDAs or BLAs, untitled or warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties, and criminal prosecution.

Pharmaceutical product development in the U.S. typically involves preclinical laboratory and animal tests, the submission to the FDA of a notice of claimed investigational exemption or an investigational new drug application (“IND”), which must become effective before clinical testing can commence, and adequate and well-controlled clinical trials to establish the safety and effectiveness of the drug or biologic for each indication for which FDA approval is sought. Satisfaction of FDA pre-market approval requirements typically takes many yearsvariants and the actual time required may vary substantially based upon the type, complexity and novelty of the product or disease.

Preclinical tests include laboratory evaluation of product chemistry, formulation and toxicity, as well as animal trials to assess the characteristics and potential safety and efficacy of the product. The conduct of the preclinical tests must comply with federal regulations and requirements including good laboratory practices. The results of preclinical testing are submitted to the FDA as part of an IND along with other information including information about product chemistry, manufacturing and controls and a proposed clinical trial protocol. Long term preclinical tests, such as animal tests of reproductive toxicity and carcinogenicity, may continue after the IND is submitted.

Submission of an IND may not result in FDA authorization to initiate a clinical trial if FDA raises concerns or questions about the design of the clinical trial or the preclinical or manufacturing information supporting it, including concerns that human research subjects will be exposed to unreasonable health risks. A separate submission to an existing IND must also be made for each successive clinical trial conducted during product development.

Clinical trials involve the administration of the investigational new drug to healthy volunteers or patients under the supervision of a qualified investigator. Clinical trials must be conducted in compliance with federal regulations; good clinical practice, or GCP, as set forth in FDA guidance, which is meant to protect the rights and health of patients and to define the roles of clinical trial sponsors, administrators, and monitors; as well as under protocols detailing the objectives of the trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated. Each protocol involving testingimpact on U.S. patients and subsequent protocol amendments must be submitted to the FDA as part of the IND. Sponsors of clinical trials of FDA regulated products, including drugs and biologics, are required to register and disclose certain clinical trial information. Information related to the product, patient population, phase of investigation, study sites and investigators, and other aspects of the clinical trial is then made public as part of the registration. Sponsors are also obligated to disclose the results of their clinical trials after completion. Competitors may use this publicly available information to gain knowledge regarding the progress of development programs.

The FDA may order the temporary or permanent discontinuation of a clinical trial at any time, or impose other sanctions, if it believes that the clinical trial is not being conducted in accordance with FDA requirements, or presents an unacceptable risk to the clinical trial patients ( See Item 3). The study protocol and informed consent information for patients in clinical trials must also be submitted to an institutional review board, or IRB, for approval. An IRB may also require the clinical trial at the site to be halted, either temporarily or permanently, for failure to comply with the IRB’s requirements, or may impose other conditions

Clinical trials to support NDAs or BLAs for marketing approval are typically conducted in four sequential phases, but the phases may overlap.

• Phase 1: Studies are initially conducted in a limited population to test the product candidate for safety, dose tolerance, absorption, metabolism, distribution and excretion in healthy humans or, on occasion, in patients, such as cancer patients when the drug or biologic is too toxic to be ethically given to healthy individuals.

• Phase 2: Studies are generally conducted in a limited patient population to identify possible adverse effects and safety risks, to determine the efficacy of the product for specific targeted indications and to determine dose tolerance and optimal dosage. Multiple Phase 2 clinical trials may be conducted by the sponsor to obtain information prior to beginning larger and more expensive Phase 3 clinical trials.

• Phase 3: These are commonly referred to as pivotal studies. When Phase 2 evaluations demonstrate that a dose range of the product is effective and has an acceptable safety profile, Phase 3 clinical trials are undertaken in large patient populations to further evaluate dosage, to provide substantial evidence of clinical efficacy and to further test for safety in an expanded and diverse patient population at multiple, geographically-dispersed clinical trial sites. In most cases FDA requires two adequate and well controlled Phase 3 clinical trials to demonstrate the efficacy of the drug. A single Phase 3 trial with other confirmatory evidence may be sufficient in rare instances where the study is a large multicenter trial demonstrating internal consistency and a statistically very persuasive finding of a clinically meaningful effect on mortality, irreversible morbidity or prevention of a disease with a potentially serious outcome and confirmation of the result in a second trial would be practically or ethically impossible.

• Phase 4: In some cases, FDA may condition approval of an NDA or BLA for a product candidate on the sponsor’s agreement to conduct additional clinical trials after NDA or BLA approval. In other cases, a sponsor may voluntarily carry out additional trials post approval to gain more information about the drug or biologic. Such post approval trials are typically referred to as Phase 4 studies.

After completion of the required clinical testing, an NDA or BLA is prepared and submitted to the FDA. FDA approval of the NDA or BLA is required before marketing of the product may begin in the U.S. The NDA or BLA must include the results of all preclinical, clinical, and other testing and a compilation of data relating to the product’s pharmacology, chemistry, manufacture, and controls. The cost of preparing and submitting an NDA or BLA is substantial. Under federal law, the submission of most NDAs or BLAs is additionally subject to a substantial application user fee, currently exceeding $2,169,000, and the manufacturer and/or sponsor under an approved new drug application are also subject to annual product and establishment user fees, currently exceeding $104,000 per product and $554,000 per establishment. These fees are typically increased annually.

The FDA has 60 days from its receipt of an NDA or BLA to determine whether the application will be accepted for filing based on the agency’s threshold determination that it is sufficiently complete to permit substantive review. Once the submission is accepted for filing, the FDA begins an in-depth review. The FDA has agreed to certain performance goals in the review of NDAs and BLAs. Most such applications for standard review drug or biologic products are reviewed within ten to twelve months; most applications for priority review drugs or biologics are reviewed in six to eight months. FDA can extend these reviews by three months. Priority review can be applied to drugs or biologics that the FDA determines offer major advances in treatment, or provide a treatment where no adequate therapy exists. For biologics, priority review is further limited only for products intended to treat a serious or life-threatening disease relative to the currently approved products.

The FDA may refer applications for novel drug or biologic products, or drug or biologic products which present difficult questions of safety or efficacy, to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation, and a recommendation as to whether the application should be approved. The FDA is not bound by the recommendation of an advisory committee, but it generally follows such recommendations.

Before approving an NDA or BLA, the FDA will typically inspect one or more clinical sites to assure compliance with GCP. Additionally, the FDA will inspect the facility or the facilities at which the drug is manufactured. The FDA will not approve the product unless compliance with cGMP - a quality system regulating manufacturing - is satisfactory and the NDA or BLA contains data that provide substantial evidence that the drug or biologic is safe and effective in the indication studied.

After the FDA evaluates the NDA and the manufacturing facilities, it issues an approval letter or a complete response letter. A complete response letter generally outlines the deficiencies in the submission and may require substantial additional testing or information in order for the FDA to reconsider the application. If and when those deficiencies have been addressed to the FDA’s satisfaction in a resubmission of the NDA, the FDA will issue an approval letter. The FDA has committed to reviewing such resubmissions in 2 or 6 months depending on the type of information included.

Additional Controls

The PHS Act also provides authority to the FDA to immediately suspend licenses in situations where there exists a danger to public health, to prepare or procure products in the event of shortages and critical public health needs, and to authorize the creation and enforcement of regulations to prevent the introduction or spread of communicable diseases in the U.S. and between states.

Biosimilars

The Patient Protection and Affordable Care Act, or Affordable Care Act, signed into law on March 23, 2010, included a subtitle called the Biologics Price Competition and Innovation Act of 2009, or BPCI Act, which created an abbreviated approval pathway for biological products shown to be highly similar to, or interchangeable with, an FDA-licensed reference biological product. The BPCI Act is susceptible to modification or elimination by the United States Congress and the executive branch of government as part of its current policy of dismantling or indirectly affecting The Patient Protection and Affordable Care Act. We cannot be certain how, or if, any adjustments would impact the Company. This is conceptually similar to the established process for generic drug approval in that it attempts to minimize duplicative testing. Biosimilarity, which requires that there be no differences in conditions of use, route of administration, dosage form, and strength and there be no clinically meaningful differences between the biological product and the reference product in terms of safety, purity, and potency, must be shown through analytical studies, animal studies, and at least one clinical study, absent a waiver by the Secretary. Interchangeability requires that a product must demonstrate that it can be expected to produce the same clinical results as the reference product and, for products administered multiple times, the biologic and the reference biologic may be switched after one has been previously administered without increasing safety risks or risks of diminished efficacy relative to exclusive use of the reference biologic. No biosimilar or interchangeable products have been approved under the BPCIA to date. Complexities associated with the larger and often more complex structures of biological products, as well as the process by which such products are manufactured, pose significant hurdles to implementation that are still being worked out by the FDA.

A reference biologic is granted twelve years of exclusivity from the time of first licensure of the reference product, and no application for a biosimilar can be submitted for four years from the date of licensure of the reference product. The first biologic product submitted under the abbreviated approval pathway that is determined to be interchangeable with the reference product has exclusivity against other biologics submitting under the abbreviated approval pathway for the same condition for the lesser of (i) one year after first commercial marketing of the first interchangeable biosimilar, (ii) eighteen months after the first interchangeable biosimilar is approved if there is no legal challenge, (iii) 18 months after the resolution in the first interchangeable applicant’s favor of a lawsuit challenging the reference biologics’ patents, or (iv) 42 months after the first interchangeable biosimilar’s application has been approved if a lawsuit is ongoing within the 42 month period.

Post-Approval Regulation