Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this formForm 10-K. x¨

Indicate by check markcheckmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”,filer,” “accelerated filer” and “smaller reporting company” in ruleRule 12b-2 of the Exchange Act. (Check One)one):

Large accelerated filer | o | Accelerated Filer filer | o |

| Non-accelerated filer | o | Smaller reporting company | Accelerated Filer oþ

|

Non-accelerated Filer o

(Do not check if a smaller reporting company) | Smaller Reporting Company x

| | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act Rule 12b-2).

Yes: oAct) Yes þ No ¨

| No: x

|

The Company’saggregate market value of the registrant’s common stock asheld by non-affiliates was $149,767 based on the closing sale price of December 31, 2008 was not tradedcommon stock on any stock exchange or any other quotation system.

June 30, 2011. The number of shares of common stock outstanding as of May 6, 2009March 15, 2012 was 15,589,367.

Documents Incorporated by Reference: NONE20,006,402.

TABLE OF CONTENTS

| PART I |

| |

Item 1. | Business | | | 4 | |

Item 1A. | Risk Factors | | | 4 | |

Item 1.1B. | Description of BusinessUnresolved Staff Comments | 5 |

| | | 5 | |

Item 2. | Description of PropertyProperties | 32 |

| | | 5 | |

Item 3. | Legal Proceedings | 33 |

| | | 5 | |

Item 4. | Submission of Matters to a Vote of Security HoldersMine Safety Disclosures | 33 |

| | | 5 | |

| |

| PART II |

| |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | | 6 | |

Item 6. | Selected Financial Data | | |

Item 5. | Market for Common Equity and Related Stockholder Matters | 34 |

| 6 | |

Item 6. | Selected Financial Data | 34 |

| | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 34 |

| | | 6 | |

Item 8.7A. | Financial StatementsQuantitative and Qualitative Disclosures about Market Risk | 38 |

| | | 7 | |

Item 8. | Financial Statements | | | 8 | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 38 | | 9 | |

Item 9A. | Controls and Procedures | | | 9 | |

Item 9B. | Other Information | | | 9 | |

| | | |

Item 9A. | Controls and Procedures | 38 |

| | | |

| PART III |

| |

Item 10. | Directors, Executive Officers and Corporate Governance | | | 10 | |

Item 11. | Executive Compensation | | |

Item 10. | Directors, Executive Officers, Promoters and Control Persons; Compliance with Section 16 (A) of the Exchange Act | 41 |

| 10 | |

Item 11. | Executive Compensation | 44 |

| | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder MatterMatters | 44 | | 11 | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | | | 11 | |

Item 14. | Principal Accounting Fees and Services | | | 11 | |

|

| PART IV |

|

Item 15. | Exhibits and Financial Statement Schedules | | | 12 | |

| | | |

Item 13. | Certain Relationships and Related Transactions | 44 |

| | | |

Item 14.Signatures | Exhibits and Reports on Form 8-K | 45 |

| | | |

Item 15. | Principal Accountant Fees and Services | 45 |

| 13 | |

SIGNATURES | 46 |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934.statements. These statements involve risks and uncertainties, including, among other things, statements regarding our business strategy, future revenues and anticipated costs and expenses. Such forward-looking statements include, among others, those statements including the words “expects,” “anticipates,” “intends,” “believes,” “may,” “will,” “should,” “could,” “plans,” “estimates,” and similar language or negative of such terms. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this report. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we do not know whether we can achieve positive future results, levels of activity, performance, or goals. Actual events or results may differ materially. We undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances taking place after the date of this document.

PART I

Item 1. | Description of Business |

BusinessGreen Planet Bioengineering Co., Ltd. (“Green Planet” or “Company”) now operates as a public reorganized shell corporation with the purpose to acquire or merge with an existing business operation.

Our History

Mondo Acquisition II, Inc. was incorporated in the State of Delaware on October 30, 2006. Since inception, we have been engaged in organizational efforts to obtain initial financing. We were formed as a vehicle to pursue a business combination through2006 and changed the acquisition of, or merger with, an operating business. We filed a registration statement on Form 10-SB with the U.S. Securities and Exchange Commission (the “SEC”) on May 2, 2007, and since its effectiveness, we have focused our efforts to identify a possible business combination. On October 2, 2008, we changed our name to Green Planet Bioengineering Co., Limited (“Green Planet”).

OnLtd. on October 24,2, 2008. In October 2008, (“Closing date”), we executed and consummated a Share Exchange Agreement by and among (i)the Company acquired Elevated Throne Overseas Ltd.,Ltd, a company incorporated in British Virgin Islands, limited liability companyand its subsidiaries (“Elevated Throne”) which isoperated the parent company of FuJian Green Planet Bioengineering Co., Ltd., a wholly foreign-owned enterprise (“WFOE”) organized underbusiness in the laws ofagritech sector in the People’s Republic of China (“PRC”); (ii) the stockholders of 100% ofChina. The Company divested Elevated Throne Overseas Ltd.’s common stock (the “Elevated Throne Overseas Ltd., Shareholders”); and (iii) our then-controlling stockholder, Cris Neely (who owned 93.5%). Prior to the Share Exchange Agreement, Mr. Min Zhao and Ms. Min Yan Zheng were the controlling persons of Elevated Throne Overseas Ltd. (100%One Bio, Corp. (“ONE”). At closing, we acquired control of Elevated Throne Overseas Ltd., by issuing to the Elevated Throne Overseas Ltd.’s Shareholders (Mr. Zhao and Ms. Zheng) 14,141,667 shares of our Common Stock in exchange for all of the outstanding capital stock of Elevated Throne Overseas Ltd. (the “Transaction”). Immediately after the Closing date of this transaction, we had a total of 15,141,667 shares of common stock outstanding, with the Elevated Throne Overseas Ltd.’s Shareholders owning approximately 93.40% of our outstanding common stock, and the balance held by those who held the common stock prior to the Closing Date. Upon closing of the Transaction, Mr. Min Zhao and Ms. Min Yan Zheng became our controlling shareholders and we no longer were a “blank check” company.

Elevated Throne Overseas Ltd. owns 100% of FuJian Green Planet Bioengineering Co., Ltd., which is a WFOE under the laws of the PRC. WFOE has entered into a series of contractual arrangements with Sanming Huajian Bio-Engineering Co., Ltd., a limited liability company headquartered in, and organized under the laws of, the PRC.

on April 14, 2010. As a result of the Reverse Merger Transaction, we acquired 100% of the capital stock ofdivestment, Elevated Throne Overseas Ltd. and consequently, controlbecame a 100% owned direct subsidiary of the business and operations of Elevated Throne Overseas Ltd., FuJianONE while Green Planet Bioengineering Co., Ltd., and Sanming Huajian Bio-Engineering Co., Ltd. Prior tostill remained as a subsidiary.

Subsequently in March 2012, the Reverse Merger Transaction, we were a public reporting “blank check” companyCompany in its 8-K filing announced that ONE has sold its entire stockholding in the development stage. From and afterCompany to Global Fund Holdings Corp. an Ontario, Canada corporation which will effectively become the Closing Date of the Share Exchange Agreement, we are no longer a “blank check” company and our primary operations consist of the business and operations of Sanming Huajian Bio-Engineering Co., Ltd., which are conducted in China.

Contractual Agreements with Sanming Huajian Bio-Engineering Co., Ltd.new majority stockholder.

Prior to the reverse merger, our business was conducted through Sanming Huajian Bio-Engineering Co., Ltd., its largest shareholders being Mr. Min Zhao and Mr. Min Yan Zheng with a 35.07% and 35.97% interest respectively. Sanming Huajian Bio-Engineering Co., Ltd. (“Sanming Huajian”) has the licenses and approvals necessary to operate its business in the PRC.ITEM 1A. RISK FACTORS

PRC law places certain restrictions on roundtrip investments through the acquisition of a PRC entity by PRC residents. To comply with these restrictions, in conjunction with the reverse acquisition, we (via our wholly-owned subsidiary, FuJian Green Planet Bioengineering Co., Ltd.) entered into and consummated certain contractual arrangements with Sanming Huajian Bio-Engineering Co., Ltd. and their respective stockholders pursuant to which we provide these companies with technology consulting and management services. Through these contractual arrangements, we have the ability to substantially influence these companies’ daily operations and financial affairs, appoint their senior executives and approve all matters requiring stockholder approval. As a result of these contractual arrangements, which enable us to control Sanming Huajian and operate our business in the PRC through Sanming Huajian we are considered the primary beneficiary of Sanming Huajian . Accordingly, we consolidate the results, assets and liabilities of the Sanming Huajian in our financial statements.

We entered into the following contractual arrangements, each of which are enforceable and valid in accordance with the laws of the PRC:

Entrusted Management Agreement. Pursuant to this entrusted management agreement among Fujian Green Planet Bioengineering Co., Ltd., Sanming Huajian, and the Sanming Huajian Shareholders (the "Entrusted Management Agreement"), Sanming Huajian and its shareholders agreed to entrust the business operations of Sanming Huajian and its management to Fujian Green Planet Bioengineering Co., Ltd. until Fujian Green Planet Bioengineering Co., Ltd. acquires all of the assets or equity of Sanming Huajian (as more fully described in the Exclusive Option Agreement below). Prior to the occurrence of such event, Sanming Huajian will only own those certain assets that are not sold to Fujian Green Planet Bioengineering Co., Ltd. We anticipate that Sanming Huajian will continue to be the contracting party under its customer contracts, banks loans and certain other assets until such time as those may be transferred to Fujian Green Planet Bioengineering Co., Ltd. Under the Entrusted Management Agreement, Fujian Green Planet Bioengineering Co., Ltd. will manage Sanming Huajian‘s operations and assets, and control all of Sanming Huajian’s cash flow through an entrusted bank account. In turn, it will be entitled to any of Sanming Huajian’s net profits as a management fee, and will be obligated to pay all Sanming Huajian payables and loan payments. The Entrusted Management Agreement will remain in effect until the acquisition of all assets or equity of Sanming Huajian by Fujian Green Planet Bioengineering Co., Ltd. is completed.

Shareholders’ Voting Proxy Agreement. Under the shareholders' voting proxy agreement among Fujian Green Planet Bioengineering Co., Ltd. and the Sanming Huajian Shareholders, the Sanming Huajian Shareholders irrevocably and exclusively appointed the members of the board of directors of Fujian Green Planet Bioengineering Co., Ltd. as their proxy to vote on all matters that require Sanming Huajian shareholder approval. The members of the board of directors of Fujian Green Planet Bioengineering Co., Ltd. are identical to those of the Company.Exclusive Purchase Option Agreement. Under the exclusive option agreement among Fujian Green Planet Bioengineering Co., Ltd. and the Sanming Huajian Shareholders, the Sanming Huajian Shareholders granted Fujian Green Planet Bioengineering Co., Ltd. an irrevocable and exclusive purchase option to acquire Sanming Huajian’s equity and/or remaining assets, but only to the extent that such purchase does not violate limitations imposed by PRC law. Current PRC law does not specifically provide for a non-PRC entity's equity to be used as consideration for the purchase of a PRC entity's assets or equity. The option is exercisable when PRC law specifically allows foreign equity to be used as consideration to acquire a PRC entity's equity interests and/or assets, and when the Company has sufficient funds to purchase Sanming Huajian’s equity or remaining assets. The consideration for the exercise of the option is the shares of Common Stock received by the Sanming Huajian’s Shareholders under the Share Exchange Agreement.

Share Pledge Agreement. Under this share pledge agreement among Fujian Green Planet Bioengineering Co., Ltd. and the Sanming Huajian Shareholders (the "Share Pledge Agreement"), the Sanming Huajian Shareholders pledged all of their equity interests in Sanming Huajian, including the proceeds thereof, to guarantee all of Fujian Green Planet Bioengineering Co., Ltd.’s rights and benefits under the Restructuring Agreements. Prior to termination of this Share Pledge Agreement, the pledged equity interests cannot be transferred without Fujian Green Planet Bioengineering Co., Ltd.’s prior consent.

Completion of the PRC Restructuring

The PRC restructuring transaction closed on the Closing Date. However, Fujian Green Planet Bioengineering Co., Ltd. is required under the agreements to complete additional post-closing steps required in order to maintain its good standing under PRC law. These steps include Fujian Green Planet Bioengineering Co., Ltd. making required regulatory filings and giving proof to regulatory authorities that it has received the required portion of its registered capital as of the deadline required under PRC law. Specifically, Fujian Green Planet Bioengineering Co., Ltd. must receive 15% of its total registered capital of $2.0MM (“License Payment”) by 3 months of effectiveness of business license, and the remaining $1.7MM by two years from effectiveness of business license, in order to maintain the validity of its business license and its certificate of approval to exist as a wholly foreign-owned entity in the PRC issued by the Fujian Provincial Municipal Government and the Sanming Administration for Industry and Commerce, respectively. This license and approval would become invalid and be immediately cancelled if Fujian Green Planet Bioengineering Co., Ltd. was to fail to make timely payment of the first installment of its registered capital, in which case we could cease to have any claim to control Sanming Huajian Bio-Engineering Co., Ltd. under PRC law. To date no License Payment has been made and the Company has been working with the regulatory authorities in order to extend the payment timeline and satisfy the requirements.

Upon consummation of the PRC Restructuring Agreements above, the contributions of Sanming Huajian Bio-Engineering Co., Ltd.’s registered capital, and therefore the ownership of Sanming Huajian Bio-Engineering Co., Ltd., took their current form, which is represented in the table below:

| | Amount of Contribution (RMB) ‘000 | | | Percent of Capital Contribution | |

| Min Zhao | | | 13,328.15 | | | | 35.07 | % |

| Min Yan Zhen | | | 13,668.65 | | | | 35.97 | % |

| Jiangle Jianlong Mineral industry Co. | | | 11,003.20 | | | | 28.96 | % |

| Total | | RMB 38,000.00 | | | | 100 | % |

Subsidiaries

As a result of the Reverse Merger Transaction, Elevated Throne Overseas Ltd. and FuJian Green Planet Bioengineering Co., Ltd. are our wholly-owned subsidiaries. Sanming Huajian Bio-Engineering Co., Ltd., the entity through which we operate our business, has no subsidiaries.

Sanming Huajian Bio-Engineering Co., Ltd.’s Organization History

Sanming Huajian Bio-Engineering Co., Ltd. was originally incorporated in April 2004 in the People’s Republic of China as Sanming Zhongjian Biological Technology Industry Co., Ltd. Its original registered capital was RMB 6 million and its original shareholders were Ou Shanyan (80%), Zhao Yime (10%) and Zheng Yingyue (10%). The company’s original business scope included planning to produce and sell environmentally conscious food, health products, chemical products, and biological products.

On August 17, 2004, the company changed its name from Sanming Zhongjian Biological Technology Industry Co., Ltd. to Sanming Huajian Bio-Engineering Co., Ltd. and its shareholders changed from Ou Shanyan, Zhao Yime, and Zheng Yingyue to Min Zhao and Zheng Jianrong with Min Zhao holding a 60% equity interest and Zheng Jianrong holding a 40% equity interest.

On May 22, 2006, the company changed its operation plan to focus on natural plant extractions, the production of bio-fertilizer and the sale of chemical and agricultural products and by-products as well as the development of biological engineering technology.

On July 8, 2006, the company’s registered capital increased to RMB 33,500,000 and its shareholders changed from Min Zhao and Zheng Jianrong to Min Zhao, with a 35.07% equity interest, Min Yan Zheng with a 35.97% interest and Jiangle Jianlong Mineral Industry Co., Ltd., with a 28.96% equity interest.

On April 15, 2008, the company’s registered capital increased to RMB 38,000,000.

Sanming Huajian Bio-Engineering Co., Ltd’s Business

Sanming Huajian Bio-Engineering Co., Ltd is a research and development company with a focus on improving human health through the development, manufacture and commercialization of bio-ecological products and over-the-counter products utilizing the extractions of tobacco leaves.

Growth

In order to capitalize on Green Planet’s current success and on the overall growth in the bio-health industry, the firm has designed an aggressive three-year expansion plan. This expansion is set for deployment throughout Asia and launch into the US; and it will be implemented through a 3-phase strategy:

Phase I

| ● | Filing for GMP certificate and building GMP manufacturing facility to produce the company’s entire product line |

| ● | Apply for ISO certification |

| ● | Begin the production and sales of “Paiqianshu” |

| ● | Apply for retail certifications on liquid and pill forms of CoQ10 (over-the-counter) supplements |

| ● | Trademark the “Green Planet” brand supplements |

Phase II

| ● | Obtain distributors for over-the-counter Q10 supplements in China |

| ● | Initiate & execute sales and marketing plan across domestic markets |

| ● | Obtain distributors throughout Asia for retail Q10 supplements |

| ● | Initiate & execute sales and marketing plan across Asia |

Phase III

| ● | Leverage product portfolio to increase sales of raw Q10 materials worldwide by continuous R&D |

| ● | Obtain established distributors for raw Q10 & retail Q10 supplements in the US |

| ● | Launch retail sales and marketing plan in the US |

| ● | Launch downstream retail Q10 products as they are developed and certified |

Phase I

China will continue to be the company’s primary market due to the demand/supply imbalance. The company will continue to increase its number of distributors and penetrate new territories, increasing revenue growth and profitability.

Phase I has been in action throughout 2008 with most of it accomplished. Filing for the GMP certificate has been completed, and the company is in the midst of building the GMP facility and its in-house manufacturing line. Application for an ISO certificate was approved in April 2008, and the company is in the process of obtaining the retail certifications on its private brand Q10 supplements called “Green Planet.” The company filed brand name certificates during 2008. In addition, the company started its trademark work on the “Green Planet” brand during 2008.

GMP Facility and Certification

‘GMP’ is an English acronym for ‘Good Manufacturing Practice’ which is a Chinese designation meaning to have a good operational norm with good manufacturing standards. It describes an autonomic management system that emphasizes production quality and health safety in the manufacturing process. It also specifies a set of mandatory standards that are applicable to any pharmaceutical or food industries in China. China requires such enterprises to achieve high health standards from all aspects including raw materials, personnel, facilities and equipment, production process, packaging, transport, and quality control in accordance with the relevant state laws and regulations to form a set of operating standards to help enterprises improve their corporate environmental hygiene and to detect existing problems in production process, and thereby improving them.

GMP certification has been successfully obtained. Green Planet has met all the criteria and conditions for the certification.

Facility Costs and Benefits

The GMP facility will require $8M USD to build along with $10M USD for manufacturing equipment. A portion of this investment has been allocated for the GMP certification process. Once the facility is in its final stage, the company will initiate its advertising campaign for “Paiqianshu” and start taking orders from established distributors. Production will commence once the facility is complete and manufacturing assembly line is ready. The company intends to add 50 plant workers, four sales associates and one new sales director to launch and market this product. The company plans on manufacturing 5 million boxes of “Paiqianshu” each year with 90% sold into China alone. The GMP facility is expected to complete its 1st phase in April of 2009 and it will go into production in early 3rd quarter of 2009.

The company has already identified its desired prime territories in China for “Paiqianshu”; and is currently adding new distributors. During 2007 Green Planet expanded its presence in China, distributing to more than 5 provinces and a number of tier-2 cities. Expansion into the new territories will begin in early 2009.

Phase II

Green Planet is expected to continue the deployment of its 2nd Phase strategy in the second half of 2009. Such deployment will include the design and execution of the company’s advertising and promotion campaigns; the creation and launch of its brands; the hiring and training of the sales team. The company has identified the targeted regions and territories across Asia and domestic China to launch its products, including Korea, Japan, Singapore, and Taiwan. The company’s goal is to add over 2000 retail outlets by the end of 2009.

Q10 health supplements

The firm intends to offer its Q10 health supplements through two separate brandings:

| 1. | Green Planet Bio’s house brand “Green Planet” |

| 2. | private labeling of mass merchandisers’ house brands |

“Green Planet” branded Q10 products are intended to be sold in mass retailers (not necessarily pharmacies) that do not carry and/or do not intend to carry their private house brands like Lianhua Supermarket, Hualian Group, Wangfujing Department Stores, and Dashang Group.

In addition to its Green Planet brand channel, management believes a significant opportunity lies within mass pharmacy chains that utilize private label supplements such as A.S. Watson (known as Watsons), SuperPharm; Sugi Pharmacy, and Shanghai No. 1 Pharmacy. Green Planet will initiate a private label program catered to the needs of these mass merchants.

Note: Watsons is the largest health and beauty retail chain in Asia operating over 1,550 stores and 1,000 pharmacies in 13 markets across the world.

Capital requirements for our expansion into to the Asia market are expected to reach $5M USD. These funds shall cover the firm’s working capital requirements to carry out a) our aggressive marketing strategy and b) our R&D requirements. As a result of our successful penetration into the Asia market, we expect to position Green Planet as an important player in the Asia health industry.

The deployment will commence in the second quarter of 2009 and by the end of 2010 we anticipate our Q10 health supplements to be in over 2000 outlets across Asia.

Phase III

Green Planet will continue its growth strategy launching the third and most influential phase. The company intends to launch its products and technology in North America with a focus on the US market. In addition the company will leverage its product portfolio to increase raw Q10 sales by continuous R&D of its downstream products. Management has planned for two main channels to distribute and market it’s products.

Internet Wholesalers

In this category are mainly retail web portals offering a “one-stop shopping” concept.

Some key players are:

| ● | www.ebay.com |

| | |

| ● | www.amazon.com |

| | |

| ● | www.bizrate.com |

| | |

| ● | www.swansonvitamin.com |

| | |

| ● | www.vitacost.com |

| | |

| ● | www.supplementwarehouse.com |

Retailers and Merchandisers

Green Planet intends to distribute its retail products (again, using the two branding methods described earlier – house and private brands) through pharmacy chains such as Walgreen and CVS in the US, Shoppers Drug Mart/Pharmaprix and London Drugs in Canada and other mass merchandisers such as Wal-Mart, Targets, and K-Mart. This will provide an international footprint, limit direct competition and capitalize on the flow of customers to these mass merchandisers.

Deployment will commence in the beginning of 2010 and by the end of 2010 management anticipates its Q10 health supplements to be in over 1000 outlets across North America.

Principal Products

Since 2007, Sanming Huajian has developed a variety of natural organic products using tobacco leaves. These products are:

Solanesol

Solanesol is extracted from abandoned tobacco leaves and is a pharmaceutical intermediate. Not only can it produce raw Q10 and Vitamin K2 through the synthesis method, but it can also be used as a synthesized raw material in anti-allergic drugs, anti-ulcer drugs, hypolipidemic drugs and anti-cancer drugs.

Nicotine Sulphate

Nicotine sulphate is extracted from abandoned tobacco leaves and it is an important raw material for pesticide and can be used in the processing of insecticides. The nicotine content in pesticides is 40%.

Organic Fertilizers

“Ji Mai” trademark fertilizer is made by using abandoned tobacco leaves as the main raw material, adding the appropriate accessories and fermented with microbial, which is applicable to all kinds of fruit trees, and is also used as a soil conditioner.

Botanical Pesticides

Pesticides consist of 40% Nicotine Sulphate and other insecticide raw materials are regarded as organic or botanical because Nicotine Sulphate is derived from abandoned tobacco leaves.

Organic Green Barley Supplements (Paiqianshu)

“Paiqianshu” mung bean vitamin oral liquid has the ability to eliminate lead from the human body without any side effects. It contains many nutrient elements such as Calcium gluconate, zinc gluconate, and vitamin C. This nutrient is extracted from green barley or ‘mung bean’.

Raw CoQ10

Coenzyme Q10 is also commonly referred to as ubiquinone, ubidecarenone, and coenzyme Q. It is a vitamin-like substance that is naturally present in most human cells except red blood cells and eye lens cells and is responsible for the production of the body’s own energy. In each human cell, food energy is converted into energy in the mitochondria with the aid of Coenzyme Q10.

Because dysfunctional energy metabolism has been cited as a contributing factor for a number of medical conditions, Coenzyme Q10 has been used in the treatment of cardiac, neurologic, oncologic, and immunologic disorders. Although the Dietary Supplement Health and Education Act of 1994 does not allow claims for treatment of specific diseases in the United States, Coenzyme Q10 has been cleared for treatment indications in other countries, such as for congestive heart failure (CHF) in Japan since 1974.1

Natural Q10 Supplements

Because of its ability to transfer electrons and therefore act as an antioxidant, Coenzyme Q10 is also used as a dietary supplement. Supplement of Coenzyme Q10 is a treatment for some of the rare and serious mitochondrial disorders and other metabolic disorders where patients are not capable of producing enough Coenzyme Q10 because of their disorder. Supplement of Coenzyme Q10 has been found to have a beneficial effect on migraine headache symptoms.2 Recent studies have also found Coenzyme Q10 to have beneficial effects on brain health and neurodegenerative diseases in animal models.

Q10 supplements is one of many downstream products that is produced from raw Q10 (which initially derives from extracts of abandoned tobacco leaves- Solanesol).

Distribution

We have established contracted distributors that are focused in the bio-health industry and raw chemical intermediates industry. In addition, we have established distribution channels through government referrals within local government in some provinces such as universities and hospital research centers.

Market Analysis

Our product, Q10 has two distinct market segments: Raw Q10 and Retail Q10 products. The following chart outlines the global estimated demand of raw Q10 by 2010 in tonnage:

Country | Demand (in tons) |

US | 200-220 |

JAPAN | 160-180 |

ASIA (EXCLUDING JAPAN) | 100-150 |

EUROPE | 80-100 |

OTHER COUNTRIES | 60 |

TOTAL | Average approx. 655 |

1 Tran MT, Mitchell TM, Kennedy DT, Giles JT. Role of coenzyme Q10 in chronic heart failure, angina, and hypertension. Pharmacotherapy 2001-21:797-806.

2Rozen T, Oshinsky M, Gebeline C, Bradley K, Young W, Shechter A, Silberstein S (2002). "Open label trial of coenzyme Q10 as a migraine preventive". Cephalalgia 22 (2): 137–41

Raw Q10 is supplied to companies or institutions that 1) use it for research and development purposes or 2) use it to produce its downstream retail products. Today, we produce and market raw Q10 and we are in the process of patenting our over-the-counter retail brand of Q10 supplement in both liquid and tablet form which we’ve fully developed in 2007. Our nutrient and supplement brand called “Green Planet” is now going through the trademark application process. Our current raw Q10 production capacity is 20 tons per year and with our growth plan realized we will be able to produce and supply a big part of China’s demand.

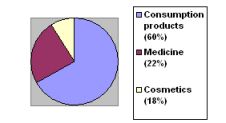

Retail Q10 products can be further classified into 3 sub-categories: Consumption products, medicine, and cosmetics. The market share of each is displayed by the following pie chart:

Note: consumption products include nutrients, vitamins and supplements

Management Team

The company’s management is well experienced in the bioengineering industry and provides the company with the strategic leadership required to maintain the company at the forefront of its industry competitors. The team is led by Mr. Min Zhao the company CEO, Shanyan Ou the VP of Sales & Marketing, and Dr. Jian Ming Chan our Chief Scientist. The team is fully committed to drive Green Planet on a successful track. Stock options programs are currently in place for senior managers. Green Planet Bio’ has employment contracts with all senior managers.

Sales and Marketing

Sales

We mainly base our business on the wholesale sales of bio-ecological products. Our distribution process is established through contracted distributors and sales agreements. The company is continuously evaluating its sales and distribution strategy and assesses the performance of its business partners and execution of its business plan.

Marketing

For raw chemical material products such as Solanesol, CoenzymeQ10 or Nicotine Sulphate, we utilize the following strategies:

● | First, we have established a strong referral programs with major universities where most distributors look for new products and new technologies today. |

| |

● | Second, we have used the following channels to get the name and brands out to potential distributors: |

| |

| - | Web advertising |

| | |

| - | Internal web optimization through Search engines and Sponsored links |

| | |

| - | Trade shows |

| | |

| - | Exhibitions |

| | |

| - | Conferences |

| | |

● | Third, we network through the local government in some provinces to introduce and refer us to established distributors. |

Intellectual Property

The following table is a list of our current Patents issued by the People’s Republic of China:

Patent Name | Application No. | Designer | Application date | Valid until | Owner of patent |

| Synchronization and high efficiency process of Solanesol and Nicotine Sulphate | 200610069846.6 | Min Zhao, Chen Yanmei, Liu Caiqing | 2006.8.11 | 2026.8.11 | Sanming Huajian Bioengineering Co., Ltd. |

| A Method of Eliminating Plum bum Products with Basic liquid of zymogene mung bean | 200710009735.0 | Lin Xuanxian, Chen Jianmin, Chen Yanmei | 2007.11.01 | 2027.11.01 | Sanming Huajian Bioengineering Co., Ltd. |

Note- The patent of “Solanesol-clean extraction method” is exclusively owned by Fudan University. However, we have obtained the right to use this technology patent until July 27, 2010, according to the statements of Article 3, Section 1 in “Technology Development Contract ”which was entered into on July 28, 2005 between Fudan University and Sanming Huajian. Since August 11, 2006, we have been designing the “synchronization and high efficiency process of Solanesol and Nicotine Sulphate” and applied for the patent ownership and have used it in the production process.

Trademarks

The following table is a list of our current trademarks issued by the People’s Republic of China:

Trademark | | Certificate

No.

| | Category | | Registrant | | Valid Term |

Paiqianshu | | 4322405 | | No.30 Refined food from plants, etc.

| | Sanming Huajian | | From 2007-4-20 to 2017-4-20 |

Jimai QQ | | 4322404 (Application No. here. It will be the Certificate No. later.)

| | No.30 Refined food from plants, etc. | | Sanming Huajian | | 10 years since the date of certificate issuing |

Jimai | | 5425649 (Application No. here. It will be the Certificate No. later.)

| | No.1 Fertilizer, chemical products, etc. | | Sanming Huajian | | 10 years since the date of certificate issuing |

Jinliang | | 4538612 (Application No. here. It will be the Certificate No. later.)

| | No.3 Cosmetic, household and personal care chemicals, etc. | | Sanming Huajian | | 10 years since the date of certificate issuing |

PURESOLAN | | 6869795 (Application No. here. It will be the Certificate No. later.)

| | No.5 Medical products, etc | | FuJian Green Planet | | 10 years since the date of certificate issuing |

GREENPLANET | | 6871472 (Application No. here. It will be the Certificate No. later.)

| | No.5 Medical products, etc | | Fujian Green Planet | | 10 years since the date of certificate issuing |

Green Planet pays a license fee of RMB500 per year for each trademark for the period of ownership from October 22, 2004 to October 22, 2014.

Need For Government Approval

None

Employees

Sanming Huajian currently has approximately 153 full-time employees broken down into:

Management (16)

Research and Development (30)

Supporting staff (7)

Manufacturing staff (100)

Employee benefits include:

The company provides benefits according to the laws of PRC when applicable. Benefits packages are not recognized in the PRC as in the United States.

Financing Activities

In October, 2008 Prestige Ventures, Corp. (“Prestige”) subscribed to 140,000 common shares of Green Planet for a price of $1/share for a total value of $140,000. The Green Planet common shares issued pursuant to this transaction are restricted securities. Subscription agreement provides Prestige with piggy-back registration rights upon the filing by Green Planet of a registration statement on form S1 or other similar registrations.

You should consider carefully each of the following business and investment risk factors and all of the other information in this report. If any of the following risks and uncertainties develops into actual events, the business, financial condition or results of our operations could be materially and adversely affected. If that happens, the trading price of our shares of common stock could decline significantly. The risk factors below contain forward-looking statements regarding our business. Actual results could differ materially from those set forth in the forward-looking statements. See "Special Note Regarding Forward-Looking Information."

Risks related to doing business in the People’s Republic of China

Our business operations take place primarily in the People’s Republic of China. Because Chinese laws, regulations and policies are continually changing, our Chinese operations will face several risks summarized below.

Our ability to operate in the People’s Republic of China may be harmed by changes in its laws and regulations.

Our offices and manufacturing plants are located in the People’s Republic of China and the production, sale and distribution of our products are subject to Chinese rules and regulations. Currently, China does not have rules and regulations on raw material products. However, health foods and the Q10 raw material sales must obtain government written instructions to a subordinate, therefore, we are obtaining GMP authentication as described herein.

The People’s Republic of China only recently has permitted provincial and local economic autonomy and private economic activities. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership.

Our ability to operate in the People’s Republic of China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters.

Also, we are a state-licensed corporation and production and manufacturing facility and are subject to Chinese regulation and environmental laws. The Chinese government has been active in regulating our industry. Our business and products are subject to government regulations mandating the use of good manufacturing practices. Changes in such laws or regulations in the People’s Republic of China that govern or apply to our operations could have a materially adverse effect on our business. For example, the law could change so as to inhibit our purchases from suppliers of tobacco leaves because of trade tariffs. Our manufacturing costs may be increased and consequently affect our profit margins and revenue.

If we were to lose our state-licensed status, we would no longer be able to manufacture our products in the People’s Republic of China, which is our sole operation.

There is no assurance that the People’s Republic of China’s economic reforms will not adversely affect our operations in the future.

Although the Chinese government owns the majority of productive assets in the People’s Republic of China, in the past several years the government has implemented economic reform measures that emphasize decentralization and encourage private economic activity.

Because these economic reform measures may be inconsistent or ineffectual, there are no assurances that:

| ● | We will be able to capitalize on economic reforms; |

| ● | The Chinese government will continue its pursuit of economic reform policies; |

| ● | The economic policies, even if pursued, will be successful; |

| ● | Economic policies will not be significantly altered from time to time; and |

| ● | Business operations in the PRC will not become subject to the risk of nationalization. |

Since 1979, the Chinese government has reformed its economic systems. Because many reforms are unprecedented or experimental, they are expected to be refined and improved. Other political, economic and social factors, such as political changes, changes in the rates of economic growth, unemployment or inflation, or in the disparities in per capita wealth between regions within the People’s Republic of China, could lead to further readjustment of the reform measures. This refining and readjustment process may negatively affect our operations.

Over the last few years, the People’s Republic of China's economy has registered a high growth rate. During the past ten years, the rate of inflation in the People’s Republic of China has been as high as 20.7% and as low as -2.2%. Recently, there have been indications that rates of inflation have increased. In response, the Chinese government recently has taken measures to curb this excessively expansive economy. These corrective measures were designed to restrict the availability of credit or regulate growth and contain inflation. These measures have included devaluations of the Chinese currency, the Renminbi (RMB), restrictions on the availability of domestic credit, reducing the purchasing capability of certain of its customers, and limited re-centralization of the approval process for purchases of some foreign products. These austerity measures alone may not succeed in slowing down the economy's excessive expansion or control inflation, and may result in severe dislocations in the Chinese economy. The Chinese government may adopt additional measures to further combat inflation, including the establishment of freezes or restraints on certain projects or markets.

While inflation has been more moderate since 1995, high inflation may in the future cause Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in the People’s Republic of China, and thereby harm the market for our products. Future inflation in the PRC may inhibit our activity to conduct business in the People’s Republic of China.

To date, reforms to the People’s Republic of China's economic system have not adversely impacted our operations and are not expected to adversely impact operations in the foreseeable future; however, there can be no assurance that the reforms to the People’s Republic of China's economic system will continue or that we will not be adversely affected by changes in the People’s Republic of China's political, economic, and social conditions and by changes in policies of the Chinese government, such as changes in laws and regulations, measures which may be introduced to control inflation, changes in the rate or method of taxation, imposition of additional restrictions on currency conversion and remittance abroad, and reduction in tariff protection and other import restrictions.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in the People’s Republic of China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties or businesses.

For example, changes in policy could result in imposition of restrictions on currency conversion, imports or the source of suppliers, as well as new laws affecting joint ventures and foreign-owned enterprises doing business in the People’s Republic of China. Although the People’s Republic of China has been pursuing economic reforms for the past two decades, events such as a change in leadership or social disruptions that may occur upon the proposed privatization of certain state-owned industries could significantly affect the government's ability to continue with its reform.

We face economic risks in doing business in the People’s Republic of China. As a developing nation, the People’s Republic of China's economy is more volatile than that of developed Western industrial economies. It differs significantly from that of the U.S. or a Western European Country in such respects as structure, level of development, capital reinvestment, resource allocation and self-sufficiency. Only in recent years has the Chinese economy moved from what had been a command economy through the 1970s to one that during the 1990s encouraged substantial private economic activity. In 1993, the Constitution of the People’s Republic of China was amended to reinforce such economic reforms. The trends of the 1990s indicate that future policies of the Chinese government will emphasize greater utilization of market forces. The People’s Republic of China government has confirmed that economic development will follow the model of a market economy. For example, in 1999 the Government announced plans to amend the Chinese Constitution to recognize private property, although private business will officially remain subordinated to the state-owned companies, which are the mainstay of the Chinese economy. However, there can be no assurance that, under some circumstances, the government's pursuit of economic reforms will not be restrained or curtailed. Actions by the central government of the People’s Republic of China could have a significant adverse effect on economic conditions in the country as a whole and on the economic prospects for our Chinese operations. Economic reforms could either benefit or damage our operations and profitability. Some of the things that could have this effect are: i) level of government involvement in the economy; ii) control of foreign exchange; methods of allocating resources; iii) international trade restrictions; and iv) international conflict.

Under the present direction, we believe that the People’s Republic of China will continue to strengthen its economic and trading relationships with foreign countries and business development in the People’s Republic of China will follow market forces. While we believe that this trend will continue, there can be no assurance that this will be the case. A change in policies by the People’s Republic of China government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the Chinese government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the People’s Republic of China's political, economic and social life.

The People’s Republic of China legal and judicial system may not adequately protect foreign investors and enforce their rights.

The Chinese legal and judicial system may negatively impact foreign investors. In 1982, the National People's Congress amended the Constitution of China to authorize foreign investment and guarantee the "lawful rights and interests" of foreign investors in the People’s Republic of China. However, the People’s Republic of China's system of laws is not yet comprehensive. The legal and judicial systems in the People’s Republic of China are still rudimentary, and enforcement of existing laws is inconsistent. Many judges in the People’s Republic of China lack the depth of legal training and experience that would be expected of a judge in a more developed country. Because the Chinese judiciary is relatively inexperienced in enforcing the laws that do exist, anticipation of judicial decision-making is more uncertain than would be expected in a more developed country. It may be impossible to obtain swift and equitable enforcement of laws that do exist, or to obtain enforcement of the judgment of one court by a court of another jurisdiction. The People’s Republic of China's legal system is based on written statutes; a decision by one judge does not set a legal precedent that is required to be followed by judges in other cases. In addition, the interpretation of Chinese laws may be varied to reflect domestic political changes.

The promulgation of new laws, changes to existing laws and the pre-emption of local regulations by national laws may adversely affect foreign investors. However, the trend of legislation over the last 20 years has significantly enhanced the protection of foreign investment and allowed for more control by foreign parties of their investments in Chinese enterprises. There can be no assurance that a change in leadership, social or political disruption, or unforeseen circumstances affecting the People’s Republic of China's political, economic or social life, will not affect the Chinese government's ability to continue to support and pursue these reforms. Such a shift could have a material adverse effect on our business and prospects.

The practical effect of the People's Republic of China legal system on our business operations in the People’s Republic of China can be viewed from two separate but intertwined considerations. First, as a matter of substantive law, the Foreign Invested Enterprise laws provide significant protection from government interference. In addition, these laws guarantee the full enjoyment of the benefits of corporate Articles and contracts to Foreign Invested Enterprise participants. These laws, however, do impose standards concerning corporate formation and governance, which are not qualitatively different from the general corporation laws of the several states, similarly, the People’s Republic of China accounting laws mandate accounting practices, which are not consistent with the United States Generally Accepted Accounting Principles (U.S. GAAP). The People’s Republic of China's accounting laws require that an annual "statutory audit" be performed in accordance with People’s Republic of China’s accounting standards and that the books of account of Foreign Invested Enterprises are maintained in accordance with Chinese accounting laws. Article 14 of the People's Republic of China Wholly Foreign Owned Enterprise Law requires a Wholly Foreign-Owned Enterprise to submit certain periodic fiscal reports and statements to designate financial and tax authorities, at the risk of business license revocation. Second, while the enforcement of substantive rights may appear less clear than United States procedures, the Foreign Invested Enterprises and Wholly Foreign- Owned Enterprises are Chinese registered companies, which enjoy the same status as other Chinese registered companies in business-to-business dispute resolution.

Any award rendered by an arbitration tribunal is enforceable in accordance with the United Nations Convention on the Recognition and Enforcement of Foreign Arbitral Awards (1958). Therefore, as a practical matter, although no assurances can be given, the Chinese legal infrastructure, while different in operation from its United States counterpart, should not present any significant impediment to the operation of Foreign Invested Enterprises.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which precedents set in earlier legal cases are not generally used. The overall effect of legislation enacted over the past 20 years has been to enhance the protections afforded to foreign invested enterprises in the PRC. However, these laws, regulations and legal requirements are relatively recent and are evolving rapidly, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign invested enterprises to hold licenses and permits such as requisite business licenses.

In addition, some of our present and future executive officers and our directors may be residents of the People’s Republic of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States, or to enforce a judgment obtained in the United States against us or any of these persons.

The People’s Republic of China laws and regulations governing our current business operations are sometimes vague and uncertain. There are substantial uncertainties regarding the interpretation and application of People’s Republic of China laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. We and any future subsidiaries are considered foreign persons or foreign funded enterprises under People’s Republic of China laws, and as a result, we are required to comply with People’s Republic of China laws and regulations. These laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We cannot predict what effect the interpretation of existing or new People’s Republic of China laws or regulations may have on our business.

Governmental control of currency conversion may affect the value of your investment.

The majority of our revenue will be settled in Renminbi, and any future restrictions on currency exchanges may limit our ability to use revenue generated in Renminbi to fund any future business activities outside the People’s Republic of China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the Renminbi for current account transactions, significant restrictions still remain, including, primarily, the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in the People’s Republic of China authorized to conduct foreign exchange business.

In addition, conversion of Renminbi for capital account items, including direct investment and loans, is subject to governmental approval in the PRC, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the Renminbi.

The value of our securities will be affected by the foreign exchange rate between U.S. dollars and Renminbi.

The value of our common stock will be affected by the foreign exchange rate between U.S. dollars and Renminbi, and between those currencies and other currencies in which our sales may be denominated. For example, to the extent that we need to convert U.S. dollars into Renminbi for our operational needs and should the Renminbi appreciate against the U.S. dollar at that time, our financial position, our business and the price of our common stock may be harmed. Conversely, if we decide to convert our Renminbi into U.S. dollars for the purpose of declaring dividends on our common stock or for other business purposes and the U.S. dollar appreciates against the Renminbi; the U.S. dollar equivalent of our earnings from our subsidiary in the People’s Republic of China would be reduced.

The People’s Republic of China government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the People’s Republic of China. We receive substantially all of our revenues in Renminbi, which is currently not a freely convertible currency. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency dominated obligations. Under existing People’s Republic of China foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where Renminbi is to be converted into foreign currency and remitted out of the People’s Republic of China to pay capital expenses, such as the repayment of bank loans denominated in foreign currencies.

The People’s Republic of China government may also, at its discretion, restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain expenses as they come due.

The fluctuation of the Renminbi (RMB) may materially and adversely affect your investment.

The value of the Renminbi against the U.S. Dollar and other currencies may fluctuate and is affected by, among other things, changes in the People’s Republic of China's political and economic conditions. As we rely almost entirely on revenues earned in the People’s Republic of China, any significant revaluation of the Renminbi may materially and adversely affect our cash flow, revenue and financial condition. For example, to the extent that we need to convert U.S. Dollars we receive from an offering of our securities into Renminbi for our operations, appreciation of the Renminbi against the U.S. Dollar could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert our Renminbi into U.S. Dollars for the purpose of making payments for dividends on our common shares or for other business purposes and the U.S. Dollar appreciates against the Renminbi, the U.S. Dollar equivalent of the Renminbi we convert would be reduced. In addition, the depreciation of significant U.S. Dollar denominated assets could result in a charge to our income statement and a reduction in the value of these assets.

On July 21, 2005, the People’s Republic of China government changed its decade-old policy of pegging the value of the Renminbi to the U.S. Dollar. Under the new policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. On July 21, 2005 the RMB was 8.28 for 1 USD and as of December 31, 2008, the RMB was 6.85 for 1 USD, which is approximately 20% appreciation of the RMB against the USD. While the international reaction to the Renminbi revaluation has generally been positive, there remains significant international pressure on the People’s Republic of China government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the Renminbi against the U.S. Dollar.

Recent PRC State Administration of Foreign Exchange Regulations regarding offshore financing activities by People’s Republic of China residents have undergone a number of changes which may increase the administrative burden we face. The failure by our shareholders who are People’s Republic of China residents to make any required applications and filings pursuant to such regulations may prevent us from being able to distribute profits and could expose us and our People’s Republic of China resident shareholders to liability under People’s Republic of China law.

State Administration of Foreign Exchange issued a public notice ("October Notice") effective from November 1, 2005, which requires registration with the State Administration of Foreign Exchange by the People’s Republic of China resident shareholders of any foreign holding company of a People’s Republic of China entity. Without registration, the People’s Republic of China entity cannot remit any of its profits out of the People’s Republic of China as dividends or otherwise; however, it is uncertain how the October Notice will be interpreted or implemented. In the event that the proper procedures are not followed under the October Notice, we could lose the ability to remit monies outside of the People’s Republic of China and would therefore be unable to pay dividends or make other distributions. Our People’s Republic of China resident shareholders could be subject to fines, other sanctions and even criminal liabilities under the People’s Republic of China Foreign Exchange Administrative Regulations promulgated January 29, 1996, as amended.

Risk Related to the Company's Future Business and Industry

We give no assurances that any plans for future expansionbusiness will be implemented and if we do not secure adequate financing our profitability may be adversely affected.or find profitable business opportunities.

Our ability to implement and execute our Three Rural Planfuture business plans and ultimately generate enough business revenue to be profitable is directly influenced by our ability to secure adequate financing. The company is currently profitable. We have recently received 6.3 million RMB (approximately $919,700) and have received a total of 31.7 million RMB (approximately $4,627,000) from prior investors. However, iffinancing or find profitable business opportunities. If we do not receive significant funding from future investors or find profitable business opportunities, we will experience delays in our growth strategiesbusiness plans and, ultimately, in our profitability.

We have a limited operating history and limited historical financial information upon which you may evaluate our performance.

We are in our early stages of development and face risks associated with a new company in a growth industry. We may not successfully address these risks and uncertainties or successfully implement our operating strategies. If we fail to do so, it could materially harm our business to the point of having to cease operations and could impair the value of our common stock to the point investors may lose their entire investment. Even if we accomplish these objectives, we may not generate positive cash flows or the profits we anticipate in the future.

Although our revenues have grown rapidly since our inception from the increasing demand for our products, we cannot assure you that we will maintain our profitability or that we will not incur net losses in the future. We expect that our operating expenses will increase as we expand. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

| o | expand our product offerings and maintain the high quality of our products; |

| | |

| o | manage our expanding operations, including the integration of any future acquisitions; |

| | |

| o | obtain sufficient working capital to support our expansion and to fill customers' orders in time; |

| | |

| o | maintain adequate control of our expenses; |

| | |

| o | implement our product development, marketing, sales, and acquisition strategies and adapt and modify them as needed; and |

| | |

| o | anticipate and adapt to changing conditions in the containerboard and paper products markets in which we operate as well as the impact of any changes in government regulation, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

We will face a lot of competition, some of which may be better capitalized and more experienced than us.

We face competition in the bio-ecological products industries, both domestically and internationally. Although we view ourselves in a favorable position vis-à-vis our competition, some of the other companies that sell into our market may be more successful than us and/or have more experience and money that we do. This additional experience and money may enable our competitors to produce more cost-effective products and market their products with more success than we are able to, which would decrease our sales. We expect that we will be required to continue to invest in product development and productivity improvements to compete effectively in our markets. However, we cannot give you assurance that we can successfully remain competitive. If our competitors could develop a more efficient product or undertake more aggressive and costly marketing campaigns than us, which may adversely affect our marketing strategies and could have a material adverse effect on our business, results of operations or financial condition.

The People’s Republic of China legal and judicial system may not adequately protect foreign investors and enforce their rights.

Our business is largely subject to the uncertain legal environment in the People’s Republic of China and your legal protection could be limited. As our present and possibly, future executive officers and directors are residents of the PRC, and our operating entity, Sanming Huajian Bioengineering Co., Ltd. is incorporated and situated in the People’s Republic of China, legal recourse against any of them could be limited or inadequate. The legal and judicial systems in the People’s Republic of China are still rudimentary, and enforcement of existing laws is inconsistent. Many judges in the People’s Republic of China lack the depth of legal training and experience that would be expected of a judge in a more developed country. Because the Chinese judiciary is relatively inexperienced in enforcing the laws that do exist, anticipation of judicial decision-making is more uncertain than would be expected in a more developed country. It may be impossible to obtain swift and equitable enforcement of laws that do exist, or to obtain enforcement of the judgment of one court by a court of another jurisdiction. The People’s Republic of China legal system is based on written statutes; a decision by one judge does not set a legal precedent that is required to be followed by judges in other cases. In addition, the interpretation of Chinese laws may be varied to reflect domestic political changes.

A slowdown in the People’s Republic of China economy may adversely affect our operations.

A slowdown or other adverse developments in the People’s Republic of China economy may materially and adversely affect our customers, demand for our services and our business. Because our customers are primarily wholesalers, a drop in their customer base would naturally spell a drop of demand for our products.

All of our operations are conducted in the People’s Republic of China and most of all of our revenue is generated from sales in the People’s Republic of China

Although the People’s Republic of China economy has grown significantly in recent years, we cannot assure you that such growth will continue. Also, while we believe the demand for our products are independent of the health of the economy; we do not know how sensitive we are to a slowdown in economic growth or other adverse changes in the People’s Republic of China economy. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in the People’s Republic of China may materially reduce the demand for our products and materially and adversely affect our business.

Conversely, our major competitors may be better able than us to successfully endure downturns in our sector. In periods of reduced demand for our products, we can either choose to maintain market share by reducing our selling prices to meet competition or maintain selling prices, which could likely, sacrifice market share. Sales and overall profitability would be reduced under either scenario. In addition, we cannot assure you that additional competitors will not enter our existing markets, or that we will be able to compete successfully against existing or new competition.

Inflation in the People’s Republic of China could negatively affect our profitability and growth.

While the People’s Republic of China economy has experienced rapid growth, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth can lead to growth in the money supply and rising inflation. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies, it may have an adverse effect on profitability. In order to control inflation in the past, the People’s Republic of China government has imposed controls on bank credits, limits on loans for fixed assets and restrictions on state bank lending. Such an austere policy can lead to a slowing of economic growth. In October 2004, the People's Bank of China, the People’s Republic of China’s central bank, raised interest rates for the first time in nearly a decade and indicated in a statement that the measure was prompted by inflationary concerns in the Chinese economy. Repeated rises in interest rates by the central bank would likely slow economic activity in People’s Republic of China which could, in turn, materially increase our costs and also reduce demand for our products.

A widespread health problem in the People’s Republic of China could negatively affect our operations.

A renewed outbreak of SARS, bird flu or another widespread public health problem in the People’s Republic of China, where all of our revenue is derived, could have an adverse effect on our operations. Our operations may be impacted by a number of health-related factors, including quarantines or closures of some offices that would adversely disrupt our operations.

Any of the foregoing events or other unforeseen consequences of public health problems could adversely affect our operations.

A widespread national disaster or Act of God in the People’s Republic of China could negatively affect our operations.

A widespread national disaster such as flooding, hurricane or other weather conditions that may adversely impact the growing of tobacco leaves may have an adverse effect on our business. Any such disaster could have the effect of inhibiting the growing of tobacco leaves which could cause us to curtail our operations. Further, a scarcity of tobacco leaves could also have the effect of increasing the cost of our purchasing the extracts, which could have the effect of depleting our assets or curtailing our operations.

Enforcement against us or our directors/officers may be difficult.

Because our principal assets are located outside of the United States and all of our directors and nearly all our officers reside outside of the United States, it may be difficult for you to enforce your rights based on United States Federal Securities Laws against us and our officers and directors in the United States or to enforce a United States court judgment against us or them in the People’s Republic of China.

Nearly all of our directors and officers reside outside of the United States. In addition, our operating subsidiary is located in the People’s Republic of China and substantially all of our assets are located outside of the United States. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the United States Federal securities laws against us in the courts of either the United States or the People’s Republic of China and, even if civil judgments are obtained in United States courts, to enforce such judgments in People’s Republic of China courts. Further, it is unclear if extradition treaties now in effect between the United States and the People’s Republic of China would permit effective enforcement against us or our officers and directors of criminal penalties under the U.S. Federal securities laws or otherwise.

We may have difficulty establishing adequate management, legal and financial controls in the People’s Republic of China.

The People’s Republic of China historically has not adopted a western style of management and financial reporting concepts and practices, as well as in modern banking, and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the People’s Republic of China. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards.

Inadequate funding for our capital expenditure may affect our growth and profitability.

Our inability to fund our capital expenditure requirements may adversely affect our growth and profitability. Our continued growth is dependent upon our ability to raise capital from outside sources. Our ability to obtain financing will depend upon a number of factors, including:

| o | our financial condition and results of operations, |

| | |

| o | the condition of the People’s Republic of China economy and the containerboard sector in the PRC, |

| | |

| o | conditions in relevant financial markets; and |

| | |

| o | relevant People’s Republic of China laws regulating the same. |

If we are unable to obtain financing, as needed, on a timely basis and on acceptable terms to our investors or lenders, our financial position, competitive position, growth and profitability may be adversely affected.

We may not be able to effectively control and manage our growth.

If our business and markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. In addition, we may face challenges in managing expanding product offerings and in integrating acquired businesses with our own. Such eventualities will increase demands on our existing management, workforce and facilities. Failure to satisfy such increased demands could interrupt or adversely affect our operations and cause production backlogs, longer product development time frames and administrative inefficiencies.

Significant fluctuations in raw material prices may have a material adverse effect on us.

Although we have exclusive contracts with our raw materials suppliers, any significant fluctuation in price of our raw materials may have a material adverse effect on the manufacturing cost of our products. We are subject to market conditions and although these raw materials are generally available and we have not experienced any raw material shortage in the past, we cannot assure you that the necessary materials will continue to be available to us at prices currently in effect or acceptable to us.

We depend on a concentration of customers.

Our revenue is dependent, in large part, on significant orders from wholesale customers. We believe that revenue derived from such customers will continue to represent a significant portion of our total revenue although we plan to diversify our customer base by, among other things, expanding our sales. Our inability to continue to secure and maintain a sufficient number of large customers or increase our customer base would have a material adverse effect on our business, operating results and financial condition. Moreover, our success will depend in part upon our ability to obtain orders from new customers, as well as the financial condition and success of our customers and general economic conditions.

We may be exposed to intellectual property infringement and other claims by third parties, which, if successful, could cause us to pay significant damage awards and incur other costs.